3-16 OCTOBER 2023 STRICTLY FORTRADEUSERSONLY HORIZON SCANDAL P2 BACK PAGE Three retailers outline the ways they turn to their community for support P4 ILLICIT VAPES Trading standards acts on reports made by Retail Express about dodgy sellers STORE ADVICE Postmasters criticise latest compensation payouts announced by government IT TAKES THREE TO TANGO P3 Retailers force Britvic to step in over Frozen Brothers’ ‘shameful’ service Tango Ice Blast supplier U-turns on compensation refusal a er drinks giant vowed to ‘investigate’ NICOTINE IN A VELO POUCH WEIRD INSTANT ENJOYMENT ANYWHERE WONDERFUL THE WEIRDLY WONDERFUL NICOTINE POUCH This product contains nicotine and is addictive. For adult nicotine consumers only. SPEAK WITH YOUR LOCAL BAT REPRESENTATIVE AVAILABLE AT VAPERMARKET.CO.UK

• How to grow your sales in the biggest next-gen categories: the devices driving profits, and the latest trends in pod systems, nicotine pouches and disposables

• Product spotlight – short fills: an in-depth look at some of the most known short fills on the market, and how to answer your customer’s questions

• Regional trends – pre-filled pods: discover the bestselling pre-filled pods in convenience, by region

• Product news: The latest vape products to add to your range

Convenience retailer store profile

Quick guide to CBD e-liquids

And much more!

Follow us on Twitter: @Vape_Retailer

copy from

magazine wholesaler today or contact Kate Daw on 07886 784465

advertise in Vape Retailer please contact Natalie Reeve on 020 7689 3372

magazine

Order your

your

To

The leading

for retailers selling vape products CHARGE YOUR VAPE SALES WITH VAPE RETAILER

PLUS

UP IN THE OCTOBER ISSUE OF VAPE RETAILER ON SALE 11 OCTOBER

COMING

MUST-STOCK BRANDS Your ultimate guide on the current bestselling lines in convenience P14 3-16 OCTOBER 2023 STRICTLY FORTRADEUSERSONLY HORIZON SCANDAL P2 BACK PAGE Three retailers outline the ways they turn to their community for support P4 ILLICIT VAPES Trading standards acts on reports made by Retail Express about dodgy sellers STORE ADVICE Postmasters criticise latest compensation payouts announced by government P3 IT TAKES THREE TO TANGO Retailers force Britvic to step in over Frozen Brothers’ ‘shameful’ service Tango Ice Blast supplier U-turns on compensation refusal a er drinks giant vowed to ‘investigate’

I THINK it’s fair to say that the relationship retailers have with Evri, formerly myHermes, is somewhat rocky. Over the years at Retail Express, we’ve covered a range of stories about how store owners felt let down and unsupported by the parcel rm.

It’s important to stress the incidents don’t reflect everyone’s experiences with Evri, but one thing we try to achieve at Retail Express is helping retailers when they have no one else to turn to, and it’s impossible to shy away from the fact that the rm comes up a lot as a common denominator.

In my experience, I was never able to get a proactive response from them, despite numerous attempts. But hopefully this is about to change. As you read this, I’ll be on my way to Barnsley, visiting one of Evri’s newest hubs.

I REALLY HOPE THIS IS A TURNING POINT

The ve biggest

Postmasters claim Horizon payouts ‘aren’t enough’

ALICE BROOKER

POSTMASTERS have criticised the government’s latest £600,000 payouts to Horizon victims and are instead calling for individualised compensation.

The announcement came last month and is available to victims who can prove they were falsely imprisoned as part of the historic account-

I was invited by the lead of a new team representing the rm directly in a bid to reset our relationship, and have the opportunity to speak transparently about the occurring issues retailers face and the help they need.

I really hope this is a turning point in a long-standing, turbulent road. In the meantime, don’t hesitate to get in touch when you have either a positive or negative experience with Evri, as hopefully I’ll be in a far stronger position to be able to help moving forward.

ing scandal. They can choose to take the payment instead of going through a full assessment of their loss. The difference will be paid to postmasters who have either received an initial compensation payment or reached a settlement with the PO of less than £600k.

Although PO’s postal affairs minister, Kevin Hollinrake, claims the money pro-

vides “some form of relief to those wrongfully caught up in this scandal”, postmasters slammed the latest offering.

Vince Malone, owner of Premier Tenby Stores in Pembrokeshire, told Retail Express: “There needs to be negotiating on an individual level. I wouldn’t be surprised if some postmasters think £600,000 is a fair return, but for others

it is insulting.”

National branch secretary for the Communications Workers Union Sean Hudson added that the payment “barely scratches the surface”. He explained: “If you take into account their loss of earnings and the psychological damage they’ve suffered, it won’t come anywhere near £600k –it’s more than that.”

Strong c-stores Google warning

CONVENIENCE stores bucked the trend in a poor six months for independent shop closures.

resulting in a net reduction of 1,915 independents in the UK.

formation about their store on the search engine.

News editor Alex Yau @AlexYau_ 020

3358

Specialist reporter Dia Stronach 020 7689 3375

Figures from the Local Data Company revealed that during the �irst half of 2023, independent store closures were the highest since records began, with 21,000 shutting,

However, there are now 62 more convenience stores than at the beginning of the year, building on the 531 new convenience stores added in the �irst half of 2022.

One retailer revealed last week that a third-party web specialist had recently created a page displaying incorrect in-

‘Predatory’ agents

“Customers came to the shop looking for those deals and we had to tell them they were incorrect and couldn’t honour them,” they said. “It creates a negative reputation of your store.”

Licence removals

cial property expert said that “unscrupulous estate agents” were common. They said: “They try giving retailers an unrealistic market price. Retailers pay them as part of the listing agreement, but the property won’t get sold.” Subscribe online at newtrade.co.uk/our-products/ print/retail-express. 1 year subscription: UK £65; overseas (EU) £75; overseas (non-EU) £85 Retail Express’ publisher, Newtrade Media, cares about the environment.

RETAILERS have been warned against “unscrupulous estate agents”, after major markups on shops.

LOCAL authorities are reportedly revoking stores of their alcohol licenses in response to vape test-purchasing breaches.

Gill Sherratt, head of licensing at Napthens Solicitors, said: “That goes against every principle of the licensing pro-

For the full story, go to betterretailing.com and search ‘closures’ For the full story, go to betterretailing.com and search ‘Google’ For the full story, go to betterretailing.com and search ‘estate agents’ For the full story, go to betterretailing.com and search ‘licence’ News reporter Alice Brooker @alice_brooker 07597 588955 Cover image: Getty Images/UD10671 For the full story, go to betterretailing.com and search ‘Post O ce’

cess and the system because it is meant to be a stepped approach and cooperation, and giving people an opportunity.”

However, she did stress there were legitimate concerns around disposables and their appeal to children.

@retailexpress betterretailing.com facebook.com/betterretailing

stories this fortnight 01 02 03 04

05

Editor Megan Humphrey @MeganHumphrey 020 7689 3357 Editor – news Jack Courtez @JackCourtez 020 7689 3371 Editor in chief Louise Banham @LouiseBanham Senior features writer Priyanka Jethwa @PriyankaJethwa_ 020 7689 3355 Features editor Charles Whitting @CharlieWhittin1 020 7689 3350 Production editor Ryan Cooper 020 7689 3354 Sub editors Jim Findlay 020 7689 3373 Robin Jarossi Head of design Anne-Claire Pickard 020 7689 3391 Senior designer Jody Cooke 020 7689 3380 Junior designer Lauren Jackson Production coordinator Chris Gardner 020 7689 3368 Head of marketing Kate Daw 020 7689 3363 Head of commercial Natalie Reeve 07856 475 788 Senior account director Charlotte Jesson 07807 287 607 Commercial project manager I y Afzal 07538 299 205 Account director Lindsay Hudson 07749 416 544 Account managers Megan Byrne 07530 834 009 Lisa Martin 07951 461 146 Management accountant Abigayle Sylvane 020 7689 3383 Managing director Parin Gohil 020 7689 3388 Head of digital Luthfa Begum 07909 254 949 our

independent retail

say Evri wants to do better by

One site in north London was priced at £200,000 leasehold with a weekly turnover of under £3,000. A commerFeatures writer Jasper Hart @JasperAHHart 020 7689 3384 40,152 Audit Bureau of Circulations July 2022 to June 2023 average net circulation per issue Retail Express is printed and distributed by News UK at Broxbourne and delivered to news retailers free by their newspaper wholesaler. Published by: Newtrade Media Limited, 11 Angel Gate, City Road, London, EC1V 2SD; Phone: 020 7689 0600 Reproduction or transmission in part or whole of any item from Retail Express may only be undertaken with the prior written agreement of the Editor. Contributions are welcome and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information. No warranty for goods or services described is implied.

Megan Humphrey, editor

7689

Most noticeably was back in 2021, when we uncovered that a “technical glitch” had resulted in the underpayment of parcels, equating to losses of thousands of pounds.

STORE owners have been told to “take control” of their Google business pro�iles, after claims of reputational damage caused by incorrect listings.

Frozen Brothers pays up as Britvic ‘investigates’

resulting in 43 days of “downtime”.

INFAMOUSLY unreliable

Tango Ice Blast machine

provider Frozen Brothers has backed down and paid out compensation to a retailer, after Tango brand owners Britvic said it would “investigate” a retailer’s complaints.

More than 100 stores have now complained of repeated Frozen Brothers machine breakdowns, sometimes leaving the devices out of action for a month at a time. The breakdowns often cost stores £50 in lost CO2, plus the cost of the syrup mix, and also leave them with £220-to-£330 in monthly machine lease payments without the sales to offset.

Despite the burden this places on retailers, messages from Frozen Brothers to angry customers, seen by Retail Express, routinely refuse compensation, claiming that its terms and conditions mean it is “not liable to the customer for any pure economic loss”, or for “indirect or consequential loss”.

Mike Jonas, owner of The Orchard Convenience store & Delicatessen in Weaverham, Cheshire, received this refusal on 11 September.

“We will treat this as the end of the matter,” Frozen Brothers said, despite the company admitting that the machine had suffered three “major faults” within six months in 2023 alone,

However, around the same time, Jonas asked for Britvic to intervene, using Retail Express’s previous reporting to highlight Frozen Brothers’ pattern of poor service. “I would be so grateful if you could make Frozen Brothers do the right thing,” Jonas urged. Britvic then con�irmed it would “investigate” the problems.

Around a week later, Frozen Brothers messaged Jonas “out of the blue” with a change of heart, stating:

“We have, in this instance only, decided to issue compensation as a one-off gesture of goodwill.”

The shop owner said: “The only thing that changed between Frozen Brothers denying me compensation and calling the matter closed, and the company later paying me compensation, was Britvic promising to investigate and to contact Frozen Brothers.”

Jonas’ compensation consisted of a credit note for £234.26 (excl VAT). Equivalent to £5.43 compensation per day the machine was out of action. Frozen Brothers suggested it would demand the compensation back if it was “forced to incur any further legal and/or other costs in enforcing any provision in the agreement”.

While he said the amount offered does not offset his losses, Jonas thanked Britvic for its support, and said

other disgruntled Frozen Brothers customers had now contacted Britvic for help after getting “no help” from Frozen Brothers.

Asked about the level of complaints it has received about Frozen Brothers, a Britvic spokesperson told Retail Express: “We are aware that a number of retailers have been in touch with Frozen Brothers on issues surrounding Tango Ice Blast machine maintenance and their agreements. Britvic licenses the use of its

Tango Ice Blast trade ]mark to Frozen Brothers for use with the convenience channel. As part of that licence agreement, Frozen Brothers is required to deal directly with its customers on any faults or complaints. We encourage retailers to continue contacting Frozen Brothers directly on any queries they may have.”

Frozen Brothers also supplies Coca-Cola and Fantabranded machines, which retailers have also reported issues with. It is understood

that Frozen Brothers’ rights to use these brands were granted by the Coca-Cola Company based in Atlanta, US, and not by its UK or European af�iliates. Frozen Brothers failed to respond when approached by Retail Express, but the messages sent to Jonas stated “we do take all complaints seriously” and denied any liability. Frozen Brothers added that it had taken “reasonable action” to supply, repair, replace and maintain equipment.

What security measures have you put in place to deter incidents of crime?

“WE have CCTV systems in place, but the biggest impact on shoplifting has been identifying what products are being targeted and then moving them into areas of the store where they can be in constant eyesight of sta . It’s things like washing-up liquid, co ee, tablets, steaks and cheese. Whatever’s easy to stu into a jacket. Now if they do it, they know we’ll be watching them.”

Suki Khunkhun, Woodcross Premier, Wolverhampton, West Midlands

“WE are looking at upgrading our security system to include Very Sure and a fogging system. People recognise the Very Sure sign outside and think twice before coming into that place. I want to get new IP cameras that give you the full control, especially outside as it means I can help the police and get in their good books. I’ve also been impressed with the Facewatch system that some retailers have.”

Sam Nagi, Sam’s Mini Market, Halifax, West Yorkshire

“WE’VE got a smoke cloak, and silent alarms that summon the police within ve minutes, and a dual-function alarm because when we got broken into, they cut the phone lines. This one runs o a SIM card, so it has a satellite as well. So, even if they used a jammer to block the signal, they’d only have 15 minutes before it triggered the alarm. We’ve also put extra shutters in the back.”

Natalie Lightfoot, Londis Solo Convenience Store, Glasgow

FOOD WASTE: Retailers are saving between £600-to-£800 a week in food waste and lost sales using the Gander app, which promotes discounted groceries to nearby shoppers. The company said: “Independent retailers using Gander saw anywhere up to about £800£1,000 of waste a week brought right down to about £200.”

For the full story, go to betterretailing.com and search ‘Gander’

REP VISITS: British American Tobacco (BAT) is to resume eld support to independent retailers in Northern Ireland from this month onwards. A spokesperson said: “Following a thorough evaluation of BAT’s current presence in Northern Ireland, we are excited to announce our decision to reinforce our commitment to the convenience and impulse channels.”

GOOD WEEK BAD WEEK

VAPE SUPPLY: Supplier Vape Dinner Lady has assured retailers business is “continuing as usual”, following a re at its manufacturing site at Shadsworth Business Park in Blackburn on 11 September. The supplier said: “The majority of customers will not experience any change to their scheduled orders,” but that some may experience interruption.

BUSINESS RATES: The Fed, alongside other trade groups is urging the government to ditch the next business-rates multiplier. The move is set to cost businesses an extra £400m a year. Last month, 44 retail leaders penned a letter to chancellor Jeremy Hunt, calling for a rates freeze, expected to be announced in this year’s Autumn Budget.

For the full story, go to betterretailing.com and search ‘business rates’

03 betterretailing.com

3-16 OCTOBER 2023

express

the column where you can make your voice heard

an

yourself

Do you have

issue to discuss with other retailers? Call 020 7689 3357 or email megan.humphrey@newtrade.co.uk

JACK COURTEZ

@retailexpress facebook.com/betterretailing megan.humphrey@newtrade.co.uk 07597 588972

Natalie Lightfoot

TRADING standards have taken action to investigate dodgy vape sellers after acting on intelligence provided by Retail Express and Philip Morris Limited (PML).

In September 2022, Retail Express and the tobacco supplier went undercover to purchase illicit vapes from several stores in Southall,

west London. Vapes over the legal 2ml e-liquid limit were sold from convenience stores and vape shops, with the offending products submitted to Ealing trading standards as evidence.

A freedom of information request submitted to the trading standards department by Retail Express revealed it had acted on the evidence and investigated four of the illicit sellers. Each seller was visit-

ed once since Retail Express’s undercover operation.

In its response, the department said: “Illicit vapes were only found in one of the above-mentioned premises. The premises is currently under investigation and therefore no further detail can be disclosed at this stage.”

PML UK & Ireland head of field force Cem Uzundal said: “We regularly tackle illicit tobacco and nicotine products

in communities across the UK, and share our findings with trading standards.

“Through this activity, we’re sending a clear message to retailers of illicit cigarettes and vapes that they cannot act with impunity, while also demonstrating to those who operate legitimately that action is being taken. It’s great to hear trading standards have been able to follow up on the evidence we provide.”

Action taken on illicit vape reports PO retail scheme

THE Post Office (PO) is expanding its ‘branch MOT’ initiative, helping postmasters generate savings of at least £12,615 a year.

Launched last year, group chief retail officer Martin Roberts said: “Area managers visit

NewstrAid Cost of Living Crisis Fund

Are you struggling with the Cost of Living?

Are you worried about paying your bills and putting food on the table?

Have you worked in the sale or distribution of newspapers and magazines in the UK full time for 2 years or more?

If the answer is yes to the above questions then you could be eligible for a grant from the NewstrAid Cost of Living Crisis Fund.

Created in response to the current Cost of Living Crisis, the fund offers grants of up to £250 per household to help bridge the gap between income and costs for anyone with a newstrade connection. That means people who work or have previously worked in the sale and distribution of newspapers and magazines for a minimum of 2 years, full time. Eligibility

For more information scan the QR code, call us FREE on 0800 917 8616 or email: mail@newstraid.org.uk

branches and craft recommendations for postmasters to make positive changes.”

To date, 2,781 branches have had an MOT, with 60% describing the experience as valuable, with 41% claiming to have made changes.

For the full story, go to betterretailing.com and search ‘Post Office’

£3.8BN BOOM FOR C-STORES

RETAILERS are to see an 8% sales increase, worth £3.8bn, across the convenience sector by 2026, according to the ACS’s Local Shop Report 2023.

Tobacco and e-cigarettes are responsible for most sales across categories (21.9%), followed by alcohol (15.9%), chilled foods (12.4%) and soft drinks (7.6%), not including fresh milk.

The average basket spend

For the full story, go to betterretailing.com and search ‘convenience’

was revealed to be £7.75, with an average visit rate of 2.7 times a week per customer.

Chicken opportunity

FRIED chicken operator Miss Millie’s is on the hunt for independent retailers.

Miss Millie’s has 11 sites across the UK, recently striking a deal with Londis stores, operated by Motor Fuel Group. The company’s

chief executive, Carl Traill, told Retail Express that existing franchisees are generating £15,000-£18,000 in weekly sales.

“It’s an opportunity for stores to get trade throughout the entire day,” he said.

For the full story, go to betterretailing.com and search ‘chicken’

NEWS 04

ALEX YAU

criteria apply.

PRODUCTS

JTI launches Ploom X Advanced

PRIYA KHAIRA

JTI has launched Ploom X Advanced, an upgraded version of its Ploom X device, �irst unveiled in October 2022.

The new device is available in the Greater London area in selected supermarkets, and accredited independent and convenience stores.

The device includes two key improved features, including an optimised HeatFlow system, with higher vapour volume during initial puffs offering an enhanced user experience; and faster charging, taking less than 90 minutes to achieve full charge.

The Ploom X Advanced works exclusively with Evo tobacco sticks, which are available in a variety of

�lavours with an RRP of £4.50 per pack.

The new device is available in a pre-packed format that includes the Ploom X Advanced device, charger, USB cable, cleaning sticks, plus two packs of Evo tobacco sticks (Bronze and Green Option). This bundle will be available for retailers within the Greater London area at an RRP of £19.

Mark McGuinness, marketing director at JTI UK, said: “The heated tobacco category continues to grow at a rapid rate and offers huge potential, which is why we are continuing to invest and improve our offer.”

Alongside the new device, the Evo tobacco sticks range will now include a new Gold variety, and improved Bronze and Amber �lavours.

Mr Kipling expands Halloween range

PREMIER Foods has expanded its Halloween range for 2023 with the introduction of Mr Kipling Chocolate & Orange Slices.

The supplier says the snacks (RRP £2) are ideal for trick-or-treating, dessert, or snacking at home or on the go. They are currently available alongside the rest of the Premier Foods Halloween range.

Value sales of chocolate

Mars introduces 250ml Milk can

and orange-�lavoured cakes have grown by 11% year on year, and 66% of consumers are looking to try new seasonal �lavours of products they already know and love.

“Building on the growing success of the chocolate & orange �lavour in cakes, the slices are set to meet demand for this �lavour pro�ile,” said Naomi Shooman, global marketing director for sweet treats at Premier Foods.

MARS Chocolate Drinks and Treats (MCD&T) has launched its Mars and Galaxy Milk Drinks in a 250ml can format.

The new format is available to retailers from Costco in cases of 12, with an RRP of £1.20 each, with wider availability expected in the coming months.

It is part of the supplier’s push for more sustainable and recyclable packaging. If it is successful, the supplier said it would likely roll out to other varieties in the range.

Glass and metal can packaging now account for 20% of all �lavoured milk sales. Cans represent 11%, a 22% increase on their share three years ago.

The supplier said the new format gives shoppers more consumption options.

Fanta launches Halloween promo

COCA-COLA Europaci�ic Partners (CCEP) has unveiled its 2023 Halloween campaign for Fanta, including an onpack promotion offering prizes and surprises.

Until 7 November, shoppers can scan QR codes on limited-edition packs of Fanta, which will take them to the Coca-Cola app to play a Halloween game. They then

�ind out whether they’ve won a prize from a £70,000 prize pool – Fanta’s biggest ever – or a scary surprise.

Prizes include immersive horror experiences across the UK including travel and accommodation, home entertainment systems and big-night-in supplies, along with a list of Fanta’s top 10 scary �ilms.

Yazoo launches Thick N’ Creamy milkshake

YAZOO is diversifying its range with the launch of the Thick N’ Creamy milkshake format.

The non-HFSS range is the brand’s �irst NPD launch since 2016. It is available in 300ml bottles in Indulgent Chocolate and Creamy Strawberry varieties, with a £1.49 price-mark.

Independent retailers can stock the new range from Unitas, Bestway, Spar and Sugro.

The bottles feature a blue and gold colourway to appeal to current Yazoo shoppers and to new customers a. They are also made from 100% RPET with tethered caps and peelable sleeves to make

recycling easier.

Maren Fuhrich, brand manager at Yazoo, said: “Yazoo Thick N’ Creamy is perfectly positioned to appeal to shoppers craving a thicker, more indulgent milkshake.”

indulgent milkshake.”

05 3-16 OCTOBER 2023 betterretailing.com

* Terms and conditions apply visit www.paypoint.com/parksavings for details. Bundle deal includes PayPoint Service, Park Savings and Collect+ Service. 50% OFF your PayPoint service fee when you sign up before 31st October * Sign up today!

PRODUCTS

Premium spirit sales to soar

PRIYA KHAIRA

THE “premium+” spirit category will be an important sales driver for convenience retailers this festive season despite ongoing in�lation and cost-of-living issues, according to Pernod Ricard UK.

The supplier says shoppers are expected to move away from extravagant gifts, with 80% viewing food and drink as good affordable gifting options.

At the same time, Pernod Ricard UK has grown its value sales by 7.2% and increased market share by 2.7%, which it says makes it the fastest share-gaining wine and spirits supplier in the UK.

It recommends convenience retailers start providing gifting alcohol options as early as October, as shoppers look to spread the cost of Christmas across more months.

Additionally, shoppers are expected to continue to host at-home celebrations, so the supplier is leaning into this by providing tips about easyto-make cocktail serves.

With searches for cocktail inspiration up by 555% on social media site Pinterest, Pernod Ricard has put together a ‘Top 5 festive serves’ list that can be recreated at home. Neck tags will be placed across its range that direct shoppers to a YouTube channel with cocktail inspira-

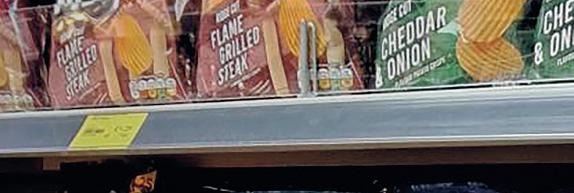

KP Nuts adds euroholes to PMPs

KP SNACKS is changing the design of its KP Nuts £1.25 price-marked pack (PMP) range by adding euroholes to each pack.

The rollout has taken place across the KP Nuts range, including the recently launched Flavour Kravers Flame Grilled Steak.

Other lines getting the new design include Original Salted Peanuts, Dry Roasted Peanuts, Salt & Vinegar Peanuts, Honey Roast Peanuts and Thai Sweet Chilli Coated Peanuts.

Eurohole packs are important for giving retailers more �lexibility in how they merchandise their bagged

sponsored

snacks, the supplier said. With the nuts category growing by 10.4% annually, retailers have further opportunities to drive sales with the ability to hang their products on prongs or clipstrips.

tion and how-to videos. There are also 500 cocktail jiggers up for grabs across

its Absolut range as a gift for customers to win with a purchase.

Country Choices refreshes brand

COUNTRY Choice has refreshed its Bake & Bite instore bakery and food-to-go brand with new imagery and updated PoS.

The new imagery of pastries, savouries, cakes, handheld snacks and more appears on the brand equipment, which includes freestanding hot and ambient display units, and grab-andgo �ixtures.

Meanwhile, PoS featuring the new imagery includes posters, hanging signs and banners.

Phil Carratt, Country Choice head of marketing and strategy, said the refresh also factored in the various

Pukka partners with Art of Football

PUKKA has partnered with fashion collective Art of Football to launch an exclusive clothing collection inspired by the pastry brand’s longrunning association with football.

The 400-piece collection includes a 1970s-inspired football shirt and a 1990sinspired drill top, which features the retro Pukka Pies logo on the front and the brand’s famous ‘Don’t compromise’ slogan on the back.

A collection of caps featuring the names of all the pies available at football grounds around the country and an exclusive T-shirt will also be available.

Isaac Fisher, managing director at Pukka, said: “Pukka

Sample a case of Pepsi Max

BRITVIC has partnered with Retail Express to offer 200 retailers the chance to stock Pepsi Max bottles running the supplier’s new on-pack promotion in partnership with videogame EA Sports FC 24.

Each retailer will receive a case of 24 500ml bottles, worth more than £40 based on an individual RRP of £1.85. A spokesperson for the supplier said: “We’re celebrating our Pepsi Max EA Games partnership with an on-pack promotion running across 500ml bottles. Shoppers simply have to enter a unique code on the microsite to unlock EA Sports FC 24 in-game re-

wards, available with every participating Pepsi product. Head to atyourconvenience. com to order a supporting PoS kit.”

and football go hand in hand, with millions of fans enjoying a Pukka halftime pie at football matches around the country.”

Proceeds from sales of the collection will go towards Pukka Athletic.

Epicurium expands crisps range

WHOLESALER Epicurium has added nine new brands to its crisps range, as a response to growing demand for on-the-go snacking options.

The nine new brands are: Savoursmiths, Shore, Mr Trotter’s, Taste of Game, Fair�ields Farm, Made for Drink, Howdah, Total XP and Two Farmers. Their addition takes Epicurium’s crisps range to more than 35 brands, with more than 200 lines available.

To enter, head to betterretailing.com/ competitions

The wholesaler said it had undertaken months of research which revealed consumers’ growing desire for “bolder and healthier” snacks.

Epicurium’s research iden-

ti�ied four core opportunities within the crisps category: sustainable and independent brands, exotic and bolder �lavours, innovative protein snacks and healthier living, which the new brands allow the wholesaler to expand further into.

new products on offer from Bake & Bite since its last brand refresh.

Red Bull launches Winter Edition

RED Bull has unveiled its �irst limited Winter Edition variety.

Red Bull Winter Edition Spiced Pear is now available to convenience retailers, having launched in Sainsbury’s last month.

Retailers can choose from 250ml (RRP £1.50), 250ml £1.45 price-marked and 355ml Sugarfree (RRP £1.80) varieties to stock.

Innovation and new �lavours are a proven opportunity to drive new shoppers into the category, the supplier said. Research shows that converting a further 24% of shoppers could deliver an additional 12 million purchases and incremental sales of £483m.

Additionally, Red Bull Editions sales have quadrupled in two years, with one in 10 Red Bull shoppers only buying Editions.

The launch aims to tap into the growing trend of �lavoured energy drinks and reach more consumers.

Jägermeister brings back on-pack promo

MAST-JÄGERMEISTER UK has brought back its ‘Freeze to win’ on-pack promotion, producing 250,000 bottles in support of the campaign.

The 70cl promotional bottles have a temperaturesensitive back label which reinforces Jägermeister’s perfect serve – a shot chilled to -18°C.

When kept in the freezer, the bottles reveal a secret code upon reaching the optimal temperature.

This code gives consumers the opportunity to win prizes, including tickets to 2024 festivals, mini-Jägermeister freezing cradles to keep Jägermeister chilled at home, Jägermeister e-shop vouchers, premium branded

“In-store bakery and food to go allows retailers to make signi�icant margins of around 35%-45%,” he added. green shot glasses and more. The bottles are available until the end of the year.

Johnny Dennys, MastJägermeister UK head of brand and trade marketing, said: “After last year’s success, it was a no-brainer to relaunch this interactive promotion.”

06

Pladis expands McVitie’s BN range Walkers adds to RRP PMP range

PLADIS is expanding its McVitie’s BN range once more with the addition of BN Popping Candy Cake Bars.

The range is available in Crackling Chocolate and Sizzling Strawberry varieties, in packs of �ive individually wrapped bars with an RRP of £1.25.

These offer chocolate topped with chocolate cream and strawberry sponge with light cream respectively, �illed with popping candy pieces.

The supplier says having the bars individually wrapped makes them ideal for family shoppers or for portion-controlled snacking.

BN’s previous launch this

year, Mini Rolls, has generated £900,000 in retail sales value since launch. Meanwhile, the brand’s biscuit range, which launched last year, has topped £4.3m in sales this year alone.

WALKERS is expanding its price-marked pack (PMP) range with the addition of top-selling Wotsits Giants varieties, Really Cheesy and Flamin’ Hot.

The addition of the £1.25 PMPs takes the supplier’s number of RRP PMP launches this year into double �igures. Its RRP PMP range is growing by 21.4%, and it is hoping the Wotsits Giants range, which has delivered £9.3m in value sales in the past year, will help this growth to continue.

Mike Chapman, head of wholesale at PepsiCo, said: “Wotsits Giants have been hugely popular since launch,

Hancocks unveils Halloween range

HANCOCKS has unveiled its 2023 Halloween range, featuring new launches and returning top sellers from Crazy Candy Factory, Candy Realms, Bonds of London and Bubs.

New among the wholesaler’s pick-andmix range are the Halloween Eyeball Mix and Milk Chocolate Pumpkins varieties.

Meanwhile, Crazy Candy Factory has launched a Zombie Brain impulse line, while Pez has introduced a new spooky bat dispenser character.

with shoppers loving the fact that they are twice the size of regular Wotsits. By stocking best-selling �lavours like Wotsits Giants RRP PMPs, retailers can capitalise on existing shopper demand and drive snacking sales.”

Head of convenience UK, foods division, Kepak

PG

Tips unveils relaunch

LIPTON Teas and Infusions has invested in a relaunch of its PG Tips tea brand, giving it a new look and blend and upgrading its Manchester factory.

The relaunch comprises a new blend across Original, Gold and Decaf varieties, a square, biodegradable teabag and new packaging to better re�lect the brand’s premium nature. It also has no plastic outer wrap, and is 33% more compact for easier stacking at home and in-store.

THIS summer, Rustlers partnered with independent convenience retailers across the UK to help them maximise their chilled ready meal sales across multiple occasions.

set to go live in the �irst half of 2024, which it says is the largest ever spend in the tea category.

The trials took place in August and saw store owners receive merchandising advice, marketing materials and Rustlers stock. They also tested a big-night-in deal, unique to their store, to encourage Rustlers sales into the evening. Retailers cross-promoted Rustlers with pot desserts, sharing snacks and take-home so drinks.

Insights from the Retail Data Partnership show that the average basket containing a Rustlers product is £13.261, an 82% increase on the convenience store average of £7.27,- according to the ACS2. If you promote Rustlers in highly visible locations, you can encourage your shoppers to pick up additional items for lunch or in the evening.

By moving the range to the centre of the chiller and brand blocking Rustlers bestselling and new products – including Quarter Pounder, Twin Cheeseburger, BBQ Rib, Chicken Sub and the new Marinara Meatball Sub –retailers who took part in the trials experienced upli s in excess of 20%3. In the next issue of Retail Express, we’ll explore these results in more detail.

launched Candy Realms. The

World of Sweets recently launched Candy Realms. The brand has also added Spooky

Rubicon Raw’s new on-pack promo

RUBICON Raw has launched an on-pack promotion giving shoppers the chance to win ‘The ultimate snowsports experience’, as part of its continued partnership with GB Snowsport.

Shoppers can be in with a chance of winning a snowsport lesson with a GB athlete, a week’s skiing holiday in Switzerland and £1,000 cash. They can enter by buying

cans featuring GB Snowsport athlete and reigning Team Snowboard Cross world champion Charlotte Bankes. More than two million of these cans will be available, across plain and price-marked 500ml cans and some 4x500ml multipacks until the end of November.

Additionally, the supplier has invested £40m to upgrade PG Tips’ Trafford Park factory in Manchester. It will also support the relaunch with a multimillionpound marketing campaign

Pladis to launch new Jacob’s biscuits

PLADIS is expanding its Jacob’s savoury biscuit brand with the launch of two new cracker varieties aimed at attracting more shoppers aged 35-plus.

The supplier has added a Cheese & Pickle variety to its Cheddars range, which has seen a year-to-date sales increase of 43.1%.

It has also unveiled Rosemary Mediterranean crackers, which contain �ive packs of four individually wrapped crackers.

Both varieties will be available to convenience and wholesale from October.

Jacob’s Cheddars Cheese & Pickle will carry a £1.25 RRP, while Mediterranean Rosemary will have an RRP

For more information on how you can drive double-digit sales in your store, email foodtogo@kepak.com or visit kepaktrade.co.uk/contact

of £1.99.

“Our experience is that Jacob’s Cheddars’ innovation brings new shoppers to an already growing category subsegment, so we are excited by this new addition to our range,” said Asli Akman, marketing director at Pladis UK&I.

1Retail Data Partnership – Basket Analysis – 52 w/e – 21.05.23, 2ACS Local Shop Report 2022, 3Retailer EPoS data from trial period

07 3-16 OCTOBER 2023 betterretailing.com

Tubes, Alien Balloons with Popping Candy, Skull Candy Pops and Spooky mallows to its range.

Retailers also have access to PoS to help drive incremental sales. Paid feature

ROSS DAVISON

Partnering for the future

COMING UP IN THE 6 OCTOBER ISSUE OF RN

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS

What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

VAPE: How would a potential ban on disposables affect your sales?

“A DECISION like this could cost me up to £3,000 in weekly lost sales. There will be hundreds of stores that rely on this category as a real cash driver. It’s a huge concern for small retailers who have become vape destinations.”

Jet Sunner, Michaels Supermarket, Billesley, Birmingham

One Stop has the tools for support online

CRIME: Is dummy packaging and security tags a valuable deterrent?

“I CAN see how these are needed, but security tags are a waste of time. I don’t think they are a deterrent. People know what they’re doing. If a tag alerts the alarm, is a member of staff going to run out after someone? I wouldn’t tell my staff to. Is it worth it?”

Maqsood Akhtar, Blackthorn News & Food, Rotherham

“I UNDERSTAND why businesses are doing this to survive. Those that come in and see that will ultimately be deterred. Hopefully, it helps with shoplifting rates. The police aren’t doing anything about the thefts, and people know that.”

Harj Dhasee, Mickleton Village Stores, Gloucestershire

“I FEEL like it’s an empty threat. We don’t think it’s going to happen. If they ban them, they’ve got to ban cigarettes. Children de�initely need to be protected, and the age restriction needs to be better enforced.”

DIVERSITY: How are you prioritising this within your business?

“I WOULD like to think that I have built up a good enough relationship with my staff in the store that they feel con�ident to approach me. So many different situations can happen in the business, and you can’t just rely strictly on one way of managing them.”

Atul Sodha, Londis Hare�ield, Uxbridge, west London

“I WOULD like to see the industry provide more resources to retailers on the wider issues. If I had a problem, though, my �irst port of call would be the ACS for advice, and One Stop has the tools for support online. Other than that, I wouldn’t know where to go.”

Aman Uppal, One Stop Mount Nod, Coventry

The police aren’t doing anything

FRONTAGE: What changes have you made to appeal to passers-by?

“WE’VE painted the outside white, which means it can be clearly seen from the busy main road. We also pull out all the weeds, and we’ve found that customers notice things like that and will always mention it. In the future, I want to introduce a canopy, advertising our opening hours.”

Raj Dhother, Whitminster Village Stores, Gloucestershire

“I MAKE an effort to change our main window display to relate to local, regional and national events – such as Poppy Appeal, Mother’s Day or carnival season – as well as seasonally appropriate instore offers. I also make sure that our ‘open’ sign can be seen from a long distance.”

Trudy Davies, Woosnam & Davies News, Llanidloes, Powys

08

3-16 OCTOBER 2023 betterretailing.com

OPINION

We’ve painted the outside white

It’s a huge concern for small retailers

Amrit Singh, H & Jodie’s Nisa Local, High Heath, Walsall

see what

retailers are charging for take-home soft drinks and boost your own profits Winter remedies: what you need to offer the most comprehensive winter remedies range Christmas biscuits and cakes: how to build and promote your biscuits and cakes range this festive season + STAY INFORMED AND GET AHEAD WITH RN betterretailing.com/subscribe

ADVERTISE IN RN please

Natalie

sales data analysed for every issue 69+ unique retailers spoken to every month 71% of RN’s news stories are exclusive At RN, our content is data-led and informed by those on the shop floor ORDER YOUR COPY from your magazine wholesaler today or contact Kate Daw on 020 7689 3363

Pricewatch:

other

To

contact

Reeve on 07824 058172 3,451 retailers’

Our social channels are the quickest way to keep up to date with all things the Fed. From the latest industry news to upcoming events, membership benefits, partner offers and commercial support. Join our retailer community today #theFed t h e f e d o n l i n e . c o m Federation of Independent Retailers Fed The E s t . 1 9 1 9 T: 0 2 0 7 0 1 7 8 8 8 0 | E: c o n t a c t u s @ n f r n . o r g . u k @theFedonline @ theFed-NFRN YouTube @ theFed_online Twitter @ theFedonline Facebook @ theFed LinkedIn Make money, save money, make business easier! Instagram Follow us Instagram Subscribe to YouTube Follow us Twitter Like us Facebook Follow us LinkedIn RN Full page ad.indd 2 21/07/2023 13:20

Connecting, supporting and empowering women working in independent convenience retail The Studio, Birmingham Building Business Confidence 5 October 202310.45am onwards Develop your personal and business skills through practical workshops Feel inspired as leading retailers and suppliers share their stories Share experiences and build a network of like-minded retailers Secure your FREE place today at bit.ly/3qDsgim, by scanning the QR code or by contacting Kate Daw: kate.daw@newtrade.co.uk // 07886 784465 Headline partnerSupporting partners Collaborators

Keeping on top of wastage

KEEPING our wastage low is an important part of the business.

The most a ected category is our chilled section, hence we still do our ordering of fresh and chilled products manually. We have an EPoS ordering system for everything else in the store, but we always order our chilled products manually because we feel we can manage our waste better, depending on the time of the week and the season.

‘Our MP thanked us for our e orts during the Covid-19 pandemic’

WE were invited to Parliament last month by our MP, Gareth Bacon, as a thank you for serving our community during the Covid-19 pandemic. It was a fantastic day, and

we got the chance to look around the House of Lords and Commons. We also had a sit down with Gareth, and he told us how grateful he was for everything we did during the pandemic. It felt

WIN £50-worth of BrewDog Mixed packs

nice to get some recognition for the work we put in at that time – as an independent retailer, it was very tough. We had the opportunity to speak with him about the current challenges we are facing as an

independent retailer, including rising bank charges and the ultra-low emission zones.

Anita Nye, Premier Eldred Drive Stores, Orpington, south-east London

Anita Nye, Premier Eldred Drive Stores, Orpington, south-east London

WIN £50-worth of McVitie’s White Chocolate Digestives

BREWDOG has partnered with Retail Express to o er ve retailers the chance to win £50-worth of Mixed 330ml packs. With socialising and entertaining more frequent over the festive period, larger packs are the key formats for cra beer. The BrewDog Mixed 330ml can eight-pack, featuring the brand’s bestsellers, is a great option, o ering shoppers the opportunity to trial di erent styles of beer for sharing occasions.

TO ENTER

Fill

Each issue, one of seven top retailers shares advice to make your store magni cent

We analyse our wastage reports weekly and at the moment it is currently on about 4%.

Over four years ago, we partnered with a company called Too Good To Go. At the end of each day, any unsold products that are about to reach their sell-by date are placed in a bag and sold to customers for a third of their retail price.

A lot of people rely on these bags because of the costof-living crisis. With the economy the way it is, our bags are always in demand and they always sell. We vary our bags so that there are a few products in each, and so that customers can get some variety. We also try to put them online at the same time every day so people know when they can reserve a bag using the app.

We also own two co ee shops, and we use the Too Good To Go scheme there as well.

It’s a no-brainer to get involved in and I’d highly recommend it to any fellow retailers. Not only are you helping local customers, but it also reduces the amount of wastage that is le at the end of each day. We have also noticed that it has brought new customers into the store. I like to trial new products in my stores, and Too Good To Go gives us the opportunity to do this more o en and for longer periods of time.

PLADIS has joined forces with Retail Express to o er ve retailers the chance to win £50-worth of McVitie’s White Chocolate Digestives stock – a new take on the nation’s favourite biscuit. The long-anticipated launch presents a signi cant opportunity to grow sales, particularly as it’s being supported with ongoing activity across shopper marketing and social media.

TO ENTER

Fill

11 betterretailing.com 3-16 OCTOBER 2023 Letters may be edited LETTERS

Get in touch @retailexpress betterretailing.com facebook.com/betterretailing megan.humphrey@newtrade.co.uk 07597 588972 Sunita Aggarwal Spar Hackenthorpe, Sheffield

in your details at: betterretailing.com/competitions

competition closes on 31 October. Editor’s decision is nal.

This

in your

at: betterretailing.com/competitions

31 October. Editor’s decision is nal.

details

This competition closes on

ENERGISE SOFT DRINKS SALES

RETAIL EXPRESS catches up with Shelley & Anu Goel and Ankur Patel to find out how RED BULL’s advice has improved their soft drinks sales

THE so drinks category is vital to retailers, shopped by 99% of people1. It’s also large, containing di erent segments for di erent shopper needs, so retailers need to keep working hard to make sure their xtures are appealing. In July, Ashley Harwood from Red Bull, whose products are key sellers, visited two retailers to help them e ectively display the category. We nd out what e ect it had on their sales.

FOCUS ON SHELLEY & ANU GOEL

One Stop Gospel Lane, Solihull

CHALLENGES

SHELLEY and Anu found it di cult to use their limited shelf space to its fullest extent. There are many new products in the category, so they wanted to ensure new products stand out, key brands are visible, and the xture is more appealing and easier to shop.

CHANGES TO DRIVE SALES

Organise by segment: We split the category into ve segments – energy, colas, carbonates, fruit drinks and waters – so it’s shoppable.

Spotlight brand leaders: We put the beacon brands, such as Red Bull and Coca-Cola, at eyelevel so shoppers can pick them up quickly.

Share of space: We made sure bestselling brands have enough facings – 14% of SKUs make up 80% of sales2, more brands does not mean more sales.

SHELLEY SAYS

“THE project went really well. The new lines sold like wild re, and existing lines sold faster also. We’re delighted with the trial period, especially compared with last year, when the weather was better. If the sales continue this well, it’s worth more than £7,000 in extra so drinks sales per year.”

KEY LESSONS FOR YOUR STORE

1 Make sure your soft drinks are organised by segment for shopability.

2 Putting beacon brands at eye-level makes them the easiest for shoppers to see.

3 More brands doesn’t mean more sales – give priority to top sellers.

THE RESULT

5.7%

If you want to grow soft drinks sales and improve the performance of your store, call 020 7689 0500

SUPPLIER ADVICE 12

GET INVOLVED

AFTER

BEFORE

The increase in soft drinks sales by following Red Bull’s advice

FOCUS ON ANKUR PATEL

Costcutter Cockshut Hill, Birmingham

CHALLENGES

SOFT drinks is a vast, fast-moving category, so Ankur sometimes struggled to know which brands would drive sales. He wasn’t sure how to organise his range to make it easier for shoppers to nd what they need and wanted to understand how much space to give top sellers.

CHANGES TO DRIVE SALES

Vertical segments: We merchandised each segment vertically as shoppers do not look horizontally across the so drinks xture. Brand block: We grouped brands together in the xture, so beacon brands are easily distinguishable from other products.

Allocate adequate space: We gave bestsellers extra facings, as that’s better than having an unknown line.

ANKUR SAYS

THE RESULT

9.8%

The increase in soft drinks sales by following Red Bull’s advice

“I’M really happy I took part in the project and with the changes. My xture looks cleaner and it’s boosted sales. Customers are buying more of everything; my Red Bull sales have gone up by 42% and so drinks are now worth almost £8,000 in additional sales per year.”

KEY LESSONS FOR YOUR STORE

1 Merchandise each segment vertically to let shoppers nd what they need.

2 Group brands within their segments so beacon brands, such as Red Bull, stand out.

3 Allocate adequate space to top sellers as their availability will drive more sales.

RED BULL’S TOP TIPS

1 Organise your so drinks by segment so customers can see what they want.

2 Work with suppliers to ensure your range reflects your customer base.

3 Increase facings of top sellers instead of gambling on lesser-known lines.

4 Keep category beacon brands at eye-level to make them easiest to spot.

GET INVOLVED

EXPERT ADVICE ASHLEY HARWOOD Category lead, Red Bull

“I’M delighted that both retailers have seen such success o the back of the changes that we made to their xtures. Both have seen signi cant increase in their Red Bull sales and also across the category. This shows us that making simple changes – such as moving brands to eye-level, organising by segment and giving your bestsellers additional facings –can make a huge di erence to your sales.”

For more advice and tips, and to see more of Shelley & Anu’s and Ankur’s stores, go to betterretailing.com/energise-soft-drinks-sales-after

BEFORE betterretailing.com 3-16 OCTOBER 2023 Promotional feature 13

AFTER

In partnership with

1Kantar Worldpanel | Household Penetration | April 2023, 2Nielsen ScanTrack | Total Coverage | Last 12 weeks | w/e 10.06.2023

THE FOUNDATION OF STORE SALES

muststocks

ANOTHER challenging winter is around the corner, as the cost-of-living crisis continues to bite for shoppers up and down the country. By now, retailers should be more aware of how the impact on shopper nances has adjusted their customers’ spending, but they need to be mindful of the key lines their customers are looking for as well as emerging segments.

cost-of-living

In this feature, we will explore ve must-stock categories, with top suppliers highlighting their bestselling lines for retailers this winter and beyond. They will also advise retailers on how to take advantage of and get the most out of their products, with merchandising, ranging and promotional tips. Leading manufacturers in key convenience categories including crisps and snacks, so drinks, next-gen nicotine and more provide insight into what’s driving their sales growth.

BrewDog highlights the growth opportunity for the under-represented cra beer segment in convenience, while Helix Sweden introduces its On! nicotine pouch brand to retailers and shows how they can grow sales in the category.

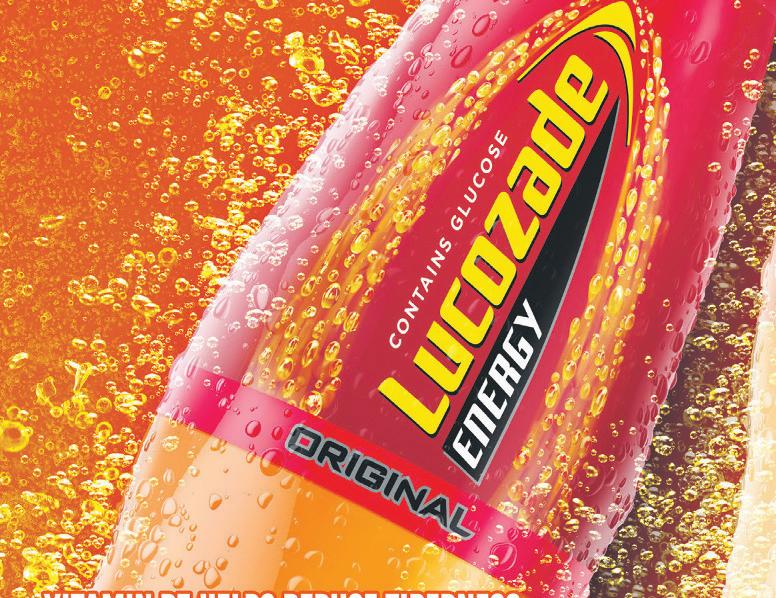

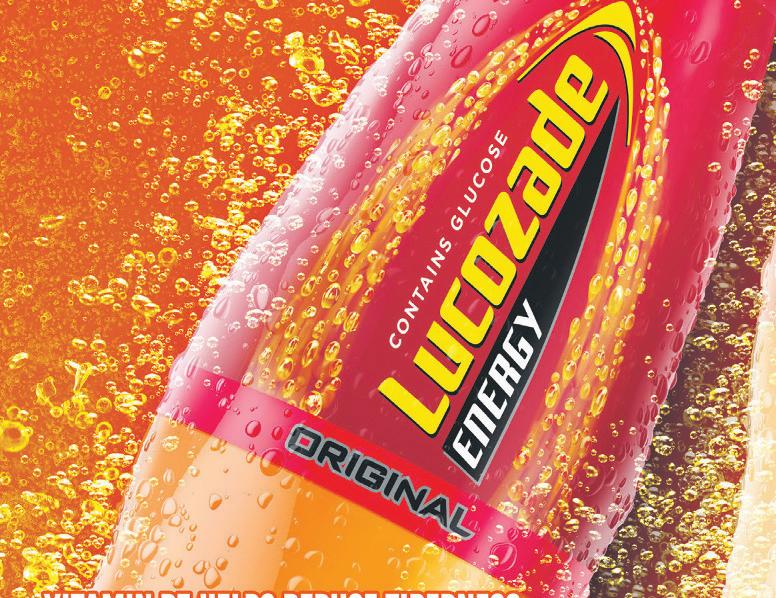

Suntory Beverage & Food GB&I outlines the changes it has made to the packaging and recipe of its Lucozade Energy range, while Schwartz shows how retailers can build basket spend with a well-curated range of herbs, spices, seasonings and recipe mixes to support customers who prefer scratch cooking.

Last, but not least, KP Snacks explores the merits of its recently launched ‘25 to Thrive’ ranging advice, and how it has helped retailers increase their crisps, snacks and nuts sales. Despite the nancial pressures of the past 18 months, shoppers still look to top brands, especially within convenience – read on to nd out how they can help you keep your customers coming back.

14 MUST-STOCK BRANDS

Bringing snack sales to life in independent retail Bimal Patel won £1,000 of stock through a Snack Display competition Sign up today! All you need to know Tutorials, trends and planograms Quick and easy access News, bestseller information, and Point of Sale Regular competitions Your chance to win great prizes

MUST-STOCK BRANDS CRAFT

BEER

BREWDOG

THE PRODUCT

CRAFT Beer provides an opportunity for retailers to drive growth, with just 8.4% of cra beer sales going through the impulse channel vs 28.1% of beer. The category under-indexes in this channel, providing signi cant headroom for growth1. BrewDog has six of the top 10 cra beer brands in impulse, with 45.6% of sales from the top three brands2. With BrewDog Punk IPA the number-one cra beer brand3, it acts as a signpost for the category – available in single cans, fourpack, eight-pack and 12-pack formats. The four-can pack remains the most important cra beer format throughout the year with 47.4% share4. As a result, BrewDog Punk IPA 330ml can four-pack is the number-one cra beer line in total impulse, with 17% share sales, up 9.4% vs last year5.

GETTING THE MOST FROM BREWDOG

WE know BrewDog shoppers are extremely valuable, spending 28.8% more on total basket than average beer shoppers6. Listing top-performing cra beer lines, such as BrewDog Punk IPA, will help to increase total spend. BrewDog Punk IPA is the signpost brand for cra beer7, so should be displayed at eye-level and brand blocked to be the signal for the category at xture. Location is key – when buying cra , 76% of men want chilled beer from the fridge in convenience stores8. If chiller space is available, BrewDog Punk IPA should be sited here. Focus on multipacks – the four-pack can is the most important format for cra beer and BrewDog shoppers9.

VIEW

“SINCE

15

3-16 OCTOBER 2023 betterretailing.com 1Nielsen Scantrack 12 wk w/e 25.02.2023 | Total Coverage, 2Punk IPA, Hazy Jane and Lost Lager – Nielsen Scantrack 26 wk w/e 25.02.2023 | Total Impulse, 3Nielsen Total Coverage Latest 12 wks Nielsen 25.02.23, 4Nielsen Scantrack MAT w/e 05.11.2022 | Total Coverage, 5Nielsen Scantrack 12 wk w/e 25.02.2023 | Total Impulse, 6CONVENIENCE RETAILER X SHOPPER LOYALTY DATA 52 W/E 25.03.23, 7Green Shoots Eye Tracking Shopper Journey Research September 2021, 8BrewDog Bespoke Shopper Research – Dunnhumby Shopper Thoughts Panel – July 2022 – When buying Cra beer in Convenience stores, which of the below are important factors when making your choice? Select all that apply – ‘I want a chilled product to drink straight away’, 9Nielsen Beer Scantrack MAT TY Value Sales Total Coverage to w/e 27.02.21 must-stock In partnership with Ronak Patel, Budgens Arbury, Cambridge RETAILER

stocking BrewDog Punk IPA, we have been able to assess how popular it is. We’ve had great success with the brand and recognised there is a market for cra beer. With BrewDog’s help, we have been able to stock a wider range across two shelves, creating brand awareness.” why

BOOST YOUR PROFIT WITH BREWDOG BLACKHEART. UPSTOCK NOW IT’S NOT SO BLACK AND WHITE ANYMORE.

stockit

ON!

In partnership with MUST-STOCK BRANDS NICOTINE POUCHES

Not for

Sweden AB

THE PRODUCT

ARE you a retailer that likes to be at the forefront of the changing tobacco landscape?

If so, On! nicotine pouches are for your store. On! is an innovative, tobacco-free nicotine pouch product for adult tobacco consumers seeking reduced social friction and anytime, anywhere nicotine satisfaction. On! consumers no longer smell like smoke or need to step away from a conversation and can multitask while using the product. They can experience nicotine satisfaction throughout their day. On! has 20 pouches per can and is available in various flavours and nicotine strengths, including 3mg (regular) and 6mg (strong). There are potentially 1.8 million nicotine pouch consumers across the UK.

GETTING THE MOST FROM YOUR PRODUCT

FOR On!, your store is the most important place to connect with adult tobacco consumers. That’s why it o ers breadth and flexibility in sales solutions and displays. Everything is aimed at maximising the returns on its partnership for you. On! nicotine pouches are for tobacco consumers aged 18-plus and are to be merchandised with other nicotine products in a non-self-service location.

SUPPLIER VIEW

Viktor Hjulström, business development manager, Helix Sweden AB

To order On!, please contact your local distributor or visit vapelocal.info/onre or scan the QR code

must-stock 16

A

REGULAR STRONG Available to order on Vape Local

“AS a company within Altria group, Helix shares Altria’s commitment to moving beyond smoking by responsibly leading the transition of adult smokers to a smoke-free future. On! is a nicotine pouch from us and part of our premium portfolio of product o erings across a variety of flavours and nicotine strengths. Switching to On! nicotine pouches allows the adult tobacco consumer to experience nicotine satisfaction without smoke or odour, including occasions when they can’t smoke, such as when working, shopping, travelling or socialising.” Helix

under 18.

This product contains nicotine which is a highly addictive substance.

tobacco free alternative without smoke or odour

MUST-STOCK BRANDS ENERGY DRINKS

LUCOZADE ENERGY

THE PRODUCT

LUCOZADE Energy has recently enhanced its Original and Orange varieties, following 18 months of extensive research and development and input from 6,500 consumers.

The new recipes deliver a bolder taste for the unique Original flavour and more citrusy, orange notes for Orange, giving consumers more of what they love.

The Orange and Original flavours feature a fresh pack design that reveals more of the liquid, creating greater appeal by allowing for more taste, flavour and refreshment cues. The consumer research revealed that the sleeves help increase purchase intent1 among shoppers. The changes are e ective across all Lucozade Energy Orange and Original bottles in single and multipack formats. They will also roll out across bottles of the remaining Lucozade Energy flavours in the coming months.

GETTING THE MOST FROM LUCOZADE ENERGY

ALL of SBF GB&I’s drinks, including the enhanced Lucozade Energy Original and Orange flavours, are non-HFSS, which means retailers can stock them anywhere in store.

Lucozade Energy brings di erent so drink buyers to your chillers, so using it as a category signpost – and ensuring you o er the right range of flavours to further widen the appeal of the brand’s range – is key.

Retailers should place familiar brands like Lucozade Energy at – or just below – eye-level to help shoppers navigate the category quickly.

why stock it

SUPPLIER VIEW

Zoe Trimble, head of Lucozade Energy, Suntory Beverage & Food GB&I

Zoe Trimble, head of Lucozade Energy, Suntory Beverage & Food GB&I

“WE are excited to have launched this new taste and look for Lucozade Energy Original and Orange, and are con dent the bold new flavours and design will help us reach even more shoppers.

“Our Core Brand Innovation programme is at the heart of our approach to brand building. We believe that brands must evolve to keep up with changing consumer needs.

“The goal is to better understand the lives of our consumers, what they’re looking for and what drives their decision-making, so we can adapt to meet their needs.”

17

3-16 OCTOBER 2023 betterretailing.com 1+6pp increase in purchase intent (Source: The Big Picture in Feb 2021. Category Considerers (n=300))

In partnership with

must-stock

must-stock

THE PRODUCT

THE herbs, spices, and seasonings category has seen a consistent 6% compound annual growth rate (CAGR) growth over the past four years1. This growth has been fuelled by the popularity of scratch cooking as a cost-e ective solution amidst the cost-of-living crisis. Notably, seasonings and garlic are the fastest-growing sectors, with impressive growth rates of 18.9% and 18.3%, respectively1. Summer is a key sales period, but retailers should stock a core range all year round. Schwartz allows shoppers to add and explore flavour possibilities when cooking. Branded seasonings are particularly successful as shoppers prioritise flavourful dishes without compromising quality. Additionally, dry garlic alternatives o er a quick and convenient option for time-pressed shoppers.

GETTING THE MOST FROM SCHWARTZ SPICES

AS the dominant player in the herbs, spices and seasonings market, Schwartz holds a commanding 21% share, with 43% of shoppers buying the brand in the past year1. Impressively, the brand has outpaced market growth by 12.5%, surpassing the overall growth rate of 8.8% and contributing £6.4m of value to the category1 Stock the best-performing Schwartz products in impulse: Garlic Granules, Black Peppercorn Mill and Mixed Herbs1. Ensure you use its merchandising equipment that automatically brings jars from the back of the shelf to the front, coupled with PoS messaging centred about convenience and flavour.

Megan Jackson, category manager, McCormick

Megan Jackson, category manager, McCormick

“SHOPPERS shop herbs, spices and seasonings through two main missions, stocking up (67%) and for a speci c recipe (33%), with a high proportion of purchases planned (90%)2. It’s therefore critical that retailers’ in-store ranges cover the top sellers: Garlic Granules, Black Peppercorn Mill and Mixed Herbs. It is also critical that retailers ensure merchandising is neat and in an A-Z format to ensure visibility of products and ease of navigating the xture.”

MUST-STOCK BRANDS HERBS & SPICES

1Nielsen Total Coverage including discounters 52 w/ee 08.07.23, 2Shopping Behaviour Xplained insights

SUPPLIER VIEW

SCHWARTZ 18 Stock the right ingredients for tasty sales! GROWTH* +5% YOY Reasons to stock the market leader... Source: *Nielsen Impulse MAT to 25.02.23, **Corporate Knights lobal Sustainability Index McCormick is #1 foods products SHORT SHELF SPACE 18 SKUS =798mm LONG SHELF LIFE 18 MONTHS 58% OF SCHWARTZ SALES COME FROM OUR TOP 10* Visit www.schwartz.co.uk/get-in-touch #1 most sustainable globalfoodcompany **

why stock it

THE PRODUCT must-stock

RECIPE mixes are a quick and easy way to make dishes. This might be why their growth is particularly prevalent in the most recent 12 weeks, up by 9.2%1. Some of the largest-growing flavours include British staples such as beef casserole (+20.9%) and sausage casserole (+26.9%), as well as more exotic cuisine dishes like Mexican tacos (+24.2%)1. Retailers should group their recipe mixes by segment, protein types and usage, then by brand, so shoppers can see the choice available to them. Meal solutions using PoS or cross-category displays with other key ingredients can also boost sales and spend.

GETTING THE MOST FROM SCHWARTZ RECIPE MIXES

WITHIN Schwartz Recipe Mixes, there are more than 100 flavours, but the bestsellers are Chilli Con Carne, Creamy Pepper Sauce and Cheese Sauce. Those have grown fast in impulse this year, by 49%, 9% and 38%, respectively2. Combine your core range with seasonal products for the best range. Ninety-one per cent of Schwartz recipe mix sales come from its top 10 lines2, so having these popular sellers at eye-level is key for optimising sales. The brand also continues to drive growth with new products, so balance top sellers with new entrants to keep customers returning to the xture for inspiration.

WHY stock it

SUPPLIER VIEW

Megan Jackson, category manager, McCormick

Megan Jackson, category manager, McCormick

“SCHWARTZ is the number-one recipe mix brand and is improving its core range while also launching a new range of restaurant-inspired recipe mixes. This range allows shoppers and consumers to create meals inspired by Las Iguanas, Bella Italia and The Real Greek at home, while an on-pack promotion enables them to access a discount in these restaurants. Schwartz is leading the way with innovation.”

Choose

MUST-STOCK BRANDS RECIPE MIXES 19 3-16 OCTOBER 2023 betterretailing.com In partnership with SCHWARTZ

1Nielsen: Coverage including Discounters/GB during Latest 12 Weeks, 2Nielsen Total Coverage including discounters 52 w/e 08.07.23

seasonally relevant recipe mix

the most from your range Stock the range and make a packet! RECIPEBRANDMIX IN THE UK* No.1 Visit www.schwartz.co.uk/get-in-touch Stock recipe mixes from the market leader... Source: *Total Coverage inc Discounters - MAT to 25.02.23, **Nielsen Impulse MAT to 25.02.23, ***Corporate Knights lobal Sustainability Index McCormick is #1 foods products 91% of Schwartz sales COME FROM OUR TOP 10** #1 Most Sustainable *** GLOBAL FOOD COMPANY +22% YOY** SALES IN IMPULSE

products to get

KP SNACKS

THE PRODUCT

KP SNACKS launched its impartial ‘25 to Thrive’ ranging advice earlier this year to continue to support retailers and help them bag their share of crisps, snacks, nuts and popcorn (CSNP) category growth. The category is now worth over £4bn1 and growing faster than any other impulse category2. ‘25 to Thrive’ o ers a core range recommendation of 25 SKUs from across the entire category, meeting today’s shopper needs.

The 25 lines include bestsellers from multiple suppliers, featuring iconic KP Snacks brands Hula Hoops, McCoy’s, KP Nuts and Butterkist. The range predominantly consists of price-marked packs (PMPs), ranging from the UK’s numberone best value brand Space Raiders in a 40p PMP to larger £1.25 PMPs, catering to all shopper occasions and prices.

GETTING THE MOST FROM KP SNACKS

KP SNACKS is supporting retailers to revive their sales, drive impulse purchases and thrive in a competitive market. ‘25 to Thrive’ encourages retailers to focus on the food-to-go category, which represents 17% of convenience missions3, and capitalise on the strength of PMP formats, with £1.25 PMPs accounting for 66% of independents’ sales3. KP Snacks’ £1.25 PMP portfolio is driving incremental sales, representing 38% of total £1.25 PMP sales and growing ahead of the market at +50% (vs +30.3%)3

To succeed in CSNP, retailers should stock all of the core ‘25 to Thrive’ range, positioning CSNP xtures with prominence.

WHY stock it

RETAILER VIEW

Lewis Woodward, Nisa Colley Gate, Halesowen, West Midlands

“SINCE implementing the ‘25 to Thrive’ ranging advice, we’ve had really positive comments from customers about the overall appearance of our CSN bays. Value jumps out with the new layout, and in the current climate, shoppers want to see products they recognise at the best price. We also saw a signi cant increase in wider CSN sales thanks to the advice.”

3-21 OCTOBER 2023 betterretailing.com must-stock In partnership with MUST-STOCK

SNACKS 20 1Nielsen IQ, Total Coverage, Total Value, 17.06.23 MAT, 2Kantar 12 w/e 11.06.23, 3Nielsen IQ 52 w/e 09.09.2023

BRANDS CRISPS &

Bag your share of growth with our category wide range recommendation download now for bigger profits Scan here to download our easy retailer guide The right core range to meet today’s shopper needs! to Thrive 12158 Retail Express Mini ad-25TT.indd 1 01/08/2023 13:01

260x339.indd 1 19/09/2023 17:32:45

HEATED TOBACCO

EDUCATION

Have a retailer cheat sheet: Narinder Sungu, of Shenstone Post O ce in Sta ordshire, said: “We have been stocking heated tobacco for three years, but having a store cheat sheet to remind us of the bene ts and features of it would be useful.”

Get the message across: Asim Iqbal, of Roslin Convenience Store in Edinburgh, said: “While there is a demographic for heated tobacco where I am, we need help to get the message out as to what it can o er customers over other tobacco products.”

Product demonstrations: Pramit Patel, of Epping News in Essex, said: “Oneon-one selling is very valuable. We would like to continue to have demonstration days to show us how to use Ploom and put us in a better position to sell to consumers.”

Expert views: Rob Kirby, programme development manager, and Tom McKenna, Ploom brand manager, JTI UK

Kirby said: “JTI wants to better understand the best way to create educational tools that retailers can use to learn more about the category. We can also look into increasing product demonstrations in store. We are in the process of developing a new suite of PoS to explain how heated tobacco works and the bene ts it o ers to existing adult consumers, including the potential cost savings.”

McKenna said: “As a responsible manufacturer, JTI encourages retailers to range Evo tobacco sticks with conventional tobacco products as a youth access prevention measure. We provide information directly to retailers to enable them to explain our flavour portfolio to existing adult smokers.”

22 NETWORKING

ROUNDTABLE WITH JTI

In August, JTI UK and RETAIL EXPRESS publisher NEWTRADE MEDIA hosted

10 retailers in London to learn more about the heated tobacco category, and nd out what opportunities it presents

CUSTOMER EXPERIENCE

Cost savings: Andrew Cruden, of Market Square News in Northampton, said: “I tell customers they’ll save money by investing in heated tobacco and that it’s a viable alternative to smoking. We sell around 15 devices per month.”

Incentives: Hemali Latif, of Nisa Local Splott in Cardiff, said: “Cost is one of the biggest priorities for my shoppers, so the potential cost saving versus smoking is welcomed. It would be worth giving staff a device to help them learn more about heated tobacco technology.”

Word of mouth: Vinal Patel, of Jimmy’s Store in Northampton, said: “Our driving force has been staff recommending the product after using it themselves. We have sold 150 devices this year.”

Expert views:

Kirby: “Retailers must establish who their customer is. If they are a cigarette smoker, they might opt for a tobacco flavour in heated tobacco for a familiar experience, whereas a dualist who uses conventional tobacco and vapes, might be more likely to choose a fruit and menthol variant.”

McKenna: “While heated tobacco isn’t the same as smoking a cigarette, it’s a similar experience. People generally move from cigarettes and rolling tobacco to heated tobacco. The main demographic is 35-to-50-yearolds looking to save money in the long term.”

PLOOM X ADVANCED

Enhanced performance: The new Ploom X Advanced model features optimised HeatFlow technology, which offers a higher vapour volume during initial puffs, and provides an optimised user experience with a faster charging time of 90 minutes or less.

Cost savings: Customers can save up to £3,600 a year with Ploom. This is compared with the average cost of smoking 20 cigarettes (RRP £14.54) and 20 Evo tobacco sticks (RRP £4.50) per day*.

Regional trends: JTI estimates that over half a billion tobacco sticks are sold in the UK every year, with 43% of heated tobacco volume sales in Greater London.

Expert view:

McKenna: “The cost-of-living crisis is fuelling the growth in lower-priced nicotine alternatives, and 70% of heated tobacco consumers are switching from value tobacco lines. Alongside launching Ploom X Advanced, our Evo tobacco sticks range now includes a new Gold variant, which has a smooth and mild tobacco flavour, alongside improved blends for the existing Bronze and Amber flavours.

“JTI has developed a pre-packaged bundle consisting of a Ploom X Advanced device, charger, USB cable, cleaning sticks and two packs of Evo tobacco sticks (Bronze and Green). This has been created to fulfil consumer needs by simplifying the purchasing process and has an RRP of £19.”

THE ATTENDEES

SESSION LEADER

PRIYANKA

JETHWA

Editor, Vape Retailer

NARINDER SUNGU

Shenstone Post Office, Lichfield, Staffordshire

SHITAL PATEL

Jimmy’s Store, Northampton

ASIM

IQBAL

Roslin Convenience Store, Edinburgh

HEMALI

LATIF

Nisa Local Splott, Cardiff

SUKI

ATHWAL Shop Around the Clock, Tenterden, Kent

ANDREW CRUDEN Market Square News, Northampton

In partnership with 23 3-16 OCTOBER 2023 betterretailing.com

PRAMIT PATEL Epping News, Epping, Essex

PATEL Jimmy’s Store, Northampton

JTI EXPERTS

VINAL

GET INVOLVED To find out how you can maximise sales of heated tobacco, or if you are interested in being a pilot store, please get in touch on 020 7689 0500 or visit betterretailing.com/heated-tobacco-roundtable

TOM MCKENNA Ploom brand manager

*Potential saving includes the cost of a Ploom device. Calculation compares the average cost of smoking 20 cigarettes and 20 Evo tobacco sticks per day. With 20 sticks in a pack and a recommended retail price of £4.50, Evo costs less than half the price of a pack of cigarettes. The current average selling price of a pack of 20 king size cigarettes is £14.54 (ONS data July 2023). ANIL PATEL Food & Wine Corner, Harrow, north-west London KEN SINGH BB Stores, Pontefract, West Yorkshire

ROB KIRBY Programme development manager

RETAILERS

CATEGORY ADVICE NEXT-GEN NICOTINE 24 THE FUTURE OF VAPING CHARLES WHITTING explores what’s working for retailers in next-gen nicotine 18+ only. For adult nicotine consumers only. For trade use only. This product should not be discarded in household waste but in the nearest WEEE collection bin. *Based on laboratory testing of newly manufactured product and may vary depending on individuals usage behaviour. For further information on how we calculate number of puffs, please visit http://www.vuse.com/gb/en/puffcount Dispose of responsibly. This product contains nicotine and is addictive. REDESIGN ED FOR ULTIMATE PERFORMANCE NEW AND IMPROVED VUSE GO 700 Contact your local BAT sales representative. Available at vapermarket.co.uk CH ARGE BEYOND

THE DISPOSABLES OPPORTUNITY

WHEN it comes to next-gen nicotine products, disposables are most frequently cited by retailers as the bestselling subcategory to the extent that some stores have stopped stocking any other varieties.

“Disposable, single-use devices account for more than 81% of sales within the category – and more than 92% in convenience stores – and have been responsible for the majority of growth in the cat-

egory,” says Richard Cook, director of national accounts at Juul Labs UK.

With a smaller initial cost compared to re llable pods, a concept that’s easier to understand, and a wide range of brands and flavours, disposables have been lauded as a lifeline in many stores.

“When we opened our store we used to have liquids and pods, but they didn’t sell well and we had trouble with the products leaking and break-

ing,” says Imtiyaz Mamode, from Wych Lane Premier in Gosport, Hampshire.

“When disposables came onto the market we found them easy to use and customers started buying them. We moved all the liquids and pods o the shelves and just stocked disposables. Now 95% of our next-gen products are disposables.”

Displaying a wide range of disposables prominently can drive footfall and sales.

25 3-16 OCTOBER 2023 betterretailing.com

UP TO 70 0 PUFF S *

THE DISPOSABLES QUESTION