What’s Happening

Join

Join

As we settle into winter now is the perfect time to prepare for the end of financial year (EOFY).

In this edition we bring you essential tax reminders, marketing tips and networking opportunities to make the process easier.

• Reviewed your expenses and organised receipts for deductions?

• Checked your tax obligations including BAS lodgement due dates?

• Thought of applying for a small business energy incentive or WHS incentive?

• Considered speaking with a financial advisor for strategic tax planning?

• Decluttered your workspace by updating your website, refreshing social media?

• Set new fresh goals for the year ahead?

Did you know about:

Small business concessions: There a number of concessions, including for payment and reporting options, which apply to sole traders, partnerships, companies and trusts. There are varying eligibility requirements, so check your eligibility each year.

Small business roll-over: The small business roll-over allows eligible small businesses to defer all or part of a capital gain made from selling an active asset. If you acquire a replacement asset or incur costs on making capital improvements to an existing asset, these gains will be deferred until you dispose of the asset.

Small business 50% active asset reduction: To apply the small business 50% active asset reduction, you need to meet basic eligibility conditions common to all 4 small business CGT concessions. Unlike the other small business CGT concessions, the small business 50% active asset reduction applies automatically. This is unless you choose for it not to apply. We want to help you navigate through these challenging times and take advantage of what government incentives are on offer.

For a quick list of extra resources and information visit: business.gov.au, wsbusiness.com.au, or simply contact us for free advice at gai@penrithcbdcorp.com.au or connect@penrithcbdcorp.com.au

its renovations.

The NSW Government continues to transform how businesses interact with its services with new enhancements to the Service NSW Business Bureau’s digital tools, which include:

Sharing access

Securely invite team members to access the Business Profile.

Simplifying voucher management

Update and manage bank details securely. Voucher redemption and financial management can be delegated.

Tracking applications in real time

Providing transparency and certainty.

Digital Products

License Manager

Search, save, organise, track and renew business, employee and subcontractor licences.

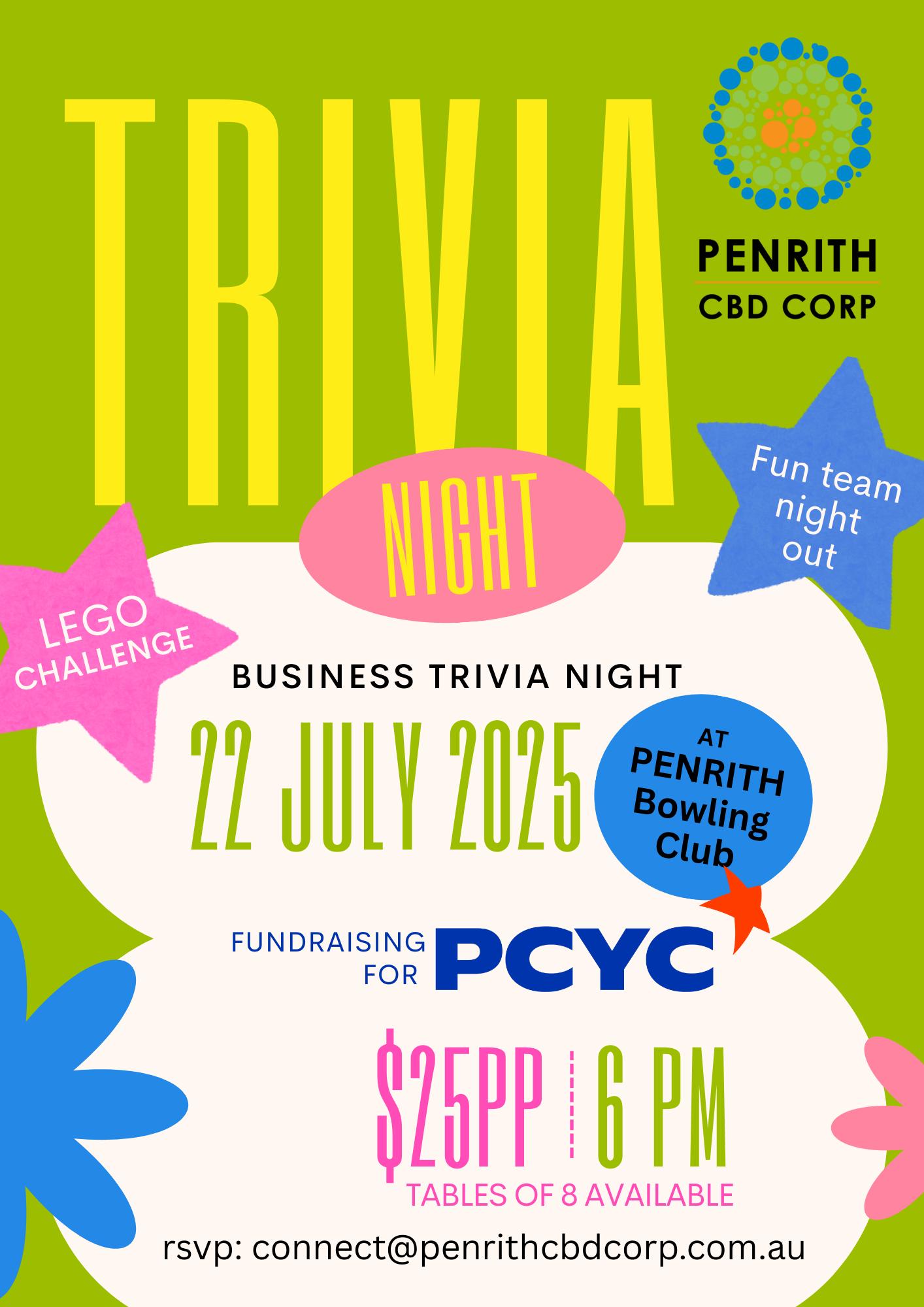

First Wednesday of every month (except January)

FREE at Penrith RSL 7.30am

RSVP connect@penrithcbdcorp.com.au

Advisor and event bookings

A free, independent business advisor for advice on marketing, cashflow, and planning.

Self-check compliance for motor repair businesses

An easy-to-use self-assessment tool.

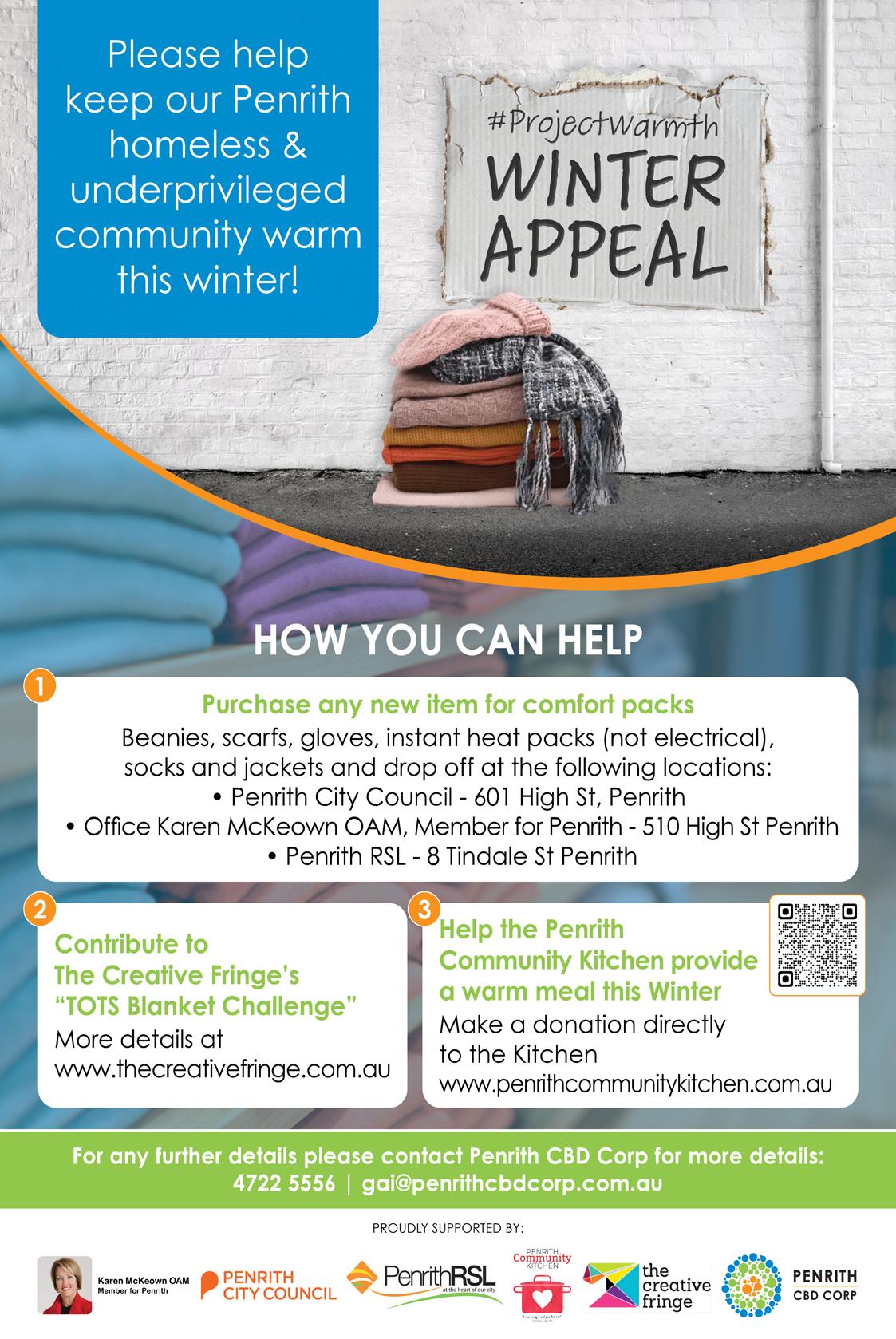

Penrith Community Kitchen

PCYC

Business Vehicle Registration

W: penrithcommunity kitchen.com.au

Access renewals through the Business Profile and app. More than 22,800 businesses have accessed this feature.

W: pcycnsw.org.au

P: (02) 4732 1755

P: (02) 4721 1444

For details, check out the Service NSW website www.service.nsw.gov.au/business

Luke Priddis Foundation

W: lukepriddisfoundation.com

P: (02) 4736 2202

NADO Disability Services

W: nado.org.au

P: 1300 738 229

The Food for Kids Program

Supporting local schools

W: penrithcommunitykitchen.com.au