IMPACT INVESTING 101

This deck is designed to be used in a variety of ways. You can use it for your own personal knowledge and understanding of impact investing. You can use it in it’s existing format as a ready-made presentation to give to your community (see the script in the notes section!), or you can download and edit it to best suit your needs. In sum, it’s an open source educational tool to help provide a foundational understanding of the exciting topic of impact investing!

Ready to dive in?

Impact investing refers to investments made with the explicit intention to generate positive, measurable social and environmental impact alongside a financial return.

Traditional investing prioritizes the financial return on investment (ROI) of investments, whereas impact investing includes the explicit intention of social and environmental impact, in addition to financial return.

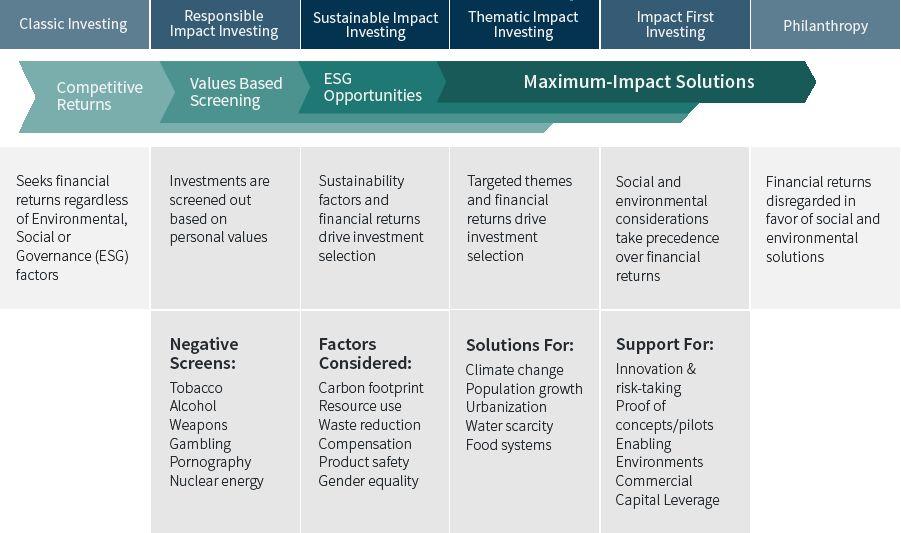

Source: PymwymicImpact investments intentionally contribute to social and environmental solutions. This differentiates them from other strategies such as ESG investing, Responsible Investing, and screening strategies.

A hallmark of impact investing is the commitment of the investor to measure and report the social and environmental performance of underlying investments.

Impact Investors use the best quantitative or qualitative impact data and evidence available to increase their contribution to positive impact.

Investors commit to using shared conventions, approaches and standards for describing impact goals, strategies and performance.

Source: The GIINImpact Investing exists on a spectrum between investing that is returns-focused (traditional investing) and purely impact-focused (philanthropy). Depending on the investor’s goals, different approaches and tools are employed to prioritize impact, ROI, or a balance of both.

Watch (10 mins)

● What were your key takeaways from this video? What did you learn?

● Did anything surprise you in the video?

● What questions did this video bring up for you about impact investing?

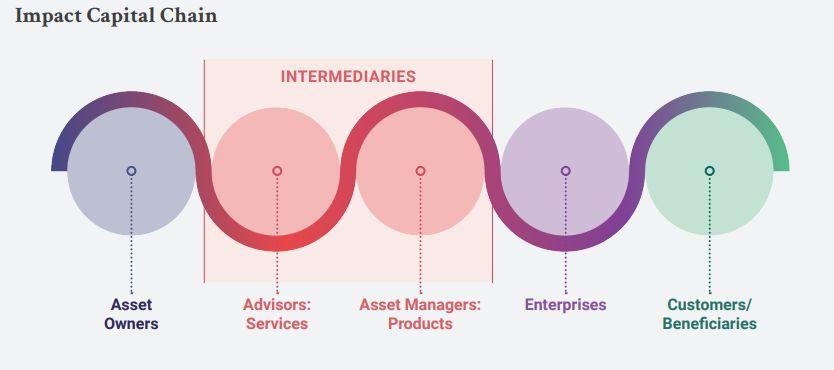

The Impact Capital Chain is an overview of all of the key people and entities that make up an impact investment.

Source: Rockefeller Philanthropy Advisors, Godeke & Briaud

Often referred to as limited partners or “LPs,” Asset Owners are the institutions or people - pension plans, insurance companies, official institutions, banks, foundations, endowments, family offices or individual investors - who own the actual assets. Asset Owners make the ultimate allocation decisions along the impact capital chain.

Advisors are licensed financial professionals who provide services to asset owners on how to deploy their assets in exchange for fees—and may or may not offer their own investment products. Investment advisors often work with asset owners to select asset managers.

Source: Rockefeller Philanthropy Advisors, Godeke & Briaud

Asset Managers are the universe of financial professionals who manage money, securities, and other forms of assets on behalf of the asset owner. Their goal is to oversee the management and growth of the value of assets under their management.

Capital is ultimately put to use by the entities that generate the impact and financial return.

These enterprises can take on a range of corporate forms, including nonprofits, for profits, and hybrid structures (such as benefit corporations).

Source: Rockefeller Philanthropy Advisors, Godeke & Briaud

Finally, the enterprise creates a positive or negative change for the customers and beneficiaries. Ideally, representatives of this group are invited into the asset owner’s strategic decisions and impact evaluation.

The Impact Market System outlines the value-add across the capital chain.

Source: Rockefeller Philanthropy Advisors, Godeke & Briaud

Source: Rockefeller Philanthropy Advisors, Godeke & Briaud

Impact Investing is not an asset class. Impact Investing is an investment strategy that can be applied across asset classes.

In general, financial returns for impact investing are competitive with traditional investments.

● According to the Global Impact Investing Network, (The GIIN,) more than 88% of impact investors reported that their investments met or exceeded their expectations.

● Studies show that the median impact fund realized a 6.4% return, compared to 7.4% from non-impact funds.

Impact investing can be done on an individual level with personal 401k plans, and individuals who have their own investments in stocks and bonds!

To help balance out risk, a diversified portfolio should include a mix of asset classes.

Asset classes are groupings of investments that have similar characteristics. There’s no standard list of asset classes, but it’s widely accepted that there are four main types of asset classes, ranked from low to high risk:

- Cash and cash equivalents

- Fixed income (or bonds)

- Equities (or stocks)

- Real assets / Alternatives (real estate, commodities, infrastructure)

Watch this 17-minute video explaining the main types of asset classes.

● How well do you feel like you understand what asset classes are, and the different types of asset classes? Clarify any doubts with the group.

● Now that you have a better sense of each asset class, why do you think it’s important to have a diversified portfolio across many asset classes?

SDGs are a useful framework to contextualize, communicate, and align impact objectives amongst a broad group of stakeholders, including governments, development finance institutions (DFIs), investors, and nonprofits.

“The SDGs emphasize the importance of collaboration and alignment amongst a diverse group of stakeholders; this is consistent with our approach to solving social and environmental problems across our investment strategies.” -

This report from The Global Impact Investing Network

profiles leading companies who are using the SDGs for their impact investments.

In these profiles, experienced investors explain how aligning to the SDGs is helping them develop impact strategies and goals, communicate with stakeholders, and attract new capital. Discussion Questions:

● How do you see the investors using the SDGs for their benefit?

● What stood out to you about the example cases in the report?

● Ms. Mutooni talks about the need for “consistency and validation of data in order to bring the rigor of traditional investing into impact investing.” Why do you think she’s recommending consistency and data validation? What barriers do you see arising in this space?

● Impact measurement and management includes identifying and considering the positive and negative effects one’s business actions have on people and the planet in order to mitigate negative impacts and maximize positive ones.

● IMM is an iterative process by nature and is constantly evolving. There is no one right way to measure impact!

● Various strategies exist to measure impact and will depend largely on the set objectives of the project or investment. Source: The GIIN

Image Source: HBS Online

Image Source: HBS Online

From the perspective of a charitable trust or foundation, there are three main approaches to impact measurement:

This is where the impact measurement and monitoring is done by the investee and foundation itself.

Individual investors may elect to have a fund manager invest on their behalf. The fund managers will often conduct impact assessments as they see appropriate to the investment, and report to the investors.

Another alternative is to leverage services offered by third party intermediaries that can help social enterprises and investors conduct impact measurement. Typically, these intermediaries will have their own proprietary approach to measuring impact. A one-off fee or subscription may be required to access these services.

Source: Impact Investing Hub

From the perspective of a charitable trust or foundation, there are three main approaches to impact measurement:

‘Theories, models and frameworks’ refer to higher level types of tools that can be leveraged to frame and assess overall project or business success. These are often umbrella tools that set up an overarching impact measurement framework, and to which other metric-based tools can then be integrated.

‘Metrics and ratings’ refer to tools and techniques that can be used to measure and track impact performance. Typically, these metrics and ratings are measurable and quantifiable, and can be tailored to fit specific sector needs. Metrics and ratings are often the underlying building blocks for more advanced theories, models and frameworks.

‘Third party assessment’ refers to services offered by third parties that can help social enterprises, intermediaries and investors conduct impact measurement. Unlike other impact measurement tools that are freely available, these services can only be accessed through the third parties and cannot be self-conducted by stakeholders.

Source: Impact Investing Hub

● Why do you think there is a growing demand for impact measurement in the impact space?

● What benefits do you see with impact measurement as a “two-sided tool” as referenced in the video?

● What questions does this raise for you about impact measurement?

Marketing Toolkit (Coming February 1st!) Use this Guide to promote your members to sign up for the 2023 Sustainable Cities Impact Investing Challenge.

Engagement Results Form Submit this form to report on your engagement results to Net Impact for 100 Gold Status points! All chapters who submit will be entered into a raffle

I. Better Money Better World: Host talks with the top impact investors driving market-leading returns while bending the arc of human history toward sustainability and justice.

II. Money and Meaning: Highlights the stories of innovators in our community who are leveraging the power of capital markets to create a more just and sustainable economy. Expands the conversation around impact investing and explores strategies to finance & support social change.

III. Impact Alpha: Investment news and commentary focused on sustainability.

IV. Dollars and Change: Wharton Social Impact Initiative talks with leading industry experts who are changing the world through social enterprises, impact investing, corporate social responsibility programs, social impact research, and more.

V. ESG Insider: A podcast from S&P Global that takes you inside the environmental, social & governance issues shaping the business world today.

I. Intentional Endowments Network: Weekly updates on recent developments in higher education, sustainability, ESG and responsible investing fields.

II. Bloomberg Green: A daily digest of climate news and insights on the latest in science, environmental impacts, zero-emission tech and green finance.

III. Impact Alpha: Award-winning impact investing news, delivered straight to your inbox.

IV. SOCAP Global: SOCAP Global is the thought leadership platform for the accelerating movement towards a more just and sustainable economy.

Impact Investing Career Profile Explore informational videos featuring

impact investment professionals, a career guide, and infographics.