185

New Zealand After reaching 5% in 2021, real GDP growth will ease to 3% in 2022 and 2% in 2023. High inflation and rising interest rates will weigh on private consumption. Economic growth will slow but remain solid as pent-up demand during the surge in COVID-19 infections in early 2022 is unleashed and gradual reopening of the border allows the tourism sector to recover. Inflation will decline in 2023 but remain high, as firms pass on global commodity price inflation and workers demand higher wages. Monetary policy should be tightened further to reduce inflation to within the 1-3% target band. Fiscal policy should avoid concentrating the burden of macroeconomic stabilisation on monetary policy, and support for households and businesses should be tightly targeted to those most vulnerable to high inflation. The economy is under pressure from high inflation New Zealand’s economy has been subject to large fluctuations caused by COVID-19. The surge of the Omicron variant in early 2022 reduced mobility and private consumption despite the new COVID-19 response framework sparing any lockdown. Inflation surged to its highest levels since 1990, driven by a very tight labour market, as well as persisting global supply chain disruptions and rising global energy prices. wage growth is strengthening as the unemployment rate hit a historic low (3.2%) and skills shortages are widespread, but falls short of inflation. After a record surge, house prices have fallen by 4% since November 2021. The gradual reopening of the border since March 2022 has so far resulted in a net outflow of migrants, partly because migrant workers who need new work visas can only enter from July 2022. Although the direct impacts of the war on Ukraine on economic growth are limited given the small shares of Russia and Ukraine in New Zealand’s trade, the indirect impacts through higher fuel and commodity prices have rapidly increased costs of inputs and living, weighing on business and consumer confidence.

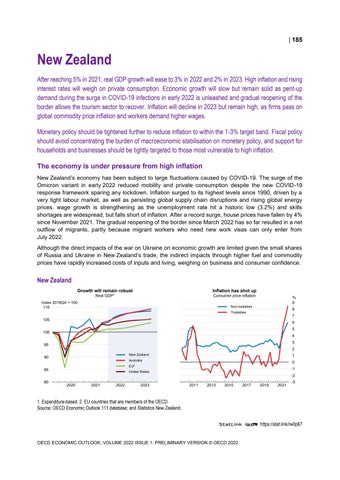

New Zealand Growth will remain robust

Inflation has shot up

Real GDP¹

Consumer price inflation

Index 2019Q4 = 100 110

% 9

Non-tradables

8

Tradables

7

105

6 5

100

4 3

95

2 New Zealand

90

0

EU²

85 80

1

Australia

-1

United States

2020

2021

2022

2023

-2 0

0

2011

2013

2015

2017

2019

2021

-3

1. Expenditure-based. 2. EU countries that are members of the OECD. Source: OECD Economic Outlook 111 database; and Statistics New Zealand. StatLink 2 https://stat.link/rw0p67

OECD ECONOMIC OUTLOOK, VOLUME 2022 ISSUE 1: PRELIMINARY VERSION © OECD 2022