SPRING /// 2025

SPRING /// 2025

The winds are shifting in the UK property market, but not just from within. This is a year shaped by forces beyond its borders—economies wobble, conflicts redraw financial priorities, and the pulse of global trade beats unevenly.

In Europe, inflation cools but uncertainty lingers. The Bank of England holds its breath, poised between stability and change. Capital, ever restless, waits for its cue—does it stay, does it flee, or does it simply move differently? London, always the beacon, is now both sanctuary and battleground. The city's gravitational pull remains, its story still unfinished. Interest rates soften, and first-time buyers re-enter the fray. The rules are being rewritten, but for whom?

The world no longer stands still. Borders tighten, yet movement accelerates. The modern buyer is not bound by nation, but by opportunity. A home is not just shelter, but a strategy. And as history turns its pages once more, one thing is certain—where there is change, there is fortune.

Read our property market comment, discover what’s happening in the market and what predictions we can make?

What’s caught our eye in the last couple of months. From furniture to paintings.

An asbestos-ridden former engineering factory in Stoke Newington becomes a striking newbuild.

Discover a slimline surface that mirrors Lazenby’s signature polished concrete style in a breathtaking collection of colours. Naturally waterproof and stain-resistant, this innovative concrete alternative is designed to endure.

What’s going on in the property market, and what is the spring likely to

bring?

Moveli Market Commentary

hey say it's a time for new beginnings, but so far this year feels different. The market is still grappling with the impact of the Budget back in October, which was poorly received by financial markets and businesses alike.

The abolition of non-dom status and changes to agricultural property relief received a big thumbs down. As did increased Employer National Insurance, set to hit from this April. Several large employers have already warned this could see them cut jobs. Job insecurity is likely to directly affect sentiment in the property market across the spectrum. Yet, there were some positives in the Budget. Inheritance Tax was not increased, as many forecast, for

the wider population. Increases to Capital Gains Tax do not apply to property.

As we go further into 2025, there has been some cause for optimism. Inflation seems to be under control at last. From an all time high of 11% in late 2022 it appears to be settling above the Bank of England’s 2% target. With the latest December 2024 figure at 2.5% and with economists predicting a slight increase to 2.8% for January’s rate (at time of writing), Capital Economics forecast that inflation could be under 2% by this time next year.

Of course this is good news for the property market as it means interest rates are firmly on a downswing. Many experts have

"According to Morgan Stanley the bank rate may drop to 3.5% before 2025 is out."

been forecasting a 0.5-0.75% cut across this year. But the latest Morgan Stanley forecast goes much further: They forecast bank rate will drop to 3.5% before 2025 is out – which could equate to five rate cuts this year. Capital Economics are predicting a similar outcome.

Indeed, potential buyers and sellers themselves seem to be cautiously optimistic. Rightmove say 2024 saw

“Stamp Duty changes may trigger a buying rush, followed by uncertainty, price dips, and market fluctuations.”

the biggest ever ‘Boxing Day bounce’, with record site traffic and a 26% increase in listings compared to 2023. Zoopla say buyer demand is tracking 14% ahead of this time last year.

Looking ahead, what other factors are likely to affect the market as we move further into 2025?

In response to the outcry, the phasing out of non-dom tax concessions has been softened – ever so slightly. Many will argue the damage has been done, however. A message has clearly been sent that the UK no longer welcomes the wealthy, and many have already shipped out.

A key issue is likely to be the ending of Stamp Duty concessions (in England) on 31 March, which will make buying even more expensive. It will particularly impact the all-important first time buyer. For example someone buying an average-priced London home at £525,000 will see their Stamp Duty bill rise from £5,000 now

to around £16,250 in April. An increase of 225%.

In all likelihood there will be a rush of completions until March 31 followed by a hiatus later in the spring. A survey of agents by GetAgent says that almost half (47%) believe the market will see a drop transactions after March, and 45% feel house prices could dip. At the very least this change is likely to distort price stats for the next few months.

Proposals by the FCA for ‘simplifying responsible lending and advice rules for mortgages’ could boost mortgage lending. They could stimulate the market and have some impact on prices.

Lastly, let’s end where we started – with Budgets. Officially there won’t be a Spring Budget 2025 this year – but there will be a Spring Forecast, on 26 March. Some will wonder if the Chancellor’s definition of a forecast might stretch to further tax changes.

A fair summary might be that, in early 2025, house prices are stable on a national basis. The Nationwide HPI says that house prices nationally rose by 4.7% in 2024. The Halifax HPI says 3.3%. These are fairly modest levels compared to recent years. They do at least mean property values are ahead of the (current) rate of inflation.

Looking ahead, Halifax seem unwilling to commit to a 2025 forecast, suggesting merely ‘modest house price growth this year’. Perhaps not wanting to be caught with egg on their faces, Nationwide forecast prices will rise on average between 2% and 4% in 2025.

Of course, national price stats can hide regional differences – a moral if ever there was one for taking local advice when buying or selling.

In particular, a given over the last few decades has been that where London leads, regional

markets follow. But it may not be safe to rely on this maxim in future. Zoopla says that Scotland and northern England have the best prospects for house price growth in 2025, while inner London and southern England sit at the other end of the rankings.

Of all the sub-markets, prime central London is perhaps most likely to be impacted by the ‘wealth not welcome’ subtext to

First time buyer stamp duty increase.

£5,000

£16,250 Before April 2025 After April 2025

“Prime Central London prices will see a 21.6% cumulative rise by 2029 –ahead of the wider London at 15.3%.”

the Budget. Some of the stats make uncomfortable reading. With one ‘millionaire’ leaving the UK every 49 minutes in 2024, according to one report. It also appears that this trend is moving down the pay brackets as those affected by the cost of living crisis also ship out to lower tax regimes such as the UAE, Switzerland, Italy and even the United States.

In 2024 super-prime property sales (properties selling for £15m+) dropped 25% by volume and 34% by value, down to a five year low according to Beauchamp Estates. According to PrimeResi, prime prices have fallen 20% since 2014, ranging from -9.6% in Bayswater to -26.3% in Earls Court. Another corporate estate agency described the last ten years as a ‘lost decade’ for this market.

commentators suggest that prime prices are now at a level where they are starting to look attractive.

Looking ahead, longer term forecasts for this sector are mixed. Knight Frank forecast that PCL prices will see a 21.6% cumulative rise by 2029 – ahead of the wider London (15.3%) and wider UK market (19.3%). However Savills forecast just 9.4% growth in prime London prices (23.4% in the mainstream market) over the same timeframe.

Increase

£525,000 +225%

Of course, London living is also about lifestyle and not just money. Some affluent ‘refugees’ who depart the UK might find that the grass isn’t greener in, for example, Dubai. Some

That London property prices will always rise faster than elsewhere has generally been a given over the last few decades. Covid, however, signalled something of a shift change. That could be due to buyers seeking out more space, and better value, away from London. Lloyds Bank data shows that, nationally, property prices rose by 20.4% between 2020-2022. Yet in London the rise was as low as 3.8%. In 2024 seven London boroughs actually

recorded price falls, in the order of 3-4%, and led by Ealing with a 4.9% fall, according to Halifax HPI figures.

While longer term forecasts are by no means negative they suggest future London price rises will be more moderate than elsewhere.

As rising prices and mortgage rates have stretched affordability – and working from home has made commutability less essential – one report suggests 2024 was a testing year for this sector. Investec says that in these locations, sales prices for

properties over £1m declined by 9% or circa £150,000 on average last year. It claims that it was also the slowest sector of the market, with houses taking 121 days on average to sell. It claims that Kent was hardest hit, followed by Berkshire, with Hertfordshire escaping more likely.

Looking ahead, another forecasts suggests these ‘outer commute’ areas will underperform almost every other sector over the next five years. With a forecast of just a 2% rise in 2025 (UK 4%) and just 15.9% over five years (UK 23.4%). It is, however, perhaps far too early to assume the demise of this ever-popular

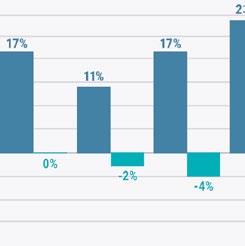

This bar chart visualises the percentage change in house prices across different market segments in 2024 and the forecasted changes for 2025. Data: Propertydata.co.uk & The Land Registry, Savills, Knight Frank.

market. With proximity to capital and country the home counties have enduring appeal. Competitive pricing and falling mortgage rates in 2025 could see affordability restored.

This is a diverse market and buyers may have very different reasons for buying. Their purchase may be a lifestyle choice. It may be driven by the demand for more space, or to seek out better value than in London. It may be a second home. Some of these properties may be effectively agricultural properties. It is a perfect example of a market where local, expert

" Rental reform dominates 2025 as landlord confidence rises, yields improve, but market uncertainty challenges stability."

advice is absolutely essential.

After enjoying impressive rates of price growth during Covid, peaking at 9.4% pa at the end of 2021 (Savills figures), values in this sector declined gradually as the pandemic faded. In late 2023 they declined circa 5% pa, when the wider market was still appreciating. Prices in this sector suffered further small declines in the light of the autumn 2024 Budget.

A corner may have been turned in this market. The prime regional housing markets seem to continue a slow march to recovery. Whilst suburban and northern markets have proved the most resilient of all, and as you would expect second home hotspots have remained somewhat more price sensitive.

The big story of 2025 will most certainly be rental reform in England. After the Conservatives’ Renters (Reform) Bill collapsed it is now almost certain that Labour’s on-steroids version, the Renter’s Rights Bill, will become law. This is likely to happen within the next few months.

Reports that this impending new legislation has led landlords to exit the market are numerous.

The last English Private Landlord Survey suggested that 30% of private landlords were planning on selling some or all of their properties. However, the optimistic will argue that there are still very good reasons for being a landlord in the UK, or even expanding a portfolio. Shortage of supply has pushed up rents and improved yields over the last few years.

The HomeLet Rental Index now puts the average UK rent at £1,284 pcm, a 1.8% rise over the year. In London it is £2,071 pcm, a 2.6% fall over the year.

Paragon Bank put average landlord yields nationally at 6.72%. Again, it is the regions where the numbers look more favourable. Paragon say London yields are the lowest in the country at 5.52%. Top of the charts are the north east and Cumbria (8.02% yield) and Wales (7.95% yield).

Meanwhile latest Landlord Trends report from Pegasus Insight (Q4 2024) suggests landlord confidence has increased slightly year-onyear, with 37% saying they feel ‘good’ or ‘very good’ about their prospects compared to 33% in Q4 2023.

Oddly, the uncertain nature of the prime London sales market could be benefitting the prime rental market. The Beauchamp Estates’ Prime Central London Lettings Survey 2024 reports that this market is ‘highly resilient’ with ‘the super-luxury and short-term rental sectors booming’. They add that the market is being driven by wealthy American, European and Chinese tenants.

The wider London lettings market has long been at boiling point. Tenant affordability has been tested across most if not all boroughs over the last few years. Interestingly, despite high capital values, landlords’ interest in this market appears to be strengthening. A report by Simply Business says that ‘London has bounced back as the buy to let capital of the UK’. It saw 13% growth in new landlords in 2023-2024 – more than anywhere else.

Spring is traditionally a time of year when the property market starts to warm up. It will be interesting to see what happens to the rental market as the year progresses.

There is certainly a lot going on that could affect the market this spring. Particular things to look

‘London has bounced back as the buy to let capital of the UK’. It saw 13% growth in new landlords in 2023-2024 – more than anywhere else.

out for include the progress of interest rate cuts, any further tax announcements by the Chancellor and the impact of the Stamp Duty changes in April. And, most important of all of course, how buyers and sellers react.

While the market does face some challenges this year there are still very good reasons to be optimistic about the property market in 2025.

The old factory was transformed into Ranas' studio and house and was among the winners of the Royal Institute of British Architects’ London Awards in 2023.

In 2011, artist Rana Begum bought a derelict factory in Stoke Newington, determined to create a home and studio reminiscent of her childhood in rural Bangladesh. A colloaboration with Peter Culley of Spatial Affairs Bureau, the awardwinning space consists of two larch-clad structures linked by a courtyard, with a studio below and living quarters above.

After a decade of careful planning, Rana, her partner Steve Webb, and their children moved in by 2021. The interiors evolved

slowly—budget constraints meant living with just a camping stove for two years—but thoughtful details, like Steve’s bespoke bookshelves and repurposed furniture, add warmth.

Floor-to-ceiling windows overlook Abney Park Cemetery, filling the space with shifting light, a theme central to Rana’s art. “I needed this space to bring calmness,” she says. The result is a seamless blend of home, studio, and artistic vision, where creativity and nature coexist beautifully.

Matthew Davies / Opes I

t has been a promising start to the year with the Bank of England starting February 2025 with its third interest rate cut in 6 months after the monetary policy committee voting to cut rates by a majority of 7 to 2 in favour of rate cuts.

This takes pressure off borrowers and gives confidence to house buyers and investors. Interest rate expectations have shifted since the start of the year with analysts predicting the return of lower mortgage rates faster than previously forcasted. Capital Economics, the respected economic think tank, are forecasting that the base rate will end 2025 under 3.5%. Goldman Sachs, have been even more bullish and estimate that rates will be cut rapidly in the next year, as low as 2.75% by the end of 2025.

With rates moving in a positive trajectory for the UK mortgage and property markets many are asking whether now is the right time to buy before rates come

down and the market becomes saturated with buyers forcing the demand vs supply metrics to change and prices to rise. Afterall a reduction in the bank base rate rates to 3% would represent a 40% year on year reduction in mortgage payments making higher property prices more accessible once again.

There are other encouraging signs outside of rate changes that indicate a positive uptake in the property market this year.

"Buyers and investors eye opportunities amid positive market trends..."

The UK Autumn budget and US elections have resulted in volatility in a wide range of markets and international buyers can benefit from a weak pound against the US dollar and other major currencies. Overseas buyers currently benefit from a tangible forex discount on UK property when buying in pounds

compared to previous years with sterling dropping to $1.21 recently.

Take home pay (owner occupiers) and rents (landlords) have risen sharply in recent years and are forecasted to continue to rise making UK property more attractive from a affordability (owner occupiers) and yield (landlords) perspective.

Property owners are benefitting from 3-5% house price growth currently with the RICS housing survey also reporting positive sentiment in the market with the outlook on prices, new buyer enquiries and activity all rising. Across the board we are seeing a relaxing of mortgage regulation and criteria helping buyers transact easier.

Planning reform and the wider availability of labour and building materials is resulting in reduced build/ renovation/ costs on UK property further stimulating the market.

www.opesfp.com

Our digital blog, in print.

We are extremely pleased to have recently launched Moveli brokers in Warwickshire, Cheltenham, Emerson Park and Barnes & Kew.

We're pleased to have been instructed on the sale of units in this prestigious development by world renowned architects Skidmore, Owings & Merrill.

Check out amazing properties before they even hit the market, some never do. Follow us (scan QR above):

moveli.property

We're proud to have expanded our network to fifty brokers, covering Prime Central London, Greater London, the Home Counties, the Southwest, Warwickshire, and beyond. Working collaboratively, our team leverages strong connections across central London, the UK, and internationally to find the right buyer for your property.

Every Moveli broker is highly experienced with on average 17.5 years experience in the business. Find some of our broker’s properties featured across the following pages. Below, further information on some of the brokers featured this issue.

See all our brokers here

Grant Alexson

Prime Central & Northwest London

35 Years Experience

Stephen Codner

Prime Central & North London

20 Years Experience

Sally Jane Hobson

Buckinghamshir & Berkshire

21 Years Experience

Nick Karamanlis

Hackney & West Essex

20 Years Experience

Kara Flynn & Edd Holt

Warwickshire

25 Years Experience

Grant is a well known and renowned estate agent with over 35 years’ experience at the highest-level in the industry. He has advised thousands of private clients from all over the world in the sales and marketing of their family homes, as well as corporate clients in the design and sale of their multi-unit developments.

Stephen, is a highly experienced estate agent, bringing nearly 30 years of expertise in the North, Northwest, and Prime Central London property markets, and the surrounding areas. Committed to delivering an exceptional personal service, he consistently aims to exceed expectations, and meet each client's unique needs, regardless of complexity.

Sally has worked as a professional estate agent in the area almost as long as being a local resident. She offers her valuable market knowledge built upon during a 15 year career working at two of the largest prime corporate agencies in Beaconsfield and Gerrards Cross, and not surprisingly has been involved in some of the areas most prestigious sales.

Nick is an established and highly accomplished estate agent with close to two decades of experience operating in East London and West Essex. He has experienced every facet of agency and has navigated varying market conditions across the years, transacting over 1,000 properties for his clients.

Kara & Edd are two of our newest brokers who are operating as a team covering their home county of Warwickshire. They are both superb agents and have over a quarter of a century of combined experience in the area, with some of their properties previously listed in the national press.

LISTING HIGHLIGHTS

Kemplay Road, NW3

£8,500,000 FOR SALE — Grant Alexson

This months property selection, from flats and penthouses to townhouses and country piles. Our growing network of highly experienced estate agents covers from Prime Central London to the Home Counties and beyond.

See all our properties here

Nettlebridge, BA3

£1,400,000 FOR SALE — Sharon Clesham

Manhatten Loft Gardens, E20

£Varying FOR SALE

— Chris Price & David McGuinnness

Rochester Road

£3,250,000 FOR SALE — Natalie Malka

Kemplay Road, NW3

£8,500,000 FOR SALE

— Grant Alexson

Double fronted detached period house originally built in 1872

5/6 Bedrooms, 4 Reception rooms, 3 Bathrooms en-suite, 3 WC's Garage and off street parking

Between the High Street and the Heath

Walled rear garden

5/6 Bedrooms with 3 En-suite bathrooms

4 Reception rooms and kitchen on the ground floor

Separate side entrance to the lower ground floor ideal for a consulting room

Newly restored double fronted detached period house located in this prime Hampstead Village location between the Heath and the High Street.

Buckland Crescent, NW3

£3,850,000 SOLD

— Natalie Malka

An outstanding architecturally designed three-bedroom maisonette with an additional large study/media room and a south-facing garden offered in meticulous condition having undergone total refurbishment.

Fieldgrove House BS30

£3,200,000 FOR SALE

— James Giblin

Fieldgrove House is an exceptional Grade II listed family house in a stunning lakeside setting. A secret oasis of tranquillity in a superb location, just outside the cities of Bath and Bristol.

£7,250,000 SALE AGREED

— Natalie Malka

Victorian semi-detached house

South facing garden

Open plan kitchen/dining/family room

Spacious double reception room

5 bedrooms

5 bathrooms

Self-contained garden studio

in partnership with Moveli. An exceptional Victorian home with a southfacing garden, located on the highly desirable Branch Hill directly opposite Hampstead Heath.

Smith Street, SW3

£5,000,000 FOR SALE

— Stephen Codner

Set on a fine Late Georgian terrace, this impressive five storey Freehold family home, built circa 1800, with the house being dramatically transformed between 2010-2011 into an excellent family residence. Now offering over 3088 Sq.Ft. with five bedrooms.

Bourdon Street, W1K

£2,695,000 FOR SALE

— Kim Turner

A beautifully presented, light and contemporary apartment, prestigiously situated in the heart of Mayfair.

Holland Street W8

£4,800,000 FOR SALE

— Jeremy Creasor

Five bedroom period family house (2431 sq. ft.)

Refurbished condition

Central W8 location

Self-contained 615 sq. ft. apartment in lower ground (under same title)

Four bath/shower rooms

First floor south facing terrace

Smart luxury kitchen with Miele appliances

Walk in wardrobe space

High ceilings

Ground floor cloakroom/WC

An outstandingly attractive five bedroom freehold house. Situated in the heart of Kensington, this spacious and bright refurbished period townhouse offers impressive accommodation over five floors.

Pembroke Square, W8

£4,000,000 SOLD

— Jeremy Creasor

A wonderful three/four bedroom Grade II Listed period home which is perfectly located on the favoured west side of this beautiful square.

Egerton Place, SW3

£4,500,000 SOLD — Jeremy Creasor

This property is in an ideal location for the shops and amenities Knightsbridge has to offer and sits directly in between Knightsbridge and South Kensington underground stations.

Smith Street, SW3

£5,500,000 FOR SALE

— James Giblin

4 Bedrooms (currently arranged as 3), 3 Bathrooms and 2 WC's

55 ft (16m) South-West Facing Garden Freehold Property

2749 sq ft (255 sq m) Across Five Floors

Beautifully Maintained and Fully Renovated in 2015

Prime Chelsea Location, Moments from King’s Road

Nestled in the heart of Chelsea, just moments from the iconic King’s Road, this elegant Georgian period home offers a rare blend of historic charm and modern convenience.

£2,150,000 SALE AGREED

— Manuel Detogni

Discover this beautifully presented three bedroom home in the heart of soughtafter Bolton Gardens. Spanning 120 m², this residence combines space, comfort, and convenience in one of London’s most desirable neighborhoods.

Moscow Road, W2

£9,500,000 SOLD

A quite incredible and extremely rare lateral apartment. This awe-inspiring home has been completely redesigned and renovated to the highest specification and offers a wealth of impressive living and entertaining space.

Exeter Road, NW2

£3,350,000 SOLD

— Natalie Malka

Detached Victorian house

Two reception rooms

Spacious kitchen/family room

Five bedrooms

Three bathrooms

Separate study

Utility room

South-west facing garden

This stunning detached family home, nestled on a wide, treelined street within the soughtafter Mapesbury Conservation Area, has been beautifully renovated and extended by its current owners.

Regents View, E2

£1,625,000 FOR SALE

— Chris Price

Located on the edge of Regent’s Canal near London Fields, world-renowned Architects RSHP have transformed the iconic Bethnal Green Gasometers into 555 unique homes.

Nettlebridge, BA3

£1,400,000 FOR SALE

— Sharon Clesham

A stunning 4 bedroom home close to Bath, surrounded by countryside and close to the heart of a village. With spacious rooms, fabulous features, and stunning gardens.

A newly built five to six-bedroom London townhouse, ideally positioned along Abingdon Road, just off Kensington High Street and adjacent to Holland Park.

Abingdon Road, W8

£8,950,000 FOR SALE

— David McGuinness

Large open plan kitchen / dining / family room

Private garden

Secure Garage

Media Room

Gym and pool with steam, jacuzzi and entertaining space

Spa change

Principal suite with ensuite and walk in wardrobes

Four further bedrooms with ensuite bathrooms

Ample storage spaces

Lift & Study

6,146 sq ft (571 sq m)

Underhill Road SE22

£2,100,000 SOLD

— David McGuinness

Fantastic example of a well developed family home in the heart of East Dulwich

Berrymede Road, W4

£1,500,000 FOR SALE

— Jason Scott

A fantastic opportunity to acquire a recently extended and beautifully presented four bedroom, two bathroom (one en-suite) end of terrace family home with an eat-in kitchen/dining room and landscaped garden in one of Chiswick's sought after locations.

Gaia is an extraordinary coastal residence that embodies the pinnacle of modern design, luxury, and sustainability.

Marine Drive, EX23

£2,700,000 FOR SALE — Jonathan Mowday

Off-market exclusive

Grand Designs style home

EPC Rated A

Glorious coastal location

Panoramic views

Private sauna, hot tub and leisure room

Expansive roof terrace

5 double bedrooms each with ensuite and dressing rooms

Chevening Road, NW6

£3,250,000 SOLD

— Natalie Malka

A stylish and beautifully presented sixbedroom Victorian house situated on one of Queens Park's most desirable roads, moments from the park itself, boasting an idyllic 80’ landscaped mature garden.

Rochester Road, NW1

£3,250,000 FOR SALE

— Natalie Malka

An exceptional lateral family home positioned on the highly desirable Rochester Road with direct views onto Rochester Terrace Gardens.

£2,500,000 SOLD

— Kikku Maini

Grand and elegant Victorian family home with an abundance of period features

Impressive hallway leading to two generously sized reception rooms

Spacious kitchen with ample dining and family seating areas

Basement

Secure off-street parking

Landscaped private garden with a modern garden office

Close proximity to prestigious schools and a variety of shops, bars, cafes, and restaurants

This Victorian family home exudes grandeur and elegance with an abundance of period features and spacious living areas.

Parkgate Road, SW11

£1,449,999 SALE AGREED

— David McGuinness

A very rare and superb opportunity to acquire this wonderfully recently redeveloped and fully modernised 4 bedroom mid terrace home.

Manhattan Loft Gardens, E20

£2,500,000 FOR SALE

— Chris Price & David McGuinness

Incredible double-cantilevered new development designed by the renowned Skidmore, Owings & Merrill architects, with floor to ceiling windows.

Andalus Road, SW9

£1,100,000 SOLD — Archie Lloyd

Situated in the heart of Clapham North is this sizeable four bedroom Victorian house. With its prime location, you're just moments away from trendy cafes, boutique shops, green spaces, and excellent transport links.

Gorst Road, SW11

£3,000,000 SOLD

— Paul Clappison

This substantial detached six-bedroom Victorian house is located in one of the most sought after roads between the commons. Arranged over three floors measuring 3,223 sq ft (299.4 sq m) and has a large south-facing garden.

De Beauvoir Road, N1

£2,500,000 FOR SALE

— Nick Karamanlis

A stunning five-bedroom linked semi-detached family home, spanning approximately 2,000 sq. ft., featuring rare amenities such as off-street parking and a spacious roof terrace

Ronin Mews, E8

£2,200,000 FOR SALE

— Nick Karamanlis

An exceptional three bedroom freehold gated mews house with south facing private roof terrace, set off a sought-after residential London Fields turning, Parkholme Road.

Weaver House is a contemporary luxury property set in a picturesque location with expansive grounds of approximately 6 acres. The property is available individually or as part of a larger estate.

Plymtree, EX1 5

£2,950,000 FOR SALE

— Jonathan Mowday

6 Bedrooms

Energy Efficient Grand

Designs Home

Approx 6 Acres

Additional Property Available

Glorious Internal Finish

Further Options For Customisation

Freehold

Kelvedon Road, SW6

£1,450,000 SOLD

— Charlie Crane

An excellent five-bedroom, Victorian family house in a great location close to Parsons Green and Fulham Road. The property has been fully extended and offers a huge 1842 sq ft (171 sq m) of internal space as well as an Astro turfed garden and roof terrace.

Shelgate Road, SW11

£1,850,000 SOLD ABOVE GUIDE PRICE

— Paul Clappison

An outstanding five-bedroom Victorian house on one of the most highly soughtafter roads ‘Between the Commons’.

East Close, W5

£2,195,000 FOR SALE

— Kikku Maini

Stunning 5/6-bed detached home in a quiet culde-sac. 32ft kitchen/diner, luxurious suite, bi-fold doors to a landscaped garden, and office. Close to top schools, parks, and Ealing Broadway. Stylish, spacious, and perfect for modern family living!

Snowbury Road, SW6

£2,200,000 SOLD

— Daniel Oxtoby-Hood

A stunning four-bedroom end of terrace home located on one of Fulham’s prettiest streets. Situated in the popular Bury Triangle the property also has an incredible south facing garden.

Chapman Lane, SL8

£2,995,000 FOR SALE

— Sally Jane Hobson

4,500 Sq Ft Luxury Accommodation

6 Beds, 4 Baths, 4 Receptions Annexe Accommodation

Heated Swimming Pool

Gated/Security/CCTV Privately Owned Road

0.48 Acre Plot

South Facing Landscaped Gardens & Views

Commuter Access to London Paddington & Marylebone

Walking Distance to Bourne End Station, High Street & River Thames

Field View is an immaculately presented, extended luxury family home originally built in 2002 now offering 4,500 Sq Ft of outstanding accommodation on a 0.48 acre plot with views on premier private Chapman Lane.

Loxford Road, CR3

£1,425,000 SOLD

— Philip Knight

A superbly positioned family home with envious views, set in landscaped gardens of about half an acre (0.2 Ha), tucked away on a sought-after residential road close to Caterham School.

Church Lane, BS40

£785,000 FOR SALE

— Amy Rogers

A striking house located in the beautiful village of East Harptree, with masses of renovation potential.

Chigwell, IG7

£7,500,000 SOLD OFF-MARKET

— Chris Price

Grange Gardens, SL2

£1,850,000 FOR SALE

— Sally Jane Hobson

High Pines is an attractive stock-brick remodelled, interior-designed 5-bed detached home, located on a very private 0.6 acre south-facing level plot in the very soughtafter private cul-de-sac of Grange Gardens.

A rare opportunity to acquire one (or both) of these Stunning New Family Homes, of around 8800 sq ft.

Sylvan Avenue, RM11

£5,250,000 FOR SALE

— Andrew Vale

Brand New Luxury Homes

Stunning Designs

Six En-suite bedrooms

Stunning Open-plan Living , Dining and Kitchen

Drawing and Dining Rooms

Cinema Room

Lift

Fabulous position on Emerson Park

Gated

Part Exchange Considered

Cheriton Square, SW17

£1,475,000 SOLD

— Simon Armitage

An elegant double fronted period family home situated on an attractive street in Balham, with four large bedrooms, three bathrooms, two reception rooms, cloakroom, large basement and patio garden.

The Avenue, TW12

£1,325,000 FOR SALE — Fraser Allen

fronted Edwardian house located a short walk from Hampton Station, the local amenities of Hampton Village and many excellent local schools.

Temple Road, B93

£1,800,000 FOR SALE

— Edward Holt & Kara Flynn

Situated on a private road in the prestigious “Golden Triangle”, 21 Temple Road presents buyers with endless potential.

Cavendish Crescent, BA1

£1,500,000 SOLD

— Sharon Clesham

An elegant Georgian ground floor apartment with private entrance. Totally restored to the highest level with private landscaped garden.

High Drive, CR3

£3,500,000 FOR SALE

— Philip Knight

Built in 2010 by a renowned local developer, this property showcases unparalleled craftsmanship, using the finest hand-sourced materials. The design, which won an Architect Prize, spans approximately 5,505 sq. ft. across three floors.

With an average experience of 17+ years in the industry, our brokers are amongst the most qualified. If you’re looking for the right advice on your sale, let or search get in touch.