92

Bulgaria After a rebound of 4.2% in 2021, growth is expected to weaken to 2½ per cent in 2022 and 2¼ per cent in 2023 and be accompanied by a surge in inflation mainly because of the war in Ukraine. Soaring energy and food prices, growing uncertainty and supply difficulties for certain raw materials will weigh on activity and only be partly offset by the expected increase in public investment and the measures taken by the government to protect households from rising prices. The reinforcement of infrastructure financed with European funds and the support measures in the face of rising energy prices are welcome to limit the economic impact of the conflict. However, targeted and temporary aid for low-income households would be preferable to freezing energy prices. More investment in renewable energies would also be beneficial for the country's energy security and transition. Bulgaria faces an inflationary surge The economy was rebounding and inflation surging when the war in Ukraine started. Growth weakened in the first quarter 2022 with the increase in prices. National CPI inflation reached 14.4% year-on-year in April 2022 due to the rise in food and energy prices and the tightness of the labour market, with unemployment declining below 5%. High inflation, together with the depreciation of the Turkish currency, has weakened competitiveness. A further pick-up in inflation is expected in the short term by the business sector. However, wage increases remained moderate in the first quarter of 2022 due to limited rises in the public sector. With the pandemic slowing, COVID-related restrictions were lifted in end-March 2022.

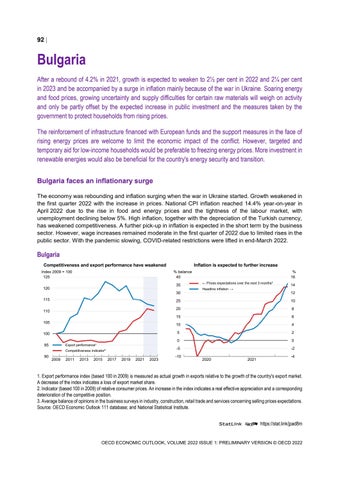

Bulgaria Competitiveness and export performance have weakened Index 2009 = 100 125

Inflation is expected to further increase % balance 40 35

120

30 115 110 105 100 95

Export performance¹ Competitiveness indicator²

90

2009

2011

2013

2015

2017

2019

2021

2023

0

% 16 ← Prices expectations over the next 3 months³ Headline inflation →

14 12

25

10

20

8

15

6

10

4

5

2

0

0

-5

-2

-10

2020

2021

-4

1. Export performance index (based 100 in 2009) is measured as actual growth in exports relative to the growth of the country's export market. A decrease of the index indicates a loss of export market share. 2. Indicator (based 100 in 2009) of relative consumer prices. An increase in the index indicates a real effective appreciation and a corresponding deterioration of the competitive position. 3. Average balance of opinions in the business surveys in industry, construction, retail trade and services concerning selling prices expectations. Source: OECD Economic Outlook 111 database; and National Statistical Institute. StatLink 2 https://stat.link/jpad8m

OECD ECONOMIC OUTLOOK, VOLUME 2022 ISSUE 1: PRELIMINARY VERSION © OECD 2022