WHY IS VALUATION IMPORTANT?

VALUE CREATION

PRICE IS WHAT YOU PAY. VALUE IS WHAT YOU GET.

VALUE CREATION

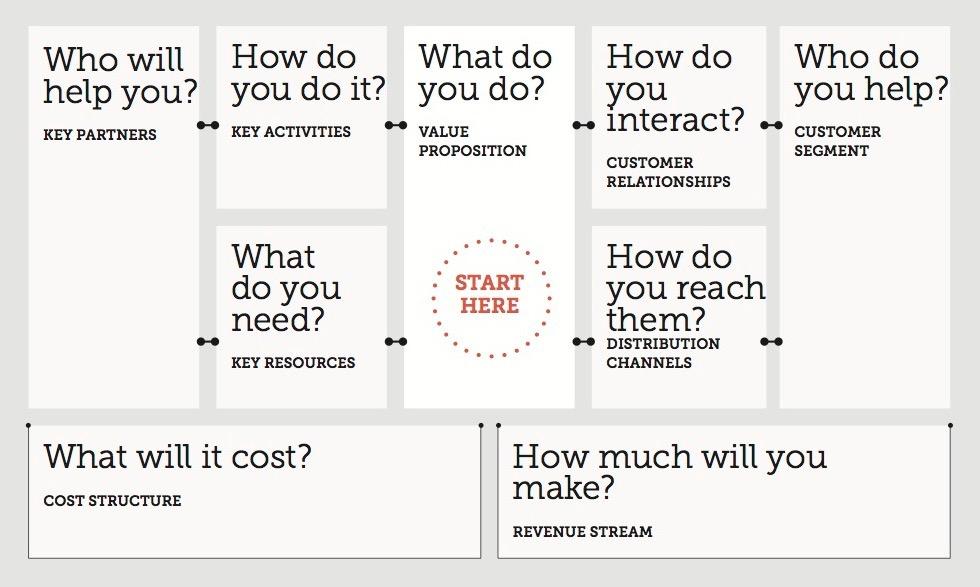

BUSINESS MODEL CANVAS

BEE

CAR

HOW CAN YOU VALUE A COMPANY?

VALUE CREATION VALUATION METHODS

▸ STOCK MARKET VALUATION

▸ NPV OF FUTURE CASH FLOWS (ALSO CALLED DCF VALUATION)

▸ EBITDA MULTIPLES

▸ REVENUE MULTIPLES

▸ SIMILAR DEALS

▸ NET ASSET VALUE

▸ LIQUIDATION VALUE

▸ NUMBER OF USERS

BEE CAR

EBITDA MULTIPLE VALUATION

EBITDA MULTIPLE

Take the multiple for a similar company or the “industry-standard” multiple for example, the airline industry multiple is 6 Equity Value = 6 x EBITDA – Debt + Cash

THE FACT IS THAT ONE OF THE EARLIEST LESSONS I LEARNED IN BUSINESS WAS THAT BALANCE SHEETS AND INCOME STATEMENTS ARE FICTION, CASH FLOW IS REALITY.

Chris Chocola Businessman and Politician

DISCOUNTED CASHFLOW VALUATION BEE CAR

THE PRESENT VALUE CONCEPT

The Present Value (PV) concept is central to finance. Put simply, it equates the receipt tomorrow of a sum of money to today’s value such that the owner of that money is indifferent between receiving the money today versus tomorrow.

THE CONCEPT OF PRESENT VALUE

PERSON A PERSON B PERSON A

PERSON B

“MONEY

€10 = 10% DISCOUNT RATE PER YEAR

THE NET PRESENT VALUE CONCEPT

VALUING A COMPANY USING NPV

‣ CASH FLOW STREAM

‣ DISCOUNT RATE

‣ TERMINAL VALUE ESTIMATE

Enterprise Value of company today = Discounted cash flows + Terminal value

VALUE CREATION

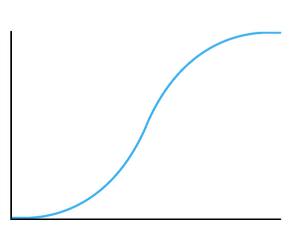

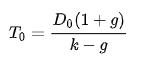

TERMINAL VALUE

The year when company FCF grows at the constant rate

Cash Flow Time

• D0 = Cash flows at a future point in time which is immediately prior to N+1, or at the end of period N, which is the final year in the projection period.

• k = Discount Rate.

• g = Growth Rate.

VALUING A COMPANY USING NPV

‣ CASH FLOW STREAM

‣ DISCOUNT RATE

‣ TERMINAL VALUE ESTIMATE

Enterprise Value of company today = Discounted cash flows + Terminal value

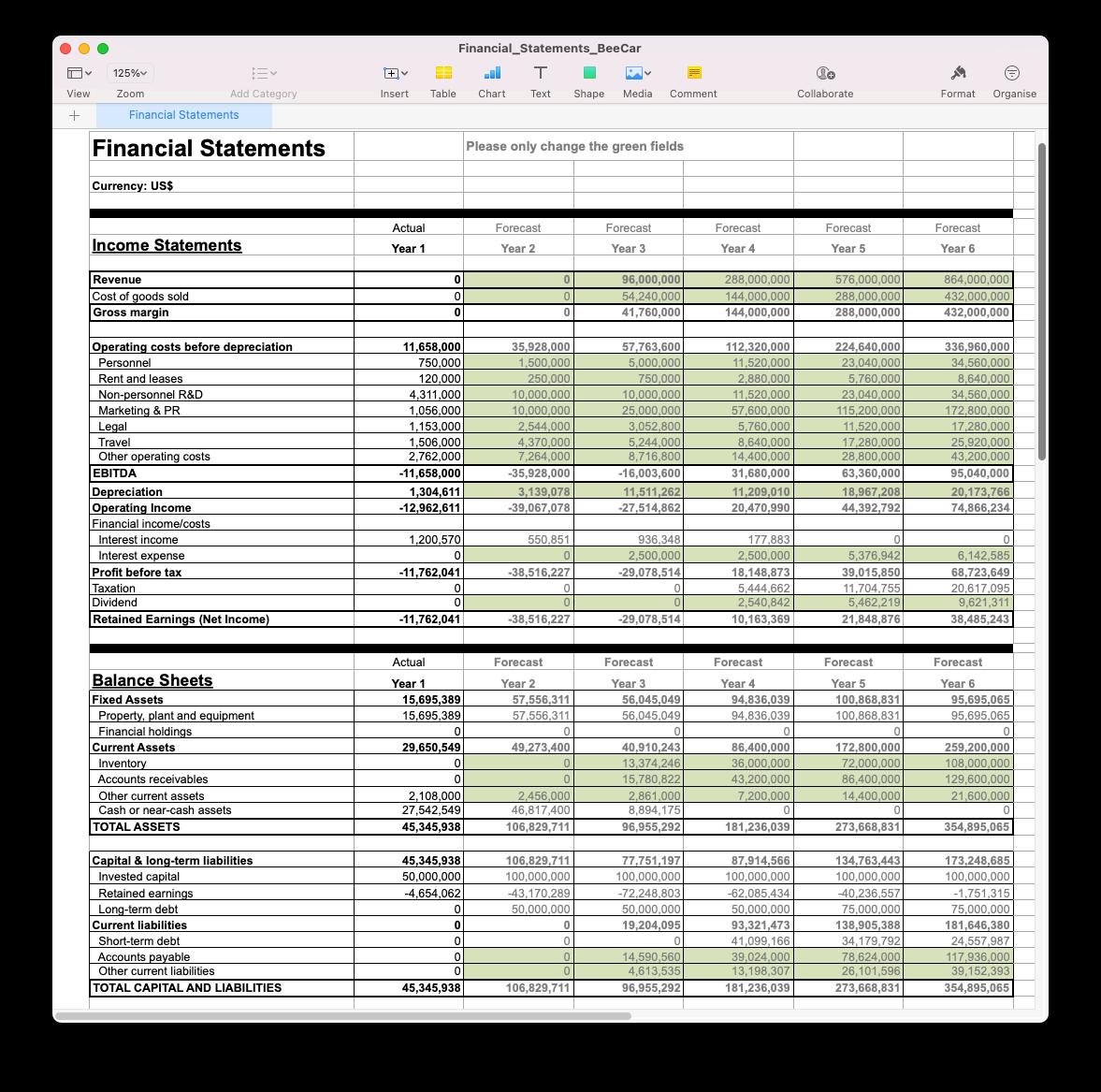

BEE CAR

WHAT IS THE VALUE OF BEE CAR?

BEE CARS VALUATION

▸ NPV OF FUTURE CASH FLOWS

Use the Excel spreadsheet sent to you from Alexander Fisher, CFO of NDCC

Use a discount rate of 12%

▸ EBITDA MULTIPLES

Do a valuation in a year in the future when EBITDA is positive and discount back to todays value

▸ REVENUE MULTIPLES

Do a valuation in a year in the future when the revenue curve flattens out and discount back to todays value

▸ NUMBER OF USERS

Do a valuation in a year in the future when the the number of user stabilises and discount back to todays value

▸ SIMILAR DEALS

https://www.marketwatch.com/

VALUE CREATION

https://www.khanacademy.org/

BEE CAR VALUATION

▸ NPV valuation of Bee Car

(One XL file per team)

▸ Bee Car valuation using one or more alternative methods (PDF)

▸ Your conclusion:

What do you believe is the value of Bee Car and why?

(One PDF per team)