PAGE 38

APRIL 1, 2022

Ocean City Today / Public Notices

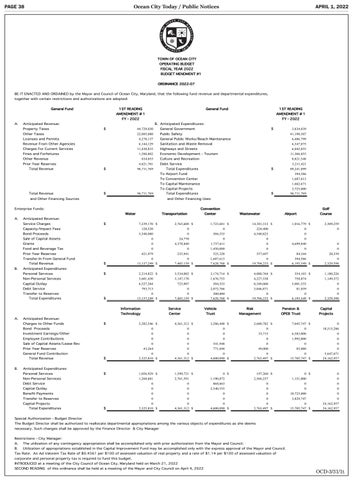

TOWN O F OCEAN N C IT TY O PERA ATING BUDG GET T FISC CAL YEA AR 202 22 BUDGET MENDMENT T #1 O OR RDINA AN NC CE E 20 02 22-0 07 BE IT ENACTED AND ORDAINED by the Mayor and Council of Ocean City, Maryland, that the following fund revenue and departmental expenditures, together with certain restrictions and authorizations are adopted: General Fund

1 ST READING

General Fund

1 ST READING

AMENDMENT # 1

AMENDMENT # 1

FY - 20 022 A.

FY - 20 022

Anticipated Revenue: Property Taxes

B. Anticipated Expenditures: $

Other Taxes

44,729,030

General Government

22,885,080

Public Safety

$

3,834,039 41,190,507

Licenses and Permits

4,278,137

General Public Works/Beach Maintenance

Revenue From Other Agencies

6,144,129

Sanitation and Waste Removal

6,347,875

Highways and Streets

6,042,855

Charges For Current Services

11,430,835

Fines and Forfeitures

1,588,802

Other Revenue

834,055

Prior Year Reserves Total Revenue

4,821,701 $

96,711,769

6,486,799

Economic Development - Tourism

11,306,855

Culture and Recreation

8,821,548

Debt Service

5,211,421

Total Expenditures

$

89,241,899

To Airport Fund

Total Revenue

$

96,711,769

and Other Financing Sources

1,687,613

To Capital Maintenance

1,662,671

To Capital Projects Total Expenditures

Co C on nve en nttiio on n W Wa atte err

Trra an nssp po orrtta attiio on n

Service Charges

$

7,239,170 $

Bond Proceeds

Aiirrp po orrtt

C Co ou urrsse e

2,765,608 $

1,723,681 $

14,381,313 $

1,016,779 $

0

0

224,400

0

5,348,080

0

504,535

4,540,823

0

2,309,259 0

Sale of Capital Assets

0

24,770

0

0

0

Grants

0

4,378,840

1,737,611

0

4,699,840

Food and Beverage Tax

0

0

1,450,000

0

0

0

421,479

235,941

525,328

557,697

84,344

20,339

$

0 13,137,249 $

0 7,405,159 $

1,687,613 7,628,768 $

0 19,704,233 $

394,586 6,195,549 $

0 2,329,598

$

Transfer-In From General Fund Total Revenue

0

Anticipated Expenditures: Personal Services

2,214,822 $

3,534,082 $

3,174,714 $

4,080,764 $

354,103 $

1,180,226

Non-Personal Services

3,601,430

3,147,170

1,676,753

4,227,538

758,874

1,149,372

Capital Outlay

6,527,284

723,907

504,535

8,349,060

5,001,533

0

793,713

0

2,072,766

3,046,871

81,039

0

Debt Service Transfer to Reserves Total Expenditures

0 13,137,249 $

$

0 7,405,159 $

200,000 7,628,768 $

0 19,704,233 $

0 6,195,549 $

0 2,329,598

Information

Service

Ve ehi cl e

Ri sk

P en sion &

Capi tal

Techn ol ogy

Cen ter

Trust t

Managem en t

OPEB Tru st t

Pr ojje ects

Anticipated Revenue: Charges to Other Funds

$

2,282,546 $

4,361,312 $

3,286,448 $

2,680,782 $

7,045,747 $

0

Bond Proceeds

0

0

0

0

0

18,515,286

Investment Earnings/Other

0

0

0

33,715

6,583,000

0

Employee Contributions

0

0

0

0

1,992,000

0

Sale of Capital Assets/Lease Rev

0

0

541,948

0

0

0

43,264

0

771,694

49,000

85,000

0 4,600,090 $

0 2,763,497 $

Prior Year Reserves General Fund Contribution Total Revenue B.

W Wa asstte ewa atte err

128,520

Prior Year Reserves

A.

G Go ollff

C Ce en ntte err

Anticipated Revenue: Capacity/Impact Fees

B.

3,725,000 96,711,769

$

and Other Financing Uses

Enterprise Funds: A.

394,586

To Convention Center

0

$

0 2,325,810 $

0 4,361,312 $

0 15,705,747 $

5,647,671 24,162,957

$

1,056,929 $

1,599,721 $

1,268,881

2,761,591

1,190,872

2,566,237

1,151,000

0 $

0 0

Debt Service

0

0

868,663

0

0

0

Capital Outlay

0

0

2,540,555

0

0

0

Benefit Payments

0

0

0

0

10,725,000

0

Transfer to Reserves

0

0

0

0

3,829,747

Anticipated Expenditures: Personal Services Non-Personal Services

Capital Projects Total Expenditures

$

0 2,325,810 $

0 4,361,312 $

0 $

0 4,600,090 $

197,260 $

0 2,763,497 $

0 15,705,747 $

0 24,162,957 24,162,957

Special Authorization - Budget Director The Budget Director shall be authorized to reallocate departmental appropriations among the various objects of expenditures as she deems necessary. Such changes shall be approved by the Finance Director & City Manager Restrictions - City Manager: A.

The utilization of any contingency appropriation shall be accomplished only with prior authorization from the Mayor and Council.

B.

Utilization of appropriations established in the Capital Improvement Fund may be accomplished only with the express approval of the Mayor and Council.

Tax Rate: An Ad Valorem Tax Rate of $0.4561 per $100 of assessed valuation of real property and a rate of $1.14 per $100 of assessed valuation of corporate and personal property tax is required to fund this budget. INTRODUCED at a meeting of the City Council of Ocean City, Maryland held on March 21, 2022 SECOND READING of this ordinance shall be held at a meeting of the Mayor and City Council on April 4, 2022

OCD-3/31/1t