YOU SPIKES!

North Coast Building Industry Association (NCBIA) BUILDER newsletter is the official newsletter of the NCBIA and is published monthly by the NCBIA. The NCBIA is an affiliate of the Ohio Home Builders Association (OHBA) & the National Association of Home Builders (NAHB).

Advertising Policy - The North Coast Building Industry Association reserves the right to reject advertising in the Builder newsletter based on content. Acceptance of advertising does not imply endorsement of the product or service advertised.

NCBIA Office

5321 Meadow Lane Court - B Suite 23

Sheffield Village, OH 44035

Phone: 440.934.1090 info@ncbia.com | www.ncbia.com

NCBIA Staff Executive Officer

Judie Docs | judie@ncbia.com

Executive Assistant

LaBreeska Bellan | labreeskancbia@gmail.com

Marketing Associate Ashlyn Bellan-Caskey | ashlynncbia@gmail.com

2024 NCBIA Officers

President

Tim King, K. Hovnanian Homes

Vice President

Mike Meszes, DRC Construction Co.

Associate Vice President

John Toth, Floor Coverings International Treasurer

Melanie Stock, First Federal Savings of Lorain

Secretary

Jon Sherer, Ascent Custom Homes and Remodeling

2024 NCBIA Board of Directors

Sam Hudspath, All Construction Services

Joey McCormick, Bumble Bee Blinds

Sara Majzun, Majzun Construction Co.

John Eavenson, Perpetual Development

Theresa Riddell, The Nelson Agency

Jason Rodriguez, The S.J.R Building Co.

Kevin Walker, Walker Wealth Managements & Great Lakes Properties & Investments

NCBIA Life Directors

Jeremy Vorndran, 84 Lumber

Tom Caruso, Caruso Cabinets

Bob Yost, Dale Yost Construction

Liz Schneider Dollar Bank

Mary H. Felton, Guardian Title

Jack Kousma, Kousma Insulation

Jeff Hensley, Lake Star Building & Remodeling

Dave Linna, Linna Homes & Remodeling

Chris Majzun Jr., Majzun Construction Co.

Chris Majzun Sr., Majzun Construction Co.

Jim Sprague, Maloney + Novotny, LLC

Randy Strauss, Strauss Construction

Tom Lahetta, Tom Lahetta Builders, Inc.

2024 NAHB Delegate

This member represents our local industry in Washington DC

Tim King, K. Hovnanian Homes

NAHB Senior Life Delegate

Randy Strauss, Strauss Construction

Ohio’s State Rep. to NAHB

Randy Strauss, Strauss Construction

OHBA 2024 President

Enzo Perfetto, Enzoco Homes

OHBA Past President

Randy Strauss, 1996

2024 OHBA Trustees

Tim King, K. Hovnanian Homes

John Eavenson, Perpetual Development

OHBA Area 2 Vice-President

Ric Johnson, CAPS Builder & Right at Home Technologies

Explore

Blueprint/Drawing

Contact Ashlyn Bellan-Caskey at ashlynncbia@gmail.com $10

For more information on any of these

& services, please contact the NCBIA Office at (440) 934-1090 or email judie@ncbia.com

“ “ “ “ “ “

$50 each (plus shipping, if applicable) $35 per hour Contact Ashlyn Bellan-Caskey at ashlynncbia@gmail.com

each (plus shipping, if applicable)

Want to be a sponsor for any of these events? Let us know! Sponsor early to get maximum exposure!

Call or email Judie at judie@ncbia.com for marketing opportunities to help your bottom line!

Do you have some business news to share?

Thursday, November 14, 2024

November Membership MixerHosted by: Connie Linkous

5:30 - 7:30 PM

Lighthouse Estates 5937 Cape Hatteras Dr, Vermilion

Wednesday, November 20, 2024

Executive Committee Meeting 3:30 - 5 PM

Board of Directors Meeting 5 - 6:30 PM

NCBIA Office

5321 Meadow Lane Court - B, Suite #23

Sheffield Village, OH

Monday, November 25, 2024

2025 Home Show Committee Meeting

9:30-10:30 AM

NCBIA Office

5321 Meadow Lane Court - B, Suite #23 Sheffield Village, OH

Thursday, December 12, 2024

Ugly Sweater Christmas Party 2024 5 - 7 PM

Captain's Club 232 Park Avenue, Amherst

Check the website at www.ncbia.com for up-to-date changes, additions, and corrections to these events!

Business anniversaries, accomplishments, awards, publications, etc.? Send to judie@ncbia.com. We want to hear from you!

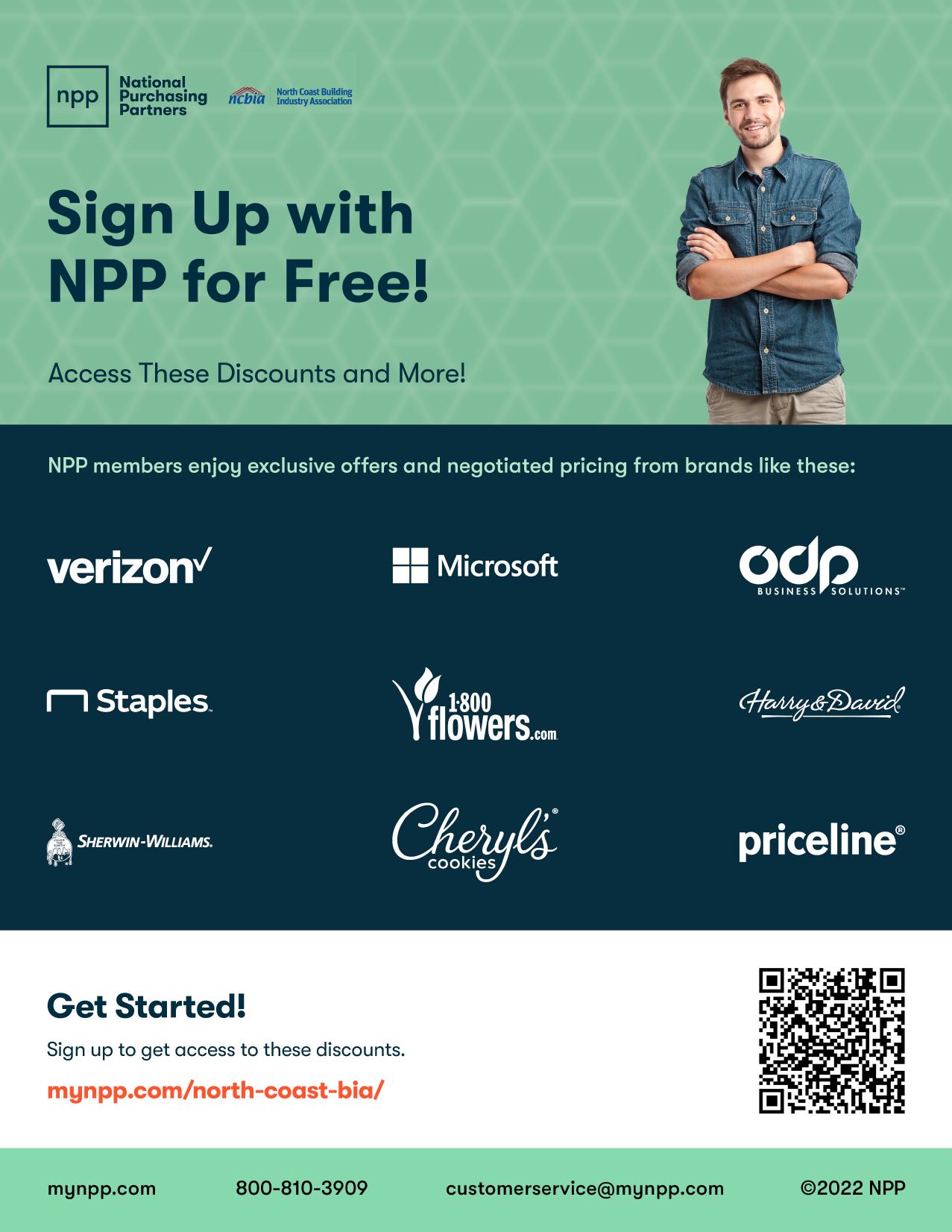

1. 22% off Verizon monthly access fees on Corporate liable lines. $34.99 or higher, 2 corporate lines required.*

2. For a limited time, save $5/month for a year on two UNLIMITED plans by Verizon Wireless: Business Unlimited Pro 5G and Business Unlimited Plus 5G.1

1. 10-year price guarantee, one month free, and prices as low as $69/month.2 Restrictions apply.

WHAT IS A Spike?

What’s in it for me?

When you recruit and retain members on behalf of the Federation, you are not only giving back to the industry, but you will also be recognized and rewarded through NAHB’s Spike Club.

As you continue to recruit and retain additional members, you accrue more Spike credits, which unlock new levels of recognition.

How do I become a Spike?

To become a Spike, you must earn at least six credits. The fastest way to earn credits is to recruit member to NAHB. You also can earn credits when members you recruited renew their memberships and when they join a council at their local association.

How we calculate Spike credits:

• 1 credit for each new Builder or Associate member you recruit

• 1 credit on the first membership anniversary of each member you recruited

• 0.5 credit for each membership anniversary that follows for each of those members

• 0.5 credit for recruiting council members

Once you accrue six credits, you become a Spike and officially join NAHB’s Spike Club - a network of members across the nation who have helped grow their local associations. As you continue to accumulate credits, your status rises within the Spike Club.

International Builders’ Show Closing Concert

The International Builders’ Show (IBS) Closing Concert is the final celebration of the home building industry’s largest annual event.

Spikes who have recruited at least one new builder and/or associate member int he last year will receive two general admission tickets to the IBS Closing Concert. Spikes who have recruited at least five new builder and/or associate members in the last year can access the Spike VIP section and enjoy complimentary food and drinks during the concert.

*Note that the Spike ticket qualification period begins Nov. 1 and ends Oct. 31. So, start recruiting!

Tim King, K. Hovnanian Homes

by Judie Docs, CSP, MCSP, MIRM, CMP, CGP

HOW CAN YOU Support Membership Development?

Membership development is vital to the future of any association. The continuous influx of new members and the retention of current members are critical for maintaining NAHB’s powerful voice in the homebuilding industry. Your membership is one of the most valuable resources for building your association. Just as a nail in the home building industry is essential to the development and strength of a building, volunteers who recruit and retain members play a vital role in an association's growth, development, and stability.

EVENT SPONSOR

Member: $2000

Non-Member: $2500

Event Sponsors:

Everything on Supporting Sponsor list, PLUS radio interview, booth space, logo on staff t-shirts and all printed advertising, mention in radio advertisements and option to have your company’s banner hung at show entrance!

Saturday, March 15th 9-5 Sunday, March 16th 10-3

Spitzer Conference CenterLorain County Community College 1005 North Abbe Road, Elyria

My company would like to sponsor the 2025 NCBIA Home Show. (Please select below)

Event Sponsor($2000) Member Supporting Sponsor ($300)

SPONSOR INFORMATION

SPONSOR

Member: $300

Non-Member: $500

Includes: mention in radio ads, your logo in event program, Facebook event page, slideshow during event, option to put promotional items in swag bag, and recognition in BUILDER newsletter.

PAYMENT METHOD:

Please Indicate how you would like to pay for your sponsorship.

___Check Enclosed ___VISA/MC/AMEX/DISC* *If you select credit card, our office will call for your card information.

QUESTIONS? CONTACT THE NCBIA www.ncbia.com (440) 934-1090 judie@ncbia.com

Supporting Sponsors:

Sponsor:

ON HOUSING

PRIVATE RESIDENTIAL CONSTRUCTION Spending Rises in September

Private residential construction spending inched up 0.2% in September, according to the Census Construction Spending data. The September report shows a 4.1% rise compared to a year ago.

The monthly increase in total private construction spending for September was largely due to more spending on singlefamily construction. Spending on single-family construction rose by 0.4% in September. This broke a five-month streak of declines, aligning with the modest gains in single-family starts during September. Compared to a year ago, spending on single-family construction was 0.9% higher. In contrast, multifamily construction spending continued to decline, edging down 0.1% in September after a dip of 0.3% in August. Year-over-year, spending on multifamily construction was down 8.1%, as there is an elevated level of apartments under construction being completed. Meanwhile, private residential improvement spending stayed flat for the month and was 13.5% higher than a year ago.

The NAHB construction spending index is shown in the graph below. The index illustrates how spending on singlefamily construction has slowed since early 2024 under the pressure of elevated interest rates. Multifamily construction spending growth has also slowed down after the peak in July 2023. Meanwhile, improvement spending has increased its pace since late 2023.

Spending on private nonresidential construction was up 3.5% over a year ago. The annual private nonresidential spending increase was mainly due to higher spending for the class of manufacturing ($39.4 billion), followed by the power category ($6.9 billion).

BY: NA ZHAO

2024-2025 Membership Blitz

Multiple Ways To Win! Cash Prizes!

How It Works:

• The Blitz will run from the Ugly Sweater Party on December 12th through the final day of the Home & Remodeling Show on March 16th.

• For each new member you bring in during that time period you will receive 1 ticket into the drawing for a $200 cash prize !

• Your new member will also be entered into a separate drawing for a cash prize!

• The NCBIA member that brings in the most members during the Blitz will win $800 cash!

Attendance Incentive!! There are 5 upcoming events from the 12th of December to the final day of the home show.

• Ugly Sweater Party – 12/12

• January Mixer – Date TBD

• Installation Night – 2/1

• February Mixer – Date TBD

• Home & Remodeling Show 3/15 & 16

If a current NCBIA member attends 4 out of 5 of these above mentioned events they will receive:

• One ¼ ad in a newsletter of the month of their choosing

• Two Free tickets to our Night at the Races event in April

• Entered into a drawing for a portion of the 50/50 money raised at each event!

A 50/50 raffle will be held at the 1st four events mentioned on this flyer.

• Half of money will go to someone present at that event.

• The other half will go into a pot that will grow with each event!

• The total pot will be split into 2 at the March GM Meeting.

o One of the New Members will win half

o The other half will go to one of our Members that hit the attendance goal incentive!

usbank.com/splash/ corporate-payments/transportation/ nahb.html

BUSINESS MANAGEMENT

Up to 40% off Dell computers, servers, electronics & accessories.

Up to 75% off online regular prices on their Best Value List of preferred products. Plus, free shipping over $50.

Flat-rate pricing. 50% discount for next day shipping, 30% for ground commercial/residential.

At least 75% off Less Than Truckload (LTL) shipping over 150lbs.

855-337-6811 x2897

Shipping 1800members.com/nahb 800-MEMBERS

Save 15% off monthly on a new RingCentral Office service. Receive $50 off the list price on any RingCentral phone. Current NAHB RingCentral users are eligible for discounts by calling and re-signing a 24 month agreement. Message, Video & Phone

ringcentral.com/nahb 800-417 0930

ON HOUSING

THE U.S. ECONOMY POSTED Another Solid Growth in Third Quarter

BY: JING FU

The U.S, economy grew at a solid pace in the third quarter of 2023, boosted by strong consumer spending and government spending. According to the “advance” estimate released by the Bureau of Economic Analysis (BEA), real gross domestic product (GDP) expanded at an annual rate of 2.8% in the third quarter of 2024, following a 3.0% gain in the second quarter of 2024. This quarter’s growth matched NAHB’s forecast.

Furthermore, the data from the GDP report suggests that inflation is cooling. The GDP price index rose 1.8% for the third quarter, down from a 2.5% increase in the second quarter of 2024. The Personal Consumption Expenditures Price (PCE) Index, which measures inflation (or deflation) across various consumer expenses and reflects changes in consumer behavior, rose 1.5% in the third quarter. This is down from a 2.5% increase in the second quarter of 2024.

This quarter’s increase in real GDP primarily reflected increases in consumer spending, exports, and federal government spending.

Consumer spending, the backbone of the U.S. economy, rose at an annual rate of 3.7% in the third quarter. It marks the highest annual growth rate since the first quarter of 2023. The increase in consumer spending reflected increases in both goods and services. While goods spending increased at a 6.0% annual rate, expenditures for services increased 2.6% at an annual rate.

The U.S. trade deficit increased in the third quarter, as imports increased more than exports. A wider trade deficit shaved 0.56 percentage points off GDP. Imports, which are a subtraction in the calculation of GDP, increased 11.2%, while exports rose 8.9%.

In the third quarter, federal government spending increased 9.7%, led by a 14.9% surge in national defense outlays.

Nonresidential fixed investment increased 3.3% in the third quarter. Increases in equipment and intellectual property products were partly offset by a decrease in structures. Meanwhile, residential fixed investment decreased 5.1% in the third quarter and dragged down the contribution to real GDP by 0.21 percentage points. Within residential fixed investment, single-family structures declined 16.1% at an annual rate, multifamily structures decreased 8.7%, while improvements rose 13.9%.

For the common BEA terms and definitions, please access bea.gov/Help/Glossary.

ANNUAL UGLY SWEATER

Applying for Membership!

Bob Kreimes, Bob Kreimes Construction Company

Bob Kreimes, L & R Kreimes Company

Amanda Yarham, Eyring Movers

Michael McLaughlin, Axis Insurance

Ken Throckmorton, Forever Fence & Rail

Cathie Emery, Sims-Lohman Fine Kitchens & Granite

Mark McClaine, 84 Lumber

Joe Mancuso, 84 Lumber

Andrew Wilson, 84 Lumber

Chris Collins, Carter Lumber

Jerry Caruso, Caruso Cabinets

Erin Tober, Ferguson Enterprises

Matt Herb, Fidelity National Title

Lisa Matuszak, First Federal Savings of Lorain

Kevin Henceroth, Henceroth Construction, LLC

David Ritchey, Hercules Fire Protections & Plumbing

Beth Grayson, Home Appliance Sales & Service

John Chandler, Howard Hanna Real Estate

Jon Hammer, Infinity from Marvin

Diana DeCesare, K. Hovnanian Homes

Michael Bossetti, Makena Construction

Pat Shenigo, Shencon Construction, LLC

Albert Gasparini, Traditional Marble & Granite

Bill De Capua, Union Home Mortgage

D. Mark Clement, Weathertight Construction, Inc.

William Gill, William Gill Construction, Inc.

EYE ON HOUSING

NEW HOME SALES Improve in September

Home buyers moved off the sidelines in September following the Federal Reserve’s recent move to cut interest rates for the first time in four years.

Sales of newly built, single-family homes in September increased 4.1% to a 738,000 seasonally adjusted annual rate from a downwardly revised August number, according to newly released data from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. The pace of new home sales in September is up 6.3% compared to a year earlier.

Despite challenging affordability conditions, home builder confidence edged higher in October as they anticipate that mortgage rates will gradually, in an uneven manner, moderate in the coming months. There is a significant need for additional housing supply, as many prospective home buyers are entering the market.

Following the Fed’s actions in September, mortgage rates fell to 6.18%, from 6.5% in August. However, new home sales will likely weaken in October due to a recent rise in long-term rates.

A

new home sale occurs when a sales contract is signed, or a deposit is accepted. The home can be in any stage of construction: not yet started, under construction or completed. In addition to adjusting for seasonal effects, the September reading of 738,000 units is the number of homes that would sell if this pace continued for the next 12 months. New single-family home inventory in September remained elevated at a level of 470,000, up 8.0% compared to a year earlier. This represents a 7.6 months’ supply at the current building pace. Completed for-sale new homes rose to 108,000, the highest level since 2009.

PHOTO GALLERY

IMAGINE THE POSSIBILITIES

There has never been a better time to be a Carter Lumber customer in the Cleveland/Akron area. We now have even more resources to provide our customers with quality materials and exceptional service. We’re more than just a lumberyard!

Contact your nearest store location to see how having Carter Lumber as a part of your team can help you grow your business and your bottom line.

EYE ON THE ECONOMY

MORTGAGE RATES REVERSED Downward Trend in October

In October mortgage rates reversed their recent downward trajectory, returning to levels two months earlier. According to Freddie Mac , the average rate for a 30-year fixed-rate mortgage increased 25 basis points (bps) from September to 6.18%. The 15-year fixed-rate mortgage saw an even steeper increase of 34 bps to land at 5.60%.

These increases coincided with heightened volatility in the 10-year Treasury yield, which jumped 38 bps over the month, moving from 3.72% in September to 4.10%. This spike followed a weaker-than-expected labor report driven by the disruptions from two hurricanes, as well as the Boeing strike, and the 2024 election.

However, the largest part of the increase for interest rates is due to growing, post-election concerns over budget deficits. NAHB will be revising its interest rate outlook as the final election results are determined and the fiscal policy position comes into focus. Nonetheless, long-term interest rates have increased since September due to election developments.

BY: CATHERINE KOH

TWO DAY SHOW!!!!!

EXHIBITOR CONTRACT

Company Name (as it will appear in show) __________________________________________

Contact Person (print) _________________________________________________________

Primary Product(s)/Service(s) ___________________________________________________

Email address __________________________

Booth spaces are LIMITED and available on a 1st Come, 1st Served Basis! 2024 SOLD OUT - Act now to secure your booth!

BOOTH INFORMATION

Electric is optional and available on a 1st Come, 1st Served Basis!

Will you need electricity? _______ YES _______ NO ______# of Booth Spaces ____________TOTAL AMOUNT DUE

I understand that I have contracted for exhibit space by signing this contract and I am liable for the full cost of the booth space. I also understand that the final location of space will be determined by show management when payment is made in full. The undersigned represents that he/she is fully authorized to execute and complete this agreement. The undersigned also understands and agrees to the rules and regulations on the reverse side of this contract.

Authorized Exhibitor Signature

PAYMENT METHOD:

Please Indicate how you would like to pay for your booth space.

Printed Name ___Invoice ___Check Enclosed ___VISA/MC/AMEX/DISC*

*If you select credit card, our office will call for your card information.

Please send completed form to Judie@ncbia.com or 5321 Meadow Lane Court - B, Suite 23 Sheffield Village, OH 44035

Event Sponsors: **A $5.00 Convenience Fee will be charged for all Credit Card Payments

LIMITED TIME OFFER!

Earn 30¢ per gallon for the first three months once you reach 100 gallons in each calendar month. Thereafter, save 6cpg for every gallon pumped.*

Th e 7-Eleven Comm er ci al Fl ee t M ast er ca rd

Fleet Savings Made Easy

Perfect fit for mid-sized to larger fleets that need the added convenience of fueling where Mastercard® is accepted. With the 7-Eleven Commercial Fleet Mastercard®, your fleet can customize reports for a complete fuel management solution.

Rebates & Savings

Earn 30¢ per gallon for the first three months once you reach 100 gallons in each calendar month. Thereafter, save 6cpg for every gallon pumped.*

Security & Fraud Controls

Enjoy the security of advanced card prompts.

Earn 30¢ per gallon for the first three months once you reach 100 gallons in each calendar month. Thereafter, save 6cpg for every gallon pumped.*

Customize and download cost and performance reports monthly or in real-time.

Monitor transactions and manage your account online, in real-time.

Use card prompts to help prevent misuse. Simple online access.

Accepted at your favorite 7-Eleven & Speedway locations and anywhere Mastercard is accepted, regardless of fuel brand.**

Name

Online Control & Visibility

Set card controls and access detailed reporting online anytime.

The 7F LEET Diesel Network Ma stercard ®

Fueling your fleet for the road ahead.

Diesel Network Mastercard offers significant discounts on diesel at the over 260 locations that make up the 7FLEET Diesel Network as well as discounts on commercial truck lane diesel across the AMBEST network.

Network Discounts

Save an average of 53cpg on truck diesel lane gallons fueled in the 7FLEET Diesel Network.*

Security & Fraud Controls

Enjoy the security of advanced card prompts.

Online Control & Visibility

Set card controls and access detailed reporting online anytime.

Customize and download cost and performance reports monthly or in real-time.

Monitor transactions and manage your account online, in real-time.

Use card prompts to help prevent misuse.

Simple online access.

Accepted at your favorite 7-Eleven & Speedway locations and anywhere Mastercard is accepted, regardless of fuel brand.**

7-Eleven Fleet Card Program Application

Please send the application to

INFORMATION – Required.

AUTHORIZED REPRESENTATIVE – Required.

Application Terms: By signing this Application, the Authorized Representative represents, warrants, and agrees that: (a) he or she is authorized to apply to FLEETCOR TechnologiesOperating Company, LLC (“FLEETCOR”), a Louisiana limited liability company, for an unsecured, partially secured, or fully secured line of credit (“Account”) on behalf of the company identified above (“Client”); (b) FLEETCOR may obtain Client’s credit report and check Client’s credit standing when processing this Application or periodically evaluating any resulting Account’s creditworthiness; (c) this Application is subject to approval and acceptance by FLEETCOR; (d) if the Application is approved by FLEETCOR in Louisiana, the resulting Account: (i) will be governed by Louisiana law; (ii) will not be a revolving credit account and the Amount Due/Total Amount Due shown on each Account Statement will be due and payable on the Due Date shown on the Statement; (iii) will be used solely for commercial purposes and not for personal or household purposes; (iv) will be suspended, and the Client’s redit history may be reported to credit reporting agencies, if the Client’s unpaid balance ever meets the Account’s Credit/Spend Limit; and (e) acceptance, signing (in whatever form), or use of any of the Cards issued to Client will constitute Client’s acceptance of the Client Agreement available at www.fleetcor.com/terms/7-Eleven-mc or www.fleetcor.com/terms/7-Eleven-dn Equal Credit Opportunity Act Notice. The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age (provided that the applicant has the capacity to enter into a binding contract); because all or part of the applicant’s income derives from any public assistance program; or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act. The federal agency that administers compliance with this law concerning this creditor is the Federal Trade Commission, Equal Credit Opportunity Act, Washington, D.C. 2 0580. FLEETCOR considers your privacy important. View our privacy policy available at www.fleetcor.com/privacy-policy to find out more.

I agree to the Application Terms and the Client Agreement (Please check box) ☐

BUSINESS OWNER(S) / PERSON WITH SIGNIFICANT MANAGEMENT RESPONSIBILITY – Required.

To help fight financial crimes, the U.S. Department of Treasury require financial institutions to obtain, verify, and record information about beneficial owners of entities opening accounts. Beneficial owners are persons who, directly or indirectly, own 25% or more of the entity. We may use third-party resources to verify your identity. For questions about this regulation and how FLEETCOR uses and protects this data, please speak with your sales representative. Patriot Act Notice. Section 326 of the USA PATRIOT Act mandates that FLEETCOR verify and record certain information about you (the Client, Authorized Representative, or anyco-maker or guarantor) while processing this Application.

Beneficial Owner (Individuals who own 25% or more of a Legal Entity)* ☐ Not Applicable, Sole Proprietor, Government

this person have significant responsibility for managing the legal entity listed above?