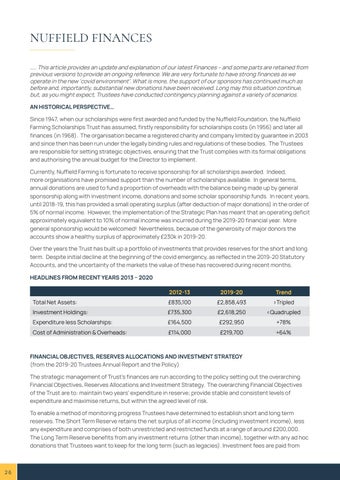

NUFFIELD FINANCES ….. This article provides an update and explanation of our latest Finances – and some parts are retained from previous versions to provide an ongoing reference. We are very fortunate to have strong finances as we operate in the new ‘covid environment’. What is more, the support of our sponsors has continued much as before and, importantly, substantial new donations have been received. Long may this situation continue, but, as you might expect, Trustees have conducted contingency planning against a variety of scenarios. AN HISTORICAL PERSPECTIVE… Since 1947, when our scholarships were first awarded and funded by the Nuffield Foundation, the Nuffield Farming Scholarships Trust has assumed, firstly responsibility for scholarships costs (in 1956) and later all finances (in 1968). The organisation became a registered charity and company limited by guarantee in 2003 and since then has been run under the legally binding rules and regulations of these bodies. The Trustees are responsible for setting strategic objectives, ensuring that the Trust complies with its formal obligations and authorising the annual budget for the Director to implement. Currently, Nuffield Farming is fortunate to receive sponsorship for all scholarships awarded. Indeed, more organisations have promised support than the number of scholarships available. In general terms, annual donations are used to fund a proportion of overheads with the balance being made up by general sponsorship along with investment income, donations and some scholar sponsorship funds. In recent years, until 2018-19, this has provided a small operating surplus (after deduction of major donations) in the order of 5% of normal income. However, the implementation of the Strategic Plan has meant that an operating deficit approximately equivalent to 10% of normal income was incurred during the 2019-20 financial year. More general sponsorship would be welcomed! Nevertheless, because of the generosity of major donors the accounts show a healthy surplus of approximately £230k in 2019-20. Over the years the Trust has built up a portfolio of investments that provides reserves for the short and long term. Despite initial decline at the beginning of the covid emergency, as reflected in the 2019-20 Statutory Accounts, and the uncertainty of the markets the value of these has recovered during recent months. HEADLINES FROM RECENT YEARS 2013 – 2020 2012-13

2019-20

Trend

Total Net Assets:

£835,100

£2,858,493

>Tripled

Investment Holdings:

£735,300

£2,618,250

<Quadrupled

Expenditure less Scholarships:

£164,500

£292,950

+78%

Cost of Administration & Overheads:

£114,000

£219,700

+64%

FINANCIAL OBJECTIVES, RESERVES ALLOCATIONS AND INVESTMENT STRATEGY (from the 2019-20 Trustees Annual Report and the Policy) The strategic management of Trust’s finances are run according to the policy setting out the overarching Financial Objectives, Reserves Allocations and Investment Strategy. The overarching Financial Objectives of the Trust are to: maintain two years’ expenditure in reserve; provide stable and consistent levels of expenditure and maximise returns, but within the agreed level of risk. To enable a method of monitoring progress Trustees have determined to establish short and long term reserves. The Short Term Reserve retains the net surplus of all income (including investment income), less any expenditure and comprises of both unrestricted and restricted funds at a range of around £200,000. The Long Term Reserve benefits from any investment returns (other than income), together with any ad hoc donations that Trustees want to keep for the long term (such as legacies). Investment fees are paid from

26