WHY WORK WITH US?

WHY WORK WITH US?

We can help make your process a success. Talk to our sales team today!

EXECUTIVE DIRECTOR

Alex Walsh

BUSINESS OPERATIONS MANAGER

Leanne Ziemba

PRESIDENT

Daniel Lausch Lactalis USA – Commonwealth

VICE PRESIDENT

Rebecca Wallick HP Hood

TREASURER

Adam Seybolt Stewart’s Processing Corp.

SECRETARY

Ryan Elliott Byrne Dairy

PRESIDENT

Daniel Seitzer

Ecolab

VICE PRESIDENT

Paul Knoerl Pactiv Evergreen

TREASURER

Ryan Osterhout KCO Resource Management

SECRETARY

Bruce Alling

Double H Plastics, Inc.

PUBLISHER

Bill Brod billbrod@nedairymedia.com

EDITOR

Courtney Kless courtneyk@nedairymedia.com

CONTENT DIRECTOR

Steve Guglielmo steveg@nedairymedia.com

RESEARCH & DEVELOPMENT COORDINATOR

Athena Cossette athena@nedairymedia.com

COPYWRITER

Nicole Smith

CONTRIBUTORS

Melinda Aiken

GRAPHIC DESIGNER

Renate Wood, Robin Barnes

SALES

Tim Hudson thudson@nedairymedia.com

Lesli Mitchell

lmitchell@nedairymedia.com

Jake Horodnick jakeh@nedairymedia.com

PRODUCED BY

Northeast Dairy Media

Editorial correspondence should be directed to courtneyk@nedairymedia.com

Advertising correspondence and materials should be sent to lmitchell@nedairymedia.com

View our media kit to discover the opportunities to reach NDFA members.

An official magazine of the Northeast Dairy Foods Association, Inc., a nonprofit organization. This publication carries authoritative notices and articles in regard to the activities and interests of the associations. In all other respects, neither the association nor the producer of the publication, Northeast Dairy Media, is responsible for the contents thereof or the opinions of the contributors.

The entire contents are © 2025 by Northeast Dairy Media. Nothing may be reproduced in whole or in part without written permission of the publisher. The association and Northeast Dairy Media reserve the right to print portions or all of any correspondence mailed to the editors without liability on its part and no such correspondence will be returned.

Visit The Northeast Dairy Foods & Suppliers Associations online at ndfsa.org for current information on association programs and services, or call the association at 315-452-MILK (6455). Questions and comments may also be sent to the association at leanne.ziemba@ndfsa.org

BY DANIEL LAUSCH PRESIDENT, NORTHEAST DAIRY FOODS ASSOCIATION

In this edition of Northeast Dairy Magazine, we are exploring the subject of trends.

Since dairy is in our association’s name, let’s start with the dairy cows living on the farms here in the northeastern U.S.

Today, we have fewer dairy farms than we did 20 years ago, but those currently operating tend to milk more cows and raise fewer replacement heifers. They are also generally doing a better overall job of providing what is best for the dairy cows, and in turn, the cows are producing much more milk per lactation than they did 20 years ago. If each cow can average one additional productive lactation, each farm can raise less replacement young stock.

As a result, many dairy farms are now breeding a percentage of their less productive dairy cows to beef bulls, producing a dairy/beef cross calf that will be worth considerably more at the weekly livestock auction. The buyers of these crossbreed dairy/beef calves are looking for them to enter the beef cattle sector of production agriculture either as future beef cows expected to produce a yearly beef calf or as steers entering a feedlot finishing operation.

Next, let’s look at the milk tankers picking up milk from each dairy farm. Twenty years ago in the Northeast region, the larger dairy farms could fill a milk tanker every other day, but farms with enough cows to fill a tanker by themselves were few and far between. Among today’s dairy farm population, filling a milk tanker every other day — or even every day —

from a single farm is very common. In fact, we have now moved from an individual dairy farm filling one tanker per day to now filling more than one per day. We have seen tremendous growth on individual dairy farms in regions with access to good-quality cropland, labor, enough water to grow the forages needed to feed hundreds of dairy cows, and enough cropland to utilize the manure with all the nutrients applied for growing the next year’s crops.

Our dairy plants are now finding ways to handle more milk with less manual labor. This is where we see larger vats and more efficient fillers and packaging equipment. New conveyors supply automated palletizers, which can stack faster and safer than one or two people can stack and shrink-wrap the finished product pallets by hand.

Today’s consumers prioritize four items: convenience, health, variety, and sustainability.

No single factor is more important than the others, but if your product misses one or two of the four items, your future sales volume will not look promising (and staying on the retail shelf for yet another slotting cycle will be riskier). If your company’s retail product could be improved in any of these four basic areas, you should work to improve your SKU. As an example, is just one component of your packaging keeping it from being placed in the recycling bin versus the trash bin? Explore healthier ingredients. Explore finding a better recipe mix. Is a cleaner label keeping you from improving toward these four consumer trends?

L

Saverio

Pr

BY DANIEL SEITZER PRESIDENT, NORTHEAST DAIRY SUPPLIERS ASSOCIATION

s we move through 2025, it’s easy to get concerned with things we don’t control. Whether it’s politics, when Taylor Swift will release a new album, or what the Fed will do with interest rates, we don’t control any of it. What we CAN control is staying vigilant and in tune with our customers and their needs. The dairy industry faces a dynamic landscape with evolving consumer preferences, technological advancements, and environmental considerations. To remain relevant in this competitive market, producers and suppliers must stay informed about key trends and adapt to the changing demands. In short, we need to ASK.

Having said that, here are some thoughts as we explore the trends shaping the dairy sector, the critical factors for maintaining relevance, and the innovative products capturing consumer interest.

One of the most prominent trends in the dairy industry is the growing emphasis on health and wellness. Consumers are increasingly seeking products that offer nutritional benefits, support digestive health, and cater to specific dietary needs. This shift is driving demand for dairy products enriched with probiotics, omega-3 fatty acids, and other functional ingredients. As an industry, we must prioritize transparency and clear labeling to communicate the health benefits of products effectively. Clean, simple, and transparent — just like we all want in our personal lives and choices, too.

Environmental sustainability continues to be a critical concern for both consumers and industry stakeholders. Dairy producers are adopting eco-friendly practices, such as reducing greenhouse gas emissions, implementing water

conservation measures, and embracing renewable energy sources. Suppliers should also consider sustainable packaging solutions to minimize waste and enhance their brand’s eco-conscious image. Producers and end consumers are demanding it.

Advancements in technology are revolutionizing the dairy industry, from farm management to product development. Precision farming techniques, such as automated milking systems and data-driven herd management, are improving efficiency and productivity. Additionally, innovations in food processing and preservation are enabling the creation of novel dairy products with extended shelf life and enhanced taste profiles. Staying abreast of technological developments is vital to maintaining competitiveness and long-term success.

To remain relevant, dairy producers and suppliers must have a deep understanding of consumer preferences and behaviors. This involves conducting market research, analyzing sales data, and engaging with consumers through social media and other platforms. By identifying emerging trends and preferences, businesses can tailor their offerings to meet the evolving demands of their target audience. We have to embrace the importance of where useful technology and data can take us.

Diversification is key to sustaining growth and relevance in the dairy industry. Producers should explore and embrace opportunities to expand their product portfolios, such as introducing plant-based dairy alternatives or developing lactose-free options. Suppliers can also benefit from diver-

sifying their services, offering solutions that cater to various segments of the market, including retail, food service, and industrial applications.

Building Strong Brand Identity

A strong brand identity is vital for standing out in a crowded market. Producers and suppliers should invest in marketing strategies that highlight their unique value propositions, such as quality, sustainability, or innovation. Collaborations with influencers, participation in industry events, and engaging storytelling can help build a loyal customer base and enhance brand recognition. Connect with people, and they’ll always reach for you first.

Plant-Based Dairy Alternatives

As much as I hesitate to say it, the rise of plant-based diets

enhance the nutritional profile of dairy offerings. Dairy producers have great ideas, and our customers are willing to pay for that unique differentiation!

Artisanal and Specialty Items

There is a growing appreciation for artisanal and specialty dairy products, such as gourmet cheeses, handcrafted butter, and unique yogurt flavors. These items offer a premium experience and cater to consumers looking for high-quality, locally sourced, and authentic products. Producers can differentiate themselves by focusing on craftsmanship and regional heritage.

Convenience and On-the-Go Options

Busy lifestyles are driving demand for convenient dairy products that can be consumed on the go. Single-serve yogurt cups, ready-to-drink milkshakes, and portable cheese snacks are examples of products that align with this trend. Suppliers

BY ALEX WALSH, EXECUTIVE DIRECTOR

s the first quarter of the year comes to a close, the associations have been very active and engaged in a variety of ways. It’s been a busy, but promising and exciting, few months.

The staff and boards are excited and looking forward to what the next few months have in store. In this article, you will read a lot about opportunities, not just for the industry or the associations, but for you as a member as well.

Our best-in-class advocacy efforts are in full force in each and every state of the organization, as well as activity in Washington. You will read more about the associations’ policy and regulatory actions in the legislative update article. It’s important to note, however, how critical the efforts of the associations, the legislative committee, and engagement from members are when it comes to providing the dairy industry’s voice and carrying out our messages to policymakers.

Back in March, we held the fifth annual Dairy Blender in Rochester, New York. It was a fantastic turnout of processors, manufacturers, and suppliers to learn from the presentations given by Cayuga Milk Ingredients, Saputo, and Yancey’s Fancy. This event — which morphed out of COVID — has been a way to bring plant tours to the people. As 120 attendees listened to the products they produce, future plans and goals, and what they look for from suppliers, it continued to prove to be a valuable event in our event portfolio. Thank you, again, to all of the members who came out, our presenters, sponsors, and the staff for making this year’s Blender another huge success.

Be sure to mark your calendars for:

• June 5: Dairy Day at the New York State Capitol

A great opportunity for processors and manufacturers to engage with state legislators and policymakers, celebrate the prominence of the dairy industry, and hand out samples.

• July 9: Bruce Krupke Memorial Golf Tournament and Clambake

Enjoy a morning of golf, followed by an afternoon of all-you-can-eat-and-drink fare, surrounded by more than 900 of your friends in the industry.

• Sept. 17-19: Northeast Dairy Conference

A mixture of business, networking, and fun. With a range of presentations from speakers on various topics impacting the industry, exhibit booths, relationship building, golf, and enjoyment, this is a worthwhile and valuable event you won’t want to miss.

Registrations are open, and details of these events are posted on the associations’ website.

The associations will also be awarding $20,000 in scholarships again this year. The deadline to apply is June 1, and more details and application information are available on our website. This is another valuable benefit of being a member of the association!

Speaking of the association’s benefits, depending on what your company does — whether you’re a processor, manufacturer, distributor, or supplier — companies join for various goals and purposes. No matter what yours are, the association is here to assist you with achieving those goals, improving your operations, and expanding your business. Let’s take a look at some of the benefits and ensure you are taking full advantage of what the NDFSA has to offer:

Advocacy – The NDFSA is your watchdog and your advocate. We are on the front lines fighting against proposals that impede progress and growth, driving policies that support dairy products, and monitoring issues on the horizon.

Cost-savings programs – Not all members, especially processors or manufacturers, join solely for the associations’ lobbying capabilities. Some may be start-ups, newer in business, or smaller and don’t have the resources, and turn to the

NDFSA for ways to alleviate time and/or capital on human resources solutions, energy savings programs, insurance discounts, and more!

Educational platforms – We partner with various colleges, universities, trade schools, agencies, and career centers. Utilize these capabilities of the association to your benefit to attract and retain your workforce, advancement opportunities with access to certification programs and professional development courses, and the Cornell University Boot Camps giving students and adults courses highlighting careers in the industry that drive labor recruitment. Some of these are offered in person or virtually and also include association-hosted webinars.

Networking opportunities – The NDFSA’s event portfolio offers members enhanced engagement and relationship-building opportunities amongst industry leaders and professionals. Our events provide an excellent platform for you to open doors with new customers, make connections, and strengthen existing relationships. Additionally, you’re able to raise your profile at our events by being in atten-

is June 1!

For more information, and to apply, click here.

dance, as well as enhance brand visibility opportunities. Resources – Providing you and your company with resources and information that will increase efficiency and continually serve to improve your operations. These include the Membership Directory and Buyer’s Guide, which detail contact information and the scope of business, as well as industry news with our weekly newsletter and quarterly magazine, and economic analysis with access to dairy pricing information, market data, and forecasts to operate more effectively for the future. There are also action alerts informing you of updates on legislative and regulatory actions impacting the industry.

The benefits of being a member of the NDFSA are boundless. We have seen some historical and monumental announcements coming from members about their growth and expansion that will be shaping the industry for years to come. The NDFSA is proud to partner with our members and assist in your growth and continued success. It’s an exciting time in the industry, in the Northeast, and for the associations, and we are enthusiastic about what the short- and long-term future holds.

For this issue, we asked board members from the Northeast Dairy Foods Association and the Northeast Dairy Suppliers Association the following question: Are there trends you are seeing that consumers are gravitating towards that will have an effect on the dairy and/or food and beverage industry?

This is what they said.

Editor’s note: These answers were edited for clarity.

Tony Nassar, Director of Dairy Procurement, Chobani

More protein and less sugar are the asks from consumers. Ultra-filtered milk is in more demand from processors.

In the ice cream segment, we are seeing consumers continuing to spend more on feature flavors, which are crafty, unique flavors that may or may not become future everyday flavors. It’s always fun experimenting with new flavors, but there are certain flavors that aren’t meant to be an ice cream flavor. For example, several years ago, we worked on a hot Buffalo wing ice cream. Let’s just say it would be best to order a dozen wings from your favorite pizzeria or restaurant.

Novelties continue to show strong growth due to their convenience and portion control. We installed a new extruded stick novelty line last year to take advantage of this trend, offering premium and super-premium Perry’s branded bars in four and six count retail packs. We are also co-manufacturing for two national super premium brands and looking to add several others later this year and in 2026.

Consumers are asking more and more sustainability questions, which include eco-friendly packaging and carbon-neu-

tral production. The ethical sourcing of ingredients and the current focus on artificial colors are questions being asked. Lastly, more and more ice cream brands can be bought online, including Perry’s, for those friends and family members that moved away and miss hometown favorites. Or it’s a way for ice cream connoisseurs to try ice creams that they read about on social media but can’t find at their local stores.

Bucklin, Sales Manager, Smurfit Westrock

Consumers look for health and nutrition benefits while mindful of their budget. Some look for trends, even in dairy. Lactose-free product growth has been strong for years now with no sign of slowing. Greek yogurt demand plateaued many years ago, so marketers must find new ways to maintain demand. Packaging, both labeling and container size, can be one tool to achieve this.

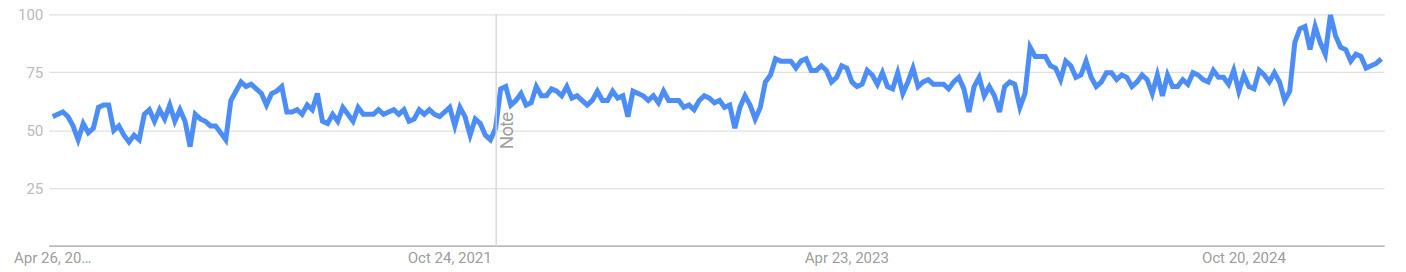

Paul Knoerl, Packaging Equipment Specialist, Pactiv Evergreen

Over the past 10 years, consumers have been trending towards a preference for dairy products and beverages with enhanced nutritional and health benefits. Many of the dairy and plant-based products introduced in this time frame have promoted reduced calories/carbohydrates, pro-

biotics, reduced sugars/sweeteners, zero lactose, as well as increased protein and vitamins. Higher energy drinks have seen considerable growth amongst some generations of consumers.

The success of fairlife milk with increased protein levels and reduced sugar with zero lactose has been a primary leader in promoting these increased health benefits of milk to consumers. Other brands, for example A2, and regional dairy companies have followed suit with similar offerings and differentiated product lines.

One can see similar patterns in new products from ice cream and yogurt manufacturers to address consumers' desire for healthier products with nutritional advantages.

Cost concerns have increased substantially with consumers due to the inflation experienced post-COVID. Consumers are looking for more value and lower prices to help with their increased weekly grocery bills. We are beginning to see a trend by dairy product producers to consider downsizing package sizes to address this concern and achieve a lower price point for their customers.

Rick Wadhams, Owner, Wadhams Enterprises

From where we stand in the hauling/trucking business, I’m not sure what the consumer trends are other than I feel they are looking for the best prices but still want the dairy products that lead to a healthy diet. That’s more from a personal observation from my family.

On a different subject, a trend we see is that many of the larger farms and milk producers are in growth mode, building barns and adding milk cows. This may partly be because of the new fairlife plant being built right now in Rochester (Greece), which will take in huge volumes of milk, and now it has just been announced that Chobani is building a huge yogurt plant in Rome, New York.

BY ALEX WALSH, EXECUTIVE DIRECTOR

To no surprise, the first few months of the legislative sessions — both at the state and federal levels — have been stressful and entertaining, to say the least.

What we’ve seen is a consistently tumultuous political landscape. The dramatic shift in policies, regulations, and practices in the Trump administration from the Biden administration transition alone, not to mention the trickle-down effect, has caused waves throughout the food and agriculture sectors all along the supply chain — from farmers, processors, suppliers, and retailers to the consumers. This is all occurring in the midst of ongoing inflation challenges. While uncertainty and constant evolution on issues remain, the agility and resiliency of, especially that of dairy processors and manufacturers, remain strong, with the determination to find resolutions.

There certainly is no shortage of pending regulatory changes, proposed bills, and issues to discuss, but in this article, we will highlight a few, with the annotation that by the time of publication, things could be completely different.

For starters, while the U.S. Food and Drug Administration (FDA) has deemed certified artificial colors safe (also commonly known as GRAS, generally recognized as safe) when used in accordance with FDA regulations, the Trump administration, led by Health and Human Services Secretary Robert Kennedy Jr., is considering phasing out the use of certain certified artificial colors in foods manufactured and sold in the United States. At the same time, five states — Arizona, California, Utah, Virginia, and West Virginia — have passed laws banning the use of certified artificial colors in foods sold to schools and, in some states, all foods sold in the states. These lists also continue to grow.

The main goal of the Healthy Dairy in Schools Commitment is to ensure the public, especially parents,

policymakers, and lawmakers, continues to view dairy as a healthy, nutritious, and wholesome food option for America’s students, while a secondary goal is to ensure there is no disruption to the marketing or availability of nutritious dairy foods sold to schools, even as states impose new standards on certified artificial colors. On the flip side, there has been a reinvigorated push for whole milk back in schools, which seems to have promising momentum. This would not only be welcoming news for the dairy industry, as many members supply milk for schools, but also for the industry as a whole as we continue to combat misconceptions.

Similarly, as the federal administration continues to make sweeping changes when it comes to food policy and regulations, states are countering or expanding those proposals with their own, for example on SNAP benefits.

Most states with Make America Healthy Again (MAHA)aligned bills do include specific language ensuring milk and milk-containing products are exempt from restrictions, but some states, including New York, do not specifically exempt dairy. A bill in the New York assembly, A4416, creates a list of “healthy and nutritious foods and beverages” (including but not limited to milk and cheese). This list “shall not include foods and beverages with significant amounts of added sugar, artificial sweeteners, or sodium…,” which would likely target ice cream. The associations have been very active with legislators on these bills and making progress when it comes to educating lawmakers and slowing or even completely stopping the movement of these bills.

At the same time, Extended Producer Responsibility (EPR) bills continue to rise up and spin heads with their complexities. In New York, a second “industry-friendly” version of EPR has been introduced. Maine and New Jersey are also considering proposed legislation on this issue. The sentiment behind EPR in the dairy industry has evolved over

As we look to the last half (for most states) of the legislative session, rest assured that the Northeast Dairy Foods & Suppliers Associations are laser-focused on issues impacting our members and the industry. You can expect the annual last-minute changes, fanfare, drama, political negotiations, and stress to increase as we approach the recess. Nevertheless, the NDFSA remains your steady voice and advocate on your behalf.

the last few years as well. Since its conception in around 2018 or 2019, the philosophy of EPR has shifted from basically vehemently opposed to an acceptance that these regulations are coming; let’s find a workable solution for all stakeholders involved. Because this is, and is going to be, a monumental issue impacting the dairy industry, consumers, and many other industries for years to come, it’s important to spend some time on this.

The new version in New York, known as the Affordable Waste Reduction Act, S5062/A6191, is sponsored by Senator Monica Martinez and Assemblymember Chantel Jackson, respectively. It provides a more comprehensive and collaborative framework for waste reduction similar to Minnesota’s Packaging Waste and Cost Reduction Act. Both laws set targets for waste reduction, recycling rates, and the incorporation of post-consumer recycled content, aiming to drive continuous improvement in packaging sustainability. S5062 establishes PRROs and an inclusive advisory board that ensures multiple stakeholders, including businesses, municipalities, and environmental groups, have a voice in the decision-making process. S5062/A6191 also takes a broader approach to waste reduction, not just focusing on packaging but addressing waste management holistically.

The funding mechanism in S5062 is more equitable, ensuring that all parties in the supply chain contribute fairly without disproportionately impacting businesses or consumers.

1. Compliance dates and performance standards must be reasonable, achievable, and informed by a third-party needs assessment. For S1464/A1749 to even be achievable, dairy and food processors and manufacturing companies will need a longer runway for compliance and implementation. This legislation establishes several source reduction, minimum post-consumer recycled content, and recycling rate targets, yet none of these targets are based on a needs assessment or facts on what progress in New York can realistically be made and when. By setting such aggressive targets, our organizations are very concerned that compliance with this legislation would ultimately be unachievable, placing our members in an untenable situation.

• S5062/A6191 takes a different approach, and we recommend that New York conduct a robust needs assessment and rates study prior to setting any mandatory performance goals. We also recommend that New York look to Colorado to understand the important role of a needs assessment.

2. The definition of “producer” is confusing and will make it challenging for our members to determine whether they have compliance obligations. The dairy processing industry has a complex supply and manufacturing chain well beyond the brand names consumers see at the store. The dairy processing industry has a strong co-manufacturing and private-label business, complex business-to-business operations, and imports. Over the last year, it has been challenging for our members to determine their legal obligations in states such as Oregon, Colorado, and California.

• S5062/A6191, however, is based on the Minnesota EPR law, which was informed by the manufacturing industry and therefore more clearly spells out legal obligations.

3. Shifting landfilling disposal costs to producers leads to more landfilling, not more recycling. The NDFSA and IDFA are not aware of any other jurisdictions that require food companies to reimburse municipalities for the disposal of packaging materials. Under S1464/A1749, we are concerned that producers would be funding the cheapest and easiest materials management option instead of funding recycling innovation and capacity, leading only to more landfilling. Our members want their fees to fund recycling and its infrastructure, not more landfilling.

• S5062/A6191 does not reimburse landfilling. To be successful, EPR must function to share costs between producers and local governments fairly and reasonably. EPR is a multistakeholder endeavor and not just a funding mechanism.

4. The legislation’s source reduction targets are not realistic and do not sufficiently consider a company’s recent source reduction achievements. Our members support

source reduction as a method to reduce packaging waste, lower costs, and improve sustainability outcomes. For this reason, dairy companies have been proactively working with packaging suppliers and investing in technology to maintain food safety and product quality while reducing packaging weight and other source reduction strategies for many years. S1464/A1749, however, imposes arbitrary source reduction targets and deadlines, none of which are based on a needs assessment for individual materials. The source reduction waiver provisions to consider efforts within the last 2-5 years are helpful but still a burdensome annual waiver that misses source reduction achievements that many companies began in the last decade. Furthermore, producers’ options are limited since producers cannot fulfill the requirement by switching to a non-plastic material.

• S5062/A6191 takes a different approach, benchmarking source reductions in a needs assessment and basing performance measures on the real needs and capabilities of New York.

5. The legislation does not consider the food safety and food quality needs of packaging. S1464/A1749 does not consider further source reduction or other mandates that cannot be fulfilled because of food safety and quality reasons. The bill’s exemption for conflicts with federal law is too vague and requires a conflict as opposed to a technological and economic barrier. Food safety and quality are of paramount importance to the dairy industry, particularly for fresh and Grade “A” dairy products that are highly regulated by the FDA and the NYS Department of Agriculture and Markets.

• S5062/A6191 avoids these concerns by allowing the PRRO to set a base source reduction target using a needs assessment.

6. Federal agencies are the proper regulators for food packaging materials. Our organizations understand the legislature’s desire to remove PFAS from the environment and food packaging, and our members share that goal. However, the EPA and FDA are taking the lead on a national PFAS policy, and we respectfully ask New York to let those agencies do their statutorily mandated jobs. The FDA is acting on PFAS in food contact materials.

We are also concerned that New York continues to describe PFAS in terms of “intentionally” or “unintentionally added,” as opposed to what is controllable. Those are not terms used by federal regulators or scientists in this area of chemical contaminants, complicating FDA-required good manufacturing

processes and chemistry requirements for food contact materials. There are also concerns about how any company could certify that packaging lacked unintentionally added PFAS, because while the FDA has a packaging testing method, it is not yet validated. Finally, from a policy perspective, we do not believe that adding a PFAS ban is related to expanding and improving recycling systems.

• We suggest that New York defer to the EPA and FDA on chemicals, as they should be considered separately from S1464/A1749, recycling, and EPR.

• We also request the removal of provisions requiring producers to reimburse municipalities for disposal and landfilling activities in favor of fair and equitable allocation of costs between these entities.

7. This legislation will place New York’s dairy processing companies doing business in multiple states at a competitive disadvantage. Many of our New York-based members conduct business operations in multiple states bordering New York and throughout the country. Through the enactment of S1464/A1749, conducting business in neighboring states would significantly increase the cost of business and place dairy products produced in New York at a significant competitive disadvantage. Many dairy brands manufactured in New York also compete in the national marketplace, and costs associated with this legislation would hurt New York dairy producers, processors, and manufacturers, not only regionally but also nationally. Moreover, requiring food and beverage manufacturers to absorb additional costs would unnecessarily place additional risk on businesses that are already struggling to compete with other present economic factors, such as historic levels of inflation and pending tariff implications, resulting in an increase in food and beverage prices.

S1464/A1749 goes beyond these other states without considering the lessons those state regulators are already learning about the challenges in designing a workable EPR program. Our members share the goals of an efficient and stakeholder-driven EPR system, but New York is moving in a direction with S1464/A1749 that will ultimately not lead to an improved recycling program. Many industries are supporting producer-driven bills in Washington and Minnesota. We urge legislators to examine the other laws and implementation issues to develop a program that bridges lessons learned in other states.

Other regulatory change proposals that have been increasing at the state levels this legislative session include taxes on sugary beverages (which in some instances include milk), as

well as what seems to be an increasing push to allow for the loosening of restrictions around the sale of raw milk. The associations have been vocal and opposed to these proposals wherever they arise.

As a prime example of non-industry-specific policy changes that are more business-focused that the associations monitor is the expansion of Vermont’s unpaid family and medical leave law. The bill would:

• Broaden the definition of family to include domestic partners, grandparents, grandchildren, siblings, and others with close family-like relationships.

• Add job-protected bereavement leave.

• Add protections for employees dealing with the impacts of domestic violence or sexual assault.

• Expand parental leave to cover miscarriage recovery and foster care placements.

• Add new leave protections for employees with family members in active military service.

For our members in Vermont, we are closely monitoring and engaged. And, to bring this full circle, while it may be a general business policy, we all know that the dairy industry is

not your “general business,” with producers, processors, and manufacturers operating seven days a week, 365 days a year, around the clock. These are the types of proposals that could have greater impacts on other types of businesses, resulting in further labor challenges.

As we look to the last half (for most states) of the legislative session, rest assured that the Northeast Dairy Foods & Suppliers Associations are laser-focused on issues impacting our members and the industry. You can expect the annual last-minute changes, fanfare, drama, political negotiations, and stress to increase as we approach the recess. Nevertheless, the NDFSA remains your steady voice and advocate on your behalf.

BY GARY LATTA

New York and the rest of the Northeast are fast becoming a dairy juggernaut. With the recent announcement of Chobani’s $1.2 billion investment for a new yogurt plant in Rome, New York, the wonderful news keeps pouring in.

There are several large plant investments being made across the country. Many of these are new construction, and others are expansions of existing facilities. Several large cheese plants are coming online in the Southwest, while the upper Midwest has some smaller projects going on that are also cheese-related. Most dairy manufacturing facilities are constantly upgrading and making investments of some sort. It is an ongoing process. The future is both a wonderful opportunity and a challenge for U.S. dairy producers and manufacturers.

On April 22, Governor Kathy Hochul, Chobani Founder and CEO Hamdi Ulukaya, along with government and dairy industry leaders, met at Rome’s Griffiss Business and Technology Park to celebrate the announcement. The new Chobani

facility will be 1.4 million square feet and add an additional 1,000 new jobs to the company’s existing nearly 1,000 employees in New York. The new plant is expected to process at least 12 million pounds of milk per day. Chobani joins several other major dairy players that have announced new facilities and expansions in the Northeast.

In April of 2024, fairlife, the Coca-Cola Company, and Governor Hochul announced their new $650 million, 745,000-square-foot facility in Webster, New York. Fairlife will produce its ultrafiltered milk with less sugar, more protein, and longer shelf-life products in the new plant, which is expected to create 250 new jobs in the area. The new facility is expected to be operational near the end of 2025.

In 2022, Great Lakes Cheese broke ground on their new 486,000-square-foot manufacturing and packaging plant on a 200-acre site in Franklinville, New York. The new $700 + million plant will replace Great Lakes Cheese’s Cuba plant just south of Franklinville and will process at least 1.42 billion pounds of milk annually.

The new facility became operational in early 2024 and is expected to employ at least 500 people, nearly doubling the number that worked at the Cuba facility.

In January 2025, Byrne Dairy announced a $120 million expansion to its dairy manufacturing facility in Cortlandville, New York, that will create an estimated 250 new jobs. The expansion will add 26,000 square feet of new production area and three new stainless-steel silos. In recent years, Byrne has been busy with several additions and upgrades to its extended shelf-life and aseptic plant operations in DeWitt, New York, near Syracuse. In September of 2024, Byrne revealed its new Innovation Center located next to the DeWitt facility to be used for product development, shelf-life testing, sensory evaluation, analytical testing, and other services.

Hood purchased its Batavia, New York, extended shelf life facility from Dairy Farmers of America (DFA) in July of 2017. DFA had acquired the plant from Muller Quaker in December of 2015. Hood owns the Lactaid brand and made several

sizable investments and expansions at the facility, which is at least 460,000 square feet and employs about 450 people. Hood owns and operates 12 manufacturing facilities throughout the U.S. Most of its operations are in the Northeast, where its packages fluid milk, cream, cottage cheese, ice cream, sour cream, and more. In 2024, the Batavia facility was named Dairy Foods Plant of the Year. In total, HP Hood employs approximately 3,400 people.

In 2023, Wells Enterprises (Wells) announced a $425 million expansion to its Dunkirk, New York, ice cream and novelties manufacturing facility. Wells plans to add 270 new jobs to its existing 380 full-time jobs for a total of 650 employees at this one location. A chocolate manufacturing operation will be housed inside the facility. The new production capabilities will increase output over four times to support the company’s growth in novelty and packaged ice cream. The expanded facility is expected to be operational by late 2025.

Wells is headquartered in Le Mars, Iowa, with manufacturing plants in Le

Mars; Henderson, Nevada; and Dunkirk, New York. It manufactures more than 200 million gallons of ice cream per year with sales in all 50 states. In total, the company employs more than 4,000 people in multiple manufacturing plants for its Blue Bunny, Halo Top, Bomb Pop, and Blue Ribbon Classics brands.

Cayuga Milk Ingredients (CMI) in Auburn, New York, was founded in 2014 and utilizes the milk supplied by 32 family-owned farms in the surrounding region. CMI recently announced a $150 million, 130,000-square-foot facility expansion plan to include a new aseptic processor and bottling and packaging lines that will produce finished products for the extended shelf-life beverage market. Other improvements are planned for wastewater treatment, stormwater retention, parking, and utility upgrades. The expansion of bottling lines and improvements to its milk receiving bays will increase plant capacity to 150,000 gallons per day. CMI estimates the new upgrades will add 100 full-time positions to its existing 70 employees.

In mid-2020, BelGioioso Cheese built a new $25 million, 100,000-square-foot cheese manufacturing plant in Glenville, New York. In 2011, BelGioioso acquired the Cappiello cheese plant in nearby Schenectady. The new Glenville plant expanded production capability, adding 50 jobs and retaining 31 existing jobs. BelGioioso operates nine plants in the U.S. and manufactures specialty Italian cheeses from local dairies.

Lactalis USA is always busy with expansions and upgrades to its facilities across the country. In January 2025, Lactalis opened their $2 million Culinary & Sensory Institute in Buffalo, New York. The facility is designed to help expand its culinary expertise and has both residential and commercial kitchens where food professionals work on the latest food trends. Recently it was reported that Lactalis will spend $5 million to replace a battery charging area at its Buffalo cheese facility to build a new and bigger one. They also plan to build a new engine room.

In 2023 Lactalis announced that it would invest $32 million to expand the Buffalo facility, increasing its production of whey. The project will add 6,600 square feet for a new evaporator and a 4,000-square-foot building for new electrical equipment. The Buffalo plant produces 280 million pounds of dairy products annually. Other Lactalis U.S. locations include California, Arizona, Idaho, Wisconsin, Vermont, and New Hampshire. Lactalis Buffalo employs approximately 684 people. About 97% of the milk at the Buffalo plant comes from New York dairy farms.

In June of 2023, Agri-Mark Inc., a leading dairy farm

cooperative in the northeast, completed a $30 million expansion of the McCadam cheese plant in Chateaugay, New York. The project added 9,600 square feet to their existing 110,000-square-foot manufacturing facility.

DFA owns 46 plants across the nation, with nine of them located in the Northeast. DFA not only supplies farm milk to its own plants but is a major supplier to many dairy companies in the Northeast. DFA and other northeast cooperatives play a critical role in balancing milk supplies.

In March of 2024, the Maryland and Virginia Milk Producers Cooperative, with farmers and dairy processing facilities in 11 states, purchased Hood’s extended shelf-life ultra-high temperature dairy processing plant in Philadelphia. The new owners plan to double plant capacity from 10 million gallons to 25 million gallons by 2026.

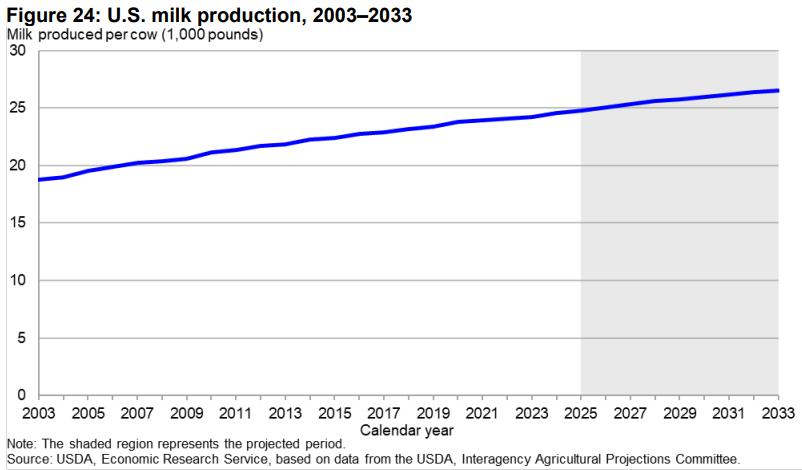

The USDA-ERS, and its projection committee consisting of 10 agencies, released the latest Long-Term Agricultural Projections to 2033 in February 2025. The image displayed on page one of this paper shows that the USDA is optimistic for steady milk production growth to 2033. Their assumptions are as follows:

• Milk production is projected to rise at a compound annual growth rate (CAGR) of 1.1% per year to 253.6 billion pounds in 2033.

• Feed prices are expected to decline from the high values of recent years through the middle of the projection period but increase thereafter at a steady pace.

• Following the low margins experienced through most of 2023, and their lagged impact on the milking herd, the national dairy herd is projected to decline though 2025, but then start rising in 2026.

• As domestic demand for dairy products grows and exports increase, milk prices are expected to rise relative to input prices, supporting dairy herd expansion.

• Technological and genetic advances will contribute to increasing cow milk yields as well as the milk fat and skim-solids (protein, lactose, and minerals) content of the milk.

• In 2033, annual milk production per cow is projected to average 26,540 pounds.

The following developments are projected for the U.S. dairy sector:

• Domestic use on a milk fat, milk-equivalent basis is projected to increase by a CAGR of 1.1% over the projection period. On a skim-solids basis, domestic use is projected to increase at a modest CAGR of 0.7% from 2025 to 2033.

• Demand for cheese is expected to rise based on increas-

ing consumption of food eaten away from home and rising consumer incomes. Butter demand is also expected to expand. However, the decline in per capita consumption of fluid milk products is expected to continue.

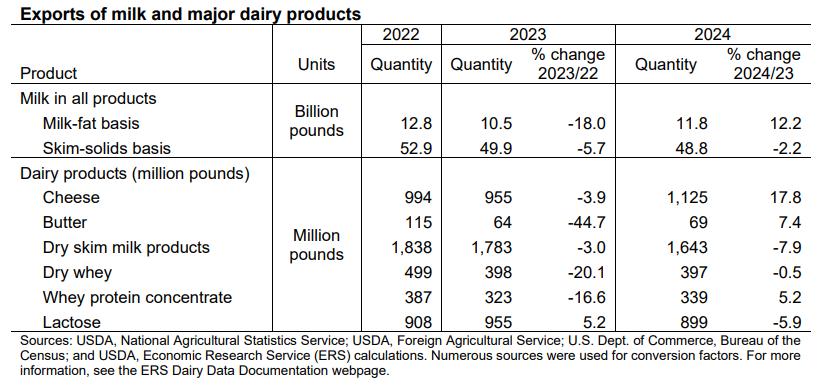

• Global demand for U.S. dairy products is expected to continue to rise over the projection period, especially for products with high skim-solids content, such as dry skim milk products (nonfat dry milk and skim milk powder), whey products, and lactose. On a skim-solids basis, dairy exports are expected to grow from 23.0% of 2024 milk production to 25.5% of 2033 milk production. However, on a milk-fat basis, exports are expected to decline and remain comparatively low, projected at 3.9% of 2033 milk production, down from 5.2% of the projected 2024 milk production.

• The nominal all-milk price is projected to trend upward over the projection period. However, it is not projected to reach the 2022 record high.

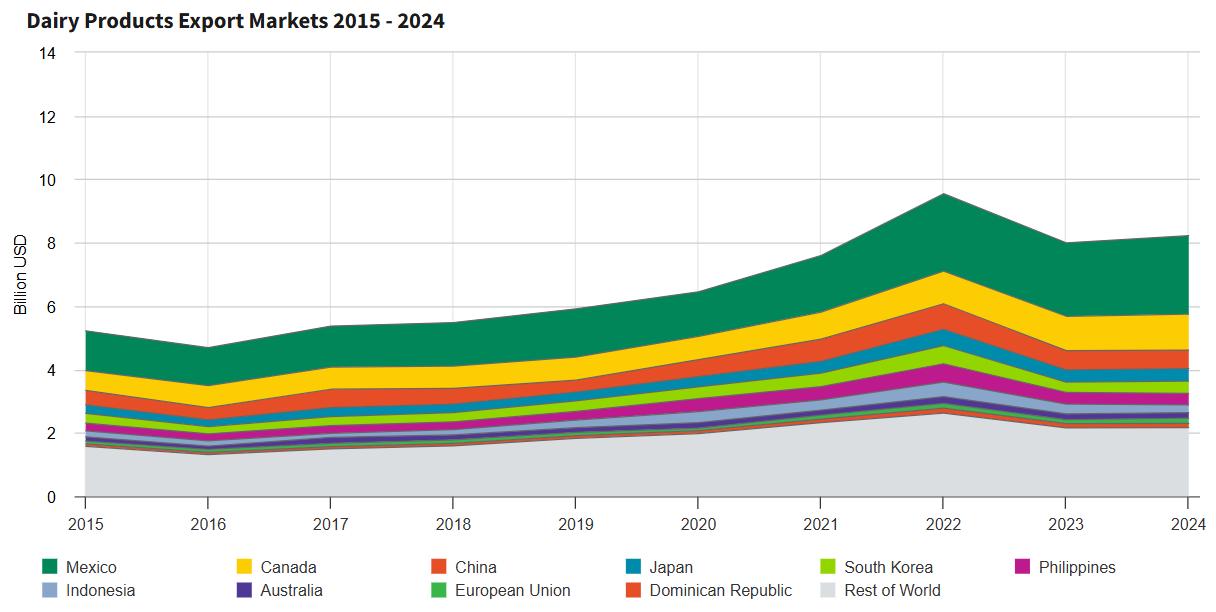

The U.S. remains competitive with most dairy exports internationally. Some observers are concerned that if international dairy prices get weaker, they will become more competitive with the U.S. export price and dampen our sales. U.S. prices for now, especially cheddar cheese, are attractive globally.

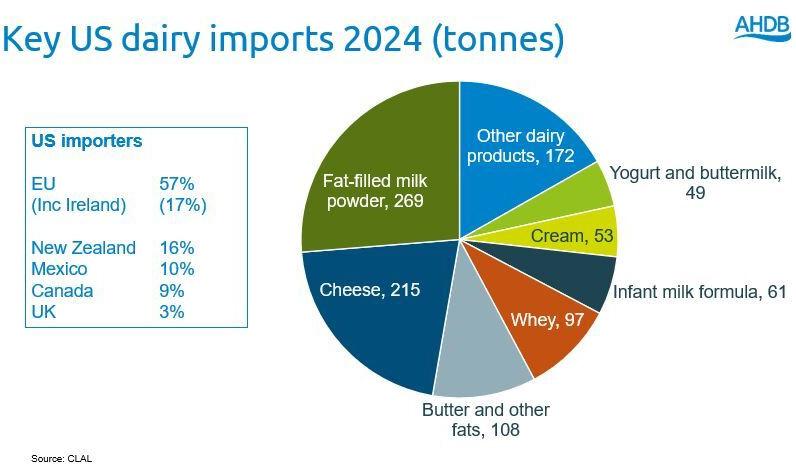

Source: Weekly Dairy Outlook, Prof. Normand St-Pierre Ohio State University

U.S. consumers cannot get enough butter. Butterfat yields at the farm continue climbing, and a record 2.2 billion pounds were produced last year. The U.S. keeps importing more butter every year, and we saw 173 million pounds of it in 2024. Much of this is boutique-style butter used by pastry chefs and bakers, coming in from Ireland and known for its slightly higher butterfat content. U.S. dairy now exports about 17% of its milk production, an amount that is climbing each year. The industry is genuinely concerned about tariffs, immigration labor, and highly pathogenic avian influenza (HPAI), or “bird flu.” Several reports point to HPAI as a key reason some large dairy states like California are struggling with milk production.

The tariff situation has been changing and evolving each week at a dizzying pace. Most industry observers are cautious about making predictions as to how it all will end. Mexico and Canada are the two biggest export destinations for U.S. dairy products. The Trump administration has put a lot of pressure on Mexico regarding the border issues of illegal drugs and migrant crossings. The administration has also put pressure on Canada for numerous issues, including their dairy protectionist measures. So far, the U.S. has not been able to break into the Canadian dairy market as it would like to. Canadian dairy is protected politically but is feeling pressure from within from consumer and free market groups. What will come of USMCA? Will it be revised or replaced by something better? Is this a pivotal moment for US-Canadian dairy relations?

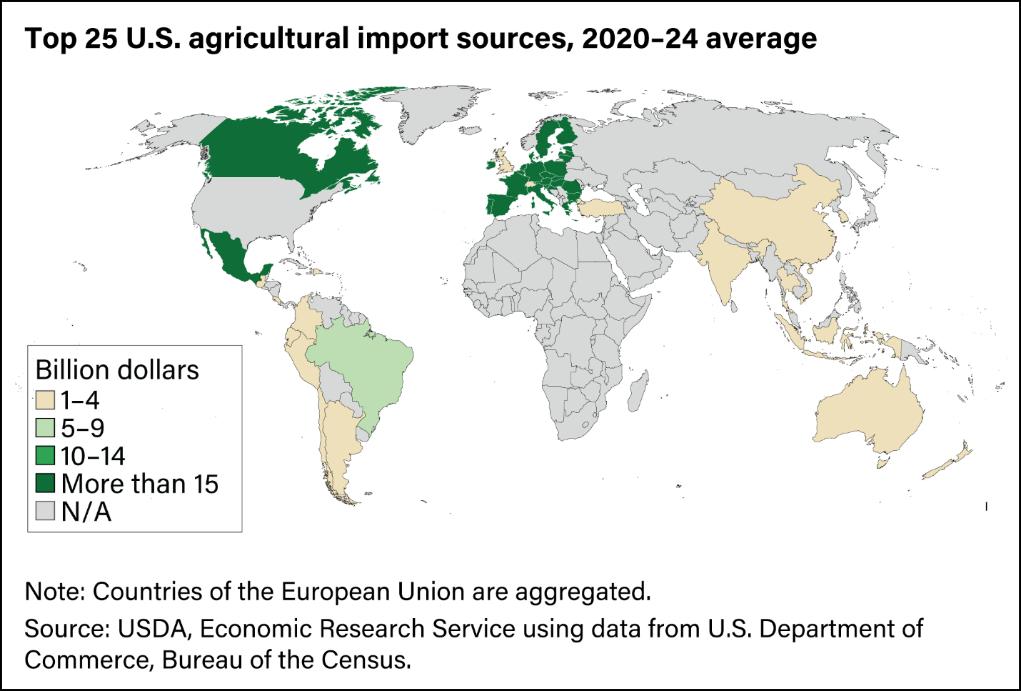

One thing is for certain: Agricultural imports and exports are important for Mexico, Canada and the United States. Mexico is the No. 1 export market for U.S. dairy and agriculture. In 2024, U.S. dairy exports totaled 757,081 metric tons valued at $2.47 billion. The 10-year average value is $1.71 billion, with 96% growth over the past decade. Mexico, Canada, and the European Union are the top three agricultural exporters to the U.S. These three are responsible for 60% of all agricultural sales to the U.S. between 2024. Mexico ships on average $41.6 billion a year, mostly horticultural products like fruit, vegetables, and alcoholic beverages. Canada ships $35.0 billion annually to the U.S., mostly processed products (baked goods), meat, vegetable oils, and some vegetables.

The British (UK) Agriculture and Horticulture Development Board (AHDB) recently did its own analysis of the tariff threat in their publication “ The impact of Trump's tariff announcements on the British dairy sector.”

The UK admits the tariffs are sending ripples through global markets. However, it does not export as much dairy to the U.S. as other countries…. like the EU collectively.

Susie Stannard writes, “Of other nations trade to the US, 57% of total dairy imports (based on average of 2022 to 2024) comes from the EU (with Ireland making up 17% of that alone), 16% comes from New Zealand, 10% from Mexico, 9% from Canada and other nations making up a small proportion. To contextualize, UK dairy imports make up only 3% of US dairy imports. On the face of it, that means that the UK has much less to lose than some other countries.”

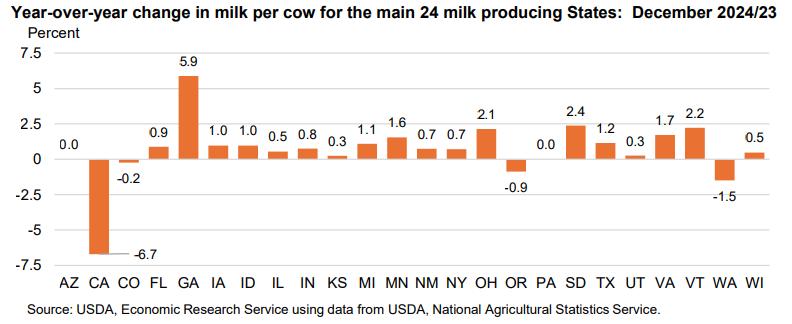

The USDA’s National Agricultural Statistics Service (NASS) reported that 2024 annual milk production in the U.S. was down 0.2 % from 2023. From 2015, the U.S. annual total milk production has increased 8.3%. The

average annual milk production per cow has increased 8.1% from 2015, and the average annual number of milk cows has increased 0.2%.

A summary of all states’ 2024 annual milk production is found in the February 2025 issue of USDA Milk Production. All 50 states collectively showed a drop of 0.2% from the year 2023. Looking at the larger milk-producing states, we see a production change as follows:

A few large dairy states experienced a drop in annual milk production last year.

2024 % Change in Milk Production

Others are small but positive increases. Several of these states have been struggling with bird flu. Bird flu’s impact on dairy seems to be getting under control in many states. To view the latest CDC update with an excellent interactive map, visit H5 Bird Flu: Current Situation

The USDA’s latest forecast has 2025 milk production increasing to 226.9 (+0.7) billion pounds from higher cow numbers (+25,000) and improved output per cow (+10 pounds). Therefore, product price forecasts are adjusted lower

Milk Cows – United States: 2015-2024

per Cow – United States: 2015-2024

from last month, including cheddar cheese $1.790 (-2.0 cents), dry whey $0.510 (-1.50 cents), butter $2.445 (-7.0 cents), and nonfat dry milk (NDM) $1.22 (-3.5 cents).

With lower product price forecasts, the projection for Class III and IV milk prices are also revised downward from their previous estimates to $17.60 (-$0.35) and $18.20 (-$0.60) per hundredweight (cwt), respectively. The all-milk price forecast for 2025 is $21.10 per cwt, down $0.50 from the USDA’s previous month’s forecast.

• In 2025, overall food prices are anticipated to rise slightly faster than the historical average rate of growth.

• In 2025, prices for all food are predicted to increase by 3.5%.

• Food-at-home prices are predicted to increase by 3.2%.

• Food-away-from-home prices are predicted to increase by 3.8%.

Source: Food Price Outlook - Summary Findings, Updated: 4/25/2025

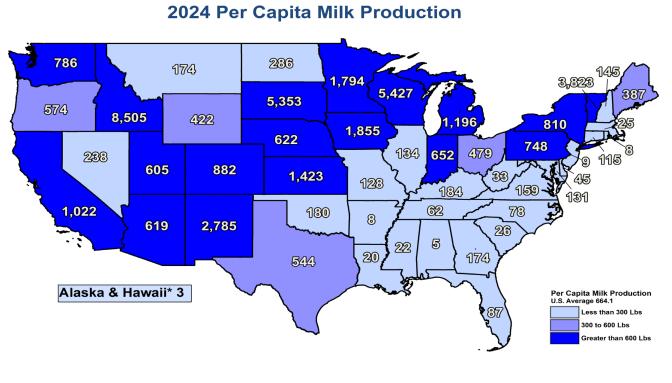

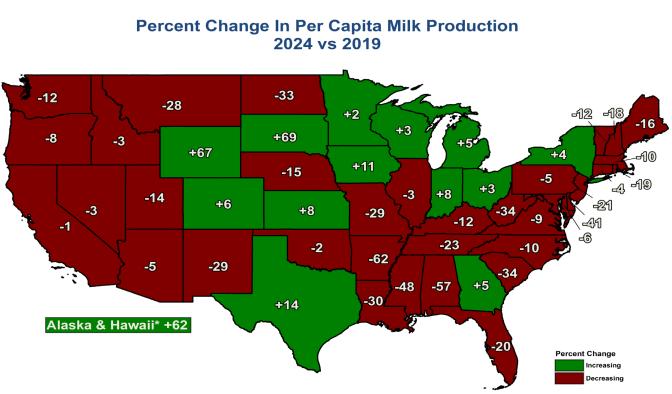

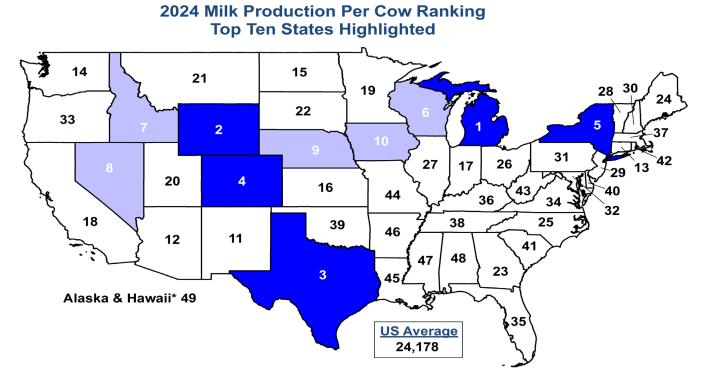

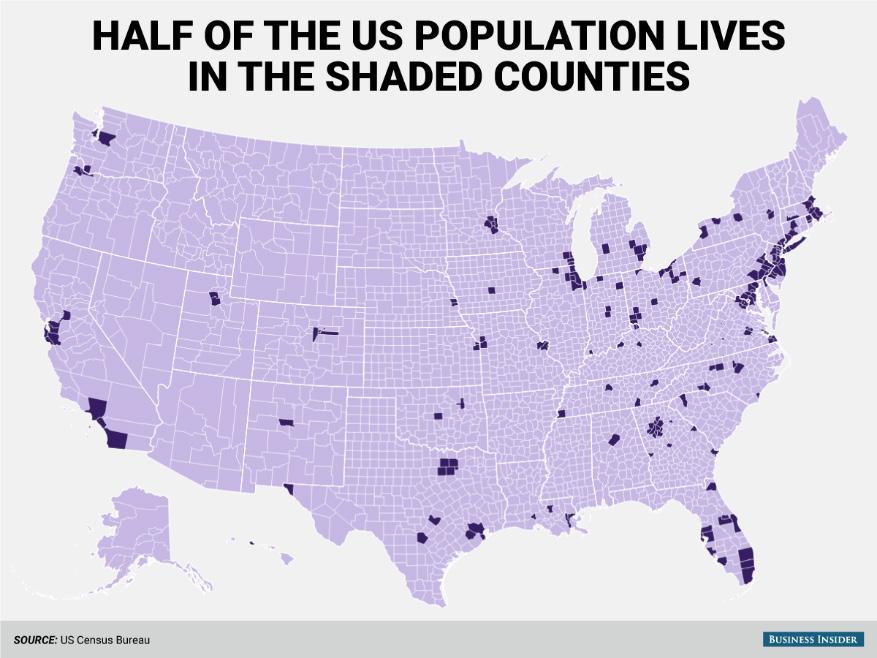

One of the most fascinating graphics is the annual map of U.S. per capita milk production by state. This, along with other images, is published annually by the Federal Central Milk Marketing Order. The per capita milk production map is revealing in that it shows the size of the milk supply compared to the number of citizens or consumers in that state.

Looking at the Northeast this way, it is interesting to compare the smaller, highly populated coastal milk-producing states with Vermont’s whopping 3,820 lbs. per capita. The percentage change in per capita milk production graphic reveals that over the past five years only New York increased supply relative to its population.

The Northeast is sometimes described as evenly balanced between the four classifications of milk utilization.

New York and Vermont have seen ICE enter dairy farms in recent weeks to investigate a single worker but end up taking others into custody during the process. President Trump has said on camera the U.S. needs to develop a plan where the serious undocumented agricultural worker can remain on the farm for a longer period of time. A program that is longer lasting than H-2A and more suited to dairy farms that need year-round workers. Congress has been floating the Farm Workforce Modernization Act, a bipartisan bill that passed the House on two occasions but stalled in the Senate.

Gary Latta is a dairy product specialist consultant for the Northeast Dairy Foods Association, Inc. He has more than 30 years of experience in providing economic analysis, statistics, and information to the dairy processing industry.

You asked for Quick Setup...

You asked for Better Visibility...

You asked for Increased Accessibility...

You asked for Repeatable Package Performance...

You asked for the same great Shelf Life Optimization features...

You asked for all of these benefits to be

Gable Top format. Now you have it!

Limited-Time Dairy Products, Whole Milk Lead 2025 Industry Trends

EDairy Blender Recap — Plus Previews of the Upcoming Events

ach year for the Q2 issue, Northeast Dairy Magazine talks to Donna Berry (who covers new products and trends for the dairy industry) about what we can expect in the coming year.

Canastota Dairy Products Carries on a Century-Old Legacy

Limited-time products are once again expected to be “a very big business” in 2025.

“Formulators are getting a bit more creative with their concepts, and a lot of opposites are attracting when it comes to flavors,” said Berry. “We know the spicy movement, which

was sweet and spicy, but there are others, like sour and citrus. There are a lot of mashups and unexpected flavors. But what makes them attractive as limited-time offerings is that only a certain amount are made. When you see them in the store, even if they sound bizarre, you want to try them.”

How AI-Powered Tools Save Time, Boost Productivity

Products made with whole milk will also continue to perform well.

“There’s been some education that, especially with kids, they need the fat that’s in dairy,” said Berry. “I think dairy

processors across all categories are doing a much better job marketing the nutrient density of their products. And as we see a return to more minimally processed, simple food –direct from the farm, so to speak – dairy is really benefitting.”

Here are some other trends to watch out for in 2025:

“Retail volume sales for all dairy products in the United States increased in 2024,” said Berry. “While fluid milk was only an increase of 0.1%, which is something they normally wouldn’t even report, considering the fact that it has been decreasing for the last 30 or 40 years, that was big news.”

A big reason for that turnaround is consumers’ willingness to pay more for value-added products (i.e., grass-fed, organic, A2, higher protein, and omega-3 fortified milk).

There has been a lot of activity with lactose-free products, in particular, across all dairy categories, “but they’re really fueling the sales in fluid milk,” said Berry. “Lactose, and sensitivity to lactose, was the main driver of consumers leaving dairy.”

To meet the growing demand, Dairy Farmers of America launched two new products. The first, Milk50 by DairyPure, is a low-sugar, low-calorie milk that comes in three flavors: original, chocolate, and vanilla. TruMoo Zero Whole Chocolate Milk followed two months later, offering consumers a high-protein alternative to traditional chocolate

milk (without any added sugar). And, of course, both products are lactose-free.

The biggest volume growth, however, belonged to cottage cheese.

“It’s the original high-protein dairy product,” said Berry. “It’s gotten so much traction on social media, and it’s really taking off. But there hasn’t been much innovation in that space because they can’t even produce the basic product to keep orders filled. I do foresee down the road more products packaged similarly to yogurt, with a side container of muesli or nuts and fruits, and more variety in flavors.”

It has been the exact opposite in another category.

“Dips have been really impressive this past year with all the innovations,” said Berry. “Companies are really pushing the limits when it comes to bold flavors, the types of ingredients, and even mashups in that space. Sweet and savory dips are both very much trending.”

Some companies are incorporating meat in them, too. Good Foods Group, for example, rolled out a new line of 24-ounce dairy spreads and dips at the end of 2024, with flavors like Bacon Date Goat Cheese and Chicken Taco.

“A lot of these dips are coming out as limited-edition or seasonal,” said Berry. “There was a lot of activity around the [Big Game], no surprise. It will probably slow down a bit

One company embracing the limited-edition trend is Stewart’s Shops. It recently introduced its seasonal offerings:

• Boston Cream Dream

• Peanut Butter Caramel Chaos

• Stargazer

• Strawberry Shortcake

• Mango Dragon Fruit Sherbet There’s also a new flavor designed to let customers “relive [their] childhood nostalgia.” Dirt Cake is a vanilla pudding ice cream blended with a swirl of chocolate cookie crumbs and chunks of pound cake.

around the summer and come back at the holidays.”

A growing focus is being placed on making cheese more snackable and portable, yet when it comes to flavor innovation, “that’s never really been lacking in this space,” said Berry.

“I have seen the sweet and spicy cheeses getting a little hotter and getting more creative with flavors.”

Take Sargento, which partnered with McCormick to launch three new flavors of its seasoned shreds: Cholula Queso Quesadilla and Asadero with Hot Sauce Seasoning; Frank’s RedHot Cheddar, Colby Jack, and American with Cayenne Pepper Seasoning; and McCormick Mozzarella and Parmesan with Crushed Red Pepper.

Not much has changed in the butter space.

“I think what we’re seeing is not necessarily more innovation but making those flavored butters and premium butters more available,” said Berry. “Distribution has been gained by a lot of them, especially the higher-fat butters, like the European butters.”

That’s the case for Wyke Farms; the England-based company introduced its Ivy’s Reserve Salted Farmhouse Butter to the U.S. market earlier this year.

Berry said that pints and frozen novelties are taking up the most space in retail freezers right now.

“Consumers really like the size, even though it costs more on a per-ounce basis versus the big gallon,” she added. “They want better quality, more indulgence, and portion control.”

At the same time, fruits and nuts are becoming popular ingredients as consumers look for healthier options — and as cocoa prices hit an all-time high.

“Recent innovations haven’t really focused much on chocolate at all,” said Berry. “The base is seldom chocolate, and any chocolate bits and pieces that are in there, they’re making a little bit go a long way. As a result, fruit flavors have really taken off this year. And there’s the healthful halo of, ‘If I have some fruit in my ice cream and it’s made with real fruit, I can see the pieces, that gives me permission to indulge.’”

A trend from last year is also sticking around: nostalgic flavors.

“They provide a sense of comfort for some consumers,” said Berry.

Editor’s note: Thank you to Donna Berry for sharing her knowledge on this topic. You can read her blog at berryondairy.com

Perry’s Ice Cream is taking a trip down memory lane with the launch of its two newest flavors.

Cherry Pie blends cherry ice cream with cherries and graham cracker pieces, while Lemon Meringue Pie mixes lemon ice cream, meringue ice cream, and bits of pie crust.

“At Perry’s, we’re always looking for ways to innovate while staying true to the flavors our customers are seeking,” said Associate Product Manager Megan Mergler in a press release. “These new flavors were inspired by the comfort and familiarity of homemade pies, and we’re excited to share these unique creations with our fans.”

The U.S. Food and Drug Administration (FDA) is proposing to require a front-of-package (FOP) nutrition label on most packaged foods to provide accessible, at-a-glance information to help consumers quickly and easily identify how foods can be part of a healthy diet.

The proposed FOP nutrition label, referred to as the Nutrition Info box, would detail and interpret the relative amounts of three nutrients—saturated fat, sodium, and added sugars—in a serving of food and would appear on the package’s front so that it is immediately visible when a consumer is deciding whether to buy, use, or eat the food.

While calories would not be included in the Nutrition Info box, a manufacturer could voluntarily include a calorie statement

The next time you pick up one of Cabot Creamery’s eight-ounce cheese bars, you may notice a change in the material. The cooperative announced in June that it would begin using 30% post-consumer recycled (PCR) packaging.

The move is a result of a sustainable packaging study launched in 2022 and is expected to reduce greenhouse gas emissions and fuel consumption by as much as 25%.

“This is a pivotal moment in our journey to become a greener company, introducing one of the first cheeses in a post-consumer-recycled package,” said CEO David Lynn in a press release. “As the first dairy cooperative to achieve B-Corp status, we have a long-held commitment to sustainable practices, and this shift to PCR packaging in our 8-ounce bar line represents a major milestone in that commitment.”

Cracker Barrel Cheese is changing the way we snack on game day.

In the days leading up to the Big Game in New Orleans, the company sent 50 AI-powered, refrigerated robots to locations around the city, distributing nearly 100,000 of its cheese sticks.

“Activating during the Big Game week was an absolute game-changer for Cracker Barrel Cheese,” said Brand Director Amanda Vaal in a press release. “We built relationships with nearly 100,000 devoted Cracker Barrel Cheese fans in an innovative and engaging way, and this showed us how Cracker Barrel Cheese is such an integral part of game day snacking. Seeing the fans’ reactions as they interacted with the robots and enjoyed our cheese was truly amazing.”

are you getting the dairy connection newsletter?

Our weekly email newsletter includes the latest industry news, as well as updates from the NDFSA members.

TWO ADVERTISING OPTIONS ARE AVAILABLE:

A spotlight ad (600x300) placed in the body of the newsletter, plus a logo and a 50-word description at the top.

A banner ad (600x150) placed in the body of the newsletter.

Contact your sales rep for more information.

dsm-firmenich, a global leader in nutrition, health, and sustainable innovation, announced ‘Milky Maple’ as its Flavor of the Year for 2025.

This unique creation taps into two beloved trends: the creamy softness of milk mixed with the rich, natural sweetness of maple. The blended flavor provides a sense of calm and contentment and can be incorporated into a wide range of applications.

“As food and beverage trends shift toward comfort, nature and personal wellbeing, people increasingly gravitate towards flavors that offer a taste of familiarity, balance and connection,” said Maurizio Clementi, executive vice president of taste, texture, and health at dsm-firmenich. “Milky Maple’ delivers on this demand – it is a soothing embrace that draws people into a world of warmth and indulgence.”

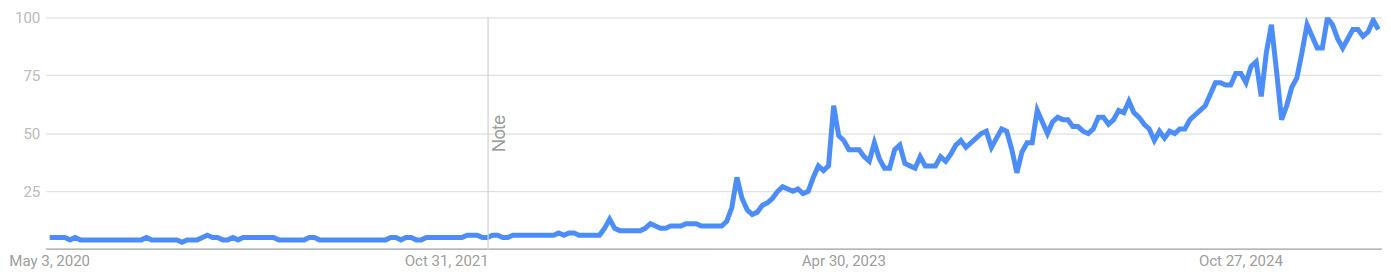

Maple, long cherished as a North American dietary staple, is rapidly expanding its presence worldwide. Since early 2019, dsm-firmenich’s trend analysts have observed maple transcending geographic and cultural boundaries, gaining popularity as a versatile ingredient across Europe, Asia, and beyond. Maple’s adaptability is evident as it moves beyond

syrup to influence an array of culinary creations, from baked goods to savory dishes.

“Maple is evolving from a regional favorite to a global flavor phenomenon,” said Jeffrey Schmoyer, VP of human insights at dsm-firmenich. “Its ability to offer a feeling of coziness and its versatility have driven its momentum across diverse cultures and cuisines.”

Maple as a flavor traces its roots back to the sap of select maple tree species – most notably the sugar maple – that flourish in cool, northern climates. As a naturally derived ingredient, maple sap offers a unique sweetness with warm, earthy undertones, making it an attractive alternative to traditional sweeteners and an essential part of the ‘brown note’ flavor family.

The creamy allure of milk is also enjoying a surge in popularity, especially in Asia, where its smooth taste and texture provide a perfect pairing for maple’s sweetness. This growing trend underscores milk’s timeless ability to evoke nostalgia and simplicity, further reinforcing ‘Milky Maple’ as both a flavorful and immersive sensory experience.

BY COURTNEY KLESS

Canastota Dairy Products is one of the newest members of the Northeast Dairy Foods Association, but you may already know the company by its former name, Queensboro Farm Products.

That company’s journey began in 1909, when Samuel and Louis Miller drove their horse, Nellie, through the streets of New York City, delivering their dairy products.

Over time, Queensboro Farm Products expanded to 15 receiving plants across New York, Connecticut, and New Jersey, including one in Canastota, where all production was moved in the mid-1970s. In the years that followed, many major companies (i.e., Friendly’s Ice Cream, Häagen-Dazs, Baskin-Robbins, McDonald’s, and Burger King) turned to the company for their finished products.

Then, a year and a half ago, the owners decided it was time

for them to retire. There weren’t any family members that could take over the business, so the Lowville Dairy Producers Cooperative stepped in and purchased the facility.

The cooperative has a long history, too — it was established in 1936.

“We have expanded substantially since then,” said General Manager Andy Laslo. “All of our farms at the time were in the Lowville area, and the majority of our farms now, roughly 80%, are still in Lewis County New York. Currently, we have 220 member farms, which are part owners.”

Together, they produce more than 310 million gallons of Grade A milk annually. Despite this, the cooperative has faced losses from dumping milk since 2020.

“Some of these losses were due to not being able to find markets for some of our extra milk we had during the spring flush, while others were due to plant reductions on the week-

“We’re proud of every employee that we have; they’re like family members to us. We don’t have very many employees, so our relationship with them is very important to make sure their ideas are taken seriously, and any input they have helps make us more productive.”

– Andy Laslo, General Manager of the Lowville Dairy Producers Cooperative

ends, holiday shutdowns, maintenance shutdowns, or just from the unexpected breakdowns,” said Laslo. “By acquiring the Canastota plant, we are able to salvage this milk, use some of it for production, use some of it to process and sell the byproducts to other plants (such as cream and skim condensed milk), and the rest can be reloaded and shipped out of state. Since we are not the only co-op that is facing these situations, we have the ability to salvage raw milk for other co-ops and save them from dumping and reduce losses on their side.”

Now called Canastota Dairy Products, the company manufactures 12 products at its Canastota plant. Butter, sour cream, ice cream mixes, cream cheese, and buttermilk are the largest by volume; the rest are smaller and more region-specific. It also has a store that sells items produced at the plant (like butter, sour cream, cream cheese, buttermilk, ice cream mix, and eggnog) — plus cheese from the Lowville Producers Dairy Cooperative’s store, which, according to Laslo, carries more than 75 different varieties.

Throughout the years, service has remained a top priority.

“Queensboro has always operated as a boutique dairy,

willing to make any adjustments for their customer needs,” said Steven Miller, one of the previous owners.

That hasn’t changed under the new leadership.

“The majority of businesses we work with are distributors or smaller start-up companies,” said Laslo. “We’re a niche business because we have the ability to produce at really small volumes new products that are coming to the market. So, a lot of companies reach out to us first because big dairy manufacturers can’t produce small quantities in small batches. We also do a lot of milk processing for companies that don’t have the ability or aren’t big enough for the time being to process the milk themselves. So, we process it for them, and they bottle it at their facilities and distribute it.”

This personal approach is also at the heart of the company’s culture.

“We’re proud of every employee that we have; they’re like family members to us,” said Laslo. “We don’t have very many employees, so our relationship with them is very important to make sure their ideas are taken seriously, and any input they have helps make us more productive.”

• Optimizing service levels

• Benchmarking costs against our large, proprietary database of similar businesses

• Negotiating new contracts with lower pricing and more favorable terms/conditions

• Verifying and controlling future costs by on-going monitoring of vendor invoices

to have your expenses reviewed by our team of experts.

Call 315-935-9379 or email Steve Thompson at steve@IntegrityCostConsulting.com to start saving today!

Many dairy manufacturers are unknowingly overpaying vendors, losing thousands in unnecessary costs. This case study explores how ICC helped a specialized manufacturer uncover hidden savings through a detailed vendor audit and cost analysis with minimal effort to the manufacturer. By identifying overpriced contracts and inefficiencies, ICC delivered substantial annual savings while improving vendor transparency and control. With rising input costs and tight margins, cost recovery and smarter vendor management are more critical than ever. Learn how ICC’s strategic approach can help your operation cut waste, boost profitability, and gain better control over your expenses.

In today’s economic climate, every dollar matters. Cutting costs is a common goal for many organizations, whether to improve margins, profitability, or productivity.

In today’s economic climate, every dollar matters. Cutting costs is a common goal for many organizations, whether to improve margins, profitability, or productivity.

Integrity Cost Consulting (ICC) works with organizations lacking time and industry experts to verify, reduce, and control non-labor expenses.

Integrity Cost Consulting (ICC) works with organizations lacking time and industry experts to verify, reduce, and control non-labor expenses.

The Challenge

A Syracuse-based manufacturer had a priority to reduce costs, but wasn’t clear where to begin. Monthly invoices from numerous vendors were being paid based on an assumption the charges were correct. “If the charges looked right, we paid it.”

A Syracuse-based manufacturer had a priority to reduce costs, but wasn’t clear where to begin. Monthly invoices from numerous vendors were being paid based on an assumption the charges were correct. “If the charges looked right, we paid it.”

A staff member was assigned the task and began by requesting bids from 2-3 vendors in key expense areas. Soon, the staff member was inundated with meeting requests from competing vendors wanting to pitch their services and pricing.

A staff member was assigned the task and began by requesting bids from 2-3 vendors in key expense areas. Soon, the staff member was inundated with meeting requests from competing vendors wanting to pitch their services and pricing.

“

“

I wish I had been able to meet with ICC first. They identified so many cost-savings opportunities for me that I didn’t even know I should be looking for.” – VP of Operations

I wish I had been able to meet with ICC first. They identified so many cost-savings opportunities for me that I didn’t even know I should be looking for.” – VP of Operations

The Solution

The Solution

After hosting a free 30-minute discovery call, we learned more about the manufacturer’s current expenses and cost-cutting goals.

After hosting a free 30-minute discovery call, we learned more about the manufacturer’s current expenses and cost-cutting goals.

We recommended an audit of the following expenses:

We recommended an audit of the following expenses:

• Waste disposal

• Waste disposal

• Telecommunications

• Telecommunications

• Electric and gas delivery and supply

• Electric and gas delivery and supply

• Textile rental

• Textile rental

We’ll

We’ll

We review many expense categories for various types of clients. Below are some of the more common categories that yield savings across all industries:

We review many expense categories for various types of clients.

Below are some of the more common categories that yield savings across all industries:

Industrial Laundry/ Textile Rentals

Using our benchmarking database from over 60,000 locations and our diverse team of industry experts, we were able to review all expenses immediately. This eliminated the need for our client to meet with vendors.

Using our benchmarking database from over 60,000 locations and our diverse team of industry experts, we were able to review all expenses immediately. This eliminated the need for our client to meet with vendors.

Using our benchmarking database from over 60,000 locations and our diverse team of industry experts, we were able to review all expenses immediately. This eliminated the need for our client to meet with vendors.

Using our benchmarking database from over 60,000 locations and our diverse team of industry experts, we were able to review all expenses immediately. This eliminated the need for our client to meet with vendors.

Using our benchmarking database from over 60,000 locations and our diverse team of industry experts, we were able to review all expenses immediately. This eliminated the need for our client to meet with vendors.

Our audit uncovered multiple vendor overcharges that had been occurring for many years.

Conclusion

Conclusion

Our audit uncovered multiple vendor overcharges that had been occurring for many years.

Our audit uncovered multiple vendor overcharges that had been occurring for many years.

Our audit uncovered multiple vendor overcharges that had been occurring for many years.

Our audit uncovered multiple vendor overcharges that had been occurring for many years.

Some of the overcharges were refundable and others were not, so our team worked quickly to make the necessary billing and contract changes.

Some of the overcharges were refundable and others were not, so our team worked quickly to make the necessary billing and contract changes.

Some of the overcharges were refundable and others were not, so our team worked quickly to make the necessary billing and contract changes.

Some of the overcharges were refundable and others were not, so our team worked quickly to make the necessary billing and contract changes.

Some of the overcharges were refundable and others were not, so our team worked quickly to make the necessary billing and contract changes.

In addition to correcting billing errors, we were able to negotiate new, more favorable contracts with some of the manufacturer’s current vendors. This allowed the business to reduce expenses immediately without any operational disturbances.

In addition to correcting billing errors, we were able to negotiate new, more favorable contracts with some of the manufacturer’s current vendors. This allowed the business to reduce expenses immediately without any operational disturbances.

In addition to correcting billing errors, we were able to negotiate new, more favorable contracts with some of the manufacturer’s current vendors. This allowed the business to reduce expenses immediately without any operational disturbances.

In addition to correcting billing errors, we were able to negotiate new, more favorable contracts with some of the manufacturer’s current vendors. This allowed the business to reduce expenses immediately without any operational disturbances.

In addition to correcting billing errors, we were able to negotiate new, more favorable contracts with some of the manufacturer’s current vendors. This allowed the business to reduce expenses immediately without any operational disturbances.

“

“At no cost to us, the ICC team reviewed the information we sent and was able to save us thousands of dollars a year by finding errors and overcharges as well as renegotiating contracts on our behalf.” – VP of Operations

“At no cost to us, the ICC team reviewed the information we sent and was able to save us thousands of dollars a year by finding errors and overcharges as well as renegotiating contracts on our behalf.” – VP of Operations

– VP of Operations

“At no cost to us, the ICC team reviewed the information we sent and was able to save us thousands of dollars a year by finding errors and overcharges as well as renegotiating contracts on our behalf.” – VP of Operations