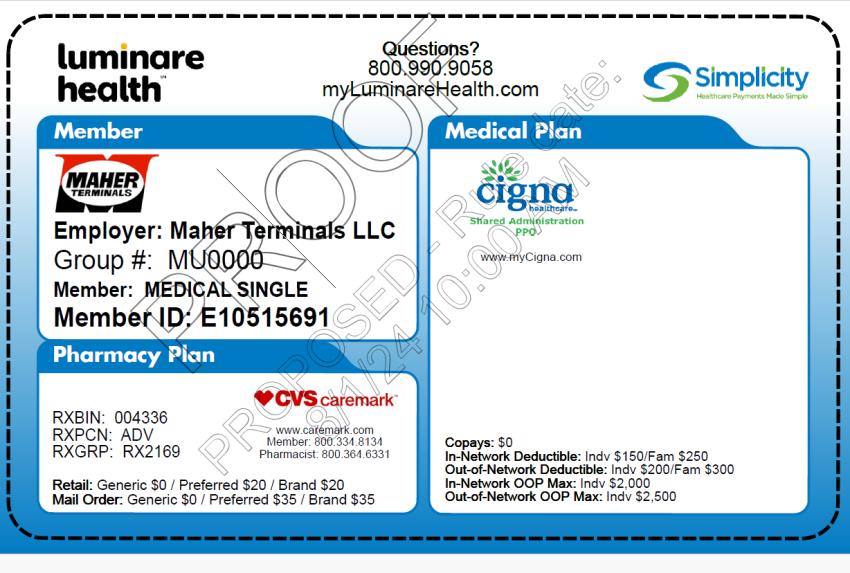

Network: Cigna

Third Party Administrator (TPA): Luminaire

Pharmacy Benefits Manager (PBM): RxBenefits

Maher PPO Plan

*This is a brief summary of the plan for comparison and does not include all provisions and exclusions under the plan For a complete description of plan benefits, please review the Summary of Benefits and Coverages (SBC) and/or Summary Plan Description (SPD). Maher Terminals believes this Plan is a “grandfathered health plan” under the Patient Protection and Affordable Care Act

All full-time employees working 30 hours or more per week are eligible for benefits effective the first of the month following your date of hire.

Your eligible dependents include:

• Your legal spouse*

• Dependent children up to age 26 regardless of student or employment status (must be able to validate)

• Dependent children over age 26 that are incapable of self- support due to total physical or mental disability (under most benefits outlined).

• If you choose to enroll your spouse/dependent child(ren), you will need to provide:

• Name

• Social Security Number

• Date of Birth

• Address (if different)

• Required Documents

*Legal spouse is defined as the spouse of the employee under a legally valid existing marriage, as defined by the state in which the employee was legally married, unless court ordered separation exists.

Unless you experience a life-changing qualifying event, you cannot make changes to your benefits until the next Open Enrollment period (November 1 –30th). Qualifying events include:

• Marriage, divorce, or legal separation

• Birth or adoption of a child

• Change in child’s dependent status

• Death of a spouse, child, or other qualified dependent

• Loss/Addition of other coverage

• Eligibility change due to relocation

• Qualified Medical Child Support Order

If you experience a qualifying life event during the year, notify Human Resources within 30 DAYS of the event to ensure the desired benefit coverage going forward.

PLEASE NOTE: Not every change in status permits a change in benefits plan elections. The election change must be consistent with the change in status that has occurred.

Luminare Health serves as our TPA for your medical claims and benefits. Access Luminare Health’s portal or mobile app for:

• General medical plan information including benefits, claims, and provider searches

• Help with challenging health issues including tests, treatments, new diagnosis, and care coordination

• Assistance with a catastrophic illness or injury

Luminare Member Services

Contact for all medical plan questions/concerns

Member ID

Use this number when contacting Luminare Health

RxBenefits/CVS

Caremark

Member Services

Pharmacy Plan

Info

Needed by pharmacist to process or file an Rx claim

Pharmacy

Cost/Copays

v

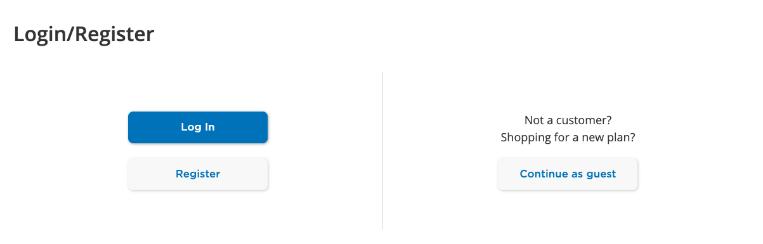

www.Cigna.com

Network: Select “PPO: Choice Fund PPO” Option

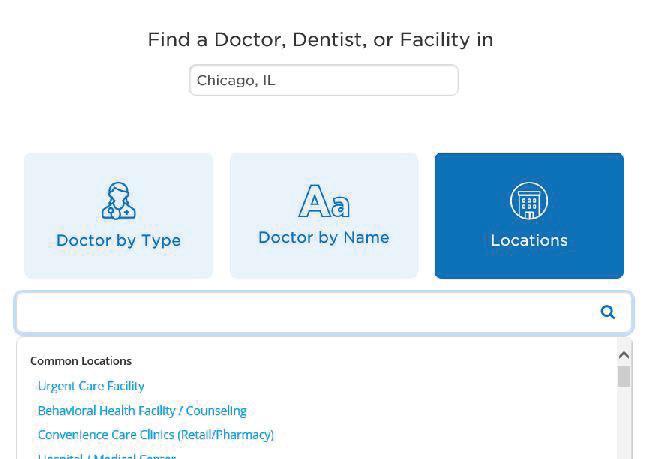

1. Go to Cigna.com and click “Find a Doctor, Dentist or Facility”

2. On the “How are you Covered” page, Select “Employer or School”.

3. Enter the geographic location you want to search and select the search type.

4. Members will then be prompted to either Login/Register for myCigna.com, or “Continue as guest.”

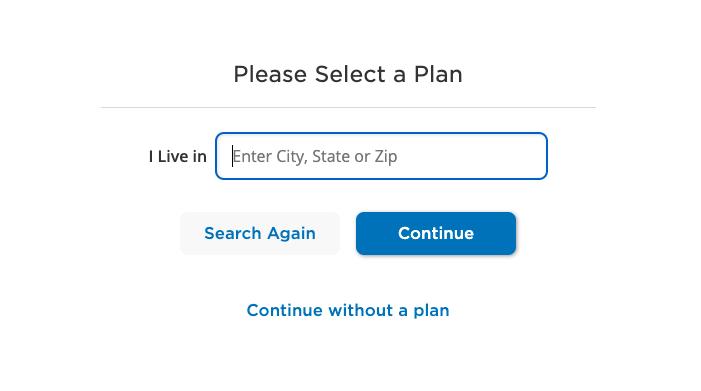

5. Fill in the “I Live in” field and click “Continue.”

6. Under “Please Select a Plan,” Select PPO. (Note: the network name may appear differently in different geographical areas.)

1. Follow Steps 1 – 3 listed on the previous Medical Provider Search. Then Go To Step 3a below:

3a. Click on Doctor by Type to bring up a list of provider types, for example Behavioral Health Counselor.

• When using the search process for the first time, you will see a pop-up window. To continue searching on Cigna.com, select “Continue as Guest”. (Selecting Login/Register will redirect you to myCigna.com)

• Selecting “Behavioral Health Counselor” brings up a page with a list of common issues that can be selected or skipped.

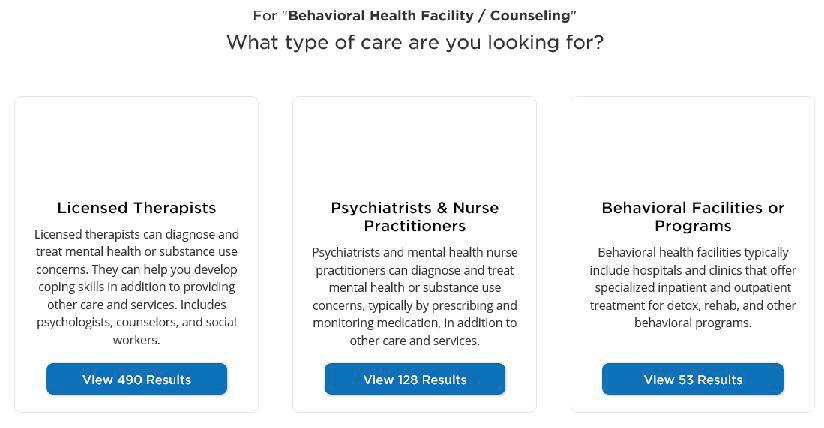

• Selecting “Addiction” or “Skip” brings up the “What type of care are you looking for?” page where you select between “Licensed Therapists”, Psychiatrists & Nurse Practitioners”, and “Behavioral Facilities & Programs”.

• Each will have a View Results button which includes the number of providers found in the City, State entered on landing page. The City, State can be edited at any time by selecting it.

• Selecting any of the “View Results” buttons will bring up the list of providers on the left and a map with their locations indicated by drop pins on the right.

3b. Click on Doctor by Name to bring up a box to type in the provider’s name. If you enter a full or partial name, such as a last name, a list of possible providers comes up from which your provider can be selected.

3c. Click on Locations to bring up a search box and list of potential location types.

• Select “Behavioral Health Facility/ Counseling” from the list to bring up the “What type of care are you looking for?” page where you select between “Licensed Therapists”, “Psychiatrists & Nurse Practitioners”, and “Behavioral Facilities & Programs” (same as under step 3a above). Continue to step 4 below for instructions for finding an in-network behavioral health facility.

4. To find an in-network Behavioral Health facility select Locations (step 3c.) and then select “Behavioral Health Facility / Counseling”

5. Next, select “Behavioral Facilities or Programs”

Maher Terminals offers all employees access to a powerful cost and quality transparency tool called Healthcare Bluebook (HCBB). HCBB ranks local providers by cost and quality with an easy-to-read color system to help you get quality care without overpaying. You can even earn cash-back rewards on select procedures! By using HCBB, you will:

By comparing what local providers charge for a specific procedure, you can make sure you’re not paying more than you should.

By checking the quality ranking of local providers for a specific procedure, you’ll know you’re in good hands.

You can access HCBB on your computer or via phone or tablet so you can shop from anywhere at any time.

You can earn cash-back rewards on select procedures. Luminare Health will share information about members’ claims with HBCC through a secure data feed. Those members that visited a fair price “green” provider on an eligible procedure will receive a rewards check from HCBB.

1. Log in to luminarehealth.com

2. Click the Healthcare Bluebook link in the My Links section.

3. Search by procedure, physician, or hospital.

Download the free Bluebook mobile app for on-the-go access

All employees and covered dependents enrolled in the medical plan have access to Teladoc at no additional cost (no copay or deductible) for virtual care to treat mild illnesses.

Consult with a state-licensed and U.S. boardcertified doctor via phone, video, or mobile app and receive professional guidance, diagnosis, and even a prescription (when necessary) from wherever you are – home, office, or on the road.

• Acute conditions and common illnesses such as allergies, sinus infections, pink eye, and rashes

• When your physician is unavailable and cannot be seen in a timely manner

• When your schedule doesn’t permit traveling to see your physician at their office (work, etc.)

• When you are traveling for work or on vacation

TELEDOC PROVIDERS:

• Are available 24/7/365

• Can consult via mobile app, 1-800-Teladoc, or Teladoc.com

• If medically necessary, can provide an electronic prescription that can be sent to the pharmacy of your choice

Go to http://www.teladoc.com/ to register as a member and download the mobile app for easy access to virtual providers

Maher Terminals’ employees and eligible dependents covered in the medical plan have prescription drug coverage through RxBenefits/CVS Caremark, our Pharmacy Benefit Manager. Access the pharmacy benefit by presenting your medical ID card along with your prescription at any of the chain or privately-owned pharmacies.

Log into My RxBenefits member portal at https://member.rxbenefits.com/home to manage and access your pharmacy benefit information including:

View pharmacy benefits coverage (Generic vs Brand)

View prior authorization status, including explanations of decisions

Receive timely communication and personalized updates for alternative medication therapies (related to anti-inflammatory and dermatological conditions)

800-334-8134

(8am - 7pm EST, M-F), or email customercare@rxbenefits.com

Dental Benefits are administered by Delta Dental of NJ. Benefits under this plan include Preventive, Basic, Major, and Orthodontic Services.

Major Services Include:

• Crowns

• Bridges

• Dentures

• Partial Dentures

Orthodontia for Children

• Up to age 19

• $2,000 lifetime maximum

Dental Provider Network Search:

• DeltaDentalNJ.com/FAD

• Network Name: Delta Dental PPO

How can I save the most money with my dental plan?

You’ll save the most when you see a dentist in the Delta Dental PPO network, as they offer the greatest discount. You’ll pay less with PPO dentists than with Delta Dental Premier® or out-ofnetwork dentists.**

How can I find a PPO dentist?

Visit DeltaDentalNJ.com/FAD and be sure to select the “Delta Dental PPO” network. Dentists with the “Greater Savings” icon participate in the PPO network.

Call the Delta Dental Customer Service Department at 800-452-9310 or call 800-DELTAOK to have a listing sent to you.

*Deductible applies to all services

**Balance billing may occur when using a Premier or non-network provider

The Maher Terminals Comprehensive Medical Plan allows for one (1) eye exam & refraction per calendar year (claims processed through the medical plan). In addition, Maher offers fully insured vision benefits through EyeMed. The chart below is a breakdown of the benefits available under the EyeMed Plan. America’s largest vision network with the right mix of providers!

Several in-network options for buying eyewear online!

Maher Terminals insures all full-time employees under a Basic Life Insurance Policy, which provides a benefit of 3.5x salary, up to maximum $850,000 without evidence of insurability .

• Employees: Each active, full‐time employee working 30 or more hours per week, except any person working on a temporary or seasonal basis.

• Enrolled: Date of Hire

• 3.5x earnings, rounded to the next higher $1,000 (maximum of $850,000)

• Up to a maximum of $850,000 without Evidence of Insurability

• Age: 70

• Original Benefit Reduced To 50%

• Conversion privilege

• Portability

• Bereavement Counseling Service

• Travel Assistance Service

• Identity Theft Remediation

• Legal & Financial Services

• Coverage is employer paid.

Remember to review your life beneficiary information throughout the year, and update if necessary, especially in the event of any life changes such as birth, death, divorce, etc. Contact HR to update your information.

Maher Terminals provides all full-time employees with a Short-Term Disability Wage Supplement benefit if you become temporarily disabled.

To be eligible for company supplemental wage payments, employees:

1. Must apply and be approved for short-term disability benefits through the state of New Jersey

2. Must remain within close vicinity of the employee’s home while on STD

3. Cannot engage in outside employment

4. Avoid activities that may delay recovery and a return to work

• All full-time employees (both exempt & non-exempt) will continue to receive their full wages for up to eight (8) weeks or four (4) bi-weekly payrolls. During this period employees are required to surrender the full amount of the STD payment to Maher for the period that full wages were paid.

• If employees do not return after the 8 weeks, the company will supplement employee’s State STD benefit as follows:

o Employees employed five (5) years or less, 50% of the difference between their regular wages and the disability benefit to be received

o Employees employed five (5) years up to ten (10) years, 75% of the difference between their regular wages and the disability benefit to be received

o Employees employed more than ten (10) years, will continue to receive full wages while out on approved STD and is required to surrender the full amount of the STD payment to Maher for the period that full wages were paid.

Short-term disability (STD) insurance is administrated by the state of New Jersey.

STD Benefit overview:

• Eligibility: worked 20 weeks earning at least $260 weekly or earned a combined total of $13,000 for the year

• Benefit: 85% of average weekly wage up to maximum

• Benefit duration: 26 weeks

• Elimination period: 1 week; benefits begin on the 8th day of disability, known as the “waiting week”. If disabled for 31 days or more, waiting week is retroactively paid.

Maher Terminals insures all full-time employees under a Long-term Disability (LTD) policy. The LTD policy is a disability income protection insurance that provides a benefit for “long term “disability resulting from a covered injury or sickness. Benefits begin at the end of the elimination period and continues while you are disabled up to the maximum benefit duration.

o Enrolled: Date of Hire

o Benefit Amount: Monthly benefit is an amount equal to 60% of covered earnings, up to a maximum benefit amount (see HR for maximum amount)

o Elimination Period: 180 consecutive days of total disability

o Maximum Benefit Duration: Benefits not to exceed the longer of:

▪ Social Security retirement age

▪ Duration of benefits in age chart (see HR for age chart)

o Contribution Requirements: Coverage is employer paid

The NJ Commuter Benefit allows employees to use pre-tax dollars (up to IRS maximum) to pay for qualified parking and commuter expenses.

Eligible Expenses:

o Mass transit costs (train, bus, ferry, and van pool)

o Parking fees (at work or at park-and-ride sites)

Maher provides paid vacation time to all regular, full-time employees for rest and relaxation. Vacation time is granted on January 1st of each calendar year based upon an employee’s length of service with Maher Terminals.

If a regular, full-time employee is hired before July 1st of the calendar year, then the employee is entitled to one (1) week of vacation time within the same calendar year after completing six (6) months of service. Thereafter, vacation time is accrued as follows:

Six (6) months of service

Five (5) years of service

Fifteen (15) years of service

Two (2) weeks effective the January 1st following your six (6) month service anniversary

Three (3) weeks effective the January 1st following your fifth (5th) year service anniversary

Four (4) weeks effective the January 1st following your fifteenth (15th) year service anniversary

In order comply with the New Jersey Sick Leave Law, employees are front-loaded 40 hours of PTO on January 1st of each year (new employees are awarded prorated hours based on the number of weeks worked in the first year of service after 90 days of employment). These hours may be used for personal (non-sick) related reasons as well as illness.

No carry-over of days at the end of the year; no pay-out of remaining days upon termination of employment.

*See Holiday Calendar for details Length of

COMPANY PAID HOLIDAYS

President’s Day

Good Friday

Memorial Day

Independence Day

Labor Day

Columbus Day

Thanksgiving Day

Friday or Monday after Thanksgiving

Christmas Eve & Day

New Year’s Eve & Day

2 out of 5 Elective Holidays*

Maher Terminals offers options to eligible employees to help you save for retirement. All new, full-time employees are eligible to participate in the plan on the 1st of the month following their date of hire.

The 401 (k) plan is an investment tool with pre-tax and post-tax options. While both accounts allow your savings to grow tax-free, they differ in tax treatment at the time of contributions and withdrawals. Pre-tax and post-tax catch-up contributions are also available for participants age 50 and older.

Pre-Tax – Contributions are pre-tax, meaning your taxable income is reduced by the amount you contribute, and you do not pay income tax on the earnings in the account (such as interest) until you start making withdrawals, typically at retirement.

Roth – There are no immediate tax savings for a Roth contribution, however, the contributions can be withdrawn tax-free when in retirement.

Employees may contribute a percentage of their salary up to the plan maximum of 80% and not to exceed the annual limit set by the IRS each year. Employees 50 years of age and older may make an additional contribution, known as “catch up” contributions, which are also subject to annual limits set by the IRS.

Profit Sharing* – Maher may make discretionary contributions into employees’ 401(k) accounts.

• Must be employed for 6 months to be eligible

• 3-year vesting period

• Employee directed investing

The Maher Terminals 401(k) and Profit Sharing Plan is administered through John Hancock Retirement Plan Services (JHRPS). Once you have met eligibility requirements, you can go online to view your account, make any changes to contributions and/or investments at myplan.JohnHancock.com

JHRPS does not offer financial advice but rather offers tools to help you prepare for retirement via the participant portal.

New employees are auto-enrolled in the 401(k) with a contribution rate of 6% invested in the age-appropriate life-cycle funds with a 30 day window to make initial changes to contribution rates, investments, or to opt-out.

Available quarterly, semi-annually, or annually based on the requested auto balance date.

Employees enrolled in the 401(k) will have an automatic increase in contribution of 1% every year up to a maximum contribution of 15%. Enrollees can log into their account to adjust this auto increase.

Maher matches 25% on all employee contributions. Catch-up contributions are not matched.

As an alternative to participation in the Maher Terminals Pension Trust, which was closed to new participants effective 12/31/2008, Maher may make a contribution to employees’ Nonelective Contribution Plan.

• Must be hired 2009 or later

• Must be employed for 6 months to be eligible

• 3-year vesting period

• Employee directed investing

• All employees hired prior to 2009, who have met eligibility rules, are participants in the Plan.

• Closed to employees hired 2009 or after.

Remember to review your 401(k) and Profit Sharing Plan beneficiary information throughout the year, and update if necessary, especially in the event of any life changes, such as birth, death, divorce, etc. Update your information by:

• Logging into your account at myplan.johnhancock.com

• Select Maher Terminals 401 (k) and Profit Sharing

• Click on the “Quick Links” drop down

• Click on “My Profile, Beneficiary, and Settings”

• Click on the “Beneficiaries Tab”

*At Company’s Discretion

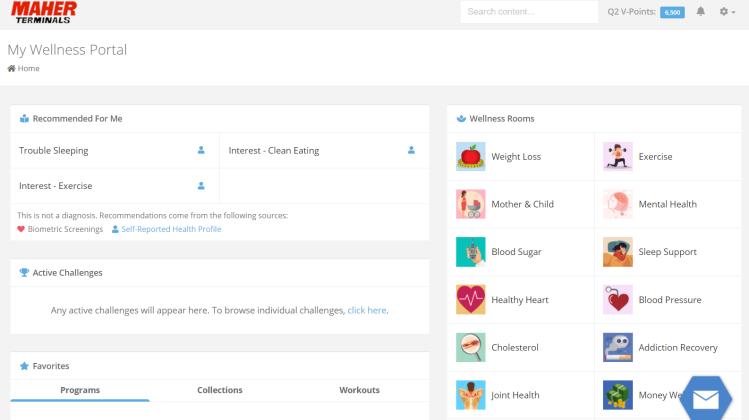

Maher Terminals is committed to providing employees and their families the resources to lead a healthier lifestyle. Maher Strong is our initiative developed to emphasize education, opportunities, and fun regarding your health and wellness.

Maher Terminals provides a Wellness Platform, powered by Vigoroom. Available to all employees at no cost, this tool provides various customized ways for you to Eat Well, Move Well, Sleep Well, Feel Well, Live Well!

The platform is accessible via the website or mobile app. On the platform you’ll:

• Get access to 100’s of programs to help you lose weight, relieve stress, anxiety & depression, sleep better, strengthen your body, improve finances, get in shape, and so much more!

• Have the ability to build your own unique and personalized health and fitness profile.

• Earn points by engaging with content designed to improve your health for a chance to win prizes!

• Easily navigate the user-friendly platform.

• Connect your wearable device to track your steps, blood sugar, weight, sleep, and activity over time. 300+ supported devices!

Through Luminare, Maher Comprehensive Medical Plan members have access to the Active & Fit Direct Program. For a discounted monthly membership fee and a one-time enrollment fee you can have access to the following benefits.

• A gym membership to your choice of 11,900+ standard gyms and/or 5,600+ premium exercise studios with 20% – 70% discounts on most

• You can switch gyms or cancel anytime

• Over 9,000 on-demand workout videos so you can work out at home or on the go

• Once enrolled, you can enroll your spouse

• A variety of workout classes available anytime on YouTube and Facebook

• Activity tracking through the Active&Fit Direct Connected! tool, which aggregates data from over 250 wearable fitness trackers and apps

• One-on-one well-being coaching on fitness, nutrition, stress, sleep, and more

• Digital resources and classes

• No long-term contracts

myLuminareHealth.com

Go to the “My Links” tile

Click on “Fitness Center Membership Program”

Offered to all Maher Terminals’ employees and their families, the EAP from ACI Specialty Benefits is provided at no cost. Contacting an advocate to help handle life’s challenges is confidential and your information will never be shared with Maher Terminals.

The EAP provides professional services to help employees address a variety of personal, family, life, and work-related issues. From everyday stress to relationship issues at work or home, the EAP provides support for overall health, well-being, and life management. EAP benefits are 100% confidential and available to all covered employees and family members, regardless of location.

• Unlimited telephonic clinical assessment and referral

• 24/7 live answer, online, mobile, and social access to services

• Local and international network of providers

• Support available in 180 languages

• All family members eligible for services

• Child, elder, and pet care referrals

• Legal and financial consultation

• Education referrals and resources

• Referrals for personal services

• Health and wellness resources

• Veteran-specific support

• Community-based resource referrals

Employees can register for myACIonline to get instant access to personalized benefits information and to request referrals and services. To conveniently access services:

1. Go to http://rsli.acieap.com

2. Click on “Sign Up” using the code that is provided on the website

3. Log in with your email address and password used when signing up for an account

Start accessing benefits immediately!