Checking out of the resort

After nearly 10 years at the helm of Canyon Ranch Lenox, Mindi Morin is taking some time o to figure out what’s next.

Page 2

Checking out of the resort

After nearly 10 years at the helm of Canyon Ranch Lenox, Mindi Morin is taking some time o to figure out what’s next.

Page 2

2025 | VOL. 4, NO. 7

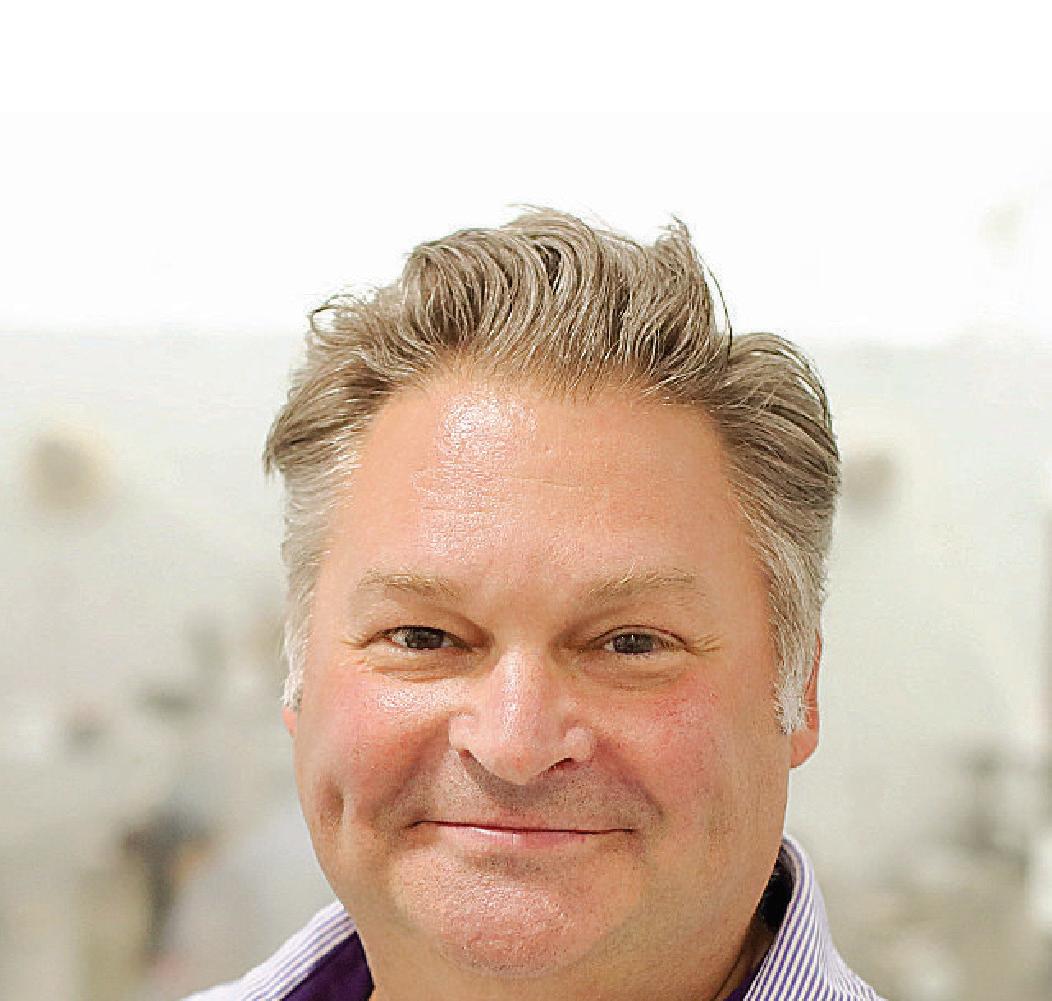

Stephen Boyd, CEO of Boyd Biomedical, is shown at the company’s Lee facility. After a $1.5 million investment in a new o ce in Waltham and a reorganization, the company is poised to double the size of its design team.

BY LAUREN DORSEY

The Berkshire Eagle

LEE — When Bronly S. Boyd returned from Vietnam in the 1970s, he wasn’t aiming to build a cutting-edge biomedical company. He and his wife, Sarah, were looking for a place to settle down, and the Berkshires beckoned.

They landed in Lee, and in 1979, Boyd launched a small business that focused on converting paper made at the town’s paper mills into other products.

Nearly 45 years later, that same business — now known as Boyd Biomedical — is helping design, develop and manufacture medical products used by patients around the country.

“The Berkshires are this incredibly unique place, and most of that is because of the people,” said Matthew Boyd, Bronly’s youngest son and now the company’s chief commercial offi-

cer. “Lee, in particular, has always been wonderful for us.”

Now, with a $1.5 million investment in a new office in Waltham and a companywide reorganization, Boyd Biomedical is entering its next phase.

The new Waltham facility, which opened earlier this year, positions the company’s Design by Boyd division — one of three new units formed under a structure introduced around the same time — closer to its Boston-area clients.

The other two divisions, Build by Boyd (based at the company’s headquarters in Lee) and Launch by Boyd, round out the organization’s updated purpose statement: Design, Build, Launch.

Each division reflects a distinct stage in the company’s work helping clients create, test and deliver new biomedical products.

“We’re a partner to all these innovators in the biomedical ecosystem that

By C larenC e Fanto

LENOX — At 45, Mindi Morin already can boast to having 40 years in the hospitality business.

At age 5 she was assigned to greet guests as the hostess at her family’s first bed-and-breakfast venture in Ancaster, a community in Hamilton, Ontario.

“I actually had my own business cards,” Morin recalled in her office at Canyon Ranch, where she’s leaving her post as managing director. “As I got older and taller, the jobs got harder” as she was promoted to kitchen jobs including dishwasher and eventually a bartender.

Her mom, an American and model in the garment industry, and her dad, a Canadian who worked for Alcan Aluminum Limited, had met in Montreal. Eventually, they relocated to Nova Scotia with Mindi and acquired the Lion Inn, a four-room bed and breakfast in the historic, picturesque coastal town of Lunenburg.

Now, Morin has decided she needs a break after climbing the ladder at Canadian Pacific Hotels, starting with a four-year stint at a resort in Jasper, Alberta. As a dual Canadian-American citizen, Morin was transferred to Canadian Pacific’s Fairmont hotels in Vancouver, B.C., San Francisco, Pittsburgh and Washington, D.C.

When a mentor from San Francisco’s Fairmont moved to Canyon Ranch in Tucson, Ariz., Morin recalls asking him, “What’s this Canyon Ranch place?” She quickly learned that the Lenox location opened in 1989 at the former Bellefontaine mansion built in 1897.

When a general manager slot opened there, she was interviewed by Canyon Ranch’s founders, Mel and Enid Zuckerman, and landed the job at the 126-room health-oriented luxury resort in November 2016.

Morin and her husband, Max Scherff, put down roots in Lenox, bought their first house and shared it with five cats and two German shepherds. (Scherff is now general manager at Prospect, the 49-cabin “landscape hotel” in Egremont.)

Morin has been a visible presence in Lenox Town Hall

on the Affordable Housing Committee and currently the Finance Committee.

“You need to embed yourself into the community you live in for people to even take you seriously,” she said.

So why leave?

“We have accomplished so much and we’ve added so much programming with heavy-hitter speakers coming in, I’d be selfish to not allow somebody else to take the lead,” Morin said. “To be in this job for nearly 10 years, that’s a long time for me. What better time to be able to enjoy summer in the Berkshires, not working, not having any responsibility besides just enjoying myself.”

She emphasized that it was strictly her decision: “If anything, it’s much harder to leave now because we have such great momentum, I’m going to miss it. It’s just time for me to try something new,” she said. “It was a difficult decision because I love it here so much, I love the staff here, they are the best I’ve ever worked with by far. That’s the hardest part of leaving.”

Recently, Morin negotiated with a national wireless tower company to site a new cell facility on Canyon Ranch property, subject to zoning board

approval.

“The present and future have never been more exciting,” said Canyon Ranch CEO Mark Rivers in a prepared statement. “With reinvestments in our property and fresh takes on unique experiences, it is a special moment for us.”

At some point, Morin acknowledged, she’ll need a job. But first, she’ll join a friend next month for a seven-day horseback riding expedition in British Columbia.

Additional excerpts from The Eagle’s conversation with Morin follow, condensed for length and clarity:

THE EAGLE: Any thoughts about what comes next?

MORIN: I feel like I’m doing the right thing, and the right thing will come to me when I’m ready for it. I’m really open to anything. Right now, I’m just excited to have some time off. It’s definitely sad to leave but I’m excited about what’s next and to watch how Canyon Ranch continues to be more and more successful.

THE EAGLE: When you arrived in 2016, what was the mission presented to you for Canyon Ranch Lenox?

MORIN: The first was to get the 19 condominiums open.

It was exciting because I love capital projects like that. And then it was just to keep the mission alive, since we were at a transitional point as Mel and Enid were retiring. Personally, I was always in hotels, very transactional; check ‘em in, check ‘em out. But here it’s like an experience, and for me the goal was to fully understand and be able to articulate and lead the team.

THE EAGLE: What are you most proud of?

MORIN: Probably how resilient the entire team was during COVID. We all just rallied together. It was a really scary and sad time. But I was very confident that we would reopen, though we didn’t realize how much this would impact us. (Canyon Ranch had to close twice during the pandemic, six months in mid-2020 and then four months in early 2021.)

THE EAGLE: Any frustrations?

MORIN: During my first couple months, I felt people didn’t know what we did: “What are they doing behind the gates?” But as I became involved in the community, I was hearing from people that we don’t let anybody in. They felt excluded, so it was a challenge for me, to reinitiate spa days; now it’s year-round for Lenox residents. We introduced dropin services, Transformation Tuesdays, bringing the community in. That was a frustration I wanted to tackle and now I feel I’ve accomplished it. But aside from COVID, I haven’t had a lot of frustrations.

THE EAGLE: Have you noticed a change in what guests are looking for?

MORIN: We don’t jump on the next trend. We stay true to our roots. We’re not going to jump on “the cabbage diet” or kimchi. We’re very science and evidence based, We have many different types of guests coming here for many types of things, so we just meet them where they are. The Michelin Guide awarded Canyon Ranch Lenox two keys, “an exceptional stay,” out of its three-key maximum. It’s Michelin’s highest rated spa resort in the Berkshires and all of New England.

Canyon Ranch investments

Departing Managing Director Mindi Morin called the investments made in the Lenox property since 2016 “phenomenal” though corporate office management in Fort Worth, Texas, declined to provide a dollar total. Among the upgrades listed by Morin:

• The indoor pool was reopened after COVID and locker rooms were upgraded.

• To meet the demand for outdoor activities, an outdoor boot camp has been added, the ropes course is enhanced, and so has the 2-mile loop trails around the property. Also: Canoeing, kayaking, a rowing studio, cross-country skiing, fitness classes.

• Outdoor attractions such as the summer supper series on the lawn, introduced last year, are continuing. New tents have been put up for sound healing, tarot card readings and healing energy. Outdoor aerial yoga is being added.

• Instead of outsourcing to third parties, Canyon Ranch now has its own liquor license for corporate and social groups that want to have a glass of wine with dinner, and for guests in the cafe only.

• To ensure healthy cuisine, the nutrition team and staff doctors monitor the right amount of protein, salt and calories.

• Heating and air conditioning units were updated on all the resort’s major buildings.

• Corridors have been enhanced connecting the buildings.

• The demonstration kitchens have been enhanced.

• Lighting has been upgraded, especially in the studios.

really flourishes here in Massachusetts,” Boyd said. “Across the company, our whole goal when we come to work every day is to help folks get life-changing, life-saving products and therapies into the market to help the patients who need them.”

Although both changes — the reorganization and facility — are still new, Boyd said they’re already paying off.

“We’ve been really happy, in particular with the growth of the Design by Boyd division, that we’ve seen since the building opened,” he said.

Led by Joseph Ting, the Design division currently includes five engineers who specialize in areas ranging from industrial design to biomedical engineering.

Until recently, they worked remotely or used borrowed space in either the company’s Lee facility or its Boston offices.

Now, they’re collaborating in person — meeting with clients, developing prototypes and creating small batches for clinical trials.

“We have been doing design and development work for a long time, and we’ve wanted to grow that team and our capabilities there. This seemed like the right moment,” Boyd said.

As part of that vision, Boyd said the company could as much as double the size of its design team in the next two years.

The transition from paper converting to biomedical powerhouse didn’t happen overnight, but the company began laying the groundwork for the shift shortly after first opening its doors, as it quickly pivoted into general contract manufacturing.

“It’s what they call co-packing in the consumer products industries,” Boyd said. “We started working with more advanced materials like nonwoven films, foils and different types of flexible materials very early on.”

That decision proved successful, and the organization continued to grow. It began moving into the biomedical field

almost 20 years ago, when, in the early 2000s, the company’s leaders saw an opportunity to shift focus.

“Just by geography, we had always been involved in materials and advanced materials, and Massachusetts has always had a really great biomedical ecosystem,” Boyd said. “We saw that it was a growing and exciting market.”

Boyd had a hand in that shift, joining the company in 2008 after finishing business school in Boston.

“It was this exciting opportunity of being able to practice some entrepreneurial skills and try to grow the business in a market that the rest of the team at

Boyd was really interested in,” he said. He’s also not the only family member to remain involved. Bronly Boyd now serves as the company’s chairman, Steven Boyd — Matthew’s older brother — is its chief executive officer, and Peter

Boyd Biomedical in Lee, shown in 2021, has embarked on a companywide reorganization that includes a $1.5 million investment in a new office in Waltham. The Lee office is home to the company’s manufacturing operation.

PAGE 3

Boyd — the middle brother — is its production manager.

Today, the company spans nearly every aspect of biomedical product creation.

In Waltham, the Design by Boyd division creates, develops and tests potential products.

As soon as they have a fully realized device that has gone through clinical trials, it’s time for the Build by Boyd

team in Lee to step in. There, the company manufactures the products for widespread use.

When they’re done, the final division, Launch by Boyd, takes the reins.

“Launch is where we’re helping our clients think through their branding, and we’re helping sell and market their product,” Boyd said.

The company works with an extensive array of clients, from small startups to large established companies.

“We also work with academic centers and labs that are doing biomedical re-

Risk

search, and innovation teams that are trying to push products out,” he said.

While Boyd couldn’t share any of the individual products the company has helped bring to market, he was able to speak to the general categories of devices they typically help create.

“We’ve worked across almost all clinical specialties, from dermatology to electrophysiology,” he said. “In Lee, we have built stick-to-skin devices, advanced limb care and in-vitro testing devices.”

Both the expansion into Waltham and company restructuring build on years of earlier investment and growth.

Over time, the company has worked to vertically integrate nearly every aspect of its operations, Boyd said.

“I think that the growth of our business can be a bit hard to see or understand from the outside because over the past 20 years, it’s really been about the transition to more advanced capabilities,” he said.

While they may not have been flashy, the company’s changes have been substantial, beginning with the organization’s significant investment into its 100,000-square-foot facility in Lee.

“We’ve put many millions of dollars of capital investment in new equipment, new clean rooms and technical staff to support all of the manufacturing work that we do in Lee,” Boyd said. “Since I joined the business in 2008, we have modernized every corner of that facility and business.”

Now the space — clean, bright, modern and efficient — is better suited to handle the ambitions the Boyds have for it.

“It’s a fun place to work, and we have the tools to do our job, right down to the IT systems and program management tools we need to do it effectively,” Boyd said.

At the same time, the company has been investing in the people it needs to bolster its marketing and design services.

“It’s been a lot of purposeful investment [across] the board,” Boyd said.

Despite the company’s expansion, and their additional facility in Waltham, Boyd’s headquarters remain firmly in Lee — and Boyd said they have no plans of ever moving.

“Our headquarters are never something we’ve ever thought about changing,” he said. “It’s an incredible place, I grew up near there. It’s a wonderful area to live in, and we have a lot of great people who feel the same way.”

Lauren Dorsey can be reached at ldorsey@ berkshireeagle.com or 413-496-6190

BERKSHIRE COUNTY

Mobile farmers market returns for third season

The Berkshire Mobile Farmers Market has launched its third season bringing fresh, locally sourced food directly to six locations across Berkshire County through Oct. 17. The mobile market addresses food access challenges by delivering seasonal produce, eggs, meat, dairy products, and pantry staples such as bread, maple syrup, and honey to areas with limited access to fresh, healthy food options.

Operating on a tiered pricing system, the market ensures affordability for all community members. Customers can choose to pay full retail price, receive a 50 percent discount, or access products at no cost through the market’s food pantry option. The market also accepts SNAP/HIP benefits and Farmers Market Nutrition Program coupons.

This year’s schedule follows:

• Tuesdays: 3 to 5 p.m., Cheshire Town Offices; 3:30 to 5:30 p.m., Becket Town Hall.

• Wednesdays: 11:30 a.m. to 1:30 p.m. Wahconah Park, and 3 to 5 p.m. Sheriff’s Office, 264 Second St., Pittsfield.

• Thursdays: 11 a.m. to 1 p.m. Adams Town Offices, no market June 19.

• Fridays: 3:30 to 5:30 p.m. Monterey Community Center, no market July 4.

The Berkshire Mobile Farm-ers Market represents a partnership between Berkshire Grown, Berkshire Bounty, the Berkshire Regional Planning Commission, the Southern Berkshire Rural Health Network, Berkshire United Way and Community Health Programs. Information: berkshiremobilefarmersmarket. org.

NORTH ADAMS

BFAIR earns three-year CARF accreditation

Berkshire Family & Individual Resources received a three-year Commission on Accreditation of Rehabilitation Facilities accreditation for their Day Habilitation and Adult Family Care services. The accreditation extends through 2028.

During the accreditation process, the CARF surveyors noted that “this achievement is an indication of [BFAIR’s], dedication and commitment to improving the quality of the lives of the persons served. Services, personnel and documentation clearly indicate an established pattern of conformance to standards.”

For over 30 years, BFAIR has been providing adult family care, residential, employment and day services for adults and children with developmental disabilities, acquired brain injury and autism.

PITTSFIELD

BMC earns an ‘A’

Berkshire Medical Center, the community teaching hospital of Berkshire Health Systems, has earned an “A” Hospital Safety Grade for spring 2025 from The Leapfrog Group, an independent national nonprofit watchdog focused on patient safety.

Leapfrog assigns a grade from “A” to “F” to general hospitals across the country based on over 30 measures of errors, accidents, injuries, and infections as well as the systems hospitals have in place to prevent them.

“The care and safety of our patients is paramount at Berkshire Medical Center,” said Dr. James Lederer, BHS chief medical officer/chief quality officer. “This ‘A’ Hospital Safety Grade is a clear affirmation of the high quality of care provided by our healthcare team and a recognition of our commitment to excellence in serving the Berkshire community.”

The Leapfrog Hospital Safety Grade stands as the only hospital ratings

program focused solely on preventable medical errors, infections and injuries that kill more than 500 patients a day in the United States. This program is peer-reviewed, fully transparent and free to the public. Grades are updated twice annually, in the fall and spring.

To explore Berkshire Medical Center’s full grade details and to find tips for staying safe in the hospital, visit HospitalSafetyGrade.org.

PITTSFIELD

Bishop West Real Estate has announced that Berkshire Access Realty has officially joined forces with Bishop West. This move enhances the company’s presence across Massachusetts, New York and Vermont, reinforcing its commitment to providing real estate services throughout the tri-state region.

Berkshire Access Realty, founded and led by broker Mary Jane Dunlop, has served clients in the Berkshires for over two decades. By joining Bishop West, clients of both firms will benefit from expanded resources, marketing reach and collaborative expertise.

“This partnership is built on shared values — personalized service, local expertise and a dedication to community,” said Corey Bishop, co-owner and broker. “With this expansion, we’re even better positioned to serve buyers and sellers across the region.”

Mary Jane Dunlop, former broker-owner of Berkshire Access Realty, expressed her enthusiasm for the transition.

“Joining Bishop West Real Estate is an exciting new chapter. I’ve always admired their professionalism and forward-thinking approach,” she said. “This move allows me to continue doing what I love — serving my clients — with the backing of a dynamic, growth-oriented team.”

Bishop West Real Estate offers residential, commercial and investment real estate services with offices strategically located in Massachusetts, New York and Vermont.

For more information, visit bishopwestre.com or call 413-448-2502.

GREAT BARRINGTON

Triplex Cinema names new board president, members

The Triplex Cinema has announced the appointment of Gail Lansky as the new president of its board of directors. Additionally, Leslie Chesloff, Matthew Penn and Mitch Smilowitz have joined the board.

Lansky has spent her entire career working with non-profit organizations, including the Yiddish Book Center, the Harold Grinspoon Foundation and Amherst Cinema. She most recently worked as the director of admissions and marketing at Lander-Grinspoon Academy in Northampton, and is currently a part-time preschool teacher. Prior to becoming board chair, Lansky was a member of the Triplex board of directors.

Chesloff is a 35-year veteran of the television entertainment field, holding executive level positions with Columbia Pictures Television, Chris Craft Corporation, The Tribune Company, and Lifetime TV Networks. Since 2015 Chesloff has been a real estate agent with William Pitt Sotheby’s. Penn is an Emmy-nominated director who has worked with extensively in both theatre and television. He has directed iconic shows such as “Law and Order,” “The Sopranos,” “NYPD Blue” and many others, and has directed theatre productions for Barrington Stage, Shakespeare & Company, Berkshire Theatre Group, and Great Barrington Public Theatre.

Smilowitz is the CEO of The Joint Retirement Board, a not-for-profit organization that is the plan sponsor

and plan administrator of a denominational (403b) retirement plan. He has extensive experience in investment analysis, financial planning and tax compliance.

NORTH ADAMS

NARH among honorees earning MassEcon awards

North Adams Regional Hospital has received a Gold recognition by MassEcon in the 21st Annual Team Massachusetts Economic Impact Awards.

MassEcon is the state’s private sector partner in promoting business growth in Massachusetts.

NARH was among three organizations honored in Western Massachusetts, achieving Gold, while a Silver honor went to Electro Magnetic Applications and Bronze to the Berkshire Innovation Center, both in Pittsfield.

The winners were recognized during a ceremony at UMass Boston in April, and the organizations that were honored were selected after site visits, interviews with regional teams of judges, and 90-second “pitches” during a finalist’s reception. Altogether, the expansion projects included in the awards represent a financial investment of $280 million, and 822 jobs added to the state’s economy.

“Berkshire Health Systems, and the entire staff of North Adams Regional Hospital, are honored to be recognized for this achievement,” said Laurie Lamarre, BHS vice president and NARH chief operating officer. “The reopening of North Adams Regional Hospital fulfilled a vision of restoring acute care services to the North Berkshire region, and my colleagues at NARH are committed to improving the health and well-being of all of the people we serve.”

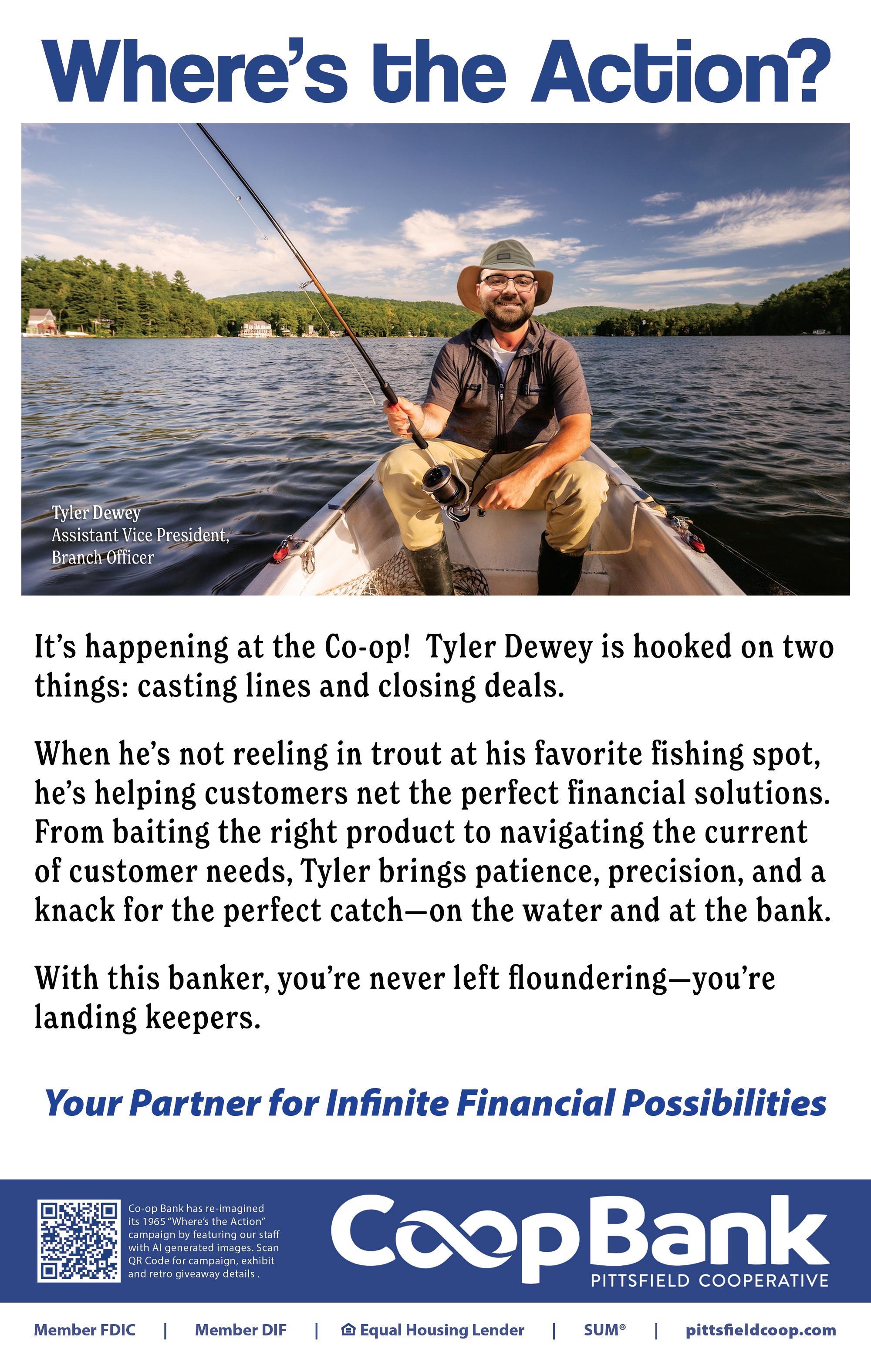

PITTSFIELD Co-op Bank uses AI to revive classic ads

Pittsfield Cooperative Bank is bringing the past into the future with its “Where’s the Action?” campaign, a bold reimagining of its classic, hand-illustrated advertisements from 60 years ago. By pairing the original headline with newly created advertising images — crafted using cutting-edge artificial intelligence — the bank is blending nostalgia with modern innovation.

Decades ago, the Co-op’s ads stood out for their hand-drawn illustrations that captured the energy and spirit of the community. Now, six decades later, the bank is honoring that legacy by fusing timeless creativity with today’s technology. By using AI to generate fresh visuals while preserving the original ad concept and headline, the campaign bridges generations — celebrating craftsmanship, employees, and the evolution of banking.

In a fresh twist, the AI-generated visuals feature Co-op employees engaged in their personal passions— whether it’s coaching, carpentry, volunteering, astrology, or sports — highlighting their dedication both inside and outside the bank.

The campaign launched May 1 with in-branch exhibits showcasing the vintage and AI-enhanced ads, followed by a rollout across print, social media and digital platforms.

For information, visit pittsfieldcoop. com.

PITTSFIELD

Berkshire Health Systems announces the election of Ashley Benson, a licensed independent clinical social worker, and Matthew Lauro of Mountain One Bank, to the BHS board of trustees.

Benson is the founder and owner of Optimal Healing LLC, and is a psychotherapist, consultant and

clinical supervisor. A Berkshire native and mental health professional with over two decades of experience in social work and clinical practice, she founded her practice in 2019 to provide holistic health resources to the community and formally established Optimal Healing in 2022. She specializes in trauma-focused care and the treatment of children, adolescents and families.

She earned her undergraduate degree from Berkshire Community College and the Massachusetts College of Liberal Arts, followed by a master’s in social work from Smith College. She holds two post-graduate certifications: advanced clinical social work supervision from Smith College School for Social Work and advanced [ractice with children and adolescents from Springfield College.

Lauro is senior vice president and Western Massachusetts commercial team leader for MountainOne Bank. He is responsible for managing existing portfolio risk, loan growth and a team of commercial bankers.

Lauro is active in the community as a board member for Berkshire Education and Correction in Pittsfield, former national council member of the Avon Old Farms School for Boys in Avon, Conn., and former trustee of the Pittsfield Affordable Housing Trust.

He received his bachelor of science in business management from the Lally School of Business Management at Rensselaer Polytechnic Institute, Troy, N.Y.

Departing the BHS board of trustees are Timothy Burke, Barton Raser and Dr. John Loiodice.

A free monthly publication by The Berkshire Eagle 75 South Church Street, Pittsfield, MA 01201 Visit berkshirebusinessjournal.com for advertising information and to subscribe NEWS DEPARTMENT 413-447-7311 news@berkshireeagle com

ADVERTISING DEPARTMENT AMY FILIAULT Advertising Manager 413-496-6322 afiliault@berkshireeagle com

CHERYL GAJEWSKI, Director of Advertising Sales 413-841-6789 413-496-6330 cmcclusky@berkshireeagle com

Share your news with the Berkshire Business Journal. If you have a company promotion, a new business or a new venture, let the Berkshires know about it Remember the 5 Ws and that briefer is better Email text and photos to BBJ@newenglandnewspapers com. Provide your expertise in the Berkshire Business Journal. Do you have the answer to a persistent question about business and the Berkshires? Do you have ideas and suggestions on how our business community can grow? If you have a comment to make about doing business in the Berkshires or if you re looking to raise an issue with the business community this is the venue for that We welcome letters up to 300 words and commentary up to 600 words Send these to BBJ@newenglandnewspapers com

Berkshire Business Journal is published monthly by New England Newspapers Inc., 75 S Church St Pittsfield, MA 01201. Periodicals postage paid at Pittsfield, MA 01201. Berkshire Business Journal is delivered free to businesses in Berkshire County via third class mail. Additional distribution is made via drop-off at select area newsstands

By Dylan T hompson

PITTSFIELD — Xion Roman is paying it forward by helping at-risk youth build foundations for success.

Roman, who has been in the Berkshires for two years and lives in Pittsfield, incorporates the youth into his construction business, Brethren Builders.

One of their most recent projects was building a patio at Dottie’s Coffee Lounge.

“The goal is to keep kids out of the streets,” Roman said. “Let them learn not just work skills, but life skills to cope through some of the trauma that they’ve gone through.”

Roman, 37, says the way he grew up was “traumatizing,” and he finds the work he does to be “therapeutic.”

“I’m so in love with giving back and developing the community,” Roman said. “I see so much potential in Pittsfield.”

Roman was born in Lowell, but spent his childhood raised by his grandparents in Isabela, Puerto Rico. After they sent him back to the U.S. at the age of 12, Roman spent time in juvenile detention and foster homes.

He joined the U.S Marine Corps at the age of 20 and served for a little over six years. Roman says his time spent in the system is the “biggest motivation behind what I’m doing.”

Roman founded Brethren Builders in 2021 in Lowell before bringing it to the Berkshires in 2024.

The company focuses on residential and commercial projects and has made it a priority to provide at-risk and marginalized youth with the chance to learn the construction trades and develop a strong work ethic.

“It’s always been the motive behind why we’re doing what we’re doing,” Roman said. They offer hands-on training and mentorship to the youth, giving them valuable skills in the industry. Currently, Roman has one partner, and he takes on part-time employees.

Roman is also working full time with a local home builder out of Dalton and Windsor and is taking online classes at Merrimack College with a major in business and leadership.

In January, Roman and a few young men from a local neighborhood built stage lights for Dottie’s, which he says was one of the first jobs he did in the area. Last week, Roman

and his crew finished the patio for the business, which took two weeks to build.

They are also working on a mural on the patio that is expected to be finished this weekend.

Roman worked closely with Jessica Rufo, proprietor of Dottie’s and Dorothy’s Estaminet, to complete the projects. He says that Rufo has been the “greatest champion for Brethren Builders.”

“I like to collaborate with people and have them take the reins,” Rufo said. “Leave their mark on the space within boundaries … The relationship with [Roman] was an easy one.”

Rufo is also pleased with the patio and stagelights, and the suggestion Roman had to build a

new lounge space.

Roman has now teamed up with 18 Degrees and MassHire and is looking to build more partnerships in the community. Roman is appreciative of the support of the community and says that everyone has been “so receptive and warm and really just embracing us.”

This summer, Roman is hoping to partner with MassHire’s Youth Works Program. This will be MassHire Career Center’s 21st year implementing the program that serves low-income youth ages 14-25 throughout the region and provides them with structured work readiness training and enriching work experiences.

Roman would serve as a host employer in the program, help-

To contact Brethren Builders

Business number: 413822-9252

Founder Xion Roman’s cell: 939-342-6266

Email: Brethrenbuildersltd@gmail.com Website: brethrenbuilders.org

ing the youth gain valuable skills in the building trades industry.

“His life experiences and inspiring perseverance make him such an ideal role model for youth facing challenging life circumstances,” Heather Shogry-Williams, youth program director of MassHire Berkshire Workforce Board, wrote in an email to The Eagle.

Shogry-Williams also added that Roman’s success and motivation are a “beacon of hope that can truly help youth foster their own perseverance.”

Roman is also focused on a few projects this summer, including rehabbing a local house that burned down on Dalton Ave last month and other local properties.

Over the last two years, Roman says he’s done about four or five projects with kids, but he is expanding. Roman is also working with people coming out of imprisonment and is hoping to help steer them in the right direction.

“Anyone who needs help, we’re teaching them,” Roman said. “The goal initially was kids … but we’re open to wherever the need takes us, and the need right now just seems so grand that we can’t shut people out.”

By M aryjane Willia Ms

PITTSFIELD — After sitting empty for about six years, a former money printing facility is soon to be filled — with other people’s stuff.

The long-shuttered building at 428 Merrill Road has been transformed into a CubeSmart self-storage facility, which opened in June. The site will feature 431 climate-controlled units ranging in size from 5-by-5 feet to 10-by-30 feet.

“We saw the value there and thought it would be a pretty good market for self-storage, given the demand we’re seeing,” said Jack Martinson, a partner with Engelsma Construction. “We hope to provide a nice, clean, well-secured facility that Pittsfield citizens can store their stuff in.”

Based in Minneapolis, Engelsma Construction is launching a series of self-storage projects across the country, starting with Pittsfield. The company partnered with CubeSmart to operate the facility, while retaining ownership of the building.

Martinson said the decision to invest in Pittsfield was driven in part by a lack of available storage options in the area.

“A few other operators in the area are basically full,” Martinson said. “We think it’s a necessary service for the [city]... so we wanted to provide a more up-todate facility with new technology, security systems [and] competitive pricing.”

The $3.5 million renovation was handled by Salco Construction Co., a Pittsfield-based con-

tractor. The project included restoring and upgrading the systems inside the 60,000-squarefoot building.

“The reason we went with them is that they were right in the backyard of the project,” Martinson said. “And trusting someone that’s local and knows people at the city was what we were looking for, and they’ve done an absolutely phenomenal job.”

To complete the transformation, the exterior will also be revamped with new paint, a fence,

On the web...

CubeSmart is now taking reservations for space at the new facitity. For reservations or information, visit cubesmart.com.

driveway paving, landscaping and signage.

“The front of the building had been overrun with growth… it did not look pretty,” Martinson said. “So I think

it’ll provide a little bit better view for the neighbors.”

CubeSmart plans to hire a local facility manager to oversee day-to-day operations.

In 2020, the building was slated to be converted into a cannabis cultivation and manufacturing facility by Sunhouse Mass LLC owner Cory Roberts. But Roberts later backed out, citing concerns that the marijuana market was becoming oversaturated, said Perri Petricca, who managed the building at the time through P.A.P. Realty Co.

Martinson said the city has been very helpful throughout the construction process, and he hopes the CubeSmart will promote further development in the area.

“Hopefully [the facility] can open the gates to larger nationally recognized brands [coming] into the city … we’d be proud to lead the forefront,” he said. “We’re just excited to contribute something to the community, and hopefully be a part of the city overall.”

By M aryjane Willia Ms

PITTSFIELD —

Placita

Latina is downsizing.

The Latin American restaurant and market is preparing to move from its current home at 41 North St. to a smaller space at 17 Wendell Ave. Extension later this summer.

Owner Vladimir Cruz Romero said rising overhead costs and shifting customer habits prompted the decision to relocate.

“The bills are too high over here,” he said. “People don’t like to come here and stay for dine-in, it’s more for to-go [and] delivery. … It’s not good to have this big space for a couple tables.”

The new location, tucked behind Otto’s Kitchen and Comfort, is only 927 square feet, which makes the rent, cleaning and utility costs much more manageable than at the 6,370-square-foot North Street space.

“We feel [the move] is good because here is a lot of work, for maintenance, cleaning, everything,” he said of the business. “It’s more lost money over here.”

Placita Latina will close at its current location on July 19 for cleaning and moving preparation, with plans to reopen in the new space in August.

Despite the change in address, Cruz Romero said customers can expect the same lineup of Salvadoran and Mexican

dishes — including the restaurant’s signature pupusas — with a few potential new offerings in the mix.

“The customer is happier,” he said, noting that many regulars live or work closer to the new location and have responded positively to the move.

The new space will seat about 25 people and showcase a fresh version of the Placita Latina logo, designed by Cruz Romero for the move.

While the restaurant will retain its vibrant Latin American décor, the market portion may eventually be moved into a separate location for more space, Cruz Romero said. He may also hire additional employees with the money he’s saving to make it a “nicer experience.”

The North Street storefront is currently listed for lease at $5,500 per month by real estate agent Timothy Gallagher. The property is owned by Mary and Samir Abdallah, who also own Hot Harry’s Fresh Burritos in the same building.

Placita Latina opened in the space in 2022, founded by Vladimir Cruz Romero, his mother Maria Romero Valdez, and her partner Abraham Lopez de la Cruz. The location had previously sat vacant for three years following the closure of J. Allen’s ClubHouse Grille.

By Talia l issauer

GREAT BARRINGTON — Robin Helfand, founder and owner of Robin’s Candy in Great Barrington, has sold the Main Street shop that bears her name to a longtime customer, Elise Contarsy.

Robin’s Candy, which declares itself to be the town’s “sweetest destination,” is a candy store that specializes in hard-to-find candy, handcrafted chocolates and gives a signature toothbrush to every customer.

“I’m really excited to be up here and lead this successful business into its next iteration,” Contarsy said.

Contarsy is a New York native who has spent the past two decades connecting with the region by visiting regularly, sending her children to Eisner Camp and taking them to ski at Ski Butternut.

“She is very much a part of the fabric of the community and of the Berkshires,” Helfand said. Contarsy has spent her career in retail and had always wanted to own her own business. At the suggestion of a friend who knew how much she loved the store, she got to know Helfand and decided she wanted to buy it.

The shop wasn’t up for sale when Contarsy asked, but Helfand saw how passionate she was about the store and saw a huge opportunity for herself to grow as a consultant.

“And for me, it was an easy decision,” Helfand said.

Helfand first opened the shop in Millerton, N.Y., in 2004, then moved to Great Barrington in 2007 before settling at 288 Main

St. in 2008. The business quickly became a staple for the town, earning praise from celebrities and being featured in commercials.

This change will allow Helfand to focus on RH Consulting, a consulting company she founded for small businesses in the region.

Helfand is staying on temporarily to ensure a smooth transition and help implement Contarsy’s ideas — starting with a reorganization of the store’s layout. Contarsy plans to keep the shop running like it has to maintain continuity. The store closed for a few days for the refresh and has since had a soft reopening,

with a larger relaunch event sometime mid-summer.

“I want people to come on in and enjoy the experience, the same experience you’ve enjoyed and have really treasured for almost two decades,” she said. “My goal is to make it feel as welcoming as it always has.

Contarsy is most excited to see everyone’s smiling faces as they explore the store.

“I’m excited for greeting all the customers all summer and over the holidays and the winter ski season, and being part of the community and continuing to serve everyone this fun, joyous experience,” she said.

For the last five years, Helfand

has had the help of a full-time manager, along with a collection of students to help part time so she can balance both the candy store and her consulting business. Now, she plans to move full time to consulting and spend more time with her family.

“It lets me pay it forward and focus on how to help other small business owners, founders, people that have launched business so that they can achieve the kind of success that we were fortunate to achieve,” she said.

Her work in consulting has strongly benefited from her experience with the candy store as she is guiding customers based on her lived experience.

While she’s excited to move forward, she said she’ll miss the people most — the staff who kept everything going and the customers who always left with a smile. She said she loved watching families come in together and share candies from their generations, and watching kids open their piggy bank to make their first ever purchase, typically in small coins.

“I’ll miss the real joy of the experience one has while shopping at Robin’s,” she said. “It’s the happy candy memories. We’ve built this really special experience for local residents but it’s also on every visitor’s list. We’re really proud of having built this experience.”

Helfand has watched the store grow into a must-visit place in Great Barrington. But, she said she will never forget the early success sparked by a shoutout from comedian Paula Poundstone to a sold-out Mahaiwe Performing Arts Center a week after they first opened.

They were then featured in a Christmas episode of Ina Garten’s cooking show followed by a commercial with American Express that honored small businesses across the country.

These celebrity interactions helped the store make national news, but Helfand said what really stuck out for her was the way her community rushed to help whenever she asked.

“It is really about the joy of having a community store that is supported by and loved by the community,” Helfand said.

There are often assumptions made about the customer base in cannabis retail. From who is choosing to shop with you, to what their budget is before they are asked one question, there are lots of assumptions being made about the customer standing in your store. And even more importantly, the customer that has never stepped foot inside.

seen, or just tolerated at the edge of someone else’s clubhouse?

When we are helping another dispensary grow (we still regularly consult for retailers seeking the insight gleaned over the last 14 years in legal cannabis), one of our first questions is: “What is your current demographic?” For stagnant stores, the answer is often some version of “mostly men, aged 25 to 40.” Which is fine if that’s your business model. However here’s the cold truth: your customer base is who you speak to. And if your store only speaks to young stoner dudes, then that’s who will show up. That’s not the market. That’s your mirror.

At Canna Provisions, we spend a lot of time thinking about this — not just demographically, but psychographically. Starting with our website and menu to who are we inviting in with our music, our language, our staff, our product selection? Are we building an environment where people feel welcome and

Let me put it another way: most people still don’t consume cannabis. So if we want to grow this industry, we have to start by making it less intimidating for the people who aren’t already here. That includes people who may have never stepped foot in a dispensary before. People who didn’t grow up with weed culture or who are returning to cannabis after decades away from it. People who are curious but cautious. If you lose them in the first 30 seconds (if the store feels unwelcoming, if they’re ignored, if they’re overwhelmed by the menu or by the vibe) you don’t just lose a sale. You lose a chance at longterm trust. And in this business, trust is everything.

For us, that means getting out from behind the spreadsheets and standing on the sales floor. Listening. Watching who walks in, who lingers, who leaves, and who comes back. What I’ve seen over and over is this: the vast majority of women who come into our store are shopping for someone else. A parent recovering from surgery. A spouse who can’t sleep. A friend going through chemo. A different friend moving through anxiety. And so on.

They’re there because they’re

caretakers. Because that’s what women do — they take care of the people around them. And they’re looking to us for real information. Not sales pitches. Not lingo. Information. They want to know what’s safe. What works. What might help without making things worse. Sometimes they’re there for themselves. A beverage after work. A little edible to unwind. Something to help sleep or manage pain. But even then, they often bring a friend. They talk about it in groups. And they remember how they were treated.

So what happens if the store is too loud, the staff isn’t paying attention, or the vibe screams “frat house”? You lose them. Not just that day, but probably for good. Because unlike someone who’s been buying weed for 20 years, they’re still on the fence about this whole experience. And that makes the stakes higher for every single interaction.

This is why we obsess over retail experience. It’s not just about selling cannabis. It’s about earning trust. Our budtenders aren’t just friendly; they’re trained. They know how to shift gears when a group of older Canyon Ranch guests walks in, or when a 22-year-old is buying her first pre-roll. That’s not an accident. That’s design.

We’ve built a menu that’s large and diverse, but we also stand behind every product on our shelves. If a product gets

repeated complaints, or if our staff doesn’t believe in it, we pull it. That’s what our “Code Red” system is for. Because the fastest way to lose credibility is to sell something your own team won’t vouch for.

You wouldn’t eat at a restaurant where the chef won’t eat the food. Why would cannabis be any different?

The best operators already understand this. They’re not chasing hype. They’re curating environments. They’re watching which products get asked about again and again. They’re listening to the questions first-time buyers ask. They’re investing in staff development, product education, and customer service — things that feel basic in any other industry but still get overlooked in cannabis.

And they are regularly developing their staff to be better workers, and better humans, with ongoing training and education on key issues plaguing many dispensaries. For example, budtenders often gravitate to an idea that customers are on a similar budget as themselves, so training should include never assuming what a customer wants to spend.

Because despite being years into adult use, many in this space still treat cannabis retail like an extension of weed culture. But this isn’t 2010. Customers today don’t care how long you’ve been in the game. They care about whether you can

answer their questions. Whether your products are fresh. Whether your staff makes them feel like they belong.

In places like the Berkshires, where tourism, wellness, and aging populations intersect, this matters even more. Our stores don’t just serve locals. They serve people visiting from across the country — people who walk in with zero context, or bad experiences elsewhere. And we get one shot to show them what this industry can actually be.

The truth is, people keep saying we’re great at cannabis retail. But the reason we’ve won awards, grown our customer base, and built long-term loyalty isn’t because we’re doing anything revolutionary. It’s because we’re great at retail. Full stop. Great retail is inclusive. It’s intentional. It adapts. And it doesn’t rest on the assumption that people will just walk in because you’re the newest license in town. You have to give people a reason to come back, and that reason better be more than your discount board. So if you’re one of those shops wondering why your customer base looks like a rugby team, here’s a suggestion: Start by looking in the mirror. Because the best dispensaries don’t shout louder. They just listen better.

Meg Sanders is CEO and co-founder of Canna Provisions.

I recently watched a segment on “60 minutes” that explored the potential for artificial intelligence to impact education.

In the piece, Sal Khan, founder of Khan Academy, discusses Khanmigo – an AI-powered tutor developed to enhance education. Khanmigo provides personalized tutoring to students and helps teachers with tasks like lesson planning and grading.

One former English teacher talked about how she previously taught 100 students. When she needed to review first drafts of an essay, she would spend only about 10 minutes per student. But that limited amount of time per essay still meant that she was spending about 16 hours just to review first drafts. AI-powered tools like Khanmigo already have shown the capacity to review papers and provide thoughtful feedback in a matter of seconds. The potential efficiency for teachers is game changing.

As I read, listen and watch pieces like this about the impact of AI, I can’t help but think about how best to invest in it. While it is becoming more apparent that AI has the potential to make significant changes to the world of work, it’s difficult to know which companies will be the biggest beneficiaries.

In my lifetime, there have been several similar technological advancements that have radically changed how we operate — computers, the internet, and cellphones. Each of these new technologies ended up bringing huge amounts of growth to the companies that capitalized on them. But with perfect hindsight, it’s clear that picking the right companies to capture these trends was incredibly difficult.

In the late 1990s, Global Crossing was widely regarded as a premier investment opportunity, building and operating a global fiber-optic telecommunications network built to provide high-capacity internet and data services worldwide. By 1999, Global Crossing’s stock had soared and the company was valued at $47 billion.

Global Crossing then collapsed spectacularly. The dot-com bubble burst, demand for bandwidth shrank, and Global Crossing could not generate enough revenue to cover its massive costs. By January 2002, the company filed for bankruptcy.

Meanwhile, Amazon was an upstart online retailer that specialized in books. Many investors in the 1990’s viewed Amazon as overvalued. Amazon did not show a profit until the 4th quarter of 2001, nearly five years after becoming a publicly traded company.

torola, two of the largest companies in the world. It looked obvious that these companies were going to benefit massively from the rapid proliferation of cellphones. Turn the page to the early 21st century, and you might have jumped on the Blackberry bandwagon.

Any of these investment ideas looked foolproof at the time.

But the company that ultimately capitalized on cellphones didn’t develop its first model until 2007 – nearly a decade after the craze began.

If you bought Apple computer in the late 1990’s, you had no idea that iPhones were going to be the impetus to propel Apple to one of the largest companies in the world. In 1999, Apple showed revenue of just over $6 billion. By 2024, that revenue was $391 billion. These stories are meant to point out that even if we know a new technology is likely to impact the world, it can be very difficult to identify companies in which to invest. In early June, Nvidia took over as the largest company in the world once again. As the biggest chipmaker for AI-related technology, it looks obvious that Nvidia will continue to be a huge beneficiary of the trend. That may or may not be true. There may be upstarts that aren’t even on our radars as investors that take over in the next decade. AI is evolving rapidly, but also faces regulatory, ethical, and competitive risks that we cannot predict.

What are we to do as investors to capitalize on this trend? If you want to find the next Amazon, Apple or Nvidia, it’s going to be very difficult. One might argue that you really need to get lucky to pick the right stock. I study markets religiously, and I couldn’t guess who the next big winner will be. The only way to make sure you capture the next big winner is by owning a broadly diversified portfolio of stocks — ideally the entire market. Apple IPO’d in 1980 and was a part of the S&P 500 by 1982. A simple investment in an S&P 500 index fund would have provided exposure to Apple from those early days. Granted, it was a very small slice of the overall investment, but it gave you ownership of Apple that paid off bigtime.

In my lifetime, there have been several similar technological advancements that have radically changed how we operate — computers, the internet, and cellphones. Each of these new technologies ended up bringing huge amounts of growth to the companies that capitalized on them. But with perfect hindsight, it’s clear that picking the right companies to capture these trends was incredibly difficult.

A $1,000 investment in the S&P 500 in 1982 would be worth more than $48,000 today with dividends reinvested, thanks in large part to that little slice of Apple.

In the late 1990s, many investors would have chosen Global Crossing over Amazon — and with good reason at the time. Moreover, even if you did buy Amazon stock in January 1999, a $1,000 investment would have collapsed to just $113 by late 2001. It was impossible to foresee that same $1,000 investment would eventually be worth over $78,000 today.

Cellphones are another great example. If you were an investor interested in cellphone technology in 1999, you likely found your way to Nokia or Mo-

Could you try to target the next Apple by picking individual stocks? You can try, and maybe you’ll hit the lottery. I’ll admit, I try it with a little bit of money too. Your investment style is going to be unique to your personality and tolerance for risk.

But a simpler way to capture all the opportunities is to own a little bit of everything. Even if you don’t hit the lottery, broad diversification has consistently proven to be one of the most effective ways to build wealth over time.

In a university lab, a graduate student uses a mobile phone to control a robotic arm on the other side of the country. A moment later, a technician in Pittsfield uses that same interface — on the same hardware — to learn skills critical for modern manufacturing. The distance between cutting-edge research and rural workforce development has never felt shorter.

At the Berkshire Innovation Center (BIC), we often talk about building bridges. Between startups and legacy manufacturers. Between students and career opportunities. Between world-class research and real-world application.

Lately, one of the most exciting bridges we’ve been part of connects two seemingly unrelated projects: a robotic hand designed for future factories and disaster zones — and a robotic arm helping train the next generation of manufacturing professionals right here in the Berkshires.

Earlier this month, MIT researchers won the Best Paper award in the Manufacturing Division at the American Society for Engineering Education’s 2025 Annual Conference. The paper, titled “Application of Phone-Based Robotic Arm Teleoperation in HandsOn Labs for Engineering Education,” highlights a deceptively simple innovation: making remote robotics education accessible through smartphones. This is more than a clever interface. It’s a potential breakthrough in how hands-on skills are taught in rural areas like ours—where access to advanced equipment and expertise is often limited.

At the heart of the paper is the work of MIT’s LEAP Group led by Dr. John Liu, which has been collaborating with the BIC through our Manufacturing Academy led by Dr. Dennis Rebelo. Together, we’ve been piloting robotic arm simulations with students employed in technical jobs across Western Massachusetts. These students are learning how to program and operate robotic arms — tools increasingly common in modern manufacturing environments — using the same interface as researchers at one of the most prestigious engineering schools in the world.

This is what the BIC was built to do: take the most advanced thinking in science and technology and make it usable, relevant and empowering for people and businesses in our region.

MAJOR PARTNERSHIP

That spirit of translation and collaboration also underpins a second major partnership we’ve joined this year — one that could reshape the field of robotics altogether.

The Human AugmentatioN via Dexterity (HAND) Engineering Research Center, led by Northwestern University in partnership with MIT and others, was launched recently with support from the National Science Foundation. Its mission is audacious: develop robotic hands with human-like dexterity, capable of performing tasks that range from delicate caregiving to rugged industrial work. Think robots that can sort recyclables by touch, assist with elder care, or assemble complex devices with minimal programming.

The implications for manufacturing are enormous. In industries that rely on both high precision and adaptability — like aerospace, medical devices or specialty plastics — current robotics solutions often fall short. The HAND ERC aims to change that. And through our role as a regional implementation partner, the BIC is helping ensure that these breakthroughs don’t stay locked in the lab. We’re working to bring them to factory floors and job training programs in Western Massachusetts. These two projects — one focused on training the workforce of today, the

Graduates and instructors of the BIC Manufacturing

common in modern manufacturing environments —

engineering schools in the world.

other on building the technologies of tomorrow — might seem unrelated. But they’re deeply connected by a shared philosophy: that robotics isn’t just about automation. It’s about augmentation. It’s about empowering people with better tools, expanding what’s possible in education, and strengthening the resilience and competitiveness of manufacturers of all sizes.

And they share one more thing: a belief that this kind of innovation doesn’t have to be confined to major metro areas or coastal tech hubs. Through thoughtful partnerships and strong regional infrastructure, places like the Berkshires can play a central role in shaping the future of work and technology. These efforts strengthen both our BIC talent and the professionals in firms that rely on forward momentum. Massachusetts is uniquely positioned to lead this effort. We have world-renowned institutions as collaborators. We have a state government committed to manufacturing innovation. And we have an advanced manufacturing base that stretches from the Boston suburbs to the hills of Western Mass. — home to companies producing mission-critical parts for the defense, biomedical and renewable energy sectors.

What we need — and what the BIC is actively building — is a system that connects these assets. A place where students can get hands-on experience with the same technologies used in federally funded research centers. A place where small manufacturers can test-drive emerging solutions before making capital investments. A place where rural communities can feel — not just included in — but essential to the state’s innovation economy.

The robotic arm and the robotic hand — one helping train students, the other being developed to support workers — are more than engineering projects. They are symbols of the kind of ecosystem we’re building here. One where expertise flows across boundaries, where innovation is shared, and where regional hubs like the BIC help ensure that breakthroughs at places like MIT and Northwestern lead to meaningful, measurable progress in places like Pittsfield.

This isn’t about tech for tech’s sake. It’s about creating good jobs, expanding access to opportunity, and

strengthening the backbone of our economy: the manufacturers, educators and entrepreneurs who keep our communities moving forward.

At the BIC, we’re proud to play a

role in that story — and we’re just getting started.

NAR Chief Economist Lawrence Yun’s presentation this June at the Realtors legislative meetings offered a clear look at the current housing market and what may lie ahead. For those of us in the Northeast, his insights underscored how our regional market differs from national trends and why inventory challenges will continue to shape our outlook.

Yun began by noting that the Federal Reserve has revised its 2025 economic forecast. GDP growth has been lowered from 2.1 percent to 1.7 percent, while inflation is expected to climb from 2.4 percent to 2.7 percent. These figures suggest a slowing economy that affects everything from mortgage rates to housing demand.

Mortgage rates remain the driving factor behind the national housing slowdown. Existing-home sales have fallen to multidecade lows for the second year in a row. For many buyers, higher rates translate to larger monthly payments, making homeownership harder to attain.

Yet Yun projected a moderate recovery ahead. He expects existing-home sales to rise by 6 percent in 2025, increasing as the year goes on from a slow start. Home prices are forecast to increase steadily, up about 3 percent in 2025 and 4 percent in 2026. Berkshire County residential sales showed a 4 percent increase through May 2025 compared to the same time in 2024.

While these national projections are positive, the Northeast market — including Berkshire County — faces different pressures. Chronic inventory

CREATIVE CONNECTION

Existing-home sales have fallen to multidecade lows for the second year in a row. For many buyers, higher rates translate to larger monthly payments, making homeownership harder to attain.

shortages and low building rates will keep prices elevated and limit the pace of recovery here, even as other regions may rebound more quickly.

In Berkshire County, we have seen a steady increase in the number of homes on the market, now 12 percent higher than at the same time last year. However, with only three months of absorption — the rate of sales versus demand — we remain well below a balanced market. A balanced Berkshire market typically has between seven to eight months of inventory.

Yun’s data reinforced this

point. Many areas of the country are benefiting from new-home construction catching up with demand. In contrast, the Northeast continues to struggle with a lack of new housing. Zoning restrictions, high building costs, and limited developable land contribute to this ongoing inventory shortfall. This imbalance between supply and demand will likely persist over the next several years, making it harder for buyers and keeping upward pressure on prices.

Nationally, Yun noted that the inflation rate hit 2.3 per-

cent in April. Housing costs remain a key component of consumer inflation, though there are early signs of easing. A decline in inflation could eventually lead the Fed to reduce interest rates, but only once they are confident inflation is under control. The labor market continues to perform well. Payroll employment now exceeds pre-pandemic levels by seven million jobs. Wage growth of 3.8 percent is also outpacing inflation, giving households more spending power. Yun expects another 1.6 million new jobs in 2025 and 2.4 million in

2026, which should support consumer confidence and housing demand.

There are also early signals of growing buyer interest. Mortgage applications have begun to increase, and surveys show that most renters still aspire to own homes. As mortgage rates moderate, this demand could strengthen further.

But in our region, limited inventory remains the key challenge. Even if interest rates fall, the lack of homes on the market will continue to restrict sales. Yun’s presentation highlighted how Northeast inventory levels are projected to stay low well into 2026, unlike the improving supply picture in other parts of the country.

Policy changes will be necessary to address these issues. Easing zoning restrictions, supporting new construction, and finding creative ways to expand housing stock will all be important for our region. Without these steps, inventory constraints will continue to slow growth and limit affordability.

Yun closed with a balanced view. The market remains difficult but is far from broken. Employment and wages are strong, and demand for homeownership remains high. In the Northeast, much of the future depends on how well we can address the persistent supply problem.

The takeaway is clear: success in the coming years will depend on understanding local inventory dynamics and navigating a complex market. Those who stay informed and adaptable — with a professional at their side sharing the latest data — will be best positioned to make decisions based on facts.

Sandra J. Carroll is the chief executive officer of the Berkshire County Board of Realtors and the Berkshire County Multiple Listing Service.

Overhead, equipment, payroll, operating expenses ... there’s seemingly no end to the list of things that small-business owners need to finance just to keep their business running — let alone growing.

Fortunately, there are plenty of credit options available to address both short- and long-term needs, including some designed for those that don’t qualify for conventional loans.

Here’s a look at some of the options and why they may — or may not — work for you:

BUSINESS LINES OF CREDIT

Ideal for short-term financing, emergencies, or seasonal needs

Sometimes referred to as a working line of credit, a business line of credit provides flexible access to funds up to a predetermined limit. This option allows you to borrow only what you need and pay interest only on the amount used. It’s ideal for managing cash flow, covering unexpected expenses, or taking advantage of short-term opportunities.

Typically, line advances are used to fund timing differences between the outlay of cash for inventory purchases, invoiced services and subsequent

collection of receivables. Business lines of credit typically have lower interest rates compared to credit cards and can be secured or unsecured.

Ideal for large assets that could strain cash reserves

Whether you need to purchase, repair, replace, or upgrade the equipment and technology that keeps your business running, an equipment loan provides the means to fund the investment without tying up large sums of cash. Loan repayment is typically structured to correspond to the useful life of the purchased asset. Plus, these loans are secured by the equipment itself, which often results in lower interest rates and easier qualification compared to unsecured loans. Repayment terms are usually tied to the life expectancy of the equipment, typically three to 10 years. While longer the repayment term increases the amount of interest you pay overall, it also works to make payments more affordable each month.

VEHICLE

Ideal for purchasing, replacing or refinance business-related vehicles

From cargo vans and small cars to light-duty trucks and even dump trucks, dependable transportation is what keeps many businesses rolling. With terms typ-

ically ranging from three to seven years and even discounted APRs when using autopay, you can structure a vehicle loan that works for your current budgeting and future growth plans.

COMMERCIAL REAL ESTATE LOANS

Ideal for buying or building new property, renovating existing income-producing property or refinancing debt on a commercial property

Like a mortgage for personal real estate, which is secured by the home it covers, commercial real estate (CRE) loans are secured by a lien against the commercial property. Where they differ is in that term for CREs typically range from five years to 20 years, with the amortization period often longer than the term of the loan.

REAL ESTATE INVESTMENT LOANS

Ideal for buying property from which you can generate income

Real estate investment loans make it possible to purchase property you plan to generate income from by leasing it to one or more tenants who pay monthly rent.

Eligible non-owner-occupied property types include:

• Office buildings

• Mixed-used commercial buildings

• Multi-family homes, or larger apartment buildings

• Condominiums or townhomes

• Manufactured homes

SMALL BUSINESS ADMINISTRATION (SBA) LOANS

Ideal for a wide range of business purposes

The U.S. Small Business Administration offers several loan options ideal for small businesses. With options ranging from $500 to $5.5 million, SBA loans can be used as working capital or to pay for long-term fixed assets and operating capital. SBA loans often have competitive interest rates, flexible overhead requirements, longer repayment terms compared to conventional bank loans, and, in some cases, no collateral requirements.

If you’re evaluating credit options for your small business, you may find it helpful to consult with your lending institution to review:

• Your specific funding needs and timeline

• Your business’s qualifications (credit score, time in operation, revenues)

• Cost of capital (interest rates, fees and terms)

• How quickly you need the funds

• Impact on cash flow and ability to repay The right financing tools can fuel your small business’s growth while maintaining financial stability.

E. Smith

ADAMS

YHWH LLC sold property at 202 Columbia St., Adams, to David Baxter, $132,500.

James M. and James B. Shea sold property at 146A Bellevue Ave., Adams, to Nicholas Bushey and Megan and Christopher Dargie, $289,900.

James A. and Jeffrey P. Bua sold property at 7 Apremont St., Adams, to Amanda Lamberti, $200,000.

Jeffrey R. Mullen sold property at 1-3 Quality St., Adams, to PB Summer Street LLC, $220,000.

Michael J. and Mandy E. Bostwick sold property at 210 West Road, Adams, to Nolan and Katie Brassard, $440,000.

Thaddeus G. Gwozdz sold property at 82 East Road, Adams, to Francis D. and Francis G. Maguire, $275,000.

Melissa A. Dewey sold property at 35 Randall St., Adams, to Lisa Mendel and Peter Wagner, $175,000.

Bonnie L. Lennon sold property at 5 McKinley St., Adams, to Thomas Verni, $387,500.

Evgeny V. Plekhanov and Elisabeth S. Jones sold property at 86 Orchard St., Adams, to Adam Bush and Claudia E. Bresett, $387,500.

Michelle M. Alcombright sold property at 172 Columbia St., Adams, to Michael P. and Gail T. McKenna, $115,000.

ALFORD

Matthew C. Smith sold property at 64 Great Barrington Road, Alford, to Jessica Abbott, $200,000.

BECKET

Susan Schneider sold property at Sir Jeffrey Drive, Becket, to Michael Mazmanian $5,000.

Susan M. Schneider sold property at Excalibur Court, Becket, to Michael Mazmanian, $25,000.

Randolph K. and Cathleen A. Hildack sold property at 601 Otis Road, Becket, to Steve R. and Joann D. Graydon, $400,000.

Bonnie L. Downes sold property at 859 Moberg Road, Becket, to Fumi Realty Inc., $170,000.

Jeffrey A. and Consuelo F. Wilkinson sold property at Moberg Road, Becket, to Community LD LLC, $13,500.

Andre B. Ledoux sold property at Porcupine Courts, Becket, to Shane Haluch, $23,000.

Robert and Sharon Rainer sold property at Gentian Hollow, Becket, to Gregory Rawlings, $20,000.

Julia R. Bale sold property at 22 Laurel Lane, Becket, to Allen E. Bale, $77,150.

David J. Nadeau sold property at Sherwood Forest, Becket, to Dennis Manley, $3,500.

Angela N. Sedelow sold property at 2271 Jacobs Ladder Road, Becket, to Rory and Pamela M. Flynn, $305,000.

Alexander Jack sold property at 305 Brooker Hill Road, Becket, to Linda Curetty, $296,000.

Mark Boomsma sold property at Partridge Lane, Becket, to Salvador and Tamara A. Rivera, $24,000.

CHESHIRE

Caleb J. Robert sold property at 612 Notch Road, Cheshire, to Kim A. Visconti and Glenn A. Davis, $420,000.

Darius A. and Arica L. Griffin sold property at 87 Wells Road, Cheshire, to Christopher H. and Vanessa C.R. Hilchey, $385,963.

Catherine C. Record sold property at 527 North State Road, Cheshire, to Cameron Michael Lesure and Sierra Marie Dewkett, $257,000.

Melanie G. and Heather M. Herzig sold property at 121 Depot St., Cheshire, to John Stephen Whalley and Dawn Marie Gaynor-Whalley, $294,000.

Victor A. Lampiasi sold property at 520 Stafford Hill Road, Cheshire, to Stacy Ann and Timothy W. Kitchell Jr., $522,000.

ASRG LLC sold property at 287 South State Road, Cheshire, to Common Brands LLC, $560,000.

Jerry Smosky sold property at 781 East Road, Clarksburg, to Alexander J. Goldman and Elissa M. Roy, $435,000.

James E. and Judith M. Roberts sold property at 70 Brooks Heights, Clarksburg, to Tobe A. Cote, $355,000.

Kevin W. and Susan E. Garvey sold property at 114 Lincoln Drive, Clarksburg, to Lyndsey M. Degrenier, $430,000.

Lisa Gaudreau and Cynthia Ann and Jeffrey Martin sold property at 1355 River Road, Clarksburg, to Robert Snyder, $360,000.

Patricia Gero sold property at 9 Sunset Drive, Dalton, to Leydet Properties LLC, $92,500.

Mark and Virginia Messina sold property at 174 Depot St., Dalton, to Anthony Reinhold and Hailey Graham, $275,000.

John and Jessica Wilkinson sold property at 24 Third St., Dalton, to Karli Cassavant, $150,000. 58 Flansburg Ave. LLC sold property at 58 Flansburg Ave., Dalton, to Katherincq Ogando and Elizabeth Calderon, $300,000.

Timothy E. and Kathleen A. Tomasi sold property at 58 Frederick Drive, Dalton, to Thomas M. and Tammy Cooney, $549,000.

Denise B. and John W. Wood, trustees of Denise B. Wood Trust-2016, sold property at 24 Grange Hall Road, Dalton, to Albert G. Zander Jr. and Anna R. Schwartz, $625,000.

Jared B. Decoteau sold property at 159 Depot St., Dalton, to Brandon M. and Kate E. Lyon, $520,000.

Christian J. Flores sold property at 35 High St., Dalton, to John E. Scalzo Jr. and Pamela L. Scalzo, $165,000.

Susan E. Donnelly, Daniel R. Scace and Gail A. Wojtkowiak sold property at 48 Elaine Ave., Dalton, to Seven Sages LLC, $200,000.

EGREMONT

Claudia L. Laslie sold property at 0 Pumpkin Hollow Road, Egremont, and 0 Egremont Plain Road, Great Barrington, to George O. Klemp and Lynne Sebastian, $230,000.

17 Sheffield Road LLC sold property at 14 Pine Crest Cross Road, Egremont, to Nana Owusu-Sarpong and Emily M. Robertson, $2,200,000.

Keene Land Holdings LLC sold property at 17 Main St., Egremont and Great Barrington, to Buttonball Properties LLC, $1,350,000.

Millard’s End LLC sold property at 43 Millard Road, Egremont, to Michael A. Aronow and Ronni B. Aronow, $756,000.

FLORIDA

Becky A. Tovani sold property at 175 Mohawk Trail, Florida, to Jeremy Harrington, $35,000.

Timothy L. and Tracie M. Therrien sold property at 100 Central Shaft Road, Florida, to Corey O’Brien, $410,000.

GREAT BARRINGTON

Lenox Landings Barrington Brook Holdings LLC sold property at Thrushwood Lane, Great Barrington, to Michael J. Brooks, $325,000.

Noel Arce and Teresa Arce sold property at 357 State Road, Great Barrington, to Hudson Keith Brown, $276,000.

Janice Shields sold property at 53 Division St., Great Barrington, to Jedidiah P. Shields, $49,409.32.

Michael J. Ball sold property at 12 Cooper Road, Great Barrington, to William D. Waite & Donna J. Leep, $425,000.

Estate of Constance E. Friedrich sold property at 4 Pleasant View Drive, Great Barrington, to Robert F. Adam and Signe Adam, $846,000.

Estate of Harry A. Hoy III, Susan Hoy-Daugherty, Michelle Hoy-Midkiff, Daniel Hoy, David Hoy, Peter Hoy, Claire Hoy-Reiner, and Paul Hoy sold property at 214 South St., Great Barrington, to

Lise LaPrelle, $350,000.

Kevin Hinkamper and Andrea Hinkamper sold property at 222 Pleasant St., Great Barrington, to Julie Kunz, $295,000.

Martin J. Pildis and Ellen W. Pildis sold property at 399 State Road, Great Barrington, to Michael A. McHale and Cynthia L. McHale, $802,000.

310 Great Barrington LLC sold property at 34 Bridge St., Unit 310, Great Barrington, to Amy S. Harrison and Neal R. Harrison, $875,000.

Franciscus T. Vanderwerf sold property at 155 Division St., Great Barrington, to Harrison L. Levenstein and Clara C. Stickney, $317,000.

Natalia Castro sold property at 91 Brush Hill Road, Great Barrington, to Willo LLC, $967,500.

Tammy and Samuel Winters sold property at 2774 Hancock Road, Hancock, to Darlene Church and Michael Luczynski, trustees of the Michael Luczynski & Darlene Church Revocable Joint Trust, $462,000.

Nathaniel E. and Elizabeth A. Hoogs sold property at 37 Corey Road, Hancock, to Kenneth N. Levesque, trustee of the Kenneth N. Levesque Trust, and Tracy A. Levesque, trustee of the Tracy A. Levesque Trust, $125,000.

Michelle McManus, trustee of the Timothy McManus 2012 FT, sold property at Corey Road, Unit 853, Hancock, to Dominic J. Nardi, $720,000.

Joy M. Licht sold property at 170 Pine Cone Lane, Hinsdale, to Charles J. and Suzanne L. Newman, $555,500.

Charles J. and Suzanne L. Newman sold property at 160 Pine Cone Lane, Hinsdale, to James R. and Louise E. Rose, $495,000.

Peter W. Samsel sold property at 500 Michaels Road, Hinsdale, to Adam and Melanie Baptiste, $438,000.

Catherine A. Spinney, trustee, Spinney Family RVT, sold property at 165 Pine Cone Lane, Hinsdale, to Usama Nadeem and Nadeem Asif, $482,575.

Michelle A. Pyser sold property at 281 Forest Hill Drive, Hinsdale, to Kerry Raheb, $850,000.