CarloAltavilla(ECB)

MiguelBoucinha(ECB)

MarcoPagano(UniversityofNaplesFedericoII)

AndreaPolo(LuissUniversity)

19April2024

“Navigatingthepathtonetzero–theinterplayofclimate,monetaryand financialpolicies”

ECB–OECDWorkshop

Theopinionsinthispresentationarethoseoftheauthorsanddonotnecessarily reflecttheviewsoftheEuropeanCentralBankandtheEurosystem

ClimateRisk,BankLendingandMonetaryPolicy

Researchquestions

1 Dobankspricefirms’climateriskoverandabovecreditrisk,when grantingloans?E.g.,becausebanks’IRMsdonotfullyaccountforclimate riskorbankshavereputationalconcerns

inassessingclimaterisk,dotheytakeintoaccountfirms’ plans toreduce emissions(inadditiontocurrentemissions)?

dobanks committed toenvironmentalprotectionchargeahigherlending premiumonclimaterisk?

2 Doesmonetarypolicyaffectbanks’pricingofclimateriskand,ifso, how? Twoalternativeviews,withoppositepredictions:

financialfrictionschannel:aslow-emissionfirmshavefewertangibleassets, hencelesscollateral,monetarytighteningdiscouragesmorelendingtothem

→ promptsbanksto raiserates moretofirms lessexposedtoclimaterisk

risk-takingchannel:monetarytighteningdiscouragesbanks’risk-taking

→ promptsbanksto raiserates moretofirms moreexposedtoclimaterisk

1/24

Mainfindings

1 Dobankspricefirms’climateriskoverandabovecreditrisk,when grantingloans?YES

bankschargehigherinterestratestofirmswithgreatercarbonemissions, controllingforfirms’probabilityofdefault theyalsochargelowerratestofirmsthatcommittoloweremissions botheffectsarelargerforbankscommittedtodecarbonization

2 Doesmonetarypolicyaffectbanks’pricingofclimaterisk? YES

consistentlywitha“climaterisk-takingchannelofmonetarypolicy”,tighter policyinducesbankstoincreasebothcreditriskpremiaandcarbonemission premia → morepenalizingformorepollutingfirms

comparativestatement:restrictivemonetarypolicyincreasesthecostofcredit toallfirms,butitscontractionaryeffectismilderfor(i)firmswithlow emissionsthanforthosewithhighemissionsand(ii)forthosethatcommitto decarbonizationthanforthosethatdon’t

2/24

1 Literature 2 Data

3 Results

4 Conclusions

Literature Outline

3/24

Researchonthepricingofclimateinfinancialmarkets

Evidencethat securitymarkets priceclimate(esp.transition)risk:

stockmarket:BoltonandKacperczyk(2021,2022),Hsu,LiandTsu(2023)

optionmarkets:Ilhan,SautnerandVilkov(2020)

bondmarkets:HuynandXia(2021),Bakeretal(2021)

For creditmarkets theevidence(limitedtosyndicatedloans)isambiguous:

NO:Beyen,DeGreiff,DelisandOngena(2021)

YES,afterthe2015ParisAgreement:EhlersandDeGreiff(2021)

Also,noconsensusonwhether bankscommittedtoenvironmental policies lendpreferentiallytolow-emissionfirms:

NO:EhlersandDeGreiff(2021)andGiannetti,Jasova,Loumiotiand Mendicino(2023)

YES:Degryse,Goncharenki,TheuniszandVadasz(2020)andKacperczykand Peydr`o(2021)

Noevidenceonthe impactofMP impactofMPonthepricingofclimate risk

Literature

4/24

Literatureonfinancialfrictionschannelofmonetarypolicy

BernankeandGertler’s(1989,1995)ideathatmonetarypolicyhasdifferent effectonfirmsdependingontheircollateralcapacity:

inthepresenceofincentiveproblems,banksprovidelesscredittofirmswith lowerratiooftangibleassetstofuturecashflow

restrictivemonetarypolicyworsensproblem:banksrestrictcreditrelatively moretocollateral-poorfirmsthantocollateral-richones

Iovino,MartinandSauvagnat(2021):firmswithlowcarbonemissionshavea lowerfractionoftangibleassets,hencecanofferlesscollateral

Combiningthisfactwiththeroleoffinancialfrictionsinmonetarypolicy: monetaryexpansion → looserlendingstandards,esp.forlow-emissionfirms monetaryrestriction → tighterlendingstandards,esp.forlow-emissionfirms

Prediction: monetarypolicytighteningmorerestrictiveforGREEN firmsthanforbrownones

Literature

5/24

Literatureonrisk-takingchannelofmonetarypolicy

Ideaisthatmonetarypolicyaffectsbanks’yield-seekingincentives: monetaryexpansion → looserlendingstandards,esp.forriskierfirms monetarytightening → tighterlendingstandards,esp.forriskierfirms

Duetointeractionbetweenmonetarypolicyandbanks’informationalissues:

AcharyaandNaqvi(2012):toelicitloanofficers’effort,theirpayistiedto loanvolume → abundantliquidityinducesmorerisktaking

Dell’Ariccia,LaevenandMarquez(2014):costlymonitoringofloanportfolio → dropinrisk-freerateinducesbankstocutmonitoring → takemorerisk

Evidence:

Dell’Ariccia,LaevenandSuarez(2017):U.S.bankslowertheirinternalrisk ratingofnewloanswhenshort-terminterestratesrise

Jim´enez,Ongena,Peydr`oandSaurina(2014):asovernightratesdrop,less capitalizedSpanishbanksrelaxlendingstandardstoriskyfirms

AndersonandCesa-Bianchi(2023):amonetarytighteningtriggersalargerrise increditspreadsforhigh-leveragefirms,mainlyduetoahigherriskpremium

Prediction: monetarypolicytighteningmorerestrictiveforBROWN firmsthanforgreenones

Literature

6/24

4 Conclusions

Data Outline

1 Literature 2 Data 3 Results

7/24

MergingAnacreditloanandcarbonemissiondata

Wedrawmonthlyloan-leveldatafromSeptember2018toDecember2022 fromtheAnaCreditdatabase,coveringalleuro-areacountries Foreachcreditinstrument,wehavedatafor:

theinterestratechargedbytheissuingbank

itsestimateoftheprobabilityofdefault(PD)

Forlistedfirms,wemergethesedatawithRefinitivdatafor

firm-levelcurrentcarbon(CO2andCO2equivalent)Scope1andScope2 emissiondata(inthousandtonnespermillionUSDofnetrevenues)

thefirm’scommitmenttoreducefutureemissions,namely,adummy indicatingifthefirmhasdisclosedanemissionreductiontarget Firmcommitmentisassociatedwithcarbonemissionsreductionaccordingto Carboneetal.(2022)andBoltonandKacperczyk(2023).Theyalsofind greatersign-upinEuropebyhighemittersthaninNorthAmericaandAsia

Data

8/24

Dataaboutbankcommitmentandmonetarypolicyshocks

Wecomplementthesedatawith:

informationaboutbanks’environmentalcommitment,byidentifying signatoriesofacommitmentletterinthecontextoftheScienceBasedTargets initiative(SBTi),whichpromotesnet-zeroclimatetargets(following KacperczykandPeydr`o,2021)

amonthlytimeseriesofhigh-frequencymonetarypolicysurprisesfromthe EuroAreaMonetaryPolicyEvent-StudyDatabase(EA-MPD)developedby Altavillaetal.(2019)

interestratechangesina30-minutewindowaroundECBpressconferences, expressedonamonthlybasis asinGurkaynak,SackandSwanson(2005),Jaroc`ınskiandKaradi(2020)and AndersonandCesa-Bianchi(2023)

Data

9/24

Descriptivestatistics

VariablesObservationsMeanSt.Dev.p5p10p25p50p75p90p95

(b.p.)453,2311.095.56-1.53-1.20-0.530.000.064.2114.14

Data

PD

Carbon

435,2630.180.470.000.000.010.030.090.530.82 Target

453,2310.580.490.000.000.001.001.001.001.00

10/24

Spreadb,f ,t 325,1801.510.760.180.541.081.552.002.412.76

f ,t 442,4690.963.490.070.090.150.260.501.182.48

f ,t

f ,t

Commitb,t 453,2310.110.310.000.000.000.000.001.001.00 MPt

Literature 2 Data

4 Conclusions

Results Outline

1

3 Results

11/24

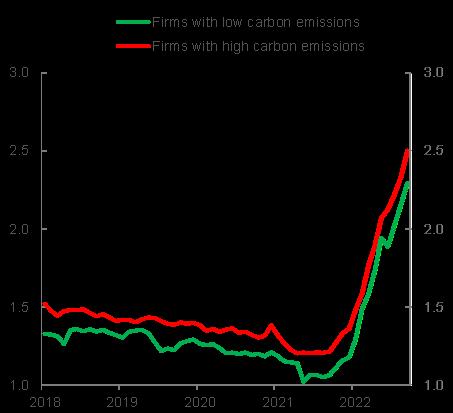

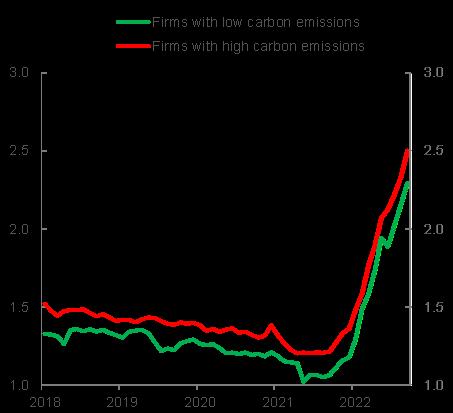

Bankpricingofclimaterisk:descriptiveevidence

Results

12/24

Bankpricingofclimaterisk:panelestimates

(1)(2)(3)(4)(5)(6)(7)

PDf ,t 0.024***0.017***0.017***0.026***0.026***0.005***0.005*** (0.0005)(0.0006)(0.0006)(0.0008)(0.0008)(0.0006)(0.0006)

Carbonf ,t 0.071***0.020***0.043***0.019***0.090***0.033**0.086*** (0.0026)(0.0061)(0.0088)(0.0066)(0.0118)(0.0169)(0.0201)

Targetf ,t -0.103***-0.067***-0.068***-0.067***-0.078***-0.034***-0.034*** (0.0024)(0.0025)(0.0026)(0.0028)(0.0032)(0.0034)(0.0034)

Carbonf ,t × -0.032***-0.103***-0.045***

Targetf ,t (0.008)(0.0139)(0.0086)

FixedEffects:

BankYesYesYesYesYesYesYes

Economicsignificance,basedonColumn1:

4bppremium(5%ofSD)forfirmswithhighemissions(90th percentile)

10bpdiscount(13%ofSD)forfirmscommittedtoreduceemissions

3bppremium(4%ofSD)onfirmswithhighPD(90th percentile)

Results

TimeYesYesYes--YesYes ILS-YesYes---ILS ×Time---YesYes-Firm-----YesYes Observations306871306788306788305401305401306864306864 R 2 0.4680.5500.5500.6020.6030.6170.617

13/24

ClimateriskandPD

Concern:whatifPDalreadyincorporatesclimateriskconsiderations?

Theoretically:

Differenthorizons

NoincentivestoincorporateclimateriskinPD

Maybedifficulttoincorporateininternalmodels

Empirically

Zerocorrelationofthetwovariables

Robustnesstest:wefindsameresultsonclimateriskvariablesifweremove PDandaddlistoffirmobservables

Results

14/24

Bankcommitment&climateriskpricing:panelestimates (1)(2)(3)(4)(5)

PDf ,t 0.0248***0.0176***0.0270***0.00512*** (0.000566)(0.000627)(0.000794)(0.000660)

Carbonf ,t 0.0414***0.0313***0.0815***0.0823*** (0.00730)(0.00907)(0.0121)(0.0200)

Targetf ,t -0.0913***-0.0591***-0.0750***-0.0238*** (0.00267)(0.00267)(0.00331)(0.00340)

Commitb,t 0.241***0.207***0.01750.213***0.0133 (0.0247)(0.0235)(0.0223)(0.0234)(0.0210)

Carbonf ,t × Targetf ,t 0.0328***-0.0229***-0.0999***-0.0394*** (0.00767)(0.00796)(0.0139)(0.00852)

Commitb,t × PDf ,t -0.00669***-0.00744***-0.00772***0.0004380.00500*** (0.00174)(0.00151)(0.00152)(0.00149)(0.00144)

Commitb,t × Carbonf ,t 0.0336***0.0339***0.0310***0.001580.00907 (0.0115)(0.0115)(0.00936)(0.0124)(0.0100)

Commitb,t × Targetf ,t -0.166***-0.157***-0.0572***-0.163***-0.0431*** (0.0194)(0.0203)(0.0154)(0.0205)(0.0146)

BankFixedEffectsYesYesYesYesYes

TimeFixedEffectsYesYes-Yes-

ILSFixedEffects-Yes---

ILS × TimeEffects--Yes--

FirmFixedEffects---Yes-

Firm × TimeEffects----Yes

Observations306871306788305401306864303466

R-squared0.4690.5510.6030.6180.694

Economicsignificance,basedonColumn2:committedbankscharge

16bp(21%ofSD)lessthanuncommittedbanksinlendingtofirmswithtarget

2bp(3%ofSD)moretofirmswithhighemissions(90

percentile)

Results

th

15/24

Monetarypolicy&climateriskpricing:panelestimates (1)(2)(3)(4)(5)

PDf ,t 0.00777***0.0242***0.0168***0.0261***0.00540*** (0.000724)(0.000546)(0.000593)(0.000769)(0.000643)

Carbonf ,t 0.0506***0.0425***0.0893***0.0856*** (0.00758)(0.00885)(0.0118)(0.0201)

Targetf ,t -0.103***-0.0688***-0.0780***-0.0349*** (0.00252)(0.00260)(0.00323)(0.00340)

Carbonf ,t × Targetf ,t -0.0260***-0.0308***-0.102***-0.0443*** (0.00788)(0.00806)(0.0139)(0.00862)

MPt 0.0150***

(0.000876)

MPt × PD f ,t 0.000263**0.000399***0.000348***0.000340**0.000274*** (0.000118)(0.000110)(0.000105)(0.000154)(0.0000914)

MPt × Carbonf ,t 0.00111*0.00107*0.00233*0.000990* (0.000673)(0.000587)(0.00138)(0.000585)

MPt × Targetf ,t -0.00329***-0.00205***-0.000509-0.00162*** (0.000575)(0.000554)(0.000686)(0.000528)

BankFixedEffectsYesYesYesYesYes

TimeFixedEffects-YesYes-Yes

ILSFixedEffects--Yes-ILS × TimeFixedEffects---Yes-

FirmFixedEffectsYes---Yes

Observations321331306871306788305401306864 R-squared0.3660.4680.5500.6030.617

Results

16/24

Impacteffectofmonetarypolicyshocksonloanpremia

Note:themonetarypolicyshockisdefinedasanunexpected increase inthe policyrate(asproxiedbytheOIS),i.e.,atightening

Column1:a25bpsurpriseincreaseinthepolicyrateresultsina35bp increaseinbanks’creditspreads

Subsequentcolumns:baselineimpactabsorbedbytimeeffects,butwecan stillestimatethedifferentialimpactonpremiaacrossfirms

Column3(withbank,timeandILSeffects):a25bpsurpriseincreaseinthe policyrateresultsin

1.4additionalriseinpremiaforhighemitters(90th percentile)

5bpsmallerriseinpremiaforfirmscommittedtoloweremissions

Results

17/24

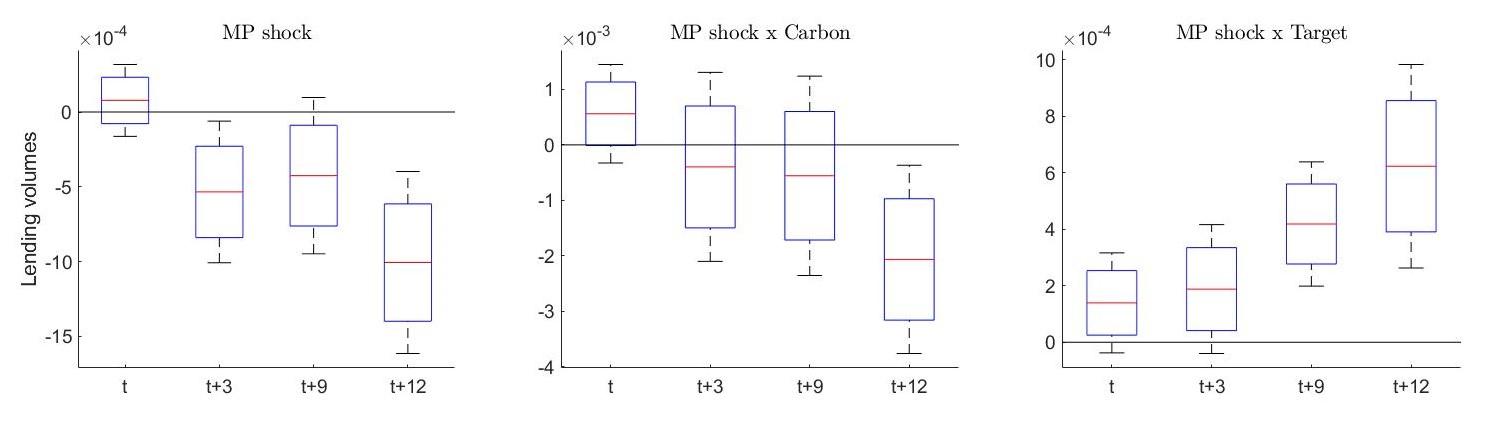

Butmonetarypolicyactswith“longandvariablelags”...

Creditsupply:banksmaytaketimetoadjusttheirlendingpoliciesto changesinmonetarypolicy

Creditdemand:firmsmaytaketimetoadjusttheirinvestment,hiringand productiondecisions–hencetheirdemandforloans–tochangesinthecost ofcredit

Uselocalprojectionestimatestocapturethesedynamiceffects: yb,f ,t+h = λ1hMPt + λ2hMPt × Carbonf ,t + λ3hMPt × Targetf ,t + θb + ϵf ,b,t+h , wheretheoutcomevariable yb,f ,t+h iseitherthelendingspreadorthe (logarithmofthe)loangivenbybank b tofirm f betweenmonth t and month t + h; MPt isthemonetarypolicyshock; θb arebankfixedeffects.

Results

18/24

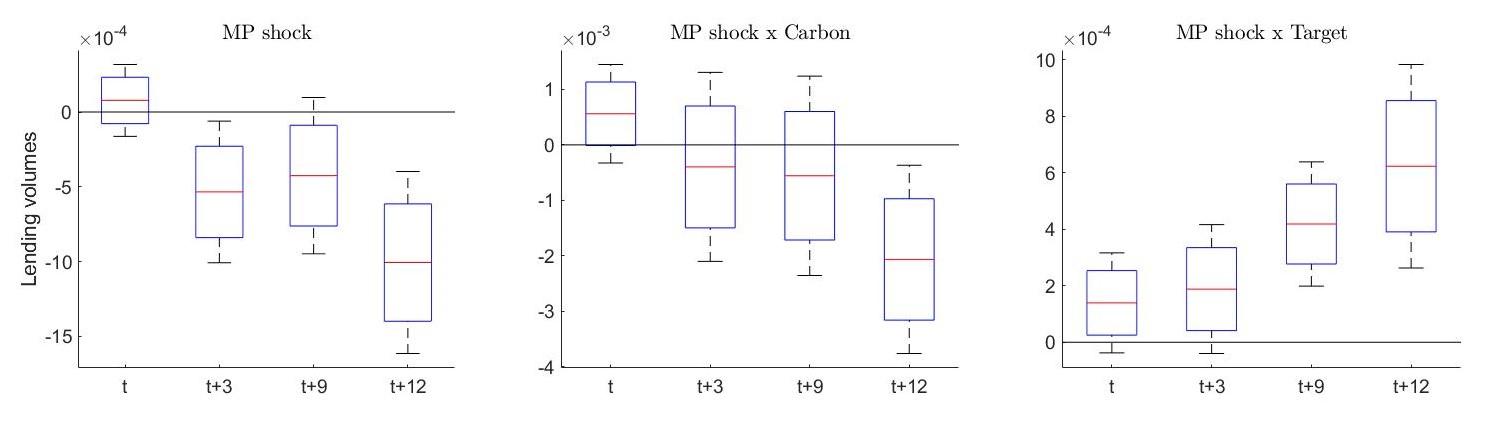

Dynamiceffectsofmonetarypolicyonloanpremia

Localprojectioncoefficientestimatesatmonth0,3,9and12 Monetarytighteninghasinitiallysmallbutgraduallyincreasingeffecton premia,slightlygreaterforhigh-emissionfirms,lesssoforcommittedones:

1st figure:25bpsurprisetightening → 39bpriseinpremiaafter12months

2nd figure:additional2bpforhighemitters(90th percentile)

3rd figure:5bpmitigationeffectforcommittedfirms,9bpafter12months

Results

19/24

Dynamiceffectsofmonetarypolicyonloanvolumes

Localprojectionestimatesaremirrorimagesofthoseinpreviousslide Monetarytighteninggraduallyreduceslending,moresoforhigh-emission firms,lesssoforcommittedones:

1st figure:25bpsurprisetightening → negligibleimpacteffect,gradualdrop inlendingby2.5%after12months

2nd figure:additional2.7%dropforhighemittersafter12months

3rd figure:1.5%mitigationeffectforcommittedfirmsafter12months

Results

20/24

Alternativeidentificationstrategy

Similarresultsifweadoptadiff-in-diffstrategyaroundtwoepisodes

December2021:endofnetpurchasesunderPEPPandreductionofAPPnet purchases

July2022:firstratehike

Results

21/24

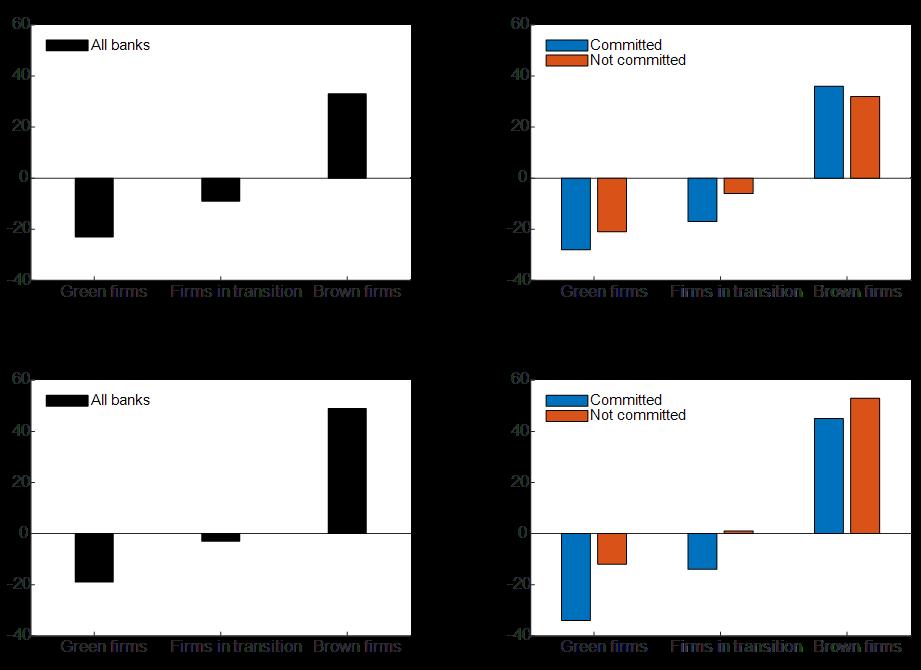

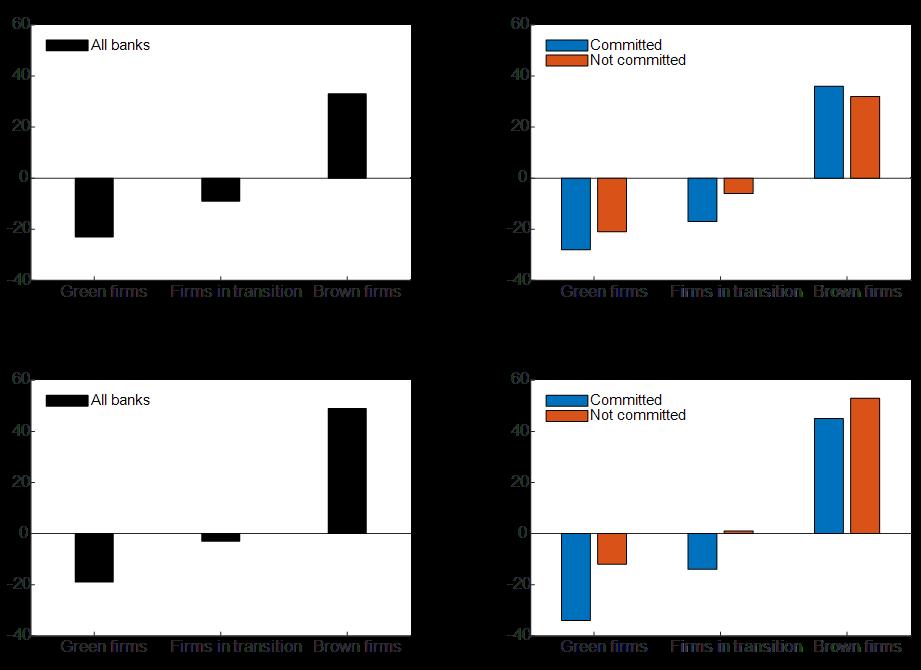

Surveyevidencedovetailswithpreviousresults

July2023BLSaskedbanksifinthepreviousyeartheychangedtheirlending policiesdifferentlyfor“brown”firms,“green”firmsandfirms“intransition”

Note:previousyearhadseenalargeandpersistentmonetarytightening

Results

22/24

1 Literature 2 Data

3 Results

4 Conclusions

Conclusions Outline

23/24

Euroarea bankspriceclimaterisk:theycharge higherratestofirmswith largeremissions,and lowerratestofirmsthatcommittogreen transition

Banks’ commitmentmatters:Committedbanks provide cheaperloansto firmsthatcommit todecarbonizationand penalize more pollutingfirms

Climaterisk-takingchannelofmonetarypolicy: contractionarymonetary policy shocksleadto

higherpremiaandlowervolumes tohighemissionfirms

mitigating effectsfor firmscommitted todecarbonization

Bottomline:

restrictivemonetarypolicyincreasesthecostofcredittoallfirms... ...butitscontractionaryeffectismilderforfirmswithlowemissionsandthose committedtoreducingthem

Conclusions

Conclusions

24/24

Thankyou!