FISCAL YEAR 2025-26

Submitted by: Kimbra McCarthy, City Manager Prepared by: Arn Andrews, Assistant City Manager

Derek Rampone, Finance and Administrative Services Director

Grace Zheng, Assistant Finance and Administrative Services Director

Elliot Young, Principal Financial Analyst

Ann Trinh, Senior Financial Analyst

Natalie Poon, Financial Analyst

Ellen Kamei Mayor

Emily Ann Ramos Vice Mayor

Chris Clark Councilmember

Alison Hicks Councilmember

John McAlister Councilmember

Lucas Ramirez Councilmember

Patricia Showalter Councilmember

Kimbra McCarthy City Manager

Jennifer Logue City Attorney

Heather Glaser City Clerk

Audrey Seymour Ramberg

Arn Andrews

Assistant City Manager

Assistant City Manager

Lenka Wright Chief Communications Officer

Danielle Lee

Chief Sustainability and Resiliency Officer

Christian Murdock Community Development Director

Roger Jensen CIO/Information Technology Director

John Marchant Community Services Director

Kimberly Thomas

Deputy City Manager

Derek Rampone Finance and Administrative Services Director

Juan Diaz Fire Chief

Wayne Chen Housing Director

Maxine Gullo Human Resources Director

Tracy Gray Library Director

Michael Canfield Police Chief

Jennifer Ng Public Works Director

5.FUND

May30, 2025

Honorable Mayor and Members of the City Council:

500 Castro Street, P.O.Box 7540

Mountain View, CA 94039-7540

650-903-6301|MountainView.gov

In accordance with the City Charter, I am pleased to submit the Fiscal Year 2025-26 Recommended Budget to the City Council for consideration. The City Council was presented with the Preliminary Recommended Budget on April 8, 2025for consideration and feedback, and will be presented with the final Recommended Budget at a public hearingon June 10, 2025, with formal adoption anticipated at a public hearing on June 24, 2025. This transmittal letter summarizes the key components of the Recommended Budget.

The Fiscal Year 2025-26 RecommendedBudget is structurally balanced and allocates resources toward long-term service delivery, Council Strategic Priority areas, continuous organizational improvement efforts, innovative programs important to our community, and building the Mountain View of tomorrow. Although the budget is stable in Fiscal Year 2025-26, thereisstill a great deal of economic uncertainty on the horizon.

More than 70% of the General Fund revenue is derived from three sources: property taxes, use of money and property (investment earnings and lease revenue), and sales tax, all of which are susceptible to fluctuations due to changes in economic conditions. Although revenues have recovered to prepandemic levels, they have moderated recently, while expenditures are currently projected to marginally outpace this slower revenue growth. As a result, we are cautiously optimistic about the future fiscal health of the City, but we are balancing against unknowns that could impact the City’s budget. Continued uncertainty surrounding the escalation of global tariffs and ensuing trade wars, inflationary pressures, elevated interest rates, supply chain interruptions, transitioning national economic policies, federal spending reductions, and geopolitical conflicts cloud the economic picture. These factors willcontribute to the likelihood of slower-paced growth in the future.

While recentbudgetsover the past few years haveprojectedsufficient financial resources to maintain current service levels, the City’s revenue streams neededto be enhanced and diversified in order to maintain ongoing fiscal stability and accomplish the bold initiatives the City is advancing.

In June 2024, theCity Councilunanimouslyapproved placinga revenue measure on the ballot for the November 5, 2024General Municipal Election. Mountain View residents overwhelmingly approved (by 73.0%) the City’sproposed ballot measure, Measure G, to increase the existing property transfer tax on the sale of property over $6.0million. The increaseis expected to generate up to $8.0millionto $9.5 millionin new revenue annually.

May 30, 2025

Page 2of 34

Per City Council direction, this additional source of revenue will be dedicated to the following funding priorities for the next 10 years:

•35.0% to40.0% forPublic Safety Facilities;

•30.0% to35.0% for Parks, Open Space, and Biodiversity;

•20.0% to25.0% for Affordable Housing; and

•5.0%to15.0% toward other general governmental services, including road maintenance, active transportation, small business support, and homeless support services, among others.

With the passage of Measure G,these important community and City Council priorities can advance without impacting the existing high-quality service delivery Mountain View residents deserve.

One important community project that Measure G will supportin the next fiscal year is thedesign and construction of the newPublic Safety Building. This project has been discussed and planned for more than 20 years andis now movingforward. The existing Police and Fire Administration facility opened in 1980and houses fixed Police Department operations, 9-1-1-Emergency Dispatch, Fire Department executive and administrative operations, Police and Fire support staff, and the City’s Emergency Operations Center. Thecurrentbuilding was designed prior to the Essential Service Seismic Safety Act of 1986 and does not meet current seismic standards for such structures.

This new facility is being designed in the Civic-Americana style (shown below) and accommodatesa 50-year service horizon to ensure that best-in-class public safety delivery continues now and well into the City’s future.Approximately $3.2millionof the new revenue created by Measure G willbe dedicated annually toward funding the new facility.

May 30, 2025

Page 3 of 34

In addition to the increased funding created by Measure G, in 2018, the City secured funding for a new Public Safety Building from the Ameswell Hotel development through an innovative public-private partnership. This included earmarking revenue from a long-term ground lease for the Ameswell Hotel, along with Transient Occupancy Tax, property tax, and sales tax generated from the hotel property. These revenue sources from the Ameswell project currently provide approximately $4.9 million in annual revenue, with the potential for nominal increases in the future. Since the inception of the partnership in 2018, the revenue has been maintained in a reserve and has a current estimated fund balance of $27.6 million toward construction of a new Public Safety Building.

Although actual revenue may fluctuate based on sales and transfer activity, historical data suggests annual total Measure G revenue could be in the range of $8.0 million to $9.5 million annually. As a result, the Recommended Budget includes an assumption of $4.0 million (40.0% of total revenue) annually in potential Measure G revenue that will be available for this project, but the actual amount received will be dependent on the sales/transfer activity of properties valued over $6.0 million. Therefore, the available project funding from Measure G revenue is highly variable.

Estimating that $4.0 million is available from Measure G, combined with $4.9 million in annual revenue from the Ameswell project, a total amount of $8.9 million annually is estimated to be available to finance the Public Safety Building project. The Recommended Budget includes an additional commitment of $6.4 million in one-time (limited period) moneys to ensure this critical project is funded and continues moving forward.

Measure G will also provide critical funding toward maintaining and increasing the City’s parks, open space, and biodiversity goals. The forthcoming Parks and Recreation Strategic Plan will identify the parks and open space resources, community facilities, and recreation programming of the future, and is expected to require ongoing financial investments in the millions. It has been shaped by community input and will address unmet community needs and evolving demographics and trends, along with establishing a long-term vision and set of action steps to enhance and expand parks and recreation services throughout the community. The Strategic Plan will be presented to the City Council in fall 2025.

At the same time, the City has been developing a Biodiversity and Urban Forest Plan, which will inform City projects and ordinances related to vegetation, wildlife, trees, and species, aiming to increase local habitats, preserve and enhance tree canopy, mitigate the effects of climate change, and create a more resilient environment. The City has been working with San Francisco Estuary Institute (SFEI) to develop the Biodiversity Plan. Council consideration of this item will occur in the latter half of next fiscal year.

One of the most pressing issues in Mountain View and the greater Silicon Valley region is housing affordability. The City’s focus on affordable housing includes the significant production of new units. The City has nine fully affordable housing projects in the pipeline. Once completed, these projects will add just over 1,000 new affordable housing units, increasing the total number of affordable housing units in Mountain View to nearly 3,000 units. The most significant barrier to advancing the pipeline is the lack of funding. Therefore, a key City priority is utilizing a portion of Measure G funding towards affordable

Year 2025-26 Recommended Budget

May 30, 2025

Page 4 of 34

housing efforts, as well as identifying additional funding opportunities and establishing partnerships with external agencies. The City has been designated by the State of California Department of Housing and Community Development as a “Pro-Housing Community,” which allows the City to receive additional funding from the state for affordable housing projects that can be leveraged with Measure G funds.

Additionally, over the next year, the City will be developing policies and programs related to the City’s State-certified Housing Element, including addressing tenant displacement and middle-income housing. The City is anticipated to update its Tenant Relocation Assistance Ordinance, adopt local replacement requirements for the demolition of existing housing units, complete the development of a Community Ownership Action Plan, and advance efforts to fund a program for the acquisition and preservation of existing rent-stabilized housing units. The process for developing a middle-income housing strategy with a focus on homeownership is expected to start in fall 2025.

The City’s commitment to sustainability and resiliency remains strong. We continue to make strides in our decarbonization efforts and push boundaries through the sustainability goals we set. In Fiscal Year 2025-26, staff will develop a decarbonization strategy and climate vulnerability assessment for Council’s consideration. The decarbonization strategy will lay out policy options to mitigate our greenhouse gas emissions and achieve carbon neutrality, recognizing the urgency of addressing climate change as quickly as we can. The climate vulnerability assessment will identify the impacts of climate change projected for Mountain View. It will serve as the basis for a resiliency strategy to ensure the community can continue to thrive into the future. We will also bring to Council a strategy to end the flow of natural gas by 2045 in Mountain View. This “north star” initiative will be based on the decarbonization strategy and climate vulnerability assessment, as well as legal analysis of the available pathways to achieve the end of flow and an assessment of our future electricity grid capacity needs to ensure a seamless transition away from natural gas. Measure G funding will help with costs related to achieving these goals.

In addition to long-term policy development, the City will continue to make progress towards decarbonization, resiliency and community engagement. In April 2025, the City launched an innovative heat pump water heater rebate in partnership with Silicon Valley Clean Energy to accelerate the transition to all-electric appliances in residential buildings. We will be launching a heat resiliency initiative in partnership with the Community Services Agency of Mountain View and Los Altos this summer to support our unhoused residents and those that live in mobile homes or vehicles. The Community Services Agency will provide heat resiliency tool kits (oral rehydration packets, fans, thermometers, solar battery chargers, and small air filtration devices) to enhance resilience during extreme heat events. To engage neighborhoods this summer, we are also launching a Cool Block Mountain View cohort. Cool Block teams in neighborhoods across the City will meet to talk with their neighbors about emergency preparedness, energy efficiency, water conservation, and creating safer, friendlier neighborhoods. Finally, we will also continue to make strides this next fiscal year in decarbonizing municipal operations through the installation of three solar arrays, electrification of water heating systems, and transition of our fleet towards electric vehicles.

May 30, 2025

Page 5 of 34

In addition to the efforts described above, the Economic Development Division, alongside a Citywide team, continues to advance major initiatives to implement the Council-adopted Economic Vitality Strategy and enhance the vibrancy of Mountain View’s downtown.

Building on the recent retail study commissioned by the City, staff is proactively engaging with property owners, developers, and real estate agents to develop innovative approaches to reduce downtown vacancies. These efforts will be supported by the upcoming comprehensive update to the Downtown Precise Plan that is currently under way and will be brought to Council in fall 2025. Minor but important updates have already been made to speed up and reduce costs for permitting restaurants, indoor recreation, and fitness center uses. Informed by a robust stakeholder engagement process, the Precise Plan will articulate the City’s vision for downtown, including priorities for development and amenities for an inviting, walkable, and flourishing downtown.

In addition, the City is supporting physical improvements and programs to help businesses attract customers and activate their spaces. The City will continue providing small business with fixture and furniture grants to help businesses enhance their outdoor seating areas along the Pedestrian Mall. In addition, downtown will continue to be served by the Citywide facade and storefront window activation grant program to aid businesses in beautifying storefront facades, windows, and signage. The City will also develop and implement a new Pedestrian Mall Storefront Activation program as part of the Council Work Plan.

The Recommended Budget includes $350,000 for grants and services and an additional $100,000 for the new Council Work Plan Pedestrian Mall Storefront Activation program.

Staff is working to implement recommendations in the Downtown Parking Strategy, as well as implementation of the parking permit program and improvements to parking facility signage. The Recommended Budget includes $180,000 for consultant services and $5,000 in new funding for parking signage repair.

A Citywide staff team is focused on providing a range of enhanced services downtown to improve the visitor experience. Building on existing efforts to create social zones and musical performances to spark activity in the Pedestrian Mall, the City implemented an umbrella share program this winter and added a decorative street treatment along the central walkway. Staff is also developing wayfinding signs to direct visitors to key destinations and highlight parking facilities. In addition to high-visibility directional arrows and a pedestrian-level walking map, the signs include striking images reflecting Mountain View’s rich history.

May 30, 2025

Page 6 of 34

In addition, staff is working on enhanced maintenance and cleaning of downtown parking facilities, including more frequent deep cleaning, graffiti abatement and elevator repairs to form a positive first impression for downtown visitors arriving by automobile. The Recommended Budget includes $36,500 for enhanced maintenance and cleaning.

Ongoing communication with downtown businesses and visitors is critical to having a successful downtown. Building on significant ongoing communications efforts, the City will create a strategy and materials to highlight the City’s investment downtown, promote and attract customers, provide information about upcoming public and private construction projects, and help merchants maintain foot traffic during construction in the area. The Recommended Budget includes $150,000 for strategic communication consulting services.

Over the past few years, we have been residents, the City Council, customers, and City employees.

Similar to recognizing the needs of our built environment, the City recognizes the importance of planning for the organization of tomorrow to best serve our community. One of the few positive developments that emerged from the COVID-19 pandemic was the recognition that as an organization, we could manage almost any situation through creative reimagining of how we approach our processes and systems and more effective use and deployment of technology. The need to continue embracing technology in our day-to-day work and service delivery is as important now more than ever.

While the last several budgets have addressed some of our service delivery challenges through the addition of critical positions, in the coming years, the ability to continuously improve through reinventing and automating many of our processes is what will enable the Mountain View organization to thrive in the future and continue to provide our residents, businesses, and customers with an excellent level of service.

Like many municipalities, many of the City’s legacy systems and processes are outdated and are reaching the end of their useful lives. Staff is seeking ways to leverage newer technology in ways that were not available when the original systems were procured. In addition, many internal processes and procedures have been developed over the years to accommodate some of these antiquated systems and processes. The introduction of new technologies provides opportunities to perform holistic business process reviews Citywide.

These reviews allow for an in-depth examination of current processes by department, division, and application, while also taking into consideration how departments overlap. The City has not historically utilized software systems to a maximum benefit, resulting in a loss of productivity due to manual

Year 2025-26 Recommended Budget

May 30, 2025

Page 7 of 34

processes, inefficient workarounds, and ineffective or unnecessary reconciliations. As we strive to continuously improve, gaining better use of various existing applications will be vital to increasing staff productivity throughout the City, which will lead to better and quicker service delivery to our customers.

The Information Technology Department is currently finalizing the development of a Five-Year Strategic Plan (Plan) that will guide our technology decisions and ensure the City is prepared for necessary upgrades and deployments in the future. The Plan will help identify strategic opportunities for process improvements and better utilization of our existing systems. In addition, in the coming fiscal year, a Technology Steering Committee will be convened and be comprised of employees representing a crosssection of the City's leadership, departments, and disciplines, who will assist in providing long-term direction for the organization’s technology resources. This committee will assist in facilitating the reasoned prioritization and development of our strategies and technology planning.

To support these important new and ongoing initiatives, the Recommended Budget contains the following improvements:

• Information Technology Services, Licenses, and Software Renewals: $128,200;

• Temporary Staffing for Information Technology: $390,000 limited-period funding;

• Professional Services for Information Technology: $50,000 limited-period funding.

This fiscal year, we will be implementing several critical technology systems and addressing outdated legacy processes and structures, as detailed below.

The City recently launched “ExpressPermitsMV,” an expedited building permit program for single-family homeowners and small businesses that will save them time and money on select projects.

The following types of projects are available through ExpressPermitsMV:

• Single-family and duplex remodels of 600 square feet or less;

• Single-family and duplex additional less than 500 square feet; and

• Commercial tenant improvements of 5,000 square feet or less for retail, office, personal service, and medical businesses.

The expedited permitting program offers these types of customers a much quicker review timeline and a scheduled meeting with City Review Staff, resulting in the most efficient way to obtain a building permit. The new program provides enhanced customer service to our residents and businesses. Whether it is a resident remodeling their home or small business owner improving their business space, ExpressPermits MV speeds up the permit process without compromising on safety. This accelerated plan check process includes an in-person, or virtual, meeting with a team of City staff who can answer questions and provide options for applicants in real time.

May 30, 2025

Page 8 of 34

Through the scheduled meeting, a City staff team will meet with the applicant to identify and discuss permit solutions or review any questions with the applicant. These meetings may involve the licensed professional who prepared the building plans, as well as the property owner, business owner, or applicant. This program is supported by a coordinated team of City staff from the Community Development, Fire, and Public Works Departments.

In addition, the City expanded the Same-Day Building Permit Program in March 2025 to include permits for the replacement of air conditioning (AC) units, exterior building siding replacements, and installing a sewer cleanout at the property line. By June 2025, the program will also include all-electric heat-pump installations or replacements for water heaters and heating and cooling (HVAC, furnace) equipment, furthering the City’s efforts toward building electrification and sustainability.

The Same-Day Building Permit Program allows for permits to be issued instantaneously online without construction plans if a project meets code requirements. These permits are available for minor improvements in single-family residential homes and duplexes, such as replacing a water heater, furnace, a water service line, electrical service panel upgrade, replumbing a home, and replacing a tub-shower unit. Implementing a same-day process for these types of projects reduces the time to obtain a building permit, allowing homeowners to start their projects more quickly and predictably.

This collection of near-term enhancements is part of the ongoing efforts by the Community Development Department to improve permit procedures, increase transparency on program implementation, and offer more beneficial tools to the community, particularly for residents and small businesses.

In addition to the permitting process improvements, this year, we will begin onboarding a Land Management System (LMS). Sometimes called a “Community Development System,” an LMS is a software suite comprising several applications that manage the creation, issuance, and tracking of developmentrelated activities commonly associated with planning and zoning, permitting, inspections, licensing, code enforcement, and parcel/address management. An LMS system will be a core solution for the ongoing process improvements in the Community Development Department to help elevate the customer experience. A multi-department City team is currently outlining the specifications for the procurement of this next generation process and technological improvement.

The illustration below shows the extent to which a LMS will benefit every aspect of the planning and zoning, permitting, inspections, licensing, and code enforcement processes.

Another exciting business transformation occurring this fiscal year will be the implementation of a new Utility Billing System(UBS). The current UBS isa system from the 1990s which is no longer supported and cannot be upgraded.Staff initiated a competitive procurement last year and is currently in the final stages of contracting with a new firm to implement a new UBSin the next fiscal year. This new system will provide significant opportunities to automate processes associated with billing for water, wastewater, and recycling.This implementation will allow for a single, comprehensive, and integrated solution to manage the City’s utility business functions.The project will also improve and streamline the City’s utility operationsto take advantage of best practices through automation, integration, and workflows.

The City Manager’s Office,in conjunction with the Finance andAdministrativeServices Departmentand City Attorney’s Office,is currently leading a multi-department review of the City’s contracting process. The City does not currently own any contract management software and primarily utilizes manual processes.Contract management software helps agencies manage their contracts throughout the entire contract lifecycle, including creating, negotiating, signing, storing, tracking, and analyzing contracts. Staff is working onidentifyingareas where the current contracting process can be simplified and automated, and the Citywide team has already identified several steps which unnecessarily encumber the contracting process. In addition to simplifying the process forstaff, a contract management system willprovide an improved user experience for vendors choosing to do business with the City. In support of this important implementation, the Recommended Budget includes$150,000 in limited-period funding for a Contract Management Softwaresystem.

Fiscal Year 2025-26 Recommended Budget

May 30, 2025

Page 10 of 34

Similar to the contract improvements discussed above, the deployment of a work order management system will enable significant efficiencies among multiple departments. The goal of the work order management application is to provide paperless processes to handle Service Requests, Work Orders, Preventive Maintenance tasks, Asset Management, and Reporting Services. In addition, this solution will be integrated with the City’s existing Geographic Information System (GIS) to manage asset inventories, including all GIS data sets that will have work orders performed against them.

This project will support multiple groups in the Public Works and Community Services Departments, including Facilities, Forestry and Roadway Landscape, Parks and Open Space, Street Maintenance, and Utilities Management, among others. Approximately 150 staff members throughout these divisions will benefit from utilizing the new work order management application.

As restructuring the City’s Document Processing Division. Document Processing (DP) was formed decades ago when word processing was new and there was minimal , echnology has evolved since then, along with the business needs of the City, and this work can now be completed successfully by department . The City will join many other public and The Recommended Budget includes reclassification of three DP employee within the

As staff works toward the development of an Artificial Intelligence (AI) Acceptable Use Policy this fiscal year, we are learning how the thoughtful application of AI could help advance Council’s Strategic Priority of “Community for All.” During the preliminary review of the Recommended Budget in April, the City Council expressed interest in implementing an AI translation service to supplement the existing efforts of our Multicultural Engagement Team during meetings. AI-powered translation services use artificial intelligence to translate text, speech, and even images across various languages. They offer a range of features, from simple text translation to real-time conversation translation and document processing and are designed to be both accessible and efficient. Residents would be able to join a Council meeting in person or online and choose their preferred language to both listen and interact during public comment if they choose. Staff is exploring a potential solution with a vendor and will implement a new system next fiscal year. The Recommended Budget contains $60,000 in limited period funding towards this effort.

Fiscal Year 2025-26 RecommendedBudget

May 30, 2025

Page 11of 34

Council Strategic Priorities and Work Plan—Fiscal Year 2025-26 and Fiscal Year 2026-27

TheCity Council has adopted seven Strategic Priorities to support the City of Mountain View Vision:

“A welcoming and vibrant city that plans intentionally and leads regionally to create livable, sustainable neighborhoods, access to nature and open spaces, and a strong, innovationdriven local economy.”

In January 2025, the City Council began the process of developing a new two-year Work Planspanning Fiscal Year 2025-26 and Fiscal Year 2026-27.

Over the past several months, Council has reviewed and reaffirmed the City’s seven Strategic Priorities; proposed and approved new and carryover projects for inclusion in the Work Plan; and received feedback from Council boards, commissions, and advisory bodies. TheStrategic Priorities and Work Plan is expected to be formally approved by the City Council on June 24, 2025.

The Council Work Plan is comprised of 16 projects, shown in the table below.

Fiscal Year 2025-26 Recommended Budget

May 30, 2025

Page 12 of 34

Project

Stevens Creek Trail Extension

Low- and Middle-Income Housing

R3 Zoning Update

End of Natural Gas Flow by 2045

Community for All Action Plan

City Broadband Network

Smart Water Meters

2026 Charter Amendment Measure

2026 Revenue Measure

City Code Cleanup

Citywide Objective Design Standards

Pedestrian Mall Vacant Storefront Activation Program

Pavement Condition Index Increase

City Policy/Template Updates

City Volunteer Framework

Pickleball Solutions

Execute funding agreement(s) with the City of Sunnyvale and begin the conceptual design.

Identify funding support, City properties, and partnership opportunities and address barriers to condominium development to create a strategy for supporting low- and middle-income homeownership.

Complete the update of R3 Zoning District development standards.

Adopt a resolution and identify legal pathways, electrical grid improvements, and community resiliency work to support implementation.

Create and promote a Community for All Action Plan.

Develop the conceptual design for a Citywide fiber network.

Create a plan for installing smart water meters and associated supportive technology Citywide.

Place measure on the 2026 ballot with modernizing amendments to the City Charter.

Develop a revenue measure and place it on the 2026 ballot.

Review and make periodic amendments to the City Code to remove contradictory, unenforceable, or otherwise outdated sections.

Create Citywide objective design standards for new multi-family and mixed-use developments.

Develop and implement vacant storefront display and pop-up program guidelines.

Develop and begin implementing a strategy to increase the pavement condition index on arterial streets to 70.

Update City policies, templates, and documents as needed.

Create a framework to support opportunities for volunteer organizations to work with the City.

Expedite the completion and implementation of the Pickleball Feasibility Study, including the construction of new permanent courts and an interim expansion of pickleball hours at Rengstorff Park. Table of Contents

Fiscal Year 2025-26 Recommended Budget May 30, 2025

Page 13 of 34

The Fiscal Year 2025-26 Recommended Budget document, which includes all City funds, is divided into nine sections as follows:

1. Introduction—Includes a summary of the City’s overall financial plan and recommended changes;

2. City and Community Information—Includes the community profile and other information about the City;

3. General Operating Fund Forecast—Includes the General Operating Fund (GOF) five-year revenue and expenditure forecast and an economic update on federal, state, and local trends;

4. Department Budgets—Includes operating plans for all City departments;

5. Fund Schedules—Includes recommended budgets for all funds;

6. Capital Improvement Projects—Includes the Recommended Capital Improvement Program (CIP) for Fiscal Year 2025-26;

7. Miscellaneous Information—Includes description of the budget process, position listing, debt administration and payments, and other information;

8. Shoreline Regional Park Community—Includes the recommended budget for the Shoreline Regional Park Community; and

9. Glossary and Index—Includes the glossary and index for this document.

This budget has been prepared in accordance with Section 1103 of the City Charter, the State Constitutional limit on the proceeds of taxes, and all applicable regulations.

The Fiscal Year 2025-26 Recommended Budget is structurally balanced and continues the recent trend of a slightly positive, yet slowing, economic outlook that stems from uncertainty in key economic indicators as well as slowing or minimal growth in property tax, sales tax, and other local tax revenues.

The total Recommended Budget for Fiscal Year 2025-26 includes $662.9 million in revenues and $648.9 million in expenditures (excludes a projected vacancy factor of $11.8 million). Some expenditures, such as capital projects, are funded from existing available resources, including the planned use of reserves. The Fund Schedules Section of this document presents the City’s financial picture in detail.

Fiscal Year 2025-26RecommendedBudget May 30, 2025 Page 14of 34

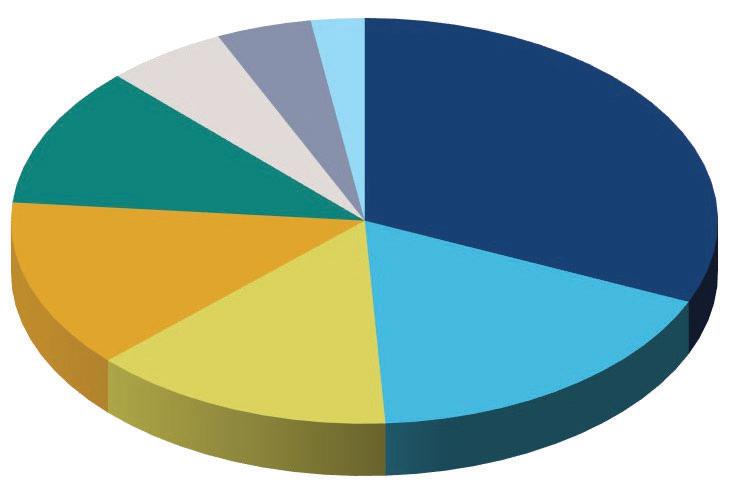

Total Fiscal Year 2025-26 Recommended Revenues—All Funds (dollars inmillions)

Total Revenues -All Funds: $662.9M

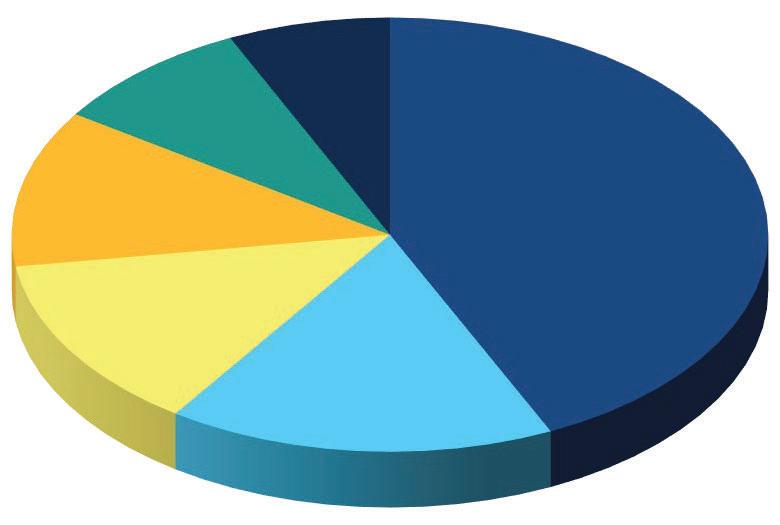

Total Fiscal Year 2025-26 Recommended Expenditures—All Funds (dollars inmillions)

Total Expenditures -All Funds: $648.9M

Revenue may be less than expenditures due to the use of fund balance/equity in excess of reserves.

Year 2025-26 Recommended Budget

May 30, 2025

Page 15 of 34

The General Operating Fund (GOF) is the single largest City fund and provides funding for core community services, such as public safety (Police and Fire), Parks, Recreation, Library, some Planning, Public Works, Sustainability, and all City Administration support functions, including City Attorney, City Clerk, City Manager, Human Resources, Finance and Administrative Services, and Information Technology. These core community services, paid for in the GOF, are primarily supported by major revenue sources that include property taxes, sales taxes, use of money and property (lease revenue), and other local taxes (business license, transient occupancy, and utility users). These four major GOF revenue sources account for $165.1 million, or 84.3%, of the GOF revenue in the Fiscal Year 2025-26 Recommended Budget. The remainder of revenues in the GOF are generated by a variety of other resources.

The GOF’s financial health is shaped in large part by positive and negative economic forces beyond the City’s control. Many GOF revenues are driven by the economic climate of Silicon Valley, the greater Bay Area, and the state. During the Great Recession of 2008, due primarily to declines in property taxes, sales taxes, and transient occupancy tax (TOT) revenues, the GOF faced structural deficits before corrective actions were taken for four consecutive fiscal years. In strategically and proactively addressing these ongoing structural deficits, the City was able to better position itself for the economic recovery in the ensuing years leading up to today. In addition, the City’s sound fiscal practices and budget discipline have allowed the City to maintain its AAA credit rating for more than 10 years, a status held by only a minority of other California cities.

Over the past few years, the City’s major revenues have generally remained strong and have benefited from inflation as well as the increase in interest rates, but they are not growing at the same rate as in the past. Staff continually monitors the GOF revenues and expenditures throughout the year. Despite incorporating the most recent available data into the forecasting process, a considerable amount of volatility and uncertainty yet remains about the future of the economy for various reasons, including geopolitical conflicts, on-and-off tariffs, and federal spending cuts and layoffs, which have prompted retaliatory trade actions, boycotts of American-made products and tourism, and stock and bond market declines that have sunk consumer confidence and increased predictions for a recession. Until such time as the volatility settles down and greater stability returns, the ability to more accurately forecast future revenues and expenditures will continue to be challenging.

The City maintains fiscally prudent budgeting practices of balancing ongoing expenditures with ongoing revenues and adopting structurally balanced operating budgets. In recent years, the City has experienced strong revenue growth with a larger-than-normal net operating balance that has allowed the City to address a portion of its infrastructure needs and unfunded liabilities. This situation has also helped the City to weather the revenue losses experienced during the COVID-19 pandemic. Although it is difficult to forecast revenues under this climate of extreme uncertainty, the GOF Recommended Budget for Fiscal Year 2025-26 continues in the tradition of balanced budgets and is projected to achieve a nominal operating balance.

Fiscal Year 2025-26 Recommended Budget

May 30, 2025

Page 16 of 34

A summary of the GOF Recommended Budget is summarized below (dollars in thousands):

Based on the current available information and assumptions, the GOF is projected to end the fiscal year with an operating balance of approximately $232,000.

Due to the need to address a few staffing requirements within the City, staff is recommending the addition of four ongoing positions in the GOF. This includes two new ongoing positions and two positions converted from limited period to regular ongoing status in the City Attorney's Office, City Manager's Office, Community Services Department, and the Human Resources Department.

A summary of the Fiscal Year 2025-26 GOF Recommended Budget is provided below. Details of the Recommended GOF revenues and expenditures are included Fund Schedule Section of this document.

The City of Mountain View provides a defined benefit pension plan for all full-time employees and some part-time benefitted employees as part of their total compensation package. Defined benefit plans provide a fixed, preestablished benefit payment for employees in retirement based on a formula which considers an employee’s years of service and highest average annual salary. The defined benefit pension has been a standard part of compensation in governmental organizations and in Mountain View, and is in lieu of participating in Social Security, except for the required Medicare rate of 1.45% of all wages.

The City’s pension plans over the past several decades, like all other CalPERS participants, have experienced unfavorable investment returns, changes in actuarial assumptions, and unfavorable demographic shifts which have outweighed any positive plan experiences. These unfavorable actuarial experiences have resulted in rising employee-related costs due to the corresponding escalation in payments to fully fund benefits.

Year 2025-26 Recommended Budget

May 30, 2025

Page 17 of 34

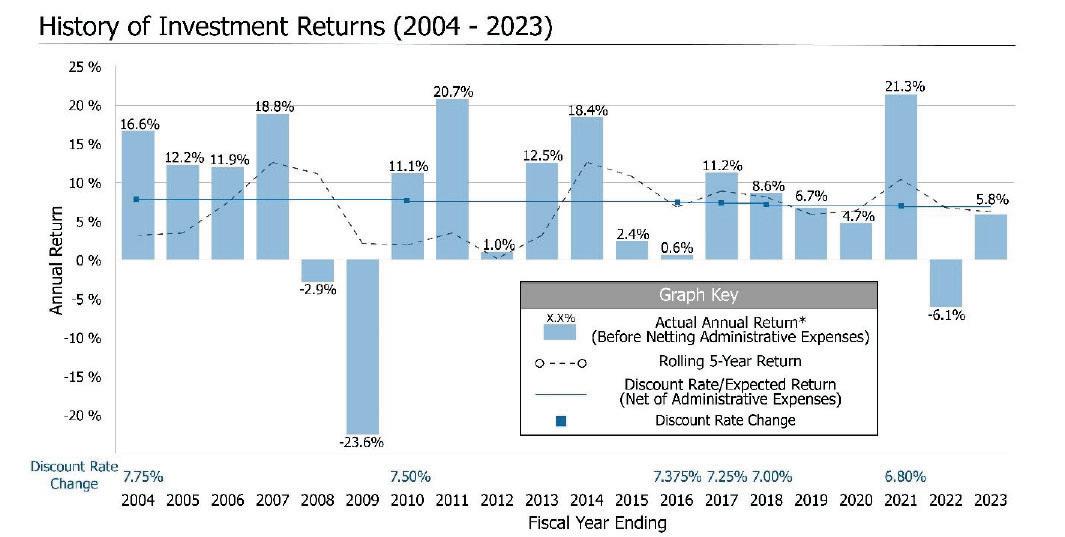

An Unfunded Accrued Liability (UAL) obligation represents the market value of the pension plan assets minus the discounted value of the future liabilities. When a plan’s Market Value of Assets is less than the Actuarial Accrued Liability, the difference is the plan’s UAL. When there is a UAL, the City must make up the difference. The City’s most recent actuarial report from CalPERS (released in August 2024) indicates that the City has a UAL of $149.3 million in the Safety Plan and $149.6 million in the Miscellaneous Plan, for a total of $298.9 million as of June 30, 2023, up from $283.6 million a year prior, an increase of 5.4%. This large increase is primarily attributable to CalPERS only realizing an investment gain of approximately 5.8% in Fiscal Year 2022-23, which is 1.0% less than its assumed investment return of 6.8%.

As of June 30, 2023, the City’s funded status was 69.3% for its Safety Plan and 73.2% for its Miscellaneous Plan, virtually unchanged from the year before, when they were 69.3% and 73.3% respectively. Overall, the combined funded status on June 30, 2023 was 71.4%, which is unchanged from a year earlier.

6/30/216/30/226/30/23

Notably, CalPERS reported an investment return of 9.3% for Fiscal Year 2023-24, which is 2.5% higher than the assumed investment return. This better-than-expected return for the prior fiscal year will have a positive impact on the City’s overall funding status when the new actuarial report from CalPERS is released in August 2025. Based on CalPERS’ projections, the City’s overall funding status could increase by up to 5.0%, from 71.4% to 75.0%.

Conversely, due to the recent volatility in the financial markets, the current investment return to date (from July 1, 2024 to May 1, 2025) for CalPERS is estimated to be a little over 4.0%, based on the current balance of the investment fund of $530.3 billion, compared to $506.6 billion as of June 30, 2024. This estimate assumes that contributions and distributions are equal, which has historically been the experience of the fund.

Below is a chart that illustrates the City’s pension plans’ sensitivity to changes in the assumed investment rate of return. As the assumed interest rate earnings is increased, the funding percentage of the City’s pension plans increases. Conversely, as the assumed rate of return decreases, the funding status of the

Fiscal Year 2025-26RecommendedBudget

May 30, 2025

Page 18of 34

City’s pension plans decreases. It is possible that future changes to the assumed discount rate will be to lower the investment rate of return, which will have a negative impact on the City’s funded status.

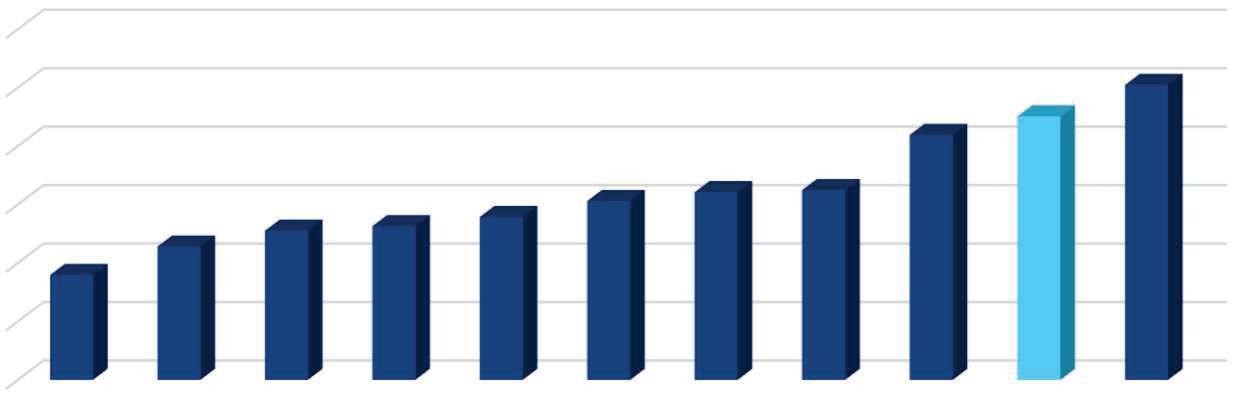

If the fund experiences an investment return of anything less than 6.8% this year, it will have a negative impact on the City’s funding status and will cause the City’s pension costs to increase more than expected in the future. The following is a chart with the 20-year historical annual returns of the CalPERS Public Employees’ Retirement Fund for each fiscal year ending June 30, as reported by the CalPERS Investment Office.

* AsreportedbytheInvestmentOfficewith a three-month lag on private equity and real assets and without any reduction for administrative costs Source: CalPERS Actuarial Valuation—June 30, 2023.

May 30, 2025

Page 19 of 34

CalPERS’ Asset Liability Management (ALM) strategy is an in-depth process that aligns its investment approach (assets) with its obligations to pay retirement benefits (liabilities). Every four years, CalPERS conducts an ALM review to assess its funding status, risk tolerance, and future cash flow needs. It then sets a strategic asset allocation—deciding on what mix of stocks, bonds, real estate, and private equity to invest in—to balance long-term growth with the need to reliably fund pension payments.

The ALM strategy aims to: achieve an investment return that meets or exceeds the discount rate (assumed rate of return), which is currently 6.8%; minimize employer contribution volatility; and manage the risks of being underfunded or overexposed to market downturns.

This approach is essentially a balancing act between growth, risk, and the stability of retirement benefits, and helps ensure a sustainable pension plan for future generations who have guaranteed benefits.

The CalPERS Board of Administration (Board) is currently in the middle of the ALM process, with education and strategy sessions being held through July 2025. Any recommended updates to the portfolio mix, discount rate, and other actuarial assumptions, such as inflation, payroll growth, and mortality rates, will be released in September 2025 and voted on by the CalPERS Board in November 2025. Any impacts to the City as a result of approved updates will be analyzed by staff and included in the in the midyear budget update to Council in February 2026.

The City prudently recognized the potential impacts to future service delivery if unfunded pension obligations were not addressed and additional funding strategies not identified. For the CalPERS pension liability, the City Council adopted a strategy to contribute a significant lump-sum contribution of $10.0 million (General Fund) in Fiscal Year 2017-18 as well as proportionate contributions from other funds.

During the Fiscal Year 2017–18 budget process, Council approved using sublease revenue from Parking Lots C and D from SFX to help fund the City’s unfunded pension liability. On May 23, 2023, Council approved an amendment of this sublease for the annual lease revenue of $930,000, escalating by 2.0% annually through Fiscal Year 2028–29. The first $10.0 million of this revenue is dedicated to the pension liability. Once that target is met, future lease revenue will be redirected to the Capital Improvement Reserve.

In Fiscal Year 2024–25, the City budgeted $930,000 from the Google parking lease in the General Fund, and with proportionate contributions from other funds, a total pension payment of $1.2 million is anticipated. For Fiscal Year 2025-26, $950,000 is budgeted from the lease plus contributions from other funds to reach a total projected payment of $1.2 million.

Fiscal Year 2025-26 Recommended Budget

May 30, 2025

Page 20 of 34

Additional discretionary payments made to CalPERS from Fiscal Year 2018-19 through Fiscal Year 2023-24 are listed below.

Additional Discretionary Payments to CalPERS (in millions)

2018-194.75$

FY 2019-204.49$ 3.89 $ 8.38$

2020-211.11$

2021-222.23$

2022-231.93$

2023-244.10$

2024-252.70$

In 2013, California pension reform became law under the Public Employees’ Pension Reform Act (PEPRA). PEPRA, effective for all new employees hired after January 1, 2013, made broad prospective changes to pensions in California with the goal to create a more sustainable pension system by reducing an employer’s pension liabilities and increasing employee contributions toward their pension benefits. As a result, the pension costs associated with a PEPRA employees are lower than an employee hired prior to January 2013.

As more non-PEPRA employees retire and more of the workforce is comprised of PEPRA employees, the City will gradually see stabilization and eventually lower pension costs. However, it is expected that substantial savings from the reform will take many years to be realized due to the number of PEPRA employees only recently comprising just over 50.0% of the City’s active workforce and substantial investment losses experienced by CalPERS in the past not being paid off for another 20 years.

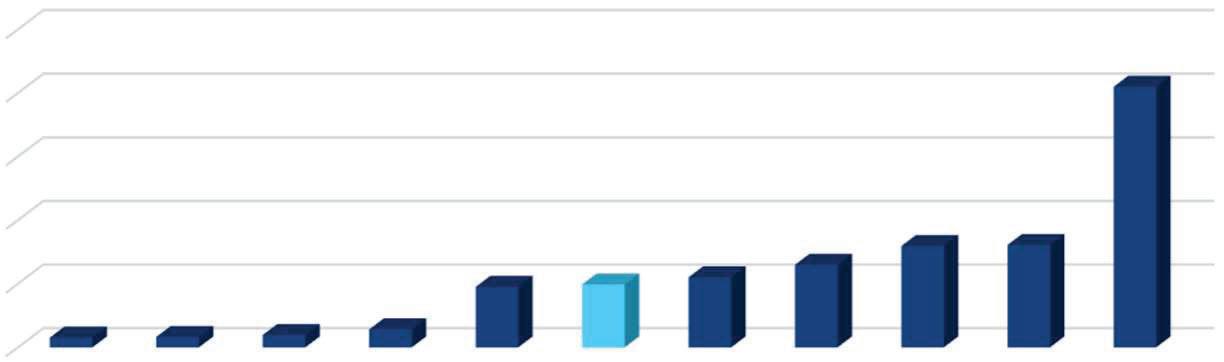

As shown in the chart below, the overall percentage of active PEPRA employees employed by the City has gradually increased over the last four years, from 39.3% to 53.6%, based on the most recent valuation from CalPERS, meaning that the City’s active employees are roughly 54.0% PEPRA and 46.0% Classic formula. This split should continue to change, with PEPRA employees continuing to outnumber Classic formula employees. There are more PEPRA employees in the Miscellaneous Plan than in the Safety Plan, by a ratio of nearly two to one, with 60.3% of miscellaneous employees versus 32.5% of safety employees.

May 30, 2025

Page 21 of 34

The City continues to explore potential budget and interest savings that would result if additional discretionary payments (ADP) above the contributions calculated by CalPERS were allocated. In addition, in the next fiscal year, staff will be researching of the possible implementation of a Section 115 pension trust fund (similar to the City’s retiree health trust fund) that could assist in paying off the City’s pension liability early by allowing the City to safely and securely set aside funds, separate and apart from the state retirement system, in a tax-exempt, irrevocable trust to reduce pension liabilities and stabilize pension costs. The opportunity to contribute additional discretionary payments to CalPERS or to fund a Section 115 pension trust fund would be dependent on the availability of operating balances or one-time funds.

A second category of retirement-related benefits which impact the City’s finances is the City’s retiree health program, also called Other Post-Employment Benefits (OPEB). In 2009, the City established a Section 115 OPEB trust account through the California Employer’s Retiree Benefits Trust (CERBT) program to fund retiree health benefits. As of March 31, 2025, there was a balance of approximately $172.2 million in the trust account. Since inception of the City’s CERBT account in February 2009, the City has realized an annualized rate of return of approximately 6.8%.

As of the most recent actuarial report based on the June 30, 2023 valuation, the City’s Actuarial Accrued Lability (AAL) was $163.7 million and Actuarial Value of Assets was $170.1 million, resulting in a funded status of 103.9%. Compared to the prior actuarial report, as of June 30, 2021, the funded status has dropped from 107.2% to 103.9%. The decrease in funded status was partially a result of a decrease in the assumed investment rate of return from 6.0% (used for the June 30, 2021 report) to 5.6% (used in the June 30, 2023 report).

Fiscal Year 2025-26 Recommended Budget

May 30, 2025

Page 22 of 34

Included in this Recommended Budget document is a detailed Forecast beginning on Page 3-1. Forecasting is a best practice and an important part of a city’s financial planning process as it provides an outlook on a city’s future financial condition by identifying financial needs and potential budget imbalances. The Forecast is designed to enhance the City’s ability to identify key drivers and trends in revenues and expenditures and paint a helpful picture of the future economy of the City. While it is challenging to accurately predict local government revenues due to the variable nature of the revenue sources and their connection to regional, state, national, and even international economic conditions, it is generally possible to identify reasonable financial trends and provide a conceptual financial picture for a multi-year period, which is useful to the City Council’s decision-making. However, with the high degree of uncertainty surrounding the current economic climate, forecasting financial trends is difficult to project.

The Forecast includes staff’s best estimates for the projected fiscal outlook for the GOF (including the Fiscal Year 2025-26 Recommended Budget).

The Forecast was prepared assuming positive revenue trends for the future years and does not include a potential recession. Although it is impossible to forecast the timing of a potential recession, it is nearly certain that one may occur within the next five years. For Fiscal Year 2025-26, the GOF is estimated to end with an estimated $232,000 operating balance. The Forecast projects the fund will end with negative balances in the remaining forecast years. Although concerning, the deficits are less than 2.0% of projected revenues.

Based on current projections, balancing the GOF in future years and maintaining a structurally balanced budget may require a pause or slowing of adding new staffing positions and forgoing the addition of new programs and/or enhancement of current programs, unless additional dedicated ongoing funding sources are attained.

For Fiscal Year 2025-26, GOF revenues are projected to grow $11.5 million (6.3%), compared to the Fiscal Year 2024-25 Adopted Budget, to $195.7 million. More detail on each revenue source can be found in the General Operating Fund Forecast Section. The City’s recent revenue history and estimated revenues for the current fiscal year and projected revenues for Fiscal Year 2025-26 are as follows (dollars in thousands).

Fiscal Year 2025-26 Recommended Budget

May 30, 2025

Page 23 of 34

TOTAL AUDITED REVENUES & ADOPTED EXPENDITURES

$250,000

$200,000

$150,000

$100,000

$50,000

1 Other Local Taxes consist of Transient Occupancy Tax, Business Licenses, Utility Users Tax, and Cannabis Tax.

2 Other Revenues consist of Licenses, Permits and Franchise Fees, Fines and Forfeitures, Intergovernmental, Charges for Services, and Miscellaneous Revenues.

The chart above demonstrates the cyclical nature of the City’s balance between revenues and expenditures. In recessionary years, small margins existed between GOF revenues and expenditures while that gap widens during high-revenue-growth years. The expenditures in the chart include a vacancy factor.

Fiscal Year 2025-26 RecommendedBudget

May 30, 2025

Page 24of 34

A summary of the major categories of GOF Revenues for the Fiscal Year 2025-26 Recommended Budget is as follows.

Fiscal Year 2025-26 General Operating Fund Recommended Revenues (dollars inmillions)

General Operating Fund Revenues: $195.7M

1 Other Local Taxes consist of Transient Occupancy Tax, Business Licenses, and Utility Users Tax.

2 Other Revenues consist of Licenses, Permits and Franchise Fees, Fines and Forfeitures, Intergovernmental, Charges for Services, and Miscellaneous Revenues.

Expenditures

The Recommended Budget includes the addition of necessary expenditures. To address heavy workloads, current demands for resources continue to be addressed through limited-period funding.

Recommended expenditures for Fiscal Year 2025-26 include the addition of $1.0millionof net non-discretionary increases, which are necessary to preserve current service levels, and $1.6 millionof net discretionary additions for resources to meet increased demands. In total, including increases for personnel costs, there is a 7% increase, or $13.4million, in expenditures from the Fiscal Year 2024-25 Adopted Budget. The majority of the increase is related to increases in personnel costs. Included in the Recommended Budget expenditures is an estimated vacancy factor of $9.3millionbased on average expenditure savings over the prior five fiscal years.

Fiscal Year 2025-26 RecommendedBudget May 30, 2025

Page 25of 34

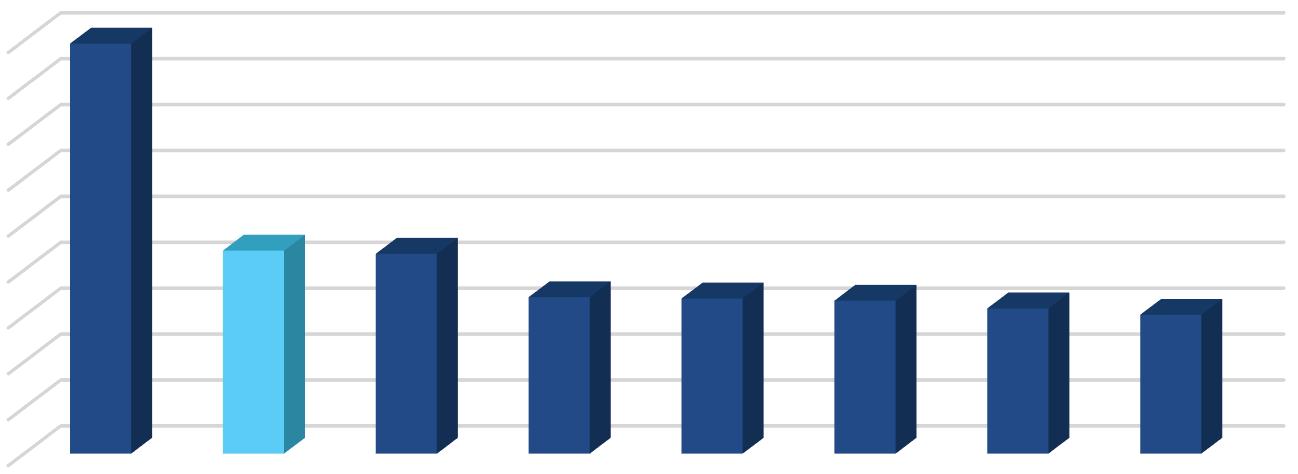

The major components of GOF recommended expenditures by department are as follows.

Fiscal Year 2025-26 General Operating Fund Recommended Expenditures (dollars inmillions)

* Admin./Support Departments include: City Council, City Clerk, City Attorney, City Manager, Information Technology, and Finance and Administrative Services. NOTE: Excludes an estimated vacancy factor of $9.3million.

Fiscal Year 2025-26 Recommended Budget Changes

The following is a discussion of major recommended expenditure changes for Fiscal Year 2025-26.

Non-Discretionary Increases

For Fiscal Year 2025-26, a total of $1.0millionof net non-discretionary increases are included to fund existing and new required operational costs, such as increases inutilities, information technology costs, and janitorial costs. A listing of all non-discretionary items, $50,000and over, is as follows (see the complete listing of non-discretionary items with descriptions under the Miscellaneous Information Section).

Fiscal Year 2025-26 Recommended Budget

May 30, 2025

Page 26 of 34

Net new expenditures totaling $1.6 million are included for high-priority ongoing programs; $1.1 million is related to personnel (fully loaded cost). These are included in the Fiscal Year 2025-26 Recommended Budget and future projections in the Forecast. A listing of all discretionary items, $50,000 and over, is as follows (see the complete listing of discretionary items with descriptions under the Miscellaneous Information Section).

• Deputy City Attorney Position (1.0 FTE): $288,100

• Website Coordinator Position (1.0 FTE): $254,900

• Parks Maintenance Worker I/II Position (1.0 FTE): $183,100

• Administrative Assistant Position (1.0 FTE): $173,800

• Reclassification of Five Firefighter/HazMat Positions to Firefighter/Paramedic/Hazardous Materials Positions: $166,500.

• State Legislative Advocacy: $150,000

• Fire Overtime Costs: $100,000

• Elimination of Document Processing Technician III Position (0.5 FTE): ($92,200)

• Reclassification of Document Processing Technician III Position to Principal Financial Analyst Position: $77,800

• Contract Services for Traffic Maintenance and Repair Services: $64,000

• Management Forum: $60,000

• Contract Services for Street Sweeping Services: $58,000

Limited-Period Expenditures

Funding of $7.7 million for limited-period items are recommended for one-time, high-priority programs, and are included in the Recommended Budget; $1.3 million is related to personnel, most of which is a continuation of current staffing (notated with an asterisk [*]). A listing of all limited-period items, $50,000 and over, is as follows (see the complete listing of limited-period items with descriptions under the Miscellaneous Information Section).

• One-Time Deferred Compensation Employer Contributions: $1,490,000

• Temporary Staffing for Information Technology: $390,000

• Safe Parking Program: $368,000

• Contract Services for Economic Vitality: $350,000

• IT Analyst I/II Position (1.0 FTE)*: $255,900

• Senior Management Analyst Position (1.0 FTE)*: $255,900

• Hourly Staff for Human Resources: $255,000

• Firefighter Recruit Academy: $223,800

• Hourly Wages for Public Works: $220,000

• Human Resources Technician Position (1.0 FTE)*: $205,400

• Consulting Services for Planning/Economic Development: $200,000

• Contract Services for Sidewalk Ramping, Grinding, and Inspecting: $200,000

• Management Fellow Position (1.0 FTE)*: $198,700

• Hourly Wages for City Management: $182,000

• Contract Services for Citywide Design Standards: $175,000

Year 2025-26 Recommended Budget

May 30, 2025

Page 27 of 34

• Succession Planning: $162,000

• Lead Security Services Guard (1.0 FTE)*: $161,400

• Senior Stagehand Position (1.0 FTE)*: $151,900

• Contract Management Software: $150,000

• Federal Legislative Advocacy: $120,000

• Cardiovascular and Metabolic Screening Program for Police: $117,000

• Contract Services for Facilities: $102,000

• 2026 Revenue Measure: $100,000

• Career Success Allowance Program: $100,000

• Contract Services for Forestry Outreach: $100,000

• Downtown Strategy Consulting: $100,000

• Employee Relations/Labor Negotiations Attorney Services: $100,000

• Safe Routes to School: $100,000

• Porter Services at Senior Center: $96,600

Software Services for Automatic License Plate (Flock) Cameras: $90,000

• Library Assistant I/II Position (0.5 FTE)*: $85,800

• Recreational Vehicle Tow Subsidy Program: $80,000

• Security Services: $80,000

• City Broadband: $75,000

• Hourly Wages for Finance: $75,000

• Organization Wellness Programs: $75,000

• Emergency Alert and Evacuation Software: $67,000

• AI Translation Software: $60,000

• Low Income Home Ownership Program: $50,000

• Professional Services for IT: $50,000

Low- and Middle-Income Home Ownership Strategy: $50,000

* Represents continuation of limited-period position.

The Fiscal Year 2024-25 estimated GOF operating balance carryover of $10.6 million (subject to changes in assets and liabilities and grant/donations carryover), prior fiscal year unallocated balance of $9.7 million, and one-time revenue of $8.2 million provides an available balance of $28.4 million, which is sufficient to fund the following items included in the Recommended Budget:

• $7.7 million for limited-period expenditures;

$5.0 million to the Public Safety Building Reserve;

$2.3 million for the General Fund Reserve;

• $2.2 million for the Compensated Absences Reserve;

• $2.2 million for the General Liability Fund;

$2.0 million for the Strategic Property Acquisition Reserve;

$1.0 million for the Capital Improvement Reserve;

• $1.0 million for the Development Services Fund (DSF); and

• $1.0 million for the Parental Leave Reserve.

Fiscal Year 2025-26 Recommended Budget

May 30, 2025

Page 28 of 34

The resulting available balance, after funding the above priorities, is $4.0 million. Staff will return to Council after the conclusion of the fiscal year-end audit with any modifications and final balances available for allocation.

Other General Funds

Development Services Fund

Development Services is a General Fund program separated from the GOF to facilitate better tracking and accounting of development activity. This separation was established to allow for an effective way to match revenues and expenditures. Initially created for Building Services, this fund was expanded in Fiscal Year 2014-15 to encompass all development activity.

For Fiscal Year 2025-26, operating revenues are projected at $10.6 million, which includes a $1.0 million transfer from the General Operating Fund. Operating expenses are estimated at $19.1 million, which includes a projected vacancy factor of $2.5 million, but excludes a one-time $5.7 million transfer to the Land Use Document Fee Fund.

The Land Use Document Fee was established in Fiscal Year 2015-16 to recover costs associated with preparing and updating major land use planning documents. These fees are restricted in use and may only be spent on projects related to the preparation of General Plan updates, Precise Plan updates, and zoning updates. As of the end of Fiscal Year 2024-25, there is a balance of $5.7 million in Land Use Document Fees. Staff is recommending the creation of a special revenue fund to improve accountability and transparency of the fee. As a result, a one-time transfer of the current balance will be made from the Development Services Fund to the newly established Land Use Document Fee Fund.

Excluding this one-time transfer, the Development Services Fund shows an annual operating shortfall of $8.5 million. There are multiple contributors to this shortfall, including timing mismatch between service delivery and revenue collection, the current slowdown in economic activity, decline in large development projects proceeding to construction, along with various processing fees not recovering the cost of providing city services.

To address this, a Master Fee Study was recently completed and reviewed by the Council Finance Committee, and new fee rates are being presented to the City Council for adoption with the Recommended Budget on June 10, 2025. In anticipation of these new rates, staff has included a 30.0% revenue increase assumption in the Fiscal Year 2025-26 projection, based on development trends observed in the prior fiscal year and the results of the fee study. Although the proposed fees are intended to fully recover costs, state guidelines require that development applications submitted prior to the adoption of the new rates remain subject to the previous fee schedule. This will result in a transition period before the fund becomes fully cost-recoverable.

The Development Services Fund is projected to have a negative fund balance of $14.5 million at the end of Fiscal Year 2025–26.

Year 2025-26 Recommended Budget

May 30, 2025

Page 29 of 34

The Conveyance Tax Fund is a General Fund subfund, separate from the General Operating Fund (GOF), established to improve specific tracking and accounting solely of Real Property Transfer (Conveyance) taxes. The City has two tiers of conveyance tax:

• Tier 1 charges $1.65 for every $500 (or portion thereof) of property value.

• Tier 2 charges $15 for every $1,000 of the total sale price for properties over $6.0 million.

This new subfund allows for effective tracking of the revenue and expenditures directed by the City Council based on this revenue. Previously, the Conveyance Tax was included in a Special Revenue Fund, combined with the Construction/Conveyance Tax Fund. However, effective December 20, 2024, with the implementation of Measure G, which added a second tier to the Real Property Transfer tax revenue, this revenue is now categorized under the General Revenue Fund and recorded within the General Fund.

According to the resolutions passed by Council, Measure G revenue will be allocated as follows:

• 35.0% to 40.0% to Public Safety Facilities;

• 30.0% to 35.0% to Parks, Open Space, and Biodiversity;

• 20.0% to 25.0% to Affordable Housing; and

• 5.0% to 15.0% to other General Government Services.

Additionally, if annual Measure G revenue exceeds $12.0 million in a fiscal year, any amount above this threshold will be allocated as follows:

• 45.0% to 55.0% to Parks, Open Space, and Biodiversity;

• 25.0% to 35.0% to Affordable Housing; and

• 10.0% to 20.0% to other General Government Services.

For Fiscal Year 2025-26, the estimated revenue for this fund is approximately $14.6 million, with $5.1 million generated from Tier 1 and $9.5 million from Tier 2 (Measure G).

The Shoreline Regional Park Community (Shoreline Community) was created by legislation in 1969, known as the Shoreline Regional Park Community Act (Act), for the development and support of the Shoreline at Mountain View regional park (Shoreline at Mountain View) and to economically and environmentally enhance the surrounding North Bayshore Area. In accordance with the Act, all tax revenues received by the Shoreline Community are deposited into a special fund and used to pay the principal of and interest on loans, advances, and other indebtedness of the Shoreline Community. The Act prescribes the powers of the Shoreline Community, including the construction and replacement of the infrastructure needed to serve the Shoreline Community, such as streets, curbs, gutters, parking lots, sidewalks, water and sewer services, lighting, waste disposal, power and communications, and housing and levees as well as operations and maintenance of Shoreline at Mountain View.

Fiscal Year 2025-26 Recommended Budget

May 30, 2025

Page 30 of 34

The Shoreline Community is a separate legal entity with its own budget and financial statements but is considered a blended component unit of the City, and financial activities are reported with the City’s financial documents. A separate budget for the Shoreline Community is adopted by the Board of the Shoreline Community (City Council) and is included in a separate section of this Recommended Budget document.

For Fiscal Year 2025-26, operating revenues are projected at $82.7 million, $891,000 higher than the Fiscal Year 2024-25 Adopted. This is primarily due to higher investment earnings offsetting property tax revenues lost from appeals and corrections. It is important to note that Assessed Value in the Shoreline Community can be significantly impacted by economic conditions. Operating expenditures are recommended at $62.0 million, $19.5 million higher than Fiscal Year 2024-25 Adopted, primarily due to $17.0 million one-time contracting services for a recycled water project and $1.0 million from higher salaries and benefits. Ongoing changes of $878,000 are included as well as limited-period expenditures of $799,000. In addition, there is a $25.7 million transfer to capital projects to fund necessary projects that benefit the Shoreline Community ($11.7 million from the Sea Level Rise Reserve and $9.8 million from the CIP Reserve).

The fund is estimated to have a $54.2 million ending balance after reserving $74.9 million for the General Reserve, the Landfill Reserve, the Sea Level Rise Reserve, bond proceeds (mainly from interest earnings), the Development Impact Fee Reserve, CIP Reserve, and the reserve for the AWPS Project and a potential site contamination liability. Importantly, remaining reserve balances are obligated for current and future funding requirements of the Shoreline Community.

A 2021 Shoreline Sea Level Rise Study Update was presented to the City Council on June 22, 2021. The current cost estimate for the identified sea level rise adaptation projects is $122.0 million. The projects are in various of phases of implementation (planning, design, and construction) and some have not started. It is anticipated additional reserves will be needed to provide for increased costs due to inflation and more stringent regulatory requirements. Currently, the Shoreline Community set aside $6.0 million annually for the Sea Level Rise Projects and the Shoreline Community has accumulated approximately $22.5 million to date. Staff anticipates the need for approximately $17.0 million in appropriations in calendar year 2025 for project construction.

In addition, the Educational Enhancement Reserve Joint Powers Agreement (JPA) by and between the City and the Mountain View Los Altos High School District and the Mountain View Whisman School District was extended for three years, through June 30, 2027. The agreement provides annual payments to the school districts and includes an escalator based on the rate of property tax revenue growth. Future payments to the school districts could impact the financial condition of this fund.

The City’s enterprise utility funds are fully funded by the rates charged to customers; there is no General Operating Fund support to the utility funds. Utility rates charged by governmental entities for water, sewer, and trash/recycling/compost services are considered property-related fees and are subject to the procedural requirements of Proposition 218, Article XIII, of the California Constitution. Proposition 218 requires governmental agencies to conduct a majority protest hearing prior to adopting any changes in utility rates. A notice is required to be mailed no later than 45 days prior to the public hearing and is

Fiscal Year 2025-26 Recommended Budget

May 30, 2025

Page 31 of 34

required to include the proposed rate adjustment, the calculation methodology, and describe the process for submitting a protest vote. The legislation also provides for future rate increases within prescribed limits to be approved without holding a hearing each year for up to an additional four years.

A Proposition 218 hearing for all three utility funds was held on June 25, 2024, approving a five-year schedule of rates. As such, no Proposition 218 public hearing is required for the Fiscal Year 2025-26 rates. A notice of the proposed rate changes is mailed to all ratepayers on May 20, 2025.

For Fiscal Year 2025-26, the recommended water rates reflect a total revenue increase of 5.0%, comprised of 2.5% pass-through and inflationary increases and a 2.5% scheduled increase previously approved at the public hearing on June 25, 2024. Water rates include two components: the fixed monthly meter charge and the water consumption charge.

• Fixed Monthly Meter Charge: Customers pay a fixed monthly meter charge based on water meter size, with higher charges for larger meters that place more demand on the water system.

• Water Consumption Charge: These charges are based on metered water consumption. Water consumption charges for residential customers are billed according to a three-tiered rate structure; all other customers pay a uniform rate for all water use.

The 2.5% pass-through and inflationary increase is calculated as follows. The San Francisco Public Utilities Commission (SFPUC) has notified the City of a proposed 2.3% increase in wholesale rates effective July 1, 2025. The Santa Clara Valley Water District (Valley Water) has notified the City of a proposed 9.9% increase in the well water rate for Fiscal Year 2025-26, which corresponds to a 9.43% increase in the treated water rate. The Consumer Price Index (CPI) for All Urban Consumers in the San Francisco Metropolitan Area for February 2025 is 2.7%. The combination of increases from SFPUC and Valley Water, and the CPI increase for City costs, results in an approximate 3.0% rate increase. A 2.5% rate increase is recommended within the pass-through approved on June 25, 2024.

The recommended recycled water consumption rate is increasing to $7.50 per unit and is within the notto-exceed 85% of the potable uniform water consumption charge.

Fiscal Year 2025-26 projected operating revenues, with the recommended rate adjustments, are $50.6 million, and operating expenditures are $46.5 million (excluding depreciation expense and transfers to capital projects), resulting in an operating balance of $4.1 million. The rate adjustments to wholesale water costs as provided and the minimum water purchase from SFPUC are included in expenditures.

Fiscal Year 2025-26 reserve balances are projected to be $29.0 million, which includes the water transfer reserve, the balance of capacity and development impact fee revenues received, and the interest earned on the balance as well as the full reserve requirement for the fund. The projected ending balance for this fund is $12.8 million, and the cash-available goal is $5.6 million, or 10.0% of total expenditures.

Fiscal Year 2025-26 Recommended Budget

May 30, 2025

Page 32 of 34

For Fiscal Year 2025-26, the recommended rates account for overall 6.0% revenue increases, including the second year of adjustments to the rate structure to align rates with the cost of providing service. Due to the rate structure adjustments, impacts will vary based on customer class and billed usage. The 6.0% increase is made up of 3.5% from pass-through and inflationary increases, and 2.5% included in the schedule of rates approved at the public hearing on June 25, 2024.

The adopted rates for future years include phased-in rate structure adjustments and base annual rate increases of up to 2.5% for each of Fiscal Years 2025-26 through 2028-29, 0.5% to gradually increase funding for wastewater system operations and capital improvement needs, and up to 2.0% for Treatment Plant capital costs. In addition, the City will continue its historical practice of implementing additional annual pass-through rate adjustments to account for Treatment Plant operating increases and inflation.

The majority of the City’s sanitary sewer trunk main infrastructure was installed in the 1950s and 1960s. Staff has previously indicated through the budget and CIP process that there are major City sewer main replacement projects necessary over the next 10 years. As identified previously, capacity and development impact fees have provided a source of funding for some projects; however, the fees received are not sufficient to fund all projects, and staff recommended issuing debt to secure additional funds. On October 23, 2018, the City Council approved a $10.1 million loan financing for Wastewater infrastructure projects, and the proceeds have funded multiple capital projects allocated over three fiscal years. The financing structure includes the ability to draw funds as needed for the first 18 months, lowering interest cost, and the ability to prepay 10.0% of the outstanding balance each year and all of the outstanding balance after 10 years without penalty. All funds have been fully drawn, and annual payments will be approximately $852,000 henceforth.

In addition to the $10.1 million loan noted above to fund infrastructure capital projects, Capacity and other Development Fees have provided an additional source of funding for some of these infrastructure capital projects where allowed. In order to support the capital projects, an annual $2.9 million is available from the rate revenue. For Fiscal Year 2025-26, $1.8 million will be funded from the rate revenue.

Fiscal Year 2025-26 projected operating revenues, with recommended rate adjustments, are projected at $38.7 million (including $4.3 million in revenue generated by the rate increases for planned Treatment Plant capital costs that is being reserved and/or used to pay new capital debt costs), and operating expenditures are $29.5 million (excluding depreciation expense and transfers to capital projects), resulting in an operating balance of $9.2 million. Of the $4.3 million revenue generated for Treatment Plant capital costs, $3.0 million will be used for up-front capital costs and new debt, and the balance will be reserved for future debt.

For Fiscal Year 2025-26, there is $1.8 million for capital projects funded by rates and available balance, and $673,000 being returned to development impact fees. There are projected Fiscal Year 2025-26 reserve balances of $34.5 million, which includes the Treatment Plant reserve, the balance of capacity and development impact fee revenues received, and the interest earned on the balance as well as the full reserve requirement for the fund. The projected ending balance for Fiscal Year 2025-26 is $23.3 million, and the cash-available goal is $3.6 million.

Fiscal Year 2025-26 Recommended Budget

May 30, 2025

Page 33 of 34

For Fiscal Year 2025-26, the recommended rates account for overall 3.0% revenue increases, as well as the second-year phase-in rate increases from the cost-of-service study, both included in the schedule of rates approved at the public hearing on June 25, 2024. In total, single-family rates are increasing 7.5%, multi-family/commercial rates are increasing 5.0%, and debris boxes are increasing 5.0%.