218

Turkey After a strong recovery in 2021, growth will moderate over the projection period. Very high inflation and declining consumer confidence will limit consumer spending. Investment will be held back by uncertainty about geopolitical factors and financial conditions. While exports will continue to benefit from the reallocation of global supply chains, the war in Ukraine will adversely affect external demand and commodity prices. Accommodative monetary policy coupled with high commodity and food prices will keep consumer inflation above 70% in 2022. Strengthening the independence of the central bank and tightening monetary policy will be key to shore up confidence and anchor inflation expectations. Fiscal policy is expected to remain supportive over the projection period, including support to lower-income households that are facing high commodity prices. Structural reforms to enhance skills and the quality of training for workers and the unemployed are key to facilitate a move to higher paying jobs. Given its heavy dependence on oil and gas imports, Turkey should continue to diversify supply sources and improve energy efficiency. Economic activity is moderating after the strong recovery in 2021 The economy grew by 11% in 2021, boosted by strong exports and high consumer spending. Exports of goods reached a record high in 2021 supported by strong external demand, with Turkey benefitting from supply chain disruption in Asia and the lira depreciation. Domestic demand has been supported by strong credit growth and facilitated by expansionary monetary policy, in spite of high inflation. Employment has recovered to pre-pandemic levels, helped by the rebound in economic activity, and income has been boosted by a minimum wage increase of 50%. However, leading indicators – such as consumer confidence and the PMI – signal a gradual moderation of economic momentum. At the same time, prices are increasing significantly further, due to accommodative monetary policy, higher commodity prices and the exchange rate depreciation, and have begun to erode real incomes and limit consumer spending.

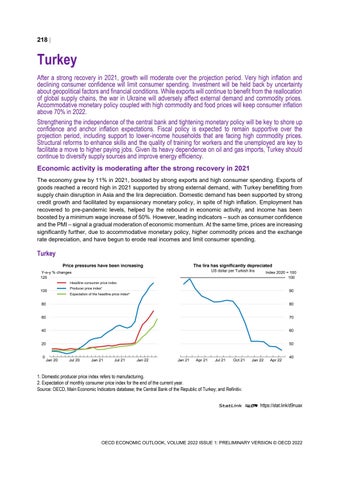

Turkey Price pressures have been increasing

The lira has significantly depreciated US dollar per Turkish lira

Y-o-y % changes 120

Index 2020 = 100 100

Headline consumer price index

100

Producer price index¹

90

Expectation of the headline price index²

80

80

60

70

40

60

20

50

0

Jan 20

Jul 20

Jan 21

Jul 21

Jan 22

0

0

Jan 21

Apr 21

Jul 21

Oct 21

Jan 22

Apr 22

40

1. Domestic producer price index refers to manufacturing. 2. Expectation of monthly consumer price index for the end of the current year. Source: OECD, Main Economic Indicators database; the Central Bank of the Republic of Turkey; and Refinitiv. StatLink 2 https://stat.link/d9nuax

OECD ECONOMIC OUTLOOK, VOLUME 2022 ISSUE 1: PRELIMINARY VERSION © OECD 2022