89

Canada Supply-chain disruptions have slowed but not arrested Canada’s economic recovery. With a fourth wave of infections receding, output is projected to surpass pre-pandemic levels by the end of 2021 and grow faster than trend at 3.9% in 2022 and 2.8% in 2023. Inflation is projected to moderate as production bottlenecks clear, before strengthening again as unemployment falls. More persistent supply constraints could, however, mean that inflation stays higher for longer and delay a projected acceleration in trade and consumer spending. Monetary support should start to be withdrawn as remaining spare capacity in the economy is absorbed. Underlying price pressures and financial imbalances need to be closely monitored. Budget deficits will decrease over the next two years as improved business conditions enable a gradual withdrawal of pandemic support. The public debt burden should be reduced in the medium term to rebuild fiscal space for future shocks. Measures to improve housing affordability and childcare support are appropriately on the social policy agenda. Improvements to insolvency processes would support a strong business sector recovery. The recovery is back on track despite supply constraints A fourth wave of infections peaked in September, delaying economic re-opening plans in some provinces. But case numbers have since fallen, enabling further lifting of containment measures. The United States has also reopened its northern border to vaccinated Canadians. Data on trade and household consumption have revealed the significant effect of larger-than-anticipated disruptions to the manufacture and supply of durable goods, including motor vehicles. Cooling housing market activity has also been tempering growth in domestic expenditure. Residential construction remains at high levels, but has declined from a peak registered during lockdown conditions in April. With these drags on growth, industry output data suggest the recovery resumed in the third quarter, but at a modest pace. Firms surveyed in the Bank of Canada’s Business Outlook Survey continue to anticipate strengthening sales notwithstanding supply-side constraints. Disruption due to recent flooding in British Columbia risks exacerbating bottlenecks in some sectors.

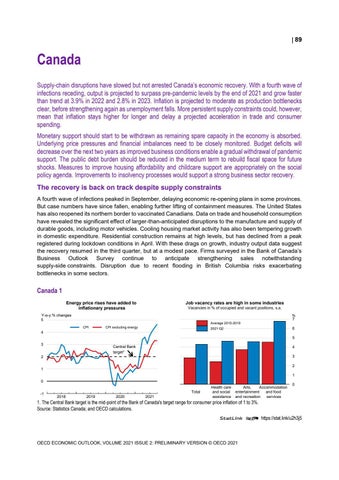

Canada 1 Energy price rises have added to inflationary pressures

Job vacancy rates are high in some industries Vacancies in % of occupied and vacant positions, s.a.

Y-o-y % changes 5

Average 2015-2019 CPI

CPI excluding energy

6

2021 Q2

4

% 7

5 3

Central Bank target¹

4 3

2

2

1

1 0 -1

0 2018

2019

2020

2021

0

Total

Health care and social assistance

Arts, Accommodation entertainment and food and recreation services

0

1. The Central Bank target is the mid-point of the Bank of Canada's target range for consumer price inflation of 1 to 3%. Source: Statistics Canada; and OECD calculations. StatLink 2 https://stat.link/u2h3j5

OECD ECONOMIC OUTLOOK, VOLUME 2021 ISSUE 2: PRELIMINARY VERSION © OECD 2021