LendingPoint is committed to providing comprehensive and competitive benefit programs that are flexible enough to meet the needs of you and your family. This guide includes information to help you understand your options plus resources to contact for questions and further assistance.

All full time employees working a minimum of 30 hours per week are eligible for benefits the first day of the month following date of hire, (on the 1st if hired the 1st of the month). You may also enroll your legal dependents, including your spouse and dependent children under age 26. Coverage for domestic partners is also available. Please contact HR for details.

Unless you experience a life changing qualifying event, you cannot make changes to your benefits until the next Open Enrollment period. If you experience a qualifying event, you must submit your request to change your benefits within 30-days of the date the event occurred. Qualifying events include:

• Marriage, divorce or legal separation

• Birth or adoption of a child

• Change in child’s dependent status

• Death of a spouse, child or other qualified dependent

• See HR for additional life events such as loss of employment.

• Full time employees working 30 hours or more per week are eligible for all benefits. Have your information ready.

• Have Social Security numbers and birth dates for you, your spouse & your dependent children ready when you enroll. Some benefits cannot be issued without this information. This information is also needed for your beneficiary.

Are

• You will still need to record your decision to waive coverage. Make your Elections.

• Enrollment can be completed 24/7 in Employee Navigator or by speaking with a Benefits Counselor by making an appointment: https://calendly.com/lending point 1/oe

Enrollment can be completed 24/7 in Employee Navigator or by speaking with a Benefits Counselor by scheduling an appointment.

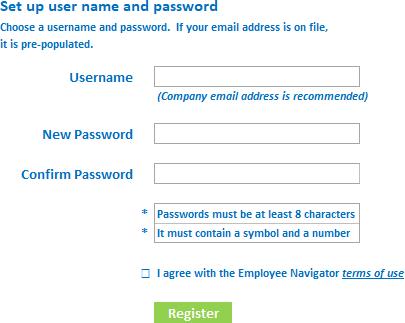

If you have not yet registered, follow the instructions below. If you do not remember your login credentials use the forgot username/password option.

If you would like to learn more about the benefits being offered to you or need assistance enrolling, use the link below to schedule a time to speak with a professional Benefits Counselor!!

https://calendly.com/lending-point-1/oe

Once you are ready to make your elections, you can create an account and/or login to Employee Navigator by clicking the below link:

https://www.employeenavigator.com/benefits/Account/Login

• Click the 'Register as a new user' link.

• Enter the information requested on the registration screen. The Company identifier is "LendingPoint".

• Enter your desired password on the resulting screen. Please note the password requirements. You may also set/change your username here it will default to your email address if that has already been entered in the system.

• If you have successfully completed the registration, you will receive a notification on the next screen and will be able to log in using your new username and password.

• Once logged in, click the "Start Benefits" link.

Open your camera app and point your phone’s camera at the code above to schedule a Benefit Counseling session:

Digital tools to keep you connected

Register for your personalized website on myuhc.com® and download the UnitedHealthcare® app. These digital tools are designed to help you understand your benefits and make informed decisions about your care.

• Find care and compare costs for providers and services in your network

• Check your plan balances, view your claims and access your health plan ID card

• Access wellness programs and view clinical recommendations

• 24/7 Virtual Visits – Connect with providers by phone or video to discuss common medical conditions and get prescriptions*,* if needed *

• View your health care financial account(s) such as HSA, FSA or HRA

• Compare prescription costs and order refills Download the app Available for iPhone and Android

Register today

Scan the QR code or go to myuhc.com and click Register Now See next page for registration steps

Eligible employees have access to a 1-year Apple Fitness+ subscription at no additional cost.* The first fitness service powered by Apple Watch.

Adding value to your benefits may help inspire healthier behavior:

• $79 value per employee can be shared with up to 5 family members.

• A single, comprehensive offering for various fitness levels powered by Apple Watch.

• Access to on-demand workouts on iPhone, iPad and Apple TV, with new workouts and meditations added every week.

Discover a wellness offering designed to help make fitness more accessible for your employees. It adds value to your benefits and may help them take ownership of their health and well-being.

UnitedHealthcare is bringing quality digital fitness classes right to your employees’ fingertips. It’s a program that helps them lead more active lives and it’s available at no additional cost to them.

• UnitedHealthcare plansinclude 1 year of Peloton® App Membership*

• $155 value per employee and each covered family member

• Single,comprehensive offering for various fitness levels, no equipment required

• Access to Peloton’s engaging digital fitness and meditation classes

• Members and participants may purchase Peloton Bike, Bike+ or Tread at special pricing*

Peloton’s immersive live and on demand digital classes may help employees of all fitness levels get motivatedto achieve theirhealth goals. The digital experience makes it convenient to jump into a workout anywhere, anytime, from a phone, tablet or TV.

• Engaging variety of classes to choose from

• Flexibility that may fit any schedule with classes from 5 to 90 minutes

• Exciting workouts led by expert instructors who bring their knowledge, personality and curated playlists

• Help for achieving goals through progress tracking with workout metrics

• Motivating challenges and training programs

• Engaging social features to connect with others

Only 50%

of adults get the exercise needed to help reduce and prevent chronic diseases1

per year is spent on health care costs associated with inadequate physical activity1

Flexible spending accounts (FSAs) allow you to pay for non reimbursed healthcare and eligible day care expenses on a pre tax basis before Federal, State, Social Security and Medicare taxes. Flores and Associates administers the LendingPoint FSA(s).

There are two types of flexible spending accounts: medical and dependent care. You may participate in one or both. You decide how much you want to deposit into your account. That amount is deducted on a pre tax basis evenly during the calendar year from your paycheck. You must re-elect this benefit each year if you want to participate.

Your medical FSA reimburses you for eligible, out of pocket medical, dental and vision expenses for yourself and your covered dependents. When you have a qualified expense, you can use your Flores Debit Card to pay for expenses on a pre tax basis.

Please note: The Limited F.S.A. (covering dental and vision expenses) is available to H.S.A. participants.

The dependent care spending account is a pre tax way for you to pay for eligible dependent care expenses so you (and if you are married, your spouse) can work. You can set aside tax-free income to pay for qualified dependent care expenses, such as daycare, that you normally pay for with after tax dollars. Qualified dependents include children under 13 and/or dependents who are physically or mentally handicapped.

Funds in this account are available as contributions are made. Expenses may only be reimbursed after the dependent care services have been performed. For example, if a dependent care provider requires payment at the beginning of the week, the employee may not seek reimbursement until the end of the week.

Note: For more information on qualified expenses, visit the Flores site at: www.flores247.com

Medical:

Dependent Care: $5,000

Health Savings Accounts (HSAs) are a great way to save money and pay for medical expenses. HSAs are tax advantaged savings accounts that accompany high deductible health plans (HDHPs).

HSA money can be used tax free when paying for qualified medical expenses, helping you pay your HDHP’s larger deductible. At the end of the year, you keep any unspent money in your HSA. This rolled over money can grow with tax deferred investment earnings, and, if it is used to pay for qualified medical expenses, then the money will continue to be tax free. Your HSA and the money in it belong to you, not your employer or insurance company.

Flores & Associates administers the HSA. You must be enrolled in the High Deductible Plan in order to enroll in the HSA. For the HSA, you have the option to set up your HSA bank account with Flores & Associates. You decide how much you want to contribute to your HSA bank account, up to the IRS limits.

Deductions are taken from your paycheck on a pre tax basis and sent directly to your Flores HSA bank account. You monitor and access your HSA bank account 24/7 through the Flores & Associates online portal and mobile app. You will be issued a Debit Card (with your contributions loaded). You can also order checks for a small fee.

Life insurance can help provide for your loved ones if something were to happen to you. LendingPoint is pleased to provide all full time employees with $50,000 in group life and accidental death and dismemberment (AD&D) insurance.

In addition to basic life insurance, some employees may want to purchase additional coverage. With voluntary life insurance, you are responsible for paying the full cost of coverage through payroll deductions. You can purchase coverage for yourself, your spouse or your dependent children. The chart below outlines your benefit options for voluntary life insurance.

$10,000 $100,000

Spouse

Child

$5,000 increments to a maximum of $100,000, not to exceed 50% of the employees benefit amount $5,000 $25,000

Options of $1,000, $2,000, $4,000, $5,000 or $10,000 (at 6 months old) Child 15 days to 6 months old $100

*Amounts over the Guarantee Issue are subject to Evident of Insurability.

LendingPoint provides full time employees with short and long term disability income benefits. This coverage provides income protection for regular expense items, which are typically covered by your paycheck. If you experience a disability that impacts your ability to work and earn a paycheck, disability insurance helps cover the gap. At LendingPoint, we want to do everything we can to protect you and your family. That’s why we pay for the full cost of short and long term disability insurance meaning that you owe nothing out –of-pocket.

Coverage Effective Date Benefit Cost

Short-Term

Accident insurance provides a financial cushion for life’s unexpected events. You can use it on anything you want, such as to help pay costs that aren’t covered by your medical plan. It provides you with a lump sum payment when you or your family need it most. And best of all, the payment is made directly to you, and is made regardless of any other insurance you may have. It’s yours to spend however you like, including for you or your family’s everyday living expenses.

If you are out of work unexpectedly, you may also have trouble meeting household expenses like your mortgage payments, car payments, childcare expenses or household upkeep expenses due to lost or reduced income while you recover. Hospital indemnity insurance can help you be better prepared by providing you with a payment to use as you see fit if you experience a covered event and meet the policy and certificate requirements. Typically, a flat amount is paid for the day that you are admitted to a hospital and a per day amount is paid for each day of a covered hospital stay, from the very first day of your stay.

Critical Illness Insurance is coverage that can help safeguard your finances by providing you with a lump-sum payment — one convenient payment all at once when you or your loved ones need it most. The extra cash can help you focus on getting back on track without worrying about finding the money to cover the costs of treatment. The payment is made directly to you and is in addition to any other insurance you may have. It’s yours to spend however you like, including for everyday living expenses. While recovering, critical illness insurance is there to make life a little easier.

$0.42 $0.67 $0.60 $0.86

$0.48 $0.77 $0.67 $0.96

$0.59 $0.94 $0.78 $1.13

-

-

-

-

$0.74 $1.17 $0.93 $1.36

$1.02 $1.58 $1.21 $1.77

$1.43 $2.19 $1.62 $2.38

$2.06 $3.14 $2.25 $3.33

$2.90 $4.40 $3.09 $4.59

$4.07 $6.15 $4.26 $6.34

- 69 $5.70 $8.60 $5.89 $8.79

$7.69 $11.59 $7.88 $11.78

$10.65 $16.02 $10.84 $16.21

Coverage that helps with unexpected expenses, such as those that may not be covered under your medical plan.

Accidents can happen when you least expect them. And while you can’t always prevent them, you can get help to make your recovery less expensive and stressful.

In the U.S. there are approximately 29.4 million trips to the emergency room annually due to injuries.1 These visits can be expensive — in fact, ER bills average around $1,389 per visit,2 and even seemingly small injuries can come with unexpectedly high hospital bills.

You may be thinking — that’s why I have health insurance. But even the best medical plans may leave you with unexpected expenses like deductibles, copays, extra costs for out-of-network care, and non-covered services.

You can’t plan for accidents, but you can try to handle them better by being financially prepared.

Accident insurance provides a financial cushion for life’s unexpected events. You can use it on anything you want, such as to help pay costs that aren’t covered by your medical plan. It provides you with a lump-sum payment — one convenient payment all at once — when you or your family need it most. The extra cash can help you focus on getting back on track, without worrying about finding the money to help cover the costs of treatment.

And best of all, the payment is made directly to you, and is made regardless of any other insurance you may have. It’s yours to spend however you like, including for your or your family’s everyday living expenses.

Whatever you need while recovering from an accident or injury, accident insurance is there to make life a little easier.

With MetLife Accident Insurance, you can take your coverage with you if you change jobs or retire.3

Accident insurance can help you manage unexpected expenses

— so you can focus on getting well.

This plan provides a lump-sum payment for over 150 different covered events, such as:

•Fractures6

•Dislocations6

•Second and third degree burns

•Skin grafts

•Torn knee cartilage

•Ruptured disc

•Concussions

•Cuts or lacerations

•Eye injuries

•Coma

•Broken teeth

You’ll receive a lump-sum payment when you have these covered medical services or treatments:7

•Ambulance

•Emergency care

•Inpatient surgery

•Outpatient surgery

•Medical Testing Benefits (including X-rays, MRIs, CT scans)

•Physician follow-up visits

•Transportation

•Home modifications

•Therapy services (including physical and occupational therapy, speech therapy)

This plan provides protection 24 hours a day — while on or off the job.

See your Disclosure Statement or Outline of Coverage/Disclosure Document for full details on your coverage.

1. Centers for Disease Control and Prevention: Emergency Department Visits. CDC/National Center for Health Statistics. Accessed July 2020.

2. "Emergency Rooms vs. Urgent Care Centers” Debt.org. Last updated November 12, 2019.

Help protect yourself, your family and your budget from the financial impact of unexpected injuries.

3. Eligibility for portability through the Continuation of Insurance with Premium Payment provision may be subject to certain eligibility requirements and limitations. For more information, contact your MetLife representative.

4. Coverage is guaranteed provided (1) the employee is actively at work and (2) dependents to be covered are not subject to medical restrictions as set forth on the enrollment form and in the Certificate. Some states require the insured to have medical coverage. Additional restrictions apply to dependents serving in the armed forces or living overseas.

5. Covered services/treatments must be the result of an accident or sickness as defined in the group policy/certificate. See your Disclosure Statement or Outline of Coverage/Disclosure Document for more details.

6. Chip fractures are paid at 25% of Fracture Benefit and partial dislocations are paid at 25% of Dislocation Benefit.

7. Covered services/treatments must be the result of a covered accident as defined in the group policy/certificate. See your Disclosure Statement or Outline of Coverage/Disclosure Document for more details.

METLIFE'S ACCIDENT INSURANCE IS A LIMITED BENEFIT GROUP INSURANCE POLICY. The policy is not intended to be a substitute for medical coverage and certain states may require the insured to have medical coverage to enroll for the coverage. The policy or its provisions may vary or be unavailable in some states. There is a preexisting condition limitation for hospital sickness benefits, if applicable. MetLife’s Accident Insurance may be subject to benefit reductions that begin at age 65. And, like most group accident and health insurance policies, policies offered by MetLife may contain certain exclusions, limitations and terms for keeping them in force. For complete details of coverage and availability, please refer to the

Medical bills have contributed to 58% of bankruptcies.1 In 2020, one in four working-age adults with insurance coverage reported medical bill problems or debt in the past year.2

The financial consequences of surviving a critical illness are something few people are prepared for. Expenses that may not be covered by medical plans, such as co-pays, deductibles, childcare, mortgage, groceries and experimental treatments, could cut into your savings.

When critical illness affects your family, you’ll have the support you need when it matters most with MetLife Critical Illness Insurance

Critical Illness Insurance is coverage that can help safeguard your finances by providing you with a lump-sum payment — one convenient payment all at once — when you or your loved ones need it most. The extra cash can help you focus on getting back on track without worrying about finding the money to cover the costs of treatment.

And best of all, the payment is made directly to you, and is in addition to any other insurance you may have. It’s yours to spend however you like, including for everyday living expenses.

While recovering, critical illness insurance is there to make life a little easier.

For questions, call MetLife at 1 800 GET-MET8 [1 800 438-6388]

Coverage to helppay forexpenses associated with ahospitalization that may not becovered underyourmedical plan.

People may not budget for hospital1 bills. But you can be prepared.

Because even the best medical plans may leave you with extra expenses. No one ever expects to be in the hospital. And your stay can require a variety of treatments, testing, therapies and other services — each of which can mean extra out-of-pocket costs, beyond what your medical plan may cover.

With an average cost of just over $10,700 per hospital stay in the U.S.,2 it’s easy to see why having hospital indemnity coverage may make good financialsense. Just think about the possibility of havinga hospital stay due to an accident or illness3:

•Your child gets hurt on the school playground

1.Hospital

•You experience chest pains while exercising and are admitted to the hospital to be checked and monitored

•Your spouse4 undergoes an emergency appendectomy

Some of the expenses you may not expect include:

•Medical plan deductibles and co-pays

•Extra expenses associated with out-of-network care and treatment.

If you are out of work unexpectedly, you may also have trouble meetinghousehold expenses like yourmortgage payments, car payments, childcare expenses or household upkeep expenses due to lost orreduced income while you recover.

Hospital indemnity insurance can help you be betterprepared by providing you with a payment to use as you see fit if you experience a covered event and meet the policy and certificate requirements.

Typically, a flat amount is paid for the day that you are admitted to a hospital and a per-day amount is paid for each day of a covered hospital stay, from the very first day of your stay. This payment can help you focus more on your recovery and can help you focus less on the extra expenses associated with a hospitalization resulting from an accident or illness may bring.

See your Disclosure Statement or Outline of Coverage/Disclosure Document for full details.

•Acceptance is guaranteed for you and your eligible family members.5

•Competitive group rates

•Premium payment through payroll deductions

METLIFE'S HOSPITAL INDEMNITY INSURANCE IS A LIMITED BENEFIT GROUP INSURANCE POLICY. The policy is not intended to be a substitute for medical coverage and certain states may require the insured to have medical coverage to enroll for the coverage. The policy or its provisions may vary or be unavailable in some states. Prior hospital confinement may be required to receive certain benefits. There may be a preexisting condition limitation for hospital sickness benefits. MetLife’s Hospital Indemnity Insurance may be subject to benefit reductions that begin at age 65. Like most group accident and health insurance policies, policies offered by MetLife may contain certain exclusions, limitations and terms for keeping them in force. For complete details of coverage and availability, please refer to the group policy form GPNP12-AX, GPNP13-HI, GPNP16-HI or GPNP12-AX-PASG, or contact MetLife. Benefits are underwritten by Metropolitan Life Insurance Company, New York, New York. In certain states, availability of MetLife’s Group Hospital Indemnity Insurance is pending regulatory approval. Hospital does not include certain facilities such as nursing homes, convalescent care or extended care facilities. See your Disclosure Statement or Outline of Coverage/Disclosure Document for full details.

Quality legal assistance can be pricey. And it can be hard to know where to turn to find an attorney you trust. You can have a team of top attorneys ready to help you

MetLife Legal Plans gives you access to the expert guidance and tools you need to handle the broad range of personal legal needs you might face throughout your life. This could be when you’re buying or selling a home, starting a family, dealing with

Reduce the out-of-pocket cost of legal services with MetLife Legal Plans.

Our service is tailored to your needs. With network attorneys available in person, by phone or by email and online tools to do-it-yourself — we make it easy to get legal help. And, you will always have a choice in which attorney to use. You can choose one from our network of prequalified attorneys, or use an attorney outside of our network and be reimbursed some of the cost.1

Best of all, you have unlimited access to our attorneys for all legal matters covered under the plan.

When you need help with a personal legal matter, MetLife Legal Plans is there for you to help make it a little easier.

Our website provides you with the ability to create wills, living wills and powers of attorneys online in as little as 15 minutes. Answer a few questions about yourself, your family and your assets to create these documents instantly. In states where available, you also have access to sign and notarize your documents online through our video notary feature.2

Create an account at legalplans.com to see your coverages, select an attorney and get a case number for your legal matter. Or, give us a call at 800.821.6400 for assistance.

Call the attorney you select, provide your case number and schedule a time to talk or meet.

There are no copays, deductibles or claim forms when you use a network attorney for a covered matter.

Cover the costs on a wide range of common legal issues

Access experienced attorneys to help with estate planning, home sales, tax audits and more.

With MetLife Legal Plans, you, your spouse and dependents get legal assistance for some of the most frequently needed personal legal matters — with no waiting periods, no deductibles and no claim forms when using a network attorney for a covered matter.

Home & Real Estate

• Debt Collection Defense

• Identity Management Services

3

• Boundary or Title Disputes

•

• Identity Theft Defense

• Negotiations with Creditors

• Personal Bankruptcy

• Home Equity Loans

• Mortgages

• Property Tax Assessments

• Promissory Notes

• Tax Audit Representation

• Tax Collection Defense

• Sale or Purchase of Home

• Security Deposit Assistance

• Tenant Negotiations

•

Family

•

• Refinancing of Home

• Zoning Applications Estate

• Powers of Attorney (Healthcare, Financial, Childcare, Immigration)

•

• Name Change

• Parental Responsibility Matters

•

• Disputes Over Consumer Goods & Services

• Incompetency Defense

• Revocable & Irrevocable Trusts

• Simple Wills

• Prenuptial Agreement

• Protection from Domestic Violence

• Review of ANY Personal Legal Document

• Pet Liabilities

• Small Claims Assistance

• Powers of Attorney

• Prescription Plans

•

• Habeas Corpus

• Repossession

To learn more about your coverages and see our attorney network, create an account at legalplans.com or call 800.821.6400 Monday – Friday 8:00 am to 8:00 pm (ET).

Your account will also give you access to our self-help document library to complete simple legal forms. The forms are available to you, regardless of enrollment.

1. You will be responsible to pay the difference, if any, between the plan’s payment and the out-of-network attorney’s charge for services.

2. Digital notary and signing is not available in all states.

3. This benefit provides the Participant with access to LifeStages Identity Management Service provided by Cyberscout, LLC. Cyberscout is not a corporate affiliate of MetLife Legal Plans.

4. Does not cover DUI.

Group legal plans provided by MetLife Legal Plans, Inc., Cleveland, Ohio. In certain states, group legal plans are provided through insurance coverage underwritten by Metropolitan General Insurance Company, Warwick, RI. Some services not available in all states. No service, including consultations, will be provided for: 1) employment-related matters, including company or statutory benefits; 2) matters involving the employer, MetLife and affiliates and plan attorneys; 3) matters in which there is a conflict of interest between the employee and spouse or dependents in which case services are excluded for the spouse and dependents; 4) appeals and class actions; 5) farm and business matters, including rental issues when the participant is the landlord; 6) patent, trademark and copyright matters; 7) costs and fines; 8) frivolous or unethical matters; 9) matters for which an attorney client relationship exists prior to the participant becoming eligible for plan benefits. For all other personal legal matters, an advice and consultation benefit is provided. Additional representation is also included for certain matters. Please see your plan description for details. MetLife® is a registered trademark of MetLife Services and Solutions, LLC, New York, NY. [MLP3wHC]

Eachinvestmentisdifferent,andyoucan choosebasedonyourgoalsandhowyou feelaboutrisk.Youcanalsopickfrom theplan'sinvestmentoptionslater.But bypickingitlater,youunderstandthat untilyoumakeanewinvestment selection,you'redirectingcontributions totheplan'sdefault.*

Forafulllisting,refertothe InvestmentOptionSummary.

You've got this, and we've got your back when it comes to educational resources.

To learn more, visit principal. com/Welcome or use the Principal mobile app. You can also text ENROLL to 78259. Sitio web disponible en Español.

We’ll help you roll eligible outside retirement savings into your retirement account.

Don’t leave the decision up to someone else if something happens to you before retirement. Always designate a beneficiary to ensure the money in your account goes to a loved one.

Staying in the know when it comes to retirement planning is a pretty good idea. We’ll send you educational information about what’s important to you.

In order to get the most out of your health care benefits, you need to understand the terms used by insurance companies, the government, health plans and health care providers. This way, you can make better decisions and ultimately receive better care.

Claim A request by an individual (or his or her provider) for the insurance company to pay for services obtained.

Coinsurance – The money that an individual is required to pay for services after the deductible has been met. It is often a specified percentage of the charges. For example, the employee pays 20% of the charges while the health plan pays 80%.

Copayment – An arrangement where an individual pays a specified amount for various health care services and the health plan or insurance company pays the remainder. The individual must usually pay his or her share when services are rendered. Copayments are usually a set dollar amount (such as $20 per office visit), rather than a percentage of the charges.

Deductible A set dollar amount that a person must pay before insurance coverage for medical expenses can begin. They are usually charged on an annual basis.

Dependent Any individual, adult or minor whom a parent, relative or other person may choose to cover on his or her insurance plan.

Generic Drugs A prescription drug that has the same active ingredient formula as a brand name drug. Generic drugs usually cost less than brand name drugs. The Food and Drug Administration (FDA) rates these drugs to be as safe and effective as brand name drugs.

In network Typically refers to physicians, hospitals or other health care providers who contract with an insurance plan (usually an HMO or PPO) to provide services to its members. Coverage for services received from in network providers will typically be greater than for services received from out of network providers, depending on the plan.

Out of network Typically refers to physicians, hospitals or other health care providers who do not contract with an insurance plan to provide services to its members. Depending on the insurance plan, expenses incurred for services provided by out of network providers might not be covered, or coverage may be less than for in-network providers.

Out of pocket Maximum (OOPM) The total amount paid each year by the member for the deductible, coinsurance, copayments and other health care expenses, excluding the premium. After reaching the out of pocket maximum, the plan pays 100% of the allowable charges for covered services the rest of that calendar year.

Premium – The amount of money charged by an insurance company for coverage.

Preventive Care – Any medical checkup, test, immunization, or counseling service used to prevent chronic illnesses from occurring.

Primary Care Physician (PCP) A health care professional who is responsible for monitoring an individual’s overall health care needs. Typically, a PCP serves as a gatekeeper for an individual’s medical care, referring him or her to specialists and admitting him or her to hospitals when needed.