TRUE PARTNER

–SINCE 1960–

We pride ourselves on our unwavering strength and stability. In good times and challenging times, we remain a solid foundation for our clients, employees and community. That was true when we opened our doors over 60 years ago and it’s true today.

We share our clients’ entrepreneurial spirit, and that spirit drives us to a state of constant improvement. 2022 brought another year of record earnings and strong financial performance. Additionally, we dramatically improved our reporting capabilities, enhanced our commercial lending team, expanded our residential lending opportunities, celebrated with the Stoneham community at our new branch on Main Street, and structured creative solutions for our QSR and commercial real estate clients.

We also continued our longstanding tradition of giving back to our communities through employee volunteerism, corporate sponsorships, and donations from the Northern Bank Charitable Foundation.

These are just the highlights. Every day we’re looking for new ways we can help our clients achieve their goals and realize their dreams, because that’s what a True Partner does — a True Partner finds a way to get you where you want to go. Whether it’s a new home or a new business, Northern Bank is here to help our clients grow.

On behalf of everyone at Northern Bank, thank you for your business and support. We’re looking forward to exploring new opportunities to help our clients, employees and communities grow in 2023 and beyond.

JAMES J. MAWN ESQ. President & CEO | Northern Bank

At Northern Bank, we believe that helping entrepreneurs build a successful business helps build a stronger, more vital community for us all. That’s not just a philosophy, it’s something we put into practice every day.

Our business was founded and built by entrepreneurs. When traditional banks struggled to finance their new venture, they decided to start a bank of their own — a bank that would support the entrepreneurial spirit of the community. A bank designed to help entrepreneurs realize their vision and make individuals’ dreams their reality. A bank that would be a True Partner no matter the challenges presented. A bank you could always count on.

WHERE WE STARTED Founded in 1960 by two entrepreneur brothers

WHERE WE ARE TODAY

32,000+ business and individual customers

250 employees

13 branches

WHAT WE’VE ACHIEVED

217% asset size increase in 10 years

34.4% employees with a tenure of 5+ years

$2.83B total assets and growing — financially sound with a local lending team and a national lending reach

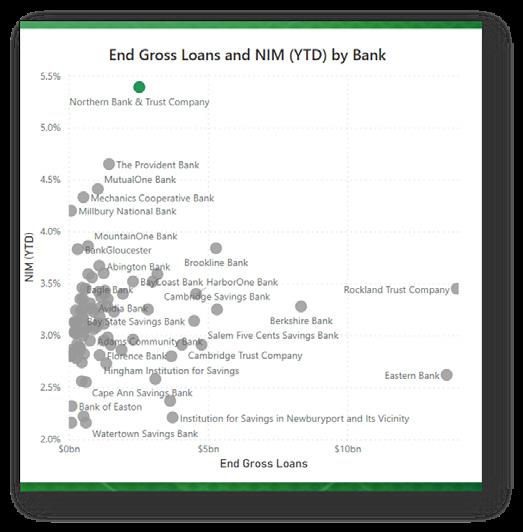

Return on average assets, as compared to return on equity, shows a balance sheet with strong performance that does not rely on “levering up” to fund a low-yielding securities portfolio. Northern Bank’s return on equity is also strong, providing substantial capital accretion over time.

Higher net interest margin reflects an operating model built on commercial lending, without leveraging the balance sheet to fund a lowyielding securities portfolio.

Cash and Balances Due from Depository Institutions

Noninterest Bearing Balances Interest-Bearing Balances

Providing exceptional service at high volume. Our Contact Center experienced a busy 2022. 50,000+ Calls received

* Based on responses from 227 surveyed customers.

At Northern Bank, we never stop looking for innovative ways to better serve our customers and meet their changing needs.

On January 17, we launched a new subsidiary to manage all current and future residential lending under the Northern Home Loans brand. By expanding our mortgage operation, Northern Bank can now provide customers with more flexibility, increased lending options and greater access to competitive rates. Northern Home Loans widens the Bank’s geographical reach and that means now we are able to more effectively serve customers who are in the market for a vacation home or a move to another state.

Our 1031 Exchange team meets our investor clients where they are by attending industry and network events, providing webinars and seminars, and staying up on the latest tax law developments. In 2022, the team hit the road in September and appeared at the 2022 Federation of Exchange Accommodators annual conference in Las Vegas. (L-R) Sarah Starling, Taylor Franklin and Michele Fitzpatrick represented the Bank well!

Other 1031 Exchange team highlights for 2022, include:

6 WEBINARS

Hosted with an average of 30 attendees each session

5 INDUSTRY CONFERENCE EXHIBITS

8 SEMINARS

Presented to realtor associations/offices each offering the class as a 2-credit hour-long CE credit

1

10

Attended by VP of 1031 Exchange to earn a real estate license and 8 additional 1031 exchange courses

16

Every year Northern Bank celebrates its employees with a week’s worth of recognition. In March 2022, the Bank showed its appreciation by giving every employee a free gift from the company store. Choices included jackets, polo shirts, mugs and more. The Bank caught all the action on camera and produced a video that was shared on social media.

In 2022, our Retail division established the Retail Recognition Program, which was created to boost morale, incentivize desired behaviors and encourage teamwork, collaboration and sales results. The recognition program promotes Northern Bank’s Peak values and recognizes team contributions toward the overall success of the bank.

After a long break from in-person events due to COVID, employees did a great job raising awareness for the Bank’s products and services while making connections with existing and potential customers.

At Stoneham’s 38th Annual Town Day, the Bank gave away more than $10,000 in cash prizes and hired a balloon artist that attracted hundreds of children and their families.

In Melrose, the branch team organized a gift card raffle and handed out children’s goody bags with piggybanks and other promotional items.

And in Reading, the Northern team handed out more marketing goodies during the 14th Annual Fall Street Faire.

Throughout 2022, we celebrated the Stoneham, MA community with our new branch on Main Street. Northern Bank has always had strong ties to Stoneham’s thriving business community, so it only made sense that we established our newest bank branch in the center of town, along Route 28. The branch is our 13th location and features a modern design and innovative functionality that has set a new benchmark for future branch buildouts.

At Northern Bank, we recognize the passion and dedication it takes to start and manage a small business. Founded by entrepreneurs over 60 years ago, we understand our small business clients’ goals and challenges and work with them to turn their ideas into reality.

In 2022, we were named the top lender in Massachusetts to new small businesses and to those in the accommodations industry by the SBA.

An SBA loan helped an upholstery company relocate to a larger workshop and headquarters.

In 2006, Shane Lawless purchased an upholstery business in West Concord, MA. By 2022, the time had come for Lawless Upholstery to upgrade its 900-square-foot spot on Commonwealth Avenue. The full-service shop, which specializes in reupholstery, furniture restoration and custombuilt furniture, was bursting at the seams after long-sustained growth. It had added wallpaper coverings and furnishings to its growing business.

“We were expanding the business and had been renting for 16 years,” said Shane. “We were looking for the right piece of real estate and it came up across the street from us.”

Now that he had found the perfect location to relocate his business, Shane called on Northern Bank to help finance the purchase. After going over his options, Shane selected an SBA loan to fund what he called “the biggest purchase of my life.”

There are two key advantages of an SBA loan:

Only 10% equity is required vs. other loan options which usually require around 20-25%.

SBA loans provide long-term, fixed rate financing for major fixed assets.

The SBA loan process was a smooth one and Shane was ready to close on the new 5,000 square foot property within 45 days.

We make it a point to support and celebrate our small business clients whenever we have the opportunity.

During Small Business Month in May, we created a social, web and billboard campaign that recognized all the challenges small businesses have had to work through the last few years and congratulated them on succeeding despite the obstacles.

We also created an SBA loan specific marketing campaign to highlight our clients’ own SBA loan success stories and how working with Northern Bank

Northern Bank — through donations, grants and volunteer time — was a force for good throughout 2022. Eighty-seven Northern Bank employees donated 679 hours of volunteer work in 2022. Meanwhile, the Northern Bank Charitable Foundation issued $489,000 in grants and the Bank itself dished out $34,200 in donations.

Birthday Wishes

Boys & Girls Clubs of Stoneham

Boys and Girls Club of Greater Billerica

City Kids

Comfort Zone Camp

Cradles to Crayons

Daniel’s Table Inc.

Dunkin’ Joy

First Church Stoneham Food Pantry

Heading Home: Annual Giving

Heading Home: She4She

Hillinger Fund

Joslin Diabetes

Junior Achievement

Lions Club International: Woburn Middlesex

Melrose Farmer’s Market SNAP Program

Merrimack Valley Housing Partnership

Mystic Valley Elder Services

Nashoba Learning Group

National Brain Tumor Society

PMC Kids Ride Burlington

Ron Burton Training Village

Second Chances, Inc.

Shop the Block

Stoneham Senior Center

Sudbury Food Pantry

The Corey C. Griffin Foundation

The Joey Domenici Foundation

The McGarry Scholarship Winner: Brigid McCarron

Women’s Money Matters (fka Budget Buddies, Inc.)

YMCA: Melrose Family Branch / Metro North

Northern Bank Charitable Foundation 2022 Grants $489,000 TOTAL

“e” Inc.

Big Brothers & Big Sisters of Central Mass/MetroWest

Boys & Girls Clubs of Woburn

Freeman Realty |The Reading BID

Lions Club International: Woburn Middlesex

LS Youth Baseball, Inc.

Merrimack Valley Housing Partnership

Neighbor Brigade

Reading Education Foundation: Festival of Trees

Reading Scholarship Foundation

Smile Mass, Inc

South End Baseball

St. Charles School

Stoneham Memorial Day Parade Committee / Field of Honor

Sudbury Education Resource Fund: 2023 College Fair

Sudbury Valley Trustees

The Concord Education Fund

The Forbes School

The McGarry Scholarship Finalist: Colin Campbell

The McGarry Scholarship Finalist: Katherine Boyle

The McGarry Scholarship Finalist: Lily Gigante

The McGarry Scholarship Finalist: Michael Parent

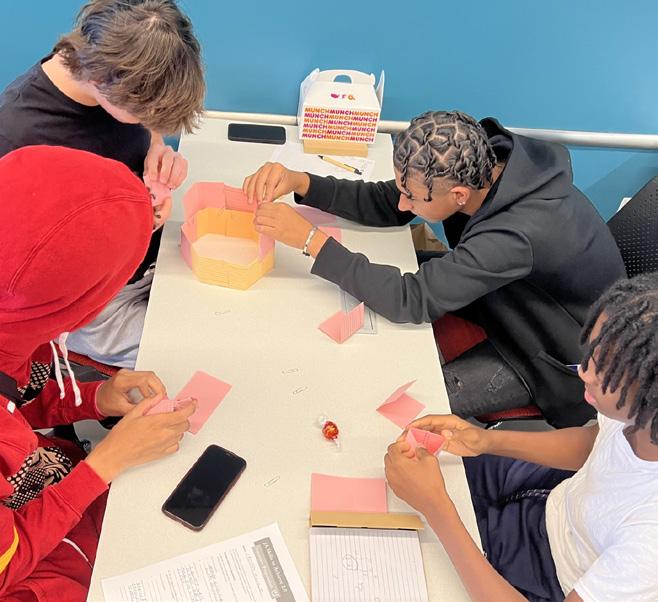

Town of Acton: Acton Business Scholars Program

Town of Chelmsford Scholarship Fund

Town of Chelmsford Scholarship Fund, Inc.

Up With Books: Every Summer Has a Story

VNA Hospice & Palliative Care

Voices of Hope: Burlington, MA (American Cancer Society)

Westford Chamber Players

Wm F. Eggo VFW Post 2597

YW Boston

Chinese Language School

Over the course of 2022, 87 Northern Bank employees participated in 679 hours of volunteer work in the communities that we serve. A portion of the hours were driven by 20 Northern Bank hosted events, for CRA credit, that included:

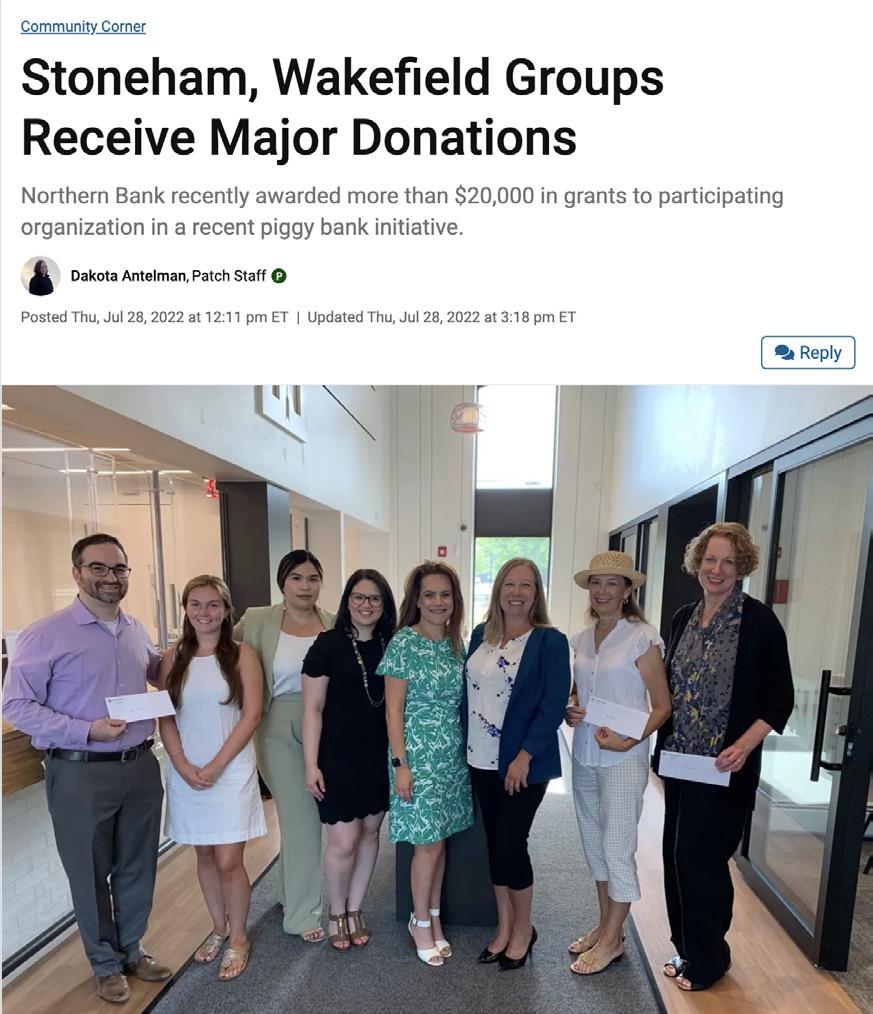

In celebration of Northern Bank’s newest branch in Stoneham, the bank’s charitable foundation recently awarded a grand total of $20,500 in grants to three local nonprofits.

The summertime program — which called on residents and businesses to vote for their favorite charity by dropping one of three tokens inside an oversized piggy bank — concluded with the Stoneham Food Pantry earning the most votes and $13,000.

Second-place went to the Stoneham Senior Center, which was awarded $5,000. The Boys & Girls Club of Stoneham & Wakefield finished third and took home $2,500.

Representatives from all three winning organizations recently gathered at the Stoneham branch to celebrate. The $13,000 for the food pantry is a windfall, as the organization spent more than $1,500 in June on new groceries for those in need.

The food pantry celebrated its win on social media, calling the grant a “much needed windfall.”

The Boys & Girls Club similarly thanked Northern Bank while celebrating their grant. “This investment in our community will make an immediate impact on those most vulnerable,” the Club wrote.

Congratulations to Brigid McCarron, the 2022 winner of Northern Bank’s annual James E. McGarry, Jr. college scholarship.

The $5,000 award honors the late “Jim” McGarry of Woburn for his 50 years of service to Northern Bank and pays tribute to his lifelong affinity for local fire and police departments. Applicants must have a parent or guardian who is an active firefighter or police officer in Middlesex County.

McCarron, whose father, John, is a Melrose firefighter, topped more than 40 local high school senior applicants for this year’s scholarship.

“I am fortunate for the experiences provided by the organizations I volunteer for,” said McCarron. “I have received vastly more than I have given through my community service. Being the recipient of an award whose purpose is to acknowledge the work and sacrifices of the first responders — many of which I have seen firsthand through my father — is an immense privilege. Mr. McGarry’s work for his community is inspiring and something I will continue to try to emulate in my work.”

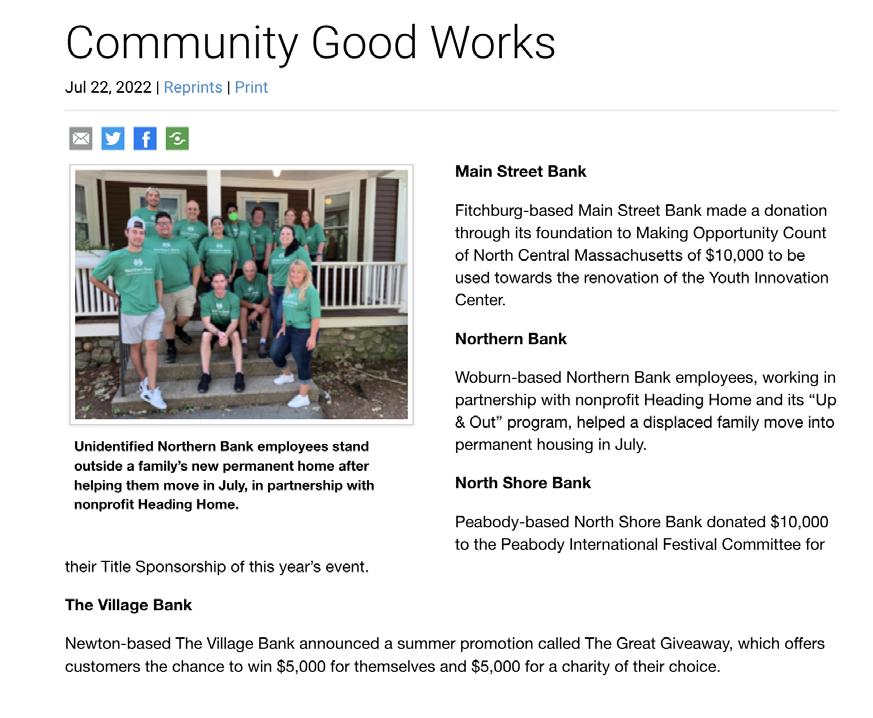

Working in partnership with nonprofit Heading Home and its “Up & Out” program, about a dozen employees volunteered to move a displaced family into its new home. On a very hot and humid day, they hauled furniture and other household items donated by Northern Bankers to help alleviate the financial burden for the family.

The benefiting family — a single mom with three children — was overwhelmed with gratitude and hugged every volunteer at the end of the day.

The Northern Bank Charitable Foundation and employee volunteers were a powerful force for good this summer and the media took notice.BANK CONCLUDES CHARITABLE GIVING PROGRAM “UP & OUT” MOVE WITH HEADING HOME JAMES E. MCGARRY SCHOLARSHIP