& MARKET

PERSPECTIVES

FED RATE CUTS: WHAT YOU NEED TO KNOW

SPECIAL REPORT: THE IMPACT OF SOCIAL MEDIA ON INVESTING AND POLITICS

THE COST OF LIVING: WHY INFLATION IS GOING DOWN BUT PRICES ARE NOT

GOVERNMENT DATA: WHY THE DISCONNECT BETWEEN THE NARRATIVE AND OUR REALITY

JOHN NORRIS Chief Economist

DAVID MCGRATH, CFA Managing Director Associate Managing Director

A Letter from Our CHIEF ECONOMIST

If you only had one word to best explain the 3rd quarter of 2024, it would be finally

For close to two years, investors have been anticipating the start of the next Fed easing cycle. Put in layman’s terms, everyone has been waiting for the Federal Reserve to cut interest rates. Although the official economic data has arguably suggested the economy doesn’t need the Fed to do so, there has been a lot of speculation that the official data has been, shall we say, surprisingly upbeat.

In September, the Fed finally delivered. On September 18, it cut the overnight lending target rate by 50 basis points (0.50%). In some ways, this move felt sort of anticlimactic. After all, the sun still came up in the East the next morning.

But should it have? If so, just how aggressive should the Fed be in cutting the overnight rate moving forward?

The answer to the first question is a resounding yes. While the aggregate economy is doing much better than anyone would have predicted a couple of years ago, there is a lot of secondary data and anecdotal evidence to suggest it isn’t as strong as advertised. Had the Fed waited until the numbers matched up with reality, it probably would have been too late.

As it is now, Chairman Jay Powell and company have a good chance of engineering a proverbial “soft landing.” This is when economic growth cools, but doesn’t contract, allowing businesses and consumers to regroup without retreating. While soft landings aren’t exactly unicorns, they aren’t necessarily the norm, either.

As for how aggressive the Fed should be in cutting rates moving forward? If the official inflation gauges remain subdued, it will likely take the overnight target lending rate at least into the mid-3% range. However, if the economic data comes in weaker than anticipated, a 3.0% overnight rate isn’t out of the question.

The only real question is, by when?

The safe answer is: “by the end of 2025, if not sooner.” However, the probable-case scenario is by the end of the 2nd quarter of 2025.

With that said, the markets had another great run of it this past quarter. Domestic stocks were up. International stocks – both developed and emerging – fared well. Interest rates fell, meaning bonds posted positive returns. Cash continued to pay an attractive absolute rate. Shoot, even our old friend gold, that shiny hunk of metal, soared in price.

In so many ways, for investors, it doesn’t get much better than the 3rd quarter of 2024. Everything was up in value. The economy continued to expand, even if the general public had a hard time believing it. Then, to top it off, the Fed started cutting interest rates, giving businesses and consumers a little boost in the process.

Finally.

Thank you for your continued support.

John Norris Chief Economist

Our Investment Committee distributes information on a regular basis to better inform our clients about pending investment decisions, the current state of the economy and our forecasts for the economy and financial markets. Oakworth Capital currently advises on approximately $2.2 billion in client assets. The allocation breakdown is in the chart below.

THIRD QUARTER KEY TAKEAWAYS

The Fed has finally cut interest rates. New money continues to pour into the stock market and prices keep rising. American politics are becoming more polarized than ever. All of this and more in our Investment Committee’s third quarter key takeaways.

INTEREST RATES

After 18+ months of agonizing about when it would do so, the Federal Reserve finally cut the overnight lending target rate during the quarter. In truth, it was somewhat anticlimactic. The sun came up in the East the next morning, and people went back to wondering when it would do so again.

INFLATION

Officially, inflation is coming down in the U.S. economy. This means the rate of pricing increases is lower than it previously was. It does NOT mean prices are going down. Not surprisingly, this has confused many American consumers who still get sticker shock when they go to a grocery store or restaurant.

EQUITY OPTIMISM

Despite the continued rally and multiple expansion in U.S. stocks, they still seem to be the most reasonably valued of all overvalued asset classes. It seems domestic investors would rather take their chances on corporate America generating a profit than the U.S. Treasury being a good steward of the public coffers.

GLOBAL UNCERTAINTY

Despite better returns during the 3 rd quarter, international investments have continued to lag domestic ones in 2024, in aggregate. The reason for this is simple. Is there a legitimate long-term alternative to the U.S. dollar as the world’s primary reserve currency? Also, which sizable, developed economy is poised to outperform the United States for the foreseeable future? The answers to these questions are extremely unclear.

REPUBLICAN VERSUS DEMOCRAT

During the 3 rd quarter, the Democratic Party proved it has stronger leadership and greater unity than the Republican Party. The GOP would struggle to accomplish what the Democrats did – removing a sitting president from their ticket – without significant internal conflict, about as likely as flying to the moon.

THE UNITED KINGDOM

In July, the Tory Party lost the general election in the UK in historic fashion. The previous prime minister, Rishi Sunak, has already vanished into irrelevance, and the new one, Keir Starmer, is apparently realizing the enormity of the mess he inherited.

CORPORATE EARNINGS

In aggregate, U.S. corporate earnings continue to prove surprisingly resilient, even if unremarkable. However, this has been more than enough to keep new money flowing into the stock market and prices climbing.

GOVERNMENT DATA DEBACLE

Thanks to some noticeable, and sizable, negative revisions to key economic data during the quarter, investors are increasingly questioning the accuracy of the government’s official statistics. This isn’t a good thing. At a minimum, the various agencies should examine their current methodologies for potential improvement.

STOCK MARKET RESILIENCE

The traditional “summer swoon” in the stock market didn’t happen this year. There wasn’t any real “sell in May and go away” in 2024. Not surprisingly, the reasons appear to be the anticipation of Fed rate cuts and the sheer amount of liquidity still sloshing about in the financial system.

POLITICAL SKEPTICISM

There were two assassination attempts on Donald Trump during the 3 rd quarter. Historically, assassination attempts on major American political figures are very rare. However, in 2024, the deep-seated cynicism in our society led many to suspect they were actually staged for political gain. This level of distrust makes one wonder whether outside forces are trying to defeat the U.S. by fomenting discord from within.

U.S. STRENGTH AND RISK TOLERANCE

The money has been so easy in the investment markets over the last 18 months, reinforcing the belief that Americans are relatively tolerant of risk. It also strengthens the belief that the United States remains a more attractive investment option compared to the rest of the world. Why either political party would want to mess that up is beyond me.

VOTER AMBITION

As the presidential campaigns progress, it is becoming increasing apparent this election is less about voting for a party’s policy platform than it is voting against the other party’s nominee.

GOLD

Through September 25, gold is up almost 30% year-to-date in 2024. That is a pretty hefty return for a hunk of metal that doesn’t pay interest or generate a profit. While it has historically been a safe store of value due to its scarcity, what does gold’s performance tell us about global investors’ perceptions of the world? Intuitively, it probably isn’t good. Glad we own some.

ECONOMIC OVERVIEW

In 3 rd quarter of 2024, it was finally made clear: Washington must overhaul its methodologies to better reflect today’s economy and consumer behavior.

John Norris

In 2024, particularly during the 3rd quarter, the only economic releases that have truly mattered relate to either labor markets or inflation. Everything else has been almost irrelevant. The ISM Report(s) on business? Big deal. Durable goods orders? No one is paying attention. Metrics like the trade deficit, monthly budget statement, regional purchasing managers’ indices, capacity utilization, industrial production, wholesale inventories, retail inventories, leading indicators and a host of others? Okay Boomer. You do you.

The reason for this is simple. The Federal Reserve has a so-called “dual mandate.” These are price stability and full employment . To be sure, all of the releases listed above have some kind of correlation with those two things. However, why mess around with conjecture and mental gymnastics when the government is going to tell you exactly what it thinks inflation and job growth were the previous month?

Further, we know well in advance when they are going to do it.

• With perhaps an exception or two each year, the Bureau of Labor Statistics (BLS) releases “The Employment Report” on the first business Friday of each month.

• Also, the BLS typically releases the Consumer Price Index (CPI), the most widely cited inflation gauge, during the second full business week of the month.

• Of course, each and every business Thursday, the BLS reports on “weekly initial jobless” claims.

• If that weren’t enough, the Bureau of Economic Analysis (BEA) releases the “Personal Income and Outlays” report on either the last business Friday or last business day of the month.

This series contains the “price indices for personal consumption expenditures,” which everyone widely believes to be the Fed’s preferred inflation benchmarks.

If, for some reason, you just must have the specific dates, you can go to www.bls.gov

Essentially, the investing public knows when the “real data” comes out, and is giving shorter shrift to pretty much everything else. Or so it would seem. If inflation and jobs are the two main concerns for the Federal Reserve, and Washington provides that information, then everything else is sort of just noise, right?

INFLATION & JOBS

When I got into the industry in the early 1990s, people still cared about the Federal budget deficit. Intuitively, this makes perfect sense.

• After all, the bigger the deficit, the more the Treasury must borrow in the financial markets.

• The more it borrows, the greater the supply of Treasury debt sloshing about the system.

• The greater the supply of debt, the more likely interest rates will go up.

Really, the thought process was good old supply and demand stuff. Basic economics.

Back then, no one would have dreamed the demand for debt would somehow swamp the deluge of it. However, times change, as do analysts’ preferred economic reports. Shoot, people used to seriously care about the Philadelphia Fed Report – a Business Outlook Survey that provides insight into the manufacturing sector – and it could move the markets. These days? Let’s just say the report’s popularity has declined.

This is important because the entire world has been waiting for the Fed to make a change to U.S. monetary policy for a very long time. More specifically, people have been eagerly awaiting a rate cut for nearly two years. However, inflation data continued to come in a little too high, and jobs numbers remained too strong. As a result, the Fed wasn’t able to cut the overnight lending target rate until the 3rd quarter.

INFLATION

First, everyone knows prices are higher than they were not so long ago. For many goods and services, they are much higher, as in eye-watering. In April 2022, the trailing 12-month CPI hit a 40-year high of 9.1%, and a lot of people thought even that number was too low. However, since that time, the rate of price increases has been increasing at a decreasing level.

As confusing as it may seem to the average consumer, that means the rate of inflation is coming down even if prices are not.

This has caused a disconnect between what the government says inflation is and what John Everyman’s wallet is telling them. How can Washington say inflation is coming down when a trip to the grocery costs an arm and a leg? Fair enough. But, as far as inflation is concerned, the powers that be focus on relatives and not absolutes.

Relatives Versus Absolutes

Think of it this way. A $1 increase in the price of an item that costs $10 is 10%, right? That stinks. However, if the price of an item has risen to $100, and it goes up by $5, that’s only a 5% increase. Although the price is significantly higher in absolute terms, the percentage increase in price is now only half what it once was. And voilá! Inflation is coming down.

This is illustrated in the chart below. The dark black line represents how the 12-month CPI has come down while the shaded area, representing the aggregate level of prices, demonstrates how costs for the American consumer are still going up.

INFLATION IS GOING DOWN BUT PRICES ARE NOT

Source: Bloomberg Financial

Fortunately, the Fed focuses on the black line instead of the shaded area. Obviously, it tells us inflation is coming down, which has given the monetary authorities enough reason to start making money cheaper in the U.S. economy.

As for your personal experience with inflation? Inflation has always been where you wanted to look for it, and everyone’s experience will be different. Personally, the official 12-month CPI for August 2024 at 2.5% probably doesn’t accurately reflect my household budget. However, that is the BLS’s story and they are sticking with it.

LABOR MARKETS

Then, there is the curious question about the health of the labor markets.

It’s well known that the job market was extremely tight when the economy reopened after the worst of the pandemic. Older people quit the workforce in droves, and it was hard to get people to work at any price, let alone one that made sense for employers. As a result, business owners added warm bodies as fast as they could, much like they did with their inventories. It didn’t matter if there was an immediate need for the headcount. They could worry about that later.

To that end, I would argue the tightness in the labor markets peaked during the middle of 2022. Since that time, things have started to slacken. The ISM Report(s) on Business have suggested as much.

The NFIB Small Business Hiring Plans Index would imply the same. So would just about every other economic report, except for the ones that matter.

As an anecdotal aside, my son graduated college this past spring, magna cum laude in finance. After he landed his first career-type job in March, I asked him how many of his fraternity pledge brothers had found employment. He said maybe 50% had, maybe. When I asked him about his friends who graduated in 2022, he told me 100% had either found a job or been accepted to graduate school by Christmas 2021.

Still, every month, The Employment Situation would report that the U.S. economy had created, or was creating, a head-scratching number of new, payroll jobs. It didn’t matter what business owners, my son, or other non-governmental economic data sets said. The labor markets were still on fire.

Until they weren’t.

LABOR DATA ADJUSTMENTS

This past quarter, in a move that surprised no one who analyzes the data, the BLS made a major revision to its previously reported data. By major, I mean it essentially erased 818K previously reported payroll jobs for the period from April 2023 to March 2024. That isn’t an insignificant number; this was on top of a previous monthly revision, almost all of them negative as well.

If that weren’t enough, it has wiped away over 200K jobs from its estimates for April through July 2024. In essence, over 1MM jobs that the BLS told us the economy had created didn’t really exist. Even more frustrating, it probably has even more revising to do to have the numbers jibe with all the other data.

Even with all the changes, the monthly data had been suggesting the labor markets were cooling somewhat. Perhaps not as much as they actually were, but cooling nonetheless. Further, the official unemployment rate had ticked up ever so slightly to 4.2% from its recent low of 3.4% in January 2023. Is that 4.2% still too low? I think it probably is. However, as with the CPI, it is the BLS’ data, and what it says is what goes.

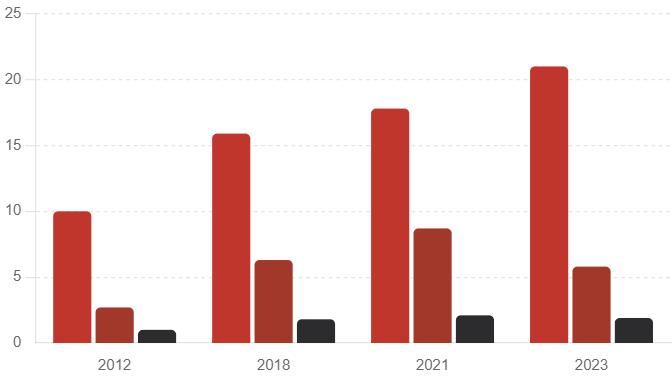

The dark black line in the chart below illustrates the rise in the official Unemployment Rate, while the shaded area demonstrates how monthly job gains have moderated.

FEWER NEW JOBS MEANS MORE UNEMPLOYMENT

Source: Bloomberg Financial

How accurate are these numbers the government gives us? The answer is simple. No one should consider any of the data 100% accurate. It isn’t. It never has been. And it never will be.

All of this came to a head during September. Price increases appeared to be under better control, even if prices were still too high. The labor markets seemed to be less overheated, even if the official data was still somewhat rosy. With these factors combined, the Federal Reserve finally had some room to cut the overnight lending target rate. After all, according to the reports that matter, the Fed had achieved some semblance of price stability and full, stable employment.

The question most people have, or arguably should have, is this: How accurate are these numbers the government gives us? When there seems to be such an enormous disconnect between them and what the average person is actually experiencing? The answer is simple. No one should consider any of the data 100% accurate. It isn’t. It never has been. It never will be.

No one really thought it was.

However, it wasn’t until this year, culminating during the 3rd quarter, that it became all too apparent that Washington needs to retool its methodologies to better reflect today’s economy and consumer behavior. The vagaries are simply too great and the implications too important.

Even so, and in the end, what really matters is the Fed finally embarked on its much-awaited easing cycle during the quarter. At the end of the quarter, the upper end of the overnight lending target range was 5.00%. By the middle of 2025, it will likely be somewhere in the mid-3% range.

If it isn’t, laughingly, the powers that be can revise their data sets to make it so.

SPECIAL REPORT: SOCIAL MEDIA

Social media's influence on retail trading and politics raises the challenge of balancing free speech with protecting market and political integrity. So who is responsible for regulating? Individuals? Or regulatory bodies?

Chris Cooper

Social media has emerged as a powerful force in investing and political engagement. What began as a way of keeping up with friends and family online has evolved into a platform that can guide individuals into speculative “investing”. Retail trading surged after brokerage firms introduced zero commission-based trading in 2019. This decision democratized access to stock markets, enabling individual investors to actively trade in capital markets, specifically equity markets, which was previously dominated by institutional players. Once trading became a popular pastime, it didn’t take long for the masses to share their trading ideas and strategies on social media sites.

Additionally, it didn’t take long for Aunt Sue to stir up political opinions on her favorite social media platform. Beyond that, social

media posts, advertisements, and bots have been targeted by both political parties as “election interference.”

U.S. elections have shed light on the integrity of democratic processes, as platforms increasingly serve as conduits for misinformation and strategic manipulation.

Undoubtedly, social media has transformed retail trading behaviors, resulting in interesting and sometimes frustrating market movements, while also making it difficult to decipher the truth during heightened electoral periods.

THE RISE OF RETAIL INVESTING AND SOCIAL MEDIA

The arrival of zero-commission brokerage trading, initially made popular by platforms like Robinhood, has significantly lowered the barriers of entry for retail investors. The growth of low-cost trading coincidently expanded in the months leading up to the surge of

American Retail Investors Continue Setting Records

Individuals poured a record-breaking $1.5 billion into the stock market every day in February 2023.

stay-at-home trading during the COVID-19 pandemic. Lockdowns and the distribution of stimulus checks catalyzed an influx of new traders into the market, many of whom sought to capitalize on market volatility, and many of whom were just bored. Social media platforms, particularly Reddit and Twitter, emerged as primary venues for sharing investment ideas and strategies, leading to the phenomenon known as “meme stocks.”

Source: Vistual Capitalists

COVID-19 HITS

Pandemic boredom, federal assistance checks and no-fee investing platforms were all credited with the retail investor wave in 2020.

REDDIT SHORT-SQUEEZE

Retail investors looked to shortsqueeze hedge funds for their positions on companies like GameStop and AMC in early 2021.

Peak net retail flow in 2023 was 84% higher than 2019.

Q1 2023 EARNINGS SEASON

Earnings seasons in January may have prompted the rapid return of retail investors, many of whom retreated to safer assets last year.

MEME STOCKS AND INVESTMENT TRENDS

Meme stocks, the most popular being GameStop (GME) and AMC Entertainment holdings (AMC), became symbols of a new era in retail trading, fueled by social media narratives similar to that of the Robinhood legend of “seizing from the rich and powerful.”

Hedge funds will, from time to time, short stocks (borrowing shares to then sell at the current price, with an expectation that the price will drop, and then buying them back at the lower price to return to the owner) of companies they believe are entering a challenging environment. In early 2021, it was discovered that two favorites of the social media crowd, GME and AMC, were being heavily shorted by large institutions. What began as retail trading quickly turned into something more than just a quick profit. All of a sudden, an entire online community shifted its focus, taking a stand against powerful institutional players. Retail traders pursued a “hold the line” movement in a virtuous attempt to save GME and AMC stock.

Phrases like “HODL,” an acronym born from a misspelled forum post advocating to hold assets for the long term, and “diamond hands,” symbolizing steadfast conviction despite volatility, quickly became mantras of the community. Both depicted the ethos of this Robinhood-like movement that led to an over 371% pop in GME and a 531% surge in AMC within a few trading days. The WallStreetBets community on Reddit, spearheaded by influencers like Keith Gill (online forum name: Roaring Kitty), utilized memes to humorously

and creatively promote these stocks, which sparked a buying frenzy and created the astronomical price increases mentioned earlier. This grassroots mobilization highlighted the power of social media in shaping abnormal and irrational investment behaviors within market trends.

There are two sides to every coin, though. It is one thing if hedge fund managers fundamentally believe economic headwinds will present monetary challenges for a company and then attempt to profit from a possible drawdown. It is another thing when the social media-induced retail trading boom – largely focused on the buying and holding of heavily shorted stocks – is exploited by short sellers who use social media to disseminate negative sentiment about companies and utilize unauthenticated information in order to drive down prices.

A notable example is Globe Life. The firm Fuzzy Panda posted disparaging content that accused the insurance company of committing widespread fraud in April 2024. The allegations triggered others to sell or even further short the stock, which created artificial selling pressures and led to a 60% drop within a single day. The stock has nearly recovered all losses (at least at the time of this writing), but the pain was borne by shareholders for months. Such rapid spread of harmful (mis)information on social media can lead to swift shifts in investor sentiment, resulting in significant market impacts, particularly for smaller companies less equipped to withstand speculative attacks.

SOCIAL MEDIA’S INFLUENCE ON U.S. ELECTIONS

Social media has also presented separate, yet parallel, challenges in the political arena for several cycles now. While platforms provide political discourse and engagement, they can also facilitate the spread of misinformation and negative sentiment, often from accounts that do not belong to an actual human.

One of the most concerning aspects of social media’s dynamic in politics is the use of bot accounts – automated accounts designed to simulate human interaction and amplify specific messages via mass algorithmic coding.

In late 2022, Elon Musk bought Twitter for $44 billion. The multi-billionaire said he made the purchase to “help humanity”. One of the major undertakings he and his team assumed was to rid the platform of as many bot/spam accounts as possible. They successfully removed roughly 11% of these accounts, aiming to create a more trustworthy and open space for users to communicate and share content reliably.

Those on both sides of the aisle accuse each other – and their supporters – of distorting political hot topics by flooding social media feeds with negative content about candidates. This strategy aims to shape public perception through sheer volume and repetition. These accounts can be programmed to mimic human behavior, engaging with real users and amplifying disinformation. While the freedoms of such a vast platform are available for all, the customizable aspects of the app create echo chambers, which can negate the power of open discourse.

• How do we know what truth is?

• How do we know that we don’t know XYZ?

• Does all our information come from a single, or likeminded, channel/outlet?

Understanding personal and subjective limitations when digesting information would enable social media to be a tool rather than a rage room to fulfill its usefulness.

SOCIAL MEDIA, DONE RIGHT

The impact of social media on both investing in the stock market and on U.S. elections is multifaceted. Retail trading has seen unprecedented growth, fueled by platforms that have eliminated transaction fees and social media sites/apps that stir up trading frenzies. Simultaneously, the electoral landscape is being transformed by the ability of social media to shape narratives and influence voter behavior through the deployment of bots and algorithmic manipulation. The balancing act of personal freedoms, such as free speech, in relation to ensuring the integrity of financial markets and elections, will require diligence at the individual’s level.

Ultimately, the intersection of social media with investing and politics is a testament to the evolving nature of influence in the digital age.

CATCH MORE FROM OUR INVESTMENT COMMITTEE EXPERTS

MEET THE MEMBERS:

Our Investment Committee

Our Investment Committee experts are responsible for overseeing the investment decisions on behalf of Oakworth Capital Bank. Their objective is to manage investment strategy, monitor the performance of all portfolios and conduct research to identify key opportunities.

Started over 20 years ago, Common Cents is a weekly blog written by Chief Economist John Norris, detailing and explaining the events that impact our economy. John distills the latest information, making it easy to understand how these events affect daily life.

In this weekly podcast, Chief Economist John Norris and Portfolio Manager Sam Clement exchange perspectives on the driving factors influencing our economy. Trading Perspectives can be found on Apple Podcasts, Spotify, Google Play, YouTube, and all other major podcast outlets.

THE CHINESE ECONOMY: LOOK BEFORE

YOU LEAP

China's economic rise is impressive, but challenges in housing, debt management and central planning echo our 2008 financial crisis. How will China navigate these headwinds, and what does it mean for the global economy?

RYAN BERNAL

Surprisingly, the 20th century unveiled some common economic trends between the United States and China. Midway through the century both countries had undergone a period of serious domestic turmoil, with The Great Chinese Famine occurring exactly 30 years after The Great Depression. Although both

countries would eventually bounce back, there are fundamental differences in the decisions each country’s leaders took in order to recover. The impact on the economic decisions made in those crucial years can still be seen in our everyday lives, the largest being the ideological differences between the communist-based Chinese

economic system and the capitalist-based U.S. economic system. Though China is called a communist country, in taking a deeper look we see that the Chinese have an interesting hybrid economic model that uses both communist elements and capitalist ones. China promotes state ownership of key sectors while allowing private enterprise to operate in some areas. This pragmatic approach, initiated by reforms from the late 1970s under Deng Xiaoping, has fueled China’s rapid economic rise. The country has seen rapid ascendency from a largely agrarian society to the world’s second largest economy, thanks in part to being the number one exporter in the world. Despite this, the coexistence of market forces with stateled development has led to inefficiencies, structural challenges and even political turmoil.

While careful central planning from the Chinese Communist Party (CCP) has helped catapult the Chinese economy into a global superpower, that same planning is threatening to hinder growth or even disrupt key market systems. The Chinese government retains significant influence over key industries, such as banking, telecommunications and energy, all of which are the most sensitive to regulation, censorship and supply chain disruptions. As a result, China’s strategy often stabilizes the economy in the short term but stifles competition and innovation over the long term.

Even with the information provided by the CCP, it is increasingly difficult to get an understanding of the true Chinese economy from an outsider’s perspective. We are often given misleading information (or no information at all) regarding the country’s economic conditions when communist leaders believe it may reflect poorly on the regime. A great example was in July 2023 – China posted their youth unemployment data at a staggering rate of 21.3% - and decided that they would rather suspend future releases of this report than face their economic situation.

Even more impactful is the Chinese government’s willingness to remove industry leaders and business owners in their country for speaking out against communist ideas or the CCP, undermining any consumer or investor confidence in Chinese companies. Many prominent CEOs have gone “missing” after denouncing practices by the central Chinese government. One high-profile example of this is when Alibaba founder Jack Ma went missing in 2020, following a speech given at the annual People’s Bank of China

financial markets forum. Ma openly criticized China’s regulators and banks, after which he disappeared for over a year. Many suspected the Chinese government detained and “reeducated” the CEO during that time. This breach in open market practices and overall censorship has acted as a warning for potential startups and investors – the fickle Chinese government can and will intervene if they deem you an enemy.

THE HOUSING SECTOR

China’s housing sector, once a highpoint of their economic prosperity, has begun to show signs of deeply rooted problems. For years, China’s central planning authorities have encouraged rapid urbanization, leading to an enormous increase in new housing construction. Although this helped China with modernization

efforts, it led to many speculative investments in the housing sector. As a result, Chinese real estate developers such as Evergrande began churning out as much new construction as possible, without a thought wasted on the proposition that the housing market might actually decline. With the building intensity came rising construction costs, which caused these developers to pile massive amounts of debt onto their balance sheets. As demand inevitably began to wane, these companies were suddenly left holding the bag. As time went on, many properties were left unsold and empty, creating “ghost towns” throughout the country. This culminated in early 2024, with the spectacular collapse of Chinese developer Evergrande. At the time of its demise, it owed around $300 billion to investors, with many of their future projects funded by pre-selling units to consumers. As a result, many investors and homeowners with money already invested in these projects were left without their deposit, their properties or their trust in the system.

LAND REVENUE SHORTFALL

Adding to the emerging crisis is another complication that ties in with China’s unique economic system – regional Chinese governments. Local Chinese governments have two main ways of creating revenue: selling usage rights to land under their government jurisdiction (as all land in China is owned by the government) and collecting land- and property-related taxes. By 2021, the share of revenue produced by land leasing had increased to 30% of total government revenue. This might have been a great idea when property prices were rising, but it introduced a host of problems when these values started to slip. Not only were they realizing less revenue from land leases, but vacant buildings and homes weren’t generating any taxes. All of this will eventually lead to less investment and spending by local governments. You can start to see how this cycle can perpetuate into an even worse slowdown, and why this raises alarms in Beijing.

RELIANCE ON LAND REVENUE DECLINES AMID DOWNTURN

Source:

HOUSING IS A HUGE ECONOMIC DRIVER IN CHINA

Source: BMO Economics

So, what has China done about this burgeoning economic disaster? It has released plans to create a stimulus program some journalists have dubbed an “economic bazooka”. The plan would introduce overall monetary easing policies throughout the country, in hopes of reducing debt and debt servicing costs for their largest developers as well as consumers. A few of the easing policies include:

• lowering the Chinese banks’ reserve requirement ratio by 50 basis points

• requiring less cash on hand for major lending institutions

• cutting mortgage rates by 50 basis points to reduce debt servicing burdens on the consumer

• reducing the minimum downpayment on new home purchases by 15%

• providing $71 billion to brokerage houses, mutual funds and insurance companies to buy Mainland-listed stocks through ETFs and large-cap stocks.

These changes might sound like a positive development for the Chinese economic system, but they actually reveal the seriousness of the underlying issues.

COMMODITIES

If China does have a 2008-like financial crisis, what does that mean for the U.S. consumer? While it isn’t out of the realm of possibility, it is unlikely that a slowdown in China’s housing market would have a direct impact on Americans. However, we could see indirect effects on a global scale. One of the more interesting impacts of a Chinese slowdown would be commodities pricing – specifically, a large drop in demand and prices. With China being the world’s second-largest importer (following the United States), any decrease in demand would see huge implications for commodities like oil, natural gas, steel, copper and other precious metals. We have already seen a slowdown in demand for oil in China since the COVID-19 pandemic, putting downward pressure on crude oil prices.

This would impact the bottom line for many U.S. companies, which rely on the large consumer base in Southeast Asian countries (for example, Tesla or LVMH). Less disposable income for the average consumer means less to spend on non-essential goods. This is amplified when considering the Chinese population, now sitting at 1.41 billion.

Additionally, we could see a larger impact on countries with strong diplomatic ties to China. As China’s domestic struggles intensify, its ability to provide loans to developing nations may be compromised. China may even have to start calling on countries to repay existing debts, such as the whopping $26.6 billion total loan exposure to Pakistan.

China may have some significant economic headwinds in its future, but does that spell doom and gloom for the whole continent of Asia? Not exactly.

There are other nations in the region that are positioned for growth and could very well pick up some of the country’s global slack.

to have missed – boasting a 9.7% annual GDP growth in 2021. It has continued to see high single-digit growth since. Unfortunately, it remains to be seen if India can take advantage of its momentum, as its increasingly bureaucratic government often gets in its own way.

China’s economic trajectory is at a critical juncture. While its state-controlled hybrid system propelled it to global prominence, mounting challenges remain in the housing sector, banking industry, and overall growth, raising questions about the sustainability of its economic model. As the Chinese government seeks to stabilize the situation with rate cuts and other interventions, the global implications are yet to be seen. From neighboring economies like India to major trading partners like the United States, China’s economic health has a profound impact on global markets.

INDIA IN SUMMARY

One nation that the Investment Committee has taken a closer interest in is India. India and China share many of the same economic boons, including a large population, growing consumer base, and rapidly increasing living standards. India continues to attract foreign investments, particularly in technology and manufacturing. It has already seen a spike in economic growth over the past couple of years, with a tremendous recovery after COVID – one that China seemed

Despite the stark economic ideological differences between China and the United States, there are some striking similarities. From enduring hardships in the mid-20th century to potential housing market crises in the 21st , China appears to have adopted several strategies from the U.S. economic playbook. Ironically, one of those lessons seems to echo that of our 2008 financial crisis — an event China would have been wise to avoid.

THIRD QUARTER EQUITIES

Despite a multitude of recent disaster and uncertainty, the markets have shown impressive resilience. With the economy and consumer activity holding strong and stocks reasonably priced, the outlook is complex but full of potential.

David McGrath

As I sit down to type a review of the 3rd quarter equity markets on the first day of October, it strikes me what is currently going on around us: a good portion of the Carolinas is under water, Iran is lobbing ballistic missiles into Israel, and all major East Coast and Gulf Coast ports are shut down due to a union strike. And that’s just today’s news – we haven’t even touched on politics yet!

During the quarter, we saw the current president of the United States drop out of the election, while his opponent, a former president of the United States, survived two separate assassination attempts. Never mind the large percentage of Americans fearing the end of the Republic, if “the other side” wins the election in November.

Despite all these negative news stories hitting headlines, major stock indices were at or very near all-time highs as the 3rd quarter ended. How did the markets stay near all-time highs in the middle of all this mayhem?

There are times when the disconnect from current headline news and stock market performance seems unusually wide, and this is one of those times. It is difficult to watch news stories of human disaster followed by a headline about stocks reaching all-time highs.

It is important to remember that stock prices adjust to the economic impact of an event, not the emotional impact. Horrible news headlines do not always translate into horrible stock performance.

The solid returns in the 3rd quarter came with plenty of volatility. Some of that volatility was provided by NVIDIA, the most talked about stock of the past two years. NVIDIA was slightly down for the quarter,

but what a wild ride it was. The stock declined by 27%, gained 31%, lost 21% and finished the quarter with a 20% gain. You can see in the following chart how the volatility in this one stock influenced the entire S&P 500 over the past quarter.

NVIDIA’S VOLATILITY DURING 3RD QUARTER

Source: YCharts

THE LABOR MARKETS

T he rest of the market volatility was not driven by any of the news stories that were mentioned earlier. Instead, the cooling labor market played a key role. A more balanced labor market has helped

inflation continue to ease from its peak in the summer of 2022. The jobs report that was released in early August was so weak that it sparked concerns of a potential recession in the not-so-distant future.

Subsequent economic data releases helped ease fears of a dramatic

downturn, though the slowdown was significant enough for the Federal Reserve to start reducing interest rates by half a percent in September. These are the types of news headlines that move equity markets.

The idea that the Fed could engineer a soft landing for the economy has resurfaced, and most major indices closed the quarter very near all-time highs. We also started to see a rotation from the mega-cap growth stocks that have delivered dramatic returns over the past 18 months, to areas of the market that have struggled with the higher

interest rate environment, specifically small- and mid-cap stocks, and value sectors.

SMALL-CAP EQUITIES

Many of these smaller stocks had already priced in a recession, and that hope that we might avoid a major slowdown allowed for some strong relative performance. The small-cap index had an incredible increase in value mid-July. The bad jobs report in early August took some of the shine off this beaten-up sector of the market, but it still finished with the strongest return of all domestic indices by the end of the quarter.

CORPORATE EARNINGS

I would argue that the most important determinate of stock prices is corporate earnings. When actual (and expected) earnings move higher, you can normally expect stock prices to move with those earnings.

This past earnings season was, by any measure, very good. Unlike the past several quarters, that strong earnings performance was not

ECONOMIC SECTOR

driven solely by mega-cap growth companies. Those value sectors of the markets, including utilities, financial and healthcare sectors, provided exceptionally strong year-over-year earnings growth. The stock performance from those sectors reflected that good news. And no sector of the market was happier to see interest rates move down than real estate, which also showed an impressive return for the quarter.

All three quarters of 2024 have provided equity investors with solid returns, but this last quarter was the broadest rally for stocks. The continued slow recovery out of China put more pressure on oil prices, subsequently the energy sector was the only economic sector that produced a negative return in the 3rd quarter.

Looking Forward

The most anticipated event of the 4th quarter will be the election. Traditionally, the end of a Presidential election is a good environment for equity markets, as some political certainty is established for at least 2 years. Markets gain a clearer sense of which economic sectors are likely to benefit based on which political party controls the White House, Senate and House of Representatives.

We are also eager to jump into 3rd quarter earnings season. This earnings season is not expected to be quite as robust as last earnings season, with an expected growth of 5.1% above the same quarter last year. It is the 4th quarter earnings season we are looking forward to. As of today, the 4th quarter earnings growth is expected to be over 15% stronger than

same period of last year. If corporations are going to bring down their 4th quarter earnings forecast, they will most likely do it during the 3rd quarter. If we can make it through this next earnings season with full-year estimates still at current levels, we have an excellent chance of finishing this year with yet another positive return for stocks.

These earnings projections, however, may hinge on what changes the Federal Reserve makes during their two meetings in the 4th quarter. Weaker jobs data could prompt the Fed to lower interest rates in a more aggressive fashion the next several months, but that could also force down corporate earnings. Be careful what you ask for…

On top of all that (natural disasters, domestic unrest, political uncertainty), the geopolitical issues seem to be intensifying. Despite these concerns, it’s remarkable to see how resilient the markets have remained. Though uncertainty remains, the economy and the consumer are still humming along steadily, and most stocks are relatively affordable, making for a complex yet promising landscape ahead.

Meet Our Wealth Advisors HERE TO SERVE YOU

Managing both the broad view and the complexities of our clients’ wealth management and trust needs is our hallmark. Our holistic approach allows us to manage assets not just for today, but for generations.

Your client advisor works to understand deeply your values and goals, then coordinates an elite, multidisciplinary team of financial experts to preserve your invested dollars, provide a readily accessible stream of liquidity and generate a competitive rate of return – all based upon a statement of investment policy we have defined uniquely for you.

We advise clients on the appropriate asset allocation and execute this strategy through the use of an openarchitecture investment platform. We then work closely to achieve their generational financial objectives.

THIRD QUARTER ALLOCATIONS

The pendulum is swinging back and broadening in a healthy way— not just under-performing large-cap tech but by stronger performance across the board.

Sam Clement

The 3 rd quarter of 2024 was a nice change of pace from the first half of the year, at least in a few respects. You may remember our previous pieces on just how narrow the market has been — or to put it differently, how few companies were contributing to the overall return of the market. This pendulum has started to swing back, and we have seen more and more companies contributing to that return. This includes value-oriented stocks, more sectors, market capitalizations and even more countries.

Our somewhat easy prediction that the lack of volatility in the markets during the first half of the year would normalize has also come true. While the primary predictor for that was

election-driven uncertainty, we have seen other sources of volatility emerge, including the complex Japanese yen carry trade and the Federal Reserve’s jumbo rate cut. As a result, the Volatility Index, better called the uncertainty index, has picked back up, and that is before we even get to the election.

As always with this portion of our quarterly piece, the focus is on:

1. How we are positioning our portfolios, and

2. What changes we anticipate making going forward.

THE MARKET

As the S&P 500 continued to be led by large-cap tech, the market’s concentration in that area continued to grow.

However, as predicted, the pendulum is swinging back and is broadening in a healthy way — not by large-cap tech underperforming, but by stronger performance across the board. In fact, for 3 rd quarter, the equal weighted S&P 500 outperformed the standard cap-weighted index, and that doesn’t

include the small-cap stocks that outperformed both the equal weighted and cap weighted.

In allocating portfolios, up through this point in the year, we’ve focused on value stocks and small- and mid-cap stocks, continuing to add to them accordingly. As this chart shows, equal-weighted, value, small-, and mid-cap stocks all outperformed the S&P 500 for the quarter.

3RD QUARTER MARKET RETURNS

The lesson learned from value stocks over the past few years?

The benefits of diversification. If you were invested solely in value stocks for the first half of this year, you missed out on key outperformance in the growth side of the market. This is something that really helped push things to all-time highs and fully dug us out of the trench created by the bear market

of 2022. However, it is worth noting that this outperformance from growth stocks over value stocks was for a very valid reason — earnings. The earnings growth in the market came almost entirely from the same few names driving the outperformance. Funny how that works… the areas of the market whose earnings are outperforming expectations tend to perform the best.

GROWTH VS. VALUE – FIRST HALF PERFORMANCE

As we entered the second half of the year, things started to change a bit. The fast-growing tech names have now been more accurately priced in line with their rapid growth, and, as we remember from 2 nd quarter, valuation matters. To us, this didn’t necessarily signal that tech was in for a rude awakening, but rather that the remainder of the market was becoming more appealing as we began to see green shoots of earnings growth. Value stocks and smaller companies started to contribute more as well.

SMALL CAPS

Small-cap stocks have struggled for what feels like years, and the investor sentiment followed suit. In recent years, it was not uncommon to find someone asking if small-cap stocks were worth investing in anymore. This isn’t exactly rocket science, as the areas of the market that were in the forefront of the new economy happened to be the largest tech companies. Like value stocks, the smaller companies have seen an uptick in earnings. Additionally, the yield curve starting to steepen and normalize is providing a huge tailwind for the space.

Smaller companies are naturally more sensitive to changes in interest rates. Their balance sheets are typically less flush with cash than those of their large-cap counterparts. This makes these companies extremely sensitive to changes in the yield curve. An inverted yield curve is about as bad as it gets for a small company’s ability to borrow. Banks are less incentivized to lend money when the spread is tight.

What we have seen lately is the flip side of this.

The Federal Reserve has started cutting rates while the economy remains strong, resulting in a steepened yield curve. Coupled with increasing earnings in the sector, this has created a favorable environment for these companies to succeed, and we are beginning to see the effects. While smaller companies tend to be more volatile than larger companies, this two-pronged positive environment for smaller companies has drawn us to continue to increase our exposure in this space.

FIXED INCOME

Fixed income is never as exciting to talk about as equities. Frankly, if the goal of the fixed income portion of a portfolio is to be a ballast, it probably shouldn’t be. We have continued to lean on Treasuries for fixed income, as it has felt like the safest option. Any fixed income instrument outside of United States Treasuries carries additional risk, because bond issuers, unlike the United States Government, are not the controller of the currency (which also happens to be the global reserve currency). To take on this additional risk, you need a justifiable rate of additional return, and that has largely been nonexistent.

Essentially, the bond market is saying things look pretty good, with strong company balance sheets, as they are not demanding a significant premium. There is an adage that the bond market is smarter than the stock market because it focuses on balance sheets, not cash flow. There is some truth to this, and these tight credit spreads we are seeing support the sentiment that the economy is still chugging along.

In summary, our allocation still prefers stocks over bonds and cash, and we anticipate a continued broadening out of the stocks contributing to the portfolio’s returns. This has been the case for 3 rd quarter, and this trend should continue.

As always, we will continue to stay focused on the everchanging landscape in front of us and remain committed to our goal of generating the best possible risk-adjusted returns for our clients.

2024 YEAR-END PREDICTIONS

Political gridlock, a flattening yield curve, shifting behavioral patterns, stock market rallies (and possible sell-offs), a housing conundrum and other predictions from our Investment Committee to close out 2024.

• At the end of the 3rd quarter, The People’s Bank of China made several monetary policy changes to help to support the struggling financial system and economy in that country. At first, global investors cheered the news. During the 4 th quarter, the true depth of the problems will become more apparent, and the cheering will stop.

• U.S. economic reports continue to come in slightly softer, especially the labor numbers. It won’t be awful, just weaker. As a result, the Fed will cut the overnight rate at both of the two FOMC meetings during the 4 th quarter. Depending on the data, the rate will be either 4.25% or 4.50% at the end of December.

• The results for the White House, Senate and House of Representatives will all be close. Regardless of outcome, neither the Democrats nor the Republicans will have what could truly be considered a “mandate.” In this probable-case scenario, the end result of this election season will be

political gridlock. Given how fractured our political system currently is, that is not a bad thing.

• With that said, due to the expiration of the so-called “Trump tax cuts” at the end of 2025, a lot of ultra-high net worth investors will breathe a sigh of relief should the Republicans make a clean sweep of it. The thought process is that the GOP will either extend the tax cuts or make them permanent. This would, could or should potentially save some families literally millions of dollars in estate taxes.

• Historically, the 4 th quarter is a good one for stocks. There is little to suggest it won’t be in 2024. However, given the relatively rich valuations in domestic stocks, any stronger-than-normal rally to end this year will simply “steal” returns from the start of 2025.

• The Democrats have proposed some pretty dramatic increases to long-term capital gains tax rates.

Should they sweep the elections, we might see the markets sell off before year-end, as investors and fund companies “lock-in” the capital gains they would ordinarily take in January. Again, this could save some investors a significant amount of money.

• Aaron Judge will win the MVP award for the American League in baseball. Shohei Ohtani will win it for the

National League. Although some people will complain Ohtani is only a designated hitter, his finish to the regular season was classic and will sway voters.

• All other things being equal, slower economic growth counterbalanced by a massive supply of new debt issuance should keep long-term interest rates in a relatively stable range during the quarter. However, thanks to the Fed, short-term rates should continue to fall. This will cause the yield curve to flatten, which should benefit small-cap stocks relative to large-cap ones.

• Foreign central banks that haven’t done so yet will start cutting their overnight lending target rate equivalents. The goal will be to keep their currencies from appreciating too much in order to protect local manufacturers. Whether that sort of thing really works is a matter for debate.

• Even with lowered borrowing costs due to Fed rate cuts, small businesses – particularly low margin local establishments and smaller franchise owners – will continue to struggle due to shifts in consumer behavior. Although the official inflation gauges are coming down, prices at, say, dining establishments for a family of four, are uncomfortably high for many.

• Universal Pictures believes it has a potential hit on its hands with its big screen take of the famous musical “Wicked.” It turns out they do, proving a movie musical with a good cast, good production values and a good score can still bring people into the theaters. If nothing else, the first weekend will be a smash, as millions of fans will go to see if Ariana Grande can pull off the role of Galinda. Odds are, she can.

• The labor markets will continue to cool, but not collapse, during the 4 th quarter. As a result, the official unemployment rate should increase slightly during the last three months of 2024. However, given the Bureau of Labor Statistics’ (BLS) antiquated methodology for calculating it, it is anyone’s best guess just how accurate the numbers are.

• Housing affordability for first-time homebuyers is at or near all-time lows. Regardless of who wins the election, there will be increased pressure on Washington to “do something” about the problem. The issue is primarily with the existing supply of housing for sale, not the demand. Unfortunately, Washington will focus on the latter, potentially making a bad situation even worse.

FIND OAKWORTH ACROSS THE SOUTHEAST

Central Alabama Office

850 Shades Creek Parkway Birmingham, Alabama 35209

Phone: (205) 263-4700

South Alabama Office

1 St. Louis Street, Suite 3200 Mobile, Alabama 36602

Phone: (251) 375-7800

Central Carolinas Office

6000 Fairview Road, Suite 125

Charlotte, North Carolina 28210

Phone: (704) 901-7250

Middle Tennessee Office

5511 Virginia Way, Suite 110

Brentwood, TN 37027

Phone: (615) 760-1000

This report does not constitute an offer to sell or a solicitation of an offer to buy or sell securities. The public information contained in this report was obtained from sources and vendors deemed to be reliable, but it is not represented to be complete and its accuracy is not guaranteed.

The opinions expressed within this report are those of the Investment Committee of Oakworth Capital Bank as of the date of publication. They are subject to change without notice, and do not necessarily reflect the views of Oakworth Capital Bank, its directors, shareholders and employees.