100

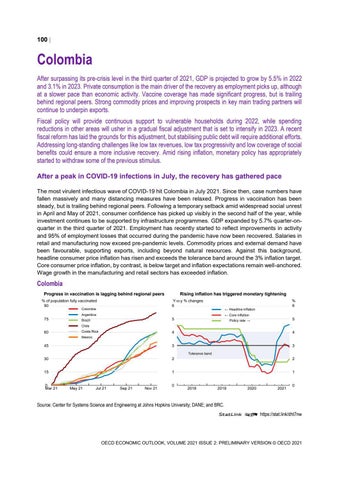

Colombia After surpassing its pre-crisis level in the third quarter of 2021, GDP is projected to grow by 5.5% in 2022 and 3.1% in 2023. Private consumption is the main driver of the recovery as employment picks up, although at a slower pace than economic activity. Vaccine coverage has made significant progress, but is trailing behind regional peers. Strong commodity prices and improving prospects in key main trading partners will continue to underpin exports. Fiscal policy will provide continuous support to vulnerable households during 2022, while spending reductions in other areas will usher in a gradual fiscal adjustment that is set to intensify in 2023. A recent fiscal reform has laid the grounds for this adjustment, but stabilising public debt will require additional efforts. Addressing long-standing challenges like low tax revenues, low tax progressivity and low coverage of social benefits could ensure a more inclusive recovery. Amid rising inflation, monetary policy has appropriately started to withdraw some of the previous stimulus. After a peak in COVID-19 infections in July, the recovery has gathered pace The most virulent infectious wave of COVID-19 hit Colombia in July 2021. Since then, case numbers have fallen massively and many distancing measures have been relaxed. Progress in vaccination has been steady, but is trailing behind regional peers. Following a temporary setback amid widespread social unrest in April and May of 2021, consumer confidence has picked up visibly in the second half of the year, while investment continues to be supported by infrastructure programmes. GDP expanded by 5.7% quarter-onquarter in the third quarter of 2021. Employment has recently started to reflect improvements in activity and 95% of employment losses that occurred during the pandemic have now been recovered. Salaries in retail and manufacturing now exceed pre-pandemic levels. Commodity prices and external demand have been favourable, supporting exports, including beyond natural resources. Against this background, headline consumer price inflation has risen and exceeds the tolerance band around the 3% inflation target. Core consumer price inflation, by contrast, is below target and inflation expectations remain well-anchored. Wage growth in the manufacturing and retail sectors has exceeded inflation.

Colombia Progress in vaccination is lagging behind regional peers % of population fully vaccinated 90

Rising inflation has triggered monetary tightening Y-o-y % changes 6

Colombia

← Headline inflation

Argentina

75

← Core inflation

5

Brazil

% 6 5

Policy rate →

Chile

60

Costa Rica

4

4

Mexico

45

3

3 Tolerance band

30

2

2

15

1

1

0 Mar 21

May 21

Jul 21

Sep 21

Nov 21

0

0

2018

2019

2020

2021

0

Source: Center for Systems Science and Engineering at Johns Hopkins University; DANE; and BRC. StatLink 2 https://stat.link/dht7nw

OECD ECONOMIC OUTLOOK, VOLUME 2021 ISSUE 2: PRELIMINARY VERSION © OECD 2021