Office of Financial Aid

Congratulations on your admission to North Central College! We look forward to supporting you on this journey. We believe a North Central education is a valuable asset that will help you push past what you thought was possible!

With that, we recognize that paying for college can be a daunting process no matter how you arrived at this point. To make things as easy as possible, our office has provided you with the best financial aid offer based on your Free Application for Federal Student Aid (FAFSA) and in accordance with federal, state, and institutional regulations. Additionally, we have crafted this Financial Aid Planning Workbook to assist you in understanding the resources available to make this opportunity affordable.

We encourage you to work your way through the Five Financial Aid Steps outlined in this workbook and stay tuned for additional information about securing student employment, maximizing student loan options, exploring payment plan options and more.

We look forward to partnering with you and your family to ensure you are informed and confident in your decision. Don’t hesitate to contact your admissions counselor if you have any questions.

We are here for you!

Warm regards,

Kevin Towns

Senior Director of Financial Aid

FINANCIAL AID STEPS 1-2 Step #1

Make Sense of the Information

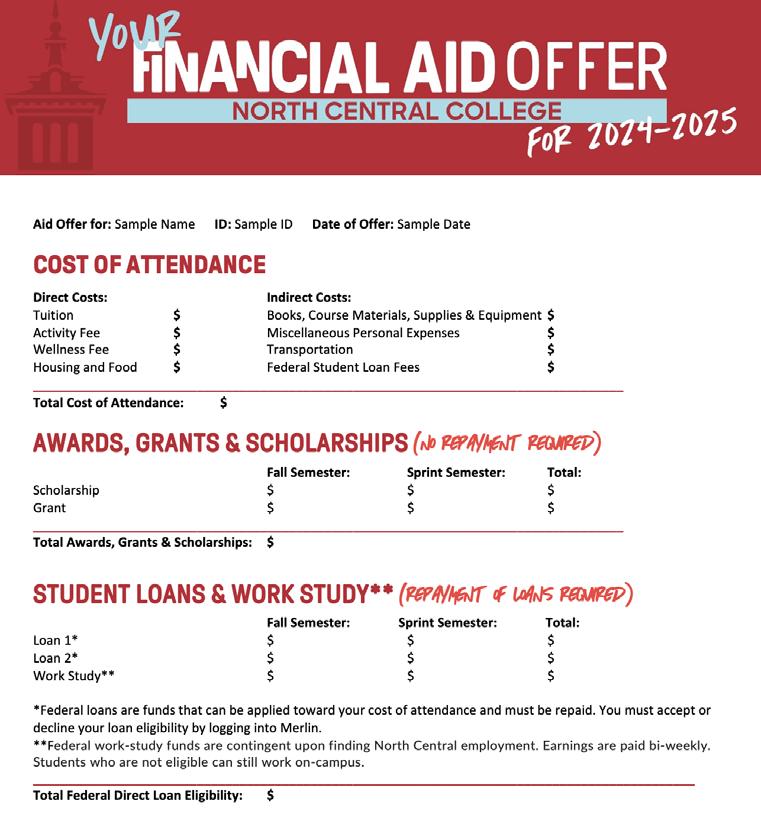

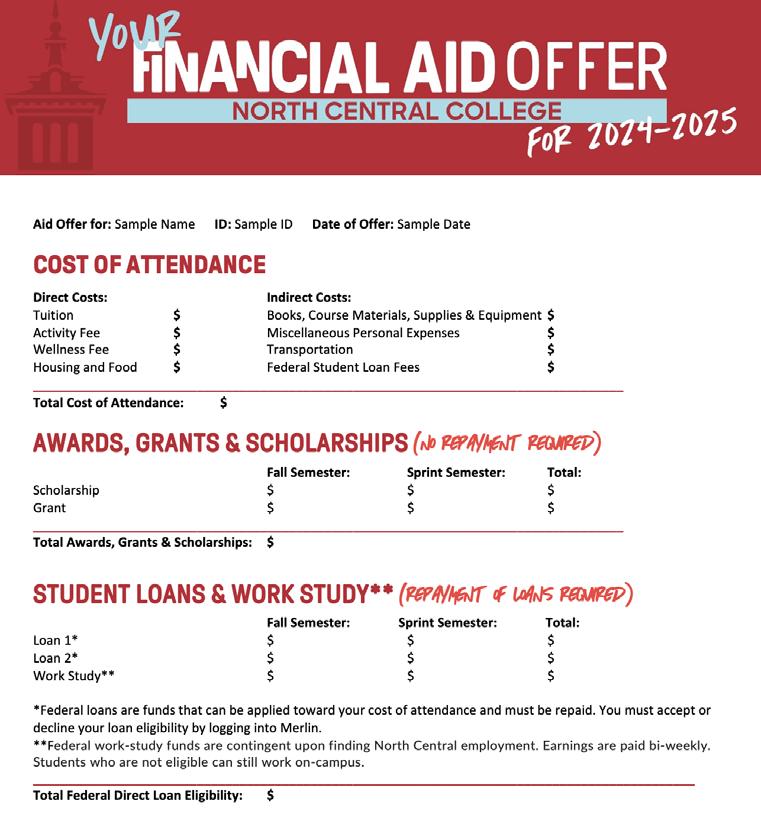

Understanding Your Aid Offer

Your aid offer is based on the anticipation of full-time enrollment and housing plan as communicated on your admission application.

what it all means:

Cost of Attendance:

Cost of attendance (COA) is an estimate of your total cost of educational expenses based on your anticipated enrollment and housing plans for one academic year. Your COA is divided into direct and indirect costs and also indicates the maximum amount of financial aid in one academic year.

• Direct costs are based on your housing plan. Your direct costs include tuition, standard fees, housing, and food (if living on-campus).

• Standard fees include the Wellness Fee and the Student Activity Fee.

Sample Aid Offer

Wellness Fee: The Wellness Fee is $50/semester ($100/year) that is applied to all full-time, degree-seeking students’ accounts. The Wellness Fee supports services provided by the Dyson Wellness Center at North Central College. These services include medical care, mental health counseling, advocacy and health education. Services are provided by licensed clinicians. While the services do not cover chronic health conditions and instead remain focused on acute and short-term care, clinicians assist with referrals and local resources when needed.

Student Activity Fee: There is a Student Activity Fee of $90/semester ($180/year) that is applied to all full-time, degree-seeking students’ accounts. The Student Activity Fee supports a variety of student activities on campus provided by student clubs and organizations as well as large scale events provided by the Student Affairs & Athletics division.

• Indirect costs are based on the average student’s educational expenses put into categories. Your indirect costs include housing and food (if commuter); books, course materials, supplies, and equipment; personal expenses, travel, and federal student loan fees.

Grants & Scholarships:

Grants: Gift assistance that does not need to be repaid and is determined by a student’s Student Aid Index (SAI) and/ or financial need. Grants can be provided by the federal or state government, institutions or outside organizations. Amounts can adjust year after year depending on the FAFSA.

Scholarships/Awards: Gift assistance that does not need to be repaid and is generally given on the basis of academic achievements. Amounts generally stay the same year after year.

Estimated Net Price:

Estimated amount after deducting grants and scholarships from cost of attendance.

Federal Work-Study:

Employment opportunity for students to contribute to educational costs while in school. Students usually work on campus at minimum wage for fewer than 12 hours a week. Work-study is not reduced from charges on your aid offer because you will receive a paycheck for hours worked.

Student Loans:

Assistance borrowed through a federal, institutional or external source that must be repaid, generally with interest. Amounts and types can change annually.

Estimated Direct Cost Balance:

Estimated amount owed after grants, scholarships, and loans are deducted from direct costs.

Step #1 cont.

Financial Aid Vocabulary

When it comes to financial aid, learning the lingo is half the battle. Here are helpful definitions to commonly used terms.

STUDENT AID INDEX (SAI):

An index number calculated based on FAFSA data. This figure is used by a financial aid office to determine a student’s eligibility for need-based aid.

FINANCIAL NEED:

A calculation used to determine need-based eligibility amounts. The financial need calculation is cost of attendance minus student aid index. Note: In cases where a student aid index is negative, the number zero is used.

VERIFICATION:

A federal process where a FAFSA is required to be reviewed by a financial aid office to ensure the form was completed correctly. This process generally requires additional documentation.

MERIT FINANCIAL AID:

Awards listed with a number (ex. ‘28 Presidential Scholarship) are guaranteed for maximum four years as a first-year student or three years as a transfer student. The number indicates the last year of automatic renewal. All awards require full-time enrollment.

NEED-BASED FINANCIAL AID:

Awards that do not include a number (ex. North Central Grant) can adjust annually based on funding level, eligibility, and FAFSA results. The amount of these awards can also change if a student adjusts their enrollment in any given semester.

Step #2

Schedule an Appointment

We are committed to providing the resources and support to ensure you are confident in your decision. Schedule a meeting with your admission counselor to review your financial planning workbook.

During your appointment you can:

• Review your aid offer

• Calculate cost and compare awards

• Explore additional options for aid

• Discuss housing and food costs

• Create a game plan for remaining expenses

FINANCIAL AID STEPS 3-5

Step #3

Compare North Central to Other Colleges

In order to make the best decision, it’s recommended that you compare awards equally. Use this chart to help compare how much you’re expected to borrow or contribute to your education.

A.

B. Required Fees

C. Housing

D. Food

E.

F.

G. Awards

H. Grants

L. Unsubsidized Loans

M. Institutional Loans

N. Total Loans (add K-M)

O. Estimated Remaining Balance After Loans (subtract N from J)

Step #4

Charges* North Central College College #2

College #3

Tuition

Total

Free Money North Central College College #2 College #3

Estimated Bill (total boxes A-D)

University/College

Scholarships

I. Total Free Money (total F-H)

(subtract

Student Loan Borrowing North Central College College #2 College #3

J. Estimated Balance Before Loans

I from E)

K. Subsidized Loans

There is no better time than now to begin exploring and securing other options to cover educational costs. Get a Head Start on Other Resources Apply for outside scholarships y northcentralcollege.academicworks.com y Contact your admission counselor for additional options Consider savings and summer work y Student summer work y Student and parent savings/assets y Other family or friend support Review Parent PLUS or private loans y studentaid.gov y elmselect.com *Planning for Additional Costs Charges will be impacted based on the choices you make regarding the items listed below: • Housing selection & meal plan option • Special fees associated with courses (i.e. lab and music lesson fees) • Specialty program fees (i.e. Honors Program, study abroad) • Student Orientation • On-campus parking

Step #5 (AGAIN!)

Visit Campus

Visit in person or through our virtual tour. Experience the Cardinal difference and make the most of your investment.

Why North Central?

The short answer: we check all the boxes.

Inclusive Cardinal Community

2,800+ students call North Central College home

1/3 of students are transfer students

40% of students are first-generation college students

Ideal Location

Our 68-acre campus is:

y Covered in green space, gardens and our own arboretum

y Steps from Downtown Naperville

y A 30-minute train ride to Chicago

Our hometown of Naperville, IL is:

y Ranked 3rd in “Best Cities to Live in America” (Niche, 2022)

y Named “Safest City in America” (MoneyGeek, 2023)

y Complete with 150+ shops, restaurants and the beautiful Naperville Riverwalk

Check out our virtual tour!

Exciting Campus Life

100+ student organizations including award-winning programs like:

y Cardinal First, first-generation college student community

y Association of Commuter & Transfer Students

26 NCAA Division III athletic teams with a legacy of excellence:

y 44 national team championships

y 903 national academic awards

4 world-class fine and performing arts venues

Distinctive Programs

90+ undergraduate and 19 graduate programs

100% of classes taught by faculty, not teaching assistants

Average class size is 20

Professional academic advising and faculty mentors

Outcomes & Opportunities

92% of graduates are working in their field or enrolled in graduate school

30,000+ alumni network of industry experts and mentors

Access to internships, research and job opportunities

Student Resource Guide

Office of Admission

630-637-5800 | admissions@noctrl.edu

northcentralcollege.edu/admitted-student

Office of Financial Aid

630-637-5600 | finaid@noctrl.edu

northcentralcollege.edu/tuition-aid

Office of Residence Life

630-637-5858 | reslife@noctrl.edu

northcentralcollege.edu/housing

Office of Dining Services

630-637-5645

northcentralcollege.edu/housing-dining

Office of Student Accounts

630-637-5689 | studentaccounts@noctrl.edu

northcentralcollege.edu/paymentplan

Contact us!