176

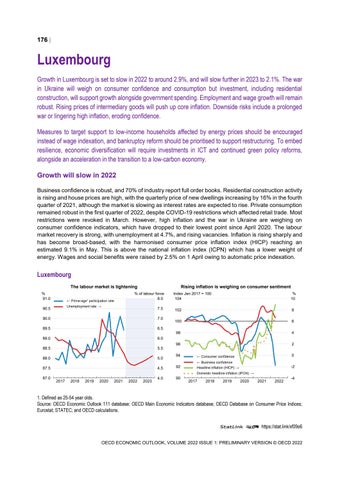

Luxembourg Growth in Luxembourg is set to slow in 2022 to around 2.9%, and will slow further in 2023 to 2.1%. The war in Ukraine will weigh on consumer confidence and consumption but investment, including residential construction, will support growth alongside government spending. Employment and wage growth will remain robust. Rising prices of intermediary goods will push up core inflation. Downside risks include a prolonged war or lingering high inflation, eroding confidence. Measures to target support to low-income households affected by energy prices should be encouraged instead of wage indexation, and bankruptcy reform should be prioritised to support restructuring. To embed resilience, economic diversification will require investments in ICT and continued green policy reforms, alongside an acceleration in the transition to a low-carbon economy. Growth will slow in 2022 Business confidence is robust, and 70% of industry report full order books. Residential construction activity is rising and house prices are high, with the quarterly price of new dwellings increasing by 16% in the fourth quarter of 2021, although the market is slowing as interest rates are expected to rise. Private consumption remained robust in the first quarter of 2022, despite COVID-19 restrictions which affected retail trade. Most restrictions were revoked in March. However, high inflation and the war in Ukraine are weighing on consumer confidence indicators, which have dropped to their lowest point since April 2020. The labour market recovery is strong, with unemployment at 4.7%, and rising vacancies. Inflation is rising sharply and has become broad-based, with the harmonised consumer price inflation index (HICP) reaching an estimated 9.1% in May. This is above the national inflation index (ICPN) which has a lower weight of energy. Wages and social benefits were raised by 2.5% on 1 April owing to automatic price indexation.

Luxembourg The labour market is tightening % 91.0

← Prime-age¹ participation rate

Rising inflation is weighing on consumer sentiment

% of labour force 8.0

Unemployment rate →

90.5

7.5

90.0

7.0

89.5

6.5

89.0

6.0

88.5

5.5

88.0

5.0

Index Jan 2017 = 100 104

% 10

102

8

100

6

98

4

96

2

94

0

← Consumer confidence ← Business confidence

87.5

4.5

92

-2

Headline inflation (HICP) → Domestic headline inflation (IPCN) →

87.0

2017

2018

2019

2020

2021

2022

2023

4.0

90

2017

2018

2019

2020

2021

2022

-4

1. Defined as 25-54 year olds. Source: OECD Economic Outlook 111 database; OECD Main Economic Indicators database; OECD Database on Consumer Price Indices; Eurostat; STATEC; and OECD calculations. StatLink 2 https://stat.link/xf09o6 OECD ECONOMIC OUTLOOK, VOLUME 2022 ISSUE 1: PRELIMINARY VERSION © OECD 2022