Property Details

Maps

Local Schools

Community Utilities & Resources

Title & Escrow

The information contained is provided by WFG’s Customer Service Department to our customers, and while deemed reliable, is not guaranteed.

Property Details

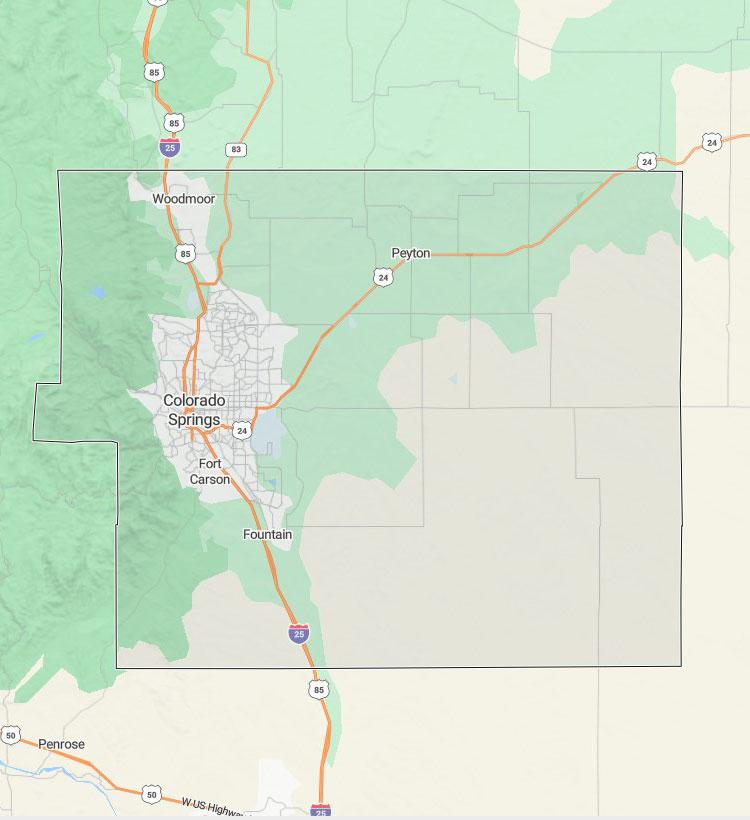

Maps

Local Schools

Community Utilities & Resources

Title & Escrow

The information contained is provided by WFG’s Customer Service Department to our customers, and while deemed reliable, is not guaranteed.

109 W OLD BROADMOOR RD COLORADO SPRINGS CO 80906

64303-14-003 EL PASO COUNTY CO

OwnerInformation

Owner Name: JOY LORI / MORRIS RAY

Vesting: JOINT TENANT

Mail Address: 109 W OLD BROADMOOR RD COLORADO SPRINGS CO 80906

Owner Status: OwnerOccupied

LocationInformation

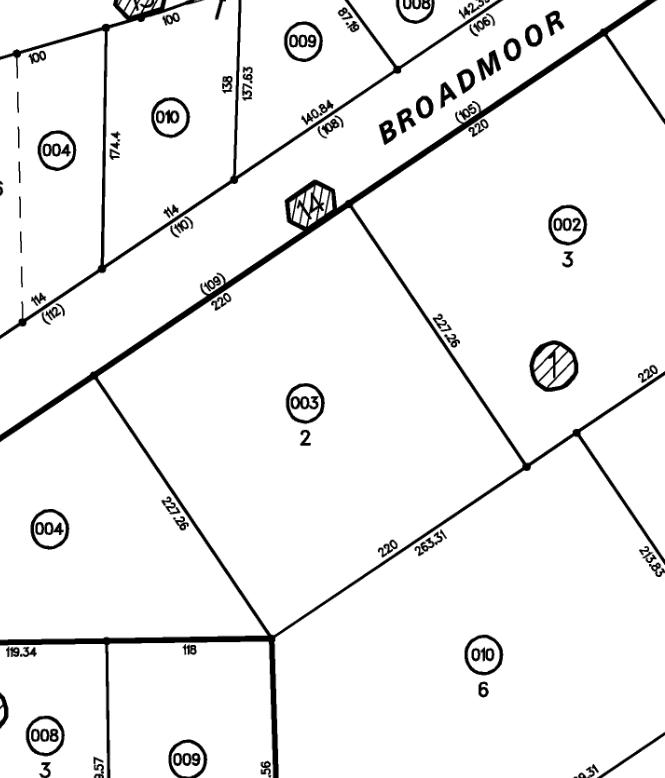

Legal Desc: LOT 2 BLK 1 PIEDMONT SUB

County: EL PASO

Census/Block: 003100 / 1013

Tsp-Rng-Sec: T14-R66-S30

Lot / Block: Lot: 2 Block: 1

Housing Tract: PIEDMONT SUB LastMarketSale

Date: 2021-11-12/2021-11-12

Sale Price: 862000

Document #: 2021.209953

Doc Type: GENERAL WARRANTY DEED

$ Sqft: $260.11

Alt Parcel #

School District: CHEYENNE MOUNTAIN 12

Municipality:

Parcel #: 64303-14-003

Lender:

Loan:

Document #:

Loan Type:

Loan Term: PriorSaleInformation

Date: 2008-05-15/2008-05-13

Lender: Price: 545000

Document #: 2008.55985

Doc Type: WARRANTY DEED

Loan: 490000

Document #:

Loan Type: CONVENTIONAL

The above is believed to be accurate, but is not guaranteed. Copyright © 1995-2025 CDS Marketing, Inc.

109 W OLD BROADMOOR RD COLORADO SPRINGS CO 80906

64303-14-003 EL PASO COUNTY CO

PropertyCharacteristics

Gross Area: 3 Garage Area:Interior Wall

Living Area: 3

Above Grade: 3, Foundation:

Bedrooms:

Bath (F/H): 3/ Construction: FRAME

Fireplace:

PropertyInformation

This map/plat is being furnished as an aid in locating described land in relation to adjoining streets, natural boundaries and other land, and is not a survey of the land depicted. Except to the extent a policy of title insurance is expressly modified by endorsement, if any, the company does not insure dimensions, distances, location of easements, acreage or other matters shown thereon.

This map/plat is being furnished as an aid in locating described land in relation to adjoining streets, natural boundaries and other land, and is not a survey of the land depicted. Except to the extent a policy of title insurance is expressly modified by endorsement, if any, the company does not insure dimensions, distances, location of easements, acreage or other matters shown thereon.

This map/plat is being furnished as an aid in locating described land in relation to adjoining streets, natural boundaries and other land, and is not a survey of the land depicted. Except to the extent a policy of title insurance is expressly modified by endorsement, if any, the company does not insure dimensions, distances, location of easements, acreage or other matters shown thereon.

This map/plat is being furnished as an aid in locating described land in relation to adjoining streets, natural boundaries and other land, and is not a survey of the land depicted. Except to the extent a policy of title insurance is expressly modified by endorsement, if any, the company does not insure dimensions, distances, location of easements, acreage or other matters shown thereon.

109 W OLD BROADMOOR RD COLORADO SPRINGS CO 80906

64303-14-003

EL PASO COUNTY CO

Cheyenne Mountain School District No. 12, In The County Of E

ElementarySchools

Broadmoor Elementary School719-475-6130

440 W Cheyenne Mountain Blvd COLORADO SPRINGS CO 80906

Grades: KG to 06

Charter School: N

Magnet School: N

Area Desc:

Distance: 0.72 Miles

Title One: NO

The Vanguard School (elementary)719-471-1999

1832 South Wahsatch COLORADO SPRINGS CO 80906

Grades: KG to 06

Charter School: Y Magnet School: N

MiddleSchools

Area Desc:

Distance: 0.87 Miles

Title One: SWP

The Vanguard School (middle)719-471-1999

1832 South Wahsatch COLORADO SPRINGS CO 80906

Grades: 07 to 08

Charter School: Y

Magnet School: N

Area Desc:

Distance: 0.87 Miles

Title One: NO

Cheyenne Mountain Junior High School719-475-6120

1200 West Cheyenne Road COLORADO SPRINGS CO 80905

Grades: 07 to 08

Charter School: N Magnet School: N

HighSchools

Area Desc:

Distance: 1.07 Miles

Title One: NO

The Vanguard School (high)719-471-1999

1832 South Wahsatch COLORADO SPRINGS CO 80906

Area Desc:

Grades: 09 to 12 Distance: 0.87 Miles

Charter School: Y

Magnet School: N

Title One: NO

Cheyenne Mountain High School719-475-6110 1200 Cresta Road COLORADO SPRINGS CO 80906

Grades: 09 to 12

Charter School: N

Magnet School: N

Area Desc:

Distance: 1.51 Miles

Title One: NO

Your assigned school should be the first school in each category, but it is recommended you check with the district or school. The above is believed to be accurate, but is not guaranteed. Copyright © 1995-2025 CDS Marketing, Inc.

List continues. Click below to view more. Gaps in Cross-Disciplinary Skills for PWR for FRL Students Enhancing Engagement and Providing Consistent Support for Struggling Students Cultural Relevance and Representation in ELA Curriculum and Instruction

730,395 POPULATION

2020 Census Data

$81,851

2023 Estimated Census Data

35.62

MEDIAN AGE

2023 Estimated Census Data

El Paso county is the most populous county in the state of Colorado. In July 1858, gold was discovered along the South Platte River in Arapahoe County, Kansas Territory. This discovery precipitated the Pike's Peak Gold Rush.

El Paso County is home to 17 public school districts, in addition to several private schools. In the 2023–2024 school year, Cheyenne Mountain School District 12 in Colorado Springs was ranked the #1 public school district in Colorado.

2020 Census Data

343.5 inhabitants per sq. mile

287,459 housing units

2023 Estimated Census Data

65.25% of homes owner occupied

34.75% of homes rented

2023 Estimated Census Data

23.28% under age 18

10.28% between ages 18 to 24

29.35% between ages 25 to 44

22.51% between ages 45 to 64

14.58% above age 65

Most populous county in Colorado 2,127 square miles

Highest Average Temperature 84º Lowest Average Temperature 16º

Many residents of the mining region felt disconnected from the remote territorial governments of Kansas and Nebraska, so they voted to form their own Territory of Jefferson on October 24, 1859. The following month, the Jefferson Territorial Legislature organized 12 counties for the new territory including El Paso County. El Paso County was named for the Spanish language name for Ute Pass north of Pikes Peak. Colorado City served as the county seat of El Paso County.

MacUne, Cynthia S DVM - MacUn45 Old Broadmoor Rd E719-636-33410.35

Olson, Patricia DVM - Banfiel2160 Southgate Rd719-475-80250.68

Ireland, Darrel W DVM - Aaria115 E Ramona Ave719-632-33660.80

Fernyak, Stephanie DVM - Bear960 Pico Pt719-685-11771.54

Boley, John DVM - Animal Hosp1015 Cheyenne Meadows Rd719-579-94881.82

109 W OLD BROADMOOR RD COLORADO SPRINGS CO 80906

64303-14-003 EL PASO COUNTY CO

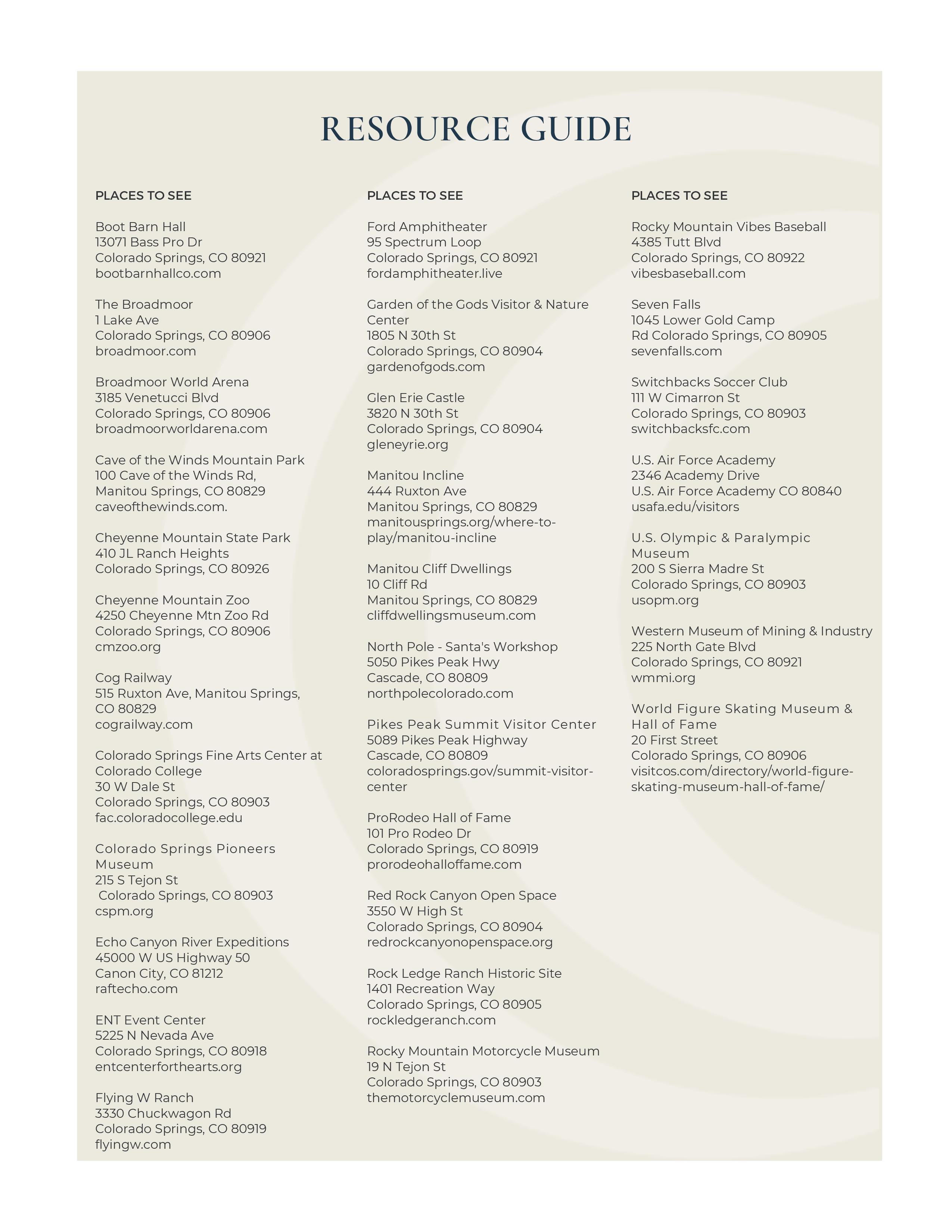

Grocers and Supermarkets

Flaksmart Cash N Carry815 S Sierra Madre St719-381-10501.67 Mi

Military Resale Group Inc2180 Executive Cir719-391-45642.37 Mi

Safeway Food & Drug - Falcon-7655 McLaughlin Road719-495-73002.43 Mi

Health Clubs and Spas

Paler, Michael Master - Tai C108 E Cheyenne Rd, Ste 211719-375-83390.60 Mi

24 Hour Fitness1892 Southgate Rd719-633-24420.69 Mi Fitness Together202 E Cheyenne Mountain Blvd719-579-97970.73 Mi

Physique Etc1763 S 8th St719-447-93800.77 Mi

McMichael Vanessa Fitness & K1801 Cheyenne Blvd719-632-44351.66 Mi

Cedar Springs Hospital2135 Southgate Rd719-633-41140.70 Mi

Penrose-st Francis Hlth Servs2215 N Cascade Ave719-776-50004.57 Mi

Hospitals - Acute Care

Memorial Hospital Central1400 E Boulder St719-365-50003.20 Mi

Centura Health-penrose St Fra2222 N Nevada Ave719-776-50004.59 Mi Nursing Homes NameAddressTelephoneDistance

Cheyenne Mountain Care And Re835 Tenderfoot Hill Rd719-576-83801.01 Mi

Centura Health-namaste Alzhei2 Penrose Blvd719-776-63001.82 Mi

Emeritus At Bear Creek Long T1685 S 21st St719-329-17742.44 Mi

109 W OLD BROADMOOR RD COLORADO SPRINGS CO 80906

64303-14-003 EL PASO COUNTY CO

Nursing Homes

NameAddressTelephoneDistance

Cedarwood Health Care Center924 W Kiowa St719-636-52212.69 Mi

Terrace Gardens Health Care C2438 E Fountain Blvd719-473-80002.78 Mi

Offices and Clinics of Chiropractors

NameAddressTelephoneDistance

Lowenstein, MARC T DC - Accid1310 S 21st St719-630-70322.97 Mi

Garrison, John C DC - Crossin627 N Weber St, #2719-471-73333.09 Mi

Williams, Danny C DC - Willia1819 W Colorado Ave719-635-35553.25 Mi

Ohrdorf, Ronald T DC - Weber1220 N Weber St719-635-30853.65 Mi

Holliger, Maria V DC - Caring4975 Austin Bluffs Pky719-574-82788.75 Mi

Offices and Clinics of Dentists

NameAddressTelephoneDistance

Margaret A Rabel1815 Woodburn St719-471-46270.59 Mi

Johnson & Johnson620 Southpointe Ct, #ct-210719-527-90980.70 Mi

Philip B Holden620 Southpointe Ct719-576-12220.70 Mi

Richard E Mutchler202 E Cheyenne Mountain Blvd719-576-65510.73 Mi

All-care Family Dentistry214 E Cheyenne Mountain Blvd719-579-83230.74 Mi

Offices and Clinics of Medical Doctors

NameAddressTelephoneDistance

Silver, Gordon S MD - Silver10 Cypress Ln719-635-13940.16 Mi

Brown Veterinary Hospital45 E Old Broadmoor Rd719-636-33410.40 Mi

Feldman, Laura DO - Feldman L730 Cheyenne Boulevard #100719-632-03240.66 Mi

Banfield2160 Southgate Rd719-475-80250.68 Mi The above is believed to be accurate, but is not guaranteed.

Emergency/Police/Medical/Fire

911

Poison Control (800) 222-1222

www.aapcc.org

United States Postal Service (800) 275-8777

www.usps.com

Xfinity (800) 266-2278

www.xfinity.com

Spectrum (844) 509-8921

www.spectrum.com

Dish Network (800) 318-0572

www.dish.com

DIRECT TV (800) 531-5000 www.directtv.com

Colorado Springs Gazette (866) 632-6397

www.gazette.com

Mountain Metro Transit (719) 385-7433

www.coloradosprings.gov/mountainmetro

Colorado Natural Gas (800) 720-8193

www.coloradonaturalgas.com

Colorado Springs Electric (719) 448-4800 www.csu.org/electric-service

Colorado Springs Water (719) 448-4800

www.csu.org

Colorado Springs Sewer (719) 448-4800

www.csu.org

Waste Management Garbage (800) 808-5901 www.wm.com

Waste Connections (719) 591-5000 wasteconnections.com/colorado-springs

Cheyenne Mountain School District 12 (719) 475-6100

www.cmsd12.org

Because of you… we obsess over

Cyber fraud and email hacking is on the rise. Fraudsters may access individual email accounts and monitor the life of your transaction. At the time funds are due to the escrow, fraudsters intercept the information for wiring funds and the fraudsters change the information without the knowledge of the sender or recipient, resulting in the funds being sent to an outside account and never credited to the intended party.

To protect and reduce your risk, WFG has implemented the following procedures for outgoing and incoming wires:

In the escrow paperwork provided you will be asked to provide written instructions on how you want funds dispersed at the close of escrow. If you choose to have the funds sent via wire transfer, WFG will contact you by phone to con rm the wire information provided.

For funds that are to be wired to WFG for your transaction, we will send speci c wire instructions to the remitting person via an encrypted email. We recommend you reach out to your WFG contact to con rm the wire instructions prior to remittance.

We look forward to processing your escrow transaction for you. We know that this can be a stressful time and we are here to assist you in any way we can to make this a good experience.

http://national.wfgnationaltitle.com/2016/04/05/obsess-cyber-security/

Every day, hackers try to steal your money by emailing fake wire instructions. Criminals will use a similar email address and steal a logo and other info to make it look like the email came from your real estate agent or title company. You can protect yourself and your money by following the steps below.

Don’t send sensitive nancial information via email.

Call, don’t email. Con rm your wiring instructions by phone using a known number before transferring funds.

We will never email wiring instructions to you nor change WFG account information after it’s been provided to you by our sta .

Keep your email account clean, remove any stale messages. Hackers can watch your business patterns and use this information against you.

Ask your bank to con rm the name on the account before sending a wire.

Call your title company or real estate agent within four to eight hours to con rm they have received your money.

This is for informational purposes only and should not be considered legal advice.

The purchase of a home is likely going to be one of the most expensive and important purchases you will ever make. You and your mortgage lender want to make sure the property is indeed yours and that no individual or government entity has any right, lien, claim, or encumbrance to your property.

The title insurance company’s function is to make sure your rights and interests to the property are clear, that transfer of title takes place e ciently, and correctly, and your interests as a homebuyer are protected. Title insurance companies provide services to buyers, sellers, real estate developers and builders, mortgage lenders, and others who have an interest in the real estate transfer. Title companies issue two types of policies - “Owners Policy” (which covers the homebuyer) and “Lenders Policy” (which covers the bank, savings and loan, or other lending institution over the life of a loan). Both are issued at the time of purchase for a one-time premium.

The title company conducts an extensive search of public records to determine if anyone other than you has an interest in the property before issuing a policy. The search may be performed by title company personnel using either public records, or more likely, information gathered, reorganized, and indexed in the company’s title “plant”. With such a thorough examination of records, title problems can usually be found and cleared up prior to purchase of the property. Once a title policy is issued, if for some reason any claim, which is covered under your title policy, is ever led against your property, the title company will pay the legal fees involved in defense of your rights as well as any covered loss arising from a valid claim. That protection, which is in e ect as long as you or your heirs own the property, is yours for a one-time premium paid at the time of purchase.

The title company works to eliminate risks before they develop. This makes title insurance di erent from other types of insurance. Most forms of insurance assume risks by providing nancial protection through a pooling of risks or losses arising from unforeseen events, like re, theft, or accident. The purpose of title insurance, on the other hand, is to eliminate risks and prevent losses caused by defects in title that happened in the past. Risks are examined and mitigated before property changes hands. Eliminating risk has bene ts to both of you, the home buyer, as well as the title company. It reduces the chance adverse claims might be raised, and by doing so reduces the number of claims that have to be defended or satis ed. This keeps costs down for the title company and your title premiums low. With title insurance you are assured that any valid claim against your property will be taken on by the title company, and that the odds of a claim being led is slim.

When your o er has been accepted and conveyed, escrow is opened. An escrow is an arrangement made under contract between a buyer and seller. As the neutral third party, escrow is responsible for receiving and disbursing money and/ or documents. Both the buyer and seller expect the escrow agent to carry out their written instructions associated with the transaction and also to advise them if any of their instructions are not being met, or cannot be met. If the instructions from all parties to an escrow are clearly set out, the escrow o cer can proceed on behalf of the buyer and seller without further consultation.

The Seller/Agent

• Delivers Purchase Sale Agreement to the escrow agent

• Prepares the paperwork necessary to close the transaction

• Approves the commitment for title insurance, or other items as called for by the Purchase Sale Agreement

The Buyer/Agent

• Deposits funds required to close with the escrow agent

• Executes the paperwork and loan documents necessary to close the transaction

The Lender

• Deposits loan documents to be provided by the buyer

• Deposits the loan funds

• Informs the escrow agent of the conditions under which the loan funds may be used

• Clears Title

• Obtains title insurance

• Obtains payo s and release documents for underlying loans on the property

• Receives funds from the buyer and/or lender

• Prepares vesting document a davit on seller’s behalf

• Prorates insurance, taxes, rents, etc.

• Prepares a nal statement (often referred to as the Closing Disclosure or CD) for each party, indicating amounts paid in conjunction with the closing of your transaction

• Forwards deed to the county for recording

• Once the proper documents have been recorded, the escrow agent will distribute funds to the proper parties

Escrow is the process that gathers and processes many of the components of a real estate transaction. The escrow agent is a neutral third party acting on behalf of the buyer and seller.

Title insurance insures against nancial loss from defects in title, liens, or other matters. It protects both purchasers and lenders against loss by the issuance of a title insurance policy. Usually, during a purchase transaction the lender requests a policy (commonly referred to as the Lender’s Policy) while the buyers receive their own policy (commonly referred to as an Owner’s Policy).

It will protect against lawsuits if the status of the title to a parcel or real property is other than as represented, and if the insured (either the owner or lender) su ers a loss as a result of a title defect. The insurer will reimburse the insured for that loss and any related legal expenses.

While the purpose of most other types of insurance is to assume risk through the pooling of monies for losses happening because of unforeseen future events (like sickness or accidents), the primary purpose of title insurance is to eliminate risks and prevent losses caused by defects in title arising out of events that have happened in the past. To achieve this, title insurers perform a thorough search and examination of the public records to determine whether there are any adverse claims (title defects) attached to the subject property. These defects/claims are either eliminated prior to the issuance of a title policy or their existence is excepted from coverage. The policy is issued after the closing of your new home, for a one time nominal fee, and is good for as long as you own the property.

A title search is made up of three separate searches:

• Chain of Title – History of the ownership of the subject property

• Lien & Encumbrance Search – Discloses liens and encumbrances on the subject property

• Exceptions from Coverage Search –Includes Easements, Covenants, Conditions and Restrictions, etc.

After the three searches have been completed, the le is reviewed by an examiner who determines:

• If the Chain of Title shows that the party selling the property has the rights to do so.

• Whether there are any unsatis ed judgments on the Judgment and Name Search against the previous owners, sellers, or/and purchasers.

Rights established by judgment decrees, unpaid federal income taxes, and mechanics liens all may be prior claims on the property, ahead of the buyer’s or lender’s rights. The title search will only uncover issues in title that are of public record and therefore allowing the title company to work with the seller to clear up these issues and provide the new buyer with title insurance.

Once the searches have been examined, the title company will issue a commitment, stating the conditions under which it will insure title. The buyer, seller, and the mortgage lender will proceed with the closing of the transaction after clearing up any defects in the title that have been uncovered by the search and examination.

The examples below are typical. However, the real estate purchase agreement will ultimately determine who is paying for what expenses.

• Real Estate Commission

• Document preparation fee for Deed

• Payo of all loans in the seller’s name (or existing loan balance if being assumed by Buyer)

• Interest accrued to lender being paid o

• Statement Fees, Reconveyance Fees, and any prepayment penalties to Payo Lender

• Home Warranty (according to contract)

• Any judgments, tax liens, etc. against the seller

• Tax proration (for any taxes unpaid at time of transfer of title)

• Any unpaid Homeowners’ Association dues

• Recording charges to clear documents of record against seller

• Any bonds or assessments (according to contract)

• Any and all delinquent taxes

• Notary Fees

• Title Insurance Premium for Lender’s Policy

• Escrow Fee (one half)

• Document preparation (if applicable)

• Notary fees

• Recording charges for all documents in Buyers’ names

• Tax proration (from date of acquisition)

• Homeowners’ Association transfer fee

• HOA proration (from date of acquisition)

• All new loan charges (except those required by lender for seller to pay

• Interest on new loan from date of funding to 30 days prior to rst payment date

• Assumption/Change of Record fees for takeover of existing loan (if applicable)

• Bene ciary Statement Fee for assumption of existing loan (if applicable)

• Inspection Fees (roo ng, property inspection, geological)

• Home Warranty (according to contract)

• Fire Insurance Premium for rst year

• Any bonds or assessments (according to contract)

The distinction between personal property and real property can be the source of di culties in a real estate transaction. A purchase contract is normally written to include all real property; that is, all aspects of the property that are fastened down or which are an integral part of the structure. For example, this would include light xtures, drapery rods, attached mirrors, and trees and shrubs in the ground. It would not include potted plants, free-standing refrigerators, washer/dryer, microwave, bookcases, lamps, etc. If there is any uncertainty whether an item is included in the sale or not, it is best to be sure that the particular item is mentioned in the purchase agreement as being included or excluded.

DISCLAIMER:

This information is provided for informational purposes only and no warranties are made.

Ownership of property vested in one person rather than held jointly with another.

Parties need not be married; may be more than two persons.

Parties need not be married; may be more than two persons.

Also called sole tenancy.

The sole owner may use, encumber, rent, sell, and convey at their discretion.

The owner may transfer the property via a Will, Trust, or a Bene ciary Deed upon their death.

Each joint tenant holds an equal and undivided interest in the estate, unity of interest.

Upon death, the estate of the decedent must be “cleared” through probate or adjudication.

One joint tenant can partition the property by selling his or her joint interest.

Each joint tenant holds an undivided fractional interest in the estate. May be disproportionate interest e.g. 20% and 80%; 40% and 60%; etc.

Each tenant’s share can be conveyed, mortgaged, or devised to a third party.

Requires signatures of all joint tenants to convey or encumber the whole.

Requires signatures of all to convey or encumber the whole.

Estate passes to surviving joint tenants outside of probate.

No court action required to “clear” title upon the death of joint tenant(s).

Upon death, the tenant’s proportionate share passes to his or her heirs by will or intestacy.

Upon death, the estate of the decedent must be “cleared” through probate or adjudication.

DISCLAIMER – The foregoing contains informational examples only and is not to be construed as legal advice. Given the complexities involved in acquiring and holding legal title to real property, WFG strongly recommends that you seek legal advice from an attorney prior to doing so.

55 Madison Street, Suite 690

Denver, CO 80206 (720) 475-8325

NORTH

12050 N Pescos Street, Suite 110 Westminster, CO 80234 (720) 475-8350

8610 Explorer Drive, Suite 105

Colorado Springs, CO 80920 (719) 598-5355

7800 E Union Avenue, Suite 310 Denver, CO 80237 (720) 475-8300

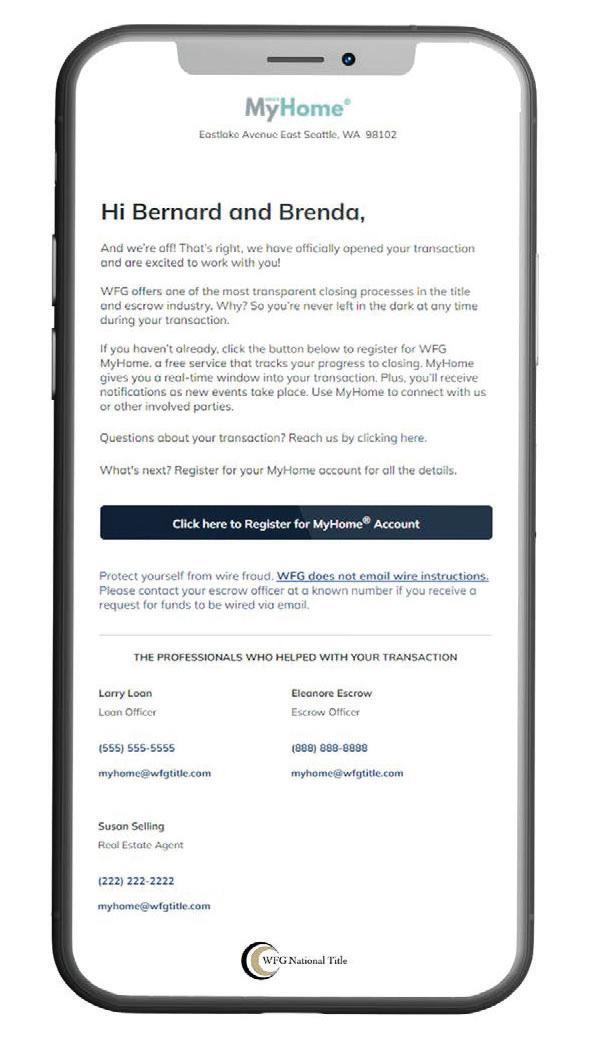

WFG’s My Home

CC&R’s (if applicable)

The information contained is provided by WFG’s Customer Service Department to our customers, and while deemed reliable, is not guaranteed.

Colorado Springs, CO 80906

REPORT FOR 6/23/2025

Single-Family Homes

This week the median list price for Colorado Springs, CO 80906 is $816,000 with the market action index hovering around 46. This is an increase over last month's market action index of 44. Inventory has held steady at or around 97.

This answers “How’s the Market?” by comparing rate of sales versus inventory.

In the last few weeks the market has achieved a relative stasis point in terms of sales to inventory. However, inventory is sufficiently low to keep us in the Seller’s Market zone so watch changes in the MAI. If the market heats up, prices are likely to resume an upward climb.

Market Segments

Each segment below represents approximately 25% of the market ordered by price.

Again this week we see prices in this zip code remain roughly at the level they’ve been for several weeks. Since we’re significantly below the top of the market, look for a persistent up-shift in the Market Action Index before we see prices move from these levels.

In the quartile market segments, we see prices in this zip code have settled at a price plateau across the board. Prices in all four quartiles are basically mixed. Look for a persistent shift (up or down) in the Market Action Index before prices move from these current levels.

The market plateau is seen across the price and value. The price per square foot and median list price have both been reasonably stagnant. Watch the Market Action Index for persistent changes as a leading indicator before the market moves from these levels.

7-Day Median

Inventory has been climbing lately. Note that rising inventory alone does not signal a weakening market. Look to the Market Action Index and Days on Market trends to gauge whether buyer interest is keeping up with available supply.

In the last few weeks the market has achieved a relative stasis point in terms of sales to inventory. However, inventory is sufficiently low to keep us in the Seller’s Market zone so watch changes in the MAI. If the market heats up, prices are likely to resume an upward climb.

Not surprisingly, all segments in this zip code are showing high levels of demand. Watch the quartiles for changes before the whole market changes. Often one end of the market (e.g. the highend) will weaken before the rest of the market and signal a slowdown for the whole group.

The properties have been on the market for an average of 99 days. Half of the listings have come newly on the market in the past 47 or so days. Watch the 90-day DOM trend for signals of a changing market.

It is not uncommon for the higher priced homes in an area to take longer to sell than those in the lower quartiles.

Instant access to

WFG’s MyHome® provides full transparency, real-time updates, and post-closing home information in a secure built with YOU in mind.

Contact information for

Sign up for an account at https://myhome.wfgtitle.com today!

Click Register for MyHome® account on a MyHome® email to https://myhome. wfgtitle.com

Complete a brief registration form. Use your email address on immediate access.

via text, email, or

for your transaction

your escrow team

TRANSACTION CLOSED

GATHER UP

SIGNING SCHEDULED

CLOSE TO SIGNING

TITLE CLEARED

UPDATER INVITATION

TITLE REPORT DELIVERED

TRANSACTION STARTED

MIDPOINT FEEDBACK

EARNEST MONEY

We believe these are the correct conditions and restrictions.

However, no examination of title has been made and WFG National Title assumes no liability for any additions, deletions or corrections.