Thepurposeofthisguideistoprovideyouwith informationonthebenefitsNEISDofferssothat youasanemployeecanmakethebestbenefit choicesforyouandyourfamily’sneeds.

Thisguideprovidesgeneraldescriptionsofthe benefitsNEISDoffersandisnotintendedto provideallofthedetailsforthesebenefits.

Formoredetailedinformationpleasevisitour website:wwwneisdnet/Benefits

Theofficialplandocumentswillprevailifany inconsistenciesarefoundbetweentheNEISD BenefitGuideandtheofficialplandocuments Youshouldbeawarethatanyandallelements ofNEISD’sbenefitsprogrammaybemodifiedin thefuture,atanytime,tomeetInternalRevenue Servicerules,orotherwiseasdecidedbyNorth EastISD.

Contactusforanyquestions,concerns,comments, orsuggestions

Phone:210-407-0187

Fax:210-804-7014

Email:eb@neisd.net

EmployeeBenefitsContacts&FAQs NEISDBenefitFormsLibrary

MondaythroughFriday8:00amto4:45pm. Closedonschoolholidays.

Hourssubjecttochangeduringthesummermonths Visitwwwneisdnet/benefitsforhours

NorthEastISD 8961TesoroDr,Suite209

Asanewhire,youhavethefirst31-daysofemploymenttoenrollinbenefits.Your coveragewillbeginthefirstdayofthemonthfollowingyourhiredate. Oncethe electedplanhasbecomeeffective,changescannotbemade.Ifyoumissyournew hireenrollmentopportunity,youmustwaituntilthefollowingDistrict-wideOpen Enrollmenttoenroll.TheeffectivedatewouldbeJanuary1stofthefollowingyear. Newhirepremiumswillbedeductedinthesamemonththatcoverageisineffect. BenefitscannotbededucteduntiltheyhavebeenelectedinEmployeeCenter.Any past-duepremiums,owedfromdeductionsonmissedpaycheck(s),willbe deductedonthenextavailablepayrollcheck.

Ifyour31stdayfallsonaweekend,holidayor extendedbreak,yourformsmustbereceivedin theEmployeeBenefitsofficeonorbeforethelast workingdaypriortoyour31stday.Requestsfor changestoyourbenefitsthatwerereceivedafter your31-daydeadlinehaspassedcannotbe processed

Ifyouexperiencealifeeventthataffectsyourbenefitneeds,pleasecontactyourEmployeeBenefitsTechnician immediately Examplesofqualifyinglifeeventsare:

Birth/Adoption

Death

Marriage/Divorce

Dependentlossofeligibility(lossofjob,FTtoPT,employereliminatesbenefits,laidoff,etc)

Dependentgainedeligibility(newemployee,PTtoFT,newemployerbenefits,etc.)

DependentOpenEnrollment(Employer,Medicare,orMarketplace)

GainorlossofEligibilityforMedicareorMedicaid

HIPPA(HealthInsurancePortabilityandAccountabilityAct)allowsforaspecialenrollmentof31-daysduetothe abovementionedqualifyingevents.Ifyouexperienceaqualifyingevent,yourwrittenrequesttoenrollorchange yourbenefits,mustbereceivedintheEmployeeBenefitsofficewithin31-daysfrom,andincluding,thequalifying eventdate.Supportingdocumentation,confirmingthequalifyingevent,isrequiredtoprocessachangetoyour benefits.Theeffectivedateforyourbenefitswillbethe1stdayofthemonthfollowingyourqualifyingevent,with theexceptionofbirth.Theeffectivedateforbirthofachildwillbethedateofbirth.

OpenEnrollmentisheldinOctobereveryyear.Employeesareprovidedthis opportunitytoaddanewbenefit,stopabenefit,orchangeabenefit,aswellas, addordropeligibledependentsfromtheirbenefits Intheweeksleadingupto OpenEnrollment,moreinformationwillbee-mailedtoyouinyourNEISDemail regardingthisevent

Part-timeemployeesworkingatleast20hoursperweek

Full-timeemployeesworkingatleast32hoursperweek

Thissectionisprovidedtohelpyoudeterminehowyour premiumswillbedeductedforvariousbenefits,andwhen benefitsmaybecomeeffective Forallcategoriesof employees,therewillbeexceptionstotheinformation outlinedbelow.Ifyouhavespecificquestions,pleasecontact theRiskManagement/EmployeeBenefitsOfficeat210-4070187

Employees who are paid on a monthly basis, such as Administrators, Teachers, Counselors, Nurses, Librarians, etc., have benefits deducted based on an annual premium. The standard deduction rate for each paycheck is based on the annual premium divided by 12 paychecks.

Employees who are hired as Administrative & Instructional Support Staff, such as Secretaries, Bookkeepers, Specialists, Clerks, Teacher Assistants, Bilingual Assistants, Lunchroom Assistants, etc., have benefits deducted based on an annual premium. The standard deduction rate for each paycheck is based on the annual premium divided by 26 paychecks.

ALLBENEFITSAREDEDUCTEDIN THECURRENTMONTHOF COVERAGE.

Newhiresaredeductedforbenefits theyelectinthemonththat coverageisineffect.Benefits cannotbededucteduntiltheyhave beenelectedinEmployeeCenter. Anypastdueamountswillbe deductedonthefirstavailable payrollcheck.

Auxiliary (hourly) employees who are hired as Custodians, Police Officers, Computer or Copier Technicians, Print Shop, or Maintenance who work on a year- round basis have benefits deducted based on an annual premium.

The standard deduction rate for each paycheck is based on the annual premium divided by 26 paychecks.

Auxiliary (hourly) employees who are hired as Bus Drivers, Bus Assistants, Food Service Workers, and K.I.N. who work during the school year have benefits deducted based on an annual premium. The standard deduction rate for each paycheck is based on the annual premium divided by 20 paychecks.

MEDICAL, DENTAL, VISION, FLEXIBLE SPENDING ACCOUNTS, AND CANCER PLANS

As a new hire, you have the first 31-days of employment to enroll in benefits. Your coverage will begin the first day of the month following your hire date. Once the elected plan has become effective, changes cannot be made. If you miss your New Hire deadline, your next natural opportunity to enroll in benefits will be in October during the annual Open Enrollment The effective date for Open Enrollment elections would be January 1st

DISABILITY INCOME PROTECTION

As a new hire, you have the first 31-days of employment to enroll in benefits. Your coverage will begin the first day of the month following your hire date. Employees must be actively at work for coverage to begin. If you miss your New Hire deadline, your next natural opportunity to enroll in benefits will be in October during the annual Open Enrollment.

As a new hire, you have the first 31-days of employment to enroll in benefits Your coverage will begin the first day of the month following your hire date Employees must be actively at work for coverage to begin If you miss your New Hire deadline, your next natural opportunity to enroll in benefits will be in October during the annual Open Enrollment. The effective date would be January 1st. Group Term Life Policies: The effective date for any coverage amounts over the guaranteed issue amount will be determined by The Standard and is subject to underwriting.

As a new hire, you have the first 31-days of employment to enroll in benefits UNUM Provident must approve all applications The effective date is determined by UNUM Provident Insurance

There is no monetary cost for joining the Catastrophic Sick Leave Bank, however, you must donate three days of your local sick leave or anticipated local sick leave to join as per District policy. For membership to be complete, an employee must work at least 108 days in a school year to earn the three days donated for membership

If you enroll within the first 31-days of employment, your effective date will be the first day of the month following your hire date You may also join the Bank during the following Districtwide Open Enrollment in the Fall of any subsequent year. If enrolling during Open Enrollment, your effective date will be January 1st of the following year. A member must have earned membership before any Catastrophic Sick Leave Bank days may be granted.

TheInternalRevenueServiceallowsemployeestopaysomebenefitpremiums withbeforetaxdollars Health,dental,vision,flexiblespendingaccounts,health savingsaccounts,andcancerinsurancesofferedbytheDistrictare administeredonapre-taxbasis.Formanyemployees,thisbecomesa wonderfulbenefitbecauseyouremployeepremiumcontributionsarededucted beforetaxesarecalculatedbasedonyourincome,thusreducingyourtaxable income.Thisinturnlowerstheamountoffederalincometaxyoupayeachpay period!Youseeanimmediatetaxsavingsoneachpaycheck.

Itcostsyounothing.ThisisaserviceprovidedbyNorthEastISDunderthe regulationsfromtheIRSTaxCode,Section125.

WhenyoupayeligiblepremiumsthroughtheCafeteriaPlan,yourselectionsare finalforthecurrentbenefityear,unlessyouexperienceaqualifyingevent,as outlinedintheInternalRevenueCode,Section125,andrelatedregulations. Unlessyouexperienceoneofthesechangesthataffectsyourfamilystatus,or anotherchangedescribedintheprovisionsofFMLAoftheDistrict’sCafeteria Plan,youmaynotdropyourdependentsorchangeyourcoverageforthat benefityear

Ifyouwishtochangeorcancelyourbenefitelections,youcanmakeyour changesduringtheannualOpenEnrollmentperiodinOctoberwithaneffective dateofJanuary1,usingEmployeeCenter

Allnewemployeeshave31calendardaysfromandincludingtheirhiredateto gotoEmployeeCentertoelectorwaiveparticipationinallNEISDbenefits. Changescannotbemadeonceabenefithasgoneintoeffectwithouta qualifyingfamilystatuschange.

MedicalInsurance:

Therewillnotbeahealth insurancepremiumincrease onJanuary1,2025.TheNEISD BoardofDirectorshas approvedthenewdistrict contributionamountof$618 permonth.Thiswillgotowards thecostofanyhealth insuranceplan.Itwillalsocover thecostoftheHIBbenefitfor anyemployeewhowaives medicalcoverage

BlueEdgeHDHP-2025InNetworkIndividualDeductible andIndividualOut-ofPocket limitsis$3,300. The2025InNetworkFamilyDeductibleand Out-ofPocketlimitsis$9,000 The2025Out-ofNetwork IndividualDeductibleand IndividualOut-ofPocketlimitis

$6,600.The2025In-Network FamilyDeductibleandOut-of Pocketlimitsis$18,000.

HSAlimitsfor2025:

LimitsfromtheIRStypically comeoutinthemonthof October. For2025thelimitsare asfollows:$4,300forsingle coverage

$8,550foremployeeplusone dependent

Ourhealthplansareadministeredby

Wehavethreeplanstochoosefrom:

LowPPO

HighPPO

BlueEdgeHighDeductibleHealthPlan(HDHP)

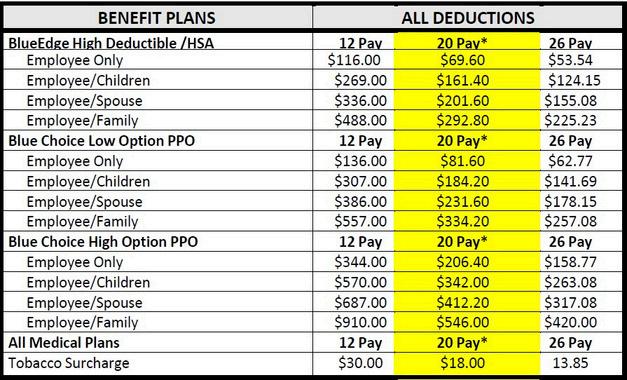

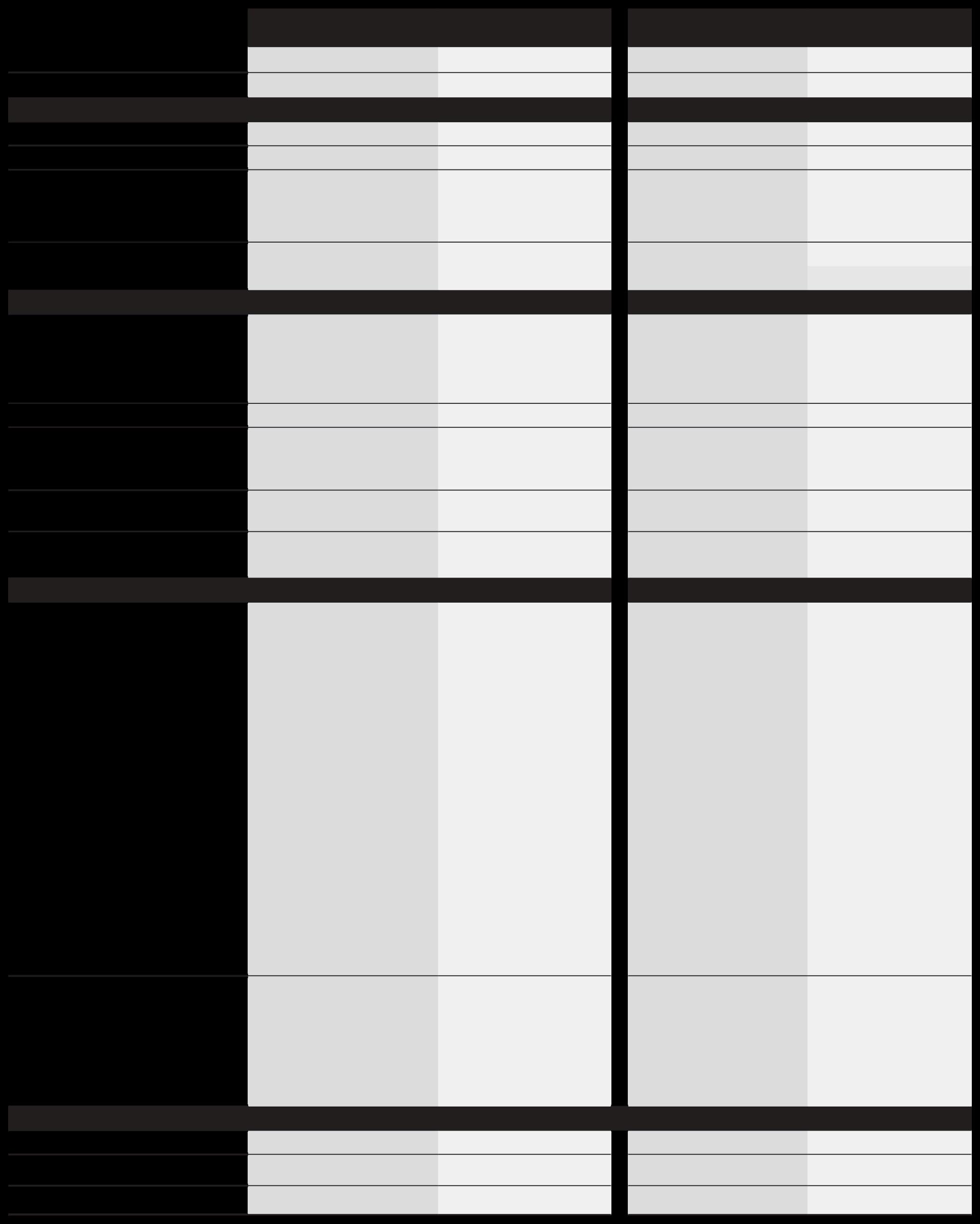

NEISDhasoneofthebesthealthplansamongstotherschooldistrictsin SanAntonio.TheDistrictcurrentlycontributes$600.00peremployeeper monthtowardsthecostoftheirhealthinsurancepremiums.Belowarethe premiumratesforplanyear2024.Theratesshownarewhattheemployee paysperpaycheck Allpremiumdeductionsarecalculatedbythenumber ofpaychecksyoureceivefortheyear Premiumsmaydifferdueto rounding

Paraprofessionalswhoarepaidtothepunch(PA10)andAuxiliary10monthemployeeswhoworklessthan 230daysayear,usethecolumn titled"20Pay"fordeductionamounts

Asummaryofbenefitsforeachplanareincludedonthenext fewpages;thesespagescomefromtheBCBSGetToKnowGuide ForafullcopyoftheGetToKnowGuide,visitourwebsite: www.neisd.net/Page/11172

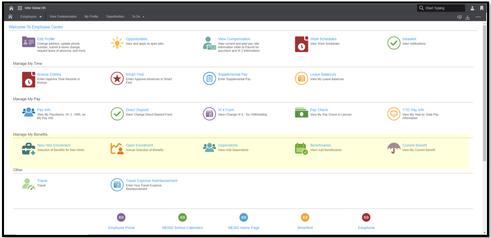

LawsonESSislocatedinEmployeeCenterandcanbeusedwithGoogleChrome, MozillaFirefox,Safari,MicrosoftEdge,andotherbrowsers LawsonESSisNOTavailable onSmartphones,iPadorothertablets Uponcompletionofyourenrollment,youwill be promptedtoeitheremailyourselforprintoutaconfirmationpage Pleasemake surethataprinterisavailablebeforeyoubegintheenrollmentprocess.Thisisyour onlyopportunitytoprinttheconfirmationpageandhaveproofofwhatyouelected.

Gotowww.neisd.netandclicktheLOGINtabontheupperrightsideofyourscreen. 1. ClickontheLOGINlinkthatisbelowthestatement“Loginusingyouractivedirectory credentials” 2 NextyouwillclickonMyNEISDtab 3 OntheleftsideofthescreenyouwillseeashadedboxwithQuickLinks,selectthe EmployeeCenter. 4.

5LogintoNEISDPRODwithyoursamecredentialsusing@neisdnet

Youwillneedtouseyourfullemailaddresstologinandthepasswordthatyoupreviouslycreated. Ifyouneedassistancewithyourusernameandpassword,contacttheHELPDESKat210-356-4357.Useprompts1and8.

SocialSecuritynumbersarerequiredforalldependents

Supportingdocumentationisrequiredfordependentswithdifferentlastnamesthanyours.Youmaysendacopyofbirth certificate,marriagecertificateorothersupportingdocumentationtotheEmployeeBenefitsoffice. Dependentswithdifferentlastnamesthanyourswillberemovedanddonothavecoverageuntilourofficereceivesthe requiredsupportingdocumentation

UnderManageMyBenefits,youcanaccessthelinksforNewHire Enrollment,Dependents,Beneficiaries,CurrentBenefits,andOpen Enrollment.

TheOPENENROLLMENTlinkifyouareenrollinginbenefitsormaking changestoyourexistingbenefitsduringOpenEnrollment Ifyouarenewlyhired,andwithinyour31daydeadline,selectNEWHIRE ENROLLMENT

Thebenefitenrollmentprocesswillbeginonthescreensthatfollow.

TheDependentscreenwillpromptyoutoadddependentsormakechangestoanyexistingdependentsyouintendtocover underyourNEISDbenefits Note:thissteponlycreatesthedependentsprofile Itdoesnotenrollyourdependentsinany benefits Followtheinstructionsoneachscreentoenroll Youwillselecttheplanyouwanttoenrollinorwaiveparticipation foreachbenefitoffered

Ifchangesarenecessary,selecttheMAKECHANGESoptionatthebottomofthepage.Ifnochangesarenecessaryselect OKandconfirmyourelections.

Afterconfirmingyourelections,youwillbepromptedtoeitheremailorprintyourconfirmationpage Makesurethatthere arenoerrormessagesonyourconfirmationpage Thiswillbeyouronlyopportunitytoprintyourconfirmationpage IfyouExitbeforeyoucompletethenewhireenrollmentoropenenrollmentprocess,yourbenefitchoicesWILLNOTbe saved.Youwillneedtocomebackandcompletetheenrollmentprocessatanypointwithinthedatesofyournewhire enrollmentoropenenrollmentperiod.

IfyouhavecompletedyourNEWHIREENROLLMENT,andneedtomakeachangebeforethebenefithasgoneintoeffect,you willneedtocontacttheEmployeeBenefitsOfficetomakechanges

IfyouneedtomakechangestoyourOPENENROLLMENTelections,youmaydosobyloggingbackintoEmployeeCenterand repeattheprocess YouwillneedtoConfirmationPageagainaftermakingyouropenenrollmentchangesandsavingyour elections.

(per person) Other

Hospital deductible (per admission)

Penalty for Failure to Preauthorize

PCP Referral Required

Pre-Existing Conditions Limitation

Physician Services

Office Visit

Office Procedure

Urgent Care Office Visit

Office Procedure

Specialist Office Visit/Airrosti

Office Procedure

Retail Health Clinic

Office Procedure

MDLIVE Virtual Visit

Office Procedure Routine Exams

Gynecological Exam

Cancer Screening

Eye Exam (1 every 12 months)

Hearing Exam

Well-Child Care

Immunizations

Influenza

Pneumoccocal

Zoster, minimum age of 50

Rabies

Hep B

T-Dap

Tetanus Vaccines

Allergy Testing/Treatment

Testing

Injections

Office Visit

$4,500/calendar year

$9,000 /calendar year

$6,500/calendar year

$15,000/calendar year unlimited

Diagnostic X-ray and Lab $100

$4,000

$12,000 Out-Of-Network

$9,000/calendar year

$18,000/calendar year

$13,000/calendar year

$30,000/calendar year unlimited

$250

$4,000/calendar year $11,250/calendar year

$100

$8,000/calendar

$22,500/calendar

General Information

Calendar-Year deductible Individual Family

Coinsurance Maximum Individual

Out-of-Pocket Limit**

Lifetime Maximum (per person) Other Hospital deductible (per admission)

Penalty for Failure to Preauthorize PCP Referral Required

Pre-Existing Conditions Limitation

Physician Services

Office Visit

Office Procedure

Urgent Care Office Visit

Office Procedure

Specialist Office Visit/Airrosti

Office Procedure

Retail Health Clinic

Office Procedure

MDLIVE Virtual Visit

Office Procedure Routine Exams

Gynecological Exam

Cancer Screening

Eye Exam (1 every 12 months)

Hearing Exam

Well-Child Care

Immunizations

Influenza

Pneumoccocal

Zoster, minimum age of 50

Rabies

Hep B

T-Dap

Tetanus Vaccines

Allergy Testing/Treatment

Testing

Injections

Office Visit

Diagnostic X-ray and Lab

$3,300***/calendar year

$9,000/calendar year

Unlimited

$3,300***/calendar year

$9,000/calendar year unlimited

Out-Of-Network

$6,600/calendar year

$18,000/calendar year

Unlimited

$6,600/calendar year

$18,000/calendar year

unlimited

** Out-of-pocket limit: deductible, coinsurance percentage, prescription drug copay and medical copay.

*** $100 increase due to IRS Regulation

Pre-Existing Conditions Limitation

Hospital Services

Inpatient Hospital Expenses

Outpatient Surgery

Emergency Medical Services copay (copay waived if admitted) (Facility Only)

Non-Emergency Use of ER

Pre-Existing Conditions Limitation

Other Services

Chiropractic Services Office Visit

Other Services

Maximum

Durable Medical Equipment

Skilled Nursing or Convalescent Facility

Max. Days/Calendar Year

Hospice Care Lifetime Maximum

Health Care Calendar Year Maximum

Prescriptions

Retail Pharmacy Card (copay for a 30-day supply)

Generic Non-Preferred Generic

Preferred Brand Name

Non-Preferred Brand Name

Preferred Specialty

Non-Preferred Specialty

Immunizations Covered Influenza

Pneumoccocal

Zoster, minimum age of 50

Rabies

Hep B T-Dap

Tetanus Vaccines

Mail Order Prescriptions (copay for a 90-day supply)

Generic

Preferred Brand Name

Non-Preferred Brand Name

Mental

Outpatient

BlueEdge HSA In-Network No

Benefits for the plans are paid at a percentage of the allowable amount as determined by Blue Cross and

of Texas. The comparison is not the summary plan description. Please refer to your summary plan description benefit booklet for a detailed description of your health plan, including limitations and exclusions. Benefits will be paid according to the summary plan description only.

* If service is delivered by a primary care physician, the copayment is $25. If service is delivered by a specialist, the copayment is $35.

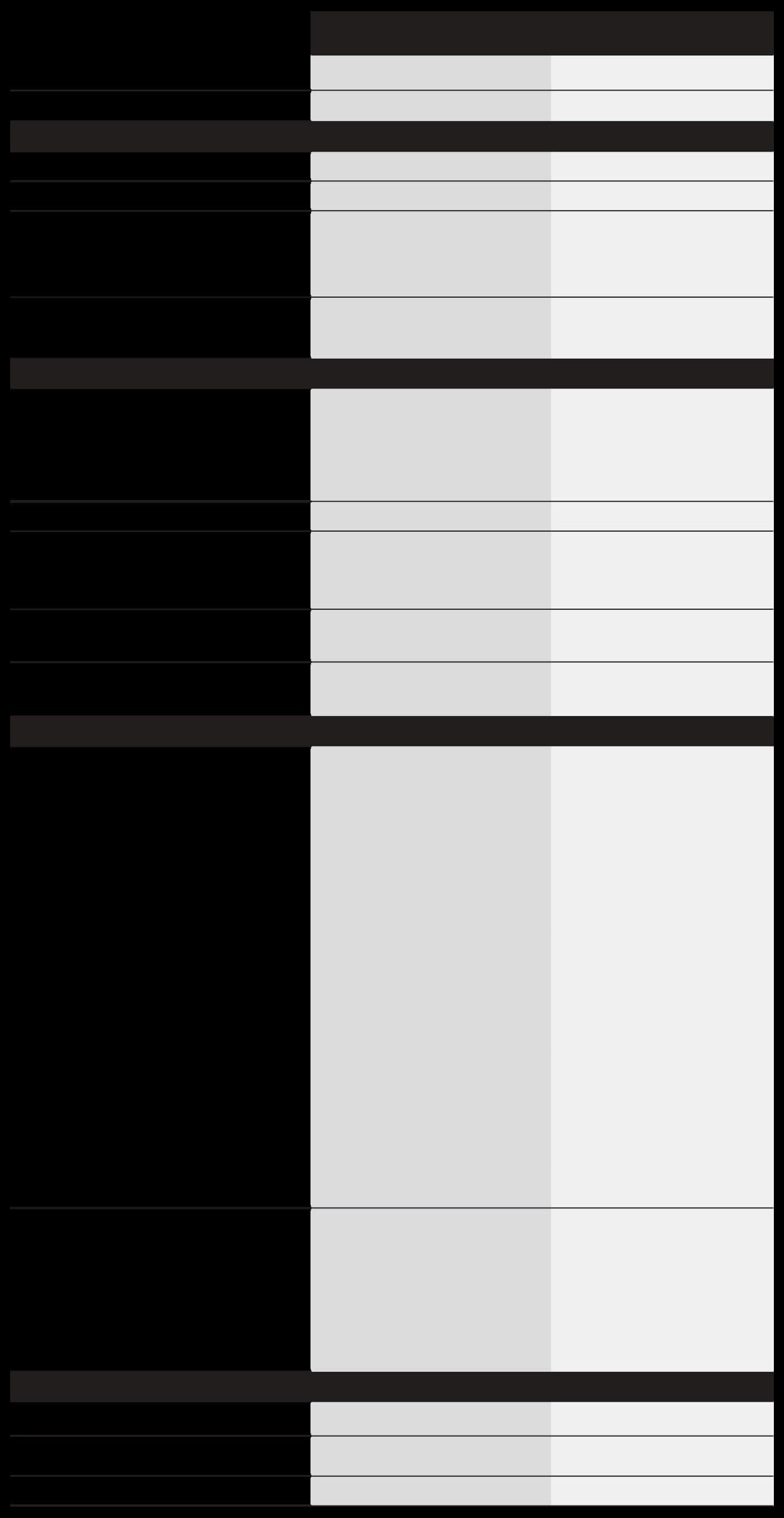

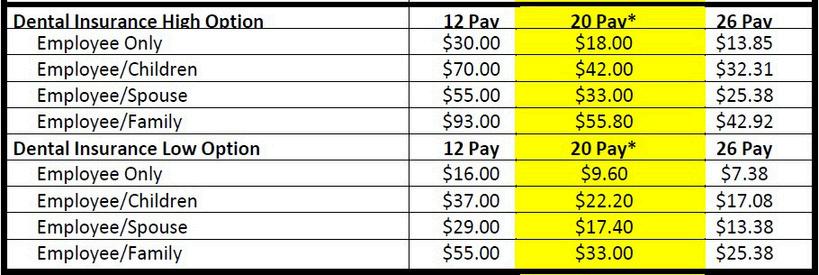

OurdentalplansareadministeredbyDeltaDental Wehavetwoplansto choosefrom. Bothplanshaveadeductibleof$50perperson/$150perfamily eachcalendaryearandcoverDiagnosticandPreventativeservicesat100%.

LowPPO-coversbasicservicesonly;60%coveredatinnetworkproviders; witha$750perpersoncalendaryearmaximum.

HighPPO–coversbasic;80%coveredatinnetworkproviders.

$1,750perpersonpercalendaryearmaximum•Major,prosthodontics andorthodonticservices(12monthwaitingperiodforfirsttimeenrollees); 50%coveredatinnetworkproviders.

$2,000Lifetimemaximumfororthodontics

Bothplanscovertwo(2)cleaningsperyearat100%.

Formoredetailedinformationvisitourwebsite:https://wwwneisdnet/Page/11167

Belowarethepremiumratesforplanyear2024.Paraprofessionalswhoarepaidtothepunch(PA10)andAuxiliary 10-monthemployeeswhoworklessthan230daysayear,usethecolumntitled"20Pay"fordeductionamounts.

*Premiumsmaydifferduetorounding

OurvisionplanisadministeredbyAvesis.

Avesisisanationalleaderinprovidingexceptionalvisioncarebenefits formillionsofcommercialmembersthroughoutthecountry.

TheAvesisvisioncareproductsgiveourmembersaneasy-to-use wellnessbenefitthatprovidesexcellentvalueandprotection.

Formoredetailedinformationvisitourwebsite:https://www.neisd.net/Page/11178

Belowarethepremiumratesforplanyear2024 Paraprofessionalswhoarepaidtothepunch(PA10)and Auxiliary10-monthemployeeswhoworklessthan230daysayear,usethecolumntitled"20Pay"fordeduction amounts

*Premiummaydifferduetorounding

Thereisa$150.00allowanceforcontactsorlenseswhenpurchasedthroughanetworkprovider.

HSAsanindividuallyowned,tax-advantagedaccountthatyoucanusetopayforcurrentorfutureIRS-qualified medicalexpenses.WithanHSA,you'llhavethepotentialtobuildmoresavingsforhealthcareexpensesor additionalretirementsavingsthroughself-directedinvestmentoptions.

OurhealthsavingsaccountinadministeredbyHSABank.EnrollmentintheBlueEdgeHighDeductible(HDHP) planisrequiredtoparticipateinthisbenefit.

Formoredetailedinformationvisitourwebsite:https://www.neisd.net/Page/27203

Forthecalendaryear2025,theannualcontributionlimitisasfollows:

PlanHighlight

TheDistrictcontributes$500annually($125depositedeachquarter)toemployeeswithemployeeonlyhealth coverageand$1,000annually($250depositedeachquarter)toemployeeswithatleastonedependent coveredontheirBlueEdgehealthplan.

IfyoudonotqualifyforanHSAaccount,perhapsanFSAaccountwillworkforyou.Ourflexiblespending accountsareadministeredbyNationalBenefitServices(NBS).

WehavetwoFSAaccountstochoosefrom:

Forthecalendaryear2025,thecontributionlimitsareasfollows:

HealthFSA-isusedtopayforIRSapprovedeligibleout-of-pocketmedical,dental,andvisionexpenses.It canbeusedbyyouandyourdependentswhethercoveredonthehealthplansornot. DependentCareFSA-isusedtoreimburseexpensesrelatedtothecareofyoureligibledependentswhile youwork Itcanbeusedfordaycare,beforeschoolorafterschoolcareforchildrenunderage13

Fundsmustbeelectedeachyear “Useitorloseit”fundsdonotrolloverandmustbeusedbyDecember31stof thecalendaryear Formoredetailedinformationonthisbenefit,visitourwebsite: https://wwwneisdnet/Page/11170

PlanHighlight:

ContributetoanFSA,havemoneyavailableforout-of-pocketexpenses,andpaylesstaxes!

TheprimarypurposeoftheHospitalIndemnityPlanistoprovideabenefitforeligibleemployeeswhoarenot enrolledinanyofthehealthplansofferedbyNEISD.

Theplanprovidesadailyhospitalbenefitintheeventyouhaveanillnessorinjurythatrequiresaninpatient hospitalconfinement.TheHospitalIndemnityBenefitwillpaya$250dailybenefitforanyapprovedinpatient hospitalconfinement.

Ourhospitalindemnitybenefit(HIB)isadministeredbyNEISD.Ifyouchoosetowaiveenrollmentinourhealth plans,youareautomaticallyenrolledinHIB.Thisisnotahealthinsuranceplan.

Formoredetailedinformationvisitourwebsite:https://wwwneisdnet/Page/11173

Premiums

Nocosttotheemployee;theDistrictpaysforthis

PlanHighlight:

TheHospitalIndemnityBenefitisasupplementalplan andbenefitsarepaiddirectlytotheemployee

TheNEISDCatastrophicSickLeaveBankisavoluntaryemployeebenefit programdevelopedtoprovideupto45paiddaystomemberswhohave sufferedacatastrophicillnessorinjury.TheCatastrophicSickLeaveBank hasstrictcriteriaandisforsuchmedicalconditionsthatareusually consideredlife-threateningorwiththethreatofseriousresidualdisability. OurcatastrophicsickleavebankbenefitisadministeredbyNEISD.

Formoredetailedinformationvisitourwebsite:wwwneisdnet/Page/11165

Premiums

CosttoparticipateintheCSLBprogramisaone-timedonationofthree(3)ofyoursickdays.

PlanHighlight

Youonlyhavetore-donatethree(3)sickdayswhenyouusethreeormoredaysfromthebank.Ifyouuseless thanthree(3)days,youonlyneedtore-donatethenumberofdaysthatwereused

Adisabilitycanhappentoanyone Long-termdisabilityinsurancehelpsprotectyourpaycheckifyou’reunableto workforalongperiodoftimeafteraseriouscondition,injuryorsickness.Ourdisabilityinsuranceplanis administeredbyTheStandard Therearemanyoptionstochoosefromdependingonyourneeds

PERCENTAGE*

66 2/3%

$100 Increments between $200 and $10,000, but not more than 66 2/3% of current monthly earnings Minimum $100

The elimination period you can select has two numbers: •The first number is the number of days you must be disabled by an accident before your benefits can begin. •Second number is the number of days you must be disabled by a sickness before the benefits can begin.

Elimination period options: 0/7, 14/14, 30/30, 60/60. 90/90, 180/180

Plan A: Injury and Sickness

Disabled before: Age 62

Benefit Duration: As long as you are disabled or to the end of the month age 65 is attained. Plan B: Injury

Disabled before: Age 62

Benefit Duration: As long as you are disabled or to the end of the month age 65 is attained. Plan B: Sickness

Disabled before : Age 63

Benefit Duration: As long as you are disabled or 3 years.

*Employees who elect an elimination period of 45 days or less, If you are confined to a hospital for 4 hours or more due to a disability, the elimination period will be waived and benefits will be payable from the first day of disability.

Premiumratesforplanyear2025,visitwwwneisdnet/Benefits

Protectyourpaycheckwhenyouareunabletoworkduringaninjuryor illness.

Premiumratesforplanyear2025,visitwww.neisd.net/Benefits

Formoredetailedinformationvisitourwebsite:www.neisd.net/Page/11164

TheDistrictprovidesa$15,000lifeinsurancepolicyforeachemployee,atnocostto theemployee Employeesareautomaticallyenrolleduponemployment

ThisisatermlifepolicythatincludesamatchingAccidentalDeathandDismemberment(AD&D)policy.

WholeLifeInsuranceprovidesconsistentcoveragethroughretirementwithpremiumsandbenefitsthatwon’t changeasyougrowolder Theseareindividualpoliciesthatcanbuildcashvalueovertime Employeesdonot havetoenrollinwholelifecoverageinordertopurchasecoveragefortheirspouse,children,orgrandchildren Formoredetailedinformationvisitourwebsite:wwwneisdnet/Page/11163

Premiums

Premiumratesforplanyear2025areavailableonthewebsiteabove.Formoreinformation onWholeLiferates,pleasecontacttheEmployeeBenefitsofficeat(210)407-0187.

Didyouknowyoucancoveryourgrandchildrenwithawholelifepolicy?Seeplandetails

OurcancerinsuranceplanisadministeredbyAllstate.Receivinga cancerdiagnosiscanbeoneoflife’smostfrighteningevents.Unfortunately, statisticsshowyouprobablyknowsomeonewhohasbeeninthissituation.

WithCancerInsurancefromAllstateBenefits,youcanrestalittleeasier. Ourcoveragepaysyouacashbenefittohelpwiththecostsassociatedwith treatments,topayfordailylivingexpenses,andmoreimportantly,toempower youtoseekthecareyouneed Ourcancerplanoffersoptionsfortheemployee andtheirdependents

Formoredetailedinformationvisitourwebsite:wwwneisdnet/Page/11164Premiums

Premiums

SeeourAllstateflyerforpremiumratesforplanyear2025.Flyercanbefoundatwww.neisd.net/Benefits

PlanHighlight

ThisbenefitoffersaWellnessbenefit,getpaidforyourannualcheckup

OuremployeeassistanceprogramisadministeredbyComPsych Your ComPsych®GuidanceResources®programofferssomeonetotalktoand resourcestoconsultwheneverandwhereveryouneedthem

EAPisabenefitthatisnocosttotheemployee

Call: 833 475 0996 TTY: 800.697.0353

Online: guidanceresources.com

Formoredetailedinformationvisitourwebsite:www.neisd.net/Page/11169 EAPoffersavarietyofservicestoincludelegal assistanceandfinancialplanningassistancein additiontotakingcareofyouremotionalhealth.

App: GuidanceNow™ Web ID: NEISD

NEISDunderstandsthatahealthyworkforceleadstoaproductiveworkforce We’ve teamedupwithBlueCrossandBlueShieldofTexas(BCBSTX)toprovideacomplete wellnessprogramthathelpssupportemployeesintheirhealthandwellbeingjourney

YourNEISDwellnessprogram,DiscoverWellness,hasactivitiesforallbenefitseligible employeesaswellassupplementalactivitiesforthosecoveredundertheDistrict’s MedicalPlanwithBCBSTX.Ifyouhavequestions,pleasecontactyourBCBSTXWellness Coordinator,KristinSerna,atwellness@neisd.net.

BCBSTXIncentiveProgram:EmployeescoveredthroughNEISD’sBCBSTXprogram mayqualifytoreceivea$75annualpremiumcreditforcompletingspecifichealthrelatedactivities

BCBSTXFitnessProgram:Thisprogramoffersfourdifferenttieredmembership optionsforBCBSTXcoveredmemberstoaccessthousandsofgymswithinanational network Nosignedcontractsarerequired,andyouarenottiedtoanyonfacility

MemberRewards:BCBSTXoffersMemberRewards,aprogramadministeredthrough SapphireDIgitaltohelpyoudeterminehowtosavemoneywhengoingforcare, compareservicesacrossproviders,andevenpotentiallyprovideyouwithcash rewardswhenyouchooseaneligiblelocation

Blue365:Blue365isawebsiteforhealth-focuseddiscounts.Discountsinclude health-relatedproductssuchasfitnesstrackersandsubscriptions,aswellashealth andfitnessclubs,nutritionservicesandmuchmore

AsanNEISDemployeeyouarecontributingtoTRSretirement, however,wedonotcontributetosocialsecurity Inordertoretire comfortably,itisimportanttohaveadditionalretirementfunds setaside.

NEISDoffersthreesupplementalretirementplans:

403(b)

457(b)

457(b)Roth

The403(b)and457(b)arefundedwithyourpre-taxdollarsand the457(b)Rothisfundedwithyourafter-taxdollars.Ourretirementplansare administeredbyNationalBenefitServices(NBS)andEmpowerRetirement

Formoredetailedinformationvisitourwebsite:www.neisd.net/Page/11176

Forthecalendaryear2024,thecontributionlimitsareasfollows:

Employeesundertheageof50

Employeesaged50andover

Wecurrentlydonothavethenew2025 limitsfromtheIRS

Wecurrentlydonothavethenew2025 limitsfromtheIRS

Youcanenrollandmakechangestoyourcontributionsatanytimeduringtheyear. NoneedtowaitforOpenEnrollmentoralifeevent

This notice only applies to employees/retirees/COBRA participants and/or their dependents that are Medicare eligible and are:

•Over the age of 65 –OR-

•Under the age of 65 with a Disability

Please read this notice carefully and keep it where you can find it. This notice has information about your current prescription drug coverage with North East ISD and about your options under Medicare’s prescription drug coverage. This information can help you decide whether or not you want to join a Medicare drug plan. If you are considering joining, you should compare your current coverage, including which drugs are covered at what cost, with the coverage and costs of the plans offering Medicare prescription drug coverage in your area. Information about where you can get help to make decisions about your prescription drug coverage is at the end of this notice.

There are two important things you need to know about your current coverage and Medicare’s prescription drug coverage:

Medicare prescription drug coverage became available in 2006 to everyone with Medicare You can get this coverage if you join a Medicare Prescription Drug Plan or join a Medicare Advantage Plan (like an HMO or PPO) that offers prescription drug coverage. All Medicare drug plans provide at least a standard level of coverage set by Medicare. Some plans may also offer more coverage for a higher monthly premium.

North East ISD has determined that the prescription drug coverage offered by the North East ISD Health Plan is, on average for all plan participants, expected to pay out as much as standard Medicare prescription drug coverage pays and is therefore considered Creditable Coverage. Because your existing coverage is Creditable Coverage, you can keep this coverage and not pay a higher premium (a penalty) if you later decide to join a Medicare drug plan. 2.

When Can You Join A Medicare Drug Plan?

You can join a Medicare drug plan when you first become eligible for Medicare and each year from October 15th to December 7th. However, if you lose your current creditable prescription drug coverage, through no fault of your own, you will also be eligible for a two (2) month Special Enrollment Period (SEP) to join a Medicare drug plan

If you decide to join a Medicare drug plan, your current North East ISD coverage will be affected. Generally, your North East ISD Plan is a Primary Plan if you are an active employee, and Medicare is a Primary Plan if you are a retired employee. See pages 7- 9 of the CMS Disclosure of Creditable Coverage To Medicare Part D Eligible Individuals Guidance (available at http://www.cms.hhs.gov/CreditableCoverage/), which outlines the prescription drug plan provisions/options that Medicare eligible individuals may have available to them when they become eligible for Medicare Part D.

If you do decide to join a Medicare drug plan and drop your current North East ISD coverage, be aware that you and your dependents will be able to get this coverage back if you are an active employee with a qualifying event or during Open Enrollment, and will not be able to get this coverage back if you are a retired employee.

You should also know that if you drop or lose your current coverage with North East ISD and don’t join a Medicare drug plan within 63 continuous days after your current coverage ends, you may pay a higher premium (a penalty) to join a Medicare drug plan later.

If you go 63 continuous days or longer without creditable prescription drug coverage, your monthly premium may go up by at least 1% of the Medicare base beneficiary premium per month for every month that you did not have that coverage For example, if you go nineteen months without creditable coverage, your premium may consistently be at least 19% higher than the Medicare base beneficiary premium. You may have to pay this higher premium (a penalty) as long as you have Medicare prescription drug coverage. In addition, you may have to wait until the following October to join. .

If you have questions regarding...

Blue Choice Low Option PPO Blue Choice High Option PPO NEISD group number: 93748 BlueEdge HSA™ Option NEISD group number: 190965

Contact

Blue Cross Blue Shield of Texas Customer Service Helpline 1-800-521-2227

NEISD Employee Benefits Office

Director

Francy

Leal

of Employee Benefits (210) 407-0187

NOTE: You will get this notice each year. You will also get it before the next period you can join a Medicare drug plan, and if this coverage through North East ISD changes. You also may request a copy of this notice at any time

For More Information About Your Options Under Medicare Prescription Drug Coverage…

More detailed information about Medicare plans that offer prescription drug coverage is in the “Medicare & You” handbook. You’ll get a copy of the handbook in the mail every year from Medicare. You may also be contacted directly by Medicare drug plans.

For more information about Medicare prescription drug coverage: Visit www.medicare.gov

Call your State Health Insurance Assistance Program (see the inside back cover of your copy of the “Medicare & You” handbook for their telephone number) for personalized help Call 1-800-MEDICARE (1-800-633-4227). TTY users should call 1-877-486-2048.

If you have limited income and resources, extra help paying for Medicare prescription drug coverage is available. For information about this extra help, visit Social Security on the web at www.socialsecurity.gov or call them at 1-800-772-1213 (TTY 1-800-325-0778).

Remember: Keep this Creditable Coverage notice. If you decide to join one of the Medicare drug plans, you may be required to provide a copy of this notice when you join to show whether or not you have maintained creditable coverage and, therefore, whether or not you are required to pay a higher premium (a penalty).

East

8 8961 TESORO DRIVE, SUITE 209 – SAN ANTONIO, TEXAS 78217

Phone 210-407-0187, Fax 210-804-7014

www.neisd.net

eb@neisd.net

RiskManagementandEmployee

BenefitsDepartment

MEMO TO: All Employees and Eligible Dependents

SUBJECT: CONTINUATION OF HEALTH COVERAGE UPON GROUP INELIGIBILITY

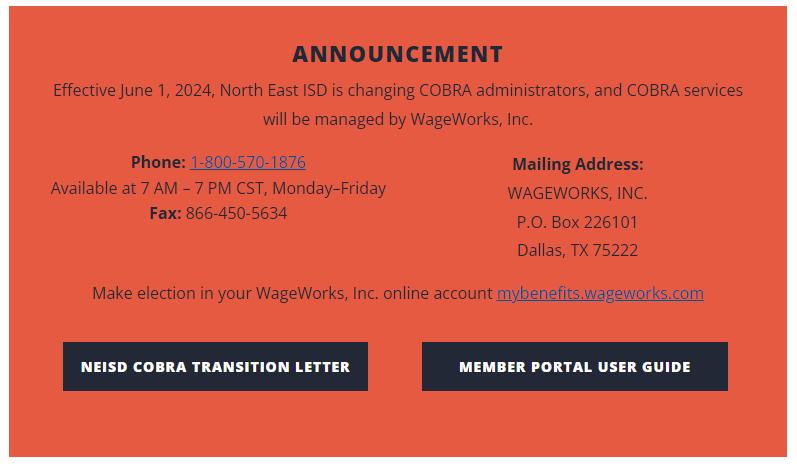

North East Independent School District (NEISD) will offer continued health coverage to employees and their eligible dependents who no longer meet the District eligibility requirements. This coverage is offered under the conditions set forth by the Consolidated Omnibus Budget Reconciliation Act of 1985, more commonly called COBRA, and as amended by the Omnibus Budget Reconciliation Act of 1989. The “qualifying events” under which an employee and/or dependent will be eligible to continue coverage are:

A reduction in hours;

An employee’s death;

Voluntary or involuntary termination of employment (other than for gross misconduct);

Retirement;

Divorce or legal separation;

The employee’s or eligible dependent’s entitlement to Medicare benefits;

A dependent child who is no longer eligible for coverage under the applicable plan provisions; or Leaves other than FMLA, e g , educational, military, workers’ compensation (except when integrated with FMLA).

The coverage would apply to an individual (known as a “qualified beneficiary”) who, on the day before the qualifying event, was:

The covered spouse of the employee;

A covered dependent child of the covered employee; or

A covered employee, in the event of termination

A “qualified beneficiary” has at least sixty (60) days from the date of the termination or other qualifying event in which to elect continuing coverage, and no less than sixty (60) days after receiving notice of the right to continue coverage. In the case of a divorce or a dependent child who is no longer eligible, the covered employee or qualified beneficiary has the responsibility of notifying the Employee Benefits Office in writing within thirty-one (31) days of the status change. The continued coverage will be identical to the health coverage provided to the active employee and their dependents. Coverage would begin on the date of ineligibility due to the qualifying event and endson the earliest of the following:

Eighteen (18) months for employee whose employment has terminated or whose hours have been reduced;

Thirty-six (36) months for widows, divorced spouses, dependent children, and spouses of covered employees who become entitled to Medicare benefits;

The date on which the employer ceases to provide a group health plan to any employee (the replacing carrier must cover the individual on continuation);

The date on which coverage ceases under the plan because of failure, on the part of the beneficiary, to make timely payment of premium required;

The date (after the date of election) on which the qualified beneficiary becomes entitled to benefits under Medicare;

COBRA continuation coverage WILL NOT cease if a qualified beneficiary becomes covered under another group health plan that contains an exclusion with regards to pre-existing conditions (effective 12/31/89);

Qualified beneficiaries determined to be disabled under the Social Security Act at the time a qualifying event occurs, can extend COBRA continuation coverage for eleven (11) additional months provided notification requirements are met.

The qualified beneficiary has a forty-five (45) day period from the date he or she elects continuation to pay the first premium. The cost will be the full premium, without district contribution, plus a two percent (2%) service charge to be paid directly to NEISD. Coverage cannot be verified until the first premium is received. For more information, please contact the Employee Benefits Office at 407-0187.

Main Number: 210-407-0498 Fax: 210-804-7014 www.neisd.net/page/434 E-mail: eb@neisd.net

Eligibility/Coverage COBRA (ContinuationofCoverage)

PayrollDeductions/Premiums

MedicalIDCardsand ClaimsAssistance

HSABankCardClient AssistanceCenter

DentalIDCardsand ClaimsAssistance

VisionIDCardsand ClaimsAssistance

Andy McClung VACANT

Martha Lozano

Michele Vasquez

Martha Lozano

Michele Vasquez

BlueCross / BlueShield

BlueEdge and PPO Plans HSA Bank

Delta Dental Avesis

jmcclu7@neisdnet

mlozan1@neisd.net mvasqu8@neisd.net mlozan1@neisd.net mvasqu8@neisd.net www.bcbstx.com www.hsabank.com

wwwdeltadentalinscom/neisd

Eligibility/Coverage Claim Forms / Processing HOSPITAL INDEMNITY PLAN

Contact

Andy McClung VACANT

E-mail / Website jmcclu7@neisd.net EMPLOYEE ASSISTANCE PROGRAM

Contact

ComPsych

Andy McClung VACANT

Enrollment/Election Changes

Contact

National Benefit Services, LLC P. O. Box 6980 West Jordan, UT 84084

Contact

Enrollment/Claim Forms and Processing

Membership/Coverage Questions

janet@highlander financial.com janet@highlander financial.com

RetirementQuestionsand GeneralInformation

BeneficiaryDesignation/ ChangeForms RefundRequestForm

Allstate

Action

457(b)/457(b) Roth

General Information and Assistance

Contact

National Benefit Services

Address Changes

Death Claim Assistance

LeaveofAbsenceRequests

BenefitQuestionswhileonLeave ofAbsence

COBRA/PremiumPayments

BeneficiaryChangesforDistrict ProvidedLifeInsuranceand GroupTermLifeinsurance

LongTermCare

ADA Accommodation Requests

403(b) Action Name Changes Title

Francy Leal

Empower Retirement

Francy Leal

Anabel Nieto

Francy Leal

HumanResources

AndyMcClung

VACANT

MicheleMatheny

EmilyAragon

MarthaLozano

MicheleVasquez

MarthaLozano

MicheleVasquez

AndyMcClung

VACANT

Genworth

RenaBuley, ADACoordinator

“ManageMyProfile” sectioninEmployee Center “ManageMyProfile” sectionin

Employee Center

jmcclu7@neisd net mmathe@neisd net earago@neisd.net mlozan1@neisd.net mvasqu8@neisd.net mlozan1@neisd.net mvasqu8@neisd.net

“Manage My Benefits” section in Employee Center www.403benefits.com fleal@neisd.net www.empowermy retirement com anieto1@neisd net fleal@neisd net

accommodations@neisd net EMPLOYEE BENEFITS STAFF

Name

DavidGracia,CSRM

Jason Saul

Francy Leal, MBA, PHR, RTSBA

Michele Vasquez

Martha Lozano

Andy McClung

VACANT

Anabel Nieto

SeniorDirectorofRiskManagement &EmployeeBenefits

DirectorofRiskManagement

DirectorofEmployeeBenefits

EmployeeBenefitsTechnician

EmployeeBenefitsTechnician

EmployeeBenefitsTechnician

EmployeeBenefitsTechnician

Wellness&RetirementPrograms Specialist

dgraci@neisd.net jsaul@neisd.net fleal@neisd.net mvasqu8@neisd.net mlozan1@neisd.net jmcclu7@neisd.net

anieto1@neisd.net