Metroline wins £422m Bee Network growth

London subsidiary of Singapore-based ComfortDelGro has won four Tranche 3 bus franchises in Greater Manchester, boosting its size by 30%

Metroline has been revealed as the big winner in the third and final round of Greater Manchester Bee Network contracts. The company, which is a subsidiary of Singapore-owned ComfortDelGro, has been awarded contracts to operate four bus franchises by the Greater Manchester Combined Authority. It is a major expansion for ComfortDelGro, which has been present in the UK market since acquiring London-based Metroline in 2000. This latest series of awards under Transport for Greater Manchester’s Tranche 3 tender process will see Metroline operate bus services for the Hyde Road, Sharston, Tameside and

Wythenshawe franchises for a period of five years with options to be extended for two, one-year terms. Collectively, these franchises are worth £422m and comprise a total of 232 services, 420 buses and over 1,350 employees - representing a 30% increase over its London portfolio. ComfortDelGro’s group CEO, Cheng Siak Kian, said: “With

“We look forward to other new bus franchise opportunities”

Cheng Siak Kian

our proven record of operational excellence in Greater London and other public transport operations around the world, we are well-placed to deliver on TfGM’s vision and transport strategy.

“We are honoured to be a partner in Greater Manchester’s transportation story and look forward to other new bus franchise opportunities in the North West and across the UK in the future.”

Metroline is the fourth largest scheduled bus operator in London and operates about 17% of the city’s scheduled bus services. The group’s other UK operations include Scottish Citylink, Megabus and CMAC Group.

MORE ON PAGE 4

FORTEVERYNIGHT

Former Virgin exec laments lack of flair

Ember raises £11m to boost expansion

Electric coach firm will add new routes

12 Whitehornrailways have ‘slipped back’

13

Singapore-based firm rolls out technology

Norman Baker on the revolution in aviation

18

CPT’s Paul White sees big challenges

ISSUE 310 5 APRIL 2024 NEWS, VIEWS AND ANALYSIS FOR A SECTOR ON THE MOVE

03 SBS pioneers predictive maintenance

Pigs won’t fly but taxis are taking off

14 Scotland’s bus dilemma

NET

NEWS COMMENT

ZERO

EDWARD

E Y / CCHQ COMMENT INNOVATION & TECH

PM POPS IN Prime minister Rishi Sunak visited Trentbarton’s garage in Heanor, Derbyshire, last month to launch the Conservative Party’s local elections campaign. He is pictured with Ben Bradley MP and Trentbarton boss Tom Morgan

MASS

Publiccontrolled. Customerfocused

It’s not often that you hear someone making the case for the private sector to take the lead role on the railways these days. Those who remain active have realised that it’s easier to swim with the tide than against it. Having long departed the sector for the space industry, Will Whitehorn takes a different view. Back in the nineties and noughties, Whitehorn worked closely with Sir Richard Branson when successive governments placed their trust in private sector companies to revive Britain’s railways. Branson’s Virgin Group achieved huge growth on its West Coast intercity services (although some argue that much of this should be credited to broader influences). In today’s era of greater public control, Whitehorn believes that the railway is missing the commercial nous of companies like Virgin (see page 8).

Private and public sector organisations can each be responsive to customer needs. Equally, they can each be aloof and out of touch. The challenge for Britain’s railways, and for those bus networks that also revert to public control, is to strive for the former. Publiclyowned Transport for London, for example, has recently been praised by the Railway Industry Association for its stable leadership, robust vision and proactive implementation of ticketing innovations. In an environment where public transport has a high profile and is increasingly dependent on public funding, greater public control is inevitable. But the sector must be innovative and customer-focused.

IN THIS ISSUE

16 SURVEY S HINE S LIGHT ON CU STOMER VIEWS

Alex Warner writes: “The return of the Transport Focus survey [of bus users] delighted me because it shone the light after some time in the shadows on customer sentiment and created a sense of competitiveness among regions and operators.”

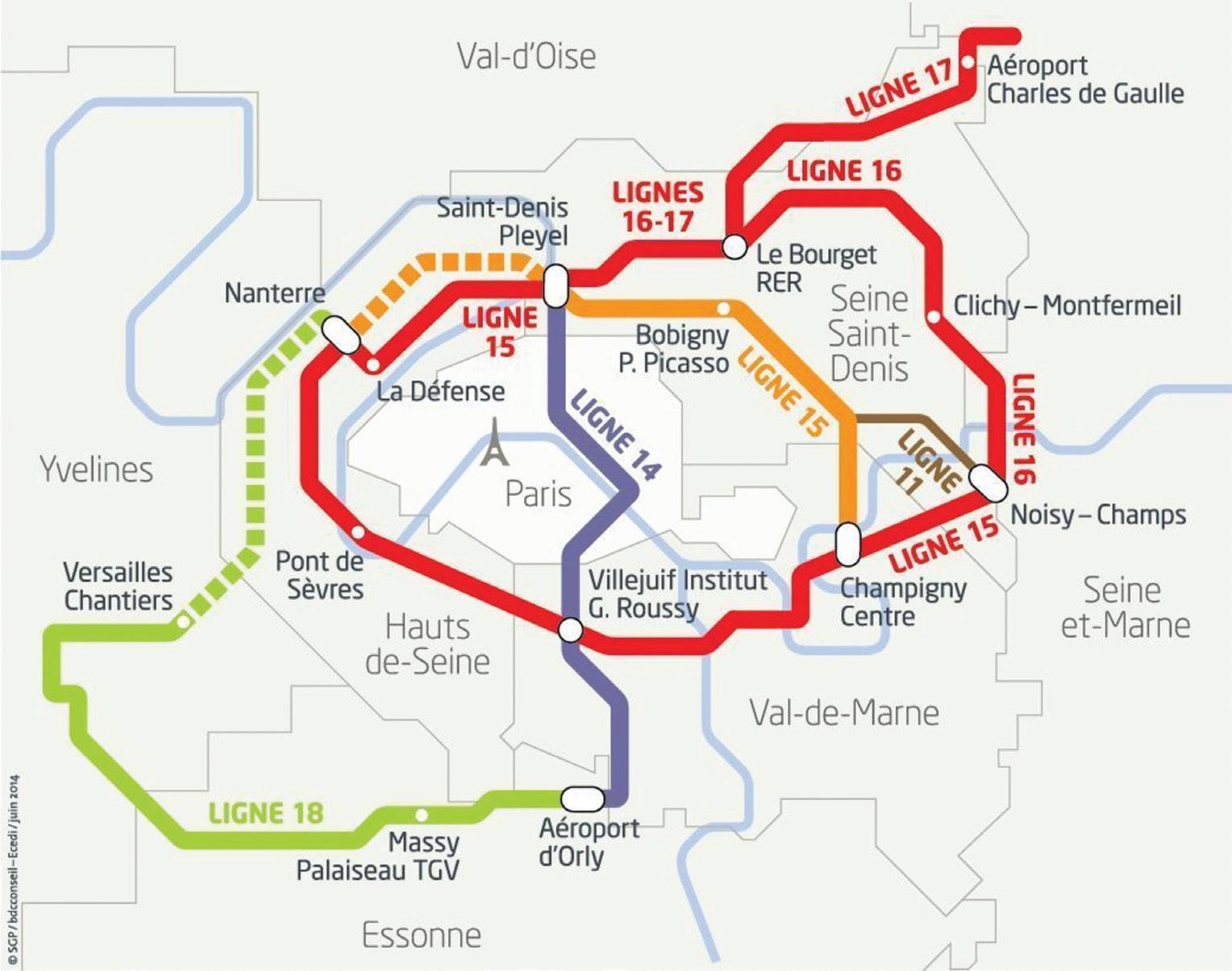

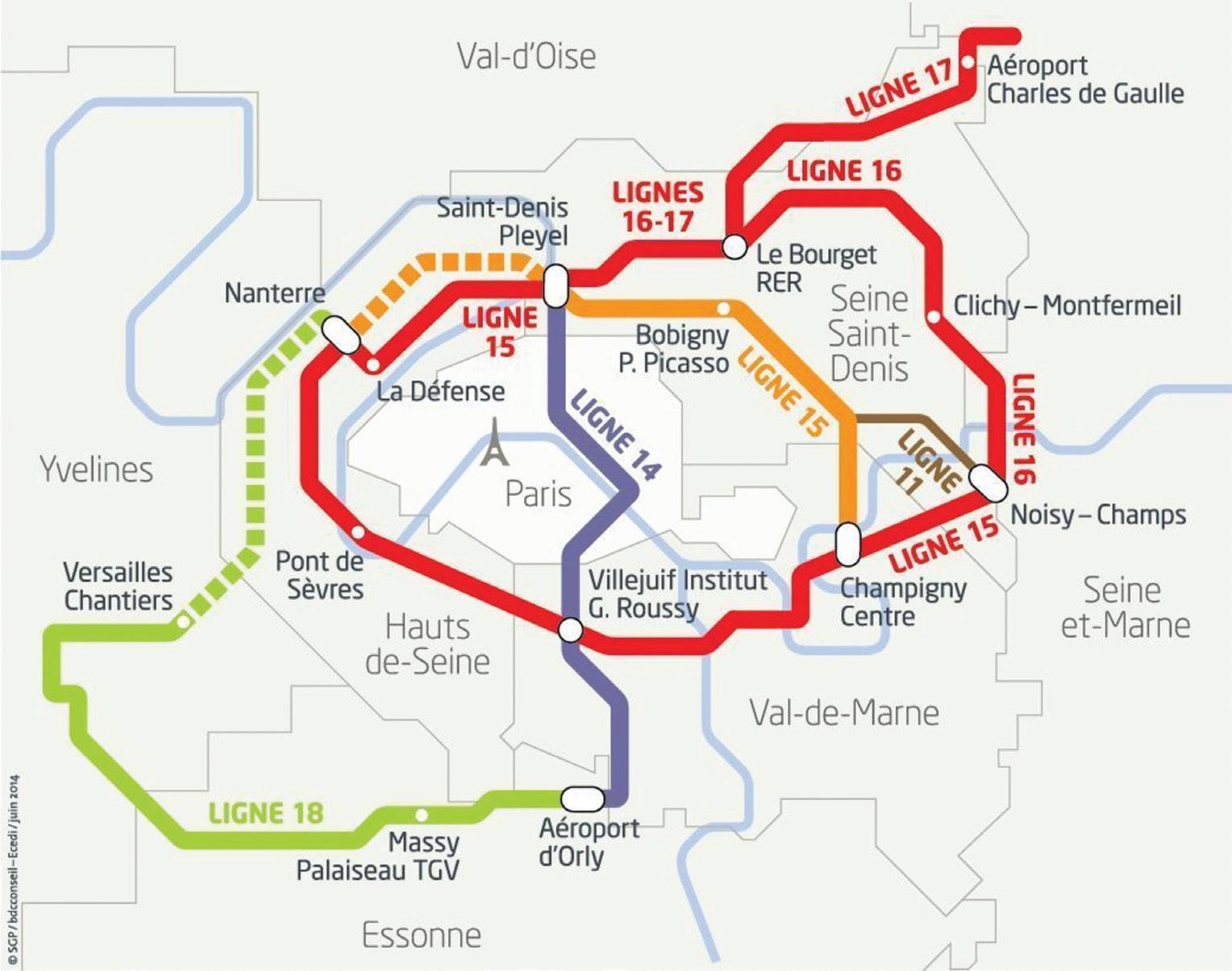

20 R EVOLUTIONI S ING S UBURBAN TRAN S PORT

Giles Bailey recently had a guided visit to the project exhibition exploring the Grand Paris Express transport project, potentially the most important and transformational urban mobility project currently under construction in Europe.

22 A NEW APPROACH TO BU S PRIORITY?

New guidance explains what should and should not happen to help buses, but how does it stack up with the Plan for Drivers? Nick Richardson: “Without any disincentive to use cars, incentives to use buses will have limited impact.”

25 T HE END OF THE LINE FOR L ITCHURCH L ANE?

Our Whitehall insider imagines what’s going on inside the minds of the mandarins at Great Minster House, home of the Department for Transport. “Will a Labour government, post the general election, throw Alstom a lifeline?”

REGULARS NEWS 04 NET ZERO 12 INNOVATION & TECH 13 COMMENT 14 GRUMBLES 25 CAREERS 26 DIVERSIONS 28

S ATION PAGE Alstom 25 Arriva 16-18, 28 Avanti West Coast 7, 25 CILT 26 CPT Scotland 18-19 ComfortDelGro 1, 4, 16-18 East Yorkshire 16-18 Ensign Bus 16-18 Ember 12 First Bus 16-18 Go-Ahead 26 Go North East 9, 16-18, 26 Go North West 16-18 Hitachi 25 LibertyBus 9 LNER 28 Lothian Buses 9 Mellor 9 Metrobus 5 Metroline 1, 4 Nottingham City Transport 26 ORR 6 Oxford Bus Company 9 Rotala 4 RIA 6, 7 SBS Transit 13 ScotRail 28 Stagecoach 4, 13 Stratio 13 TfGM 1, 4 TfL 7, 9 TfW 10, 11 Transdev 16-18 Transport Focus 16-18 Trentbarton 1, 16-18 Van Hool 9 Virgin 8 Vision Bus 4

ORGANI

Robert Jack Managing Editor PASSENGER TRANSPORT editorial@passengertransport.co.uk forename.surname@ passengertransport.co.uk Telephone: 020 3950 8000 Managing Editor & Publisher Robert Jack Deputy Editor Andrew Garnett Contributing Writer Rhodri Clark Directors Chris Cheek, Andrew Garnett, Robert Jack OFFICE CONTACT DETAILS Passenger Transport Publishing Ltd PO Box 5496, Westbury BA13 9BX, UNITED KINGDOM Telephone (all enquiries): 020 3950 8000 EDITORIAL editorial@passengertransport.co.uk ADVERTISING ads@passengertransport.co.uk SUBSCRIPTIONS subs@passengertransport.co.uk ACCOUNTS accounts@passengertransport.co.uk Passenger Transport is only available by subscription. Subscription rates per year; UK £140 (despatch by Royal Mail post); Worldwide (airmail) £280 The editor welcomes written contributions and photographs, which should be sent to the above address. All rights reserved. No part of this publication may be reproduced in whole or in part without the publisher’s written permission. Printed by Cambrian Printers Ltd, Stephens & George Print Group, Goat Mill Road, Dowlaid, Merthyr Tydfil CF48 3TD © Passenger Transport Publishing Ltd 2024 ISSN 2046-3278 SUBSCRIPTIONS HOTLINE 020 3950 8000 PASSENGER TRANSPORT PO Box 5496, Westbury BA13 9BX 020 3950 8000 editorial@passengertransport.co.uk CONTENTS www.passengertransport.co.uk 5 April 2024 | 03 HAVE YOUR SAY Contact us with your news, views and opinion at: editorial@passengertransport.co.uk

Metroline cleans up in final franchise round

London bus operator wins three of the four large franchises in the third and final round of bidding for Greater Manchester’s new Bee Network

CONTRACTS

Transport for Greater Manchester has completed the process to franchise the region’s bus network with the award of the third and final tranche of contracts covering 248 different bus services in Stockport, Tameside, Trafford and the remaining parts of Manchester and Salford.

It is understood that initially TfGM intended to announce the winners on March 25, coinciding with the launch of the second phase of the franchised Bee Network in Bury, Oldham, Rochdale, parts of Salford, and north Manchester. However, those plans were postponed by several days due to an appeal by an unsuccessful Tranche 3 bidder.

However, industry rumours suggesting some significant changes to the status quo have proved to be correct with Stagecoach, the dominant incumbent operator in the area only winning one large franchise covering Stockport.

Walking away with four of the large franchises covering operations from Hyde Road, Sharston, Wythenshawe and Tameside is ComfortDelGro subsidiary and London bus operator Metroline. The contracts are worth over £400m and come with a peak vehicle requirement of over 400 buses - a figure that is likely to require significant mobilisation activity.

ComfortDelGro’s managing director and group chief executive

officer Cheng Siak Kian said that the group’s track record with transport operations in Greater London and elsewhere in the world means it is “well-placed” to deliver on the contracts.

“This aligns with our broader strategy to strengthen and strategically grow our core public transportation and point-topoint businesses,” added Mark Greaves, chairman of both ComfortDelGro and Metroline holding company Braddell Ltd.

Greater Manchester’s SME bus operators received little positive news, as Rotala

“Awarding the last round of franchised contracts is a major milestone”

Eamonn Boylan

subsidiary Diamond Bus once again secured gains on smaller franchise contracts. In the third tranche, the privately-owned bus group secured three contracts encompassing Tameside, Trafford, and Stockport, while the fourth and final small franchise contract for Tameside went to Go-Ahead subsidiary Go North West.

In 2019, Greater Manchester had over 40 SME bus operators, yet the Bee Network franchising process has only seen Boltonbased independent Vision Bus secure a handful of school bus contracts so far. Despite the recent closure of bidding for school bus contracts related to Tranche 3, it appears unlikely that the region’s remaining independent bus operators will make significant progress in the face of stiff competition from larger multi-national operators. The final round of Bee Network

services will launch on January 5, 2025, at which point all buses across Greater Manchester will be franchised and under local control.

“Awarding the last round of franchised contracts is a major milestone towards delivering the Bee Network,” said Eamonn Boylan, chief executive of Greater Manchester Combined Authority and TfGM. “That ambition is central to our devolution journey. It’s exciting to think that in around nine months’ time all bus services across the whole of Greater Manchester will be under local control and accountable to the people they serve.”

Meanwhile, new statistics published by TfGM suggest that Bee Network bus services continue to be more reliable than before bus franchising and are outperforming services elsewhere in Greater Manchester.

The latest figures covering March 17-23 suggest 75.8% of Bee Network buses were on time. This compares with 65.9% on non Bee Network services in Greater Manchester and 63.5% for the equivalent period before the launch of franchised services. Of the various factors contributing to highway delays during this period, roadworks accounted for the majority at 64%, followed by other incidents at 21%, events at 11%, road traffic collisions at 3%, and motorway incidents at 1%.

TfGM has also reported an increase in patronage on Bee Network services. Between November 5-18, the average weekday patronage on Bee Network buses stood at 131,095, which rose to 138,010 between March 3-16, marking a 5.27% increase. Notably, March 6 saw a peak in Bee Network patronage, reaching 141,720, with over 17 million journeys recorded on the Bee Network so far.

NEWS ROUND-UP 04 | 5 April 2024 www.passengertransport.co.uk

Metroline will have a 400 bus business in Greater Manchester

Government reveals winners of ZEBRA 2

West Sussex wins largest allocation from funding stream

ZERO EMISSION BUSES

The government has revealed the recipients of the £143m in funding from the second round of the Zero Emission Bus Regional Areas scheme (ZEBRA 2). This funding will enable 25 councils to introduce 955 zero-emission buses across England.

Transport secretary Mark Harper highlighted the emphasis of ZEBRA 2 on zero-emission buses for rural areas. He added:

“This latest investment into our bus fleet builds upon the £3.5bn invested in our bus network since 2020. It ensures the protection and enhancement of bus routes until 2025, along with the extension of the £2 bus fare cap until the end of 2024, made possible by reallocated HS2 funding.”

The funding allocation slightly exceeds the £129m initially announced when ZEBRA 2 funding applications were opened in November last year. It follows the £268m allocated to 16 local transport authorities in previous rounds of the ZEBRA funding

process in 2021 and 2022.

The Department for Transport has revealed that a total of 58 expressions of interest were received as part of ZEBRA 2 but

SECOND ZERO EMISSION BUS REGIONAL AREAS (ZEBRA 2) PROGRAMME FUNDING AMOUNTS

Source: Department for Transport

it is unknown how many of those resulted in firm bids for funding.

West Sussex County Council secures the largest allocation, receiving £10.1m for 43 hydrogen fuel cell electric vehicles (FCEVs) to be run by Go-Ahead-owned Metrobus on rural and interurban services in the Crawley area.

However, the DfT notes that this funding is contingent upon certain conditions. It is believed that these conditions may be associated with a pending planning application for a hydrogen refueling facility at Metrobus’s Crawley depot. In recent weeks the Health & Safety Executive has objected to the plans on public safety grounds.

All of the other successful ZEBRA 2 bids are on the basis of battery electric vehicles (BEVs) of varying types (see table below).

www.passengertransport.co.uk 5 April 2024 | 05

LTA Funding Buses Notes West Sussex County Council £10.1m 43 FCEV single deckers for Metrobus, funding is subject to confirmation Plymouth City Council £9,5m 50 BEV double deckers for Plymouth Citybus; Cornwall Council making contribution to six buses Liverpool City Region CA £9.4m 58 BEV double deckers for unknown operator (potentially linked to bus franchising process) West Northamptonshire Council £9.4m 51 BEV buses for Stagecoach Leicestershire County Council £8.1m 46 25 BEV double deckers for Arriva and 21 BEV single deckers for Kinchbus Tees Valley Combined Authority £7.4m 62 BEV buses for Stagecoach in Stockton and Arriva in Darlington and Redcar Transport North East £7.4m 43 Single and double deck BEV buses for Arriva (14); Go North East (11); and Stagecoach (18) Torbay Council £7.1m 49 BEV buses for Stagecoach West of England CA £6.6m 74 67 BEV double deckers and 7 BEV single deckers for First West of England at Hengrove Depot Gloucestershire County Council £5.9m 58 42 BEV buses for Stagecoach; 15 for Pulhams Coaches; and 1 for Lydney Dial-a-Ride service Hull City and East Riding Councils £5.7m 40 21 BEV buses for East Yorkshire and 19 BEV buses for Stagecoach Devon County Council £5.3m 41 BEV buses for Stagecoach Derbyshire County Council £5.1m 57 39 BEV double deckers and 18 BEV single deckers for Stagecoach’s Chesterfield depot Essex County Council £4.8m 55 31 BEV single deckers and 24 BEV double deckers for First Essex Reading Borough Council £4.7m 24 BEV double deckers for Reading Buses Isle of Wight Council £4.5m 22 BEV double deckers for Southern Vectis Warwickshire County Council £4.3m 27 BEV buses for Stagecoach Wiltshire Council £3.4m 23 BEV buses - a mix of single and double deckers for Salisbury Reds and Stonehenge Tour Surrey County Council £3.2m 19 13 BEV single deckers for Falcon Buses and 6 BEV single deckers for White Bus Staffordshire County Council £3.1m 17 11 BEV double deckers for Arriva and 6 BEV single deckers for Diamond Bus Brighton and Hove City Council £2.9m 16 BEV double deckers for Brighton & Hove Buses Nottinghamshire County Council £2.8m 23 13 BEV double deckers and 10 BEV single deckers for Stagecoach Somerset Council £2.2m 25 12 BEV double deckers and 13 BEV single deckers for First South West North Somerset Council £2.1m 24 BEV double deckers for First West of England’s Weston depot Cornwall Council £1.3m 8 BEV buses for Truro park and ride and Falmouth town service

Mark Harper

Rail industry reports continuing growth

The Office of Rail and Road reports strong rail patronage growth but the latest statistics are still below passenger numbers before the pandemic

PATRONAGE

The latest rail patronage figures from the Office of Rail and Road reveal a significant increase in rail travel across Great Britain, with a total of 417 million journeys made by passengers in the most recent quarter (October 1 to December 31, 2023). This marks a 20% increase from the 348 million journeys recorded in the same quarter the previous year.

Despite this growth, passenger numbers still remain below pre-Covid pandemic levels, currently standing at 90% of the 461 million journeys recorded in the same quarter four years previously (October to December 2019).

The increase in journeys comes despite ongoing industrial unrest with seven days of strike action experienced in the final three months of 2023, which led to potential disruptions with ‘trains planned’ dropping by as much as 68% on the most affected days.

However, looking at the broader picture, there were a total of 1,570 million journeys made in the year ending December 31, 2023, representing a 20% increase from the 1,300 million journeys recorded in the preceding 12 months.

This growth aligns with recent research conducted by consultancy firm Steer for the Railway Industry Association, indicating a potential for continued passenger growth (PT308). Steer’s findings suggest that even with modest growth

rates, rail patronage could return to pre-pandemic levels by 2036, with the possibility of doubling long-term passenger numbers by 2050.

Breaking down the data by sector, London and South East emerges as the largest, recording 293 million journeys in the latest quarter, marking a 19% increase from the previous year. The long distance sector saw a 21% increase, recording 34.8 million journeys, while the regional sector experienced a 22% increase with 87.7 million journeys.

The data also shows growth among open access operators, with a combined total of 2.3 million passenger journeys, reflecting a 14% increase from the previous year.

The ORR highlights that Transpennine Express and Avanti West Coast both planned significantly more trains, resulting

The impact of split ticketing on journey estimates is being addressed in collaboration with the Rail Delivery Group to provide more accurate data reflecting actual travel patterns. RDG estimates that overall, split tickets accounted for around 5% of passenger journeys between April 2022 and March 2023 (it was around 3% in the previous year).

In terms of revenue, passenger income reached £2.6bn in the latest quarter, marking a 20% increase from the previous year when adjusted for inflation. However, this is still below prepandemic levels, at 79% relative to the £3.3bn in the same quarter four years ago (October to December 2019).

in substantial increases in passenger journeys for both of these operators.

Meanwhile, the Elizabeth Line stands out with the largest increase in passenger journeys, rising by 40%. This growth is attributed in part to the gradual expansion of services since the central section of the line opened in May 2022. Conversely, Heathrow Express, which now faces competition from the Elizabeth Line between central London and Heathrow Airport, saw the smallest increase at 5%, followed by c2c and LNER, both up by 6%.

However, the ORR warns that these latest figures may be influenced by the growing trend of split ticketing among passengers. In particular, some train operators’ journeys may be overestimated due to the impact of passengers buying ‘split tickets’

Passenger revenue per journey was £6.27 in the latest quarter, a slight decrease compared with the £6.28 in the same quarter in the previous year. Passenger revenue per kilometre was 17.2 pence, slightly lower than the 17.3 pence in the previous year.

With a total revenue of £1.3bn, London and South East remained the largest sector in the latest quarter. Of the three sectors, London and South East recorded the smallest increase in revenue (up 19% on the £1.1bn in the previous year). The long distance sector showed the largest growth (up 21%), with £839m of revenue in the latest quarter compared with the £694m in the previous year.

Journeys made with season tickets grew by 7% and they made up 14% of total franchised ticket sales in the latest quarter. This is one percentage point less than the previous year and down 20 percentage points from the 34% of sales four years ago.

Advance tickets saw the largest increase in sales with growth of 38% in the latest quarter. Overall they accounted for 30.3 million passenger journeys.

NEWS ROUND-UP 06 | 5 April 2024 www.passengertransport.co.uk

London and South East remains the largest rail passenger market

Mayors offer vision for HS2 alternative link

Cheaper ‘French-style’ solution would follow planned HS2 route

CONNECTIVITY

A privately supported review led by Andy Burnham and Andy Street, the mayors of Greater Manchester and the West Midlands, has proposed replacing the axed northern leg of HS2 with a more cost-effective ‘Frenchstyle’ alternative following the same route.

The consortium considered alternative strategies to enhance connectivity between the two cities, such as modernising the current West Coast Main Line and constructing bypasses at bottleneck locations along the existing route. However, after thorough evaluation, it was determined that only a

RIA CALLS FOR RAIL RETAIL REFORMS

‘Better customer experience could help build growth’

TICKETING

The Railway Industry Association has released a new report that calls for a revolution in the way railway fares are structured. The analysis has found that a focus on enhancing the customer experience and ridership through retail reform can drive revenue growth without increasing ticket prices.

The report, Destination: Revenue Growth, argues that the current state of UK mainline ticketing reflects years of fragmented development, stemming from a blend of legacy and modern systems influenced by rail privatisation, devolution, and

new rail link would sufficiently accommodate the anticipated growth on the corridor by the 2030s.

The proposals would connect Handsacre Junction at the northern extremity of the first phase of HS2 to Manchester Airport, with the potential for funding from both private and public sources, mirroring the financing model employed for the construction of the Bordeaux to Tours TGV line in France. In that case around €3.8bn of the total €7.8bn construction cost was financed privately, which will be recouped via a 50-year concession contract.

Savings would also be made by engineering the line for slower running speeds and it would be built to a lower specification. It has been suggested that

fluctuating political visions.

It adds that this fragmented approach has resulted in a railway system that falls short of customer expectations, deterring potential passengers and leading to increased costs for taxpayers and underutilisation of assets.

The RIA contrasts UK rail with Transport for London, citing its stable leadership, robust vision, and proactive implementation strategies, which have led to a highly regarded ticketing system praised both locally and internationally. At TfL contactless ticketing has built public trust, fuelling significant growth in patronage and revenues. In contrast, the National Rail ticketing system frequently encounters mistrust.

“Government policy has identified the same concerns,” added the RIA.

this would make the scheme “considerably cheaper” than that envisaged for HS2.

“Although only provisional findings, it is clear that a new line between Handsacre and Manchester Airport is the best option for improving connectivity, and the most attractive option for significant private sector involvement,” said Street.

Burnham said he was focused on delivering an alternative. “It’s becoming drastically clear that the existing West Coast Main Line and the congested M6 will not be sufficient to cope with increasing passenger and freight volumes,” he added.

The full review, which is being carried out by firms including Arup, Arcadis, Mace and EY, is expected to report on the proposals in full later this year.

“The cornerstone of the current rail reform agenda, the so-called Plan for Rail, makes a number of promises on rail retail. However, the RIA has identified several shortcomings in the proposals for rail retail implementation, and these will need to be resolved to meet desired Rail Reform outcomes.

“In addition, the blueprint discussed in Destination: Revenue Growth charts a timeline of recent government U-turns and indecision, which arguably makes it impossible for any entity - private or state - to plan for a better future.”

The report has four key asks:

Establish a consistent national vision for rail retail that harmonises national and regional interests while maintaining an equitable balance between the private and public

‘AVANTI WILL NOT LOSE CONTRACT’

Merriman claims problems will remain no matter what

PERFORMANCE

Rail minister Huw Merriman has dismissed calls to terminate Avanti West Coast’s contract despite a motion passed by the Transport for the North board urging transport secretary Mark Harper to transfer control to the Department for Transport’s Operator of Last Resort as soon as possible (PT309).

“The reason is that there are issues with the West Coast Main Line that will remain, regardless of who the operator is,” Merriman told MPs on March 21. “It is essential to get underneath the bonnet, look at the issues and fix them, rather than looking just at what is on the side of the car.”

In response to TfN’s motion, the Department for Transport has claimed that stripping Avanti of the contract “would just cause more upheaval for passengers rather than solving the challenges the operator is facing”.

sectors;

Standardise interfaces between different ticketing ecosystems and modes to enable interoperability and foster innovation;

Ensure equal access to core data, fares, and features to foster competition, innovation, and support for rail retailers, thereby benefiting customers; and

Implement a clear common contracting framework to provide certainty for providers, attract new entrants, and promote collaboration within the rail industry.

“Providing better, simplified fares and ticketing, rooted in the principles of trust and value, are vital to driving net revenue growth and customer satisfaction,” commented RIA innovation director Milda Manomaityte.

www.passengertransport.co.uk 5 April 2024 | 07

Rail re-nationalisation is ‘tragedy’ - Whitehorn

Former Virgin executive Will Whitehorn tells Lunch with Leon podcast why he believes that Britain’s railway is ‘back in a mode of managed decline’

RAIL POLICY

Will Whitehorn, a close colleague of Sir Richard Branson throughout the nineties and much of the noughties, has warned that Britain’s railway will suffer from managed decline and a lack of innovation under public control.

Whitehorn served as an official spokesman for Branson as his Virgin Group sought to transform intercity rail services on the West Coast Main Line, and he says that the group can take credit for passenger numbers on the route rising from 12 million to 40 million a year under its stewardship.

Speaking to Leon Daniels for the Lunch with Leon podcast, which is produced in association with Passenger Transport, Whitehorn said: “It’s a bit of a tragedy that it’s all been re-nationalised - which it already has - because there is no innovation and it seems to me to be back in a mode of managed decline.”

Whitehorn says there is no doubt that Virgin’s tenure of the West Coast route was a success, but rail franchise contracts failed to respond to major societal changes, such as an increase in working from home, which became even more widespread in the aftermath of the pandemic.

“The franchise contracts the government had with train operators were not flexible enough, so they almost all went into losses even before covid had happened,” he said. “But the immediate instincts of - I’m afraid I’m going to be a little bit rude -

transportation civil servants and ministers on both sides of the house, and MPs, has been the solution to this is basically take it all back under state control.”

Whitehorn believes this is a backward step for the railway and he believes that this is already being demonstrated in Scotland, where the SNP-led Scottish Government has taken the ScotRail franchise in-house.

“There is no improvement whatsoever [in Scotland],” he said. “There is again decline. There has been a cut in the number of services. They are later and they are not working as well.”

He continued: “The railways were going somewhere quite good for a while and they have slipped back ... Why are we bothering to

have a regulator anymore in the railways? They are all government contracts. They are regulating themselves. All of these things I am finding ridiculous.”

Whitehorn also criticised the government for wasting money on an HS2 scheme it will never complete instead of backing a cheaper alternative. He recalls how Virgin proposed investing in a “reasonably fast line” from London to Birmingham to offer extra capacity and a new fleet of 140-160mph “Super Pendolinos”. He claims that this would have sped up journeys between London and the North and increased capacity for a fraction of the cost.

“We went to see ministers. We said you cannot build what you are trying to build. It will never

“The railways were going somewhere quite good for a while and they have slipped back” Will Whitehorn

happen,” recalled Whitehorn.

“It beggars belief to me ... I am absolutely convinced there were quite a lot of people who were still in the mindset, ministerially and in the civil service, who had less experience of operating a transport business, that it was a kind of ‘Grand Projets’ - we must be the fastest railway. You could tell there was that mindset going on.”

After working on planes and trains with Virgin, Whitehorn went on to serve six years as president of Virgin Galactic. He believes that the space sector, together with AI (artificial intelligence) will lead technological advances in the years ahead.

“I am chair of a company called Seraphim Space Investment Trust,” he said. “We’ve invested ourselves alone in 28 new space companies over the past few years, many of whom are now becoming major players in the industry of supplying information and data from space that is essential for everything around us to work, from the production of food to insuring, shipping, you name it you are going to find space in the middle of it. And, AI alongside, that’s where the revolution is really going to take off.”

He believes that existing space technology could already have a transformational impact on rail. he explained: “The big change that is going to come even in the UK in rolling stock and railways, if we had the willpower to introduce the technology that already works, is to manage the train separations with moving block signalling but using space satellites now as well. And that would make the capacity no problem on the UK rail network.”

NEWS ROUND-UP 08 | 5 April 2024 www.passengertransport.co.uk

LISTEN TO THE FULL INTERVIEW leondaniels.co.uk/ podcast

Will Whitehorn believes that existing space technology could already have a transformational impact on rail

No resolution found for Van Hool’s future

Belgian company extends deadline to avoid bankruptcy

MANUFACTURERS

Belgian bus and coach manufacturer Van Hool this week announced that it will extend its efforts to secure a sustainable future for the company.

Belgian media reports have suggested that Van Hool has debts of more than €400m and the Mechelen Enterprise Court has approved a further week for the company to avoid bankruptcy and secure its future.

Van Hool had set a deadline of March 31 to reach a resolution that would safeguard as many operations and jobs as possible. It had outlined a recovery plan that would include the relocation of coach production to its existing

ISLAND RECOVERY NOW AT 100%

Jersey’s bus network returns to 2019 levels

PATRONAGE

Jersey’s bus passenger numbers have bounced back to pre-pandemic levels according to new data from operator LibertyBus. In 2023, island bus patronage recovered to 100% of its pre-pandemic figures.

In 2023 the Channel Island logged over five million individual bus journeys. A survey conducted by LibertyBus, the operator of the network for The States of Jersey, received over 3,200 responses. The survey indicated a slight decrease in commuting, attributed to remote work arrangements. Leisure travel constituted 37% of bus trips.

facility in Macedonia (PT309). However, complications arose due to an inheritance ldispute among the Van Hool family, which the company says remains unresolved.

Crisis manager Mark Zwaaneveld had previously issued an ultimatum to the family, all descendants of company founder Bernard Van Hool, urging them to resolve their dispute. This disagreement reportedly revolves around Bernard Van Hool’s decision to bequeath his shares in the manufacturer to his eight sons, excluding his two daughters. In 1999, three of the sons sold their shares to their brothers and their descendants, sparking legal action by the daughters.

Amid speculation about bankruptcy and a potential sale, Van Hool has engaged in discussions with prospective

buyers to explore options for relaunching the company.

Local media reports indicate that Van Hool staff were sent home for two weeks starting March 23, pending a decision on the company’s future, with sources suggesting that Van Hool is burdened with around €400 million of debt.

Potential buyers reportedly include Dutch conglomerate VDL, in collaboration with a third party, as well as industrial magnate Guido Dumarey, known for acquiring UK-based minibus manufacturer Mellor in late 2023.

A corporate turnaround specialist, Dumarey is said to advocate a swift resumption of operations at Van Hool if he completes a purchase, with some coach production continuing in Belgium under his ownership.

A NEW STAR IN THE NORTH EAST

Former Go North East commercial development manager Daniel Graham has launched his own bus operation. Graham said Northstar had been created to “lead the way in bespoke, highquality transport solutions” and commenced operations over the Easter weekend on a Tyne and Wear Metro replacement service with a single bus.

IN BRIEF

LOTHIAN DIVIDEND RESTORED

Lothian Buses will return dividends of £3.2m to its public sector owners for the first time since 2019 as a result of a strong performance in 2023. The operator reported an increase of over 17% in patronage with revenues reaching £176.6m.

“Our annual accounts for last year demonstrate continued recovery and growth since the pandemic, despite significant operating challenges and wider economic pressures,” said Lothian managing director Sarah Boyd.

BICESTER VILLAGE ELECTRIC

The shuttle bus service between Bicester Village retail complex and Bicester North has gone electric with the introduction of a Wrightbus Electroliner GB Kite single decker. Oxford Bus Company has operated the service, which is jointly funded by Value Retail PLC and Chiltern Railways, since 2020. The operator was recently awarded a further three-year contract to operate the shuttle service and the additional park and ride bus service, which serves Bicester Village on busier shopping days, until April 2027.

GREEN GRANT AWARDS

Transport for London has been awarded two grants totalling more than £16m from the Public Sector Decarbonisation Scheme. A grant worth £14m will be used to reduce carbon emissions at six sites on TfL’s London-wide estate. The second grant, worth more than £2m, will be used for carbon reducing measures at two London Underground depots. It will see heat pumps, solar panels, LED lighting, improved glazing and wall insulation installed at the sites, including head office Palestra.

www.passengertransport.co.uk 5 April 2024 | 09

Slow entry into use for Welsh infrastructure

Transport users are waiting months to use new infrastructure in Wales after construction work has been completed. Rhodri Clark reports

INFRASTRUCTURE

Passengers are waiting for months to use new Welsh transport infrastructure after the building work finishes.

The new facilities are part of the Welsh Government’s attempts to increase the proportion of trips made by public transport and active travel to 35% by next year, compared with 32% in 2019.

The new Cardiff Central bus station was due to open last summer after the Welsh Government stepped in with funding to rescue the original project, due for completion in 2017. Construction finished last year but Transport for Wales,

which has been fitting out the station, is unable to say when the £30m facility will open and which bus services will use it.

Construction of a £3.5m transport hub at Porth, Rhondda, was completed last summer but the facility remains unopened. Also completed last summer was a £7.1m new park and ride facility at Pontypool & New Inn station, including a new footbridge with lifts. The new car park and footbridge remain fenced off, with all passengers continuing to access the station via the subway and the steps up to the platform.

There was a similar delay last year after Quakers Yard station,

line was completed in December, enabling a new service to Newport to commence in January.

Cardiff Bus has warned for many years that the absence of a central bus station reduces bus passenger numbers in the city. The previous bus station closed in 2015 to make way for property development on the site.

Transport for Wales said construction of the new bus station had been delayed by about eight months as a result of Covid-19. TfW’s fitting out of the facility had not suffered delays and the bus station would open this spring. TfW was finalising the first operational date.

on the Merthyr Tydfil line, was closed in April for an expected two months while a second platform and new footbridge were installed. The station did not reopen until December, after TfW had provided a rail replacement bus for eight months. A £3m transport interchange at Barry Docks station was completed last summer but had no buses until January.

Not all new facilities have been slow to come into use, however.

Dinas Rhondda station, which was rebuilt with a second platform and a footbridge with lifts, opened on time in February. Additional capacity along the Ebbw Vale

Some of the land occupied by Porth’s new transport hub is owned by TfW and some by the local authority. TfW said the parties had agreed the principles on land ownership and operational matters. “There have been no delays attributed to these activities,” said a TfW spokesman. “The construction of the building is complete, except for very minor finishing works. Transport for Wales is also currently undertaking relevant quality assurance work required for the building to open. A target opening date will be announced later this year.”

TfW did not respond to questions about why the processes required at Porth and Quakers Yard had not been completed sooner and what lessons it had learned from the delays to the opening of new facilities.

Passenger Transport sent Torfaen council questions about the project at Pontypool station on March 19 but had not received a response as this week’s issue closed for press. When questions were raised in December about the delayed opening of the car park and footbridge, the council said the new assets were subject to safety testing.

NEWS ROUND-UP 10 | 5 April 2024 www.passengertransport.co.uk

Quakers Yard station remained closed for months after construction of platform and the new footbridge were completed

£9m spent on standby rail replacement buses

Amount exceeds shortfall in last year’s Bus Transition Fund

RAIL REPLACEMENT

Transport for Wales has revealed that it spent over £9m on standby rail replacement buses and coaches last year, taking its total rail replacement spend in 2023 to £25.4m.

TfW had at least one replacement vehicle in use or on standby every day in 2023. The only exceptions were Christmas Day and Boxing Day, when TfW does not schedule any trains.

TfW’s spending on rail replacement transport will reduce as the Core Valley Lines modernisation comes to a close and more of TfW’s new trains are in service.

A response to a Freedom of Information request reveals that TfW’s total pre-planned and emergency bus costs was

RAIL AND BUS SPENDING PLANS

TfW plan offers £223m for rail and £30m for bus

INVESTMENT

Transport for Wales has revealed its capital investment plans for 2024/25, including £223m for rail and £30m for “acquisition of buses and other bus advisory projects”.

Most of the rail capital investment budget, £166m, relates to the later stages of the Core Valley Lines (CVL) modernisation programme. There is also £57m for rail passenger services, including new trains and depot and station improvements. A further £14m of capital funding is budgeted

£25,401,892. This figure would have been significantly lower were it not for TfW’s policy of placing buses or coaches on standby around the rail network. Last year’s standby expenditure of £9,366,057 is almost 37% of the year’s total. TfW declined to explain to Passenger Transport why so much money was spent on standby vehicles.

The amount spent on standby replacement vehicles is more than the shortfall in last year’s Bus Transition Fund, which addressed the post-pandemic gap between revenue and costs on scheduled bus services. The Welsh Government admitted in the summer that the fund would not be enough to maintain the existing network, and many lifeline bus services were withdrawn or reduced during the year.

Network Rail, which is owned by the UK Government, covered some of TfW’s rail replacement

for renewals and management of TfW’s rail assets, says TfW’s business plan for 2024/25.

Bus industry sources are downbeat about how much the funding for acquisition of buses will achieve in this financial year. The Welsh Government aims for all TrawsCymru services, which are managed by TfW, to be zero emission by 2026.

Since the fleet is spread out across Wales, electrifying TrawsCymru will involve planning processes for, and investment in, many discrete charging facilities, each for small numbers of vehicles. The electric fleet will also require duplication of vehicles, because battery range is currently insufficient to cover a full

transport costs during the year, where buses or coaches were needed because TfW was unable to use Network Rail’s infrastructure.

Network Rail refunded a total of £11,625,211 in relation to planned closures for engineering works on its own railways and the Core Valley Lines (CVL). Although the CVL are owned by the Welsh Government, Network Rail administers the compensation payable to train operators when use of the CVL infrastructure is restricted. The system was created to ensure fairness between TfW and any other train operator which might use the CVL.

Colin Lea, TfW’s planning and performance director, said: “Rail replacement transport is vital so passengers can complete their journeys during times of planned improvement work, when there is disruption to services due to bad weather and other incidents,

day’s work on the longer TrawsCymru routes.

TfW’s revenue funding for 2024/25 includes £390m for rail passenger services and transport interchanges, £37m for “other rail-related spend” and £6m to support bus services. The bus support is separate from the Welsh Government’s funding this year for local authorities to maintain non-TrawsCymru services

TfW’s business plan also reveals a major expansion of capped contactless ticketing on trains, currently available only on TfW and CrossCountry services between Newport, Cardiff and Pontyclun and on the Ebbw Vale line.

“We’ve delivered a pilot of the

and to provide additional capacity and support when there are major events taking place, often at weekends or late evenings.

“With the once-in-a-generation work taking place as part of the South Wales Metro, such as the recent 10-month closure of the Treherbert line, we’ve been running more rail replacement services than normal but this will decrease as the transformational work is completed and more of our £800m fleet of brand new trains come into service.

“We have a dedicated road transport team who work to ensure we’re providing the right level of capacity for our customers, while also closely monitoring our spend on rail replacement transport.”

For several months in spring and summer 2023, TfW had to cancel services because the fleet of Class 175 trains was temporarily withdrawn in response to a series of fires on the units.

There was further disruption to services in the autumn when some of the new Class 197 trains suffered wheel damage and were temporarily withdrawn.

first Pay-As-You-Go network outside of London and the South-East of England,” says the business plan. “We intend to roll out Pay-As-You-Go across the entire CVL in 2024/25. This will make rail ticketing simpler, easier and better value for money for our customers.”

TfW has been reviewing retail sales channel costs. “A programme to ensure greater value for money has been established, including rolling out more dynamic revenue management pricing across the network, launching competitive sales products (advanced and multi-flex). A more innovative approach to fares and pricing is under development and will be rolled out across 2024/25.”

www.passengertransport.co.uk 5 April 2024 | 11

Ember raises £11m to accelerate expansion

Scottish coach operator, which launched full electric Edinburgh-Dundee service in October 2020, now funded to support roll out of new services

ELECTRIC VEHICLES

Electric coach operator Ember this month announced that it has raised an £11m Series A financing round. The company will use the funding to accelerate the rollout of its electric bus services and further invest in EmberOS, the platform that controls the network and delivers “a gamechanging customer experience”.

Founded in 2019 by Pierce Glennie and Keith Bradbury, Ember began operating its first service (E1, linking Dundee and Edinburgh) in October 2020 with two coaches. It currently has a fleet of 24 vehicles and launched two further routes: E3, DundeeGlasgow (launched in August 2022) and E10, Dundee Railway Stations-Dundee Michelin Scotland Innovation Parc (launched in January 2024).

Ember says that rather than just providing software to help legacy operators go electric, it is taking a full-stack, first-principles approach to create a new, highly optimised, all-electric network. It claims that this allows it to flexibly scale across multiple geographies and seamlessly adapt to shifting passenger demands to offer a superior customer experience at lower cost - all with zero emissions. This approach includes building its own dedicated ultra-fast charging network, designing and operating its own routes and working closely with its manufacturing partner on vehicle development. Everything is brought together by EmberOS,

the proprietary tech platform that orchestrates all operations - including charge management, routing, and end-to-end network optimisation.

The goal is to both take advantage of the superior margins achieved by optimal use of electric buses and to take cars off the road by offering a dramatically superior and far more climate-friendly travel experience at a lower cost.

Ember has five new charging hubs under parallel development, all modelled on its core hub blueprint. Ember’s Dundee hub is capable of delivering charging speeds of 600kW to a single bus, with a large proportion of the power coming from the 4MW of on-site wind turbines. Future hubs

are co-located with renewables where possible, further reducing energy costs.

Over 750,000 journeys have already been made with Ember and that’s expected to double over the coming year as the network expands. Ember will soon take delivery of the first batch of its next generation bus, with a 563kWh battery and a range of over 500 kilometres. Ember is running services 24/7 at an hourly frequency during daytimes. Each bus covers up to 900 kilometres per day with multiple high speed charging sessions.

Keith Bradbury, co-founder of Ember, said “Travelling by bus or coach doesn’t have to be rubbish. It should be possible to deliver

“Travelling by bus or coach doesn’t have to be rubbish. It should be possible to deliver an experience that beats a car”

Keith Bradbury, co-founder of Ember

an experience that beats a carbecause someone else is doing the driving so you can have your time back - but that requires a relentless focus on the passenger experience. Things like live tracking that actually works, super-simple pricing, easy ticket changes and near-perfect reliability.”

“Under the hood it’s a delightfully complicated problem to solve” adds Pierce Glennie, co-founder of Ember. “EmberOS is the digital twin of our network, and we continue to add layers of data that enable the system to always know what’s going on. That means things like real-time vehicle states, current traffic conditions, nearby bus lanes, battery cell temperatures and the health of our chargers. When you put all of that together you can really bring down operational costs and deliver a better experience.”

The £11m Series A financing round was by Inven Capital, 2150 and AENU. Existing investors Pale Blue Dot and SkyScanner co-founder Gareth Williams also participated in the oversubscribed round.

Daniel Edgerley, investment director atInven Capital said: “We have been impressed with both Keith and Pierce as founders and as visionaries of the future of shared transportation. Our commitment to the company underscores our belief in their customer-centric and innovative approach to electrification and digitalisation across the business.

“Their decision to fundamentally link their smart infrastructure design, assets and technology platform enables unparalleled optimisation, as well as visibility and data-evidenced insights that gives clean transportation a clear advantage over incumbent solutions. We are excited to be a part of Ember’s mission of revolutionising transportation.”

12 | 5 April 2024 www.passengertransport.co.uk NET ZERO

Ember currently has a fleet of 24 vehicles

SBS pioneers use of predictive maintenance

Singapore’s main bus operator rolls system out across fleet

ARTIFICIAL INTELLIGENCE

SBS Transit, the biggest public bus operator in Singapore, and Stratio, provider of predictive maintenance for public transport, have announced a strategic collaboration that will boost service reliability of SBS Transit’s buses through a fleet-wide implementation of predictive maintenance technology.

The partners claim that it marks the first-ever deployment of predictive maintenance of this scale representing 62% of Singapore’s public bus fleet.

Powered by Artificial Intelligence (AI) and Machine Learning (ML) algorithms, the solution by Portuguese Stratio provides an early warning system that enables technicians to anticipate and correct faults before they can lead to bus breakdowns.

QR CODE READERS FOR BUSWAY

Stagecoach equips buses with new techology

TICKETING

Buses in Bedford and on the Cambridgeshire Busway are set to get new QR code readers. The technology will be installed on 65 buses working out of Bedford and 45 buses working out of Fenstanton. It is hoped that they will speed up boarding times and also make life easier for drivers as they will no longer need to manually record tickets on the Stagecoach app.

In April 2022, SBS Transit started installing this system on 1,000 of its buses and experienced at least a 20% drop in bus breakdowns. With positive feedback, it has begun to install it fleet-wide where work is expected to complete by the end of 2024.

With the deployment of this technology across more than 3,000 SBS Transit buses, its maintenance teams will gain real-time visibility over critical systems and components such as brakes, electric systems, and fluid levels, and will be able to remotely monitor data from over 200 vehicle parameters. This will effectively minimise downtime, save costs, and enhance passengers’ experience.

With this new phase of roll-out,

the system will also be equipped with the ability to predict faults with the bus air-conditioning system where failures related to it rank among the top three leading causes of bus repairs. Being able to spot early signs of trouble would improve commuter experience.

The Stratio bus condition monitoring system will also be piloted on the electric buses that SBS Transit operates. Significantly, it will monitor the state of health of the bus battery pack for operational efficiency and effectiveness.

As part of the collaboration, both partners will also work on refining condition monitoring features that are better matched to Singapore’s weather and road

“We are committed to bus service reliability as part of our efforts to promote public transport usage”

Jeffrey Sim, Group CEO of SBS Transit

The QR code readers will give more accurate data to help with service planning, so that the bus operator can better understand customers’ travel needs and plan routes accordingly.

Customers, who currently show the driver the in ticket on their mobile phone, will now just scan their mobile phone on the QR code reader. Stagecoach East managing director Darren Roe said: “We always want to look to the latest technology which will help our customers to access our services easily and conveniently, and these QR Code Readers will really add to our offering.”

conditions that could extend their lifecycle, support operations, and ensure a successful transition to zero emission buses. This will involve collecting relevant data as part of the process and this project is expected to complete by the end of 2025.

Jeffrey Sim, Group CEO of SBS Transit, commented: “We are committed to bus service reliability as part of our efforts to promote public transport usage. It is also aligned with our sustainable mobility roadmap. With this bus condition monitoring system, we are able to anticipate faults and undertake predictive maintenance and contribute to better service reliability and elevate our passengers’ travel experience. “As a leading public transport operator, we have also taken a step forward by extending this predictive maintenance technology to our fleet of electric buses where 50% of Singapore’s public fleet will be green by 2030. Our investment in this system will enable us to do a better job at operating and maintaining these zero-emission vehicles and we will continue to set the standards for the industry.”

The technology will be

www.passengertransport.co.uk 5 April 2024 | 13 INNOVATION & TECHNOLOGY

installed on 65 buses working out of Bedford and 45 buses working out of Fenstanton

COMMENT

NORMAN BAKER

Pigs don’t fly but taxis are taking off

There’s nothing new about the concept of avoiding traffic by travelling overhead, but flying taxis could take this to another level

Congestion: here is an issue to unite everyone from the extreme petrol heads through to the greenest environmentalist.

Nobody benefits from this, not the motorists sitting alone in their far too large SUVs, nor the passengers on a bus boxed in by cars and vans going nowhere. And certainly not the economy. Data published by the Inrix Global Traffic Scorecard showed that congestion cost the UK economy £8bn in 2021, equivalent to an average of £595 per driver.

The traditional approach to this problem from government has been to build more roads, and wider roads, even if this has meant demolishing town centres or slicing through beautiful countryside. It is in fact still a favoured approach from the present administration, even though as long ago as 1994, a seminal report from the snappily named Standing Advisory Committee on Trunk Road Assessment (SACTRA) proved beyond doubt that providing more road space simply generates more vehicle movements. You can’t build your way out of congestion. At best, you just move it.

Then along came the idea of modal shift, which as a concept has gone in and out of fashion like the tide for almost 30 years. Getting people onto public transport (and some buses can take up to 90 passengers) or cycling or walking, or nowadays using Zoom or Teams to avoid travelling at allhere are the green ways to cut congestion. The idea is currently out of fashion with the present government and their divisive and self-defeating, so-called Plan for Drivers, seeking to limit bus lanes and the like, will only make congestion worse for drivers.

The latest idea is to bypass the roads altogether and use the air.

Using the space above the road is of course not new, demonstrated by the numerous rail lines which do so on viaducts, embankments or stilts. Even the ‘Underground’ has long sections which do this, such as those on the lines from Earl’s Court to Wimbledon, or Paddington to Hammersmith.

Last month I visited perhaps the most dramatic example of this, namely the monorail, or Schwebebahn, in Wuppertal, Germany. This is the world’s oldest operating suspension monorail, where the vehicle is connected with wheels to a fixed track above, as opposed to using a cable.

The Wuppertaler Schwebebahn (suspension railway)

14 | 5 April 2024 www.passengertransport.co.uk

“Aviation stands on the cusp of its next, potentially biggest, revolution since the jet engine”Sophie O’Sullivan, CAA

The initial idea in fact came from Britain, pioneer of so much in terms of railway. The British engineer Henry Robinson Palmer filed a patent application for a horse-drawn suspended single-rail system in 1821, and constructed a demonstration at Woolwich Arsenal soon after.

The Wuppertal system is over eight miles long and carries 20 million passengers a year. Much of it is built over a river, making it a creative transport corridor.

It was inaugurated with a test run in 1900 by Kaiser Wilhelm II and was an immediate success. The surprise is that it was not widely replicated across Germany. For a long time the only other such system in the country was in Dresden, opened in 1901, subsequently added to by the H Bahn in Dortmund in 1984 and, close to Wuppertal, the Sky Train at Dusseldorf airport in 2002. Perhaps the huge amount of ironwork required acted as a deterrent.

Moreover, the concept has not really set the world alight. There are today outside Germany just six operating suspension monorails across the world. These can be found in Russia, Japan and China.

The Wuppertal ride itself is smooth though the vehicle does tilt going round curves, which reminded me of the tilting Advanced Passenger Train which British Rail developed in the 1970s and introduced in 1981. That of course led to various jokes such as “Waiter, have you seen my sausage roll?”. The train, which operated on the curve-heavy West Coast Main Line, had a short life, though today’s Pendolinos on that line also tilt.

At first glance, I did wonder how safe the system was, with vehicles and passengers being held from above by seemingly not very much. Yet there have really only been two incidents since the line opened. In 1950, someone had the bright idea of carrying an elephant, Tuffi, on board for advertising purposes. The animal duly panicked and crashed through the side of the carriage and plunged into the river below. Fortunately, all she suffered was a bruise. Tuffi by name and nature.

More seriously, on April 12, 1999, the first train of the day struck a steel component that had been left attached to the line by workmen. The impact tore the first bogie and the vehicle fell into the river about 30 feet below. Five people died and 47 were injured.

The latest use of air, however, will not be relying on structures to support it. Under

the Department for Transport’s recently released Future of Flight Action Plan, flying taxis could be taking to the skies as early as 2026, with driverless taxis commonplace by the end of the decade.

If this sounds like something out of Flash Gordon, be assured that reality has caught up with science fiction.

The first certified passenger-carrying automated driverless flying car has been given the go-ahead in China and will begin service shortly. It can carry two passengers or 270kg of cargo. Battery powered, it can reach speeds of 80mph with a range of 18 miles. A central command centre controls the flight path, altitude and speed. Passengers select their destination by using a touch screen inside the pod. It uses vertical take-off and landing so does not require expensive ground-based infrastructure.

Successful pilotless test flights have also taken place in Slovakia and Japan. In the United States, the Federal Aviation Administration has issued a timeline for certification. The UK, through the Civil Aviation Authority, has a similar authorisation process underway.

This is no quirky sideline but likely to be mainstream business. The investment banking outfit Morgan Stanley reckons that the global air mobility market will be worth one trillion dollars by 2040, and nine trillion by 2050.

“Morgan Stanley reckons that the global air mobility market will be worth one trillion dollars by 2040”

There are obvious questions to answer, notably how safe these vehicles will be, not least because of the expanding use of drones and the potential for collisions.

The really pertinent question is how widespread the use of these taxis will be. Are they going to be expensive trips, available only for the very rich and those who love helicopters, like the prime minister? Or as battery technology in particular advances, are they going to draw people away from private cars, buses, trams and even trains? Are they going to be used just for short hops or for longer journeys as well?

The CAA’s head of innovation, Sophie O’Sullivan, says: “Aviation stands on the cusp of its next, potentially biggest, revolution since the invention of the jet engine.”

The aviation minister, Anthony Browne, also uses the word revolution, and predicts that the adoption of new technology could boost the country’s economy by £4bn in just this decade - a huge figure. He also talks about how this development can “reinvigorate smaller aerodromes” by using them as vertiports for electric aircraft.

Someone at the DfT needs to do some serious mapping as to what this new kid on the block will mean for transport choices, and therefore in turn for transport investment. If it is to be a rich person’s plaything, then the impact on other modes will be minimal. But if, for example, it is going to be possible for large numbers to fly at reasonable cost between Brighton and Eastbourne, does the country really need to spend over £1bn as is mooted on an environmentally destructive dual carriageway between those places, on the A27 between Lewes and Polegate? (Does it anyway, in fact, given there is a really good railway service between Brighton and Eastbourne via Lewes and Polegate).

It seems clear the flying taxi is coming, for better or for worse. The challenge now is to make sure it is safe, environmentally friendly, and plays a positive rather than disruptive role in our transport mix.

ABOUT THE AUTHOR

Norman Baker served as transport minister from May 2010 until October 2013. He was Lib Dem MP for Lewes between 1997 and 2015. What impact will air

www.passengertransport.co.uk 5 April 2024 | 15

taxis have?

ALEX WARNER

Survey shines light on customer views

The Your Bus Journey survey of bus users by Transport Focus provides insights and a league table we should all care about

Who was surprised by the Transport Focus ‘Your Bus Journey’ scores? I certainly wasn’t and felt faintly reassured by the results as it proved the merits of a mix of my many mystery shops across the UK’s bus network, alongside gut instinct and a glimpse into some of the internal workings of companies. I could have predicted some of those topping the tables and maybe also those languishing in and around the relegation zone.

I’m delighted that the top four in the survey are all members of my Great Scenic Journeys scheme. I’m not for one second suggesting I had a hand in their success in any shape or form, more that their subscribing to our marketing and customer service proposition demonstrates that they care about what customers think and how to improve satisfaction, and also intensify their marketing to get bums on seats. Throughout my time in consultancy, I’ve tended to find that those who want to engage are those who actually fret about customers having a good journey and are attentive in providing a strong, customer-driven proposition and good marketing. Time and again, they tend to be the ones that win awards. The businesses that reached the heights are all, in my view, led by fine leaders and strong teams - grounded, not rah-rah, self-obsessed sorts but those who quietly get on with the job in hand, building on their significant experience they also have longevity in their roles and in turn an intimate knowledge of their local market garnered over a lengthy

period, where they’ve seen the nuances, peaks and troughs of trends in market conditions. Marc Reddy, Andrew Wickham, Ben Gilligan, and Dave Astill - when the results were unveiled, did anyone think of those at the helm of these companies and feel a sense of surprise? No, these are folk with the highest of reputations in the industry and having mystery shopped fairly extensively the services at all

“The businesses that reached the heights are all, in my view, led by fine leaders and strong teams”

these companies, I concur that their all-round proposition, particularly the friendliness of their drivers, is absolutely first rate, so too the marketing, under the stewardship of the crème de la crème of the transport industry’s commercial talent.

I could have predicted others in the top 15. We’ve all long known, for instance, that Trentbarton’s attentiveness to customer service has been unstinting for many years now and a legacy has been created. No shock that their bus drivers hit the top spot. For many years they’ve run a driver mystery shopping programme which is the most fastidious in the industry, with every report initiating a conversation between the depot manager and the driver, irrespective of its content and with awards aplenty for high performers.

The nationwide score for driver satisfaction was 85%, with a span between the best and worst results (between 74% and 93%). On the one hand, a figure of 85% belies that lazy, age-old stereotype that bus drivers are miserable, grumpy so-and-sos. However, it’s not really a cause for celebration, in that 15% of customers board a bus and are dissatisfied with the driver. Again, from my various mystery shops of the UK, I’m not really surprised by some of the league table placings here and I know for a fact that all those in the top 10 have invested heavily in improved training, development and performance management of their drivers when it comes to customer service - ahem, some with Yours Truly (shameless sales pitch here, I know…).

Meanwhile in South Essex, in Ensign Bus, First has acquired a small company, fiercely proud of its commitment to providing a high quality customer service and under the leadership of Garry Nicholass, you’ll struggle to find someone more integrated in the local market or more driven to proactively identify and meet current and future customer needs. Morale there is high, as it is at those other high flyers. I’m not surprised either to see Go Ahead’s Cornwall business right up there too - another to benefit from a longstanding managing director, in Richard Stevens, who has his finger on the pulse on the requirements of his local community. Reading Buses continue to be ‘there or thereabouts’ and so too Transdev, a company which perfectly sets its business up to succeed, devolving accountability to small individual business

Levels of bus users satisfaction were high in East Yorkshire

16 | 5 April 2024 www.passengertransport.co.uk COMMENT

units that reflect the specific nuances of each market that they serve. I’ve long bored anyone who cares to listen that its number 36 bus from Leeds to Harrogate and Ripon sets the benchmark across every customer touchpoint for bus services across the UK and beyond.

It would be unfair of me to comment as extensively on those in the bottom spots.

If you are in Arriva West Yorkshire’s shoes, you’ll be feeling the pain right now - I don’t know this organisation, but I do know that Arriva has been through much change in recent times, moving to a more centralised structure and now slightly more devolved. The protracted Arriva Group sale process won’t have helped - with that there will have been inevitable uncertainty and there has been a fairly high level of turnover in the bus division in recent years. However, there are some very good people, particularly in the West Yorkshire business, and challenges don’t get overcome quickly. The road to recovery takes time, but I would be surprised not to see them climb the league table in future years.

It would be interesting for a nationwide employee satisfaction survey to be conducted around the same time as Transport Focus Your Bus Survey scores. I would bet my model railway in the attic on there being a very strong correlation between staff and customer engagement. From my fairly good insight into those top four companies, their people are hugely motivated and engaged, benefiting from an understanding, empathetic and credible leadership and one that focuses in an authentic, sincere, undersold and unpatronising way on employees. Those languishing in the lower regions of the Transport Focus survey tend to be companies where I hear tales of a communication vacuum or those that have just lost their way a little and need to galvanise their team around a unified, exciting plan and narrative. Others are those where sometimes leadership is high profile and noisy but lacking self-awareness and a realisation that their messaging is totally at odds with the actions their organisation takes towards its people.

The Transport Focus results hit the headlines around the time that Greater Manchester franchising also dominates the narrative across our sector, and it’s worth a mention given that the latter is designed to improve customer satisfaction. Unlike the Transport Focus scores,

The test for franchising will be in around two years when it has calmed down. We’ll see how the traditional operators have settled into the required new approach”

it’s difficult to accurately determine how it’s all going as there as so many conflicting stories. That Go North West, purveyors of the initial franchised services are third from bottom in the league table, one above Diamond North West is interesting. Stagecoach, who last weekend took over services from their Queens Road depot, have fared markedly better towards the top and this bodes well. Under Rob Jones’ leadership, their part of the Bee Network is in the most reliable of hands. I would expect Diamond to score better next time round as they’ve put a lot of effort into driving customer satisfaction and are building something impressive here, the results of which will be yielded in due course, I feel.

It’s difficult unless you are a regular bus customer in Greater Manchester to determine if franchising has been a success, including the transition from old to new operators as part of Tranche 2. Ignoring the industryled social media outputs in some quarters, and digging deeper into posts from actual customers, many claim it’s been a worsening service, caused by driver shortages and vehicle unreliability. Next year’s Transport Focus surveys could be the real crucial test.

I confess to being pretty won over by the concept of franchising. I like the uniformity and the focus on customer service and also the profile that it has shone on the value of bus services in Greater Manchester and other cities on the horizon. It’s also been pleasing to witness, first hand, in some parts, strong, quiet but effective collaboration between operators to achieve a seamless transition and respect that this is an emotional time for many drivers, transitioning to a new employer and environment after many years without change. I know for a fact there’s been a lot of emotion felt by drivers, those whose daily lives are most affected by changes in employer. Some are relieved to move, others excited and many feeling nervous apprehension. Just as when a railway franchise changes hands, we should never underestimate the impact on frontline employees and the ability to manage the transition in a grounded, empathetic

manner will undoubtedly have an impact on the mood of drivers when they are behind the wheel and interacting with customers. It’s only human nature.

The test for franchising will be in around two years when it has calmed down. We’ll see how the traditional operators have settled into the required new approach and also the impact of newcomers such as ComfortDelGro, who have fared well in the Tranche 3 selection and have a growing and increasingly glowing reputation.

Another interesting feature of the survey was the fairly even spread across the league table of the various owning groups. All of the big players experienced placings at various ends of the table, with there not really being an apparent flux of one group dominating the top spots. This suggests perhaps that however great an operator is, overall satisfaction can still be determined by a whole range of other factors, sometimes out of their control, such as the condition of bus stops, a lack of bus priority measures or occasionally subjective stuff such as the extent at which many journeys are ‘distress purchases’, where there is no alternative or for moribund reasons, such as commuting, as opposed to fun days out or with lovely scenery out of the window. Survey someone who has just got off an open top bus by the seaside and they’ll tend to be in a better mood than the person who is reflecting on his or her daily grind to work or trip to the doctor.

And if we’re really getting subjective here (trust me, folk throw this accusation at me when I reveal my own customer survey results), people in X part of the country tend to be cheerier, more appreciative ‘glass half full’ types, than those self-entitled whingers who reside in Y. I’m not daring to reveal actual place names here, suffice to say us lovely lot in leafy Surrey are always keen to accentuate the positives and heap praise, of course.

Apart from its North West business and maybe its North East company, where prolonged industrial action didn’t majorly dilute the customer satisfaction survey scores

CONTINUED ON PAGE 18

www.passengertransport.co.uk 5 April 2024 | 17

CONTINUED FROM PAGE 17

as much as might have been expected, all the other Go Ahead brands, performed very strongly indeed and were more consolidated at the upper echelons than their peers.

Another excellent job done by Go Ahead’s hugely popular regional supremo Martin Dean and the superb, devolved structure in play there, where the focus is intently on local markets and the needs of customers.

Arriva were out of the top spots and predominantly in mid-table combined with a presence in the lower regions, whilst First appear to have enjoyed more success its Kernow, South Yorkshire, Leicester and York companies compensating for travails in West of England/North Somerset and alwayschallenging Norfolk. Stagecoach enjoyed mainly highs and despite a few struggling results, they were, in footballing terms, akin to my beloved Crystal Palace in never falling below lower to mid-table and at no point genuinely in danger of the relegation zone. These are really interesting times. The return of the Transport Focus survey delighted me because it shone the light after some time in the shadows on customer sentiment and created a sense of competitiveness among regions and operators. I wonder if in future times, we may see the survey treated with such importance, that managing directors are hired and fired on the basis of the results? A league table is guaranteed to solicit interest and be a call to action, so too the results of winners and losers in a competitive tender, such as Greater Manchester franchising. Other locations across the UK will in the coming months and years be embarking on their own versions of franchising. Buses will become more high profile and the stakes will be higher than ever. If this doesn’t excite you - nothing will.

ABOUT THE AUTHOR

Alex Warner has over 30 years’ experience in the transport sector, having held senior roles on a multi-modal basis across the sector. He is co-founder of transport technology business Lost Group and transport consultancy AJW Experience Group (which includes Great Scenic Journeys). He is also chair of West Midlands Grand Rail Collaboration.

The albatross and the elephant

The Scottish Government’s Fair Fares Review has grabbed headlines but it cannot address the biggest transport challenges