I am fortunate to have assumed the leadership of the Philadelphia Accelerator Fund in October of 2022 after a great deal of strategic thinking and groundwork had already been done. PAF’s first strategic plan, completed in May of 2021, thoughtfully articulated both the challenges and opportunities facing the organization during its formative stage. As we revisit this plan and adapt it for the years ahead, we can also look back on the presuppositions that underpinned its founding. The early success we have had is a vindication of what the founders of PAF understood when that initial plan was assembled:

1) The City of Philadelphia badly needed a mission-based lender focused exclusively on affordable housing development. Far smaller cities and regions with less vacant property than Philadelphia, more manageable housing challenges, greater local wealth, and better access to bank capital had well-established, active Community Development Financial Institutions (CDFIs) dedicated to affordable housing finance.

2) Financing affordable housing development is, dollar-for-dollar, the most impactful kind of investment that CDFIs and other local stakeholders can make towards improving our city. Access to affordable housing may not solve every problem that afflicts Philadelphia, but in its absence, every other problem is dramatically less solvable. How much more difficult is it to educate a child who lacks a safe place to sleep at night? How much more difficult is it to police a community overrun by vacant property? And how can a family hope to build generational wealth when half or even two-thirds of its household income goes to pay rent?

3) Improving Philadelphia’s housing development network can itself be a driver of prosperity for those who have been denied opportunities in the past. The City has legions of Black and Brown-owned contracting firms, emerging nonprofits, and talented entrepreneurs ready to build the housing that we desperately need. By expanding access to capital, PAF could help individuals build their businesses and nonprofits scale up.

These realities informed the early organization of the Fund as an effective resource for affordable housing development. Greg Heller, Dave Thomas, Anne Fadullon, Mo Rushdy, and Jojy Varghese (among many others), invested the hours and applied their know-how in establishing the Board, getting the start-up capital together, and framing out the institution.

And so, two years after accepting the position as Executive Director of PAF, I believe the veracity of the three core assumptions articulated above has been overwhelmingly borne out. We have demonstrated the need for PAF and then some — with $6,334,498 in closed loans, 163 units of deed-restricted affordable housing in development and a credible pipeline for more than $9,000,000 in new loans and 312 units. The Fund now manages $14,900,000 of loan capital. We obtained CDFI certification from the U.S. Department of the Treasury in the Fall of 2024. We delivered a clean audit to prospective investors for our first fiscal year of lending. We raised $341,000 in operating grants and $4,900,000 in new loan dollars, ensuring our long-term sustainability. And, with the addition of Leah Apgar in February 2024, we have a Director of Lending and Operations who could run the lending program at any CDFI in the country. Her diligence, creativity, and wealth of industry experience have enabled PAF to do more and

NEW LOANS IN THE PIPELINE

$9,000,000

AFFORDABLE HOUSING UNITS IN THE PIPELINE

do it faster than anyone could have reasonably expected when that first strategic plan was written.

Having proven the concept, we now enter a new phase of our institutional development as we transform ourselves into a mature loan fund. That is the purpose of this strategic plan, and the reason why we have invested considerable time and energy in its development. Our plan makes one thing perfectly clear — we will grow intentionally while maintaining our focus on our core purpose and principles. We understand that early successes in no way guarantee future success, and rapidly growing nonprofit organizations like PAF must be especially diligent about maintaining core purposes and principles.

Thus, as we grow strategically and deliberately, PAF remains committed to a future where every Philadelphian has access to safe, quality housing at a price within their means. We will also work continuously towards building an affordable housing ecosystem within the City in which more housing — both in real terms and as a percentage of overall development — is constructed by Black- and Brown- owned firms and local nonprofits, including by developers building in their own communities. The future prosperity of Philadelphia must be a shared prosperity, in which local wealth generated by the development of housing stays within the City.

$6,334,498

DEED-RESTRICTED AFFORDABLE HOUSING UNITS IN DEVELOPMENT

312 163

In addition to addressing the need for quality affordable rental housing, our financing programs aim to create affordable homeownership where possible, thereby helping to build wealth for homebuyers. This is especially critical for Black- and Brown-led households which have historically been denied access to homeownership as a means of wealth creation. We will work to manifest the promise of Turn the Key, the City’s mortgage buydown assistance program for income-qualified homebuyers, helping to deliver quality, newly constructed homes to a generation of Philadelphia families that could not afford them otherwise.

Finally, we envision a better Philadelphia more broadly — a growing city where more people want to build their lives. While the population of Philadelphia has stabilized over the last 20 years, it remains half a million people below its post-WWII peak. With tens of thousands of vacant parcels, abandoned structures in need of rehabilitation, antiquated zoning, and former industrial space in need of remediation (among other land use challenges), we believe affordable housing redevelopment is a critical component of our future success as a city.

I am extraordinarily proud of what we have accomplished in just a couple of years, and I am even more excited about what we can achieve going forward.

Sincerely,

David Langlieb Executive Director, Philadelphia Accelerator Fund

PAF OPERATIONALIZES ITS MISSION IN TWO WAYS: by financing deed-restricted affordable housing in Philadelphia at as deep an affordability level as economically feasible and by supporting Blackand Brown-owned development firms and nonprofit developers in the City. The first activity serves the residents of Philadelphia, a quarter of whom live below the federal poverty level, through financing affordable for-sale and rental housing. By policy, a minimum of 51% of the housing units financed by PAF are deed restricted as affordable for at least 15-years. In practice, to date, 79% of the housing units financed by PAF have been affordable at 80% AMI or less.

NEARLY 4 OUT OF 5 HOUSING UNITS FUNDED BY PAF ARE DESIGNED TO BE ACCESSIBLE TO LOWER-INCOME INDIVIDUALS OR FAMILIES WITHIN THE COMMUNITY.

The second part of the mission builds local capacity by helping underserved developers scale up their activity, and in so doing helps reduce the City’s racial wealth gap. Philadelphia has a growing number of diverse developers who have faced discriminatory barriers in lending, preventing them from obtaining the capital they need to be successful and produce more affordable housing projects for low-income individuals. PAF seeks to counteract the negative impact of predatory and discriminatory lending in communities. To serve historically disadvantaged developers, PAF loan policies prioritize underwriting the project rather than the guarantor. In line with PAF’s core value of creating access to opportunity, PAF has neither minimum personal net worth nor minimum liquidity requirements.

To that end, PAF staff uses its financial expertise and capital to finance the following types of projects and borrowers, with the goal of providing equitable access to capital and opportunity:

• Black- and Brown-owned development firms.

• Small developers, especially those scaling up development capacity.

• Development of City of Philadelphia Land Bank properties, returning vacant land to productive use, by creating new affordable for-sale homes.

• Deed-restricted rental housing with long-term affordability components.

• Additionally, PAF provides a responsible financing alternative to high-interest rate “hard money” lenders.

We envision a future where every Philadelphian has access to safe, quality housing at a price within their means and where owning a home builds generational wealth for new homebuyers. We envision a more just Philadelphia, with a citizenry that works cooperatively to overcome the ugly legacies of discrimination and prejudice. We envision a Philadelphia where economic growth benefits entire communities rather than a select few. Finally, we envision a better Philadelphia in the broadest sense — a growing city where more people want to live, work, raise families, meet friends, and pursue

• ACCESS TO OPPORTUNITY: We recognize and respond to the financial needs of the communities we serve and provide equal access to opportunity.

• INNOVATION: We believe systemic change is necessary in our community, and therefore, we foster creative solutions to financial problems. We consistently seek unique and innovative ways to improve community development outcomes and achieve equitable solutions.

• COMPASSION: Active listening and integrity are integral to our work. We endeavor to recognize and respond to the needs of our community and constituency with respect and compassion.

• COLLABORATION: Intellectual curiosity and asking the right questions enables us to understand and identify challenges in our community and to work cooperatively on developing solutions. Our work is driven by relationships and partnerships in the private, public, and nonprofit sectors. The free exchange of ideas helps us to develop the best financial solutions to community development problems.

• EXCELLENCE: Externally, we consistently seek to deliver high quality and impactful financial products to our clients and our investors who have entrusted us with stewardship of financial resources to benefit the community. Internally, we reflect our professionalism and commitment to inclusive excellence through investing in our staffing, infrastructure, and technology and pursuing internal initiatives that build a unified team.

PAF was incorporated as a nonprofit corporation on October 10, 2019. Numerous committed professionals and community stakeholders in Philadelphia had a vision to create the city’s first solely housingfocused loan fund. The goal was (and continues to be) to finance projects developed by Black- and Brown-owned development firms, as well as nonprofits, and to add value within Philadelphia, filling market gaps to create affordable housing. Rather than competing with other mission-based lenders, PAF was designed to partner with existing institutions and leverage new capital for affordable housing development. This vision included providing exceptionally flexible loans for difficult-to-underwrite projects and borrowers, offering the ‘but for’ or gap financing needed to make these projects happen.

PAF’s first strategic plan was adopted by the Board of Directors in May 2021. This plan outlined several goals and priorities for the organization. At the time, it was unclear how long it would take to achieve the milestones outlined in the plan. While certain ideas shifted and concepts were refined as the organization developed, many of the strategies laid out in that plan were executed in their original form. Since inception, PAF is pleased to celebrate the following successes:

• PAF raised a $10 million loan loss reserve, funded by the City of Philadelphia and Philadelphia Redevelopment Authority. This funding enabled PAF to leverage private debt capital for its revolving loan fund.

• PAF raised its initial $10 million of loan capital from Citizens Bank and Univest Bank & Trust Co., seeding its revolving loan fund. During 2024, an additional $4.9 million of lending capital was raised from Penn Community Bank, Firstrust Bank, Wilmington Savings Fund Society FSB, and the City of Philadelphia. PAF used this capital to fund its first NINE loan transactions totaling $6,334,498 , which leveraged $55,998,976 in total development costs, in 2023-2024. These projects have financed 163 housing units, with 129 units affordable at 80% of AMI or less.

• In January 2023, PAF closed its first loan, a $1.3 million acquisition, rehabilitation, and minipermanent loan to a Black developer for 17 units of affordable rental housing in the Parkside neighborhood of Philadelphia.

• In June 2024, PAF raised its first significant operating grant from the Barra Foundation. Since then, PAF raised additional operating and program support from philanthropic institutions, including TD Charitable Foundation, PNC Foundation, WSFS Cares Foundation, and Woodforest National Bank. These important grants aided in solidifying PAF’s financial position.

• In September 2024, PAF was approved for certification as a Community Development Financial Institution (CDFI) by the U.S. Department of Treasury CDFI Fund. This certification reflects the early success of PAF at making impactful loans. Approved target markets under PAF’s certification include Black-owned or led development firms and the City of Philadelphia. This certification will provide PAF with deeper access to capital to serve its target market and borrowers.

9 $1,300,000 $6,334,498

TOTAL AMOUNT HOUSING UNITS FINANCED

163

THE LAST TWO YEARS... JANUARY 2023... (129 units affordable at 80% of AMI or less)

TOTAL DEVELOPMENT COSTS LEVERAGED IN 2023-2024

$55,998,976 LOANS CLOSED FIRST LOAN CLOSED

• In addition to certification approval, the CDFI Fund awarded PAF a $300,000 Technical Assistance (TA) grant in November 2024. This grant will be disbursed over three years and will go a long way towards solidifying the organization’s operations.

• As demand for PAF’s loan products has grown and PAF has engaged in discussions with borrowers and potential borrowers about their financing needs, the organization has refined and curated its loan products to fill gaps in the market. PAF now offers a suite of essential loan products to respond to developer needs, which include financing one to four-unit projects, replacing “hard money” and nontraditional lenders in transactions, and providing subordinate financing to reduce the amount of cash required from borrowers in certain transactions.

• Recognizing the importance of ensuring that each loan meets the organization’s mission, PAF implemented an impact scoring matrix as a component of its underwriting process. To date, 100% of PAF loans have been to Black- and Brown-owned development firms, nonprofits, or joint ventures with a Black or Brown partner. Further, all PAF-financed transactions contain deed restrictions in line with the policy goals of the original strategic plan: 79% of units financed are affordable at 80% of AMI or less.

• When PAF was formed, one of the primary stated goals was to support the development of affordable homeownership in the City by expanding access to the Land Bank’s affordable housing disposition process. PAF provided numerous letters of interest to small, Black- and Brownowned development firms looking to build affordable, for sale housing on vacant parcels and in mid-2024, many of these projects came to fruition. As of this writing, PAF has issued NINE commitments for loans totaling $2,924,458 , which will support these projects in 2025, creating 72 new homeownership units in the City. PAF has developed a strong partnership with the City’s Turn the Key subsidy program, significantly reducing the effective prices of these newly-constructed homes financed by PAF.

• PAF has established the infrastructure of a healthy nonprofit organization by expanding staffing, enhancing back-office functions to deliver high-quality services, and positioning the organization for future growth.

TECHNICAL ASSISTANCE (TA) GRANT AWARDED TO PAF

$300,000 NOVEMBER 2024...

100% LOANS TO BLACK AND BROWN-OWNED DEVELOPMENT FIRMS AND NONPROFITS

9

$2,924,458

TURN THE KEY HOMEOWNERSHIP PROJECTS COMING IN 2025 TOTAL AMOUNT NEW HOMEOWNERSHIP UNITS COMING IN 2025...

72

In October 2024, PAF staff met to discuss the organization’s mission, vision, achievements to date, and to develop a plan for the future growth of the organization. This discussion was rooted in a desire to meet the financing needs of Black and Brown developers and nonprofits undertaking affordable housing projects in the Philadelphia ecosystem. Furthermore, staff was attuned to the pitfalls of “growth for the sake of growth.” While increasing the size of the PAF loan fund may be important to meet specific financing needs, this growth must have a specific purpose that is aligned with the mission, vision, and values of PAF outlined in this strategic plan.

STAFF EARNESTLY SOUGHT TO UNDERSTAND THE FINANCING NEEDS OF ITS CURRENT AND PROSPECTIVE BORROWERS, SPECIFICALLY ASKING THE FOLLOWING QUESTIONS:

• What should be PAF’s mission?

• Is there one thing that makes PAF unique from other lenders?

• What does PAF do well? In what ways is PAF meeting financing needs in the Philadelphia market?

• In what ways is PAF not meeting financing needs in the Philadelphia market? What other products and services should PAF be offering? What can we do better?

• What are your recommendations and suggestions for the future of PAF?

PAF’S BOARD OF DIRECTORS WAS ALSO ENGAGED IN THE ORGANIZATION’S STRATEGIC PLANNING PROCESS. PAF’s Board is comprised of individuals from the public, private, and nonprofit sectors, including lenders, developers, and other community development professionals, providing a diverse cross-section of ideas for the organization. The Board engaged in a lively and robust discussion that helped to guide the organization towards the goals articulated in this strategic plan.

In its first two years of active lending, PAF has achieved many early successes. Over the next five years, PAF will build on those successes to meet its mission, doubling down on effective strategies and what PAF is already doing well, while adding “tools to the toolkit” by developing new financial products and services, and continuing to build organizational infrastructure and financial strength. This strategic plan both articulates current essential products that PAF is already offering and will continue to offer, as well as many areas where PAF intends to expand its programs, impact, and internal and external resources to serve its borrowers. It is essential that PAF continues to be flexible, responsive, nimble, and financially stable to ensure future success and better serve the communities of Philadelphia.

Five goals, each directly connected to PAF’s core values, are outlined for the 2025-2029 Strategic Plan, along with specific strategies to achieve these goals.

PAF has worked and will continue to work collaboratively with the non-profit Accelerator for America to develop a data analysis and mapping tool used to identify areas of the City most in need of affordable housing.

• GOAL 1: PAF will finance a minimum of 940 units of quality affordable housing, providing greater access to safe and economically-viable housing options for Philadelphia residents.

• GOAL 2: PAF will continue to develop innovative new loan products to address market gaps while prioritizing lending to developers and nonprofits that have been systemically denied access to financial resources and opportunity.

• GOAL 3: Through collaboration with other partners, PAF will strengthen the capacity of Black and Brown and female-owned development firms and nonprofits creating affordable housing in Philadelphia.

• GOAL 4: Grow PAF’s financial capacity to support the goals of the strategic plan and strengthen the sustainability of the organization, building a compassionate and unified organization and team.

• GOAL 5: While growing and expanding the organization, PAF will continue to balance impact and risk, measuring both within a rigorous and robust framework, facilitating the delivery of excellent results both externally and internally.

PAF WILL FINANCE A MINIMUM OF 940 UNITS OF QUALITY AFFORDABLE HOUSING, SERVING A MINIMUM OF 2,200 PEOPLE, PROVIDING GREATER ACCESS TO SAFE AND ECONOMICALLY-VIABLE HOUSING OPTIONS FOR PHILADELPHIA RESIDENTS.

PAF WILL USE THE FOLLOWING STRATEGIES TO ACHIEVE THIS GOAL:

• Finance a minimum of 450 rental units of housing generating $22.5 million of loan volume, serving a minimum of 1,050 people.

• Finance a minimum of 490 homeownership units of housing generating $24.5 million of loan volume, serving a minimum of 1,150 people.

• Attain a leverage ratio of at least 1:5 across PAF’s entire loan portfolio (defined as PAF Loan: Total Development Costs).

• Require a deed restriction such that a minimum of 51% of the units are affordable for at least 15 years for every project financed. In reality, based on the prior two years of lending data, PAF anticipates that nearly 100% of financed units will be affordable at 80% of AMI and less.

• Collaborate with other strategic partners to improve, broaden, and strengthen the City’s affordable housing development ecosystem more comprehensively, including Accelerator for America and other nonprofits working to expand the supply of affordable housing in Philadelphia.

Over the past two years, PAF has exclusively financed affordable housing projects and firmly believes that affordable housing is an essential component of thriving communities.

As one of the poorest large cities in America, Philadelphia is in dire need of high-quality affordable housing. Median household income in most of Philadelphia’s census tracts is at or below 80% of the MSA’s median income, but the average monthly rent is $1,390 in Philadelphia County and 63% of homes are valued at greater than $200,000 at this writing, far beyond the reach of low-income residents (according to census.gov). Philadelphia County has a homeownership rate of only 51.8%, compared to the 69.5% homeownership rate in Pennsylvania. Furthermore, the City contains approximately 40,000 vacant parcels; not only are vacant properties an eyesore in neighborhoods, but often they become sites of crime, vandalism, and other undesirable activities, leading to further disinvestment in low-income communities. Developing these properties as quality affordable housing reduces blight and provides the units that city residents need.

40,000

450 490

During its first two years of active lending, PAF’s financing of affordable rental units has included both first mortgage lending on small projects that would have difficulty accessing capital in traditional financial markets, as well as subordinate financing in conjunction with other lenders for larger multi-unit projects. Both products are vitally important. In the first case, many developers or nonprofits would be forced to turn to hard money or high-interest-rate lenders for financing small-scale, nonbankable projects. In the second case, PAF is providing low-cost financing which partially acts as an equity substitute enabling developers and nonprofits to finance projects with only a fraction of the equity that would typically be required.

Further, almost all rental projects financed by PAF to date will be rented to tenants receiving Housing Choice Vouchers (HCVs) from the Philadelphia Housing Authority (PHA).

Under this program, market rents are organized by zip code in the City of Philadelphia, with the highest-rent communities designated as “Group 5 — High Opportunity Rents” and the least expensive communities designated as “Group 1 — Basic Rents.” The program subsidizes eligible landlords who rent their properties to pre-approved PHA tenants, and tenants are required to pay approximately 30% of their income towards rent and receive a utility allowance. While non-HCV rental projects will also be financed by PAF, we anticipate that tenants in the majority of financed rental projects will receive either HCVs or some other form of rental assistance. This type of rental assistance is critically important for individuals and families to afford safe, high-quality rental housing.

To date, all homeownership housing units financed by PAF have been acquired by developers through the Philadelphia Land Bank and potential homebuyers are eligible for up to $75,000 of mortgage buydown assistance through the Turn the Key Program. Properties are acquired through the Land Bank for up to $1,000/parcel, which adds a substantial subsidy into the project. Therefore, between the discounted purchase price and mortgage buydown assistance, the developers are able to complete the projects with a significant affordability component included. Ultimately, these new three-bedroom homes sell to LMI homebuyers for as little as $205,000 (affordable at 40% to 50% of AMI).

All units financed by PAF include a deed restriction such that a minimum of 51% of the units are affordable for at least 15 years. This deed restriction is a vital tool to ensure long-term affordability for both homebuyers and renters.

Homebuyers are also eligible for closing cost grant subsidies, enabling residents of Philadelphia to acquire a new row home with nominal money down and a monthly payment that is at least $500 a month less than what an equivalent rental property would cost. Over the next five years, PAF anticipates that financed homeownership projects will almost exclusively come through the Land Bank and Turn the Key programs, as it is difficult for low-income residents to buy a home without these subsidies. PAF firmly believes that homeownership is an important means of long-term wealth generation for Philadelphia residents and will therefore continue to focus on investing in properties like these.

While it will take significant lead time to secure the necessary funding sources and implement corresponding loan programs, PAF’s five-year loan projections are aggressive, yet achievable. They include 15% loan growth in the latter half of the strategic plan (2027-2029) and anticipate that PAF will begin to recycle certain loan capital, originally deployed as shorter-term debt for the construction of homeownership projects, in 2028-2029. Furthermore, PAF anticipates that offering a long-term loan product funded through Bond Guaranty Program (BGP) proceeds, discussed later in this plan, will significantly bolster the demand for PAF’s loans and help grow and strengthen the organization’s balance sheet.

Finally, PAF also recognizes that it can be a challenge to access and understand vacant property data throughout Philadelphia. Therefore, PAF has worked and will continue to work collaboratively with the non-profit Accelerator for America to develop a data analysis and mapping tool used to identify areas of the City most in need of affordable housing. This tool will also help prospective loan applicants identify the owners of vacant parcels with title issues and decipher out-of-state investor LLC ownership. Philadelphia is one of 11 cities participating in this pilot program. Free access to this state-of-the-art data analysis tool will be given to prospective PAF loan applicants as well as interested technical assistance partners.

PAF’S FIVE-YEAR LOAN PROJECTIONS 15%

15% LOAN GROWTH IN THE LATTER HALF OF THE STRATEGIC PLAN (2027-2029)

PAF WILL CONTINUE TO DEVELOP INNOVATIVE NEW LOAN PRODUCTS TO ADDRESS MARKET GAPS WHILE PRIORITIZING LENDING TO DEVELOPERS AND NONPROFITS THAT HAVE BEEN SYSTEMICALLY DENIED ACCESS TO FINANCIAL RESOURCES AND OPPORTUNITY.

WHILE NOT AN EXHAUSTIVE LIST, PAF WILL USE THE FOLLOWING NEW STRATEGIES TO ACHIEVE THIS GOAL:

• Establish a revolving line of credit product by 2026 to support scattered-site homeownership housing development.

• Secure Capital Magnet Funds (CMF) from the CDFI Fund, thereby allowing PAF to develop an even more affordable (lower interest rate) unsecured predevelopment and subordinate loan product, supporting deeply affordable rental housing projects with long-term, low-cost loans.

• Secure Bond Guaranty Program (BGP) funding from the CDFI Fund to develop a loan product supporting affordable rental housing projects with long-term, fully amortizing loans that have a fixed interest rate for the life of the loan, providing borrowers with patient capital necessary for their projects.

• Continue to provide essential subordinate financing for both homeownership and rental housing projects in conjunction with other senior financing, specifically to reduce required upfront equity in transactions.

• Continue to provide early stage and working capital financing for deeply affordable tax credit projects.

• Explore creating a new loan product to promote environmental sustainability and resilience in affordable housing projects, accessing Greenhouse Gas Reduction Act funding via the Opportunity Finance Network for this purpose.

PAF will continue to use its resources to develop loan products that address barriers preventing Black and Brown-owned and led development firms and nonprofits access to affordable capital.

PAF believes it is essential to offer a revolving line of credit product to developers and nonprofits, specifically to support scattered-site homeownership housing development. This product will enable developers to respond to market opportunities with flexibility and speed, including purchasing properties through foreclosure or tax sale or from private sellers, thereby securing properties that may otherwise be purchased by investor developers. PAF will underwrite these loans for a sample “box” project at the loan application stage in line with PAF impact and credit criteria. By offering affordable lines of credit for scattered-site housing, PAF can support developers and nonprofits with a product that conventional lenders often find too burdensome or unprofitable.

PAF will seek to secure Capital Magnet Funds (CMF) from the CDFI Fund to support deeply affordable rental housing projects and which will be leveraged with other private capital to finance projects at a minimum of a 1:10 ratio. Low-income families across America experience difficulty finding affordable housing, with 21% of households in Philadelphia County experiencing severe housing cost burden such that they spend more than 50% of their income on housing. This burden severely limits what can be spent on necessities such as food, medical care, transportation, and savings.

CMF was created by the CDFI Fund to spur investment in affordable housing and related economic development efforts that serve low-income families and low-income communities across the country. PAF will use a CMF grant award for the following: (a) predevelopment loans for affordable rental housing projects and (b) subordinate financing for affordable rental housing projects. While PAF currently provides subordinate financing, CMF will allow PAF to double-down and develop an even more affordable loan product with the funding source.

As the organization grows and evolves, PAF anticipates seeking Bond Guaranty Program (BGP) funding at the midway point of the proposed Strategic Plan period. Enacted through the Small Business Jobs Act of 2010, the CDFI BGP responds to a critical market need — long-term, low-cost capital that can be used to spur economic growth and community revitalization. Through BGP, Qualified Issuers apply to the CDFI Fund for authorization to issue bonds worth a minimum of $100 million in total. The bonds provide CDFIs with access to substantial amounts of capital through the private market for various project types — affordable and mixed-income housing, small business, commercial real estate, charter schools, early education centers, healthcare centers, and nonprofit real estate. As a CDFI that will be seeking an award smaller than $100 million, PAF can join a pool of other CDFIs who are using the Opportunity Finance Network as their qualified issuer to collectively reach $100 million.

This unique program incentivizes and empowers CDFIs such as PAF, to execute larger-scale projects that would not otherwise be possible with traditional CDFI capital sources. Loan parameters required under the program are as follows: (a) loans must be amortizing; (b) loans must be at an 80% or less LTVR; (c) loans must be at a 1.20x or greater DSCR; and (d) loans must be within an approved asset class. PAF will use BGP proceeds for affordable, mixed-income, and mixed-use housing transactions in several specific ways:

• To refinance existing loans at low interest rates, freeing up capital for new investments.

• To provide amortizing loans, ranging from five years to 25-years, either for stabilized transactions or as a conversion option at construction completion. Many PAF borrowers would otherwise not have access to long-term, fixed-rate financing for their projects.

Further, PAF anticipates using BGP funding to provide borrowers with a first mortgage loan that can be coupled with a subordinate mortgage from existing PAF financing sources, thereby allowing for up to 95% LTV financing on long-term rental projects. Many developers and nonprofits are denied access to this type of advantageous and patient financing in the market, particularly for smaller, one to four-unit, non-tax credit projects.

PAF will continue to offer its essential subordinate loan product. Many developers do not have the required upfront equity to meet the equity requirements of traditional financial institutions, which are often 20% to 25% of a project cost. These requirements tie up developer cash, which could be used to develop more projects. Furthermore, smaller developers simply may not have this amount of cash on their balance sheets and are unable to bring a project to fruition under these conditions. By providing subordinated debt for bank-led transactions, PAF incentivizes bank lenders to approve loans they would not otherwise make. PAF loan policies do not require minimum personal net worth or liquidity for developers. This is critical for smaller Black and Brown-owned firms, many of which are owned by lower net worth individuals than the white-owned firms operating in the City. If a project generates a satisfactory 1.15x target DSCR and meets the affordability requirements, the personal financials of an owner-guarantor will not be a barrier to loan approval.

PAF will also continue to provide critically needed working capital and early-stage predevelopment funding for affordable housing tax credit projects. These projects are often developed by a nonprofit partner lacking the liquidity of a large for-profit developer. Upfront costs for large multi-family projects can often approach $1 million, including legal expenses, architectural drawings, and other fees associated with securing site control, often a requirement for a tax credit application. Financing at this early stage of development is risky due to the unsecured nature of the lending and because repayment is dependent on the sponsor securing full project financing. At the same time, PAF recognizes the importance of supporting nonprofit organizations developing these projects, removing lack of financing as a barrier to entry, and focuses on balancing impact and risk in underwriting, as discussed further in Goal 5.

OVER THE NEXT FIVE YEARS, PAF WILL EXPLORE ADDING CLEAN ENERGY CRITERIA TO UNDERWRITING AND IMPACT EVALUATIONS.

Finally, PAF recognizes the importance of environmental sustainability in financed projects.

The Opportunity Finance Network, as the trade association for CDFIs, has been awarded $2.29 billion through the Clean Communities Investment Accelerator, part of EPA’s $27 billion Greenhouse Gas Reduction Fund, to distribute to CDFIs at a 0% cost of capital to finance clean energy projects. Over the next five years, PAF will explore accessing this funding source and incorporating clean energy criteria into its underwriting and as a part of its impact matrix when evaluating projects. Incorporation of clean energy into projects will also reduce carrying costs, thereby economically benefiting homebuyers and renters, as well as positively impacting the environment.

THROUGH COLLABORATION WITH OTHER PARTNERS, PAF WILL STRENGTHEN THE CAPACITY OF BLACK AND BROWN AND FEMALE-OWNED DEVELOPMENT FIRMS AND NONPROFITS CREATING AFFORDABLE HOUSING IN PHILADELPHIA.

PAF WILL USE THE FOLLOWING STRATEGIES TO ACHIEVE THIS GOAL:

• Partner with high quality technical assistance providers who are serving Black and Brown developers, including (but not limited to) the Building Industry Association — Urban Developers Association (BIA-UDA) technical assistance program, the PHILLY RiSE Development Accelerator Program, the City of Philadelphia’s Minority Developer Program (MDP), the Urban Renewal Builders (URB) cohort, and the Jumpstart programs (such as Jumpstart Germantown and Jumpstart Kensington).

• Partner with local CDFIs and community development corporations (CDCs) on affordable housing opportunities within their respective catchment areas. Coordinate further with CDCs to connect developer clients with nonprofit credit counseling providers to offer services to PAF developer clients who may benefit from credit counseling, with the goal of ultimately moving the developers along the financing continuum to more traditional financial resources.

• Work directly with prospective applicants to help analyze budgets, pro forma projections, and business strategy.

• Partner with banks, CDFIs, and other capital sources to help borrowers assemble full project financing needed for their development work.

PAF recognizes that collaborations and partnerships across the public, private, and nonprofit sectors are vital to developing affordable housing in a manner that is desired and needed by the community, while also supporting under-resourced developers. PAF seeks to empower Black, Brown, and female developers who may lack financial and strategic resources and to support their growth as entrepreneurs. Likewise, PAF aims to build the capacity of nonprofit housing developers. Partnering with technical assistance programs is essential to achieving this goal, as these providers are often better equipped than PAF to train participants in the development process, including how to: apply for dispositions through the Philadelphia Land Bank for vacant properties, navigate the process of obtaining permits and approvals from the City, and more broadly, implement strategies to sustainably scale their businesses.

Partnering with local technical assistance providers helps to maintain the quality of PAF’s borrower pipeline, and these providers can be confident that PAF will make affordable financing opportunities available to their clients. PAF will build on and expand the collaborations it has developed with programs like these over the past two years and develop similar relationships with more providers.

In the years ahead, PAF will collaborate with these technical assistance partners to help build out the resource network available to emerging developers in the City. PAF will help to enhance the quality of the technical assistance provided by its partners through ongoing discussions with participants of these programs, including phone calls and in-person meetings, and providing feedback to strengthen the content of technical assistance providers. In the new fiscal year, PAF will be conducting follow-on surveys with participants to further ensure the quality of partner programs.

In all respects and under all circumstances, PAF values its clients, endeavoring to treat all borrowers and potential borrowers with kindness, compassion, and respect. As needed, PAF works directly with prospective loan applicants to help analyze financial aspects of the project, budgets, pro forma projections, and housing affordability levels — all skills which are in PAF’s areas of expertise.

In the past year, PAF piloted a test case engagement with a nonprofit credit counselor to assist developer clients who are working through credit challenges. While PAF does not have any specific credit score threshold when providing financing, credit scores can often be a barrier to accessing financing from traditional financial institutions; part of PAF’s goal is to broaden the access that its borrowers have to capital, in part by helping borrowers improve their personal financial position to access bank debt. Towards this end, PAF will continue to seek grant funding to absorb the cost of credit counseling with approved counselors on behalf of borrowers. Third-party credit counselors will assist eligible clients by conducting soft credit pulls and reviewing specific problem issues. These personalized analyses of borrowers’ credit reports will enable the counselors and their clients to develop actionable plans, with a focus on paying down debt and improving credit scores. Success will be monitored by credit score improvement with soft credit pulls.

PAF’S APPROACH: ADDRESSING PERSONAL FINANCIAL HURDLES.

SOLUTION: PARTNER WITH A NONPROFIT CREDIT COUNSELOR TO ASSIST BORROWERS.

PAF also maintains ongoing partnerships with numerous lending institutions to better serve prospective and existing borrowers. PAF can magnify the impact of its limited financial resources by collaborating with other capital providers, often providing predevelopment loans and/or taking a subordinated position to de-risk the transaction for these lenders — while simultaneously underwriting those transactions in a thoughtful and considered manner to ensure repayment.

While PAF endeavors to build borrower capacity, this goal is challenging to measure, as it contains qualitative components as well as quantitative components. As borrowers take on future projects of greater size and increasing complexity, this increase can signal greater capacity from a developer standpoint. As borrowers are able to access more traditional financing, which may be preferable to PAF financing, particularly in instances of tax credit, bond, or HUD 221(d)(4) transactions, they have clearly moved along the continuum to a more sophisticated developer and borrower profile.

GROW PAF’S FINANCIAL CAPACITY TO SUPPORT THE GOALS OF THE STRATEGIC PLAN AND STRENGTHEN THE SUSTAINABILITY OF THE ORGANIZATION, BUILDING A COMPASSIONATE AND UNIFIED ORGANIZATION AND TEAM.

PAF WILL USE THE FOLLOWING STRATEGIES TO ACHIEVE THIS GOAL:

• Increase the total size of the revolving loan fund to approximately $40 million. A portfolio of this size will generate sufficient interest income to support and enhance the long-term sustainability of the organization.

• Diversify sources of loan capital as well as sources of grant funding, using impact data to tell a cohesive story to raise capital.

• Maintain a self-sufficiency ratio (earned income/operating expenses) above industry standards such that only 10% of PAF operations are supported by grant sources.

• Grow organizational net assets to $6,800,000 by the end of FY2029, maintaining a net asset ratio of at least 12%.

• Invest in new positions and infrastructure to support organizational growth.

• Utilize the BGP program as a component of self-sufficiency through the interest rate spread generated on long-term loans with a fixed-rate, long-term capital source.

• Promote a positive organizational culture, build an inclusive, diverse, and united team, seek and retain talent through appropriate compensation structures, promote work-life balance, and value and respect employees.

• Review and re-evaluate policies and procedures no less than annually to ensure that they continue to meet both the internal and external needs of the organization. These policies include PAF’s General Loan Policy, Construction Loan Policy, Employee Handbook, and related items.

• Explore the viability of securing an Aeris rating upon having five years of historical financial data.

Financial stability and self-sufficiency are of vital importance to PAFs sustainability and future success of. PAF can only serve its clients if it is in a financially strong position to do so. While a goal will never be “growth for the sake of growth,” the projected growth of the loan fund will assist in supporting PAF operations through interest income and growing revenue, which ultimately allows PAF to meet the financial needs of borrowers and to finance impactful projects. BGP will be an important capital source for PAF in the future, both to provide long-term financing to borrowers, as well as to establish consistent interest income for the organization.

Furthermore, a critical resource is low-cost lending capital at longer terms, either via grants, EQ2s, PRIs, family foundations, or other funding sources that lower the overall pooled cost of capital. These low-cost sources of capital serve the dual purpose of enhancing the sustainability of the organization while simultaneously enabling PAF to reduce interest rates for borrowers.

PAF anticipates exponential growth over the next five years, both in the dollar size of the loan portfolio and in the number of closed loans. As such, PAF is committed to developing an appropriate organizational structure, as well as internal policies and procedures, to support that growth. PAF’s Executive Director, its first full-time employee, joined the organization in October 2022, followed by its second full-time employee, its Director of Lending & Operations, in February 2024. PAF will invest in new positions as it grows, specifically targeting hiring a Director of Finance in 2025. At the same time, PAF will carefully control and monitor expenses as the organization strategically grows.

As the organization expands, PAF’s Board and staff are deeply committed to maintaining a compassionate, collaborative, and innovative work culture that is built on shared values and goals, as well as mutual trust. Furthermore, PAF values diversity and appreciates the benefit of collaboration among staff from differing personal and professional backgrounds. A positive work culture ensures that staff is contented and excited to come to work each day, thereby enabling PAF to meet its mission more efficiently and effectively. A small, dedicated team also contributes to PAF’s nimbleness and responsiveness to borrower needs.

GROW ORGANIZATIONAL NET ASSETS GOALS BY END OF FY2029:

$6,800,000

MAINTAIN NET ASSET RATIO

12%

WHILE GROWING AND EXPANDING THE ORGANIZATION, PAF WILL CONTINUE TO BALANCE IMPACT AND RISK, MEASURING BOTH WITHIN A RIGOROUS AND ROBUST FRAMEWORK, FACILITATING THE DELIVERY OF EXCELLENT RESULTS BOTH EXTERNALLY AND INTERNALLY.

PAF WILL USE THE FOLLOWING STRATEGIES TO ACHIEVE THIS GOAL:

• As a first threshold when evaluating a project, PAF utilizes its impact matrix to determine if the project aligns with the mission, vision, and core values of the organization. Projects that do not score sufficiently on PAF’s impact matrix will not move forward in the underwriting process.

• As a second threshold when evaluating a project, PAF utilizes its risk matrix and underwriting credit criteria. The risk matrix, along with PAF’s risk rating grid, allows for active portfolio management and will provide for proactive management of any future delinquencies or nonperforming loans.

• In line with Goal 4, review and re-evaluate PAF’s impact matrix, risk matrix, and underwriting criteria a minimum of annually to ensure that they are working together to meet the stated mission and vision of the organization.

• Develop a more robust impact tracking system which includes granular loan impact data, including racial, ethnic, and gender information, borrower type (LLC, corporation, nonprofit, etc.), census tract data, and other data points, allowing PAF to use impact data to tell a cohesive story (related to Goal 4).

As a CDFI, it is of paramount importance for PAF to balance impact and risk when evaluating projects and borrowers. Therefore, PAF is focused on project impact score first, and then on credit due diligence second; if a project does not meet PAF’s impact criteria, it does not advance to full underwriting.

PAF has a detailed social impact and risk rating grid, which is used to measure the impact and financial viability of all projects and borrowers. This tool has been vital in evaluating the initial loans of the organization and will continue to be used and built upon during the next five years. The social impact grid addresses the following factors:

• Ownership of the project sponsor: Projects that are 100% Black, Brown, or woman-owned are scored most highly in PAF’s impact grid.

• Sponsor track record: PAF seeks to support sponsors that demonstrate a shared commitment to affordable housing. Therefore, projects are scored most highly when the sponsor has demonstrated a commitment to diversity, equity, and inclusion within their own staff and vendors, focuses on affordable housing benefiting marginalized communities, and actively measures and evaluates community impact.

• Housing affordability (term, depth, and share): Projects are scored most highly when affordability exceeds 40 years, the AMI restrictions are 50% or less, and when 100% of the units being financed are deed-restricted as affordable.

• Bankability: As PAF seeks to support developers and projects that are otherwise excluded from traditional capital markets, projects score mostly highly when they have been turned down by a traditional financing institution or another CDFI due to inadequate collateral, lack of a strong guarantor, or other credit weaknesses.

• Alignment with community needs: Projects score most highly when the developer has formally assessed community needs and solicited community feedback, integrating that feedback into the project plan.

• Housing Instability Risk: PAF focuses on financing projects in communities that exhibit all three risk factors for housing instability — high poverty, high housing cost burden, and displacement risk.

• Other community benefits: Projects score most highly when they create community assets beyond housing, including healthcare services, job training, food access, or other community amenities. PAF also considers other factors to be beneficial in certain cases, such as a project’s historic preservation component or the remediation of environmentally-degraded land.

The purpose of this process is to ensure that projects with high social impact (such as deep affordability) move forward even when they do not underwrite as well as less impactful projects. This process of blending in an impact score is utilized to ensure that PAF is fulfilling its mission of financing impactful deals and providing opportunity to borrowers who are focused on community development. On an ongoing basis, PAF uses data management tools to accurately track its impact data and to ensure that the organization is meeting its stated mission.

PAF recognizes that individual Philadelphia neighborhoods have unique housing needs. We aim to invest in projects that provide maximal affordable housing while meeting these unique needs, including rehabilitation of existing structures as well as ground-up infill construction.

Additionally, PAF seeks borrowers who share a strong social-impact focus, and who are committed to the equitable development of Philadelphia’s communities. As part of the loan application process, project sponsors must provide a plan that outlines their commitment to diversity and inclusion in construction and permanent jobs, contracting and workforce. In addition, applicants must provide a plan that describes their community-based marketing strategy, to provide local outreach and access to the affordable units in the project. Sponsors are encouraged to provide opportunities for local ownership in the project, to promote community wealth building.

From a risk perspective, PAF’s underwriting criteria are far more flexible than traditional banks and financial institutions, and often more flexible than other CDFIs. PAF truly seeks to fill market gaps with its products and to add value in the mission-driven finance ecosystem of Philadelphia, not to compete with other CDFIs. As a result, PAF has primarily focused on smaller transactions, subordinate financing, predevelopment loans, and other products that fill the most critical gaps in the market. If a project and borrower is able to obtain full financing at reasonable rates and terms from another source, PAF will not move forward with the financing. At the same time, PAF closely evaluates and underwrites project viability to ensure PAF loans will be repaid, so that the organization can continue to benefit others with its financial resources in the future. In fact, as a responsible lender, PAF does not want to provide a devel-

oper or nonprofit with financing that will be a struggle to repay, but rather only provide financing that is responsible and prudent for both PAF and the borrower. When underwriting prospective borrowers, credit risk factors that are considered include management capacity, development capacity, sponsor financial condition, project risk factors, loan repayment risk, and loan security position.

Further, while PAF does not currently have any delinquencies nor any nonperforming loans, the organization’s General Loan Policy, along with its risk matrix and risk rating grid, provides policies and guidelines to manage future troubled loans. Policies and procedures outlined include those around troubled debt restructurings, nonaccrual loans, and steps to take back collateral properties as other real estate owned. As PAF grows, challenges with loans will inevitably arise, and while policies and procedures are currently in place to react to those situations, they will continue to be evaluated and refined over the next five years, both to reflect the market’s best practices and to achieve PAF’s mission.

While PAF currently tracks its impact data, PAF will develop a more robust impact data tracking system, which includes more detailed data points. This tracking will also allow for analysis of data at a more granular level. For example, PAF will track the average size of loans to individuals of different races and ethnicities and similar data points, allowing for the “slicing and dicing” of data in different ways.

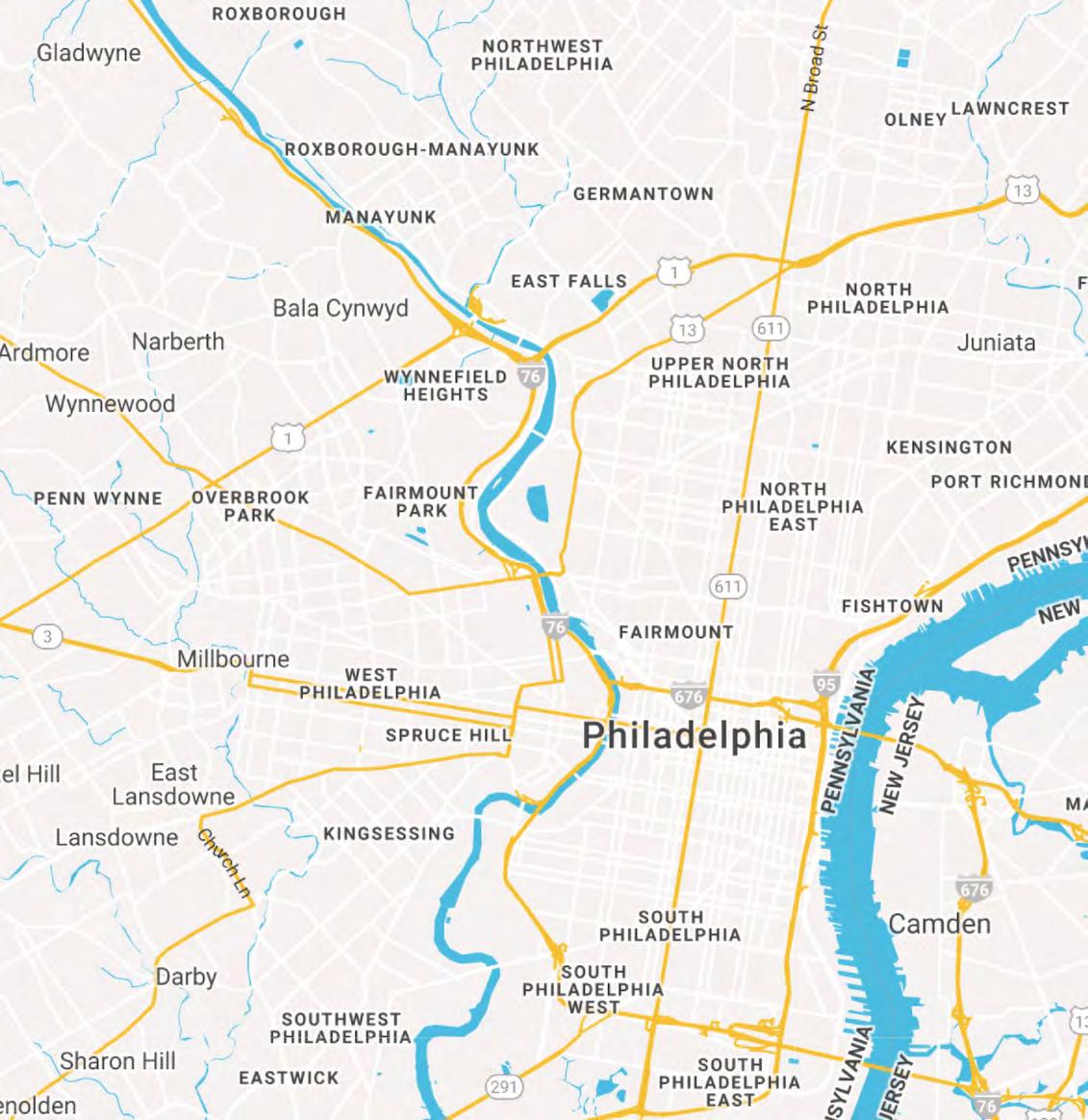

PAF invests exclusively within the City of Philadelphia but can lend in any neighborhood. The adjacent map denotes project geography for closed loans, numbered chronologically in order of closing date. These projects are either completed or in development. As of this writing, more than a dozen additional investments have been approved at the Credit Committee and Board level and are in the process of closing. The bulk of these approved projects are scattered site Land Bank dispositions located in Mantua, South Philadelphia, West Kensington, or Parkside. Affordable rental projects are also on track to close in Cobbs Creek and Germantown.

In line with its broader lending mission, PAF seeks to finance the maximum number of units of quality housing at the most aggressive, economically viable affordability level. Vacancy rates and development opportunities vary by neighborhood, but PAF is positioned to invest its resources wherever financeable projects can be built.

The goals presented above are both aspirational and achievable, as well as carefully aligned with the overall mission and values of the organization and the needs of the City. The methodical, deliberate pursuit of these goals will position PAF as a reliable, impactful, and sustainable resource to its clients and to Philadelphians in the years ahead.

David Langlieb Executive Director

Leah Apgar Director of Lending & Operations

Mo Rushdy Board Chair, The Riverwards Group

Charles Lomax Board Treasurer, Lomax Real Estate Partners

Jennifer Bellot Board Secretary, Jefferson College of Nursing

Vidhi Anderson Board Member, HumanGood

Paul Badger Board Member, The Badger Group

Jennifer Lucas Crowther Board Member, Philadelphia Industrial Development Corporation

Anne Fadullon Board Member, MAKE Advisory Services, LLC

Karen Fegely Board Member, Department of Commerce, City of Philadelphia

Michael Johns Board Member, Philadelphia City Council

Jessie Lawrence Board Member, Department of Planning and Development, City of Philadelphia

Suzanne Mayes Board Member, Cozen O’Connor

Katya Noreika Board Member, Nonprofit Finance Fund

James Sanders Board Member, Univest Bank and Trust Co.

Matthew Stitt Board Member, PFM Group Consulting LLC

David Thomas Board Member, Philadelphia Housing Development Corporation

PROJECTED TOTAL LOAN FUND CAPITALIZATION 2025–2029 Totals

PROJECTED NEW LOANS CLOSED

$47,084,416

PROJECTED NEW LOANS CLOSED

67

$40,046,844

PROJECTED NEW HOUSING UNITS FINANCED

PROJECTED NEW RENTAL UNITS FINANCED

PROJECTED TOTAL HOUSING UNITS FINANCED SINCE INCEPTION

942 450 1,105 492

PROJECTED NEW HOMEOWNERSHIP UNITS FINANCED