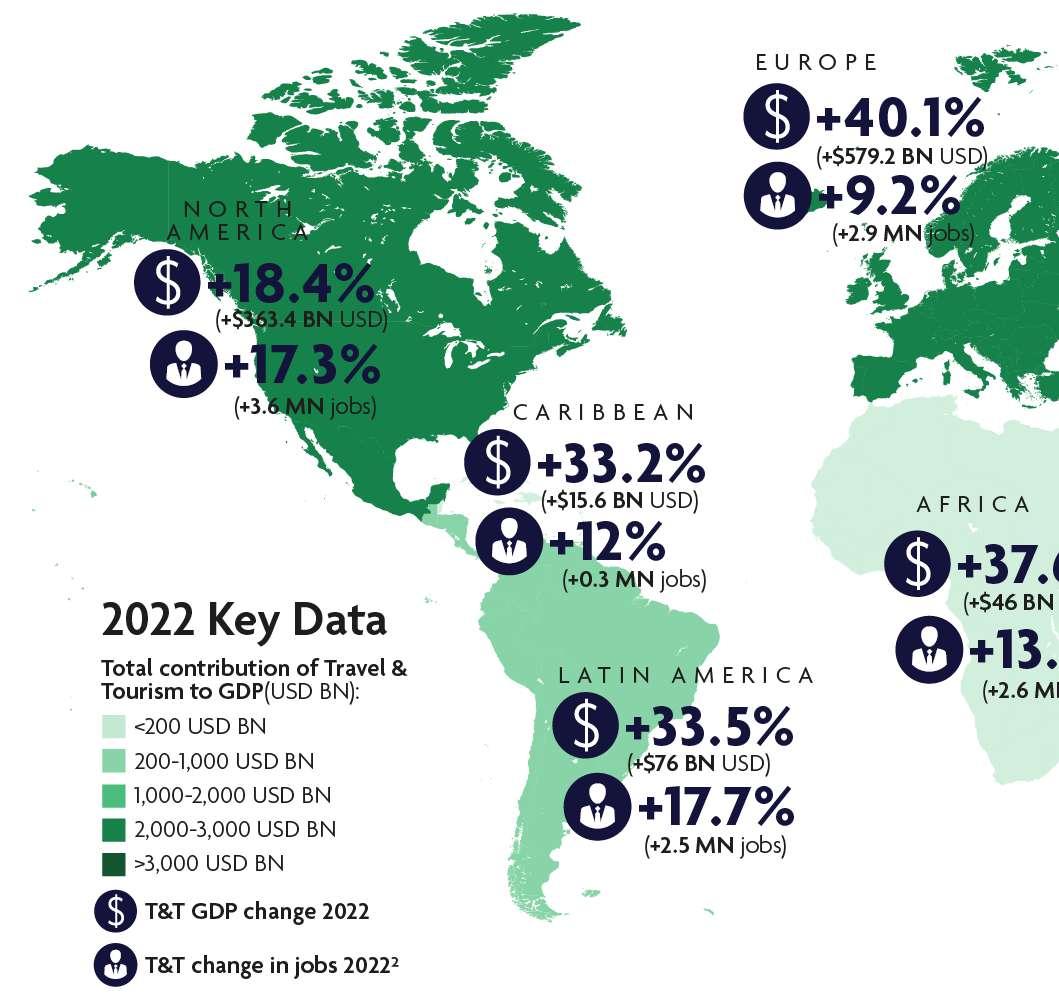

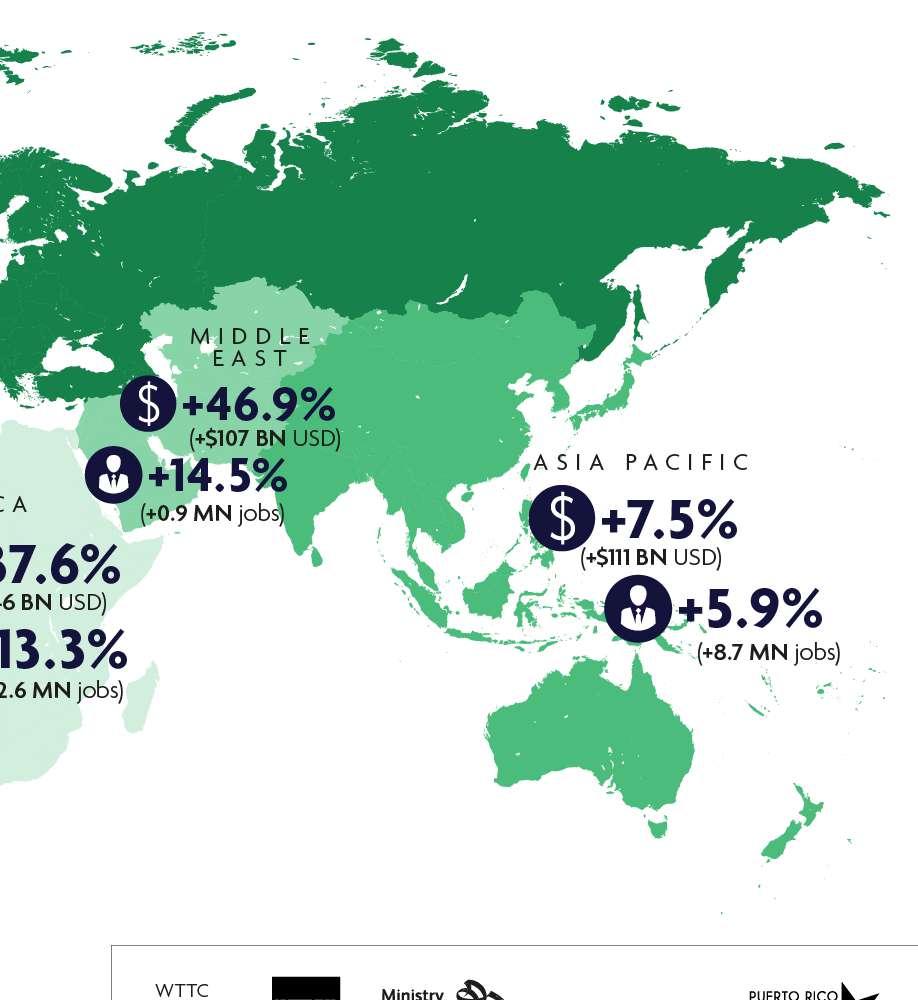

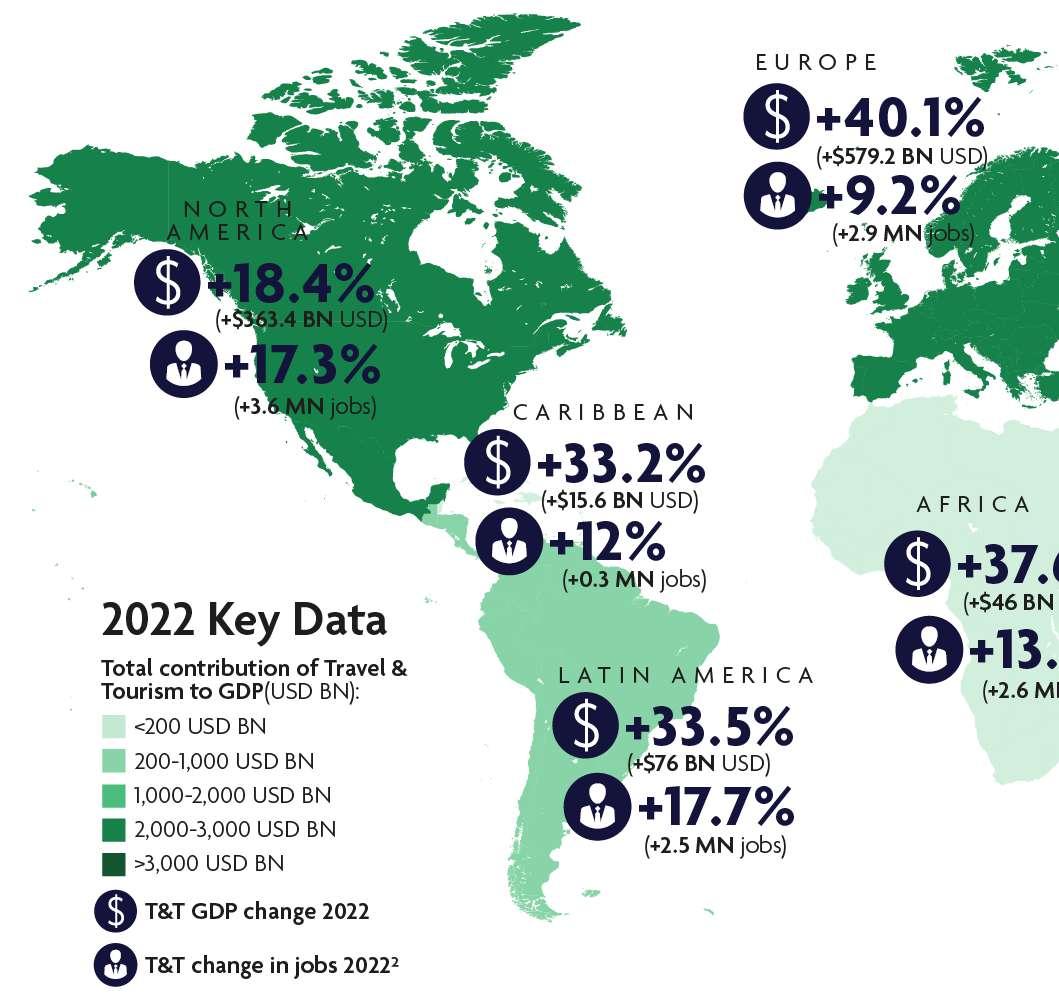

According do WTTC, prior to the pandemic, Travel & Tourism (including its direct, indirect, and induced impacts) accounted for 1 in 5 new jobs created across the world during 2014-2019, and 10.3% of all jobs (334 million) and 10.4% of global GDP (US$ 10 trillion) in 2019. Meanwhile, international visitor spending amounted to US$ 1.9 trillion in 2019.

WTTC’s latest annual research shows:

In 2022, the Travel & Tourism sector contributed 7.6% to global GDP; an increase of 22% from 2021 and only 23% below 2019 levels.

In 2022, there were 22 million new jobs, representing a 7.9% increase on 2021, and only 11.4% below 2019.

Domestic visitor spending increased by 20.4% in 2022, only 14.1% below 2019.

International visitor spending rose by 81.9% in 2022, but still 40.4% behind 2019 numbers.

BRAZIL AND LATIN AMERICA

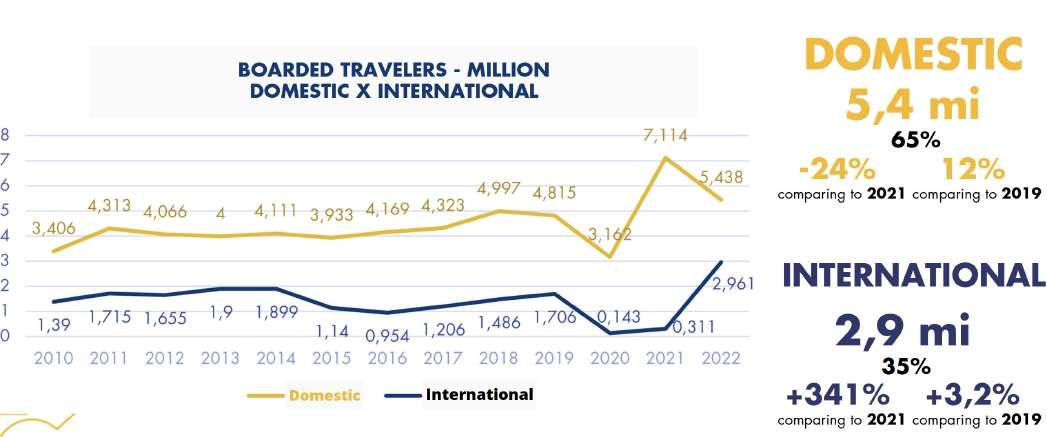

Latin America numbers show a great recovery compared to 2019 figures:

- 3.9% in passengers (2022 x 2019)

- 4.1% in revenue (2022 x 2019)

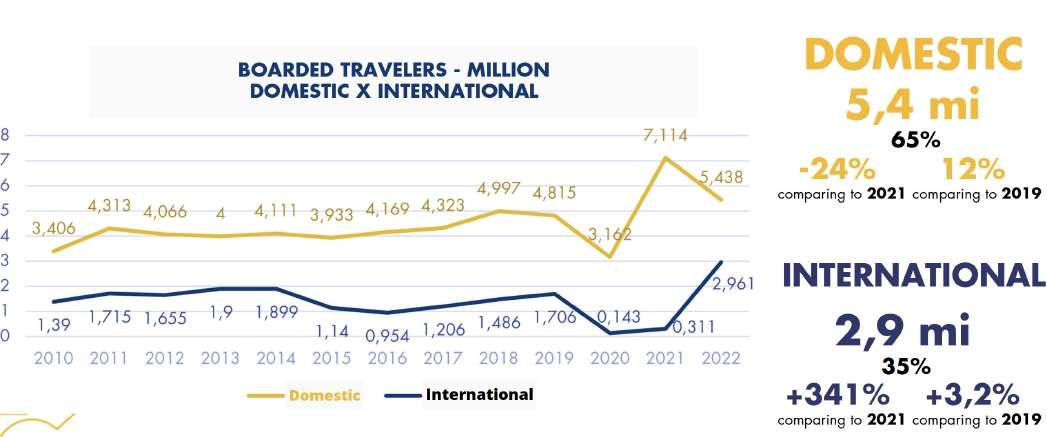

Brazil itself has reached 96% of the pre-pandemic air travelers

The Tourism revenue was US$ 40 billion in 2022 (+28% over 2021), according to FecomercioSP study

PANROTAS Brazilian Overview 2023/2024 3

INTRODUCTION

PANROTAS Brazilian Overview 2023/2024 4 BRL 667.8BN (USD 123.7BN) BRL 458.9BN (USD 85.0BN) BRL 558.6BN (USD 103.5BN) Change: -31.3% Change: +21.7% Economy change: -3.6% Economy change: +4.4% 8.1% of total jobs 7.2% of total jobs 7.0% of total jobs Change: -18.9% Change: +2.9% BRL27.6BN BRL17.3BN BRL15.4BN 2.3% of total exports 1.2% of total exports 0.9% of total exports (USD 5.1BN) (USD 3.2BN) (USD 2.9BN) Change: -37.4% Change: -10.6% BRL436.9BN BRL288.4BN BRL374.8BN (USD 80.9BN) (USD 53.4BN) (USD 69.4BN) Change: -34.0% Change: +29.9% 7.67MN 6.22MN 6.40MN 2019 2020 2021 7.7%5.5% 6.4% Brazil Key Data Visitor Spend: of Total Economy 10.3% Total GDP contribution: 2019 5.3% 2021 USD 9,630 BN Total Travel & Tourism jobs: 333 MN = 1 in 12 jobs 289 MN Change in Jobs2: -62.0MN = -18.6% Travel & Tourism GDP change: Domestic: International: of Total Economy = 1 in 11 jobs 2020 6.1% USD 5,812 BN USD 4,775 BN 271 MN = 1 in 10 jobs -50.4% =USD -4,855 BN (Economy GDP = -3.3%) +21.7% =USD 1,038 BN (Economy GDP = 5.8%) +18.2MN = + 6.7% Total contribution of Travel & Tourism to GDP: of Total Economy Total contribution of Travel & Tourism to Employment: BRL 667.8BN (USD 8.1% of total jobs BRL27.6BN 2.3% of total exports (USD 5.1BN) 7.67MN 2019 7.7%5.5% BRAZIL 2022 Global Data Brazil Key Data Visitor Spend: of Economy 10.3% Total GDP contribution: 2019 5.3% 2021 USD 9,630 BN International: 2020 6.1% USD 5,812 BN USD 4,775 BN Total contribution of Total contribution of

TRAVEL & TOURISM 2022

ECONOMIC IMPACT 2023 1

KEY HIGHLIGHTS FROM WTTC

PANROTAS Brazilian Overview 2023/2024 6

1. All values are in constant prices & exchange rates. As reported in March 2023

Global Data

2. Where the country or region has implemented job support schemes and supported jobs are still recorded as employment by national statistical authorities, job losses exclude those supported jobs (where known)

Total GDP contribution:

10.3%

5.3%

6.1%

Brazil Key Data

Total contribution of Travel

7.7%5.5%

of Total Economy

Total contribution of Travel

7.67MN

total jobs

PANROTAS Brazilian Overview 2023/2024 7

BRL 667.8BN (USD 123.7BN) 8.1% of

2019

BRAZIL 2022 Annual

Visitor

Spend:

2019

2021 USD

2020

9,630 BN

USD 5,812

USD

BN

4,775 BN

BRAZIL OFFICIAL INFORMATION

OFFICIAL NAME: Federative Republic of Brazil

GOVERNMENT SYSTEM: Federal Presidential Republic

PRESIDENT:

Luiz Inácio Lula da Silva

CAPITAL: Brasília

LANGUAGE: Portuguese (whenever possible bring promotional material and have your website in Portuguese)

LOCATION: South America

AREA: 8.516 million km² or 3.288 million mi²

POPULATION: 207.750.291 million (Preliminary population of municipalities based on IBGE 2022 Population Census data collected up to December 25, 2022)

CURRENCY: REAL

CITIES: 5.570

DIVISION: Brazil is divided into five regions with 26 states and one Federal District

MAJOR CITIES: São Paulo, Rio de Janeiro, Porto Alegre, Belo Horizonte, Fortaleza, Recife, Salvador, Curitiba, Florianópolis, Manaus and Brasília

OFFICIAL TIME ZONE: GMT3

INTERNET TERMINOLOGY: .br

INTERNATIONAL DIALING CODE: +55

LIFE EXPECTANCY: 77 years (considering the year of 2021 and excluding the covid-19 pandemic)

OFFICIAL WEBSITE: www.gov.br/planalto/en and www.visitbrasil.com/en/

MINISTER OF TOURISM: Daniela Carneiro

EMBRATUR PRESIDENT: Marcelo Freixo

PANROTAS Brazilian Overview 2023/2024 8

BRAZIL IS THE 12TH GLOBAL ECONOMY

Brazil’s GDP was US$ 1.92

TRILLION (or R$ 9.9 trillion) in 2022

2022

GDP growth: 2.9%

Projection for 2023: + 1.4% (According to Ipea)

ECONOMIC PERFORMANCE

Inflation 2022: 5.79%

Projection for 2023: 5.6%

Unemployment rate 2022: 9.3%

Projection for 2023: 8.75%

Interest rate 2022: 8.16%

Projection for 2023: 8.25%

Exchange rate average 2022 ± R$ 5.20 to US$ 1

Projection for 2023: ± R$ 5.25 to US$ 1

Consumer confidence (dec/22): 88 (was 75.5 one year before - 2022)

Family expenditures 2022: + 4.3%

Services growth 2022: + 4.2%

Sources: BCB, CNI, FGV, IBGE, IMF, Ipea

PANROTAS Brazilian Overview 2023/2024 9

BRAZIL: LARGEST \ GDP IN LATIN AMERICA

Brazil’s GDP is more than 3 times larger than Argentina’s, more than 6 times larger than Chile’s or Colombia’s and more than 8 times larger than Peru´s.

PANROTAS Brazilian Overview 2023/2024 10 COUNTRY GDP/2021 (IN US$ BILLION) POPULATION IN 2021 (IN MILLIONS) INTERNATIONAL ARRIVALS (IN MILLIONS) Brazil 1,920.00 (2022) 207,750.291 (2022) 3.6 2022 Mexico 1,270.00 126,705,138 31.9 2021 Argentina 487.23 45,808,747 0.3 2021 Chile 317.06 19,493,184 0.2 2021 Colombia 314.46 51,516,562 2.1 2021 Peru 223.25 33,715,471 0.4 2021 Cuba 107.35 (2020) 11,256,372 0.4 2021 Ecuador 106.17 17,797,737 0.7 2021 Dominican Republic 94.24 11,117,873 5.0 2021 Guatemala 85.99 17,109,746 0.6 2021 Costa Rica 64.28 5,153,957 1.3 2021 Panama 63.61 4,351,267 0.6 2021 Uruguay 59.32 3,426,260 3.1 2019 Venezuela 42.53 28,199,867 0.3 2019 Bolivia 40.41 12,079,472 0.2 2021 Paraguay 39.5 6,703,799 0.1 2021 El Salvador 28.74 6,314,167 1.2 2021

Source: The World Bank, UN and UNWTO

BRAZILIAN POPULATION BY REGION DEZ 2022 (IN MILLION)

LARGEST CITIES IN BRAZIL DEZ 2022 (POPULATION IN MILLION)

PANROTAS Brazilian Overview 2023/2024 11

North Region 17,834,762 Northeast Region 55,389,382 Southeast Region 87,348,223 South Region 30,685,598 Midwest Region 16,492,326 TOTAL 207,750,291

1 São Paulo 12,200,180 2 Rio de Janeiro 6,625,849 3 Brasília 2,923,369 4 Salvador 2,610,987 5 Fortaleza 2,596,157 6 Belo Horizonte 2,392,678 7 Manaus 2,054,731 8 Curitiba 1,871,789 9 Recife 1,494,586 10 Goiânia 1,414,483 11 Porto Alegre 1,404,269 12 Guarulhos 1,383,272 13 Belém 1,367,336 14 Campinas 1,170,247 15 São Luís 1,061,374

BRAZILIAN POPULATION

BRAZILIAN’S EXPENDITURES GDP IN INTERNATIONAL TRANSACTIONS (INCLUDES TRAVEL AND OTHER PURCHASES)

2022: US$ 12.18 billion

2021: US$ 5.2 billion

2020: US$ 5.3 billion

2019: US$ 17.6 billion

2018: US$ 18.26 billion

2017: US$ 19 billion

2016: US$ 14.5 billion

2015: US$ 17.36 billion

2014: US$ 25.57 billion

2013: US$ 25 billion

2012: US$ 22 billion

2011: US$ 20.8 billion

Sources: Banco Central do Brasil (Brazil Federal Bank)

PANROTAS Brazilian Overview 2023/2024 12

BRAZIL’S ECONOMIC SCENARIO IN 2023

GUILHERME DIETZE, ECONOMIST AT FECOMERCIOSP

Virtually throughout the entire last decade, the Brazilian economy fluctuated between recession and low-growth moments. One can argue that the 5% growth in 2021, was strong. However, it was immediately after the 3.3% decrease in the pandemic. Yet, right after that there was a downturn, with a 2.9% GDP’s variation last year.

For 2023, however positive the perspective may be, the projected growth is only 1%, a much weaker pace than the almost 3% projected by the IMF for the global average this year.

The great villain of a milder economic scenario is the significant interests’ rate.

SELIC, the basic interest rate, is currently 13.75% a year. The Central Bank initiated its expansion cycle in 2021, when the rate was 2%, in an attempt to hold the inflation back, which was rising to the two digits threshold. And it’s important to reinforce that this movement – the interests’ increase –wasn’t exclusive to Brazil. An intense work of the monetary authorities of countries and economic blocks is currently occurring to suppress prices’ rise.

The United States, for example, with FED’s actuation (the Federal Reserve), has raised interest rate to the “unimaginable” level of 4.75% and 5% a year. Over there, the new interests’ level has taken the peace from business owners in a country where interests have historically always been low. The consequence of the increasing price of capital is to lead to a slower dynamic in the American economy, and consequently, affect all the countries, given its influence of 25% in the global GDP.

Back to the domestic scenario, Brazil started feeling the impacts of high interests at the end of 2022 and should keep facing difficulties in 2023. In retail commerce, there has been a retreat in sales in those sectors that depend on credit, like household appliances, furniture, construction materials and vehicles.

The negative performances of these sectors of commerce have generated consequences for the industry. Most automakers, for example, have stopped production and given collective vacation, in face of the scenario with uncertainties and expensive credit impacting the consumption. Agribusiness, which had an excellent 2022, will face considerable challenges this year. The first point is the global economy’s downturn, which pushes commodities’ prices down. Moreover, the costs of basic materials and land preparation were pricey last year. Therefore, with lower prices this year, the tendency is that the rentability will remain leaner.

OPPORTUNITIES

Although it seems, generally, a complicated scenario, there are many opportunities for the economy, above all, in the services’ sector, which has been lifting off from the national average performance and has been an important expansion drive for the country. In January, a month when the industry registered a slight annual increase of 0.3% and commerce increased 0.5%, the service sector grew 6.1% according to IBGE. The highlight goes to national tourism, which according to FecomercioSP, had a turnover of R$ 19.4 billion at the beginning of the year, an annual rise of almost 20%. Just to have an idea, the growth was 28% last year. The complete reopening of the economy, the solid comeback of events, besides the inflation in the sector, are all factors that have contributed so that tourism could be an important traction for the Brazilian economy. The downfall in the unemployment rate is a key ally of the national economy because it gives conditions for the buying power restoration. The current level is similar to the one seen in 2015, in other words, it has regressed to a “normal” threshold. With more

PANROTAS Brazilian Overview 2023/2024 13

income, it is possible for families to pay their overdue bills, and afterward, to increase their expenditure in the commerce and service sectors. Certainly, if it weren’t for the high interests and the persistent inflation, consumers would have conditions to give an even stronger pace to the economy in 2023. Considering inflation, the general price index, IPCA by IBGE, rose 2.09% in the first quarter of the year. It is still a high threshold, but below the 3.20% one from the same period last year. The trend is that prices will keep pressuring and finish the year close to 6%, again above the maximum limit of the inflation goal defined by the National Monetary Council.

Despite inflation’s high level for 2023, the tendency is that it gives clear cooling-down signs in the second semester, in a way of converging to the center of the inflation goal for the upcoming year. Given that, monetary policy has both medium- and longterm effects, the idea we have today is that the Central Bank’s Monetary Policy Committee will start reducing SELIC in the middle of this year, which should result in more significant impacts from 2024 onwards. Therefore, the Brazilian economy should navigate with low growth this year. However, even with the obstacles along the way, opportunities will take place, and it is necessary to look in a longer term, understanding that the interests’ curve, in little time will start to relent, and thus, it will once again propel the economic activity at a stronger pace.

PROJECTIONS FOR THE END OF 2023:

PANROTAS Brazilian Overview 2023/2024 14

GROSS DOMESTIC PRODUCT (GDP): + 0.9% EXTENDED NATIONAL CONSUMER PRICE INDEX (IPCA): 6% INTEREST RATE (SELIC): 12.50%

TOP 10 SOCIAL MEDIAS IN BRAZIL

1 WhatsApp (169 million)

2 YouTube (142 million)

3 Instagram (113 million)

4 Facebook (109 million)

5 TikTok (82 million)

6 LinkedIn (63 million)

7 Messenger (62 million)

8 Kwai (48 million)

9 Pinterest (28 million)

10 Twitter (24 million)

TOP 10 INTERNATIONAL DESTINATIONS SEARCHES IN TIK TOK (BRAZIL)

1 Disney: + 4,2 billion video views

2 Portugal: + 1,9 billion

3 Paris: + 579 million

4 Dubai: + 452 million

5 South Korea: + 363 million

6 Alaska: + 286 million

7 Egypt: + 144 million

8 Maldives: + 134 million

9 New York: + 130 million

10 Cancun: + 82 million

Average time in social media (Brazil): 3h46min/day

PANROTAS Brazilian Overview 2023/2024 15

BRAZILIANS IN THE UNITED STATES

2019: 2.1 million (7th biggest market)

2020: 424,000

2021: 239,000

2022: 1.2 million (7th biggest market, and 5th biggest overseas)

2023: 1.46 million *

2024: 1.75 million *

2025: 1.95 million *

2026: 2.32 million *

2027: 2.5 million *

1 ST QUARTER 2023

INTERNATIONAL OVERSEAS VISITORS TO THE US

Source: NTTO

*Projections

BRAZIL IN 2023 (TO THE US)

January 135,198

February 101,447

March 103,830

Total 1 st Quarter 340,475 visitors

BRAZIL IS NBR 3 OVERSEAS MARKET AND NBR 5 GLOBAL

Source: NTTO

PANROTAS Brazilian Overview 2023/2024 16

Country of Residence Number of Arrivals % Change from 2022 United Kingdom 756,543 61.1% South Korea 364,337 393.8 % Brazil 340,475 53.4 % Germany 318,004 77.8 % India 308,743 63.9% France 283,478 55.5% Japan 268,204 559.7% Australia 175,719 185.0% China. PRC 171,655 274.7 % Italy 161,614 101.6% Colombia 160,880 (8.2 %) Spain 150,437 30.3 % Argentina 146,253 39.9% Chile 104,050 4.9 % Ireland 95,680 69.0 %

NATIONAL TRAVEL AND TOURISM OFFICE FORECAST OF

INTERNATIONAL VISITATION TO THE US

BY TOP ORIGIN COUNTRIES (FEBRUARY 2023)

VOLUME (ESTIMATE IN THOUSANDS)

Overseas includes all countries except Canada and Mexico.

Source: U.S. Department of Commerce, International Trade Administration, Industry & Analysis, National Travel and Tourism Office; Statistics Canada; INEGI.

PANROTAS Brazilian Overview 2023/2024 17

Actual Forecast Rank Visitor Origin Country 2019 2020 2021 2022 2023 2024 2025 2026 2027 Total All Countries 79,442 19,212 22,100 51,778 62,753 74,944 82,350 87,021 91,010 1 Canada 20,720 4,809 2,529 14,689 16,783 19,643 22,015 23,310 23,983 2 Mexico 18,328 6,809 10,397 12,970 16,789 19,208 21,32 21,856 22,589 Overseas 40,393 7,594 9,175 24,120 29,181 36,093 39,303 41,855 44,437 3 U.K 4,780 730 461 3,466 4,197 4,694 4,923 5,186 5,437 4 Japan 3,753 697 122 597 1,479 2,072 2,346 3,012 3,500 5 China 2,830 378 192 368 849 1,381 2,172 2,519 2,830 6 South Korea 2,298 439 203 920 1,328 1,756 2,068 2,327 2,511 7 Brazil 2,105 424 239 1,225 1,461 1,751 1,957 2,115 2,273 8 Germany 2,064 294 249 1,481 1,775 2,056 2,115 2,255 2,337 9 France 1,844 298 222 1,318 1,556 1,752 1,858 2,001 2,070 10 India 1,474 336 433 1,257 1,426 1,556 1,632 1,731 1,860 11 Australia 1,319 209 52 642 865 1,066 1,257 1,375 1,448 12 Italy 1,086 141 136 718 773 930 1,059 1,110 1,162 13 Colombia 944 270 1,064 944 957 1,004 986 1,020 1,045 14 Spain 943 152 182 773 870 939 986 1,030 1,061 15 Argentina 854 198 302 525 545 596 664 713 750 16 Netherlands 727 111 86 473 707 790 760 805 836 17 Ireland 521 80 49 403 488 530 547 569 594 18 Taiwan 500 91 50 137 328 393 378 435 475

VOLUME (ANNUAL PERCENT CHANGE)

Overseas includes all countries except Canada and Mexico.

PANROTAS Brazilian Overview 2023/2024 18 Actual Forecast Rank Visitor Origin Country 2019 2020 2021 2022 2023 2024 2025 2026 2027 Total All Countries - 0.4 - 75.8 15.0 134.3 21.2 19.4 9.9 5.7 4.6 1 Canada - 3.5 - 76.8 - 47.4 480.8 14.3 17.0 12.1 5.9 2.9 2 Mexico - 0.3 - 62.9 52.7 24.7 29.4 14.4 9.5 3.9 3.4 Overseas 1.3 - 81.2 20.8 162.9 21.0 23.7 8.9 6.5 6.2 3 U.K 2.6 - 84.7 - 36.9 652.3 21.1 11.8 4.9 5.3 4.8 4 Japan 7.4 - 81.4 - 82.6 391.6 147.5 40.1 13.2 28.4 16.2 5 China - 5.4 - 86.6 - 49.3 91.9 130.6 62.7 57.3 16.0 12.4 6 South Korea 4.0 - 80.9 - 53.9 353.7 44.4 32.2 17.8 12.5 7.9 7 Brazil - 4.7 - 79.9 - 43.5 411.8 19.2 19.9 11.8 8.1 7.5 8 Germany 0.1 - 85.8 - 15.2 494.4 19.8 15.8 2.9 6.6 3.7 9 France 4.3 - 83.8 - 25.4 493.5 18.1 12.6 6.1 7.7 3.5 10 India 6.9 - 77.2 29.0 190.1 13.5 9.1 4.9 6.1 7.4 11 Australia - 3.2 - 84.2 - 74.9 1123.8 34.8 23.2 17.9 9.4 5.3 12 Italy 1.2 - 87.1 - 3.5 429.1 7.8 20.2 13.9 4.9 4.6 13 Colombia 0.1 - 71.4 293.8 - 11.3 1.4 4.9 - 1.8 3.3 2.5 14 Spain 7.6 - 83.9 20.4 323.9 12.4 8.0 4.9 4.5 3.0 15 Argentina - 14.0 - 76.9 52.6 73.9 3.9 9.4 11.4 7.4 5.1 16 Netherlands 0.3 - 84.7 - 22.9 451.1 49.4 11.7 - 3.8 6.0 3.8 17 Ireland - 1.9 - 84.6 - 38.5 715.0 21.3 8.5 3.1 4.0 4.3 18 Taiwan 4.5 - 81.8 - 44.5 171.6 139.0 19.8 - 3.6 14.9 9.2

U.S. Department of Commerce, International

Administration, Industry & Analysis, National Travel and Tourism Office; Statistics Canada; INEGI.

Source:

Trade

VOLUME (SHARE OF 2019)

PANROTAS Brazilian Overview 2023/2024 19 Actual Forecast Rank Visitor Origin Country 2019 2020 2021 2022 2023 2024 2025 2026 2027 Total All Countries 100 24 28 65 79 94 104 110 115 1 Canada 100 23 12 71 81 95 106 113 116 2 Mexico 100 37 57 71 92 105 115 119 123 Overseas 100 19 23 60 72 89 97 104 110 3 U.K 100 15 10 73 88 98 103 109 114 4 Japan 100 19 3 16 39 55 63 80 93 5 China 100 13 7 13 30 49 77 89 100 6 South Korea 100 19 9 40 59 76 90 101 109 7 Brazil 100 20 11 58 69 83 93 101 108 8 Germany 100 14 12 72 86 100 103 109 113 9 France 100 16 12 71 84 95 101 109 112 10 India 100 23 29 85 97 106 111 118 126 11 Australia 100 16 4 49 66 81 95 104 110 12 Italy 100 13 12 66 71 86 98 102 107 13 Colombia 100 29 113 100 101 106 105 108 111 14 Spain 100 16 19 82 92 100 105 109 113 15 Argentina 100 23 35 61 64 70 78 84 88 16 Netherlands 100 15 12 65 97 109 105 111 115 17 Ireland 100 15 9 77 94 102 105 109 114 18 Taiwan 100 18 10 27 66 79 76 87 95 Overseas includes all countries except Canada and Mexico. Source: U.S. Department of Commerce, International Trade Administration, Industry & Analysis, National Travel and Tourism Office; Statistics Canada; INEGI.

BRAZILIAN

TRAVELERTHE

PROFILE IN THE USA 2021

Total arrivals 2022:

Total expenditures in the US 2021:

1.2 MILLION US$ 1.9 BILLION

Arrivals in 2020: In 2019:

424,000

2.1 MILLION, WITH US$ 10.1 BILLION IN EXPENDITURES 2021

TRIP PURPOSE (ONE RESPONSE): TRIP PURPOSE (MULTIPLE ANSWERS):

Business – 7.5%

Conventions – 2.9%

Education – 4.9%

Vacation – 44.6%

Visit friends & relatives – 37.6%

Health treatments – 1.5%

Business – 14.6%

Conventions – 3.7%

Education – 6.3%

Vacation – 56%

Visit friends & relatives – 44.1%

Health treatments – 4.2%

PANROTAS Brazilian Overview 2023/2024 20

INFORMATION SOURCES USED FOR TRIP PLANNING

Airlines:

Corporate travel department:

Personal recommendation:

Travel agency (on-line):

Travel agency (office):

2021

ACTIVITIES IN THE US:

Travel office (destination):

Tour operator:

Travel guides:

Theme parks: Historical locations:

Museums:

Camping/hiking:

Casinos:

Concerts/musicals:

Fine dining:

National Parks/ monuments:

Nightclubs:

9.5%

Shopping:

Sightseeing:

Small towns: Eco excursions:

Golfing/tennis:

Skiing:

Sporting event: Guided tours:

PANROTAS Brazilian Overview 2023/2024 21 67.1% 16.1% 39.1% 31.3% 17.1% 16.4% 12.1% 12.3%

35.1% 28.1% 27% 31.9% 6.4% 86% 12.4% 64.8% 26.2% 26.6%

2.5% 2.8% 2.4% 15.6% 9.9% 6.1%

TRANSPORTATION BETWEEN CITIES:

Air travel: Bus: Railroad:

Rented auto: Advance trip decision: First international trip to the US:

31 DAYS

Brazil is Top 3 to Florida , behind only Canada and United Kingdom, with 709,000 visitors in 2002, still 46% down from 2019 figures. Biggest number was achieved in 2015, with 1,45 million visitors. In 2019 Florida received 1,3 million Brazilian tourists.

7.1%

Length of stay:

15 NIGHTS

Stayed at hotels:

New York expects 670,000 Brazilian visitors in 2023, which represents 80% of pre-pandemic numbers.

57.1% 1.4

Travel party size:

Brazil has direct flights to/from 13 of the Top 15 Ports of Entry in the US: New York/JFK, Miami, Los Angeles (begins in August), Newark, Orlando, Chicago, Fort Lauderdale, Washington DC, Atlanta, Houston, Boston and Dallas.

Orlando received 575,000 Brazilians last year. Brazil is Top 3 for the destination, behind only Canada and UK.

PANROTAS Brazilian Overview 2023/2024 22 32.6% 10% 2.4% 36.5%

Source: NTTO

WEEKLY FLIGHTS TO/FROM BRAZIL FLIGHTS FROM BRAZIL TO THE US - MAY 2023 ONLY DIRECT FLIGHTS

SEASONAL/NEW FLIGHTS TO THE US

• American Airlines will fly from Rio de Janeiro to New York in October/23.

• Azul will fly from Belo Horizonte to Fort Lauderdale (jun/23) and Orlando (Sep/23). And from Recife to Orlando (jun/23).

• Delta will fly from Rio de Janeiro to Atlanta (Dec/23) and New York (Dec/23).

• LATAM will fly from São Paulo to Los Angeles (Aug/23).

PANROTAS Brazilian Overview 2023/2024 24

Airline From To Flights Seats AA GIG MIA 31 7,254 AA GRU DFW 31 8,835 AA GRU JFK 31 8,463 AA GRU MIA 62 16,834 AD BEL FLL 9 1,566 AD MAO FLL 8 1,392 AD REC FLL 9 2,574 AD VCP FLL 44 13,004 AD VCP MCO 31 9,211 DL GRU ATL 37 10,098 DL GRU JFK 31 7,378 G3 BSB MCO 31 5,766 G3 BSB MIA 31 5,766 G3 FOR MIA 4 744 G3 MAO MIA 9 1,674 LA FOR MIA 4 1,208 LA GRU BOS 14 4,228 LA GRU JFK 31 10,055 LA GRU MCO 13 3,926 LA GRU MIA 45 16,362 UA GIG IAH 31 6,634 UA GRU EWR 31 8,556 UA GRU IAD 31 7,440 UA GRU IAH 31 7,967 UA GRU ORD 31 9,858 TOTAL 661 176,793 Destination Flights % Share Seats % Share Africa 13 1.2% 3,500 1.4% Central America 82 7.9% 13,203 5.3% North America 196 18.8% 55,136 22.2% South America 481 46.1% 88,406 35.6% Asia 23 2.2% 9,357 3.8% Europe 248 23.8% 78,464 31.6% Total 1,043 100% 248,065 100% Source:

2023

CONNECTIVITY

ANAC Flights March

Source: ANAC Flights May 2023

PANROTAS Brazilian Overview 2023/2024 25

FLIGHTS PER AIRLINE 32 12 77 6 6 14 16 12 231 17 15 4 4 8 11 99 47 15 8 22 79 16 11 60 36 41 25 10 19 8 82 - 20 40 60 80 100 120 140 160 180 200 220 240 260 UNITED TURKISH TAP TAAG SWISS SKY AIRLINES QATAR LUFTHANSA LATAM AIRLINES LAN PERU S.A. KLM JETSMART CHILE JETSMART ARGENTINA ITA IBÉRIA GOL FLYBONDI ETHIOPIAN EMIRATES DELTA AIR LINES COPA AIRLINES BRITISH AIRWAYS BOLIVIANA DE AVIACIÓN AZUL AVIANCA AMERICAN AIRLINES AIR FRANCE AIR EUROPA AIR CANADA AEROMÉXICO AEROLINEAS ARGENTINAS 12 14 16 79 16 60 10 19 120 220 UNITED TURKISH TAAG SKY AIRLINES LATAM LAN PERU KLM JETSMART JETSMART ITA FLYBONDI ETHIOPIAN AIRWAYS AZUL AMERICAN FRANCE AIR AEROLINEAS 32 12 77 6 6 14 16 12 231 17 15 4 4 8 11 99 47 15 8 22 79 16 11 60 36 41 25 10 19 8 82 - 20 40 60 80 100 120 140 160 180 200 220 240 260 UNITED TURKISH TAP TAAG SWISS SKY AIRLINES QATAR LUFTHANSA LATAM AIRLINES LAN PERU S.A. KLM JETSMART CHILE JETSMART ARGENTINA ITA IBÉRIA GOL FLYBONDI ETHIOPIAN EMIRATES DELTA AIR LINES COPA AIRLINES BRITISH AIRWAYS BOLIVIANA DE AVIACIÓN AZUL AVIANCA AMERICAN AIRLINES AIR FRANCE AIR EUROPA AIR CANADA AEROMÉXICO AEROLINEAS ARGENTINAS 32 13 77 5 5 14 16 12 231 17 15 4 4 8 11 99 47 14 8 23 79 16 11 60 36 41 26 10 19 8 82 - 20 40 60 80 100 120 140 160 180 200 220 240 260 UNITED TURKISH TAP TAAG SWISS SKY AIRLINES QATAR LUFTHANSA LATAM AIRLINES LAN PERU S.A. KLM JETSMART CHILE JETSMART ARGENTINA ITA IBÉRIA GOL FLYBONDI ETHIOPIAN EMIRATES DELTA AIR LINES COPA AIRLINES BRITISH AIRWAYS BOLIVIANA DE AVIACIÓN AZUL AVIANCA AMERICAN AIRLINES AIR FRANCE AIR EUROPA AIR CANADA AEROMÉXICO AEROLINEAS ARGENTINAS

TOTAL WEEKLY DESCRIPTIVE

Source: ANAC Flights March 2023

TRVL LAB, PANROTAS’ research and market analysis division, in partnership with MAPIE, disclosed a new study carried out with travelers. And it got to 6 trends from these travelers for the following months and years.

TOURISM AS A PRIORITY

The purchase of experiences is starting to be more important than the acquisition of material products. According to 29% of respondents in the study, traveling is a priority in their lives. 25% of them have an allocated budget for trips, and 23% affirm having already bought unplanned trips stimulated by discounts.

HUMANIZED DIGITAL TOURISM

Although technology makes travelers’ lives a lot easier, they don’t want to relinquish humanized customer service. 30% of them affirm they prefer the human contact to digital convenience, while 13% consider the customer service via artificial intelligence tools to be satisfactory. 43% of travelers say that they will make their travel reservations online in the upcoming months, and 58% of surveyed individuals affirm that they are used to searching on several websites before booking. 51%, in turn, read the comments made by other travelers before making the reservation.

WELLNESS TOURISM

Wellness Tourism is a priority for travelers heard by the survey. 54% find that trips are part of their health and wellness maintenance, while 32% take the opportunity to fit these experiences in their trips. At last, 19% of respondents intend traveling to destinations that focus on health and wellness.

TOURISM OF SUPER-EXPERIENCES

Trips that encompass content are gaining strength, mainly in relation to visits, workshops, and experiences, which allow the traveler to know local culture aspects in a more profound way. Furthermore, there is a desire of rescuing

the roots and ancestrally and being in touch with nature. 25% of individuals surveyed in the study prefer taking less trips, but having better quality experiences, while 23% want to visit places that cherish historic and cultural authenticity. 19%, in turn, want to travel to a destination with full contact with nature and/or ecotourism.

REGENERATIVE TOURISM

The choice of sustainability increasingly becomes more present in travel decisions. After all, there’s an increase in the collective consciousness in matters related to the climatic crisis and in the social impacts generated by consumption choices, which is beginning to reach Tourism in a more significant way. More and more clients will opt for sustainable, responsible, and regenerative alternatives. 28% of them treasure brands/ companies that promote sustainability, while 15% are up to paying more for products and services that are environmentally and socially responsible, and 17% prioritize local and/or communitarian suppliers when making a purchase.

HYBRID TOURISM

The increasing adoption of new work formats also affects tourism. Bleisure is here to stay and will demand adaptation of products, services, and experiences by the sector’s businesses. 40% of respondents say that they have flexibility to travel out of the high season, and 25% have flexibility to work anywhere. 18%, in turn, work remotely only.

MAIN CONCERNS

Regarding travelers’ concerns, the main one is related to violence and criminality, followed by flight tickets’ high prices and by the inflation and economic crisis.

The survey was carried out with 1,348 Brazilian travelers from all regions in the country, belonging to the upper, middle, and working classes, and with ages between 30 and 59 years. The full study is available on trvl.com.br.

PANROTAS Brazilian Overview 2023/2024 26

1 5 6 2 3 4

TRVL LAB IDENTIFIES 6 TRENDS IN TRAVEL

ABAV - BRAZILIAN TRAVEL AGENCIES ASSOCIATION

WWW.ABAV.COM.BR

• Foundend in 1953

• Presence in all 27 Brazilian states

• 2,176 members, including receptive tour operators, outbound tour operators, consolidators, Meeting & Incentive tour operators, small, medium and big travel agencies off and on line.

• ABAV National has the main role to promote

Tourism from a business perspective among social, private, public and Governmental sectors.

• ABAV work also involves helping to build documents and plans for the national Tourism sector and present them to the Congress, Senate and Presidency, demanding relevant guidelines throughout the year.

• Member of FOLATUR

ABAV'S Members

80% of total sales

55% to 80% Domestic and international air tickets

90% Tourism Packages

$$ USD 5,63 bi

Total sales in 2022

28% Car rental

$$ USD 3,5 bi

Total sales in 2021

60% Hotel booking

$$ USD 2,6 bi

Total sales in 2020

92% Cruises

$$ USD 8,4 bi

Total sales in 2019

PANROTAS Brazilian Overview 2023/2024 27

27 - 29

Expected visitors: 36k

Expetec exhibiting Brands: + 2.000

International Hosted Buyers

Programme Goal: 50 buyers and 50 Mice

Domestic Hosted Buyers Programme for Travel Agents and Tour Operators

Goals: 800 selected buyers

Congress Training Area Goals: 60 panels & trainings

Tours Operator Island

Goals: 35 Tour Operators

Innovation: Technology Island

PANROTAS Brazilian Overview 2023/2024 28

1PM TO 8 PM RIO DE JANEIRO

SEPTEMBER RIOCENTRO FROM

BRAZTOA (BRAZILIAN TOUR OPERATORS) INSIDE BRAZTOA

BRAZTOA TOUR OPERATORS

PANROTAS Brazilian Overview 2023/2024 29

BRAZTOA (BRAZILIAN TOUR OPERATORS)

BOARDING DISTRIBUITION - INTERNATIONAL

CONSUMER PROFILE

PANROTAS Brazilian Overview 2023/2024 30

BRAZTOA ASSOCIATES (BRAZILIAN TOUR OPERATORS)

ABREUTUR

Rua Lauro Müller, 116 – Conjunto

904/905 – Torre Rio Sul – Botafogo

Rio de Janeiro - RJ - 22299-900

(21) 2586-1840

rcorrea@abreutur.com.br

www.abreutur.com.br

RONNIE CORREA

AGAXTUR

Rua Frei Caneca, 1246, 10º andar

São Paulo - SP - 01307-002

(11) 3067-0900

aldo@agaxtur.com.br www.agaxtur.com.br

ALDO LEONE FILHO

AMBIENTAL

Av. Ipiranga, 344, 15º andar, Edifício

Itália

São Paulo - SP - 01046-010

(11) 3818-4600

zuquim@ambiental.tur.br www.ambiental.tur.br

JOSÉ ZUQUIM

ÁSIA TOTAL

Rua Araújo, 216, 5º andar, Conjunto

51

São Paulo - SP - 01220-020

(11) 3172-2111

jeff@asiatotal.com.br

www.asiatotal.com.br

JEFFERSON SANTOS

BANCÓRBRAS

SCN Quadra 04, Bloco A, Ed. Brasal II, Loja 193

Brasília - DF - 70304-000

(61) 3314-7010

carlos.pereira@bancorbras.com.br www.bancorbras.com.br

CARLOS PEREIRA

BEST BUY TRAVEL

Rua Barão de Teffé, 160, 14º andar, Sala 1402 Jundiaí - SP - 13208-760 (11) 4805-7272 mkt@bestbuytravel.com.br www.bestbuytravel.com.br

VICTOR VAN OORSCHOT

BRT OPERADORA

Rua Presidente Faria, 321 - Centro Curitiba - PR - 80020-290 (41) 3219-5400 marco.ruzze@grupobrt.com.br www.brementur.com.br

MARCO AURÉLIO DI RUZZE

BUTTERFLY TOUR

Rua Fernando Lobo, 102, Conjuntos 304 e 306 Juiz de Fora - MG - 36016-230 (32) 2102-5253

comercial@butterfly.tur.br www.butterfly.tur.br

OTACIANO AVIDAGO

BWT OPERADORA

Avenida Presidente Affonso Camargo, 330, Rodoferroviária Curitiba - PR - 80060-090 (41) 3888-3488

adonaif@bwtoperadora.com.br; www.bwtoperadora.com.br

ADONAI FILHO

CENTURY TRAVEL

Rua Vergueiro, 981, Conjunto 11 - Liberdade São Paulo - SP - 01504-001 (11) 3207-2644 century@ centurytravel.com.br www.centurytravel.com.br

TOYOHARU FUJII

CI

Praça Charles Miller, 152 São Paulo - SP - 01234-010

(11) 3677-3600

cgarcia@ci.com.br

www.ci.com.br

CELSO LUIZ GARCIA

COSTA CRUZEIROS

Avenida Paulista, 460 –10º Andar – Bela Vista São Paulo - SP - 01310-904

(11) 2123-3655/3145-3655

hermann@br.costa.it

www.costacruzeiros.com.br

RENÊ HERMANN

CT OPERADORA

Avenida Esportes, 1065Jd. Planalto

Valinhos - SP - 13270-210

(19) 3871-9999

fabiano@ctoperadora.com.br

www.canadaturismo.com.br

FABIANO CAMARGO

CVC VIAGENS

Rua das Figueiras, 501Ed. Absoluto - Bairro Jardim

Santo André - SP - 09080-370

(11) 2123-2100

priscilabures@cvc.com.br

www.cvc.com.br

PRISCILA BURES

DISCOVER CRUISES

Avenida Ibirapuera, 2315, 9º andar - Indianópolis

São Paulo - SP - 04029-200

(11) 4063-0754

atendimento@discovercruises.com.br

www.discovercruises.com.br

PABLO ZABALA

PANROTAS Brazilian Overview 2023/2024 31

DIVERSA TURISMO

Praça Dom José Gaspar, 134, 5º andar, República São Paulo - SP - 01047-010 (11) 5087-3466 contato@diversaturismo.com.br www.diversaturismo.com.br

ARNALDO FRANKEN

DOMUNDO VIAGENS

Avenida Rio Branco, 277, sala 1301 - Centro Rio de Janeiro - RJ - 20040-904 (21) 3267-0499 / 98353-2657 contato@domundo.com www.domundo.com

ANDRE SALGADO

E-HTL

Avenida Ipiranga, 1044º andar, conjunto 41 a 44 São Paulo - SP - 01046-010 (11) 3138-5656

janaina.orsatti@e-htl.com.br www.e-htl.com.br

FLAVIO LOURO

EASY TRAVEL SHOP

Rua da Prata, 39, 1º andar, Sala 3 Baueri - SP - 06410-000 (11) 4858-5700

contato@etstur.com.br www.etstur.com.br

MICHAEL BARKOCZY

EUROPLUS

Rua dos Andradas, 1001, cjto. 602 Porto Alegre - RS - 90020-015 (51) 3086-8900

operadora@europlus.com.br www.europlus.com.br

MARILIA WEBER

(BRAZILIAN TOUR OPERATORS)

FLOT

Avenida São Luis, 50 –16º Andar – Conjunto 162 São Paulo - SP - 01046-926 (11) 4504-4504 / 4504-4530 flot@flot.com.br www.flot.com.br

JOSÉ EDUARDO BARBOSA

FLYTOUR VIAGENS

Av Juruá, 641 – Alphaville Barueri - SP - 06455-010

(11) 4503-1900

reifer@flytour.com.br www.flytour.com.br

REIFER DE SOUZA JUNIOR

FORMA TURISMO

Rua Euclides Pacheco, 1326, Vila Gomes Cardim São Paulo - SP - 03321-001

(11) 2039-1300

sac@formaturismo.com.br www.formaturismo.com.br

PATRICIA CALDEIRA

FRANÇATUR

Avenida Treze de Maio, 13, sala 720 Rio de Janeiro - RJ - 20031-901 (21) 2102-2440

marketing@francatur.com.br www.francatur.com.br

MAURICIO SILVA

FRT OPERADORA

Avenida Brasil, 1354, Sala 304, Edifício Mario da Rosa, Centro Foz do Iguaçú - PR - 85851-000 (45) 3521-8500

coo@frt.tur.br

www.comprefacil.tur.br

DANIELLE MEIRELLES

INCOMUM

Rua Dom Jaime Câmara, 170, Sala 904

Florianópolis - SC - 88015-120 (48) 3211-5600

fabio@incomum.com

www.incomum.com

FABIO CESAR FRASSETTO

INTEREP

Rua Leopoldo Couto de Magalhães Jr, 758 – 2º andar

São Paulo - SP - 04542-000 (11) 3035-2811

rosana@interep.com.br www. interep.com.br

CYNTHIA RODRIGUES

INTERPOINT

Alameda Jaú, 1717 –Casa 03 - Jardim Paulistano São Paulo - SP - 01420-002 (11) 3087-9400

heloisa@interpoint.com.br www.interpoint.com.br

HELOISA LEVY

ITAPARICA TOUR OPERATOR

Av. Tancredo Neves, 2539Cond. Shopping CEO - Torre Nova Iorque - Sala 2903

Salvador - BA - 41820-021 (71) 3205-6666

tercia@itaparicatour.com

www.itaparicatour.net.br

TERCIA VASCONCELOS

PANROTAS Brazilian Overview 2023/2024 32

(BRAZILIAN TOUR OPERATORS)

LUSANOVA TOURS

Avenida São Luiz, 11214º andar - Centro

São Paulo - SP - 01046-000

(11) 2879-6767

sergio.vianna@lusanova.com.br www.lusanova.com.br

SERGIO VIANNA

MATUETÉ

Avenida Nove de Julho, 5109, 6º Andar

São Paulo - SP - 01407-200

(11) 3071-4515

viajar@matuete.com www.matuete.com

ROBERT BETENSON

MSC CRUZEIROS

Av. das Nações Unidas, 14171Torre Crystal – 4º andar

São Paulo - SP - 04794-000

(11) 5053-5300

info@msccruzeiros.com.br www.msccruzeiros.com.br

ADRIAN URSILLI

NCL - NORWEGIAN CRUISE LINE

Rua Peixoto Gomide, 996, SL 740 São Paulo - SP - 01409-001 (11) 3177-3131

info@ncl.com.br www.ncl.com.br

ESTELA FARINA

NEW AGE TOUR OPERATOR

Alameda Rio Negro, 503 - Sala 2020

Barueri - SP - 06454-000

(11) 4395-7078

atendimento@newage.tur.br www.newage.tur.br

TOMAS PEREZ

NEW IT

Rua Sete de Setembro, 998º, 11º e 12º Andares - Centro Rio de Janeiro - RJ - 20050-005 (21) 3077-0200

newit@newit.com.br www.newit.com.bt

ALEXANDRE LIMA

NOVA OPERADORA

Rua Ouvidor Peleja, 111, cjtos. 122 e 123 São Paulo - SP - 04128-000 (11) 5042-5100

atendimento@novaoperadora.com www.novaoperadora.com

ANDRE PEREIRA

ORINTER TOUR & TRAVEL

Alameda Rio Branco, 238 - 1º andar Blumenau - SC - 89010-300 (47) 3221-0100

operadora@orinter.com.br www.orintertouroperator.com.br

ANA MARIA BERTO

POLVANI TOURS

Rua Bandeira Paulista, 600conjuntos 102 e 103 - 10º andar São Paulo - SP - 04532-001 (11)3083-4411 / (11) 3898-2646 polvani@polvani.com.br www.polvani.com.br

GERARDO LANDULFO

POMPTUR

Av. Marques de São Vicente, 2219, Edificio Office Time - 5º andar - Água

Branca

São Paulo - SP - 05036-040 (11) 2144-0400

pomptur@pomptur.com.br www.pomptur.com.br

MARINA FIGUEIREDO

QUEENSBERRY

Avenida São Luis, 165 – 4º AndarCentro

São Paulo - SP - 01046-911

(11) 3217-7100

junior@queensberry.com.br

www.queensberry.com.br

MARTIN JENSEN

R11 TRAVEL

Rua Espírito Santo, 315, Santo Antônio

São Caetano do Sul - SP

09530-700

(11) 3090-7200

cferrete@r11travel.com.br

www.r11travel.com.br

RICARDO AMARAL

RAIDHO

Av. dos Carinás, 595, Indianópolis

São Paulo - SP - 04086-011

(11) 3383-1200

atendimento@raidho.com.br

www.raidho.com.br

ROBERTO HARO NEDELCIU

RCA

Rua São Luis, 50 – 30º Andar –Conjunto 302 – República

São Paulo - SP - 01046-926

(11) 3017-8700

rca@rcaturismo.com.br

www.rcaturismo.com.br

RODOLPHO GERSTNER

SCHULTZ OPERADORA

Rua Visconde do Rio Branco 1488, 11° Andar - Sala 1106

Curitiba - PR - 80420-210

(41) 3303-6565

atendimento@sp.schultz.com.br

www.schultz.com.br

AROLDO SCHULTZ

PANROTAS Brazilian Overview 2023/2024 33

SNOW OPERADORA

Rua Major Lopes, 457, São Pedro Belo Horizonte - MG - 30330-050

(31) 3303-7600

oper@snowoperadora.com.br www.snowoperadora.com.br

PAULO MEDINA

SQUAD VIAGENS

Avenida Jeronimo Monteiro, 1000, Sala 1520

Vitória - ES - 29010-935

(27) 2125-1181

contato@voudesquad.com.br www.squadviagens.com.br

DEOMAR ASSUNÇÃO

STELLA BARROS

Avenida Brasil, 299, Jardim América

São Paulo - SP - 01431-000

(11) 2166-2250 / 3135-0350

rildo.amaral@stellabarros.com.br www.stellabarrros.com.br

RILDO AMARAL

TBO HOLIDAYS BRASIL

Avenida Nove de Julho, 5966, sala 20

São Paulo - SP - 01406-200

(11) 3078-1550

tbobrasil@tboholidays.com www.tboholidays.com

SUELI MURUCI

TRANSEUROPA

Rua Visconde de Pirajá , 550 , loja 229, Ipanema

Rio de Janeiro - RJ - 22410-901

(21) 2224-2297

transeuropa@transeuropa.com.br www.transeuropaviagem.com.br

PAULO MAX

(BRAZILIAN TOUR OPERATORS)

TRANSMUNDI

Rua Uruguaiana, 10 – Grupo 1401 Rio de Janeiro - RJ - 20050-090 (21) 2262-6262

contato@transmundi.com.br www.transmundi.com.br

MIGUEL ANDRADE

TT OPERADORA

Av. Santo Amaro, 4644Brooklin Paulista São Paulo - SP - 04556-500 (11) 5094-9494

ttoperadora@lufthansacc.com.br www.lufthansacc.com.br

PABLO ENRIQUE BERNHARD

TRITRAVEL

Rua 5, Numero 9, Bairro Industrial Planalto - PR - 85750-000 (46) 2555-9900

comercial@tritravel.com.br www.tritravel.com.br

ROSAURO BARETTA

VELLE

Alameda Santos, 1470, CJ 1105 - Cerqueira Cesar

São Paulo - SP - 01409-900

(11) 3253-7203

ricardo@velle.tur.br www.velle.tur.br

RICARDO ALVES

VOETUR

STRC - Trecho 2 - Conjunto “E”Lotes 1/2 - Bairro Guará

Brasília - DF - 71608-900

(61) 2106-6300

humberto@voetur.com.br

www.voeturoperadora.com.br

HUMBERTO CANÇADO

ASSOCIADOS PARCEIROS

Air Canada

Alameda Santos, 17, conjuntos 171 e 172

São Paulo - SP - 01418-102

(11) 3254-6615

accpayable.br@aircanada.ca

www.aircanada.com.br

GIANCARLO TAKEGAWA

Argentina - Inprotur - Instituto Nacional de Promoción Turística

Avenida Paulista 2313, Sobreloja, Bela Vista

São Paulo - SP - 01311-300

(11) 3897-9522

npisoni@argentina.travel argentina.travel

NATALIA PISONI

Aruba Tourism Authority

Rua Alfredo Guedes, 72, Conj. 72 São Paulo - SP - 02034-010

(11) 2768-3111

c.barbosa@aruba.com

www.aruba.com/br/organizacao/ aruba-tourism-authority

CARLOS HENRIQUE BARBOSA

Atlantica Hotels International Brasil Alameda Rio Negro, 585, 13º andar, Ed. Padauiri

Barueri - SP - 06454-000

(11) 3531-4800

recepcao.corp@ahi.com.br

www.reserveatlantica.com.br/

DAIANE NOGUEIRA

PANROTAS Brazilian Overview 2023/2024 34

(BRAZILIAN TOUR OPERATORS)

Balneário Camboriú Convention

Bureau Rua 3160, 533

Balneário Camboriú - SC

88.330-284

(47) 3360-0696

contato@visitebc.com.br www.visitebc.com.br

TATIANE RECH

Banco Daycoval

Avenida Paulista, 1993

São Paulo - SP - 01311-200

(11) 2392-9911

adm.daytravel@bancodaycoval.com.br www.bancodaycoval.com.br

EDUARDO CAMPOS

Buenos Aires - VISIT BUENOS AIRES

Avenida Paulista 2313, Sobreloja, Bela Vista

São Paulo - SP - 01311-300

(11) 3897-9522

info@visitbue.com

https://turismo.buenosaires.gob.ar/br

MARÍA LAURA PIERINI

Canela - Secretaria de Turismo de Canela

Rua Dona Carlinda, 455, Centro Canela - RS - 95680-000

(54) 3282-5190

turismo@canela.rs.gov.br www.canela.com.br

CARLA REIS

CatalunhaAgencia Catalana de Turismo

Avenida Juscelino Kubitschek, 1726, 11° andar, conj. 111

São Paulo - SP - 04543-000 (11) 3053-0477

jordisole_ext@gencat.cat

http://act.gencat.cat/

JORDI SOLÉ PÉREZ

Colômbia - PROCOLOMBIA

Alameda Santos, 1800, cj. 10 B São Paulo - SP - 01418-200 (11) 3171-0165

ncasasfranco@procolombia.co www.procolombia.co

NICOLAS CASAFRANCO

Coris Brasil

Alameda Santos, 1357, 9º Andar São Paulo - SP - 01419-908 (11) 3236-9696

claudia.brito@coris.com.br www.aprilbrasil.com.br

CLAUDIA BRITO

Dubai - Department of Economy and Tourism

Rua Dr. Rafael de Barros, 210 4º Andar Cj. 42 – Paraiso São Paulo - SP - 04003-041 (12) 99119-3253

t.issa@dubaidet.ae visitdubai.com

TATIANA ISSA

EFEX FINANCE

Rua Dom Paulo Pedrosa, 573, conj 11 São Paulo - SP - 05687-000

(19) 99727-5150

marcelo@efex.finance

www.efex.finance

MARCELO DE CASTRO

Emirates

Rua James Joule, 92, 7º Andar

São Paulo - SP - 04576-080

(11) 5503-5000

camila.caparroz@emirates.com

www.emirates.com.br

CAMILA CAPARROZ

Espanha - Centro Oficial de Turismo Espanhol

Rua Joaquim Floriano, 413, Cj 42, Itaim Bibi

São Paulo - SP - 04534-011

(11) 3704-2020

info.saopaulo@tourspain.es

www.spain.info

OSCAR ALMENDROS BONIS

GTA Assist

Rua Paulo Mantovan Freire, 324, Bloco B – 16° andar – conjunto 1601

São Paulo - SP - 01046-030

(11) 3150-4511

suporte@gtaassist.com.br

www.gtaassist.com.br

CELSO GUELFI

INFOTERA Tecnologia

Rua Padre Adelino, 2074, 5º andar

São Paulo - SP - 03303-000

(11) 2096-4650

laercio@infotera.com.br

www.infotera.com.br

LAERCIO ANANIAS

Intermac Assistance

Avenida São Luís 112, 7º Andar, Conjunto 702 – Centro

São Paulo - SP - 01046-000

(11) 3258-3610

wellington@macassistencia.com.br

www.intermacassist.com

WELLINGTON MORATO

Israel - Ministério de Turismo de Israel

Av. Brigadeiro Faria Lima, 1713Jardim Paulistano

São Paulo - SP - 01452-001

(11) 3034-6423

renatav@goisrael.gov.il

www.goisrael.com.br

RENATA VUONO

PANROTAS Brazilian Overview 2023/2024 35

Itália - ENIT - Agência

Nacional Italiana de Turismo

Avenida Paulista, 1971, 3º andar

São Paulo - SP - 01311-300

(11) 2148-7261 / 7270

saopaulo@enit.it

www.enit.it

FERNANDA LONGOBARDO

KissimmeeExperience Kissimmee

Avenida Roque Petroni

Junior, 999, 1307

São Paulo - SP - 04707-910

(11) 5185-8715

luiz.moura@itms.net.br

www.experiencekissimmee.com

LUIZ DE MOURA JUNIOR

MikeTec Tecnologia

Rua da Prata, 39, 1º andar, Sala 2 Baueri - SP - 06410-000

(11) 2222-1256

contato@miketec.com.br

www.miketec.com.br

JOSÉ EMERSON AMARAL

Nemo Tecnologia

Avenida Brigadeiro Faria Lima, 1485, 1º andar

São Paulo - SP - 01452-002

(11) 94497-3080

alexandre.toledo@nemogroup.net

www.nemogroup.net

ALEXANDRE TOLEDO

Peru - PROMPERU

Avenida Brigadeiro Faria Lima, 19125º andar - Conjunto 5F

São Paulo - SP - 01489-900

(11) 3097-9844

turismo@escritoriodoperu.com.br www.peru.travel

MILAGROS OCHOA KOEPKE

(BRAZILIAN TOUR OPERATORS)

Travelex Bank

Av. Engenheiro Luis Carlos Berrini, 105, 5º andar, Berrini One São Paulo - SP - 04571-010 (11) 3614-1123 / 0800-014-1006

ccme@travelexbank.com.br www.travelexbank.com.br

MIRIAM URIZAR VELASCO

Universal Assistance

Avenida Ipiranga, 345 - Sobreloja São Paulo - SP - 01046-010 (11) 2107-0300

roberto.roman@universal-assistance. com www.universal-assistance.com

PANROTAS Brazilian Overview 2023/2024 36

MAIN EVENTS

SEE ALL THE EVENTS AT WWW.PANROTAS.COM.BR/AGENDA-EVENTOS

FESTIVAL DAS CATARATAS

May, 31-June 02

Foz do Iguaçu, PR

ABROAD CORPORATE

June, 14

Curitiba, PR

ABROAD CORPORATE

June, 29

Belo Horizonte, MG

LGBT+ TURISMO EXPO

July, 20

Rio de Janeiro, RJ

NEXT – GOIÂNIA

August, 01

Goiânia, GO

ABROAD MICE

August, 02

Rio de Janeiro, RJ

NEXT – RIBEIRÃO PRETO

August, 03

Ribeirão Preto, SP

VISIT USA – SÃO PAULO

August, 07

São Paulo, SP

NEXT – PORTO ALEGRE

August, 08

Porto Alegre, RS

VISIT USA – CAMPINAS

August, 09

Campinas, SP

NEXT – CURITIBA

August, 10

Curitiba, PR

ABROAD MICE

August, 29

Porto Alegre, RS

DOWNLOAD CORPORATE TRAVEL

October

São Paulo, SP

EXPO SKI 2023

September, 11-12

São Paulo, SP

EQUIPOTEL

September, 19-22

São Paulo, SP

ABAV EXPO 2023

September, 27-29

Rio de Janeiro, RJ

100X BRASIL

October

São Paulo, SP

ABROAD CORPORATE

October, 17

Porto Alegre, RS

BTM TRAVEL MARKET

October, 19-20

Fortaleza, CE

ABROAD CORPORATE

November

São Paulo, SP

ABROAD MICE

December, 05

Belo Horizonte, MG

FESTURIS

November, 09-12

Gramado, RS

2024

LACTE 19

February 26-27

São Paulo, SP

FÓRUM PANROTAS 2024

March 05-06

São Paulo, SP

WTM LATIN AMERICA

April, 02-04

São Paulo, SP

LGBT CONFERENCE

April

São Paulo, SP

ILTM LATIN AMERICA 2024

May

São Paulo, SP

BNT MERCOSUL

May, 24-25

Balneário Camboriú, SC

PANROTAS Brazilian Overview 2023/2024 37

INTERNATIONAL DESTINATIONS

WITH REPRESENTATIVES IN BRAZIL

NORTH AMERICA

CANADA

VIA RAIL CANADA & ALTERRA MOUNTAIN COMPANY / IKON PASS @VERTEBRATTA

Sheila Nassar (Marketing) sheila@vertebratta.com

55 (11) 988 888 879 www.viarail.ca/en www.ikonpass.com/ www.vertebratta.com

MEXICO

LOS CABOS

DGX TRAVEL

Diana Pomar

diana.pomar@dgxtravel.com

Brasil 55 (11) 966 380 087

Mexico 52 (55) 220 55162 brasil@visitloscabos.travel www.dgxtravel.com/pt-br/

UNITED STATES

BRAND USA AVIAREPS

Lizandra Pajak lpajak@TheBrandUSA.com.br

Ana Elisa Facchinato afacchinato@ TheBrandUSA.com.br

Ingrid Santos isantos@TheBrandUSA.com.br

55 (11) 4862 0062 traveltrade.visiteosusa.com.br www.aviareps.com.br

CHICAGO SPOTLIGHT

Mariana Haddad mariana@spotlightmarketingpr.com

55 (11) 982 838 057 www.choosechicago.com/ www.spotlight-marketingpr.com

DISNEY DESTINATIONSWALT DISNEY WORLD RESORT AND DISNEY CRUISE LINE

Cinthia Douglas Sales & Marketing Director

Luiz Araujo Jr

Sr. Sales Manager Brazil

Barbara Modenesi Rumennik Sales Training Manager, Brasil wdpr.marketing.brasil@disney.com www.disneyagentesdeviagens. com.br

FLORIDA: DISCOVER THE PALM BEACHES AVIAREPS

Daniel Rocha

drocha@aviareps.com

55 (11) 4063 8293

www.thepalmbeaches.com/ portugues

www.aviareps.com.br

FLORIDA: GREATER MIAMI CONVENTION & VISITORS BUREAU IMAGINADORA

Tathiana Leal

tathianaleal-miami@ imaginadora.com.br

55 (21) 982 952 626

www.miamiandbeaches.com

FLORIDA: KENNEDY SPACE CENTER VISITOR COMPLEX

TM AMERICAS

Juanita Ariza Gomez

juanita@tmamericas.com

www.kennedyspacecenter.com www.tmamericas.com

FLORIDA: KISSIMMEE ITMS

Luiz Moura Jr.

luiz.moura@itms.net.br

55 (11) 999 330 930

www.experiencekissimmee.com

www.itms.net.br

PANROTAS Brazilian Overview 2023/2024 38

FLORIDA: NAPLES, MARCO ISLAND & EVERGLADESPARADISE COAST AVIAREPS

Rodrigo Pereira rpereira@aviareps.com

55 (11) 4063 8293

www.paradisecoast.com.br www.aviareps.com

FLORIDA: ORLANDO MAGIC J TERRA MARKETING

Jane Terra jane.terra@terra.com.br

55 (21) 2494 0322

55 (21) 999 816 713

www.nba.com/magic/ tourismpartner

www.jterramarketing.com

FLORIDA: SEAWORLD PARKS & ENTERTAINMENT IMAGINADORA

Juliana Bordin

julianabordin@imaginadora. com.br

55 (11) 975 152 934 www.seaworldparks.com.br www.imaginadora.com.br

FLORIDA: TAMPA BAY AVIAREPS

Joyce Cordeiro

jcordeiro@aviareps.com

55 (11) 4063 8293 www.visittampabay.com www.aviareps.com.br

FLORIDA: VISIT CENTRAL FLORIDA

TM AMERICAS

Juanita Ariza Gomez

juanita@tmamericas.com visitcentralflorida.org/ www.tmamericas.com

FLORIDA: VISIT FLORIDA AVIAREPS

Rafaela Gross Brown rbrown@aviareps.com

55 (11) 4063 3084

55 (11) 942 492 119 www.visitflorida.com/ portugues www.aviareps.com

GOCITY AVIAREPS

Daniel Rocha drocha@aviareps.com

55 (11) 4063 8293

https://gocity.com/pt-br www.aviareps.com.br

NEW YORK –BROADWAY INBOUND BEB

Julienne Gananian julienne@beb.tur.br

55 (11) 942 240 409

www.broadwaycollection. com/pt-br

NEW YORK CITY TOURISM + CONVENTIONS

INTERAMERICAN NETWORK

Ana Beatriz Di Pietro anabeatriz@ interamericanetwork.com

55 (11) 3214 7529 www.nycgo.com

PARK CITY IMAGINADORA Camila Lucchesi camila.lucchesi@imaginadora. com.br

55 (11) 981 964 772

www.visitparkcity.com

SAN FRANCISCO SMI Igor Romeu igor.romeu@smilatam.net

55 (11) 995 096 321

www.sftravel.com

www.smilatam.net

PANROTAS Brazilian Overview 2023/2024 39

TRAVEL NEVADA 1GMS

Luciana Alonso

luciana.alonso@1gms.com

55 (11) 991 837 604

https://travelnevada.com/ www.1gms.com

TRAVEL SOUTH USA, EXPLORE GEORGIA AND NEW ORLEANS & CO

RIVER GLOBAL

José Madeira

jmadeira@riverglobal.net

Allan Colen

acolen@riverglobal.net

55 (11) 3051 9080

55 (11) 988 991 551

https://travelsouth.visittheusa. com/pt-br/ www.riverglobal.net

UNIVERSAL

DESTINATIONS & EXPERIENCES

Gabriella Cavalheiro

Director Business Development, LatAm

gabriella.cavalheiro@nbcuni.com

Renato Gonçalves

Manager Business Development

renato.goncalves@nbcuni.com

55 (11) 4550 6130

55 (11) 4550 6134

www.universalorlando.com/ portuguese/

VEGAS ATTRACTION GROUP

IDEAS4BRAND

Maria Camilla Alcorta

mariacamilla@ideas4brand.com www.ideas4brand.com

VISIT USA

Jussara Haddad Coordinator of the Visit USA Committee at US Commercial Service in Brazil - São Paulo

jussara.haddad@trade.gov

55 (11) 3250 5074

https://br.usembassy.gov/pt/

US TRAVEL ASSOCIATION/IPW

INTERAMERICAN NETWORK

Vera Achcar

vera@interamericanetwork.com

55 (11) 3214 7500

www.ipw.com

CENTRAL AMERICA AND THE CARIBBEAN

ANGUILLA TOURIST BOARD

INTERAMERICAN NETWORK

Ana Beatriz Di Pietro anabeatriz@ interamericanetwork.com

55 (11) 3214 7529

https://ivisitanguilla.com/pt/

ARUBA

VITRINE GLOBAL

Carlos Barbosa

c.barbosa@aruba.com

c.barbosa@vitrineglobal.com

55 (11) 2768 2111

55 (11) 991 073 654

www.aruba.com

BAHAMAS

TM AMERICAS

Juanita Ariza Gomez

juanita@tmamericas.com

www.bahamas.com/pt

www.tmamericas.com

CAYMAN ISLANDS

PTG CONSULTING

Mauricio Vianna

55 (11) 988 150 169

mvianna@ptgconsulting.com

www.visitcaymanislands.com/pt-br

www.ptgconsulting.com

CURAÇAO

Janaína Araujo

jaraujo@curacao.com

55 (11) 2659 5559

55 (11) 947 581 630

www.curacao.com/pt

DOMINICAN REPUBLIC

Paola Gómez

brasil@godominicanrepublic.com

55 (11) 2189 2403

www.godominicanrepublic.com

PANROTAS Brazilian Overview 2023/2024 40

JAMAICA

1GMS

Luciana Alonso

luciana.alonso@1gms.com

55 (11) 991 837 604 www.visitjamaica.com/ www.1gms.com

ST. MAARTEN

INTERAMERICAN NETWORK

Danielle Roman danielle@interamericanetwork. com

55 (11) 3214 7500 www.vacationstmaarten.com

ST. MARTIN

AVIAREPS

Joyce Cordeiro

jcordeiro@aviareps.com

55 (11) 4063 8293

https://www.st-martin.org/pt/ www.aviareps.com

SOUTH AMERICA ARGENTINA

VISIT ARGENTINA

INPROTUR

Natalia Pisoni

npisoni@argentina.travel

(54 11) 4850 1400 www.argentina.travel @visitargentina

BUENOS AIRES

María Laura Pierini

Promotion Manager

mlpierini@visitbue.com

(54) 9 11 67468652

www.turismo.buenosaires.gob.ar @travelBuenosAires

BUS TURISTICO DE BUENOS AIRES BY GRAYLINE

IDEAS4BRAND

Maria Camilla Alcorta mariacamilla@ideas4brand.com

www.ideas4brand.com

CHILE

IMAGINADORA

Jéssica Sanchez jessicasanchez@ imaginadora.com.br

55 (11) 982 545 993

www.chile.travel/pt-br/

COLOMBIA

PROCOLOMBIA

Vivian Echeverri

saopaulo@procolombia.co

55 (11) 3171 0165

www.colombia.travel

www.procolombia.co

PERU

PROMPERÚ

Milagros Ochoa de Koepke

mochoa@promperu.gob.pe

55 (11) 5990 3358

55 (11) 999 625 482

www.promperu.gob.pe

www.peru.travel

EUROPE AUSTRIA

ADVANTAGE AUSTRIA

Consul Günther Sucher

saopaulo@advantageaustria.org

55 (11) 3044 9944

www.advantageaustria.org/br

BELGIUM

VISIT BRUSSELS

AVIAREPS

Helen Demuro

hdemuro@aviareps.com

55 (11) 3106 2386 – ext 128

www.visit.brussels/pt

www.aviareps.com.br

PANROTAS Brazilian Overview 2023/2024 41

CZECH REPUBLIC

CZECH TOURISM TOURISM OFFICE IN SÃO PAULO

Luiz Fernando Destro

Diretor Brasil

55 (11) 994 365 211

saopaulo@czechtourism.com www.visitczechrepublic.com/ pt-PT

FRANCE

ATOUT FRANCE

Caroline Putnoki

South America Director caroline.putnoki@atout-france.fr

55 (11) 3372 5507

Izabèle Pesinato

Deputy Director izabele.pesinato@atout-france.fr

55 (11) 3372 5506

www.atout-france.fr/ www.france.fr/fr

GERMANY

VISIT BERLIN

Adriana Martins

visitberlin@berg.tur.br

55 (15) 997 007 012

www.visitBerlin.de

GREAT BRITAIN

VISITBRITAIN

Priscila Moraes Country Manager, Brazil

priscila.moraes@visitbritain.org

Íris Schardt

Communications Manager, Brazil

iris.schardt@visitbritain.org

www.visitbritain.com/en www.visitbritain.org/traveltrade

GREECE

ATHENS EXPRESS

IDEAS4BRAND

Maria Camilla Alcorta

mariacamilla@ideas4brand.com www.ideas4brand.com

REGION OF BURGUNDY; CITY OF BEAUNE and CITY OF DIJON

VERSION UNIQUE

Alexandre Rizaucourt

alexandre@versionunique.com

55 (11) 966 268 064

www.bourgognefranchecomte. com/

www.beaune-borgonha.com/ www.destinationdijon.com/

ITALY

CARRANI TOURS

IDEAS4BRAND

Maria Camilla Alcorta

mariacamilla@ideas4brand.com

www.ideas4brand.com

ENIT

Fernanda Longobardo

Coordinator Brazil

saopaulo@enit.it

55 (11) 4564 4700

www.enit.it

www.italia.it

NORWAY

VISIT NORWAY

GVA

Gisele Abrahão

gisele@globalvisionaccess. com

55 (11) 967 302 000

https://www.visitnorway.com

PANROTAS Brazilian Overview 2023/2024 42

PORTUGAL

PORTUGAL TOURISM

Bernardo Cardoso (Director) bernardo.cardoso@ turismodeportugal.pt

Alexandre Mesquita Product Manager alexandre.mesquita@ turismodeportugal.pt

55 (11) 3084 1830

55 (11) 970 530 475 www.visitportugal.com/pt-pt www.turismodeportugal.pt

VISIT MADEIRA AVIAREPS

Rodrigo Pereira

55 (11) 4063 8293 rpereira@aviareps.com www.madeiraallyear.com

www.aviareps.com.br

SPAIN

TURESPAÑA

Tourism office at Spain Embassy in Brazil -SP

Oscar Almendros Bonis Director/Tourism Counselor oscar.almendrosbonis@ tourspain.es

Maria Elvira Viedma elvira.viedma@tourspain.es

55 (11) 3704 2020

www.spain.info

CATALONIABARCELONA CATALONIA TOURISM AGENCY

Jordi Solé

55 (11) 3053-0477 / 55 (11) 98756-0063

jordisole_ext@gencat.cat www.catalunya.com

Facebook: catalunyaexperience. br

Instagram: catalunyaexperience. br

SWITZERLAND

SWITZERLAND TOURISM, SWITZERLAND CONVENTION & INCENTIVE BUREAU

Mara Pessoa

Manager Trade Relations Brazil

mara.pessoa@switzerland.com

info.br@switzerland.com

55 (11) 3149 3333 / 3330

55 (11) 930 391 110

www.myswitzerland.com/pt

TURKEY

MERIDIAN TOURS IDEAS4BRAND

Maria Camilla Alcorta

mariacamilla@ideas4brand.com

www.ideas4brand.com

AFRICA

SOUTH AFRICA

SOUTH AFRICAN TOURISM

Tati Isler

tati@ticomunicacoes.com

55 (11) 999 769 296

Marcelo Marques

marcelo@southafrica.net

55 (11) 954 782 596

Diogo Caldeira

diogo@ticomunicacoes.com

55 (11) 982 795 909

www.southafrica.net

www.ticomunicacoes.com

ASIA AND OCEANIA

HONG KONG

HONG KONG

TRADE DEVELOPMENT COUNCIL

Marina Barros – Director

55 (11) 3159 0765

55 (11) 3159 0778

sao.paulo.consultant@hktdc.org

www.hktdc.com

PANROTAS Brazilian Overview 2023/2024 43

ISRAEL

DIESENHAUS UNITOURS IDEAS4BRAND

Maria Camilla Alcorta mariacamilla@ideas4brand. com

www.ideas4brand.com

MALDIVES

MALDIVES HAPPY TRAVEL (DMC) BEB

Julienne Gananian

55 (11) 942 240 409

julienne@beb.tur.br

www.happytravel.com

OMAN

OMAN HAPPY TRAVEL (DMC) BEB

Julienne Gananian

55 (11) 942 240 409

julienne@beb.tur.br

www.happytravel.com

SAUDI ARABIA

HAPPY TRAVEL (DMC) BEB

Julienne Gananian

55 (11) 942 240 409

julienne@beb.tur.br

www.happytravel.com

SEYCHELLES

VISIT SEYCHELLES GVA

Gisele Abrahão

gisele@globalvisionaccess.com

55 (11) 967 302 000

https://seychelles.com/home

www.facebook.com

visiteseychelles

THAILAND

THAILAND TOURISM

Jefferson Santos

brazil@capitalmarketing.com.br

55 (11) 3159 2771

www.turismodatailandia.org

UAE

DUBAI BUSINESS EVENTS (MICE) AVIAREPS

Daniela Fabbri

daniela.fabbri@dubaidet.ae

55 (11) 4862 0062

https://www.visitdubai.com/ pt/whats-on

www.aviareps.com.br

DUBAI TOURISM AVIAREPS

Tatiana Issa

tatiana.issa@dubaidet.ae

55 (11) 4063 8897

www.visitdubai.com/pt

www.aviareps.com.br

DUBAI HAPPY TRAVEL (DMC) BEB

Julienne Gananian

55 (11) 942 240 409

julienne@beb.tur.br

www.happytravel.com

PANROTAS Brazilian Overview 2023/2024 44

ABOUT PANROTAS

WWW.PANROTAS.COM.BR

OUR PORTAL

Users/month:

427,096

Pageviews/month:

2,198,029

Sessions/month:

624,276

16,060 ( All Days ) and 19,757 ( Only Week Days )

Pageviews/day:

66,606

Sessions/day:

18,917

Session duration:

11 m 15 seg

Page per session:

3,52

PANROTAS SOCIAL MEDIA

PANROTAS Brazilian Overview 2023/2024 45

Users/day: 48,000 + followers 86,924 + followers 4,123 travel professionals 4,665 travel professionals

PANROTAS PORTAL 1

2

• Real time coverage of the Tourism Industry news and events

• Corporate Travel special hotsite

• Special sections: Aviation, Hotels, Destinations, People, Investments and Personalized ones for events, brands and special celebrations/campaigns

• Special coverages of events

• Special articles on important subjects for the industry

• 23 years in the market and only trade news portal in the Top 100 list of most visited Tourism portals in Brazil

YOUR BRAND AND STORIES WILL GET A BOOST WITH PANROTAS MAGAZINE

• 2 special Editions a month

• Digital and print versions

• Special issues on: Cruises, Tour Operators, ESG, LGBT Travel, Vacation Guide, Luxury Travel, Forum PANROTAS (Tourism Trends), Visit the Caribbean, Visit Florida, US Destinations, and Year in Review

• Distributed to our mailing list and at the main trade shows in Brazil such as Abav Expo, WTM Latin America, Festuris and ILTM Latin America

PANROTAS Brazilian Overview 2023/2024 46

3 4

PANROTAS FORUM 2024

• March, 5th and 6th 2024

• WTC Events Center São Paulo

• Attendance in 2023: +1,700 travel Leaders

• Some of the sponsors 2023: Walt Disney World/Disney Destinations, Delta Air Lines, Latam Airlines, Gol Airlines, Air France-KLM, BWH Hotel Group, Localiza, Aviva, Iberostar, ViagensPromo, CVC Corp and Despegar/Decolar

PANROTAS EVENTS

• PANROTAS has a list of other proprietary events such as: PANROTAS Next (roadshow through Brazilian cities)

• PANROTAS Power List luncheon (October)

•PANROTAS Best in Class Award (WTM Latin America)

• And we also organize and help you create your trade event in Brazil

PANROTAS Brazilian Overview 2023/2024 47

5

PANROTAS NEWSLETTER

+ 27,000 travel professionals receive our daily Newsletter

6 7

EXCLUSIVE E-BLAST

Distribute print and/or digital promotional material to up to 19,000

PANROTAS AT

Our community receive news and the digital version of PANROTAS Magazine

SUBSCRIBE TO OUR MONTHLY REPORT –BOM REPORT

• IN ENGLISH

• IN PORTUGUESE

PANROTAS Brazilian Overview 2023/2024 48

TRANSMISSIONS AND VIDEOS

Talk live with the audience, broadcast your event in our portal and social medias. Use our channels to promote your brand or activations.

SECTIONS AT PORTAL PANROTAS

PANROTAS Brazilian Overview 2023/2024 49

OUR PARTNERS 8 9 10

CONTACT US

PANROTAS Brazilian Overview 2023/2024 50

Adrian

Special projects for the US Market, both at PANROTAS platform and publications and LADEVI’s. abertini@ladevi.com +1 305 680 2683

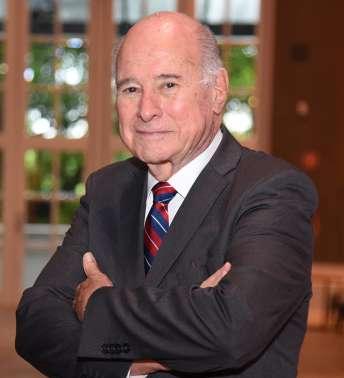

José Guillermo Condomí Alcorta President and founder guillermo@panrotas.com.br

Bertini

José Guilherme Alcorta CEO

guilherme@panrotas.com.br

artur@panrotas.com.br +55 11 97336-7236

Artur Luiz Andrade Editor-in-chief and chief communication officer

Ricardo Sidaras Commercial Director rsidaras@panrotas.com.br