2 minute read

for College Three Ways to Aim for a Debt-Free Degree

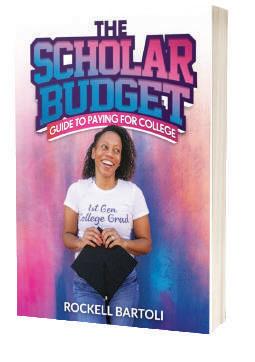

By Rockell Bartoli

Before you agree to the terms and conditions of a student loan, read these facts:

Advertisement

1. The average student loan balance is more than $35,000.

2. Americans with student debt are likely to have multiple loans.

3. The number of borrowers defaulting on their student loans is in the six figures.

As a student loan borrower, I understand there are times we need to use student loans as a resource to help pay for college, but there are ways to minimize and even avoid the need to borrow money. In my book, The Scholar Budget Guide to Paying for College, I cover 15 ways to create a game plan to help you earn a debt-free degree.

About the Author

Rockell Bartoli has spoken to thousands of students and has delivered empowering messages for organizations such as TRIO, Burger King's McLamore Foundation, and Carnival Cruise Line's Scholarship & Mentoring Program. As the founder of The Scholar Budget, she educates, trains, and equips students with the tools to earn a debt-free degree while learning how to become financially savvy. Find the English and Spanish versions of her book, The Scholar Budget Guide to Paying for College on Amazon and visit her website www.scholarbudget.com to download her scholarship book for free, or book her for a speaking engagement.

Here are three things you can start doing right now:

Apply for scholarships

Scholarships are golden for so many reasons: a. You don’t need to pay them back. Yep, you get to use that money for your education or educational expenses without incurring debt. b. It’s your reward for earning good grades, being involved in your community, being a great athlete, having a talent, overcoming obstacles, thinking outside of the box, being a good human being, or just shooting your shot, even when you thought you wouldn’t get it. c. They can significantly decrease your need for student loans. d. Did I already say that you don’t have to pay them back?

Work for an employer that will help you pay for college

Employer tuition assistance programs are out there, but you must do your research. For example, Comcast, Starbucks, Verizon, Disney, Chick-Fil-A, Walmart, Target, Home Depot and FedEx offer this benefit to employees. It is an excellent way to pay for college, as you don’t have to pay the money back unless your employer has a unique requirement. You may need to commit to working with them for a certain number of years, but that isn’t common. This is a benefit that specific employers offer and is worth looking into.

*You can find out more here or scan the QR code: https://bit.ly/CompaniesThatPayForCollege

1 2 3

Be all you can be in the Army

I know the military isn’t for everyone, so I don’t want you to consider it an option to pay for college unless you are interested in joining the military and all it entails. Do your research and connect with others who are serving or have served. Ask questions so you have a better vision of what you can expect on your journey. I have quite a few friends and family members who have joined or retired from the military. Many took advantage of the tuition assistance program or the G.I. Bill offered. In addition, the military offers the ROTC scholarship. It can cover tuition and fees, book and uniform allowance, and a monthly stipend. You complete your studies while also taking a military science class and lab and then enlist as an officer once you graduate. It can cover both undergraduate and graduate degrees.

*Explore those options here or scan the QR code: www.goarmy.com