112

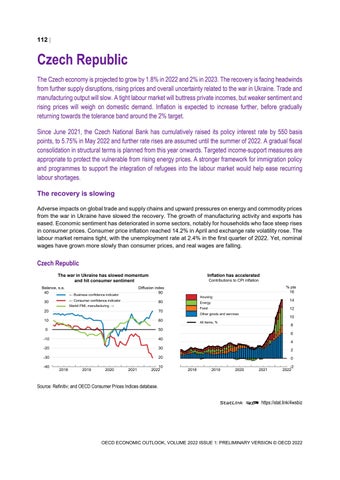

Czech Republic The Czech economy is projected to grow by 1.8% in 2022 and 2% in 2023. The recovery is facing headwinds from further supply disruptions, rising prices and overall uncertainty related to the war in Ukraine. Trade and manufacturing output will slow. A tight labour market will buttress private incomes, but weaker sentiment and rising prices will weigh on domestic demand. Inflation is expected to increase further, before gradually returning towards the tolerance band around the 2% target. Since June 2021, the Czech National Bank has cumulatively raised its policy interest rate by 550 basis points, to 5.75% in May 2022 and further rate rises are assumed until the summer of 2022. A gradual fiscal consolidation in structural terms is planned from this year onwards. Targeted income-support measures are appropriate to protect the vulnerable from rising energy prices. A stronger framework for immigration policy and programmes to support the integration of refugees into the labour market would help ease recurring labour shortages. The recovery is slowing Adverse impacts on global trade and supply chains and upward pressures on energy and commodity prices from the war in Ukraine have slowed the recovery. The growth of manufacturing activity and exports has eased. Economic sentiment has deteriorated in some sectors, notably for households who face steep rises in consumer prices. Consumer price inflation reached 14.2% in April and exchange rate volatility rose. The labour market remains tight, with the unemployment rate at 2.4% in the first quarter of 2022. Yet, nominal wages have grown more slowly than consumer prices, and real wages are falling.

Czech Republic The war in Ukraine has slowed momentum and hit consumer sentiment Balance, s.a. 40

Inflation has accelerated Contributions to CPI inflation

← Business confidence indicator

Housing

← Consumer confidence indicator

30

% pts 16

Diffusion index 90 80

Markit PMI, manufacturing →

14

Energy

12

Food

20

70

10

60

0

50

-10

40

-20

30

2

-30

20

0

-40

2018

2019

2020

2021

10 2022

Other goods and services

10

All items, %

8 6 4

0

2018

2019

2020

2021

-2 2022

Source: Refinitiv; and OECD Consumer Prices Indices database. StatLink 2 https://stat.link/4wsbiz

OECD ECONOMIC OUTLOOK, VOLUME 2022 ISSUE 1: PRELIMINARY VERSION © OECD 2022