Golf Classic

North Coast Building Industry Association (NCBIA) BUILDER newsletter is the official newsletter of the NCBIA and is published monthly by the NCBIA. The NCBIA is an affiliate of the Ohio Home Builders Association (OHBA) & the National Association of Home Builders (NAHB).

Advertising Policy - The North Coast Building Industry Association reserves the right to reject advertising in the Builder newsletter based on content. Acceptance of advertising does not imply endorsement of the product or service advertised.

NCBIA Office

5321 Meadow Lane Court - B Suite 23

Sheffield Village, OH 44035

Phone: 440.934.1090 info@ncbia.com | www.ncbia.com

NCBIA Staff Executive Officer

Judie Docs | judie@ncbia.com

Executive Assistant

LaBreeska Bellan | labreeskancbia@gmail.com

Marketing Associate Ashlyn Bellan-Caskey | ashlynncbia@gmail.com

2024 NCBIA Officers

President

Tim King, K. Hovnanian Homes

Vice President

Mike Meszes, DRC Construction Co.

Associate Vice President

John Toth, Floor Coverings International Treasurer

Melanie Stock, First Federal Savings of Lorain Secretary

Jon Sherer, Paraprin Construction, LLC

2024 NCBIA Board of Directors

Sam Hudspath, All Construction Services

Joey McCormick, Bumble Bee Blinds

Dave Linna, Linna Homes & Remodeling

Sara Majzun, Majzun Construction Co.

John Eavenson, Perpetual Development

Theresa Riddell, The Nelson Agency

Jason Rodriguez, The S.J.R Building Co.

Kevin Walker, Walker Wealth Managements & Great Lakes Properties & Investments

NCBIA Life Directors

Jeremy Vorndran, 84 Lumber

Tom Caruso, Caruso Cabinets

Bob Yost, Dale Yost Construction

Liz Schneider Dollar Bank

Mary H. Felton, Guardian Title

Jack Kousma, Kousma Insulation

Jeff Hensley, Lake Star Building & Remodeling

Chris Majzun Jr., Majzun Construction Co.

Chris Majzun Sr., Majzun Construction Co.

Jim Sprague, Maloney + Novotny, LLC

Randy Strauss, Strauss Construction

Tom Lahetta, Tom Lahetta Builders, Inc.

2024 NAHB Delegate

This member represents our local industry in Washington DC

Tim King, K. Hovnanian Homes

NAHB Senior Life Delegate

Randy Strauss, Strauss Construction

Ohio’s State Rep. to NAHB

Randy Strauss, Strauss Construction

OHBA 2024 President

Enzo Perfetto, Enzoco Homes

OHBA Past President

Randy Strauss, 1996

2024 OHBA Trustees

Tim King, K. Hovnanian Homes

John Eavenson, Perpetual Development

OHBA Area 2 Vice-President

Ric Johnson, CAPS Builder & Right at Home Technologies

43-44 37-38

Membership Meeting & Cookout Photo Gallery and Thank you Sponsors!

46 -

on the Economy: Labor Markets Drive Fed's Stance on Interest Rates 49-50

Affordability: What Americans Say About Housing Affordability

on the Economy:

the Economy:

Housing Inventory:Why Both New and Existing Supply Matters

Dr. Dietz was an engaging speaker.

“ “

Copies Training Room

Such an interesting economic presentation, especially because of the focus on our area.

Blueprint/Drawing

Contact Ashlyn Bellan-Caskey at ashlynncbia@gmail.com $10 each (plus shipping, if applicable) Your New Home

Design Services Warranty Books

at ashlynncbia@gmail.com

Verizon Wireless

$10 each (plus shipping, if applicable) Your New Home

1. 22% off Verizon monthly access fees on Corporate liable lines. $34.99 or higher, 2 corporate lines required.*

2. For a limited time, save $5/month for a year on two UNLIMITED plans by Verizon Wireless: Business Unlimited Pro 5G and Business Unlimited Plus 5G.1

Verizon 5G Business Internet

1. 10-year price guarantee, one month free, and prices as low as $69/month.2 Restrictions apply.

Save the Date!

Want to be a sponsor for any of these events? Let us know! Sponsor early to get maximum exposure!

Call or email Judie at judie@ncbia.com for marketing opportunities to help your bottom line!

Thursday, August 1, 2024

NCBIA Golf Classic

8 AM - 4 PM

Sweetbriar Golf Course

750 Jaycox Road Avon Lake, OH

Tuesday, August 6, 2024

Clambake Committee Meeting

8:30 AM - 9:30 AM

NCBIA Office

5321 Meadow Lane Court - B, Suite #23

Sheffield Village, OH

Monday, August 12, 2024

2025 Home Show Committee Meeting

1:30 PM - 2:30 PM

NCBIA Office

5321 Meadow Lane Court - B, Suite #23

Sheffield Village, OH

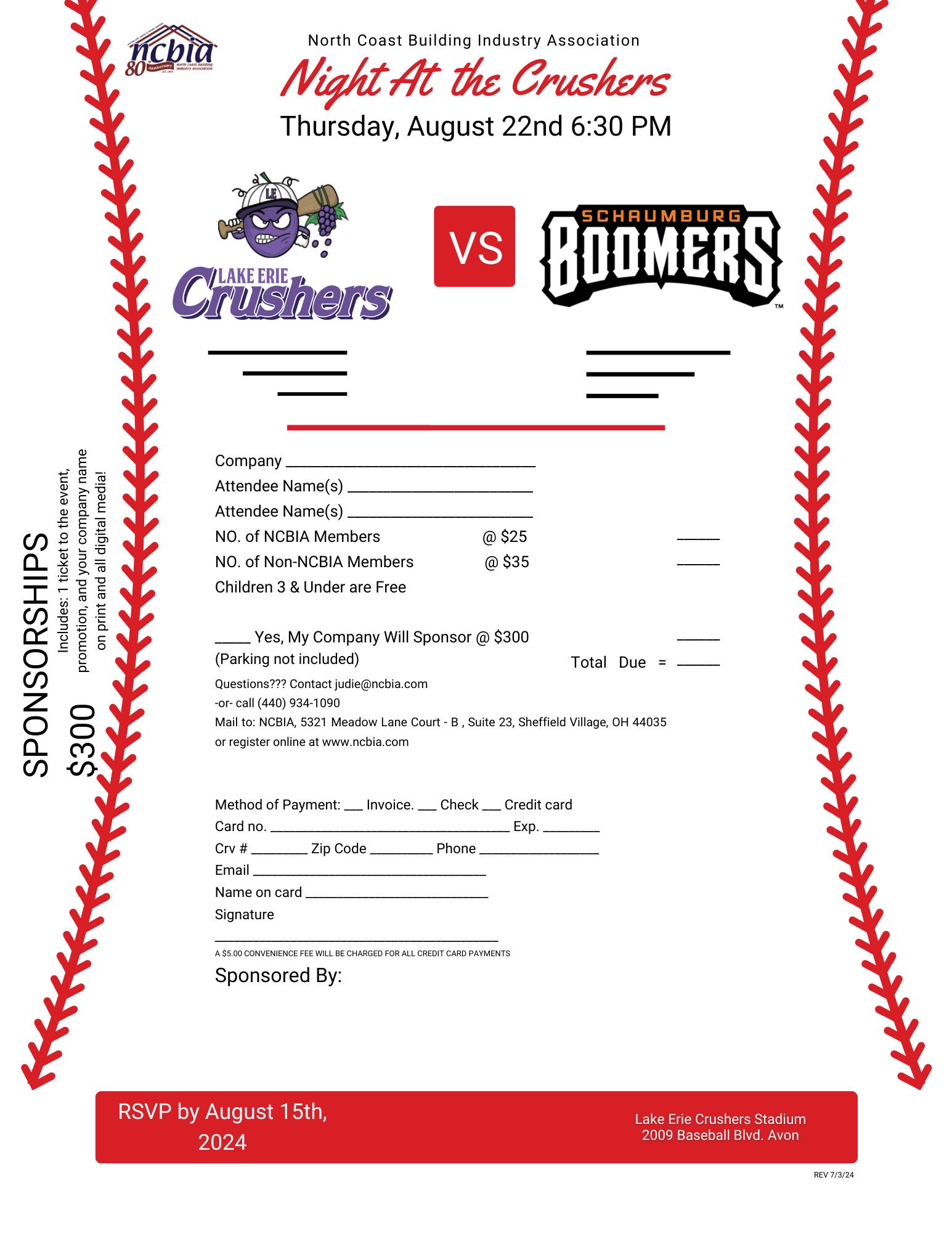

Thursday, August 22, 2024

Night at the Crushers

6:30 PM

Lake Erie Crushers Stadium

2009 Baseball Blvd. Avon, OH

Wednesday, August 28, 2024

Elected Officials Reception

4:30 PM - 6:30 PM

Parkers Grille & Tavern

32858 Walker Road Avon Lake, OH

Wednesday, September 11, 2024

Executive Committee Meeting 3:30 - 5 PM

Board of Directors Meeting 5 - 6:30 PM

NCBIA Office

5321 Meadow Lane Court - B, Suite #23

Sheffield Village, OH

Saturday, September 14, 2024

Annual Softball Game & Family Picnic

2 - 5 PM

Amherst Township Park 44786 Middle Ridge Road, Amherst

Thursday, September 26, 2024

Member Mixer

5 - 7 PM

Hosted by Granite Works Stone Design 875 Crocker Road, Westlake

Thursday, November 7, 2024

Build PAC Wine Pairing Dinner

5 PM

Cole’s Public House

209 South Main Street, Amherst

Check the website at www.ncbia.com for up-to-date changes, additions, and corrections to these events!

Do you have some business news to share?

Business anniversaries, accomplishments, awards, publications, etc.? Send to judie@ncbia.com. We want to hear from you!

Congratulations to Connie Linkous of K. Hovnanian Homes, her husband Ron, and daughter Rowan on the arrival of baby boy, Lawson Linkous!

Welcome to Repros! They have proudly supported the building industry since 1973 and now they are serving us right in our own office. How convenient is that!

Repros specializes in blueprint services, HP printer sales and service, used printers, and is a full-service copy shop.

They ensure that site signage, builder frames, yard signs, fleet graphics and other printing needs are met with precision and efficiency. See attached brochure for everything that Repros can provide to you. The NCBIA can now print your engineering blueprints at a considerable discount, and you can pick them up right at our office. Simply email your file to judie@ ncbia.com.

I sincerely hope that you will take advantage of this benefit and all that our member Repros Engineering has to offer!

To see all Repros Engineering has to offer there is Their Flyer is Linked Below REPROS BENEFITS

Repros Special

Tim King, K. Hovnanian Homes

JUST A REFRESHER

of What the NCBIA is a Part of About

Vision Statement

NAHB

Building Homes, Enriching Communities, Changing Lives

Mission Statement

NAHB strives to protect the American Dream of housing opportunities for all, while working to achieve professional success for its members who build communities, create jobs and strengthen our economy.

Core Values

• Commitment: We have an unwavering commitment to the industry and our mission.

• Dedication: We are dedicated to the fundamental value of an attainable place for all to call home.

• Integrity: We create a solid foundation for our professional network and communities to thrive.

• Collaboration: We are active partners with local and state associations to best respond to evolving industry and member needs.

• Trust: We are respectful, honest and transparent in our decisionmaking to fulfill our mission.

Our History and Membership

Since it was founded in the early 1940s, NAHB has served as the voice of America’s housing industry. We work to ensure that housing is a national priority and that all Americans have access to safe, decent and affordable housing, whether they choose to buy a home or rent.

NAHB helps its members build communities. Each year, NAHB’s members construct about 80% of the new homes built in the United States, both single-family and multifamily.

A Federation of more than 700 state and local associations, NAHB represents more than 140,000 members. About one-third are home builders and remodelers. The rest work in closely related specialties such as sales and marketing, housing finance, and manufacturing and supplying building materials.

NAHB is member-driven, with more than 1,700 members serving on the association’s Leadership Council, which elects the Senior Officers and helps set the association’s agenda. Meeting its members’ business needs and ensuring that they have the tools and resources necessary to succeed is an equally important task, so NAHB also provides educational opportunities, including the International Builders’ Show , the single most important event of the year for the home building industry and the world’s largest show of its kind for the residential and light commercial construction industry.

NAHB’s affiliates include:

• Home Innovation Research Labs, which develops, tests and evaluates new materials, methods, standards and equipment to improve the technology and the affordability of America’s housing.

• HBI , our workforce development arm, which develops and administers a wide range of educational and job training programs.

• The National Housing Endowment , our philanthropic arm, dedicated to helping the housing industry develop more effective approaches to home building, enhancing education and training for future generations of leaders in residential construction and increasing the body of knowledge on housing issues.

NAHB is also a founding partner and member of the International Housing Association , which works to advance home building around the globe with educational programs and entrepreneurial opportunities. Hope you found this interesting and are proud of what you are a part of!

by Judie Docs, CSP, MCSP, MIRM, CMP, CGP

COMING SOON! More Marketing Opportunities for Our Members!

One of the benefits of NCBIA membership is the opportunity to share special discounts or Hot Deals with other members and our community. Market your business to members as well as consumers by enhancing your informational home page with pictures and text. You can post hot deals, job openings and events to help consumers and fellow members find you.

Hot Deals/Member-to Member Deals

These are specials that members wish to post for consumer viewing on our website. Member-to-Member deals are also available.

When deals are added, subscribers to the Hot Deals eNewsletter will receive an automatic email notification.

Deals – offer coupons and special deals; fellow members may be your best customers!

Job Postings – submit job postings.

Advertise events – add your events to our online event calendar displayed with quick links; use these links to share on your social media

Network with other members – check out other member listings, jobs, and deals.

This is all the information that we will need for a Hot Deal:

Title – Enter a title for the Hot Deal.

Tagline - Enter the text that will display.

Category

Description

Offer Start/End Date

Job Postings – Just send us your job posting and we will handle the rest. Your job listing will appear on our website as well as social media.

We are excited to offer these value-added benefits and look forward to helping you maximize your business’s potential. Stay tuned for more information coming soon!

EVENT SPONSOR

Member: $2000

Non-Member: $2500

Event Sponsors:

Everything on Supporting Sponsor list, PLUS radio interview, booth space, logo on staff t-shirts and all printed advertising, mention in radio advertisements and option to have your company’s banner hung at show entrance!

Saturday, March 15th 9-5 Sunday, March 16th 10-3

Spitzer Conference CenterLorain County Community College 1005 North Abbe Road, Elyria

My company would like to sponsor the 2025 NCBIA Home Show. (Please select below)

Event Sponsor($2000) Member Supporting Sponsor ($300)

Event Sponsor ($2500) Supporting Sponsor ($500)

SPONSOR INFORMATION

SPONSOR

Member: $300

Non-Member: $500

Includes: mention in radio ads, your logo in event program, Facebook event page, slideshow during event, option to put promotional items in swag bag, and recognition in BUILDER newsletter.

PAYMENT METHOD:

Please Indicate how you would like to pay for your sponsorship.

QUESTIONS? CONTACT THE NCBIA www.ncbia.com (440) 934-1090 judie@ncbia.com

Supporting Sponsors:

Bag Sponsor: ___Invoice ___Check Enclosed ___VISA/MC/AMEX/DISC* *If you select credit card, our office will call for your card information.

HARVARD REPORT SHOWS STAKEHOLDERS MUST ADDRESS Housing Affordability Crisis Together

High housing costs are affecting households across the board — from renters to first-time home buyers to current owners, according to the latest Harvard University Joint Center for Housing Studies’ (JCHS) The State of the Nation’s Housing 2024 report . The report highlights the significant jump in both rent and home prices — which are up 26% and 47%, respectively, since 2020 — and primarily affected by a lack of inventory.

Unsurprisingly, the number of households that are cost burdened (i.e., spending more than 30% of their income on housing and utilities) is also growing. Half of all renter households — 22.4 million in total — were cost burdened in 2022, up 2 million since 2019 and the highest number on record.

The number of cost-burdened homeowners also grew by 3 million to 19.7 million between 2019 and 2022, with most of the increase among households with incomes under $30,000, as insurance rates and property taxes have risen. High interest rates are also having a negative impact, as fewer homeowners are putting their homes on the market because they have locked in lower interest rates and would face a sharp increase in costs with a new mortgage at the current rates.

Housing demand continues to rise as additional households are formed and seek housing options, putting additional pressure on the market. Generation Z has added 8 million households in the past four years, along with a surge in immigration, which accounted for 3.3 million households in 2023.

Among these challenges, one of the bright spots is the efforts to boost housing supply — even amidst rising interest rates.

According to the report, multifamily completions rose by 22% to 449,900 in 2023, the highest annual level in more than three decades, and the number of units under construction in March 2024 remained near the record high. On the single-family side, new homes have constituted about a third of available single-family inventory since 2021 — a sharp increase from the past four decades, during which new construction made up just 14% of inventory on average.

“It points to the strength of interest in homeownership,” stated JCHS managing director Chris Herbert during a panel discussion following the report’s release, noting the efforts home builders are making to build smaller homes and provide a variety of options where possible.

During the panel, Herbert and others specifically addressed some of the challenges facing housing attainability, highlighting several key issues related to NAHB’s 10-point plan to solving the housing affordability crisis — most notably zoning reform, which is gaining momentum at both the local and state level.

“Addressing these challenges will not be easy,” Herbert noted in a press release. “But with concerted efforts by policymakers at all levels of government, together with the private and nonprofit sectors, we have the ability to increase the supply of quality, affordable homes in thriving communities across the U.S.”

Learn more about NAHB’s solutions to the housing affordability crisis at nahb.org/plan.

SHARE OF ONE-STORY NEW HOMES Increased in 2023

The rising trend of two or more stories homes reversed in 2023, according to data obtained from the US Census Bureau’s Survey of Construction (SOC) and tabulated by NAHB. The share of homes started with two or more stories decreased for the first time in 2023 after gains in the previous two years. Despite the decline, the share of two or more-story homes started remained higher than the share of one-story homes started in 2023. Nationwide, the share of new homes with two or more stories fell from 52% to 51% in 2023, while the share of new homes with one story grew from 48% to 49%. Though single story homes are more common in the Midwest and South, their shares in the East North Central (Midwest) and South Atlantic (South) declined in 2023. Noteworthy, the share of one-story homes in New England fell to nearly 2021 levels after a significant increase in 2022.

Looking deeper, five of the nine divisions saw a greater share of newly-built two or more stories homes. Among these, New England and the Middle Atlantic had significantly higher proportions (83% and 78%) of two or more stories homes. This proportion increased notably in New England, from 75% in 2022, jumping eight percentage points. In contrast, new homes started with two or more stories in the Mountain and Pacific division were at 52% and 57%, both lower than the previous year. By and large, the greatest concentrations of two-or-more story homes were in divisions along the coasts of the country.

New homes started in the Midwest and South generally showed a stronger preference for single-story homes, except for the South Atlantic division. In the Midwest (East North Central and West North Central), 52% and 59% of new homes started were one-story, while in the South (East South Central and West South Central), the shares were 60% and 58%.

BY: FAN-YU KUO

THANK YOU SPIKES!

SUPER SPIKE (250-499 SPIKE CREDITS)

Terry

Dave

GREEN SPIKE (50-99 SPIKE CREDITS)

Jim

Chris

Jeremy Vorndran ......... 84 Lumber ....................................................

Tim King K. Hovnanian Homes

LIFE SPIKE (25-49 SPIKE CREDITS)

Steve Schafer ................ Schafer Development .................................

John Daly ...................... Network Land Title ....................................

BLUE SPIKE (6-24 SPIKE CREDITS)

John Toth Floor Coverings International

Chris Collins Carter Lumber

Dave LeHotan All Construction Services

Mark McClaine ............ 84 Lumber ....................................................

Ken Cassell ................... Cassell Construction...................................

John Blakeslee Blakeslee Excavating, Inc

Steve Flemming Shamrock Development 11.50

Ashley Oates 84 Lumber 10.00

Scott Kosman Lakeland Glass 9.50

Mike Meszes DRC Construction 7.00

Tim Hinkle ................. Green Quest Homes ............................... 6.50

Jim Tipple ..................... Maranatha Homes ...................................... 6.50

Lindsay Yost Bott Dale Yost Construction 6.00

Welcome New Members!

Danielle Rendina (Primary Associate)

Granite Works Stone Design 875 Crocker Road Westlake, OH 44145 (440) 892-8761 drendina@granitewsd.com

https:// graniteworksstonedesign. com

Sponsored by: Sam Hudspath, All Construction Services

I have worked in the kitchen and bathroom remodeling industry for almost 8 years as a design and sales consultant, educating myself on countless material options. I have built and maintained relationships with various trades and vendors. I love to share inspiration and experiences with others and hope to share a little bit of knowledge as people move through their own remodeling projects. From cabinetry and countertops, flooring, tile, electrical and plumbing, I have always helped my clients navigate through the decision to create their dream space!

Rebecca Smiddy (Affiliate Associate)

Greater Cleveland Habitat for Humanity 2110 West 110th Street Cleveland, OH 44102 (216) 429-1299 x-235 rsmiddy@clevelandhabitat.org http://www.clevelandhabitat.org

Sponsored by: Adam Metzner, Greater Cleveland Habitat for Humanity

Greater Cleveland Habitat for Humanity (GCHFH) develops opportunities for all of God's people to act out their faith. By working in partnerships to eliminate substandard housing, we enable families and volunteers to improve lives. We create hope by building homes, strengthening neighborhoods, and reweaving communities. GCHFH is a 501 ( c ) ( 3 ) nonprofit charitable organization that offers qualified families, with demonstrated need, willingness to partner, and the ability to pay a zero-interest loan, an opportunity to build and buy a home. We bring urban and suburban communities together to “eliminate poverty housing and homelessness from the world, and to make decent shelter a matter of conscience and action.” As an affiliate of Habitat for Humanity International, we are part of a worldwide powerhouse building in 3,000 locations across 100 countries.

Thanks for Renewing!

Ashley Oates, 84 Lumber

Mark Ballock, 84 Lumber

Scott Kubit, Bob Schmitt Homes, Inc.

Bob Yost, Dale Yost Construction

Doug Rogers, Dollar Bank

Darrell Myers, Floor Coverings International

Brian Searle, Floor Coverings International

Jen Toth, Floor Coverings International

Connie Linkous, K. Hovnanian Homes

Adam Murawski, K. Hovnanian Homes

Chris Pintner, K. Hovnanian Homes

Paul Samek, Luxury Heating Company

Jim Sprague, Maloney + Novotny, LLC

Denny Reaser, Reaser Construction

Randy Strauss, Strauss Construction, Inc.

Kevin Walker, Walker Wealth Management and Great Lakes Properties and Investments

Jack Snyder, Granite Works/Stone Design

Jim Berlekamp, Kitchen Tune-Up (Cleveland West)

Welcome New Members!

Dawn Berlekamp (Primary Associate)

Kitchen Tune-Up (Cleveland West)

PO Box 771744

Lakewood, OH 44107 (440) 491-2580

dberlekamp@ kitchentuneup.com

http://www.kitchentuneup. com

Sponsored by: John Toth, Floor Coverings International

Cabinet renovations can dramatically transform the look and feel of any kitchen, providing a fresh update without the need for a complete overhaul. If you’re considering updating your cabinets to create more storage space or seeking full cabinet redooring to refresh their appearance, there are several different options available.

Custom cabinetry offers the perfect solution for homeowners look to tailor their kitchen space to their preferences and needs, ensuring every inch is used efficiently. Cabinet refacing is another popular option, giving your kitchen design a new look by replacing the door fronts while keeping the existing cabinet boxes intact. For those on a budget, cabinet painting can be an effective way to breathe new life into tired or outdated cabinets with a new color. Each of these methods can work in harmony to achieve the aesthetic and functional goals of your kitchen renovation, making your cabinets not just storage solutions, but focal points of your home’s heart.

Kevin Flanigan (Primary Builder)

Shamrock Development

P.O. Box 26

Grafton, OH 44044 (440) 926-3950

kflanigan@generalplug.com

http://www.shamrock-dev.com

Sponsored by: Mary H. Felton, Guardian Title

Shamrock Development

Company is one of Lorain County’s premier developers with residential, commercial, and industrial properties for those with higher standards. They are building neighborhoods in Grafton! Waterford Crossing, Tanglewood and Emerald Pointe along with Fiddler’s Green and Fox Rund which are the most recent neighborhoods being built.

Fred Morey (Affiliate Associate)

Repros Engineering 1518 Copley Road Akron, OH 44320 (440) 823-5424

fred.morey@reprosinc.com http://www.reprosinc.com

Sponsored by: Lou LaGuardia, Repros Engineering

Repros is your premier destination for comprehensive building, engineering, and construction printing and signage solutions throughout Northeast and Central Ohio. Repros has proudly supported the building industry since 1973 and their services are available right in the NCBIA office.

Our Color Graphics division ensures that your builder frames, yard signs, fleet graphics and other printing needs are met with precision and efficiency. Whether you are embarking on a construction project or seeking to enhance your business visibility, Repros is here to provide top-notch service tailored to your specific requirements.

Repros Engineering division specializes in blueprint services, HP wide format equipment sales and service, used wide format printers, and 4 conveniently located full-service copy shops across Northeast Ohio.

Repros is your premier destination for comprehensive building, engineering, and construction printing and signage solutions throughout Northeast and Central Ohio. Repros has proudly supported the building industry since 1973, with locations in Canton, Cleveland, Akron, Broadview Hts.

James Phillips (Primary Associate)

The Phillips Company 111 Ferndale Drive Wakeman, OH 44889 (517) 927-1455 jamesphillips@thephillipsco. com

Sponsored by: James Barnes, O’Neal Tax and Bookkeeping, LLC

Over forty-five years of experience helping organizations grow. Educated at Hillsdale College in psychology and an MBA in Marketing and Social Psychology from Michigan State University. Highly successful consulting with a focus on implementation and building thriving teams, by leading seminars in sales techniques, marketing, and organizational growth. He has led monthly CEO round tables and keynoted national conventions, facilitated corporate retreats, and authored article for national and local business publications. He has led over 450 small to mid-size organizations to much greater achievement, ROI, and better control of future success while creating a culture of thriving.

TWO DAY SHOW!!!!!

EXHIBITOR CONTRACT

Company Name (as it will appear in show) __________________________________________

Contact Person (print) _________________________________________________________

Primary Product(s)/Service(s) ___________________________________________________

Email address __________________________

Booth spaces are LIMITED and available on a 1st Come, 1st Served Basis! 2024 SOLD OUT - Act now to secure your booth!

BOOTH INFORMATION

Electric is optional and available on a 1st Come, 1st Served Basis!

Will you need electricity? _______ YES _______ NO ______# of Booth Spaces ____________TOTAL AMOUNT DUE

I understand that I have contracted for exhibit space by signing this contract and I am liable for the full cost of the booth space. I also understand that the final location of space will be determined by show management when payment is made in full. The undersigned represents that he/she is fully authorized to execute and complete this agreement. The undersigned also understands and agrees to the rules and regulations on the reverse side of this contract.

Authorized Exhibitor Signature

PAYMENT METHOD:

Please Indicate how you would like to pay for your booth space.

Printed Name ___Invoice ___Check Enclosed ___VISA/MC/AMEX/DISC*

*If you select credit card, our office will call for your card information.

Please send completed form to Judie@ncbia.com or 5321 Meadow Lane Court - B, Suite 23 Sheffield Village, OH 44035

Event Sponsors: **A $5.00 Convenience Fee will be charged for all Credit Card Payments

RULES AND REGULATIONS GOVERNING EXHIBITS

MANAGEMENT: The North Coast Building Industry Association (NCBIA) shall be deemed Event Management and shall have all rights thereto assigned. (From here on the North Coast Building Industry Association will be referred to as NCBIA).

CHARACTER OF EXHIBITS: NCBIA reserves the right to approve all exhibits. The exhibits and the distribution of promotional material shall be limited to the confines of the Exhibitor’s space. Under no circumstances shall any Exhibitor be permitted to attract attention to his/her exhibit in such a way as to distract or interfere with the other exhibitors.

REGISTRATION: Exhibitors and their employees at the Event should wear a registration badge and/or tag for proper identification.

SET UP/REMOVAL OF EXHIBITS: All exhibits must be placed and ready at the opening of the show and no movement of exhibits will be permitted until after the close of the show. Exhibits must remain intact until after closing of the show and be removed within such time as may be specified by the NCBIA. Strict compliance with move in and move out times is mandatory. A fine for late move in and/or early move out will be assessed at the discretion of the NCBIA.

RAFFLES: Exhibitors are encouraged to conduct games, lotteries and/or similar activities to increase patron participation, so long as it does not interfere with the other exhibitors.

CARE OF EXHIBITS/AISLES: Aisles must be kept clear at all times. Seating for buyers must be confined within the exhibitor’s space. Exhibitors are requested at all times to cooperate with the NCBIA in maintaining all exhibits in appropriate condition.

*In the event that the Exhibitor does not exhibit as provided herein or fails to comply in any respect with the terms of this agreement, the NCBIA management shall have the right without notice to the Exhibitor, to license the use of said space to any other company, enterprise, person or persons and the Exhibitor agrees to pay any deficiency, loss and/or damage sustained by the NCBIA as a consequence of such failure to occupy space as provided in this agreement. In addition, it is agreed that should the NCBIA be unable to license the use of said space as herein provided, it shall have the right to occupy said space for its own purposes without prejudice to its rights against Exhibitor pursuant to this agreement, including but not limited to the payment of a license fee.

*Exhibitor will not sub license any part of the space herein provided for without the express written consent of the NCBIA. In the event the exhibit premises are destroyed or rendered unavailable for any reason whatsoever (whether before or during the scheduled exhibition), the rights of the Exhibitor under this agreement shall be limited to a pro-rated refund of the amount paid for the space licensed.

DIRECT SALES: All direct sales vendors must make the payment for their space in full at the time of registration.

REFRESHMENTS: No sample food and/or beverage products may be distributed by exhibitors except upon written authorization of the NCBIA.

COMPLIANCE WITH LAWS: Exhibitors must comply with all federal, state and local laws, regulations and rules that may be in force during the exhibit.

INSURANCE: Exhibitors who desire insurance on their exhibits must procure same at their own expense. The NCBIA will not be responsible for any losses incurred by the Exhibitor or its employees because of theft, damage or for any cause whatsoever nor to any property of employee(s) or Exhibitor(s) while en route to or from exhibit. The Exhibitor agrees to make no claim for any reason whatsoever, including negligence, against the NCBIA or NCBIA management, its agents or employees while in the show quarters. Exhibitor agrees to indemnify and hold harmless the NCBIA against any loss, damage or expense (including reasonable attorney’s fees) act or omission of Exhibitor or its agents connected in any way with its exhibits.

DECORATIONS, SIGNS, ETC: All equipment in conjunction with the exhibit must be provided by the Exhibitor. However, only the sign of the firm covered by the Exhibitor’s agreement may be placed in the booth or upon printed list of exhibitors or program. All decorations must conform to fire regulations. No exhibit is permitted that is more than eight feet high, or that obstructs other exhibits due to its design or size or that presents a safety hazard to other exhibitors and/or attendees.

PAYMENT DEFAULT: Payment must be made prior to event set up.

REFUND POLICY: A partial refund will only be given with a minimum of 45 days notice prior to the event. The NCBIA retains the right to use their own discretion when deeming the reason for refund as a viable one to determine whether refund shall be granted.

*The NCBIA shall have the right to make such rules and regulations in connection with the Exhibition as it may deem proper and may amend them at any time, and the NCBIA shall have the full power in the matter of interpretation and enforcement thereof. The rules and regulations heretofore referred to are printed on this agreement and are incorporated herein by reference. Exhibitor agrees to abide by said rules and regulations.

*It is agreed that this instrument is a license, and not a lease, and that no leasehold or tenancy is intended to be or shall be created hereby.

*This agreement cannot be varied, modified or canceled by the Exhibitor without the express written consent of the NCBIA.

*IN WITNESS THEREOF, the Exhibitor has caused this application and agreement to be executed by authorized representative.

EYE ON THE ECONOMY

INTEREST RATES TO REMAIN Higher for Longer

Interest rates moved higher in recent weeks because of disappointing progress for inflation data and solid labor market reports. In fact, Fed Chairman Powell noted this week that there has been a “lack of further progress so far this year on returning to our 2% inflation goal.” These offsetting factors — higher interest rates on the negative side but supportive macro conditions — left builder sentiment flat in April.

The benchmark 10-year Treasury rate has increased by more than 30 basis points since the start of April, placing long-term interest rates at their highest level since early November of last year. In turn, the average 30-year fixedrate mortgage has increased to almost 6.9%, per Freddie Mac in last week’s data. Mortgage rates have crept higher because of concerns that inflation reduction progress has stalled in recent quarters, but they are still well below last fall's highs when they approached 8%.

The year-over-year pace for inflation ticked up to 3.5% in March, still too far from the Fed’s 2% target. The shelter inflation component (i.e., housing) remains a leading source of cost pressure at a 5.7% year-over-year gain. The best way to reduce shelter inflation is with additional supply of affordable, attainable housing which is, for the most part, out of the Federal Reserve’s control. An NAHB estimated index of residential construction costs shows why housing costs continue to rise, with building material costs up 2.2% year over year in March. Gypsum prices reached a new high in March, up more than 2% in just that month alone.

Wages in home building are also increasing as the labor market remains tight. Residential construction wages were more than 6% higher than a year ago as of March, with this pace of growth accelerating over the last eight months. In February, there were 441,000 unfilled construction sector positions, the rate of which has been trending higher since March of 2023 as builders increased labor demand with expectations of improving construction conditions in 2024. Over the last year, home builders and remodelers added 78,800 jobs on a net basis to the industry’s workforce, which now totals 3.3 million. Aggregate U.S. labor data remains tight as well, which represents an inflation risk to the Fed. Total nonfarm payroll employment increased by 303,000 in March, with the unemployment level at just 3.8%.

BY: DR. ROBERT DIETZ

Because of the offsetting factors of higher interest rates and positive labor market conditions that support demand for new housing, the NAHB/Wells Fargo Housing Market Index, a key measure of home builder sentiment, was flat at a level of 51 in April. This relatively neutral reading of sentiment suggests the industry is set to expand construction volume later in 2024 provided interest rates move lower on improved inflation data. Fundamentally, housing itself will help this process, because as more apartments are supplied to the market, rent growth will slow, which will lower the growth rate for shelter inflation and bring overall consumer inflation closer to the Fed’s 2% target. Remodeling sentiment, as measured by the NAHB Westlake Royal Remodeling Market Index, remained positive at a level of 66 in the first quarter, indicating ongoing favorable home improvement market conditions.

Nonetheless, higher rates this spring had an effect on the construction data in March. Single-family starts decreased 12.4% to a 1.02 million seasonally adjusted annual rate. The multifamily sector, which includes apartment buildings and condos, decreased 21.7% to an annualized 299,000 pace. While apartment construction starts are down, the number of completed units entering the market is rising as a result of the previously elevated construction levels. The pace of completions for apartments in buildings with five or more units is up 27.4% for the first quarter of 2024 compared to the first quarter of 2023. A higher pace of completions in 2024 for multifamily construction will place some downward pressure on rent growth and help ease shelter inflation.

TO Judie Docs

July 1, 2024

To: Local and State HBA Executive Officers

From: Carl Harris, 2024 NAHB Chairman of the Board

RE: 2024 Legislative Conference Update

Dear Executive Officer:

As we look forward to celebrating the July 4th holiday this week, I am happy to report that because of your tireless efforts during the recent NAHB Legislative Conference, we can also celebrate important progress that has been made to advance our priorities on two top issues – energy codes and workforce development. Your leadership and advocacy for housing on Capitol Hill were meaningful, and I am pleased to share with you how your successful grassroots efforts are making a difference on behalf of housing.

HUD and USDA’s adoption of the 2021 IECC was one of the three issues we took to lawmakers, and I’m happy to report that Congressman Warren Davidson, along with 38 other lawmakers, recently introduced a Congressional Review Act resolution of disapproval to allow Congress to overturn this harmful rule After the 4th of July holiday, when Congress is back in session, we will launch a grassroots campaign to encourage you to follow up with your Members of Congress and ask them to cosponsor this crucial resolution.

In other positive news on this issue, the House Transportation, Housing, and Urban Development Appropriations Subcommittee has approved language that would prevent HUD from using federal funds to implement this rule. The full appropriations committee is expected to consider the bill in July and, if approved, will be advanced to the House floor for a vote.

Another key issue featured during the Legislative Conference was the importance of workforce development NAHB has been a strong proponent of Job Corps, which is a vital source of skilled labor for the housing industry

I am pleased to share that the House Labor-HHS Appropriations Subcommittee has approved language that would keep Job Corps 100% funded at $1.76 billion in fiscal year 2025. This is a significant win for the housing industry. The fact that Job Corps is fully funded in the House spending bill so early in the 2025 appropriations process is a strong sign that Job Corps will remain fully funded in fiscal year 2025.

Our message to lawmakers that the housing supply shortage is the primary cause of growing housing affordability challenges and ensuring we have enough workers to build the homes the nation needs is ringing loud and clear on Capitol Hill

Once again, please accept my deepest appreciation and thanks for your outstanding contributions during the 2024 NAHB Legislative Conference. Your commitment, dedication, and advocacy are what make our industry great.

OHBA EXECUTIVE VP COLUMN

TAKING NOTE OF SOME KEY Objectives Accomplished

As you likely know, OHBA has aggressively advocated the housing crisis is due to a deficit of housing. Yet increasing demand without increasing supply fuels ever increasing home prices. This is a textbook example of economics and often not understood in some circles. While many have urged for subsidies and other forms of housing relief, we alone have been advocating for relief on the supply side of the equation.

A few years ago, Rep. Derrek Merrin from Toledo, responding to members there, introduced legislation so newly developed lots are taxed when the lot is sold, and construction begins. As no house had yet to be constructed, no additional costs are borne by local government. Sounds simple, I know. Despite much opposition, we achieved passage in the state budget. The celebration was short lived as the measure was vetoed at the request of every local government and planning association in Ohio. The narrative was that we would encourage OVER BUILDING and exert pressure on schools and government services.

Enter the widely acknowledged housing deficit. While tempted to say, “told you so,” we went back to work and attained a substantive version of the previous exemption. Despite the fact that this remedy is the fastest and most equitable way to increase the supply of housing, it took many hearings and painful discussions amongst the groups that opposed it earlier. Our language was reenacted and then entered the bureaucratic destruction mill at the tax department. They always disliked the method we advanced but sat by silently and preyed on the language and hijacked it with their tax mumblese. Reluctantly, admitting it was law, they ruled the property owner would be subject to additional hearings and the process could take up to three years to realize the enacted relief.

We were able to exercise our many contacts here and sought a fair and equitable process. We ably demonstrated the taxers were acting unreasonably and blockading clear initiatives to deal with the housing deficit. We achieved passage of a clear and direct method to get relief and help deal with the need for housing production so urgently needed in Ohio. You can find the new law in Ohio Revised Code 5709.56.

Additionally, with passage of the bill, HB 50, we reversed a prior appeals court case ruling that home remodeling is not construction.

These are major accomplishments enabled by your membership in our federation which works hard for you every day.

Ohio Home Builders Association Phone- 614/228-6647

by

Vincent J. Squillace, CAE, OHBA Exec. VP

NAHB BUILDERS REPORT 22% All-Cash Sales in 2024

Up to this point in 2024, the median builder has sold 22% of its homes to buyers who used all cash to pay for them (i.e., did not take out a mortgage), according to a recent NAHB survey. The survey took the form of a special question appended to the instrument used to collect data for the May NAHB/Wells Fargo Housing Market Index.

The percentage of all-cash sales is interesting, in part because it may indicate the availability of mortgage credit. Recently, the percentage has fluctuated directly with interest rates—especially the Federal Reserve’s target federal funds rate. This was discussed in detail in an earlier post on the Census Bureau’s quarterly “New Houses Sold by Price and Financing” release. Briefly, the Census release shows the share of all-cash sales increasing substantially since the Fed began tightening in 2022, reaching a peak of 10.7% in the fourth quarter of 2023 before declining to 6.6% in early 2024.

This is obviously a much lower share of all-cash sales than the 22% median reported in the May 2024 NAHB survey. Before simply concluding that the two surveys contradict each other, we should consider possible explanations.

The quarterly Census report is based on a sample of new homes. The NAHB survey is based on a sample of builders, many of whom tend to be small (see, for example, the recent article on Who Are NAHB’s Builder Members?). Larger builders, by definition, build a disproportionate number of the new homes; so, if larger builders tend to have smaller shares of all-cash sales, the different sampling frames could explain the apparent discrepancy between the Census and NAHB percentages.

This is not the case, however. In fact, in the NAHB survey, it is the smallest builders who show the lowest share of all-cash sales.

BY ROBERT DIETZ

There is another possibility, if we get into the Census Bureau’s definitional weeds. The quarterly Census report is based on new homes sold, meaning that a potential buyer has either signed a sales contract or made a downpayment on the home. But this does not cover all new single-family homes. The Census Bureau classifies others as contractorbuilt or owner-built. On a contractor-built home, the ultimate homeowner hires a general contractor (i.e., builder) to build an individual home on the owner’s lot. This usually involves a contract to build, but that is not technically the same thing as a sales contract according to Census definitions. On an owner-built home, the owner functions as the general contractor.

In addition to the quarterly report on houses sold, the Census Bureau produces an annual file from the same underlying data that can be tabulated for all types of new single-family homes. NAHB recently tabulated the 2023 file, and it shows that contractor-built (and owner-built) homes are much more likely than homes built for sale to be financed with all cash.

In NAHB’s latest census of its members, 54% of singlefamily builders listed their primary operation as singlefamily custom building, which roughly corresponds to building contractor-built homes under the Census Bureau’s classification scheme.

To summarize, NAHB’s May 2024 survey shows a median of 22% all-cash sales, considerably higher than the recent peak of 10.7% reported by the Census Bureau in its quarterly release on new houses sold. The discrepancy does not seem attributable to the differences between a survey of houses and a survey of builders but may be largely due to the presence of custom builders in the NAHB survey. These are builders who specialize in contractor-built homes, which are demonstrably more likely to be financed entirely with cash but are excluded from the reports on new houses sold.

The NAHB survey results are therefore useful for timely information on new home financing that includes custom home building.

Ohio workers’ comp & experience modification rate

An employer’s experience modifica3on rate (EMR), which is determined by the Ohio Bureau of Workers’ Compensa3on (BWC), greatly impacts workers’ compensa3on premium that an employer pays. If you have safer opera3ons, with liIle to no workers’ compensa3on claims, you will have a beIer than average EMR. If you have a less safe opera3on, with numerous costly claims, you will have a worse than average EMR. Typically, the beIer your EMR, the lower the premium that you will pay to the BWC.

The BWC uses your historical payroll, industry type and claim costs to determine your EMR. A company with claim costs that are typical for their size and industry, will have an EMR of 1.0. If the company has lower claim costs than typical, their EMR will be below 1.0. If the employer has higher claim costs than typical, their EMR will be above 1.0. The lower the EMR, the lower the premium that will be paid compared to similar businesses. The higher the EMR, the higher the premium that will be paid compared to similar businesses.

Addi3onally, the lower your EMR, the greater likelihood that you will qualify for higher discounts through group ra3ng programs and group retrospec3ve ra3ng programs. These programs allow employers to band together to receive addi3onal discounts or rebates on their premium. Discounts and refunds can exceed 50% of the premium that you pay to the BWC.

An employer’s EMR is based on claims that occurred in the past compared to historical payroll. Your payroll is categorized by your industry type. To lower your EMR, you must reduce claims and claim costs. The best claim is one that never occurs. A robust workplace safety program can limit future claims from occurring which will ul3mately improve your EMR.

If your company does have a claim, there are several strategies that you can implement to help reduce the overall cost in the claim. Every claim is different, but generally, geTng injured workers healthy and back to work safely and quickly, will keep costs down. There are many addi3onal strategies that can be enacted to reduce or lower costs in a claim that has occurred. Partnering with Sedgwick will help determine the best strategies for a specific claim.

If you have any ques3ons, contact our Sedgwick program manager, Dominic Po3na, at 614-579-4723 or dominic.po3na@sedgwick.com.

Forkli' safety in the workplace

Forkli's, also known as powered industrial trucks, play a crucial role in various industries, from manufacturing and construc9on to warehousing and logis9cs. However, if not managed properly, their opera9ons pose significant risks to both operators and bystanders. Implemen9ng comprehensive safety measures and adhering to regula9ons is paramount to prevent accidents and ensure a secure working environment.

Between 2021 and 2023, there were approximately 198 fatali9es that resulted from forkli' opera9on. Recent data iden9fies the causes of forkli' fatali9es by type of accident:

The Occupa9onal Safety and Health Administra9on’s (OSHA) standard 29 CFR 1910.178 spells out the requirements for safe opera9on of forkli's. Some of the highlight of the standard include:

Pre-Shi' Inspec9ons

Employers are required to perform a pre-shi' examina9on of the forkli'. Under OSHA’s regula9on 29 CFR 1910.178(q)(7), “Industrial trucks shall be examined before being placed in service and shall not be placed in service if the examina9on shows any condi9on adversely affec9ng the safety of the vehicle. Such examina9on shall be made at least daily.” The regula9on goes on to say “Where industrial trucks are used on a round-the-clock basis, they shall be examined a'er each shi'. Defects when found shall be immediately reported and corrected.” If, during examina9on, a deficiency is found and the forkli' cannot be operated safely, it must be taken out of service. Whether you use the manufacturers recommenda9on or create your own checklist be sure to document each inspec9on. It is important to have a process to remove the key and prevent employees from opera9ng the forkli' un9l it is safe to do so.

Employee Training

Per OSHA, around 20-25% of forkli'-related injuries are caused by inadequate training. Safe opera9on and training requirements can be found under 29 CFR 1910.178 (l). Highlights of employee training include:

• Safe Opera9on

◦ Employers shall ensure that each operator is competent to operate a forkli', as demonstrated by successful comple9on of the training.

◦ No employee shall operate a forkli' (except for training purposes) un9l they have successfully completed all required training.

• Training Program Implementa9on

◦ Training shall consist of formal instruc9ons, prac9cal training, and evalua9on of the operator’s performance in the workplace.

◦ Training and evalua9on must be done by a person with knowledge, training, and experience to train operators and evaluate their competence.

◦ Trainees may operate forkli's only under the direct supervision of a person who has the knowledge, training, and experience to train operators.

◦ Training may be performed as long as it does not endanger the trainee or other employees.

• Training Program Content - Ini9al training requires employees to understand the limita9ons of the forkli' Some of these limita9ons include:

◦ Engine or motor opera9ons and opera9ng instruc9ons.

◦ Warnings and precau9ons, steering and maneuverability.

◦ Visibility, stability, vehicle inspec9on and maintenance.

◦ Differences between the truck and an automobile.

• Refresher Training and Evalua9on - As with any safety program, retraining employees is key to safe opera9on. Highlights of refresher training include:

◦ Evalua9on of competency tests for employees every three years.

◦ Retraining is required if:

▪ The operator is involved in an accident or near miss.

▪ The operator is observed opera9ng the forkli' in an unsafe manner.

▪ The operator receives an unsa9sfactory evalua9on.

▪ The operator is assigned to a different type of truck.

▪ If there are changes in the workplace in a manner that could affect the safe opera9on of the forkli'

• Avoidance of Duplica9ve Training

◦ If an operator has previously received training and such training is appropriate to the truck and working condi9ons encountered, addi9onal training in that topic is not required if the operator is found competent and has been evaluated to operate the truck safely.

• Cer9fica9on

◦ Employees must be trained and evaluated, and the cer9fica9on must have the name of the operator, the date of training, and the name of the person(s) performing the training or evalua9on.

Powered Industrial Vehicles offer a variety of services that can make our jobs easier, but they need to be respected. Inspec9ons, opera9ons, maintenance, and communica9on are key to keeping the workplace safe and protec9ng employees. Following the above guidelines and other requirements within the standard will help in developing a policy on proper forkli' opera9on and training of employees. Otherwise, you are pubng your employees at risk for a poten9al injury, fatality, or an OSHA cita9on.

OSHA’s full Powered Industrial Trucks regula9on can be found at (hcps://www.osha.gov/laws-regs/regula9ons/ standardnumber/1910/1910.178).

For more informa9on on OSHA’s Local Emphasis Program on Powered Industrial Trucks, go to hcps:// www.osha.gov/sites/default/files/enforcement/direc9ves/cpl-04-05-2305.pdf

If you need help iden9fying poten9al hazards in your workplace, please contact Andy Sawan, risk services specialist at Sedgwick at andrew.sawan@sedgwick.com or 330.819.4728.

TWO DAY SHOW!!!!!

EXHIBITOR CONTRACT

Company Name (as it will appear in show) __________________________________________

Contact Person (print) _________________________________________________________ Cell # _______________________________________________________________________

Primary Product(s)/Service(s) ___________________________________________________

Email address __________________________

Booth spaces are LIMITED and available on a 1st Come, 1st Served Basis! 2024 SOLD OUT - Act now to secure your booth!

BOOTH INFORMATION

Electric is optional and available on a 1st Come, 1st Served Basis!

Will you need electricity? _______ YES _______ NO ______# of Booth Spaces ____________TOTAL AMOUNT DUE

I understand that I have contracted for exhibit space by signing this contract and I am liable for the full cost of the booth space. I also understand that the final location of space will be determined by show management when payment is made in full. The undersigned represents that he/she is fully authorized to execute and complete this agreement. The undersigned also understands and agrees to the rules and regulations on the reverse side of this contract.

Authorized Exhibitor Signature

PAYMENT METHOD:

Please Indicate how you would like to pay for your booth space.

Printed Name ___Invoice ___Check Enclosed ___VISA/MC/AMEX/DISC*

*If you select credit card, our office will call for your card information.

Please send completed form to Judie@ncbia.com or 5321 Meadow Lane Court - B, Suite 23 Sheffield Village, OH 44035

Event Sponsors: **A $5.00 Convenience Fee will be charged for all Credit Card Payments

PHOTO GALLERY

LABOR MARKETS DRIVE FED'S Stance on Interest Rates

Labor markets remain central to the Federal Reserve’s monetary policy outlook. With inflation reduction stalling during the last few quarters and labor market conditions remaining tight, the Fed remains on hold for rate cuts. At the conclusion of its June meeting, the Fed held rates constant at a top target rate of 5.5%. Furthermore, in its newly published economic projections, the Fed sees just one rate cut in 2024, coming at the end of the year. May inflation data surprised with betterthan-expected readings, but inflation remains elevated. As such, the central bank will need additional, sustained progress on inflation to finally begin easing monetary policy.

The May employment data were mixed. Total job creation surprised to the upside with an estimated gain of 272,000 jobs, beating Wall Street expectations. However, the separately measured unemployment rate rose to 4%. NAHB is forecasting incremental gains for the unemployment rate in the months ahead, as the effect of tight financial conditions ripples through the economy. However, the jobless rate is expected to remain below 5%.

Other employment indicators are also showing signs that should allow the Fed to ease policy in the months ahead. For example, the total number of open jobs for the U.S. economy has fallen to 8.06 million. NAHB estimates that if this count falls into and remains in the 7 million to 8 million range, it will demonstrate sufficient labor market cooling to allow the beginning of interest rate cuts.

In addition to a decline in overall job openings, the count of unfilled positions in construction dropped to 338,000 in April. This number may face downward pressure in the months ahead as the multifamily construction market slows. Indeed, the three-month absorption rate for new multifamily rental units fell to a more than decade low at the end of 2023. Additional near-term slowing for construction hiring will be the result of declines for outstanding financing for construction and development purposes. For instance, the stock of outstanding residential construction loans declined 2% during the first quarter of 2024, falling to $95 billion. ($105 billion was the post-Great Recession high point.)

BY: DR. ROBERT DIETZ

New research shows the construction labor market is evolving with an eye toward addressing the long-run skilled labor shortage. According to NAHB analysis of 2022 Census data (most recent available), 1.29 million women worked in construction in the United States, accounting for 10.97% of the industry. However, only 2.8% of women in construction work in actual trade roles. This needs to improve in the years ahead. Texas, California, and Florida account for 30% of the nation’s total number of women in construction.

Bringing young people into the construction industry is critical for meeting long-term needs. According to NAHB analysis, the median age of construction workers is 42 — one year older than a typical worker in the national labor force. However, the number of younger people joining the industry is gradually rising. The share of younger construction workers ages 25 and under increased from 9% in 2015 to 10.8% in 2022. Meanwhile, the proportion of workers ages 35 to 54 declined from 71.8% to 67.3%.

IMAGINE THE POSSIBILITIES

There has never been a better time to be a Carter Lumber customer in the Cleveland/Akron area. We now have even more resources to provide our customers with quality materials and exceptional service. We’re more than just a lumberyard!

Contact your nearest store location to see how having Carter Lumber as a part of your team can help you grow your business and your bottom line.

WHAT AMERICANS SAY About Housing Affordability HOUSING AFFORDABILITY

Nearly four out of five Americans (77%) agree that America is in the midst of a housing affordability crisis and that officials at all levels of government are not doing enough to address this vital issue, according to a survey conducted by the polling firm Morning Consult on behalf of NAHB.

More than half (56%) say that it’s important to create more medium-density housing that is affordable to moderateincome households, younger households and first-time home buyer s.

So how do we ease the housing shortage and help create more affordable housing?

Policymakers Need To Do More

Regulations play a key role in housing affordability, and the majority of consumers think stronger efforts need to be made at both the local and the federal level to help alleviate the c ost of housing:

• 80% said their city and county officials were not doing enough to encourage the production of housing that is affordable to low- and moderate-income households.

• 51% said their elected representative to the U.S. Congress is doing too little to address housing affordability at the national level.

Provide Incentives to Increase Supply

There are a number of initiatives that can help solve the housing affordability crisis, which NAHB has outlined in its 10-point blueprint . U.S. consumers agree that the following tactics would be most effective in easing the housing crisis in their area:

• 74% said government should provide incentives to builders and developers to create more housing that is affordable to low- and moderate-income households.

• 64% support incentivizing local governments to ease zoning regulations that prevent the construction of more affordable housing.

Consider Varying Housing Types and Consider Regulatory Impact

Eighty percent say policymakers should factor in housing affordability when considering new laws and regulations. This includes zoning reform, which would allow a greater variety of housing types to meet varying price points for potential home owners.

Most would support the development of the following housing types within a 10-minute walk of their home to help ease the housing supply shortage:

• New single-family homes for sale (78%)

• Senior living community (76%)

• New townhomes for sale (68%)

• Two-story apartment building with units for rent (64%)

• Two-story condominium building with units for sale (62%)

BUILDER CONFIDENCE WANES as Housing Starts Fall Back

The higher-for-longer interest rate environment put downward pressure on builder sentiment and overall building conditions over the last month. Interest rates have settled lower on signs the economy is slowing, with the 10-year Treasury rate ranging below 4.3% and mortgage rates registering at just under 6.9%, per Freddie Mac last week.

Persistently high mortgage rates are keeping many prospective buyers on the sidelines, as reflected in the latest NAHB/Wells Fargo Housing Market Index (HMI) which declined two points to 43 in June. The HMI survey also revealed that 29% of builders cut home prices to bolster sales in June, the highest share since January 2024 (31%) and well above the May rate of 25%. However, the average price reduction in June held steady at 6% for the 12th straight month. Additionally, the use of sales incentives ticked up to 61% in June.

Consistent with the weaker HMI reading, single-family starts decreased 5.2% in May to a 982,000 seasonally adjusted annual rate. However, on a year-to-date basis, single-family starts are up 18.8%, albeit off weak early 2023 data. Single-family permits decreased 2.9% to a 949,000-unit rate, the lowest pace since June 2023.

Multifamily construction declined 6.6% to an annualized pace of 295,000 — the lowest since April 2020. Moreover, the three-month moving average for multifamily starts is the lowest since the fall of 2013, as the sector continues to decelerate. For example, the ratio of multifamily completions to starts was 1.8 in May. By comparison, this ratio was 0.6 in April 2022, when many more apartments were starting construction compared to finishing construction, demonstrating the significant reversal for the multifamily construction pipeline.

BY: DR. ROBERT DIETZ

Existing home sales fell for the third straight month in May because of lingering high mortgage rates and record-high prices. Total existing home sales fell 0.7% to a seasonally adjusted annual rate of 4.11 million in May. On a year-overyear basis, sales were 2.8% lower than a year ago. At the current sales rate, May unsold inventory sits at a 3.7-month supply, up from 3.5 last month and 3.1 a year ago. This inventory level remains very low compared to balanced market conditions (4.5- to 6-month supply) and illustrates the long-run need for more home construction.

The cost of inputs to residential construction fell 0.09% over the month, according to the latest Producer Price Index (PPI). This was the first decrease in the index since October of last year. While the index fell over the month, it was 2.91% higher than in May of last year. Copper has been an issue recently. The non-seasonally adjusted PPI for copper rose 8.5% in May after rising 3.4% in April. Over the year, the index was up 17.1%.

With interest rates elevated and markets somewhat on hold until the Fed begins easing, home construction trends are likely to be flat at a softer pace in the months ahead. Significant demand exists on the sidelines, as would-be buyers wait for housing affordability conditions to improve. NAHB is forecasting the first rate cut from the Fed will occur in December of this year, about a half year later than was expected from the viewpoint of the end of 2023.

EYE ON THE ECONOMY

CONSIDERING HOUSING INVENTORY: Why Both New and Existing Supply Matters

Total (new and existing) home inventory is an important measure for gauging and forecasting home prices and home construction impacts. The intuition is clear: more inventory yields weaker or declining home price growth and home building activity. Lean inventory levels lead to price growth and gains for home building. The metric “months’ supply” is a common measure of current market inventory. For both new and existing home markets, months’ supply converts inventory from a count of homes into a measure of how many months it would take for that count of home inventory to be sold at the current monthly sales pace.

Housing economists typically advise that a balanced market is a five- to six-months’ supply. Larger inventory levels than this benchmark risk producing deteriorating conditions for price growth and building activity.

In the Census May 2024 newly-built home sales data , the current months’ supply of inventory is 9.3. Some analysts have noted that, given the five- to six-month benchmark, that this means the building market for single-family homes is possibly oversupplied, implying declines for construction and prices lie ahead. However, this narrow reading of the industry misses the mark. First, it is worth noting that new home inventory consists of homes completed and ready to occupy, homes currently under construction and homes that have not begun construction. That is, new home inventory is a measure of homes available for sale, rather than homes ready to occupy. In fact, just 21% of new home inventory in May consisted of standing inventory or homes that have completed construction (99,000 homes).

More fundamentally, an otherwise elevated level of new home months’ supply is justified in current conditions because the inventory of resale homes continues to be low. Indeed, according to NAR data, the current months’ supply of single-family homes is just 3.6, well below the five- to six-month threshold. It is this lack of inventory that has produced ongoing price increases despite significantly higher interest rates over the last two years. Taken together, new, and existing single-family home inventory, the current months’ supply of both markets is just 4.4, as estimated for this analysis. This is admittedly higher than the 3.6 reading, using this approach, from a year ago, but it still qualifies as low. See the following graph for total months’ supply going back to the early 1980s using data from the NAR existing home sales series and the Census new home sales data, as calculated by NAHB.

BY: DR. ROBERT DIETZ

Yes, inventory is rising and will continue to rise, particularly as the mortgage rate lock-in effect diminishes in the quarters ahead. But current inventory levels continue to support, on a national basis, new construction, and some price growth, per this current reading of total months’ supply. Further, the housing deficit (NAHB estimates about 1.5 million homes), which was produced by a decade of underbuilding due to a perfect storm of supply-side challenges, has generated a separation in the normally colinear measures of new and existing home months’ supply. This separation became particularly pronounced during the COVID and post-COVID period of the housing market. June 2022 recorded the largest ever lead of new home months’ supply (9.9) over existing single-family home months’ supply (2.9). This separation makes it clear that an evaluation of current market inventory cannot simply examine either the existing or the new home inventory in isolation. With the current total months’ supply at 4.4, what does this mean for the market, particularly with respect to pricing and construction trends? To examine this question, I calculated the total months’ supply reported on the first graph in this post. I then examined price movements and single-family construction starts data with respect to current total months’ supply. The results are broadly consistent with the existing rules of thumb regarding market conditions.

All Charts & Attachments LINKED HERE

LIMITED TIME OFFER!

Earn 30¢ per gallon for the first three months once you reach 100 gallons in each calendar month. Thereafter, save 6cpg for every gallon pumped.*

Th e 7-Eleven Comm er ci al Fl ee t M ast er ca rd

Fleet Savings Made Easy

Perfect fit for mid-sized to larger fleets that need the added convenience of fueling where Mastercard® is accepted. With the 7-Eleven Commercial Fleet Mastercard®, your fleet can customize reports for a complete fuel management solution.

Rebates & Savings

Earn 30¢ per gallon for the first three months once you reach 100 gallons in each calendar month. Thereafter, save 6cpg for every gallon pumped.*

Security & Fraud Controls

Enjoy the security of advanced card prompts.

Earn 30¢ per gallon for the first three months once you reach 100 gallons in each calendar month. Thereafter, save 6cpg for every gallon pumped.*

Customize and download cost and performance reports monthly or in real-time.

Monitor transactions and manage your account online, in real-time.

Use card prompts to help prevent misuse. Simple online access.

Accepted at your favorite 7-Eleven & Speedway locations and anywhere Mastercard is accepted, regardless of fuel brand.**

Name

Online Control & Visibility

Set card controls and access detailed reporting online anytime.

The 7F LEET Diesel Network Ma stercard ®

Fueling your fleet for the road ahead.

Diesel Network Mastercard offers significant discounts on diesel at the over 260 locations that make up the 7FLEET Diesel Network as well as discounts on commercial truck lane diesel across the AMBEST network.

Network Discounts

Save an average of 53cpg on truck diesel lane gallons fueled in the 7FLEET Diesel Network.*

Security & Fraud Controls

Enjoy the security of advanced card prompts.

Online Control & Visibility

Set card controls and access detailed reporting online anytime.

Customize and download cost and performance reports monthly or in real-time.

Monitor transactions and manage your account online, in real-time.

Use card prompts to help prevent misuse.

Simple online access.

Accepted at your favorite 7-Eleven & Speedway locations and anywhere Mastercard is accepted, regardless of fuel brand.**

7-Eleven Fleet Card Program Application

Please send the application to

INFORMATION – Required.

Type

below.

AUTHORIZED REPRESENTATIVE – Required.

Application Terms: By signing this Application, the Authorized Representative represents, warrants, and agrees that: (a) he or she is authorized to apply to FLEETCOR TechnologiesOperating Company, LLC (“FLEETCOR”), a Louisiana limited liability company, for an unsecured, partially secured, or fully secured line of credit (“Account”) on behalf of the company identified above (“Client”); (b) FLEETCOR may obtain Client’s credit report and check Client’s credit standing when processing this Application or periodically evaluating any resulting Account’s creditworthiness; (c) this Application is subject to approval and acceptance by FLEETCOR; (d) if the Application is approved by FLEETCOR in Louisiana, the resulting Account: (i) will be governed by Louisiana law; (ii) will not be a revolving credit account and the Amount Due/Total Amount Due shown on each Account Statement will be due and payable on the Due Date shown on the Statement; (iii) will be used solely for commercial purposes and not for personal or household purposes; (iv) will be suspended, and the Client’s redit history may be reported to credit reporting agencies, if the Client’s unpaid balance ever meets the Account’s Credit/Spend Limit; and (e) acceptance, signing (in whatever form), or use of any of the Cards issued to Client will constitute Client’s acceptance of the Client Agreement available at www.fleetcor.com/terms/7-Eleven-mc or www.fleetcor.com/terms/7-Eleven-dn Equal Credit Opportunity Act Notice. The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age (provided that the applicant has the capacity to enter into a binding contract); because all or part of the applicant’s income derives from any public assistance program; or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act. The federal agency that administers compliance with this law concerning this creditor is the Federal Trade Commission, Equal Credit Opportunity Act, Washington, D.C. 2 0580. FLEETCOR considers your privacy important. View our privacy policy available at www.fleetcor.com/privacy-policy to find out more.

I agree to the Application Terms and the Client Agreement (Please check box) ☐

BUSINESS OWNER(S) / PERSON WITH SIGNIFICANT MANAGEMENT RESPONSIBILITY – Required.

To help fight financial crimes, the U.S. Department of Treasury require financial institutions to obtain, verify, and record information about beneficial owners of entities opening accounts. Beneficial owners are persons who, directly or indirectly, own 25% or more of the entity. We may use third-party resources to verify your identity. For questions about this regulation and how FLEETCOR uses and protects this data, please speak with your sales representative. Patriot Act Notice. Section 326 of the USA PATRIOT Act mandates that FLEETCOR verify and record certain information about you (the Client, Authorized Representative, or anyco-maker or guarantor) while processing this Application.

Beneficial Owner (Individuals who own 25% or more of a Legal Entity)* ☐ Not Applicable, Sole Proprietor, Government Entity, Not

this person have significant responsibility for managing the legal entity listed above?