Publisher

Oregon Society of CPAs

Mailing address

10206 SW Laurel St., Beaverton, OR 97005-3209

503-641-7200 | 800-255-1470 | Fax: 503-626-2942 www.orcpa.org | information@orcpa.org

Chair

John D. Hawkins

Chair-Elect

Gary A. Holcomb

Vice Chair

Adam R.K. Abplanalp

Past Chair

Tracy M. Allen

Board of Directors

Tricia S. Duncan

Jonathan D. Grover

Cameron Irtifa

Megan S. Kurz

Michael L. Lortz

Tiffany K. Nash

Harriet A. Strothers

Ray L. Widmer III

Yvonne D. Zbranak

President/CEO

Chapter Council Chairs

Benton-Linn

Ross E. Holliday

Central Oregon

Yvonne D. Zbranak

Eastern Oregon

Jody L. Deardorff

Emerald Empire

Sarah C. Coffman

Mid-Columbia

R. Angelo Sampson

South Coast

Larry A. Reiber

Southern Oregon

Matthew L. Bowers

Sherri L.D. McPherson, IOM, CAE

Managing Editor Analiese Terrazas aterrazas@orcpa.org

Editor

Susan Fleming sfleming@orcpa.org

The Oregon Society of CPAs assumes no responsibility for statements or advertisements herein and reserves the right to reject any advertising. Statements and opinions expressed are those of authors and not necessarily those of OSCPA. Publication of an advertisement does not constitute an endorsement of the product or service by Accounting Connect or OSCPA.

Update your contact information at www.orcpa.org/my-cpa/profile

Copyright© OSCPA 2024

Magazine design by Joleen Funk

joleen.funk@gmail.com

Stock images by istockphoto.com & stock.adobe.com

Cover image by Kathryn Davidson, Photos by Orion

Connect with OSCPA

What aspiring professionals don’t understand about the accounting world 22

Building a diverse ecosystem 26

A lifetime of learning: From the fast lane to chairing the Board 30

Generative Artificial Intelligence solutions: Understand your risks 37

New horizons: Advancing culture across generations 5

Member News 7

2024-25 Board of Directors 15

Volunteer Thank You 17

Professional Development 40

Oregon Community Foundation 2

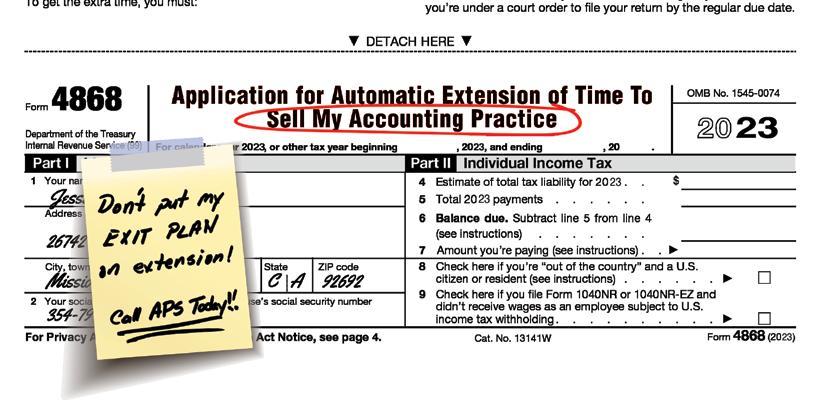

Private Practice Transitions 25

Accounting Practice Sales 45

I am honored to serve as Chair of the Oregon Society of CPAs Board of Directors for 2024-25 and am enthusiastic about the year to come. We are in a time of great change. Like many other professions, the accounting profession is experiencing a number of challenges, but we should also consider that we have many exciting opportunities before us. I am excited to be in a role where I can impact and support OSCPA members to gain awareness of these opportunities.

In preparation for this article, I took time to reflect on my professional background as a tax practitioner within a public accounting firm. I have been in tax my entire career and when this issue of the Society’s magazine publishes May 1, I will have completed my 38th tax season. For most of my career, I described my firm as one that provided traditional services of tax, accounting, and audit. Today, our clients now look to us for those valued traditional services and more. This has greatly expanded the breadth of what we do. We serve clients as their most trusted advisors. This is desired by our clients — and is also an opportunity for the profession. Clients want and need consulting and advisory services to run and grow their businesses, and they need our expertise to improve their personal finances. We need to continue to adapt to these additional services that clients want and need from us. This is an exciting time to build on our relevance and thrive.

Although up to this point, I have been sharing my thoughts as a partner and leader of a CPA firm, I seriously encourage members in industry, non-profit, government, and education to consider the above related to the businesses and organizations you work for and with. They too need your guidance, knowledge, and expertise. This is why CPAs are so sought after. Trusted advisors are not limited to those in CPA firms but also the CPAs that serve and support others.

Yes, there are challenges. We have a generational shift in the profession with the retirement of many baby boomers. We are still dealing with the unprecedented challenges of the pandemic, and we are still working on some of them. The pipeline is a challenge and, as humans, it is easy for us to share our negative stories, rather than the positives. Let’s remember to share the good news too.

The generational shift is causing changes. From where I sit, one of my big concerns for tomorrow is the large number of retirements and the need to find replacements and preserve knowledge. Recruitment and retention are also on my mind. What can we do?

I now see many firms focusing on and supporting leadership and soft skill-building, not just technical training. I have been a member of the Society for long enough to know that the

most successful classes we offered as part of our CPE educational curriculum were technical. Soft skill classes simply had low enrollment or would be cancelled. When I was in the beginning stages of my career, I needed to focus on building a lot of technical knowledge all at once, especially since the significant Tax Reform Act of 1986 had just passed! Technology was different then as well. Leadership training was not the focus nor how to manage others.

Today, we are working on getting the next generation of leaders ready with more leadership training and opportunities. Plus, different generations are used to working in groups and have been exposed to leadership concepts much earlier in their education.

Let’s also remember that sometimes the right person is on the right bus, they just may need to move to a different seat.

Other essential functions of leadership include teambuilding and trust. People must have trust in the people leading them. Trust is created with integrity and competence. Team building can be more challenging in hybrid and remote work environments, but it can be done, and pays dividends.

I have emphasized the above topics of technical and nontechnical skill-building, leadership, teambuilding, and trust as I believe in their importance. And I believe hybrid and remote work is a permanent change for business.

Pipeline, including recruitment and retention, is a challenge based on a variety of factors. During and post-pandemic, we have learned to work remotely or in hybrid formats. The challenge is that people are not physically together to ensure culture — we must work on continuing to build and maintain culture. People don’t have as many opportunities to connect about random topics such as how the game went last night, inquiries about their weekend, etc.

However, with time, we realized there are alternative ways of learning and advancing culture across organizations. New and upcoming technology allows us to stretch our wings

and hire broadly, work hybrid schedules, and navigate digital challenges by using tools such as Zoom and Teams.

I’ve talked with several managing partners of Oregon CPA firms, and recruitment and retention continue to be a significant issues, although they seem to have slightly improved this last year. We are hearing that college and university enrollments are improving, as well as an increase in those sitting for the Uniform CPA Exam (a new exam could have influenced that as well). Locally, the OSCPA is working on a variety of projects including working collaboratively with the Oregon Board of Accountancy to reduce or eliminate unnecessary barriers to licensure. Other state societies are doing the same. Nationally, AICPA and National Association of State Boards of Accountancy (NASBA) each have special task forces working to understand the details of the issues to make recommendations for the future.

Returning to the OSCPA, many of the same issues that our members in firms, business, and organizations face, also impact the OSCPA. The Society will develop a new strategic plan next summer as we finish our current 2021-24 plan. We have fantastic leaders on the Board and I’m excited to work with them and our OSCPA professional staff over this coming year as we address the challenges and identify the opportunities.

I wish everyone a wonderful spring.

John D. Hawkins JD, CPA 2024-25 Chair, OSCPA Board of Directors ChairJohn@orcpa.org

John D. Hawkins JD, CPA 2024-25 Chair, OSCPA Board of Directors ChairJohn@orcpa.org

Adam R.K. Abplanalp, Cobalt PC, Portland, Sonjia L. Barker, Perkins & Co., Portland, and Harriet A. Strothers, Delap LLP, Lake Oswego, spoke at OSCPA’s State & Local Tax Conference.

Tracy M. Allen, Aldrich CPAs + Advisors LLP, Lake Oswego, Jason R. Orme, Talbot Korvola & Warwick LLP, Portland, and Joseph P. Sullivan, Delap LLP, Lake Oswego, spoke at OSCPA’s 2023 Professional Issues Update.

Christa M. Bosserman Wolfe, Clackamas River Water, Clackamas, Amy I. John, Oregon Secretary of State Audits Division, Salem, and Tonya M. Moffitt, Merina + Co., Tualatin, spoke at OSCPA’s Winter Governmental Auditing & Accounting Conference.

Kelly S. Bosch, University of Oregon Foundation, Eugene, Jared A. Holum, Perkins & Co., Portland, and Teresa K. Learnt, CareOregon, Portland, were named to Portland Business Journal’s 2024 Executives of the Year.

Nominate yourself or another member for:

OSCPA Board of Directors

The OSCPA Educational Foundation

OCPA/Legislative Action Committee (OCPA/LAC)

OSCPA Group Health Trust

Oregon Board of Accountancy

Joseph E. Fitts was promoted to senior manager at Aldrich CPAs + Advisors LLP, Salem.

Shelby R. Green, Kernutt Stokes LLP, Corvallis, was named as a finalist for the Celebrate Corvallis Junior First Citizen award.

Cass Hausserman, Portland State University School of Business, Portland, presented “A Perfect Storm: The Effect of IRS Incompetence on Taxpayer Behavior” with Mary Marshall at the American Taxation Association Midyear Meeting.

Nicholas A. Murray, Perkins & Co., Portland, spoke at OSCPA’s Not-for-Profit Knowledge Network: Form 990 Refresher.

Timothy J. Nelson was promoted to partner at Delap LLP, Lake Oswego.

Robert M. Prill, Hoffman Stewart & Schmidt PC, Lake Oswego, spoke at OSCPA’s Not-for-Profit Knowledge Network: SAS/Risk Assessment Webcast.

Portland Business Journal released its 2024 list of the Largest Accounting Firms in the Portland Metro Area. The list of CPA firms includes Alten Sakai & Company LLP, Beaverton; CliftonLarsonAllen LLP, Lake Oswego; Delap LLP, Lake Oswego; Deloitte LLP, Portland; Ernst & Young LLP, Portland; Fordham & Co. LLP, Hillsboro; Geffen Mesher & Company PC, Portland; Hansen Hunter & Co. PC, Portland; Hoffman Stewart & Schmidt PC, Lake Oswego; Isler Northwest LLC, Portland; Irvine & Company LLC, Portland; Jones & Roth PC, Hillsboro; Kern & Thompson LLC, Portland; KBF CPAs LLP, Lake Oswego; KPMG LLP, Portland; Maginnis & Carey LLP, Lake Oswego; Moss Adams LLP, Portland; McDonald Jacobs PC, Portland; Perkins & Co., Portland; Talbot Korvola & Warwick LLP, Portland; and Van Beek & Co. LLC, Tigard.

Harry L. Berry

John R. Lauseng, Aldrich CPAs + Advisors LLP, Lake Oswego, joined the All Hands broadcast with Beach Pace, CEO of Big Brothers Big Sisters Columbia Northwest, to discuss the importance of giving back to the community

Wendy L. Campos, Moss Adams LLP, Portland and Jennifer S. Price, Moss Adams LLP, Portland, celebrate Wendy’s honoree status at the 2024 Portland Business Journal Women of Influence awards.

Steven E. Ritchie, Kernutt Stokes LLP, was named to Forbes’s 2024 list of America’s Top 200 CPAs.

Congratulations to Kieran C. Mako, winner of the UWorld Accounting and OSCPA quarterly CPA Exam Review drawing. Kieran is an aspiring CPA currently pursuing a B.S. in Accounting from George Fox University.

Members of the OSCPA community who display a long-time dedication to the CPA profession and the Society are recognized as life members. To achieve life member status, candidates must meet these criteria (a) has been an active member of the Society continuously for a period of forty years and (b) has served for at least one year as a chair or vice chair of a committee, an officer of a chapter, or in leadership as a member of the Board of Directors for one of the Society boards.

Thomas A. Davies, Albany

David L. Girt, Portland

Robert N. Griffith, Lake Oswego

Donna Klostermann, Portland

Douglas W. Oas, Portland

Jan Ellen Pailthorp, Oregon City

Linda P. Smyth, Tigard

Michael N. Stone, Lake Oswego

Paul D. Waldram, Portland

The journey to earning the CPA credential unfolds through years of academic pursuit, months dedicated to preparing for the Uniform CPA Exam, hours gaining essential work experience, and culminates at the pivotal moment when you receive the prestigious designation: CPA.

Congratulations new CPAs. We are proud and excited to welcome you to the profession.

Diana K. Bautista, Connected Professional Accountants LLC, La Grande

Kamela C. Bogle, Jones & Roth PC, Eugene Yi-Hsuan Chien, Hansen Hunter & Company PC, Portland

Kiley R. Collins-Wright, Geffen Mesher & Company PC, Portland

James M. Daggett, Market Express LLC, Portland

Connor J. Drath, Moss Adams LLP, Eugene

Laura Engel, REDW LLC, Salem

Matthew Fargo, Blue Whale Accounting, St Louis, MO

Marchelle M. Farmer, Oregon City

Cooper A. Gambee, Hudspeth & Company PC, Portland

Jennifer E. Gragg, CliftonLarsonAllen LLP, Lake Oswego

Aaron T. Hiddleson, Oregon Secretary of State Audits Division, Salem

Austin B. Hoyle, RF Associates LLC, Portland

Zane B. Johnson, Moss Adams LLP, Portland

Nathaniel C. Khaw, Isler Northwest LLC, Portland

David V. Levitskiy, Moss Adams LLP, Portland

Michael M. Mayper, PricewaterhouseCoopers LLP, Portland

Orell J. Moreno, Callan Accounting CPAs & Advisors LLC, Bend

Kody H. Moss, Barnett & Moro PC, Hermiston

Hanh H. Nguyen, The Michael L Larson Company PC, Lake Oswego

Thy A. Nguyen, Fellner & Kuhn LLP, Portland

Trang Nguyen, BSM CPA Group LLC, Clackamas

Annika C. Noreus, Kern & Thompson LLC, Portland

Jason M. Park, Jones & Roth PC, Eugene

Bethany J. Phillips, Moss Adams LLP, Portland

Joshua P. Quinn, REDW LLC, Salem

Wanda F. Santos, Watters + Fryer CPAs, Roseburg

Madison R. Weidner, Hoffman Stewart & Schmidt PC, Lake Oswego

Kristen I. Yeoh, Moss Adams LLP, Portland

Benton-Linn

Samuel B. Cleary, Kernutt Stokes LLP, Corvallis

Kimberly G. Dowe, Kernutt Stokes LLP, Corvallis

Krista H. Nunn, RP Smith CPA, Rickreall

Richard M. Prewitt, Oregon State University, Corvallis

Hope C. Rogers, Kernutt Stokes LLP, Corvallis

Ashley M. Wolfe, Wolfe Tax & Accounting LLC, Dallas

Emily S. Wooldridge, Kernutt Stokes LLP, Corvallis

Central Oregon

Mitchell Bowen, Sensiba San Filippo LLP, Bend

Sindia Martinez Pipersburg, Sensiba San Filippo LLP, Bend

LeeAnn A. Nelson, Chris Mahr & Associates CPAs, Bend

Alyssa W. Potok, Callan Accounting CPAs & Advisors LLC, Bend

Ashlyn Wavra, Jones & Roth PC, Bend

Eastern Oregon

Diana K. Bautista, Connected Professional Accountants LLC, La Grande

Crystal R. Chase, Anderson Boylan Ramos PC, Hermiston

Andrew H. James, Barnett & Moro PC, Hermiston

Anthony E. Ronquillo, Dickey and Tremper LLP, Pendleton

Emerald Empire

Connor J. Drath, Moss Adams LLP, Eugene

Sara D. Dreier, Wicks Emmett LLP, Roseburg

Kelly A. Jones, Moss Adams LLP, Eugene

Kyle M. Kavanagh, Jones & Roth PC, Eugene

Stephanie C. Lansdon, Eugene

Rachael Myers, Wicks Emmett LLP, Roseburg

Lita J. Mylenek, Kernutt Stokes LLP, Eugene

Debbie K. Robertson Shaw, Robertson Shaw CPA LLC, Sutherlin

Wanda F. Santos, Watters + Fryer CPAs, Roseburg

Honore E. Scribner, B\Val CPAs & Advisors LLP, Eugene

Chad Steinhauer, Kernutt Stokes LLP, Eugene Court Wilson, Eugene

Metro Portland

Ayde Alvarado, Moss Adams LLP, Portland

Shari A. Anderson, Shari A Anderson CPA, Oregon City

Leila E. Annen, Moss Adams LLP, Portland

Jacob A. Autry, TD Consulting Group PC, Milwaukie

Emily J. Bertrand, Hoffman Stewart & Schmidt PC, Lake Oswego

Brandi I. Bigelow, Delap LLP, Lake Oswego

Aditi A. Bodas, Hoffman Stewart & Schmidt PC, Lake Oswego

Kayleb E. Brooks, PricewaterhouseCoopers LLP, Portland

Robin Carr, Dougall Conradie LLC, Portland

Jerry D. Catlin, Full Value Tax, Portland

Michael Chaney, Moss Adams LLP, Portland

Deborah A. Clark, Talbot Korvola & Warwick LLP, Portland

Marc L. Curey, Brown & Bakondi CPA Group PC, Oregon City

Karla E. Curiel, Technivorm Moccamaster USA Inc., Portland

Austin Damron, Moss Adams LLP, Portland

Jonathan P. Davenport, Hoffman Stewart & Schmidt PC, Lake Oswego

Brianna H. Dyer, Alten Sakai & Company LLP, Beaverton

Marchelle M. Farmer, Oregon City

Brianna N. Finch, PricewaterhouseCoopers LLP, Portland

Korey M. Fountain, Hoffman Stewart & Schmidt PC, Lake Oswego

Cooper A. Gambee, Hudspeth & Company PC, Portland

Jennifer E. Gragg, CliftonLarsonAllen LLP, Lake Oswego

Amit Gulecha, Amit Gulecha CPA PC, Portland

Kristen M. Guzman, McDonald Jacobs PC, Portland

Bonny L. Hayes, REDW LLC, Salem

Victoria L. Holt, Deloitte LLP, Portland

Dominik Hurst-Mayr, Moss Adams LLP, Portland

Jane J. Jaramillo, WJR II LLC, Portland

Seth Johnson, PricewaterhouseCoopers LLP, Portland

Zane B. Johnson, Moss Adams LLP, Portland

Austin Jones, Geffen Mesher & Company PC, Portland

Robert D. Jurgenson, Robert Jurgenson PC, Portland

Amy L. Kennedy, Clarity Tax Service, Portland

Shalaka Khasnis, Gary McGee & Co. LLP, Portland

Katarina A. Krouse, PricewaterhouseCoopers LLP, Portland

Tonya M. Krzeminski, Fischer Hayes Joye & Allen LLC, Salem

Niss A. Lagahi, Geffen Mesher & Company PC, Portland

Trent Lawrence, Hoffman Stewart & Schmidt PC, Lake Oswego

Lawrence R. Levinson, Tax Problem Solutions Inc, Lake Oswego

David V. Levitskiy, Moss Adams LLP, Portland

Isaac J. Mansuetti, KPMG LLP, Portland

Rachel Mardock, PAE Consulting Engineers, Portland

Brendon W. Marrow, Hoffman Stewart & Schmidt PC, Lake Oswego

Michael M. Mayper, PricewaterhouseCoopers LLP, Portland

Tanya I. Mena, Geffen Mesher & Company PC, Portland

Steven J. Merriss, Appel CPA, Portland

Alla V. Meyers, Backstop Tax LLC, Beaverton

Lisa Morris, Berg Morris LLC, Portland

Patricia Mutariswa, Dougall Conradie LLC, Portland

Trang Nguyen, BSM CPA Group LLC, Clackamas

Annika C. Noreus, Kern & Thompson LLC, Portland

Adam C. O’Hare, Kuenzi & Company LLC, Salem

Samuel T. Oldham, Geffen Mesher & Company PC, Portland

Thanh Pham, Alten Sakai & Company LLP, Beaverton

Bethany J. Phillips, Moss Adams LLP, Portland

Andrew T. Platte, Dougall Conradie LLC, Portland

Trisha Ann A. Reforma, Jones & Roth PC, Hillsboro

William H. Reph, McDonald Jacobs PC, Portland

Elizabeth Ries, Talbot Korvola & Warwick LLP, Portland

Jesse S. Rogers, DiLorenzo & Company LLC, Beaverton

Joshua Rudnick, Dougall Conradie LLC, Portland

Caryn R. Rutherford, Alten Sakai & Company LLP, Beaverton

Matthew H. Shanafelt, Shanafelt Associates LLC, Gresham

Abigail A. Smith, Geffen Mesher & Company PC, Portland

Natalie N. Smith, Gary McGee & Co. LLP, Portland

Lynette D. Soares, Delap LLP, Lake Oswego

Jack C. Strother-Blood, Moss Adams LLP, Portland

Julie F. Tiffee, Jack W Olds & Company LLP, Beaverton

Ashley Van, Delap LLP, Lake Oswego

Tamara L. Ward, Van Beek & Co. LLC, Tigard

Madison R. Weidner, Hoffman Stewart & Schmidt PC, Lake Oswego

Janet L. Williams-Reyes, Skyview Asset Management, Portland

Southern Oregon

Andrew Sherwood, KDP Certified Public Accountants LLP, Medford

Matthew Fargo, Blue Whale Accounting, St Louis, MO

Patricia M. Lawrence, Opsahl Dawson & Company, Vancouver, WA

Debra L. Owens, Make it Happen Business Solutions Inc., Linn Creek, MO

Mary V. Parmer, Moss Adams LLP, Seattle, WA

Jennifer K. Rosenlieb, Checked & Balanced Inc., Vancouver, WA

Connor D. Stanton, The Railsback Group PC, Vancouver, WA

Ian M. Bellamy, Portland

Rachel L. Ferguson, Albany

Patrick Haley, West Linn

Alana Kelley, Corvallis

Kacelyn Kubojiri, Hilo, HI

Andrew Levko, Hoffman Stewart & Schmidt PC, Lake Oswego

Chee Kheng Lim, Hillsboro

Eric J. Loechle, Aldrich CPAs + Advisors LLP, Lake Oswego

Kaylan H. Ma, Salem

Felipa Martinez Contreras, Beaverton

Michael D. Orme, Beaverton

Monique Platz, Kern & Thompson LLC, Portland

Yasmynn Rain, Portland

Kelsey Rundorff, Portland

Faith V. Thompson, Gladstone

Keith Van Ausdall, Portland

Charlene A. Vieaux, Bend

Robert Wunar, Portland

“Tell someone about your career. Share your story and share the OSCPA’s story. Stories build connections and connections help us broaden our reach and bring others into the profession. Being a CPA is all about helping. Our younger generations want to make a meaningful impact. Help them understand just how we do that through the work we do. Tell your story!”

— Tracy M. Allen, 2023-24 Past Chair, OSCPA Board of Directors

Director

Tricia S. Duncan Jones & Roth PC, Eugene

Gary A. Holcomb Ernst & Young LLP, Portland

Director

Jonathan D. Grover City of Hillsboro, Hillsboro

Director

Tiffany K. Nash Kernutt Stokes LLP, Eugene

Director

Cameron Irtifa CPA Service LLC, Beaverton

Director

Harriett A. Strothers Delap LLP, Lake Oswego

Aldrich CPAs + Advisors LLP, Lake Oswego

Director

Megan S. Kurz

Premier Community Supports, LLC Grants Pass

Director

Ray L. Widmer III Moss Adams LLP, Eugene

Director

Michael L. Lortz Downtown Development Group LLC, Portland

Director

Yvonne D. Zbranak Silverline LLP, Bend

As we bid farewell to our incredible outgoing board members, let’s take a moment to showcase the impact they’ve left. Their dedication, leadership, and vision have shaped the future of OSCPA. Outgoing Board Chair Tracy Allen presented spring plants to outgoing board members as a thank you, and as a reminder that volunteers plant seeds that will continue to grow and flourish.

2023-24 OSCPA Board of Directors

As the OSCPA fiscal year rolled over April 1, many of the 2023-24 Board members continued their terms of service.

We’d like to give special recognition to those whose terms of Board service concluded March 31, 2024. Deepest thanks and appreciation to Geoffrey T. Dougall, Dougall Conradie LLC; David S. Porter, Retired; Karen C. Anderson, Onboard Dynamics Inc; and Pedro J. Nunez Dieguez, People First Consulting LLC, for your commitment and dedication to the OSCPA Board of Directors.

Chair

Tracy M. Allen, Aldrich CPAs + Advisors LLP

Chair-Elect

John D. Hawkins, REDW LLC

Vice Chair

Gary A. Holcomb, Ernst & Young LLP

Past Chair

Geoffrey T. Dougall, Dougall Conradie LLC

Secretary

Adam R.K. Abplanalp, Cobalt PC

Treasurer

David S. Porter, Retired

Director

Karen C. Anderson, Onboard Dynamics Inc.

Director

Jonathan D. Grover, City of Hillsboro

Director

Megan S. Kurz, Premier Community Supports

Director

Tiffany K. Nash, Kernutt Stokes LLP

Director

Pedro J. Nunez Dieguez, People First Consulting LLC

Director

Ray L. Widmer III, Moss Adams LLP

Director

Yvonne D. Zbranak, Silverline LLP

Thank you to the following volunteers who contributed their time and talents in the 2023-24 OSCPA fiscal year.

Accounting & Auditing

Erin B. Galyean

Leena A. Kabadi

Alayna Marten

John S. Mohler

Paula J. Palmer

Mark A. Sleasman

Diana B. Strassmaier

Hiroshi Yoshimori

Construction Industry

Richard D. Anderson

Dane E. Brammer

Carrie L. Fortier

Shane D. Gentry

Terry L. Griffin

Carol Ann Kirby

Daryl V. Knox

Todd D. McDaniel

Michael D. Sause

Sarah C. Shaw-Stahlke

Christopher D. Valentine

ERISA

Victoria L. Bryson

Evan B. Dickens

Jeffrey A. Hart

Ryan A. Northcutt

Karen D. Porter

Mark A. Sleasman

Estate Planning

Linda M. Barnett

Nancy L. Bolton

Cameron Clark

Jason A. Clark

Reginald deGuzman

Chantha V. Dinelli

Darryl G. Eddy

Kristina D. Gochnour

John D. Hawkins

Cameron Irtifa

Kimberly A. Llorens

George S. Middleton

Karey A. Schoenfeld

Philip Shane

Rebecca I. Smith

Farming, Ranching & Agribusiness

Kathryn A. Ashford

Susan K. Crawford

Joseph E. Fitts

Carla H. Himmelmann

David B. Klinger

Minda Lourence

Kari J. Ott

Eugene L. Stewart

Kyle M. Walter

Financial & Retirement Planning

Kathleen L. Bernards

Vanessa DeHaan

Cameron Irtifa

Carol Ann Kirby

George S. Middleton

Michael R. Miller

Nelson E. Rutherford

Mylen N. Shenker

Forest Products

Clinton J. Bentz

Jay D. Broudy

Stefani M. Faunce

Jose B. Gonzalez

Andrew T. Kaiser

Rachel L. Lee

Sarah J. Padfield

Joel L. Powell

Lyn M. Smith

James L. Workman

IRS/Practitioners Forum

Douglas R. Henne

Northwest Federal Tax

Judith E. Killian

Gayle E. Kovacs

Michael R. Miller

Paul T. Mueller

Robert O. Nelson

Daniel R. Pittenger

Real Estate

Adam R.K. Abplanalp

Susan K. Crawford

Reginald deGuzman

Darryl G. Eddy

Cameron Irtifa

Michael L. Lortz

Jonathan R. McGuire

Michael R. Miller

State & Local Taxation

Karen C. Anderson

David L. Austen

Susan K. Crawford

Carla H. Himmelmann

Judith E. Killian

Toshio Kurose

Minda Lourence

Asif I. Muzaffarr

Kurt M. Sand

Diana B. Strassmaier

Penny M. Sweeting

Teresa L. Williams

Stephen B. Workman

OSCPA Strategic Committees

Business Management & Advisory Services

William H. Blair

John M. Gamiles

Cameron Irtifa

Michael R. Miller

Eric G. Nufer

Theresa C. Pilgrim

David S. Porter

Karen L. Rasmussen

Mark L. Skoglund

Audrey L. Stevens

Governmental Accounting & Auditing

Anton P. Ballek

William R. Barker

Bradley G. Bingenheimer

Christa M. Bosserman Wolfe

Gerald W. Burns

Chloe E. Dixon

Janice M. Essenberg

Julie B. Fahey

Cynthia A. Granatir

Jonathan D. Grover

Eileen E. Hendricks

Chelsea A. Hewitt

Philip L. Hopkins

Janell K. Howard

Gary J. Iskra

Amy I. John

Jessica H. Luther-Haynes

John I. Mickelsen

Daniel A. Miley

Tonya M. Moffitt

“Engaging with OSCPA is the best pathway towards investing in your future.” – Daniel Morris

Kevin S. Mullerleile

Kari J. Ott

Ryan T. Pasquarella

Roy R. Rogers

Mylen N. Shenker

Steven L. Tuchscherer

Ashley Tuttle

Ronald R. Vaught

Robert G. Yingling

Leadership Development

Hannah A. Bailey

Jackson Bevens

Natalie R. Heacock

Amanda Lilley

Alayna Marten

Chelsea A. McElroy

Denise K. Petterborg

Krysta L. Smith

Debbie S. Suchan

Selene L. Sullivan

Tracy L. White

Ray L. Widmer III

Christa H. Zumach

Legislative Policy

Tracy M. Allen

Harry E. Bose

Geoffrey T. Dougall

Janice M. Essenberg

Timothy R. Filkins

John D. Hawkins

Douglas R. Henne

Gary A. Holcomb

Thomas C. Maynard

Stephen S. McConnel

Keith H. Meyers

Steven W. Middleton

Robert G. Moody Jr.

Jason R. Orme

Selene L. Sullivan

Jayson F. Wartnik

Not-for-Profit

Thomas Achor

Erica Aitken

Alexandra Aranda

Cynthia A. Barber

Cynthia P. Bartholomew

James H. Brinkman

Gerald W. Burns

Shirley D. Cyr

Christopher Dahlvig

Rene D. Deras

Michael K. Farnsworth

Michelle J. Gall

Ian R. Gelfand

Gary J. Iskra

Todd D. Kimball

William S. Manne

Lorelei G. Martin

Gary N. McGee

Jason T. McGill

John Ng

Kristina L. Oliveira

Cheryl R. Olson

Jennifer A. Perrier

Colleen O. Chernus

Danielle M. Groves

Rebecca A. Hubinsky

Patricia A. Labatte

Briana R. Mathias

Kathryn C. Maxson-Landis

Bri Melo

Jason R. Orme

Krysta L. Smith

Agnes I. Zoltowski

Peer Review

Darlene E. Boles

Harry E. Bose

Mindy S. Davis

Evan B. Dickens

Mark D. Dickey

Sara L. Hummel

“The OSCPA offers many opportunities for CPAs to advance their personal skill set and make connections within the profession that will serve them over their entire career.”– Dave Girt

Russell D. Price

Robert M. Prill

Joseph R. Rosevear

Katie L. Sheffield

Mylen N. Shenker

Kathleen L. Sohl

Eugene L. Stewart

Brooke A. Stout

Sandra A. Suran

Suzanne B. Taylor

Kellie R. White

Robert G. Yingling

Yvonne D. Zbranak

OSCPA Women’s Initiatives

Tracy M. Allen

Elizabeth D. Almer

Emily K. Bradford

Rosemarie Brammer

Travis Irving

William E. Maas

Tiffany K. Nash

Andrew E. Peterson

Robert M. Prill

Richard V. Proulx

Professional Development (CPE)

Adam R.K. Abplanalp

Tracy M. Allen

Karen C. Anderson

James A. Carnegie

Jason A. Clark

Janice M. Essenberg

John M. Gamiles

Douglas R. Henne

Michael R. Miller

Robert G. Moody Jr.

Paula J. Palmer

Hiroshi Yoshimori

Adam R.K. Abplanalp

Katrina M. Anderson

Kathryn A. Ashford

Michelle I. Bacigaluppi

Sonjia L. Barker

Dane E. Brammer

Tandilyn Cain

Chad B. Crawford

Reginald deGuzman

David V. Deming

Geoffrey T. Dougall

James A. Elliott

Thi H. Embury

Chad W. English

Timothy R. Filkins

Craig T. Freeman

Anne-Marie A. Gorbett

Jaime N. Hanford

John D. Hawkins

Douglas R. Henne

Gary A. Holcomb

Carrie T. Huffman

George H. Hughes

Heather L. Jackson

William G. Keller

Judith E. Killian

Toshio Kurose

Heather M. Lacey

Danny J. Lee

Rachel L. Lee

Minda Lourence

Gabriel J. Markiz

Thomas C. Maynard

Daniel D. Morris

Asif I. Muzaffarr

Eileen C. Nguyen

Robert A. O’Neill

Jason R. Orme

Madeline Payne

Heather M. Porter

Katrina Z. Powell

Robert J. Riley

Gregory A. Rogers

Kurt M. Sand

William L. Siebler

Kimberly A. Spaulding

Diana B. Strassmaier

“I met so many people through committee participation in my early years — it helped launch my career.” – Karey Schoenfeld

Harriet A. Strothers

Penny M. Sweeting

Rory B. Tosh

Sean P. Wallace

Valerie Warzon

Daniela Wells

Lene H. Westfall

Stephen B. Workman

Julie L. Yang

Jennifer Young

Bruce D. Zimmerman

Young Professionals

Jasper R. Bernstein

Cameron Clark

Alyssa K. Downs

Shelly G. Hartzell

Rebecca A. Hubinsky

Jacob C. Johnson

Heather M. Lacey

Amanda Lilley

Minda Lourence

Kelly Lutz

Pedro J. Nunez Dieguez

Ruth O. Okenye

Sydney J. Sherman

Macy J. Smetzler

Andrew J. Soltis

Nasreen N. Taha

Daniel J. Wardle

Daniel Whitmore

Agnes I. Zoltowski

OSCPA Governance

OSCPA Board of Directors

Adam R.K. Abplanalp

Tracy M. Allen

Karen C. Anderson

Geoffrey T. Dougall

Jonathan D. Grover

John D. Hawkins

Gary A. Holcomb

Megan S. Kurz

Tiffany K. Nash

Pedro J. Nunez Dieguez

David S. Porter

Ray L. Widmer III

Yvonne D. Zbranak

OSCPA Group Health Trust

Darlene E. Boles

David A. Buettner

James A. Carnegie

Stanley C. Compton

Geoffrey T. Dougall

Brendan A. Hoem

Gary S. Leavitt

James J. Mullaney Jr.

Patrick Priest

Donald W. Schmidt

Michael N. Stone

OCPA/Legislative Action Committee

Adam R.K. Abplanalp

David E. Adams

Tracy M. Allen

Karen C. Anderson

Anna Barnsley Werblow

Darlene E. Boles

Harry E. Bose

James A. Carnegie

Mark E. Damon

Geoffrey T. Dougall

Janice M. Essenberg

Timothy R. Filkins

Cynthia A. Granatir

Jonathan D. Grover

Randall C. Guyer Jr.

John D. Hawkins

Douglas R. Henne

Michele C. Henney

Ross E. Holliday

Amy I. John

Daniel A. Kosmatka

Megan S. Kurz

Michael E. Lynch

Keith H. Meyers

Tonya M. Moffitt

Robert G. Moody Jr.

Tiffany K. Nash

Pedro J. Nunez Dieguez

Douglas C. Parham

David S. Porter

Katrina Z. Powell

Robert J. Riley

Harriet A. Strothers

Selene L. Sullivan

Suzanne B. Taylor

Ray L. Widmer III

Yvonne D. Zbranak

The OSCPA Educational Foundation

David E. Adams

Darlene E. Boles

Christopher Dahlvig

Tricia S. Duncan

Katherine S. Haines

Cass Hausserman

Matthew D.T. Hilton

James J. Jurinski

Suzanne P. McGrath

Sherri L.D. McPherson

Patricia M. Morris

Kara Obermire

Dwayne S. Richardson

Kristine Rupp

David M. Sacoolas

Jennifer M. Valdez

Richard W. Wingard

Richard B. Winkel

OSCPA Board Standing Committees

Audit

Adam R.K. Abplanalp

Darlene E. Boles

Harry E. Bose

John D. Hawkins

David S. Porter

Budget

Adam R.K. Abplanalp

Tracy M. Allen

Karen C. Anderson

Darlene E. Boles

Geoffrey T. Dougall

Jonathan D. Grover

John D. Hawkins

Douglas R. Henne

Gary A. Holcomb

Megan S. Kurz

Tiffany K. Nash

Pedro J. Nunez Dieguez

David S. Porter

Ray L. Widmer III

Yvonne D. Zbranak

Nominations

Matthew L. Bowers

James A. Carnegie

Sarah C. Coffman

Jody L. Deardorff

Geoffrey T. Dougall

James E. Harnish

John D. Hawkins

Ross E. Holliday

George H. Hughes

Charles R. Mello

Larry A. Reiber

Robert A. Sampson

Yvonne D. Zbranak

Professional Conduct (Ethics)

Kathryn A. Ashford

Laura K. Bergstrom

Gerald W. Burns

John D. Hawkins

Ross E. Holliday

Deborah J. Hollingsworth

TeriAnn Kruse

Minda Lourence

Ryan A. Northcutt

8 1 4 6 5 2 7

1 Benton-Linn

3

Chair: Ross E. Holliday

2 Central Oregon

Chair: Yvonne D. Zbranak

3 Eastern Oregon

Chair: Jody L. Deardorff

4 Emerald Empire

Chair: Sarah C. Coffman

5 Mid-Columbia

Chair: R. Angelo Sampson

6 South Coast

Chair: Larry A. Reiber

7 Southern Oregon

Chair: Matthew L. Bowers

8 Upper Northwest Region

Represented by: OSCPA, Beaverton

Interested in getting involved with your chapter?

Contact Sherri L.D. McPherson, IOM, CAE, President/CEO, OSCPA at 503-597-5480 / 800-255-1470, ext. 120; smcpherson@orcpa.org

Can you guess which chapter chair was inspired by Bernie Madoff early on in his career?

“[Madoff] fraud was being uncovered a little before I decided to go to school to be a CPA. There were many financial accounting scandals such as Enron at the time. The CPA license was a natural progression for me as the educational path helped me to learn how to read financial information and understand the mechanisms that allowed the frauds to work.”

Hint: The chapter of this chair had a social at DANCIN Vineyards last fall!

See answer on page 25!

James Parkin, CPA Retired, is the Executive in Residence at Oregon State University, a part-time role where he advises faculty and students on the connection between the classroom and the accounting profession, including the opportunities for accounting majors. Jim draws on his 35-year career at Deloitte to help prepare the next generation of CPAs to be successful. He enjoys giving back to his alma mater, students, and his community. Jim and his two brothers were first generation university students “because their parents insisted on it.” He agreed to share a little about his recent experiences in the classroom.

What has been the most surprising thing from your time in the classroom?

When I graduated, I knew so little about the profession and the opportunities it provided me. Going into my career blindly clearly didn’t hurt me (some might say that my naivete helped), but I could have evaluated opportunities so much better if I was further down the learning curve. I’m surprised at how little that has changed with students today. They still have a lot to understand and learn about the opportunities the accounting profession can provide and the doors it can open for someone who is proactive and eager to learn. That is exactly what I am trying to do in my classroom in helping students “navigate the profession”.

is striking about today’s

Students are really eager to absorb all the information they can and learn from folks in industry. They are sponges, asking good questions and working to get more information from me about what I’ve done and what they could do. They’ve been extremely polite and it’s really been a pleasure to be in the classroom setting with them.

What will help the profession promote itself to future CPAs?

The profession really needs to better discuss the doors that can be opened by beginning a career in accounting. This won’t necessarily be self-serving to the firm’s interest, as many of those opportunities may

be outside public accounting! However, the profession would benefit to explain the breadth of what the firms do beyond accounting and tax, but more importantly how that foundation of accounting and tax develops the skills to bring value to clients. It’s good that the profession has upped the game on their HR programs and has really caught up to the times to help employees’ well-being, but well-being programs are not the end game. Unfortunately, that is what many recruiters are pushing. The students need to know more about what a CPA does, the career opportunities that come with that designation, and professional opportunities as a CPA.

What do today’s firms need to understand when recruiting?

Two things that I would mention. First is a repeat in that the recruiting process needs to help educate the students about the profession, opportunities in the profession, and recruit them into the profession. Talk about the career opportunities they may have and the experiences they can get when beginning a career in accounting or tax. The second thing involves the recruiting process itself. The “continuous recruiting,” which may be beneficial to the firms, is putting excessive pressure on the students. They are getting offers presented to them with very short turnaround for acceptance. They are getting offers as sophomores who are midway through the introductory series of accounting and don’t fully understand even whether accounting is the right major or not. With these pressures, the firms are going to be disappointed when students don’t accept the full-time offer after

the internship or depart very quickly after starting their career. Use the students’ freshmen and sophomore years to help them better understand their career alternatives, the alternative firms, and what professional opportunities could be for them. Begin recruiting students into a firm starting in their junior year and work collaboratively among the firms to coordinate recruiting season and acceptance deadlines.

What would you say to today’s accounting faculty?

There are some really terrific faculty at Oregon State University who are eager to increase the number

of accounting majors and influence the students in a positive way. I would encourage the faculty today to seek out alumni and friends to guest lecture and speak in their classroom settings. More than half of my classes have guest speakers from industry, and I have no problem getting volunteers. The students benefit so much from the speakers, and it connects the academic studies of the textbook to the realities of what we do in the profession.

Interested in sharing awareness of accounting careers by speaking to a college or high school classroom? Contact OSCPA Events & Engagement Specialist Megan Drennan at profdev@orcpa.org.

The DEI journey is just that—a journey. It’s ongoing and requires steadfast attention and effort to be meaningful. As your organization prepares for the changing demographics and disruptive trends that societal evolution promises to bring, operating within a DEI ecosystem may just be the competitive advantage you need to cultivate a diverse and inclusive workplace.

Transforming systems, policies, and practices.

Review and update your policies and practices to ensure they’re fair and inclusive for all employees. This may include flexible work arrangements, family support, parental leave, and/or accommodations for individuals with disabilities.

Provide ongoing training opportunities to raise awareness about unconscious biases, stereotypes, and microaggressions.

This training should empower employees to recognize and address these issues. Additionally, these trainings should include a robust coaching program that provides support and training for employees from underrepresented groups to ascend into leadership positions, fostering a more diverse leadership team.

Equipping the C-suite with inclusive leadership skills.

Having a top-down strategy for DEI is critical. Senior leadership must demonstrate a genuine commitment to DEI through their actions, policies, and decisions.

Your organization should anticipate these feelings and sentiments and have a plan to manage them. Being clear with employees about a particular DEI issue your organization is facing, setting small goals with realistic expectations, and empowering your employees to take actions that move your DEI initiatives forward are all ways that can help you be prepared and respond to these matters.

Establish ERGs based on shared identities or interests to provide space for your employees to connect, share experiences, and offer insights to one another.

Revise and broaden your recruitment strategies to attract diverse candidates. To achieve this, consider expanding recruitment methods to include nontraditional sources, such as social media, alumni clubs, and affinity groups.

This can serve as a benchmark to measure progress from your employees’ viewpoints. By conducting periodic surveys, you can track the effectiveness of your DEI initiatives and make an assessment as to whether those initiatives are having the desired effect.

Set measurable DEI initiatives and regularly communicate progress to your entire organization. Take this step seriously and hold leaders accountable for achieving the goals set by the organization.

Create safe spaces for your employees to discuss DEI, including their concerns and experiences.

Andrea Wright, CPA-IL, MBA, is a Partner at Johnson Lambert LLP. Andrea has been in the industry, serving nonprofit organizations and employee benefit programs for over 20 years. Over the course of her career, Andrea has shared her knowledge and expertise as a contributor to the Illinois CPA Society, AICPA, the Association Forum, and more.

Reprinted courtesy of Insight, the magazine of the Illinois CPA Society.

The invitation to participate in the Member Spotlight series engendered an immediate, visceral reflection of “You don’t want to talk about yourself!” But as I have aged, I have come to realize that, as a Black male, I have a responsibility to talk about myself when I believe it can serve the valuable purpose of advancing both the lives of members of my race and a deeper understanding of my race.

I am the fourth of six children, born and raised in the middle of the Navajo Reservation in Arizona by two of the best parents that ever walked the planet. Both of my parents were educators. My father, a Black man, was a principal at a boarding school and my mother, a Black woman, was a teacher at a neighboring boarding school. Needless to say, education was a focal point in our family.

But it was my follow-up remark that often surprised people. “All I ever see is opportunity, because the right room full of people with no one like me in it is begging for me to occupy that empty space!” I was blessed in life to have support surrounding me at every turn. Family, friends, educators, and professionals constantly told me what I could do, rather than what I could not. Such a circumstance, and the resulting benefits, leave me with a sense of obligation to support others in their worthwhile pursuits.

Unbeknownst to me at the time, my developmental years—growing up as a minority among minorities and in an education-first environment—set the stage for a lifelong journey of continuous learning, both personal and professional. When I earned my degree from Arizona State University in 1987, I could count the number of Black accounting graduates on one hand. When I started my career at KPMG in Phoenix that same year, a period when the accounting world was often identified as “The Big 8,” I could count the number of Black auditors among all eight firms on two fingers.

Both friends and co-workers sometimes asked me if I felt pressure due to the fact that I was almost single-handedly “representing” the Black race in the Big 8 accounting world in Phoenix, and my answer was always the same. No individual has the power or authority to represent any entire race, culture, or group, and more important, no individual should ever be made to feel that they are carrying such a heavy burden.

In addition to my CPA designation, I currently maintain nine other professional certifications. I serve on the AICPA’s ABV Credentialing Committee and the AICPA ABV DEI Task Force. I have served on over 30 boards and commissions, including current service on the publicly traded company boards of NW Natural and the Jensen Quality Growth Fund. These certifications, positions and board roles don’t make me special, but they do provide me the superpower of visibility. If young Black students, adults, and professionals can see me, I guarantee that some of them will believe they can be me—not special, but visible—a superpower that is wonderfully contagious.

As we see Black History Month come to a close, I will state the obvious. Black people have achieved a number of notable accomplishments, including the invention of ice cream, the refrigerator, the spark plug, the clothes dryer, the automatic traffic signal, and something near and dear to all CPAs (at one point)—the pencil sharpener. These accomplishments made them visible.

I have a wonderful, white wife, and three exceptional, mixedrace children, one of whom just celebrated his first work anniversary—as an auditor with KPMG. He could see me, and he knew he could be me. Each of us can take steps to help others ultimately be seen.

When I was invited to participate in the member spotlight series, I was excited and honored to share my perspective

Black identity is not a monolith, especially those who are of the African diaspora. Multiple intersections define my identity: I am Black. I am Asian. I grew up with a Haitian father and a Filipina mother, but I also had a cultural influence from living on Guam for most of my childhood. I lived in Waco and Houston, Texas, for my formative early adulthood, and that helped shape my cultural identity as a Black queer woman being a part of a larger Black community.

My identity plays a role in my career, especially knowing the demographics in the accounting/audit field. In my early audit experiences, I worked with clients in the for-profit corporate world. Most of the time, I was the only Black woman and had a heightened awareness of microaggressions I faced in the workplace. Ultimately, this negatively impacted my work performance, self esteem, and motivation. Once I started having mentors who looked like me, helped me feel supported, and validated my experiences, that was the turning point in my career.

Now that I’m working with non-profit organizations at McDonald Jacobs, I have the opportunity to work with clients that come from more diverse backgrounds. As a manager, I am in a position in my career to be a mentor to the staff I work with and to pay it forward. I feel more confident showing up to work being my most authentic self. For example, I express my culture and identity by fully

“Once I started having mentors who looked like me, helped me feel supported, and validated my experiences, that was the turning point in my career.”

embracing natural hairstyles. It’s empowering to do this in spaces where historically the expectation was to conform to Eurocentric beauty standards.

Black History Month is a great reminder to me about the achievements made by the Black community. A lot of our history is centered on the impacts of systemic racism and slavery, but we sometimes fail to recognize the accomplishments our ancestors were able to achieve despite facing these hurdles. Resilience is in our blood and is a driver for our successes, both individually and as a community as a whole, and that should be celebrated.

Organizations, especially predominantly white institutions, need to recognize that the accounting field continues to lack diversity. There are still inherent biases affecting hiring, retention, and compensation, but it’s not the responsibility of people of color to find solutions or invest emotional labor into addressing these issues. As cliché as it sounds, representation matters, and mentorship from people who look like you or have similar experiences really makes a difference in feeling supported and valued.

2024-25

Chair, OSCPA Board of Directors Principal, REDW LLCThank you so much for meeting today. I wanted to start out by asking you about your path to becoming a CPA.

I gave a talk at a high school recently, and I started off by saying that at age 19 I was a college dropout. I’d thought I would follow in my dad’s footsteps, he worked with people with disabilities. I started down that path and went to community college for about a year and a half. Each quarter the college had us volunteer someplace, and through that volunteer work, I discovered I didn’t want to do that for a career. When I dropped out of school, I was working in restaurants. Later I saw friends of mine open businesses—a restaurant, a bar, etc. Some of them made it and some of them didn’t. I couldn’t help wondering: what’s making the difference? I thought it had to do somehow with the money. Through that, I ended up going back to college and majored in accounting. Math had always been kind of easy for me. My mother had always worked as a bookkeeper, and my grandfather was a PA doing municipal audits. So, some of it was in the genes, but a lot of it was just watching people open businesses, and wondering, why do some succeed and some fail? What can you do to make it more likely to succeed?

I did my undergraduate degree in Business Administration back in Tennessee at Belmont University. I liked the tax side more than audit. And all my tax professors had law degrees. So I decided I also wanted to go to law school. My wife was from Salem originally. She said she wanted to go home. Willamette University in Salem was the solution. One day after my second year at Willamette Law School, I saw Mark Mueller, who was a neighbor of ours. Mark was out on a bike ride with his kids, and he learned I’d just taken the CPA exam. He called me on Monday and asked me to come down to his firm to have lunch. I just thought it was a neighbor calling to have lunch! Next thing I know, I’m going up and down the hall meeting all the partners. I started there as an intern—went from intern to managing partner. I’ve been here 38 years this May.

We read that you took and passed the bar exam, the CPA exam, and became a father all within 10 weeks during the summer of 1987, is that right?

Yes, I took the CPA exam for the first time after my second year of law school. I had four days between my last law

school exam and the CPA exam. I crammed for four days and passed two parts and got scores of 50s with everything else. I passed Business Law (since I’d just finished two years of law school) and Practice. There was a lot of tax on the exam, and I had taken quite a few tax classes in law school. And then the following May, after I finished my last law school tests, I took the CPA exam and passed the remaining parts. My son’s due date was graduation day, just a few days later.

They had a law school graduation party on Friday night, and my wife and I attended. There was a good band and we stayed and listened to them, went home about midnight. At 5:30 in the morning my wife is shaking me, saying, “we gotta go, we gotta go to the hospital.” My son was born at 9:51 that morning. Graduation was the next day. Then I took the bar exam ten weeks later. And passed!

I first joined the Taxation and the Estate Planning Committees. (John has also served on the Audit, Budget, Joint CPA-Attorney, Legislative Action, Legislative Policy, Nominations, and Not-for-Profit Committees, in addition to the Board of Directors.) I just wanted to get involved.

The first thing that stands out is the people I’ve met. When I was younger, there would be other older people on these committees. You’d get to know them and how they progressed through their careers. It’s a tremendous learning experience. Now I am one of the older members, and I like doing what I can to help the younger folks learn and develop.

You learn a lot more about what’s going on in the profession and some of the challenges and opportunities that confront the profession today. As OSCPA Vice Chair, you’re the liaison between the OSCPA and the Oregon Board of Accountancy. I was in that role when Martin Pittioni had just returned to the BOA as Executive Director, and it’s been really nice to see the relationship between OSCPA and BOA become the collaborative one that it is today. Streamlining the process to licensure has been awesome and so important for the profession as we seek to fill the pipeline.

As OSCPA Chair-Elect, I attended the AICPA Council meeting, and there you are in the room with true leaders of the profession. There is a lot of concern about the future of people coming in and joining the profession, asking what kind of barriers are we having that prevent people from joining the profession? And even if they do join, are we creating issues that make them later want to leave the profession and do something else? The 150-hour rule comes up as a frequent scapegoat for some of our pipeline issues; I believe there are other concerns as well.

Work-life balance is a big piece and firms have to be aware of this. Also, people want to feel like they’re getting the type of work they want to work on, work where they feel engaged with what they are doing. Sometimes what they’re asked to do doesn’t hold their interest. And then I think folks of my generation like to brag about the 70, 80, 90-hour weeks they worked during tax season. That doesn’t help us at all.

You know, I come from a generation where usually one person in the family was working and the other spouse stayed home with kids and family. I could go to out-of-state conferences, meetings—that was something that we did a lot of, you know, 30, 40 years ago. Today I know that I’ve got partners at our firm where both spouses work, kids are very involved in sports and other activities, and there just is not a lot of extra time to spend on other things. So, you do what you can do, what you actually have capacity to do. I’ve enjoyed being involved in committees, that for me was what I enjoyed, some were CPE-oriented with creating a conference, and then the Taxation Committee just helps you stay on the forefront of the issues affecting the tax practice. I learned so much through these committees. The AICPA now does their Town Hall meetings and that’s been a great new resource for staying current on the profession and seeing what’s going on in the world of tax and the world of audits.

Something we didn’t have back when I was starting out was technology for attending meetings remotely. COVID-19 came along and changed the world. We didn’t do Zoom meetings

before COVID. We didn’t have the technology to do it in our firm. Virtual meetings can help with participating in OSCPA committees, and also support work-life balance. And I think it can help you focus on the why, like, what is the goal of this in the first place? Now you can sort of reinterpret how you do things. And that helps you see that overall; things don’t have to be accomplished in the same way. Now, even if you’re not in the Portland area where the OSCPA offices are, you’re able to participate and be on committees and not have to give up part of your day to travel. And in that way, technology can open doors.

exciting right now about being a CPA?

Being the client’s most trusted advisor. One of the things I like best about my job is when the phone rings, I don’t know what’s going to be on the other end. It’s a wide range of things, and I like that variety. People ask me all kinds of questions that are not necessarily accounting related, they just want business advice, they want personal advice. I enjoy that part of my job. With trusts and estates work, sometimes you’re dealing with family members when they’ve lost a loved one, and it’s a very difficult time for them. And to be able to help hold their hand through that process and try to give them some comfort is very satisfying for me. Helping clients grow their business, helping clients thrive, this is also very satisfying.

That’s great to know that you love what you do. What kind of opportunities do you see on the horizon for the accounting profession?

The scope of what CPAs do is broadening. The CPA exam has changed to involve technology. We’re frequently helping clients set up accounting software, accounting systems, maybe even helping them understand how to read their financial statements, which they have to do to keep their businesses thriving. There’s a lot of education and consulting for clients.

Is there anything about the stage you’re in now that you’re really enjoying?

I like being a mentor. I like teaching. Right after I graduated from Willamette Law School, I taught at Willamette’s MBA program for about ten years. Not only have I volunteered for the OSCPA but I’m a founding member of the Salem Police Foundation, which was created when there were

budget cuts in Salem and a group of businesspeople wanted to support the local police department. I’ve been a board member for the Union Gospel Mission. They built a new men’s mission here in Salem, and they used New Markets Tax Credits to get a lot of the funding. I was on that board and then someone told me, if you can do one New Markets Tax Credit project, you can do two. So, I helped Northwest Health Enterprises with building a medical clinic for lowincome people that provided medical services, dental services, and mental health counseling. I sometimes find myself on five different charity boards at the same time. To the extent I achieve any type of work-life balance with my firm work, I tend to fill the gap with non-profit work! In all seriousness, I believe strongly in giving. I’ve had a successful career. The community has given me a lot, and I want to give back.

We’ve heard that when you do have free time, you have an interest in driving fast cars.

I will go to the track at PIR (Portland International Raceway) and drive my Porsche there. I’ve sometimes gone over to eastern Oregon with friends and done driving out there. Every year our family goes to the Indy races that come to Portland. We’ve been going to Austin, Texas for the Formula One races. The whole family has an interest. For our 35th wedding anniversary, my wife and I took our two kids to a four-day performance driving class down in Phoenix. That was really fun.

I’m originally from Tennessee. I have a log cabin back in Tennessee that sits on land that belonged to my great-greatgrandfather Kinner Hawkins. The logs were moved to this property by my dad and he reconstructed the cabin one log at a time. The logs were cut in 1790. My dad was born on the property next to where the cabin is now. My grandfather was a sharecropper with a fourth-grade education, and here I am with a dual license as both a CPA and an attorney. I try not to forget where I came from.

I like spy novels and detective novels, I like Alex Cross novels. I’ll also read history or leadership books. I’m currently reading The Vineyard of Liberty by James MacGregor Burns; it goes from the 1780s up to the Civil War. And then there’s a second volume that continues on.

Is there anything else you would want to say to OSCPA members as you begin your term as OSCPA Board Chair?

I would remind people: it’s a great time to be a CPA. A lot of people out there need our help. Accounting is a great skill set to develop, to be able to help people in business or help individuals and families with their personal finances. I hope bright and talented people continue to join the profession and continue to stay in the CPA profession. It’s a great way to make an impact. People working day to day might not realize what a difference they’re making all the time. For people who want to make an impact on the world, they can. They can help people every day.

I would remind people: it’s a great time to be a CPA. A lot of people out there need our help. Accounting is a great skill set to develop, to be able to help people in business or help individuals and families with their personal finances. I hope bright and talented people continue to join the profession and continue to stay in the CPA profession. It’s a great way to make an impact. “ “

The Artificial Intelligence (“AI”) solutions such as OpenAI’s ChatGPT continue to gain popularity. Many CPA firms seek to leverage the use of generative AI to accelerate innovation and increase productivity. As the use of any AI technology is very organization specific, CPA firms need to obtain a solid understanding of their needs and objectives and gain an understanding of how AI works before they can begin to identify what, if any, AI opportunities are the right fit for their firm.

AI-generated information to specific client and/or firm fact patterns.

Although generative AI solutions can provide benefits for CPA firms, from CAMICO’s perspective, there are critical risks associated with generative AI that should be vetted by firms and mitigation strategies implemented to minimize potential exposures. These risks include but are not limited to concerns with accuracy and quality control, confidentiality, privacy, security, and ethical issues.

For example, consider the following areas of potential risk exposure:

In accordance with applicable professional and legal standards of care, sensitive client information, as well as firm- and personnel-related information, must be treated with the utmost confidentiality and should not be disclosed without express written permission. Since it is critical that the operations, activities, and business affairs of a firm and their clients are kept confidential when using generative AI, it is imperative firms ensure employees understand the terms of the firm’s Confidentiality Policy and are informed that any use of AI technology in violation of the firm’s Confidentiality Policy is strictly prohibited.

AI-generated content cannot be relied upon as-is, as the information may be outdated, misleading or — in some cases — fabricated. All AI-generated content must be reviewed for accuracy before placing any reliance on it and should be given the same consideration as you would to the work of an intern or first-year staff person. Firms need to have proper oversight procedures in place to ensure that personnel with the appropriate competencies will review and interpret the data and content provided, make informed decisions, and provide expert guidance in applying the

With data privacy protection initiatives spreading across the U.S., it is important for CPA firms to ensure the privacy and security of the sensitive personal information they collect, use, or store. To help mitigate data privacy and security risks, it is vital that firms prioritize data encryption, implement access controls, and adhere to data protection regulations.

In addition, transparency is a key element in overcoming generative AI privacy challenges so it may be necessary to consult with qualified legal counsel and update, if needed, the firm’s Privacy Policy to ensure transparency about the categories of sensitive information collected, the sources of that information, the purpose for the collection, and how the firm stores and shares such information.

As generative AI has raised concerns about its potential for misinformation, deception, and manipulation of public opinion, firms need to consider the implications related to its actual or perceived unethical use. For example, firms should establish written guidelines to clarify that these technologies must not be used to create content that is inappropriate, discriminatory, or otherwise harmful to others or the firm.

Document! Document your firm’s authorized usage (e.g. open use, limited use, or prohibited use) of generative AI and communicate these terms and conditions to your staff.

Get educated, as AI is here to stay. Learn more about the generative AI tools that are available and take appropriate due diligence steps to assess which, if any, of these tools may be appropriate to deliver the most benefit to your firm.

Develop an implementation strategy. Successful integration of generative AI, or any new technology, requires a wellcrafted implementation plan which should include, among other things, appropriate education, and training to ensure responsible use.

CAMICO offers a sample Generative Artificial Intelligence Chatbot Usage Policy template for this purpose on CAMICO’s Members-Only Site.

CAMICO policyholders with questions regarding this communication or other risk management questions should contact the Loss Prevention department at lp@camico.com or call our advice hotline at 800.652.1772 and ask to speak with a Loss Prevention Specialist.

Suzanne M. Holl, CPA-CA, is the Executive Vice President of Loss Prevention Services at CAMICO. With more than 30 years of experience in accounting, she draws on her Big Four public accounting and private industry background to provide CAMICO’s policyholders with information on a wide variety of loss prevention and accounting issues.

www.orcpa.org/conferences

Explore an exciting new 2024-25 OSCPA-Select™ course schedule with the knowledge you need to succeed.

33 options In-person programs

OSCPA CPE is unique – the schedule is shaped by OSCPA members. Who knows better what local CPAs need than other local CPAs? 200+

www.orcpa.org/cpe

package deals Self-study/ on-demand

4 DAYS

Designed for CFOs, aspiring CFOS, senior level financial managers, and executives. CPE: 32 / Level: 2 (Intermediate)

16

Day 1:

Advanced Profit Enhancements – 6 Tech & 2 [NT] – Webcast

May 10, 2024 – #W80459

Day 2:

Employees Today and Tomorrow [NT] – Webcast

May 13, 2024 – #W80461

Day 3:

Chief Reviewer – Webcast

June 13, 2024 – #W80507

Day 4:

The Effective CFO – 4 Tech & 4 [NT] – Webcast

June 19, 2024 – #W80514

Sign up by May 6 and save $25. That’s a savings of $100 on the full series!

Questions: Contact

Register: www.orcpa.org/cpe and enter the event number.

Construction Industry Conference

May 10

In-person: Portland Webcast

ERISA Conference

May 21

In-person: Beaverton Webcast

Real Estate Conference

June 5

In-person: Beaverton Webcast

Governmental Accounting & Auditing Conference

May 14-15

In-person: Lebanon Webcast

Farming, Ranching & Agribusiness Conference

May 30 Webcast Only

Technology Conference

June 10-11

Webcast Only

On-demand CPE from OSCPA gives you the flexibility you need to maximize your time. Gain access to convenient learning options at special member savings through our partnerships with Surgent CPE and AICPA.

Surgent’s Unlimited Plus CPE Package — $625* for OSCPA members

• Access to all Surgent live webinars (1,200+) to include late-breaking tax updates

• Over 250 on-demand/self-study courses

• Special member fee available through 6/14/24. Thereafter, member fee is $675.

To order: www.orcpa.org/cpe/S03077

Surgent’s Unlimited Self-Study CPE Package — $389 for OSCPA members

• Over 250 on-demand/self-study courses totaling over 1,200 CPE credit hours

• Instant online grading and immediate CPE certificates via email

To order: www.orcpa.org/cpe/S03078

AICPA Annual WebcastPass — $675 for OSCPA members

• Unlimited access to 500+ webcasts featuring top experts, regulators, agency representatives, and more

• Immediate access to certificates of completion with zero tests

• Access to archived webcasts on-demand

To order: www.orcpa.org/cpe/S03080

AICPA CPExpress — $385 OSCPA members

• Unlimited online access to over 450 quality courses

• Track and print CPE certificates in one place

To order: www.orcpa.org/cpe/S03081