YOUR GUIDE TO BUYING A HOME

In this meeting we discuss location, your home wish list, and start a search online

Make an Offer

Work with your Realtor to determine a competitive offer package, and submit to the sellers

Your lender will require a professional appraisers opinon of what the home is worth

Close of Escrow

You bought a house! Time to sign all the papers at the title company and get your keys

The first step is figuring out how much home you can afford If you're a cash buyer this won't apply

It's time to check out homes in person! Your agent will schedule an appointment so you can check out the property and neighborhood.

This is when we get a thorough inspection of the home and request repairs.

Once the loan gets final approval, and your complete your final walkthrough we're ready to close

It doesn’t matter if the kitchen is fabulous or the backyard is big—if you can’t pay the mortgage each month, your home will become a burden.

To end up with a home that’s a blessing to you & your family you want to start by calculating what is realistic for you. We recommend using a monthly budget spreadsheet to get an accurate view of your finances. You can use that and a mortgage calculator to see what your monthly payments, down payment, and amortization will look like.

If you ' re putting down less than 20% on a home you'll pay Private mortgage insurance (PMI). It's extra insurance coverage you have to buy if you take out an FHA loan or if you put a down payment less than 20% of your home’s value. The policy protects lenders or investors from losses due to the default of a mortgage loan.

Mortgage = Table top with four supports (legs): Credit, income, assets, and property

Credit - FICO scores, credit worthiness, monthly obligations

Income - Calculation of acceptable income for underwriting guidelines

Assets - Funds for Down payment, transactional costs, and perhaps rainy day / reserves, if applicable.

Property - Contract, Title and Escrow work, Inspections. Appraisal.

Evaluation of Credit (via the lender pulled Credit report)

Review of Supporting Documentation (provided by borrower/s): ID

Driver’s license or U.S. passport Income

Documentation for the most recent 2 years

Actual documents required dependent upon by type of income. Assets

Bank statements proving you have enough money to cover the down payment and closing costs

We will provide a gift letter for the donor to complete and provide acceptable proof of capacity to gift. (if applicable)

Additional assets "Reserves" my be required for the loan program to demonstrate the ability to "weather a rainy day". These could be Latest quarterly statements for 401(k), IRA, stock accounts and mutual funds

Determination

3% minimum down payment

Maximum loan amount $726,200

Minimum credit score 620 interest rate impacted by credit score

Mortgage insurance if less than 20% down payment options on how to structure the payment to include; monthly, single premium, and split premium

Mortgage insurance premium determined by FICO, Debt to income ratio, and the number of borrowers on the mortgage.

3.5% minimum down payment

Maximum loan amount $530,150 (may vary by county)

Minimum credit score 500 with 10% down, 580 with min 3.5% down.

interest rate not as impacted by credit score compared to Conventional mortgages

Monthly mortgage insurance (PMI)

Upfront mortgage insurance added to loan balance 1.75% of loan balance (i.e. $200K loan, $3500 UFMIP)

VA

100% financing, $0 down payment, no mortgage insurance

Loan amount up to 2MM this will depend on entitlement available to borrower

Minimum credit score 500 for loans under $726,201.

interest rate not as impacted by credit score compared to Conventional mortgages

VA funding fee added to loan balance

First time use is 2 3% of loan balance if putting down less than 5%.

Waived if Veteran has disability

Search Criteria: These often change as you look, so update your realtor as you get a better idea of what you want.

Location

Home features:

Price

MLS vs Zillow

Aways consider resale value

How long do you plan to live here? What is the school district like?

Condos and townhouse typically go down in value before single family homes.

Do you want to to sell eventually, or rent out the space?

Soon you'll be checking out homes in person, it might be just of few, or dozens! As a first time home buyer you might be wondering what to look for when you ' re looking at home in person. Of course you'll be checking for things on your wishlist like number of bedrooms, how the neighborhood feels, layout of the home, etc. Some other things you should check out might not be as obvious at first, so here's a list of a few other things to consider. Your inspection will be more in depth and can lead to better understanding of any of these issues

Signs of water damage or smell

Storage Space

Which way the house faces

This can have impacts on cooling costs, gardening, and lighting.

Room size

Roof and AC age

These can be two of your biggest expenses as a homeowner.

Soundproofing

Safety of the neighborhood

Check out the surrounding area

Closest grocery store, restaurants, schools, crime rates, traffic noise, air traffic, etc.

The next step is to make an offer, and there are a few things to decide before you submit to the sellers:

1. List price and down payment

We'll consider recent sales in the area, condition of the home, market conditions, and other offers we ' re aware of. Each offer is different and at the end of the day the most important question is what you can afford, and what the home is worth to you.

2 Closing date

The most typical closing timeline is 30 days, but based on buyer and sellers preference, and loan type it can be longer or shorter.

3. Escalation clause

This is an optional addendum we use in particularly competitive markets It allows you to escalate your offer by a specified amount if the seller receives a competing offer. The addendum includes a cap that you ' re not willing to go above.

4 Appraisal Shortfall

This is an optional addendum we use in particularly competitive markets. It is a guarantee to the seller that you will cover a shortfall up to an amount of your choosing.

5. Personal property included (washer, dryer, fridge)

Property fixtures are included in the sale according to section 1g of the purchase contract. Washers, dryers, and refrigerators and other personal property you ' re interested in.

6. Home warranty

We will usually request that the sellers provide a home warranty chosen by the buyer.

7. Acceptance deadline

Generally 24 hours but in competitive markets in can take longer

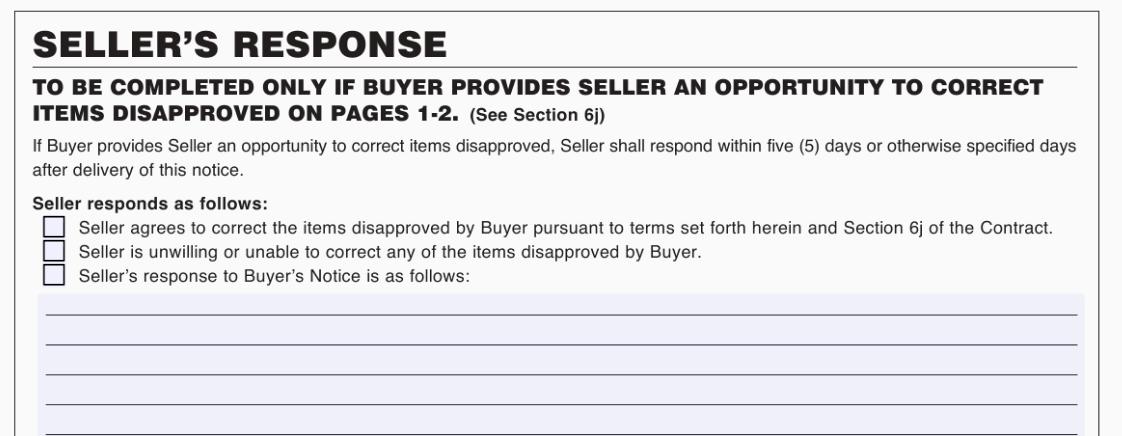

Seller's Response: Acceptance, Rejection, or Counter Offer

Once you have an accepted contract you'll begin interacting with an escrow officer through a mutually agreed upon title company.The title company is a third party that works on behalf of both the lender and the buyer. You hire them to research and insure the title of the home you ’ re buying.

Escrow: In real estate, escrow is typically used for two reasons:

To protect the buyer’s good faith deposit so the money goes to the right party according to the conditions of the sale.

To hold a homeowner’s funds for property taxes and homeowners insurance.

Because of the different purposes served, there are two types of escrow accounts. One is used during the home buying process, while the other is used throughout the life of your loan

Title Company: Title companies are adept at finding any issues that might keep a home from legally being sold. These problems include:

Unpaid fees for work performed

Undisclosed owners or heirs with claims to the property

Special assessments on the property

Outstanding loans on the home

Earnest Money Deposit: Typically, you pay earnest money to an escrow account or trust under a third-party like a legal firm, real estate broker or title company Acceptable payment methods include personal check, certified check and wire transfer. The funds remain in the trust or escrow account until closing. That's when they get applied to the buyer's down payment or closing costs.

BEWARE: WIRE FRAUD IS ON THE RISE.

Accepting wire and disbursement instructions by email is dangerous, especially changes to those instructions.Verify by calling the originator of the email using previously known contact information prior to sending funds

Beginning at contract acceptance and ending at the end of the 10th day. During this time period the Buyer will have the opportunity to conduct any and all necessary inspections described in the AAR Residential Purchase Contract. This time period can be the most critical time, considering that the Buyer’s may have the option to cancel anytime during this period.

SPDS: Seller Property Disclosure Statement

This AAR form must be completed by the Seller and delivered to the Buyer within the first (3) days after Contract Acceptance.

Seller shall deliver to Buyer a (5) year Insurance claims history report regarding Premises (or for the length of time that the Seller has owned premises), within the first (5) days after Contract Acceptance.

Inspections:

Inspections are initiated, and paid for by the Buyer at the time of inspection. Your initial inspection will be general in scope, and you can pursue further in depth inspections ie: Roof, plumbing, electrical, Pool, etc. Termite Inspection: can be performed by the certified Home Inspector or by an Independent Termite Inspector. Not all Home Inspectors will inspect for termites.

After the Buyer has performed all desired inspections they will submit a Buyer’s Inspection Notice to the Seller (on or before day 10) with a possible selection of the following:

a. Premises Accepted. (No Sellers Response required)

b. Premises Rejected. (Cancellation of Contract shall occur, and return of earnest money)

c Buyer elects to provide Seller an opportunity to perform repairs. These repairs could be minor or major depending on the inspector’s findings.

Upon receiving this Buyer’s Inspection Notice, the Seller’s will have a total of (5) day to respond to any requested repairs that may have been requested. At this time the Seller may respond with: a. No, will not perform any of the requested repairs b Yes, will perform all requested repairs

c. Yes, will perform only selected repairs that they feel are reasonable or acceptable.

Buyers Notice

Sellers response

It’s very easy for you, the Buyer, to cancel a contract during the inspection period and receive a full refund of your earnest money. If you find anything you don’t like about the house – its condition, the neighborhood, the roads, the schools or just about anything related to the house and the surrounding area – you can cancel during the inspection period and get your earnest money back. The inspection period is by far the most likely time a contract will be canceled or as they say, “fall out of escrow. ”

Simply put, an appraisal is an opinion of the value of the property you want to purchase. Lenders generally require it if you are using your home as collateral for the loan. Lenders want to ensure that the property is worth as least as much as the full purchase price.

Who does the appraisal?

An independent third party carries out appraisals. This person can have no financial stake in the outcome of the appraisal Mortgage companies usually hire an Appraisal Management Company which in turn hires a licensed local appraiser who is on their roster. The buyer pays for the appraisal as part of the home loan process, a typical appraisal costs $400-$600.

What factors into a home appraisal?

Appraisals are usually very detailed, but most include the following

Market Conditions

Comparing the property to 3 other properties in the area that have recently sold.

Any detrimental aspects of the property be it condition, proximity to major street, property damage, etc

Where the home is located, what type of area it's in, and how that affects the value.

Size of home, year built, and property details ie: pool, garage, number of stories, etc.

If a home appraises for less than contract price, most parties have three options:

1.Lower the sale price to the appraised value

2.The buyer comes out of pocket for the difference.

3 Some combination of buyer and seller concession

4.The sale is canceled, buyer gets their earnest money back.

4

After the appraisal we'll just be waiting on the final loan approval before we can close. There's not much you can do at this point, except listen to your mortgage officer when they tell you not to make any major purchases before we officially close. You don't want to lose this house over a poorly timed car purchase, shopping spree, or a silly account transfer.

A day or two before the scheduled closing you'll do a final walkthrough of the property. This is also a good time to make sure you ' ve set up all utilities for day of close. The purpose of this walkthrough is to make sure that the home is in the same condition it was when you agreed to buy it, and all agreed upon repairs have been completed. Here's a checklist of what to look for.

Requested repairs have been made.

No major, unexpected changes have been made to the property since last viewed (damage to the property).

All items included in the sale price draperies, lighting fixtures, etc.—are still on site.

All appliances are operating (dishwasher, washer/dryer, oven, etc.).

Hot water heater is working

Heating and air conditioning systems are working. No plants or shrubs have been removed from the yard.

Garage door opener, codes, keys, and other remotes are available.

Instruction books and warranties on appliances and fixtures are available.

Intercom, doorbell, and alarm are operational.

Screens are in place or stored onsite.

All personal items of the sellers have been removed. Copies of repair receipts and warranties are in hand.

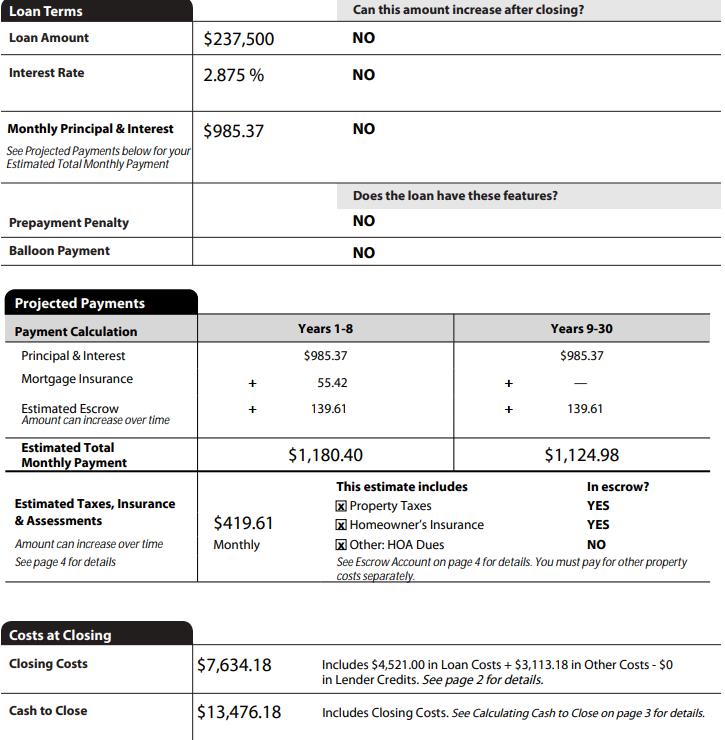

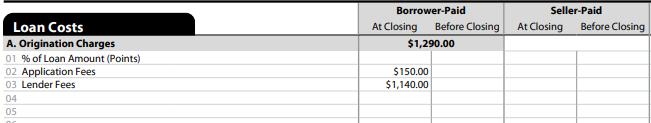

Closing costs are the fees your lender and title company charge when you finalize buying your home; these costs usually include your down payment, taxes, insurance premium, appraisal fee, and so forth. Be mindful that you’ll need to pay some of these fees before the actual closing day (earnest money, home inspection). On average, you’ll pay 1–2% of the purchase price of your home in closing fees. For example, if your home costs $300,000, you might pay between $3,000 and $6,000 in closing costs.

About 5 days before closing, your lender will send you a Closing Disclosure. This includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage.

IT'S TIME TO SIGN, PAY, AND GET YOUR KEYS!

Before you can get your keys you'll need to head to the escrow company for a signing party. Here’s what to expect: You’ll pay any remaining closing costs, as listed in your Settlement Statement. (bring your license and a certified check, unless you ' re wiring the money)

The seller will sign documents to transfer property ownership What you will sign:

Settlement statement that lists all costs related to the home sale

Mortgage note stating your promise to repay the loan. Mortgage or deed of trust securing the mortgage note. The title company will register the new deed in your name. It's all relatively simple, but be prepared for lots of paperwork!

Multiple Listing Service (MLS): A list of local and regional properties for sale compiled by real estate agents and brokers When you work with a Real Estate agent, you get access to this list which gives you access to available homes sooner than public websites (like Zillow)

Active: The property is available for sale.

Under Contract-backups: There is an accepted offer, but the deal could still fall through, so the property is available for showings and backup offers.

Contract Contingent-Buyer Sale: There is an accepted offer, but the offer is contingent upon the buyer selling their home within a specified time

Pending: The property is being sold, but the sellers have signed a contract with a buyer. The home sale is not final, so it could become available again.

Appraised Value: A professional appraiser’s unbiased estimate of a home’s fair market value

Assessed Value: The estimated value determined by a local or state government for property tax purposes. Once a value is assigned, a property tax rate will be assigned to the home that will be the tax rate you pay for as long as you own the home.

Annual Percentage Rate (APR): A method of calculating the cost of a mortgage, stated as a yearly rate that include items like interest, mortgage insurance, and certain points or credit costs. This is not the interest rate, and not what the payment is calculated from, it helps buyers compare lenders.

Amortization: the repayment of a loan over a period of time An amortization schedule shows how much of the payment goes towards the principal and how much goes towards paying off interest.

Adjustable-rate mortgage (ARM): type of mortgage that has a variable rate, not fixed. There is an initial starting interest rate, that may be fixed for a certain period of time, and then can change on a monthly or yearly basis.

8

Closing Disclosure (CD): A form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).

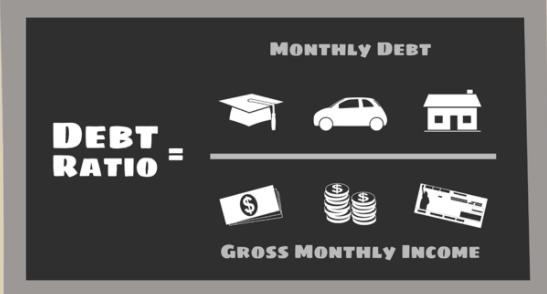

Debt-to-Income (DTI): The ratio between your monthly liabilities & proposed payment divided by your gross monthly income. Typically for conventional loans, this needs to be below 45%.

Debt to income = monthly debt payments /monthly gross income

Equity: the home’s value minus how much is owed. For instance, if your house is worth $400,000 and you owe $270,000, your equity is $130,000.

After selling, you would get the equity after you paid off the mortgage.

FHA loan: a government mortgage that is insured by the Federal Housing Administration; typically offers a lower down payment and flexibility with lending guidelines.

Fixed-rate mortgage: type of mortgage that has a set rate for the entire term of the loan. Terms usually range from 15, 20,25 or 30 years, however a 30 year term is most common.

Jumbo Mortgage: Loan amounts over $548,250; these programs typically have additional qualifying criteria.

Loan to Value (LTV): Your current loan amount divided by the value of your home

Loan to Value Ratio = Mortgage Amount / Appraised Value of Property

Loan Estimate (LE): A form that provides important information, including the estimated interest rate, monthly payment, and total closing costs for the loan. The LE also gives you information about the estimated costs of taxes and insurance, and how the interest rate and payments may change in the future.

Discount points or "Points": a fee paid by the borrower to obtain a lower interest rate. One point is equal to 1% of the loan amount. Paying points results in a lower monthly payment, but higher overall closing fees.

9

Private mortgage insurance (PMI): Insurance that protects mortgage lenders against default on loans by providing a way for mortgage companies to recoup the costs of foreclosure. PMI is usually required if the down payment is less than 20 percent of the sale price. Home buyers pay for the coverage in monthly installments. PMI is usually terminated when the home buyer has built up 20 percent equity in the property depending on loan type.

PITI: An acronym that stands for Principal, Interest, Taxes, and Insurance. These are the elements of a monthly mortgage payment

Preapproved vs. prequalified: preapproved means the lender has reviewed the buyers qualifications and supporting documents and has been approved through an automated underwriting system. If you are looking to buy a house, including a preapproval letter shows that you ’ re a serious buyer Prequalified means that a lender has given an opinion on the buyer’s ability to be approved for a loan, like getting a quote on how much money a lender might give to the buyer.

Truth-in-Lending (TIL): Provides you with your actual APR along with the total amount of interest rate paid over the life of the loan and total of all payments.

Comparative market analysis (CMA): used to find a good price for clients who are selling or buying a house. The price is based on recent sales of similar houses in the area. Less formal version of an appraisal.

Deed: Legal document that transfers ownership of real property to the buyer To make it official, the seller and buyer must sign it and file it with the local county.

Down payment: Amount of cash paid when a buyer purchases a home (shown as a percentage of the total home price). The rest of the house cost is paid through monthly mortgage payments.

Earnest money deposit: A deposit a buyer makes on a home they want to purchase. Shows a seller that the buyer is serious about buying the home. Held in an escrow account and contributes to closing costs.

Escalation clause: Clause in the contract that states that the buyer is willing to increase their offer amount if the seller receives higher offers. This is a way for serious buyers to ensure that they get the house they want if there is a lot of competition.

Escrow: The use of a third party to hold anything that is of value in a real estate transaction. The escrow account is managed by an agent that keeps money and important documents until the home buyer and seller complete the deal.

Appraisal: An objective estimate of a home’s value based on the price of similar homes in the area that have been recently sold. The lender will have a licensed appraiser determine the value of the property, so that the buyer is protected from sellers who may set unreasonable prices.

Closing costs: Fees and expenses that come with transfer of ownership. The buyer has closing costs that include the home inspection fee, loan processing fees, appraisal fee, taxes and insurance. The seller has closing costs like agent commissions, transfer tax, and an attorney fee.

Contingencies: Conditions that must be met for a real estate contract to be legally binding. If these conditions are not met, the buyer or seller can back out of the contract Common contingencies include home inspection, appraisal, and the ability to get financing.

Home Inspection Homeowner’s insurance: Type of property insurance that can cover the costs to repair, rebuild, or replace items in the home.

Homeowner’s insurance policy normally covers a lot of different things, but it does not cover damage done by floods, earthquakes, and maintenance issues.

Title insurance: Form of insurance that protects lenders and homebuyers from financial loss if there are defects in a title to a property For instance, if there are competing claims of legal ownership, incorrect signatures, or flawed records, these would be covered by title insurance.

wwwNelsonGroupSWcom

(602)806-9672

We look forward to walking you through the process of buying a home. Please feel free to reach out with any questions, we ’ re always happy to help!

Jen Nelson | Brittany Sauncy | Cora Orso

Cynthia Shobe | Teresa Capista | Katie Bloxom | Christina Paul

The Nelson Group, Realty Executives