Publisher

Oregon Society of CPAs

Mailing address

10206 SW Laurel St., Beaverton, OR 97005-3209

503-641-7200 | 800-255-1470 | Fax: 503-626-2942 www.orcpa.org | information@orcpa.org

Chair

Gary Holcomb

Chair-Elect

Adam Abplanalp

Vice Chair

Megan Kurz

Past Chair

John Hawkins

Board of Directors

Bradley Bingenheimer

Christopher Dahlvig

Tricia Duncan

Jonathan Grover

Jared Holum

Cameron Irtifa

Michael Lortz

Tiffany Nash

RL Widmer III

President/CEO

Sherri McPherson, IOM, CAE

Editor

Susan Fleming sfleming@orcpa.org

Chapter Council Chairs Benton-Linn

Central Oregon Eastern Oregon

Emerald Empire Mid-Columbia

South Coast

Southern Oregon Chapter chairs to be announced Summer 2025.

A CPA’s Journey: Gary Holcomb on Leadership, Advocacy, and Adaptability 14

The Daily Juggle: Meet Oregon’s Community College Accounting Students 18

WISP 101: What Every Firm Needs to Know 24

The Cost of AI Resistance in Corporate Finance 26

My alternative pathway 5

Member News 7

2025-26 Board of Directors 7

Volunteer thank you 9

Professional Development 30

Content and Editorial Assistance

Up10 Solutions

The Oregon Society of CPAs assumes no responsibility for statements or advertisements herein and reserves the right to reject any advertising. Statements and opinions expressed are those of authors and not necessarily those of OSCPA. Publication of an advertisement does not constitute an endorsement of the product or service by Accounting Connect or OSCPA.

Update your contact information at www.orcpa.org/my-cpa/profile

Copyright© OSCPA 2025

Magazine design by Joleen Funk joleen.funk@gmail.com

Stock images by istockphoto.com & stock.adobe.com

Cover image by Fletcher Wold Photography www.fwoldphotography.com/

Connect with OSCPA

Accounting Practice Sales 4

Private Practice Transitions 6

Happy New Year! As most of you know, OSCPA begins its year on April 1, and so does my term as OSCPA Chair. I am looking forward to working with you during the 2025-26 year. This will be anything but a typical year for our chosen profession. Among one of the many things the Society has been advocating for are alternative pathways to obtain certification. I will not go into the myriad of reasons that this is necessary, but the Oregon Board of Accountancy and similar organizations are gearing up for major changes.

I thought it might be helpful to share my own alternative pathway to certification. I attended Arizona State University (yes, it was fun) and majored in organizational communication with a marketing minor. Among the business courses I took was Introduction to Accounting I. This was my introduction—and what I thought was my conclusion—to my accounting career. Upon graduation, I attended University of Arizona for law school. I took federal income tax and thought that was the end of my tax career. I think my plan was to be a great litigator and return to my home state of Colorado.

As with many plans, life happens. I met a woman (Jennifer) in law school who had a great position at a large law firm in Phoenix. Thus, after getting married the year after graduation (32 years now!) and needing a job, I took an attorney position with the Arizona Department of Revenue in the Tax Policy section. Among other things, the section was responsible for analyzing all legislation. That was the beginning of my concentration on only state and local tax matters, which has been my focus ever since. If I was going

to be successful, I needed to better understand accounting. I entered a post-baccalaureate accounting program. I even had to take Statistics 101 with 18-year-old freshmen. During this time, I transitioned to Arthur Andersen’s SALT practice. The Big 6 firms were just beginning to have dedicated SALT practices.

Almost on a whim, my wife and I decided that we wanted to live in Portland, and I transferred to the Andersen office in Portland. In the late 90’s, you only had to have a college degree and something like 20 hours of accounting courses to sit for the exam. So, in May 1997, I made my way to Salem and sat for the exam at the state fairgrounds “shack” with my little calculator. Since 1997, I have been a CPA, and a member of the OSCPA for most of those years.

I am proud of my alternative pathway, and I hope that no one views this path with any consternation. Different pathways can all lead to a long and positive career. Likewise, I will be very interested to hear about other students’ pathways to a successful career as an accountant. As I write this, the Oregon Legislature is considering the Board of Accountancy’s proposal for alternative pathways. Other states such as Ohio, Utah, and Virginia have passed legislation and many more states, AICPA, and NASBA have proposals for alternative pathways. As I said at the

beginning, this is not a typical year, and I hope these proposals bring fresh new perspectives and many more enthusiastic individuals whose pathways take them to the great profession of accounting.

Gary Holcomb, JD, CPA 2025-26 Chair, OSCPA Board of Directors ChairGary@orcpa.org

Nominate yourself or another member for:

• OSCPA Board of Directors

• The OSCPA Educational Foundation

• OCPA/Legislative Action Committee (OCPA/LAC)

• OSCPA Group Health Trust

• Oregon Board of Accountancy

With the OSCPA fiscal year beginning April 1, 2025, OSCPA is delighted to introduce the Board of Directors for 2025-26, led by Board Chair Gary Holcomb, JD, CPA of Ernst & Young LLP, Portland. He is joined on the Board by a talented group of dedicated professionals from across Oregon.

Gary Holcomb Ernst & Young LLP

Portland

Director

Bradley Bingenheimer SingerLewak LLC Salem

Portland

Director

Christopher Dahlvig Linfield University McMinnville

Director

Cameron Irtifa CPA Service LLC

Beaverton

Supports LLC Grants Pass

Director

Tricia Duncan Jones & Roth PC

Eugene

Director

Michael Lortz Downtown Development Group LLC

Portland

Director

Jonathan Grover City of Hillsboro

Hillsboro

Director

Tiffany Nash Kernutt Stokes LLP

Eugene

Director

Jared Holum Perkins & Co.

Portland

Director

RL Widmer III Moss Adams LLP

Eugene

OSCPA shares deepest appreciation to the 2024-25 OSCPA Board of Directors: Chair John Hawkins, REDW LLC; ChairElect Gary Holcomb, Ernst & Young LLP; Vice Chair Adam Abplanalp, Cobalt PC; Past Chair Tracy Allen, Aldrich CPAs + Advisors LLP; Secretary Yvonne Zbranak, Silverline LLP; Treasurer Megan Kurz, Premier Community Supports; and Directors Tricia Duncan, CPA, Jones & Roth PC; Jonathan Grover, City of Hillsboro; Cameron Irtifa, CPA Service LLC; Michael Lortz, Downtown Development Group LLC; Tiffany Nash, Kernutt Stokes LLP; Harriett Strothers, Delap LLP; RL Widmer III, Moss Adams LLP.

View the 2025-26 Board at https://www.orcpa.org/board2526.

Thank you to the following volunteers who contributed their time and talents in the 2024-25 OSCPA fiscal year. Interested in building skills and connections through involvement in your professional community? Contact Membership Manager Kate Harrison at kharrison@orcpa.org to find a good fit for you and your schedule.

Project Committees

Accounting & Auditing

Matthew Bowers

Erin Galyean

Leena Kabadi

Alayna Marten

John Mohler

Paula Palmer

Christine Russell

Mark Sleasman

Diana Strassmaier

Hui Xu

Hiroshi Yoshimori

Construction Industry

Richard Anderson

Dane Brammer

Brian Duman

Carrie Fortier

Shane Gentry

Terry Griffin

Carol Ann Kirby

Daryl Knox

Todd McDaniel

Michael Sause

Sarah Shaw-Stahlke

ERISA

Victoria Bryson

Evan Dickens

Jeffrey Hart

Ryan Northcutt

Karen Porter

Steven Resnikoff

Mark Sleasman

Estate Planning

Linda Barnett

Nancy Bolton

Jason Clark

Chantha Dinelli

Darryl Eddy

Kristina Gochnour

John Hawkins

Cameron Irtifa

Kimberly Llorens

George Middleton

Christine Russell

Philip Shane

Rebecca Smith

Todd Smith

Farming, Ranching & Agribusiness

Kathr yn Ashford

Susan Crawford

Joseph Fitts

Christina Haron

Carla Himmelmann

David Klinger

Minda Lourence

Kari Ott

Eugene Stewart

Kyle Walter

Financial & Retirement Planning

Kathleen Bernards

Vanessa DeHaan

Cameron Irtifa

Carol Ann Kirby

George Middleton

Michael Miller

Nelson Rutherford

Mylen Shenker

Todd Smith

Forest Products

Clinton Bentz

Jay Broudy

Stefani Faunce

Jose Gonzalez

Andrew Kaiser

Rachel Lee

Sarah Padfield

Joel Powell

Lyn Smith

James Workman

IRS/Practitioners Forum

Douglas Henne

Northwest Federal Tax Conference

Gayle Kovacs

Michael Miller

Paul Mueller

Robert Nelson

Real Estate

Bryant Abaricia

Adam Abplanalp

Susan Crawford

Darryl Eddy

Cameron Irtifa

Michael Lortz

Jonathan McGuire

Michael Miller

Diane Nelson

Christine Russell

State & Local Taxation

Karen Anderson

Susan Crawford

Carla Himmelmann

Toshio Kurose

Minda Lourence

Asif Muzaffarr

Christine Russell

Kurt Sand

Diana Strassmaier

Penny Sweeting

Stephen Workman

Strategic Committees

Business Management & Advisory Services

William Blair

Cameron Irtifa

Michael Miller

Eric Nufer

Theresa Pilgrim

David Porter

Karen Rasmussen

Mark Skoglund

Audrey Stevens

Governmental Accounting & Auditing

Anton Ballek

William Barker

Bradley Bingenheimer

Christa Bosserman Wolfe

Janell Burd

Gerald Burns

Chloe Dixon

Janice Essenberg

Julie Fahey

Cynthia Granatir

Jonathan Grover

Terry Halter

Christina Haron

Eileen Hendricks

Chelsea Hewitt

Amy John

Jessica Luther-Haynes

John Mickelsen

Daniel Miley

Tonya Moffitt

Kevin Mullerleile

Kari Ott

Ryan Pasquarella

Roy Rogers

Mylen Shenker

Steven Tuchscherer

Ashley Tuttle

Ronald Vaught

Leadership Development

Hannah Bailey

Jackson Bevens

Natalie Heacock

Amanda Lilley

Alayna Marten

Chelsea McElroy

Denise Petterborg

Krysta Smith

Selene Sullivan

Tracy White

Ray Widmer

Legislative Policy

Tracy Allen

Harry Bose

Geoffrey Dougall

Timothy Filkins

John Hawkins

Douglas Henne

Gary Holcomb

Thomas Maynard

Steven Middleton

Robert Moody

Jason Orme

Selene Sullivan

Jayson Wartnik

Not-for-Profit

Thomas Achor

Erica Aitken

Alexandra Aranda

Cynthia Barber

James Brinkman

Gerald Burns

Shirley Cyr

Christopher Dahlvig

Rene Deras

Michael Farnsworth

Michelle Gall

Ian Gelfand

Gary Iskra

Todd Kimball

Michael Lortz

Lorelei Martin

Gary McGee

Jason McGill

Kristina Oliveira

Cheryl Olson

Jennifer Perrier

Russell Price

Robert Prill

Joseph Rosevear

Katie Sheffield

Mylen Shenker

Kathleen Sohl

Eugene Stewart

Brooke Stout

Sandra Suran

Suzanne Taylor

Kellie White

Peer Review

Harry Bose

Mindy Davis

Evan Dickens

Mark Dickey

Sara Hummel

Travis Irving

William Maas

Tiffany Nash

Andrew Peterson

Robert Prill

Richard Proulx

Eric Zehntbauer

Adam Abplanalp

Tracy Allen

Karen Anderson

James Carnegie

Jason Clark

Janice Essenberg

Douglas Henne

Michael Miller

Robert Moody

Paula Palmer

Harriet Strothers

Hiroshi Yoshimori

Taxation

Adam Abplanalp

Katrina Anderson

Kathryn Ashford

Michelle Bacigaluppi

Sonjia Barker

Dane Brammer

Danette Brophy

Obah Budul

Chad Crawford

David Deming

Geoffrey Dougall

James Elliott

Thi Embury

Chad English

Timothy Filkins

Craig Freeman

Anne-Marie Gorbett

Jaime Hanford

John Hawkins

Douglas Henne

Gary Holcomb

Carrie Huffman

George Hughes

Heather Jackson

Toshio Kurose

Heather Lacey

Danny Lee

Rachel Lee

Minda Lourence

Gabriel Markiz

Thomas Maynard

Asif Muzaffarr

Eileen Nguyen

Robert O’Neill

Jason Orme

Madeline Payne

Heather Porter

Katrina Powell

Robert Riley

Gregory Rogers

Kurt Sand

Jenny Santos Cortes

William Siebler

Kimberly Spaulding

Dominic Ste. Marie

Diana Strassmaier

Harriet Strothers

Penny Sweeting

Rory Tosh

Sean Wallace

Daniela Wells

Lene Westfall

Stephen Workman

Julie Yang

Jennifer Young

Bruce Zimmerman

Young Professionals

Ian Bellamy

Jasper Bernstein

Obah Budul

Cameron Clark

Alyssa Downs

Tricia Duncan

Rebecca Hubinsky

Jacob Johnson

Heather Lacey

Casey Leyes

Amanda Lilley

Minda Lourence

Pedro Nunez Dieguez

Ruth Okenye

Jenny Santos Cortes

Sydney Sherman

Macy Smetzler

Nasreen Taha

Agnes Zoltowski

OSCPA Board of Directors

Adam Abplanalp

Tracy Allen

Tricia Duncan

Jonathan Grover

John Hawkins

Gary Holcomb

Cameron Irtifa

Megan Kurz

Michael Lortz

Tiffany Nash

Harriet Strothers

Ray Widmer

Yvonne Zbranak

OSCPA Group Health Trust

Darlene Boles

David Buettner

James Carnegie

Stanley Compton

Geoffrey Dougall

Brendan Hoem

Patricia Labatte

Gary Leavitt

James Mullaney

Patrick Priest

Michael Stone

OCPA/Legislative Action Committee

Adam Abplanalp

David Adams

Tracy Allen

Karen Anderson

Anna Barnsley Werblow

Harry Bose

James Carnegie

Mark Damon

Geoffrey Dougall

Janice Essenberg

Timothy Filkins

Jonathan Grover

Randell Guyer

John Hawkins

Douglas Henne

Ross Holliday

Amy John

Daniel Kosmatka

Megan Kurz

Michael Lynch

Keith Meyers

Tonya Moffitt

Robert Moody

Tiffany Nash

Pedro Nunez Dieguez

Douglas Parham

David Porter

Katrina Powell

Robert Riley

Harriet Strothers

Selene Sullivan

Suzanne Taylor

Ray Widmer

Yvonne Zbranak

The OSCPA Educational Foundation

David Adams

Darlene Boles

Christopher Dahlvig

Tricia Duncan

Katherine Haines

Cass Hausserman

James Jurinski

Suzanne McGrath

Patricia Morris

Dwayne Richardson

David Sacoolas

Jennifer Valdez

Richard Wingard

Richard Winkel

Board Standing Committees

Audit

Harry Bose

Gary Holcomb

Megan Kurz

Yvonne Zbranak

Budget

Adam Abplanalp

Tracy Allen

Tricia Duncan

Jonathan Grover

John Hawkins

Gary Holcomb

Cameron Irtifa

Megan Kurz

Michael Lortz

Tiffany Nash

Harriet Strothers

Ray Widmer

Yvonne Zbranak

Nominations

Tracy Allen

Matthew Bowers

James Carnegie

Sarah Coffman

Jody Deardorff

Geoffrey Dougall

Kenneth Gustafson

James Harnish

Gary Holcomb

Ross Holliday

George Hughes

Larry Reiber

Robert Sampson

Kurt Sand

Yvonne Zbranak

Professional Conduct (Ethics)

Kathryn Ashford

Laura Bergstrom

Gerald Burns

John Hawkins

Ross Holliday

Deborah Hollingsworth

Minda Lourence

Ryan Northcutt

OSCPA Chapter Councils

Benton-Linn

Michael Farnsworth

Ross Holliday

Todd Yee

Central Oregon

Yvonne Zbranak

Eastern Oregon

Cameron Anderson

Jody Deardorff

Emerald Empire

Michael Bergland

Sarah Coffman

Andrea Evans

Charlotte Martin

Tiffany Nash

Dennis Quigley

Faith Quimby

Kerry Rasmusson

Justin Samudio

Ray Widmer

Mid-Columbia

Angelo Sampson

South Coast

Larry Reiber

Grant Walding

Southern Oregon

Matthew Bowers

Gerri Davis

Mary Ericksen

Vicki Forehand

Elena McKee-Dabbs

Andrea Saxon Gibson

Carrie Zippi

Have an idea for a member to spotlight, or want to share promotions, achievements, or milestones? Contact communications@orcpa.org.

Aidan Perry joined Delap LLP, Lake Oswego, as Senior Tax Accountant.

Jon Bowdoin was named partner at Aldrich CPAs + Advisors, Lake Oswego.

Christa Bosserman Wolfe started a new position as Controller at Tualatin Valley Water District, Beaverton.

Tricia Duncan, Jones & Roth CPAs and Business Advisors, Eugene has begun a position as an instructor at University of Oregon.

Natalie Myers has joined Kernutt Stokes LLP, Bend as Director of Audit and Assurance Services.

Josh Quinn was promoted to Senior Audit Manager at REDW, Salem.

Justin Smithhisler has begun a new position as Audit and Assurance Director at Wicks Emmett LLP, Roseburg.

Jessie Ulrich began a new position as Managing Director at Moss Adams, Portland.

Congratulations new CPAs. We are proud and excited to welcome you to the profession.

Sabrina Arnot, Moss Adams LLP

Amanda Higgs, The Zidell Companies

Jessica Ilievski

Rhett Miller, Koontz Blasquez & Associates PC

Grady Plank, Dougall Conradie LLC

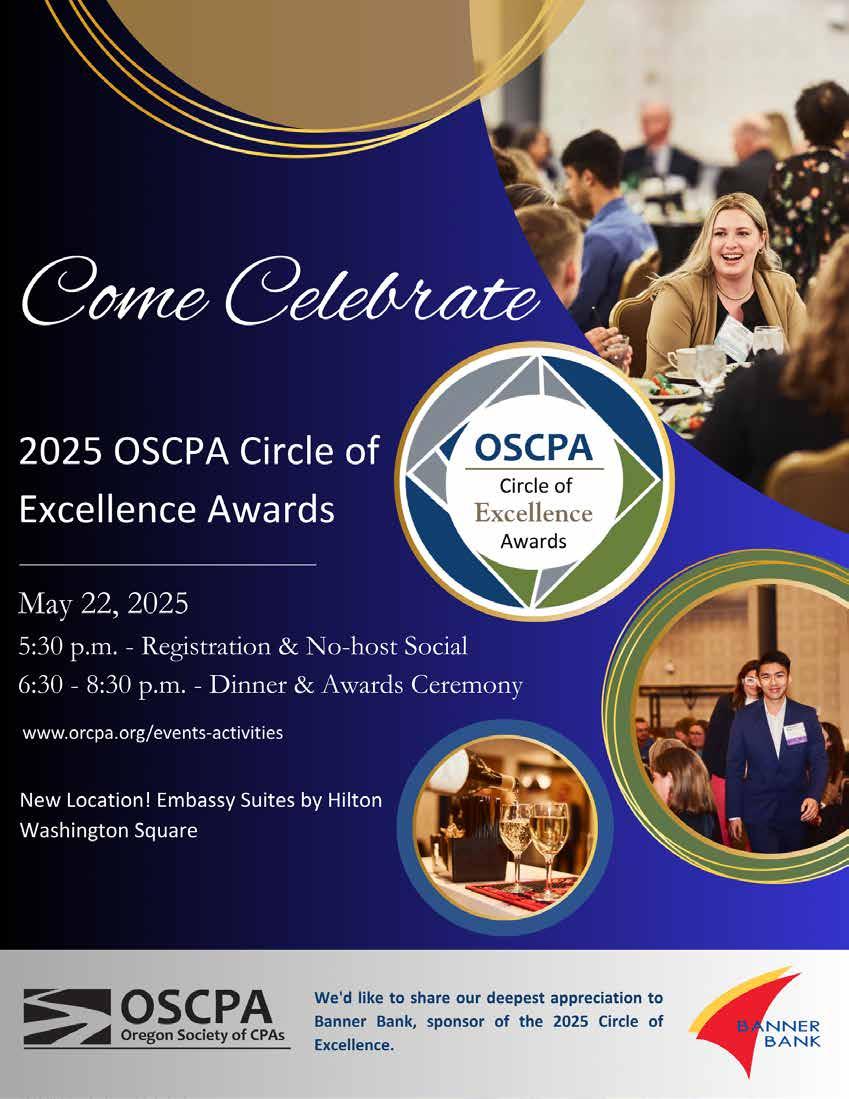

We look forward to celebrating new CPAs and all our honorees at the Circle of Excellence, May 22. See page 34 for more information.

Quinn Allen

Artemio Alvarado

Avendano Jr.

Richard Anderson

Sabrina Arnot

Joshua Bailey

Jennifer Baxter

Lynniesha Bell

Michael Bertoch

Lumiko Blubaugh

Zachary Busche

John Chambers Jr.

Sara Choe

Zachary Cord

Erick Cristobal Hernandez

Derick Cuevas

Brian Dahl

Heather Davies

Nicholas Deccio

Vincent DePinto

Kaeden Dodge

Chelsea Dore

Rebecca Dukes

Lena Eckstein

Nicholas Espinoza

Alyssa Etherly

Robert Wynhausen, 1991-92 OSCPA President

Tianna Filippi

Zachary Fleming

Meghana Ganga

William Geller

Deanna Gentry

Erica Greer

Erica Ha

Kelsey Halls

Dahlia Hanson

Brian Harris

Zhi Wei He

Michael Heryford

Devin Holmes

Crystal Holscher

Teddi Howard

Shawn Kang

Sarah Keane

Misol Kim

Sunmi Kim

Michael Kinsey

Kelly Kraemer

Tyler Kucera

Allison LaRoche

Henry Law

Judd Lewis

Kimberly Lohr

The OSCPA regrets the passing of Robert “Bob” Wynhausen, 1991-92 president of the OSCPA Board of Directors. Bob was a strong supporter of the Society and the CPA profession throughout the years, serving on numerous boards, committees, and task forces, including chairing the Federal Legislative Committee, the Legislative Policy Committee, and serving on the Board of Trustees for the OCPA/ Legislative Action Committee. We thank Bob for his years of service and commitment. He will be missed.

Elise Luke

Elaheh Madoliat

Jason Marshall

Justin Matthews

William Matthews

Kylie McCloskey

Chelsea McCloud

Ava Molinsky

Natalie Myers

Misty Ness

Yi-An Pan

Christopher Patterson

Clarissa Patubo

Kyle Peterson

Julius Pokorny

Ryan Randall

Robert Reynolds

Katie Rickman

Andrew Roluffs

Alexandra Rose

Mark Roth

Ronald Rufener

Kelsey Rundorff

Shannon Rushing

Joel Russell

Andrew Salata

Hannah Scott-Medlock

Ashlyn Simone

Joshua Sims

Audra Sprinkle-Moser

Phillip Stagg

Ethan Stupfel

Brady Stutzman

Stephania Surritt Mariscal

Mark Tabor

Clancy Terry

Faith Thompson

Sarah Tiau

Ashlee Tomasino

Kissy-Mae Torrey

Baovinh Tran

Jessica Tuthill

Graciela Vazquez

Diego Villanueva

Alvin Walters

Alyssa Watson

Charles Wayson

Haley Webb

Ryan Wilson

Nash Wood

Ruth Wu

Gary Holcomb, JD, CPA 2025-26 Chair, OSCPA Board of Directors Managing Director, Ernst & Young LLP, Portland

Thank you so much for meeting today. Can you share your journey to becoming a CPA?

My undergraduate degree was from Arizona State University in organizational communication with a marketing minor. I’d only taken one accounting courses in college, and then I went to law school at the University of Arizona and became an attorney, planning to be a litigator.

However, in law school I also met the woman who would become my wife, Jennifer. After law school she did not want to move back to Colorado where I was from. So if I wanted to be with her, and I did, I needed to find work in Arizona.

I was hired by the Arizona Department of Revenue as a Policy Analyst, which is where my interest and enjoyment in accounting really grew. From the Department of Revenue, I went to work for Arthur Andersen. By then I wanted to

continue in accounting, so I pursued a post-baccalaureate and that gave me 20 hours of accounting classes, enough to sit for the CPA exam. As people know Arthur Andersen collapsed in 2002. I worked briefly at KPMG and then had an opportunity to join Alvarez & Marsal in New York. We moved to Manhattan for two years. Our son and daughter were in first and third grade.

We loved the adventure and had the complete New York experience living in the Financial District. In the end, we missed the green—my wife wanted grass—but it was a fun, family adventure. So it hasn’t been as straight of a path as you might think, but then again, no one really has a straight path all the way through their life.

In your professional journey as a CPA, what stands out the most?

The reason I’ve stayed in public accounting, and you hear this a lot, is the variety. It’s not one constant. When you work with clients, you have to understand their business inside and out. I’ve been right there at ground level—I’ve been in La-Z-Boy factories, timber factories, I’ve been in bunny suits touring semiconductor manufacturing sites. The range of businesses that I’ve learned about has just been incredible. I’m always learning, and I’m always interested. And what that means is you’re reinventing and adapting yourself nonstop.

You’ve been in the state and local tax space most of your career. Was that unusual to be specialized when you were starting out?

I think it was. I’ve been very specialized when it wasn’t even popular to be so specialized, say 30 years ago when there

were a handful of people doing state and local tax. Within our firm now, you do have to pick a pathway. Other firms do it differently, but EY has a program where your first two years you’re allowed and actually encouraged to work for months in different groups to experience different kinds of work and see what you are interested and engaged with. People can find what they love and build a career they are passionate about.

How has OSCPA involvement influenced your career?

(Note: in addition to Board service, Gary has served as Audit Committee Chair, Budget Committee Chair, Legislative Policy Committee Chair, Legislative Analysis Subcommittee, Educational Foundation Board of Directors, and has served over twenty years on the Taxation Committee.)

OSCPA has expanded my professional network in powerful ways. However, I don’t know that newer or younger members completely realize that serving a professional organization can help their career tremendously. I have been in meetings with people who were very important to my career. Involvement in your professional community, whatever your profession, is key to your own success. Yes, it does take time, sometimes a lot of time, but it is a win-win beyond belief.

As Board Chair, what message will you be sharing with OSCPA members?

If you are a professional, OSCPA is your professional community. The Society is more than a place to get great CPE. I mean, it is a place to get great CPE. But advocacy is the focus. OSCPA protects the CPA license. We all know how hard that license is to get. I don’t know if people truly

realize how tenuous that is. We see across the country the states debating legislation saying professional licensure isn’t important anymore. Even if you’ve been licensed for decades, one bill can threaten your professional livelihood. I’m not trying to scare people, but, honestly, we should all be a little scared. Or at least be alert. Every single legislative session, OSCPA members step up and give their time to read the bills introduced in the Oregon Legislature. That is not an easy job. It’s tax season and many people are already overloaded. We’re looking for that one bill that could change everything for CPAs, clients, and the public. I don’t know if people realize that without OSCPA, there is no watchdog.

We talked about the term networking. What does networking mean to you?

I think the word networking means different things to different people. To some, it’s attending a social and drinking a beer with someone. Nothing is wrong with that, it can be a way to expand your circle. But networking has many layers. You have to prove that you have a differentiating skill. That’s where your years you’ve spent engaging with your professional peers through committee service, board service, legislative, etc., has built you a valuable network. Those relationships become part of what differentiates you as an advisor for that potential client—whether you’re a sole practitioner or part of the Big Four. Those relationships and then being able to convey your knowledge. The value of your professional relationships becomes the value to your client or employer.

The OSCPA Board recently met to envision a strategic plan for the organization’s next three years. What’s most exciting to you about the future of the OSCPA?

I’m excited about alternative pathways. OSCPA leadership and volunteers have worked hard these past few years to create more avenues toward licensure, so that any aspiring CPA who is willing to put in the effort can meet that goal. This is a huge benefit for individual aspiring CPAs, but also for the profession as a whole. Alternative pathways bring in different people, different ages, different stages of life, a variety of life experience, different abilities—it will breathe life into everything.

There is a wealth of opportunity for those entering the CPA profession. A large generation is heading into retirement, but the importance of what CPAs do will only increase. It’s not just about the number of CPAs - it’s about the depth of their knowledge. Technology and automation will allow even entry-level CPAs to do more high-level work. Regulators aren’t giving us a break and saying, “not enough CPAs, that’s okay, just let your quality go down.” Standards will stay high.

What difference do you believe you have made in the life of your clients?

As CPAs, you really do have to become the trusted advisor. Not only in the specific thing that you’re doing, but in the vitality and longevity of their business as well. Even in large businesses, you have to look out for the people in the tax group. Not just sitting back from a compliance standpoint and saying you can’t do this, you can’t do that. To advise your client or your business means you may have to put in extra work, extra effort, but that effort will be remembered.

How do you become a trusted advisor?

Curiosity. You have to be genuinely curious - about the person and their business. Care, listen, ask questions. You might be a great technician - but are you a trusted advisor? That’s something else entirely.

How do you characterize your leadership style within your firm?

I think the term would be collaborative, I try to be a team builder. I think that has always been the most successful aspect of my career.

Has that style changed over time?

Absolutely. I don’t know if it’s age, but I think when you’re younger you’re a little more aggressive, and more, my way is the right way and I’m going to make sure everyone knows it. That’s something I try to coach people on. Over time you learn that you need your own opinion, and you have that right. But in the end, you’re working with other people, and the organization’s strength is going to be in its ability to collaborate.

Are you influenced by the younger people in your office?

I’m definitely interested in them and influenced by them. My son is similar in age and a business analyst on Wall Street. Seeing how he works and interacts at work gives me insight

into what kind of environment our newer staff might find supportive. There are new ways to do things, you don’t have to do it like I did it. It’s not wrong, it’s just different. We can all adapt.

On that note, what advice do you give to new professionals starting out?

To be open to change. Our profession is all about change. When tax laws change you have the chance to learn and become an expert. You could be senior-level and know as much about tax changes as a more experienced partner. Embrace the changes and see what opportunities you can create for yourself.

How can OSCPA help members navigate change, let’s start with technology?

That’s a good question. My feeling is that new technologies are here. How are you going to use them to help change your world? It’s going to be there regardless. Why not try to figure out how to use it? Stay curious.

How about with regulatory changes?

We have great relationships with many entities that affect our profession. These have been built over decades. OSCPA members benefit from these relationships every day, even if they don’t know it. Our work together with the Oregon Board of Accountancy, we have a strong reputation with the

Oregon Legislature where they seek us out for our ability to educate and clarify the real day to day impact of proposed legislation. If you’re a CPA in Oregon, I really don’t think you can overstate how crucial OSCPA’s advocacy work is.

On a personal note, tell us about your family.

I’ve been married to my wife Jennifer for 32 years. As I mentioned, my son Nate is in New York working as a business analyst. Just last night he worked until 1:00 a.m. My daughter Katie is in Oregon and last year she started working as a nurse with Kaiser.

We have a cabin at Lake of the Woods in southern Oregon that has been in my wife’s family, and that’s where I worked during the pandemic. I spend a lot of time in Medford and places around Oregon for work and love spending time

around the state. But any time I can be at the cabin, that’s where I want to be.

What are you reading, watching, or listening to these days?

I read some type of fiction almost every day. I will read thrillers, sci-fi, post-apocalyptic, and alternative history. My favorite though is typically historical fiction. James, a novel by Percival Everett, was a recent favorite and adds a modern perspective to The Adventures of Huckleberry Finn Streaming favorites are pretty varied as well, from White Lotus, to Hacks, to Finding Your Roots. My wife and I are currently getting through Slow Horses

Before we go, one last question: What would people be surprised to know about you?

I make great Hot-Damn Dill pickles every fall.

by Cynthia Killingsworth, Portland Community College

Accounting students at Portland Community College (PCC) recently introduced themselves on the first day of class:

• Many own small businesses including food carts, bookkeeping, and camping trailer construction. One has worked as a professional musician for two decades.

• Several hold bachelor’s in other disciplines, and one has an MBA.

• Many have volunteered, including with CashOregon, as income tax preparers.

• One is still in high school.

• They work full-time, many with two or more children.

• Several are currently bookkeepers at local nonprofits.

• One grew up travelling with carnivals!

As public accounting explores more ways to nurture the next generation of accountants, it’s heartening to know that there is a bounty of expertise and determination in Oregon’s community college accounting classrooms. Understanding the challenges these students face, their creative solutions for these struggles, and how the community can network with them will help the accounting industry to better access this great pool of talent.

While the exact number of accounting students is unknown, there are nearly 8,000 students studying business in Oregon community colleges. Of these students, 30% are over the age of thirty, 55% are independent of their parents, and around half work full time. They are also pioneers in their families because the majority of them are first generation college students.

Their real-world experience is best described in their own words:

“People assume community college students are less prepared, but many of us are already working professionals juggling careers, families, and education. We bring adaptability, time management, and real-world problem-solving skills.”

“My daily juggling includes owning and operating my own food cart, managing a team, budgeting, shopping, cooking, and logging into class to engage with my peers.”

Despite the valuable skills gained from their lived experiences, students face barriers with the current public accounting recruitment model. Over the past decade,

public accounting has increasingly used complex recruiting processes that open doors to internships and ultimately, permanent positions. Many recruiting events and internship commitments begin as early as sophomore year--often before community college students have even transferred to a university. If on-campus recruiting events don’t include local community colleges, students may miss out entirely. Thankfully, more firms are increasing their outreach in a variety of ways, such as virtual events that include community college students, and these firms are seeing the benefits of connecting with community college talent.

Another challenge is the internship model itself. Since over 50% of Oregon community college students support themselves working full time, half can’t participate in traditional internships without jeopardizing their economic security and ability to stay on track with their remaining education. Students’ reflections on possible solutions for this include:

“Community college students balancing work and family would benefit most from flexible early engagement—virtual mentorships, project-based work, and hybrid networking— offering meaningful industry connections without the limitations of traditional internships.”

“Networking events during business hours don’t work for students balancing jobs, school, and families. Virtual mentorships, evening meetups, and project-based opportunities would make it easier for us to connect with professionals.”

Opening students’ pathways to public accounting

Community college students often use innovation and resilience to find creative avenues to network, build careers, and overcome challenges. This can open up opportunity for potential employers as well. For example, PCC students have practical knowledge through accounting coursework such as the principles of accounting series, accounting applications (QuickBooks), payroll accounting, spreadsheet and data analytics, and income tax preparation using professional tax software. On top of that, many have years of customer service experience in retail and food service. They gravitate towards “earning and learning,” but need the earning element to be economically sustainable. PCC’s career specialists work closely with students to help them

find entry-level roles like accounts payable to get their feet in the door and gain skills. Accounting firms with paraprofessional positions have also given PCC students the opportunity to work alongside CPAs while easing the firms’ labor challenges.

Another successful model to help students gain work experience is MFS CashOregon in Portland, which has a long history of welcoming and investing in college students through the VITA (Volunteer Income Tax Assistance) program. In 2023, thanks to a grant from the Oregon Department of Human Services, MFS CashOregon expanded its outreach with paid student internship positions. While the VITA experience is intensive, PCC students with full-time work and families are taking advantage of this opportunity because the training and work take place in evenings and weekends which align best with their busy schedules. PCC accounting alums have consistently stated that MFS CashOregon was the most impactful and rewarding experience launching their careers.

PCC accounting students also seek to combine career technical skills with professional certifications providing industry verification of these skills. PCC offers the 80-hour Basic Tax Course required for Oregon’s tax preparer certification and many accounting students elect to take this course and sit for the rigorous state exam. Tax students have even expressed interest in expanding PCC’s offerings to include partnership and corporate taxation courses, allowing them to become certified enrolled agents and increase their employability.

As students press forward into the accounting profession and work towards transferring to a four-year university, networking becomes critical. In response to the pandemic and students’ heightened concerns about making connections, the accounting faculty introduced both the Accountlandia hub and a student accounting club two years ago. Accountlandia is a website of academic and accounting resources, including a weekly newsletter and podcast series that help students build connections and confidence. The PCC accounting club is student-led and invites members of the accounting community to speak on topics from recruiting to forensic accounting to working for the Internal Revenue Service. Nearly all events are offered virtually to promote student access. Students say these programs have built their sense of belonging in college and in the field of accounting.

All these examples illustrate how community college accounting students are ready to engage with their chosen profession. The nature of their lives requires innovative approaches by students, faculty, and employers, but the results are impressive.

How employers can work with their local community college

Conversations with faculty Job boards

Share job and internships openings

Speak to classrooms or accounting clubs

Encourage aspiring CPAs on their path

Look for ways to partner and collaborate

In addition, some community colleges have advisory committees of industry experts for each of their career technical programs and actively seek members to provide feedback about topics including emerging trends, labor needs, and curriculum recommendations. Not all community colleges use networked career platforms like Handshake, but most have job boards for their students through their career centers and encourage employers to share opportunities.

Advisory committees

Share industry needs and recommendations

Faculty also know the benefits of networking with their community and appreciate conversation and collaboration with accounting professionals. There are many community college accounting programs throughout Oregon and contact and partnership information for the faculty can be accessed by reaching out to the business program.

Sources for data:

Oregon Higher Education Coordinating Commission Community College Dashboard

• Nearly 8,000 business students

• 33% Pell recipients

• 48% 25+

Community College Research Center

Student demographics:

• 55% are financially independent of parents

• 41% of undergraduates are at community colleges

• Almost three quarters work and 46% work full-time

• 80% want to transfer to a university, but only 31% actually do within 6 years

• 45% are first-generation students

Community college accounting students bring exceptional determination, practical skills, and adaptability to the table. They manage demanding lives with grace and persistence, developing strengths and skills that are directly transferable to the accounting industry. Recruiters, employers, and accounting firms who connect with community colleges will find skilled, motivated students who are ready to contribute meaningfully to the accounting profession.

Cynthia Killingsworth has eighteen years’ experience as an accounting instructor at Portland Community College. Previously she worked ten years in public accounting, eight years as a revenue agent and criminal investigator with the Internal Revenue Service, and interned with the Washington State Auditor’s Office.

PCC Institutional Effectiveness Data for business students

• 30% 30+

• 58% first-generation college students

• 50% work full-time

Inside Higher Ed

• Recovery from an extended period of enrollment declines across the nation, with an increased interest in certification programs

• Accountlandia site contact: cynthia.killingsworth@pcc.edu

PCC Accounting Club contact: teresa.langford@pcc.edu

PCC “Hire a Panther” job board

• MFS Cash Oregon

Oregon wants you to become a CPA. Join this rewarding and dynamic profession. Looking to get started? Here is a map of Oregon community colleges as well as a list of Oregon universities with accredited accounting programs. For more information on student programs or to find out how you can connect with classrooms, contact OSCPA Membership Manager Kate Harrison at kharrison@orcpa.org.

Oregon universities with accredited accounting programs:

• Bushnell University, Eugene

• Corban University, Salem

• Eastern Oregon University, La Grande

• George Fox University, Newberg

• Linfield University, McMinnville

• Oregon Institute of Technology, Klamath Falls

• Oregon State University, Corvallis

• Pacific University, Forest Grove

• Portland State University, Portland

• Southern Oregon University, Ashland

• University of Oregon, Eugene

• University of Portland, Portland

• Warner Pacific University, Portland

• Western Oregon University, Monmouth

Does one mentor stand out from your time at Linn-Benton Community College?

My mentor Sonya James has been a big help while I have been attending Linn-Benton Community College. When I faced obstacles during my academic year, I could always spend time with her just by calling. Her guidance helped me keep perspective and reframe things as growth opportunities. For example, I became a first-time dad during my first year in college. When my wife started to really struggle with postpartum mental health during our daughter’s infancy, I learned to adjust quickly. I am still learning how to really support her and just be there with her. I leaned on family and resources at Linn-Benton. I feel like I would have not made it this far without them and I am grateful that I get to keep going.

2025 OSCPA Educational Foundation Recipient Suzanne P. McGrath Endowment Scholarship

What are your future goals, and how will you define success?

My future goal is to graduate from Oregon State University with a degree in Accountancy, then gain work experience in public accounting Thanks to the Degree Partnership Program it has been a smooth transition. For me, success is contributing to something greater than myself. If I can do that every day in some way, then I count that as a win.

What advice would you give to community college students as they pursue a CPA career?

My advice is to follow what fascinates you. Some states have recently added alternative pathways to CPA licensure, so new possibilities are emerging every day

Community college: First-year Oregon community college students who are studying accounting and will be enrolling full-time in their second year at an Oregon community college, are eligible to apply for a $1,000 scholarship.

Community college transfers: Full-time Oregon community college students, including Oregon residents attending any out-of-state community college, who will be transferring in the fall to an accredited Oregon university and plan to major in accounting, are eligible to apply for $3,000 scholarships.

Watch for the next scholarship application window Fall 2025.

Oregon accounting students can sign up for a free OSCPA membership! Learn more and sign up at www.orcpa.org/student.

Klamath Community College transferring to Eastern Oregon University

2025 OSCPA Educational Foundation Recipient McPherson Family & Friends Scholarship

Does any professor stand out from your time at Klamath Community College?

My advisor, Lacey Hammond, has really stuck out to me and has helped me through the process of getting my associates degree. She has been a big help and I am truly grateful for having an advisor like her.

What are your future goals, and how will you define success?

My future goal is to further my education and get my masters degree. I will define success when I feel accomplished with what I have done and when I have reached all my goals.

What advice would you give to community college students as they pursue a career?

I would tell community college students to just keep pushing forward and thriving. Start that striving mindset while in community college and it will follow you through university or in your career.

My pathway

Charles Mello Deloitte Portland Managing Partner 2021-22 OSCPA Board Chair

“My first accounting course was with Marley Brown at Mount Hood Community College. It was a launching pad for my career. My time at community college was invaluable in giving me the space to find my future path while also getting much of my core curriculum done at a lower cost. I think the service that community college provides is incredible.”

by Kiara Williams, Rightworks

If you’re a tax preparer, accountant, or financial services provider, you’ve likely heard the term “WISP” mentioned in relation to your professional obligations. But what exactly is a WISP, why do you need one, and what should it include?

If you’re a tax preparer, accountant, or financial services provider, you’ve likely heard the term “WISP” mentioned in relation to your professional obligations. But what exactly is a WISP, why do you need one, and what should it include?

A WISP (Written Information Security Plan) is a comprehensive document that outlines how your business identifies, assesses, and manages cybersecurity risks to protect sensitive client information. It’s not just paperwork— it’s a strategic roadmap for your organization’s data security practices and a requirement for many financial professionals under federal law.

A WISP matters for several critical reasons:

• Legal compliance: For tax professionals, a WISP isn’t optional. When renewing your PTIN (Preparer Tax Identification Number) on IRS form W-12, Question 11 requires you to confirm that you have a WISP in place. Falsely stating you have one constitutes perjury and could result in license revocation or PTIN termination.

• Business survival: With a proper WISP, your firm will know exactly how to respond to potential breaches, minimizing damage and recovery time.

• Insurance and liability protection: Having a WISP in place helps protect your business if you need to make an insurance claim after a data breach. (Some insurance companies have refused to pay damages because the insured party did not have a WISP in place.)

• Client trust: Your clients trust you with their most sensitive financial information. A WISP ensures you have proper safeguards in place to protect this data and demonstrates your commitment to security.

The primary goal of a WISP is to help you protect your business. Specifically, your plan should aim to:

• Identify potential risks to the security and confidentiality of client data.

• Implement controls to mitigate those identified risks.

• Monitor the effectiveness of security measures on an ongoing basis.

• Respond appropriately to security incidents when they occur.

• Document compliance with regulatory requirements.

• Create accountability by assigning specific security responsibilities within your firm.

• Build client trust by demonstrating your commitment to data protection.

A well-crafted WISP doesn’t just check a regulatory box—it creates a culture of security awareness throughout your organization and provides a framework for continuous improvement of your security posture.

According to IRS Publication 5708, a comprehensive Written Information Security Plan includes:

Why are you creating your plan? State any legal obligations, then explain what taxpayer information is being protected with the security processes outlined in your document.

Identify who will be acting as your business’s Data Security Coordinator (DSC) and Public Information Officer (PIO).

You must define the duties and responsibilities of your chosen individuals as they pertain to your business, but generally speaking:

A Data Security Coordinator oversees information security processes, from securing data and fixing what’s vulnerable, to training staff about cybersecurity best practices.

A Public Information Officer is the single point of contact for all outward communications related to a data breach incident.

3. Risk assessment

Where may your business’s data be vulnerable? Your risk assessment must list out the type of information your office handles and how that information may be potentially threatened—internally, or externally, disclosed to unauthorized individuals, accidentally deleted, etc. This section of your WISP must also include how you plan to monitor and test these data loss risks.

4. Hardware inventory

This section must include every device that stores or processes PII (personally identifiable information), a record of the type of information stored per device, as well as each device’s physical location.

5. Security safeguards

Document the safety measures and policies you have in place—from multifactor authentication requirements to remote access protocols. Don’t forget to attach your Incident Response Plan, Data Breach Response Plan, and Breach Notification Plan, and how your DSC and PIO will operate in the event of a cyberattack.

This section should also include a “Draft Employee Code of Conduct” with employee training procedures and the steps you take to remove an employee’s access after they’ve separated, are terminated, etc.

6. Implementation clause

Here, you must confirm that your WISP is being implemented in compliance with the FTC’s GLBA (GrammLeach-Bliley Act) and Safeguards Rule (plus any regulations specific to your state.)

WISP best practices (4 tips)

No two plans will (or should) look exactly alike. Its contents depend on your business’s size and complexity, and your data’s sensitivity. However, there are a few best practices that make creating a security plan easier for everyone:

1. Designate a Qualified Individual

Before moving any further—you must assign someone to manage your WISP’s creation, implementation, ongoing maintenance, and any associated costs. This person can

be internal or external to your business, but must be comfortable knowing how to:

• Coordinate risk assessments

• Ensure third-party vendor security compliance

• Manage staff training

2. Use a template

Starting a plan from scratch can be overwhelming, and expensive, even for most security experts. Lean on trusted templates to serve as your get-started guide.

3. Schedule regular reviews

Your WISP isn’t a one-time, set-it-and-forget-it document. It must be reviewed annually, at the very least, to ensure it meets current regulations and addresses evolving threats.

4. Lean on your technology providers

Your technology providers can help make your WISP implementation much, much easier. Instead of hunting down a provider’s certifications yourself, ask them to share documentation about their security controls that support your compliance requirements.

When evaluating potential partners, ensure they:

• Understand regulatory requirements for financial services

• Clearly explain how their solutions address WISP requirements

• Get help writing your security plan

The right WISP doesn’t just fulfill a regulatory requirement–it helps you identify where your business may be vulnerable to a cyberattack.

Download our free WISP template to begin outlining your comprehensive defense plan.

And don’t forget—we’re here to help bolster your security strategy, assess your vulnerabilities, and guide your WISP creation.

Kiara Williams is Content Strategy Manager at Rightworks. She has been writing for the accounting profession for over seven years, developing eBooks, infographics, articles, and whitepapers on topics ranging from cybersecurity to culture.

by Claire Burke, CPA

In the accounting and finance world, the adoption of new technology is gaining speed, providing both opportunities and challenges for organizations. As we corporate finance professionals strive to drive greater efficiencies and value by implementing the tools available today, I wonder just how far we’ll be able to go with the technologies of tomorrow.

Let’s first imagine a world where certain finance functions are performed automatically, like accounts payable and receivable processing, journal entry preparation, account reconciliations, daily system balancing, and compiling spreadsheets to create financial reports. Next, imagine us accounting and finance professionals being able to focus more exclusively on value-added work, like analyzing data outputs, reviewing trends and flux analyses, and spending more time understanding the drivers impacting financial results to provide meaningful insights to business leaders. Fortunately, this is becoming less of a “what-if scenario” thanks to artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA). As a reminder:

AI is essentially a collection of technologies that use ML and other techniques to help a business perform tasks that typically require human intelligence. It’s a computer’s ability to learn and mimic human thinking, like judgement-based decisions, reasoning, and cognition.

ML is the use of algorithms and data to enable a computer to learn from data and make decisions or predictions without being explicitly programmed to do so.

RPA uses software to automate repetitive production tasks to streamline business processes. It also mimics human behavior to automate consistent, routine workflows in an effort to boost productivity (think bots). It’s a great tool for processes that involve a high-transaction rate of repetitive tasks. Notably, the use of bots in the business world has become so pervasive that they’re now more frequently referred to as “digital workers.”

When combined, these technologies create intelligent automation - a scalable automation approach that can significantly improve efficiency and accuracy.

While we’re not yet at a point where we can automate all accounting and finance functions, there are several workflows that are already strong candidates for what can be automated now. For example, accounts payable can use RPA to streamline the workflow of approving invoices, matching invoices to purchase orders, and issuing payments.

Another use case is financial reporting, where RPA can automate the process of data collection, analysis, and report generation. Many of us are still using spreadsheets for more customized financial reporting and analysis, which entails compiling data from multiple files, editing links to these files, or worse, inputting data directly in the spreadsheet from other sources. By teaching software that uses RPA to do this work, the process can be automated and completed with a

few mouse clicks, cutting the time needed to perform a task from hours to minutes. It also improves the quality of the financial reports by enhancing accuracy and reducing human error. AI can also assist with account reconciliations, turning a time-consuming, rote task into a more streamlined, realtime process.

While all of this fancy process automation likely sounds great, there are some challenges in making it a reality. One challenge, for example, is the resources needed to implement the technology, both the monetary and human capital kind. Not surprisingly, some technology solutions are expensive, and they take time and thorough planning to execute well. One of my favorite tools when considering an investment is a cost-benefit analysis, which allows you to lay out all the expected benefits to your organization. Ultimately, it helps justify the cost of either moving forward or not moving forward with the technology.

Also, process mapping the workflow to be automated can help you understand what challenges you’re solving, which can go a long way in ensuring you get what you need and remain within your budget and timeline. Of course, also bringing in the right people to provide input into the buildout helps mitigate missing a key element in the process.

Importantly, cybersecurity challenges can also come into play depending on the solution and your organization’s security policies. It’s best to get your IT team involved upfront when evaluating solutions to ensure they meet the security requirements of the organization.

Another challenge in implementing these technologies is the talent needed. With the changing landscape of the accounting and finance field, our talent needs are also changing. Today’s new technology solutions open the door for accounting and finance professionals to spend more time analyzing data and providing those valuable insights.

Of course, not everyone has the ability to be analytical, and this brings in another challenge. Having an analytical mindset is a difficult skill to teach if you want to upskill existing employees. There was a time when being detailoriented, organized, and possessing strong technical accounting knowledge (or at least having an aptitude to gain this knowledge) was enough. However, today we also need folks to have critical-thinking and problem-solving abilities.

The ideal accountant in this world of automation needs to be more of an accounting analyst versus a traditional staff accountant. And did I mention that they also need to be well-versed in multiple visualization tools, such as Tableau or Power BI, and capable of using them to extract accurate insights?

Admittedly, I can be dazzled by new technologies and excited by their potential. Still, I understand that, like any organization, we have to prioritize corporate resources. But while there are costs to these technologies, there’s also a cost of not implementing them. In a world where organizations are striving for greater efficiencies to drive down costs and be more competitive, falling behind competitors by not addressing inefficiencies could cost your organization more in the long run.

Claire Burke is Chief Financial Officer and Treasurer at Dearborn Group. Reprinted courtesy of Insight, the magazine of the Illinois CPA Society.

Want to learn more about AI?

Technology Conference with K2 Enterprises (2 days)

www.orcpa.org/cpe/W80716

• June 12-13, 2025

CFO Series: Preparing for Trouble - 7 Tech & 1 [NT]

www.orcpa.org/cpe/W80771

• June 16, 2025

K2’s Artificial Intelligence for Accounting and Financial Professionals (4 hours - late morning)

www.orcpa.org/cpe/W80814

• July 29, 2025

How AI Fits into the Accounting World (2 hours - late morning)

www.orcpa.org/cpe/W80822

• August 19, 2025

A C O R N H O L E S H O W O W N

ROGUE EASTSIDE PUB & PILOT BREWERY

928 SE 9th Avenue | Portland June 12, 2025

Join us as we pit lawyers and accountants against each other. Who is better at cornhole? Help us find out! Toss some bags, make new connections, and support a great cause.

Brought to you by the OSCPA Young Professionals Committee and the MBA’s Young Lawyers Section

On-demand CPE from OSCPA gives you the flexibility you need to maximize your time. Gain access to convenient learning options at special member savings through our partnerships with Surgent CPE and AICPA.

Surgent’s Unlimited Plus CPE Package — $595* for OSCPA members

• Access to all Surgent live webinars (1,200+) to include late-breaking tax updates

• Over 250 on-demand/self-study courses

• Special member fee of $595 available through 6/13/25.Thereafter, member fee is $625.

To order: www.orcpa.org/cpe/S03692

Surgent’s Unlimited Self-Study CPE Package — $380 for OSCPA members

• Over 250 on-demand/self-study courses totaling over 1,000 CPE credit hours

• Access for 12 months from date of purchase

To order: www.orcpa.org/cpe/S03694

AICPA Annual WebcastPass — $575 for OSCPA members

• Unlimited access to 500+ webcasts featuring top experts, regulators, agency representatives, and more

• Immediate access to certificates of completion with zero tests

• Access to archived webcasts on-demand

To order: www.orcpa.org/cpe/S03696

AICPA CPExpress — $385 OSCPA members

• Presented in one- or two-hour increments

• Key topics Accounting, Assurance, Ethics, Employee Benefit Plans, Not-for-profit, Fraud and forensics, and more

To order: www.orcpa.org/cpe/S03695

Construction Industry Conference

May 2, 2025

In-person: www.orcpa.org/cpe/11220

Webcast: www.orcpa.org/cpe/W80711

Governmental Accounting & Auditing Conference

May 20-21, 2025

In-person: www.orcpa.org/cpe/11222

Webcast: www.orcpa.org/cpe/W80713

Real Estate Conference

June 5, 2025

In-person: www.orcpa.org/cpe/11223

Webcast: www.orcpa.org/cpe/W80715

May 13, 2025

In-person: www.orcpa.org/cpe/11221

Webcast: www.orcpa.org/cpe/W80712

May 30, 2025

Webcast: www.orcpa.org/cpe/W80714

June 12-13, 2025

Webcast: www.orcpa.org/cpe/W80716

June

In-person: www.orcpa.org/cpe/11224

Webcast: www.orcpa.org/cpe/W80717

June

In-person: www.orcpa.org/cpe/11225

Webcast: www.orcpa.org/cpe/W80718

200+

www.orcpa.org/cpe

Day 1

Minding the GAAP - Webcast

May 15, 2025 - #W80738

Day 2

Enhancing Productivity - Webcast

May 19, 2025 - #W80740

Day 3

Doing the Right Things Right - 7 Tech & 1 [NT]Webcast

June 10, 2025 - #W80761

Questions: Contact OSCPA at profdev@orcpa.org; 503-641-7200 / 800-255-1470, ext. 3.

Day 4

Preparing for Trouble - 7 Tech & 1 [NT] - Webcast

June 16, 2025 - #W80771

Day 5

Sign up by May 9 and save $25. That’s a savings of $125 on the full series! Register: www.orcpa.org/cpe and enter the event number. Designed for CFOs, aspiring CFOS, senior level financial managers, and executives. CPE: 40 / Level: 2 (Intermediate)

Leading and Reporting - 2 Tech & 6 [NT] - Webcast

June 20, 2025 - #W80783