PERSONAL INSOLVENCY AGREEMENT

Presented By Shaw Gidley

Personal Insolvency Agreement

“A flexible way to reach a legally binding agreement with your creditors, designed to resolve personal financial difficulties”

Companies have access to the Small Business Restructuring process to compromise their debts with creditors whilst avoiding liquidation, but what do individuals have in the same financial circumstances to avoid bankruptcy

The answer is Part X of the Bankruptcy Act – Personal Insolvency Agreement (PIA)

PIAs are a means by which individuals who are insolvent, that is, cannot repay their creditors as and when they fall due and payable, can seek to reach a compromise with their creditors to resolve the personal financial distress caused by insolvency.

In recent times Shaw Gidley has assisted individuals with excessive personal liabilities compromise their debt burdens by just over $1,100,000, including tax debts, by utilising the PIA to negotiate a reduced payments to creditors in statutory satisfaction of the full amount

The PIA process is contained in Part X of the Bankruptcy Act 1966.

The process commences with an analysis of the individuals’ personal financial circumstances to ensure that a PIA is the best way to resolve the financial problems they are facing

PIAs are a relatively straight forward unobtrusive formal personal insolvency appointment that takes place in two (2) stages.

STAGE ONE

Involves the appointment of a controlling trustee, the individual providing a draft proposal to creditors which is investigated and reported, concluding with a meeting of creditors to consider the report and draft proposal.

STAGE TWO

Involves the implementation, supervision and completion of the individual’s PIA proposal to creditors, if the proposal is successful at the creditors meeting held at the end of stage 1

Controlling Trustee

To appoint a controlling trustee and commence the PIA process the individual must execute a Section 188 authority (Form 13) granting a trustee control of the individual’s property The controlling trustee must be a registered trustee in bankruptcy The person is then known as the controlling trustee.

The proposal to creditors can be presented by an individual or jointly with another PIAs are regulated by the Australian Financial Services Authority (AFSA) AFSA provide a personal insolvency agreement pack to assist with the process which includes the following checklist:

The individual(s) must also provide the controlling trustee with a draft proposal to settle creditors’ claims and a completed statement of affairs (SOA) (Form 3) The following document is an example of the pro-forma draft PIA proposal

Draft Personal Insolvency Agreement

The s188 Authority, the draft proposal, PIA proposal checklist and the SOA are all filed with the Australia Financial Services authority (AFSA) At the time of filing a filing fee of $240 must be paid to AFSA by the controlling trustee.

The SOA contains all the necessary financial and personal information the controlling trustee needs to commence an investigation into the individual’s financial affairs as well assess the draft proposal to creditors Part X PIA has no financial limits or restrictions when it comes to assets, liabilities or creditor value

There are however some practical issues the individual will need to manage whilst subject to Part X such as restrictions on managing a company and possible state-based licensing issues e g contractor’s license, and insolvency clauses (ipso facto) in supply/service agreements, but these matters will be addressed prior to entering Part X PIA Once appointed, the controlling trustee investigates the individuals’ affairs and the draft proposal.

The draft proposal will set out what, how and when (the offering) creditors will receive if the proposal is accepted

The controlling trustee will compare the offering to creditors in the draft proposal to what the result could be in a hypothetical bankruptcy situation

Personal Insolvency Agreement Checklist

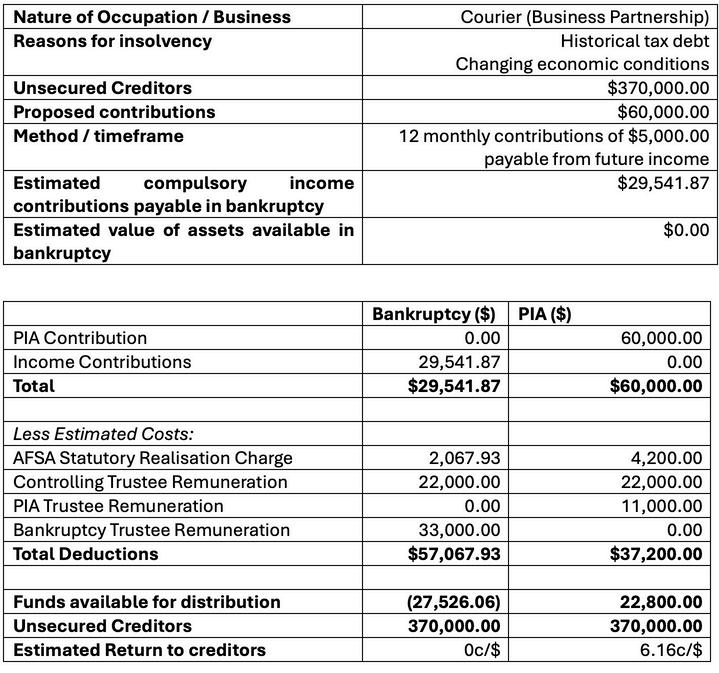

Example one:

In the above example, the Debtor proposed to make monthly contributions from future income, more than the compulsory contributions they would be required to make in a bankruptcy scenario. This offered a higher and more timely return to creditors which was ultimately accepted by the ATO.

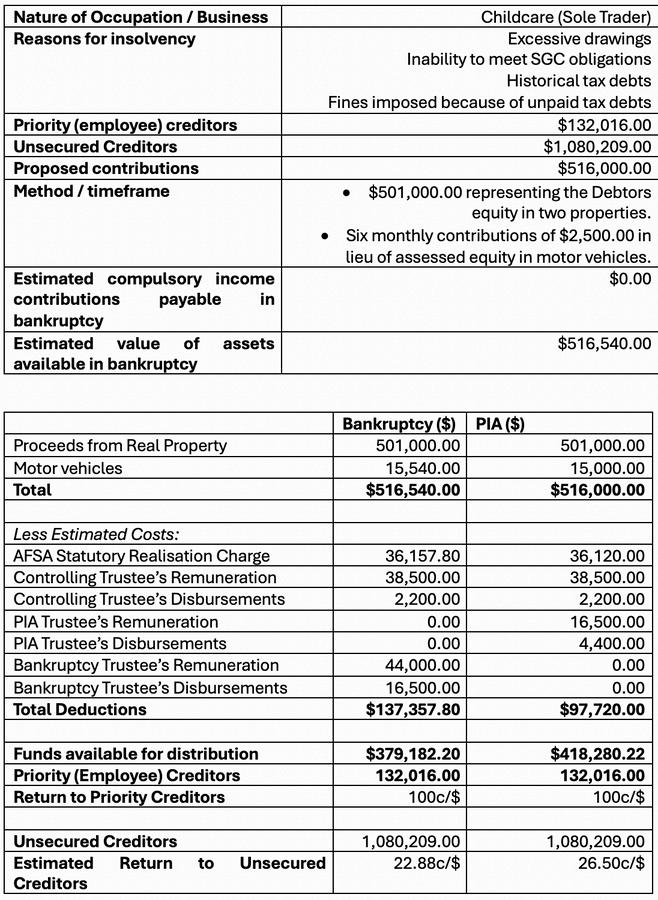

Example two:

In this example the Debtor was able to pay out priority creditors in full, while offering unsecured creditors a return that greater, more timely and more certain than in a bankruptcy scenario The ATO voted favourably for this proposal

Voting on the Proposal

After considering the proposal against a hypothetical bankruptcy outcome for creditors, and taking into account public interest matters, the controlling trustee prepares and forwards a report to creditors which includes a recommendation whether creditors should vote for or against the proposal at a meeting of creditors The required majority to pass the proposal resolution is 75% or more in value and more than 50% in number

The meeting of creditors must be held within 30 business days of executing the s188 authority

Personal Insolvency Agreement

If creditors vote favourable for the draft proposal, the PIA is executed, implemented and then administered by the PIA trustee until it is completed in accordance with the terms of the agreement.

The timing of the PIA term is detailed in the draft proposal and will be dependent upon how the PIA fund is created The PIA fund is the monies to be accumulated in the PIA require to pay trustee fees, costs and the dividend offered to creditors dividends in the proposal

THE PIA FUND CAN BE CREATED FROM:

A lump sum contribution

Sale of divisible an/or nondivisible assets.

Income contributions

Regular contributions from other sources

Or a combination of (a) to (d)

Whist there is no limit on the term of the PIA, the proposal should be of a commercial term, when compared to the circumstances at hand, but often less than 36 months, as the shorter the term the better chances of success. Shorter terms take into account the time value of money and result in less administration costs improving the rate of dividend to creditors

Whist there is no limit on the term of the PIA, the proposal should be of a commercial term, when compared to the circumstances at hand, but often less than 36 months, as the shorter the term the better chances of success. Shorter terms take into account the time value of money and result in less administration costs improving the rate of dividend to creditors

If the individual(s) subject to the PIA cannot comply with the terms of the PIA once executed, then the agreement may be:

Varied by resolution of creditors pursuant to s221A of the Bankruptcy Act; or

Terminated by a resolution of creditors the creditors pursuant to s222B of the Bankruptcy Act ; or

Terminated by a the Court pursuant to s222C of the Bankruptcy Act

If creditors vote against PIA at the meeting held at the end of the controlling trusteeship, they will then vote upon the following matters:

Whether to hand back control of the property back to the individual 1 2

Request that the individual present a debtor’s petition to AFSA within 7 days of the creditor’s meeting to enter bankruptcy voluntarily

Note, action 2 is not enforceable upon the individual although does provide grounds for a creditor to subsequently force the individual into bankruptcy through a Court application (sequestration order)

If creditors do not vote in favour of handing control of the individual’s property back, which is often the case, the property of the individual remains under the control of the controlling trustee until either one of the following events:

4 months has passed since the resolution 1

The individual becomes bankrupt. 2.

The individual dies; or 3

The Court releases the property 4

Whicher event happens sooner

In summary the PIA process provides an individual with a flexible way to resolve endemic financial distress and avoid bankruptcy Please do not hesitate to contact one of Shaw Gidley’s registered trustees if you require any further information on this valuable service

P: (02) 4908 4402

E: pgidley@shawgidley.com.au

P: (02) 4908 4403

E:jshaw@shawgidley com au

P: (02) 6580 0400

E: snewton@shawgidley com au

P: (02) 4908 4421

E: jshute@shawgidley com au

P: (02) 6580 0400

E: bismay@shawgidley.com.au

Paul Gidley

James Shaw

Jeff Shute

Scott Newton

Ben Ismay