106

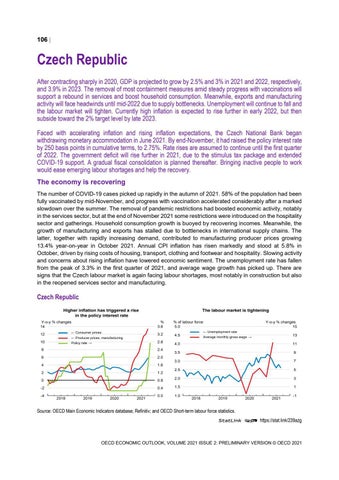

Czech Republic After contracting sharply in 2020, GDP is projected to grow by 2.5% and 3% in 2021 and 2022, respectively, and 3.9% in 2023. The removal of most containment measures amid steady progress with vaccinations will support a rebound in services and boost household consumption. Meanwhile, exports and manufacturing activity will face headwinds until mid-2022 due to supply bottlenecks. Unemployment will continue to fall and the labour market will tighten. Currently high inflation is expected to rise further in early 2022, but then subside toward the 2% target level by late 2023. Faced with accelerating inflation and rising inflation expectations, the Czech National Bank began withdrawing monetary accommodation in June 2021. By end-November, it had raised the policy interest rate by 250 basis points in cumulative terms, to 2.75%. Rate rises are assumed to continue until the first quarter of 2022. The government deficit will rise further in 2021, due to the stimulus tax package and extended COVID-19 support. A gradual fiscal consolidation is planned thereafter. Bringing inactive people to work would ease emerging labour shortages and help the recovery. The economy is recovering The number of COVID-19 cases picked up rapidly in the autumn of 2021. 58% of the population had been fully vaccinated by mid-November, and progress with vaccination accelerated considerably after a marked slowdown over the summer. The removal of pandemic restrictions had boosted economic activity, notably in the services sector, but at the end of November 2021 some restrictions were introduced on the hospitality sector and gatherings. Household consumption growth is buoyed by recovering incomes. Meanwhile, the growth of manufacturing and exports has stalled due to bottlenecks in international supply chains. The latter, together with rapidly increasing demand, contributed to manufacturing producer prices growing 13.4% year-on-year in October 2021. Annual CPI inflation has risen markedly and stood at 5.8% in October, driven by rising costs of housing, transport, clothing and footwear and hospitality. Slowing activity and concerns about rising inflation have lowered economic sentiment. The unemployment rate has fallen from the peak of 3.3% in the first quarter of 2021, and average wage growth has picked up. There are signs that the Czech labour market is again facing labour shortages, most notably in construction but also in the reopened services sector and manufacturing.

Czech Republic Higher inflation has triggered a rise in the policy interest rate Y-o-y % changes 14

% 3.6

← Consumer prices

12

3.2

← Producer prices, manufacturing

10

The labour market is tightening

2.8

Policy rate →

9

3.0

7

2.5

5

2.0

3

0.4

1.5

1

0.0

1.0

2.0

4

1.6

2

1.2

0

0.8

-2 2020

2021

13

Average monthly gross wage →

3.5

6

2019

← Unemployment rate

4.5

11

2.4

2018

Y-o-y % changes 15

4.0

8

-4

% of labour force 5.0

2018

2019

2020

2021

-1

Source: OECD Main Economic Indicators database; Refinitiv; and OECD Short-term labour force statistics. StatLink 2 https://stat.link/239azg

OECD ECONOMIC OUTLOOK, VOLUME 2021 ISSUE 2: PRELIMINARY VERSION © OECD 2021