121

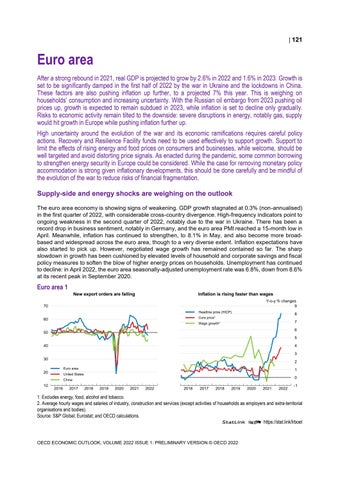

Euro area After a strong rebound in 2021, real GDP is projected to grow by 2.6% in 2022 and 1.6% in 2023. Growth is set to be significantly damped in the first half of 2022 by the war in Ukraine and the lockdowns in China. These factors are also pushing inflation up further, to a projected 7% this year. This is weighing on households’ consumption and increasing uncertainty. With the Russian oil embargo from 2023 pushing oil prices up, growth is expected to remain subdued in 2023, while inflation is set to decline only gradually. Risks to economic activity remain tilted to the downside: severe disruptions in energy, notably gas, supply would hit growth in Europe while pushing inflation further up. High uncertainty around the evolution of the war and its economic ramifications requires careful policy actions. Recovery and Resilience Facility funds need to be used effectively to support growth. Support to limit the effects of rising energy and food prices on consumers and businesses, while welcome, should be well targeted and avoid distorting price signals. As enacted during the pandemic, some common borrowing to strengthen energy security in Europe could be considered. While the case for removing monetary policy accommodation is strong given inflationary developments, this should be done carefully and be mindful of the evolution of the war to reduce risks of financial fragmentation. Supply-side and energy shocks are weighing on the outlook The euro area economy is showing signs of weakening. GDP growth stagnated at 0.3% (non-annualised) in the first quarter of 2022, with considerable cross-country divergence. High-frequency indicators point to ongoing weakness in the second quarter of 2022, notably due to the war in Ukraine. There has been a record drop in business sentiment, notably in Germany, and the euro area PMI reached a 15-month low in April. Meanwhile, inflation has continued to strengthen, to 8.1% in May, and also become more broadbased and widespread across the euro area, though to a very diverse extent. Inflation expectations have also started to pick up. However, negotiated wage growth has remained contained so far. The sharp slowdown in growth has been cushioned by elevated levels of household and corporate savings and fiscal policy measures to soften the blow of higher energy prices on households. Unemployment has continued to decline: in April 2022, the euro area seasonally-adjusted unemployment rate was 6.8%, down from 8.6% at its recent peak in September 2020.

Euro area 1 New export orders are falling

Inflation is rising faster than wages Y-o-y % changes 9

70 Headline price (HICP)

8

Core price¹

60

7

Wage growth²

6

50

5 40

4 3

30

2 Euro area

20

1

United States

0

China

10

2016

2017

2018

2019

2020

2021

2022

0

0

2016

2017

2018

2019

2020

2021

2022

-1

1. Excludes energy, food, alcohol and tobacco. 2. Average hourly wages and salaries of industry, construction and services (except activities of households as employers and extra-territorial organisations and bodies). Source: S&P Global; Eurostat; and OECD calculations. StatLink 2 https://stat.link/lrboet

OECD ECONOMIC OUTLOOK, VOLUME 2022 ISSUE 1: PRELIMINARY VERSION © OECD 2022