STATE AND LOCAL Property Tax Revenues Eclipse $700 Billion BY: DAVID LOGAN

N

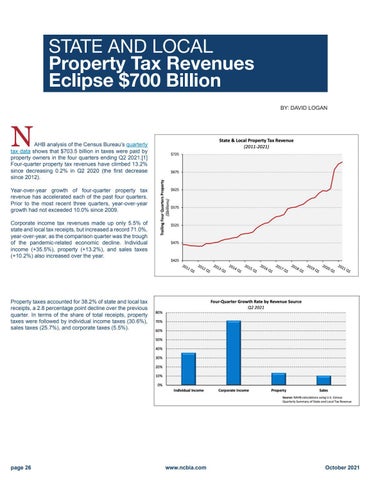

AHB analysis of the Census Bureau’s quarterly tax data shows that $703.5 billion in taxes were paid by property owners in the four quarters ending Q2 2021.[1] Four-quarter property tax revenues have climbed 13.2% since decreasing 0.2% in Q2 2020 (the first decrease since 2012). Year-over-year growth of four-quarter property tax revenue has accelerated each of the past four quarters. Prior to the most recent three quarters, year-over-year growth had not exceeded 10.0% since 2009. Corporate income tax revenues made up only 5.5% of state and local tax receipts, but increased a record 71.0%, year-over-year, as the comparison quarter was the trough of the pandemic-related economic decline. Individual income (+35.5%), property (+13.2%), and sales taxes (+10.2%) also increased over the year.

Property taxes accounted for 38.2% of state and local tax receipts, a 2.8 percentage point decline over the previous quarter. In terms of the share of total receipts, property taxes were followed by individual income taxes (30.6%), sales taxes (25.7%), and corporate taxes (5.5%).

page 26

www.ncbia.com

October 2021