NEWSLETTER N O R T H C O A S T B U I L D I N G I N D U S T R Y A S S O C I A T I O N ncbia, sheffield village, oh 44035 www ncbia com May/June 2024 - vol MMXXIV BUILDER CookoutGENERAL MEMBERSHIP IF YOU BRING A POTENTIAL MEMBER AND THEY JOIN BY JULY 25, 2024 YOU WILL GET FREE ADMISSION TO THE OCTOBER 16, 2024 GENERAL MEMBERSHIP MEETING & ELECTION NIGHT FRIDAY JUNE 28 11:30AM - 1 $30 - MEMBERS $40 - NONMEMBERS POGIE'S CLUBHOUSE 150 JEFFERSON ST. AMHERST Table Sponsors MEETING & RSVP, OR CANCEL BY THURSDAY, JUNE 20TH

North Coast Building Industry Association (NCBIA) BUILDER newsletter is the official newsletter of the NCBIA and is published monthly by the NCBIA. The NCBIA is an affiliate of the Ohio Home Builders Association (OHBA) & the National Association of Home Builders (NAHB).

Advertising Policy - The North Coast Building Industry Association reserves the right to reject advertising in the Builder newsletter based on content. Acceptance of advertising does not imply endorsement of the product or service advertised.

NCBIA Office

5321 Meadow Lane Court - B Suite 23

Sheffield Village, OH 44035

Phone: 440.934.1090 info@ncbia.com | www.ncbia.com

NCBIA Staff Executive Officer

Judie Docs | judie@ncbia.com

Executive Assistant

LaBreeska Bellan | labreeskancbia@gmail.com

Marketing Associate Ashlyn Bellan-Caskey | ashlynncbia@gmail.com

2024 NCBIA Officers

President

Tim King, K. Hovnanian Homes

Vice President

Mike Meszes, DRC Construction Co.

Associate Vice President

John Toth, Floor Coverings International Treasurer

Melanie Stock, First Federal Savings of Lorain Secretary

Jon Sherer, Paraprin Construction, LLC

2024 NCBIA Board of Directors

Sam Hudspath, All Construction Services

Joey McCormick, Bumble Bee Blinds

Dave Linna, Linna Homes & Remodeling

Sara Majzun, Majzun Construction Co.

John Eavenson, Perpetual Development

Jason Rodriguez, The S.J.R Building Co.

Kevin Walker, Walker Wealth Managements & Great Lakes Properties & Investments

NCBIA Life Directors

Jeremy Vorndran, 84 Lumber

Tom Caruso, Caruso Cabinets

Bob Yost, Dale Yost Construction

Liz Schneider Dollar Bank

Mary H. Felton, Guardian Title

Jack Kousma, Kousma Insulation

Jeff Hensley, Lake Star Building & Remodeling

Chris Majzun Jr., Majzun Construction Co.

Chris Majzun Sr., Majzun Construction Co.

Jim Sprague, Maloney + Novotny, LLC

Randy Strauss, Strauss Construction

Tom Lahetta, Tom Lahetta Builders, Inc.

2024 NAHB Delegate

This member represents our local industry in Washington DC

Tim King, K. Hovnanian Homes

NAHB Senior Life Delegate

Randy Strauss, Strauss Construction

Ohio’s State Rep. to NAHB

Randy Strauss, Strauss Construction

OHBA 2024 President Enzo Perfetto, Enzoco Homes

OHBA Past President

Randy Strauss, 1996

2024 OHBA Trustees

Tim King, K. Hovnanian Homes

John Eavenson, Perpetual Development

OHBA Area 2 Vice-President

Ric Johnson, CAPS Builder & Right at Home Technologies

May/June 2024 www.ncbia.com page 3

30 17 38-39 34-35 EXHIBITOR CONTRACT Will you need electricity? _______ YES _______ NO ______# of Booth Spaces ____________TOTAL AMOUNT DUE Electric is optional and available on a 1st Come, 1st Served Basis! Booth spaces are LIMITED and available on a 1st Come, 1st Served Basis! 2024 SOLD OUT - Act now to secure your booth! Authorized Exhibitor Signature Printed Name ___Invoice ___Check Enclosed ___VISA/MC/AMEX/DISC* *If you select credit card, our office will call for your card information. understand that I have contracted for exhibit space by signing this contract and am liable for the full cost of the booth space. also understand that the final location of space will be determined by show management when payment is made in full. The undersigned represents that he/she is fully authorized to execute and complete this agreement. The undersigned also understands and agrees to the rules and regulations on the reverse side of this contract. Company Name (as it will appear in show) __________________________________________ Contact Person (print) _________________________________________________________ Cell # _______________________________________________________________________ Primary Product(s)/Service(s) ___________________________________________________ Email address __________________________ BOOTH INFORMATION Sponsorships Available Call for More Info! Showcase Your Business Over 1000 Local Consumers Expected Our Biggest Consumer Event of the Year! Event Sponsors: **A $5.00 Convenience Fee will be charged for all Credit Card Payments Questions? Contact the NCBIA at (440) 934-1090 Spitzer Conference CenterLorain County Community College 1005 North Abbe Road, Elyria Supporting Sponsors: Saturday, March 15th 9-5 Sunday, March 16th 10-3 TWO DAY SHOW!!!!! PAYMENT METHOD: Please Indicate how you would like to pay for your booth space. Please send completed form to Judie@ncbia.com or 5321 Meadow Lane Court B, Suite 23 Sheffield Village, OH 44035 $299 Booth Space - MEMBERS ONLY AFTER July 16 2023, $399 SPECIAL EARLY BIRD PRICING FOR MEMBERS ONLY (SAVE $100)! Direct Sales Booth- $159

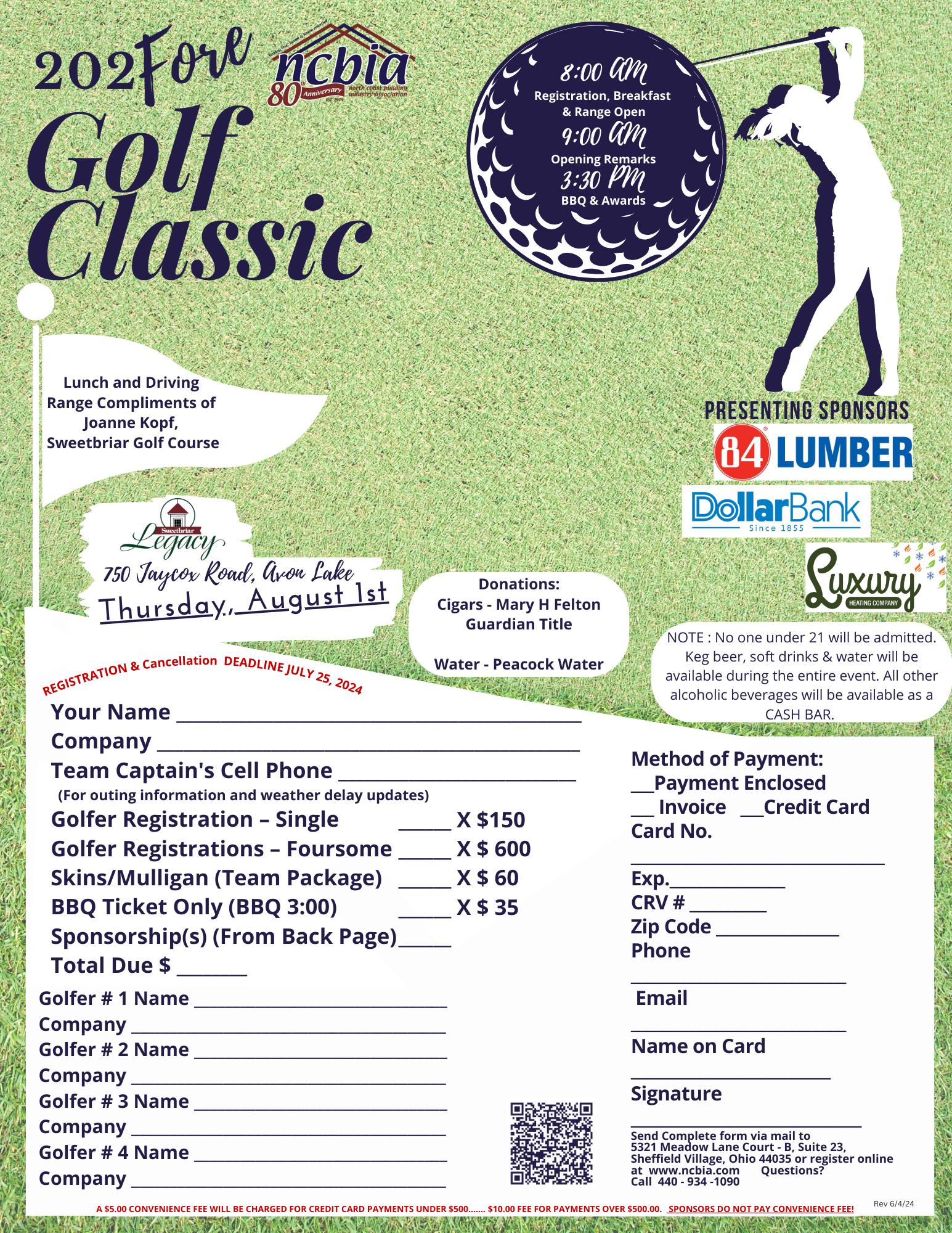

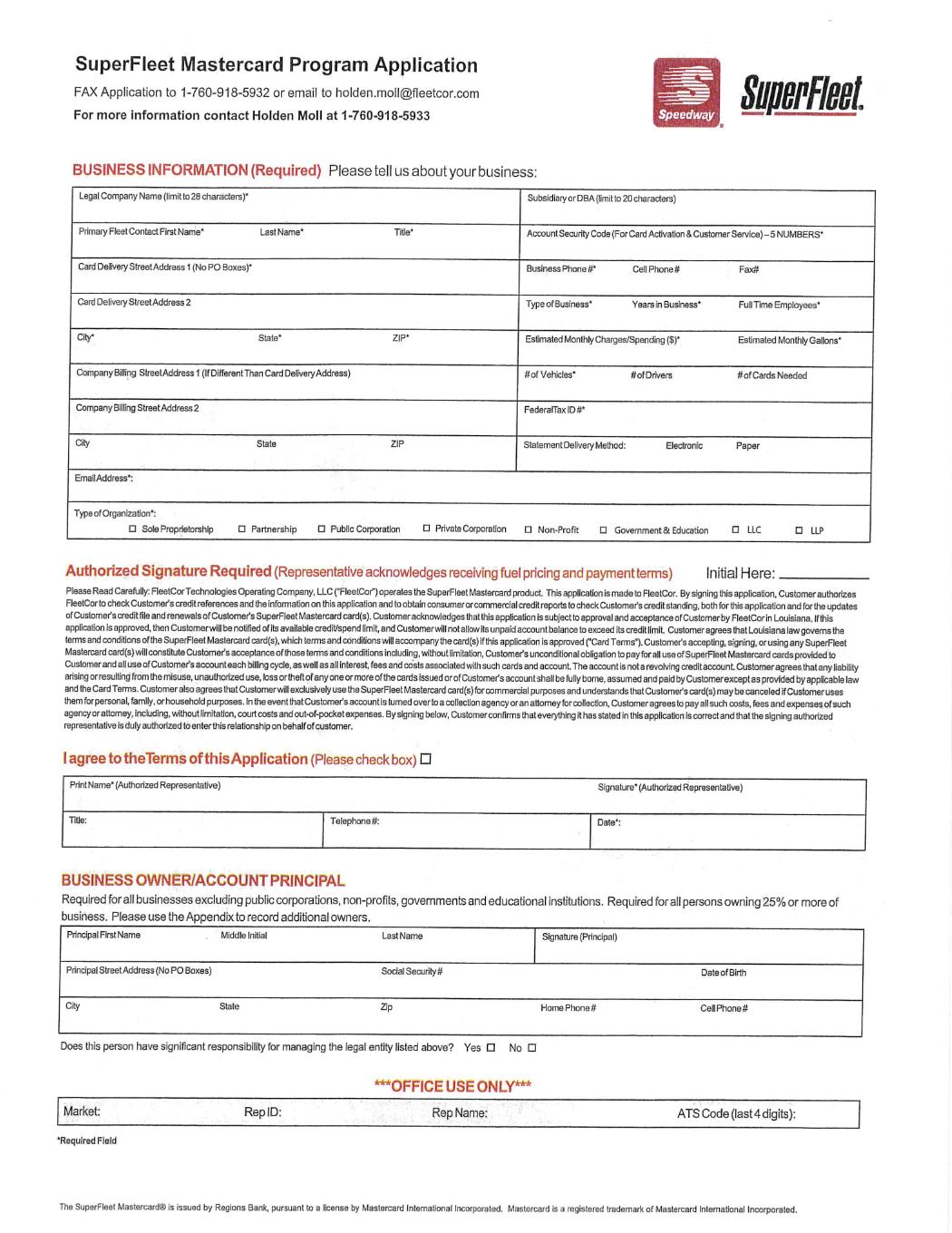

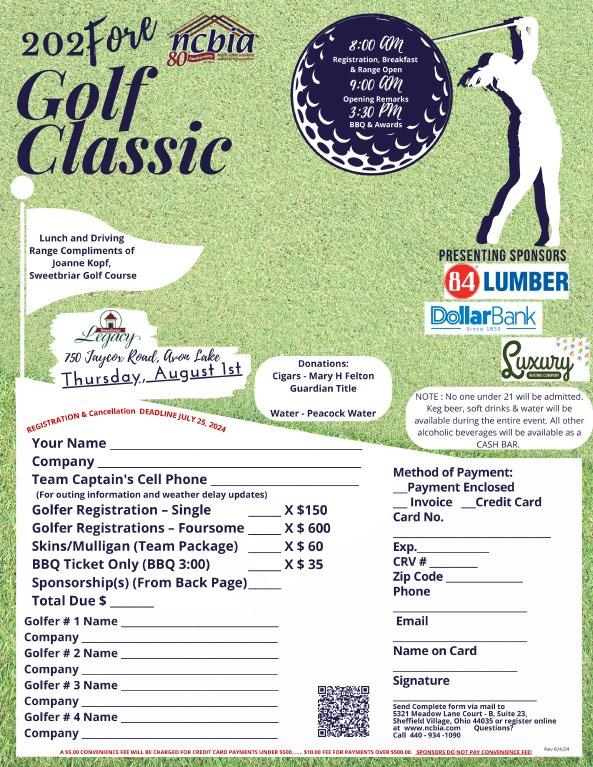

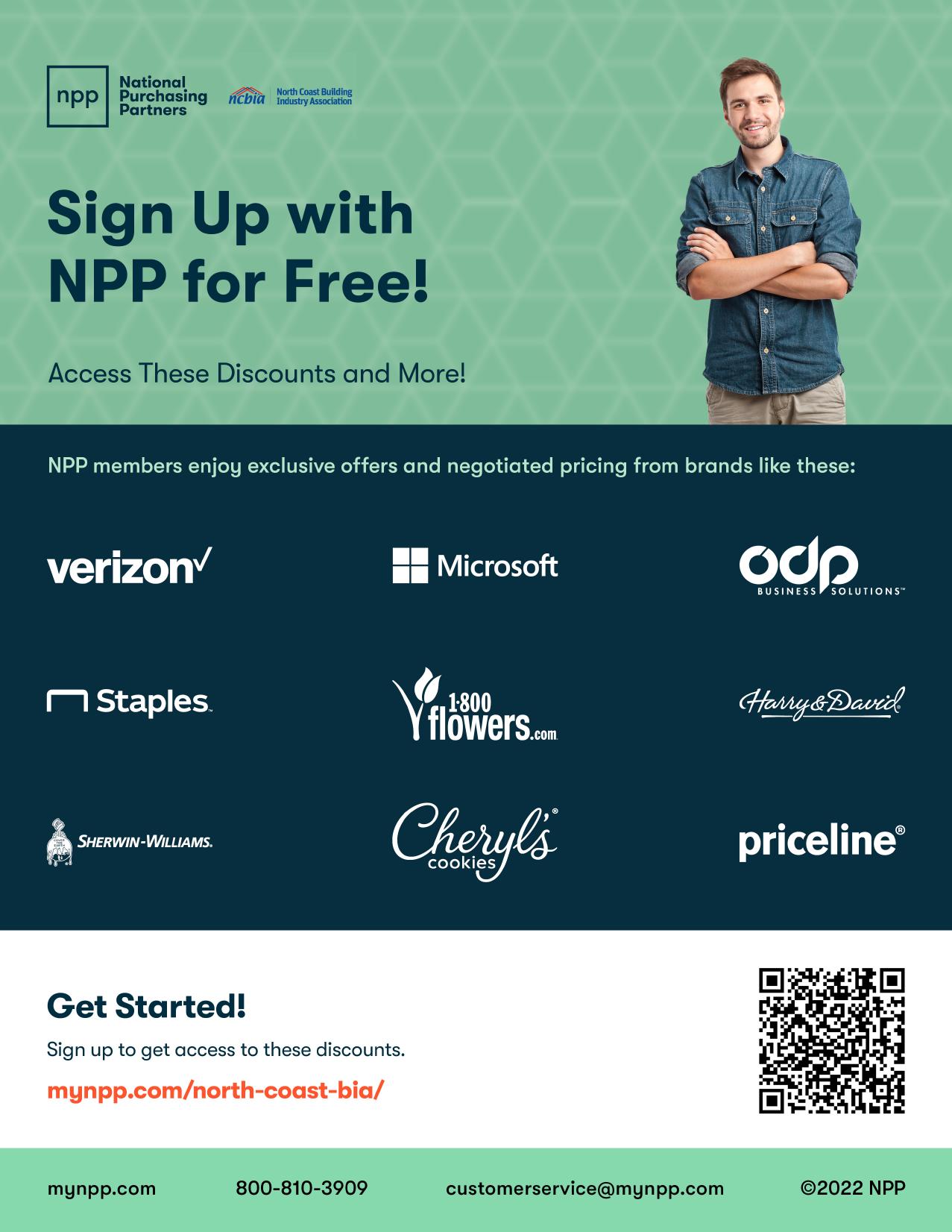

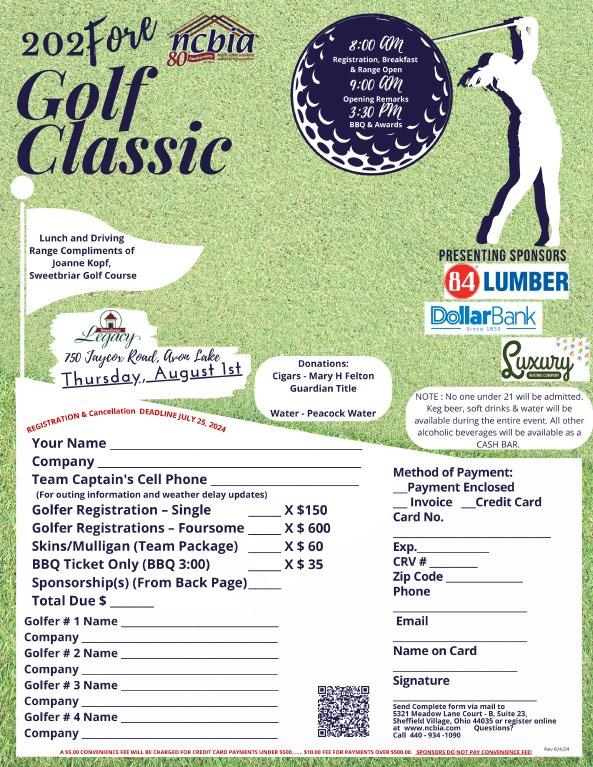

Table of Contents 6 - Menu of Services 7 - Member News 8June is National Homeownership Month - 2023-2024 NCBIA President 9Be an Engaged Partner! - Executive Officers Report 12 - Eye on Housing: Top Compromises Buyers Will Make to Reach Homeownership 13 - Eye on Housing: NAHB/Wells Fargo Debut New Cost of Housing Index 14 - Thank You SPIKES! 15 - Eye on Housing: Mortgage Activity Remains Low in May 16EO Savings Update 17Summer Member Mixer Flyer 18-19Codes Research: New Refrigerants Are (Almost) Here - What You Need to Know 20-212024 Calendar of Events 23Applying for Membership! Thanks for Renewing! Sorry to See you Go! 25Eye on the Economy: Interest Rates to Remain Higher for Longer 262024 Membership Directory 27Intro to Handshake for Employers 28 - Environmental Issues: U.S. Chamber Hosts WOTUS Roundtable One Year After Sackett Decision 30General Membership Meeting & Cookout 31OHBA Executive VP Column 32 - Eye on Housing: Private Residental Construction Spending Dips in March 33NAHB State Rep. Report 34-35NCBIA Annual Golf Classic Flyer 36-37 - Sedgwick Update 38-392025 NCBIA Home & Remodeling Show Flyer MEMBERS ONLY 40-42 - Sedgwick Update 43 - NAHB Monthly Update 44Eye on the Economy: Fed Is Set to Hold Rates Higher for Longer 45BUILD-PAC Wine Pairing Fundraising Dinner 46HBA Rebates 47 - Legislative Review 48Membership: NAHB Podcast: Jim Tobin Celebrates One Year as CEO 49Eye on the Economy: Housing Construction Cost Growth a Crucial Inflation Hurdle 50-51The Truax Article - Three of the Biggest Mistakes Home Contractors Make 52-53Spring Member Mixer Photo Gallery Thank you Sponsors! 54-58Speedway/Fleetcor Flyers May/June 2024 www.ncbia.com page 5

Dr. Dietz was an engaging speaker.

“ “

Copies Training Room

Such an interesting economic presentation, especially because of the focus on our area.

“

Blueprint/Drawing

Contact Ashlyn Bellan-Caskey at ashlynncbia@gmail.com $10 each (plus shipping, if applicable) Your New Home

Design Services Warranty Books

at ashlynncbia@gmail.com

Verizon Wireless

$10 each (plus shipping, if applicable) Your New Home

1. 22% off Verizon monthly access fees on Corporate liable lines. $34.99 or higher, 2 corporate lines required.*

2. For a limited time, save $5/month for a year on two UNLIMITED plans by Verizon Wireless: Business Unlimited Pro 5G and Business Unlimited Plus 5G.1

Verizon 5G Business Internet

1. 10-year price guarantee, one month free, and prices as low as $69/month.2 Restrictions apply.

HELP? HOW CAN WE HELP? North Coast Building Industry Association Menu of Additional Products and Services NEED SOMETHING

products

HOW CAN WE HELP? North Coast Building Industry Association Menu of Additional Products and Services NEED SOMETHING

JUST

more information on any of these products

services,

6/10/24 Color $2.82 $1.41 $0.94 Copies Training Room Design Services Warranty Books Black & White Black & White Color Color Color 25 Seats Available Graphic Design Services (8.5”x11”) (8.5”x14”) Black & White

(8.5”x11”) (8.5”x14”) (11”x17”) Single-Sided

Single-Sided

Single-Sided

Single-Sided 2-Sided $0.10 $0.20 $0.15 $0.20 $0.50 $0.25 $0.50 $0.27 $0.52 $2.00 $25 per hour

ELSE? JUST ASK! For more information on any of these

& services, please contact the NCBIA Office at (440) 934-1090 or email judie@ncbia.com

ELSE?

ASK! For

&

please contact the NCBIA Office at (440) 934-1090 or email judie@ncbia.com *Subject to change 6/10/24 *Subject to change 6/10/24

(11”x17”)

2-Sided

2-Sided

2-Sided

$50 each (plus shipping, if applicable) $35 per hour

B & W Description 24x36 / 22x34 D - Full Size $1.32 $2.82 18x24 / 17x22 C - Half Size $0.66 $1.41 12x18 / 11x17 B - Quarter Size $0.47 $0.94

Black & White Black & White Color Color Color 25

Available Graphic Design Services (8.5”x11”)

Black & White (11”x17”) (8.5”x11”) Single-Sided

Single-Sided

Single-Sided 2-Sided Single-Sided 2-Sided $0.10 $0.20 $0.15 $0.20 $0.50 $0.25 $25 per hour

Seats

(8.5”x14”)

2-Sided

2-Sided

$50 each (plus shipping, if applicable) $35 per hour Contact Ashlyn Bellan-Caskey

Blueprint/Drawing B & W Description 24x36 / 22x34 D - Full Size $1.32 $2.82 18x24 / 17x22 C - Half Size $0.66 $1.41 Color Color page 6 www.ncbia.com May/June 2024

saying:

What members are

“

“

Dr. Dietz’s presentation will help our company plan for the future.

“

Do you have some business news to share?

Business anniversaries, accomplishments, awards, publications, etc.? Send to judie@ncbia.com. We want to hear from you!

IMPORTANT NOTE: WE HAVE MOVED

Just a reminder that we moved our office location.

There have been emails and information in What’s Happening Wednesday and our Builder Newsletter sent out to employees, members, and customers regarding this move, however, this message must have slipped through some cracks and mail is still being sent to our previous address. This is causing some delays in receiving and processing payments and basically any mail correspondence to us.

Our NEW address is: 5321 Meadow Lane Court - B, Suite 23 Sheffield Village, OH 44035

Please make note of the new address and forward this to any person that will be sending your payments and correspondence.

Thank you for your support and assistance in this matter.

Sincerely,

Judie Docs

May/June 2024 www.ncbia.com page 7

JUNE IS NATIONAL Homeownership Month

Headlines across the country are highlighting the challenge of housing affordability. According to estimates from The National Association of Home Builders, more than three out of four (76.9%) U.S. households cannot afford a median-priced new home. In response, members of the residential construction industry continue to advocate for housing policies that will improve affordability in our community.

The value Americans place on owning their home continues even through challenging times. According to a recent Federal Reserve Bank of New York survey, more than two-thirds (67%) of Americans say that housing is a good investment. The sentiment among Americans is no surprise, as homeownership offers an opportunity for households to accumulate assets and build wealth over time through equity.

Each June, homeowners and home builders celebrate National Homeownership Month, bringing attention to the nearly two-thirds (65%) of Americans who own their homes and the millions more who aspire to become homeowners. Now more than ever, builders in our community are speaking up about housing affordability challenges so more families can have a place to call their own.

With a nationwide shortage of 1.5 million housing units, the lack of homes is the primary cause of growing housing affordability challenges. There is no single “silver bullet” solution to address the housing shortfall and make homes more affordable. A complex equation involving labor and materials prices; interest rates and financing costs; federal, state, and local regulations; density and growth restrictions; and supply and demand are among many factors that determine housing costs. The effort requires comprehensive strategies and a variety of tools that can be used alone or in combination to reduce costs, boost supply, and empower aspiring home buyers in our community.

Advocating for various housing policy solutions, so that owning or renting a suitable home is within reach for families in our community. One way of boosting the supply of housing available in our area is by working with local elected officials to move away from rigid zoning laws which prevent where and how many new homes can be built. For example, reducing minimum lot sizes, allowing more accessory dwelling units and prioritizing development around existing or planned transit stations can increase supply and lower overall housing costs.

Another approach to solving our community's housing affordability crisis is investing in skilled trades training. Despite the competitive pay, the residential construction industry continues to experience labor shortages, which leads to higher home building costs and construction delays. If lawmakers support funding for building and construction trades education and provide more job placement services, it will help meet the labor demands in our area.

Alleviating regulatory burdens and making sustained investments in workforce development are a snapshot of several issues our association and the National Association of Home Builders are advocating for to make the dream of homeownership a reality.

NCBIA 2023-24 PRESIDENT page 8 www.ncbia.com May/June 2024

Tim King, K. Hovnanian Homes

by Judie Docs, CSP, MCSP, MIRM, CMP, CGP

by Judie Docs, CSP, MCSP, MIRM, CMP, CGP

BE AN ENGAGED Partner

The NCBIA recognizes and understands the challenges facing our members, and we are working tirelessly on your behalf. You most likely joined because we offer development and connections with others in your field and enhance your business profile. Joining to keep abreast of the latest knowledge and practices locally, regionally, and nationally. Being involved and engaged will also assist in personal advancement.

Joining the NCBIA enables you to deepen your existing business relationships and forge new contacts. Be an active member; join a committee or step up and accept a more prominent role. You can make lasting ties with other professionals in your trade having common interests or similar concerns. The relationships are mostly rich, and an ongoing source of ideas and inspiration. These relationships are a valuable source of information and solutions when you face a challenging situation in your business. Also, the feeling that you have a support system boosts your confidence if there is a problem.

Being a partner and being engaged will help the NCBIA develop better relationships with you, but you will also interact and engage with other members. Everyone should be valued for who they are and what they bring to the table. Seeing member ’s unique contributions, recognizing, and understanding differences with mutual respect to reach common ground. We want you to feel like you are a part of this great association by learning and growing with other like-minded members.

Look in your email inbox; the NCBIA staff and leadership have been relentless in researching timely, relevant information to help our members. Our What’s Happening Wednesday, Builder Newsletter and other important emails contain valuable information to help you and at times requests to help us as well.

Refer to our 2024 Marketing Guide to see how we can help you market your company to other members as well as consumers, and in turn your investment will help us continue our work.

My confidence in the value of membership is unwavering. Whether in the past or today we will remain laser-focused on meeting the needs of and advocating for members and our community.

We will continue to concentrate on our mission “The North Coast Building Industry Association is dedicated to the advancement of the building industry, its members, and the communities it serves,” and provide unparalleled support for our members and strengthen our interest now and in the future.

We look forward to our continued partnership. If there are additional ways, we can help you and your business or how we can be more engaged, please contact me at 440.934.1090 or judie@ncbia.com

Thank you for your commitment and partnership. Our association is strong because of you.

May/June 2024 www.ncbia.com page 9

EXECUTIVE OFFICER’S REPORT

page 10 www.ncbia.com May/June 2024

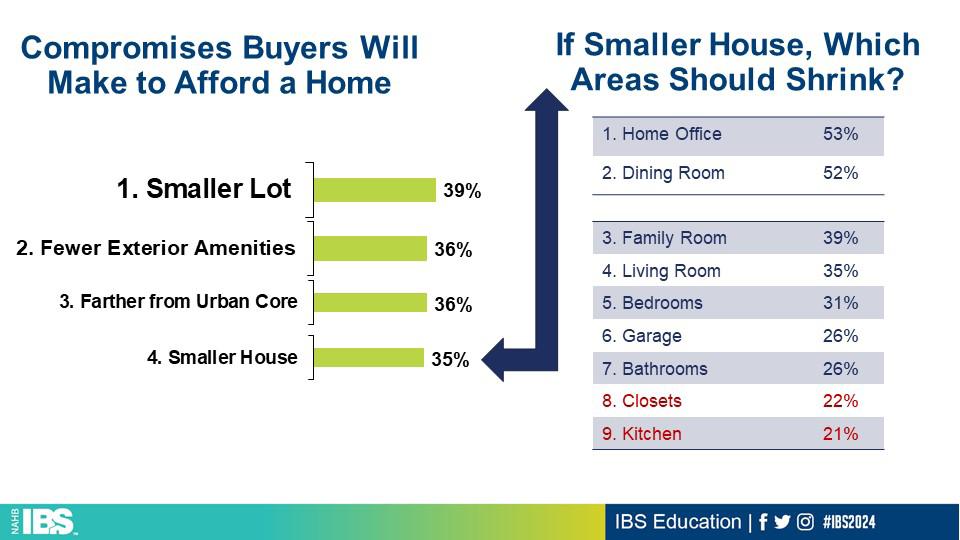

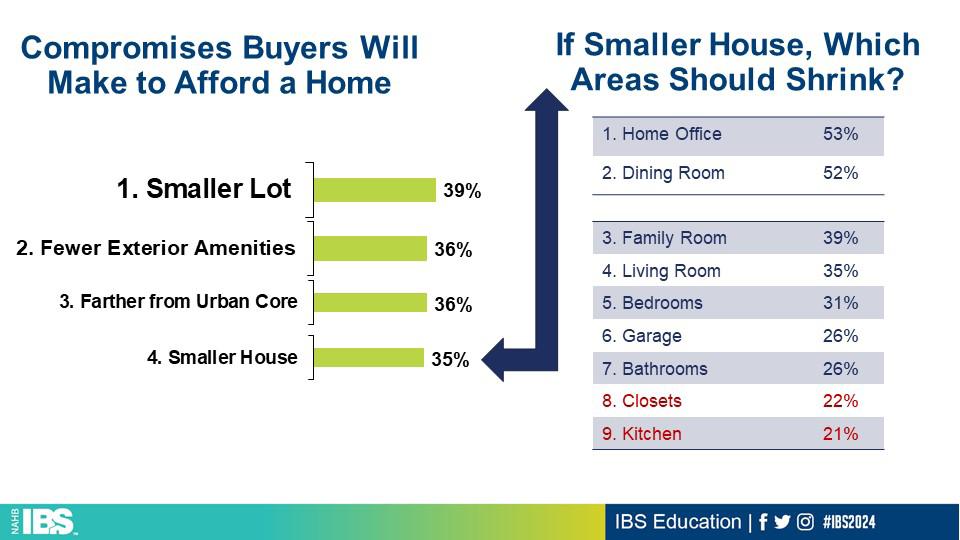

TOP COMPROMISES BUYERS WILL Make to Reach Homeownership

High mortgage rates and double-digit growth in home prices since COVID-19 have brought housing affordability to its lowest level in more than a decade. Given this reality, a recent NAHB study on housing preferences* asked home buyers about which specific compromises they would be willing to make to achieve homeownership.

For 39% of buyers, accepting a smaller lot is the path to affording a home. This finding highlights the paramount importance of reforming zoning laws that mandate lot sizes, as nearly 4 out of 10 buyers would be willing to give up land in exchange for owning a home. For 36% of buyers, accepting fewer exterior amenities is the way to homeownership—they will simply add that deck or patio at some point in the future. Another 36% were willing to move farther from the urban core and 35% will accept a smaller house if that’s what it takes to buy it.

But what areas of the home, specifically, should shrink to reduce the overall footprint of the home? Most buyers who will take the smaller house compromise sent builders and architects a clear message: shrink the home office (53%) and the dining room (52%) to save on square footage. Also, loud and clear in the message: leave the kitchen (only 21% would want that smaller) and closet space (22%) alone.

BY: ROSE QUINT

* What Home Buyers Really Want, 2024 Edition sheds light on the housing preferences of the typical home buyer and is based on a national survey of more than 3,000 recent and prospective home buyers. Because of the inherent diversity in buyer backgrounds, the study provides granular specificity based on demographic factors such as generation, geographic location, race/ethnicity, income, and price point.

EYE ON HOUSING

page 12 www.ncbia.com May/June 2024

EYE ON HOUSING NAHB/WELLS FARGO DEBUT New Cost of Housing Index

Anew quarterly Cost of Housing Index (CHI) highlights the burden that housing costs represent for middle and low-income families. In its inaugural release for the first quarter of 2024, CHI revealed that a typical family in the U.S. must spend 38% of its income to cover the mortgage payment on a median priced new single-family home. Low-income families, defined as those earning only 50% of median income, would have to spend 77% of their earnings to pay for the same new home. The figures track closely for the purchase of existing homes in the U.S. as well. A typical family would have to pay 36% of its income for a median-priced existing home, while a low-income family would need to pay 71% of its earnings to make the same mortgage payment. CHI results in the first quarter are based on a national median new home price of $420,800 and median income of $97,800. The corresponding price for an existing home is $389,400.

Additionally, CHI breaks down the percentage of a family’s income needed to make a mortgage payment on an existing home in 176 metropolitan areas based on the local median home price and median income. Percentages are also calculated for low-income families in these markets. In eight out of 176 markets in the first quarter, the typical family is severely cost-burdened (must pay more than 50% of their income on a median-priced existing home). In 80 other markets, such families are cost-burdened (need to pay between 31% and 50%). There are 88 markets where the CHI is 30% of earnings or lower.

The Top Five Severely Cost-Burdened Markets

San Jose-Sunnyvale-Santa Clara, Calif. was the most severely cost-burdened market on the CHI, where 84% of a typical family’s income is needed to make a mortgage payment on an existing home. This was followed by:

• Urban Honolulu, Hawaii (73%)

• Naples-Marco Island, Fla. (71%)

• San Diego-Chula Vista-Carlsbad, Calif. (70%)

• San Francisco-Oakland-Berkeley, Calif. (69%) Low-income families would have to pay between 138% and 168% of their income in all five of the above markets to cover a mortgage.

BY: ROSE QUINT

The Top Five Least Cost-Burdened Markets

By contrast, Peoria and Decatur, Ill. tied as the least costburdened markets on the CHI, where families needed to spend just 14% of their income to pay for a mortgage on an existing home. Rounding out the least burdened markets are:

• Cumberland, Md.-W.Va (15%)

• Springfield, Ill. (16%)

• Elmira, N.Y. (16%)

Low-income families in these markets would have to pay between 28% and 32% of their income to cover the mortgage payment for a median-priced existing home.

Visit nahb.org/chi for tables and details.

May/June 2024 www.ncbia.com page 13

THANK YOU SPIKES!

STATESMAN SPIKE (500-999 SPIKE CREDITS) Bob

SUPER SPIKE (250-499 SPIKE CREDITS)

Terry

Dave

Chris

GREEN SPIKE (50-99 SPIKE CREDITS)

Jim

Chris Mead Maloney & Novotny, LLC

Jeremy Vorndran ......... 84 Lumber ....................................................

LIFE SPIKE (25-49 SPIKE CREDITS)

Tim King K. Hovnanian Homes

BLUE SPIKE (6-24 SPIKE CREDITS)

John Toth Floor Coverings International

Chris Collins Carter Lumber

Mark McClaine 84 Lumber

Ken Cassell ................... Cassell Construction...................................

Dave LeHotan .............. All Construction Services ..........................

John Blakeslee Blakeslee Excavating, Inc

Ashley Oates 84 Lumber

Scott Kosman Lakeland Glass 9.50

Tim Hinkle Green Quest Homes 6.50

Jim Tipple Maranatha Homes 6.50

Lindsay Yost Bott......... Dale Yost Construction .............................. 6.00

Mike Meszes ................ DRC Construction ...................................... 6.00

page 14 www.ncbia.com May/June 2024

Our

SPIKES are Our FOUNDATION

Yost

Dale Yost Construction .............................. 698.25 Mary

Guardian Title

543.00

........................

H. Felton.............

.............................................

Bennett Bennett Builders & Remodelers 303.75

Kousma Kousma Insulation 297.50 Chris Majzun Jr. .......... Majzun Construction Co............................ 276.00 Sara Majzun ..................... Majzun Construction Co............................ 267.50

Perritt Perritt Building Co 225.50 Jeff Hensley Lake Star Building & Remodeling 186.25 Randy K. Strauss Strauss Construction 180.50 Tom Lahetta ................. Tom Lahetta Builders ................................. 173.50

Jack

ROYAL SPIKE (150-249 SPIKE CREDITS) Bill

RED SPIKE (100-149 SPIKE CREDITS)

Linna Sr. Linna Homes & Remodeling 138.50

Scott Greyhawk Holdings, LLC 137.00 Thomas Caruso Caruso Cabinets 117.75 Patrick Shenigo ............ ShenCon Construction, LLC ..................... 111.00 Tom Sear ....................... Ryan Homes ................................................ 110.75

Jason

Majzun Sr. .......... Majzun Construction Co............................ 107.00

99.00

Sprague Maloney & Novotny, LLC

79.00

70.00

Aaron Kalizewski ........ Grande Maison Construction....................

63.00

55.00

Liz Schneider Dollar Bank

49.50

30.50

27.50

Steve Schafer ................ Schafer Development .................................

John Daly ...................... Network Land Title ....................................

17.00

16.00

14.00

13.50

12.00

11.50

10.00

EYE ON HOUSING

MORTGAGE ACTIVITY REMAINS Low in May

The Market Composite Index, a measure of mortgage loan application volume by Mortgage Bankers Association’s (MBA) weekly survey, has been hovering around 200 since October 2022 as higher mortgage rates and low resale inventory continue to hamper potential buyers.

On a week-over-week change, total mortgage, purchasing, and refinancing activities decreased 5.2%, 4.4% and 6.8%, respectively, on a seasonally adjusted basis. However, when comparing the overall market index for this month, May decreased by 8.4% from last year, reflecting current housing affordability issues . Further highlighting these challenges, the Purchase Index has also declined by 14.5% while the Refinance Index increased 5.3% from last May.

Higher mortgage rates are a key factor behind the slowdown in mortgage activity with the 30-year fixed mortgage (FRM) rate for the week ending May 31 at 707 basis points (bps), 16 bps higher than the rate same time last year.

Despite these higher rates, May’s average loan sizes for purchasing and refinancing have remained stable compared to last year at around $438,000 and $258,000 respectively. This indicates fewer buyers are entering the market due to many being priced out, while those who are purchasing homes are buying them at a higher price. In contrast, the average loan size for an adjustable-rate mortgage (ARM) increased by 20.7%, from $831,600 to $1 million.

BY: CATHERINE KOH

May/June 2024 www.ncbia.com page 15

page 16 www.ncbia.com May/June 2024

CODES RESEARCH

TNEW REFRIGERANTS ARE (ALMOST) HERE -

What You Need to Know

BY VLADIMIR KOCHKIN

he HVAC industry is beginning to transition to new refrigerants required by the American Innovation and Manufacturing Act of 2020, which gradually phases down the use of existing classes of refrigerants and establishes new requirements for the refrigerants used in air conditioners and heat pumps. The new class of refrigerants has a lower global warming potential than current ones.

As part of this transition, the U.S. Environmental Protection Agency (EPA) has set transition dates for new equipment required to use new refrigerants, commonly referred to as A2Ls.

Residential and light commercial air conditioners and heat pumps manufactured after Jan. 1, 2025, must use the new refrigerant. The equipment manufactured prior to this date has a one-year grace period to be installed — a Jan. 1, 2026, installation deadline.

For products that do not require field assembly, such as window air conditioning units, the rules establish the final date of sale as three years after the manufacture compliance date — a Jan. 1, 2028, sale deadline — without a compliance date for installation.

EPA is evaluating an extension of transition dates by one year only for Variable Refrigerant Flow (VRF) systems with capacities of 65,000 BTU/h (19 kW) or more.

Existing air conditioning and heat pump equipment is not subject to EPA regulations and can continue to be used through equipment end-of-life. Components used for servicing and repair also are not subject to EPA regulation. The supply of R-410A, R-134a, and other refrigerants to meet servicing needs will remain available for the foreseeable future even as overall production and imports decline through the middle of the next decade, as was the case in prior refrigerant transitions in the 1990s and early 2000s.

How A2Ls are Different

All refrigerants are required to be classified by toxicity and flammability. A2Ls retain the same toxicity designation — non-toxic — as their predecessor (R-410A). However, the flammability has been reclassified as Class 2L (lower flammability), compared to Class 1 (no flame propagation) for R-410A.

A2L refrigerants require redesign of the HVAC equipment. It is important that home builders actively begin to plan for the transition and engage with their suppliers and installers to ensure an adequate pipeline of equipment in the upcoming months and to avoid potential bottlenecks, delays and last-minute change orders. Each equipment manufacturer will have their own roll-out strategy and timeline, but these changes are imminent and will happen over the coming months.

To address the slight increase in flammability, equipment manufacturers are adding safety features to equipment, revising transportation and handling procedures, and updating installation instructions.

Primary mitigation measures for the building include:

1. Minimizing the risk of refrigerant leaks by requiring enhanced testing of refrigerant lines using both pressure and vacuum methods, requiring specific joint types, and requiring nail plates at framing members where lines running through, and

2. Controlling the refrigerant concentration in the building in a potential leakage scenario to levels below the flammability limit.

In many cases, equipment manufacturers will add a leak detection sensor installed in the air handler unit and programmed to activate the main fan to quickly circulate the air throughout the home to reduce refrigerant concentration. Other safety strategies can include the use of shut-off valves also activated by leak sensors and designed to limit the quantity of the refrigerant that can leak out. For systems without leak detection sensors, the quantity of the refrigerant in the system, including the lines, will need to be sized more carefully such that a refrigerant leak into the smallest space (e.g., bathroom) directly served by the system would not exceed the established concentration limit.

Additional documentation requirements include a permanent label on the equipment listing the company that installed the system and the weight of the installed refrigerant. Although there are several A2L refrigerants approved for use, the primary two refrigerants that you should expect in the market are R-32 and R-454B. Each equipment manufacturer will specify which refrigerant is used for their equipment.

Multifamily Buildings

For multifamily buildings where refrigerant lines penetrate fire-rated floor assemblies, the building code may require that the refrigerant lines be placed in a fire-rated shaft or other fire safety measures be implemented. Developers should coordinate designs with their MEP firms. The shaft requirements can impact plan layouts and architectural designs.

Centrally Ducted System vs. Mini Splits

Different mitigation strategies will be specified for centrally ducted systems vs. mini splits. Again, builders should reach out to their vendors for information and follow installation instructions to make sure all required safety measures are implemented so that concentration limits are not exceeded in case of a refrigerant leak.

page 18 www.ncbia.com May/June 2024

NEW REFRIGERANTS ARE (ALMOST) HERE - What You Need to Know ( Cont.)

Design Software

Software programs for sizing equipment and for energy modeling should use updated specifications for the new equipment with A2L refrigerants.

What Should Home Builders Do Right Now

Have a transition plan in place that achieves the following goals:

• Coordinate a switch-over timeline with vendors and installers.

• Ensure a sufficient pipeline of existing equipment before the switch-over and new equipment after the switch-over (old and new equipment will not be compatible unless specifically stated by the manufacturer)

• Coordinate with your mechanical system designer (for multifamily buildings, evaluate if a fire-rated shaft is required)

• Make sure your HVAC contractor is knowledgeable on the new installation requirements and safety measures for the specific equipment that will be installed in your homes.

• Ensure that installation instructions are available from the manufacturer for the specific units to be installed in your homes.

• Coordinate between all involved parties throughout the process and establish a direct feedback loop.

Building Code Updates

Information about the status of building codes regarding A2L refrigerants in each state can be found using this interactive map from the Air-Conditioning, Heating, and Refrigeration Institute (AHRI).

Additional Resources from EPA, AHRI and ICC

Technology Transitions HFC Restrictions by Sector | US EPA

Frequent Questions on the Phasedown of Hydrofluorocarbons | US EPA

Safe Refrigerant Transition | AHRI (ahrinet.org)

A2L Refrigerants Transition | ICC (iccsafe.org)

BY VLADIMIR KOCHKIN

May/June 2024 www.ncbia.com page 19 CODES RESEARCH

Exclusive Entertainment Discounts! Members have access to huge savings on nationwide entertainment through MemberDeals. Find exclusive discounts, special offers, preferred seating, and tickets to top attractions, theme parks, shows, sporting events, hotels, and much more.

Save up to 40% on Top Theme Parks Nationwide

Save up to 60% on Hotels Worldwide

Save up to 40% on Top Las Vegas & Broadway Show Tickets • Huge Savings on Disney & Universal Studios Tickets • Preferred Access Tickets™ Find great seats to your favorite concerts, sports and more! Please visit https://memberdeals.com/nahb/?login=1

•

•

•

Kevin Flanigan, Shamrock Development Company

James Phillips, The Phillips Company

George Douzos, 5D Construction, LLC.

David Heider, 84 Lumber

Matt Smith, Hometown Electrical Doctor

Eddie James, James Home Construction, LLC.

Jim Berlekamp, Kitchen Tune-Up (Cleveland West)

Jeff Hensley, Lake Star Building & Remodeling

Dave Linna Sr., Linna Homes & Remodeling

Jon Sherer, Paraprin Construction, LLC.

John Eavenson, Perpetual Development

Jason Rodriguez, The S.J.R. Building Company

Nelson Agency, Inc.

4th St., Elyria, OH 44035

Fax: 440-323-8055 Drywallersinsurance1@prodigy.net A member of: Theresa Riddell (440) 420-1175 tmycps@oh.rr.com -ORBrett Adams (419) 515-0506 adamsb@sprouseagency.com

Phil Truax, Truax Law Group, LTD.

Thanks for Renewing!

Sorry to See You Go! Bob Goede, Bosh Housing Group Dan Brunner, Personal Lawn Care May/June 2024 www.ncbia.com page 23 Applying

for Membership

© 2019 Hastings Mutual Insurance Company SS-1 (10/19) Select Contractors Building Your Business (800) 442-8277 www.hastingsmutual.com 404 E. Woodlawn Ave. Hastings, MI 49058 For more information contact: Broadened Coverage This coverage helps if there’s damage to property used by you or your employees that belongs to someone else. It has a limit of $2,500 per occurrence, with a $100 deductible. Builders Risk and Installation Floater “Floater” coverage is for anything that oats, or moves from place to place — like your supplies and machinery. It also covers damage to the structures you’re working on, including scaffolding, foundations, and more. This has a limit of $5,000, with a $250 deductible. Portable Tools Coverage on your tools has a limit of $1,000 per tool, to a maximum of $2,500. It also has a $500 deductible. The information referred to is not a policy. Refer to your policy for speci c coverage. The

116

Phone: 440-323-8002

Do you want to opt-out of our referral program? Just email judie@ncbia.com page 24 www.ncbia.com May/June 2024

EYE ON THE ECONOMY

INTEREST RATES TO REMAIN Higher for Longer

Interest rates moved higher in recent weeks because of disappointing progress for inflation data and solid labor market reports. In fact, Fed Chairman Powell noted this week that there has been a “lack of further progress so far this year on returning to our 2% inflation goal.” These offsetting factors — higher interest rates on the negative side but supportive macro conditions — left builder sentiment flat in April.

The benchmark 10-year Treasury rate has increased by more than 30 basis points since the start of April, placing long-term interest rates at their highest level since early November of last year. In turn, the average 30-year fixedrate mortgage has increased to almost 6.9%, per Freddie Mac in last week’s data. Mortgage rates have crept higher because of concerns that inflation reduction progress has stalled in recent quarters, but they are still well below last fall's highs when they approached 8%.

The year-over-year pace for inflation ticked up to 3.5% in March, still too far from the Fed’s 2% target. The shelter inflation component (i.e., housing) remains a leading source of cost pressure at a 5.7% year-over-year gain. The best way to reduce shelter inflation is with additional supply of affordable, attainable housing which is, for the most part, out of the Federal Reserve’s control. An NAHB estimated index of residential construction costs shows why housing costs continue to rise, with building material costs up 2.2% year over year in March. Gypsum prices reached a new high in March, up more than 2% in just that month alone.

Wages in home building are also increasing as the labor market remains tight. Residential construction wages were more than 6% higher than a year ago as of March, with this pace of growth accelerating over the last eight months. In February, there were 441,000 unfilled construction sector positions, the rate of which has been trending higher since March of 2023 as builders increased labor demand with expectations of improving construction conditions in 2024. Over the last year, home builders and remodelers added 78,800 jobs on a net basis to the industry’s workforce, which now totals 3.3 million. Aggregate U.S. labor data remains tight as well, which represents an inflation risk to the Fed. Total nonfarm payroll employment increased by 303,000 in March, with the unemployment level at just 3.8%.

BY: DR. ROBERT DIETZ

Because of the offsetting factors of higher interest rates and positive labor market conditions that support demand for new housing, the NAHB/Wells Fargo Housing Market Index, a key measure of home builder sentiment, was flat at a level of 51 in April. This relatively neutral reading of sentiment suggests the industry is set to expand construction volume later in 2024 provided interest rates move lower on improved inflation data. Fundamentally, housing itself will help this process, because as more apartments are supplied to the market, rent growth will slow, which will lower the growth rate for shelter inflation and bring overall consumer inflation closer to the Fed’s 2% target. Remodeling sentiment, as measured by the NAHB Westlake Royal Remodeling Market Index, remained positive at a level of 66 in the first quarter, indicating ongoing favorable home improvement market conditions.

Nonetheless, higher rates this spring had an effect on the construction data in March. Single-family starts decreased 12.4% to a 1.02 million seasonally adjusted annual rate. The multifamily sector, which includes apartment buildings and condos, decreased 21.7% to an annualized 299,000 pace. While apartment construction starts are down, the number of completed units entering the market is rising as a result of the previously elevated construction levels. The pace of completions for apartments in buildings with five or more units is up 27.4% for the first quarter of 2024 compared to the first quarter of 2023. A higher pace of completions in 2024 for multifamily construction will place some downward pressure on rent growth and help ease shelter inflation.

May/June 2024 www.ncbia.com page 25

Intro to Handshake for Employers Spring 2023 Your One Stop for Tile, Cabinetry, and Countertops Avon Lake: 440.934.1751 Brooklyn Heights: 440.799.8285 Canton: 330.456.8408 Willoughby: 440.373.1195 www.sims-lohman.com Lorain Community College Handshake Program for Employers For more information contact: Cynthia Kushner (ckushner@lorainccc.edu) Michelle Pawlak (mpawlak@lorainccc.com) Hannah DiVencenzo (hdivencenzo@lorainccc.edu

ENVIRONMENTAL ISSUES

U.S. CHAMBER HOSTS WOTUS ROUNDTABLE One Year After Sackett Decision

Vincent E. Messerly, PE, President - Stream + Wetlands

On May 29, 2024, the U.S. Chamber of Commerce hosted a policy roundtable examining how the waters of the United States (WOTUS) final rule is being implemented by the Environmental Protection Agency (EPA) and the Army Corps of Engineers (Corps) one year after the U.S. Supreme Court’s Sackett v. EPA ruling on May 23, 2023. Since then, there has been:

• Temporary suspension by the Corps of the Clean Water Act (CWA) 404 permitting program, which has resulted in a nationwide backlog of more than 4,000 projects seeking either CWA 404 wetlands permits or approved jurisdictional determinations (AJDs),

• Issuance of a joint direct-final-rule Conforming Rule by EPA and Corps that went into effect Sept. 8, 2023,

• Establishment by EPA and the Corps of an internal interagency review process of all pending AJDs impacting adjacent wetlands and isolated features under the Conforming Rule, and

• Submittal by NAHB, other industry groups, and several states of requests for information, under the Freedom Of Information Act (FOIA), concerning how EPA and Corps staff are implementing the Conforming Rule. In addition, because of ongoing litigation brought against the final Conforming Rule by NAHB and other industries, more than half the states adhere to the pre-2015 regulatory regime, leaving just 23 states complying with the Conforming Rule.

The May 29 roundtable highlighted the challenges and practicalities of implementation, including how the Corps is processing AJDs. At least one Corps district — Chicago District — no longer offers standalone AJDs, resulting in NAHB members seeking jurisdictional determinations to first submit a completed CWA 404 wetland permit application to the Corps. Speakers at the roundtable explored what is needed for more timely and predictable permitting decisions, and identified what is raising the costs, impacts and unintended consequences on stakeholders for compliance.

Stacey Jensen, division director for wetlands protection, and Russ Kaiser, acting director for the Office of Oceans, Wetlands, and Communities Division in the EPA Office of Water, participated in the event. Kaiser and Jensen highlighted the EPA’s role in implementing WOTUS to deliver essential protections safeguarding the nation’s waters from pollution and degradation. EPA staff emphasized that the regulated public should be aware that the field memos implementing the WOTUS definition are applicable nationwide. Builders should be aware of what these memos say because Corps field staff will use them when their project is similar to the one addressed in the memo.

Trade associations representing state governments also participated in this event. They primarily emphasized the need for bright-line tests to make their permitting programs effective. Several states with wetlands permitting programs rely on AJDs provided by the Corps to determine what wetlands are federally regulated to determine and what type of wetlands are protected under state wetlands programs. The EPA and Corps have failed to give the states the clarity and certainty they need to implement their programs. It’s clear from the state and local governments that they need to know where the federal authority ends and their authority begins.

Vince Messerly, vice chairman of the NAHB Environmental Issues Committee, spoke during the business panel with representatives from the American Road & Transportation Builders Association (ARTBA) and the National Sand, Stone, and Gravel Association (NSSGA). Unfortunately, the EPA staff left the event before the business panel could present WOTUS's impact on the national economy and the respective industries represented.

As part of the discussion, Messerly emphasized that the agencies must be more transparent about which types of non-adjacent wetlands and ephemeral features are no longer regulated under the CWA because of Sackett. He also emphasized the necessity of standalone AJDs to developers and home builders to avoid impacting CWA jurisdiction features before seeking CWA 404 wetlands permits and thereby avoiding potential wetland mitigation costs.

He further emphasized the need for clear definitions from the agencies to comply with the Sackett decision. Although EPA staff had left, Messerly encouraged the agencies to meet with home builders and environmental consultants to “help us help you.”

More information and resources are available on nahb. org.

page 28 www.ncbia.com May/June 2024

YES VIRGINIA, REMODELING IS CONSTRUCTION

Absurd as it appears, an Ohio Court of Appeals ruled that remodeling a home is not construction. How could that be? In the opinion, the court engaging in some poorly imagined legal gymnastics, reached that conclusion. A well written dissent was persuasive though totally ignored by the majority. Sadly, the ruling cast a cloud of concern over all builders who remodel homes.

A few years ago, OHBA was successful in rewriting some prior rulings that construction of a home, whether a remodel or new build, was a service thus subject to the Consumer Sales Practice Act. That Act, the CSPA, contained many provisions which could lead to treble (triple) damages for innocent acts and with no real damages to the structure. After a few absurd rulings and million-dollar judgements against builders (in most cases there was no damage or issues with the home); The General Assembly enacted corrective measures, we lobbied for. Treble damages and a few other troubling sections were repealed and construction projects under $25,000 remained under the CSPA.

Correcting this flawed error was our top priority to remove the dark cloud hanging over any and all remodel projects in the state. With passage of HB 50, a corrective amendment we wrote was enacted in the law thus providing safeguards for all builders from frivolous lawsuits.

By the way, we were also able to amend a prior enactment providing equity in the taxation of newly developed residential lots. The tax department and school boards resisted in ways which could have denied relief as enacted by the legislature for up to three years. A companion amendment along with the above-mentioned correction was included in HB 50.

We have stated many times the proper and equitable taxation of newly developed lots is the surest and fastest way to increase the badly needed supply of sites to build homes and help ease the housing deficit crisis i n Ohio.

Thanks to your officers who spend many hours with us here supporting these meaningful efforts. They made this happen for you. That is what OHBA, and our affiliation is all about.

Ohio Home Builders Association

Phone- 614/228-6647

OHBA EXECUTIVE VP COLUMN

by Vincent J. Squillace, CAE, OHBA Exec. VP

May/June 2024 www.ncbia.com page 31

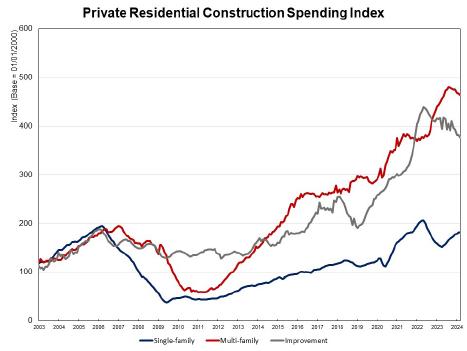

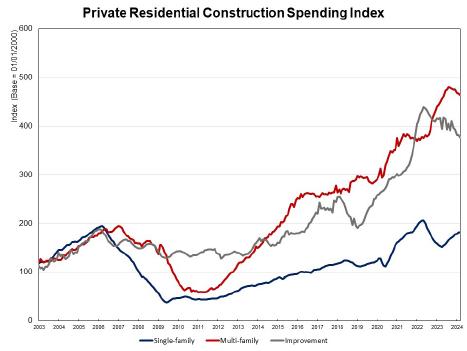

PRIVATE RESIDENTIAL CONSTRUCTION Spending Dips in March

NAHB analysis of Census data shows that private residential construction spending was down 0.7% in March, after increasing 0.7% in February. It stood at a seasonally adjusted annual pace of $884.3 billion.

Spending on single-family construction dropped 0.2% in March. This is the first monthly decline after ten straight months of gains, as elevated mortgage interest rates have cooled the housing market. Compared to a year ago, spending on single-family construction was 18.3% higher.

Multifamily construction spending declined 0.6% in March after a dip of 0.3% in February. However, spending on multifamily construction was 3.5% higher than a year ago, as a large stock of multifamily housing is under construction Nonetheless, multifamily construction spending will decline in the quarters ahead after an elevated level of apartments under construction is completed. Private residential improvement spending fell 1.6% in March after staying flat in February. It was 9.9% lower compared to a year ago.

The NAHB construction spending index is shown in the graph below (the base is March 2000). The index illustrates how spending on single-family construction experienced solid growth since May 2023 under the pressure of supplychain issues and elevated interest rates. Multifamily construction spending growth was almost unchanged in the last three months, while improvement spending has slowed since mid-2022.

BY ROBERT DIETZ

BY ROBERT DIETZ

Spending on private nonresidential construction was up 11.1% over a year ago. The annual private nonresidential spending increase was mainly due to higher spending for the class of manufacturing ($45.6 billion), followed by the power category ($0.6 billion).

EYE ON HOUSING

page 32 www.ncbia.com May/June 2024

May/June 2024 www.ncbia.com page 33

TWO DAY SHOW!!!!!

EXHIBITOR CONTRACT

Company Name (as it will appear in show) __________________________________________

Contact Person (print) _________________________________________________________ Cell # _______________________________________________________________________

Primary Product(s)/Service(s) ___________________________________________________

Email address __________________________

Booth spaces are LIMITED and available on a 1st Come, 1st Served Basis! 2024 SOLD OUT - Act now to secure your booth!

BOOTH INFORMATION

Electric is optional and available on a 1st Come, 1st Served Basis!

Will you need electricity? _______ YES _______ NO ______# of Booth Spaces ____________TOTAL AMOUNT DUE

I understand that I have contracted for exhibit space by signing this contract and I am liable for the full cost of the booth space. I also understand that the final location of space will be determined by show management when payment is made in full. The undersigned represents that he/she is fully authorized to execute and complete this agreement. The undersigned also understands and agrees to the rules and regulations on the reverse side of this contract.

Authorized Exhibitor Signature

PAYMENT METHOD:

Please Indicate how you would like to pay for your booth space.

Printed Name ___Invoice ___Check Enclosed ___VISA/MC/AMEX/DISC*

*If you select credit card, our office will call for your card information.

Please send completed form to Judie@ncbia.com or 5321 Meadow Lane Court - B, Suite 23 Sheffield Village, OH 44035

Event Sponsors: **A $5.00 Convenience Fee will be charged for all Credit Card Payments

Available Call for More Info! Showcase Your Business Over 1000 Local Consumers Expected Our Biggest Consumer Event of the Year!

Questions? Contact the NCBIA at (440) 934-1090 Spitzer Conference CenterLorain County Community College 1005 North Abbe Road, Elyria Rev. 6/4/2024 Bag Sponsor: Supporting Sponsors: Saturday, March 15th 9-5 Sunday, March 16th 10-3

Sponsorships

$299 Booth Space - MEMBERS ONLY AFTER July 16 2023, $399 SPECIAL EARLY BIRD PRICING FOR MEMBERS ONLY (SAVE $100)! Direct Sales Booth- $159

RULES AND REGULATIONS GOVERNING EXHIBITS

MANAGEMENT: The North Coast Building Industry Association (NCBIA) shall be deemed Event Management and shall have all rights thereto assigned. (From here on the North Coast Building Industry Association will be referred to as NCBIA).

CHARACTER OF EXHIBITS: NCBIA reserves the right to approve all exhibits. The exhibits and the distribution of promotional material shall be limited to the confines of the Exhibitor’s space. Under no circumstances shall any Exhibitor be permitted to attract attention to his/her exhibit in such a way as to distract or interfere with the other exhibitors.

REGISTRATION: Exhibitors and their employees at the Event should wear a registration badge and/or tag for proper identification.

SET UP/REMOVAL OF EXHIBITS: All exhibits must be placed and ready at the opening of the show and no movement of exhibits will be permitted until after the close of the show. Exhibits must remain intact until after closing of the show and be removed within such time as may be specified by the NCBIA. Strict compliance with move in and move out times is mandatory. A fine for late move in and/or early move out will be assessed at the discretion of the NCBIA.

RAFFLES: Exhibitors are encouraged to conduct games, lotteries and/or similar activities to increase patron participation, so long as it does not interfere with the other exhibitors.

CARE OF EXHIBITS/AISLES: Aisles must be kept clear at all times. Seating for buyers must be confined within the exhibitor’s space. Exhibitors are requested at all times to cooperate with the NCBIA in maintaining all exhibits in appropriate condition.

*In the event that the Exhibitor does not exhibit as provided herein or fails to comply in any respect with the terms of this agreement, the NCBIA management shall have the right without notice to the Exhibitor, to license the use of said space to any other company, enterprise, person or persons and the Exhibitor agrees to pay any deficiency, loss and/or damage sustained by the NCBIA as a consequence of such failure to occupy space as provided in this agreement. In addition, it is agreed that should the NCBIA be unable to license the use of said space as herein provided, it shall have the right to occupy said space for its own purposes without prejudice to its rights against Exhibitor pursuant to this agreement, including but not limited to the payment of a license fee.

*Exhibitor will not sub license any part of the space herein provided for without the express written consent of the NCBIA. In the event the exhibit premises are destroyed or rendered unavailable for any reason whatsoever (whether before or during the scheduled exhibition), the rights of the Exhibitor under this agreement shall be limited to a pro-rated refund of the amount paid for the space licensed.

DIRECT SALES: All direct sales vendors must make the payment for their space in full at the time of registration.

REFRESHMENTS: No sample food and/or beverage products may be distributed by exhibitors except upon written authorization of the NCBIA.

COMPLIANCE WITH LAWS: Exhibitors must comply with all federal, state and local laws, regulations and rules that may be in force during the exhibit.

INSURANCE: Exhibitors who desire insurance on their exhibits must procure same at their own expense. The NCBIA will not be responsible for any losses incurred by the Exhibitor or its employees because of theft, damage or for any cause whatsoever nor to any property of employee(s) or Exhibitor(s) while en route to or from exhibit. The Exhibitor agrees to make no claim for any reason whatsoever, including negligence, against the NCBIA or NCBIA management, its agents or employees while in the show quarters. Exhibitor agrees to indemnify and hold harmless the NCBIA against any loss, damage or expense (including reasonable attorney’s fees) act or omission of Exhibitor or its agents connected in any way with its exhibits.

DECORATIONS, SIGNS, ETC: All equipment in conjunction with the exhibit must be provided by the Exhibitor. However, only the sign of the firm covered by the Exhibitor’s agreement may be placed in the booth or upon printed list of exhibitors or program. All decorations must conform to fire regulations. No exhibit is permitted that is more than eight feet high, or that obstructs other exhibits due to its design or size or that presents a safety hazard to other exhibitors and/or attendees.

PAYMENT DEFAULT: Payment must be made prior to event set up.

REFUND POLICY: A partial refund will only be given with a minimum of 45 days notice prior to the event. The NCBIA retains the right to use their own discretion when deeming the reason for refund as a viable one to determine whether refund shall be granted.

*The NCBIA shall have the right to make such rules and regulations in connection with the Exhibition as it may deem proper and may amend them at any time, and the NCBIA shall have the full power in the matter of interpretation and enforcement thereof. The rules and regulations heretofore referred to are printed on this agreement and are incorporated herein by reference. Exhibitor agrees to abide by said rules and regulations.

*It is agreed that this instrument is a license, and not a lease, and that no leasehold or tenancy is intended to be or shall be created hereby.

*This agreement cannot be varied, modified or canceled by the Exhibitor without the express written consent of the NCBIA.

*IN WITNESS THEREOF, the Exhibitor has caused this application and agreement to be executed by authorized representative.

Signature of Exhibitor ___________________________________________________ Date___________________

Member benefit workers’ compensation

The North Coast BIA partners with Sedgwick because they help employers maximize their premium savings. Sedgwick analyzes each employer’s unique claim and premium history to find the highest level of savings in all available workers’ compensation programs.

Why Sedgwick

Partner in conrolling costs

Sedgwick saves employers millions of dollars each year, becoming a lasting partner and providing a comprehensive cost management approach.

They are committed to understanding our members’ challenges and to delivering claims excellence and providing quality, sound decision making and consistency.

Sedgwick helps employers determine the best rating or discount program available, whether it’s group rating, retrospective rating, 100% EM Cap or any other BWC program available, helping you identify, evaluate and reduce your business risks to achieve premium discounts and refunds.

Ensure that your organization is maximizing savings, meeting eligibility requirements and enrollment deadlines by contacting Sedgwick today.

Lower rates

Understanding your experience modifier (EM) is key in reducing your workers’ compensation costs and measuring how your loss prevention and cost control practices stack up against the state average, as well as others in the industry.

Our clients average an experience modifier of .66 percent (34% below base) as opposed to the industry average of 11% below base. This 23 percent difference has a direct impact on your premium.

Member programs

Group rating and group retrospective rating

Sedgwick clients annually save $160 million in workers’ compensation premium paid with the two highest performing savings options - Group Rating and Group Retrospective Rating.

• Group Rating - over $4 billion in savings over the past ten years

• Group Retrospective Rating - over $1 billion has been earned by participants since implementation in 2009

Start saving now

We annually SAVE our clients $160 MILLION in workers’ compensation PREMIUM PAID

To see how much your company can save by partnering with Sedgwick, simply complete the Temporary Authorization to Review Information (AC-3) form on the reverse side of this document and return to Sedgwick in your preferred method:

• Email: email completed form to ohio.group@sedgwick.com

• Fax: 866.567.9380

• Mail: address listed on AC-3 form

• Online: complete and submit your AC-3 form at: www.sedgwick.com/ac3/northcoastbia

To learn more about North Coast BIA’s program, contact Dominic Potina. P. 614.579.4723 E. dominic.potina@sedgwick.com

sedgwick.com/ohiotpa | 800.825.6755 © 2023 Sedgwick | 3-23

To: North Coast BIA

c/o Sedgwick

P.O. Box 884

Dublin, OH 43017

Toll-Free Phone: 800.825.6755, option 3

Toll-Free Fax: 866.567.9380 www.sedgwick.com/ohiotpa

From: Policy Number Entity DBA

Address

City/State/Zip

Note: For this to be a valid letter, the self-insured department for self-insured employers, or the employer services department for all other employers, must stamp it. Being temporary in nature, BWC will not record via computer or retain this authorization. Representative must possess a copy when requesting service relative to the authority granted therein.

This is to certify that Sedgwick including its agents or representatives identified to you by them, has been retained to review and perform studies on certain workers’ compensation matters on our behalf.

The limited letter of authority provides access to the following types of information relating to our account:

1. Risk files;

2. Claim files;

3. Merit-rated or non-merit-rated experiences;

4. Other associated data.

This authorization does not include the authority to:

1. Review protest letters;

2. File protest letters;

3. File form Application for Handicap Reimbursement (CHP-4);

4. Notice of Appeal (IC-12) or Application for Permanent Partial Reconsideration (IC-88);

5. File self-insurance applications;

6. Represent the employer at hearings;

7. Pursue other similar actions on behalf of the employer.

I understand this authorization is limited and temporary in nature and will expire on _________________________ or automatically nine months from the date received by the employer services or self-insured departments, whichever is appropriate. In either case, the length of authorization will not exceed nine months.

Completion of the temporary authorization provides a third-party administrator (TPA) limited authority to view an employer’s payroll and loss experience. By signing the AC-3, the employer grants permission to the BWC to release information to the employer’s authorized representative(s). The form allows a third-party representative to view an employer’s information regarding payroll, claims and experience modification.

Attention group rating prospects:

• Employers may complete the AC-3 for as many TPAs or group-rating sponsors they feel are necessary to obtain quotes for a group-rating program.

• Group sponsors must notify all current group members if they will not accept them for the next group-rating year. The deadline for this notification is prior to the last business day in October for private employers and prior to the last business day in April for public employers.

• All potential group-rating prospects must have: Active BWC coverage status as of the application deadline; Active coverage from the application deadline through the group rating year; No outstanding balances; Operations similar in nature to the other members of their group.

• Any changes to a group member’s policy will affect the group policy. Changes can result in either debits or credits to each of the members.

Note: For complete information on rules for group rating, see Rules 4123-17-61 through 4123-17-68 of the Ohio Administrative Code or your TPA. All group-rating applicants are subject to review by the BWC employer programs unit.

Temporary Authorization to Review Information

Print Name Title Signature Date Telephone Number Fax Number Email Address

BWC-0503 (Rev. Feb. 26, 2015) AC-3

CLICK HERE May/June 2024 www.ncbia.com page 43

FED IS SET TO HOLD Rates Higher for Longer

On May 1st, the Federal Reserve will conclude its next monetary policy meeting. With inflation progress stalling in recent quarters, the Fed is set to hold rates at their current, restrictive levels until further progress is made with key price metrics. The gradual erosion of market expectations of rate cuts for 2024 has led longterm interest rates to rise. For example, the 10-year Treasury rate (which reflects both long-term inflation expectations and near-term economic growth estimates) started the year near 3.8%. However, as the bond market lowered the number of expected rate cuts for 2024 from six to two or fewer, the 10-year rate has increased, rising to above 4.6% as of this week. Consequently, the 30-year fixed-rate mortgage averaged 7.17% last week, the first time this key rate increased above 7% since November of last year.

So, why are markets — and many economists, including those at NAHB — adjusting their rate forecasts? The primary reason is a lack of progress for inflation. This is because of a rise in certain service expenditures, such as insurance which increased by 11% in cost during 2023, as well as elevated shelter pricing due to a lack of housing supply.

However, economic growth continues to be good — but not great. Real gross domestic product (GDP) expanded at a modest 1.6% annual pace in the first quarter of 2024. This was slower than a 3.4% gain in the fourth quarter of 2023 and the lowest annual growth rate in the past seven quarters. While lower than NAHB’s forecast of a 2.0% increase, it is still solid enough to prevent the economic cooling, many thoughts would help curb inflation during the first half of 2024.

BY: DR. ROBERT DIETZ

Housing’s share of GDP rose to 16.1% in the first quarter of 2024, marking its highest portion of GDP since 2022. Indeed, despite elevated interest rates, new home sales remained solid, helped by builder incentives including mortgage rate buydowns. Sales of newly built, single-family homes in March rose 8.8% to a 693,000 seasonally adjusted annual rate. The pace of new home sales in March was up 8.3% from a year earlier. Although consumer demand has been somewhat dampened by higher interest rates, builders continue to supply new homes to the market to lift inventory and compensate for the low resale supply.

In contrast, existing home sales weakened in March, declining from a 12-month high in the prior month. Total existing home sales declined 4.3% to a seasonally adjusted annual rate of 4.19 million in March. On a year-over-year basis, sales were 3.7% lower than a year ago because of ongoing challenges with inventory. Homes available for sale made up only a 3.2-month supply in March. A 5- to 6-month supply is considered balanced.

With higher-than-expected interest rates on deck for 2024 and stubbornly low levels of supply, housing affordability will continue to be challenged.

EYE ON THE ECONOMY

page 44 www.ncbia.com May/June 2024

May/June 2024

On the latest episode of NAHB’s podcast, Housing Developments, Jim Tobin reflects on his first year as CEO with COO Paul Lopez while on the road — this week, in Idaho, along with NAHB Chairman Carl Harris, NAHB Chief Economist Dr. Robert Dietz and NAHB Chief Lobbyist Lake Coulson.

“It’s been quite a ride,” Tobin shared. “It’s been interesting because I’m not a newbie to NAHB — I’ve been here for over 20 years — but in the new role, it’s been really fun. It’s been intensely gratifying for me to travel around the country and start moving the association forward.”

Bright spots have included the strategic plan and setting the direction for the Federation, and the renewed energy among the membership and NAHB staff following some of the pivotal changes from this past year. Membership and implement of the strategic plan will be continued focuses going forward, as well as advocacy efforts during an election year.

“Just these next few months politically and what we deal with at the national level from a policy and legislative perspective are really going to be important and really set us up or set us back for the next few years,” Tobin stated.

Listen the full episode below and subscribe to Housing Development through your favorite podcast provider or watch all the episodes on YouTube.

as CEO

NAHB PODCAST: JIM TOBIN CELEBRATES One Year

May/June 2024 www.ncbia.com page 48

MEMBERSHIP

EYE ON THE ECONOMY

HOUSING CONSTRUCTION COST Growth a Crucial Inflation Hurdle

The The Consumer Price Index measure of yearover-year inflation rose by 3.5% and 3.4% in March and April, respectively. However, the shelter index increased by a larger 5.7% and 5.5% during those two months. Shelter costs continue to put upward pressure on overall inflation, accounting for nearly 70% of the total increase in all items, excluding food and energy. This ongoing, elevated and uneven inflation is likely to keep the Federal Reserve on hold until at least December of this year.

This upward pressure on shelter costs is a direct result of higher construction costs and limited housing supply. The April Producer Price Index shows that prices for inputs to residential construction increased 2.77% from a year ago, the largest yearly increase since February of 2023. With respect to particular products, the index for softwood lumber increased 6.2% in April. This was the largest month-over-month increase since January of 2022, when the index increased 21.56%. Also of note, copper prices are on the rise. The non-seasonally adjusted special commodity grouping PPI for copper increased 3.46% in April alone. Copper futures pricing is at the highest level since early 2022.

The ongoing inflation challenges and expected delays for the Fed’s eventual easing of monetary policy have taken a toll on builder sentiment. Builder confidence in the market for newly built single-family homes dropped six points in May to a level of 45, according to the NAHB/ Wells Fargo Housing Market Index. The somewhat belowneutral reading is consistent with recent construction data: Single-family starts decreased 0.4% to a 1.03 million seasonally adjusted annual rate in April. However, this pace is 17.7% higher than a year ago and 26% higher on a year-to-date basis. Meanwhile, construction of multifamily units increased in April to an annualized 329,000 pace. However, this rate is 32% lower than a year ago. Moving forward, multifamily production will see additional declines, while the pace of completions remains elevated. Indeed, April marked the fifth consecutive month for which the seasonally adjusted rate of multifamily completions was above 500,000. Currently, there are 1.8 units being completed for each unit that is starting construction. This is a dramatic reversal from when the ratio was near 1:1 in mid-2020 before falling to 0.6:1 in early 2022, when multifamily construction accelerated. In contrast, townhouse construction continues to be strong, accounting for almost 18% of single-family housing starts for the first three months of the year. Single-family attached starts totaled 42,000 in the first quarter of 2024, which is 45% higher than the first quarter of 2023.

BY: DR. ROBERT DIETZ

Nonetheless, higher mortgage rates in April (averaging 6.99% per Freddie Mac) weakened the pace of home sales. Sales of newly built, single-family homes in April fell 4.7% to a 634,000 seasonally adjusted annual rate. Total existing home sales declined 1.9% in April to a seasonally adjusted annual rate of 4.14 million, 1.9% lower than a year ago. At the current sales rate, April’s unsold inventory sits at just a 3.5-month supply.

Limited inventory, higher construction costs, and elevated interest rates continue to frustrate prospective home buyers. The new quarterly NAHB/Wells Fargo Cost of Housing Index (CHI) highlights the burden that housing costs represent for middle- and low-income families. In its inaugural release for the first quarter of 2024, the CHI revealed that a typical family in the U.S. must spend 38% of its income to cover the mortgage payment on a median-priced new single-family home. Low-income families, defined as those earning only 50% of median income, would have to spend 77% of their earnings to pay for the same new home.

page 49 www.ncbia.com May/June 2024

THREE OF THE BIGGEST MISTAKES

Home Contractors Make

As a local construction law firm, we see a lot of things contractors can do better from a legal perspective. No article can capture all of those, especially in a way that any business owner has the time or interest to digest. But of all the issues, here are three critical errors that many contractors make.

1. Not Having a Contract. A lot of contractors don’t use contracts. Something about that doesn’t sound right, but it’s true. Sometimes there’s just a proposal or estimate with a scope of work and a price. Sometimes it’s an email. Or sometimes it’s the good ole handshake deal. Well, as great as it might be to reach an agreement with a customer over a couple conversations, it’s a bad idea - for a lot of reasons (lack of clarity, poor communications or misunderstandings, failure to reach agreement on the ‘details’, lack of agreement on all the key terms, etc.). More to the point of this article, th ough, it’s not legal.

Home construction agreements are governed by two statutes in Ohio: the Home Construction Service Suppliers Act, O.R.C. 4722.01 (“HCSSA”), and the Consumer Sales Practices Act, O.R.C. 1345.01 (“CSPA”). The type of project at issue determines which Act applies. But both Acts require that contractors use a written contract with their residential customers. If you’re building a new house for a customer, and the HCSSA controls, the contract must include–

The builders name, contact information, and Employer Identifica tion Number

The homeowner’s name and contact information

The Address of the project

A description of the project work

The planned start and finish dates, or the anticipated duration of the work

The price of the work, or estimated cost

Any costs that are not included in the contract

An “excess cost” provision per the statute, for extra costs tha t go beyond the original scope of work

The builder’s certificate of insurance, showing coverage of at least $250,000

Signatures of both parties, with dates

The CSPA is less explicit about the specific requirements for a written contract for home repairs, remodels, renovations, etc. But suffice it to say that you need a written contract, and it should contain much of the same information listed above. Failure to use a written contract can lead to violations and claims for damages under either statute. Under the CSPA, that can mean “treble damages”, or TRIPLE the amount of damages claimed by the homeowner in a contract dispute - all because you did no t use a written contract.

2. Not Having a Clear “Scope of Work.” Home construction contractors are in the business of building or improving a customer’s home. Depending on the project, the work involved to do that can be very complex and detailed. Your contract needs to match that.

THE TRUAX ARTICLE

440-534-6733 Serving the construction industry - contractors, subcontractors, suppliers, builders and owners throughout Ohio and surrounding areas phil@truaxlawgroup.com Contact us to discuss your legal needs: May/June 2024 www.ncbia.com page 50

THREE OF THE BIGGEST MISTAKES

Home Contractors Make

It is not enough to have a state in a proposal, “Contractor to remodel master bathroom per Homeowner’s drawing.” A lack of clarity and alignment leads to misunderstanding and disagreement, and we’re talking about people’s homes here! This industry is draped in the customer’s emotions. So clarity and alignment are crucial.

A contractor has a right to rely on the customer’s plans, drawings, and/or specifications. But before bidding on the work, preparing a proposal, or entering into a contract, the contractor must make sure the homeowner’s objectives for the project are clear and complete. Does the design cover everything? Is there sufficient detail and dimensions in the drawing? Are the selections clear and detailed? Does the contract or proposal tie to the drawings or specifications, and does it account for things that are not decided upon yetwhether through an allowance, a contingency, or just a known change order when a decision is made? Will that future decision impact the time of the work or adjacent work and the costs thereof? Are you being hired as a design/builder, such that there is no design but rather the homeowner is relying on you to turn their general vision into a reality? If so, are the customer’s objectives clear? Is the design and specification process laid out to create at least the majority of the constructable design before work begins?

Remember, most customers have never done this before, and they’re relying on their contractor as their “expert”. So they don’t understand that if their electrical needs are not decided upon for their finished basement until after framing begins, there will be more and costly work required to put switches, outlets, and fixtures in certain places later. If nothing else, the contract must be clear that designs or decisions made later will have an impact on the time and cost of the job - and it should also be explained to the customer in person or over the phone to ensure they understand.

3. Not Having Clear Pricing. Many times, pricing for the work is not an issue. Home construction contracts are typically (A) lump sum agreements in which the contractor receives a scope of work and submits a price to perform that work, or (B) cost-plus or time-and-material agreements in which the contractor simply passes its costs onto the homeowner. In time-and-material (T&M) contracts, the contractor bills its costs for labor, equipment, and material, but includes a markup rate as part of its costs (e.g., a higher labor rate than is actually paid to employees). In a cost-plus contract, the contractor bills for actual costs plus a separate amount for overhead and profit, either a fixed fee or a percentage of the project's total cost. But what does the mark-up include and what doesn’t it include? For example, project management and supervision: is that overhead that’s covered by the mark-up or can the contractor bill for some or all project supervision? Is there a Guaranteed Maximum Price or a not-to-exceed price?

Also, for T&M or cost-plus contracts, the customer typically wants an estimate to know about how much the total project will cost. But does your cost estimate include everything in the scope of the project, and any exclusions or clarifications to help the customer understand the scope of the estimate? Also, does the estimate or contract include language confirming that the estimate is only an estimate of projected costs, and that the customer will be billed based on actual costs incurred? If not, the customer may understand the estimate to be a not-to-exceed figure, or if nothing else, provide confusion and a basis for the customer to get upset when the actual costs inevitably exceed the estimated costs.