09 Is MDR creating a two-tiered banking system?

16 PSX ka pied piper kaun? SECP thinks it’s a Lahori Broker you’ve probably never heard of

23 The “Standard” Chartered journey: From a promising global banking juggernaut to a risk-averse frugal bank

26 In conversation with inDrive’s Nikita Dirin

28 In Pakistan, the question of climate financing looms large. So what’s happening?

31 These green startups want to help the environment and make money in the process. But what do their potential investors have to say?

Profit

CONTENTS

09 23 28 23 28 16 Publishing Editor: Babar Nizami - Editor Multimedia: Umar Aziz Khan Senior Editors: Abdullah Niazi | Ahtasam Ahmad - Business Reporters: Taimoor Hassan Shahab Omer | Zain Naeem | Saneela Jawad | Ghulam Abbass | Ahmad Ahmadani | Shahnawaz Ali Aziz Buneri | Nisma Riaz | Mariam Umar - Sub-Editor: Saddam Hussain Video Producer: Talha Farooqi - Regional Heads of Marketing: Mudassir Alam (Khi) Kamal Rizvi (Lhe) | Malik Israr (Isb ) Pakistan’s #1 business magazine - your go-to source for business, economic and financial news

Is MDR creating a two-tiered banking system?

Recent results show how the banking sector differs for different participants

By Zain Naeem

Over the past one year, Pakistan has faced various challenges on both the micro and macro frontiers, impacting the general public and businesses alike. A key culprit behind this misery were record high inflation rates, which eroded the purchasing power of the populace. In response, we witnessed interest rates soaring to 22%, marking the highest in the country’s history.

In the midst of these challenges, an anomaly surfaced in the shape of Pakistan’s banking sector, which achieved its highest profitability in a single financial year in 2023.

The sector collectively earned profits of Rs. 556 billion which was the highest in their history. The reason for the rise was due to the interest income that the banks earned and the hike in interest rates of around 600 basis points during the year. This led to banks earning profits which were 85% higher than the previous year.

When the performances of the banks are analyzed, one player stands out: Meezan Bank. The bank was able to earn net profits of more than Rs 85 billion while the next best result saw MCB earn Rs. 65 billion. Next in line are the three biggest banks of the country with Habib Bank, UBL and National Bank of Pakistan earning around Rs 57 billion, Rs 55 billion and Rs 53 billion

respectively.

The question then arises, what is Meezan Bank doing which no other bank is able to do. Banks like National Bank, Habib Bank and UBL have asset bases which are in excess of Rs. 5 trillion, Rs. 4.6 trillion and Rs. 3 trillion respectively. What is Meezan Bank doing with a smaller asset base of Rs. 2.5 trillion which is able to yield almost double the profits compared to these behemoths? Profit dives deeper into the numbers.

Function of a Bank

Abank might seem like an institution that cannot be compared to a traditional business. On a closer look, however, they are not too

BANKING 9

The profit calculation mechanism in both banking models is totally different; one has a profit sharing model whereas the other guarantees a return. Islamic banks are regulated to keep a minimum 50% share of profits (if materialized) on funds invested in savings products by depositors (Mudarabah accounts). Will their business be viable if the profit-sharing ratio is increased in favor of depositors?

Minimum Deposit Rate (MDR)

Now that the money making process of a bank is known, it is vital to know that banks are regulated by the State Bank of Pakistan (SBP) and they provide the different regulations and instructions that need to be abided by. From capital reserve requirements to the deposits being given out, the State Bank has the power to mandate banks.

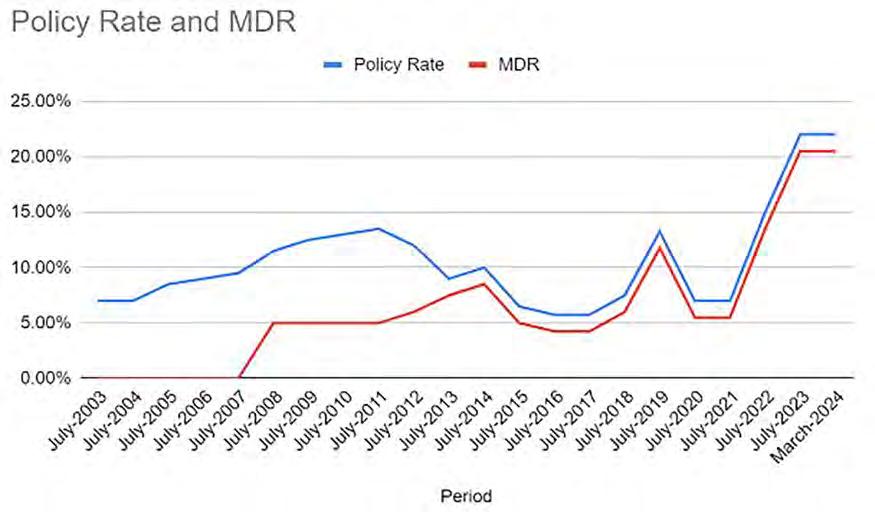

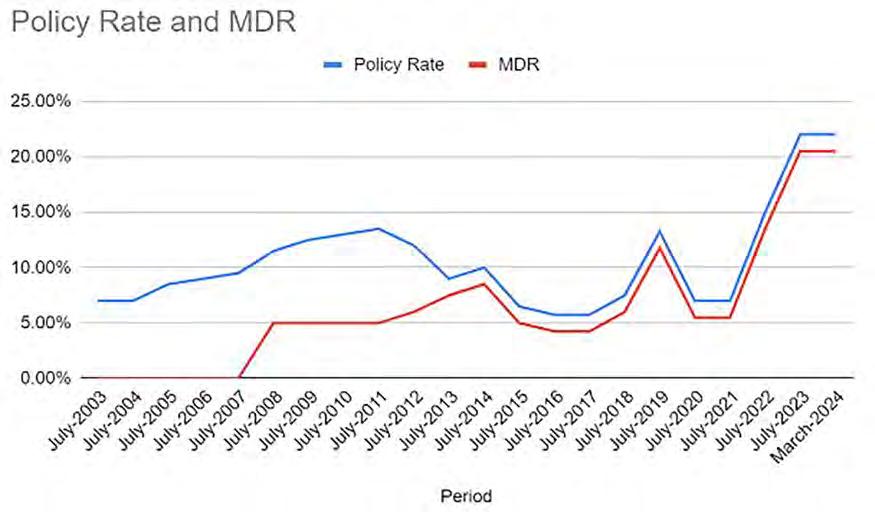

From time to time, the SBP has used its power to put into place a minimum deposit rate which is mandated on the banks. Before 2008, banks were allowed to give any return to their depositors as they chose. In 2008, a circular was released mandating the banks to pay out a minimum profit rate of 5% per annum to all categories of investors on their savings accounts. Later in 2012, this rate was increased to 6% per annum and in 2013, the minimum deposit rate was set to be 50 basis points below the SBP Repo Rate. In other words, this was going to be 150 basis or 1.5% below the prevailing policy rate.

different from a manufacturing business. A manufacturing business takes raw materials, converts it into finished goods and then charges a premium for the value addition. It takes the raw materials from suppliers who become its creditors. It sells its goods to wholesalers or the market who becomes its assets.

Banks are the same way. The only difference is that the raw material for banks is money.

Banks take deposits from its customers and money from its lenders and then give

these deposits out in the form of leases and loans to its customers. They charge a higher rate of interest to its borrowers and give a lower return to its depositors. The difference in the middle is the primary income of the bank. They can also charge fees to its customers for using their services, however, the primary focus of a banker is to maximize the difference between the interest it earns from its assets and the interest it gives out to its depositors.

The role of the State Bank to mandate such a return was based on the fact that the policy rate in the economy was much higher and it needed the depositors to be compensated accordingly. When the policy rate and MDR are seen, the trend has been that the gap was hovering around 9.5% before an MDR was put into place and has been stuck at 1.5% since the latest circular came into effect.

In the circular mandating this rate, it was also stated that Islamic Banks would not be mandated to a minimum deposit rate and they would be allowed to pay according to a profit and loss sharing ratio that the State Bank had set earlier.

The rationale for this move was the fact that Islamic Banks cannot give out fixed rate of return as it would not make them

10

Bank (In Millions) CY 23 CY 22 YoY Meezan Bank 85,431 44,937 90.10% MCB Bank 65,105 34,365 89.50% Habib Bank 57,676 34,070 69.30% UBL 55,145 31,535 74.90% National Bank 53,102 30,835 72.20% Standard Chartered Bank 42,622 19,844 114.80% Allied Bank 41,301 21,247 94.40% Bank Alfalah 36,512 18,395 98.50% Bank Al-Habib 35,930 16,688 115.30% Habib Metropolitan Bank 24,557 14,374 70.80% Askari Bank 21,489 14,060 52.80% Faysal Bank 20,246 11,438 77.00% Bank of Punjab 11,081 10,628 4.30% Soneri Bank 6,075 1,883 222.60% Total 556,271 304,299 82.80%

Nadeem Hussain, coach at Raqami Islamic Digital Bank

Fixing a rate of return on Islamic Deposits is inherently against the principles of Shariah. At the same time, while for some depositors putting money in Islamic banks has religious connotation to it, there is still some competition for deposits in the market which makes Islamic banks offer somewhat competitive rates on deposits

Mustafa Mustansir, Director Research and Business Development at Taurus Securities Limited

Shariah Compliant which meant that they could not be mandated to give out a minimum rate to their depositors. This meant that now conventional banks would be required to give a return to its depositors not less than 1.5% of the prevailing interest rates while the Islamic banks could set a rate which was approved by its Shariah Board and then submitted to the State Bank.

In addition to that, Islamic banks argued that they did not have a liquid and developed market of assets which could be compared to the instruments available in the conventional market. Due to lower avenues of investments, the banks could not guarantee a return on their investments and needed the market to mature before any such restriction could be placed on them. There was also an incentive for Islamic banks to be set up in the country by allowing them to limit their cost and set up such services.

banks offer somewhat competitive rates on deposits.”

Views of the industry

Experts in the field have differing views of the rates being provided by the Islamic Banks. Mustafa Mustansir, Director Research and Business Development at Taurus Securities Limited, states that, “fixing a rate of return on Islamic Deposits is inherently against the principles of Shariah. At the same time, while for some depositors putting money in Islamic banks has religious connotation to it, there is still some competition for deposits in the market which makes Islamic

“The profit calculation mechanism in both banking models are totally different; one has a profit sharing model whereas the other guarantees a return. Islamic banks are regulated to keep a minimum 50% share of profits (if materialized) on funds invested in savings products by depositors (Mudarabah accounts). Will their business be viable if the profit-sharing ratio is increased in favor of depositors?” says Nadeem Hussain Coach at Raqami Islamic Digital Bank.

Sana Tawfik, Deputy Head of Research at Arif Habib Limited, states that “Islamic banks have a lower cost of deposit due to no requirement of MDR being mandated on them. This compromises the return earned by the depositors compared to a conventional bank. Making this return mandatory means that people are encouraged to save. Before any such provision, banks were

giving out variable returns to depositors and rates improved near quarter end in the shape of a deposit wars.”

Mohammad Aitazaz Farooqui, Head of Research at Providus Capital, says that “The return of Islamic banks offer to their depositors are substantially lower than MDR whereas the asset deployment isn’t at a substantial disadvantageous position relative to conventional banks. It is reflected in the better interest margins of the Islamic banks.”

“Conventional banks must pay MDR of policy rate – 150 bps which is currently 20.5%. The reason for no MDR for Islamic banking is that SBP is still unable to identify products on which they set the MDR” states Yousuf Saeed, CFA Charterholder & Head of Research at Darson Securities.

In terms of the commercial side of the banks Mustansir feels that “if Islamic banks can manage to get deposits at lower rates

BANKING

than the rest of the banking industry and then place them in assets earning similar yields, then why not? Other banks can follow the same with their Islamic banking windows or products too can’t they?”

This trend of opening up Islamic banks and branches as a subsidiary of conventional banks is already being seen with many of the banks providing an Islamic alternative to the market. This can seem like a race towards the bottom where depositors are being sacrificed for the sake of better profitability.

So the question then arises whether the banking system is being divided into two tiers and if there is a need to scrape MDR altogether. Islamic banks were given an exemption from MDR at a time when the Islamic finance market did not have the same amount of sukuks. This has changed in recent years where frequency and value of sukuk bonds being floated in the market has changed. In the face of this new reality, is there merit in saying that the market needs to take cognizance of this new reality?

such a return would depend on the macroeconomic conditions of the country. Saeed opines that “For conventional industry, [MDR] is serving its purpose and giving rightful return to depositors. It should not be scrapped as it would lead to depositors withdrawing their deposits from the accounts due to a lower return.”

will have to extend financing to relatively riskier portfolios (at higher rates) to bridge that gap. The results of such a move will result in losses/reduced profit in two areas; losses/severely reduced profits to Islamic banks in case they follow their current model, increased number of NPLs.”

Muntasir feels that MDR has its importance because conventional banks still account for the majority of the depositors in the country. This depositor base will suffer in case any such action is taken. There are banking systems that exist all over the world where both systems are running in parallel to each other and in order to scrap

Hussain feels that if MDR is removed, it will lead the Islamic banks “to provide a higher return, Islamic banks will have to venture towards riskier products/financing on the asset side. Conventional banks would in essence be generating the same returns through risk-free investments in PIBs whereas Islamic banks, due to a lower rate on Sukuk and a profit-sharing ratio in effect,

Tawfiq argues that “the quantum of sukuks is much higher now and the depositors are saving a higher amount at the banks which means that the banks are not facing the same issue of liquidity that they were facing in the late 2000s. Depositors are currently saving at Islamic banks due to the nature of the deposits, however, these depositors need to be protected in a better manner before they decide to head down the conventional route as well. There are talks currently going on between the State Bank and the Islamic Banks in relation to MDR and something is in the works to facilitate the depositors with better returns.”

Saeed says that MDR is actually seen beneficial in a country where rate of investment is low due to the population being oriented towards consumption. In such an environment, MDR makes sure that saving is attractive for the market.

Tawfik seconds this notion as the country is looking to increase its investment to GDP ratio and by providing better returns to the depositor which will funnel more

12

savings translating into investment in the country.

When brokerage houses like Taurus Securities do analyze the banking sector, they consider the cost of funds and deposits of the banks in their valuation models for both types of banks. Muntasir says that such an analysis shows higher return on equity for Islamic banks due to their lower cost structure reflective of the reality.

Farooqui says that in order to encourage savings and implement proper transmission of monetary policy, deposit rates should be mandated as competition alone will not guarantee fair treatment of all depositors. In terms of the return on equity, Islamic banks do end up generating better return on equity due to lower cost of deposits and similar asset return profiles.

Behavior of Interest Rates

With the country seeing record high interest rates of 22% since June of 2023, it becomes apparent why banks have been making the amount of profits that they are. From 2004 till 2023, interest rates have gone from 7% to a low of 5.75% in 2016 to a high of 22% for the last 9 months. This has flipped the operations and functions of the bank.

In normal circumstances,

the banks would be crying for a cut in the policy rate. No business or individual would be willing to borrow at such rates and considering that the rate applicable to the consumers is indexed to the policy rate and higher than that, banks would not be able to attract parties interested in taking a loan from them.

On the other hand, with banks offering such attractive deposit rates, businesses and individuals would actually look to save and earn interest on their deposits rather than look to use that money for anything else. The sky high interest rates would also make banks skeptical in terms of loaning money to business as the risk of default is

much higher and business might default in an economy with such high interest rates and low economic activity.

In Pakistan, this has not taken place. With private credit on the decline, the government has stepped in and started to mop up most of the liquidity that is available in the market.

Through its Pakistan Investment Bonds (PIBs) and Treasury Bills (T-Bills), the government has looked to loan money from the banks. Banks are also willing to lend to the government as it is a risk free option and the government will always honor its debts. They are the ones responsible for printing the money and would just print more of the local currency in order to pay back its loans.

Recently, the newly elected Prime Minister actually lambasted the banks for investing in T-BIlls and PIBs and “sleeping” while their investments gathered profits. What the PM didn’t realize was that the day these banks would stop funding the government through its investments, the operations of the government would grind to a halt and the government would lose out financing for its day to day operations. So maybe Mr Pot needs to have a look in the mirror before calling the Kettle Bank Limited black.

This is the new reality which exists due to the rampant borrowing of the government and the capacity of banks to invest in high yielding government bonds while

BANKING

borrowing from the discount window of the State Bank and taking deposits from its depositors.

A new development that has taken place is that in parallel to government bonds, there are Shariah Compliant Sukuk investments being offered where Islamic banks have invested in the sukuk issues by the government and have been able to earn similar returns as compared to the conventional bonds.

This leads to a win-win situation for the Islamic banks. Conventional banks have to run after depositors in order to make sure their competitor banks are not able to secure these deposits. Once these deposits are secured, the banks have to give out a constant minimum return to these depositors. Islamic banks have it much easier. There are only a few banks which are offering truly Islamic banking in the country and even those banks can set a deposit rate which is acceptable to them rather than one mandated by the State Bank.

This is the true reason why Islamic banks are able to earn the return that they see while conventional banks have to face the reality of shrinking margins and higher costs. The person losing out in the end is the depositor who is maintaining an account at an Islamic bank and the winners are the shareholders of the bank who get to reap higher profits.

The Shamshad Akhtar Factor

Afew months ago, the then caretaker Finance Minister; Mrs Shamshad Akhtar, did state that the State Bank should impose a minimum deposit rate for Islamic Banks as well.

This saw the share price of these banks as it was expected that their earnings could fall in the coming period. This was a change in the behavior of finance ministers who used to talk about shifting money from the bottom line of banks to the national exchequer. For the first time, the new proposal would actually benefit the depositors for a change.

A quaint solution to this problem would be to index the deposit rate to a benchmark which moves and changes with the policy rate allowing for the depositors to get a more fair and equitable return.

A sensitivity analysis carried out by Arif Habib Limited for the September earnings of the banks showed that for every 1% increase in the minimum deposit rate mandated on the Islamic banks, Meezan would see its earnings fall by Rs 2.27 per share. Any such rate change will be felt in the bottom line.

The numbers behind the MDR divide

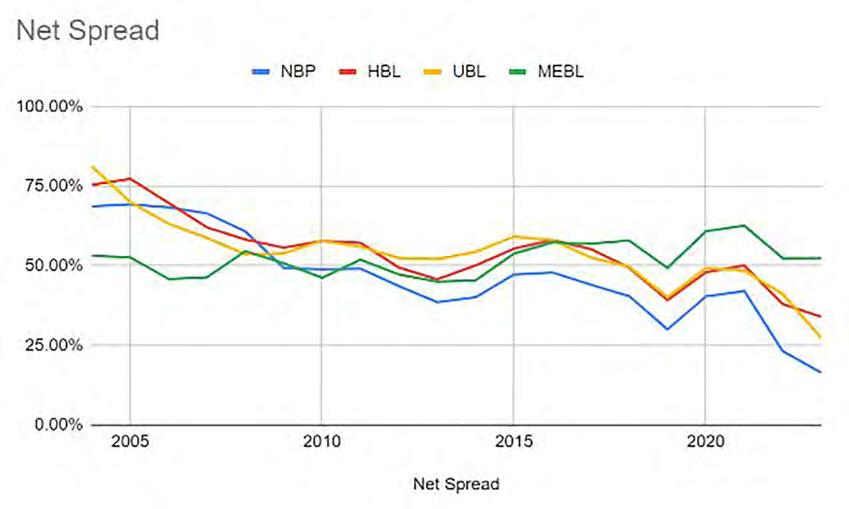

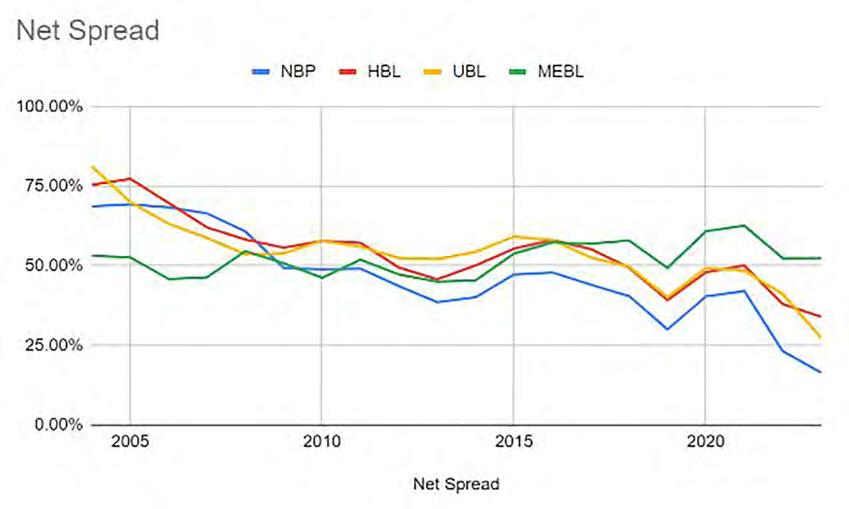

In order to analyze the data and numbers behind this divide, Meezan Bank has been compared to National Bank of Pakistan, Habib Bank and UBL which are three of the biggest banks operating in the country. In terms of analysis, the first trend that has been seen is the net spread percentage. This is the interest earned by the bank on its assets less the interest expenses which has been paid out to its creditors as a percentage of its interest earned.

In a manufacturing business, this would be considered the gross profit margin. How much the company is earning for every product that it manufactures and sells. In this case it represents how much money the bank is keeping after taking away much

of its direct costs of yielding that interest income.

In 2005, the conventional banks were earning a return of more than 70% meaning they got to keep Rs 7 out of every Rs. 10 that it was earning. After the MDR mandate was put in place, 2023 shows the banks earning only 30% in terms of its net spread. In comparison, the Islamic banks were earning around 50% in terms of their net spread in 2005 which has stayed constant till now.

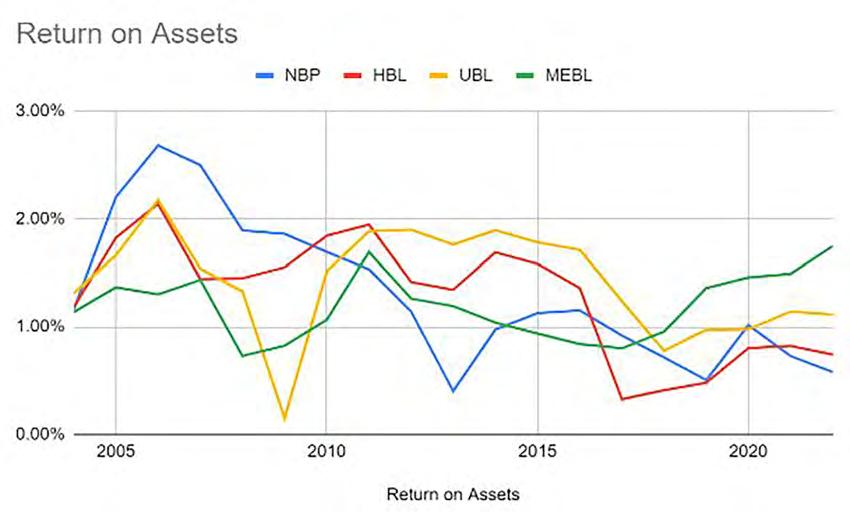

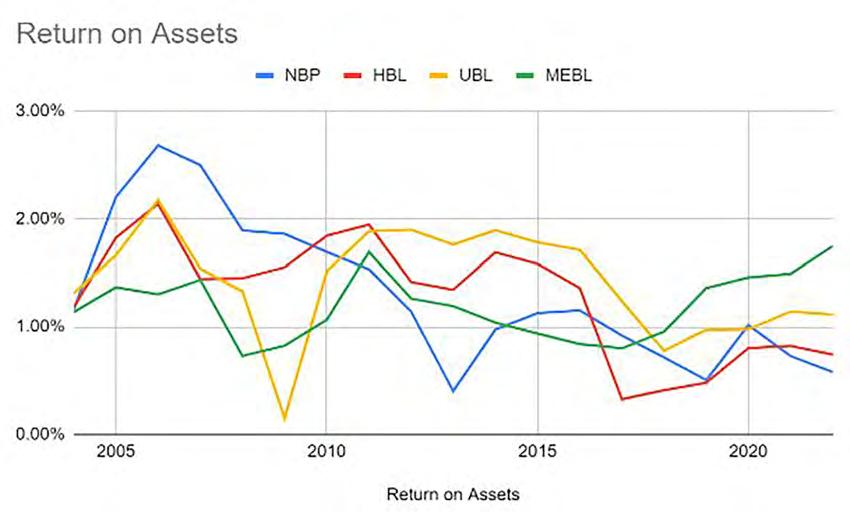

In terms of return on assets (ROA), there is a similar pattern where Meezan was only earning 1.37% in terms of its assets as net profit while National Bank, Habib Bank and UBL earned 2.2%, 1.82% and 1.66% respectively. Over time, the returns for the conventional banks fell and in 2022, Meezan saw ROA of 1.75% while National Bank, Habib Bank and UBL earned 0.58%, 0.74% and 1.11%.

Due to the low equity requirement of banks, the results of its return on assets are magnified when seen in terms of its return on equity (ROE). Conventional banks like National Bank, Habib Bank and UBL had ROE of 17%, 24% and 28% in 2005 which fell to 10%, 12% and 15% while Meezan saw its ROE go from 21% in 2005 to 39% in 2022. To put this in context, the ROE of Meezan was more than the ROE of the biggest three banks of Pakistan combined.

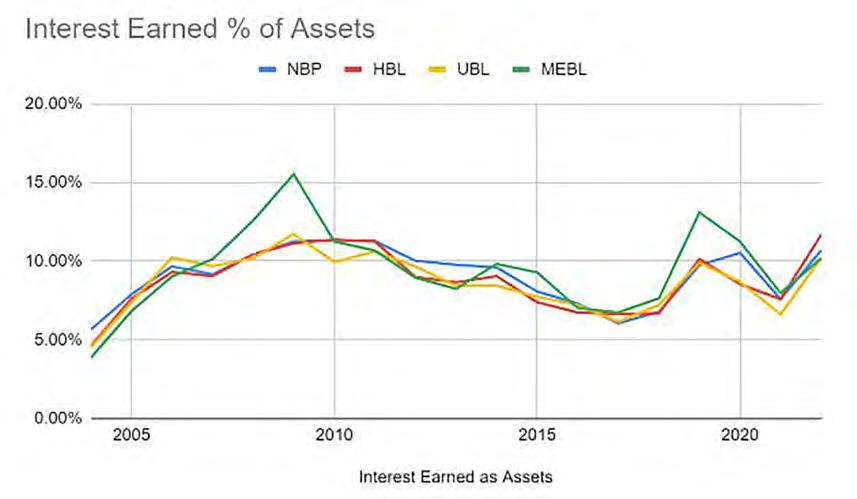

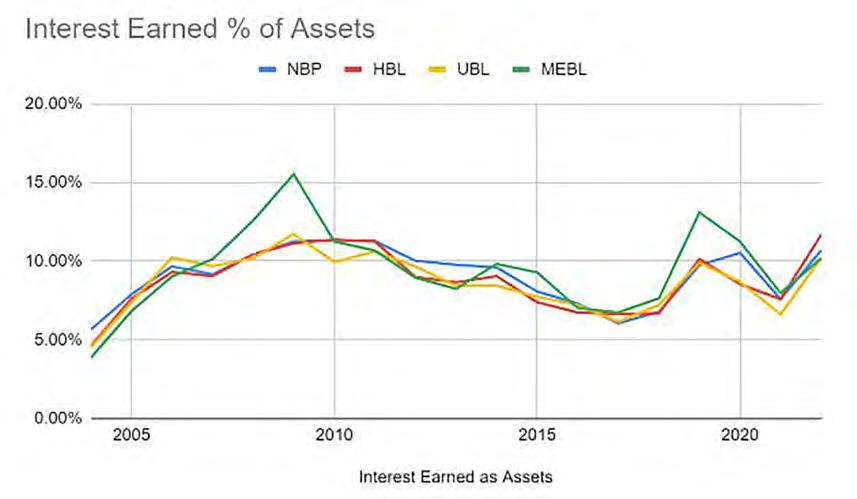

The investments of the Islamic banks yielded returns equal to those of the conventional banks. As interest rates have moved, Islamic banks’ earned interest as a percentage of assets have stayed similar to the ones of conventional banks. This means that the assets available for investment to both systems are the same and both of them are yielding a return based on the assets of the sector themselves. As of 2022, Meezan earned a return of 10% from its investment which matched the conventional banks.

On the other hand, the expense as a percentage of assets was around 1% for all banks in 2004 which increased to 7% for National Bank, 6% for Habib Bank and 5% for UBL. This percentage was lowest at 4% for Meezan Bank. This shows that the interest earned is similar while the cost is the lowest for Islamic banks.

All this debate can be boiled down to the fact that interest expense, which used to be 1 to 1 in terms of net profit has now gone to 13 times, 8 times and 5 times for National Bank, Habib Bank and UBL while Meezan Bank has seen its interest expense go to 2.5 times of its net profit. This shows that the ratio of the expense has increased by at least 5 times for conventional banks while it has increased by only 2.5 times for Meezan Bank. n

BANKING 14

16

COVER STORY

By Zain Naeem

There is supposedly a big bad wolf stalking the Pakistan Stock Exchange. Earlier this month the Securities and Exchange Commission of Pakistan (SECP), the regulating agency responsible for rounding up all said wolves big and small, filed four different criminal cases.

Within the stock market this was big news. The last time the SECP took criminal action against anyone was back in 2017. The only problem is that the SECP has been suspiciously cryptic in its announcement.

In its press release, the commission stated that four different cases have been filed against four different individuals. The violations had been carried out between 2019 to 2021 and the central accusation is stock price manipulation. What the press statement doesn’t tell us is who these four individuals are and which stocks they manipulated.

Who could they be? Suspicion might be pointed towards those in the stock market that have the biggest, scariest teeth and the sharpest longest claws. These are the Jehangir Siddiquis, the Aqeel Karim Dhedhis, and the Munaf Ibrahims that loom large in the world of Pakistani stocks. But it isn’t one of the big boys from Karachi that have come under the regulator’s scrutinous gaze. In fact, it is a little known broker from Lahore that has woken the SECP out of their slumber after seven years.

Of course, it is just a little unfair to refer to Ali Malik as a little known broker. Profit has access to copies of the criminal cases that the SECP has taken to Banking Court. The chief accused is Ali Malik of the Lahore based brokerage company First National Equities Limited (FNEL). While FNEL and Ali Malik might not be household names, within the small community of stock market brokers they carry some heft. The man has been around since the 1980s and has made a name for himself in the stock market. But it isn’t just Ali Malik that has been nominated in these cases. In fact, his entire family has been accused of allegedly being part of a blatant stock manipulation campaign from 2019-21.

The shares in question that have supposedly been manipulated belong to different companies. There is first the Treet Corporation, which is one of the largest listed companies on the PSX and has been incorporated since 1977. Then there is Buxly, which is a paint company that goes back to 1993. And then finally there is FNEL —- which is the brokerage house that Ali Malik runs, and a publicly listed company in its own right.

The accusation in all three cases is that the individuals accused bought and sold

shares either amongst themselves in some cases to artificially raise and bring down prices. There is nothing particularly outrageous about this as a concept. Stock manipulations are a part and parcel of the market and are rarely easy to prove.

The question is, what happened that made the SECP step in after seven years of not having filed any criminal charges? More importantly, why would a broker as seasoned as Ali Malik make mistakes that most market novices would spot from a mile away?

The proof, as they say, is in the pudding. And to get to the bottom of it we have to start by understanding exactly what Ali Malik and his family have been accused of.

The skeleton of the market

This story revolves around the anatomy of an accusation. We’ve already mentioned that the brokerage house FNEL has been accused of manipulating the shares of Treet, Buxly Paints, as well as its own shares from December 2020 to 2021. Before we really get into the specifics of what happened with each share, what they are essentially being summoned for is a Pump and Dump scheme. This is a form of fraud where investors artificially inflate the price of a stock through misleading or false statements, then sell off their shares at the inflated price, leaving other investors with losses.

There are many ways to manipulate stock prices for a pump and dump operation. You can spread rumours about a company, use insider information to your advantage, or as allegedly was done by FNEL, you can place fake orders. In the United States this is what is known as “spoofing” — an act once described by the Washington Post as “a silly name for serious market rigging.”

The idea of spoofing or selling fake orders actually goes back to the origins of the stock market and is one of those rare parts of modern finance that have been made more difficult by technology. You see back in the day brokers used to stand in trading pits on the floor of the exchange and shout their bids to each other across the floor and face to face. A huge part of the job was bluffing in regards to price to try and inflate the prices of certain stocks you had. But there is really only so much that a single broker on a market floor could do.

In recent times, however, technology has replaced the once loud and busy world of the trade floor. The buying and selling of stocks happens through a single digital trading system. Buyers put in an order for a certain stock at a certain price. Sellers use the same system and list their stocks for sale at certain prices. When a buyer’s price matches the price of a

seller the trade happens automatically. It is actually a pretty neat system.

But it can also be gamed. Say that a certain brokerage house slowly buys up shares in a particular company. They are not happy with its share price and want to make a quick buck. They will simply get onto their trading platform on a computer and place a bunch of orders for more of that stock. Those with the stocks would see this and hesitate to sell since they’d expect the price of the stock to go up further. After all, why else would anyone be trying to buy in such large quantities? This would cause a price increase in the stock at which point they would sell their old stocks and cancel the orders they made.

And yes, cancelling orders at a whim is very much possible in the stock market.

This is what FNEL is accused of doing with Treet, Buxly, and their own shares. But does it add up? For that, we must look into exactly what happened to the share prices of these companies in the time when they supposedly were being manipulated.

What happened with the stock prices?

One would not expect Ali Malik to have found himself in this kind of trouble. The son of a Chartered Accountant, he was born and raised in Lahore where he attended Hailey College of Commerce and developed a penchant for the stock market. He began investing and eventually moved to Karachi where he made money and became prominent. A self-made man, Ali Malik grew and became a prominent if introverted broker. So how exactly did he get in trouble with the SECP?

No real details have been released up until this point by the SECP publicly. However, through court documents that Profit has obtained as well as conversations with the SECP, it can be determined exactly what happened to the stocks under question.

Buxly Paints

The Buxly Paint example is the first one we have. The company saw its share price rise by a whopping 521% in a span of 37 trading days from July to September in 2021. The exact share price went from Rs. 58.5 per share to Rs. 363.03 per share.

This activity was deemed abnormal after it hit its high of Rs 484.70, the share price decreased back to Rs. 99.85 by October 2021. Because of the massive fluctuation, an analysis was done of the trading data of this time. The SECP has the records of all those buying and selling these shares. During this time period four clients of the FNEL brokerage house were involved in trading Buxly shares. One of these

18

clients was Ali Malik himself and two more were members of his family.

The rise in the price of the share coincided with the entry of these four individuals and they all had accounts with the same brokerage house. The SECP alleges that all these individuals acted in concert in order to carry out the manipulation. Buxly Paints was chosen as it has an illiquid stock and only 524,875 shares of its total issued capital of 1.4 million are available in the market.

The evidence collected for the investigation used order level data and timings of the queued orders which are logged by the trading system used by the PSX. The buyer pumped up the share by placing orders at higher rates initially. Once one of them had accumulated some shares, they would trade between each other in order to keep the share price high and hit the upper lock which is the highest available rate the share can trade at during a day.

The allegations become damning when the SECP states that they took random dates when the upper lock was hit and they saw that all the volume traded was carried out by these group members. The profit from these transactions has been calculated to be around Rs. 17.544 million for the group based on this trade data.

In terms of manipulating, an illiquid share is easier to manipulate due to the fact that there are few buyers and sellers. This means that due to low volume of trading, the share price can be easily raised by trading low volumes. However, the risk is that a rise of almost 600% will raise eyebrows and will be scrutinised by the SECP.

First National Equities Limited

Then there is the next situation: the stocks of FNEL itself. This one is a bit more obvious. While FNEL is a brokerage house it is also a business that is listed itself on the PSX. Its share price increased from Rs. 13.63 per share to Rs. 23.6 per share which was an increase of 73% from December 2020 to January 2021. The share price then slumped to Rs. 11.11 by April of 2021. The investigation found that during the month of Jan 2021, the average daily trading volume increased from 620,000 shares to 3.8 million shares and in April 2021 the volume increased to 21 million. In this case as well, members of the Malik family as well as two companies by the name of Biofert and First Florance Developers (Pvt) Limited (an associate company of FNEL) have been named.

The SECP claims that by trading amongst themselves, all the accused were able to pump up the volumes and the prices of the shares. In addition to that, the back ledger data of the brokerage office itself showed that some of the clients were carrying out buying at

“We will present our defence in court. All I can say at this point is Inna Lillahi wa inna ilayhi raji’un”

Ali Malik, CEO of FNEL

the brokerage house while they owed money to the brokerage house itself. In case of a debit balance in the back offices, brokerage houses are not allowed to buy more shares until they have recovered the older pending amount that it is owed.

Another red flag raised in this instance is where a client showed trading in their account which had not been authorised by them and an employee at the company traded shares on behalf of the client without their authorization. This is not allowed as it goes against the fiduciary duty of the broker to access the funds or shares of the client without their knowledge or permission.

In order to fund this scheme, the accused cycled the funds between each other’s account in order to post the money for each of these transactions. A seller of one day would transfer the funds to another person who became the buyer the next day allowing for the funds to go from one account to another. The profit from these transactions was estimated to be around Rs. 416.772 million.

Treet Corporation

Last is the manipulation carried out in Treet Corporation, which is a pretty significant presence on the PSX. The company saw its share price increase from Rs. 31.79 per share to Rs. 52.02 per share which was an increase of 64% and the volume traded increased from 1.095 million shares per day to 9.569 million shares per day. The trading data showed that six clients of FNEL were involved when the scrip saw a substantial increase.

In this case again, Ali Malik along with members of his family and FNEL’s subsidiary First Florance have been named. In addition to this, the accused also traded in the future

market as Treet has a futures market as well. This led to a profit of Rs. 27.198 million for the group. One additional tactic that was used was that orders would be placed and then deleted by the group in order to create an illusion that there were buyers for the share when they were not actually looking to buy but only feed the illusion.

One of the plus sides of this system is that everyone can see what the position of the market is in real time. Since the trading system is a collection of bids from buyers and asks from sellers, any user can get access to know how many buyers exist at a certain price and at what prices they are willing to buy. The same happens where buyers can see all the asks of sellers and how many sellers are there at different prices.

Treet Corporation has a higher trading volume in the market which can conceal any large transactions and evade the ire of the SECP. As the share is traded more, it is easier to create an illusion that the company is performing well due to which the share price is improving, even though there is no justification for the price increase. But trying to manipulate such a share can be difficult as there are a lot of players who are active in the market who can take a contrary position and foil any attempt to manipulate. Even if the stock is being traded within the group, other participants can enter and make it difficult to do so.

The other side of the equation

But is Ali Malik and his FNEL responsible for these changes? It would definitely look like it to the SECP. But there is one nagging question: Why

COVER STORY

would he do it in such a blatant way and why is the SECP going after someone with all guns blazing for the first time in seven years?

You see, stock price manipulation is common enough in Pakistan. There are many examples of stock manipulation, insider trading, and pump-and-dumps in Pakistan that just this publication has covered in the past.

Read more: Regent Plaza’s sale seems to be a classic case of insider trading. But will the regulators investigate?

Read more: Trick or Treet: Decoding the meteoric rise in the stock price of the battery manufacturer

The problem is that they are often difficult to prove. Profit reached out to Ali Malik and FNEL for comment. They simply responded by saying they would submit their reply in court and were confident that the case would be thrown away. “All I can say at this point is Inna Lillahi wa inna ilayhi raji’un,” he said in a conversation. Sources close to the brokerage that have worked with them also told Profit that the family felt very strongly that the case against them was agenda based and coming from some past vendetta with the management of the SECP.

One of the things they pointed towards was that the SECP has not initiated any criminal proceedings in seven years and has now targeted one single brokerage house in four different cases. On the one hand one could say that it could be because the evidence was overwhelming.

The SECP is alleging, after all, that the manipulation of the stocks was carried out by the group who were related to each other at the same brokerage house, in the same city, in the same office at the same trading terminal! This would be a crime that would be very easy to trace. It is indeed blatant and brazen if proven true in court.

But that makes one wonder, why would Ali Malik be so blasé in his approach towards the regulator? After all, he has nearly four decades of experience in this field and stock manipulation is nothing new in Pakistan. In fact, there are plenty of ways to go about it that aren’t particularly sophisticated but are safe because the SECP has a hard time proving it in court.

Usually what happens in the market is that shares are bought in secret through a clandestine phone call and shares are accumulated. Manipulators usually do not trade in accounts of their own shares. They place funds and give money to brokerage houses in a hidden manner and then buy shares from the market through these accounts.

A manipulator will have these kinds of arrangements with different brokerage houses and would then trade between them. Brokerage houses have their own proprietary

accounts which allow the house to buy shares and the beneficial owner of such accounts would be the brokerage houses themselves. Even though these shares actually belong to someone else and are bought on behalf of other investors, the records would show that the brokerage house owns them for themselves.

Now when a pump has to take place, the manipulator will start trading from one brokerage house and trade with another one at another house. This is presented in the market as one broker buying shares from another broker. The manipulator is able to show a large volume being traded and can even sustain a pump and dump strategy by doing it. The data released will only show one broker buying the shares while another sold them. SECP can be cognizant of what is going on but will not be able to prove manipulation outright.

In the case that was discussed, it was seen that the group got fingered as they used their own accounts. In the past, it has been seen that investors have opened up accounts of their employees, gardeners and what not in order to manipulate stock prices and carry out insider trading. This is just the first layer of complexity that is applied when manipulation is carried out. In the past, when SECP rules were not well defined and its scope was narrow, such manipulations have taken place.

It would be like a robber stealing from a bank and then leaving his ID card at the scene of the crime.

So why not do something of the sort instead? One explanation could be that they never thought the SECP would do anything at all.

The new filing of charges comes after a period of seven years when a similar case was filed by the SECP in 2017 against Cedar Capital where its Chief Executive Officer and two clients were charged for being responsible for manipulating share price of Pak Electron Limited. SECP also carried out insider trading investigations against senior employees at UBL and BoP in 2016. Both these investigations took place during Zafar Hijazi’s tenure as Chairman of SECP.

The SECP was mired by inactivity as it looked to suspend any investigation into new or pending cases of insider trading and stock manipulation since 2017. This was done in light of alleged record tampering carried out by the Chairman Zafar Hijazi. As soon as the FIA started an inquiry into the allegations made, the SECP stopped working on any of its pending cases and opening up new investigations in this regard.

And then there is another aspect: That the buying and selling of fake orders that FNEL is being accused of could be run of the mill trades. Say the market is showing that a buyer wants to buy 1,000 shares at Rs 10 while

a seller is willing to sell 1,000 at Rs 11. This is a perfect situation for manipulation. A manipulator can either place an order for 1,000,000 shares at Rs. 9.99, at Rs. 10.5 or even place an order at Rs. 11. A seller would be able to see that a buyer is looking to buy so many shares and remove their own order. This is categorised as manipulation as an illusion is being created. The manipulator does not actually want to buy the shares. He is just creating a mirage that he does and making people change their expectations and behaviour by manipulating the stock and ultimately the seller. This can even cause a buyer to enter the market thinking that there is an interest in the stock and even if they have to end up selling their shares, they will always have a buyer who wants to buy a large quantity that they can sell too. Just by placing an order, the manipulator has been able to shift the expectations of the whole market.

As SECP alleges this, there is a market reality which is being ignored. When a buyer wants to buy a stock, they will place an order at a certain rate. When the price increases, he will revise his order and place a new order. Let’s say the price is increasing in a fast manner. In that case, the buyer is more interested in getting the stock first and will keep placing orders in order to get the shares. This might seem absurd to an outsider in terms of how long it can take to cancel one order and place another. Market insiders know that the market moves in a matter of nanoseconds and speed is the key. It is normal for a buyer to keep placing orders to first buy the shares and then later cancel the orders when the transaction has been completed. Sources closer to Ali Malik state that this is the normal behaviour of the market and SECP cannot gauge the intent of a buyer when an order is being placed or cancelled.

So where does that leave us?

This is where we stand now. On the one hand the SECP has been lazy and ineffectual in countering stock manipulation. Because it is difficult to prove, they have relied on imposing fines and suspensions rather than criminal proceedings when at times that is what would have fit the bill.

On the other, you have a stock broker that is old to the market and knows all of its tips and tricks. He has been accused of very blatantly manipulating stock prices and getting caught in the process. One would normally be happy that the SECP is taking action against unfair activities in the PSX. After all, stock manipulations are what lead to investors becoming shy of the markets. A new investor will always fit the maxim of once bitten twice

TEXTILES 20

shy. But it could be argued that the manner in which this case has been approached was heavy-handed.

The criminal complaint by the SECP is based on the violation of Section 163 and Section 164 of the Securities Act 2015 under which the investigation was carried out and the case is now being pursued in the Banking Courts. One does have to take it with a grain of salt given how the SECP has managed the press on this issue. The press release by the SECP fails to name any of the individuals who were involved in the manipulation and does not disclose the brokerage house that has been charged. Usually, like in the case of Cedar Capital, the brokerage house was named outright while the designation of the individuals was also given. This was not done here.

One reason for it might be that as four complaints had been filed, the SECP was giving an impression that many different players were involved. However, this was not the case as all complaints related to one brokerage house and some key individuals who are tied to this one house alone. In terms of the complaint filed for trading in the shares of the brokerage house itself, the word sponsors is used without giving any clue of which brokerage house is being talked about.

Issues can also be raised that the investigation was carried out over a span of 5 years and that there are elements of personal vendetta that can be raised as an investigation and action has been taken after SECP had been dormant for more than 7 years. To take an action of filing

4 criminal complaints against all the group members with strict language being quoted in the press release might seem like the SECP is out with a hatchet. Representatives at the SECP state that the Commission is run by all the Commissioners and the Chairman and any such decisions have to be passed unanimously. In terms of the amount of time being taken, the Commission needs to investigate and then get the necessary approvals which take time and have to be completed before any action takes place. In addition to that, as there are tenure and personnel changes that take place, new management comes in which further delays the whole process.

Where the SECP seems lacking

One point that can be raised against the profit calculations done by the SECP is that they have considered all sales carried out during the period for the group as sales proceeds and inflated the amount of profit earned. They have ignored considering the buying price when the shares were bought. This means that all sales proceeds are considered profit which is erroneous and needs to be corrected. If buying before the review period and selling during the period makes a person culpable, then anyone who bought before the review period and sold during it needs to be reviewed. In addition to that, costs like brokerage, CDC charges, PSX lags and other charges levied on the trade have

been ignored which further inflates the amount of profit earned.

Another fact is that in terms of Buxly Paints, the court complaint fails to give details of the trading that was carried out and just claims that a profit was made without giving detailed information. Just like the data for FNEL erroneously considers sales as profits, similar mistakes could have been made here which fail to show a profit and evidence of manipulation and could be making a mountain out of a molehill. This is also the same in the complaint filed for Treet where SECP gives cursory details of the trades and mentions that the profits have been earned without giving a detailed account of this.

This raises the question, is stock manipulation always profitable?

The short answer would be no. The long answer would be that even when stock manipulation is done, there is a chance that a loss can be made. The main goal of the manipulator is to create an illusion and make people believe in that illusion to be successful. But it can always be possible that they are not able to do so. A manipulator can buy the stock initially and then inflate the price of the stock to high levels. But what if the people never enter the market? The manipulator can do two things. Either believe that he has lost or through good money after bad money and try to make the illusion grander. And end up losing it all. n Disclaimer:

The author of this article has worked for FNEL in the past. COVER STORY

The “Standard” Chartered Journey:

From a Promising Global Banking Juggernaut to a Risk-Averse Frugal Bank While the bank has become cost-effective, it has come at the cost of stagnant growth in deposit mobilisation

By Mariam Umar

As the earnings season draws to a close, we at Profit continue to be fascinated by the significant turnaround experienced by the banking sector in 2023. The rise in interest rates during the first half of the year led to strong markup income, ultimately boosting the overall earnings of commercial banks.

While this publication has previously covered the risk arbitrage strategy utilized by financial institutions over the past twelve months, this time we explore a trend that is often overlooked when reporting on the financial results of commercial banks.

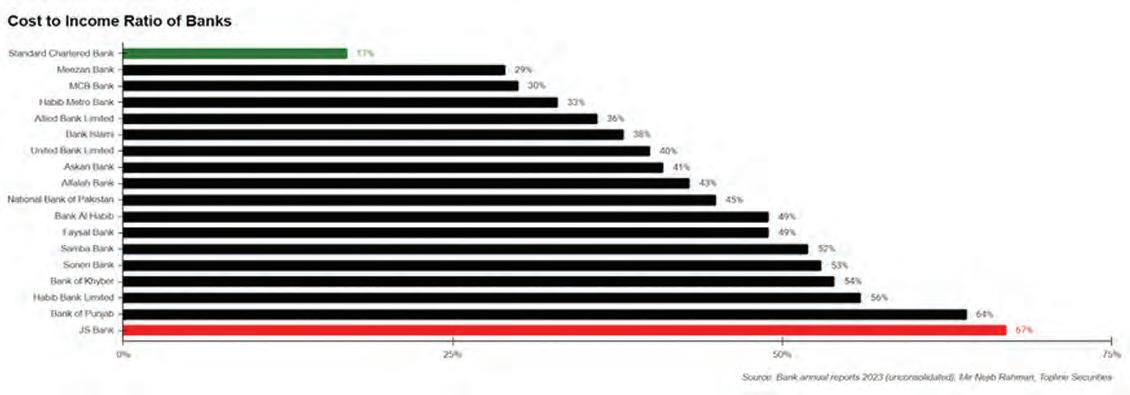

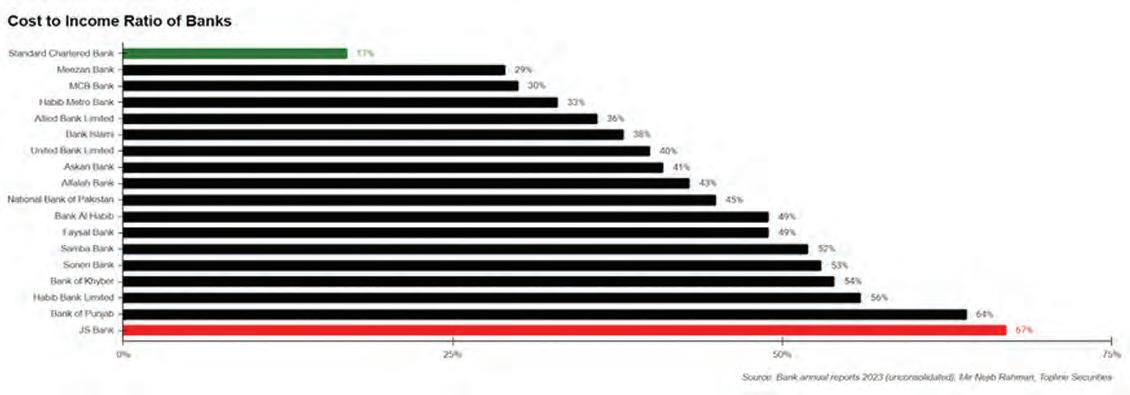

The reference being made is to the cost-toincome ratio, and the bank that emerged as the most cost-efficient in the country is none other than Standard Chartered Bank Pakistan, a medium-sized bank according to PACRA, with a cost-to-income ratio of 17%. The average cost-toincome ratio of other 15 banks analyzed stands at 43%. This indicates that Standard Chartered is not only efficient but miles ahead of its peers.

Mir Nejib Rahman, a banker and financial services consultant, emphasised the significance of the cost-to-income ratio as a crucial financial measure when valuing banks. He noted that the ratio reveals the proportion of a bank’s income consumed by its operating costs, with lower ratios indicating greater profitability. “In terms of the EU banking industry, during three quarters of 2023, the cost-to-income ratio stagnated at around 53%. The top 10 local banks in the UAE averaged at 34% in 2022, while Indian banks averaged around 44.7% in three quarters of 2023.”

“Standard Chartered Bank has done a remarkable job over the last 5 years by focusing on increasing income, implementing technology, streamlining operations, managing costs, and enforcing robust process improvement programs, which has worked towards improving their cost-to-income ratio and thereby their overall financial health and profitability. It cut down its branch network from 77 in 2018 to 40 in 2023, doubling its total assets from Rs 576 billion to Rs 1 trillion, and almost quadrupling its profit after tax (PAT) from Rs 11.2 billion to nearly Rs 43 billion in 2023. It has the highest revenue per employee and the highest cross-sell ratio in the

Pakistan banking industry,” remarked Rahman.

It does not come as a surprise, as those familiar with the bank’s strategy would have observed a gradual cost reduction effort over the years.

The journey

According to the PACRA report, Standard Chartered is a dominant player in its targeted niche market (multinational companies, established domestic corporations & affluent retail clients) through a comprehensive product suite and significant digital capabilities complemented by its international franchise and its extensive presence in Tier-I cities. The bank’s strategic focus is on retail business and digitisation along with traditional banking. The Bank is focused on enhancing yield, and cost-efficiency, increasing client revenue, and growing customer assets.

The bank was incorporated in 2006 when it acquired Union Bank and became the country’s only ‘local foreign’ bank.

At the time of the acquisition, Standard

23 BANKING

Standard

Chartered Bank has done a remarkable job over the last 5 years by focusing on increasing income, implementing technology, streamlining operations, managing costs, and enforcing robust process improvement programs, which has worked towards improving their cost-to-income ratio and thereby their overall financial health and profitability

Mir Nejib Rahman, a banker and financial services consultant

Chartered had 43 branches in Pakistan and Union Bank had 65 branches. The combined entity became the sixth largest bank in the country with a branch network of 108 branches and gave Standard Chartered the ability to say that it was truly a global bank with a nationwide local branch network.

Subsequent expansion led to a branch network of 174 by June 2008. However, in retrospect, the timing may not have been ideal for the expansion. Moreover, due to the rapid expansion drive the operating costs of the bank skyrocketed: operating costs soared by 137% in 2007 while profit margin dipped by 50%. The 2008 financial crisis worsened the situation, causing net income to plummet by nearly 75% in 2008.

Profits were now down to just Rs 723 million ($10.3 million), a far cry from just two years earlier when, in 2006, profits had hit a then-record amount of Rs 5,698 million ($94.6 million). That sharp decline in profits led to the bank scaling back expansion efforts and consolidating its position. The bank closed loss-making branches almost every year since 2008 (except 2010, 2014, and 2023). The efforts to restructure were driven by the mandate from the bank’s international management that set a target for local operators to cut down operating costs by 20%. Hence the bank had no choice but to shut down its branches and switch to digital.

A reflection of this strategy is in the bank’s director’s report for 2023, “The Bank is investing in its digital capabilities and infrastructure to enhance our clients’ banking experience through the introduction of innovative solutions. We have made steady progress in further strengthening our control and compliance environment by focusing on our people, culture and systems. We are fully committed to sustained growth by consistently focusing on our clients and product suite along with a prudent approach to building the balance sheet while bringing the best-in-class services to our customers,” read the Consequently, in the last six years, the bank’s branch network has shrunk from 77 in 2018 to 40 at the end of 2023.”

Toeing the line

While the bank has marketed itself as a local foreign bank, its banking lacks a localised institutional infrastructure. In Pakistan, the bank adheres to global risk management rules rather than allowing for tailored approaches. For example, it restricts lending based on the government’s credit rating, making loan approvals cumbersome and lengthy, and often requiring Dubai headquarters’ involvement. This process, combined with aggressive loan pricing by local competitors, puts Standard Chartered at a disadvantage.

Read: The cluelessness of Standard Chartered’s Pakistan strategy

To understand this point one needs to be cognizant of how credit ratings work. Global credit rating agencies assess sovereigns on multiple parameters including economic stability, political risk, fiscal strength, external debt levels, and institutional quality. Based on these, a credit rating, a measure of the ability to back creditors, is assigned to the country.

Thus, restricting lending based on the government’s credit rating means that even the healthiest of Pakistani companies cannot be rated above the government of Pakistan’s

credit rating. Standard and Poor’s (S&P) rating agency has rated Pakistan at CCC+ rating, signifying the nation is vulnerable to a default. Moody’s – another top global agency – has maintained Pakistan’s long-term issuer rating at Caa3, which signifies poor standing and very high credit risk. These ratings indicate that Government of Pakistan bonds fall into the “junk” category.

Low ratings mean that lending is considered riskier which either deters the lenders from disbursing advances or forces them to charge exorbitant rates to cover the risk.

Domestically, these ratings imply that, aside from relatively modest loans, some underwriters in Pakistan like Standard Chartered cannot automatically approve loans. Instead, all loan applications must be forwarded to the company’s regional headquarters in Dubai. The effect of these ratings is reflected in the gross advances (loans) and investments of the bank.

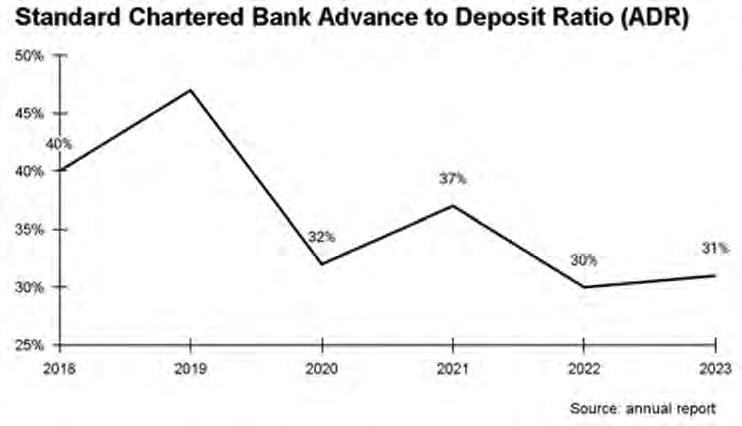

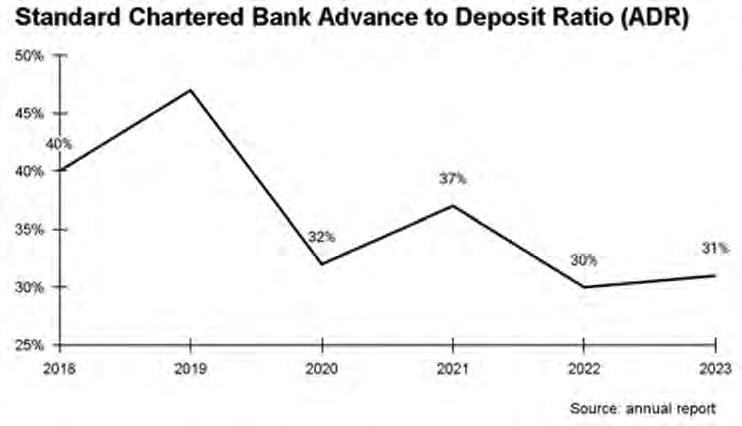

In the last six years, the bank’s gross advances to deposit ratio has decreased as advances remained muted. At the end of 2023, gross ADR stood at 31% whereas industry average ADR stood at 42%.

In the case of investments, when all other banks have been increasing investment in government securities and increasing the size of their balance sheet, Standard Chartered Bank’s

24

investment-to-deposit ratio (IDR) stands at 32% while the industry average is at 87%. Total investments almost halved from Rs 478 billion in 2022 to Rs 226.7 billion in 2023.

However, if one investigates further, it becomes clear that the bank’s liquidity from its investment book was shifted to lending to other financial institutions which amounted to Rs 365 billion in 2023 a 7x increas from the previous year. Out of these almost Rs 319 billion was attributable to reverse repo transactions.

On these, the bank’s financial statements read, “These carry mark-up rates ranging from 21.0 percent to 22.65 percent per annum (2022: 17.65 percent) per annum payable at maturity, and are due to mature in January 2024. This arrangement is governed under Master Repurchase Agreements. The market value of securities held as collateral against repurchase agreement lendings amounted to Rs 320,768.912 million (2021: Rs 31,420.494 million).” What explains this shift in the treasury strategy is that in fiscal year 2024, Standard Chartered was one of the two international banks that surrendered its primary dealer license. Primary dealers are required to participate in primary auctions of government securities (PIBs and MTBs). These dealers actively take part in the primary market by submitting bids in the auctions conducted by the State Bank of Pakistan (SBP) periodically. They also distribute government securities to non-primary dealer banks and other retail or institutional clients.

According to an industry source, Standard Chartered Bank surrendered its license due to the requirement for primary dealers to underwrite 5% of each auction. This obligation means that primary dealers must commit to purchasing 5% of the bonds offered in every government bond auction. However, because of country risk, Standard Chartered Bank rescinded its license instead of assuming even this level of exposure to the Government of Pakistan.

Read: Two International banks surrender their primary dealer license in FY24

Effect of cost-effectiveness

While the strategy to consolidate and focus on high-end retail branches in Tier-1 cities might seem contrary to the goal of financial inclusion, Standard Chartered has seemingly made it work for itself in terms of profitability.

The bank has been able to achieve this feat not only through frugality but also due to the favorable environment of rising interest rates. Net interest income doubled from Rs 44.6 billion in 2022 to Rs 94.1 billion in 2023 while the bank’s net income increased by 72% year-on-year. Operating expenses increased by 29% from the comparative period in line with inflation

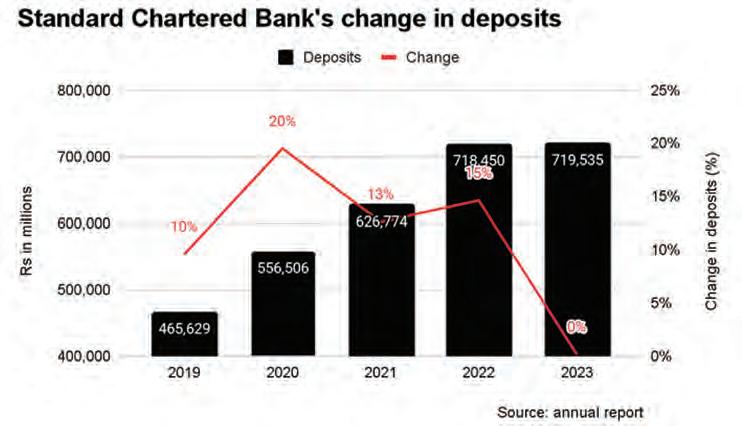

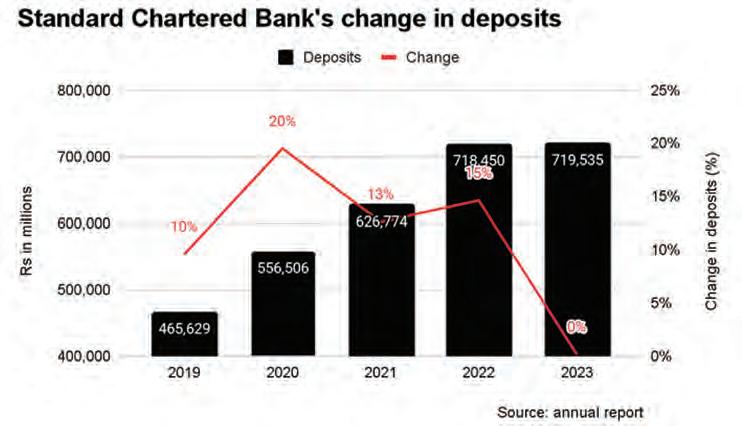

While the bank has managed to become the most cost-efficient bank, it has come at a cost. An extensive branch network is essential to mobilise deposits in Pakistan. With no change in the branch network for Standard Chartered Bank in 2023, growth in deposits was

also stagnant, unlike its peers that experienced an average growth of 25% in deposits.

However, the bank’s predominantly lowcost deposit base has enabled it to achieve one of the best Current Account and Savings Account (CASA) mix in the industry at 97%, which facilitates core operating activities as ample funds are available at a low cost when compared to term deposits and borrowings. According to the annual report, current accounts registered a healthy growth of Rs 34 billion (up 10%) since the start of 2023 and comprise 50% of the deposit base.

The global banking juggernaut, however, seems content with remaining a relatively small player in Pakistan’s financial landscape as it lags behind its peers in terms of footprint in the country. n

BANKING

Banks Growth Branches in deposits Habib Bank Limited 19% 1758 National Bank of Pakistan 38% 1526 Allied Bank Limited 10% 1481 MCB Bank 31% 1438 United Bank Limited 29% 1364 Bank Al Habib 23% 1113 Alfalah Bank 40% 1024 Meezan Bank 34% 1004 Bank of Punjab 24% 815 Faysal Bank 30% 722 Askari Bank 13% 660 Habib Metro Bank 15% 525 Soneri Bank 26% 443 Bank Islami 26% 440 JS Bank 5% 292 Bank of Khyber 16% 238 Bank Makramah 29% 177 Samba Bank 9% 47 Standard Chartered Bank 0% 40 Source: Bank annual report 2023, Topline Securities

In conversation with

inDrive’s Nikita Dirin

How is inDrive cracking the code for succeeding in the intercity ride-hailing space?

Headquartered in Mountain View, California, inDrive is the second-largest global ride-hailing service, operating in over 700 cities across 46 countries, with more than 200 million downloads since its official launch in 2013.

However, it wasn't until early 2021, when inDrive debuted in Pakistan and quickly rose to prominence as the country's most downloaded ride-hailing application, owing to its innovative bid-based model. Since then, other mobility tech m-companies, such as Bykea and Careem have also adopted the bidding model for generating fares.

inDrive’s Director of the Intercity business vertical, Nikita Dirin, coming in with over nine years of experience in international business strategy and operations in tech companies, has been instrumental in crafting and executing global business strategies, driving operational, product, and marketing activities.

Before joining inDrive, Dirin worked on launching DiDi's operations in Eastern Europe and Central Asia as an Operations Lead. He also managed engagements in email, smart devices, and ride-hailing at Mail.ru Group.

In conversation with Profit, Dirin shared some useful insights on how inDrive managed to not only find a space for itself in the Pakistani ride-hailing market but also become one of the most downloaded and used applications for ride-hailing in the country.

How does inDrive navigate the competitive landscape of Pakistan’s saturated ride-hailing industry?

Nikita Dirin: inDrive's success stems from its distinctive business model, which prioritizes fairness for both passengers and drivers. Unlike competitors who rely on heavy subsidies to gain market share, inDrive adopts a lean approach, focusing on product-market fit and local adaptation. By sending dedicated teams to engage with local communities, inDrive ensures its services resonate with the specific needs of Pakistani us-

26

ers. This strategic approach has enabled us to emerge as a market leader in various countries, leveraging its unique value proposition and commitment to innovation. Rather than shying away from competition, inDrive embraces it, confident in its ability to differentiate itself through fair practices and localized solutions.

Despite its initial potential, the Pakistani market poses challenges such as unexpected internet outages and high fuel costs, which directly impact pricing strategies. How does inDrive overcome these obstacles?

ND: You're absolutely correct about the challenges we face. Upon joining the company, I delved into understanding these intricacies further. Despite factors like fluctuating exchange rates and unforeseeable events such as internet outages during elections, our business model offers flexibility. For instance, in regions with high inflation, drivers and passengers can adjust prices within our bidding system, ensuring fair fares for both parties.

Unlike managed marketplaces where prices are set by the platform, our approach allows negotiation, fostering a more equitable environment. This contrasts with the rigidity of centralised decision-making, where international companies may struggle to adapt to local dynamics effectively. Thus, our model enables adaptability, vital for navigating diverse markets and fostering sustainable growth.

Other ride-hailing companies in Pakistan have quite a diverse portfolio, with several verticals including delivery, grocery, cargo and even micro-financing wings. Does inDrive have similar plans to expand its operations beyond ride-hailing, courier and freight?

ND: We have actually expanded and even diversified our services since we came to Pakistan. As of December 2023, inDrive.City to city vertical has been operational in over 140 cities, serving both major urban centers and smaller locales, including hill stations. This extensive coverage allows us a broad reach across Pakistan.

inDrive growth trajectory has been backed by both acquisitions and the development of internal startups. We are continuing to carefully evaluate both external and internal opportunities.

In particular, we’ve recently launched a new vertical - inDrive Money - with our partners in the financial industry in Latin America - cash loans and credit cards. Initial traction seems promising, potentially leading to a rollout in other regions. Unlike typical mobility apps, inDrive's expansion into financial and VC activities may seem unexpected, but it's a

deliberate move. We tread cautiously to avoid diluting our focus, ensuring any venture aligns with our core objectives and exhibits promising market fit, economics, and traction. While our core mobility service remains central, we explore complementary avenues thoughtfully, aiming for sustainable growth and relevance in Pakistan's dynamic market.

How has the response to the inDrive. City to city service been, considering that competitors such as Daewoo are quite affordable and widely used?

ND: In Pakistan, the widespread population distribution, with major cities like Lahore and nearby areas such as Gujranwala, creates common scenarios where individuals commute between cities for family or business purposes. For instance, a team member at inDrive who originally hails from Sargodha but studies in Lahore and has family in Sargodha frequently commutes between these cities. Such intercity travel needs often involve family visits or business trips, where privacy and convenience are paramount.

Comparing our service to buses, which I personally experienced and discussed with passengers, would not be fair. We aren’t simply different modes of transportation but also offer differing value propositions to our respective customers. Our service provides privacy and comfort, crucial for family trips, as well as rapid and flexible commutes as passengers can choose where exactly they need to be picked up and the destination point.

For business travelers, our service offers a conducive environment for working with laptops and ensures efficient, time-sensitive journeys. Considering the combined costs and time savings, our service becomes a competitive option for intercity travel, catering to diverse needs efficiently and affordably.

In Pakistan, there's significant demand for high-quality ride-hailing services like inDrive due to the ability to negotiate prices, select drivers and cars based on reviews and preferences, resulting in substantial growth in demand. This demand surged upon the launch of the city-to-city service, reflecting a preference for personalized and reliable transportation options.

What were the main challenges you encountered during the initial launch of inDrive’s intercity service, and what specific measures did you take to address and refine your model to achieve its current effectiveness?

ND: I'd rather address the current challenges we're facing than those at the outset, as they largely remain similar. Firstly, raising awareness about our intercity service is

crucial. We're actively seeking partnerships with local travel organizations and transport operators to effectively reach our target audience through cross-promotion and service integration.

Secondly, pricing is crucial, as private rides between cities, while competitively priced, still require careful consideration to maintain a balance between affordability for passengers and fair compensation for drivers.

Could you share any notable accomplishments or milestones from the previous year that inDrive achieved, particularly highlighting significant achievements or successful campaigns, whether in terms of relative metrics or otherwise?

ND: Certainly, there are several noteworthy achievements to highlight. Globally, inDrive has become the second most downloaded ride-hailing app, a remarkable feat considering our humble beginnings. In Pakistan specifically, we lead the market with over 6.5 million downloads and usage, representing approximately one-third of internet users. Our city-to-city vertical experienced significant growth, with demand more than doubling in 2023 compared to 2022, culminating in over 300,000 intercity ride orders in December 2023 alone.

What safety features does the app offer, especially in the city-to-city service, considering scenarios where passengers may be traveling long distances on highways? How do you address the unique challenges of such journeys in a region new to inDrive like Pakistan?

ND: We prioritise passenger safety and to advance security measures.

Navigating major routes in Pakistan poses some challenges, but our safety protocols start with rigorous driver verification. We thoroughly screen each driver to ensure their reliability. Additionally, our rating and review system allows passengers to provide feedback, helping us maintain service quality. Moreover, passengers can access safety features in the app for emergencies, ensuring a secure ride.

Another key challenge is maintaining transparency regarding toll roads, especially on popular routes like Islamabad to Lahore, necessitating clear communication for fair pricing. inDrive actively develops features to provide real-time toll price information, enhancing user experience and transparency. Moreover, inDrive adapts to local preferences and needs, such as offering high-capacity vehicles for large families, ensuring a personalized transportation experience. n

INTERVIEW

In Pakistan, the question of climate financing looms large. So what’s happening?

Acumen has secured $90 million in anchor funding from the Green Climate Fund. How will it address the financing requirements of agribusinesses?

28

By Ahtasam Ahmad

There is a lot of talk about climate financing in Pakistan. The floods of 2022 and the ensuing attention Pakistan has gotten at COP27 and COP28 have made it clear that there is a dire need for some sort of monetary interventions to help fix the climate crisis.

But many have felt that the focus over the years has been more on financing on a government level from international agencies. There is some point to this as well. The Global North has disproportionately contributed to the pollution of the Global South and there are many advocates for climate reparations. The process is slow and unreliable however.

In its place there are arguments that climate financing should come from the private sector. That there should be projects, startups, and initiatives that are green in nature and they should have funding readily available. This would create a bit of a two-birds-onestone situation: You save the environment and make money doing so.

In this sense, one noteworthy advancement in the realm of climate change adaptation has occurred in the country recently. Acumen Pakistan has secured anchor funding for a new $90 million Climate Fund targeting the agriculture sector in Pakistan. The initiative is structured as an innovative blended finance facility, with $80 million in equity funding allocated for early and growth-stage local agribusinesses. An additional $10 million will be used for grant funding to offer targeted assistance in enhancing the business models of investee companies and bolstering the overall climate resilience of the ecosystem in Pakistan.

While the project is being hailed as a milestone in the country’s push against climate change, the question remains: can it live up to its promise?

The climate challenge

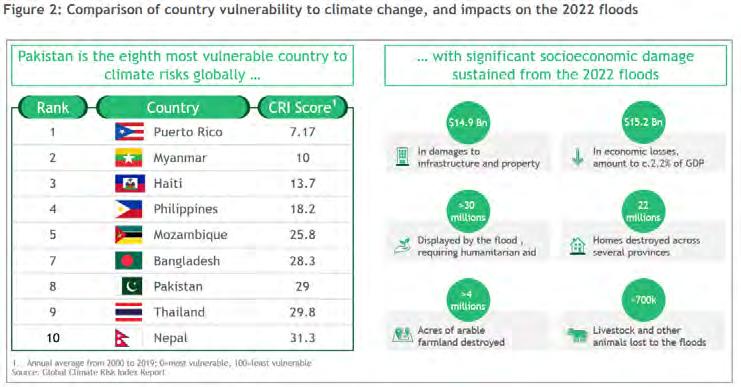

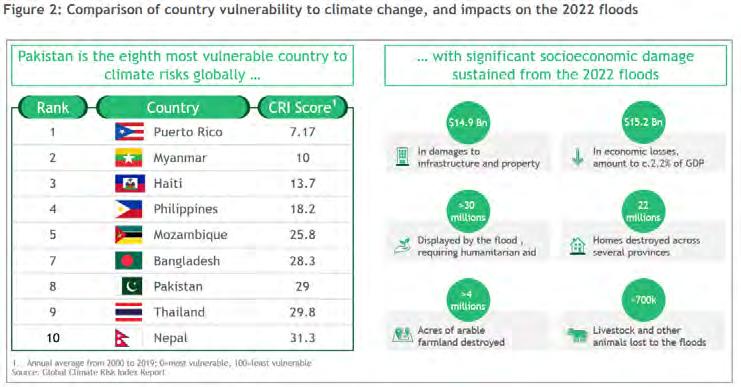

Pakistan is facing increased vulnerability to the impacts of climate change. The nation is already experiencing tangible effects like droughts, floods, and melting glaciers, putting it among the top ten most vulnerable countries to climate change. To tackle these challenges, Pakistan introduced the National Climate Change Policy (NCCP) in 2021.

Perhaps nothing encapsulates the depth of this problem like the floods Pakistan witnessed in 2022 and is still partially reeling from two years on. All in all, according to the latest report of the Post-Disaster Needs Assessment (PDNA), Pakistan needs at least $16.3 billion for post-flood rehabilitation and

reconstruction. The PDNA report, released by the representatives of the government and the international development institutions, calculated the cost of floods at $30.1 billion – $14.9 billion in damages and $15.2 billion in losses.

But there are catches to this as well. Pakistan is supposed to cut down on its own emissions and meet certain standards. As a signatory to the 2015 Paris Agreement, Pakistan aligned its first Nationally Determined Contributions (NDCs) with sustainable

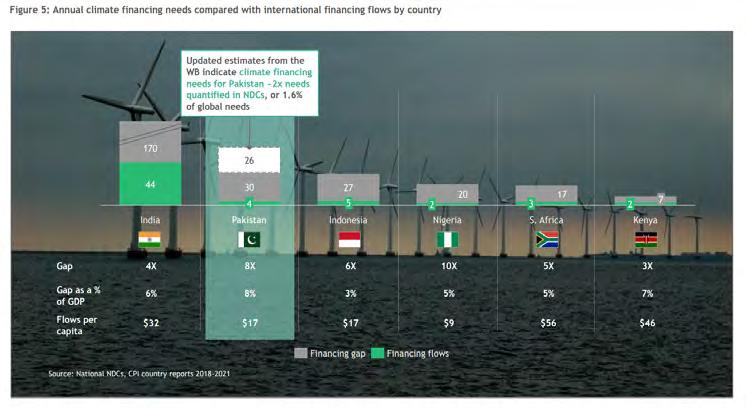

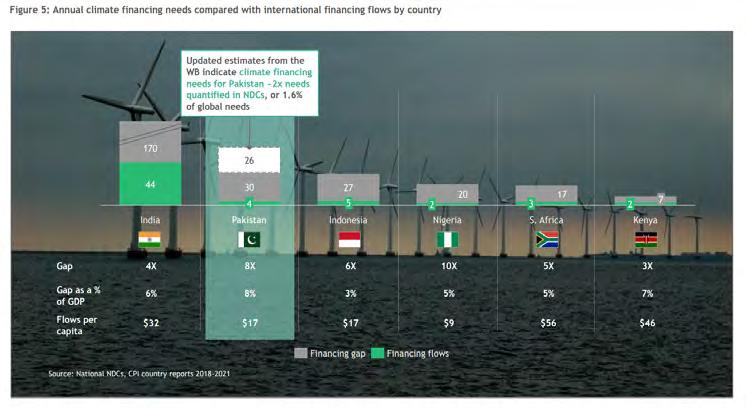

10.7% of cumulative GDP for the same period). This includes $152 billion (44%) for adaptation and resilience and $196 billion (56%) for decarbonisation. This amount significantly surpasses the historical average annual development budget at the federal and provincial levels.”

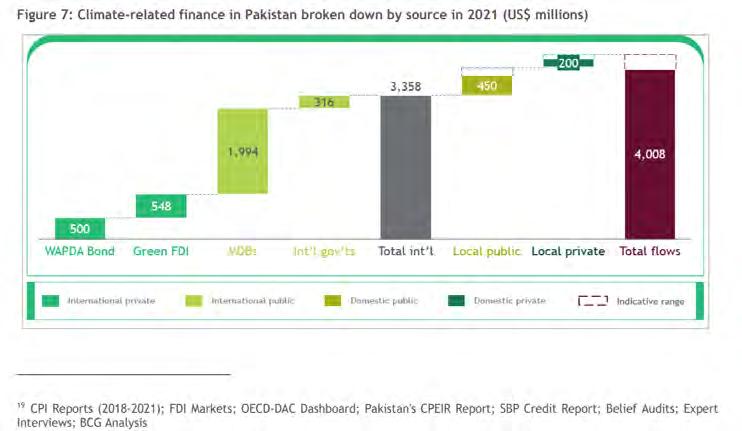

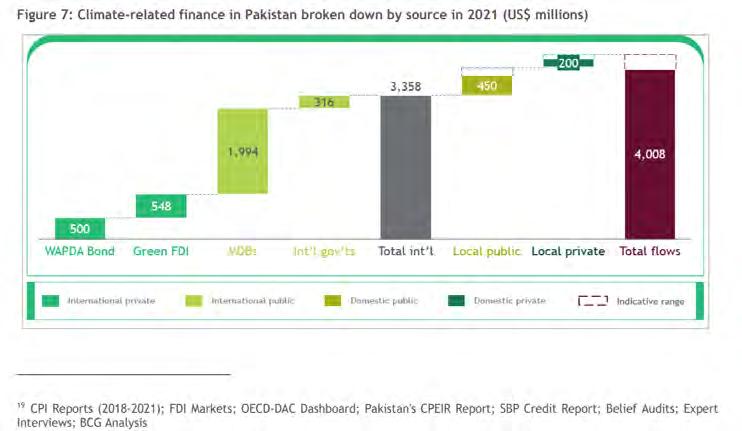

The report revealed that in 2021, a total of $4 billion in climate-related investments were made in Pakistan, sourced from both domestic and international channels. Private sector contributions made up 31% of the total

development goals and aimed to reduce 20% of projected emissions by 2030, necessitating around $40 billion. Subsequently, updated NDCs were agreed upon.

The country has now set a target of a 50% reduction in projected carbon emissions from 2015 to 2030, with 15% coming from Pakistan’s resources and 35% from international financial support. Achieving this goal involves implementing climate mitigation and adaptation actions in sectors such as energy, transportation, waste, and agriculture.

Adaptation involves making adjustments to cope with the effects of climate change, such as building seawalls to protect against sea-level rise. Mitigation, on the other hand, focuses on reducing greenhouse gas emissions to prevent further climate change, for example, transitioning to renewable energy sources.

The need to address the financing gap

According to the Word Bank’s research cited in the Accelerating Green and Climate Resilient Financing in Pakistan report by UK International Development, “total investment required for a comprehensive approach to Pakistan’s climate challenges from 2023 to 2030 is estimated at $348 billion (equivalent to

investment, while the public sector accounted for the remaining 69%.

Clearly the public sector is leading in this sense. But what is the exact breakdown? Around $650 million domestic funding came from local sources for example which accounts for 16% of this funding, with public and private sectors contributing 11% ($450 million) and 5% ($200 million) respectively.

International actors played a significant role, providing 84% ($3,358 million) of the total climate finance, with Development Partners contributing 58% ($2,310 million). Moreover, international private sector investors and project developers contributed 26% ($1,048 million) of the total financing.

Despite the country’s pressing climate vulnerabilities, there was a disproportionate focus on mitigation rather than adaptation and resilience financing in Pakistan. Mitigation efforts accounted for 79% ($3,147 million) of the financing, with substantial investments in renewable energy generation, totalling $2,020 billion, primarily facilitated through the State Bank of Pakistan’s renewable energy financing initiative.

The evident gap in raising domestic financing originates from the relatively nascent green finance market in the country, where traditional financing institutions often lack the expertise and mechanisms to evaluate climate

CLIMATE FINANCE

projects effectively.

Additionally, a perception of high risks associated with climate initiatives contributes to local financiers’ reluctance to invest in such projects. Limited public awareness and understanding of the benefits of climate financing further hampers local financial support for these initiatives.

Challenges in accessing affordable long-term capital and the absence of tailored financial products for climate projects adds to the overall scarcity of local funding options in Pakistan.

Furthermore, the cash-strapped government has limited fiscal space due to the burden of debt servicing, which constrains its ability to finance climate-related projects.

What does the fund do differently?

Acumen’s new initiative aims to provide catalytic funding to a targeted audience. In this case it is for the agriculture sector. The goal

is increasing local capacity and building the climate resilience of millions of smallholder farmers while attracting private capital towards national climate adaptation priorities. Agriculture remains one of the most vulnerable sectors in the country with regards to the effects of climate change. This vulnerability is compounded by the sector’s status as the largest employer in the country.

Small-scale agribusinesses in Pakistan struggle to raise finance due to limited access to formal financial institutions, insufficient collateral, high-interest rates, perceived risks in agriculture, and lack of financial literacy. Additionally, their seasonal and unpredictable nature makes it difficult to secure stable financing.

“We believe that this first-of-its-kind climate fund will serve as a paradigm-shifting model for Pakistan,” remarked Dr. Ayesha Khan, Regional Director for Acumen in Pakistan.

“By channeling investments into innovative agribusinesses, we will not only unlock financing for a critical sector but also

empower those who bear the brunt of climate catastrophes,” she added. The initiative is supported by the Green Climate Fund (GCF), which is the world’s largest dedicated climate fund and the primary multilateral financing mechanism for developing countries such as Pakistan in addressing climate change.