Canadian Underwriter’s 2024 Executive Outlooks

What Did We Find?

30

TOTAL OUTLOOKS

5 KEY THEMES

5 STOOD OUT

Key Stakeholders

CLIENTS BROKERS

INSURERS

TALENT

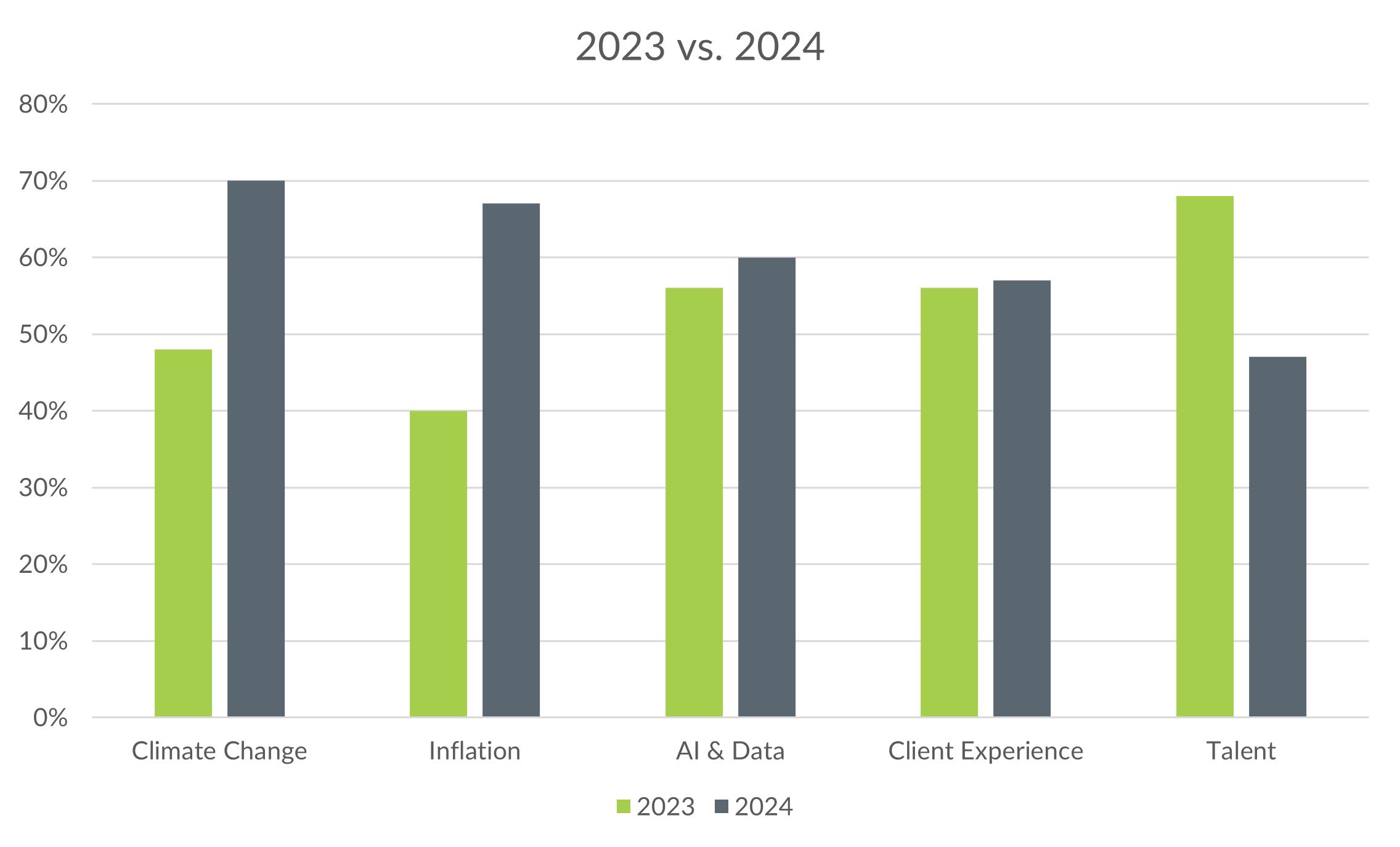

2024’s Themes

CLIMATE CHANGE & CATASTROPHIC WEATHER EVENTS

Discussed in two thirds of all Outlooks (70%)

INFLATION & MACROECONOMIC PRESSURES

Discussed in nearly two thirds of all Outlooks (67%)

AI & DATA

Discussed in over half of all Outlooks (60%)

CLIENT EXPERIENCE

Discussed in over half of all Outlooks (57%)

TALENT

Discussed in almost half of all Outlooks (47%)

Editor’s Note: over one third of all Outlooks feel that 2024 will present a lot of the same challenges we endured in 2023.

“Even though 2024 is poised to resemble 2023 in many ways, industry players must remain agile and resilient to thrive in this environment. Successful companies will remain focused on customer needs, nurturing talent, and embracing technological advancements.”

– Nick Creatura, CNA Canada

What’s New in 2024?

RAMPANT AUTO THEFT:

Losses for auto theft are estimated to be at $1 billion from 2023.1 Empowering clients to learn how to keep their vehicles safe and a collaborative approach between insurers, government, police forces, and auto manufacturers is compulsory to curb this national crisis.

IMPORTANCE OF EDUCATION:

Whether educating clients on the importance of proactive risk mitigation in growing threat areas like cyber, or introducing advanced learning and development initiatives for employees, the importance of education was another prevalent topic among the industry executives.

A CHANGING MARKETPLACE:

With the commercial market stabilizing, and even softening in certain spaces, while personal lines harden, we must be mindful of the way the evolving marketplace affects insureds, and where the best pockets of opportunity lie.

“The marketplace is changing. We are evolving from a hard commercial market into more of a firm market. The challenge for underwriters and brokers will be finding those pockets of opportunity.”

– Shawn DeSantis, Navacord

Climate Change

• Insured damage for severe weather events in Canada reached over $3.1 billion in 2023, according to Catastrophe Indices and Quantification Inc.2

• 2023 is now the fourth-worst year for insured losses nationally.2

• With climate instabilities, the future has never been so unpredictable for insurance companies.

• While the Government of Canada has committed to a national flood insurance solution, ongoing collaboration is necessary between the industry, fellow associations like the IBC, and the government to help shape and drive climate action, raise awareness, enhance response capabilities and build resilience.

Inflation & Macroeconomic Pressure

• While navigating this challenging economy, the insurance industry faces the task of finding a middle ground between increasing premiums to cover rising costs and addressing clients’ needs to reduce expenses.

• With many Canadians struggling to pay their bills and afford necessities, offering clients tailored solutions that will give them adequate coverage while striking a balance of affordability for them, is paramount.

• The cost of living continues to be a national crisis, and the combination of inflation, a looming recession, rising interest rates, and the overall volatile economy will remain a challenge in 2024.

AI & Data

• Rapid technological growth with AI at the forefront of the evolution presents a myriad of opportunities for the insurance industry.

• While leveraging AI tools can widely improve service, efficiency, and analytics, it must be used ethically so that clients are not disadvantaged from underwriting decisions rooted in AI. In other words, quality control is imperative.

• Ultimately, many insurance companies will continue their digital transformations in 2024, as it is the gateway to work process efficiencies, maximized value-add, top-tier talent, client retention, and other strategies that facilitate organizational growth and success.

Client Experience

“In a volatile environment, the customerbroker relationship is critical — the customer needs the advocacy of a broker. And the broker needs an insurer that’s enthusiastically committed to shared, profitable growth.”

– Louis Gagnon, Intact

• Clients continue to seek out honesty, dependability, and ease in the process of purchasing policies and making claims.

• In this unstable economy, where every purchase requires careful consideration, we must work even harder at delivering the seamless experience customers expect, coupled with the knowledge behind what their policies offer and to reassure them of what exactly they are paying into, in 2024.

• Prioritizing a customer-focused strategy and fostering enhanced collaboration between insurers and brokers can have a significant impact on shaping the outcomes of 2024.

Talent

• Talent shortage will continue to be a challenge in 2024.

• It’s understood that in Canada’s P&C insurance industry, people are the greatest asset.

• Organizations that value and prioritize the well-being of their employees, foster inclusive cultures, and invest in learning and development are the ones that will thrive among the uncertainty of the state of the world now.

• Internal, regular compensation reviews and competitive offers continue to be a key driver for employee retention.

2024 Forecast

BROKERS & INSURERS: 2024 FORECAST

• 2024 will see a heightened focus on alliance between brokers and insurers for the common good of our clients, as well as the industry’s external relationships with government and trade associations to help propel climate action, and with law enforcement and auto manufacturers to control the national vehicle theft crisis.

• Continued broker consolidation and a dynamic M&A landscape will persist.

• Strategic emphasis on digital transformation and leveraging AI technology, correctly and carefully, to streamline operational processes will remain in the tool box for many organizations—especially those that stand out among the rest.

CLIENTS: 2024 FORECAST

• Canada’s P&C insurance industry will continue to be highly client-centric.

• A positive client experience is more important than ever among rampant inflation and soaring interest rates.

• Customers will continue to interact in the channel of their choosing, so it’s critical to adapt and adopt to their needs and wants.

TALENT: 2024 FORECAST

• Acquiring and retaining top talent will continue to be an obstacle for the insurance industry in Canada.

• Implementing tactics to remain competitive, such as regular compensation reviews, investments in digital transformation and training and development, and positive culture from the top-down, are imperative for organizations that wish to retain their talent.

WHAT 2023 PREDICTED – WAS IT RIGHT?

Enhancing customer experience

Focus on talent and labour shortage

Active broker consolidation and M&A

Digital transformation

Financial insecurity and macroeconomic pressure

Ongoing geopolitical crisis

Climate change and catastrophic weather solutions

External Resources

OUTLOOKS - ONES TO READ

• Shawn DeSantis, Navacord

• Ben Isotta-Riches, Aviva Canada

• Celyste Power, Insurance Bureau of Canada

• Rob Marsh, Liberty Mutual Canada

• Anna McCrindell, Wawanesa

SOURCES

1. Canadian Underwriter: Uniting Industries to Tackle the Auto Theft Crisis, November 2023.

2. Insurance Bureau of Canada, January 2024. Visit Canadian Underwriter’s Outlook Hub to read all 2024 Executive Outlooks.