WHAT’S INSIDE YOUR APRIL ISSUE

WHO IS BUYING CRYPTO IN SA?

Demographics of the average crypto buyer in SA and how much they spend

Page 8

MORNINGSTAR AND HEDGENEWS AFRICA AWARDS

Winners share insights into their award-winning investment and hedging strategies

Page 9

WHAT TO KNOW ABOUT THE RUSSIAUKRAINE CONFLICT

Many SA investors are understandably concerned about how it will affect their portfolios

Page 13

SUPPLEMENT: BOUTIQUE ASSET MANAGERS

Boutique investment managers have been shown to outperform larger peers across geographies

Page 16

30 April 2022

Hedge funds Q&A with Laurium’s Kim Zietsman

KIM ZIETSMAN Head: Business Development and Marketing, Laurium Capital

Are hedge funds a high-risk investment?

To label all hedge funds (and hedge fund managers) as high risk is misleading. The risk profile of a particular hedge fund depends on the mandate of that fund. Some mandates may be very aggressive through using more leverage and having large position sizes in stocks , while others may be designed to focus on delivering low volatility returns. There are hedge fund mandates to accommodate a range of risk appetites.

What are the risks?

Hedge funds are obviously not without risk, as history internationally has shown. Fortunately, hedge fund managers in South Africa have proven themselves to be more conservative than their international counterpartsthere are some experienced managers that have long, consistent track records to prove it. Furthermore, hedge funds

Zietsman, Head: Business Development and Marketing, Laurium Capital

are now much more transparent and highly regulated by the FSCA, which should give investors comfort. It is important to choose a manager that has a solid track record and robust investment process. One of the key risks as a hedge fund manager is that your short positions increase more than your long positions, hence focusing on your short book is incredibly important. At Laurium, we are very conscious of liquidity and will not be bigger than the average daily trading volume in any of our short positions. The use of leverage is another risk. Leverage allows hedge funds to amplify their returns, but can also magnify losses.

Hedge funds have been regulated by National Treasury since 2015 as per the provisions in CISCA. The major objective of this regulation was to monitor risk to protect investors and provide investors access. Have you seen a change in the investor base since these regulations? The regulation was welcomed by the industry and gave all hedge funds an opportunity to market themselves to the public, however industry growth has been disappointing. Most assets are from a select group of pension funds and high net worth individuals.

Flows up until now from retail investors directly and via advisors has

“To label all hedge funds (and hedge fund managers) as high risk is misleading”

been negligible, but we are seeing a renewed interest in hedge funds, which is encouraging.

Why do you think hedge fund assets in SA remain small relative to CIS industry assets of almost R3tn?

• Until hedge funds were regulated by CISCA, and converted into CIS funds like ours were in 2016, they were not allowed to be marketed to the public

• Not being widely available to retail investors via LISPs, which are the primary channels used by financial advisors

Some hedge fund managers, like Laurium Capital, have moved their hedge funds from monthly pricing and dealing to daily pricing and dealing, which means they can now be added onto LISP platforms and included in model portfolios, etc

• BN 90 still restricts CIS funds from investing in HFs, even though Reg 28 allows for a 10% allocation to hedge funds

Financial advisers require a specific license to sell hedge funds to their clients

Hedge funds are not well understood, more complicated than long-only strategies, and there are many misconceptions about hedge funds.

Continued on page 3

Kim

Sustainable, simplified with iShares. Get the clarity you need to build a more sustainable portfolio.

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. Invest in something bigger.

Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection, telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock. For investors in South Africa: Please be advised that BlackRock Investment Management (UK) Limited is an authorised Financial Services provider with the South African Financial Services Board, FSP No. 43288. ©2022 BlackRock, Inc. All rights reserved. 2060143

Continued from page 1

Do advisors need a special qualification to advise clients on hedge funds?

Yes, this is another challenge we face. Cat 1.26 licensing under FAIS is required for advisors to be able to sell hedge funds. Advisors need to work under supervision with a KI with experience in hedge funds. The problem is that there are not many KIs with hedge experience. For use in DFM models, both the IFA and DFM need to be registered under Cat 1.26.

What are the benefits of investing in hedge funds?

1. Equity-like returns (after fees) with lower risk

2. Protection of capital

3. More investment options via a larger ‘toolbox’

4. Diversification – better risk-adjusted returns

5. Highly regulated environment

6. SA has quality managers with long consistent track records

7. Complement rather than replace long-only funds.

How much do you think should be allocated to non-traditional assets?

At least 15-20% of an investor’s portfolio should be invested in assets that are non-correlated to traditional investments, which makes hedge funds a key part of

VERY BRIEFLY

any well-diversified portfolio. ‘Smart money’, like the largest endowments, have at least 20% in alternative assets and some as much as 50%.

With the restrictive nature of Regulation 28, is there enough allocation within a retirement fund to effectively use a hedge fund to benefit the membership?

Regulation 28 allows for a 10% total allocation to hedge (2.5% per fund). However, CISCA, the legislation that governs CIS funds (unit trusts), does not currently allow investments in hedge funds, even though they are now regulated by the FSCA under CISCA. We believe that this should be amended as soon as possible to align with Regulation 28.

Is there a fund classification system for hedge funds as there are for other funds?

The industry does have a fund classification framework, which should assist in adding the funds onto platforms and help advisors and investors to better understand the investment strategy of the manager and fund.

How can investors access your funds?

Our funds may be accessed directly and are also available via some LISPs. Please visit www.lauriumcapital.com for more information.

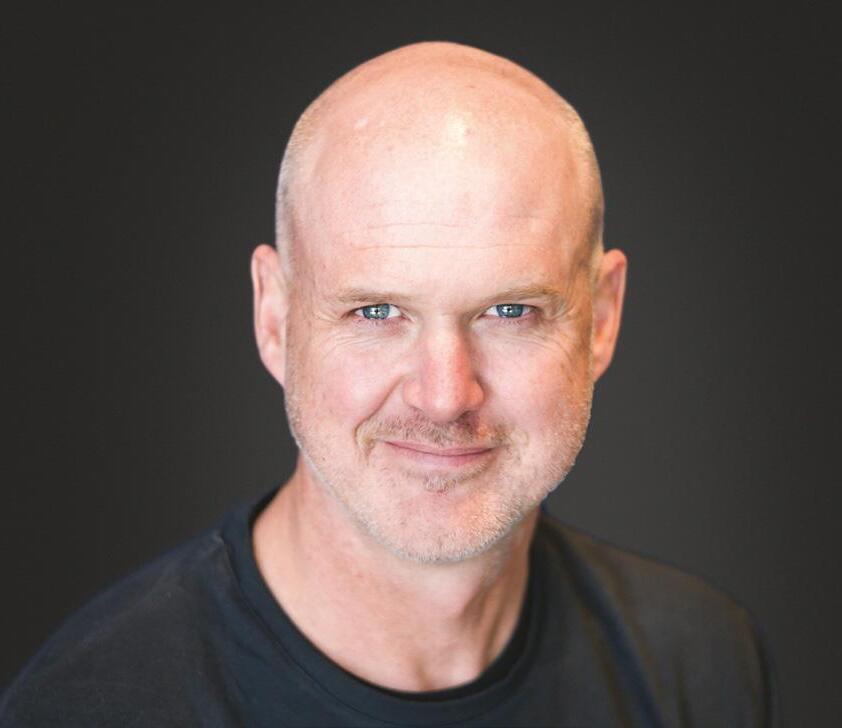

HSBC South Africa announced that it has appointed Marco Efstathiou as Head of Equities, in addition to his existing responsibilities as Head of Equities Sales. Efstathiou will now have oversight of equities trading and equities sales-trading. Efstathiou, based in Johannesburg, will continue to report locally to Nico du Venage, Head of Global Markets and Treasurer for South Africa, and globally to Camille Asmar, Head of Equity Sales, Europe and Emerging Markets. He joined HSBC South Africa in April 2021 from Citibank South Africa, where for six years he was Co-Head of South African Equities and Head of South African Equity Sales. Efstathiou is a qualified chartered financial analyst and certified stockbroker.

Agility Health the medical scheme administrator and managed care provider with a footprint throughout Africa, appointed health strategy specialist Dr Tebogo Phaleng as its new CEO. Dr Phaleng joins Agility Health from his most recent role as Chief Strategy Officer at Discovery Health, where he was responsible for strategic risk management, health policy, regulatory and industry affairs.

As a former Director of the Health Funders Association (HFA) and with more than 21 years of experience within the healthcare industry, spanning continents and the public and private sectors, Dr Phaleng brings a wealth of technical knowledge and unique insight to his new role.

Standard Bank Group appointed Liberty Chief Executive David Munro as its new Group Executive to lead the integration of the insurance and asset management company into the Group. This follows the delisting of Liberty Holdings Limited from the JSE on 1 March 2022 and the 100% acquisition of its shareholding by the Standard Bank Group.

Munro is not new to Standard Bank, having made an immense contribution over his 26-year career with the Group, first in Corporate and Investment Banking and then as Chief Executive of Liberty – which he led with great distinction under extraordinarily difficult circumstances, achieving impressive strategic progress, according to the Group in a statement.

At the time of penning this note, the RussiaUkraine conflict had gone on for a full month with no cessation in sight. The oil price rally continues to rage on, despite moves by the US, Europe and others to release millions of barrels of oil from their reserves in an attempt to tame prices. The humanitarian costs have equally surged too. As at end March, the conflict had claimed at least 20 000 lives, with thousands injured. Approximately 10 million people are displaced and damage to property is now sitting at $119bn, according to Reuters.

The conflict is slated to continue to have severe, longer-lasting implications – not only for energy prices, but global supply chains, commodity prices and global inflation too. Poorer nations that were already far behind in their economic recovery from the pandemic are feeling the brunt of it all, with price shocks and choked imports of basic commodities.

Back home in South Africa, the fuel price rose by R1.50 per litre last month, with another hike expected this month. The spill-over to food prices and cost of doing business is taking effect. Though South Africa’s headline inflation steadied at 5.7% in February 2022, on a monthly basis, inflation rose by 0.60%. This was largely driven by food prices, which recorded a 6.40% increase, and transport costs that spiked by 14.30%, which contributed 1.90% to the overall inflation rate.

The South African Reserve Bank, which is becoming increasingly uncomfortable with the inflation outlook, hiked the repo rate by 25bps at the end of March, amid upside risks to inflation stemming from the war. Though the Reserve Bank tends to distance itself from basing decisions on short-term, volatile swings in markets, geopolitics and other exogenous shocks, it will have to acknowledge that additional upside risks to its shortto-medium term CPI estimates have materialised, cautions Jeffrey Schultz, Senior Economist at BNP Paribas South Africa.

He warns that higher inflation projections and adjustments to the interest rate gap model, due to higher G3 rate hike assumptions, means that the central bank’s Quarterly Projection Model is very likely to imply a faster pace of hikes compared to its January estimates. In a nutshell, deeper negative real rates are likely to ensue over the coming quarters.

Marco Efstathiou

Dr Tebogo Phaleng

David Munro

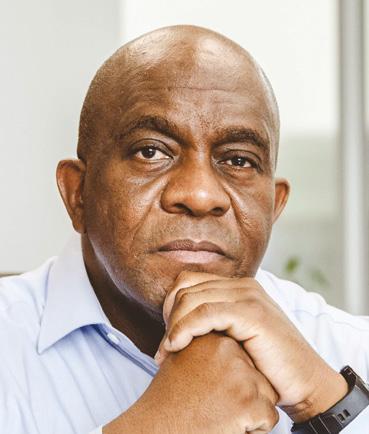

PROFILE

Leo Dlamini CEO of Bestmed Medical Scheme

What prompted your move from the energy to the private healthcare industry, and how have you found it thus far?

Well, to start with, I had a vested interest in the Scheme as one of its members! When the opportunity to stand for an appointment to the Bestmed Board came my way in 2015, I decided to take it. I had already served on a number of other boards, and the role of a trustee within a closely regulated environment was a familiar one. By July 2019, when I was appointed as Principal Officer and CEO of the organisation, I was already versed in Bestmed’s strategic and operational mandate. In addition, having had more than 20 years of operating at senior management and executive level, the leadership role in itself was not a novelty.

The transition from the energy sector to the health insurance industry was both stimulating and challenging. It was also useful in the sense that I was able to bring a different perspective to the fundamentals of Bestmed’s growth strategy.

My background and life experience enable me to relate to the national agenda and upcoming changes in the medical insurance space. Within that space, we at Bestmed are poised to grow our footprint throughout South Africa. We are deeply committed to keeping the organisation steady and to delivering on our strategic drivers.

What are some of the biggest lessons have you picked up about this particular industry?

While the industry model is largely volumes-based with small margins, a small change in a few key ratios can change a scheme’s financial performance from good to bad and vice versa – attention to detail is critical.

• Strong partnerships and collaboration are the key to success – your service delivery and effectiveness are as good and as strong as your partnerships.

The industry annually handles billions of rands. However, financial planning within this sector is relatively short. Schemes typically have financial plans that are no longer than 24–30 months.

What was one of/your first investment(s) — and do you still have it?

I bought Sasol shares in 2008 during their empowerment

share scheme – Inzalo. This was a modest acquisition of no more than R70 000 worth of shares. Ten years later, after repayment of the outstanding funding, taxes and costs, there was hardly a cash surplus for the shareholders. Stated differently, the share did not yield any dividend nor saw capital growth.

In 2018, I participated in the migration of the value of the Inzalo shares to the then-new empowerment share scheme called Sasol Khanyisa, which I still hold to this day.

What have been your best –and worst – financial moments?

The best financial moment was the sale of a property I owned in 2003. I had bought the property three years prior. During the three years of ownership, I made improvements worth about R50 000. The sale of the property yielded about R350 000 profit. I had bought the property just before the South African property market growth and sold it during the growth.

I have also bought into a few financial instruments, including retirement annuities, but most of these instruments are so aggregated that you don’t achieve significant growth or losses. These are great instruments for putting money away but I can’t say that I have seen anything exciting in the 25 years that I have been invested.

What private healthcare/health insurance market trends are you currently intrigued by or your watchlist?

The healthcare industry has gradually been changing with the deployment of modern technology. The alternative delivery models (virtual care), which were critical to ensuring the safety of members, were accelerated by the Covid-19 pandemic. Other technologybased changes have been tracking along for a while.

The area of healthcare enabled by technology is an area that continues to grow. The equipment

to which specialists increasingly have access is ever-changing and, arguably, improving, with the only limitation being funding. This is normally an area of dispute with specialists and members, where some of these medical technologies have not yet been tested and deployed locally.

Bestmed takes a cautionary approach in that it doesn’t lead the industry in funding such technologies but will immediately be guided by locally available data and/or take a cue from the regulator. While these advances in medical technology can shorten theatre times and the length of stay in hospital, the concurrent costs of funding them will be imposed onto our members in the form of higher premium increases –and we are not keen on doing this in a hurried fashion.

What are your views on the National Health Insurance Bill?

The Scheme is acutely aware of the developments related to the government’s future implementation of the NHI. Information and certainty on some aspects, such as funding and the future of Medical Schemes, are still unclear, but we remain part of this process and participate in the working groups established by the CMS to give effect to aspects related to the NHI. The Scheme has also taken note of the NHI draft Bill. The NHI will remain part of our future, although such a massive undertaking will require much more collaboration among all stakeholders across the healthcare spectrum. The board is confident that this environment will offer a few opportunities for Bestmed and that the Scheme is well-positioned to utilise the opportunities presented.

Why digital transformations in wealth management must be accelerated

their expectations. They want a greater range of services than many firms can provide without digital adoption.

To say that the wealth management industry is undergoing significant transformation would be an understatement. The entire sector is grappling with how to conduct business in a post-pandemic world while respecting the consumer and financial adviser experience.

Today, wealth management firms must be able to give better, more comprehensive experiences in automating real-time reporting on client portfolios and wealth products. Wealth management is primarily concerned with market insight and portfolio trajectory. The use of data and unifying systems delivers the richness of foresight that new consumers and younger investors expect when working with wealth management institutions.

One of the reasons for the wealth management industry’s sluggish adoption of digital transformation is the nature of their work. They built their business on personal relationships and human interaction, both of which appear to be in conflict with technology. Add to that advisors’ belief in their ability to deliver superior service to impersonal robo-advisers and mobile apps.

Family offices lag the most, with more than half still in the early stages of their digital transformation. This could be due, in part, to a conviction that they cannot automate their clients’ more complex financial problems without reducing service quality.

Company size appears to play a role in wealth management digital transformation as well, with larger firms often making more progress than smaller companies. Wealth management clients are changing, and so are

• Fee and cost pressures: Clients are increasingly feeconscious and want to know what they are paying for

• Competitors deliver a better experience: Roboadvisors and fintech are better prepared to offer products and services that match the digital expectations of today’s clients

• Client dependency on technology: Clients now enjoy real-time and curated content that caters directly to them, anywhere and anytime

• Client expectations: Clients want their investment firms to provide service on their terms – not the company’s.

The great wealth transfer

Millennials and their financial habits may make the headlines, but Gen Zers are next in line. They are now moving into a new era of their lives in which they have significant investable assets. Wealth management firms must start understanding the wants and needs of these new generations of clients.

Compared to their parents, Gen Zers and Millennials like to be more involved in their investing. They prefer to do their own research and want to understand the options available to them and how they fit in their overall investment plans. They pride themselves on their DIY skills, so earning their trust and business will take more effort.

Firms that think they can wait until tech-savvy Millennials are ready for their services will be left behind.

“Wealth management firms are facing increased competition from fintechs and robo-advisors aiming for their market share”

Pandemic impacts on the industry

Perhaps the greatest lesson of the Covid-19 pandemic was the viability of non-traditional business models across the financial services industry. It is not only possible to provide personalised advice for customers through digital services like a wealth management client portal, but investors increasingly demonstrate their preferences for digital channels.

The pandemic also affected the wealth management client experience and risk tolerance. Pre-pandemic, wealth management clients were risk-averse, preferring safer investments. Surprisingly, younger clients are already taking steps to lower their risk. For the foreseeable future,

“Family offices lag the most, with more than half still in the early stages of their digital transformation”

clients across the board have altered their investing outlook in the wake of the pandemic.

Encroaching competition

Wealth management firms are facing increased competition from fintechs and robo-advisors aiming for their market share. These groups can provide many of the digital offerings clients want, but they lack customer awareness. So far, wealth management firms have used this to support their higher fees, but that’s a position that will likely change.

Another interesting change is the way the wealth management industry segments clients. As they stop looking at them solely through the lens of wealth status, they are starting to see that some high-income clients may not be as profitable as they originally thought. With this perspective, firms that accept clients based on net worth may be losing out on revenue.

Hence, thanks to new technologies regarding deviceindependent client engagement over different interaction channels and automated investment solutions such as robo-advise, the individual and mostly less complex requirements of many clients and wealth management potentials can be served with cost-effective digital and automated solutions.

Technology entering the advisory space

There is no doubt that technology will play an increasing role in the advisory world. For that reason, analysts expect groups like Meta, Amazon and Google to enter the wealth management space. By adopting digital technologies sooner rather than later, firms will be better able to withstand that wealth management disruption.

Making digital transformation a reality

Ignoring digital transformation is no longer an option for wealth management firms. They need solutions to fill the gaps between the traditional business model and the increasing demands of the customers who want digital services.

As you begin developing and implementing your digital strategy, it’s imperative to prioritise your needs based on business impact. You don’t have to roll out the entire plan at once and will find the change easier to handle when it’s done in increments.

GREG GATHERER

Account Manager, Liferay Africa

Interest-free loan provisions gaining traction

HERNA-DETTE

VAN

DER ZANDEN Associate at AJM Tax

The South African Revenue Service (SARS) has been moving to increase its ability to collect more tax. However, the focus is not on charging more tax but rather driving enforcement. Due to the above, it is important to question what the future holds for section 7C of the Income Tax Act, traditionally a key yardstick for taxpayers when it comes to the treatment of loans and interest.

The tables began turning in tandem with higher interest rates, and lenders will have to either adapt their interest rates to borrowers or alternatively suffer the consequence of the amount being treated as a donation for tax purposes. The effect is a 20% tax on a certain portion of the interest.

Whether factors such as a reduction of the corporate tax rate (28% to 27%) and the fact that South Africa’s current inflation rate is lower than the average world inflation rate will have an impact on section 7C, is debatable.

But let’s first look at how the section works in practice. This will then clarify why and how the situation has changed for lenders. Section 7C has been in place since 1 March 2017 and serves as an anti-avoidance measure aimed at curbing the tax-free transfer of wealth to trusts through low interest or interest-free loans, advances or credits (furthermore only ‘loans’). It generally applies where a loan is directly or indirectly provided to a qualifying borrower (a trust or a company under certain circumstances), interest-free or at a lower rate than the official rate of interest.

The official rate of interest (in the case of loans denominated in rand) means a rate equal to the South African repurchase rate plus 100 basis points. Accordingly, with global inflation on a high and the corresponding increases in the interest rate, the interest charged on the above-mentioned loans will need to be reviewed.

“Until now, loans of high value have previously not found application in terms of section 7C since interest rates were low historically”

While the natural inference is that section 7C has been broadened, this is not the case.

Until now, loans of high value have previously not found application in terms of section 7C since interest rates were low historically. Also, on this note, not all loans have to be interest bearing. It was easily achievable for lenders to meet the official rate of interest or come relatively close to it.

Consequently, the difference between the interest charged on the loan and the official interest rate would not be noteworthy while it will be treated as a donation. Now, however, while the R100 000 donation tax exemption can be utilised, the bigger the value of the loan, the bigger the chance that the R100 000 exemption might be exhausted.

As this plays out, one thing is clear – SARS is focusing far more on improving tax collection. Over the past year, SARS has recruited an additional 490 staff and has invested R430m in modernising its ICT infrastructure. Furthermore, the dedicated new unit focused on high-wealth individuals is taking shape. As a consequence, over R5bn will be collected through enforcement activities.

So, effectively, this is not a case of SARS broadening section 7C, but merely a matter of course that the section will be applicable in more instances than before.

Asset managers can collaborate more to move the needle on ESG

MALCOLM FAIR Managing Director, RisCura

With ESG concerns now compellingly mainstream –something that is long overdue – South African asset managers are helping to drive improvement in ESG issues with the listed companies they invest in. It all comes down to their stewardship practices, a rather highfalutin term for the process of managers using their influence to maximise a broader definition of long-term value, which encompasses positive ESG spinoffs in the process.

But are managers doing enough? One of the factors that seem to have a bearing on this is size. But should it?

When we surveyed over 50 asset managers, we discovered that smaller managers feel they don’t hold enough shares to engage with any heft, nor do they have the resources to engage meaningfully on material ESG issues.

However, if an asset manager perceives a risk that could threaten the sustainability of an investment, it triggers a duty to act on behalf of the ultimate asset owner, whether that is a retirement fund member or an individual client.

Furthermore, smaller asset managers should be aware that the board of the company that they are engaging with has a fiduciary duty to the company. The board should investigate any issue that is of material concern to that company’s sustainability, irrespective of who raised it or how many shares they own.

And while smaller and more resourceconstrained asset managers may have challenges in having their voices heard individually, they have the option to engage collectively, coordinating with other asset managers and having their unified voice heard.

In the past, asset managers shied away from collaborating with their competitors to address an issue. RisCura first discovered this ten years ago when we did our Spoilt Votes research. The good news is that this appears to be shifting according to our latest research, Moving the Needle, which included in-depth, one-on-one interviews with 17 of the 50 managers surveyed.

In fact, collaborating on material issues was highlighted by our respondents as

one of the biggest areas of improvement over the past decade. Managers say they are far happier than before to engage and support one another in providing a united front when dealing with wider industry issues, recalcitrant management, and even specific transactions – the most recent, widely publicised manager collaboration on the Naspers/Prosus deal being a case in point, where 36 managers joined together to write a letter to the respective boards regarding their joint concerns.

There are, of course, several advantages to collective engagement, including increased efficiency by avoiding duplication of efforts, sharing research costs and responsibility, and enhancing negotiating power and legitimacy. Many of the managers indicated they would like to collaborate but that they are too small for the big managers to consider. On the flip side, the ‘big managers’ indicated they would be willing to collaborate with anyone if they had done proper research and could make a meaningful contribution.

Our recommendation is that smaller managers should specialise and become experts in particular topics. These don’t even need to be umbrella topics like climate change. They could be specific themes such as restoring gender balance on boards, ensuring water quality is improved, or less exciting engagements such as improving the quality of the audit profession locally. Issues of remuneration provide another much-needed area of required expertise as these can be quite technical and of great importance. The ‘big managers’ would surely welcome experts in specific fields at their collaboration table.

“Smaller managers feel they don’t hold enough shares to engage with any heft, nor do they have the resources to engage meaningfully on material ESG issues”

How to demonstrate fair treatment of customers – and why evidencing it is important

ELZABE BOTHA Director at Compli-Serve Gauteng

For many Financial Services Providers (FSPs), it is ‘business as usual’ when it comes to treating customers fairly, but it is important to also be able to demonstrate – through business processes – that TCF principles (Treating Customers Fairly) have been embedded in an FSP. The challenge is to evidence compliance with principles because TCF does not allow for ‘tick-box’ compliance.

Here are some practical examples to prove that TCF is a culture within an average advice-providing FSP: Regular performance reviews are conducted, and staff performance criteria includes ratings relating to client service (all staff) – good service is rewarded; bad service is addressed and consistency throughout the client relationship is monitored.

TCF training is provided to all staff members and allows for discussions around what good client service looks like.

• TCF is an agenda item for management meetings and fair customer outcomes are considered when business decisions are taken.

“TCF is an outcomesbased regulatory and supervisory approach designed to ensure that regulated financial institutions deliver specific, clearly set out fairness outcomes for financial customers”

JAN SCHOLTZ Director at Compli-Serve Gauteng

The complaints process is defined, and all staff members are aware. It should be clear that management takes complaints seriously and that proper investigations are conducted where required (route cause analysis). The complaints process should be structured with the client base in mind. Fees, costs, commissions, etc. should be clearly disclosed and should always be justifiably fair. Potential or perceived conflict of interests are properly disclosed to clients and proper comparisons are done to ensure that clients can make informed decisions.

• Client surveys can also provide evidence of client satisfaction/dissatisfaction. It is important to show that the results of these surveys are reviewed and appropriate action is taken where required.

• Depending on the size of the FSP, there should be pre-and/or post-sale compliance checks in place and these checks should consider the quality of advice. Where a product generates commission, the amount

should be properly disclosed and explained to the client together with (where applicable) why this commissiongenerating product is more suitable.

The FSP can demonstrate that it employs sufficient staff members to service the number of clients and communicates with clients in a language they understand.

All documentation provided to clients is neat and easy to read and takes the client’s level of knowledge and understanding into account, provided in a format clients can access.

The FSP requires all advisors and support staff to set automatic replies with alternative contact details when they are out of office.

• The FSP has a process in place to proactively review client portfolios/circumstances/markets when changes occur. If the FSP is aware of circumstances that could negatively affect the client and that can be mitigated, action should be taken as soon as possible.

Answer the following questions honestly:

• If you were your own client, would you be happy with your service?

If you were in the client’s shoes, would you place business with the recommended provider in the recommended product?

The TCF principles form part of the Conduct of Financial Institutions Act (COFI), which most likely will become effective this year. It is therefore advisable to be prepared; discuss this with your compliance officer or use the selfassessment tool on the FSCA’s website.

TCF Recap

TCF is an outcomes-based regulatory and supervisory approach designed to ensure that regulated financial institutions deliver specific, clearly set out fairness outcomes for financial customers. Regulated entities are expected to demonstrate that they deliver the following six TCF outcomes to their customers throughout the product life-cycle, from product design and promotion, through to advice and servicing, complaints and claims handling:

Customers can be confident they are dealing with firms where TCF is central to corporate culture

• Retail products and services that are marketed and sold must be designed to meet the needs of identified customer groups and are targeted accordingly

• Customers are provided with clear information and kept appropriately informed before, during and after point of sale

Where advice is given, it is suitable and takes account of customer circumstance

Products perform as expected, and service is of an acceptable and expected standard

Customers do not face unreasonable post-sale barriers imposed by firms to change product, switch providers, submit a claim or make a complaint (summarised from the FSCA’s website).

Who is buying crypto in South Africa?

RICHARD BALL

Lead Data Scientist at Luno

The average South African crypto buyer is most likely to be male, spends about R450 on the first purchase and holds onto it for about eight months – according to data from Luno, the largest crypto platform in the country with 9.8 million customers in 40 countries.

Interest in crypto is rising on the African continent, says Richard Ball, Lead Data Scientist at Luno. “South Africa is one of our strongest markets; in fact, South Africans make up about 43% of our verified customers. Over the past year, we verified more than 3 million new users worldwide. As we expand into new territories, the trend is starting to shift. ”

Ball says the greatest surge of interest was in Malaysia, which now makes up almost 14% of Luno’s customer base – an increase of 8% compared to a year ago.

South African customer behaviour

Ball says that South Africans usually start with an average first deposit of R450 – an increase since the dip in Bitcoin in November last year. “Most customers start with a relatively small deposit, while the top 25% of our biggest local customers start to buy crypto at around R1 500 and the highest deposit amount among our smallest 25% of customers is only around R90.”

Ball says these metrics are good news for Luno, as they indicate that South Africans are investing in crypto responsibly. Luno allows customers to buy crypto for as little as R1, in line with its mission to ensure wider access, and encourages people to start with smaller deposits while they learn more about crypto.

South Africans’ most popular crypto coins

According to Ball, the most popular crypto coins in South Africa are Bitcoin, Ethereum and XRP, with more customers buying than selling. Almost 80% of the transactions on Luno are from people buying crypto, which provides a rough indication of how bullish customers are on the top three coins.

“The average South African crypto buyer is most likely to be male, spends about R450 on the first purchase and holds onto it for about eight months”

“The greatest increase so far this year in demand is XRP, with a 25% price surge within a single week. USDC, a cryptocurrency linked to the US dollar, is the least popular on Luno’s platform, in line with its status as a stable coin.”

Ball says customers bought USDC during the market dip in the past few months. “When crypto prices fall, some customers buy into USDC to shield themselves from further market volatility. Once volatility has cooled down, traders will typically move from USDC back into crypto such as BTC. In some sense, this is in line with traditional financial markets where investors avoid risk and move to cash during periods of uncertainty.”

“The most popular crypto coins in South Africa are Bitcoin, Ethereum and XRP”

Who are South African

crypto buyers?

The local buyers are almost a mirror image of the global picture. In line with the gender split in traditional financial services, more men buy crypto in South Africa than women, with about 30% of the activity in the 18 to 29 age bracket. However, in the 60+ age bracket, a greater percentage of women, about 46%, are active on Luno.

South African customers hold their crypto for an average of eight months, which is much longer than two years ago, with the exception of traders, who would naturally be more active, says Ball. “Overall, this indicates that South African customers increasingly view crypto as a longer-term investment and are not necessarily buying it to make a quick buck.”

Behaviour depends on when customers bought

He says Luno is noticing that customer behaviour varies depending on when

customers first bought crypto. “We frequently perform cohort analysis to track the transactional behaviour of customers who first bought at a particular point in time. For example, they are grouped into a cohort: the 2017 or 2018 cohort. Customers who bought during the peaks in 2017 or 2021 tend to display different holding period behaviour compared to customers who bought when the price action was much flatter.”

Ball explains that customers who first bought when the price was surging might be more speculative, while customers who buy when the markets are flat tend to be longer-term investors.

Using Luno’s savings wallets

Customers using Luno’s savings wallets can earn interest on their crypto holdings, and Ball says about 7% of Luno’s customer base uses the savings wallet monthly. “There has been a 15% increase in local customers using the savings wallet over the past three months.

“The interest earned on crypto holdings via savings wallets is paid monthly. Luno customers can earn interest of up to 7.6% when they open a Luno savings wallet. Since South Africans are holding on to their crypto coins for longer, it makes sense to earn interest until they are ready to sell.”

Repeat buying

According to Ball, more than one in ten active Luno customers have used the repeat buy function in the past three months. South Africans buy an average of R400 worth of cryptocurrency per month using this facility. Repeat buy is an instruction to buy into the market at regular intervals and is a great way for customers to buy crypto without having to time the market. Without a repeat buy instruction, you need to keep a very close eye on movements in the market to ensure you buy when the price dips and sell when it rises.

Winners of the 2022 Morningstar South Africa Fund Awards

Independent investment research company Morningstar Research named the winners of its 2022 Morningstar Fund Awards South Africa. For the second year in a row, Satrix Investments has been awarded Best Fund House: Larger Fund Range. Truffle Asset Management, featured in this edition of MoneyMarketing scooped two awards – the first for its Truffle SCI Income Plus Fund in the Best Bond Fund category, and a second in the Best Fund House: Smaller Fund Range category.

Morningstar selects the finalists using a quantitative methodology with a qualitative overlay that considers the one-, three- and five-year performance history of all eligible funds, and adjusts returns for risk using Morningstar Risk – a measure that imposes a higher penalty for downside variation in a fund’s return than it does for upside volatility.

“The awards are designed to recognise the industry’s top-notch fund offerings and investor-friendly firms. The winners of this year’s South Africa Fund Awards demonstrate the value of a solid long-term investment strategy at a time when domestic and international markets battled turbulent macro-economic and political headwinds,” says Tal Nieburg, Managing Director of Morningstar South Africa.

“We believe this combination will ensure that the awards are given to funds that have earned strong one-year results and have also shown they have the ability to earn strong long-term returns without undue risk.”

The winners for the 2022 Morningstar South Africa Fund Awards are:

Fund category:

Best Aggressive Allocation Fund

Southern Charter BCI Growth FoF

Best Bond Fund

Truffle SCI Income Plus

Best Cautious Allocation Fund

Sasfin BCI Stable

Best Flexible Allocation Fund

BCI Flexible

Best Global Equity Fund

Fundsmith Equity T Inc

Best Moderate Allocation Fund

Southern Charter BCI Balanced FoF

Best South Africa Equity Fund

Counterpoint SCI Value

Fund house category:

Larger Fund Range

Satrix Investments

Smaller Fund Range

Truffle Asset Management

Winners of the 2022 HedgeNews Africa Awards

The annual HedgeNews Africa Awards recognise excellence among hedge fund managers and service providers in South Africa across a wide range of categories. The 2021 awards were held in the Cape winelands at the Laurent on the Lourensford Estate in Somerset West.

A total of 13 awards were presented across the various categories. The Steyn Capital SNN Retail Hedge Fund won the coveted and prestigious Fund of the Year award. The Steyn Capital SNN Retail Hedge Fund, managed by Andre Steyn at Steyn Capital Management, delivered a net 51.63% return in 2021 on a Sharpe ratio of 4.38.

Steyn Capital had an exceptional 2021, taking home a total of three trophies on the night. Its Steyn Capital SNN QI Hedge Fund won best long/short fund, the industry’s biggest category, with a return of 51.05% and a Sharpe ratio of 4.95, while its Steyn Capital Africa Fund took the honours in the pan-Africa category, with a return of 32.23% and a Sharpe ratio of 2.28.

Now in their 13th year, the Awards measured the best risk-adjusted returns of funds across 13 different categories. They are based on monthly data submitted to the HedgeNews Africa database, which includes SA hedge funds as well as other pioneering strategies applied across the broader African markets.

“Many funds in our universe delivered exceptional returns in 2021, while

In total, 58 nominations were given across 13 categories, with the one-year awards ultimately going to those funds with the top return, provided their Sharpe ratio was within 25% of the top Sharpe among the nominees – a method to appraise consistency of returns.

List of winners in each category:

Long/Short Equity

Steyn Capital SNN QI Hedge Fund

Market Neutral and Quantitative

All Weather H4 Market Neutral Retail

Hedge Fund

Multi-strategy

Blue Quadrant Capital Growth Prescient RI Hedge Fund

Fixed Income

Oakhaven SNN Strategic Fixed Income QI

Hedge Fund

Pan-Africa

Steyn Capital Africa Fund

Fund of Hedge Funds

AF Investments Performance QI Hedge Fund of Funds

Global

Optis Global Opportunities Fund Specialist strategies

Catalyst Alpha Prescient QI Hedge Fund Five-year performance (Single Manager)

Fairtree Assegai Equity Long Short SNN QI Hedge Fund

Five-year performance (Fund of Funds)

AF Investments Performance QI Hedge Fund of Funds

Sunita Takurpersadh, Head of Operations at Satrix Investments (left) and Kingsley Williams, CIO at Satrix Investments (right)

Sanelisiwe Tofile Deputy Chief Investment Officer

All Weather Capital’s H4 Market Neutral Retail Hedge Fund scoops another HedgeNews Africa award

The All Weather H4 Market Neutral Retail Hedge Fund recently scooped a 2021 HedgeNews Africa award in the market neutral and quantitative category for the second consecutive year. The fund is a long short equity market neutral South African retail hedge fund.

Its portfolio focuses on long-term capital appreciation targeting an absolute return in excess of cash. It seeks to exploit investment opportunities unique to some specific group of stocks while maintaining a neutral exposure to broad groups of stocks defined, for example, by sector, industry, market capitalisation, country or region. The portfolio aims to provide returns with lower volatility and lower drawdowns than the South African equity market.

Winning the HedgeNews Africa award was not an easy feat for the fund, which had to contend with continued unprecedented high volatility and dispersions in returns among share price performance in the past year. Nevertheless, for active stock pickers, such an environment is favourable and the fund’s investment process served it well during the year, says Chris Reddy, Portfolio Manager of the All Weather H4 Market Neutral Retail Hedge Fund.

“In addition, risk management in this type of environment is important and the fact that the return for the market neutral fund was achieved with less than half of the volatility of the index was particularly pleasing,” he says.

All Weather’s investment philosophy is that of responsible investing for superior and sustainable shareholder returns,

explains Sanelisiwe Tofile, Deputy Chief Investment Officer at All Weather Capital. “Our philosophy is based on the belief that the market continually and regularly misprices assets.”

He says mispricing occur regularly because investors either underestimate risks or do not recognise potential. All Weather tries to understand these risks and appreciate the scale of opportunities better than the market does.

For instance, the fund fared well in the early days of the pandemic-induced market instability through, among others, an approach to limit exposure to shares heavily impacted by Covid-19 lockdowns and at risk of balance sheet restructure while taking advantage of the broader sell-off in shares that had limited operational impact or, in some cases, benefited, explains Reddy.

The fund emerged victorious after it returned 28.4% during 2021, outperforming the STeFI benchmark, which returned 3.8% over the same period. It also outperformed the FTSE/ JSE Shareholder Weighted All Share Index (SWIX), which returned 21%, and the ASISA SA Equity General Category averaged 26.7% for the year.

At the time of publication, the fund had already generated a year to date return of 2.1% against its benchmark of 0.9%, while the SWIX had returned 3.1% over the same period. Asked about the sources of growth in return and performance, Reddy tells MoneyMarketing that the funds have been positioned conservatively with low net exposure to the market and derivative put option protection in place.

“We are cautious regarding the impact of more aggressive rate hikes to stem higher for longer inflation, coupled with rising geopolitical tension,” he says.

TIMOTHY RANGONGO Editor: MoneyMarketing

Not just bricks and mortar: The environmental and social impact in listed property

LESIBA LEDWABA Head of Property Portfolio Management at Ashburton Investments

Listed property is an asset class that has delivered steady income as well as capital growth over the long term. The predictability of income streams from underlying properties is fundamental to the investment merits and returns of this asset class and naturally informs the investment decision-making process.

However, over the past few years, there has been a growing focus on aspects related to Environmental, Social and Governance (ESG) when it comes to property investments, with emphasis on the environmental part.

According to a World Green Building Council global status report, buildings and construction together account for 36% of global final energy use and 39% of energyrelated carbon dioxide (CO2) emissions when upstream power generation is included. The energy intensity per square meter (m2) of the global buildings sector needs to improve on average by 30% by 2030 (compared to 2015) to be on track to meet global climate ambitions set out in the Paris Agreement. This is why there is a

push towards a net-zero emission strategy adoption by property owners.

The listed property sector has certainly made inroads when it comes to the environmental component, which was often necessitated by unreliable water and unsustainable electricity price increases from local government and/or Eskom. It’s for this reason that landlords have had to adopt technology and invest in infrastructure that provides more efficient and environmentally friendly use of resources such as water and electricity.

The Coronavirus pandemic has heightened the focus on ESG and put a greater focus on the S in ESG.

This is especially relevant and important

in a country like South Africa (SA), which faces significant socio-economic challenges. Since the start of the pandemic, the SA listed property sector has been at the forefront of providing substantial relief to small businesses and tenants in order to support jobs and ensure the survival of these businesses through the various lockdowns and waves of the pandemic.

The SA REIT Association estimates that the listed property sector has so far provided rental relief of c.R3bn.

What is often not clearly articulated is that property has always had a strong social utility, much of which is intangible and difficult to quantify. Think of mankind’s basic need for shelter, which is catered for by the residential developments in the inner cities, as well as high-end mixed-use developments. Property is also a vital part of the supply chain that enables the global and local distribution of goods and large warehouse facilities that are springing up to fulfil this role. Retail centres, student accommodation and offices have always been places of social confluence within safe environments.

One of the things to reflect on is how the ecosystem around rural and township retail centres plays a role in the social dignity and

upliftment of communities within which they operate.

From their development up to operation, jobs are being created. These centres also create safe environments for the disbursement of social grants as they are located closer to communities. Transport costs to travel to collect grants are reduced. There is always some form of informal trade that also exists alongside these centres, typically small informal traders or retailers operating just outside their perimeter.

Although, to ensure inclusivity, it would be ideal if property owners can find a way of working together with informal traders and make them part of the greater retail precinct, instead of having them operate outside the centres.

For investors and fund managers, it is important to also evaluate property funds against their social upliftment plans. Property companies must not only talk to their intentions but also provide tangible evidence and examples of putting this into action and advancing the social imperative. Investors must also engage with property companies to assist them in finding ways to unlock the social values of properties and their role in addressing our country’s socioeconomic challenges.

FNB sees growing appetite for investments as clients embrace digital platform

FNB says more South African consumers are growing accustomed to the benefits of investing, with significantly more investment accounts opened by clients between June and December 2021. As part of FNB’s focus of becoming an integrated financial services provider that is relevant to customers across their transactional, credit, insurance and investment needs, FNB Wealth and Investments proposition is attracting clients who are new to investing.

“Our commitment to helping customers throughout their money management journey and ensuring that investment solutions are accessible to all has received an overwhelmingly positive response from our customers, particularly individuals,” says Bheki Mkhize, CEO of FNB Wealth and Investment Solutions. “This is evidenced by our scaling investment activities, which resulted in a 12% increase in our overall client base over the six months to December 2021.”

A key driver in increased clients and market share has been their deliberate decision to provide solutions that help clients better manage

their short, medium, and long-term money management goals, according to Mkhize. “We are also sensitive to the preferences of all our clients. In addition, we offer them support on our digital platforms or through our skilled advisors.”

Popular investment solutions include FNB’s Global Shares (ETNs), Shares Zero, Horizon Series unit trusts, and most recently, Retirement Annuity on App. Global Shares has enabled a growing number of clients to get exposure to some of the world’s most well-known companies. Shares Zero is a no-monthly-fee investment account that allows clients to invest in FNB Exchange Traded Funds (ETFs) and ETNs at no cost, while investing into companies represented in the JSE ALSI Top 40 index for brokerage of just 0.25%.

The newly launched RA on App allows anyone to take up a retirement annuity directly through the FNB App; customers can invest in FNB’s newly launched low-cost Core Balanced Fund, with no lengthy documents to be filled out. This puts customers in control of their investments.

While investment appetite is improving among FNB clients, Chantal Marx, Head of Investment

Research at FNB Wealth and Investments, says investors should not be discouraged by levels of market volatility. “Major global conflicts, such as the one involving Russia and Ukraine, are generally detrimental to sentiment, certainty, economic growth, or market returns ... the sanctions have severely disrupted the supply of oil and other commodities, which does not bode well for the global economy.

“While South Africa’s large commodity exposure and the historical undervaluation of many of its listed shares have shielded its bourse from the full brunt of the fallout seen in global equity markets, local and global markets can be expected to remain volatile for the foreseeable future. However, investors, particularly those who are new to investing, should avoid reacting to short-term market downturns,” cautions Marx.

“The markets have always recovered well from disasters,” she argues.

“Therefore, it is critical to stay the course during this time; and while one should be aware of the risks, a decline in share values can also be an opportunity to carefully capitalise on future upward movement.”

Investing internationally: Let’s talk about wills and offshore trusts

CHANTAL ROBERTSON Head of Cross-Border Advice at FNB

Keen interest in offshore exposure and diversifying into new geographies and currencies continues to be a key theme in South African wealth management. “From a trending perspective, and across all our segments, our clients are seeing offshore as an essential component of any investment conversation,” says Chantal Robertson, Head of Cross-Border Advice.

This interest extends across the FNB Global Solutions spectrum, which has been designed to meet the offshore needs of FNB and RMB Private Bank clients, from highnet-worth individuals to aspirational clients looking to incorporate global diversification into their wealth strategy.

Increasingly, notes Robertson, offshore exposure is becoming democratised, giving the average South African the opportunity to add non-rand exposure to their portfolio.

“When we talk about investing abroad and about diversifying, people automatically think we’ve got to move the money offshore through the R1m Single Discretionary Allowance and the R10m Foreign Investment Allowance, subject to tax clearance. But it’s worth mentioning that, from a local perspective, there are JSE-listed instruments that give you access to things like the tech shares or pharmaceuticals that people are eager to acquire. By investing a small amount, on a rand basis every month, you get access – albeit indirectly – into those international markets,” she says.

There’s a lot more depth and accessibility to offshore conversations than ever before, says Robertson, who notes that offering assistance across the spectrum of client needs is the focus of the Global Solutions team. “Our clients can access these offerings, as well as specialist assistance via their private banking team,” explains Robertson.

From an estate planning perspective, two critical areas of focus for any individual with offshore exposure should be considering whether an offshore will is required, and also whether an offshore trust has a part to play in your wealth management approach.

“There’s a lot more depth and accessibility to offshore conversations than ever before”

WILLEM VAN DER MERWE Global Solutions Specialist at FNB

Offshore wills: what do you need to know?

While it is not impossible to deal with international assets in your South African will, for the most part offshore assets cannot be dealt with by a local executor. For this reason, the general rule of thumb is to have a local will and then a separate will for every jurisdiction or an all-embracing worldwide will. While a trust should, in theory, obviate the need to have an offshore will, it is still advisable to consider drafting such a document when you take funds out of South Africa.

If you have offshore property, it is typically recommended to have an offshore will. If you have an FNB Channel Islands account with balances in excess of £10 000, it is also advisable to stipulate your wishes in a separate offshore will. Since it is critical that multiple wills don’t contradict each other, the process of drafting an offshore will is best achieved with the holistic advice and guidance of an offshore expert. In some cases, such as when your offshore holdings are housed via the Global Trading Platform or in an FNB Global Account, then a South African will should suffice as these assets can typically be dealt with by the South African executor.

The FNB Fiduciary specialist team can assist South Africans to draft an offshore will that deals with assets in the United Kingdom, Northern Ireland as well as Jersey, Guernsey and the Isle of Man. While FNB International Trustees has a dedicated team looking after the deceased administration of offshore wills dealing with assets in these jurisdictions, for clients with holdings elsewhere, it is also possible to draw on FirstRand’s extensive network of professionals to find suitable expertise in other parts of the world.

Offshore trusts: a case study

While the FNB Private Wealth advisory team can help with day-to-day transactional offshore banking and guidance navigating South Africa’s regulatory framework, it is in the area of offshore estate planning that the most long-term value can be added to clients when they reach a certain threshold of offshore holdings. This is where the Global Solutions team comes into its own.

Take, for instance, the example of Bongani. Having worked in London for several years, Bongani returned to South Africa to start a family but kept the flat he purchased in Wimbledon as part of his property portfolio.

He also maintained an international share portfolio. The flat continues to provide Bongani, his wife and three kids with a passive income, and he would like to protect the property – as well as the share portfolio – so they can continue to benefit from the overseas assets in the event of his death.

Global Solutions explained the value of an offshore trust to Bongani, how he could protect these assets, ensure succession to his wife and children, and take advantage of tax efficiencies. While Bongani was initially keen to transfer all these offshore assets into an offshore trust, his enthusiasm was tempered when he considered the impact of triggering capital gains tax in the process. He also wasn’t too excited about the property transfer costs and the loan account that would be created when assets were transferred to the offshore trust, on which he would earn taxable interest.

“The FNB Fiduciary specialist team can assist South Africans to draft an offshore will that deals with assets in the United Kingdom, Northern Ireland as well as Jersey, Guernsey and the Isle of Man”

After discussing all the pros and cons, Bongani decided to only transfer the assets to an offshore trust on his death. This approach would be guided by a letter of wishes, which would be made available to the trustees on his demise to ensure they are fully aware of his wishes for the assets and his family. FNB Fiduciary was brought into the discussion to draft an offshore will, which stipulated that the overseas assets were bequeathed to the offshore trust.

Offshore trusts established for FNB Private Wealth clients by FNB International Trustees are administered in Guernsey, Channel Islands, and are governed by the laws of the British Crown dependency. There are several trust options available, including cost-effective options where the trust is either dormant or equipped with a bank account to accumulate foreign currency in the trust, or more traditional options where the trust will hold an investment portfolio or other assets, such as fixed property or private equity.

“Wealth management, including the protection of such wealth, is a highly individual process, which requires a deep understanding of each client’s needs and wants and motivations. This is even more the case when it comes to developing a robust offshore exposure to cater for a specific need,” concludes Willem van der Merwe, Global Solutions Specialist.

“Our role at Global Solutions is to take the pain points and uncertainty out of navigating a different jurisdiction by ensuring you are fully compliant with local regulations while, at the same time, able to benefit from the wealth of international solutions available to the global citizen through our solutions.”

What South African investors should know about the Russia-Ukraine conflict

ARTHUR KAMP Chief Investment Economist at Sanlam Investments

WFEROZ BASA Head of Global Emerging Markets at Sanlam Investments

ith the world gradually starting to recover from the devastating impact of the Covid-19 pandemic, the recent invasion of Ukraine by Russian forces has once again rattled global stock markets. The repercussions of this conflict are likely to be felt around the world for some time, and many South African investors are understandably concerned about how it will affect their portfolios.

It is more important than ever to stay calm and focused on one’s long-term investment strategy, says Jason Liddle, Head of Distribution at Sanlam Investments. “To help investors make the right decisions in the current volatile environment, we have asked our team of investment professionals to provide some insight.”

The global economic impact

Although the negative economic impact will be skewed towards Russia, countries that trade or have financial connections with Russia will also be impacted, states Arthur Kamp, Chief Investment Economist at Sanlam Investments. “Global gross domestic product (GDP) will likely be revised downwards due to the direct impact of this conflict. Russia accounts for 3% of global GDP, with Ukraine making up less than 0.5%. The broader restriction of trade due to the financial sanctions being imposed are also a consideration.

“The recent invasion of Ukraine by Russian forces has once again rattled global stock markets”

Russian imports and exports of goods and services account for 50% of its GDP, with exports being heavily skewed towards energy products and metals.”

Kamp predicts that if the conflict is contained to Russia and Ukraine, four outcomes are likely to emerge during the course of the crisis. “Firstly, commodity-exporting countries such as South Africa may benefit, should commodity prices be supported if these supply chains are disrupted. Oil exporters will also benefit, but the spike in oil prices will significantly negatively impact global real GDP. Russia is expected to go into recession, which means that exporters to the country (such as China, Germany, Belarus, the USA and Italy) will be impacted. Lastly, while the global economic expansion is expected to continue, it will be at a significantly slower pace while inflation remains a concern.”

MOKGATLA MADISHA Head of Fixed Interest at Sanlam Investments

ANDREW KINGSTON Co-Head of Equities at Sanlam Investments

Emerging markets are ahead of the curve

Feroz Basa, Head of Global Emerging Markets at Sanlam Investments, says that higher oil prices will place pressure on already stretched consumers with the potential risk of stagflation. “This will have a negative effect on markets. However, if the situation is solved fairly quickly, oil and commodity prices will normalise, and the focus will return to higher inflation and market valuations.”

He points out that, with the exception of Russia, emerging markets are in much better shape than during previous crises. “In fact, emerging markets are well ahead of the curve in terms of normalising interest rates relative to developed markets. Their valuations are also more attractive.”

According to Basa, Sanlam’s Global Fund’s exposure to Russia is limited to 4.5% of the portfolio. “This means that the sell-off will negatively impact it in the short term. However, most of our Russian exposure is in food retailers. These are more defensive in nature and should recover after the market’s knee-jerk reaction. The portfolio is well-diversified, and our team actively monitors its Russian exposure. Currently, they are comfortable with the portfolio’s exposure in terms of Russian stocks.”

The impact on fixed income funds

There has been an increase in volatility in the bond markets, according to Mokgatla Madisha, Head of Fixed Interest at Sanlam Investments. “Bonds have lost most of the gains they have made this year to date. It comes as no surprise that the negative sentiment in the market has increased as a result of the recent SA National Budget (which was not as positive as expected), as well as the current conflict in Ukraine.”

As a result, he explains that Sanlam’s team has been reducing the duration of its portfolios in expectation of the increased inflationary risk from oil prices. “While inflation seems to be peaking, the disinflationary cycle is anticipated to be slower than initially expected.”

The current positioning in Madisha’s portfolio is mainly informed by the relative outperformance of South African assets rather than the Russian-Ukraine crisis. “Bonds are looking more attractive due to yields selling off from their relatively expensive levels in mid-February. Meanwhile, South Africa is experiencing improving terms of trade –even as oil prices increase – which provides structural support to the ZAR.”

FERNANDO DURRELL

Portfolio Manager at Sanlam Investments

Cooler heads prevail for equity portfolios

Andrew Kingston, Co-Head of Equities at Sanlam Investments, notes that Sanlam’s equity portfolios have large overweight positions in local resource companies listed on the Johannesburg Stock Exchange (JSE).

“The current situation supports this view, as long as global GDP growth does not slow down significantly. Our equities team expects markets to remain fragile but for the South African market to be resilient. It is important for investors to stay calm, despite the devastation unfolding right now.”

He adds that many case studies have shown how wealth can quickly be eroded when clients make hasty changes or exit the market in volatile periods. “Market volatility is nothing new. However, history has shown time and again that markets do recover – sometimes quite rapidly.”

Multi-asset – Absolute return portfolios

Portfolio Manager at Sanlam Investments, Fernando Durrell, expects increased volatility in the markets from riskier assets. “I believe that our fund is currently wellpositioned due to its exposure to hard currency, randhedge SA equities, the use of protective structures and notable exposure to interest-bearing assets.”

He says that diversification remains key. “It is important to find the balance between protecting portfolios from negative returns and taking advantage of growth opportunities as and when they arise.”

The team remains confident that their disciplined process, strong focus on downside risk protection, and modelling of various scenarios provide a solid foundation to offer their clients inflation-beating returns over the medium to long term.

“To weather this crisis and avoid unnecessary losses, it is essential to remain invested and trust your portfolio manager to ‘steer the ship’ through the storm. Now is the moment to avoid making fear-driven decisions regarding investments,” says Durrell.

Liddle concludes, “Sanlam Investments has a pragmatic value long-term investment philosophy. We believe in the rigour of our research process, the talent and expertise of our investment professionals, and the robust fundamentals of the companies in which we invest. We also draw heavily on investment data from other significant historical events that show that markets inevitably correct themselves. We remain steadfast in our views and our strategy.”

Why investors should start learning more about alternative investments

Alternative investments have become far more mainstream in South Africa since the advent of the Covid-19 pandemic. Especially in the loweryield environment that the investment market currently finds itself, the hunt for diversifiers and enhanced yield has made alternative investment a critical component of any investor’s portfolio. It is therefore important for investors to start learning more about the opportunities and pitfalls of the alternative investment landscape.

“The volatility of returns on listed equities has increased considerably”

Particularly in terms of liquidity, it is crucial that investors begin to look at their portfolio and their investment options differently. Over the last few

years, and especially since the Covid-19 pandemic, the volatility of returns on listed equities has increased considerably. In this environment, including alternative investments such as private equity, hedge funds, venture capital or debt financing adds some much-needed diversification to investors’ portfolios. It has also been proven to minimise investors’ risks in the current market.

Private equity has quite a unique offering for investors as an alternative investment. Private equity is very much a long-term investment, with the typical life of a private equity investment spanning around ten years (which is often extended). It is a commitment made by

“Hedge funds can help investors to take better advantage of volatility in the market and harness it to their advantage”

the investor, and that investment is drawn over a five-year investment period and realisation period of an additional five years until the fund reaches the end of its life. While long-term commitments in this market seem like a scary proposition, it actually offers good long-term benefits and liquidity to a portfolio.

Private equity investors commonly receive interim distributions of dividends, interest or capital repayments throughout the life of the fund. Therefore, the holding period is not, in actual fact, the full ten or 12 years of the fund’s lifetime – it is closer to around seven years on a weighted average basis. If there is a liquidity crunch that forces investors to consider selling off their interest in the fund, it has also become much easier to get capital out via secondary investors.

Another prominent kind of alternative investment is the hedge fund. Hedge funds are considered to be the more liquid of the alternative strategies, and they actually complement less liquid private market strategies quite well. Not only can hedge funds provide more liquidity, but they also offer investors access to different risk premia – the outperformance of a risk-free asset is generated through alternative risk sources.

Hedge funds can help investors to take better advantage of volatility in the market

and harness it to their advantage: hedge funds are more liquid by their nature because they tend to invest in more liquid counters, whether these are listed equities or derivatives.

Unfortunately, hedge funds’ biggest challenge is escaping from the negative perception that it has gained in the market over the years. Hedge funds have a reputation for being risky, not able to keep up with markets, and being too expensive. However, a lot of work has been done over the years to manage the cost of these investment types and to bring much greater transparency to the industry. Where hedge funds were previously a point of heated debate, we’ve reached a point where there is very little question about whether they should form part of a healthy investment portfolio.

The different types of alternative investments cater to different requirements in investment portfolios while also unlocking a wider array of prospects for investors. Investing is personal and it is becoming crucial for forward-thinking investors to start looking for alternative investment opportunities that speak to the specific and personal needs of their portfolio.

RIAN SMIT

Senior Private Equity Fund Manager at Momentum Investments

KAMINI NAIDOO Portfolio Manager at Momentum Investments

Boutique Asset

Managers

WHAT’S INSIDE

... Boutique firms create a healthier investment industry

Delphine Govender, Chief Investment Officer at Perpetua Investment Managers, explains the role of boutique investment managers in contributing to a healthy industry and how it is often underestimated

Page 19

Founder’s insights: building a boutique asset manager

Truffle Asset Management’s co-founder, Louis van der Merwe, shares what it took to build a successful boutique investment manager

Page 20

Outperformance comes in small packages

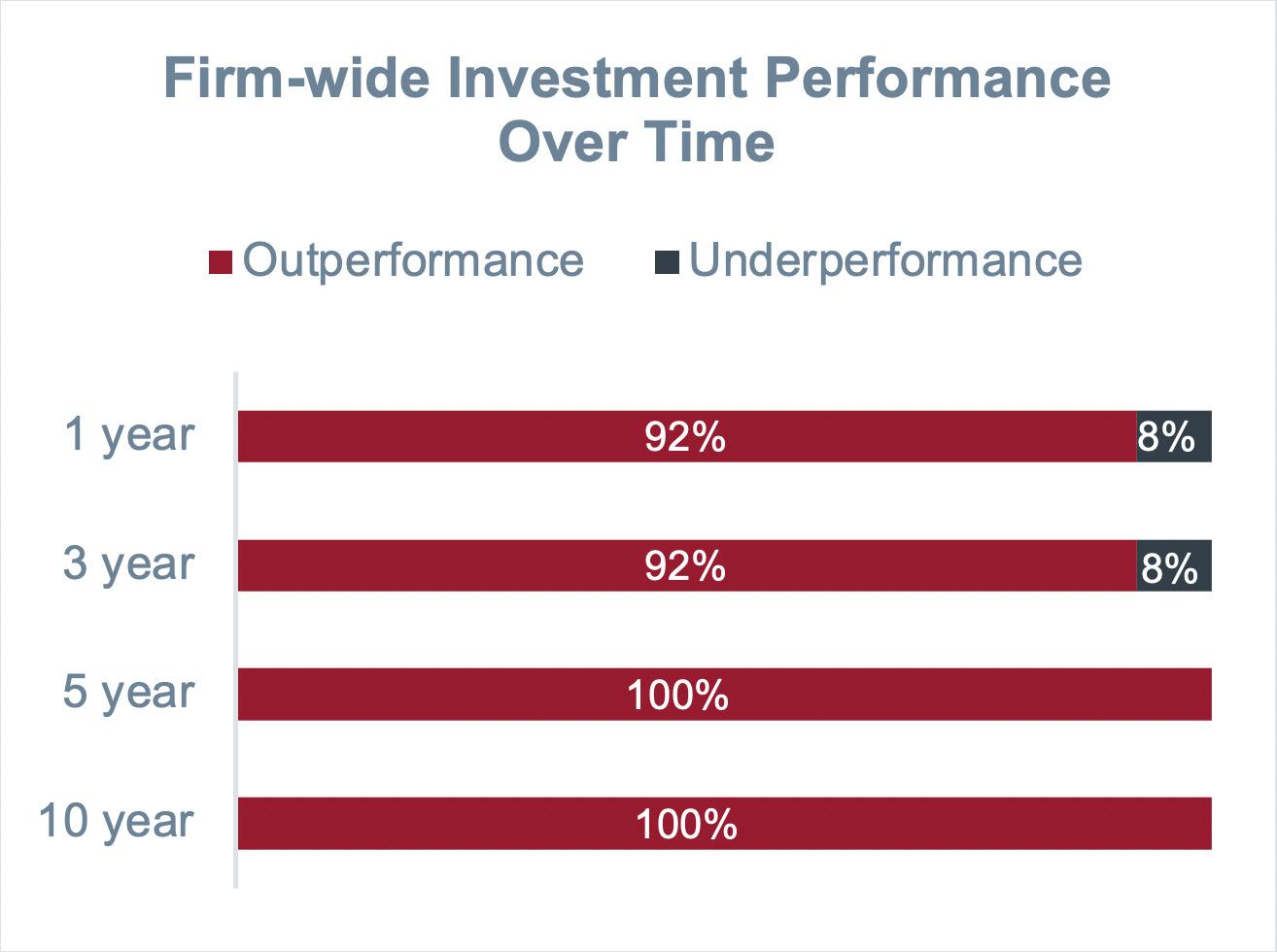

Although each boutique is unique, 36ONE’s Zandile Nkwanyana highlights six key characteristics that explain their ability to consistently outperform

Page 2 2

ESG: Looking beyond Covid-19

TINYIKO MABUNDA Research & ESG Analyst at Aeon Investment Management

ESG (Environment, Social and Governance) integration was mandated by the Principles of Responsible Investing (PRI) as early as 2006. The PRI has over the years refined this mandate and accompanying framework for signatories to incorporate into their investment processes. ESG integration is, in essence, ensuring the responsible investment of investors’ assets by incorporating relevant non-financial metrics into company valuation models.

on the following reasons:

• Difficulty in measurement: there are no set standards yet to measure ESG, and thus ESG ratings/scores provided by service companies are not comparable as they all use different methodologies in calculating these ratings/scores

• There is no conclusive evidence to suggest that adopting ESG integration policies will ultimately lead to increased profitability

There are other factors, besides ESG performance, that investors need to consider when seeking companies that generate excess returns

ESG integration is not the only avenue available to companies for implementing ‘goodness’.

standard ESG metrics to all sectors might prove to be incoherent; however, specific ESG metrics can be standardised for each sector, thus allowing investors some means to monitor ESG performance.

The onset of lockdown directives enforced as a result of the Covid-19 pandemic has exposed vulnerabilities in companies’ policies and subsequent operations. Social factors such as the retrenchment of employees were common. Some companies lowered their remuneration targets, and some even went as far as awarding their executives with ‘Covid-19 bonuses’ as a means to retain talent. However, the transition to working from home has allowed investors to engage with non-executive directors more frequently on both financial and ESG matters.

Aswath Damodara published a post on his blog, Musings on Markets, detailing reasons why he believes ESG integration will be detrimental to companies and their cost line item. Damodaran disagrees with ESG integration based