12 minute read

The world of LNG stands strong

Global warming and climate change have been pushing the global energy sector to look away from fossil fuels such as oil and coal to renewables and other clean energy sources. Still, fossil fuels have a major role to play as they currently account for the bulk of the global energy mix. Natural gas, a relatively low-carbon fossil fuel, is increasingly being viewed as a bridge fuel for many countries during their energy transition from coal and oil to other cleaner fuels. For countries shifting towards hydrogen, this can be mixed with natural gas and transported using existing natural gas pipeline networks. This saves the costs of constructing new hydrogen pipelines and makes transportation of large volumes of hydrogen feasible. With demand for natural gas expected to remain steady in the global primary energy mix for the next couple of decades, LNG will also continue to play an important role as more countries switch to natural gas to meet their environmental goals. LNG is the preferred mode of natural gas delivery over large distances involving seas and oceans. Besides, LNG also helps to mitigate geopolitical, environmental, and security issues, typically faced by cross-country gas pipelines, and helps to serve a greater number of markets than pipelines. Though LNG is finding new markets globally, there is scepticism over carbon emissions in its value chain. Carbon-neutral LNG seems to be the answer to offset this issue. The LNG value chain – natural gas production, processing, liquefaction, transport, regasification, and final combustion – results in significant emissions of carbon into the atmosphere. To account for carbon emissions in the LNG value chain and to decrease its environmental impact, the idea of carbon-neutral LNG has emerged with the first such cargo sold in 2019.

Carbon-neutral LNG – decarbonisation of the LNG value chain

Carbon-neutral LNG essentially involves offsetting carbon emissions in the LNG value chain through the purchase of carbon credits, which can be used in projects that reduce carbon emissions such as afforestation, carbon capture, etc. The concept is still in its infancy stage with less than approximately 40 such cargoes agreed or delivered to date against more than 5000 cargoes typically delivered globally every year. Asian countries such as Japan and China, which account for the bulk of global LNG demand, are spearheading purchases of carbon-neutral LNG as part of their sustainability efforts. In Japan, 15 companies led by utility company Tokyo Gas, formed the Carbon Neutral LNG Buyers Alliance in March 2021. These companies, which cater to different sectors, have allied to contribute towards Japan’s planned move to become carbon neutral by 2050. Even before the formation of this alliance, a Japanese utility, Hokkaido Gas, signed a carbonneutral LNG purchase agreement with Mitsui & Co. in February 2021, which will constitute approximately 10% of the company’s annual LNG purchases. In China, Shell Eastern Trading signed a five-year contract with PetroChina in July 2021 for the supply of carbon-neutral LNG. LNG producers are also making conscious efforts to decrease carbon emissions during LNG production through different methods such as carbon capture and

Soorya S. Tejomoortula, GlobalData, India, considers the global LNG industry over the past year and looks to the future, outlining trends, perspectives, and providing a capacity outlook.

sequestration (CCS), using all-electric motors to drive compressors and pumps as well as sourcing electricity from renewable sources. In February 2021, while sanctioning the Final Investment Decision (FID) for the North Field East LNG Project (NFE) billed as the largest LNG project ever globally, Qatar Petroleum announced that a CCS system will be constructed to reduce emissions from the project. A jetty boil-off gas recovery system and dry low NOx technology will also be used to further reduce emissions. In addition, the company plans to use solar power to meet a major portion of the project’s electricity needs. Such initiatives are expected to enhance the saleability of NFE’s LNG going forward.

Carbon-neutral LNG is still in the infancy stage, but its share in regular cargoes is expected to grow in the future due to its differentiation as a sustainable and environmentally friendly LNG for both sellers and buyers. Pressure from investors and shareholders for environmentally friendly LNG and potential legal requirements may further drive the growth of carbon-neutral LNG in the future – keeping pace with increasing LNG demand which is fuelling the global LNG regasification capacity additions.

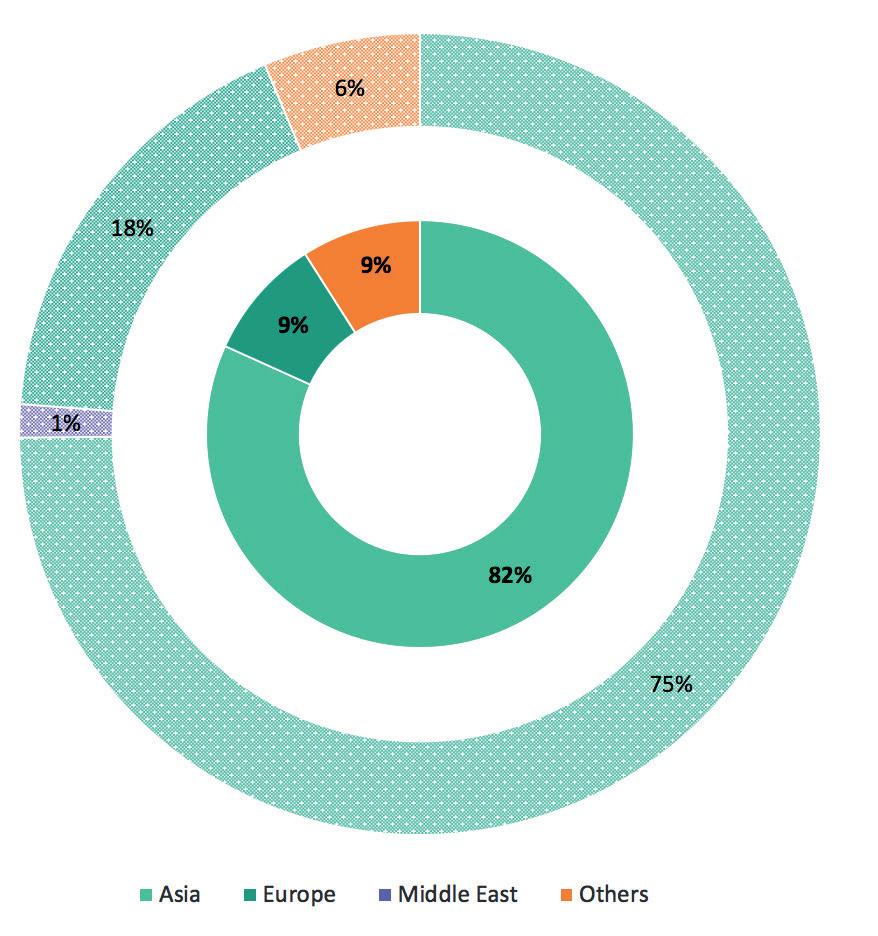

Figure 1. Proposed LNG regasification capacity additions by key regions (%), 2021 - 2030. Outer doughnut represents regasification capacity of projects in construction and commissioning stages. Inner doughnut represents regasification capacity of projects in the pre-construction stage.

Table 1. List of major carbon-neutral LNG cargo deliveries

Supplier name Purchaser name Delivered country Date

Shell Tokyo Gas Japan June 2019

Shell GS Energy South Korea June 2019

JERA - India June 2019

Shell CPC Taiwan March 2020

Total CNOOC China October 2020

Mitsui Hokkaido Gas Japan March 2021

Gazprom Shell UK March 2021

Oman LNG Shell UK June 2021

BP Plc CPC Taiwan August 2021

Petronas Shikoku Electric Power Japan August 2021

Sakhalin Energy Toho Gas Company Japan October 2021

Asia leads proposed regasification capacity additions globally

With more countries embracing natural gas in their shift towards clean energy, growth in LNG demand, and as a corollary, strong growth in global regasification capacity, is expected over the medium- to long-term. Based on known projects to date, the global LNG regasification capacity is expected to add more than 28 000 billion ft3 during 2021 - 2030. This includes projects ranging from those which are in preliminary development stages to those that are in construction. Asia would dominate with 80% of global regasification capacity additions by 2030. The announcement of key Asian importers – China, Japan, and South Korea – to become carbon neutral over the next 30 - 40 years would add further fillip to the region’s LNG demand.

During the period 2021 - 2030, Asia would also dominate global regasification capacity under construction and commissioning, with a share of 75% of the total 4949 billion ft3 from known/reported projects. Lack of adequate natural gas production coupled with rapidly increasing industrial and domestic demand for gas make China and India primary drivers of LNG regasification capacity additions in Asia.

Among global regasification projects under construction/ commissioning, Kuwait’s significant Al-Zour regasification project with a capacity of 1155 billion ft3 is in the commissioning stage and is expected to start operations in 1Q22. Billed as the largest upcoming greenfield LNG regasification project, it would help Kuwait to switch from oil-fired to gas-fired power generation and meet growing gas demand from its petrochemicals and refinery sectors.

In Asia, the 365.25 billion ft3 Nong Fab terminal in Thailand is the largest regasification terminal under construction and is part of Thailand’s plan to transform itself into a regional LNG hub. With the country’s domestic gas production on the decline, Nong Fab is expected to help the country meet its natural gas needs, mainly for power generation.

The 584 billion ft3 Tangshan II is the largest upcoming regasification terminal in China. Phase I of this project with a capacity of 341 billion ft3 is currently under construction in the Hebei province. With a total estimated CAPEX of US$1.1 billion, the Phase 1 terminal will complement the already existing Tangshan terminal to provide gas to Hebei, Beijing, and Tianjin through the Yongqing-TangshanQinhuangdao gas pipeline. Such massive regasification

capacity additions worldwide, in turn, mandates strong global liquefaction capacity additions as well.

Global liquefaction capacity expected to witness robust growth

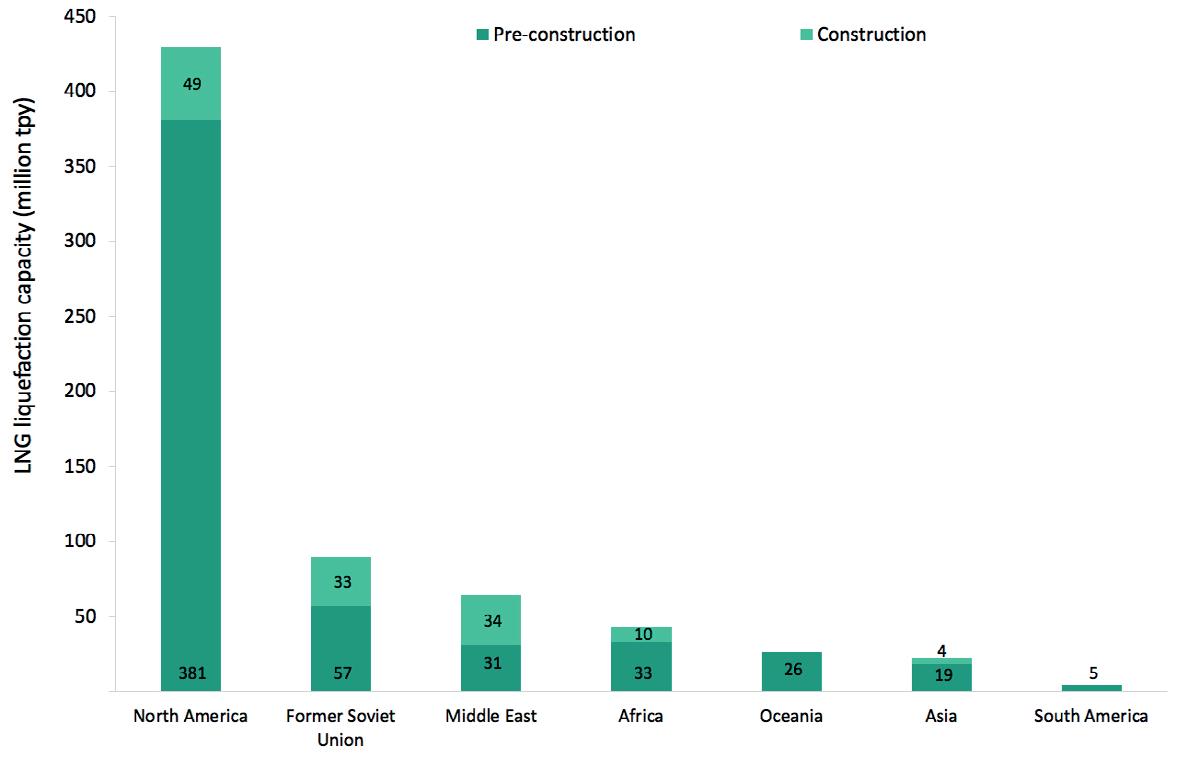

During 2021 - 2030, global LNG liquefaction capacity is expected to witness significant additions of more than 650 million tpy – including proposed projects in preconstruction and construction stages. North America, the Former Soviet Union (FSU), and the Middle East would drive this growth. Many of these upcoming projects are still in the preliminary stages and have yet to receive any approvals or start construction.

North America leads globally in terms of liquefaction capacity growth, accounting for approximately 63% of the total proposed capacity additions by 2030. Vast shale and tight gas resources, relatively low cost of gas production, strong gas processing, pipeline infrastructure, and booming Asian demand are some of the factors driving LNG production capacity growth in this region.

Among key LNG liquefaction projects under construction/ commissioning, Qatar Petroleum’s NFE project with a proposed 48 million tpy capacity is the largest ever. The first phase of the project (32 million tpy) is expected to commence operations in 2025. FID of the first phase was taken in February 2021 and this phase will increase the liquefaction capacity of Qatar to 110 million tpy by 2025 and reinforce its stature as the leading exporter of LNG in the world. LNG produced from the project will be attractive to Asian and European companies as it is priced competitively and is relatively less carbon-intensive due to a dedicated CCS system and other emission reduction technologies. Russia has two ambitious LNG liquefaction terminals under construction, Arctic 2 and Baltic. These terminals, which are coming up in multiple phases, would together add 32.8 million tpy of liquefaction capacity, helping Russia to increase LNG exports to Asia-Pacific and Europe. Novatek’s Arctic 2 LNG project is being developed in the north of Siberia with gas sourced from the Utrenneye field. The gravity-based structures (GBS) concept and local manufacturing of the required equipment means LNG supplied from this project would be highly competitive in terms

Figure 2. Projected LNG liquefaction capacity additions by region (million tpy), 2021 - 2030.

Table 2. Duration of major long-term LNG contracts signed in 2021*

Vendor Purchaser Contract signed year Contract start year Contract end year Contracted capacity (million tpy) Contract duration

OAO Novatek Shenergy Group Ltd 2021 2023 2038 3.00 15

Tellurian Investments Vitol Group 2021 2026 2036 3.00 10

Tellurian Investments Royal Dutch Shell Plc 2021 2026 2035 3.00 9

Qatargas Operating Company Ltd Pakistan State Oil Company Ltd 2021 2022 2031 3.00 9

Petronas CNOOC Gas & Power Ltd 2021 2025 2035 2.20 10

RasGas Company Ltd Korea Gas Corp. (KOGAS) 2021 2025 2044 2.00 19

Qatargas Operating Company Ltd China Petroleum & Chemical Corp. 2021 2022 2031 2.00 9

Qatargas Operating Company Ltd CPC Corp. 2021 2022 2036 1.25 14

Qatar Petroleum

Qatargas Operating Company Ltd Vitol Group

Royal Dutch Shell Plc

Woodside Energy Ltd RWE AG

Chevron USA Inc. Pavilion Energy Pte Ltd

* Major contracts in terms of contracted volumes 2021 2021 2030 1.25 9

2021 2022 2032 1.00 10

2021 2025 2031 0.84 6

2021 2023 2028 0.50 5

of price besides being exported to the Asia-Pacific markets through the relatively shorter Northern Sea route.

In North America, LNG Canada, Golden Pass LNG, and Calcasieu Pass are the largest upcoming projects with total capacities of 28 million tpy, 15.6 million tpy, and 11.3 million tpy respectively. With an estimated US$18 billion, the first phase of the Royal Dutch Shell-led LNG Canada project with a capacity of 14 million tpy is one of the largest investments in the Canadian energy sector. The first phase is expected to start operations in 2025 and would firmly place Canada on the global LNG exporters list. The LNG Canada terminal is located in British Columbia, which has a relatively shorter shipping route to North Asia, a major demand centre for LNG. In the US, the US$10 billion Golden Pass LNG terminal is being constructed in Sabine Pass, Texas. This Qatar Petroleum and ExxonMobil joint venture is a three-train liquefaction terminal with a total capacity of 15.6 million tpy, and the first train is expected to start operations in 2024.

The US$4.5 billion Calcasieu Pass project is being constructed in Louisiana, US, and is expected to start full operations in 2022. Its operator, Venture Global Calcasieu Pass LLC, plans to construct a carbon capture and storage facility, a first for existing LNG terminals in the US, and could offset approximately 500 000 tpy of carbon emissions.

Apart from the aforementioned projects, there are other significant projects under construction such as the NLNG Expansion project in Nigeria, the Sabine Pass expansion in the US, and the Tangguh expansion in Malaysia, which would lead to considerable global liquefaction capacity additions. Some of these projects have taken FIDs and are being constructed without tying their entire liquefaction capacities under long-term contracts, as the global LNG market is witnessing changes in LNG supply contracts.

Strong demand supported by prolific LNG supply alters LNG contracts

Growing global LNG demand will have ramifications on the way LNG contracts are signed. Traditionally, LNG producers have signed long-term contracts typically extending 20 years or more before committing to develop liquefaction facilities. These long-term contracts have acted as guarantees for their investments and provided certainty to their production offtakes over longer periods.

However, with the global LNG market becoming more diverse with the entry of new suppliers and demand centres, some buyers are increasingly looking for flexible and shorter contracts, different pricing mechanisms, and flexibility on supply destinations. As a result, the typical duration of long-term LNG contracts has decreased from earlier 15 - 25 years to 5 - 10 years. However, this does not mean that the era of 10+ years of contracts is over. Some buyers are still interested in contracts with longer durations, as it offers supply security.

These changes are prompting some of the suppliers to be more flexible by offering short- to medium-term contracts and taking FIDs on liquefaction projects without first contracting the entire proposed LNG capacity. This is especially true for large integrated oil and gas companies with diversified LNG portfolios, such as BP Plc and Royal Dutch Shell, as well as companies from gas-rich countries, such as Qatar and Russia.

However, growing reluctance towards long-term contracts is impacting the plans of some of the US LNG developers, who are unable to secure contracts before taking FIDs on their projects. No FIDs have been taken in the US liquefaction sector in 2020 and to date in 2021. Failure to sign long-term contracts forced Annova LNG to cancel its 6.5 million tpy project in Brownsville (South Texas), despite receiving federal approvals. In Canada, Chevron withdrew from the Kitimat Project in December 2019 after failure to offtake LNG through long-term contracts. Woodside, another partner in that project, which initially wanted to move ahead despite Chevron’s withdrawal, announced in March 2021 that it is also planning to quit the project due to its inability to find buyers.

The inability to secure long-term contracts for some LNG producers might get worse if there is a supply glut after 2025, as large LNG liquefaction capacities get operational. Buyers, especially from Asia, would increasingly like to purchase their LNG from spot markets or through short-term contracts, as an abundant supply of LNG provides these buyers with plenty of choices and purchase flexibility.

Despite the changing dynamics of the global LNG market in terms of the emergence of new buyers and sellers and a shift towards short contract durations, given the importance of natural gas in meeting global clean energy goals, demand for LNG is expected to remain strong over the next couple of decades.