MAY 2024

How AI is Shaping the Advisory

Death of CPF Special Account –So what’s next? Artificial intelligence and Personal Financial Planning Singapore 2024 Budget

FINANCIAL PLANNING

Landscape

EDITORIAL BOARD

CHIEF EDITOR

Ms Yash Mishra, CFP®

ASSISTANT CHIEF EDITOR

Ms Eliss Chen, CFP®

CONTRIBUTORS

Mr Dr Ben Fok, CFP®

Ms Yash Mishra, CFP®

Ms Eliss Chen, CFP®

Mr Adrian Tong, CFP®

Ms Joanna Leng , CFP®

Mr John Sim, CFP®

Mr Lenin Chong Sein Chin, CFP®

GUEST WRITER

Ms Lorna Tan, Head of financial Planning Literacy, DBS

Ms Eunice Chua, CEO, FIDReC Ms

in Financial Advisory

Artificial intelligence and Personal Financial Planning

AI: The battle of Growth Investing vs Value Investing again?

Singapore 2024 Budget

CPF life Vs Private Annuity

Death of CPF Special Account – So what’s next?

Book review: The Bill gates problem by Tim Schwab

Tips from FIDReC:

FPAS' VISION

FPAS envisions that all Singaporeans have access to responsible and appropriate financial planning advice by raising the professionalism in the industry through education and shared code of ethics. FPAS also provides a range of services to consumers including:

• Educate and inform the public of the need for objective professional advice in making secure financial decisions.

• Ensure sufficient professional and ethical standards to maintain the confidence and trust of consumers.

• Provide education, training and information to our members to enhance their skills in providing holistic and objective financial advice.

• Develop and maintain high ethical standards within the CFP professionals.

• Represents the industry and CFP professionals to continue to raise the professionalism of the industry and to provide high quality financial advice to Singaporeans.

Financial Planning Magazine | May Issue 2

Wanda Sim, Case Manager, FIDReC FPAS PUBLICATION Production of the Magazine. Please email events@fpas.org.sg for advertisment or article contribution. Financial Planning Magazine Contents President Message Chief Editor Message Where to invest in AI growth? The Enduring Value of the Human Touch

How to avoid market conduct disputes? EVENTS RECAP CNY Luncheon Retirement talks @HPB by Dr Ben Fok Events Calendar 3 3 4 6 8 10 12 16 17 21 22 24 26 27 Financial Planning Association of Singapore (UEN: S99SS0008L) 3 Temasek Avenue Centennial Tower #21-00 Singapore 039190 Tel: (65) 6829 7166 Email: admin@fpas.org.sg CFP®, CERTIFIED FINANCIAL PLANNER™ and and AFP®, ASSOCIATE FINANCIAL PLANNER™, and are certification marks owned outside the U.S. by Financial Planning Standards Board Ltd. Financial Planning Association of Singapore is the marks licensing authority for the CFP® and AFP® marks in Singapore, through agreement with FPSB. AWPCM, ASSOCIATE WEALTH PLANNER is registered certification marks of the Financial Planning Association of Singapore. Website: www.fpas.org.sg | www.FPA.sg Death of CPF Special Account – So what’s next? PAGE 17 Artificial intelligence and Personal Financial Planning PAGE 8 Singapore 2024 Budget PAGE 12

President Message

By Dr Ben Fok, CFP®

Dear Members,

In the dynamic financial landscape of Singapore, where innovation and technological advancement, it is paramount that we recognize the transformative impact of artificial intelligence (AI) on the financial advisory industry. As we witness the rapid integration of AI into the financial advisory processes, it becomes increasingly evident that our profession is on a profound paradigm shift—one that promises to revolutionize the way we serve our clients and navigate the complexities of modern finance.

Singapore is known for its robust financial infrastructure and forward-thinking regulatory framework, is well-positioned to capitalize on the opportunities presented by AI in the advisory space. With the government’s strong support for innovation and digitalisation initiatives, we are witnessing a proliferation of AI-driven solutions that are reshaping the advisory landscape in unprecedented ways.

One of the most significant observations on AI is shaping the financial advisory landscape in Singapore is through the emergence of roboadvisors. These digital platforms leverage AI algorithms to provide automated investment advice tailored to individual investor’s goals, risk preferences, and financial circumstances. By harnessing the power of AI, robo-advisors offer cost-effective and accessible investment solutions that cater to a broader segment of the population, democratising access to financial advisory services.

Moreover, AI is enabling financial advisors to deliver more personalized and data-driven advice to their clients. Advanced analytics tools powered by AI can sift through vast amounts of financial data, identifying patterns and trends that helps in decisionmaking. This data-driven approach empowers advisors to offer tailored recommendations and proactive guidance, ensuring that clients’ financial plans are aligned with their evolving needs and objectives.

Chief Editor Message

By Yash Mishra, CFP®

Here, we are in 2024, as FPAS continues to move on its 25 years of championing excellence in Financial Planning

We dedicate this issue to the Future! A future where technology is integrally shaping all aspects of our life. Be it currencies, whether its Central Bank digital currencies or proxies as Crypto with a moniker Digital Gold or Digital Banking as a well-established reality. We explore this alchemy between holistic planning and harnessing technology. A perspective shared in the article ‘AI and Personal Financial Planning’. We discuss ‘How to invest in AI ‘and the rise of “AI as the new battleground of Growth vs value Investing ‘. We juxtapose the Artificial Intelligence landscape with the’ Enduring value of the Human touch in financial advisory “.

Furthermore, AI is revolutionising risk management in the advisory space. Machine learning algorithms can analyse market trends and historical data to identify potential risks and opportunities, enabling advisors to construct more resilient and adaptive investment portfolios. By leveraging AI-powered risk management tools, advisors can mitigate downside risks and optimize returns, enhancing the overall resilience of their clients’ financial plans.

However, as we embrace the opportunities presented by AI, it is essential to recognize and address the challenges it brings. Data privacy and security concerns loom large in an era where sensitive financial information is increasingly digitized and stored in the cloud. As stewards of our client’s financial well-being, it is incumbent upon us to prioritise cybersecurity and adhere to the highest standards of data protection to safeguard their trust and confidence.

In conclusion, the advent of AI has undeniably transformed Singapore’s financial advisory landscape. Yet amidst this digital evolution, one fundamental truth persists: the indispensability of human insight and client-centricity. Despite the allure of digital solutions, clients still yearn for the personalized guidance and expertise provided by traditional advisers. Consequently, human advisers can harness technology to augment their services, thereby enriching the client-adviser relationship. Through leveraging data, technology, and analytics, advisers can enhance efficiency, increase convenience, and deliver bespoke advice and tailored solutions to their clients. Thus, while technology plays a vital role, human expertise remains paramount, serving as the cornerstone of the client-adviser relationship. By steadfastly prioritizing client needs, advisers can maintain true client-centricity and adeptly navigate the evolving market dynamics.

Singapore Budget highlights for 2024 steers us all towards navigating the global market where the CPF (Central Provident Fund) has been the central pillar of retirement planning and personal savings. We share insights on the difference between ‘CPF Life vs Private Annuity ‘and feature veteran financial columnist and guest writer Lorna Tan’s insights in ‘Death of CPF SA ‘.

In our book section review, we feature a compelling read on ‘The Bill Gates Problem “By Tim Schwab, where philanthropy, Power and Purpose intermingles in a long investigative journalist piece on the tech legend in his new avatar.

Enjoy the read!

Financial Planning Magazine | May Issue 3

Where to invest in AI growth?

Ever hear about Artificial Intelligence, (AI) and imagine robots taking over the world? Relax; it’s not quite that dramatic. AI is basically a fancy way of saying computers are getting good at something that like recognizing faces or writing very good articles.

Remember those old calculators that could only do basic math? Decades ago, a calculator that could solve complex equations seemed super intelligent. Today, that’s just a normal calculator function. AI is similar. It’s the new and exciting stuff computers can do, stuff that’s constantly evolving and making them seem smarter and smarter. What we call AI today will likely be a common normal tech in 5 years’ time, and by then we will refer to the next cool computer abilities as AI.

Here is the key: AI isn’t magic. It’s about programming computers to act smart. These AI minds (software) need powerful brains (hardware) to work their magic. And so, to invest in AI, is to invest in companies at the forefront of AI research and development (R&D). This article shall discuss some of the industries and well-known listed companies which are at the forefront of AI revolution. This list is not comprehensive as the field and industry continues to evolve very quickly.

The development broadly occurs in software and hardware categories. Within each category, growth is projected to flourish in various sub-categories.

SOFTWARE

Within the AI software related companies, we start with the big technology companies like Alphabet (NASDAQ: GOOG) (Google’s Gemini, which assisted with this article), Microsoft (NASDAQ: MSFT) (Open AI, the one behind ChatGPT’s largest investor), Amazon (NASDAQ: AMZN), and Meta (Facebook, NASDAQ: META).

These software & software services companies have massive AI research efforts. They both provide and use AI in various products and services, from search engines, virtual assistants, cloud computing and general AI chatbot like Gemini and ChatGPT.

AI consist of a broad spectrum techniques, such as Machine Learning, Reinforcement Learning, Computer Vision (which includes Facial recognition), Robotics, AI Assistants and Automated Driving. Currently Generative AI and Large Language Model (LLM) has captured the most attention.

A lot of non-AI companies are doing R&D into these areas of AI, for example, Tesla (NASDA: TSLA) is an electric vehicle (EV) company, but

it has strong focus on AI integration. Other smaller companies like H2O.ai (in Pre-IPO) and DataRobot (yet to IPO) are potential opportunities in the future as well.

HARDWARE

If AI software is the mind of artificial intelligence, then AI hardware is the physical brain, the machinery that makes it all work. And at the heart of this hardware lies the IC (Integrated Circuits) chips, aka microchips, which power the complex calculations needed for AI.

1) IC Design Companies

IC design companies are so called the Architects of the Brain. To make a microchip, we first need a blueprint. This is where IC design companies come in.

NVIDIA (NASDAQ :NVDA): Renowned for their graphics processing units (GPUs), NVIDIA has become a leader in AI hardware. Their GPUs excel at parallel processing, making it useful for complex AI calculations. They also offer Tensor Core GPUs specifically designed for AI workloads, acting as a type of NPU (a chip designed for general neural network processing. Neural networks are the foundation of many AI algorithms, and they excel at tasks like image recognition, speech recognition, and natural language processing (NLP).

AMD (NASDAQ : AMD): A major competitor to Intel and NVIDIA, AMD also offers powerful GPUs suitable for AI applications. They’re pushing the boundaries of chip design to deliver even more processing power.

Intel (NASDAQ : INTC): The long-standing leader in central processing units (CPUs), Intel is also developing AI-specific chips, including their Nirvana Neural Processing Unit (NPU) designed for AI acceleration.

Alphabet (NASDAQ : GOOG): The TPU (Tensor Processing Unit) designed by Google is a custom-built NPU used in their data centers for various AI tasks.

2) IC Fabrication: Building the Physical Brain

Once the design is complete, it’s time to build the chips. This is the realm of IC fabrication companies, the factories that turn those blueprints into reality. This is usually the most expensive step, and also the part that requires the highest R&D. Here are some of the key players:

Taiwan Semiconductor Manufacturing Company, TSMC (NYSE : TSM), is the

world’s largest contract chip manufacturer, TSMC produces chips designed by other companies, including those from NVIDIA, AMD, and Intel. They so far have been one of those that benefit the most from recent AI development.

Samsung (KS : 005930) is also major player in both chip design and fabrication, Samsung is a powerhouse in the industry, producing its own AI chips (including NPUs) and competing with TSMC for manufacturing contracts.

While Intel (NASDAQ : INTC) is a major chip designer, Intel also has its own fabrication facilities, allowing them greater control over the entire chip production process.

Semiconductor Manufacturing International Corporation, SMIC (HKG : 0981), a Chinese company, SMIC is a significant player in chip fabrication, although it trails behind TSMC and Samsung in terms of overall technology leadership.

3) IC Packaging: Putting it All Together

The final step involves packaging the chip; this is a bit more than simply putting the chip in a box and wrapping it in plastic. IC Packaging is a delicate process that covers the delicate circuits in a protective material and connects them using tiny wires and gold or copper connectors, allowing the chip to talk to other parts of the computer.

IC packaging is dominated by companies from China. Taiwan also boasts a strong presence in IC packaging, with companies like TSMC (NYSE : TSM)) handling a significant portion of their own chip packaging needs. Several other Taiwanese companies like ASE Technology (TPE: 3711) and PTI (TWSE : 6239) are major players in the global IC packaging industry.

Other good example will be Advanced

Financial Planning Magazine | May Issue 4

Semiconductor Engineering (NYSE: ASE), which is a Singaporean company, but with a large presence in Taiwan. JCET Group (TSE : 6406) is a major provider of electronic manufacturing services (EMS), including IC packaging and testing.

4) Other Essential Sectors:

One of them is, Electronic Design Automation (EDA) software providers. also called Electronic Computer-Aided Design (ECAD). It’s essentially a suite of tools that assist with the entire process of designing and verifying integrated circuits IC design. These software is used by the IC designers mentioned above.

EDA tools allow chip designers to virtually create the layout of the chip, placing transistors, wires, and other components with precision, helps simulate the behavior of the chip under different conditions, and finally perform rigorous checks to identify any potential issues like shorts, opens, or design rule violations that could lead to malfunctioning chips.

These tools help design and validate the manufacturing process, ensuring the fabrication equipment can create the chip layout accurately and efficiently. Notable players are Synopsys (NASDAQ: SNPS), Cadence (NASDAQ: CDNS) and Siemens EDA (owned by Siemens, FWB : SIE).

The next would-be Semiconductor Equipment Manufacturers. ASML (AMS: ASML) is the world’s leading manufacturer of photolithography and, more importantly, extreme ultraviolet (EUV) lithography machines. These machines are essentially giant cameras that use light to etch intricate patterns onto silicon wafers, forming the foundation of the chip circuitry.

These companies made the machines TSMC, Samsung and Intel uses to make chips. As of now, ASML do not have any strong competitors in the lithography machines. Other Semiconductor Equipment manufacturers which makes other important machines are Applied Materials (NASDAQ: AMAT), Lam Research (NASDAQ: LRCX), Tokyo Electron (TYO : 8035) and KLA-Tencor (NASDAQ : KLAC)

Finally, we have Chemicals Manufacturers which specialize in producing important materials such as photoresist and highgrade silicon for the semiconductor industry. These chemicals require high level of material engineering expertise and have a high barrier of entry as well. Notable players are Merck (NYSE : MRK), JSR (TYO : 4185), Sumco Corporation (TYO : 3436), Shin-Etsu Chemical (TYO: 4063).

The above list is non-exhaustive. IC Fabrication consists of many complex

processes that includes a lot of different technologies. There are a lot more other kind of important equipment used either in fabrication and packaging, or in making the materials used in fabrication and packaging. These includes Etchants, Cleaners, Electroplating Chemicals and Die Attach Materials. The above-mentioned are the ones most directly involved.

Most of today’s AI algorithms require massive amounts of Parallel Processing. CPUs which are designed for serial processing, struggle with this. This is why GPUs and specialized AI Chips like NPUs and LPUs chips are crucial. These chips are designed specifically for the parallel processing and complex calculations needed for AI tasks.

Out of the three processes mention above, IC Design companies usually have a higher profit margin, as they do not invest in capital intensive factories to make their own chips. However, IC fabrication plants are expensive to build and thus, the few chipmakers that offers Advanced Fabrication Processes (16nm and below) are protected by a strong barrier to entry.

Investing in AI related stocks offers highgrowth potential, but careful due diligence is crucial. Investors can focus on established companies at the forefront of AI research and development (R&D) and prioritize companies with strong fundamentals, sales figures, and profit margins for long-term success. Even cutting-edge technology needs a solid foundation to thrive.

In the software space, investors should always keep an eye on new IPOs, as software AI solutions have a higher chance of explosive growth as their businesses are readily scalable. Keep in mind that small software firms are higher risk investments, and exposure should be keep controlled. They can be a minor add on to the investor’s core portfolio.

This article is written with the assistance of Google’s large language model, Gemini. It’s fun, try it.

WRITER

Adrain Tong, CFP®

Financial Planning Magazine | May Issue 5

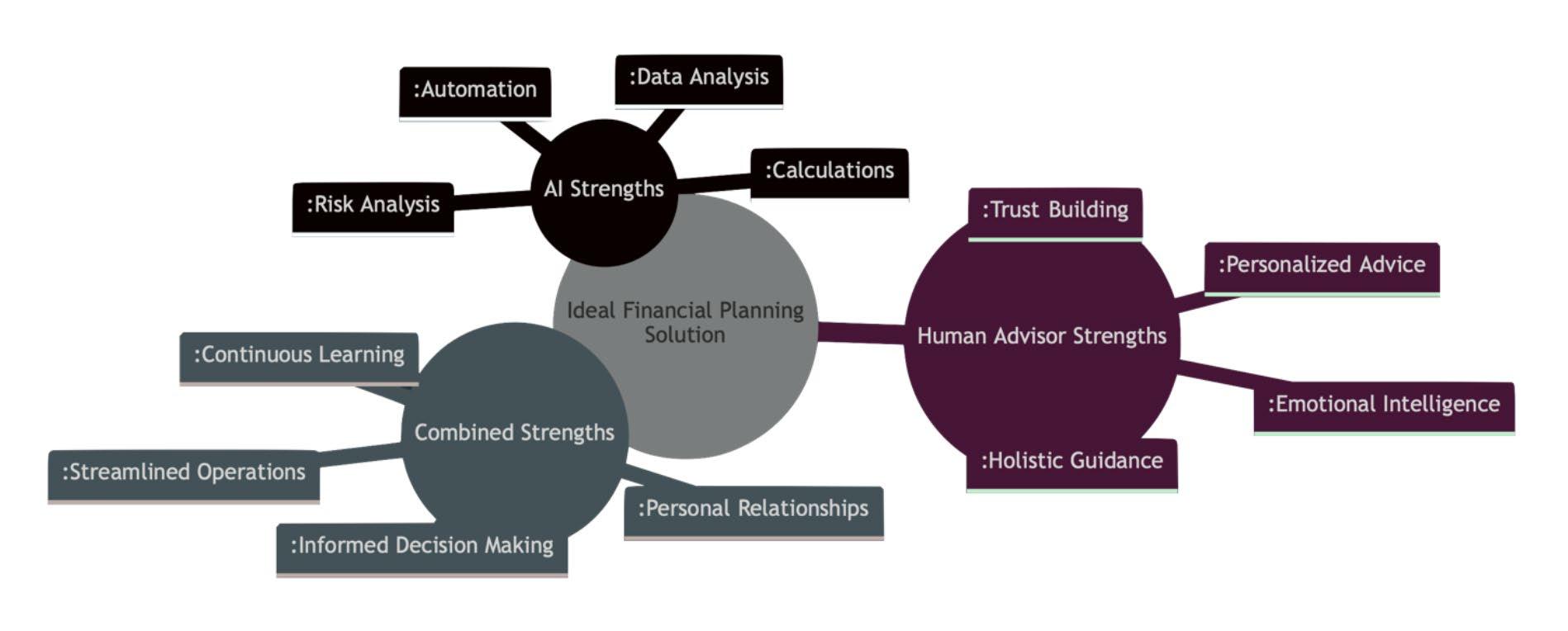

The Enduring Value of the Human Touch in Financial Advisory

As artificial intelligence (AI) continues to reshape industries, the role of human financial advisors is undergoing scrutiny. While AI offers powerful data analysis, automated processes, and optimized calculations, the human touch remains an irreplaceable asset in navigating the complexities of financial planning.

THE AI REVOLUTION IN FINANCE

AI has undeniably revolutionized the financial sector. Robo-advisors use algorithms to create and manage investment portfolios, minimizing human error. AI can process vast data in real-time, make optimized investment decisions, ensure compliance with regulations, and perform risk assessments with astounding accuracy.

However, financial advising transcends mere number crunching and regulatory adherence. It requires a nuanced understanding of each client’s unique circumstances, life goals, emotional states, and personal values –elements that AI struggles to grasp fully.

THE IRREPLACEABLE HUMAN TOUCH

While AI excels at data-driven tasks, human advisors possess emotional intelligence – the ability to build trust, empathize, and provide tailored guidance based on individual needs. Life events and financial goals are often complex and multifaceted, necessitating the human capacity for interpretation and emotional navigation.

For example, a human adviser can provide

empathetic guidance when clients are going through major life events like marriage, divorce, having children, job changes, inheritances, etc. The adviser can share personal stories of how they navigated such situations or how they helped their clients to traverse such challenges, whether it’s revising investment strategies, updating insurance policies, or estate planning.

Another good example of the human touch is for clients with complex family situations involving blended families, strained relationships, or providing for children with special needs, an adviser can sensitively navigate these real-life dynamics when structuring trusts, estates and providing legacy planning.

Moreover, human advisors offer personalized advice that aligns with clients’ best interests, which a single dimensional algorithm reliant on historical data will find it difficult to replicate. Regulation emphasizes consumercentric practices, and human advisors are better equipped to verify credentials, reputations, and client satisfaction levels.

Human advisers can rely on their “hunches” or “a bad feeling” based on their experiences to steer clear from bad situations involving money laundering from their in-person interactions with potential client.

The emotional aspect of investing also underscores the importance of human interaction. Market turbulence can trigger strong emotional responses, and human advisors provide a steadying influence, offering reassurance and guidance during emotionally charged periods of time –a realm where AI may lack emotional intelligence to do so.

For example, when clients receive a windfall like an inheritance or selling a business, it can be overwhelming for them. The adviser can while sharing the joy and celebrate with their clients, employ emotional intelligence to provide the levelheadedness to guide clients through practices for disciplined investing rather than spontaneous splurging.

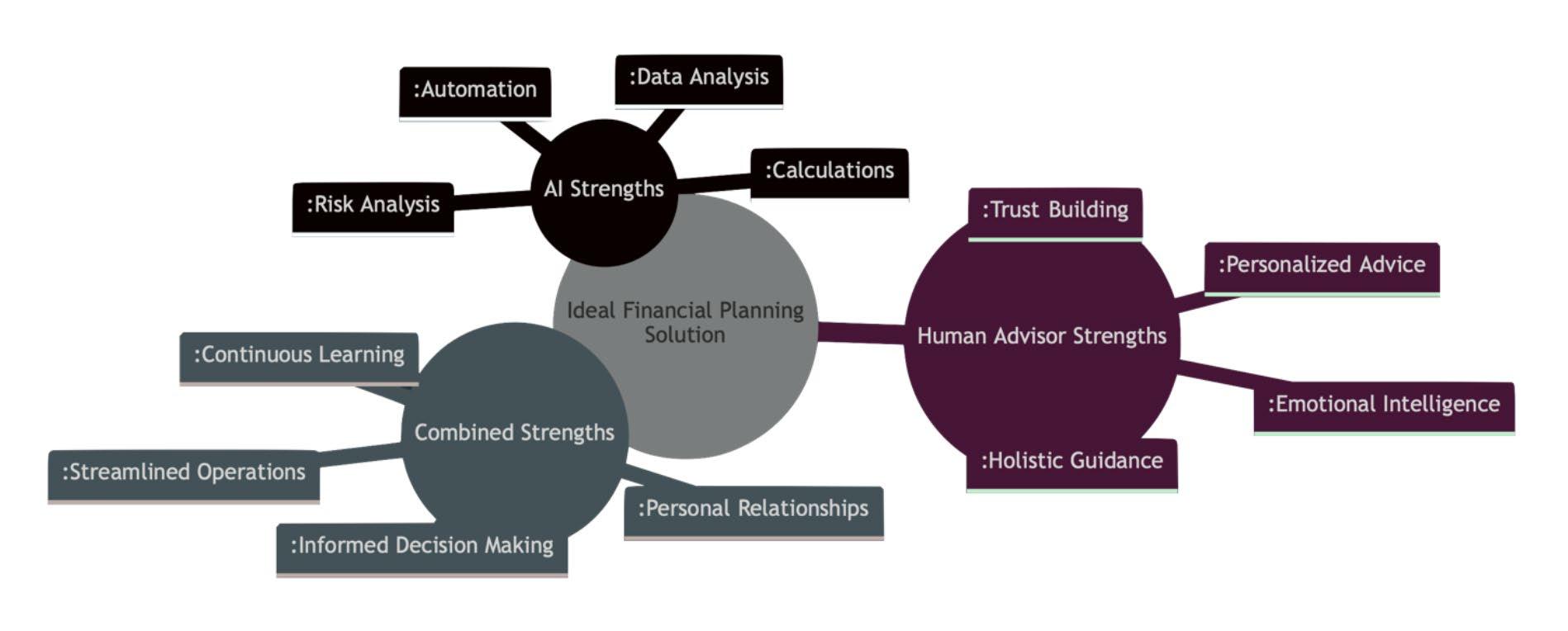

EMBRACING COLLABORATION

Rather than viewing AI as a threat, financial advisors can leverage it as a tool to enhance their services. By utilizing AI for data analysis, risk management, and process automation, advisors can streamline operations and focus on providing personalized client experiences.

This collaborative approach not only ensures accurate financial planning but also fosters stronger relationships between clients and their advisors. AI furnishes data-backed insights to inform decision-making, while human advisors interpret these insights to support clients’ emotional and personal circumstances.

The AI-powered tool space is changing so rapidly, but here are some tools that can help financial advisors begin evaluating their usefulness:

1) Marketing / Lead Generation / Content Creation

Financial Planning Magazine | May Issue 6

• Catchlight.ai: This tool is designed to help financial advisors tailor their marketing strategies to target potential clients more effectively.

• Saifr.ai: This tool uses artificial intelligence to streamline compliance and marketing materials creation, making it easier for advisors to reach out to potential clients while adhering to regulatory standards.

2) Budgeting & Savings

• Wally.me: It is a completely automated personal finance app that tracks client’s spending, cash flow and bills to help simplify budgeting decisions.

3) Investment Management

• SigFig: This tool uses advanced investment technology to provide investors with diversified portfolios tailored to their needs.

PREPARING FOR THE FUTURE

To remain competitive and relevant, financial advisors must adapt to the changes brought about by AI technology. This includes acquiring new skills, staying updated on AI advancements, and embracing digital tools to enhance their practices.

Notably, human skills such as empathy, active listening, emotional intelligence, relationship-building, and leadership are essential for success. Studies have shown that clients value advisors who demonstrate these qualities, leading to higher satisfaction, trust, and loyalty.

A good site to get a lay-of-the-land overview of the AI space is the website futuretools.io

THE PATH FORWARD: BALANCE AND CONTINUOUS LEARNING

The future of financial planning lies in striking a harmonious balance between AI technology and human touch. By embracing AI as a supportive tool, financial planners can streamline operations, enhance decision-making, and offer clients comprehensive and personalized financial advice. Simultaneously, advisors must engage in continuous learning, collaborating with AI systems to improve their advisory skills continually.

In an era defined by technological disruption, the human touch remains an essential aspect of financial advising. As AI reshapes the landscape, the true potential of financial planning can be realized through the symbiotic relationship between humans and technology, combining data-driven insights with the invaluable human capacity for emotional intelligence, personalization, and holistic guidance.

Financial Planning Magazine | May Issue 7

Chart 1: The Combination of Strengths of AI and Humans in Financial Advisory

WRITER

John Sim, CFP®

Artificial intelligence and Personal Financial Planning:

Artificial Intelligence (AI), in the context of personal finance, refers to using machine learning, natural language processing, and predictive analytics to offer personalized financial advice, automate tasks, and analyse large volumes of financial data.

Unlike traditional methods that rely heavily on manual input and analysis, AIpowered financial tools learn from individual behaviours and market trends to provide customized recommendations. Now is that a good thing? It really depends on who is trying out the tool.

And there- in lies the conundrum as a practicing financial planner for over 25 years, my first port of call is unlikely a Budgeting tool on the Internet , but I also do know that for the current generation of first time savers who are beginning their journey or those in midstream – its all about ease and simplicity of the financial planning options and so we explore the 3 key aspects in the article below:

• How does AI enhance personal financial planning?

• What AI-powered tools are available for budgeting and investing?

• What are the benefits and limitations of relying on AI for financial decisions?

DEFINITION AND RELEVANCE

AI in Personal finance encompasses algorithms that analyse spending habits, investment choices, and financial goals to offer tailored advice. This technology is pivotal for individuals looking to make informed financial decisions without the necessity of deep financial knowledge or the expense of a personal advisor.

DIFFERENCES FROM TRADITIONAL FINANCIAL PLANNING

Traditional financial planning often requires hours of manual tracking, a good understanding of financial principles, and regular consultations with financial advisors.

AI SIMPLIFIES THESE PROCESSES BY:

• Automating budget tracking and categorization

• Providing real-time financial insights and alerts

• Offering predictive analyses for investment opportunities

BUDGETING WITH AI

Budgeting is a fundamental aspect of personal finance management. AI-driven budgeting apps represent a significant advancement over traditional spreadsheetbased budgeting methods.

These tools automate the categorization of expenses and analyse spending patterns to offer personalized budgeting advice.

OVERVIEW OF AI-DRIVEN BUDGETING APPS

Many apps now leverage AI to help users manage their finances more effectively. These apps use algorithms to categorize transactions, identify savings opportunities, and predict future spending patterns.

FEATURES AND BENEFITS

• Automated Expense Tracking: AI budgeting apps automatically categorize expenses, saving users time and providing accurate financial insights.

• Customized Budgeting Advice: AI provides personalized recommendations based on spending patterns and financial goals, helping users adjust their budgets for optimal financial health.

• Future Spending Predictions: AI can forecast future expenses by analysing past spending, aiding in better financial planning.

• Real-world Examples: Apps like Mint, YNAB (You Need A Budget), and PocketGuard have set benchmarks in AI-powered budgeting. They demonstrate how AI can simplify financial management, offering subscription monitoring, bill negotiation, and financial goal-tracking features.

Financial Planning Magazine | May Issue 8

Integrating AI in personal finance management is not just about automating tasks; it is about empowering individuals with insights and tools previously accessible only to professionals.

As we explore further AI’s role in investing and debt management, it becomes clear that the potential of AI in personal finance extends beyond budgeting, offering a comprehensive suite of tools for financial empowerment.

AI IN INVESTING

AI’s influence extends beyond budgeting into investing, where it is a powerful tool for novice and experienced investors .AIdriven investment platforms are redefining how individuals approach the stock market, offering a blend of predictive analytics, automated trading, and personalized investment advice.

• Introduction to AI-driven Investment Platforms

These platforms use AI to analyse market data, predict stock performance, and provide investment recommendations. By leveraging machine learning and big data analytics, AI investment tools can sift through vast amounts of financial information to identify patterns and insights that would be impossible for a human to detect in a reasonable time frame.

• The Role of AI in Predictive Analytics for Stock Market Trends

AI forecasts market movements based on historical data and current market conditions. Predictive analytics can help investors make more informed decisions by providing forecasts on stock prices, market volatility, and potential investment opportunities

BENEFITS OF USING AI FOR PERSONAL INVESTMENT DECISIONS

• Data-Driven Insights: AI provides access to comprehensive market analyses, helping investors understand complex market dynamics.

• Risk Management: By analysing past performance and market conditions, AI can help investors assess the risk levels of different investment options.

• Portfolio Optimization: AI algorithms can suggest adjustments to an investor’s portfolio to maximize returns while minimizing risk based on the investor’s financial goals and risk tolerance.

EXAMPLES OF AI INVESTMENT ADVISORS

1. Betterment: As a robo-advisor, Betterment uses AI to manage portfolios, automatically adjusting investments to align with the user’s financial goals and risk tolerance.

2. Wealthfront: This platform provides AIdriven financial planning services, offering personalized advice on investments, savings, and retirement planning.

3. Robinhood: While known for commission-free trades, Robinhood also incorporates AI to offer its users personalized news feeds and investment recommendations.

The integration of AI in both budgeting and investing represents a significant leap forward in personal finance management. By automating complex processes and providing personalized advice, AI-powered tools are making financial planning more accessible and effective for individuals around the globe.

DEBT MANAGEMENT AND CREDIT OPTIMISATION

AI technologies offer innovative solutions in the areas of debt management and credit optimisation by, providing individuals with the tools to improve their financial health.

• How AI Helps in Managing Debts and Optimizing Credit Scores: AI systems analyse users’ financial debt levels, and spending habits to offer personalized advice on reducing debt and improving credit scores. By identifying high-interest debts and suggesting repayment strategies, AI assists in prioritizing debts efficiently, potentially saving users money on interest payments.

• Tools and Strategies for AI-Assisted Debt Repayment Plans:

I. Personalized Repayment Recommendations: AI algorithms can suggest the most effective repayment strategies, such as the snowball or avalanche methods, based on the individual’s unique financial situation, but remember it needs individual discipline. That in itself is hard.

II. Automated Payment Scheduling: AI tools can automate payments, ensuring they are made on time, which is crucial for credit score improvement.

III. Debt Consolidation Options: AI can recommend the best debt consolidation loans or balance transfer credit cards to minimize interest payments.

IV. Credit Risk Assessment and Loan Approval Processes: Financial institutions increasingly use AI to assess credit risk more accurately and efficiently. AI analyses traditional and non-traditional data points, including transaction history and social media activity, to provide a comprehensive risk profile. This speeds up the loan approval process and enables lenders to offer more personalized loan products, potentially at better rates.

In conclusion , as AI continues to integrate itself into the various aspects of financial planning that needs data monitoring or analysis , we must remail attuned to the fact that as we plan for the Life we dream to live , or aspire ,all the AI algorithms can help us distinguish between ‘ Needs’ and “Wants’ that’s where you may need a Human Coach - just as the world’s best sports persons still have their human coaches to instil discipline and objectivity .

Financial Planning Magazine | May Issue 9

WRITTEN BY Yash Mishra, CFP®

AI: The battle of Growth Investing vs Value Investing again?

IS AI STOCKS EXPENSIVE NOW?

With the rise of AI technology, investors are now arousing and suddenly the neverending debate on Growth Investing vs Value Investing comes to the forefront again as stocks related to AI burst out of the gate since December 2023.

Whenever a casual discussion happens between friends or business associates, you will often hear someone say the most classic lines “It is so expensive already. It’s too late.” One of the possible reasons why it happens more often in Singapore because retail investors in Singapore are not used to stock prices going up to more than $100 per stock.

Hence, a man on the street will be very skeptical of investing in a $200 stock, because they find it “expensive” relative to the $1-$3 stocks prices he is used to see trading on SGX. Their reference context can be how they see a “$1 Coke” being sold at an incredulous $200.

Further, in the past, SGX stocks were trade in lots of 1000 shares. Hence, the Singapore investor would mistakenly think that it will cost $200,000 just to buy into the position, when they can actually invest $2000 to buy 10 shares on US stock exchanges.

For some on the other hand, for example, would have seen Super Micro Computer (SMCI) rose from $50 in October 2022 to $100 in March 2023, and deemed that at $100, the

stock is now expensive after it doubled. They would not have imagined SMCI can reach $1000 in March 2024 (a year later), a further tenfold increase.

SHOULD YOU BUY INTO AI?

When the internet came into the forefront, the whole market went hysterical and it burst spectacularly and tragically in less than 5 years. So will the AI revolution result in another dotcom bubble, where technological index goes down 78% after the bubble burst? Is the AI revolution going to lead to a secular long term uptrend for the stock market?

The consensus is for this time versus the dotcom bubble, a lot of the companies that are related to the rise of AI technology are actually already profitable. Some companies like Nvidia (NVDA) are growing their revenue, margins, and profits as they ride on the trend.

However, there will still be companies who will raise a lot of investors monies on the promise of AI solutions and potentially not deliver profits for many years to come or even closing. For investing in such companies, one needs to be more careful.

DO I REALLY HAVE TO UNDERSTAND WHAT IS THE BUZZ ABOUT AI TECHNOLOGY?

For some investors, they believe in understanding the business behind the buzz before committing to positions. Hence they do research like understanding why Nvidia

(NVDA) is doing so well vs Intel (INTC). They learn about the different types of chips (CPU vs GPU) the chipmakers are making and why these chips are important to the AI revolution. They pored over ratios like P/E ratios, calculated the P/E expansion ratio and even read reports detailing the launches of new chips.

For investors who are in technical analysis, they will just look at the hottest stock and trade accordingly. Likewise, they tend to exit the position once they find the stock is falling and move on to other stocks.

In general, for retail investors, regardless of how they invest, they should learn about what is the AI revolution about as it is set to transform the way we work. It is probably one of the biggest technological breakthroughs since the dotcom days. Hence they can determine for themselves how long and how far AI stocks will rally.

As the AI revolution potentially will affect many industries across the board, investors will be questioning which sub-sector or space they should look into in their research? Using an analogy frequently used about the Gold Rush in 1800s, one can choose to invest in those who go up the mountains to do gold mining and potentially yielding an incredible windfall or invest in the shops who are selling the shovels at the bottom of the mountain. Likewise, investors can choose to invest in the companies selling AI solutions or

Financial Planning Magazine | May Issue 10

companies like Nvidia who makes chips that powers AI technology.

LESSONS FROM THE LONG PAST

For the dotcom days, we did see Amazon survived after declining more than 90% in 2002.

After more than 20 years, we continue to witness changes in how consumers shop online. Amazon evolved from an online bookstore and remained as one of the biggest players on online shopping (though their cloud servers’ business is the most profitable part of their businesses).

During the Covid period, the parent of Shopee, SEA (SE) experienced an explosive growth in stock prices and was one of the darlings on US stock exchanges. Today TikTok is working very hard in Southeast Asia to compete against Shopee for dominance for online shopping through TikTok Shop as well as through Livestreaming sales.

The reality is that the growth of online shopping brought on by the internet has never stopped since the dotcom craze. If we teleported those dotcom evangelists of online shopping to today’s world, they would be totally amazed how much online shopping has evolved. Most importantly, they will feel so vindicated.

But the lesson we learnt is that while the secular trend remains for the past 2 decades, the players have substantially changed. Many different business models have been tried and failed, losing investors tons of monies. Some have found the right formula and succeeded.

If you are a long-term investor in secular

trends and you believe in the AI revolution, you have to update your portfolio constantly as the market conditions and technology changes very quickly.

To do so, you either have to rely on technical analysis, valuation analysis or industry studies into the AI trend. Alternatively, you can start with macro research and then use technical analysis to time your trades.

INDEXES

If we find ourselves short of time, knowledge, or skill to do our own in-depth research, relying on indexes via trading using ETFs are very useful. This is because indexes will refresh their components stocks using their stipulated conditions. So, the indexes will both eliminate stocks and add on more relevant stocks over a period that represents the target area of the indexes.

As ETFs also have their downsides, investing with fund managers may also yield results in the medium and longer term despite their higher cost. Notably, AI themed ETFs may not be a good choice as the AI field is still developing rapidly. A broad-based technology ETF can yield better risk and reward.

MORE LESSONS FROM RECENT YEARS

Riding on the story of electric vehicles, Tesla peaked in late 2021 at $400 (stock split adjusted), after rising from $11 in mid2019. From its peak, Tesla plunged to $101, a decline of 75%. Today (April 2024), it is still hovering at around $170, with the stock supported generally at its 200-day moving average.

Most crucially, during the strong rally in 1st quarter of 2024, Tesla has been in general

decline, significantly underperforming the general market.

Tesla’s stock movements over the last few years have demonstrated again that one must be careful on how to buy into long-term secular trends. There is no question that the electric cars industry will continue to grow and gain market share against regular cars. But if you bought Tesla at $380 near the peak, you would have suffered anguish, and it might be a very long time before you breakeven and make money from this electric vehicle secular trend.

SHOULD YOU OR SHOULD YOU NOT INVEST IN AI STOCKS?

As investors, we need to be more aware that the stock market has many players with their own objectives. Investors need to be very self-aware of their own situation and needs, whether in terms of their risk appetite, skill or investment time horizon to profit from this upcoming AI revolution.

However, to choose to totally sit out this AI revolution as part of your investment strategy might be a very tough question to reply to our grandchildren in the years to come.

Disclaimer: The writer of the article had and may hold stocks mentioned in this article at the point of publication of this article.

Financial Planning Magazine | May Issue 11

WRITER

Eliss Chen, CFP®

Singapore 2024 Budget

The 2024 budget of Singapore outlines the government’s financial plan for the year, encompassing support for individuals, families, and businesses across various age groups and life stages. From newlyweds and young couples to mid-career seekers and the elderly, the budget offers provisions to cater to diverse needs and promote economic resilience. It includes enhancements for lifelong learning and career advancement, as well as measures to support aging citizens, reflecting a comprehensive approach to inclusive growth. In this article, we’ll delve into the key provisions of the 2024 budget and their significance for people of all ages in Singapore.

The fiscal allocation for the 2024 budget shows a comprehensive approach, addressing the needs of diverse demographic segments, including individuals, households, and businesses. The following summarizes some of the budgetary provisions:

FOR INDIVIDUALS

Cash CPF Medisave Account

Personal Income Tax Rebate

NS LifeSG Credit

CPF Retirement or Special Account

Source: MOF

FOR HOUSEHOLDS

CDC Vouchers U-Save

$200 to $2150 for Singaporeans aged 21 and above

$100 to $1650 for all Singaporean

50% tax payable for Year of Assessment 2024 capped at $200

For all past and present national servicemen

$400 to $2500 for Singaporeans born in 1973 or earlier

$600 in total for all Singaporean households

$550 to 950 for all HDB households

2 to 4 months offset for HDB households

2024

Note: Benefits are subject to the individual’s or household’s eligibility.

2025

Financial Planning Magazine | May Issue 12

MOF 2024/2025 DISBURSEMENT CALENDAR Sep Dec Jan Oct YA 2024 Nov Feb Mar Jul Apr Jun Aug • U-Save (ENHANCED) • S&CC Rebate • CDC Voucher (NEW) • U-Save (ENHANCED) • S&CC Rebate • Cash • CPF MediSave Account

to $190 0.5 to 1 month

to $285 0.5 to 1 month $450 or $850 $150 to $450 $300 • Cash (NEW) • U-Save (ENHANCED) • S&CC Rebate $200 to $400 $110 to $190 0.5 to 1 month • NS LifeSG Credits (NEW) $200 • Cash • CPF MediSave Account • CPF Retirement or Special Account (NEW) $200 to $600 $100 to $1,500 $1,000 to $1500 • Personal Income Tax Rebate for the year of Assessment (YA) 2024 Up to $200 • U-Save (ENHANCED) • S&CC Rebate • CDC Vouchers (NEW) $165 to $285 0.5 to 1 month $300

CPF MediSave Account

Seniors’ Bonus $150 $200 to $300

CPF Retirement or Special Account (NEW) $400 to $1,000

S&CC Rebate Source:

$110

$165

•

•

•

More information here

In contrast to the one-time assistance measures, the enhanced support for families in this year’s budget is notably appreciated. The reduction in childcare fee caps, for both the current year and the subsequent one, signifies a significant stride forward. Anticipating the trajectory, parents can envisage paying childcare fees comparable to those of primary school and student care facilities by 2026.

Such initiatives are poised to incentivize young families towards expanding their households and fostering a conducive environment for superior educational opportunities. For those within this demographic, parents should leverage the resultant savings to establish a dedicated savings plan for future personal or child-related endeavours as a prudent consideration.

FOR FAMILIES

One-year Parenthood Provisional Housing Scheme (Open Market) Voucher to rent a HDB Flat in the open market

Reduced full-day childcare fee caps for Government Anchor Operators to $640 and Partner Operators to $680

ComLink+ Progress Packages to support low-income families and save up for own home ownership

As a single parent raising two young children, finding suitable housing following my divorce proved to be an arduous task. The challenge of securing a proper living space where my children and I could comfortably engage in essential activities such as sleeping, playing, studying, and bonding as a family was daunting.

Resorting to sharing a confined space with my parents underscored the pressing need for a more permanent and conducive living arrangement. The exorbitant prices prevalent in the resale housing market, coupled with the constraints of a single income, exacerbated the financial strain. Hence, I am heartened by the recent extension of the Parenthood Provisional Housing Scheme to encompass a broader spectrum of family compositions, offering hope and relief to individuals navigating similar circumstances.

FOR PERSONS WITH DISABILITIES

Reduced out-of-pocket expenses for Singaporean students in Special Education schools and Student Care Centres

Provide employment and integration into community with by spaces in Sheltered Workshops and Day Activity Centres

More information here

The reduction in out-of-pocket expenses for students attending Special Education schools undoubtedly comes as a welcome relief for caregivers. While managing the various expenses associated with caregiving poses its challenges, it is imperative to acknowledge the importance of financial planning, particularly for children with disabilities.

Financial planners specializing in this area offer invaluable guidance and support in navigating the unique financial considerations associated with caring for individuals with disabilities. For parents who have yet to explore this avenue, I strongly encourage engaging with a few financial planners to gain insights and establish a proactive plan. As the adage goes, early planning yields better outcomes, underscoring the significance of taking proactive steps to ensure financial preparedness for the future.

Financial Planning Magazine | May Issue 13

SUPPORT FOR SENIORS

$3.6 billion for Age Well SG program to support seniors in their homes and communities

One-time Medisave bonus up to $300 for adults born in 1974 to 2003 Click here for more details.

Increased quarterly payments from Silver Support Scheme by 20% with qualifying per capita household income threshold to $2,300

Expansion of Matched Retirement Savings Scheme for Singaporeans aged 55 and above with annual matching capped at $2,000 and $20,000 lifetime cap

CPF Enhanced Retirement Sum raised to 4x the Basic Retirement Sum

Interest -free GIRO instalment plan for property tax to 24 months for eligible retirees aged 65 and above

FOR BUSINESSES

50% Corporate Income Tax Rebate capped at $40k for Year of Assessment 2024

Min Cash benefit of $2000 for hiring 1 local employee in 2023

Enhanced Enterprise Financing Scheme and SkillsFuture Enterprise Credit (till June 2025)

More information here

INVESTING IN OUR PEOPLE

FOR THE MID-CAREER

SkillsFuture level-Up for Singaporeans aged 40 and above

$4000 credit top-up for selected industry-oriented training courses

Mid-career Enhanced Subsidy for publicly funded full-time diploma

Up to $3000 monthly SkillsFuture Mid-Career Training Allowance for up to 24 months for selected full-time courses

More information here

LOW-WAGE WORKERS

Increase Workfare Income Supplement Scheme payouts to a maximum of $4,900 a year

Raise Local Qualifying Salary to $1,600

Raise co-funding levels for Progressive Wage Credit Scheme to a max of 50% this year and wage ceiling to $3,000 in 2025

ITE GRADUATES

Increase Workfare Income Supplement Scheme payouts to a maximum of $4,900 a year

Raise Local Qualifying Salary to $1,600

Raise co-funding levels for Progressive Wage Credit Scheme to a max of 50% this year and wage ceiling to $3,000 in 2025

More information here

Financial Planning Magazine | May Issue 14

As an advocate for lifelong learning, I often discuss the merits of reaching the age of 40 with friends. The government’s substantial investment in reskilling and upskilling initiatives for Singaporeans underscores the importance of adaptability and resilience in today’s employment landscape.

Even for those contented in their current careers, I believe there’s immense value in acquiring additional skills. With life expectancy extending well into our 80s and beyond, committing to a single profession for six decades seems unimaginable to me.

Beyond our professional obligations, each of us harbours unique passions and interests waiting to be explored. Embracing the opportunity to enrol in new courses not only opens doors to entirely new avenues but also has the potential to augment our existing skill sets. Therefore, I encourage everyone to seize the moment and embark on this journey of personal and professional growth, as the possibilities are boundless.

Revisions to Property Tax:

Homeowner can now expect to pay the same or lower owner-occupier residential property tax at each Annual Value band from Jan 2025 onwards. View table here.

Summary:

In summary, this year’s budget reflects a comprehensive and thoughtful approach, catering to diverse needs across various demographics. While I did not directly benefit from the provisional housing scheme, the overarching direction towards inclusivity in our policies and assistance is clear. It signifies a positive step towards ensuring equitable support for a wide spectrum of individuals and families within our society.

Financial Planning Magazine | May Issue 15

WRITER Joanna Leng, CFP®

CPF life Vs Private Annuity

This article shall compare the pros and cons of CPF Life and Private Annuities. During the 2024 budget announcements, the government announced revisions to the CPF scheme, where CPF Special Account will be closed upon a CPF member reaching 55 years old. This revision brought up many discussions on the merits of CPF Life scheme vs Private Annuities schemes offered by insurance companies.

CPF Life and private annuities are two options for ensuring sufficient funds for retirement. Understanding these two options will help a person make informed decisions about their retirement savings.

Annuities are financial instruments where retirement savings are pooled together and provide participants a lifetime income, such that the participant will not run out of retirement funds during their lifetime.

Comparing with typical life insurance which covers the risk of unfortunate early demise during one’s productive lifetime, annuities cover the risk of a person surviving much longer than their savings can afford during one’s retirement.

CPF Life, or Central Provident Fund Life, is a annuity plan available to Singaporeans and PRs through the CPF scheme. When a CPF member reaches their retirement age, the money saved in CPF Life is used to provide the member with a monthly income for the rest of their life.

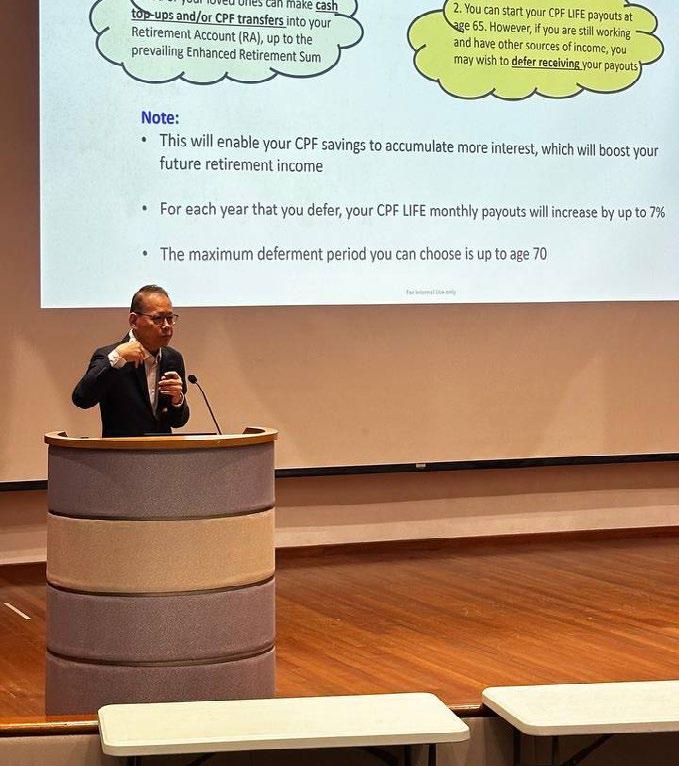

One of the main advantages of CPF Life is that the savings are guaranteed by the Singapore government. The interest rates earned by the Retirement account and subsequently the CPF Life will earn a guaranteed floor rate of 4%, potentially up to 6% per annum. The CPF member This can help the member to build up a bigger monthly payout when they reached 65.

Another advantage is CPF Life allows the member to decide to delay the start of the payout up to age 70. By doing so, the member will receive a higher monthly payout for the rest of their life.

However, CPF Life also has some limitations. One of the drawbacks is that the amount the member receive as a monthly payout may not be sufficient to meet all their financial needs in retirement. The payout is based on the amount of money they have saved in CPF Life, and the monthly amount may be lower than what they expect, especially if they have not contributed a significant amount into their CPF over the years.

The other drawback is that the earliest the

payout can start is 65 years old. For CPF members who retire earlier by choice or other reasons will not be able to receive any income. Hence if a CPF member is retrenched at age 60 will not be able to tap on their CPF Life to provide income between 60 to 65 years of age.

Private annuities, on the other hand, are retirement savings plans offered by insurance companies. These insurance companies manage the person’s money and invest it to provide them with a monthly income during retirement. Unlike CPF Life, private annuities are not mandatory, and the consumer have the freedom to choose whether to invest in them.

One advantage of private annuities is the flexibility they offer. Clients can choose to invest their monies for higher returns during the pre-retirement period. This can result in a larger monthly income during the retirement years.

They can either choose a higher risk investment strategy in their annuity plan or choose to invest separately and then purchase the annuity right at the point they decide to start receiving payouts. They can also choose to receive their payout in a limited duration like 20 years. This allows clients to tailor their annuity plan to suit their unique needs.

Private annuities also come with some risks and drawbacks. One of the main concerns is the possibility of the insurer going bankrupt or not being able to fulfil its financial obligations. If the insurer fails, there is a risk that the client may lose a portion or all of their investment and the promised monthly income. However, in Singapore, since insurers are required to ringfence their assets, this risk is significantly minimised and well managed.

The highest risk is when the investment strategies chosen by the client for their annuities plan did not yield good returns and compromised the annual payout. Clients who prefer lesser risks should consider annuities with a higher guaranteed payout.

There is also risk that the client out living the duration of their private annuity payouts (e.g. 20 years). Hence such plans should be purchased as part of a broader retirement structure with other savings.

In summary, CPF Life and private annuities are two options for saving money for retirement. CPF Life is a mandatory savings scheme managed by the government, offering a guaranteed lifelong income and attractive interest rates. Private annuities, on the other hand, are managed by insurance companies and provide flexibility in investment options and potentially higher returns. However, private annuities come with higher investment risks or higher costs.

It’s important to start thinking about your retirement savings early. Consider your financial goals, risk tolerance, and longterm plans when deciding between CPF Life and private annuities or a combination of both. It may be beneficial to consult with a financial advisor who can provide personalized guidance based on your specific circumstances. Remember, the choices you make now can have a significant impact on your financial security in the future.

Lenin Chong Sein Chin, CFP®

Lenin Chong Sein Chin, CFP®

Financial Planning Magazine | May Issue 16

WRITER

Death of CPF Special Account –

So what’s next?

News that the CPF Special Account (SA) will be closed from early 2025 for those 55 & above, has thrown a spanner in the retirement plans of some CPF members. They are likely to be “CPF-rich” and would have planned to enjoy the attractive and risk-free interest of 4.05% pa and the flexibility of making withdrawals anytime from their SA, having set aside the Full Retirement Sum (FRS) or the Basic Retirement Sum (BRS) plus property pledge in their Retirement Account (RA).

SA SHIELDING STRATEGY

Some of them managed to retain substantial amounts of SA balances because they have shielded them – by investing the money in excess of S$40,000 in their SA - before their RA was created at age 55. After turning 55, the investment was subsequently liquidated and the principal plus profit (if any) returned to their SA to enjoy the minimum 4% pa interest. With the closure of SA for those age 55 & above, it also marks the end of the use of SA Shielding strategy for that purpose, from 2025.

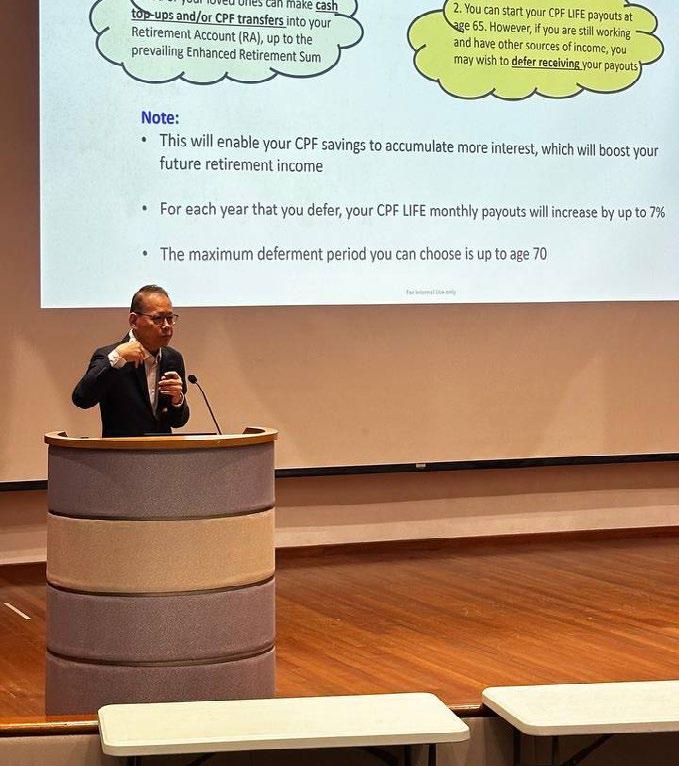

I recalled the excitement of performing the SA Shielding strategy back in 2019 when I turned 55. In a Straits Times article that was published in late 2019, I explained that I desired to have substantial savings in both my SA and RA which attract decent returns of at least 4% pa each. Thanks to the power of compounding at the SA interest of at least 4% pa as well as mandatory CPF contributions, I have about $300,000 in my SA this year.

Part of my retirement plan was to treat my SA as a fixed deposit and withdraw the interest amount (about S$12,000) every year without touching the principal amount, when I retire. Meanwhile, I have been topping up my RA up to the prevailing Enhanced Retirement Sum (ERS) each year. As such, I had expected to have S$2,300 in CPF LIFE monthly payouts for life. Coupled with the monthly withdrawals of S$1,000 interest from my SA, both payouts would be the foundation tier of guaranteed income flows to fund my retirement needs. The

other income flows will come from an annuity plan that I bought in my 40s, the Supplementary Retirement Scheme, and other investments like bonds, income funds, Real Estate Investment Trusts, and equities.

WHAT’S NEXT?

The government has decided to plug the “loophole” of retaining substantial SA balances through shielding by rationalising the CPF system with this “principle of interest rate” explanation - that shortterm savings should only enjoy short-term (lower) rates while longterm savings attract long-term (higher) rates.

It’s a sound rationale.

Along with “impacted” CPF members, I will move on and take this as an opportunity to review my retirement plan and how I can optimise my CPF nest egg, along with other financial resources.

With this change, SA and OA savings up to the FRS will be transferred to the newly created RA when a member turns 55. As the SA will be closed, any SA balance will be transferred to the OA and earn the lower interest of at least 2.5% pa. Future employer and employee CPF contributions will be channeled into OA, RA, and Medisave Account (MA). If the RA has reached FRS and/or the MA has reached the Basic Healthcare Sum, the excess contributions will go to OA. Any SA monies invested before age 55 via CPFIS-SA and liquidated after SA closure, will be transferred to the RA (if FRS is not met) or to the OA (if the FRS in RA has been met).

Financial Planning Magazine | May Issue 17

On the bright side, CPF members can top up their RA up to the ERS of 4 times of BRS from 2025, which translates to S$426,000 next year. ERS is currently 3 times of BRS.

The revised ERS will boost retirement adequacy for all as they can look forward to higher risk-free monthly payouts for life.

Here are 5 tips on what CPF members aged 55 & above can consider.

Transfer OA savings to RA

Transfer OA savings to RA up to the new ERS amount to enjoy higher monthly CPF LIFE payouts.

Keep the money in OA

Keep the money in OA and use it as a fixed deposit, enjoying the 2.5% pa interest.

Invest

Invest OA monies under the CPF Investment Scheme (CPFIS) in T-bills, fixed deposits, insurance plan, and so on. When the investment is liquidated, the proceeds will return to the OA.

Withdraw and Invest

Withdraw savings (beyond the FRS) for investments and/or insurance that are not covered under CPFIS.

Withdraw

Withdraw savings (beyond the FRS) for immediate needs, if required.

Source: CPF Board

Financial Planning Magazine | May Issue 18

Come next year, and assuming I have SA savings of just over S$300,000, I will likely use one-third of it to top up my RA to the ERS of S$426,000. I also plan to top up to the prevailing ERS each year till age 65. Based on these top-ups, CPF Board has worked out that I can expect monthly payouts of about S$3,200 under the CPF LIFE Standard Plan from age 65. This is a higher payout than the S$2,300 payout I was expecting if ERS had remained at 3 times of BRS.

The remaining S$200,000 will be transferred to my OA, at a “loss” of 1.55% (4.05% minus 2.5%) pa interest. As I have no pressing liquidity needs, I intend to keep them in my OA and invest most of it under CPFIS to earn potentially higher returns than the OA interest of 2.5% pa. If I find viable investment options outside of CPFIS, I will withdraw a portion of my OA.

In the past, it would have been more challenging for CPF members to find risk-free products that can offer an interest of at least 4% pa. In the light of the still high interest rate environment, it is possible to invest in lower-risk investment options like Singapore T-bills, Singapore Savings Bonds, corporate bonds, retirement insurance plan, and so on, and enjoy decent returns.

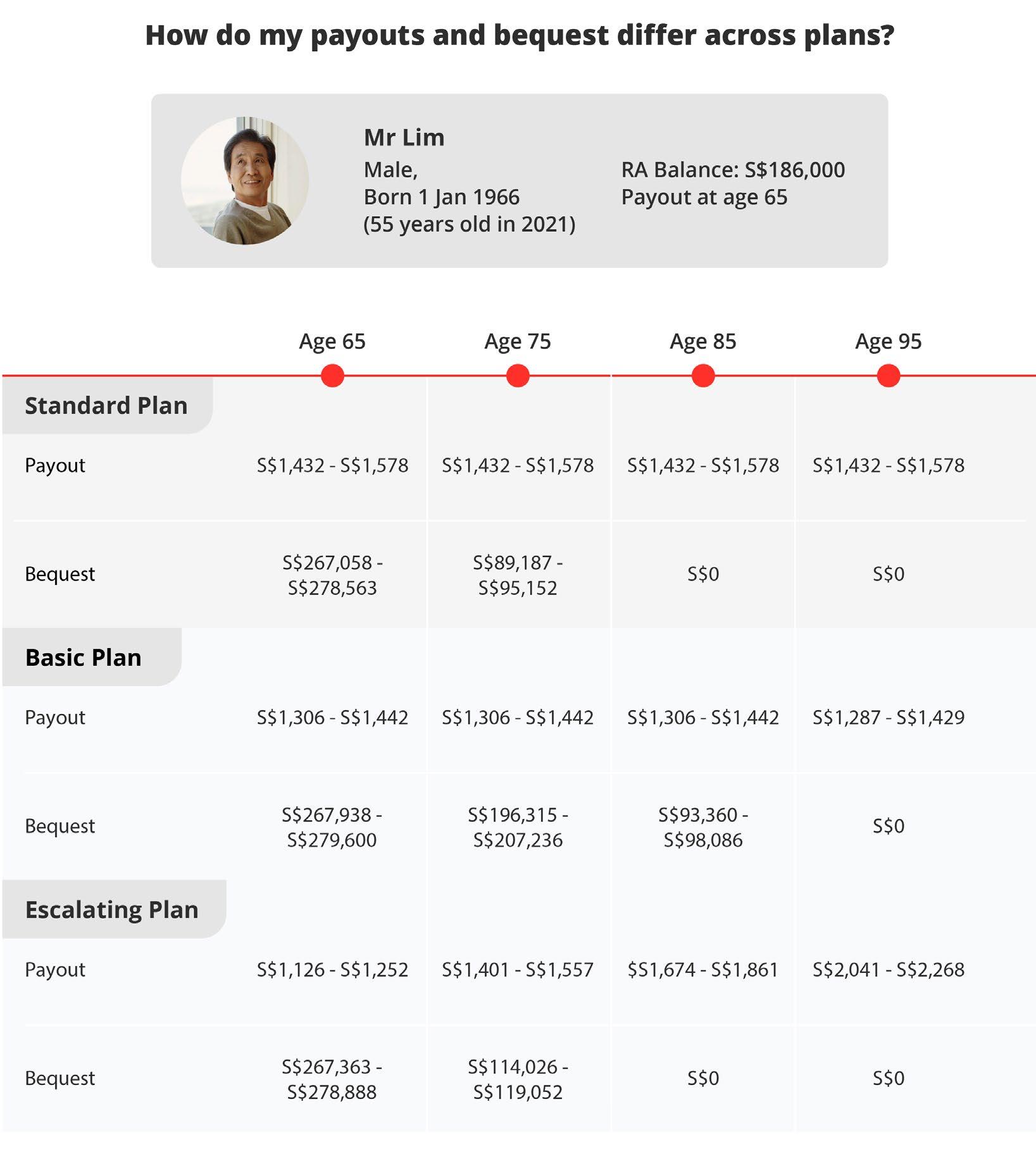

DE-MYSTIFYING CPF LIFE PLANS

There has been some noise as to which year a person should “ideally” kick the bucket so as to maximise the yields of the CPF LIFE plan. However, do be mindful that CPF LIFE is an insurance product and not an investment product.

Instead of focusing on maximising the returns, CPF LIFE should be seen as supporting members’ retirement through monthly lifelong payouts and to hedge against longevity risk. As life expectancy increases with medical advancement, no one can accurately predict how long he or she will live. Those who live longer will receive more than their CPF LIFE premiums.

Having said that, there will be greater clarity if CPF Board can reinstate information on the bequest amounts in the CPF LIFE Estimator calculator. This information was provided previously but has been removed since 2021, likely because CPF Board would prefer to have members focus on payouts than bequest amounts. Since CPF LIFE is an annuity, bequest information should be provided like other life insurance plans.

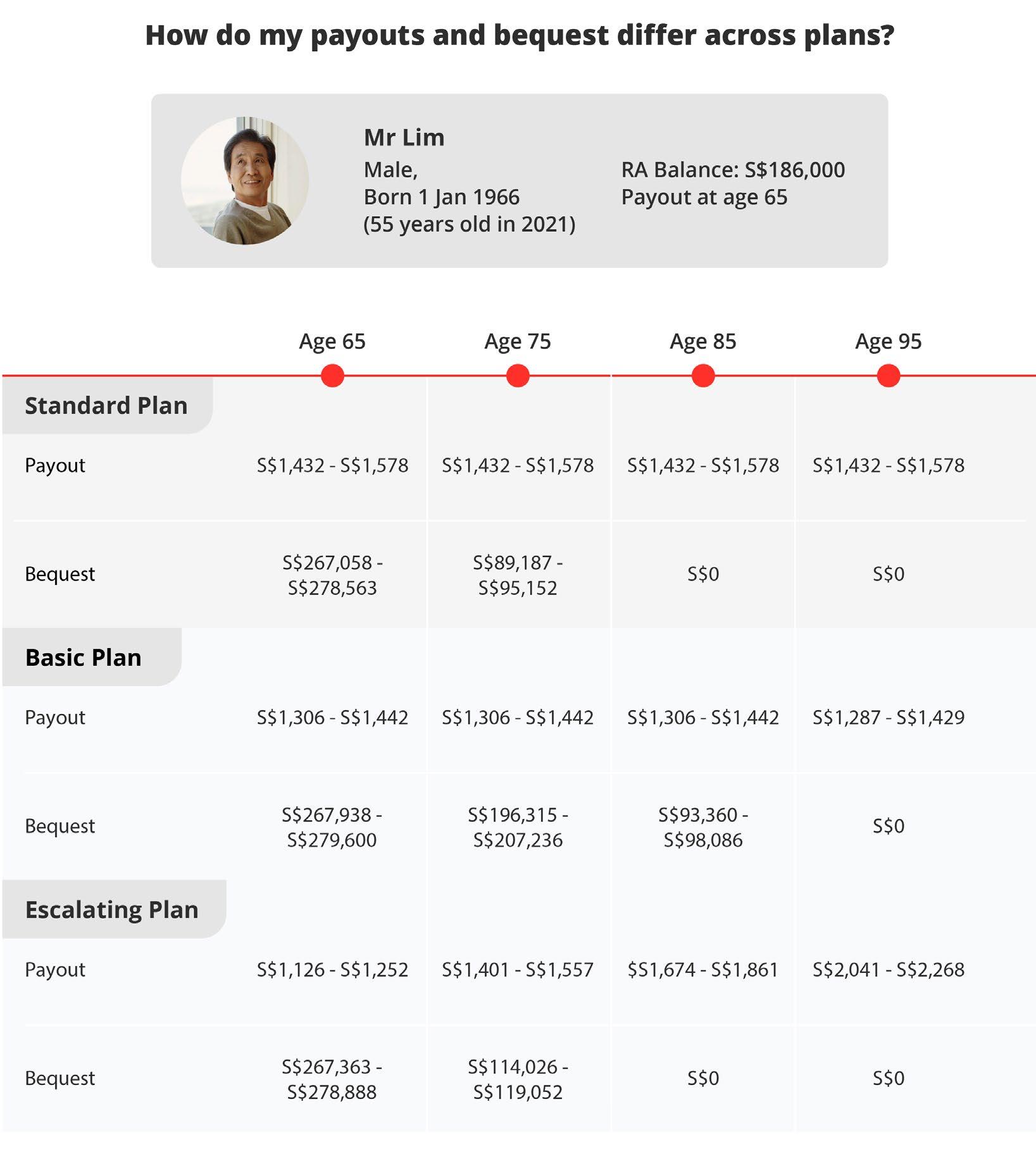

Here is a table that I generated from the CPF LIFE estimator in Dec 2020, before the bequest information was removed.

Source: Lorna Tan

Financial Planning Magazine | May Issue 19

When we reach our payout eligibility age of 65 at the earliest, we get to select 1 of 3 CPF LIFE plans. Here are some considerations

CPF LIFE Escalating Plan

For the CPF LIFE Escalating Plan, the initial monthly payouts are lower than that of the Standard Plan by 20% and they rise by 2% each year, thereafter. It will take about 23-25 years for the cumulative payouts of the Escalating Plan to catch up with that of the Standard Plan.

CPF LIFE Basic Plan

CPF LIFE Basic Plan’s monthly payouts are relatively lower than that of the Standard Plan while its bequest amounts are higher but up to a certain age. This is because the Basic Plan is structured in such a way that only 10-20% of your RA savings will be deducted as CPF LIFE premium when you join the annuity scheme. Under the Basic Plan, your monthly payouts will be paid out from your RA till it is depleted at about age 90, after which the payouts will come from the CPF LIFE pool.

Standard and Escalating Plans

For the Standard and Escalating Plans, 100% of your RA savings will be deducted as CPF LIFE premium when you join CPF LIFE.

All 3 plans

For all 3 plans, when you pass away, your beneficiaries will receive your CPF LIFE premium balance and this will exclude any interest earned. The interest earned on CPF LIFE premium along with the premiums of other CPF LIFE members, ensures that we can continue receiving payouts no matter how long we live, even if our CPF LIFE premium balance is depleted.

Beyond 90+ age

Beyond 90+ age, there is no bequest under the 3 CPF LIFE Plans. This means that for those who live to their 90s and beyond, they would be better off choosing the Standard or Escalating Plan to enjoy the higher monthly payouts.

To maximise the CPF LIFE scheme, I will need to live a very long (ideally healthy too) life. To guide my choice, I would pick the CPF LIFE plan that offers the desirable payout required to fund my retirement lifestyle and not be overly concerned about maximising the yields and bequest. For members who opt for a plan with lower monthly payouts, consider if they are adequate.

The changes to the CPF system are a wake-up call for everyone to empower themselves on financial knowledge, understand the need to invest, their risk profile and the wide range of investment options. In addition to leveraging government schemes to grow your nest egg, do reach out to professional wealth planning managers to help close your gaps and boost financial resilience.

Financial Planning Magazine | May Issue 20

WRITER Lorna

Head of Financial Planning Literacy at DBS Bank, Author of Bestsellers: Money Smart and Retire Smart

Tan

The Bill Gates Problem: Book Review

Author: Tim Schwab

Tim Schwab, the author outlines a powerful investigation of Bill Gates and the Gates Foundation, showing how philanthropy can be used as a tool to exercise enormous political power without accountability at the Global stage.

The book details how , Bill Gates transformed himself from a tech villain persona by Microsoft’s relentless quest for monopoly power in the personal computer market. In the 1990s the a US federal Government regulators sued Microsoft, which was at the time the world’s leading software company and its market practices to monopolise market share It reponed its case in 1998 and this bookposits how Bill Gates then used philanthropic pursuits to turn himself into one of the most admired people on the planet. Even as divorce proceedings and allegations of misconduct have recently tarnished his public image, the beneficence of the Gates Foundation, celebrated for spending billions to save lives around the globe, is taken as a given. In this fearless investigation, albeit a one-sided focus, it portrays Gates as still exactly who he was, when he was at Microsoft, a monopolist with an outsized belief, convinced of his own righteousness and intent on imposing his ideas, his solutions, and his leadership on the world. Often the line is blurred between a visionary and a power broker. At the core, he does not seem to be a selfless philanthropist but a power broker, a very clever engineer who has innovated a way to turn extreme wealth into immense political influence―and who has made us all believe we should applaud his acquisition of power, not challenge it as the end use of it has been philanthropic.

Piercing the blinding halo that has for too long shielded the world’s most powerful (and most secretive) charitable organization from public scrutiny, The Bill Gates Problem shows how Gates’s billions have purchased a stunning level of control over public policy, private markets, scientific research, and the news media. Whether he is pushing new educational standards in America, health reforms in India, global vaccine policy during the pandemic, or Western industrialized agriculture throughout Africa, Gates’s heady social experimentation has shown itself to be not only undemocratic, but also ineffective. In many places, Bill Gates is hurting the very people he intends to help Despite it all, has

it helped thousands if not millions? invariably yes. but in doing so has also magnified its effect without creating virtuous ecosystems that follow.

Bill Gates’s philanthropic empire needs to be seen in the context of outsized influence of individuals with money in politics. It is a dangerous model of unconstrained power that threatens

democracy, intervenes in national policies which should be the realm of Governments.

Mishra, CFP®

Mishra, CFP®

Financial Planning Magazine | May Issue 21

REVIEWED BY Yash

Tips from FIDReC: How to avoid market conduct disputes?

Market conduct disputes put a financial adviser’s career at risk. They include complaints about misrepresenting information, failing to disclose material information, and making unreasonable product recommendations.

In 2023, the Financial Industry Disputes Resolution Centre (FIDReC) handled 276 complaints relating to market conduct. This accounted for 16% of the total complaints handled by FIDReC. It also represented a significant increase from 223 claims in 2022 and 211 claims in 2021.

Through case scenarios, this article provides some tips on how financial advisers can avoid market conduct disputes.

SCENARIO 1: NON-DISCLOSURE OF MATERIAL INFORMATION

Sally purchased a hospital and surgical insurance policy from her long-time financial adviser several years ago. During the sales process, she did not pay much attention to the list of health questions and the terms and conditions stated in the insurance proposal form. She signed where the adviser told her to.

Unfortunately, Sally was diagnosed with a tumour and had to undergo surgery. While recuperating from the surgery, she submitted a reimbursement claim to her insurer. However, the doctor’s medical report revealed that Sally had other underlying medical conditions. These conditions were not declared in the insurance proposal form during application.

The insurer rejected Sally’s reimbursement claim and informed her that they would void the insurance policy as she failed to disclose pre-existing medical conditions. Sally’s appeals were unsuccessful, and she decided to approach FIDReC for help.

At FIDReC, Sally alleged that her financial adviser had not explained the health questions and policy conditions. She said that she had mentioned her underlying health conditions while chatting with the adviser. But she was not advised to disclose them. Sally was upset that her entire policy would be void and that she would not be able to enjoy the cover she thought she had.

KEY TAKEAWAYS

Financial advisers are trusted professionals in Singapore. Their suggestions are often relied on by customers without much thought. Although it is tempting to blame the customer for not reading and understanding the policy documents before signing, advisers can take active steps to protect themselves while addressing their customers’ financial needs.

Customers are usually unaware that insurance contracts are a special type of contract that rely on utmost good faith. They may not recognise that pre-existing medical conditions need to be disclosed. This is especially when they have been living with these conditions without giving them much thought. Customers may also view these conditions as minor and not

Financial Planning Magazine | May Issue 22

worth “troubling” others about. Even more unexpected for the customer, the consequences of failing to disclose could be as severe as having the entire policy voided.

Knowing this, advisers may wish to consider pre-emptive measures. They can emphasise to the customer the importance of disclosing their medical conditions and answering the health questions. If the adviser realises whether through chatting or observation that the customer takes regular medication, relies on certain aids, or displays signs of medical conditions, they may take the initiative to ask further. They could tell the customer that if there is any doubt, it would be better to disclose given the severe consequences of failing to do so.

To protect themselves, advisers should also consider documenting the advice they have given. They could do this by way of a followup text or email. They could also mark on the insurance contract as they go through it with the customer.

All insurance contracts come with a Product Summary. This is a document describing key information such as product features, benefits, risks, fees, and charges of the insurance policy. It is important for advisers to go through this information and check that the customer understands. Advisers could invite customers to initial on each page to confirm that they have read and understood.

In Sally’s case, her pre-existing medical conditions were mild and did not have any connection with the tumour. If she had made the declaration upon application, the underwriter would have been able to determine her eligibility, type of coverage and premium amount. The insurer could have accepted er reimbursement claim, and her policy could have remained in force. This would have granted her critical cover for her medical needs. A proactive adviser could have made an enormous difference to how things turned out.

SCENARIO 2: INAPPROPRIATE FINANCIAL ADVICE

Mr Ong was self-employed and planned to retire in the next 5 years. He met up with his Relationship Manager (“RM”) to discuss financial planning for his retirement. He told the RM he was looking for “stable and consistent income.” He accepted the

RM’s recommendation to buy a whole life insurance policy. This policy could be partially funded with a premium financing facility. In the suggestion of the RM, Mr Ong took a loan from the bank to maximise the policy returns. Mr Ong expected that the policy returns would be enough to fund the instalment payments for the bank loan based on what his RM told him.

Six months after the policy inception, Mr Ong started receiving payment notices from the Bank. These were for the loan instalments due to rising interest rates. Surprised, he lodged a complaint to the Bank alleging that the recommended policy and loan were unsuitable for his current financial profile and did not meet his financial goal of “stable and consistent income”.

He requested the Bank to refund the premiums and interests he had paid to date, and to cancel the insurance policy and premium financing loan without any penalty. The Bank refused and said that the product recommendation was in line with Mr Ong’s profile and goals. The Bank also pointed out that Mr Ong had signed on all the sales and loan documents. Dissatisfied with the Bank’s response, Mr Ong referred his complaint to FIDReC.

KEY TAKEAWAYS

At FIDReC, we often see financial institutions relying on signed documentation to defend the conduct of advisers. Meanwhile, the customers’ focus is that their unique needs were unmet. Again, it may be tempting to blame the customer, but we urge advisers to consider how to avoid the dispute in the first place.

Purchasing financial products is often a big step for customers. They may feel intimidated by the extensive documentation and the technical terminology. Although they may understand English, they may not understand financial concepts. When products are bundled together, customers may not appreciate the impact of the bundling on their risks. For products that require long term payment, customers may need prompting to consider their future financial situation. It is well within the ability of the financial adviser to guide the customer to consider all these aspects.

A competent financial advisor is not defined

by their ability to complete documentation for record-keeping and compliance purposes. Rather, by their ability to help customers to achieve their financial goals. Advisors will do well not to accept at face value whatever their client says. Instead, they should delve into understanding the client’s short and long-term financial goals, financial situation, and risk tolerance. They should conduct thorough fact-finding and analysis. This will enable the financial advisor to provide personalised recommendations that truly address clients’ needs and aspirations.

In Mr Ong’s case, it emerged at FIDReC that there were errors in the signed documentation that overstated Mr Ong’s income and investment experience. Beyond a generic statement that the product was deemed suitable for the client, there was no evidence of any discussion about the cost of funds, interest rates or features of the credit facility. There was also no evidence of what other options were considered and discussed by the RM that could also meet Mr Ong’s desired objectives.

More importantly, a customer who desired a “stable and consistent income” never achieved his financial goal of preparing for retirement.

CONCLUSION

In conclusion, we encourage all financial planners and advisers to continue to deliver the highest standards of professionalism and excellence in their engagement with customers. By upholding these standards, trust can be preserved, long-term relationships with clients fostered, and disputes avoided.

Financial Planning Magazine | May Issue 23 WRITER Eunice Chua, CEO, FIDReC WRITER Wanda Sim, Case Manager, FIDReC