INVESTMENT PROFESSIONALS

Traverse City Office 236 1/2 E. Front Street, #26 Traverse City, MI 49684 231-943-6988

Main Office 5931 Oakland Drive Portage, MI 49024 269-385-5888 or 888-777-0216

• We uphold a Fiduciary Standard and work with clients on a fee-only basis.

• We do not receive commissions, kick-backs, or soft dollars from product sales, eliminating inherent conflicts of interest.

• Our team of professionals holds designations and degrees such as CFP®, CFA, CPA, MBA, JD, and PhD.

• Charles received his MBA from the Kellogg School of Management - Northwestern University, his MA in Economics from WMU, and Executive Education from Harvard Business School and Columbia University. Charles Zhang, CFP®, MBA, MSFS, ChFC

• Ranked #1 on Barron’s list of America’s TOP Independent Advisors for 2024. Charles has achieved the #1 ranking three times within the past four years.*

• Ranked #4 in the nation on Forbes’ list of TOP Wealth Advisors and is the highest-ranking Fee-Only Advisor on the list.*

of LPL Financial and Charles Schwab.

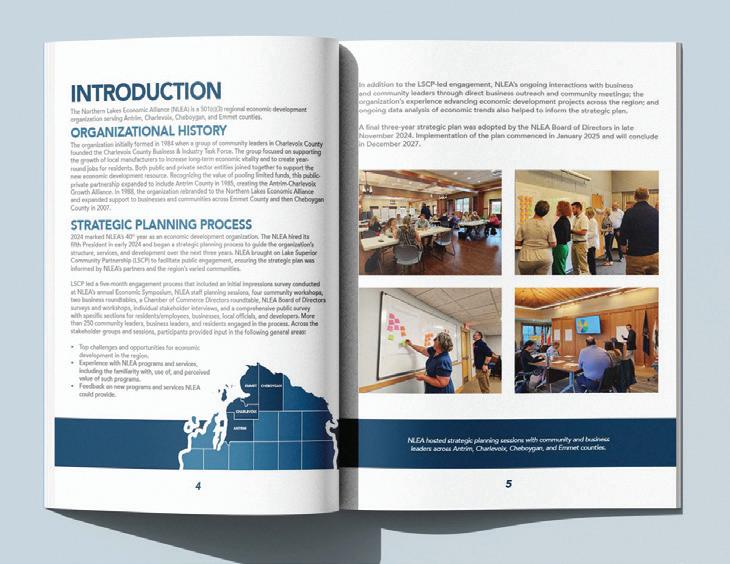

The Northern Lakes Economic Alliance (NLEA) recently unveiled its three-year strategic plan, designed to drive economic resiliency and prosperity across Antrim, Charlevoix, Cheboygan and Emmet counties. Guided by insights from more than 250 community and business leaders, the plan outlines a vision for the region’s economic future. “We envision a thriving regional economy with a robust business environment, diverse family-sustaining career opportunities, and an exceptional quality of life for all residents,” NLEA President and CEO Payton Heins said. The plan calls attention to key obstacles – such as a shrinking working-age population and limited infrastructure and development-ready sites – as well as emphasizes opportunities such as natural assets and overlooked industries that are innovating and provide higher wage career opportunities.

The Rivard Teahen Group in Traverse City is now The Rivard Teahen Wheatley Group after recently expanding its group with new team member Jon Wheatley. Wheatley joins advisors Kurt Rivard and Rebecca Teahen in providing financial planning services as part of the Baird Private Wealth Management office in Traverse City.

Bay Area Transportation Authority (BATA) is partnering with TVC-Cherry Capital Airport to launch a pilot service dedicated to helping air travelers reach their early morning flights. The new trial service will operate Monday - Friday from 4 a.m. to 7 a.m. Riders need to request a ride at least 48 hours in advance but can schedule up to two weeks in advance of their travel date. The cost to ride is $12 per person and luggage can be stored in the seat with the passengers. Initially, the new service area will be limited to Traverse City but may expand based on ridership and demand. Rides can be scheduled by calling BATA Scheduling at 231.941.2324 or through the BATA Link mobile app. To see the trial service area and learn more, visit www.bata. net/airport.

Neuco Furniture & Upholstery recently announced a move. The company has relocated to 1237 Hastings Street in Traverse City and is in the process of constructing a showroom. Learn more at callneuco.com.

HomeTown Pharmacy, a Michigan-based, family-owned company, recently took ownership of five retail pharmacies in Grand Traverse and Leelanau counties from Munson Healthcare. They include Munson Community Health Center Pharmacy, Sixth Street Drugs, Munson Medical Center Discharge Pharmacy, Munson Suttons Bay Pharmacy, and Munson Empire Pharmacy. “We are retaining the staff and staying in the same locations so there will be little change for customers,” said Dianne Malburg, president of HomeTown Pharmacy. HomeTown is already a provider of longterm care pharmacy services to several Munson-owned and operated affiliates which expanded to two additional nursing facilities this past year.

Locals Lake Leelanau is taking over the former home of Northern Latitudes Distillery (which is relocating) in Lake Leelanau and converting it into a restaurant, retail shop, catering enterprise, and community center. Local food and beverage veteran Tony West is behind the project at 112 East Philip St., tentatively slated to open its doors May 1. West said the restaurant will serve “upscale pub-style food” with a local focus, complementing existing Lake Leelanau offerings like Dick’s Pour House, Nittolo’s, and Fiddleheads. West most recently served as director of food and beverage at the Leland Lodge. He also plans to offer a “Locals to the lake to-go menu,” where boaters can pull up to the docks at the Narrows and get food delivered directly to their boats. The business will also include a retail component, which will carry merch and goods from area farms, makers, and artisans. The Leland Lodge has also announced a “new culinary chapter.” John Sisson is now helming the Leland Lodge’s food and beverage program. Sisson is best known in Leelanau as the former owner

of the Leelanau Country Inn (now the Little Traverse Inn), which he operated with his wife Linda for 21 years. Linda has also come aboard at the Leland Lodge, contributing “homemade desserts and other treats” to the menu. Christian Doran is continuing on as head chef.

Davenport University is now a partner in Direct Connect, a program of Northwestern Michigan College in Traverse City that makes transferring to earn a bachelor’s degree as streamlined as possible. With Direct Connect, NMC students are guaranteed admission to Davenport if they maintain a 2.0 GPA. Credits earned toward their NMC associate degree count as freshman and sophomore year credits at Davenport. They can then transfer into one of six Davenport business and information technology programs. Last fall, NMC debuted Direct Connect with Grand Valley State University’s Allied Health program.

Several wineries from the Leelanau Peninsula Wine Trail won honors at the recent 2025 San Francisco Chronicle Wine Competition, the largest wine competition for North American wines. Named Best of Class were Aurora Cellars’ 2022 Grüner Veltliner and Verterra Winery’s 2023 Pinot Grigio. Double Gold medal winners include Aurora Cellars’ 2023 Sauvignon Blanc; Verterra Winery’s 2021 Verterra Sparkler, 2023 Pinot Blanc, and 2023 Dry Riesling; and Shady Lane’s 2023 Grüner Veltliner. Other winning wineries were French Valley, Good Harbor Vineyards, Bel Lago, Blustone Vineyards, Boathouse Vineyards, and Leelanau Cellars

Chris and Jim MacInnes, owners of Crystal Mountain in Thompsonville with the Petritz family, have been named recipients of the Michigan Legacy Art Park’s Legacy Award. The award was established in 2009 to unite those involved in Michigan arts and culture and to demonstrate and recognize the power of collaboration and peer influence. “Michigan Legacy Art Park would not exist without the

trust, support and partnership of Crystal Mountain, led by Chris and Jim MacInnes,” said Joan Verla, board president. “As we celebrate our 30th anniversary year, we are delighted to honor Chris and Jim for believing in Michigan Legacy Art Park from the very start.” Chris MacInnes was born in northern Michigan and along with her husband Jim joined the family business at Crystal Mountain in 1985. The MacInnes’ will be celebrated at the annual Legacy Gala in August.

Nominations are being accepted until March 15 for the annual Hospitality High Five Awards by Traverse City Tourism Now in its second year, the awards honor those who excel in the northwest Michigan hospitality industry. Award winners will be chosen by an independent committee of northern Michigan hospitality experts and announced at the Traverse City Tourism annual meeting in May. “There are so many hospitality superstars in our area,” said Traverse City Tourism President Trevor Tkach. “These are the people that make our area one of the premier travel destinations in the country. It’s appropriate to put the spotlight on their contributions.” Learn more and submit nominations at traversecity.com/hospitality-awards.

Four community leaders recently joined the board of directors for Habitat for Humanity Grand Traverse Region. Paul Busekist has been the senior pastor at Bethlehem Lutheran Church City since 2011. Prior to parish ministry, Pastor Paul served as a hospital chaplain in the Chicago area. Brandie Ekren is the executive director of Traverse City Light & Power. Ekren previously served for six years on the board of directors for High fields, a nonprofit focused on stabilizing and empowering families. Al Everett of Thrive TC and Epique Realty brings a strong background in real estate development and construction technology. Everett has experience working with two architectural firms, mentoring new businesses through SCORE, and being a founding member of initiatives that promote innovative construction methods. Desiree Worthington of Worthington Fundraising Solutions has spent her 33-year career working with charitably-minded families and organizations. Worthington has led several campaigns for start-ups and large charities and has been a Certified Fundraising Executive since 2010.

412 WEBSTER STREET IN DOWNTOWN TC

Originally built in 1913 as a school, the Boardman Building has long stood as a beloved centerpiece of the Boardman Neighborhood. Now, this iconic structure is undergoing a stunning transformation under the visionary guidance of renowned local architect Ken Richmond and master builder Eric Gerstner.

Expertly Designed. Fully Customizable.

It’s been six long months since the Michigan Supreme Court made headlines by ruling that the Michigan legislature had violated the state constitution in its “adopt and amend” approach to two ballot measures related to minimum wage and paid leave. While several states across the country have instituted paid sick leave laws, the Michigan ballot measure’s lack of clarity created one of the most burdensome sick time acts in the country.

As readers may recall, I drew attention to the Earned Sick Time Act (ESTA) and tipped wage ruling in my December article. I would not usually address the same issue two quarters in a row, but the implications of these policy changes are immense and incredibly far-reaching. The court’s decision brought uncertainty and anxiety to businesses as they worked to understand the implications and application of the new rules – and concerns grew as state lawmakers spent the last few months debating last-minute changes to the regulations before they came into effect on February 21, 2025.

The irony is that many of our region’s employers, to compete for talent, already provide the required 72 hours or more of paid leave. Yet the rules under ESTA are so ambiguous regarding usage, rollover, documentation and record-keeping, reinstatement, and defining who qualifies as an employee that it creates layers of complexity that small businesses will struggle to navigate, increasing administrative burdens and potential legal risks.

The Northern Michigan Chamber Alliance spent months advocating for legis-

EDITORIAL & BUSINESS OFFICE

P.O. Box 4020 Traverse City, MI 49685 231-947-8787

ON THE WEB

tcbusinessnews.com

PUBLISHER

Luke W. Haase

lhaase@tcbusinessnews.com

CONTRIBUTING EDITOR

Gayle Neu

gneu@tcbusinessnews.com

HEAD WRITER

Craig Manning

STAFF WRITER

Art Bukowski

lative action and reasonable amendments to be made to ESTA and minimum wage requirements before the February deadline. At the same time, we prepared our regional business community for compliance with the full implementation of the requirements as they were written. It has been a balancing act: fight for the needed changes while also preparing for the worst! Unfortunately, no action was taken by the state legislature in the lameduck session at the end of 2024.

New State House and Senate bills were

make this stuff up.

To support employers in navigating these changes, the Alliance hosted a webinar on January 22 with more than 350 participants, featuring Rehmann’s Elizabeth Williams, principal of HR Solutions. The webinar provided employers of all sizes with advice on implementing and complying with the ESTA requirements as currently written – a recording is available on Traverse Connect’s website.

Activity in the state legislature finally

The Northern Michigan Chamber Alliance spent months advocating for legislative action and reasonable amendments to be made to ESTA and minimum wage requirements before the February deadline.

introduced in early January. Our local Rep. John Roth (District 104), introduced HB 4001 to modify the minimum hourly wage and Rep. Jay DeBoyer (District 63) introduced HB 4002 to modify ESTA. Both bills passed the House on January 23 with bipartisan support, after which they were sent to the Senate Committee on Regulatory Affairs. However, the Senate committee voted against taking up the House bills and instead held hearings on the Senate’s different version of legislation, beginning on February 6. No, this course of events does not make much sense and no, you can’t

CREATIVE DIRECTOR

Kyra Cross Poehlman

CONTRIBUTING WRITERS

Ross Boissoneau

Kierstin Gunsberg

Rick Haglund

COPY EDITOR Becky Kalajian

WEB PRODUCTION: Byte Productions

MAILING/FULFILLMENT Village Press

DISTRIBUTION

Gerald Morris

SERVING: Grand Traverse, Kalkaska, Leelanau and Benzie counties

ramped up as we approached the February 21 deadline with a Senate bill to replace the house version of the tipped/ minimum wage law and a modified version of HB 4002. Haley Bennett, the Director of Government Relations for the Northern Michigan Chamber Alliance, provided testimony in the Senate hearing about the danger of not acting for our small businesses. Negotiations continued through mid-February and a possible deal began to take shape with a “tie-bar” provision that ensured action on the tipped minimum wage issue could only proceed if there was also action on

AD SALES

Lisa Gillespie lisa@northernexpress.com

Kim Murray kmurray@tcbusinessnews.com

Kaitlyn Nance knance@northernexpress.com

Todd Norris tnorris@tcbusinessnews.com

Abby Walton Porter aporter@northernexpress.com

Michele Young myoung@tcbusinessnews.com

Earned Sick Time and vice versa.

As I write this (on the morning of Friday, February 21), we have a last-minute solution! The legislature just completed a marathon session with a final vote in the house at 11:15 p.m. last night, and the approved bills were presented to the governor at 1:30 a.m. this morning. The updated legislation is not perfect, but it does address a number of the issues we have been voicing for small businesses in northern Michigan: greatly reducing the administrative burden and ensuring there is not a one-size-fits-all approach to business, provisions for small businesses with 10 or fewer employees, exemptions for nonprofit organizations, and differentiated provisions for seasonal and parttime employees. There are many more details to digest from last night’s session, and there will be a learning curve for employers of all sizes as the new rules come into effect.

The legislature’s delayed actions only heightened the uncertainty building since July. Business advocates must continue to demand a balanced and practical approach to achieving fair and sustainable outcomes that support Michigan’s employers and their employees. Traverse Connect and our partners in the Northern Michigan Chamber Alliance will continue to be advocates and provide updated resources and information for employers as details of the new laws are published.

Warren Call is CEO and president of Traverse Connect.

The Traverse City Business News Published monthly by Eyes Only Media, LLC P.O. Box 4020 Traverse City, MI 49685 231-947-8787

Periodical postage qualification pending at Traverse City, MI.

POSTMASTER: Send address changes to The Traverse City Business News, PO Box 1810, Traverse City, MI 49685-1810.

The Traverse City Business News is not responsible for unsolicited contributions.

Content ©2025 Eyes Only Media, LLC. All rights reserved.

EYES ONLY MEDIA, LLC

For 40 years, Mercer Advisors has been helping families amplify and simplify their financial lives. That dedication has earned us the #1 RIA Firm in the Nation ranking from Barron’s in 2024.* More than just an accolade, it’s a testament to the trust our clients place in us.

By Art Bukowski

Sid Van Slyke is senior vice president and market leader for West Shore Bank in Traverse City. He invited us to his office in the bank’s snazzy Eighth Street digs for a look at his desk, then to a blood drive in the bank’s top floor event space, which has been used for dozens of community events over the past year. Thanks, Sid! If you have an idea for a From The Desk Of feature, please email Art Bukowski at abukowski@tcbusinessnews.com.

1. We’re rabid Detroit Lions fans at our house. The four of us as a family go to the Thanksgiving game every year; it’s become a tradition. My son started tagging along seven years ago, and he saw six losses in a row. So we were really excited this year to get the big win!

2. A few years ago, shortly after COVID, we bought a place up at Boyne Mountain. And it has become our family hangout. We spend a ton of time at Boyne – we ski, we golf, the kids love the waterpark.

3. This rock was painted by Anna Bottura, our Rotary youth exchange student from Italy. During the dark days of COVID, our kids took to painting rocks for something to do while we were locked in the house every day. Anna stayed here for an extended time because things were really bad in her home in northern Italy. So this is a wonderful little memory of her and of that time.

4. Commongrounds and the Alluvion are a big part of the reason we’re here. I knew this whole corridor was taking off, and it’s awesome to have that vibrant building next door with a coffee shop, a restaurant and a music venue.

5. We’ve probably been to 20 opening days for the

6. The picture on the mousepad is me drinking out of a ‘Just Great Movies’ Traverse City Film Festival mug. I did 15 years as a venue manager (City Opera House), and I think of my time with the film fest as how I got to know this town.

7. Here’s the West Shore Bank website. The bank is 126 years old this year, and it has only 10 offices. It is, by definition, a true community bank. To be in the position I’m in, and to build a team exactly the way I wanted, for a bank that so acutely understands the needs of the markets we sit in, has been exactly where I want to be in my career. It’s my dream job.

8. This ‘Kid from Flint’ coffee mug has been with me for about 20 years now. I was born and raised in Flint, and I carry it with me every day.

9. Blood drives are one of the many things we’ve done up here. This space was kind of my brainchild. Last year we hosted 77 events here for nonprofits, and we didn’t charge anybody a penny to use it. We want it to be a space for this community.

Wealth managers see a volatile – but healthy –year for investors Your business is our business.

By Rick Haglund

Investors have been smiling over the past couple of years as stock prices boomed. But will stocks continue their meteoric rise this year?

Standard and Poor’s 500, an index of the 500 largest U.S. publicly traded corporations, jumped 23.8% last year after a 24.2% hike in 2023. It was the first time since 1997 and 1998 that the index has recorded two back-to-back years of returns above 20%, according to FactSet, a Connecticut-based financial data firm.

“(2024) was a really great year,” said Eric Braund, founder of Black Walnut Wealth Management in Traverse City. He and other local wealth management executives mostly say they expect the good times to continue for investors, probably at a slower pace than in the past two years. But they caution there is likely to be more market volatility this year.

“We always love it when we can throw a dart at any stock on the board and make 20%,” said Marc Hudson, president of Hudson Wealth Management in Traverse City. “But there’s a good chance we could see a dip from where (the market) has been.”

A FactSet review of analysts’ forecasts in December predicted the S&P 500 to end this year up 14.8%.

Local investment advisors say uncer-

tainty over where interest rates and inflation are heading, a new administration in Washington that is announcing major policy changes almost daily and geopolitical upheavals make it difficult to predict investment returns this year.

“My proverbial crystal ball is in the shop, so stay tuned,” said Trevis Gillow, senior vice president of investments at Gillow Wealth Management of Raymond James.

Investment advisors say a change in political party control in Washington usually has little impact on long-term investment returns. But President Donald Trump’s election and his vow to radically remake the federal government have some investors on edge.

Holly Gallagher, president of Horizon Financial in Traverse City, says her firm has been fielding concerns from a few clients worried about the election of Trump.

“There’s usually a correction of 20% or more in the market every five years. We’re due for a correction.”

– Holly Gallagher, President, Horizon Financial

Inflation has fallen significantly from 9.2% in June 2022, the highest rate in more than 40 years, to 2.9% last December.

But after cutting interest rates three straight times last year, the Federal Reserve paused rate cuts in January over signs that inflation’s decline has stalled.

So far, the markets haven’t reacted negatively to the Fed’s pause, but that could change if expected rate cuts later this year don’t materialize.

The president, among other things, has threatened widespread tariffs that most economists say would be bad for the economy and taken other actions that have been alternately praised and condemned by experts and voters.

One distraught client said she was moving out of the country and, against Gallagher’s advice, sold off her entire investment portfolio, triggering a large tax bill.

“The emotions out there are real,”

Gallagher said. “You just try to be a good advisor.”

Local advisors say there are also many who support Trump’s policies, which include slashing federal spending, enacting tariffs on countries the president sees as taking advantage of the U.S. and cutting taxes.

“It’s nothing out of the ordinary,” Braund said. “We have clients on both sides of the aisle.”

An analysis Braund wrote last September found the S&P 500 index since 1933 performed about the same throughout Republican and Democratic administrations.

“We focus on the long-term in building an investment portfolio,” Braund said. “Our clients are planning for five, 10, 15, 20 years out. Short-term fluctuations in the market don’t make much of a difference.” Braund and other wealth managers say their clients are mostly well-heeled retirees and those planning for retirement.

A president’s control over the economy is limited by Congress and by monetary policy, which is determined by the Federal Reserve. And the impact of a president’s economic policies might not be felt until after leaving office, Braund says.

Nevertheless, advisors are trying to assess the impact of Trump’s election and other factors on their clients’ investment portfolios.

Gallagher says she thinks the high-flying stock market could stall out and fall by as

much as 20% this year.

“There’s usually a correction of 20% or more in the market every five years,” she said. “We’re due for a correction.”

Autumn Soltysiak, a partner at hemming& Wealth Management in Traverse City said she thinks corporate profits will be more widely spread this year, buoying the markets.

“We’re seeing more of an expansion of earnings across corporations,” she said. “Last year corporate profits were concentrated in the top seven to 10 companies. We think profits will be more broadbased this year.”

others say a strong regulatory framework is crucial to protect investors.

“Regulation is important to keep the bad actors out,” Soltysiak said. “We don’t need another Enron.”

“There will be more chaos, but we’re not expecting dramatic change.”

– Autumn Soltysiak, Partner, hemming& Wealth Management

But she said she’s not expecting inflation and interest rates to fall much, potentially offsetting some of the positive impacts of expected broad-based corporate profits and strong consumer spending.

“There will be more chaos, but we’re not expecting dramatic change,” she said.

The Trump administration also is expected to trim regulations in the financial sector, which could reduce compliance costs for corporations and boost their stock prices, Hudson said. But he and

Enron was a large, Texas-based energy company that collapsed under the weight of a massive accounting fraud in 2001 and filed what was then the largest bankruptcy in U.S. history.

In what is likely to be a chaotic year politically filled with economic uncertainty, financial advisors say it’s important for investors to do one thing: Stick with the plan.

“We test for a (market) correction to make sure our clients are in good shape. But the financial plan is the bible we stick with,” Gallagher said.

Making short-term decisions and trying to time the market usually are bad ideas in building longterm wealth, advisors say. But it is important to periodically “rebalance” portfolios to adjust asset mixes as life circumstances and investment goals change, they say.

“Ultimately, we are seeking a portfolio that fits like Cinderella’s glass slipper,” Gillow said.

and Downs?: Volatility and chaos could rule this year

• The S&P 500 index returned back-to-back gains of at least 20% in 2023 and 2024 for the first time since 1997 and 1998.

• A survey of analysts’ forecasts predict the index will rise 14.8% this year.

• Uncertainty over inflation, interest rates and economic policies in a new administration have clouded local financial advisors’ crystal balls.

• Wealth managers say it will be critical this year to stick to basic financial plans but rebalance asset classes in portfolios when needed.

By Des Worthington, columnist

As a person who has worked for the nonprofit industry in northern Michigan for the last 25 years, I’ve been in a unique position to get to know some wonderfully generous people and some great nonprofit leaders. This experience has informed my perspective. I’ve come to believe that in northern Michigan, people enjoy a high quality of life, mainly due to local nonprofit organizations’ strength and ability to carry out vital work. I’ve overstated it, but let me provide some key pieces of information.

Private nonprofit organizations make up close to 15% of all jobs within the five-county region, significantly higher than in other parts of the state. Munson Medical Center and Interlochen make the top 10 largest employers list. The governmental sector makes up five out of 10, leaving only three for-profit corporations in the top 10. In addition, organizations like 20Fathoms and the Discovery Center work to support innovation through entrepreneurialism.

Munson Medical Center is the flagship nonprofit hospital for Munson Healthcare, which means that top-notch heart, stroke and cancer care is nearby. Retirees often say that having Munson so close is one of the reasons they chose to make northern Michigan their home after retirement.

We are fortunate to live in an area where we can immerse ourselves in natural beauty. We can bike, hike, get out on the water, or gaze at the beauty while driving to work. Our landscapes remain rural and beautiful in part due to the hard work of local land conservancies, TART trails and many other conservation organizations.

It is unusual in a small community to have so many opportunities to enjoy

highly talented musicians and theater. Interlochen Center for the Arts attracts top talent. Our region is scattered with several arts organizations and venues, which are only possible through the dedication of volunteers and donors.

As we understand how our quality of life depends on the strength of the nonprofit community, it becomes abundantly clear that it is important to keep these organizations vibrant. And that is where charitable giving comes into play.

I’m often asked, “Can we sustain the important work of all these local organizations? There is only so much funding to go around.” According to a 2021 Lily Family School of Philanthropy study, about 50% of American households give to charity (and most households give to more than one charity each year). Consider the populations of the five-county region and do the math: about 90,000 people make charitable gifts each year. Meanwhile, many local nonprofits have an average of 250 donors. The largest organization I worked for had about 6,800 donors each year. It seems the pie is much bigger than people perceive, so what’s the disconnect?

My friend Rebecca Teahen has excellent professional knowledge and experience as a local fundraising executive and now works as a financial advisor. I asked

her thoughts about this perception of scarcity of donations. Rebecca just laughed.

“I’ve never considered fundraising as a competitive pursuit. All the donors I approached while working at NMC were also giving to other nonprofit organizations. Generous people choose to make gifts as a way of helping to keep the community they love strong. In my experience, nonprofit organizations that can demonstrate how their work improves the community and reach out to donors in meaningful ways will be successful,” she said.

Some charities indeed struggle to get by. But there are plenty of organizations enjoying success. I spoke with Wendy Irvin, CEO of Habitat for Humanity Grand Traverse Region. They just completed one of their most successful years on record. They had more people supporting their work and almost doubled the dollars raised in a single year. One big reason for their success is that they changed their approach. I asked Wendy about her results and learnings.

“We have spent the last year getting to know our donors and learning more about what they care about. It is important to them when we succeed in our mission. I also learn about other causes they support, and I feel grateful that they support things that help make northern Michigan a great place to live,” she said.

That was my experience as well. While

working for the Grand Traverse Regional Land Conservancy and then as the president of Munson Healthcare Foundations, I was part of raising more than $100 million for local causes. I spent the better part of 20 years listening to generous donors talk about their giving experiences. It was very enlightening. They were loyal donors to organizations that showed through their actions that they cared about the opinions and thoughts of the donors, not just their checks. I felt honored that my organization was one of their giving priorities.

So, what are the takeaways?

Nonprofit organizations are essential to the quality of life in northern Michigan and must be supported by the community. If you give to charitable causes, please include at least two local causes.

There is plenty of potential. It’s time for nonprofit organizations to seize the day! Board members and nonprofit leaders take stock of how you appreciate and honor those who support your cause. Can you do better?

Des Worthington, CFRE, has spent 30 years working with charitably minded families and organizations to achieve great things. She has led several campaigns for both start-up and large charities, resulting in preserving land for future generations, building medical facilities and sustaining essential community programs.

By Kierstin Gunsberg

Diversifying investments for steady passive income, recognizing great (and not-so-great) business opportunities, and going through spending with a finetoothed comb are all habits of financially successful families.

Another is establishing family foundations, which are gaining ground as more families utilize them to minimize their tax burdens and grow their wealth. And, say the latest reports from the National Center for Family Philanthropy, foundations are giving above and beyond their obliged minimum dollar amounts.

It’s good news for nonprofits like northern Michigan’s Groundwork Center for Resilient Communities, which secured a $100,000 grant from Battle Creek’s W.K. Kellogg Foundation late last year to tackle food insecurity statewide.

With family foundations growing, so is the demand for advisors to help them navigate the ins and outs of giving.

Renee Sovis, vice president of Traverse City-based Neithercut Philanthropy Advi-

sors, is one of them.

“We do everything from establishing the foundation’s mission and values to the whole back office for them,” she said. “We do all of the grant-making, the administrative work and run board meetings.”

Founded by Mark Neithercut in 2005, Neithercut Philanthropy Advisors works with some of Michigan’s most successful families to guide them in giving that goes

So why are families paying advisors and choosing to lead foundations instead of donating directly to causes? As Sovis puts it, like anything involving money, philanthropy isn’t always so simple, and it carries some risk.

“There’s a lot more to consider than you might think,” she said, like complying

“There’s a strong push to give while living, to address today’s challenges now.”

Renee Sovis, Vice President, Traverse City-based Neithercut Philanthropy Advisors

beyond just writing checks. The Kresge Foundation, one of their clients, awarded more than $5 million in grants to downstate social and educational organizations last year.

with anti-terrorism financing guidelines and making sure that grant money is going to a legitimate organization versus charity scams, which tend to pop up following major disasters.

Besides balancing legalities, the work of wading through causes and pinpointing where funds are most needed can feel a lot like throwing a dart blindfolded. The target’s there, but family foundations steady the aim by offering a game plan, starting with defining a giving strategy.

“Often when a family establishes a foundation, they’re taking that step to say, ‘We have the ability to do more with our success,’” she said. “So, how can we make a big difference in the world?”

To answer that question, advisors dig in to help families understand where their money can make the most impact, whether that’s contributing to global cancer research or funding local education efforts, plus the experiences that inspire them to give in the first place.

Sovis says those experiences often stem from a health or economic struggle the family overcame or a desire to give back to the communities they called home while building their wealth.

Initiatives at NMC, Munson, Norte and the Grand Traverse Civic Center have all received financial support from fami-

ly-run foundations in northern Michigan, including the Art and Mary Schmuckal Family Foundation and The Oleson Foundation, which awarded over $1.5 million last year.

“There’s nothing wrong with writing a check supporting organizations that you know and love, but our clients have us around to zoom out a little bit and to help with defining their values, mission statement, and vision,” said Sovis.

Saving through giving

Giving back is the cherry on top for family foundations, which offer tax advantages that make them an integral part of a smart long term wealth strategy. That’s why names like Rockefeller and Bloomberg are synonymous with both vast wealth and lasting philanthropy.

One of the biggest benefits of a foundation is using it in lieu of a traditional inheritance, which can be taxed up to 40%. Meanwhile, cash, real estate, stocks and other assets placed into a family foundation are safe from hefty estate taxes, making them easier to preserve for future generations.

Donor-advised funds are another draw. They allow families to make charitable contributions that reduce taxable income while maintaining control over how and when funds are distributed to causes.

And although family foundations can’t directly distribute money to family members, they can provide financial support for initiatives led by relatives. That means that in some cases, funding for things like a niece’s education, a cousin’s startup or a grandson’s work in the nonprofit sector can be pulled from the foundation, as long as those efforts fit within the foundation’s larger mission.

“Folks want to be good stewards of either family funds or just newfound wealth,” noted Sovis, who attributed part of the boom in family foundations to the rapid rise in wealth across the country since the turn of the millennium.

Numbers from the Congressional Budget Office show that total family wealth in the United States nearly quadrupled between 1989 and 2022, rising from $52 trillion to $199 trillion. The majority of that growth has been concentrated among the top 10% of families. It’s a stat that points to the importance of these families, particularly those benefiting from foundation tax breaks, taking responsibility to reinvest in the populations impacted by wealth disparities.

Habits of highly successful family foundations

Then again, a foundation and its benefits are only as impactful as it is successful.

And if money is complicated, families are even more so. Sovis points to a few fundamental habits that make for successful family foundations.

First and foremost: communication. Whether building wealth or managing a foundation, strong communication, collaboration and a willingness to listen are vital.

“Not only when they’re sitting around the table with each other, but also in their communities. These families are deeply rooted in doing the work from a place of servant leadership,” Sovis said.

Where foundations used to hold a lot of say over where and how funds would be spent – even after they were granted – the new approach is to trust nonprofits and their leaders to make their own decisions about how grant money should be spent.

Successful families also master delegation, focusing on the areas they each shine in and trusting others to handle tasks that require a different expertise. In philanthropy, that means taking a handsoff approach and allowing space for the nonprofits they fund to lead the charge.

After all, no one knows these causes better than the ones doing the day-to-day work for them, Sovis says.

“Successful family foundations are staying open to what the community needs and how they can help,” she said. “We have clients who are out there responding

to needs in their local community and we have others who are working with endangered species and broader funding initiatives around the environment. So, the strategies and focus can be very different from one client to the next, but the kinds of values and attitudes that are pervasive are of feeling called to help others.”

With more than 75% of foundations established in perpetuity, callings can evolve as new generations take over, something that requires families to stay adaptable both in their wealth management and the philanthropy that’s connected to it.

“Maybe a founder establishes a foundation, sets the mission, and then as time goes on their family takes over and are less interested in that mission. When that happens, we have to go back to the table and reevaluate those values,” said Sovis, adding that looking forward there’s a growing trend toward limited-lifespan foundations to not only mitigate the chance of a foundation’s mission getting sidelined, but to address the most pressing health, social and environmental issues.

Rather than focusing decades down the line, families are recognizing that their wealth might just have the greatest impact in the present.

“There’s a strong push to give while living,” Sovis said. “To address today’s challenges now.”

By Rebecca Teahen, columnist

Sit down at the table. Don’t rock the chair back. Use a fork. Don’t leave the table until everyone else is finished. (Yes, I sound like my mom. I’ve accepted it.)

I love good food – and while my kids clearly haven’t caught on yet – I’ve come to understand the importance of gathering around the family table for regular meals.

No one I’ve known has understood the power of the kitchen table like the late Sen. George McManus, Jr. did. In fact, I was recently reminded that he was born on the kitchen table on a farm on Old Mission in 1930! Given that entrance, perhaps it’s fitting that the kitchen table maintained such a prominent position in his life.

I invite those of you who have also spent time around George and his wife Clara’s kitchen table to remember those moments and the stories they shared. For those who didn’t have the pleasure, think of an idyllic farmhouse, kind grandparents and conversations of how you can work together to solve problems and do the most good.

George would talk about leaders from “across the aisle” finding common ground over a meal. He undoubtedly accomplished at least as much sitting at the kitchen table as in any formal meeting room. George and Clara created a tremendous legacy through their agricultural operations, community service and

leadership, hard-working family, charitable giving, and more.

What if your legacy plans could unfold as beautifully as you imagine just by talking with your family over a warm meal at your own kitchen table? Could it really be that simple?

Think about it. When our kids share their challenges at school over the dinner table, our natural inclination is to guide their responses through the lens of our values.

When we hear news of tragedy near and far, we might discuss as a family ways we can help. This begins to teach our children the power of philanthropy and how our family chooses to give.

As the school year ends, the older kids start thinking about summer jobs and saving up toward their own goals. This puts their future into perspective.

As we raise our kids, we are preparing them to face obstacles on their own. And in turn, we’re preparing them to face life’s challenges without us being there to guide them. So, trust me. Your kids are ready to talk about your legacy plans. This begs the question ... are you ready?

If you’re not, then make the time to gather your thoughts and prepare. Find a quiet moment at the table with your notepad and pencil and make some notes to guide your planning conversations.

These thought-starters will be well-informed by all the earlier family meetings you’ve had over mealtimes past:

• Your values and hopes for your family’s future.

• Your charitable priorities.

• Wishes for family property (real estate and other keepsakes).

• And if you don’t already have it done, ask other family members to help compile family history.

Once you’ve gathered your thoughts, call an all-family meeting and invite other members to contribute as well.

When it’s finally time to put these plans into action, make sure to bring in experts to the planning table. Reach out to your financial advisor, estate attorney, CPA and others to ensure that you’re not overlooking anything.

Questions to consider:

• Are your basic estate plans up to date and properly structured to achieve your goals?

• Is there a need for a charitable trust or a special needs trust to care for a loved one? Is your family considering a charitable foundation or donor-advised fund?

• Are there plans for one or more children to inherit real estate? If so, have other assets been allocated equitably or as desired?

• If the plan is to sell real estate, does your family have a relationship with a trusted wealth manager to manage the proceeds from that sale wisely?

You’ll be working with your professional advisors to put these plans in place, but don’t forget to bring these elements back to the kitchen table to share with your family. Together, you’ll craft a stronger plan, and the next generation will be invested in the success of this process.

If you’re struggling to navigate this type of in-depth family meeting, reach out to your wealth planning team. Professional advisors are happy to help facilitate these conversations. As difficult as they can be now, it only gets harder as time passes, and sadly, you may miss your opportunity all together.

With a better understanding of your goals, your family and advisors will be well prepared to help implement the plans when the time comes.

So, what are you waiting for? Pull up a chair, pour a cup of coffee, and start the conversation. Your family’s legacy begins at the kitchen table.

Rebecca Teahen, CIMA® is a financial advisor with Baird Inc. in Traverse City and serving clients nationwide. Send a note to rteahen@rwbaird.com to join her email list. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action.

By Eric Braund, columnist

Retiring successfully means more than just stepping away from work – it’s about creating the lifestyle and legacy you envision for the next chapter of your life. For affluent families and high-net-worth individuals, retirement planning requires an extra step of careful strategy, tax-conscious moves and thoughtful financial stewardship. Here’s your comprehensive checklist to help set your retirement up for success.

Retirement isn’t just about the numbers; it’s about clarifying and mapping out how you want to spend your time. As someone with significant assets, your financial means often allow the pursuit of passions, extensive travel and engaging in philanthropy, but it’s essential to be intentional about your lifestyle goals. Start by setting personal goals: What do you want your retirement to look like? Consider your desires around travel, hobbies, volunteer work and time spent with family. Also, plan for the transition itself, as many individuals struggle with the identity shift that comes when stepping away from a career. Working with a coach or mentor can be helpful in navigating this change. Staying engaged is equally important — maintaining social connections and having a sense of purpose can significantly enhance your overall satisfaction in retirement.

As you craft your retirement plan, managing taxes is just as important as managing investments. Tax efficiency is even more vital in retirement, as the way and timing of your withdrawals can leave a big impact on your tax bill.

It’s important to review your retirement accounts and understand the tax implications of withdrawing from various sources, such as IRAs, 401(k)s and taxable brokerage accounts. In retirement, drawing from these accounts strategically can help reduce taxes. Consider Roth conversions as well: Converting

traditional IRAs to Roth IRAs before or early in retirement can reduce taxes on required minimum distributions later on.

Data confirms that high-net-worth individuals often enjoy longer lifespans, which also means more years of potential healthcare expenses. One option to consider is long-term care insurance. Even if you are self-insured and have enough personal savings and investments to cover potential medical costs, long-term care coverage can shield your assets while offering comfort knowing you will be cared for in your later years.

It’s also important to review Medicare options, as Medicare doesn’t cover all healthcare needs. Supplemental plans can help fill in the gaps. If you prefer premium care, you should factor in the costs of concierge medical services or high-quality long-term care facilities. To confirm you have the right coverage, discuss healthcare and longterm care options with your advisor, who can help tailor a plan that meets your specific needs.

Estate planning is a critical component of any retirement plan to distribute your wealth according to your wishes, and for affluent individuals, it goes beyond just having a will. A comprehensive estate plan includes trusts, gifting strategies and a tax-conscious legacy plan.

It’s wise to regularly update your beneficiaries and estate documents to reflect any life changes and current wishes. Trusts can be particularly useful for managing assets, reducing estate taxes and aligning your wealth with your intentions.

If charitable giving is part of your retirement vision, now is an ideal time to plan for it in a way that’s both meaningful and tax-efficient. Donor-advised funds, charitable remainder trusts and outright gifts are all strategies that can help increase your impact.

Donor-advised funds allow you to make a charitable contribution, receive an immediate tax deduction and distribute funds to charities over time. Charitable remainder trusts can provide income for you or your beneficiaries, with the

remainder going to charity after a set period. Additionally, annual gifting to family or charities can be a valuable part of your financial plan and estate strategy.

Partnering with experienced advisors before and during retirement allows you to make well-informed decisions that can greatly influence your financial well-being. Begin by consulting a fee-only Certified Financial Planner® professional, an advisor who is held to a fiduciary standard. A reliable professional focused on your best interests can help prepare your family for the many rewarding experiences that come with retirement.

Eric Braund, CFP®, CRPC® is the founder and CFO at Black Walnut Wealth Management, a financial advisory firm providing counsel and fiduciary financial services to individuals, families, and private foundations throughout the Traverse City and northern Michigan region. Contact him at (231)421-7711 or visit BlackWalnutWM.com. Braund is an Investment Advisor Representative with Dynamic Wealth Advisors, dba Black Walnut Wealth Management. All investment advisory services are offered through Dynamic Wealth Advisors.

A seasoned flooring professional with over three decades of experience in Traverse City's design industry, Jason Harris is a dedicated sales consultant at Bay View Flooring & Design Center. He specializes in helping homeowners transform their spaces through expert flooring solutions, whether for new construction or remodeling projects. We sat down with Jason to get his insights on life at Bay View:

“My favorite aspect of the job is helping clients bring their ideas to fruition. I enjoy ensuring that everything works together—style, color, design, etc.— and is properly installed for the intended application. Sometimes, the smallest details are the most important. It's also very interesting to meet people from all walks of life and get to know them personally while assisting them with their projects.”

TOP RECOMMENDATION “I believe one of the most undersold products we have is the new laminate flooring. It is the most scratch-resistant and won't fade or stain. In addition, many of these floors now have moistureresistant properties, allowing them to be used in most areas of the home.”

“My most memorable project in the last year was helping a local couple facing daunting medical issues complete their project within a short timeframe. It allowed me to assist them so that he could rest assured knowing his loved one did not have any unfinished home projects.”

NEW + NOTEWORTHY

“International Flooring Co. is the company and Canopy is the brand discerning homeowners are going to want to keep on their radar It's quieter, features new visuals, and offers competitive pricing within its category. With exclusive rights, Bay View Flooring is the only retailer in Northern Michigan that showcases and sells this premium line.”

“I am excited to share the newest colors and styles that manufacturers are introducing in the luxury vinyl plank category. Each year, these products improve in durability and appearance due to advancements in the manufacturing process.”

“First impressions are generally best; they will be products that you'll enjoy for years to come. If you don't initially like something, it's unlikely that you will enjoy it in the future.”

jason@bayviewflooring.com

Building in beautiful Grand Traverse County means stunning natural scenery, a thriving community and the perfect balance of outdoor adventure and modern convenience—making it an incredible place to call home!

And with our newly improved EPIC-GT self service portal, we’re streamlining communications for users, making applying for permits and inspections easy and helping to speed up the approvals process. Our goal is to give our community a painless experience with permitting with better communication than before.

VISIT US AT WWW.GTCOUNTYMI.GOV/2616 TO LEARN MORE ABOUT BUILDING & PERMITS IN GRAND TRAVERSE COUNTY.

By Craig Manning

It’s based in Michigan, has more than 11 million customers, and ranks among the top 25 American banks in terms of total assets. In fact, the bank in question, Ally Financial, is the one and only Michigan-based bank to rank among the top 100 banks in the United States.

While Ally has become a legitimate player in the financial world since it launched in 2009, you won’t see its logo on a single building in the Traverse City area, unlike similarly ranked Midwest-based banks like Fifth Third and Huntington.

How come Michigan’s biggest bank doesn’t have an on-the-ground presence in one of Michigan’s key markets? It’s not that Ally’s leaders have anything against Traverse City. Rather, it’s that Ally doesn’t have a single brick-and-mortar banking branch anywhere.

Instead, Ally is an all-online bank, part of a growing class of digital-only institutions that offer most of the key services of a traditional bank – deposit accounts, debit and credit cards, ATM withdrawals,

and loans, to name a few – without the brick-and-mortar touch points. While digital-only banks still don’t have the power or user base of long-running traditional banking institutions, some 10% of Ameri-

Not so long ago, the prospect of a bank with zero physical branches would have been unthinkable. Mobile check deposits

Despite the rise of digital banking and the potential savings advantages of online-only banks, the majority of Americans still do their banking with institutions that have brick-and-mortar branch locations – at least for now.

cans have now made the switch. Beyond Ally, the online-only banking space has a long and growing list of players, including Chime, SoFi, Quontic, Bank5 Connect, NBKC, and First Internet Bank. Are these banks legitimate players in the industry, or are online banks a niche offering, or maybe even a fad? This month, the TCBN takes a closer look at this growing trend, and at what you need to know about digital-only banking.

didn’t even become legal in the U.S. until 2004, courtesy of the Check Clearing for the 21st Century Act. Two decades later, digital banking practices have skyrocketed, and in-person bank visits have dramatically declined.

According to a survey on digital financial literacy conducted last year by Capital One, at least seven out of 10 American households are enrolled in some form of digital banking. Ninety-five percent of those consumers bank online often or

occasionally, 86% use it to check balances and transactions, 77% use it to pay their bills, and 60% use it to transfer money between accounts.

Comparatively, another study last year by Self Financial found that fewer than 40% of Americans still pay monthly visits to their banking branch, let alone weekly visits (11.3%) or daily visits (7.3%). The same study reported that the number of bank branches in the U.S. was still on the rise until 2012, when it peaked at 82,461. That number has been in constant decline ever since, and dipped to less than 70,000 in 2022 for the first time since 2004. Based on current trends, Self Financial predicts that physical banking branches could be extinct in the U.S. by 2041.

The pros and cons

Online-only banks have leveraged these evolving consumer trends into a business opportunity. Because digital banking has become so commonplace, online-only banks are able to serve their customers in many of the same ways that traditional banks do – which is to say, via websites,

online portals, and mobile apps. Most online banks also have 24/7 customer support, nationwide networks of ATMs, and a variety of different account options to choose from, including checking, savings, money market accounts, and certificates of deposit.

The difference – and the benefit most proponents of online-only banks tout – is that fully digital banks have significantly lower overhead expenses than traditional banks. That’s due largely to the lack of real estate holdings. Owning or leasing branch locations amount to a costly section of the ledger for a typical banking enterprise, and digital banks – even if they have a few office locations or one-off branches here or there – are largely not carrying any of those expenses.

All-online banks can pass those savings on to their customers, usually in the form of lower fees or higher account yields. For example, according to the Ally Financial website, the bank’s savings account earns a 3.8% annual percentage rate (APY) on all balance tiers. Comparatively, the Huntington Bank website shows a maximum 3.55% APY across its highest-yielding savings accounts, for balances between $5,000 and $2 million.

There are widely cited cons around digital-only banks, too. The lack of physical location means in-person, face-to-face conversations with banking represen-

tatives are not an option. It also means that certain common bank services –including safety deposit boxes, notary services, cashier’s checks or money orders, currency exchanges, and even cash deposits – are either not possible or are more difficult to access.

The local perspective

With more customers eyeing the potential benefits of online-only banks, we wondered: What do local financial experts think of the trend? We checked in with Dawn Hemming, a long-time financial advisor and the president of Traverse City’s hemming& Wealth Management, to get her view on the matter.

While Hemming says digital-only banking is largely “out of the wheelhouse” for hemming&, she did have a few thoughts, both about the draws of online banks and the potential pitfalls.

“Digital banks tend to have better technology options and higher-yielding savings accounts,” Hemming said. She also notes that, since many customers – especially younger ones – are already accustomed to digital transactions, there’s not a big learning curve to navigate.

“We’ve seen Gen X and millennials with a comfort opening these accounts – although, anecdotally, they seemed to be more popular when interest rates were harder to find on savings accounts,” Hem-

ming added. “Ally is a popular one based in Michigan; it’s the old General Motors auto financing bank that rebranded after the financial crisis of 2008.”

Still, Hemming says she always encourages her clients to tread carefully when deciding to keep their money with a digital bank.

“It’s difficult to sort out the legitimate offerings with FDIC-insured banks,” Hemming concluded. “When looking for a digital-only bank, make sure to verify FDIC insurance. You can confirm FDIC insurance by using the FDIC’s online BankFind tool.”

Despite the rise of digital banking and the potential savings advantages of online-only banks, the majority of Americans still do their banking with institutions that have brick-and-mortar branch locations – at least for now. According to a 2022 Finder survey, just 8% of American adults had online-only bank accounts at the time – though, another 4% say they plan to open one in the near future. Finder projected that 15% of Americans would be doing their banking with digital-only banks by 2027.

We are now offering injections to treat the appearance of dynamic wrinkles that appear when you make facial expressions. The product we are offering is called Xeomin, which is preservative free, but offers the same active ingredient as Botox. Treatments are done right at our office which provides convenience, privacy, easy-access and continuity of care for your peace of mind!

By Rick Garner, columnist

In retirement, your income will come from various accounts and investment vehicles. Some common income sources include required withdrawals from 401(k)s and IRAs, automatic income from Social Security and pensions and optional income from Roth IRAs and taxable investment accounts. By implementing effective tax strategies, you can potentially reduce your tax burden and make your hard-earned savings last longer.

Creating tax diversification and maximizing your retirement income requires more than having and withdrawing funds from various account types – it’s about timing and strategy. Optimal retirement tax strategies may change from year to year based on tax laws, your income needs and your tax situation.

Here are a few common diversification strategies to consider:

Making strategic withdrawals involves mixing and matching withdrawals from different account types. By carefully sequencing your withdrawals from Roth, traditional and taxable accounts, you can potentially reduce your overall tax burden.

Income smoothing involves balancing your income across years. This retirement withdrawal strategy aims to avoid spikes in tax brackets that might lead to increased Medicare premiums or higher taxes on fixed income. This approach might involve spreading out taxable distributions to mitigate required minimum distribution (RMD)-driven tax effects in later years.

Understanding marginal tax rates is crucial to avoid unintended tax consequences. Large RMDs or other substantial withdrawals can push you into higher tax brackets. Effective, tax-efficient retirement withdrawal strategies take these factors into account in order to optimize your longterm financial picture.

Unlike traditional IRAs, owners of Roth IRAs do not have to take required RMDs, which can afford greater control of your taxable income during retirement. There are income restrictions on who can contribute to a Roth IRA. However, converting traditional IRA funds to a Roth IRA allows you to take advantage of a Roth’s potential benefits regardless of income level. It is also possible to convert pre-tax funds in a 401(k) plan to a Roth IRA.

Converting to a Roth IRA will require that you pay income tax on the amount converted in the year of the conversion, but that could be the most tax-intelligent approach for the following reasons:

• Your tax bracket could be lower today than it will be in retirement.

• Lower income in a tax year may allow you to convert funds to a Roth IRA with less tax impact.

• Roth IRA funds can continue to grow without being diminished by RMDs.

• Qualified distributions from a Roth IRA – by you or your heirs – will be income tax-free.

• A Roth IRA could lower your income tax bracket in the future because funds were taxed upon contribution rather than on withdrawal.

• Roth IRA conversions are not subject

By carefully sequencing your withdrawals from Roth, traditional and taxable accounts, you can potentially reduce your overall tax burden.

to a 10% federal additional tax.

• A Roth IRA conversion is not the right solution for everyone. Rules and restrictions apply, so the decision requires careful consideration. Working with a Certified Financial Professional™ can help you maximize your retirement savings, stay informed about changing tax laws, and

adjust your strategy as needed to meet your personal financial goals.

Rick Garner, CFP® is the director of wealth management and a CERTIFIED FINANCIAL PROFESSIONAL™ at DGN Wealth- care, LLC. Contact him at RGarner@DGNCPA.com. The views and opinions presented in this article are those of Rick Garner and not of Avantax Wealth Management® or its subsidiaries. Securities offered through Avantax Investment ServicesSM, Member FINRA, SIPC. Investment advisory services offered through Avantax Advisory ServicesSM. Avantax affiliated financial professionals may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

By Craig Manning

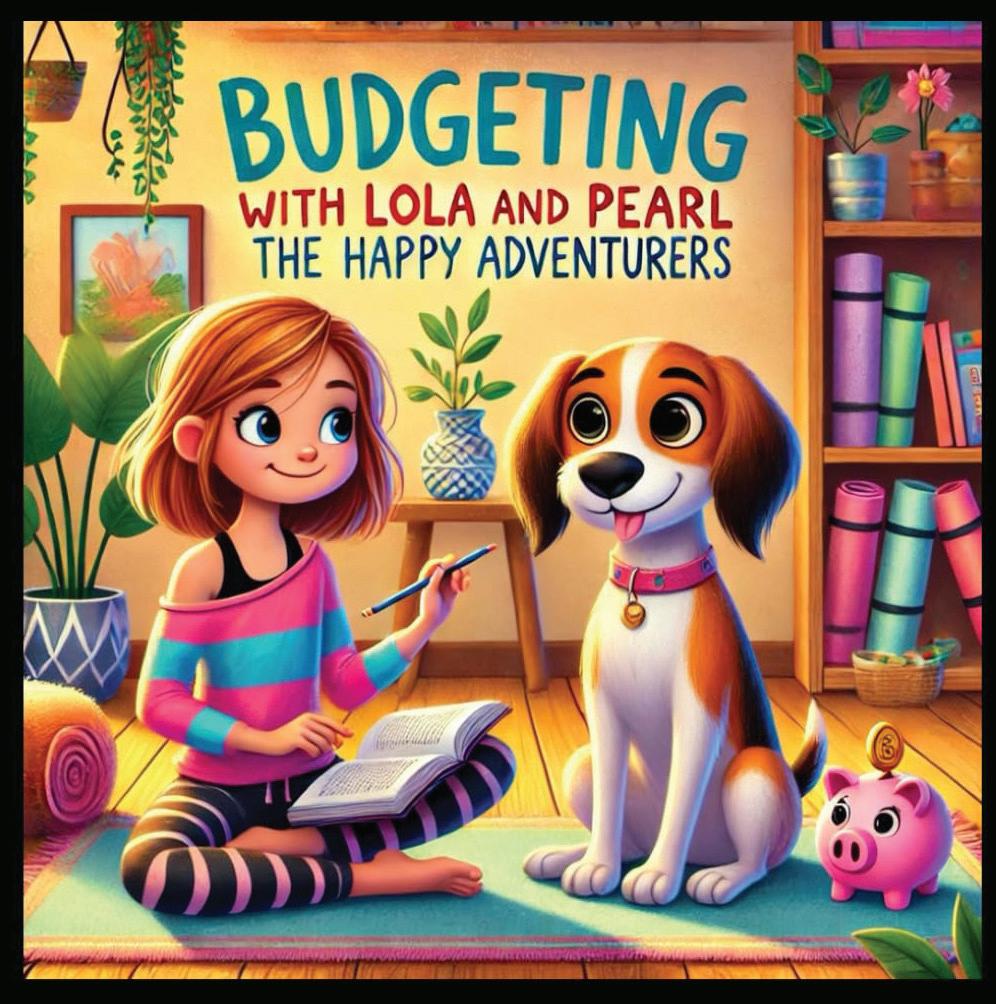

When six weeks’ worth of surgery recovery gave her a whole lot of time on the couch, Traverse City’s Lisa McKolay decided to make the time count. The result? A series of six self-published books about financial literacy, all geared toward kids and teens.

While her bachelor’s and master’s degrees are in psychology, McKolay learned the world of finance working for her mom, local investment advisor Dawn Hemming, at hemming& Wealth Management. Last January, she launched her own firm, called McK Financial Transitions Specialists, which combines her finance and psychology backgrounds into a business that seeks to “guide individuals and families through life’s pivotal financial transitions with clarity and confidence.” Such transitions may include divorces, retirements, and career changes.

Despite that career history, McKolay insists she never intended to make either finance or psychology part of her first foray into children’s fiction.

“I just love writing, and I was going to write a kid’s book about my dog, Lola, because she’s getting old and I wanted to honor her in that way,” she said. “But I guess my work just clicked in, and they ended up being financial literacy books.”

During her period of post-surgery bed rest, McKolay wrote six different books in a series she’s dubbed “Lola and Pearl: The Happy Adventurers.” The books follow the tales of a girl named Pearl and her playful beagle Lola, as they learn about budgeting and smart financial decision-making. Specifically, McKolay delves into the 75/15/10 rule, which encourages budgeting 75% for needs, 15% for wants, and 10% for long-term savings.

Recent years have seen a mounting call for budgeting best practices to be taught in American schools. Each year, the Center for Financial Literacy at Champlain College in Vermont compiles a nationwide report card, grading states on how many curricular requirements they have for personal finance education at the high school level.

In 2023, five states – including California, Massachusetts, and Washington, D.C. – received failing grades, meaning that those states had no existing financial literacy demands for high school students and no pending legislation to implement such requirements. Just seven states –Alabama, Iowa, Mississippi, Missouri, Tennessee, Utah and Virginia – received “A” grades, indicating at least one full semester of personal finance curriculum for all students.

Michigan got a B, with Champlain College noting that the state already had an economics requirement and would soon be adding a personal finance element to diploma requirements.

McKolay, who grew up and went to

school in the Traverse City area, says she wrote her books in part because she couldn’t remember the topic of personal finance ever coming up in a classroom when she was young. While she thinks any past generation could have used more of a financial literacy primer, though, McKolay thinks the need is much more pronounced for today’s youth.

“The economy is always changing: sometimes, it’s really easy to navigate a financial life; sometimes, it feels impossible,” McKolay said. “Right now, we’re in the latter situation. Things are just really expensive right now now, and we need a way to communicate how to navigate that world. The way that things are now – the way things cost – we didn’t used to have to think about it quite so hard. Now, you have to pay a lot more attention to detail, and I think kids and teens need to be ready for that.”

Historically, one of the challenges of imparting advice about financial literacy to kids has been finding ways to make the topic relevant and engaging. The question has always been: How do you get young

people to care about budgeting when, in most cases, they haven’t had to worry about that kind of thing yet?

While McKolay is hoping that framing everything around the stories of a girl and her dog will make the financial lessons of her books more accessible and relatable to kids, she thinks the key to teaching financial literacy at a young age lies in really hammering home the benefits.

“I think for everybody, but especially kids, successfully teaching financial literacy is not about setting strict rules,” McKolay explained. “It’s not about saying, ‘You have to stop yourself from buying these things; you have to have restraint.’ The message of these books is more like: ‘Hey, if you use these concepts, you’re going to have a ton of freedom to live whatever life you want, both now and in the future.’ It’s not about limiting yourself; it’s about giving yourself options.”

Despite her confidence in the message, McKolay says she initially “didn’t think these books would go anywhere besides my own bookshelf.” In the weeks since the series’ January 7 publication, though, she’s started getting interest for her books from multiple local entities.

“I just had a meeting with the librarian at Old Mission Peninsula School, and I’m going to do an after-school program there for fourth and fifth-graders, teaching basic concepts of financial literacy,” McKolay said. “I’ll also be doing a similar thing at Traverse Area District Library, except that one will be geared more toward teens. And then, in my work as a financial transition specialist, I work with a lot of attorneys and therapists, and a lot of them have asked for copies of my book to put in their offices. So, the feedback has been really positive so far.”

At Michigan State University, we applaud Teresa Woodruff, who was bestowed the National Medal of Science by President Biden. A leader in reproductive science and a dedicated mentor, Woodruff’s innovative research has resulted in breakthroughs and independent discoveries that have made an immeasurable impact on the lives of thousands of patients and their families around the world. MSU congratulates this exceptional Spartan and president emerita on her second presidential honor, recognizing her groundbreaking work and humanitarian academic leadership.

MSU Research Foundation Professor College of Human Medicine College of Engineering

By Art Bukowski

Boating has long been a favorite pastime – and major economic driver – throughout Michigan. This is especially true in northwest Michigan, where the centerpiece Grand Traverse Bay and many high-profile inland lakes are tied to countless hours of fun and millions of dollars in spending.

After the COVID pandemic, in which dealers could barely keep boats in stock, sales have come back to earth amid inflation, higher costs, economic uncertainty and a return to normal enthusiasm levels. Meanwhile, those looking to lock down a slip in Grand Traverse Bay are waiting many years for an opportunity.

The TCBN connected with several people in the boating word to see what’s trending on the water and the sales floor.

Sales trends: ‘A return to normal’

COVID was a very hard time for many businesses and individuals, but it was as hot as can be for boat sales. Boating was one of the few activities people could do together with limited restrictions, and with pretty much everything else shut down, a lot of people went out and bought a boat.

“Everything that dealers could get in stock during COVID and probably almost two years after, they couldn’t keep,” said Amanda Wendecker, a spokeswoman for the Michigan Boating Industries Association (MBIA). “Stuff was coming in without cushions and they would still sell

it immediately – it was crazy.”

But in the years since, the industry has slowed considerably, insiders say. Manufacturers firing on all cylinders finally got inventory back up right as the COVID-driven boost began to wane. Add climbing interest rates, higher prices, political uncertainty and other factors, and you’ve got all the ingredients for a hangover.

Wendecker points out, however, that Michigan had consistent year-over-year sales growth from 2009 until the streak broke in 2023 (2024 numbers aren’t yet available). It was never going to last.

“That was sort of hard to sustain,” she said. “What we’re seeing here is a correction.”

But things are looking up. Local dealers contacted for this story are all feeling bullish about the coming year, with early first quarter indicators already outpacing last year’s numbers.

“I feel like we were still coming down from that COVID surge in 2024, but we found what I believe was the bottom of the trough last year and we should be on a nice path going forward,” said Kyle Oleson, general manager of Walstrom Marine in Traverse City. “Interest rates have stabilized, boat prices have stabilized, the election is behind us and…consumer confidence is better than it was a year ago.”

Over at Irish Boat Shop in Traverse City, General Manager Colin Texter thinks fondly about the “great, great times” of COVID boat sales, but said he’s still expecting a strong year.

“We’re just seeing a return to normal,” he said. “Manufacturers are still trying to build as much as they can, but now it’s becoming more about managing your inventory and making sure you’re not overstocking.”

Like everyone else trying to sell expensive items, boat dealers have their fingers crossed for the economic and political stability needed to put customers in a buying mood and manufacturers operating at a good clip.

“If there’s going to be a trade war, that would be a concern as it would probably affect us on the supply side,” Texter said. “Almost all the boats we sell are made in the U.S., which is great, but a lot of the components that go into those boats are not. You could end up with a situation like we had in COVID where the supply

chain is broken.”

Wendecker says a return to a pre-COVID state of affairs brings plenty of positives.

“Inventory is available, and the deals and incentives and rebates that we haven’t really seen since before COVID are back,” she said. “I’m hopeful that dealers will start moving some of the inventory that they do have.”

Local dealers will continue to put a very heavy emphasis on their service departments. Walstrom has more than 50 technicians on staff ready to tend to problems, a robust support team that forms a big part of the company’s sales pitch.

“When you’re spending half a million bucks on a boat, your expectation is that the dealer can service the boat in a timely fash-

ion, especially knowing how short our season is, how valuable every single nice day is and how much is on the line,” Oleson said. “Boating is a very social activity, and people have their entire summers mapped out.”

Unfortunately, the staffing issues that continue to plague industries of all kinds are starting to be particularly apparent in boat dealer service departments. It’s something the MBIA is on top of.

“We have an aging demographic with our current industry professionals, especially marine techs. We need them now, and we’re going to need them in the future,” she said. “We’re working hard to bring awareness to the industry and develop training programs around the state at a variety of levels to help people get into the profession.”

Boat trends: Technology and new layouts

Among trends in the boats themselves is

user-friendliness and easier access to boating.

“Things like joystick docking and advanced electronics have made everything easier for boating of all sizes, from driving, docking, water sports and other things,” Wendecker said. “All the advancements that are coming to the screens on cars are coming to the screens on boats.”

Boat layouts are also changing considerably based on changes in boat use, with a premium given to the amount of people you can include in a day trip instead of how many you can sleep comfortably.

“Cruisers that used to have much larger cabins now have a smaller cabin area, and they’ve opened up the hull for more seating space for family and friends to join,” Wendecker said. “People are usually doing more day boating as opposed to taking longer trips and going farther away.”

Also gaining even more popularity (and muscle) is the king of the party – pontoon boats. Once viewed as fit only for puttering

“Things like joystick docking and advanced electronics have made everything easier for boating of all sizes, from driving, docking, water sports and other things. All the advancements that are coming to the screens on cars are coming to the screens on boats.”

– Amanda Wendecker, spokeswoman, Michigan Boating Industries Association

well, they’re so comfortable, they’re so spacious, they’ve got so much power,” said Brett Dense, general manager of Action

Revitalize a Brownfield site, consolidate multiple branches into one world-class Front Street facility

Mike and the Burdco team had such a clear understanding of our vision. They listened to our goals, communicated clearly and worked through the construction challenges we faced. His experience, along with his relationships with subcontractors and township officials made the entire process so smooth.

to all

are 416 people on the wait list for one of the 71 seasonal Clinch Marina slips, city public services director Frank Dituri says.

While officials never know how many people will relinquish their slips each year, it’s usually less than a dozen in most marinas. While Traverse City staff shies away from trying to estimate wait times when asked, they still try to set realistic expectations.

“If you say seven years and eight or nine years go by and they’re still a couple of years out, you’d just disappoint them,” Dituri said. “So, we just let them know where they are on the current wait list. We