THE MAGAZINE OF THE NATIONAL FRANCHISEE ASSOCIATION, INC. www.nfabk.org Flame 2020 Issue 2 page 22 Nancy McLamore (1926-2020): BURGER KING’s First Lady

In uncertain times, innovation is king. WE’RE HERE TO HELP. ©2020 J.R. Simplot Company From innovative LTO concepts to new, on-trend products, count on Simplot for the insights, supply and support you need to keep patrons coming back. potatoes | avocados | fruits | vegetables | grains www.simplotfoods.com Watch our BK thank you video!

NFA Editorial Board

Drew Paterno

Executive Editor dpatern@aol.com

201-445-0055

Jessica Loeding

Editor-in-Chief jessical@nfabk.org

Sean Ireland

Managing Editor seani@nfabk.org

Rachel Jackson

Associate Editor rachelj@nfabk.org

Advertising Sales

Jeff Reynolds Director of Business Partner Relations jeffr@nfabk.org

678-797-5163

NFA Officers

Dan Fitzpatrick Chair

Jim Froio Vice Chair

Drew Paterno Secretary

Steve Keith Treasurer

Steve Lewis Chair Emeritus

Christy Williams

CEO

NFA Board of Directors

CANADIAN FRANCHISEE ASSOCIATION

Mike Kitchingman

FLORIDA/CARIBBEAN

Glenn Levins

GREAT MIDWEST

Adam Velarde

Matt Carpenter

GREAT WESTERN

Nasser Aliabadi

Gary Geiger

INTERNATIONAL HISPANIC

FRANCHISEE ASSOCIATION

Guillermo Perales

LARGE FRANCHISEE GROUP

Patrick Sidhu

METRO NEW YORK

Amir Syed

MID-ATLANTIC

Gary Andrzejewski

MID SOUTH

Kevin Newell

Mike Callahan

Brent Northrop

Larry Stokes II

MINORITY FRANCHISEE ASSOCIATION

Camille Lee-Johnson

MOUNTAIN

Amir Allison

NEW ENGLAND

Brek Kohler

SOUTHERN CALIFORNIA

Shirley Humerian

SOUTHWEST

Michael Laird

OHIO RIVER

Matt Herridge

Bill Keller

Design and Layout

KT Graphic Design ktgraphicdesign@gmail.com

TABLE OF CONTENTS

2020 Issue 2

ON THE COVER

As the wife of BURGER KING® co-founder Jim McLamore, Nancy McLamore was often considered the brand’s first lady. With her passing in May, family and friends recalled the important role she played as her husband’s partner, company ambassador and so much more. Read more about this remarkable woman on page 22.

HEADQUARTERS

First Lady

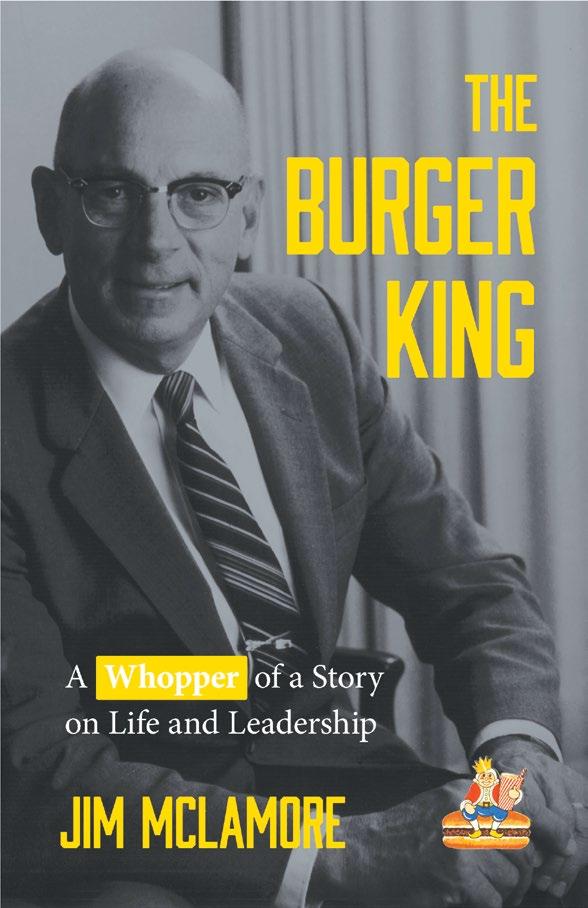

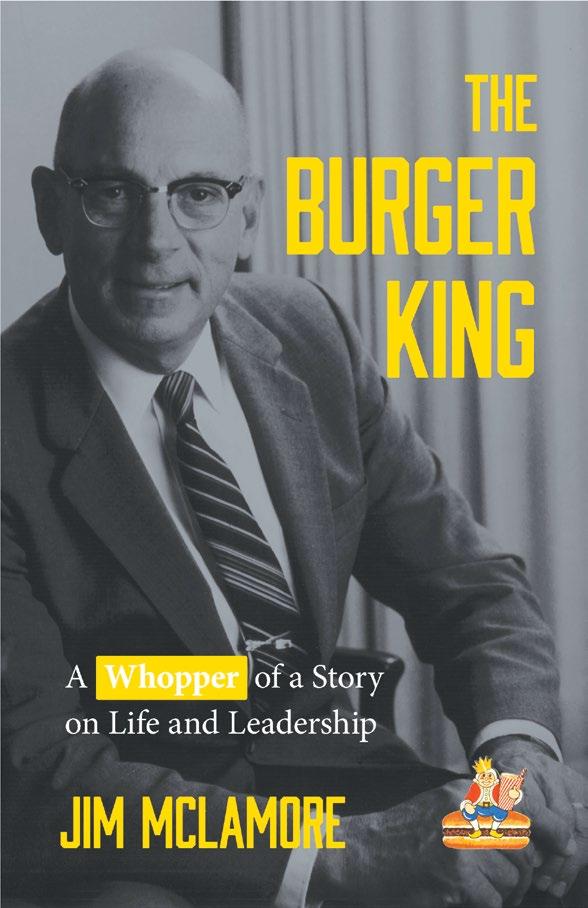

26 BK Founder’s Book Being Reissued With New Material by Sean Ireland

28 New Dashboards Offer Home Delivery Insights contributed by RSI

30 BURGER KINGSM Family Fund: A Helping Hand During a Global Pandemic contributed by the BURGER KING McLAMORESM Foundation

32 Communications Take On Added Importance in Wake of COVID-19 and Civil Unrest by Douglas H. Duerr, Elarbee Thompson

34 Six Employee Communication Strategies During Times of Crisis by Dennis Snow, Snow & Associates Inc.

36 Balance the Opposites by Dan Coughlin, The Coughlin Co.

38 Making the Most of Your Business’s Risk Management contributed by Lockton Cos.

40 Productive Worry Versus Unproductive Worry: Six Ways to Make Worrying Work for You by Laura Stack, The Productivity Pro®

42 Optimally Manage Cash Flow With a Financial Team by Charlie Koch, Prism Financial Group, a related company of Mize Restaurant Group

1701 Barrett Lakes Blvd. NW, Suite 180 Kennesaw, GA 30144 Phone: 678-797-5160 • Fax: 678-797-5170 www.nfabk.org The National Franchisee Association, Inc., comprising regional BURGER KING franchisee associations, publishes the Flame. Any reproduction, in whole or in part, of the contents of this publication is prohibited without prior written consent of the National Franchisee Association, Inc. All Rights Reserved. In keeping with our commitment to the environment, this publication is printed on certified, environmentally friendly recycled paper using eco-friendly inks. Copyright ©2020 • Printed in the U.S.A.

Columns 02 As We Look to the Future, We Cherish the Memory of a BK Pioneer by Dan Fitzpatrick, NFA chair 04 Elevanta and NFA Services Can Help You Overcome Business Challenges by Christy Williams, CEO Departments 06 NFA Member News 10 Calendar of Events 13 One Topic: 10 Facts 15 Look, Listen, Read Directories 12 Support the Vendors That Support Your Association 44 Editorial Calendar and Advertisers Guide Features 14 Spotlight on the 116th Congress: Rep. Chip Roy (R-TX-21) 16 ‘A Penny Business:’ Franchisees Battle Rising Food Costs by Sean Ireland, NFA associate director of communications 20 Healthy Companies Closely Manage P&L Statements by Sean Ireland 22 Nancy McLamore (1926-2020): BURGER KING’s

FROM THE CHAIR

As We Look to the Future, We Cherish the Memory of a BK Pioneer

This issue of Flame magazine is paying tribute to the memory of Nancy McLamore, the wife of Jim McLamore, one of the co-founders of the BURGER KING® brand. Mrs. McLamore was 93 and died May 23.

Nancy was a wonderful woman who supported her husband, Jim McLamore, in his dream of growing the BURGER KING brand from its infancy to a national brand. Mrs. McLamore was known for her grace, charity and kindness. She and Jim made an important impact on BURGER KING, the Miami, Florida, community and many other institutions, including the BURGER KINGSM McLamore Foundation. Through the foundation, millions of dollars in educational support for high school students and BURGER KING employees, as well as support for the entire BURGER KING family, has been achieved.

The McLamores often attended NFA events. Jim was a great motivational speaker and offered us a wealth of business and institutional knowledge, and Nancy was a warm presence who could make a stranger feel like a close friend within minutes.

Jim and Nancy were important to our brand for more than being its co-founders. Of course, it starts with their passion for a mission to serve great food to guests at

reasonable prices, but they contributed to the BK® system in many ways. After selling the company in 1967, Jim remained as its CEO and president for several years. Later, he served as a consultant to the brand in the 1980s and 1990s, and both his son and one of his sons-in-law were franchisees. Nancy was there every step of the way.

The McLamores often attended NFA events. Jim was a great motivational speaker and offered us a wealth of business and institutional knowledge, and Nancy was a warm presence who could make a stranger feel like a close friend within minutes. She was often a fixture at our convention long after Jim’s death in 1996. She loved our BURGER KING brand and its people, who she called friends.

We owe much to these pioneers who not only set the foundation for today’s globally celebrated BURGER KING system, but also continued to advocate for a strong BK franchisee community as a critical ingredient for the brand’s recipe of success. We hope you read more about Nancy in the story that starts on page 22.

For over 30 years, the NFA has been the champion of the community that Nancy and Jim believed in so strongly, advocating for the interests of large and small-sized franchisees across the system. The mission of the NFA requires us to collaborate on issues that affect all of us. We work with Burger King Corp. to ensure our collective views are known on subjects such as marketing, menus, operations, restaurant development and image and to find solutions that are good for both groups. We offer a clear voice to the supplier community so that vendors can partner with us and ensure their products and services meet our needs. The NFA also promotes policies and laws favorable to entrepreneurship and the economic health of small businesses with our elected officials in Washington, D.C. We know Jim and Nancy always strongly supported the NFA

by DAN FITZPATRICK

by DAN FITZPATRICK

and its mission.

2020 will be remembered as a year that has been more challenging to our industry than any other year in memory. The NFA has worked tirelessly with our franchisor, Burger King Corp., to develop meaningful relief measures for franchisees. We have consistently monitored and engaged on government relief bills and programs such as the Coronavirus Aid, Relief, and Economic Security (CARES) Act and the Paycheck Protection Program (PPP), suggesting improvements to those and other measures that have been important for our franchisees.

Together we have gotten through this, and clearly, there are challenges that await us. As we move forward, stay strong and remain engaged with the NFA. Just as Nancy and Jim McLamore were keys to BURGER KING’s past successes, together we will be just as important to its future ones. n

2 Flame | 2020 ISSUE 2

SAVE

March 9-12 | Cosmopolitan, Las Vegas

WHO SHOULD ATTEND: Franchisees | ARLs | System Suppliers

THE DATE! 2021 NFA LEAD Conference

Elevanta and NFA Services Can Help You Overcome Business Challenges

As our nation continues to struggle through the coronavirus pandemic, our business operations have all been challenged. The pandemic is an unprecedented disaster, touching off unforeseen problems in all facets of our businesses.

If there is a silver lining to the clouds of uncertainty that have been pushed over our organizations by the disease and the response to curtail it, it’s that unconventional times often lead to increased innovation and the development and use of unexpected solutions.

What do you do when there’s a new challenge you’ve never considered before? You find new ways to overcome the hurdle. In business, leaders often become willing to try solutions that they may not have considered when operations were running normally. Many times, those new ways of doing business work so well that they become permanent, even when the circumstances that led to their adoption ease.

In this way, crisis can become the progenitor for the successful evolution of some of your operations, allowing you to manage your businesses more efficiently and better serve your teams and customers.

Elevanta and the National Franchisee Association (NFA) offer services that many BURGER KING® owners might previously have considered unconventional, but under today’s circumstances provide unexpected advantages to them and their teams. Elevanta has developed many of these solutions through partnerships with industry-leading companies.

Among them are:

• Paycards: Through an agreement with rapid!, NFA offers one of the most comprehensive paycard programs available on the market. By using paycards to compensate employees, businesses eliminate paper checks, reduce costs and improve efficiency. Employees get a

flexible payment solution that frees them from having to deposit or cash paychecks, keeping them safer by eliminating unnecessary trips to their financial service provider.

• Payroll and accounting: NFA partner Mize CPAs Inc. offers the Elevanta Payroll & Accounting program, which provides a cost-effective solution for payroll processing from a full-service financial firm. The Mize CPAs program offers complete payroll processing, including many services for which others charge extra. You can outsource this time-consuming function and handle your biggest single expense more efficiently with this Elevanta program.

• Hiring and onboarding assistance: By working with TraitSet Hire, franchisees have access to a platform with hiring solutions such as Text-to-Apply and online job application processing, including behavioral assessments, that reduce faceto-face contact between managers and job candidates, keeping both groups safe. The program also offers customizable training and scheduling technology.

• Safety equipment: NFA’s preferred safety products partner, Front Line Sales, stocks and maintains safety products –including personal protective equipment – for the restaurant industry with singlesource ordering and customized programs that deliver the right products and services to your business with best-pricing strategies and dedicated account representatives. As restaurant dining rooms reopen and teams are rebuilt, having the necessary equipment and products to keep them and guests safe will be more important than ever.

• Energy procurement services: NFA members can benefit from our partnership with APPI Energy, a company that offers utility-based benefit programs in competitive deregulated areas. Analyze your utility accounts and get monthly reporting of your costs, savings and refund

by CHRISTY WILLIAMS

opportunities with no upfront fees. The savings may provide cash flow at a time when it has never been needed more.

If you have questions or would like more information about these services or the Elevanta Health or Elevanta Property & Casualty insurance programs, please contact us at 678-540-6203.

The NFA is dedicated to helping our members no matter the circumstances in the world around us. Curating and offering these services are important ways that we assist you to solve dilemmas and boost your businesses.

The challenges that we continue to face this year were unexpected. They’ve been painful in both human and economic costs. Though it remains unclear how much longer recovery will take, they present you with an opportunity to evaluate your organization and consider the new ways in which Elevanta and the NFA can help you clear the hurdles. You may discover that you can improve your operations in ways that far outlast the difficulties we face and lead to more success in the brighter future ahead. n

4 Flame | 2020 ISSUE 2

THE CEO

FROM

Your businesses are facing challenges in uncharted territory. To help, Elevanta Health deferred April health insurance premiums—estimated at $1.7 million—and provided annual participation refunds of over $300,000 to our members. That’s a combined total of $2 million we put back into the hands of members during a time when they needed it the most.

We care about your wellbeing. Contact us today for a custom quote.

memberservices@elevanta.com I elevantahealth.com/nfa I www.elevanta.com

= $1k in Refunds

= $1k in Deferred Premium

2020 ISSUE 2 | Flame 5

Ocedon Team Member Celebrates 25 Years With the Brand

José Lopez is the general manager at Ocedon’s BURGER KING® restaurant in Aurora, Colorado, and is celebrating more than 25 years with the brand. After moving to Colorado from California in 1993, he began working as a crew member at the Highlands Ranch restaurant. Lopez has served in all positions in the BK® restaurant, from kitchen crew and maintenance all the way up to his current position as general manager.

The Ocedon team, led by franchisees Ken and Elena Donahue, is proud to have a manager like Lopez working in its restaurant. Lopez’s co-workers have described him as an “all-around great manager who is exceptional at building and developing his team.”

His extensive experience in all

positions throughout the restaurant and his vast knowledge of the BK system make him a great asset to the team. Lopez is always hitting his target goals and achieving positive results. On his days off, he enjoys spending time with his family, especially his grandson, Mateo.

Recently, Lopez and his team prepared and donated meals to the Aurora Public School district staff, who provided meals to children and their families every day. These children would typically rely on breakfast and lunch at their schools, which were closed due to the coronavirus pandemic.

“On behalf of all of us in the OCEDON BK family, we thank you for all you do!” said Ken and Elena Donahue of Lopez. n

6 Flame | 2020 ISSUE 2 MEMBER NEWS

José Lopez has been working in the BK system for over 25 years.

BURGER KING Team Members in Phenix City, Alabama, Receive Surprise From Generous Guest

Schuster Enterprises’ BURGER KING® in Phenix City, Alabama, recently received an encouraging surprise. The restaurant, owned by Todd Schuster, had a guest come through the drive-thru on May 22 who was feeling quite generous.

During the peak of the COVID-19 pandemic, many restaurants were restricted to drive-thru only and team members had to ensure they were following strict safety and cleaning protocols. This guest wanted to give back to

these team members during an especially hard time for many.

The woman donated $2,000 in cash to the restaurant as an appreciation gift. The management team did not recognize her as a regular guest, but she mentioned that she simply wanted to “give back.” The woman said she is a small-business owner and appreciates all the incredible work the BURGER KING team members are doing.

The $2,000 was divided between the team members, and each received just over

$50. Schuster Enterprises also rewarded the management team with checks. “This is not the first time a customer has given money to crew members, but this is the largest we can recall in the history of our company,” said Romy Almanza, HR administrator for Schuster Enterprises.

Almanza and the rest of the Schuster team were very proud of the crew in Phenix City for doing a great job and making a tremendous impression on its guests. n

Charton Management Partners With Hall Financial Advisors to Provide Free Kids Meals

Amidst the chaos of the nation’s shutdown because of the novel coronavirus pandemic in March, restaurant operators were naturally focused on how to adjust their businesses to emphasize drive-thru and delivery service as their dining rooms were shuttered.

Looking beyond their own challenges to see how they could meet the needs of their communities, however, was something that many were also able to do. Among them was Charton Management, which owns nine BURGER KING® restaurants in Ohio and West Virginia, and worked in partnership with Hall Financial Advisors, an associate member of the National Franchisee Association (NFA).

The two companies provided 2,000 free BK® kid’s meal coupon cards to two local school systems to distribute to students who would miss meals by not being in school. The cards were provided to the Wood County, West Virginia, and Washington County, Ohio, school superintendents, who then distributed them to their students.

Franchisee Matt Herridge said Chris Hall, managing principal of Hall Financial Advisors, approached him with the idea. “[He] has a charitable organization that regularly looks for ways to give back to the community,” Herridge said. “Chris suggested the idea, and we developed it

very quickly so that we could get the meals to those in immediate need.”

Because of the quick teamwork of Charton and Hall, the coupons were made available within the first week of the closing and could be used at any of Charton’s nine locations.

“Area schools had just been closed, and parents were scrambling to adapt,” said Herridge. “School systems were trying to plan how to continue to feed students who would not be present, and no program had been put in place yet. A very large number

of children in our communities benefit from the free school lunch program. We know that small businesses are often more efficient than government agencies in solving problems and acting expediently. We saw a need and knew we could fill that need fast.”

The Charton team was thrilled to receive recognition from local TV and print media for its hard work. The team’s efforts were also complemented the following week by Burger King Corp. with its national free kid’s meals promotion through the BK app. n

2020 ISSUE 2 | Flame 7 MEMBER NEWS

Hall Financial Advisors worked with a local marketing agency to design and print 2,000 coupons for free kids’ meals, which were distributed to students in need.

Ocedon Feeds First Responders in Colorado

Ocedon, owned by franchisees Ken and Elena Donahue, operates 35 BURGER KING® restaurants across Colorado. Earlier this year, teams from Ocedon’s restaurants statewide showed support for their communities by providing food to first responders in the wake of the COVID-19 crisis.

A variety of meals, including WHOPPER® sandwiches, chicken nuggets, mozzarella sticks and jalapeño cheddar bites, were delivered to the local heroes on the front lines. The first deliveries were made in the Highlands Ranch area, where Ocedon’s team visited South Metro Fire Station No. 16, the Douglas County Sheriff’s Highlands Ranch substation and UC Health Hospital.

To show its thanks and support to the Aurora Public School District’s efforts to feed the community, the Aurora, Colorado, restaurant team donated 50 meals to the nutrition department staff at Aurora Public School District, which provided free meals to approximately 3,500 families each day during the crisis.

Following suit, the Denver team partnered up with The Redstone Group and Filtercorp, donating 50 meals and 25 gift cards to the Denver Police Department, District 4. The Canon City team also donated meals to the Canon City Police Department and Fire Department to show its appreciation.

Ocedon President of Operations Maru Schrader and Area Business Managers Lahyded Hernandez and Gustavo Martinez were among the few who travelled around the community to drop off the donations, which came to over 350 meals total. At each location, the front-line teams were very appreciative of the donations. They were happy to have delicious lunches brought directly

to their doors.

Ocedon was thrilled to be able to help those in their towns who are working hard to keep people safe. “It felt great in this time of crisis to help our first responders who are working hard every day to save lives,” said the Donahues. “They were so grateful and excited to eat some WHOPPERs!”

Ampler Burgers Opens New Mesquite Location Amid Pandemic

In mid-May, Ampler Burgers, owned by franchisee

Kevin Fernandez, opened its newest BURGER KING® restaurant in Mesquite, Texas. Despite the setbacks the COVID-19 pandemic caused for restaurant owners in the spring, the team still opened the restaurant to the Mesquite community.

The building was previously occupied by a Carl’s Jr. restaurant, and the Ampler construction team converted it into a brand-new BK® in just 49 days. The company chose this location because the building was in great condition and in a great location in the Dallas-Fort Worth market.

“This location filled a pocket for Ampler in the market and connected our district manager territory in the Southeast,” said Nick Boyle, president of real estate and development. “Traffic counts were strong, and there is a nice retail symmetry around us.”

The pandemic changed the way Ampler typically constructs its restaurants. During this build, the team took many extra precautions from taking temperatures and requiring masks to following strict sanitation protocols on materials arriving to the site.

Ampler President Matt Bars is proud of the team for adapting to the current situation and getting the job done. “Our leadership has done a wonderful job understanding the complications of

COVID-19 and the challenges it presents. The construction crews and operations teams did a spectacular job of working together to avoid any type of exposure,” said Bars.

Team members persevered through all the obstacles they faced and ended up finishing construction about a month early. “This shows that determination, creative thinking and solid planning make anything possible,” said Bars.

Due to social-distancing restrictions, the opening just consisted of the drive-thru. However, guests were still excited to get in line and enjoy a delicious WHOPPER®. Once it’s safe, Ampler looks forward to hosting a celebration of the opening to welcome Mesquite residents into the dining room. n

8 Flame | 2020 ISSUE 2 MEMBER NEWS

n

Maru Schrader and Lahyded Hernandez delivered WHOPPERs to first responders on behalf of Ocedon.

The new Mesquite, Texas, restaurant was once a Carl’s Jr. building.

The Breakfast Club Continues Traditions at Kennesaw, Georgia, BURGER KING Despite COVID-19

For many years, a group of retired U.S. Navy veterans has gathered at GPS Hospitality’s BURGER KING® restaurant in Kennesaw, Georgia. The group, nicknamed “The Breakfast Club,” is made up of about 10 veterans and their spouses. Each day, several of the members go to the restaurant to enjoy their favorite BK® items, including French toast sticks, sausage biscuits, croissants and senior coffee.

Although the COVID-19 pandemic led to temporary shutdowns of dining rooms across the country, The Breakfast Club members didn’t let the virus stop them from enjoying each other’s company. They brought their own chairs and held meetings in the parking lot of the restaurant, allowing them to appropriately social distance from each other.

Restaurant General Manager Donna went out of her way to make sure the guests’ cups were full. She has been making guests feel welcome at BURGER KING for 37 years, serving as an example of GPS Hospitality’s service-obsessed values that are encouraged among its employees.

GPS is honored that its restaurant is the primary meeting place for The Breakfast Club. “We love being an active part of

the communities we serve, and we are delighted to see their commitment to each other,” said GPS Hospitality Director of Communications Lisa Grier. “We love the spirit of The Breakfast Club and enjoy serving them at our Kennesaw restaurant.”

Although there have been many surprises over the past few months, GPS Hospitality is happy to see that the guests have continued their traditions and visit with each other at a safe distance. n

2020 ISSUE 2 | Flame 9 MEMBER NEWS Frontline Smart Oil Management® Systems lower labor costs and the cost of cooking oil. No contracts or endless leases. Skip the interview and move straight to the hiring stage. © Frontline International 2020 www.frontlineii.com 877-776-1100 In the era of a $15 minimum wage, Frontline is the answer. HIRED! F O R A C O N F I D E N T I A L V A L U A T I O N C A L L T O D A Y 9 4 9 . 4 2 8 . 0 4 9 2 E X P E R I E N C E D | D E M O N S T R A T E D T R A C K R E C O R D W W W . N A T I O N A L F R A N C H I S E S A L E S . C O M M I K E D E E G A N m d @ n a t i o n a l f r a n c h i s e s a l e s c o m E X P E R I E N C E M A T T E R S I N A C Q U I S I T I O N M O D E ? V i s i t t h e N F S w e b s i t e t o l e a r n a b o u t B u r g e r K i n g a n d o t h e r f r a n c h i s e o p p o r t u n i t i e s ! S O L D !

The Breakfast Club, a group of U.S. Navy veterans and their spouses, has been gathering for breakfast at the Kennesaw, Georgia, BURGER KING for many years.

GPS Hospitality Sought 1,500 New Employees

GPS Hospitality, owned by multiunit franchisee Tom Garrett, worked through the spring to actively recruit new full- and part-time team members. The company had a goal of securing 1,500 new hires throughout its locations in 13 states.

“Although the economy is not quite in recovery mode, we can see the importance of having our teams fully staffed, trained and

Regional Events

Oct. 21

Southwest Franchisee Association Regional Meeting

Phoenix, Arizona

Jan. 10-12, 2021

Mid South Franchisee Association Regional Meeting

New Orleans, Louisiana

National Events

Oct. 14-15

NFA Board of Directors Meeting

Atlanta, Georgia

Dec. 1-2

Elevanta Board Meeting

Atlanta, Georgia

Dec. 7-9

NFA Board of Directors Meeting

Atlanta, Georgia

March 9-12, 2021

NFA LEAD Conference

Las Vegas, Nevada

ready to serve our guests as the public becomes more and more confident in returning to our dining rooms,” said GPS Hospitality President Michael Lippert. “Our management teams will be searching for motivated candidates who share our guest-forward values to help meet those increased needs.”

To get to know candidates efficiently and safely, the company’s hiring managers incorporated video interviews with applicants for full- and part-time positions, including managers and team members, in the hopes they could join the team immediately. To make the application process simple, GPS set up a text service where potential applicants could text “GPS” to 37872 to apply for a position or visit the www.WorkForGPS.com website for an online application.

“We’ve been working with our managers to expedite the hiring process with contactless methods to ensure the health and safety of everyone involved,” said GPS Vice President of Human Resources Vickie Volan. “Once hired, new employees will receive comprehensive training, including cleaning and sanitation procedures.” n

Tasty Restaurant Group Hires New CFO

In June, Tasty Restaurant Group, owned by franchisee Robert Rodriguez, selected Neil Thomson as chief financial officer for its 190 BURGER KING® and Pizza Hut units.

As a senior finance executive, Thomson holds extensive experience in the quick-service restaurant industry with a track record of building teams, improving systems and processes, and delivering results within rapidly growing businesses.

He previously served as the chief financial officer of Del Frisco’s restaurant group and helped guide the company through a going-private deal in 2019. Prior to his tenure at Del Frisco’s, Thomson worked for 15 years in various senior roles at Yum Brands International and its affiliated Pizza Hut and KFC concepts.

“We are thrilled to welcome Neil to Tasty Restaurant Group’s executive management team,” said Rodriguez. “We are fortunate to have attracted such a well-respected industry veteran to join us, and his nearly 30 years of experience and success will prove invaluable.”

10 Flame | 2020 ISSUE 2

n MEMBER NEWS

calendar

Neil Thomson was appointed chief financial officer for Tasty Restaurant Group.

2020 ISSUE 2 | Flame 11 Our dedicated franchise team eats, sleeps, and breathes franchised restaurant lending. We’re here for you, today and tomorrow. How may we serve you? New Stores . Remodels Acquisitions . Refinancing Real Estate . Equipment ppbifranchise.com 402.562.1800 Pacific Premier Bank is a registered trademark. All rights reserved. LIKE YOUR FAVORITE CONDIMENT, WE MAKE LOANS BETTER INGREDIENTS: KNOW-HOW, BUSINESS SAVVY, STRENGTH, RELIABILITY, QSR EXPERIENCE, FLEXIBLE LENDING fancy Ketchup

Support the Vendors

That Support Your Association

12 Flame | 2020 ISSUE 2

Company Name Level Contact Name Email Phone Elevanta Health Partner Zack Johnson zackj@nfabk.org 678-540-6214 Elevanta Payroll & Accounting Partner Stephanie Luke sluke@mizehouser.com 785-233-0536 x3022 Lockton Affinity Partner Reid Robson elevanta@locktonaffinity.com 844-403-4947 Keurig Dr Pepper Diamond Josh Hanley josh.hanley@dpsg.com 770-844-1597 The Coca-Cola Co. Ruby Clint McKinney clmckinney@coca-cola.com 678-237-3063 Welbilt Ruby Joan Salah joan.salah@welbilt.com 813-504-9262 Green Dot/rapid! Sapphire Edward Cole ecole@greendotcorp.com 813-340-3276 The Hershey Co. Sapphire Kevin Austene kaustene@hersheys.com 636-265-0811 Xenial Sapphire Samantha Young samantha.young@xenial.com 215-485-0292 Casablanca Design Group Pearl John Harrison john.harrison@casablancadesign.com 770-337-0931 DTiQ Pearl Mira Diza mdiza@dtiq.com 857-277-5145 Ecolab Inc. Pearl Al Powell al.powell@ecolab.com 816-206-2513 Frontline International Inc. Pearl Giovanni Brienza gbrienza@frontlineii.com 330-861-1100 Global Building Contractors LLC Pearl Reece Milton r.milton@gbc.llc 865-640-7099 Gycor International Pearl David Rogers drogers@gycorfilters.com 800-772-0660 J.R. Simplot Pearl Brad Glover brad.glover@simplot.com 704-391-8321 Mount Franklin Foods Pearl Linda Dorsett lindad@azarnut.com 904-923-4053 Nestlé Waters North America Pearl Anthony Ventricelli anthony.ventricelli@waters.nestle.com 203-249-5397 SKECHERS Pearl Harold Surabian haroldsu@skechers.com 310-318-3100 x1860 The Middleby Corp. Pearl Brad Davis bdavis@middleby.com 786-503-4580 TraitSet Pearl Lenny Crouse lenny@hrgems.com 563-580-2649 Tyson Foods Inc. Pearl Kathy Black kathy.black@tyson.com 410-340-3974 Alliance Payroll Services Assoc. Mbr. Chris Murphy cmurphy@alliancepayroll.com 507-244-1998 Altrua Global Solutions Assoc. Mbr. Sandi Halo shalo@altrua.com 800-443-6939 Atmosphere TV Assoc. Mbr. Joey Martinez joey.martinez@atmosphere.tv 512-947-5789 CC Image Group Assoc. Mbr. Rob Cooley robcooley@ccimagegroup.com 404-433-4924 DAR PRO Solutions Assoc. Mbr. Bill Borrelli bborrelli@darlingii.com 248-705-0047 DMI Manufacturing Inc. Assoc. Mbr. Denise Bangasser denise@dmiparts.com 800-238-5384 Duke Manufacturing Assoc. Mbr. Rick Garriga rgarriga@dukemfg.com 305-606-2084 Emser Tile Assoc. Mbr. Jessica Sheldon jessicasheldon@emser.com 201-341-5468 Filtercorp Assoc. Mbr. Brian Bonham bbonham@filtercorp.com 720-329-3816 Franke Foodservice Supply Assoc. Mbr. Stephen Walls stephen.walls@franke.com 615-462-4191 Frozen Beverage Dispensers (FBD) Assoc. Mbr. Joe Clements jclements@fbdfrozen.com 214-732-9555 Ganaway Contracting Co. Assoc. Mbr. Susan Monson susan_monson@ganaway.com 770-650-7722 x106 GoPlay USA Assoc. Mbr. Graeme McKenzie graeme@goplayusa.net 858-220-9557 Hall Financial Advisors LLC Assoc. Mbr. Angela Harkness angela.harkness@wfafinet.com 866-865-4442 Honor Built Assoc. Mbr. Stewart Austin stewart.austin@honorbuilt.com 404-952-2600 Hoshizaki America Inc. Assoc. Mbr. Travis Rieken trieken@hoshizaki.com 813-995-3994 InSite Real Estate Assoc. Mbr. Tom Kostelny tkostelny@insiterealestate.com 630-617-9155 Jolt Assoc. Mbr. Briton Page briton.page@jolt.com 877-396-4112 Lancer Corp. Assoc. Mbr. Greg Edwards greg.edwards@lancercorp.com 904-631-1031 Loomis Assoc. Mbr. Tom Simon tom.simon@us.loomis.com 602-619-9886 Marmon Foodservice Assoc. Mbr. Guido Nava guido.nava@cornelius.com 630-539-6850 National Franchise Sales Assoc. Mbr. Mike Deegan md@nationalfranchisesales.com 949-428-0492 Netspend Corp. Assoc. Mbr. Michael McEnerney mmcenerney@netspend.com 470-208-0937 One More Time Assoc. Mbr. Alex Alvarez aalvarez@onemoretimeinc.com 323-839-8541 Ooma Inc. Assoc. Mbr. Alicia Azeltine alicia.azeltine@ooma.com 646-844-1146 OwlOps Assoc. Mbr. Doug Rixmann doug.rixmann@owlops.com 800-677-4860 Pacific Premier Franchise Capital Assoc. Mbr. Sharon Soltero ssoltero@ppbifranchise.com 402-562-1801 Paycor Assoc. Mbr. Jarod Alexander jalexander@paycor.com 412-715-2496 Restaurant Technologies Inc. Assoc. Mbr. Aimee Krueger akrueger@rti-inc.com 850-525-9366 Revenue Management Solutions (RMS) Assoc. Mbr. Chris Norton cnorton@revenuemanage.com 813-386-5005 Samsung Electronics America Inc. Assoc. Mbr. Samantha Verrier sverrier@sea.samsung.com 201-446-0369 Shoes for Crews Assoc. Mbr. Kim Redmin kimr@shoesforcrews.com 561-683-5090 SYR Assoc. Mbr. Todd Lancaster todd.lancaster@syrclean.com 412-779-1381 The ICEE Co. Assoc. Mbr. Kayla Wells kwells@icee.com 615-558-9462 UPshow Assoc. Mbr. Jon Tenpenny jtenpenny@upshow.tv 248-231-5714 Valley Proteins Inc. Assoc. Mbr. Ron Rogers rrogers@valleyproteins.com 540-877-3220 Veterans of Foreign Wars Foundation Assoc. Mbr. Richard Potter rpotter@vfw.org 816-968-1158 Wholesale Ceiling Solutions Assoc. Mbr. Stuart Holaway stu@wholesaleceilingsolutions.com 844-825-1500 Wintrust Franchise Finance Assoc. Mbr. Ed Semik esemik@wintrust.com 847-586-2643

One topic: 10 facts Social Media and the Restaurant Industry

1

There are 3.03 billion active social media users, while approximately 91% of retail brands use two or more social media channels.

2

Of the more than 1 million mentions on social media sites about the restaurant, food and beverage industry, 57% of these were about quick-service restaurants.

3

Seventy-one percent of customers say they’re more likely to recommend a company that responds quickly to them on social media.

4

When choosing a restaurant, Gen Z and Millennials are 99% more likely to rely on social media and online reviews than are Gen X and Boomers.

5

Nearly 72% have used Facebook to make restaurant or retail decisions based on comments and images that have been shared by other users.

6

Out of all brand mentions on Twitter, food and drink brands are mentioned the most, accounting for 32% of tweets.

7

The best times for a restaurant to post on Instagram are when people are eating and looking at pictures on their phones: 9 a.m., between 12 and 1 p.m., and 8 p.m.

8

More than 33% of diners will not choose to eat in a restaurant with less than a 4-star rating on online review sites like Yelp, Google and TripAdvisor.

9

One in eight diners will post a restaurant review after their meal.

10

Seventy-five percent of consumers will not visit or patronize a restaurant with negative reviews about its cleanliness.

Source: Review Trackers

2020 ISSUE 2 | Flame 13

Spotlight on the 116th Congress: Rep. Chip Roy (R-TX-21)

QDuring your time working with the Texas attorney general, what qualities or skills did you develop that you utilize as a representative?

AFirst, I was responsible for managing for the attorney general an organization of over 4,000 employees, with 700 lawyers managing 28,000 lawsuits, which gave me a firm understanding of the responsibility of the executive branch to carry out the laws and administration of government. But, most of all, it gave me a firm appreciation for the importance of defending the U.S. Constitution and the rule of law for the ability of free enterprise to flourish.

QHow is relief legislation, similar to what was passed during the pandemic, important to small-business owners?

AThe state and local response to COVID-19, right or wrong, crippled small businesses. Because it was the government response that prevented business owners from keeping their doors open, it was incumbent upon government to compensate for the loss. Relief legislation like the Paycheck Protection Program (PPP) and my PPP Flexibility Act provided the necessary cash flow to bridge this gap so small-business owners could pay their bills and keep their employees.

QHow has your role on the House Committee on Oversight and Reform influenced your opinions on the impact of legislation on small business?

AI’ve learned throughout my experience on the Oversight Committee that the committee can be a good venue for reviewing legislation and the implementation of such policies, but I wish the committee would exercise that role more often. For

example, there is plenty of oversight we could be doing over the trillions of dollars spent during the coronavirus response, including funds to small businesses to ensure funding was properly spent and that small businesses that need funding receive it accordingly.

QWhat challenges have you helped small businesses in your district overcome?

AI listened to small-business owners in my district and incorporated their feedback in drafting the PPP Flexibility Act, a bipartisan piece of legislation I introduced with my friend Dean Phillips of Minnesota. This bill, which passed the House and Senate almost unanimously and was recently signed into law by President Trump, provides small-business owners needed flexibility in the use of PPP funds. It helps them adapt to government-imposed lockdowns that have lasted longer than originally anticipated and gives small-business owners a greater chance of having their PPP loans forgiven.

QIn what ways are you seeking feedback from small businesses in Texas and using that information in Washington, D.C.?

ADuring the pandemic, I have met one-on-one with dozens, if not hundreds, of small-business owners in my district to understand what they need to survive. I worked with local trade organizations like the Texas Restaurant Association, the Texas Hotel and Lodging Association, and other local and national trade groups to ensure the legislation I draft and support in Congress addresses their needs during this unprecedented time. I will continue to seek their feedback as we reopen the economy so that we in D.C. understand the continuing challenges they face and adapt our policy solutions to meet those challenges. n

14 Flame | 2020 ISSUE 2

LOOK LISTEN READ

Look, Listen, Read is a quarterly compilation of some of the most highly rated and reviewed apps, podcasts, books, websites and other resources. NFA does not support or endorse the use of these tools, which merely serve as a guide to exploring a new level of knowledge and productivity for your business.

5All it takes to make creativity a part of your life is the willingness to make it a habit. It is the product of preparation and effort and is within reach of everyone. Whether you are a painter, musician, businessperson or simply an individual yearning to put your creativity to use, “The Creative Habit” provides you with 32 practical exercises based on the lessons Twyla Tharp has learned in her remarkable 35-year career.

1

The Entrepreneurship Elevated Podcast, led by author of “Profit First” Mike Michalowicz, is a show for entrepreneurs who want to increase their profits. Since when did talking about money need to be boring?! The Profit First Podcast gets serious about money by having the most fun possible.

2 Your notes. Organized. Effortless. Take notes anywhere and find information faster with Evernote. Share ideas with anyone as well as meeting notes, web pages, projects, to-do lists. With Evernote as your note-taking app, nothing falls through the cracks.

6We’ve all known the “naturals” – people who can get up to speak in any business situation and make something happen. They get the budget approved, win the big account, get the group’s support at the weekly staff meeting. When the “naturals” finish speaking people believe – and act. Now fully revised and updated, ”Speak and Get Results” helps you to be a natural and helps you to get the results you want.

3

If you are a service-based business, FreshBooks is designed for you. If you create value for your customers by applying your time and expertise to other people’s problems, FreshBooks is built specifically for you. FreshBooks uses a web-based software as a service model, whereby instead of installing and maintaining software locally, the software is accessed through a desktop or mobile device.

4

High-quality writing is more than just mechanics. Grammarly Business goes deeper with real-time suggestions for improving readability, word choice, writing style and tone. More than 20 million people around the world use this AI-powered product every day to strengthen their writing and say what they really mean. Grammarly Business’s writing assistant supports clean, mistake-free writing while offering suggestions that go way beyond grammar.

7“Built to Last,” the defining management study of the ’90s, showed how great companies triumph over time and how long-term sustained performance can be engineered into the DNA of an enterprise from the very beginning. But what about the company that is not born with great DNA? Using tough benchmarks, Jim Collins and his research team identified a set of elite companies that made the leap to great results and sustained those results for at least 15 years. In ”Good to Great: Why Some Companies Take the Leap and Others Don’t,” Collins outlines his findings from the good to great research.

8The SmallBizChat Podcast is dedicated to helping you live your best life as a small-business owner. The mission is to end small-business failure. n

2020 ISSUE 2 | Flame 15

‘A Penny Business:’ Franchisees Battle Rising Food Costs

When costs go up, profits go down. It’s a simple, unbendable rule of business that harkens back to basic school lessons on capitalism and the law of supply and demand. When food costs go up, restaurant franchisees notice immediately because of the impact on the bottom line.

No matter the reason – whether ongoing trade battles with China, the 2018 outbreak of African swine fever in overseas pork stocks or COVID-19-related shutdowns of meat-processing plants – food prices have been going up steadily since the fourth quarter of 2018, an unpleasant development that has BURGER KING® franchisees looking more closely than ever at ways to track inventory, reduce kitchen waste and keep tighter control of the money that flows into and out of their restaurants.

Restaurant Services Inc., the supply chain manager for the BK® system and the exclusive purchasing agent for the vast majority of the products and distribution services used by BK franchisees in the United States, has noted a decline in ideal gross profit measurements among BURGER KING restaurants, with rising food and packaging costs responsible for most of the downward pressure. “We measure, track and monitor food and packaging costs through the Food and Packaging Cost Index (FPCI), which is conveniently displayed on RSI Web for our members,” said Joel Neikirk, president and CEO of RSI and a former BK franchisee. “In the last 12 months, the index showed a significant increase in food costs compared to 2018, predominately driven by beef.”

As a result, companies are looking at food costs even more closely over the last year than they had traditionally. “Food cost has taken center stage on our profit and loss statements. It has always been our second-highest controllable, but today, we are tracking this metric more closely than we ever have because the room for error is so small,” said Jordan Drury, franchisee with Drury Restaurants, which owns 36 BK locations in Arkansas, Illinois, Kentucky and Missouri.

Pork and beef have been two of the biggest culprits, and a combination of factors have affected prices. Higher demand for animal protein in China is causing higher beef prices, and disease issues hurt pork supplies in China and some surrounding countries. In the United States in April, a few meat-processing plants were closed when there were severe outbreaks of COVID-19 among employees.

“Our trends have

not been any different than anyone else in the country. As commodity costs go up, food cost rises with them,” said Bill Keller, a franchisee with BMT of Kentucky, which owns 15 restaurants in the Bluegrass state. “RSI does a great job publishing NewsBriefs on what is happening and with what items. Long-timers in the system know that beef and produce pricing move weekly, so you learn to check your plate costs on a regular basis.”

by SEAN IRELAND

“We are expecting a lot of ups and downs in our cost during the next few months with changes happening in the trade agreement, with weather and BKC’s pursuit of clean products,” Keller added. “You have to stay aware of what might happen. I personally feel the days of achieving a net gross profit percentage (GP%) of 70 are gone, so you manage the pennies daily or else.”

In RSI, BK franchisees have an able ally to help them manage their food costs. “To benchmark the performance of purchasing negotiation and commodities management, we closely monitor and compare the RSI FPCI to the Producer Price Index for the same basket of commodities in the general economy,” Neikirk said. “RSI’s management goal is to ensure our product prices increase less than the general market.”

RSI tools, available through its website and mobile app, provide access to critical restaurant data that helps managers monitor food costs and act in areas of opportunity. (See sidebar, page 18.) “We are constantly incorporating data from RSI,” said Bruce Daniels, franchisee with Carolina Franchise Holdings, a company with 30 BK restaurants in Georgia, Florida and the Carolinas. “The data generated via in-store measurements allows us to better monitor waste management, truck ordering and product mix. Much of our operational strategy is predicated on measuring this historical data and course correcting as we go.

“As a franchisee that acquired a former group, we were able to implement tools and routines that were not utilized in previous years. Our gross profit has risen exponentially since our origination date, as we have managed to curtail unnecessary food costs and maximize control with all teams,” Daniels added in comments made before the COVID-19 outbreak interrupted most normal restaurant operations in mid-March. “Food costs are rising slowly, but we’ve taken the necessary steps to control what is within

16 Flame | 2020 ISSUE 2

our influence, which is operations.”

The tools provide several ways for restaurant managers and employees to take the sting out of increased costs. Of all the things to be done at the individual restaurant level, taking frequent and accurate accounting of food product is the most important. The diagnosis of problems and the adjustments needed to fix them cannot be made if food product is not tracked. “Accurate inventory management allows operators to gain visibility into their waste, a large component of food cost,” Neikirk said. “Loss equates to higher food costs and taking inventory is an area of opportunity where operators can control their costs by closely monitoring both their known and unknown waste at the restaurant.”

RSI strongly encourages restaurant operators to set what Neikirk calls a “consistent inventory-taking cadence across all restaurants – monthly, weekly and daily” – that allows for the effective benchmarking of performance and measurable results in food costs.

RSI suggests a schedule to include:

• A monthly inventory that should consist of all items in the restaurant.

• A weekly inventory that should consist of food items only.

• A daily inventory that should consist of high volume/high cost foods only.

RSI Inventory and RSI Analytics mobile apps can help manage inventory and highlight critical product line variance (PLV, the difference between the ideal cost of a product and the actual cost of that product), performance data, improve day-to-day efficiency and drive overall profitability.

“We use the RSI app and check our gross profit percentage daily along with product line variance and waste,” Keller said. “We

have a target percent for waste of 1% and variance of .5% or 1.5% total. This is checked daily and reacted to by the supervisors.”

At BMT of Kentucky, items are inventoried on midday breaks and balanced with the POS. The company also keeps a monthly GPM workbook that has every item, the plate cost GP% and combo meal in it to anticipate what happens to its margins with an increase in tomato costs or a decrease in the cost of WHOPPER® patties. “The bottom line is that you must check your inventory daily and react to your variances each day,” Keller said. “If you do this daily, you will know what your month will be because you know your problem and/or where the problem is.”

He also recommended daily checks on the top cost items via inventory reconciliation with complete monthly or period inventories so that beginning and ending inventories are always known. “You can always go backward to find a problem, but without any actual inventories, you will never find the problem or when it started,” Keller noted. “Be willing to take deep dives into all the tools that are around today. For example, we had one unit all last year that trailed our group gross profit percentage number by over 3%. We balanced all the inventory, counted coupons, changed managers and cussed a few times, but never found the issue until recently. We found using the RSI Analytics Promotions dashboard on the iPad that we could view each unit’s promos and saw many substitutions of main menu items under the two-for-$6 promotion and the two-for-$10. That POS function was turned off and margins moved up 2.5%. So, when you know that there is a problem, keep looking because there is an answer.”

Rackson Restaurants, with 51 locations in New Jersey, New

Continued on page 18

2020 ISSUE 2 | Flame 17 Order your Frymaster ® FQ4000 Controller Today! EasyTouch® Touchscreen NEW SMART4U® FQ4000 Controller welbilt.com Joan Salah | joan.salah@welbilt.com | 813.504.9262 SUPPLIER FOR OVER 40 YEARS WBT_BK_NFA_HalfPage_Multibrand.indd 1 2/14/20 4:37 PM

Penny Business

Continued from page 17

York, Connecticut, Pennsylvania, Delaware and Maryland, does complete breakfast, midday and closing counts as well as weekly and monthly inventories. “If we see a higher discrepancy with certain inventory, we then count those items more frequently throughout the day,” said New York-based Area Coach Digna Ayala. “We also set a target of running a .2% variance from ideal versus actual.”

“All stores have implemented daily and weekly counts to improve our inventory control, and our leadership team discusses variances with managers regularly,” Daniels said about Carolina Franchise Holdings. “BKC has provided a kitchen-management system called ‘Chef’ that gives real-time assistance in understanding historical sales along with current food on hand that allows our kitchen staff to hold and prep food while minimizing waste. Chef is a huge routine for us, and we actually started incentivizing our teams through their performance on grading here.”

Food waste also bears close tracking, according to Neikirk and the franchisees. “RSI has two powerful PLV tools as part of its analytics suite that members can leverage to surface potential waste and loss issues,” he noted. RSI’s PLV 91-Day Estimate takes the difference between purchases and sales to estimate a restaurant’s PLV over the previous 91 days, and PLV with Inventory takes the

RSI Tools Help Franchisees Manage Costs

RSI offers its members a host of tools available on RSI Web, www.rsiweb.com, and RSI Analytics, its mobile application, providing access to critical restaurant data and helping them to monitor food costs, take action in areas of opportunity and, ultimately, improve waste and profitability performance. Some of these tools include:

• Food Cost Outlook to better understand food cost trends and RSI’s most up-to-date food cost outlooks.

• Gross Profit Drivers to identify:

• Mix shifts adversely affecting gross profits.

• Ingredient items having the largest impact on food costs and GPs.

• Indirect cost increases, including oil and ketchup packet consumption.

• PLV benchmarking to identify restaurant waste opportunities.

• Coke Freestyle Credit Portal to request cartridge credits from Coca-Cola.

• Voids, Discounts & Deletes to monitor discrepancies in voids, discounts and delete sales patterns, which may include potential theft.

• DC Usage Ratios to benchmark oil consumption and other food cost ratios.

Download RSI Analytics from Apple or Google Play app stores.

difference between the purchases, sales and inventory to estimate a restaurant’s PLV. “Both have proven to be instrumental in helping members identify potential waste and loss opportunities that directly impact profitability in their restaurants,” he said.

The tools are only one part of the equation, however. Restaurant management and employees must be committed to reducing waste. “Food cost is getting tougher and tougher to manage, so if you’re not on top of it every shift, it will creep up on you,” Drury said. “It takes laser focus from crew and management alike. Getting the crew trained on how to look and think about food cost and ultimately take ownership over their workstations is crucial in today’s operating environment.”

Drury Restaurants uses five buckets – ones for raw waste, fry station, specialty, main boards and prep areas – in every kitchen to track waste. It’s recorded after every daypart, and from that, the company can get a rough estimate of the dollar amount of the items that are discarded. Improvement starts by reducing the amount that ends up in each bucket.

“We count certain high food cost items each night and enter that information into RTI to help produce a daily food cost variance,” Drury said. “We also do a full detailed inventory every month in every restaurant, but if I’m honest, it needs to be every two weeks. We’re working on getting there, but with all the other things our managers deal with, it’s been difficult for us to implement.”

There are other ways to find savings. “We have picked up our pace on watching and monitoring the units for theft, underringing, mobile app abuse and digital coupon abuse. Fortunately, we have video surveillance in all locations along with voice, so it helps us in verifying what happens,” Keller said.

“We have also begun taking coupons and discount programs out of our registers immediately upon expiration or program end dates,” Drury said. “This prevents our order-takers from succumbing to guest pressure to honor a deal that has expired. We always want to take care of our guests, but we always communicate that if one deal has ended, another one is always right around the corner.”

Drury Restaurants has also instituted a program to train its managers to submit all items it receives broken or out of shelf life back to the distributor for credit. Only when all its managers were consistently doing so did the company realize what it had been losing. “We quickly realized as we implemented a standard practice for our managers to submit items for credit from our distributor, the dollars began rolling in. I mean, we paid for these things, why would we not want to get credit for a case of rotten tomatoes or busted barbecue sauce?” Drury asked. “I can’t stress enough how huge this became for us. We had our teams send pictures to one person in our corporate office and that individual did the necessary paperwork and then submitted it to our distributors for credit dollars on the product. This practice completely takes the stress off the restaurants and has been transformative in making sure everything that arrives in the store is useable and sellable.”

Reducing waste and keeping costs as low as possible is one way to reduce the effect of rising food prices. Increasing revenue by raising menu prices is the other side of the coin. Any changes, however, must be carefully considered.

“If we increase our menu prices, it could offset the higher price of beef and balance our food costs,” said New York-based Operations Manager Omar Guthrie of Rackson Restaurants. “However, if we do so without conducting the proper amount of research, this could result in either reducing customer traffic growth

18 Flame | 2020 ISSUE 2

or encouraging customers to purchase from the value menu rather than purchasing premium menu items.”

“This is the challenge – prices go up daily and weekly, but you cannot change them that often,” Keller said. “Our industry is not like the corner gas station that changes on Thursday to a higher price, then reduces them on Monday. When costs are constant and at your budget, [you do] maybe two changes a year, but today you must be more vigilant.”

Keller said the Revenue Management System that BKC is funding can help in the process, but it requires operators to know where their competitors are with pricing. “You must decide if you are going to lead, follow or just settle in the middle of your competitor prices,” he said.

“You also know that some of the prices you would like to change are part of the ‘two-for-$X’ menu, so you really have to figure out where the opportunities are. If you do not, you may end up chasing your customers to the value menu that you didn’t want them to know about. We found that if we keep certain items on the combo at lower than normal pricing then we can offer value this way. Fish and the Original Chicken are great items that can help present value and really do not need to be priced over a WHOPPER or Crispy Chicken.”

Drury said mitigating food costs by boosting menu prices is part of the revenue side of the solution, but that suggestive selling and superior guest service have a larger impact. “Every order-taker in our restaurants has to understand how suggestive selling and upsizing can really impact store sales,” he said. “When you find one that’s good at it and does it every order, they are worth their weight in gold.” Carolina Franchise Holdings also focuses on upselling. “We drive repeat success with the obsession of driving high margin products and the food quality that goes behind them,” Daniels said.

Drury noted one other way that his restaurants keep as tight a lid as possible on rising food costs: good management. “A good porter that takes ownership over a store and their inventory and keeps that store organized will change your world. I don’t have to tell you how rare they are to find, but when you do, hang onto them like grim death,” he said. “In my opinion, a quality porter is capable of more positive influence on a restaurant than almost any other position. They can make everyone’s job easier from the regional general manager all the way down to the prep person. If they’re good enough and they’re devoted to your store, you, as an owner, will know the name of that individual, I promise.”

Good training is a part of good management. “Our staff controls so much of where our true food cost lies,” Daniels said. “If we over-prep, we’re wasting product. If we over-portion, we’re giving away product. If we make product inaccurately, we’re remaking product and wasting the initial batch. Our training team is a huge reason why we’ve managed to control food cost over the last year.”

Managing costs while still providing the best experience to guests can be a delicate balancing act, but it’s a tightrope that each restaurant operator must walk. Keller captures the high-wire act well: “A penny saved is a penny earned. We are in a penny business, and our teams must know that scraping the mayo out of the tub saves costs and you are not just picking on them,” he said. At the same time, he noted, “It is OK to use salt on the French fries and seasoning on the WHOPPER patties. Not doing this runs the guest away, so it does not save any money. Pennies, pennies, pennies.” n

2020 ISSUE 2 | Flame 19 COMMITTED TO SAFETY Peace of mind for your customers -detailed insights & best practices for you www.dtiq.com/products/smartaudits-how-it-works/ info@dtiq.com | 800.933.8388 77% 65% 89% DTiQ SmartAudit™ services

SEAN IRELAND is the NFA associate director of communications. You may reach Ireland at seani@nfabk.org or 678-797-5165.

HEALTH COMPANIES CLOSELY MANAGE P&L STATEMENTS

When someone has questions about their health, they go to their doctor for a checkup. After measuring the patient’s weight, blood pressure, pulse, temperature and body fat, as well as asking questions about lifestyle and family medical history, the doctor has a clear picture about the patient’s overall health and can make recommendations about needed changes in specific areas that will improve their condition.

For businesses, profit and loss statements are much like the doctor’s tools for diagnosing and reporting on a company’s health. They provide an overall picture of the company’s condition and offer insights into areas where specific changes can bring needed improvement. Unlike annual checkups, however, profit and loss (P&L) statements for BURGER KING® franchisees are much too important to be studied only once a year. Rather than being a confidential communication between doctor and patient, P&Ls are shared and used throughout the organization to guide the changes needed to boost fiscal health.

It’s common practice for businesses to generate P&L statements by month or four-week fiscal period as well as quarterly and yearly and to compare them with the same periods for previous years. It’s also common for companies to collect and review certain types of information often found on P&L statements on a weekly – or even daily – basis, such as food and labor costs and sales projections.

P&L reviews at BK®-franchisee companies like Carolina Franchise Holdings, which owns 30 restaurants in Georgia, Florida, and North and South Carolina; JPL Management, which owns 16 restaurants in Kentucky; and Syed Restaurants Enterprises Inc., which owns 22 locations in New York, go from the top levels of company management down to individual restaurant management staff, where the rubber meets the road. No one has more control over the P&L statement than those who manage the food and employees. Regular reviews arm them with the critical knowledge needed to make improvements.

The dissemination of financial information throughout the organization is an important step in managing profit and loss. For some, it can be counterintuitive, but sharing the data keeps everyone oriented toward the organization’s goal. “Several companies tend to compartmentalize the finance department,” said Bruce Daniels, franchisee with Carolina Franchise Holdings. “We leverage the information and cascade to appropriate departments so all

parties can effectively contribute to our underlying success. Don’t hoard data when it benefits teams to receive transparency, when viable. Our corporate health depends on joint initiatives.”

Though the companies differ slightly in process, each finds ways to involve the whole organization. At Carolina Franchise Holdings, period-end financials are prepared by the controller and senior financial analyst and reviewed by the owner and chief operating officer before being disseminated to the appropriate levels by district manager and restaurant general manager. JPL Management does monthly reviews of P&L statements for individual restaurants starting with the director of operations, who reviews them with district managers. They, in turn, study them with store managers at the company’s monthly manager meeting. At Syed Enterprises, the chief financial officer generates and reviews the statements and sends them to the rest of the organization with summaries for each restaurant. The company’s above-restaurant leaders then go over them in face-to-face meetings with each restaurant general manager. The companies make year-over-year comparisons by month or period and examine how each P&L stacks up against the budget to understand historical performance, actual versus expected performance and trends in sales and costs.

by SEAN IRELAND

Companies most often focus on sales, cost of goods sold and labor with their restaurant teams when looking at the P&Ls – the areas in which managers can exert the most influence. “Those three numbers will make or break the profitability of the restaurant,” JPL Management franchisee Andrew Schory said. “Our best practice is to analyze key data, such as labor, sales, food variance and cash overage or shortage daily so that the P&L result will be the desired result. We also have detailed budgets for each month to compare and give guidance.”

On the revenue side, sales numbers should include all the income streams and be parsed to show how much revenue is attributable to individual menu items. On the expense side, weekly and even daily examination and management of expenses is critically important – making an impact on the P&L even before it is generated. “Food and labor are the most important items because they are the biggest expenses as well as the ones we have the most

20 Flame | 2020 ISSUE 2

control over,” Syed Enterprises franchisee Amir Syed said. “No other items should be close to food or labor on the P&L unless you run an incredibly low food and labor budget and have extremely high fixed expenses. That’s not likely in our industry.”

Some P&L statements are examined with analytics that demonstrate every expense as a percentage of sales. It allows individual costs to be tracked to see if they grow out of line with revenue and why. For quick-service restaurants, food cost and labor cost are the two items most closely tied to sales. Restaurant managers should be constantly examining sales – not only for the revenue levels, but also for the adjustments they might suggest for product and labor needs. “The use of detailed, line-item budgets is a priority for us in controlling these items,” Schory said. “We have daily calls with regional general managers and weekly meetings with district managers to gain insight and accountability to results.”

Syed said for managing food costs, there are several things managers should be doing, such as using a build-to-inventory ordering system (with management taking an on-hand count plus accounting for daily item usage before placing an order) and using RTI Connect, an inventory-management reporting platform that pinpoints specific variance items that help identify opportunities for food savings. “RSI P&L benchmarking is incredibly useful in helping us track our line items versus national and upon-request,” Syed said. “We are also excited to see the results RTI brings once fully implemented.”

“Adjustments should be made daily for most items before the P&L is generated,” Schory said. Such careful tracking and willingness to modify orders based on sales trends and changing needs ensures that there are no surprises when the P&L is tabulated and reviewed.

Tracking sales by hours, days and weeks also helps with labor management, giving the restaurant manager a guide for how many people will be needed to meet the restaurant commitment to good service without overstaffing. “We are required by New York City law to create schedules two weeks in advance, so we pre-populate projection sheets in advance with sales, weather and budgeted labor after accounting for current trends as well as any national promotions that might be hitting during that week,” Syed added. “We then make schedules after seeing how that week shapes based on that projection. Many local jurisdictions prohibit cutting labor on the spot, so we feel this is the best we can really do to manage the business without hurting it as well as complying with all laws.”

The organizations prioritize P&L performance with their constant focus on it throughout their organizational charts. Syed Restaurant Enterprises further emphasizes the importance of hitting quarterly P&L benchmarks by tying them to a bonus program for restaurant managers. Those timely reviews, with top-to-bottom participation and open communication about profit and loss statements, are all part of the regimen that leads to quick diagnoses of problems and, ultimately, a healthy bottom line.

Just as recommended checkups – and the adjustments to lifestyle and diet that may come from them – keep people healthy, regular attention to profit and loss statements and the adjustments made to rehabilitate problems keep a company healthy. n

2020 ISSUE 2 | Flame 21 “ Guests love mints and feel special and valued. Mints are an extra touch that leads to increased revenue! ~ BK® Franchisee Owner ” Join other Burger King Franchisees, who are using tasty BK® Mints as a simple treat that keeps customers coming back. 61% REPEAT CUSTOMERS. INCREASED CUSTOMER LOYALTY. A BOOST IN YOUR BOTTOM LINE. Visit hospitalitymints.com to get started with custom-wrapped mints today. Now at’ s SWEET!

SEAN IRELAND is the NFA associate director of communications. You may reach Ireland at seani@nfabk.org or 678-797-5165.

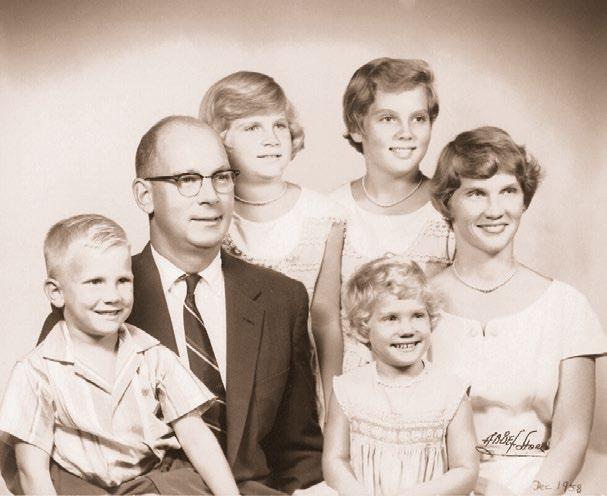

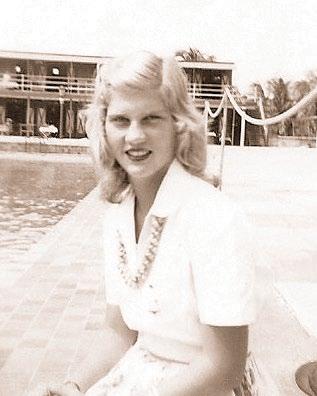

Nancy McLamore Nancy McLamore

BURGER KING’s First Lady

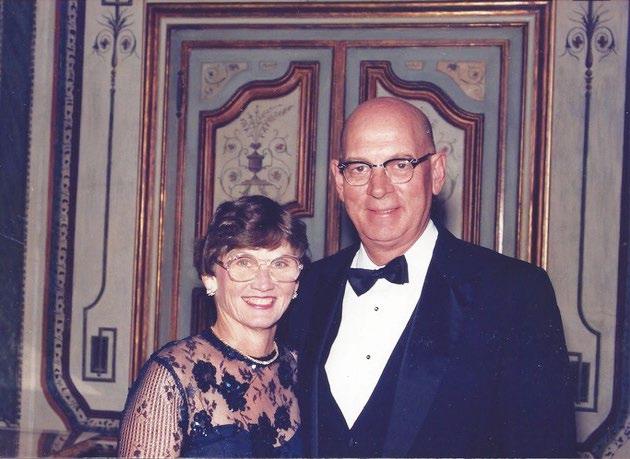

Though she probably would have rejected the idea of being called the “queen” behind the BURGER KING®, Nancy McLamore was certainly the brand’s first lady, a valuable ambassador who helped grow the company from a single restaurant in 1954 into an international franchising behemoth.

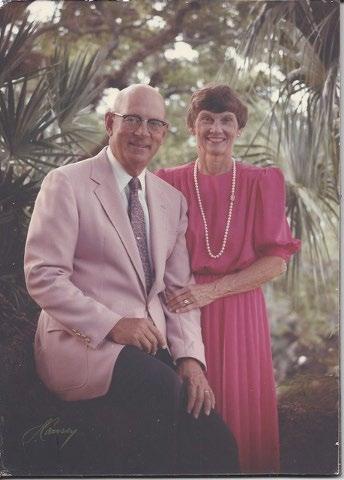

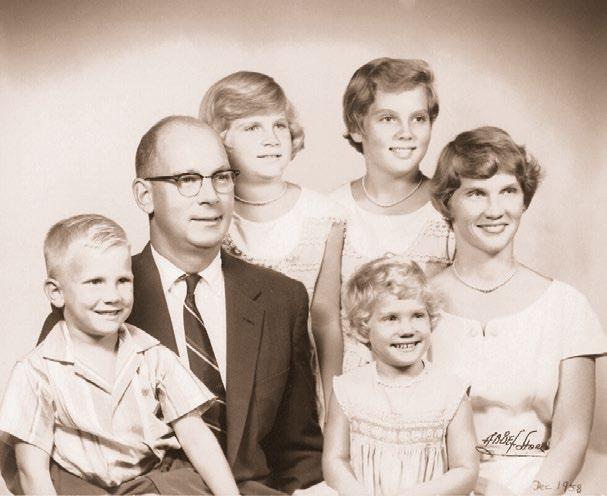

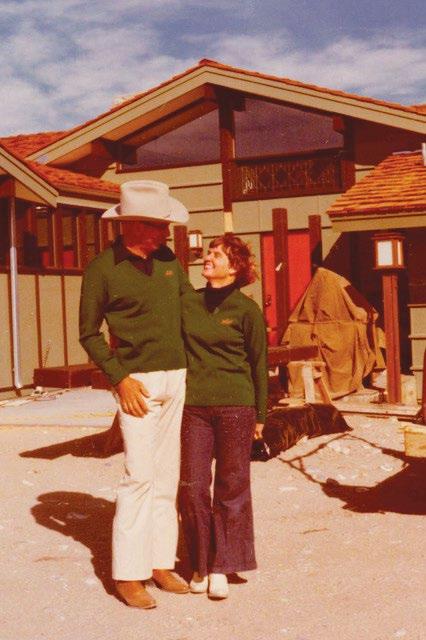

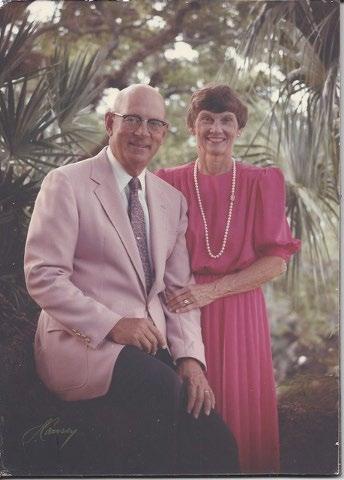

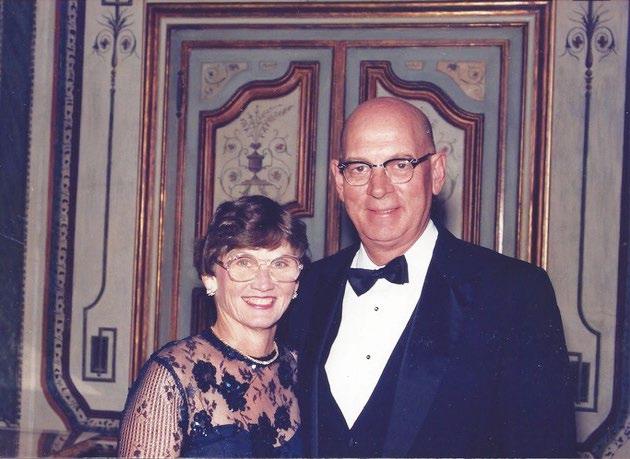

As the wife of BK® co-founder James W. McLamore, Nancy Nichol McLamore was the quiet but devoted partner who inspired her husband, supported his business and charitable endeavors, raised their family and demonstrated to all the importance of kindness, selflessness and community involvement.

Mrs. McLamore, 93, died May 23 after a brief illness.

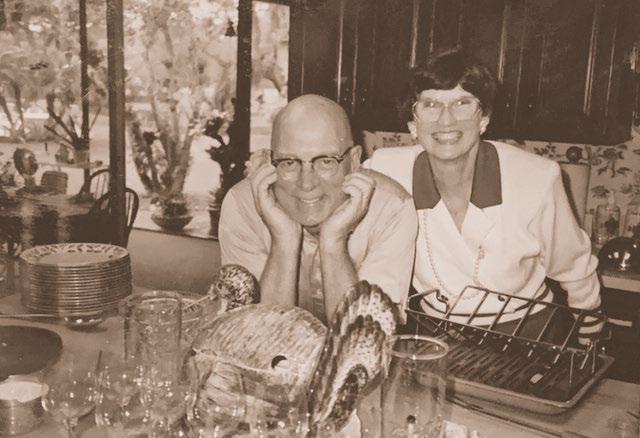

Her passing touched off fond remembrances of her and her late husband from family, longtime franchisees and others connected with the BK brand in its early years through 1967, when it was sold to Pillsbury, and into the 1970s, when her husband retired from the company. He later returned and served as a consultant for BURGER KING in the 1990s.

“She was always so supportive and loving to Dad,” said one of her four children, Sterling “Whit” McLamore. “She was incredibly organized and selfless throughout her life.”

“She was the Energizer bunny. She did it all and made it look easy, and she didn’t stop!” recalled her youngest daughter, Susie Bernard. “She was also an example of one of the most hospitable people I’ve ever observed. At holidays, there was usually an

dadditional single person or old person at the family table who didn’t have their family around or anywhere else to go, and they were always welcome at her table.”

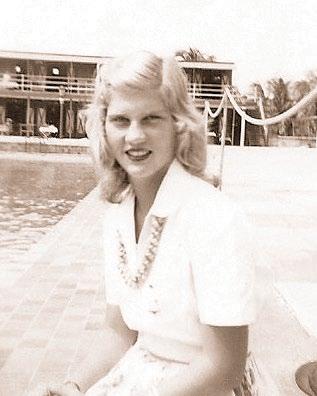

Mrs. McLamore was born in 1926 to Dr. E. Sterling Nichol, the founder of the Miami Heart Institute, and Dorothy Evans Nichol. A graduate of Miami High School, she attended Cornell University, where she met her future husband, Jim. “She was a gorgeous blond, enthusiastic, optimistic and encouraging,” Bernard said. “Mom always wanted to be a mother and have four kids. She teased that she went to college to get her M.R.S. degree. I think she saw in my dad a hard-working, honest, humble, witty, goal-oriented man who needed what she brought to their relationship.”

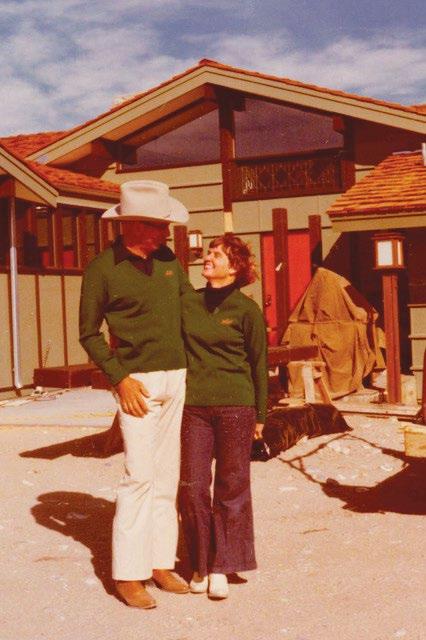

They married in 1947 and moved to Delaware, where they started their family while Jim McLamore entered the restaurant business as a manager at a YMCA cafeteria before opening his own restaurant. They later moved to Miami, and McLamore opened the Brickell Bridge Restaurant. Local restaurateur Dave Edgerton got to

22 Flame | 2020 ISSUE 2 N (1926-2020)

know McLamore as a guest of the restaurant, and over time they became friends.

As the McLamore family continued to grow, Edgerton and Jim McLamore became closer, and when Edgerton opened his first Insta Burger King, he convinced McLamore to join him in the new concept. McLamore sold his restaurant and joined Edgerton to expand their market share of the new brand. From this small start in the Insta Burger King concept came the launch of today’s BURGER KING brand.

The McLamores’ marriage was one of equals. “They each had their realm of responsibility and control and that created a mutual respect and trust within their partnership,” Bernard said. “Dad didn’t try to exert his preferences too much on the home frontier, and she trusted him completely on the business frontier. It made for a very compatible marriage that we kids were blessed to thrive under.”

“She took care of raising the four children almost entirely by herself,” Whit McLamore added. “Money was very tight throughout the building of the business, so she was incredibly resourceful in stretching every penny they earned.”

As McLamore and Edgerton perfected their business operations, developed the famous WHOPPER® hamburger and began to grow the BURGER KING brand, Mrs. McLamore was there every step of the way. “Jim was the face of the brand, and Nancy, with the four kids, was behind the scenes, but always present,” said longtime BK franchisee Jay Amarosa, now retired. “She developed and kept everything together at home while Jim built the brand.”

“Mom would wake up when dad would come home late at night, and they would sit on the porch and talk over the day – the struggles and the highlights,” Bernard said. “This was their habit, even when she had four active kids to wake up to the next morning when he left at 6 a.m. to start his day again.”

No one was more aware of what her bright presence meant to their partnership than Jim McLamore himself. “Nobody could

2020 ISSUE 2 | Flame 23

Chris Hall, Managing Principal, Hall Financial Advisors, llc named #1 in West Virginia on Forbes Best-in-State Wealth Advisor List 20201 and Barron's 2020 Top 1,200 Advisors List2 Action items to consider during market volatility ◆ Rebalance your 401k allocations ◆ Consider increasing contributions into employer sponsored plans ◆ Make 529 contributions ◆ Consider a Roth conversion ◆ Utilize tax loss harvesting to offset gains in concentrated positions ◆ Review your cash reserves Our team believes in providing advice to promote the well-being of a comprehensive, long term plan. Call or visit our website HallFinancialAdvisorsLLC.com. #1 1.

Research,

2.

Wells Fargo Advisors Financial Network and Hall Financial Advisors are not legal or

You should consult with your attorney,

and/or

planner

Investment products and services are offered through Wells Fargo Advisors Financial Network, LLC (WFAFN), Member SIPC. Hall Financial Advisors, LLC is a separate entity from WFAFN. 866.865.4442 1101 Rosemar Road, Parkersburg, WV 26105 416 Hart Street, Marietta, OH 45750 00547 Continued on page 24

Ranking algorithm

based on industry experience, interviews, compliance records, assets under management, revenue and other criteria by SHOOK

LLC, which does not receive compensation from the advisors or their firms in exchange for placement on a ranking. Investment performance is not a criterion.

The

Barron’s

Top 1,200 Advisors List rankings are based on data provided by thousands of advisors. Factors included in the rankings were assets under management, revenue produced for the firm, regulatory record, length of service, quality of practice and client retention.

tax advisors.

accountant

estate

before taking any action.

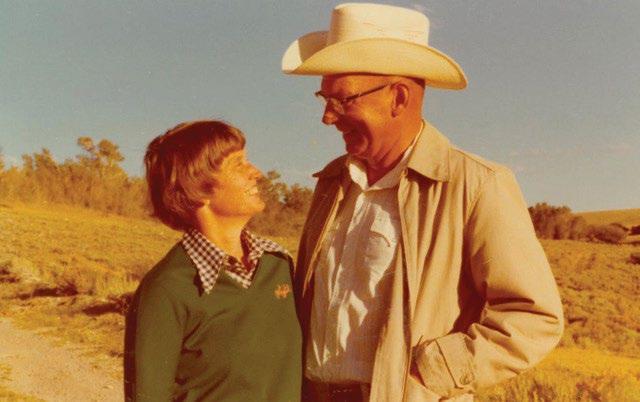

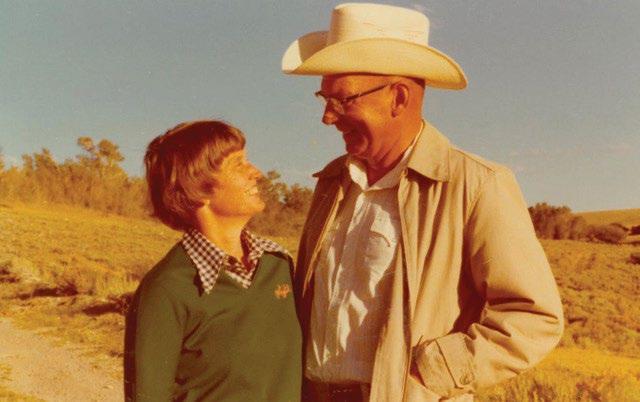

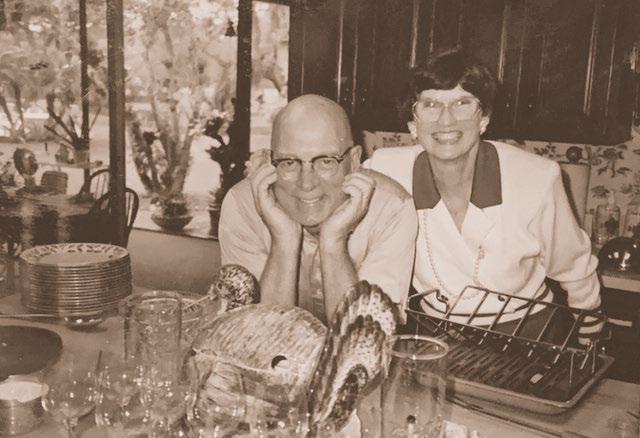

Jim and Nancy McLamore were a well-matched and devoted couple.

Nancy McLamore

Continued from page 23

have filled my life with more optimism, happiness and confidence than she was able to do,” he wrote in his book, “The Burger King: A Whopper of a Story on Life and Leadership,” which was released after his death in 1996 and re-released with additional commentary earlier this year.

“Nancy came to me as a powerful and refreshing breath of spring at precisely the time I needed someone close to remind me that life could be wonderful, worthwhile and promising. Nancy is the kind of person who looks at life in a positive and upbeat fashion. I have never known her to be ‘down’ or depressed, and I have never seen her dwell on negative thoughts. Her mission in life always seems to be one of spreading joy and happiness wherever she can. She does this with extraordinary consistency.”

Jim McLamore’s description of his wife’s personality was echoed again and again by her family and friends in the days after her death. Whether it was by showering a grandchild with special attention, visiting the elderly in hospitals or greeting people at BURGER KING conventions, even after her and her husband’s official roles with the company ended, Nancy McLamore made those around her feel valued and appreciated.