Cornerstone Schools of Alabama

March 15th, 2024

March 15th, 2024

Cornerstone Schools of Alabama

959 Hu�man Road

Birmingham, AL 35215

It is with great pleasure that we present to you the contents of our proposal for Cornerstone Schools of Alabama. As advisors and business partners, we �nd it very rewarding to truly get to know our clients, listen to their needs and learn their objectives, so that we may then structure solutions that assist in achieving the client’s goals and objectives. We believe it is fundamentally important that your �nancial solutions provider understands your business and adds value to the decision making process. The experience of Oakworth Capital Bank Client Advisors adds a great foundation and depth to our solutions for progress

Attached to this document you will �nd the following information:

• Sample Non-pro�t Quarterly Investment Review

• Balanced Strategy Investment Policy Statement & Historical Performance

• Charitable 501(c)(3) Fee Schedule

We trust the contents of this proposal are to your liking and add value. We are excited for the opportunity of earning your business and hope to show you the best part of Oakworth Capital – being a client

Warmest Regards,

John B. Norris, V Managing Director

205 263 4716

john norris@oakworth com

Central

1

251 375 7800

Middle

Wealth Management Services

6000

Central

After raising $36 6 million in investor capital, Oakworth Capital Bank opened its doors to the public on March 31, 2008 Over the years, we have developed a reputation as one of the safest banks in the United States, enjoy the highest 5-Star rating from both Bauer Financial and BankRate, as well as many other awards and accolades In 2016 Oakworth expanded our markets in the state of Alabama, adding a South Alabama o�ce in Mobile. In 2020 Oakworth expanded to the state of Tennessee, opening a Middle Tennessee o�ce in Brentwood.

Oakworth Capital Bank is a privately-owned company with less than 500 shareholders All Managing Directors and the majority of Oakworth associates directly own shares of the company, and all associates are eligible for stock options through our variable compensation incentive program(s) We believe this helps keep a strong business owner mentality throughout all positions and responsibilities

In addition to your client team, Oakworth Capital Bank’s leadership team consists of experienced and well-versed individuals allowing us to o�er a wide range of Private and Commercial Banking, Wealth Management, and Advisory Services. In following Oakworth’s core values and overall mission, we consider our ability to cater to our client’s needs with open consistent communication and utilizing advancements in technology as our primary strengths

Alabama

Shades Creek Parkway Birmingham, AL 35209

Alabama

850

205 263 4700 South

St. Louis Street, Suite

Mobile, AL 36602

3200

Tennessee

Virginia Way, Suite 110 Brentwood, TN

5511

37027 615.760.1000

Carolinas

Fairview Road, Suite 125 Charlotte, NC 28210

WWWOAKWORTH COM

704 901 7250

A B O U T O A K W O R T H

By renewing the art of client service, we created an approach that not only o�ers a more personalized experience but also challenges the status quo by reimagining how �nancial services are delivered We put more emphasis on the human connection to create a deeper understanding of your needs to help you achieve your �nancial aspirations. By renewing the age-old art of personal service combined with the bene�ts of modern technology, a more personable experience emerges...

LEARN MORE >

Our story. Our culture. Our commitment. Our community. Many �nancial institutions exist as generic commodities in a sea of acquisitions and mergers Oakworth Capital has combined our many years of experience to build a better approach from the ground up It’s a journey that we have chosen to embark upon that not only o�ers a more personalized experience for our clients, but also for our associates

LEARN MORE >

U R T E A M

Oakworth Capital has combined our many years of experience to build a better client approach. As an Oakworth client, you will have one primary client advisor dedicated to understanding you and your business, while also being surrounded by a team of professionals dedicated to your success. Our low client to advisor ratio ensures that you will receive the highest level of service in the industry. The Oakworth approach is centered around solving issues for our clients

LEARN MORE >

We believe communication is the key to successful client relationships While sharing useful information is bene�cial, regardless of source, Oakworth believes in the value proposition of developing and having its own experts and ideas. By generating our own market commentaries, economic newsletters, topical subject analysis and serials, and even conversational podcasts and videos, our clients know we are using our knowledge, creativity and expertise to help them succeed...

LEARN MORE >

O

T H O U G H T L E A D E R S H I P D I V E R S I T Y & I N C L U S I O N

Your Oakworth Client Team is here to work closely with you to achieve your generational and �nancial objectives We take pride in our clients and believe communication is key. Any member of this team is available at any given time to ensure your needs are e�ectively met at the convenience of your schedule.

John B. Norris, V

Managing Director

205 263 4716

john.norris@oakworth.com

Kaela Fowler

Client Support

205 278 2758

kaela fowler@oakworth com

Richard Littrell

Managing Director

205 278 2748

richard.littrell@oakworth.com

Ryan Bernal Investment Analyst

205 263 4689

ryan.bernal@oakworth.com

Lindsay Klein

Client Support

205 278 2761

lindsay klein@oakworth com

E T Y O U R C L I E N T T E A M

M E

INVESTMENT STRATEGY

Managing both the broad view and the complexities of wealth management and trust needs is our hallmark. Our holistic approach allows us to manage assets not just for today, but for generations. Your Client Advisor will work to deeply understand your values and goals to then coordinate an elite, multidisciplinary team of financial experts to preserve your invested dollars, provide a readily accessible stream of liquidity and generate a competitive rate of return – all based upon a unique statement of investment policy we will define for you. We advise on the appropriate asset allocation and execute this strategy through the use of an open-architecture investment platform. We then work closely with you to achieve your generational financial objectives.

INVESTMENT PURPOSE

Our investment purpose is to develop high-performing investment strategies which correspond with our client’s goals, time horizon and tolerance for risk. We do our best to incorporate a client’s entire financial picture, not just those assets at Oakworth.

PRIMARY INVESTMENT OBJECTIVES

While adhering to our client’s unique investment parameters, our overriding investment objectives are:

• Preserving the principal value of the dollars invested

• Providing a readily available source of liquidity

• Generating a competitive rate of return

INVESTMENT STRATEGY

Our investment process starts with an economic forecast and ends with a well-diversified investment portfolio.

Is the economy going to grow, stagnate, or contract?

Based on our forecast, do we overweight stocks, bonds or cash?

Do we favor domestic or international? Small or large cap?

What does the economic data suggest?

Stocks tend to outperform when the economy grows.

Domestic stocks tend to do well when the dollar is strong. Small cap stocks outperform when the yield curve is steep.

Where are we in the economic cycle? Should we overweight financials, technology, utilities or others?

Financials tend to perform better at the start of an economic recovery. Technology does best when the economy is in expansion.

What is the most effective way to invest? Individual securities, exchange traded funds, mutual funds or other?

Is there an individual company offering the best potential for return in the sector/class? Or, would it be more efficient to use a fund of some sort?

Is now the right time to buy? Should we invest now, wait a little while or average into the markets?

Has the market been extremely volatile? Has it been unusually stable? Is there any “big news” coming up that could impact the markets?

1. 2. 3. 4. 5. 6.

Developing a Macroeconomic Forecast Broad Asset Allocation Targets Setting the Asset Class Targets Economic Sector Weightings

Selecting the Individual Securities Deciding the Appropriate Time to Invest

An Introduction to WEALTH MANAGEMENT & TRUST SERVICES

Our investment purpose is to develop high-performing, diversified portfolios that correspond with individual goals, time frames and tolerance for risk based off a customized plan designed uniquely for you.

INVESTMENT MANAGER & ADVISOR

• Personal Portfolio Management

• Individual and Institutional Investment Consulting

• Advisory Services

PERSONAL TRUST SERVICES

• Full Discretionary Trustee Services

• Estate Administration

• Governing Documents Oversight

• Unique Assets in Trusts (commercial real estate, timberland, etc.)

• Additional Trusted Advisor Coordination

CUSTODIAN OF ASSETS

• Custody of all securities

• Customized Performance Measurement

• Disbursement of Income or Principal (as requested)

• Tailored Reinvestment Strategies

• Escrow Agent

WEALTH MANAGEMENT SERVICES PROPOSAL

Oakworth Capital Bank will provide a comprehensive level of �nancial services This will include, but is not limited to the following underlying services:

Wealth Management Services

• Maintaining and reviewing aggregate Personal Financial Statement

• Establish a baseline �nancial plan and continuously update the same

• Analyze investment portfolio construction and performance from any and all investment advisors

• Assess risk management strategies and insurance needs

• Understand and provide solutions for liability and liquidity needs

• Provide retirement income projections

• Coordinate with your attorney, accountant, and/or other advisors on business succession planning

• Review asset titling to ensure coordination with your estate plan

• Plan and provide solutions for incapacity

• Understand your estate plan and ensure it remains tax e�cient and consistent with your goals, objectives, and current assets

• Provide solutions for gifting strategies, both charitable and family

• Plan for funding grandchildren’s education if applicable

• Coordinate with your accountant on tax planning

• Host an annual meeting (or more frequently if desired) with your family and all of your advisors

• Providing comprehensive portfolio administration This includes, but is not limited to, the following services:

• Providing online access to the portfolio

• Providing bill payment services

• Transferring funds to and from accounts at Oakworth Capital Bank

• Custody and/or safekeeping of assets

• Aggregating information from other �nancial institutions, i.e. bank balances and portfolio assets (Oakworth Connect)

• Customizing performance measurement reporting

• Overseeing governing trust and other estate planning documents, if applicable

• Handling unique portfolio assets (timberland, other real estate, sundry assets, etc )

• Providing the necessary tax information (1099s, tax ledgers, etc ) for the portfolio to client or appointed CPA

Investment Management Services

• Determine investment time horizon, tolerance for risk, and expectations for return

• Develop appropriate asset and sector allocation guidelines

• Select appropriate investment vehicles to meet asset allocation guidelines

• Analyze market conditions and communicate Oakworth’s short-term and long-term forecasts

• A�rm client risk tolerance and expectations for return

• Execute and settle trades as agent in the market for the client

• Manage the investment portfolio with the following underlying goals:

• To aggressively invest the capital to provide maximum return

• To generate a competitive rate of return based on the appropriate benchmark

• Report on account performance in a timely manner

Fiduciary Services

• Personal Trust Services

• Full Discretionary Trustee Services

• Estate Administration

• Directed Trust Services

• Fiduciary & Trustee Roles

• Overseeing governing document

• Trust principal and income accounting

• Invoice management strategies

• Preserving assets for future generations

• Filing Fiduciary tax returns

• Coordinating with clients other trusted advisors

• Managing real estate held in Trust

Sample Portfolio QUARTERLY INVESTMENT REVIEW As of 3/13/2024

Table of Contents

Executive Summary p 1

Portfolio Overview p 2

Portfolio Performance p 3

Portfolio Class and Segment Detail p 4

Portfolio Class and Segment Detail p 5

Top/Bottom Performers p 6

Portfolio Appraisal p 7

Projected Income Summary p 9

Management Fees p 10

Ratings Disclaimer p 13

Morningstar Disclaimer p 14 Table of Contents

Executive Summary

Equities posted yet another strong month in February with the Dow Jones finishing the month up 2.5%, the S&P appreciated 5.34%, and the Nasdaq finished at an all-time high, up 6.22%. The general direction of stocks has hardly faltered over the past four months or so with 16 out of 18 weeks ending green.

Investors were spooked for all of about one day in February coming off of a January CPI print that came in at .3%, higher than December’s reading of .2%, mainly due to shelter. The 3.1% year over year increase surprised to the upside by .2% which might seem insignificant, but was enough to rattle the S&P by 2%. The market shrugged off the CPI release as the Fed’s preferred gauge of inflation, the Personal Consumer Expenditures Index, came in as forecasted. Aside from this, most investors in the month of February were anticipating the Nvidia earnings call, in which they reported robust earnings and strong outlook. The semiconductor company posted a 265% increase in revenue and said the current quarter’s revenue will be beat the current forecast as well, which provided more fuel to the AI frenzy fire. Now the 3rd largest company in the U.S. at the time of this writing, Nvidia carries a “trickle-down effect” for the rest of the economy. Suppliers and customers of Nvidia have realized strong growth alongside the high-flying company. Even smaller AI businesses have been catapulted higher. Nvidia purchased around 1.73 million shares of SoundHound AI, a conversational intelligence company, which subsequently pushed the stock up nearly 300% in February. 1.73 million shares come out to less than 1% ownership of SOUN, but investors see this as a signal that couldn’t be passed up. Another beneficiary of the AI frenzy is Supermicro Computer, which provides servers and computer racks to growing AI businesses, which has proved to be a great line of work to be in during an AI boom, as SMCI is up over 200% year to date. Needless to say, technology and, specifically, artificial intelligence will continue to garner attention so long as revenues are growing exponentially.

The 10-year Treasury yield climbed steadily throughout the front half of February as bond traders digested results of treasury auctions and inflation data. Since the mid-point of February, though, yields remained flat. The 2-year Treasury followed suit, shifting up from 4.19% to begin the month and hitting a high of 5.15% on February 26th following a somewhat weak 20-year bond auction on the 21st. The yield curve continues to show inversion, with the largest spread between the 1-month and 10-year, coming in at a 1.28%.

The next FOMC meeting will be held on March 19th through March 20th. In between meetings, Fed governors often provide personal assessment of the economy and their view on the Benchmark rate during speaking engagements. Comments have been consistent as inflation has flatted out to more moderate levels: “We have come a long way on bringing inflation down, but the last stretch will require more patience than the initial drawdown as we approach our 2% target.”

In February, The Investment Committee discussed reallocating portions of the portfolio while keeping in mind tax implications. The Investment Committee decided no trades were necessary, but we continue to search for opportunity.

Sample Portfolio As of 3/13/2024 Quarterly Investment Review Executive Summary Page 1 of 14

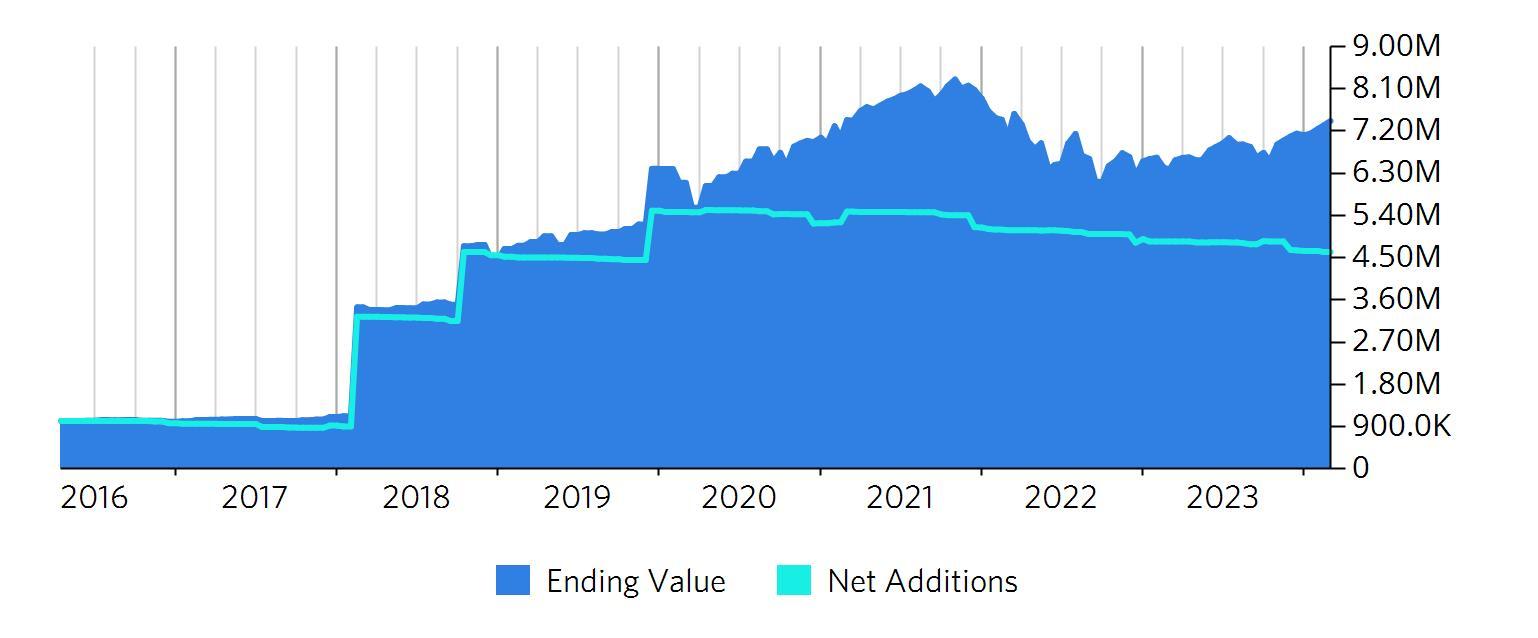

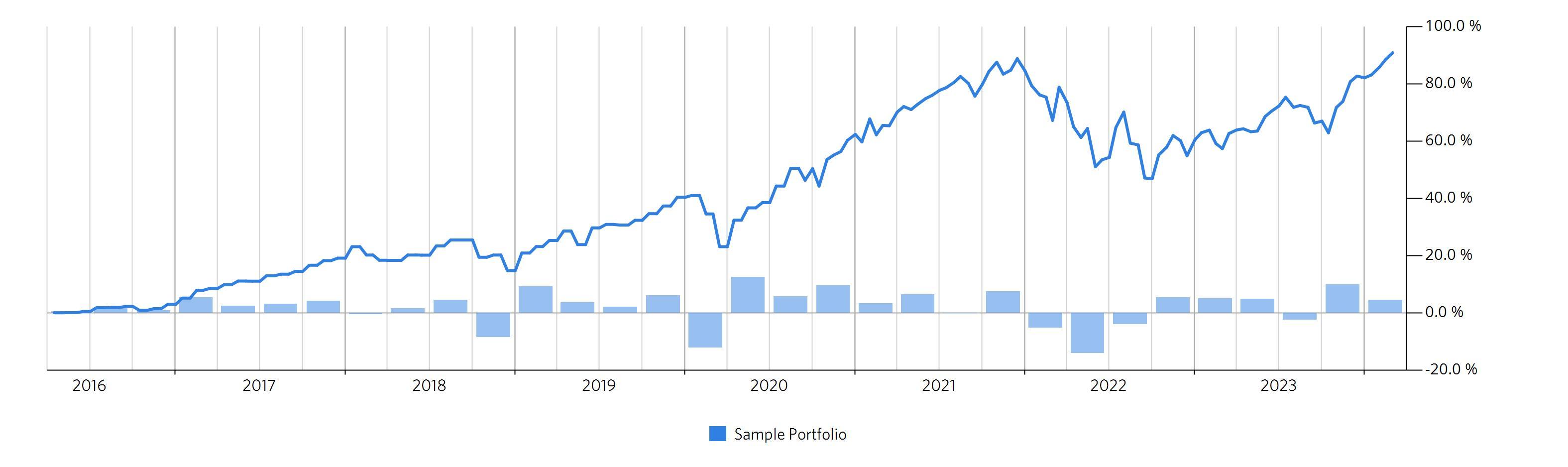

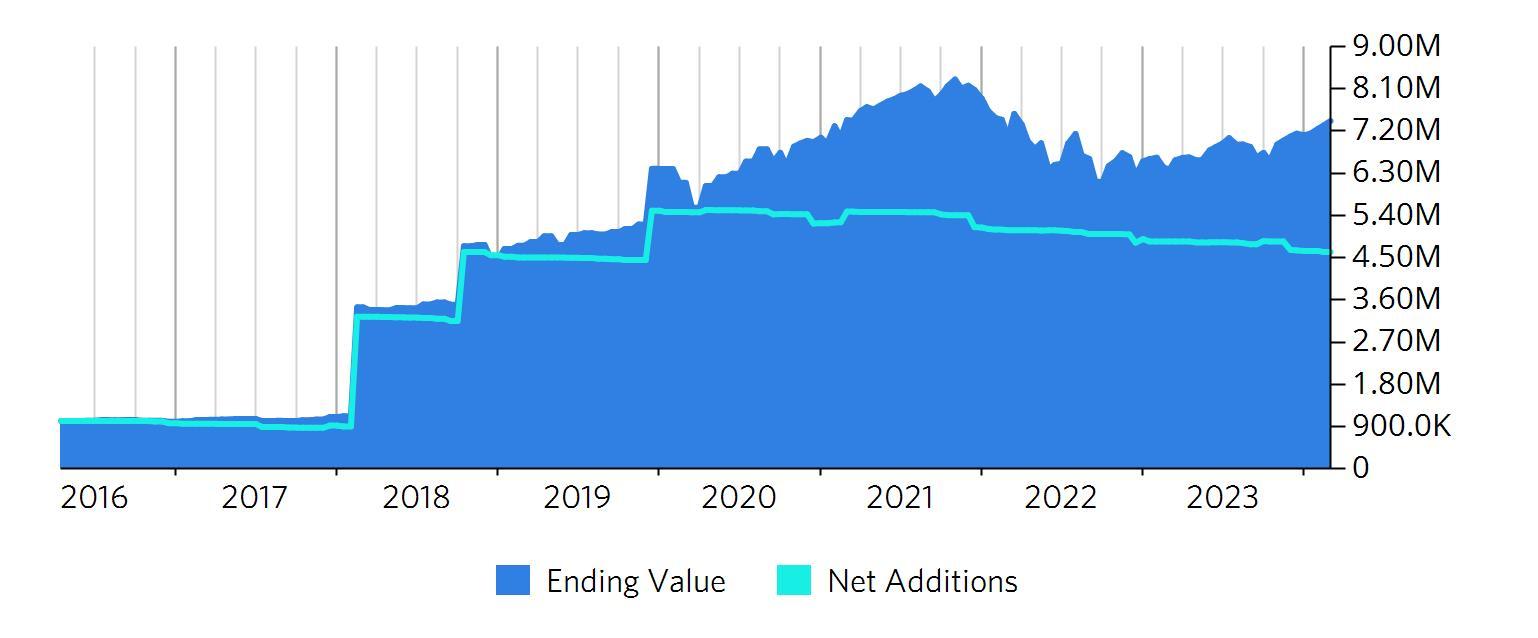

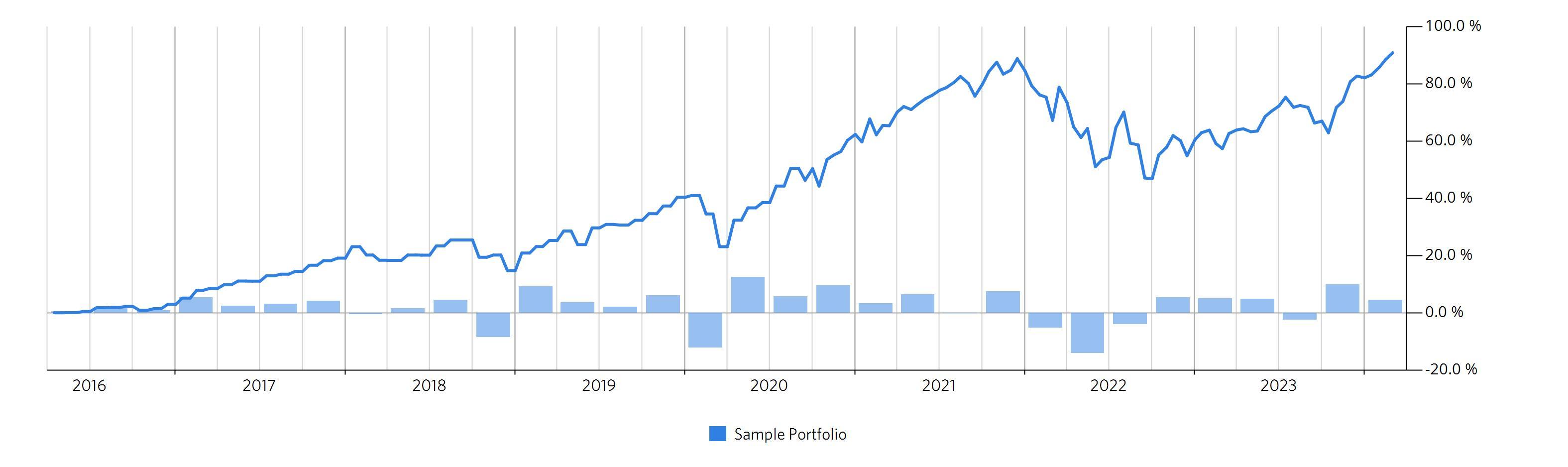

Sample Portfolio Quarterly Investment Review Portfolio Overview As of 3/13/2024 Page 2 of 14 Allocation by Asset Class Market Value and Net Additions Since Inception Portfolio Performance Since Inception Portfolio Value Summary Quarter To Date Year To Date Last 12 Months Last 3 Years Since 4/1/2016 Beginning Value 7,143,332.62 7,143,332.62 6,303,113.88 7,432,031.65 0.00 Net Additions -36,100.00 -36,100.00 -226,149.63 -862,806.09 4,620,713.56 Net Gain 306,960.58 306,960.58 1,337,228.95 844,967.64 2,793,479.64 Ending Value 7,414,193.20 7,414,193.20 7,414,193.20 7,414,193.20 7,414,193.20 Return 4.48% 4.48% 22.54% 4.88%¹ 8.48%¹ ² ¹ Annualized return, ² Level contains historical performance data Target Name Sample Portfolio 2823122013 - Sample Account Balanced

Portfolio Performance Since Inception

Summary of Portfolio Accounts

Sample Portfolio Quarterly Investment Review Portfolio Performance As of 3/13/2024 Page 3 of 14

Quarter To Date Year To Date Last 12 Months Last 3 Years Since Inception Start Date Allocation Ending Value Return Return Return Return Return Sample Portfolio 4/1/2016 100.00% 7,414,193.20 4.48% 4.48% 22.54% 4.88%¹ 8.48%¹ ² 2823122013 - Sample Account 4/1/2016 100.00% 7,414,193.20 4.48% 4.48% 22.54% 4.88%¹ 8.48%¹ ²

Annualized return, ² Level contains historical performance data

¹

Sample Portfolio Quarterly Investment Review Portfolio Class and Segment Detail As of 3/13/2024 Page 4 of 14 Portfolio Allocation (with Mutual Fund Look Through) Ending Value Allocation Sample Portfolio 7,414,193.20 100.00% US Equities 4,976,759.79 67.12% Large Cap Core 299,123.31 4.03% Large Cap Growth 1,702,096.58 22.96% Large Cap Value 1,169,131.23 15.77% Mid Cap Core 54,481.26 0.73% Mid Cap Growth 474,042.08 6.39% Mid Cap Value 478,127.79 6.45% Small Cap Growth 384,548.80 5.19% Small Cap Value 415,208.74 5.60% International Equities 664,359.89 8.96% Developed 657,188.78 8.86% Emerging Markets 7,171.11 0.10% Fixed Income 1,492,967.84 20.14% International Bonds 141,213.06 1.90% Municipal Bonds 56.78 0.00% Corporate Bonds 498,743.54 6.73% Govt/Inflation 852,954.47 11.50% Alternative Assets 122,319.03 1.65% Alternative Assets 25,144.26 0.34% Commodities 97,174.77 1.31% Cash & Equivalents 150,913.62 2.04% Cash 150,913.62 2.04% Unclassified 6,873.03 0.09% Unclassified 6,873.03 0.09% Portfolio Allocation Portfolio Allocation (with Mutual Fund Look Through)

Segment Returns

Sector Returns

Sample Portfolio Quarterly Investment Review Portfolio Class and Segment Detail As of 3/13/2024 Page 5 of 14 Year To Date Ending Value Allocation Return Sample Portfolio 7,414,193.20 100.00% 4.48% US Equities 4,756,624.08 64.16% 6.14% S&P 500 TOTAL RETURN INDEX 8.61% Energy 228,369.84 3.08% 10.31% Industrials 76,825.44 1.04% 6.56% Consumer Staples 136,225.44 1.84% 16.61% Health Care 299,431.50 4.04% 7.76% Financials 284,520.02 3.84% 8.58% Information Technology 685,018.17 9.24% -0.83% Other 3,046,233.67 41.09% 6.70% International Equities 647,771.97 8.74% 4.61% MSCI DEVELOPED EAFE (USD) (TRG) 5.33% Developed 647,771.97 8.74% 4.61% Fixed Income 1,433,825.27 19.34% -0.61% BLOOMBERG AGGR BOND INDEX COMPOSITE INDX -1.02% Corporate Bonds 1,230,689.50 16.60% -0.57% Govt/Inflation 203,135.77 2.74% -0.87% Alternative Assets 456,432.66 6.16% 5.01% 6% ABSOLUTE RETURN 1.16% Commodities 97,174.77 1.31% 5.24% Balanced 359,257.89 4.85% 4.94% Cash & Equivalents 119,539.22 1.61% 1.51% 90 DAY TREASURY BILL 1.04% Cash 119,539.22 1.61% 1.51%

Top 5 Performers - Last 3 Months

Top 5 Performers - Last 6 Months

¹

Bottom 5 Performers - Last 3 Months

Bottom 5 Performers - Last 6 Months

Sample Portfolio Quarterly Investment Review Top/Bottom Performers As of 3/13/2024 Page 6 of 14

Last 3 Months Return 1. VALERO ENERGY CORP COM 27.99% 2. JPMORGAN CHASE & CO COM 19.54% 3. WALMART INC COM 19.32% 4. SPDR S&P BIOTECH ETF 15.68% 5. SPDR S&P OIL & GAS EXPLORATION & PRODUCTION ETF 11.56% Last 3 Months Return 1. APPLE INC COM -13.44% 2. COMERICA INC COM -1.34% 3. VANGUARD INTERMEDIATE-TERM TREASURY ETF 0.00% 4. VANGUARD TOTAL BOND MARKET ETF 0.21% 5. VANGUARD SHORT-TERM CORPORATE BOND ETF 1.05%

Last 6 Months Return 1. COMERICA INC COM 36.04%¹ 2. ENCORE WIRE CORP COM 34.25% 3. JPMORGAN CHASE & CO COM 32.50% 4. GENERAL DYNAMICS CORP COM 26.64% 5. VALERO ENERGY CORP COM 24.22%¹

Not held for the entire period

Last 6 Months Return 1. SPDR S&P OIL & GAS EXPLORATION & PRODUCTION ETF -2.13% 2. APPLE INC COM -1.52% 3. ALPHABET INC CAP STK CL C 2.38% 4. CASH SWEEP 2.89% 5. VANGUARD INTERMEDIATE-TERM TREASURY ETF 3.90%¹

Not held for the entire period

¹

Sample Portfolio Quarterly Investment Review Portfolio Appraisal As of 3/13/2024 Page 7 of 14

Year To Date Symbol Units Cost Basis Unit Cost Ending Value Price Total UGL Account Allocation Yield Projected Income Return Sample Portfolio 4,949,688 7,414,193 2,464,505 2.02% 150,077 4.48% 2823122013 - Sample Account 4,949,688 7,414,193 2,464,505 100.00% 2.02% 150,077 4.48% US Equities 2,474,666 4,756,624 2,281,958 64.16% 1.43% 67,806 6.14% Large Cap Core 645,021 1,350,784 705,763 18.22% 1.75% 23,658 4.53% APPLE INC COM AAPL 1,299 32,119 24.73 222,298 171.13 190,179 3.00% 0.56% 1,247 -11.00% GENERAL DYNAMICS… GD 279 63,892 229.01 76,825 275.36 12,933 1.04% 2.06% 1,585 6.56% ISHARES S&P 100 ETF OEF 1,403 131,542 93.76 343,104 244.55 211,561 4.63% 1.09% 3,724 9.47% ISHARES U.S. HEALTHC… IYH 3,280 104,210 31.77 201,458 61.42 97,247 2.72% 5.50% 11,087 7.29% SPDR S&P BIOTECH ETF XBI 1,009 88,852 88.06 97,974 97.10 9,121 1.32% 0.02% 17 8.75% SPDR S&P OIL & GAS E… XOP 1,222 173,963 142.36 179,512 146.90 5,548 2.42% 2.45% 4,393 7.30% TECHNOLOGY SELECT… XLK 1,100 50,441 45.86 229,614 208.74 179,173 3.10% 0.70% 1,605 8.45% Large Cap Growth 337,641 1,131,053 793,412 15.26% 0.48% 5,442 8.52% ALPHABET INC CAP ST… GOOG 1,116 40,635 36.41 157,099 140.77 116,464 2.12% 0 -0.11% ISHARES RUSSELL 100… IWF 2,919 297,005 101.75 973,954 333.66 676,948 13.14% 0.56% 5,442 10.06% Large Cap Value 684,979 1,180,657 495,678 15.92% 1.93% 22,789 9.18% ISHARES RUSSELL 100… IWD 4,367 456,242 104.47 765,535 175.30 309,293 10.33% 1.90% 14,578 6.08% JPMORGAN CHASE &… JPM 1,202 86,319 71.81 230,039 191.38 143,720 3.10% 2.19% 5,048 13.19% VALERO ENERGY CORP… VLO 308 39,926 129.63 48,858 158.63 8,932 0.66% 2.70% 1,318 22.93% WALMART INC COM WMT 2,223 102,491 46.10 136,225 61.28 33,734 1.84% 1.35% 1,845 16.61% Mid Cap Core 385,086 631,663 246,578 8.52% 1.70% 10,768 4.58% COMERICA INC COM CMA 1,054 40,552 38.47 54,481 51.69 13,929 0.73% 5.49% 2,993 -7.40% ISHARES RUSSELL MID… IWR 7,014 344,534 49.12 577,182 82.29 232,648 7.78% 1.35% 7,775 5.87% Small Cap Core 363,578 386,459 22,881 5.21% 1.33% 5,122 -0.86% ISHARES CORE S&P SM… IJR 3,601 363,578 100.97 386,459 107.32 22,881 5.21% 1.33% 5,122 -0.86% Small Cap Growth 58,362 76,007 17,645 1.03% 0.04% 27 5.60% ENCORE WIRE CORP C… WIRE 337 58,362 173.18 76,007 225.54 17,645 1.03% 0.04% 27 5.60%

Portfolio Appraisal

Sample Portfolio Quarterly Investment Review Portfolio Appraisal As of 3/13/2024 Page 8 of 14 Portfolio Appraisal Year To Date Symbol Units Cost Basis Unit Cost Ending Value Price Total UGL Account Allocation Yield Projected Income Return International Equities 585,142 647,772 62,630 8.74% 3.02% 19,535 4.61% Developed 585,142 647,772 62,630 8.74% 3.02% 19,535 4.61% VANGUARD FTSE DEV… VEA 12,927 585,142 45.27 647,772 50.11 62,630 8.74% 3.02% 19,535 4.61% Fixed Income 1,386,588 1,433,825 47,237 19.34% 3.19% 45,797 -0.61% Corporate Bonds 1,188,419 1,230,690 42,271 16.60% 3.24% 39,902 -0.57% VANGUARD SHORT-TE… VCSH 4,327 326,941 75.56 333,698 77.12 6,757 4.50% 3.27% 10,907 0.28% VANGUARD TOTAL BO… BND 12,374 861,478 69.62 896,991 72.49 35,513 12.10% 3.23% 28,995 -0.88% Govt/Inflation 198,169 203,136 4,966 2.74% 2.90% 5,895 -0.87% VANGUARD INTERME… VGIT 3,473 198,169 57.06 203,136 58.49 4,966 2.74% 2.90% 5,895 -0.87% Alternative Assets 383,752 456,433 72,680 6.16% 3.71% 16,939 5.01% Commodities 58,788 97,175 38,387 1.31% 0 5.24% SPDR GOLD SHARES GLD 483 58,788 121.71 97,175 201.19 38,387 1.31% 0 5.24% Balanced 324,964 359,258 34,294 4.85% 4.72% 16,939 4.94% JPMORGAN EQUITY P… JEPI 3,060 167,839 54.85 175,552 57.37 7,714 2.37% 7.61% 13,356 5.46% VANGUARD BALANCE… VBIAX 3,946 157,126 39.82 183,706 46.56 26,580 2.48% 1.95% 3,583 4.44% Cash & Equivalents 119,539 119,539 0 1.61% 0 1.51% Cash 119,539 119,539 0 1.61% — 0 1.51% CASH SWEEP OCBSU… 119,539 119,539 1.00 119,539 1.00 0 1.61% 0 1.51%

Projected Income Summary

Sample Portfolio Quarterly Investment Review Projected Income Summary As of 3/13/2024 Page 9 of 14

Apr '24 May '24 Jun '24 Jul '24 Aug '24 Sep '24 Oct '24 Nov '24 Dec '24 Jan '25 Feb '25 Mar '25 Projected Income Sample Portfolio 6,924 5,241 25,354 6,924 5,241 25,354 6,924 5,241 25,354 6,924 5,241 25,354 150,077 2823122013Sample Account 6,924 5,241 25,354 6,924 5,241 25,354 6,924 5,241 25,354 6,924 5,241 25,354 150,077

Projected Income Summary

Sample Portfolio Quarterly Investment Review Management Fees As of 3/13/2024 Page 10 of 14 Management Fees Last 12 Months Date Action Amount Sample Portfolio -62,256.40 2823122013 - Sample Account -62,256.40 CASH 3/15/2023 Management Fee -1,072.67 CASH 3/15/2023 Management Fee -1,072.67 CASH 3/15/2023 Management Fee -1,162.06 CASH 3/15/2023 Management Fee -1,162.05 CASH 4/17/2023 Management Fee -1,089.10 CASH 4/17/2023 Management Fee -1,089.10 CASH 4/17/2023 Management Fee -1,179.86 CASH 4/17/2023 Management Fee -1,179.86 CASH 5/15/2023 Management Fee -1,096.51 CASH 5/15/2023 Management Fee -1,096.51 CASH 5/15/2023 Management Fee -1,187.89 CASH 5/15/2023 Management Fee -1,187.89 CASH 6/15/2023 Management Fee -1,089.79 CASH 6/15/2023 Management Fee -1,089.78 CASH 6/15/2023 Management Fee -1,180.60 CASH 6/15/2023 Management Fee -1,180.60 CASH 7/18/2023 Management Fee -1,123.17 CASH 7/18/2023 Management Fee -1,123.17 CASH 7/18/2023 Management Fee -1,216.77 CASH 7/18/2023 Management Fee -1,216.77 CASH 8/15/2023 Management Fee -1,145.85 CASH 8/15/2023 Management Fee -1,145.85 CASH 8/15/2023 Management Fee -1,241.33 CASH 8/15/2023 Management Fee -1,241.33

Sample Portfolio Quarterly Investment Review Management Fees As of 3/13/2024 Page 11 of 14 Management Fees Last 12 Months Date Action Amount CASH 9/18/2023 Management Fee -1,129.58 CASH 9/18/2023 Management Fee -1,129.58 CASH 9/18/2023 Management Fee -1,223.71 CASH 9/18/2023 Management Fee -1,223.71 CASH 10/17/2023 Management Fee -1,095.19 CASH 10/17/2023 Management Fee -1,095.19 CASH 10/17/2023 Management Fee -1,186.46 CASH 10/17/2023 Management Fee -1,186.45 CASH 11/15/2023 Management Fee -1,086.73 CASH 11/15/2023 Management Fee -1,086.73 CASH 11/15/2023 Management Fee -1,177.29 CASH 11/15/2023 Management Fee -1,177.29 CASH 12/4/2023 Management Fee -750.00 CASH 12/4/2023 Management Fee -750.00 CASH 12/4/2023 Management Fee -750.00 CASH 12/4/2023 Management Fee -750.00 CASH 12/4/2023 Management Fee -750.00 CASH 12/4/2023 Management Fee -750.00 CASH 12/15/2023 Management Fee -1,139.22 CASH 12/15/2023 Management Fee -1,139.21 CASH 12/15/2023 Management Fee -1,234.15 CASH 12/15/2023 Management Fee -1,234.15 CASH 1/17/2024 Management Fee -1,156.90 CASH 1/17/2024 Management Fee -1,156.89 CASH 1/17/2024 Management Fee -1,253.31 CASH 1/17/2024 Management Fee -1,253.30

Sample Portfolio Quarterly Investment Review Management Fees As of 3/13/2024 Page 12 of 14 Management Fees Last 12 Months Date Action Amount CASH 1/25/2024 Management Fee -2,000.00 CASH 2/20/2024 Management Fee -1,156.85 CASH 2/20/2024 Management Fee -1,156.84 CASH 2/20/2024 Management Fee -1,253.25 CASH 2/20/2024 Management Fee -1,253.24

Ratings Disclaimer

Copyright © 2024, Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. All rights reserved. This may contain information obtained from third parties, including ratings from credit ratings agencies such as Standard & Poor’s. Reproduction and distribution of third party content in any form is prohibited except with the prior written permission of the related third party. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. THIRD PARTY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. Third party content providers shall not be liable for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including lost income or profits and opportunity costs or losses caused by negligence) in connection with any use of ratings. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the suitability of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice. To the extent this is being provided to an individual or institutional account holder, any ratings contained herein are solely for such account holder’s own non-commercial use and may only be used by or for the benefit of the account holder in connection with the management and/or administration of such account holder’s holdings and not for any other purpose.

© 2024, Moody’s Analytics, Inc. and its licensors ("Moody’s"). Moody’s ratings and other information ("Moody’s Information") are proprietary to Moody’s and/or its licensors and are protected by copyright and other intellectual property laws. Moody’s Information is licensed to Distributor by Moody’s. MOODY’S INFORMATION MAY NOT BE COPIED OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY’S PRIOR WRITTEN CONSENT. Moody’s® is a registered trademark.

Morningstar Disclaimer

© 2024 Morningstar, Inc. All Rights Reserved.

The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Investment Policy Statement

Balanced Strategy

The purpose of the investment policy statement is to set forth and appropriately describe any pertinent policies pertaining to the management of your investment portfolio, set expectations about Oakworth’s responsibilities in managing your assets, set ranges for the asset allocation of your account, and set reasonable expectations for portfolio performance.

Oakworth Investment Responsibilities:

• Oakworth will manage your account with the following primary investment objectives:

• Preserving the stability of the principal commensurate with your risk tolerance

• Providing an adequate level of liquidity

• Generating a competitive rate of return

• Oakworth will choose investment securities and other alternatives based on a disciplined process to ensure safety and appropriateness.

• Oakworth will help to control all investment related costs, in order to provide the highest possible return given your risk tolerance.

• Oakworth’s primary investment discipline is based on a ‘top down’ macroeconomic forecast, and focuses on choosing the optimal asset allocation.

• Oakworth will make investment changes and/or recommendations based on its Investment Committee’s forecasts for the US and global economies and how the investment/asset class should perform in response.

• Oakworth will serve as an agent in the market for you. We have a fiduciary duty to execute any and all transactions solely for your benefit. Oakworth does not receive any other compensation than what is mutually agreed upon in its Fee Schedule.

Page 1

Client Communications:

Investment Strategy Overview:

Oakworth’s Investment Committee is committed to keeping you informed of market conditions and any changes in our management of your portfolio. Our various communication channels include:

1. face to face meetings

2. Zoom meetings

3. conference calls

4. email correspondence

5. market newsletters

6. podcasts

7. other digital correspondence.

We understand the importance of being a long-term investor. However, we strongly believe the marketplace continually misinterprets this as: being a long-term investor means you don’t know when to quit banging your head against the wall. Nothing is further from the truth. Being a long-term investor means having a final objective, and a strategy to achieve it. It means understanding your risk tolerance and return expectations. Finally, it means you have the flexibility to make changes as market conditions make them necessary.

The single biggest decision in the asset allocation process is: how much do you allocate to stocks relative to other asset classes? Generally speaking, stocks tend to have positive returns when the economy grows. As such, our investment strategy hinges on our macroeconomic forecast: what is the economy likely to do in the near future? What are its strongest elements or industries, and what is the likelihood for future corporate profitability?

History shows, significant, long-term bear markets and economic downturns are usually predicated by a financial system panic of some sort. Not surprisingly, there is a strong correlation between the magnitude of the financial crisis and the depth & breadth of the bear market. Since financial panics are relatively rare, we are ordinarily predisposed to be market or overweight stocks relative to fixed income, all other things being equal.

After all, investors are rewarded for the amount of risk they are willing to take. To that end, it is the financial advisor/portfolio manager’s job to ensure their client maximizes the return they receive for the amount of risk they are willing to take.

Security Selection Guidelines:

In general, long term investment performance is determined by asset performance. Historically, stock assets offer higher rates of return along with greater volatility. Fixed assets generally yield lower rates of return, lower correlation with equities and less risk. Diversification across asset geography and size is recommended based on the client’s risk tolerance.

The individual holdings will consist of individual equities, exchange traded funds and mutual funds to fit the portfolio to the client’s risk tolerance.

Page 2

Security Selection Guidelines (cont.):

Equities/Stocks:

Individual equities will be evaluated using a discipline approach, in keeping with our economic outlook. Oakworth will filter for companies that are expected to have both a strong growth rate as well as being sold at a reasonable price.

Equity Exchange Traded Funds and Mutual Funds will be used to gain secure, diversified access to sectors and markets while maintaining liquidity in the account.

The previous statements apply both to domestic and international markets.

Fixed Income/ Bonds:

Oakworth will invest both in fixed income funds such as exchange traded funds as well as mutual funds to again gain safe, diverse access to fixed income markets with abundant diversity. Oakworth may also invest in individual fixed income securities based on the client’s individual needs.

Fixed Income Exchange Traded Funds and Mutual

Funds will be used to gain secure, diversified access to sectors and markets while maintaining liquidity in the account.

Performance Monitoring:

Account

Rebalancing:

Tax Policy:

Client Responsibilities:

Oakworth will compare account performance against a peer group benchmark and/or index whose risk tolerance matches your account for comparison purposes.

Market conditions may cause certain asset classes and/or securities in your portfolio to deviate from the target weighting. Oakworth will monitor your portfolio and rebalance it back to target weightings either systematically based on variance from the target or upon your direction (in accordance with your Oakworth Advisor) to ensure the asset mix remains consistent with your risk tolerance.

Oakworth strives to use tax efficient investment vehicles in all client portfolios. While tax consequences can be an important variable, they do NOT drive the investment process. The overall goal in your investment portfolio is to maximize the total rate of return of your assets while minimizing the amount of risk you are taking.

You will be an active participant in defining your investment objectives, liquidity needs, and risk tolerances.

You will let Oakworth know of any substantive changes in your life and/or financial condition which would impact your investment objectives, liquidity needs, and risk tolerances.

You will take responsibility to read any and all information Oakworth provides you in conjunction with its management of your investment portfolio.

Page 3

Investment Strategy

Description:

Strategy Description & Highlights

Balanced Strategy

The Oakworth Balanced Strategy focuses equally on both the stability of principal and growth. It does this by investing in a mixture of different asset classes and securities with different risk characteristics. Under ordinary circumstances, historically riskier asset classes, like, equities/stocks, will comprise approximately 45-75% of the portfolio. Less risky asset classes, ordinarily fixed income and cash, will make up the remainder of the portfolio.

It is ideally suited for investors who are willing to take a moderate level of risk.

Investors should expect a ‘broad market’ return from the portfolio, somewhere in between the returns of both the bond and stock markets under ordinary market conditions.

These targets and ranges are for illustrative purposes only, and should serve only as a guide. There is no guarantee your portfolio will adhere to ranges and targets above at all times. The markets can, do and will fluctuate, which will change allocations. An Oakworth client advisor or member of the Investment Committee will communicate any significant changes or variances from the norm, whether it is due to market volatility or investment decision making.

Page 4

Balanced Strategy Broad Asset Allocation Ranges Asset Class Neutral Normal Range Cash & Money Markets <3% 0-15% Fixed Income 40% 20-55% Equities (Including International) 60% 40-70%

Disclaimer(s): Past performance is not indicative of future returns. The market value of your investments can and will fluctuate. There is no guarantee your investment portfolio will grow in market value, and there is no guarantee your portfolio would have performed as illustrated, regardless of investment advisor. Oakworth will exercise both caution and expertise in the investment management of client portfolios, but cannot guarantee returns of any kind.

Page 5

The Market Index is: 40% S&P 500/ 15% MSCI EAFE+EM/45% Barclays US Intermediate Aggregate. The peer group is the MorningstarUS Active Fund Allocation 50-70% Equity universe.

The numbers on this page are from sources we deem reliable, but Oakworth cannot guarantee their accuracy. Historical performance is gross of account level fees, and is not indicative of future results. Individual account performance can and will deviate from the mean, and this information is presented in good faith for informational purposes only. The representative account is reflective of a low transaction, tax-deferred portfolio adhering to Oakworth’s investment strategy recommendations.

While Oakworth has not been audited for GIPS compliance, performance numbers are system (First Rate) generated using the industry accepted Modified Dietz calculation methodology using time weighted cash flows. Oakworth believes these to be accurate, and presents them in good faith.

R EPRESENTATIVE B ALANCED A CCOUNT P ERFORMANCE B LENDED B ENCHMARK C OMPARISON Year Portfolio Market Index Peer Group 2008 (Dec Only) 3.13 2.65 2009 19.47 19.31 23.52 2010 12.57 10.98 11.87 2011 1.34 1.64 (0.16) 2012 11.38 10.78 11.68 2013 14.59 14.16 16.05 2014 9.10 6.67 6.13 2015 (0.06) 0.78 (1.96) 2016 6.26 6.26 7.37 2017 14.92 13.52 13.23 2018 (4.84) (3.29) (5.80) 2019 22.51 18.52 18.90 2020 12.73 11.88 11.62 2021 16.24 11.21 10.19 2022 (16.64) (13.69) (13.02) 2023 16.89 13.79 13.22 2024 (thru February) 2.62 2.53 1.50 Annualized 8.86 8.04 1 Year 17.32 14.13 12.11 3 Years Annualized 4.62 3.64 2.36 5 Years Annualized 8.36 6.91 6.19 10 Years Annualized 7.23 6.29 5.98

Charitable Fee Schedule

The below fee schedule is in effect for a one-year period beginning when said fee schedule is executed.

Minimum annual fee of $5,000.00

The above-described fees will be taken and charged to the account on a monthly basis and will be calculated in arrears based on the market value of the assets, as determined by Oakworth Capital Bank, as of the last business day of the preceding calendar month.

Oakworth Capital Bank reserves the right to charge for any extraordinary and/or unusual services it renders on behalf of the client that are in addition to its contracted responsibilities as investment agent. Any such additional compensation will be commensurate with the extent of the duties and responsibilities assumed. Other services provided by third-party professionals, such as for tax services and/or appraisals and extraneous legal fees, will be charged to the account as a separate and pass-through charge.

Trading and settlement expenses for transactions carried out by Oakworth Capital Bank are at institutional rates and are separate and apart from this schedule. Any expenses associated with using third-party investment managers will be subject to additional fees, which will be deducted from the account as separate and pass-though charges. Any such potential fees will be made known to and agreed upon by the client prior to implementation.

Oakworth Capital Bank reserves the right to receive, above and beyond the fees payable to Oakworth Capital Bank for fiduciary and investment management services, revenue-sharing or other compensation payable in connection with or in respect of the investment of assets of the account in money market mutual funds, mutual funds, exchange-traded funds, investment companies or trusts, unit investment trusts, common or collective investment funds and other pooled investment vehicles (collectively, “Investment Funds”) and/or fees and/or other compensation for services as administrative servicing agent, shareholder servicing agent, subaccounting agent, or otherwise. Oakworth Capital Bank does not currently participate in the above listed items. Securities, Investment Funds and any other nondeposit investment products are not insured by the FDIC or any other governmental agency; are not deposits or other obligations of, or guaranteed by Oakworth Capital Bank or any bank, and are subject to investment risks, including possible loss of the principal amount invested. Should we decide to participate in the above listed items we will notify clients in advance in writing. Signature

Market Value Annual Fee

the first $2,500,000 60%

the next $2,500,000 55%

assets

$5,000,000 .50%

On

On

On

above

Date Signature Date