2022-2023 Benefits Enrollment Guide October 1, 2022 September 30, 2023

This Benefits Guide contains a summary of the benefits available to all full time employees and their eligible dependents. If there is any conflict between the summary of benefits included in this Guide and the Plan Document, the Plan Document will govern.

Intralot’s Benefit Strategy Benefit Eligibility Enrollment Details NEW! PLANSelect NEW! Accident Plan NEW! Critical Illness Plan Your Medical Plan MotivateMe Virtual Care Wellbeing Benefits Your Dental Plan Your Vision Plan Health Savings Account Flexible Spending Account Life & AD&D Insurance Disability Insurance 401(K) Other Benefits & Common Questions Benefit Contacts 3 4 5 6 7 8 9 10 11 12 13 14 14 15 16 18 19 20 21 22 Your Health. Your Family. Your Benefits. Table of Contents

2 Your Health. Your Family. Your Benefits.

INTRALOT’S BENEFIT STRATEGY 1. Seek and maintain affordable options for all employees 2. Offer a full scope of benefits to support better health 3. Encourage the use of benefits plan 4. Engage employee in a healthier lifestyle 3 What’s Up For The New Plan Year? ❑ No changes to the employee paycheck deductions ❑ Cigna remains the insurance carrier for medical, dental and vision ❑ Supplemental Life and Additional Disability – true open enrollment (add coverage without evidence of good health) ❑ Medical plan benefits will stay the same, except for the out-ofpocket maximums ❑ Additional Benefits: ❑ Cigna Accident Plan ❑ Cigna Critical Illness Plan

Benefits Eligibility

YOUR BENEFITS

Intralot is committed to providing comprehensive benefit programs that are flexible enough to meet your needs. Getting the most from your benefits is up to you. You know your family, your goals and your lifestyle best. This Guide includes information to help you understand your options plus resources to contact for questions and further help.

BENEFIT ELIGIBILITY

All full time employees working a minimum of 30 hours per week are eligible for benefits to begin on the first day of the month following the date of hire. You may also enroll your legal dependents, including your legal spouse and dependent children under 26 years of age defined as biological child(ren), stepchild(ren) and legally adopted child(ren).

QUALIFYING LIFE EVENT

Unless you experience a life changing qualifying event, you cannot make changes to your benefits until the next Open Enrollment period. Qualifying events include things like:

• Marriage, divorce or legal separation

• Birth or adoption of a child

• Change in child’s dependent status

• Death of a spouse, child or other qualified dependent

• Change in residence

• Change in employment status or a change in coverage under another employer sponsored plan

If you experience a qualified life event during the year, notify HR within 30 DAYS of an event to ensure the desired benefit coverage.

Employee Benefits Guide

Page 3

4

Enrollment Details

What’s Changing?

Medical: the only change is to the out of pocket maximum. The out of pocket maximum is the sum of the deductible, copays and coinsurance.

Dental: we are eliminating the DHMO due to service and network issues.

What’s New ?

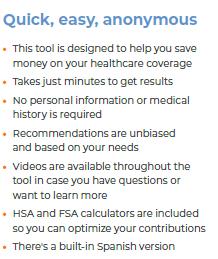

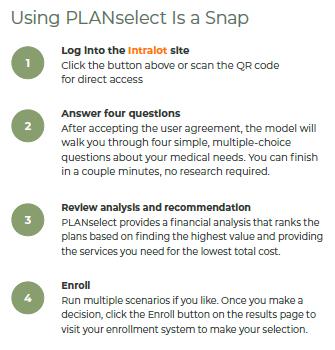

Plan Select Tool: this new tool helps to determine which medical plan may be a good fit for you and your family. You can compare cost for each of the plan based on your healthcare use.

Accident

and Critical Illness

Plans: two new plans will be available for employees to purchase.

OPEN ENROLLMENT

Open Enrollment is the one time of each year you may make benefit election changes outside of a qualifying life event. Benefit elections made during open enrollment will be effective October 1, 2022.

• Open Enrollment Begins: Wednesday August 31,

• Deadline to Enroll: Midnight on September 11

• Everyone must re-enroll due to the changes in the medical plan, the new benefits offered and the elimination of the DHMO.

• If you do not re enroll, your current elections will carry over to the new plan year.

• Changes in elections will be effective October 1, 2022.

5

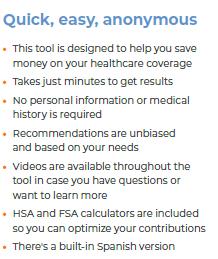

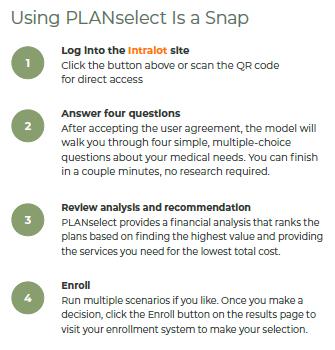

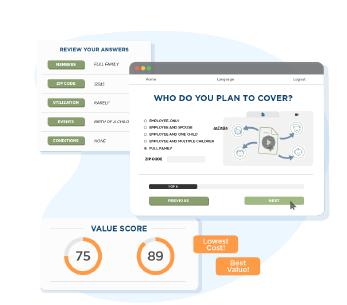

Introducing PLANSelect

New This Year

PLANSelect is a technology based confidential tool to help determine which plan will be the best value and the lowest cost. By answering a few questions, the tool will show your estimated cost by plan.

With this information, you can make the decisions as to which plan you will choose for the upcoming year. Go to PlanSelect

6

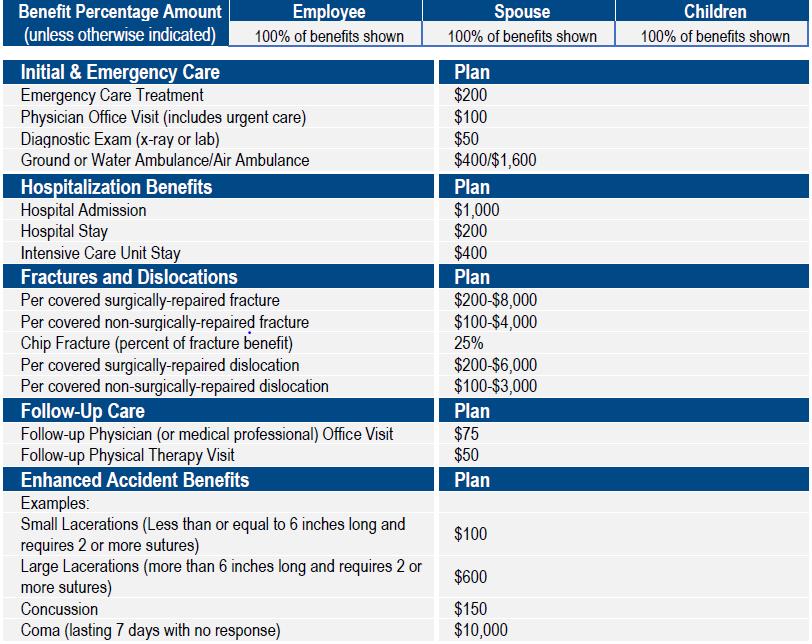

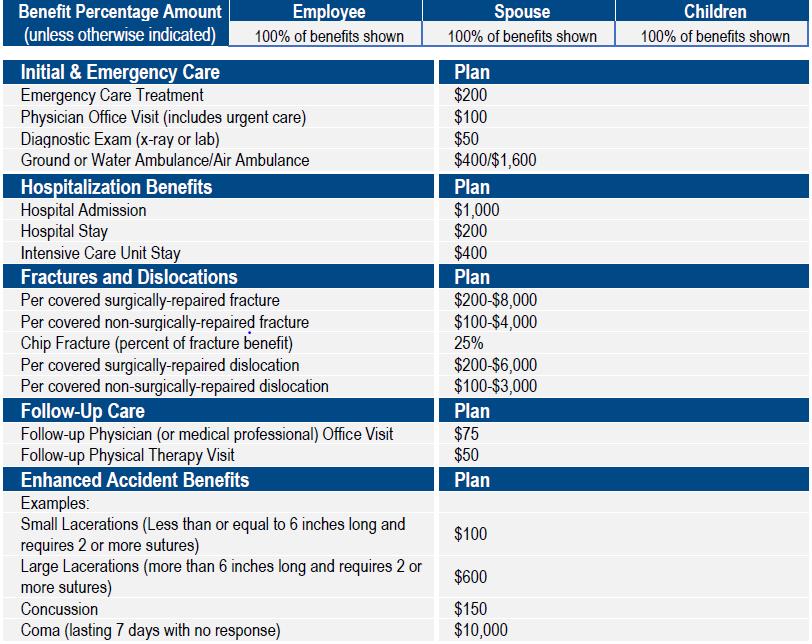

NEW! Accident Plan

Accidental Injury coverage provides a fixed cash benefit according to the schedule below when a Covered Person suffers certain Injuries or undergoes a broad range of medical treatments or care resulting from a Covered Accident.

7

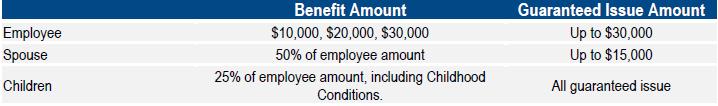

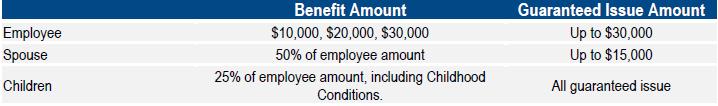

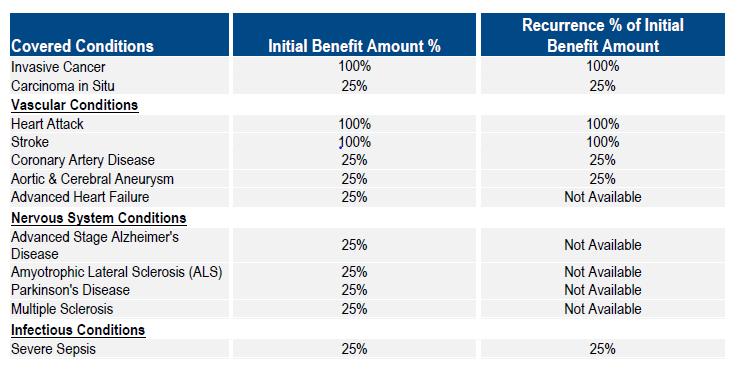

Critical Illness insurance provides a cash benefit when a Covered Person is diagnosed with a covered critical illness or event after coverage is in effect.

Rates are based on the coverage you elect and your age.

NEW! Critical Illness

$10K, $20K

$30K; Coverage guaranteed without evidence

$50 reimbursement.

exclusions.

8

You elect the benefit amount

or

of good health. A Wellness benefit is included with a

Please see ADP for the rates, specific benefit levels, plan limitations and

A few of the benefits are:

Page Guide Bi-Weekly Employee Cost Plan A Plan B Plan C Plan D Employee only $54.47 $89.41 $108.04 $44.26 Employee & Spouse $114.08 $192.01 $233.54 $84.54 Employee & Child(ren) $96.63 $161.98 $196.81 $82.46 Employee & Family $148.01 $250.40 $304.96 $129.16 Your Medical Plan Cigna Medical Plan Summary BENEFITS (In-Network)* Plan A Plan B Plan C Plan D Deductible Individual $3,000 $1,000 $500 $3,000 Family $6,000 $3,000 $1,000 $6,000 Coinsurance (after deductible) Your Share After Deductible 0% 15% 20% 10% Primary Care $25 copay $25 copay $30 copay 10% after deductible Specialist $40 copay $50 copay $60 copay 10% after deductible Urgent Care $35 copay $35 copay $35 copay 10% after deductible Emergency Room $150 copay $150 copay $150 copay 10% after deductible Lab/X Ray (Outpatient) $25 copay PCP/ $40 copay Specialist $25 copay PCP/ $50 copay Specialist $30 copay PCP/ $60 copay Specialist 10% after deductible Outpatient Surgery Facility Covered at 100%; deductible waived $150 copay $200 copay 10% after deductible Pharmacy Benefits Retail (30 Day Supply) Tier 1 $15 copay $15 copay $15 copay 10% after deductible Tier 2 $30 copay $30 copay $30 copay Tier 3 $75 copay $75 copay $75 copay Tier 4 20% up to $200 20% up to $200 20% up to $200 Mail Order (90 Day Supply) Tier 1 $30 copay $30 copay $30 copay Tier 2 $60 copay $60 copay $60 copay Tier 3 $150 copay $150 copay $150 copay Tier 4 20% up to $200 20% up to $200 20% up to $200 *in network benefits illustrated; See complete plan details on ADP. Pharmacy Benefits –Tiers Tier 1 typically generics Tier 2 – typically preferred brands Tier 3 typically non preferred brands Tier 4 injectable specialty medications 9 Out of Pocket Maximum (includes copays, co insurance & deductible) Individual $8,700 $8,700 $8,700 $7,050 Family $17,400 $17,400 $17,400 $17,100

MotivateMe

WELLNESS INCENTIVE

Our wellness incentive is through Cigna’s MotivateMe program. Earn reward points by completing wellness activities and initiatives. Points may be exchanged on the MotivateMe platform for gift cards and debit cards.

• MotivateMe rewards are available to employees and covered spouses on a Cigna medical plan

• Participants can earn points that can be used to redeem up to $285 (per participant) in gift or debit cards.

• Go to myCigna.com to learn more.

Employee Benefits Guide Page 8 Goal Employee Reward* Spouse Reward Get a personalized health assessment $25

$25

my annual physical (preventive exam) or OB/GYM exam (preventive exam) $75

a preventive dental exam $25

lessons of the 16 week

Diabetes Prevention Program Omada $50

Complete Online Health Coaching with My Health Assistant $25

activity

$25

activity

participated in a wellness activity

age/gender appropriate preventive cancer screening

flu shot

or

vaccination) $50

Have fun and earn rewards on Apps & Activities $20

$20

in a

Fitness Challenge

MOTIVATEME INCENTIVE STRUCTURE

(1x per year)

(1x per year) Complete

(1x per year) $75 (1x per year) Complete

(1x per year) $25 (1x per year) Complete 9

Cigna

(1x per year) $50 (1x per year)

per coaching

(up to 2x per year)

per coaching

(up to 2x per year) I

(received an

,

,

COVID

(1x per year) $50 (1x per year Get connected!

per month (up to $60/year)

per month (up to $60/year) Participate

Cigna

$50 (1x per year) $50 (1x per year)

2022 - 2023 *Maximum earnings per member in one plan year is $285. Frequency of specific goal reward per year is indicated. 10

Virtual Care

Intralot employees on one of the Cigna medical plans have access to MDLIVE telehealth benefits via phone, video or mobile app for non emergency medical and behavioral/mental health assistance. Consult with a board certified doctor and receive professional guidance, diagnosis and even a prescription (when necessary) without leaving your home or having to schedule with your local primary care provider

How much does it cost?

The cost of a virtual care visit is the same as your out-of-pocket expense for a non-preventive care office visit.

Plans A - C: $25 PCP and $40 specialist

Plan D: Average $60 consultation charge will apply until you've met your plan deductible at which point you’ll be responsible for 10% of the negotiated rate for the virtual care visit.

When to use this benefit?

• To treat minor conditions and common illnesses such as allergies, sinus infections, urinary tract infections, pink eye, rashes and influenza

• To avoid busy/crowded doctors’ offices and urgent care clinics

• 24/7/365 even on weekends and holidays

• When you prefer to stay at home

• For non-emergency care

Behavioral health visits

Licensed counselors and psychiatrists can diagnose, treat and prescribe most medications for non emergency behavioral conditions virtually such as:

• Addictions

• Depression

• Stress

• Life changes

Appointment:

Schedule an

Go to myCigna.com, locate “Talk to a doctor or nurse 24/7” and click “Connect Now”

11

Wellbeing Benefits

HEALTHY PREGNANCIES, HEALTHY BABIES

If you, a covered spouse, or a covered dependent are expecting, you are eligible for Cigna’s Healthy Pregnancies, Healthy Babies program. You have access to live nurses 24/7 plus you can earn up to $150 when you engage and complete the program.

This incentive is separate from the MotivateMe reward options identified previously. Go to myCigna.com to learn more.

PARENTAL LEAVE

Intralot Parental Leave (IPL) provides up to 80 hours of paid parental leave to full time eligible employees following the birth of your child or the adoption of a child.

Eligible employees who meet the requirement of a “parent” are eligible for the IPL. A parent is defined as:

• Birth mother/biological father

• Legal spouse of the birth mother/legal spouse of the biological father

• Adoptive parent

HEALTHY REWARDS

Cigna members can get discounts on a variety of health and wellness products and services through the Healthy Rewards program. Weight management and nutrition, fitness club and equipment discounts, vision and hearing care, alternative medicine, mind/body and vitamins, health and wellness products are all available with instant savings for members when visiting a participating provider. Find out more at myCigna.com .

Employee Benefits Guide Page 9

12

Your Dental Plan Cigna Dental Benefits Low Plan In-Network* High Plan In-Network* Deductible Individual $50 per calendar year Family $150 per calendar year Annual Maximum $1,500 per member $5,000 per member Coinsurance Preventive & Diagnostic 100% covered; no subject to deductible Basic Services Covered at 70% Covered at 80% Major & Implant Services Covered at 40% Covered at 50% Orthodontic Services (limited to children up to age 19) Covered at 50% up to $1,500 Covered at 50% up to $3,000 • In network Benefits are shown; Please review the benefit summary on ADP for complete details including out of network options. • The Dental DHMO is eliminated as of 9/30/2022 due to service and the dental network. Dental Bi-Weekly Deductions Low Plan High Plan Employee Only $4.70 $6.16 Employee & Spouse $10.48 $13.74 Employee & Child(ren) $8.81 $11.55 Family $13.76 $18.05 13

One

Your Vision Plan Vision Benefits IN NETWORK* Service Frequency Exam Lenses Contacts Frames

exam every calendar year

pair every calendar year

One

One

pair every calendar year

pair in any 2 calendar years Co-pays Exam Materials $0 copay Frames Allowance Private Practice Retail Chain Up to $130 Lenses Single Vision Bifocal Trifocal Lenticular Up to $32 Up to $55 Up to $65 Up to $80 Contact Lens Benefit In In lieu of lenses and frames Elective Allowance Up to $130 Therapeutic Allowance 100% covered Important Note: If you are enrolled in one of the Cigna medical plans, you automatically receive the vision plan. The cost of the vision plan is included in the medical payroll deduction. *For out of network coverage refer to the benefit summary in ADP. 14

One

Health Savings Account

Employees who enroll in Medical Plan D (the High Deductible Health Plan HDHP) are eligible to participate in a Health Savings Account (HSA). Participation means you have ownership of a tax exempt savings account you can use to set aside pre tax dollars to pay for current or future medical, pharmacy, dental, vision and other IRS approved health care expenses for yourself or other family members.

HSA dollars roll over each year and accrue interest. You own the money in your HSA, so the balance stays with you even if you leave the company or retire.

NOTE: If you are enrolled in Medical Plan D and contribute to the HSA, you are not permitted to enroll in the Medical FSA described earlier too. However, you will have the option to enroll in the Limited Purpose FSA for dental and vision eligible expense reimbursement.

The HSA is administered through Cigna’s HSA partner, HSA Bank. Set up your HSA and access your account online anytime at myCigna.hsabank.com or by calling 1 800 244 6224.

Why Consider Plan D (HDHP with HSA)?

• Lowest Payroll Contribution Option

• Infrequent Medical Care Users Save If you usually take advantage of no cost Preventive Care only and rarely use your other medical plan benefits, your total out of pocket (payroll deductions plus out of pockets expenses like copays or coinsurance) may be less.

• Can Still Take Advantage of Network Provider Negotiated Rates Claim expenses are processed at the same negotiated rate between the health care provider and the insurance company rather than the market or street rate. You don’t pay more for the same service from a network provider.

• Control You own your HSA, so money left in your account at the end of the year carries over year over year. Your HSA goes with you, even if you change jobs or retire! Plus you choose when to access funds from your HSA or how to pay for services at the time of each service or claim processing.

2023 HSA MAXIMUM EMPLOYEE CONTRIBUTION Employee Only: $3,850 Family: $7,750 Catch Up Contribution Limit (age 55+): $1,000 *Minimum Employee Contribution: $25/pay period 15

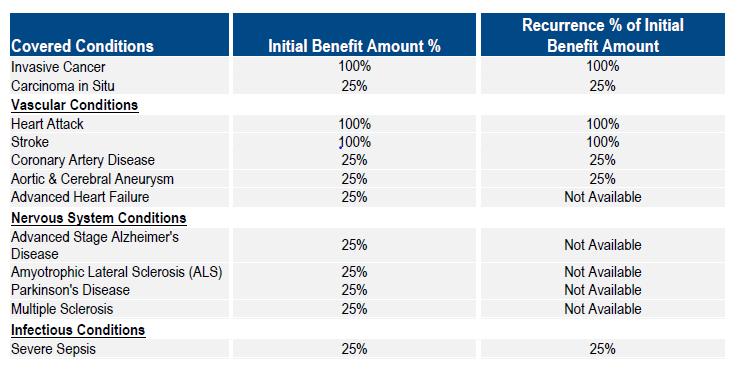

Flexible Spending Account

Flexible Spending Account:

A Flexible spending account (FSA) allows you to pay for your non reimbursed health care and eligible day care expenses with tax free dollars. There are two types of flexible spending accounts: medical and dependent care. You may choose to participate in one, both or not at all.

A Medical FSA reimburses you for eligible, out of pocket medical, dental and vision expenses for yourself and your dependents (dependents do not have to be covered on your Intralot plan). You will be provided with a debit card to pay for qualified expenses, and you can roll over up to $500 of unused medical funds from one FSA plan year to the next. If you elect the HDHP plan, you may only enroll in the Limited Purpose Medical FSA, which covers dental and vision expenses only – no medical. A Dependent Care FSA reimburses you for eligible dependent care expenses so you (and if you are married, your spouse) can work.

Your FSA contributions are deducted from your paycheck on a pre tax basis (before Federal, State, Social Security and Medicare taxes). Once you enroll, you decide how much you want to deposit into your account annually. That amount is deducted evenly during the calendar year from your paycheck before taxes are taken out.

Intralot’s FSA Plan Year - January 1 through December 31

The FSA plan year is January 1st through December 31st however the Open Enrollment period for this benefit is incorporated with the other health and welfare benefits. You must elect to participate every year and contributions will begin for the next plan year with the first payroll date in January.

2022 MAXIMUM EMPLOYEE CONTRIBUTION Healthcare: $2,850 Dependent care: $5,000 16

17

Life and AD&D Insurance

BASIC LIFE INSURANCE/AD&D

Life insurance can help provide for your loved ones if something were to happen to you. Intralot is pleased to provide all full time employees with $50,000 in Basic Life Insurance. A matching benefit in Accidental Death & Dismemberment (AD&D) Insurance is also provided at no cost to you.

SUPPLEMENTAL LIFE INSURANCE

In addition to Basic Life Insurance, you may want to purchase additional coverage. With Supplemental Life Insurance, you are responsible for paying the full cost of coverage through payroll deductions. If you purchase supplemental coverage for yourself, you may purchase coverage for your spouse and/or your dependent child(ren).

Supplemental Life Benefit

Employee $10,000 increments to lesser of 3 times your annual earnings or $300,000

Spouse $5,000 increments to $50,000, not to exceed 50% of the Supplemental Employee Life election

Child (up to age 19)

$10,000 ($500 for children under 15 days of age)

ONLY THIS YEAR – TRUE OPEN ENROLLMENT

Guaranteed Issue Amount

Up to $150,000 if enrolled timely when newly eligible

Up to $50,000 if enrolled timely when newly eligible

$10,000

You can increase your Supplemental Life Insurance or take coverage for the first time without having to provide “evidence of good health”.

• You may elect coverage up to the Guaranteed Issue Amounts as reflected above. If you elect coverage over the Guaranteed Issue, you will have to complete Evidence of Insurability.

• In the future, you will have to provide “evidence of good health” or complete and Evidence of Insurability Form for additional coverage. The insurance company must approve your application and will determine your coverage effective date.

EFFECTIVE DATE

Your and/or your Spouse or Child (if applicable) coverage effective date may be delayed for but not limited to the following reasons:

• you are not actively at work on your effective date;

• the individual is inpatient in a facility or home confined and under the care of a physician on the intended effective date;

• your election or authorization for payroll deductions are not received timely;

• or you or your dependents EOI application is pending the insurance company’s decision.

See Certificate for further details.

18

Disability Insurance

SHORT & LONG-TERM DISABILITY INSURANCE

Intralot provides full time employees with short and long term disability income benefits at no cost to the employee. This coverage provides income protection for regular expense items, which are typically covered by your paycheck. If you experience a non work related disability that impacts your ability to work and earn a paycheck, disability insurance can help cover the gap.

You may “buy up” to increase the amount of the benefit for either short or long term disability. Please note, you may not collect short term disability benefits if you are also receiving workers’ compensation benefits.

Short term Disability

Long term Disability

Benefit

Coverage begins on the 8th day of disability 60% of basic weekly earnings, up to $1,000 Duration: 11 weeks

Coverage begins after 90 days of disability 60% of basic monthly earnings, up to $10,000

Buy-Up Option 66.66% up to $1,000 per week 66.66% up to $10,000 per month

ONLY THIS YEAR – TRUE OPEN ENROLLMENT

You can elect the Buy Up Option for Short Term or Long-Term Disability without having to provide “evidence of good health”.

• Rates are listed in ADP when you enroll.

• In the future, you will have to provide “evidence of good health” or complete and Evidence of Insurability Form for additional coverage. The insurance company must approve your application and will determine your coverage effective date.

Beneficiary Information

to review and

this information throughout the year in the event of any life

such as a birth, death, divorce, etc. 19

Remember

update your life and 401(k) beneficiary information. Update

change

401 (k)

Intralot offers a 401(k) plan to eligible employees who are at least 21 years of age. A 401(k) is an investment tool with tax advantages. As a participant, your taxable income is reduced by the amount you contribute. This means you do not pay income tax on the earnings in the account (such as interest) until you start making withdrawals, typically at retirement. Intralot contributes up to a 6% match to your account.

Employees are automatically enrolled in the 401(k) the 1st of the month after 30 days of full time employment at a 3% contribution. Intralot offers a 100% match of employee contributions up to 6% and you are vested at 100% with the company after two years of employment. Salary contributions automatically increase by 1% on July 1st of each year, up to a maximum of 10%. You may opt out or change your contribution percentage by contacting Principal directly at 800 547 7754 or www.principal.com.

20

2022 MAXIMUM EMPLOYEE CONTRIBUTION 401(K) $20,500 Age 50+ Catch up Limit: $6,500

Other Benefits

Employee Assistance Program:

Intralot provides all employees access to the Life Assistance Program through Cigna. This benefit is provided at no cost. Contacting a Cigna advocate to help handle life’s challenges is confidential and your information will never be shared with Intralot Human Resources. Life Assistance & Work/Life Support includes:

• Up to 3 face to face emotional or work life counseling sessions per occurrence per year.

• Available to all family members each family member is eligible for 3 sessions per occurrence per year.

• Free 30 minute consultation and 25% discount on select fees from a network attorney for a legal matter or from a financial consultant for tax planning or preparation.

Cigna’s Life Assistance Program 1-800-538-3543 www.cignalap.com

Common Questions

What changes are effective October 1, 2022?

Leaves of Absence

• Any election changes to your medical, dental, vision, life and disability coverage as you have processed in ADP.

How do I make a change?

• Log onto https://workforcenow.adp.com

• Follow the prompts for Open Enrollment and complete your enrollment (or decline) for all insurance options.

• Detailed plan descriptions can be found under the Benefit Forms tab.

• If you encounter technical issues with ADP, need to reset your password or have trouble accessing the site, please contact ADP: ADP MyLife Advisors 855-547-8508 or MyLifeAdvisorCS@adp.com

When are election changes due?

Elections must be completed by midnight on September 11th . Your current plan year elections will carry forward unless you process any change(s) in ADP.

Will I get a new ID card if I don’t make changes?

YES! Anyone enrolled in one of the Cigna medical plans will receive a new ID card in the mail (because of the increased out of pocket). Once you get the new card, destroy your old card.

age>Disability (print your confirmation page.) or (888) 842 4462 7:00 am 7:00 pm CST

Sign up for text notifications about your

at myNYLGBS.com

How to file a disability and leave claim: 1. Notify Intralot Human Resources of an upcoming leave of absence. 2. File your Claim with NY Life: myNYLGBS.com>Cover

3.

claim

21

Benefit Contacts Resource Name

to Contact

& Dental Benefits

Vision Benefits

Short and Long Term Disability Insurance

www.myNYLGBS.com Flexible Spending Accounts

www.flores247.com Employee Assistance Program (EAP)

800

Accident and Critical Illness

800

3207 supphealthclaims@cigna.com 401(k)

800

www.principal.com The Benefit Butler 404

6070 benefitbutler@palmerandcay.com ADP MyLife Advisors 855 547 8508 MyLifeAdvisorCS@adp.com Intralot HR Lynne Robertson 678 473 7221 Lynne.Robertson@intralot.us The Benefit Butler is an expert on claims processing, coverage and anything benefits related. Our benefits partner and consultant, Palmer & Cay, provides this service to you at no cost. The Benefit Butler is available via phone or email and can help explain your situation and seek a resolution. benefitbutler@palmerandcay.com (404) 991-6070 22

How

Medical

1 800 244 6224 www.mycigna.com

1 877 478 7557 www.mycigna.com

1 888 842 4462

1 800 532 3327

1

538 3543 www.cignalap.com

1

754

1

547 7754

991