79

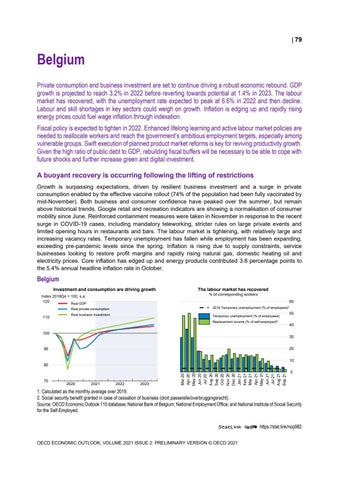

Belgium Private consumption and business investment are set to continue driving a robust economic rebound. GDP growth is projected to reach 3.2% in 2022 before reverting towards potential at 1.4% in 2023. The labour market has recovered, with the unemployment rate expected to peak at 6.6% in 2022 and then decline. Labour and skill shortages in key sectors could weigh on growth. Inflation is edging up and rapidly rising energy prices could fuel wage inflation through indexation. Fiscal policy is expected to tighten in 2022. Enhanced lifelong learning and active labour market policies are needed to reallocate workers and reach the government’s ambitious employment targets, especially among vulnerable groups. Swift execution of planned product market reforms is key for reviving productivity growth. Given the high ratio of public debt to GDP, rebuilding fiscal buffers will be necessary to be able to cope with future shocks and further increase green and digital investment. A buoyant recovery is occurring following the lifting of restrictions Growth is surpassing expectations, driven by resilient business investment and a surge in private consumption enabled by the effective vaccine rollout (74% of the population had been fully vaccinated by mid-November). Both business and consumer confidence have peaked over the summer, but remain above historical trends. Google retail and recreation indicators are showing a normalisation of consumer mobility since June. Reinforced containment measures were taken in November in response to the recent surge in COVID-19 cases, including mandatory teleworking, stricter rules on large private events and limited opening hours in restaurants and bars. The labour market is tightening, with relatively large and increasing vacancy rates. Temporary unemployment has fallen while employment has been expanding, exceeding pre-pandemic levels since the spring. Inflation is rising due to supply constraints, service businesses looking to restore profit margins and rapidly rising natural gas, domestic heating oil and electricity prices. Core inflation has edged up and energy products contributed 3.8 percentage points to the 5.4% annual headline inflation rate in October.

Belgium Investment and consumption are driving growth

The labour market has recovered % of corresponding workers

Index 2019Q4 = 100, s.a. 120 Real GDP 110

60

Real private consumption

2019 Temporary unemployment (% of employees)¹

Real business investment

Temporary unemployment (% of employees) Replacement income (% of self-employed)²

100

50 40 30 20

90

10 0 70

2020

2021

2022

2023

0

Mar 20 Apr 20 May 20 Jun 20 Jul 20 Aug 20 Sep 20 Oct 20 Nov 20 Dec 20 Jan 21 Feb 21 Mar 21 Apr 21 May 21 Jun 21 Jul 21 Aug 21 Sep 21

80 0

1. Calculated as the monthly average over 2019. 2. Social security benefit granted in case of cessation of business (droit passerelle/overbruggingsrecht). Source: OECD Economic Outlook 110 database; National Bank of Belgium; National Employment Office; and National Institute of Social Security for the Self-Employed. StatLink 2 https://stat.link/nop982 OECD ECONOMIC OUTLOOK, VOLUME 2021 ISSUE 2: PRELIMINARY VERSION © OECD 2021