08

08 Demonetisation — a solution to Pakistan's woes or another disaster?

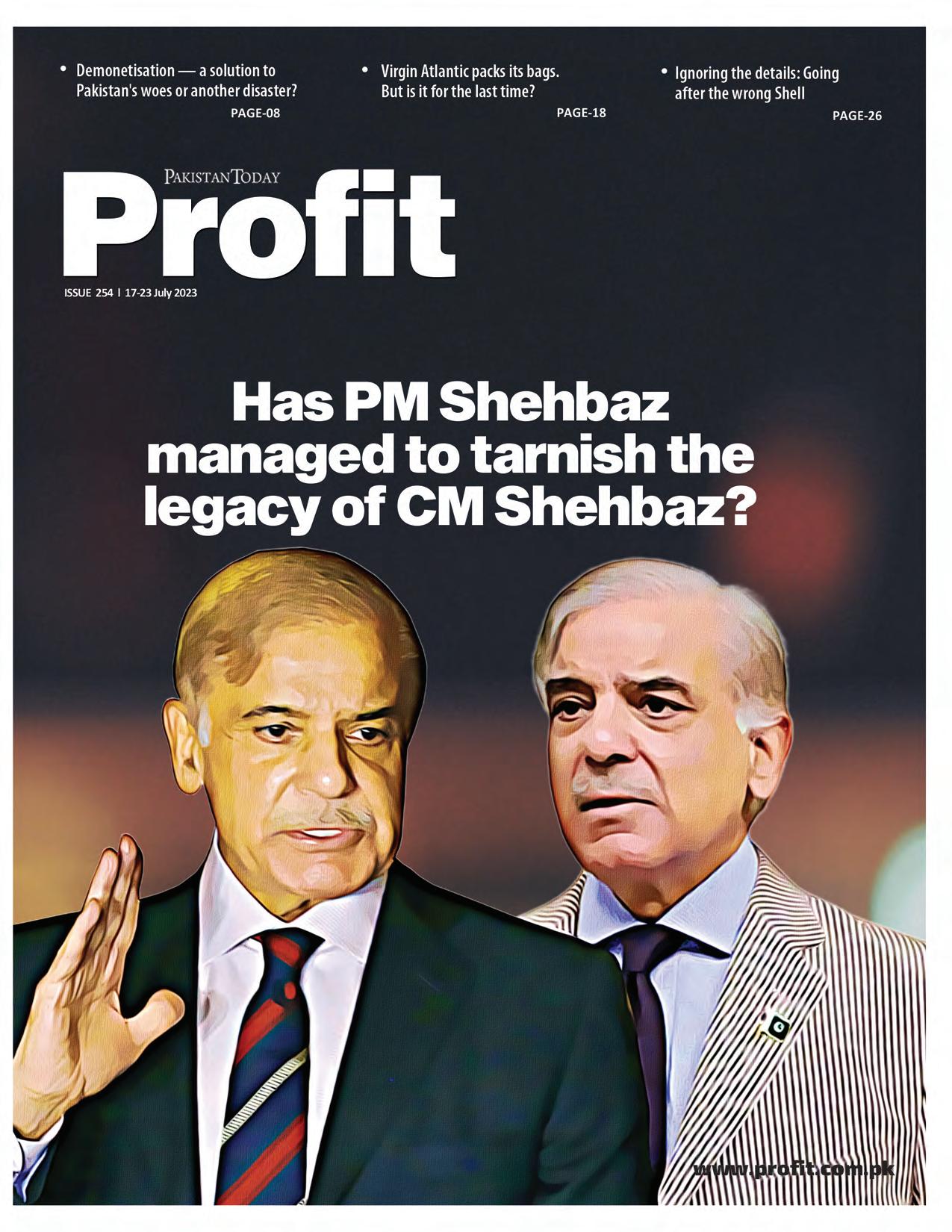

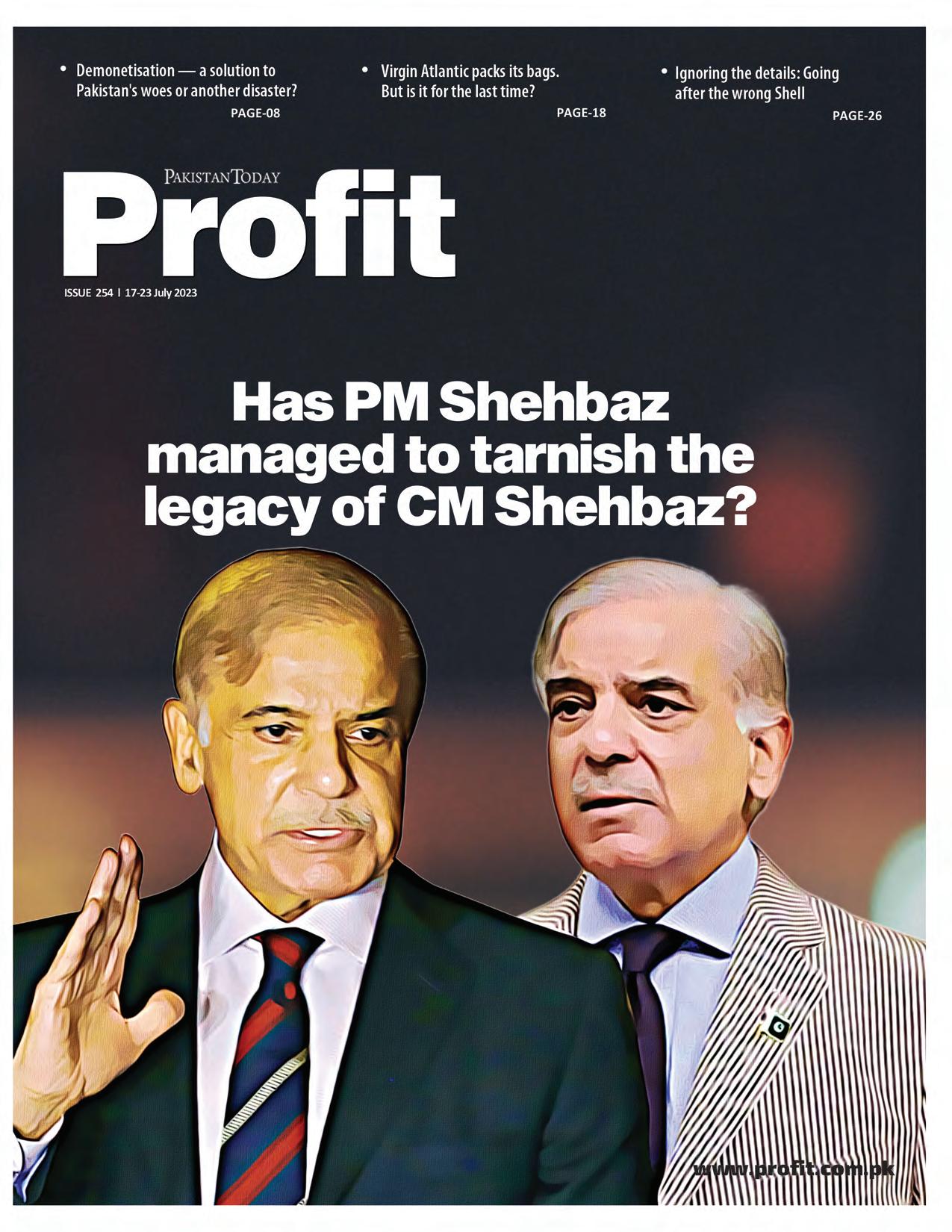

12 Has PM Shehbaz managed to tarnish the legacy of CM Shehbaz?

18

18 Virgin Atlantic packs its bags. But is it for the last time?

22 There is an IMF standby agreement, but what next?

Taimur Khan Jhagra

26

26 Ignoring the details: Going after the wrong Shell

28 Deconstructing the Jazz Cash Account Block Fraud

30 The benami account saga

Publishing Editor: Babar Nizami - Joint Editor: Yousaf Nizami

Senior Editor: Abdullah Niazi

Executive Producer Video Content: Umar Aziz - Video Editors: Talha Farooqi I Fawad Shakeel

Reporters: Taimoor Hassan l Shahab Omer l Ghulam Abbass l Ahmad Ahmadani

Shehzad Paracha l Aziz Buneri | Daniyal Ahmad |Shahnawaz Ali l Noor Bakht l Nisma Riaz

Regional Heads of Marketing: Mudassir Alam (Khi) | Zufiqar Butt (Lhe) | Malik Israr (Isb)

Business, Economic & Financial news by 'Pakistan Today'

Contact: profit@pakistantoday.com.pk

There have been proposals that demonetising Rs 5,000 notes will help combat tax evasion and black money. But what would such a move entail?

By Urooj ImranDemonetisation is a double-edged sword. On one hand, it can tackle the problems of counterfeit currency, corruption, tax evasion, and inflation but on the other, it can harm the people who rely on cash for their daily transactions. It can shrink the circulation of black money, but it can also trigger cash shortages and chaos. It can speed up the transition to digital payments, but it can also leave out those who lack access to technology.

A government can decide to demonetise for various reasons, and it usually announces a deadline during which the currency — for example, Rs 5,000 notes — can be used or

exchanged from banks. But demonetisation is not a magic bullet. It has many risks and challenges, and it requires flawless planning and execution.

It also depends on the context and conditions of each country. What works for one may not work for another. Demonetisation is not just a word — it is a process of removing the legal tender status of a currency, and it has been tried by several countries, such as India, the US, the EU, and Zimbabwe. But is it a good idea for Pakistan?

Independent macroeconomist Ammar H. Khan noted that there was a lot of cash circulating in Pakistan’s economy — Rs 8.68 trillion as of June 2023, according to

the State Bank of Pakistan’s (SBP) latest statistical bulletin. He said that when this much cash was out in the open, it tended to find its way into sectors such as real estate.

“So, a lot of real estate projects are launched and informal businesses pop up because cash needs to find a way and it keeps getting reallocated towards these. It is not reallocated towards industry or other areas which can generate jobs,” he explained. “Proper allocation of capital is one reason to demonetise.”

Secondly, he added, higher currency in circulation also drives inflation, which rose to a record high of 37.97 percent in May. Khan elaborated that when cash is not being used for productive purposes, a country’s dependence on imports increases. So, eventually,

the excessive cash in the economy drives more consumption and that consumption is supported by imports. Pakistan does not have the dollars to fund these imports, he pointed out.

And former Khyber Pakhtunkhwa finance minister Taimur Khan Jhagra said that in the context of creating barriers to the informal economy, demonetisation was “definitely worth considering”.

“In the context of bringing more of the grey and black economy [into the formal economy], we need to consider demonetisation as well as any other steps that will do the same. So, for example, encouraging transactions through credit cards, or other forms of e-payment etc., and incentivising those.”

Asenior banking professional who spoke to Profit noted that Pakistan’s economic situation was bordering on “precarious” with foreign exchange reserves down to $ 4.46 billion as of June 30, 2023, inflation close to 30 percent,

interest rate at a record high of 22 percent and many other factors that indicated a weak economy.

“Demonetisation is best done in stable economies, in which central bank reserves are adequate, inflation is low and GDP growth is decent to high — four percent. It will be regressive if it is done in this current environment when inflation is peaking [and] the economy is in the doldrums. Demonetisation at this point will only cause further nuisance for the general public. We are already burdened with inflation and high taxation, both direct and indirect.”

He added that the effects of demonetisation lasted for several months, which would be a terrible idea given Pakistan’s fragile economic situation.

However, Khan said that while the process of demonetisation would be complex and challenging, not going ahead with it would only mean prolonging the economic pain. “Might as well take the pain today instead of tomorrow,” he commented.

The banking professional also acknowledged that demonetisation could be a good

idea for Pakistan under better economic conditions with certain prerequisites in place. One of the things that Pakistan would need prior to demonetisation was a proper digital banking infrastructure that would be able to sustain the exponential number of transactions that would result in the process, he said.

“The current infrastructure, unfortunately, is inadequate. It’s weak. When India went for demonetisation in 2016, it had the UPI digital banking system in place. So, it was able to sustain the impact of demonetisation and kind of smoothen the journey for the general public from cash to digital. So, from our perspective, I don’t think we are ready for it as of yet from the digital banking standpoint and also from the economic standpoint,” the banker said, noting that Pakistan kept going through boom-and-bust cycles — a process of economic expansion followed by contraction that occurs repeatedly.

Addressing this, Khan said demonetisation was actually a way to fix Pakistan’s boom-and-bust cycles. He elaborated that the country went through these cycles because it started consuming more, which in turn, required dollar-based imports. Demonetisation would help fix this as it would mop up the surplus cash in the economy and reduce consumption, Khan said.

However, it all depended on policy decisions, the economist continued. “When all this cash comes back into the system, how will the government reallocate it? Does it go towards imports or does it get reallocated towards a more productive area? So, demonetisation is the first step. Capital allocation is the second step that needs to be done.”

One effect of demonetisation is a rise in cash deposited in banks, potentially increasing the amount available to them to lend to businesses and spurring economic growth. The senior banking professional said, however, that in Pakistan’s case, the impact would be minimal.

“Let’s assume that of the currency in circulation (CIC) in Pakistan right now, Rs 3 trillion is in the form of Rs 5,000 banknotes, which are demonetised. This cash comes back into the banking system.

“However, Pakistan’s government is running a perennial deficit. Consequently, it is borrowing more and more. The incumbent government has borrowed Rs 3.5 trillion in the past 13-14 months, which is potentially more than the inflows [from demonetisation].”

If the government continued to borrow from commercial banks at a rate of Rs 500600 billion a month, then demonetisation, which would be a one-off measure, would have a “very temporary” effect, the banker said.

Demonetisation can be done in a phased manner. However, it should not take so long that people figured out a way to game the system

Taimur Khan Jhagra, Ex-KP finance minister

The effect on small businesses would also be zero in Pakistan’s case because its commercial banks traditionally do not lend to consumers or small and medium enterprises (SMEs) as they consider them to be “high risk”, he said.

“If demonetisation happens and money goes into the banks, the only beneficiaries are going to be those who were previously beneficiaries as well as large enterprises and conglomerates etc. So, SMEs, the agri sector, small businesses and individuals etc. will not see a positive impact because they will still not be lent money by the banks.”

Economist Sakib Sherani, who has been part of economic advisory councils under different prime ministers, said that while demonetisation has its pros, people need to be careful about the idea as it could potentially cause a lot of disruption in developing economies.

Of the demonetisations that have happened around the world, very few have been successful, Sherani said. “The ones in developed countries have generally been more successful, but the ones in developing countries have been less successful and there’s a reason for that.”

This is because demonetisation could not be done in a vacuum, he explained. So, for instance, if the government withdrew Rs 5,000 notes from circulation, it would have to provide more notes of Rs 500 and Rs 1,000 instead. Besides this, it would also need tax authorities and banks to have the proper infrastructure, instruments, and details of a framework to ask questions of people who brought in large amounts of that currency such as a sack full of Rs 5,000 notes.

“[The government] needs to have an entire protocol and a supporting infrastructure where it can ask these questions and then it also needs to close down all the other avenues. Pakistan has so many avenues for black money

to exist,” he said, adding that the real estate sector among others needed to be taxed. Meanwhile, Khan said that one con of demonetisation would be the trouble people would face in depositing their cash in banks, but there were ways to mitigate this. A presidential order could be issued to mandate that anyone who had a CNIC would also need to have a bank account, he suggested. Everyone could be given a period in which they could deposit the cash, for example, three months, and the government could impose a tax on anyone who had undocumented cash beyond a certain limit.

Jhagra also said that demonetisation could be done in a phased manner. However, it should not take so long that people figured out a way to “game the system”, he added. The ex-minister said the government would need to evaluate which segment would be impacted most by demonetisation. “I think it would primarily still hit large cash transactions by a group that tries to stay out of the tax net.”

Pakistan’s tax-to-GDP ratio — a figure to gauge tax revenue relative to the size of the economy as measured by the GDP — has remained between 8.4 to 9.8 percent over the last seven years — one of the lowest in the world. It was measured at 9.6 percent in FY23.

Can demonetisation reduce tax evasion? Khan said that once demonetisation happens, cash will come into the economy and evasion will “automatically reduce”.

“That’s the whole point. The surplus capital will come into the system and [the government] can tax it. If it does not want to tax it, that is a different story. Every single person in the world does not want to pay taxes. A structure needs to be in place in which people are forced to pay taxes.”

Therefore, demonetisation would need to be accompanied by Federal Board of Revenue (FBR) reforms, he added. This was what

Jhagra said as well.

“In this case, demonetisation is not a stand-alone initiative. It is part of an overall drive to get rid of or reduce the size of the informal economy. It would need to be accompanied by some [reform] drives at the FBR in terms of ensuring tax collection. It would be accompanied by bringing traders and large parts of the informal economy into the tax net,” he said.

“I would do demonetisation as part of a compendium of three or four major reforms so that it signals that we are actually breaking down the informal economy. In the current system, staying outside of the tax net and the formal economy is actually legal. You can choose to be a non-filer,” the former minister noted.

Meanwhile, Sherani spoke about the loopholes in Pakistan’s taxation laws. There is an entire section in the Income Tax Ordinance 2001 that allows people to bring in dollars to Pakistan without any questions asked, he pointed out. The economist was referring to ‘Part VII - Exemptions and Tax Concessions’ of the ordinance. Over the last 20-40 years, people have been converting money that originated from certain untaxed, unreported, or illegal activities in PKR and converting it into dollars, sending it abroad, and then bringing it back into the country using the loophole, he added.

“My whole point is that you just can’t do something without all the other important supporting instruments and frameworks,” he stressed.

He also emphasised the role of cashless transactions in widening the tax net as it would “close all other avenues [of evasion]”. While acknowledging that demonetisation would force people to deposit their Rs 5,000 notes in banks which would broaden the tax net, the senior banking professional said it would “once again have a one-time impact” because of the prevalent culture of tax evasion.

People would continue to look for ways to evade tax, he said, adding that this was

A lot of real estate projects are launched and informal businesses pop up because cash needs to find a way and it keeps getting reallocated towards these. It is not reallocated towards industry or other areas which can generate jobs. Proper allocation of capital is one reason to demonetise

Ammar H. Khan, Economist

why FBR reforms, strong tax machinery, and the right infrastructure were needed before initiating demonetisation, he added.

He pointed out that despite multiple International Monetary Fund (IMF) programmes, successive Pakistani governments chose not to tax the agricultural sector which makes up 30 percent of the country’s GDP. Taxes on real estate were low whereas taxes on the retail sector were either zero or non-existent, he added.

“A serious government would have already gone on to tax these sectors first. In my view, the government should be looking at the existing tax collection potential. If you look at the agricultural rent for land in Central Punjab, right now it is between Rs 150,000 and Rs 400,000 per acre. So, the agri rental income in Punjab and Sindh has gone up by four to six times. Whereas the tax paid on that land is zero.”

While several countries have demonetised currencies over the years, the most famous example is India. On November 8, 2016, Indian Prime Minister Narendra Modi announced in an unscheduled television address that the Rs 500 and Rs 1,000 notes — which accounted for 86 percent of the currency in circulation — were “just worthless piece[s] of paper” effective immediately. The public was told that it had until the end of the year to exchange the currency for new notes of Rs 500 and Rs 2,000, with the government framing the move as a measure to deal with corruption and black money.

This led to widespread chaos as long queues formed at banks across the country and a liquidity crisis was created. Sherani cited India as a cautionary tale and said it was a prime example of the disruption demonetisation could cause in developing economies. “It has been eight years and economists say the ripple effects are still being felt. Obviously, the government has [imposed] secrecy on how much damage was done but independent studies say that it ended with deep repercus-

sions on small businesses and households.

“So, Pakistan needs to be careful. If we do decide to implement demonetisation, we have to plan it carefully, in a particular sequence, and it has to be done gradually.”

In a report written for Next Capital, former finance minister Hafiz Pasha noted that the percentage of currency in circulation in India as part of its gross national product declined rapidly post-demonetisation. However, it recovered strongly later, so much so, that the figure stood at 11.73 percent in FY21 compared to 7.7 percent in FY17 following the move to demonetise.

Separately, the senior banking professional also said that while demonetisation contributed to the increase in India’s digital transactions, COVID-19 had a greater impact. In FY21, India’s digital banking transactions were worth INR 5,554 crores, which was the first year of COVID. The transactions went up to INR 8,840 crores in FY22, and then INR 9,192 crores in FY23, according to data from India’s Press Information Bureau.

“So COVID, I think, had a greater impact on increasing digital banking and digital transactions as compared to demonetisation,” he commented.

Can a government, including a coalition such as the present one, actually push through demonetisation? Sherani believes the incumbent government or any other government with a similar sort of makeup and credentials would not demonetise “simply because they have very large constituencies that are in the untaxed or very lightly taxed sectors”.

“It is either agriculture or trade or the real estate sector. But these three sectors alone make up about 50-60 percent of the economy, so in that sense, it requires a government with political will, but also with a much more reformist makeup than the governments we have seen in Pakistan, especially this particular government.”

Meanwhile, when mentioned to Jhagra

that economists appear to be divided on demonetisation, the former provincial minister commented, “Economists and lawyers are always divided on everything.”

He was also adamant that lawmakers stop thinking of political repercussions in terms of fixing the economy. “When you need to deal with a complex but critical issue, you are not going to wait to develop consensus, you are going to do your homework and implement. I think it is a fair assumption to say that if we (KP government) had not traversed the journey of pension reforms, the federal government would not have done it now.”

“And so similarly ... in terms of fixing the economy, the political cost cannot be questioned because those political compromises lead to plenty of political costs anyway. The current turbulence is linked to the fact that the economy is in bad shape. There has been a political cost to that anyway. The government is fearful of elections because they know that they are unpopular and they have shied away from many economic decisions. But if people are experiencing economic pain anyway, why not use that as a building platform and get through difficult reform?” he asked.

Pakistan has a very large and thriving shadow economy at present. According to a global research report of Ipsos on tax evasion published in 2022, its size is estimated at a whopping 40% of GDP. Demonetisation is one way to address this but clearly there are a lot of things that can go wrong if implemented in a country such as Pakistan where even more factors have to be just right in order to even think about such a major shake-up in the economy. Until the political and economic situation in the country is relatively stable, demonetisation may only remain an interesting idea to debate, not a serious policy proposal that is intended to be implemented fully by an elected government.

Nonetheless, there is a case to be made about its necessity in a system as stubborn as ours when it comes to reforms, that can address the problem of tax evasion and a general culture of nonchalance towards paying taxes and being part of the documented economy. n

The government needs to have an entire protocol and a supporting infrastructure where it can ask these questions and then it also needs to close down all the other avenues. Pakistan has so many avenues for black money to exist

Sakib Sherani, Economist

Only four men have held the office of both Chief Minister of the Punjab and Prime Minister of Pakistan. The first two managed this feat on technical grounds. The latest two, Mian Nawaz and Mian Shehbaz, are brothers.

The first to achieve this double was Feroz Khan Noone. An old Unionist stalwart who had served on Churchill’s war cabinet and whose split from Khizar Hayat Tiwana in 1946 proved vital to the creation of Pakistan, Noone was prime minister for just under 10 months in 1958 before his government was dismissed by Iskander Mirza’s martial law. But before his brief premiership, Mr Noon was chief minister of Punjab from 1953-55. But this was at a time when provincial elections and legislatures were not a developed concept, and Noone had been unilaterally appointed to the position by Khawaja Nazimuddin.

After Noone, the second person to go from Chief Minister of the Punjab to Prime Minister of Pakistan was Malik Meraj Khalid. An old favourite of Zulfiqar Ali Bhutto, Meraj was appointed CM after the 1971 general election for nearly two years before making way for Hanif Ramay.

Of course, Malik Meraj’s three months as prime minister were in a caretaker capacity. A venerable personality and a politician of immense integrity, Meraj was a man the nation often turned to at its darkest hours. During the ugly mud slinging of the vote of no confidence against Benazir, it was Meraj who steadied the ship with dignity as speaker. And when Benazir’s government was dismissed by Farooq Leghari, it was again Meraj who came in as caretaker and conducted a relatively fair election and remained aloof from Leghari’s efforts to politicise the process.

But the first man to not just hold the position of Chief Minister of the Punjab as well as Prime Minister of Pakistan but also be elected to both posts was none other than

Mian Muhammad Nawaz Sharif. With one stint as CM in the Zia era and three shots at the premiership, Mian Nawaz was alone in this achievement.

That is until last year, when his brother and loyal deputy took over as prime minister of the country. In an inverse, Mian Shehbaz has had three stints as chief minister and is in his first go as prime minister. With the recent announcement that the government will hand over control to a caretaker setup in August, the year long tenure of the younger Sharif has come to an end.

The only question is, how did he measure up and what will his legacy be?

There is a reason for doing this story. And while the little history lesson might serve as an interesting anecdote, it is also important for context. Ever since the independence of Bangladesh in1971, Punjab has been the single most electorally significant province in the country.

As a result it has had an undue amount of influence on the country’s economic and social development. The point is that while the Takht-e-Punjab has been one of the most coveted offices in the land (and perhaps the most powerful) there aren’t many politicians that have been able to be both strong chief ministers and strong prime ministers. In fact, it is only Mian Nawaz who retains a vague legacy for ‘good management’ in both capacities.

But when Shehbaz Sharif came into the office of prime minister, there were expectations of him. From 2008 to 2013 the younger Sharif had ruled the Punjab with an iron fist. As an administrator, Shehbaz was of a variety that can best be described as ‘basic but competent.’ These are the leaders and managers that rely on infrastructural development and tangible, marketable projects.

Remember, when Shehbaz came to power in Punjab, he was the first chief minister of the province after the 18th amendment. This meant that he was now also responsible for

health, education, agriculture, taxation, and other segments of the economy and governance that have very direct implications on the voting population.

He quickly set out on a number of ambitious projects. Among his administration’s most prominent ventures were Lahore’s Metro Bus Project and the Orange Line Metro Train project — both of which are highly subscribed and have made a significant impact on Lahore’s public transport. But the effort was not entirely concentrated on this as it should be. Shehbaz’s government also was quite happy to build roads, widen boulevards, make corridors signal free and construct underpasses and flyovers.

There were other successes. The handling of waves of dengue fever in Punjab were thwarted and later governments in other provinces like KP learned later that this kind of management was not easy. Multiple sources, both bureaucrats and politicians that worked closely with the younger Sharif in these 10 years, have said that another major feature of his government was efficiency.

“As CM he obviously was not managing the economy. But he was still involved in economic management,” says one former departmental secretary who served under both Shehbaz Sharif governments. “I still remember meetings about prices in Ramzan Bazaars would happen months before Ramzan. The CM was also deeply interested in waste management and bringing in Turkish companies to help manage this issue as well. He worked tirelessly and abhorred inefficiency.”

While Nawaz was often seen as the one who could pull in crowds and win over voters, Shehbaz became known more for his practical skills in implementing policy and for his ambitious development agenda in Punjab.

“I worked for seven years with Shehbaz Sharif and became a key member of his team to reform and digitise the Punjab government. From disease outbreaks to attendance of school teachers; from land records to government taxes; from disaster management to metro buses,” says Umar Saif, former chairman of

From the 22nd of May to the 23rd of June the government walked over coals to get the deal and avoid default. Through various missteps, tantrums and shifting goal posts one thing has remained constant: sustained clarity of PM Shehbaz. He deserves most credit for the deal

Fahd Husain, senior journalist and SAPM

the PITB. “Everything was run by state-of-theart digital systems, generating real time data and analytics for informed decision making. Shehbaz Sharif knows governance better than anyone I have met. His ability to learn new things alway impresses me. Keeping up with his speed and expectation is not easy.”

This was a reputation that Shehbaz earned over the years. He was supposed to be an effective administrator that “got the job done” with his quickness being dubbed ‘Punjab Speed’. Of course on many other fronts he failed. Punjab’s educational outcomes continued to remain low, and in fact from 2008-2018 the share of students going to private school in the province rose from 28% to 38% on the elementary level. Healthcare facilities also saw no significant improvement but none of this stopped Shehbaz from developing the reputation of a hard nosed, dedicated, administrator.

In 2018 things changed. The Pakistan Tehreek i Insaaf came to power in the centre and despite being the single largest party in the Punjab Assembly could not form a government. The era of Usman Buzdar began and with his elder brother in exile, it fell to Mian Shehbaz to take up the mantle of leader of the opposition at the centre.

In many ways this was a demotion. The Chief Minister of Punjab is a powerful man. On some days even more powerful than the prime minister. Yet it was still a step into federal level politics. And for Shehbaz it was also an opportunity. It is worth mentioning that Shehbaz has had national aspirations for a while. Back in 2013 when the PML-N came into power in Islamabad, Shehbaz had contested a national assembly seat. “Mian Shehbaz very seriously considered giving up the chief ministership to come to Islamabad and take over the energy ministry. The 2008-13 PPP government had some successes but failed at fixing the load shedding problem,” says one

Umar Saif, former chairman of PITB

party insider. “Mian Sb thought he would take over the power ministry and solve this high profile issue.”

Of course, there was another angle to this. The younger Sharif was also hoping to give a boost to his son Hamza’s political career by installing him as chief minister and also setting him up to eventually succeed his uncle Mian Nawaz as the leader of the party. Eventually the Sharif family patriarch decided that Hamza was too young and Shehbaz’s talents would be better spent on Punjab. But in 2018 there was no option for him but to dutifully take up the role of opposition leader.

This is a journey many politicians all over the world have made. Where a provincial or state level leader rises up and becomes a national leader. In neighbouring India, the best example is Prime Minister Narinder Modi who was an illustrious chief minister in Gujarat for many years before he became PM. Much like Mian Shehbaz, Modi gained a reputation as a no nonsense CM that got things done. Other Indian PMs including P.V Narasimha Rao had also made the journey from CM to PM.

In the US, it is an even more common phenomenon. Of the 80 Americans who have served as President, Vice President or both since the nation was formed, 27 or just over one-third had been governor of a state. This includes 17 of the 45 presidents (38%) and 16 of the 49 vice presidents (33%).

But not everyone can take the heat of the transition. Largely the problem is that managing a country on a federal level and managing a province are two very different ball games. There are some similarities such as parliamentary work and cabinets, but largely these are very different jobs. Essentially, a prime minister is only really responsible for three things: defence, diplomacy, and the economy. A chief minister has a lot more to do.

Remember, ever since the 18th amendment the federal government has a lot less on its plate. But since devolution has not gone down to local government levels, a chief minister is still able to do projects such as road building and other such initiatives. But that

doesn’t mean a PM has nothing to do with development.

Essentially, there are three ways a PM can work on infrastructural development. There is the building of national motorways and highways which are essential for travel but also for trade. Then there is electricity generation which is also a huge hurdle. These are both arenas in which Mian Nawaz excelled during his multiple stints as PM. And then finally there are national subsidies and packages targeting different groups of people or sectors of the economy.

So how has Shebaz Sharif fared on these fronts?

To put it mildly, it has been underwhelming at best. When the PDM coalition ousted Imran Khan and brought Shehbaz Sharif in, the headline that the UK’s Guardian ran with was “Shehbaz Sharif: the diligent administrator now PM of Pakistan.” The expectation was that the younger Sharif would bring his famous ‘Punjab Speed’ to Islamabad. “While Khan was known for charisma, Sharif’s reputation is one of capability,” said Fahd Husain, a senior journalist and later SAPM to Mian Shehbaz, when he was first elected. Hussain said Sharif’s leadership style would probably mark the end of the “confrontational” and populist politics Khan came to be known for, where he made grand promises of reform and held large rallies, and he would instead be a prime minister who “talks less and works more”.

“Shehbaz is used to rolling up his sleeves and getting down into the nitty-gritty of work. We will be seeing a workaholic in office who will obsess on issues of performance, governance and delivery.”

How did that go? Look at it this way. In his time as CM, Shehbaz used to insist on being called “Khadim e Ala” instead of “Wazir

Everything was run by state-of-the-art digital systems, generating real time data and analytics for informed decision making. Shehbaz Sharif knows governance better than anyone I have met. His ability to learn new things alway impresses me.

Keeping up with his speed and expectation is not easy

e Ala”. The title actually caught on. When he became prime minister Shehbaz dubbed himself “Khadim e Pakistan” in an attempt to graduate from Punjab politics. Let’s just say that title hasn’t quite stuck.

The task Mian Shehbaz walked into was gargantuan. The country was hurtling towards default after a deal with the IMF was completely derailed by the previous government, difficult decisions had to be made, and no government that was coming in could find itself in a situation where the electorate would be happy with them.

This seemed to be enough to paralyse Punjab Speed. Mian Shehbaz ended up dragging his feet on the issue of removing the fuel subsidy that former prime minister Imran Khan had put in place and this resulted in negotiations with the IMF souring. While he had to let go and hike petrol prices eventually, decision making remained sluggish.

Eventually, the biggest fumble from Mian Shehbaz has been the appointment of Ishaq Dar as finance minister in place of Miftah Ismail. With his brash style, Dar delayed the IMF programme significantly. In

the eight month period where the IMF would not sign a staff level accord, Mian Shehbaz’s own credibility took great hits because of the constant repetitions that the deal was right around the corner.

Eventually, to his credit, it was Mian Shehbaz himself who managed to secure the deal. In the last week leading up to the end of June, the prime minister met with the director of the IMF on the sidelines of an international moot, the government bulldozed an amended budget through parliament, the State Bank of Pakistan convened an emergency meeting of its Monetary Policy Committee, and the IMF released a statement expressing it satisfactions with the steps taken by Islamabad. It became painfully clear that the PM had to step in himself and do the job Dar was unable to do.

“From the 22nd of May to the 23rd of June the government walked over coals to get the deal and avoid default. Through various missteps, tantrums and shifting goal posts one thing has remained constant: sustained clarity of PM Shehbaz. He deserves most credit for the deal,” said Fahd Hussain in a tweet following the deal being secured.

It is true that Mian Shehbaz has a certain diplomatic charm that some like. He is fluent in multiple languages and his mannerisms and ease in speaking to other world leaders helped him in what was a significant success for Pakistan at the COP27 conference of the UN which was vital to the country after a year of catastrophic floods.

However, the fact of the matter is that when he came to power the most significant issue was securing a deal with the IMF. He has succeeded in doing so. On other fronts, his Prime Minister Youth Initiative and other such programmes in the recent budget will gain him some popular support. But as far as development is concerned, he did not have the time to do so. His mandate was for a year and in that year the job on his plate was avoiding default and safely moving towards elections. He has managed both, but not with the efficiency he has come to be known for. This brief stint as PM will be a blow to his otherwise good reputation as an administrator. Whether he gets another shot at rectifying this is for the electorate and his older brother to decide. n

Afestive cake cutting at the Islamabad airport has concealed a rather dismal event — Virgin Atlantic has flown its ultimate flight in Pakistan. The airline had launched its operations in 2020 with a grand total of seven weekly flights, only to slash them down to three, and now bid adieu to the country with its last flight, VS379 soaring for London Heathrow at 01:08 pm on April 9.

This marks the end of Virgin Atlantic’s short-lived venture in the Pakistani market. The airline served 249,207 passengers up until June 2022 based on the latest aviation statistics made available by the Pakistan Civil Aviation Authority (PCAA). Profit has previously talked about the various reasons as to why Virgin Atlantic might have left. However, we will do so again and in greater detail this time.

Before that, let’s look at Virgin Atlan -

tic’s short lived stint in Pakistan.

In 2019, Virgin Atlantic announced its bold entry into the Pakistani market, with plans to offer non-stop flights from London and Manchester to Lahore, Islamabad, and Karachi. The airline set its sights on capturing the visiting friends and relatives (VFR) market, which was one of the first sectors to bounce back from the pandemic. Virgin Atlantic also seized the opportunity presented by the absence of Pakistan International Airlines (PIA), which was barred from flying to Europe and the UK due to safety concerns in May 2020.

On December 10, 2020, Virgin Atlantic operated its inaugural flight to Pakistan from Manchester Airport, the United Kingdom’s busiest non-London airport. Virgin flight VS362 took off from Manchester at 13:06

and touched down in Islamabad at 01:34 am. With a significant portion of the UK’s Pakistani diaspora residing in the Manchester region, it was an ideal location for Virgin Atlantic to capture the VFR market.

While no direct competition existed on the new route from Manchester, Virgin Atlantic faced stiff competition from its rival British Airways (BA) on flights from London to Pakistan. In response to Virgin Atlantic’s route announcement, BA launched its own connection to Lahore. BA has had a long-standing history of serving Pakistan. For instance, it flew to Islamabad from Gatwick (typically via Manchester) using B747-400s, and then nonstop from Heathrow between 2003 and 2008. After a hiatus of over a decade, it resumed its service to the country in 2019.

BA and Virgin’s interest in Pakistan stemmed from various factors, including enduringly strong point-to-point demand, generally robust freight demand, and – significantly in recent times – a large and clear opportunity following Pakistan International Airlines’ (PIA) ban from the UK, US, and EU. In 2019, PIA commanded 95% of the nonstop UK-Pakistan market, according to OAG schedules data.

According to booking data, Heathrow to Lahore had an average one-way fare of $260 in 2019, excluding a 20-30% fuel surcharge (retained by the airline) and taxes. In contrast, Heathrow to Delhi is 7% farther, yet achieved a 21% higher average fare due to a stronger traffic mix. Freight demand provided an additional boost to revenue.

The route already seemed low-yield based on BA’s decisions. Their return to profitability indicates that they were on the lookout for more lucrative routes which clearly did not include Pakistan.

After British Airways’ exit from Pakistan, Virgin Atlantic announced ambitious plans to ramp up its operations in October 2022. The airline intended to operate five two-way flights from Lahore to London and four flights from Islamabad on weekdays — providing passengers with more options and greater convenience.

However, in a surprising turn of events in February 2023, Virgin Atlantic announced that it would suspend its services between London Heathrow and Pakistan. The airline cited its plans to expand its existing network and optimise its resources as the reasons for its decision. It also joined the SkyTeam alliance, opening up new avenues for code-sharing and cooperation with other carriers.

In April 2023, Virgin Atlantic

bid farewell to its service between London Heathrow and Lahore. The final flight, VS364, soared into the night sky from Lahore on the 30th of April 2023 at 9:55 pm. Its Islamabad service remained as the last connection until the fated aforementioned VS379.

Virgin Atlantic — synonymous with its eccentric nature in the industry — boasted its glamorous image and luxurious cabins, bringing novelty to a stagnant sector. However, it failed to generate profits even before the pandemic. Its business centred on long-haul flights, which were highly susceptible to travel bans in 2020. The airline revised its profitability estimates. It stated on 10 May that it aimed to make a profit in 2024, after previously forecasting that it would be profitable by 2023. It recorded a pre-tax loss of £342 million. The announcement underscores its enduring challenges and distinguishes it

from its competitors, which returned to profitability after Covid-19 travel restrictions were eased last year. Virgin Atlantic’s financial position has been dubious as far back as 2017 with the company averaging a net loss of $399.7 million from 2017 to 2021.

Its decisions in 2023 are part of its bid to stem these losses, if not obtain profitability, in 2024. As restrictions have been lifted, it has rebuilt its UK-US network, adding new routes to Austin (AUS) and Tampa (TPA). In May 2023, Virgin also relaunched its flights from LHR to Shanghai (PVG), China after a hiatus of three years.

The company has also made other strategic decisions in 2023 such as expanding its route network across three continents. The carrier is set to fly to São Paulo (GRU) in Brazil, its first appearance in South America. In Asia, the carrier will add its third destination in India with flights to Bengaluru (BLR), make a long-awaited return to Dubai (DXB) and begin new services to the Maldives. In

From a marketing perspective, you become more aggressive and competitive when you see that a new player is entering the market

Abdullah Khan, Head of Marketing and Corporate Communication at PIA

North America, the carrier is planning to resume seasonal Manchester to Las Vegas, begin serving the island of Turks and Caicos in the Caribbean, and expand connections from Barbados to move islands.

The icing on the cake, or perhaps the tipping point in Pakistan no longer being a strategic market for the airline, was its entry as the nineteenth member of the SkyTeam Alliance. It already had joint ventures with popular members such as Air France, KLM, and Delta (who own 49% of the carrier), making its integration into the alliance a smooth one. Membership will enable Virgin to benefit from its peers through a myriad of benefits, most important of which is the potential for additional codesharing.

All the while, Pakistan has become less, and less of a strategic market for them owing to developing factors in the country’s aviation industry.

Pakistan is not the highest yielding market for airlines globally, however, the opportunity cost for an airline starved of funds like Virgin Atlantic is heightened because of unique factors to Pakistan’s aviation market.

The International Air Transport Association (IATA), the trade association for the world’s airlines representing some 300 airlines or 83% of total air traffic, accused Pakistan of disallowing foreign airlines from repatriating their earnings. IATA alleged that Pakistan has blocked $225 million in airline funds, making it the second largest market, after Nigeria ($551 million) and before Bangladesh ($208 million), to do so.

Feroze Jamall, IATA’s Country Manager for Pakistan, shed light on the situation: “At present, airlines are unable to repatriate their sales earnings from Pakistan due to the country’s foreign exchange controls, which hinder the ability of foreign companies to transfer their funds out of Pakistan.”

He further elaborated that “Airlines are

encountering lengthy delays before they can repatriate their funds, with some airlines still having funds trapped in Pakistan from sales made in 2022.”

According to Jamall, “A considerable portion of an airline’s operational expenses, such as maintenance, over-flights and fuel, are denominated in US dollars and settled through their head offices. As a result, the challenges in currency repatriation affect airlines’ prompt access to their collection proceeds to fulfil payment obligations and increase their exposure to unfavourable foreign exchange movements.”

Jamall also emphasised that “the procedure for applying for currency repatriation is burdensome. Airlines are mandated to provide an auditor’s certificate with each remittance indicating the amount to be transferred. This compels them to undergo a monthly audit process (instead of an annual one), adding to their operating expenses in Pakistan and prolonging the process.”

So, apart from Virgin Atlantic not being able to get its money out of Pakistan while making no money globally, there was the perceived threat that it would face competition from a resurgent PIA.

Virgin Atlantic’s foray into Pakistan was a game-changer, particularly in light of the major setback faced by PIA, the national flag carrier of the country. In May 2020, a scandal erupted when it was revealed that 150 pilots had fraudulent licences, leading to a ban on PIA flying to Europe and the UK. This gave Virgin Atlantic a distinct advantage over its competitor, as it was one of only two airlines offering a direct route at the time.

However, in 2023, PIA made a remarkable comeback when it successfully passed an audit by a team of experts from the UK CAA. This paved the way for another audit by EASA and raised the question: is PIA a threat? The answer is open to debate, and depends on who you ask. It’s no secret that PIA already dominated these routes, and is a favourite to do so again even if BA and Virgin

stuck around. PIA, however, has a different opinion on the matter.

According to Abdullah Khan, Head of Marketing and Corporate Communication at PIA, Virgin’s departure from the market may not have been due to PIA’s re-entry. “From a marketing perspective,” he elucidates, “you become more aggressive and competitive when you see that a new player is entering the market.”

“PIA has cleared back-to-back audits and is now awaiting a physical audit to fulfil EASA’s requirements,” Khan continues. Additionally, he mentions that “the UK Department for Transport has a separate condition that will be resolved on a governmental-governmental level.”

“The general rule of thumb,” asserts Khan, “is that if you see competition entering into the market, you essentially become more aggressive in your marketing mix rather than unilaterally leaving the market.”

He also underscores the potential of the UK to Pakistan route, comparing it to routes such as UK to India, UK to China, and UK to Bangladesh. “The allure of a route,” he expounds, “is based on the number of people travelling to a destination, the customers’ purchasing power, and the actual supply of flights available in the market.”

With a substantial Pakistani diaspora in the UK and robust purchasing power among consumers, Khan believes that the market could easily operate 50 direct pointto-point flights per week, based on current equipment deployed by different careers.

Acombination of all the aforementioned factors is perhaps the likely reason for the exit. Virgin Atlantic’s abrupt decision came a mere four months after its statement that it sought to double down on the Pakistani market due to the future potential it saw in it. Maybe, like BA’s constant spells, Virgin too will make a comeback? Who knows. Until then, more layover flights to the UK until PIA returns. n

At present, airlines are unable to repatriate their sales earnings from Pakistan due to the country’s foreign exchange controls, which hinder the ability of foreign companies to transfer their funds out of Pakistan

Feroze Jamall, IATA’s Country Manager for Pakistan

Dollar 4.4 billion. Pakistan’s foreign reserves with the SBP at the end of June. Equal to less than four weeks of our import bill. Our balance of payments challenge may be our most difficult economic problem to fix.

For the layman, this is basically the difference between the outflows and the inflows of foreign exchange from the country. It is critical because almost all international payments require foreign currency, mostly US dollars. Outflows include things like import payments, foreign loan repayments, and other capital going out of the country. Inflows include things like proceeds from exports, remittances of overseas Pakistanis, foreign direct investment, and loans taken.

Whenever we have a balance of payments deficit, as we almost always do, the deficit is financed by burning existing foreign exchange reserves. When we embark on spurts of growth, the deficit has been as high as $2 billion a month. So, when reserves deplete to as low as four weeks of import cover, as they have every few years (from immediate memory, 1999-2000; 2007-8; 2013; 2017-18; and now) we get to the brink of default; that is, at risk of not being able to honour due international payments. The consequences of default would make the current economic pain we are going through seem trivial.

Our solution; beg the IMF and our friends for an injection of dollars; simply put, fresh loans. We have done this again, and again, and again. 24 IMF programmes to be exact. Einstein says that insanity is trying the same thing repeatedly and expecting different results. Well, we seem not to agree! Going to the IMF is not the issue; continuing to not execute either the IMF’s reform prescriptions, or to have any better ideas ourselves – is what is shameful. It is almost as if we have reconciled ourselves to a state of economic mediocrity, that we will talk about till death, but do nothing about.

Pakistan has so much more potential than what we’ve achieved, and

truth be told, we cannot blame anyone but ourselves for our economic woes. Politicians, bureaucrats, the judiciary, and all others who have ruled this country have either played a direct part in creating this crisis, or at a minimum, resisted reform. The media, barring exceptions, has also played into populist, uninformed narratives, making reform that much more difficult.

The good news: things don’t need to be like this. Pakistan can be economically much more resilient. It can be a powerhouse. But it will take years of sustained work. And it will take an attitude of not shying away from difficult reforms, much of which will not be popular and may be misunderstood. To date, that process has not begun in earnest.

Having spent my time in government primarily at the provincial level, this is an area where there are people much more qualified than I am to comment, but just a few thoughts from my experiences from the ground.

Whenever there is talk of our forex challenge, our import bill gets all the heat. “Let’s use less fuel, it’s all imported.” “Close all the markets at 8 PM to save electricity and forex”. “Ban all luxury items.” With time on hand these days, I looked at our import bill in detail. At $70 billion, it is roughly equal to 20% of GDP. Bangladesh is similar. For India, imports are 26% of GDP (around $600 billion). The world average is 30%, and the EU is at 55%. Even in terms of the absolute value of our imports, we rank 50th globally, lower than where we are placed in GDP (ranked in the 40s).

According to 2021 data, energy imports are around $20 billion, or only around 27% of Pakistan’s import bill. Remember, Pakistan has amongst the lowest per capita consumption of energy globally; we rank 167th globally with 29 vehicles per 1000 people; 164th in electricity consumption per capita – just behind Laos, and just ahead of Cambodia, Zimbabwe, and North Korea. Other large categories of imports; electrical and electronic equipment; machinery; iron and steel; pharmaceuticals; edible oil; vehicle related imports; plastics and organic chemicals; together account for another 46%; no one category accounts for more than 8% or $6 billion. Everything else is minor in value. Contrary to our belief, this is not a market that consumes a lot. We don’t really import that much.

Or at least, suppressing imports is not the silver bullet required to fix our balance of payments challenge. You could argue that whenever we get our economy on track sustainably, imports will grow, they must grow, as a percentage of GDP and in absolute terms. We will consume more fuel, more electricity, and need more machinery and more raw materials. But in parallel, this must happen with

greater investment in an economy with the capacity to export more.

Stifling imports doesn’t work. This PDM government has tried it the entire past year. Implications: to completely stifle economic and industrial activity, and lose the export momentum built in 2021-22, after a decade. This is other than the rent seeking opportunities created by choking imports at Karachi port and giving babus the discretion to decide who will be allowed to import into the country and who won’t.

Of course, this is not to say that we should be turning a blind eye to our imports. Controlling the exchange rate, as Ishaq Dar did through 2013-17 and this past year, an import subsidy has been given to everyone, specifically the rich, and demand artificially inflated. A market determined exchange rate would itself regulate demand. We need to look at the structure of our imports also, rather than just the quantum. It is dominated by finished or near finished goods. Or looked at differently, our import basket doesn’t result in the sort of value addition that other countries achieve; nor in exciting the world to invest in Pakistan.

The answer lies elsewhere. Think about it. Why do Bangladesh’s exports total $50 billion today, twice what we export. With an apparel industry are we not better placed to develop? Why is it that Vietnam, decimated by war till the late-1970s, had exports equal to Pakistan of $10 billion in 1996, but today has exports of $340 billion? Why is it that Pakistan, the 5th largest market in the world, attracts foreign direct investment of just over $1 billion per year; 84th globally, below Ethiopia, Congo, Belarus, Gabon, Turkmenistan, Bangladesh, and Cote D’Ivoire.

Cracking these questions holds the key to solving our balance of payments challenge.

Consider three numbers:

• Exports: $28 billion (down $4 billion from PTI’s last year in government)

• Remittances: $27 billion (down $4 billion from PTI’s last year in government)

• FDI: $1.3 billion (down 22% versus PTI’s last year in government)

Now remember Vietnam’s export numbers. $340 billion.

Since we need to finance imports of $70 billion plus debt repayment of over $20 plus billion every year for the next three years, the three numbers above mean that we face a balance of payments crisis like never before. Clearly, if our economy performs to its potential, a market the size of Pakistan should be much more attractive to investors. It should also be able to produce and export more. The problem; our economy has never developed in

the way it could have.

Growth in FDI and exports is key to solving Pakistan’s balance of payments challenge in the medium and longer term. The issues and solutions involved in solving both issues are similar; and tied to the state and structure of our economy. The challenges and what needs to be done have been written about, talked about, and discussed extensively. There are manifestos, plans, studies, policies, papers upon papers, all saying good things. Result? Very little change.

Here are a few of the important challenges and actions, and the state of the union on each:

1. Political stability and continuity of policy is key to building private sector and investor confidence, yet this has never happened and remains elusive today.

2. The right tax policy and incentives will encourage FDI and exports. This will also help create a level playing field, encourage competition and innovation. Yet our tax policy and implementation do the exact opposite. By overtaxing the formal economy, we tend to consistently encourage informalization and discourage scale, ambition, and innovation. Investors shy away. Firms do not attain the size and scale necessary to develop the capabilities to compete and export in world markets. Money finds its route to the easiest investments there are – real estate for example.

3. Ease of business efforts and the cutting of cumbersome regulatory processes are critical to create a conducive business environment. While Pakistan moved up significantly in the Ease of Business rankings in the PTI government; we must be honest. There is still a long, long, long way to go. The amount of red tape businesses and investors face remains a huge challenge to solve.

4. Providing a level playing field will encourage competition, drive innovation, develop export capacity, and make investment attraction easier. Yet, with our culture of red tape, privileged access, and rent seeking as a means of getting things done, most sectors don’t develop to scale and are dominated by a few players. All these factors act as barriers to competition, and privileged businesses exist by extracting reasonable profits in a protected local landscape. This, as much as anything else, stifles the ambition in these firms required to grow, and to export.

5. Anchor investors from the corporate sector, facilitated by the government, can help to transform sectors, develop value addition capacity, improve product quality, and develop export potential. Yet the corporate sector is viewed with suspicion, over-taxed, over-regulated, and this last year, not even allowed to repatriate profits. Why would they invest in Pakistan?

6. Quality infrastructure such as roads and reliable energy are basic building blocks required to make Pakistan a more competitive business destination. Yet, today, infrastructure remains such that we cannot even guarantee 24-7 energy availability, to businesses or to homes.

7. Special Economic Zones can be used as islands of excellence where investors can be given one stop shop services; yet there is not a single special economic zone anywhere in Pakistan that we have got right and can show as an example to replicate.

8. Access to finance is a critical issue, and while we have talked about this as an issue for ages, we have developed no viable solutions.

9. Our Boards of Investment can work as dynamic organizations that facilitate investors, resolve issues, cut through red tape, and help build a vibrant “Brand Pakistan”. Yet, like every other public sector entity, each of our boards of investment have been bureaucratized.

10. A robust legal framework can give investors the confidence and protection they need with their money. Yet, whether it is our courts, or government after government, we have a track record of scaring investors away from investing in the country.

This is not an exhaustive list. There are other challenges; the impact of the exchange rate manipulation on businesses; the importance of labor productivity, and the poor state of our universities and technical and vocational training; to name a few. The longer we have not solved these problems, the more complex they have become to solve. They are not solvable in a day.

But what should be clear is that in increasing exports and attracting FDI, there can be no shortcuts. We need businesses in the country and outside to develop confidence in Pakistan as a market. This needs to be based on some fundamentals of performance; consistent growth; good profits; and a favourable business environment. None of this can happen overnight. Building confidence is a function of time. What we can do though is to begin now, and with elections just around the corner, it can be the starting point for economic stability. This should be our India 1991 moment.

One fundamental question is to decide whether we believe the solutions to our problems lie in truly committing to an open market economy. I believe they do, and that fundamentally, the 250 million strong Pakistan market with its cheap, young labor should be attractive to the world. But we must stop fooling ourselves that the environment we live in today is welcoming to the private sector. It is not. Recognizing that reality is the first step to solving our problems. And given the state of the economy, there can be no bigger burning platform than now.

Many voices will agree with much of what has been stated above. It’s not rocket science. At any given time, those in government will always tell you we are making progress in all these areas to boost exports and investment. The billion-dollar question then; why then doesn’t that progress translate into results?

We must recognize that the reality on the ground may be very different to what is told to us. This may be worth illustrating with a few personal anecdotes.

In 2009-10, while working for a consulting firm, we were engaged by the Planning Commission precisely to tackle the question of increasing exports and FDI. I was personally looking at the opportunity in the horticulture sector and visited Fruit Logistica, the world’s largest fresh produce show. In discussions with the three largest players in the sector, all told me that they would be very interested in investing in Pakistan. This, despite the risks of the war on terror, at its peak then. But they questioned why it was me, a consultant talking to them, rather than the government, through its words and actions, showing them that the investment was worth it. The horticulture export opportunity was sized at more than a billion dollars incrementally back in 2009-10. Thirteen years later, the latest fruit and vegetable export strategy shows that Pakistan’s exports remain stagnant, the problems remain the same, as does the prescription. Nothing has moved.

This article talked earlier of creating “Brand Pakistan” to market our exports better. At the same fair in 2010, it was very interesting to see the Pakistan stall and compare it to others. The stall advertised Pakistani citrus and mango, but the mangoes on display were not even Pakistani mangoes. Most of the time, the poorly lit stall wasn’t staffed. By comparison, from India, to Morocco, to Mexico, countries aspiring for a footprint in the food export market had spent money, and their work on branding was more than visible. Pakistan got this right at Expo 2020 in Dubai, but to build a country brand, we need to do this consistently.

We also looked at the pharmaceutical sector then. Given low labor costs and the large domestic market, the pharmaceutical industry in Pakistan should be importing less, while being a great potential source of increased export revenue. But just consider, when an industry is not allowed to recover the cost of manufacturing Panadol, as happened a few months ago, why would it invest in Pakistan to the extent that it develops export capabilities, or to serve more local market

needs with domestic manufacturing?

More recently, as minister, I remember engaging with the two large e-taxi companies in creating a legal framework that could regulate the sector but do so in a manner that incentivized them to invest and create jobs, while solving our urban mobility needs. Try as I might to explain to the government officials involved that the primary goal here was not raising revenue, the bureaucracy working on the draft legislation would bring it all back to high service tax rates, and draconian regulations that would only have made both companies pack up and leave the market. We fixed the issue, but it dawned on me how dealing with the government for the corporate sector was a complete nightmare.

Once, a hotel developer bringing an international chain to KP came to me for help. The authorities were telling him he couldn’t build the hotel where he wanted because it was forest land. There were no answers to the question as to how a hotel had existed at the exact same spot for half a century, or why the relevant department had not objected when it was part of the decision-making process in conceiving the project. An identical case recurred with a chair-lift developer.

Another time, I talked to another hotel developer who had expanded to 16 properties in the country, to gauge his interest in leasing properties in the public sector. His reply was very interesting. He said he stayed miles from any government engagement, and that that was the key to his success. He had no confidence in the government being consistent in its policies.

There are examples upon examples I can quote. The above examples serve as enough of a look in the mirror. The reflection isn’t pretty. The irony is, I feel we did a decent job at KP, in trying to overcome some of these challenges. But this didn’t seem to make dealing with the government much easier. Imagine how much more we could do if the government administration were embracing a culture of encouraging the private sector to invest in Pakistan? Our commitment to a market economy cannot just be on paper, or in political statements, but continuously in action after action, over time.

We do have one success story. Pakistanis abroad. While we bemoan, with some justification, the exodus of people from Pakistan, remember that overseas Pakistanis, white or blue collar, remain an asset. Pakistan’s corporate sector is so small, migrating abroad allows middle class professional Pakistanis opportunities to thrive in a competitive, merit-based job market and

improves their quality of life. Life abroad also gives blue collar workers and labourers the opportunity to support their families back home. Pakistan has the 3rd largest diaspora in the world, and they are an asset. Witness the economic impact back home of millions of Pashtuns in the GCC. If you take out the $30 billion overseas Pakistanis remit back home, Pakistan does not stay solvent. It is overseas Pakistanis that save this country from default.

The next time some of you visit Dubai, or anywhere in the GCC, do notice how few Pakistanis you will see behind a counter at a Starbucks, or at a hotel reception. Note how so many jobs where a slightly more advanced skill level is required, you will see Indians, Filipinos, and Sri Lankans, but almost no Pakistanis. And therein lies an opportunity for us. If we can upskill people wanting to gain employment abroad even in basic professions; as drivers; nurses; gardeners; retail and hospitality staff; by teaching them better language skills, and better professional values; these Pakistanis will start to command better jobs and better pay in the job market; and this will result in increased remittances. In my pre-political career, we helped the Punjab Skill Development Fund do exactly this, by creating partnerships between employers, training providers and trainees, in the hospitality industry in the gulf. The question is, are we willing to dismantle our archaic TEVTA based vocational education system and adapt it to the needs of the private sector to achieve these aims?

Certainly, a focus on utilizing and upskilling our overseas Pakistani community is better than their illegal migration through touts, with occasional tragedies such as happened off the Greek coast.

Our balance of payments crisis may have no pain-free or easy solution, but all the fixes discussed are doable. India, China, Vietnam, Morocco, Singapore, Korea, all these countries have their economic transformation stories. Why can’t Pakistan have its own?

The choice is ours. We can be perennially stuck in cycles of foreign exchange shortages and five-year export and investment policies we don’t intend to execute. Or we can commit to an open market economy, a lean government without the red tape and hostility towards the private sector of today, and reforms that continue through electoral cycles; and reap the dividends.

Pakistan is a real economy, with a resource base, and talent. There is no reason we cannot make a country of 250 million, the 5th largest globally, an attractive investment destination for the world. n

By Areeba Fatima

By Areeba Fatima

Shell recently announced that it wants to make its shareholders happy, so it’s going to distribute a bigger chunk from its cash flows. This means Shell will pay a bigger dividend and buyback more of its own shares. Starting from the next quarter, it will spend $5 billion on buying back shares, instead of $4 billion.

But hold your horses before you go tweeting this out and then get called out for spreading misinformation. We are talking about Shell plc, the London based global company, and not about Shell Pakistan.

A similar mistake was made by the officers at Pakistan Stock Exchange (PSX) very recently so you must not feel so bad for yourself.

On 19 June 2023 a groggy PSX regulator typed out an “Enquiry on News Published in Print/Electronic Media” and asked Shell Pakistan to answer for Shell Plc’s CEO Wael Sawan’s plan to make the British company’s stocks shinier. This letter was written in

reference to a news item that appeared in Pakistan’s Business Recorder headlined “Shell boosts dividend, steadies oil output under new CEO’s plan”.

Despite six various factual indicators in the article screaming that this is about Shell plc’s new CEO Wael Sawan’s efforts at taking the company forward, Hafiz Maqsood Munshi, who heads compliance at PSX, thought it best to write to Shell Pakistan Limited as an initiation of an official inquiry.

Naturally Lalarukh Hussain-Shaikh, the Company Secretary sent an extremely polite response confirming that PSX had mistakenly and perhaps unfortunately misread the article itself. “In light of the aforementioned news item, you have drawn Shell’s attention to the requirements of Clauses 5.6.1 (a) and 5.6.2 of the PSX Regulations; however, after careful examination, it is to clarify that the news article does not pertain to Shell Pakistan, and relates to Shell plc. Therefore, the information presented in the news item does not relate to Shell Pakistan’s activities, decisions, or future plans.”

Perhaps had PSX done a “careful

examination” of the BR article, there would have been no need for this correspondence to take place. However, it did happen and Shell Pakistan’s rather polite clarification was added to a never-ending pile of responses sent by companies to enquiries of potential market manipulation, simply saying “Sorry, we have no idea how the market is moving.”

So far this was funny and we were all laughing. However, this is serious regulatory business; on average the PSX sends out a few of these notices almost every day in efforts to maintain fair and equitable market conditions. But if the guards are sleeping on watch then who is watching the guards?

Remember Shell announced earlier this month that they will be exiting the Pakistani market by selling more than 77% of their market shares. And so one would naturally expect the market to react, and the market indeed reacted, as Shell’s stock price shot upwards from Rs 89 to Rs 116 by 20 June 2023. But when you actually look at the graph and zoom out a little, this upward journey really began somewhere between 2nd and 5th June. After hitting a 6 month low at 68 on 29 May, the stock price be-

How an embarrassing bureaucratic faux pas by PSX made it even more obvious that the regulator is not up to the task

gan steadily and then sharply increased after 3 June 2023. It rapidly reached 76 on 5 June 2023 and then began to exponentially rise after 12 and 13 June 2023, which is a day or two before Shell officially announced its intention to exit.

Expecting the bare minimum from from one of the most robust and historically well performing stock exchanges (while simultaneously maintaining a series of well documented efforts at market manipulation), one would assume that the PSX would have sent out a letter of enquiry or notice to the company sometime around 2nd to 5th June 2023. PSX regulations bind the companies listed with them to disclose any price-sensitive information immediately in order to keep things fair and square. When such a clarification is not already available and a movement is noted, PSX sends in a reminder to the company to be immediately notified; more than 16,000 of such entries are listed on their website.

But one is left to wonder why the share price is soaring in the first place. If a company announces that it is about to sell more than 77% of its shares, the supply of these shares has suddenly increased in the market so by simple rules of economics the price should naturally go down. However, it did not, why?

Shell Petroleum Co is divesting from Pakistan because of a plethora of reasons but

one of them is that Pakistan right now is a bad market. Why is this creating a positive market signal for its share price to rise?

There is a peculiar legal reason to deduce what could be driving the share price forward. The Securities & Exchange Commission of Pakistan (SECP) wants to protect the small shareholders in big businesses. So for example in the case of Shexit from Pakistan, whoever the potential investor is, will be bound by the law to ensure that the minority shareholders are also offered an equal opportunity to exit at a premium. So for example, if Saudi Aramco decides to buy the more than 77% shares that Shell is divesting from in Pakistan, they will have to offer the same deal to the rest of the 23% shareholders. The SECP essentially makes it compulsory for the acquirer to make an offer to buy at least half of the shares held by the minority shareholders.

This could mean that it is entirely possible that Shell got in conversation with a potential buyer and made the announcement only after reaching a satisfactory level of post-announcement certainty. This means the demand for shares will now rise, because the potential investor will have to make a public offer for the rest of the shares as well .

When it comes to sifting the wheat from the chaff, the PSX is comparable to a headless chicken at the task, that is, it seems they can’t or won’t take notice of real cases of market manipulation if their lives depended on it. Despite placing an upper hold on trading after a mysterious 25% rise in Shell Pakistan’s closing share price between 1 June 2023 and 6 June 2023, the regulator should have sounded alarm bells, considering long standing chatter surrounding a Shell sale has reached a precipice earlier this

year after Shell’s parent company signaled a desire to end operations across a number of territories, with industry insiders predicting the only roadblock to a sale was finding a buyer for the oil marketing supermajor. What’s shocking is the regulators turned a blind eye to the lack of disclosure around potential sale between 1 and 6 June 2023.

Surprisingly, PSX did not request disclosures regarding the openly reported source of the sudden spike. It seems like the regulators were the stereotypical stockbrokers who were so busy counting their money they forgot to do their jobs.

Two weeks later, Shell Pakistan was officially on the market, ready to be gobbled up by a hungry buyer and everyone wanted a piece of the pie.

Shell Pakistan’s parent company, Shell Petroleum Company Limited, announced its decision to exit Pakistan after 76 years of operation on 14 June 2023. An exploration of these reasons is another story, which we published earlier this month - a compounding economic crisis, foreign exchange losses, Dollar outflow restrictions, and Shell’s global strategy to simplify its portfolio.

With the stock price evidently rising since 3 June, it is clear that someone out there knew of Shell’s intention before the official announcement was made and PSX missed out on a real opportunity of doing their job.

For the average investor who is playing fair and taking their bankers’ advice, These are the kind of games some influential stock market investors play while laughing all the way to the bank while their incompetent and possibly corrupt friends at the PSX are having a fun time doodling. n

In January 2021, the country’s premiere investigation unit, the Federal Investigation Agency (FIA) release a public service announcement regarding an “Easypaisa Account Block Fraud,” according to this PSA, a stranger gets in touch with the victim and claims to be a representative of the company informing the customer that their Easypaisa account has been blocked and that if you want to use it again you must tell us a certain code. Once the victim communicates the code the hacker is able to empty their digital wallet.

Over the years, several other digital wallets have begun operating in Pakistan, only recently the State Bank of Pakistan (SBP) issued licenses for 12 new electronic money institutions (EMIs). However, the hackers have not evolved their strategy, perhaps because they did not need to. Despite FIA’s explicit warnings and multiple banking institutions publicly announcing disclaimers for not revealing any personal information or OTPs, pin codes and passwords to anyone on call, customers have constantly been facing these fraudulent calls and text messages.

On 17 June 2023, this correspondent received a call from someone claiming to be Kashif Rizwan, senior supervisor at the Islamabad Jazz Cash office. He told us that the correspondent’s Jazz Cash account has been blocked and that the correspondent should tell him the OTP she will receive so he can unblock her account. However, since this was a typical jazz mobile number and not a landline number or the official Jazz helpline number which is 4444, the correspondent did not share any details and began searching out whether this has recently happened to other people.

On a Facebook group called Voice of Customer Pakistan, several social media users have warned other members of the group about their experiences of being defrauded by an alleged Jazz Cash representative who called them and asked for an OTP or pin code after which money started transacting out from their Jazz cash wallets. Some of them were contacted by a Facebook account with the title Jazz cash and were told to add a specific amount of money

into their accounts after which they received the calls. A lot of posts from other Facebook groups also popped up from 2021.

Telecom companies such as Telenor and Jazz have consistent ly denied any strange activity on their networks or large-scale data breaches. However, Twit ter users claimed in January 2022 and in May 2020 that the databases were hacked and being sold via Telegram. In 2020, the leaked personally identifiable information (PII) of 115 million subscribers was leaked and being sold for 300 bitcoins and the majority of these subscribers had chosen Jazz as their mobile operator.

In January 2022, similar tweets and posts reappeared on social media platforms, claiming that leaked Jazz and Telenor databases were being sold for just $250. Jazz and Telenor tweeted out an official rejection of this claim and eventually the tweets sharing screenshots of leaked telecom databases were subsequently removed from the platform.